#Fixed Income Investments

Text

Fixed Income Investments

MIG Sons & Co offers a range of fixed income investments with varying risk profiles and potential returns. These investments include bonds, treasury bills, and fixed deposits. Investors can choose from short-term or long-term options, depending on their investment goals and risk appetite. MIG Sons & Co provides expert guidance and personalized advice to help investors make informed decisions and achieve their financial objectives. For more valuable information visit our website.

0 notes

Text

Why are Bonds Known as Fixed Income Investments?

Savvy investors love to diversify their portfolios across several asset classes to protect themselves against unforeseen turns in the investment market. One of the ways they do this is through ownership of bonds.

Bonds have developed a reputation for being less volatile than other investment sources; they deliver a steady income stream while shielding the investor’s principal even in a falling market. This characteristic is no surprise, as bonds are generally classified as fixed-income investments. But what does the term ‘fixed-income’ mean, and what are the benefits of owning fixed-income assets? Read along to find out.

What are Fixed Income Investments?

Fixed-income investments pay their investors fixed interest or dividend payments until maturity. They tend to focus more on capital preservation and a steady income stream. They are typically low-risk, low-reward investments whose principal goal is to deliver as much income as possible with as little risk to the investor and the amount invested. Fixed income has three significant characteristics:

They are more focused on capital preservation.

They have an unwavering stipulated (fixed) interest payment at specified intervals.

The owners bear little to no risk of the business they invested in, nor do they own any part of the business.

Government and corporate bonds are prominent examples of fixed-income investments.

What are Fixed Income Bonds?

Bonds are debtor notes issued by either government or corporations to investors. Other investments usually pay out variable income securities based on underlying measures like short-term interest rates. Fixed-income bonds pay a fixed, predetermined rate that doesn’t change throughout the bond’s duration.

When many fixed-income bonds mature, the company pays the investors the equivalent of their principal and specified fixed interests. If the bond issuer defaults, the investor gets paid first before the stockholders.

Types of Fixed Income Bonds

Fixed-income bonds are an essential concept for both the issuer and the investor. The bond issuer gets to raise needed capital for projects or other operations without losing shares or control over its company. In contrast, the investor gets a regular fixed income with minimal risk of loss. Here are some common types of fixed-income bonds:

Government Bonds

Government bonds are fixed-income bonds entirely issued and backed by the government of a country or region. They are also called municipal bonds at the state or local government levels. They are considered among the safest bonds to undertake amongst investors, while the government uses the funds to embark on annual expenditures. Most of them are tax-free.

Corporate Bonds

Corporate bonds are issued and backed by private institutions; their value and risk assessment are based on their creditworthiness and the collateral to which the bond is tied. Corporations with higher credit ratings pay lower interest rates, and money obtained from bonds is helpful to a company’s expenditure.

Junk Bonds or High Yield Bonds

Because many bonds are low-risk investments, they usually come with lower returns. High-yield bonds come with higher returns but at a significantly higher risk. This increased risk results from being issued by corporations with low credit ratings or the assets tied to them being shaky. Investors who can manage more risks go for this bond type.

Certificate of Deposits

A certificate of deposit is a fixed deposit account with significantly higher profit rates, and financial institutions usually offer them a maturity of fewer than five years. Additionally, certificates of deposits come with National Credit Union Association (NCUA) protection.

Fixed Income Bonds to Buy in the United States

With a sound investment strategy, you can buy several fixed bonds in the United States. Here are some of the more prominent ones:

Treasury Bonds (T-Bonds)

Treasury bonds are issued at the Federal level and backed by the United States. They are considered one of the safest bonds and have 20 to 30 years of maturity. You can purchase them in multiples of $100.

Treasury Inflation-Protected Securities (TIPS)

One of the risks often associated with bonds is the depreciation of the principal’s value due to inflation. TIPS protect the investor from all that as the value adjusts with deflation and inflation.

Treasury Notes (T-Notes)

Treasury Notes are similar to treasury bonds but have a lower maturity length. While T-bonds mature in at least two decades, T-Notes have a much shorter time frame of two to ten years. Like T-bonds, however, they are acquired by an increment of $100.

Municipal and Private Corporate Bonds

Municipal bonds are issued at state and local government levels and can also be invested in the United States. In addition, several private corporations also offer bonds to investors when they wish to raise funds for a project or venture.

Fixed Income Investment Strategies

Although bonds are relatively safe for the investor, they still must be cautiously approached. Here are just a few strategies you might want to use:

Laddered Bond Portfolio Investment

The laddered investment strategy is focused on diversifying bond portfolios by acquiring bonds with different maturity dates. This strategy enables the investor to use the principal of lower rung bonds in higher rung bonds.

Bullet Bond Portfolio Investment

This investment strategy involves purchasing various bonds at different dates but with the exact maturity dates. The strategy works for investors who need massive amounts of cash at a future date.

Barbell Bond Portfolio Investment

The Barbell strategy requires investing in very short-term and long-term bonds. The investor has to pay attention to his investments to keep reinvesting the short-term bonds when they mature.

Benefits of Fixed Income Investments

Fixed-income investments are highly beneficial in many ways. Some of the advantages of this sort of investment include the following:

They make it easier to diversify your investment, especially when the market is very volatile.

They provide good returns and a steady stream of income.

Fixed income comes with a relatively lower risk exposure than other investment classes.

Fixed-income bonds are less likely to be affected by market volatility.

Conclusion

Bonds are known as fixed investments because they offer fixed interest returns and have significantly lower risk exposure than most investments. You can choose multiple bond investment types and strategies for these investment routes. Investing in fixed investment bonds is one way to save something for a rainy day. Contact REICG Real Estate Investment Fund.

#Real Estate Investment Fund#diversifying bond portfolios#Fixed Income Investments#Fixed Income Bonds#Government Bonds#Corporate Bonds#Benefits of Fixed Income Investments

1 note

·

View note

Text

Invest in yourself, create a new income stream, and help people get business and personal loans. Credit repair also available on this platform. bit.ly/workinmypajamas

#lines of credit#business loan#startup funding#get a loan#personal loan#bridge loan#arrest your debt#fix my credit#low interest loan#i need a loan#self empowerment#self improvement#career change#affiliate marketing#Invest in yourself#create a new income stream#self employed#self encouragement#self love#work from anywhere#work from the beach#work from home

17 notes

·

View notes

Text

Top 5 Reasons your Business will benefit from Solar

Sustvest has seen businesses from all different industries and verticals invest in on-site solar. We are making the renewable energy asset class, which is only accessible to ultra-high net worth individuals, family offices, or funds, available for anyone to invest in starting as low as 5000 INR.

An Improved Via Tax Benefits

At least half of your original investment in solar is recouped through tax credits and deductions, allowing solar to deliver a double-digit internal rate of return (IRR) in many cases. Now, thanks to the Inflation Reduction Act of 2022, the federal Investment Tax Credit (ITC) is back up to 30%. You can also increase the tax credit through adders, including an additional 10% if the project meets domestic content.

Reduced Utility Expenses

On-site solar replaces an otherwise sunken expense with an asset. The money you typically pay to the utility company can be used to purchase a three-decade solar asset that provides long-term benefits.

To your company. Even owners of triple-net (NNN) leased properties where tenants pay the electrical bills can recoup their investment while offering their tenants energy savings.

Potential to be Cash Flow Positive Immediately

Colorado’s Commercial Property Assessed Clean Energy (C-PACE) program allows businesses to implement solar with little to no money out of pocket (100% loan-to-cost), enabling projects to be cash-flow positive.

From year one, after recouping the tax benefits. Additionally, building owners can bundle the cost of a new roof, solar PV system, LEDs, and heating, ventilation, and air-conditioning upgrades into one fixed-

Interest loan with terms up to 25 years. The loan structure removes all risk for property owners, as the non-recourse financing is tied to the property via a special tax assessment. As a result, C-PACE Financing can transfer to the next owner if the property is sold.

Brand Reputation and Differentiation

The Denver metro area is growing and increasingly competitive, attracting many national and international firms. Commercial solar sets these businesses apart from the competition and provides Real estate investors with access to a more sophisticated tenant class with internal sustainability committees or mandates. Solar helps increase occupancy and base rates, meet corporate sustainability goals, comply with regulations (such as Energize Denver), and retain quality employees and tenants. Companies that have installed solar know that few capital energy improvements offer such a holistic Range of benefits.

Increased Property Value

In addition to utility savings from solar, some utilities will purchase the renewable energy credits (RECs) generated by your system. For example, a 200kW system on a 30,000 square foot flat roof in Xcel Energy.

The territory will generate approximately $11,000 in annual income for 20 years. This income directly increases your property’s Net Operating Income (NOI).

To Sum It Up

On-site commercial solar electricity is cheaper than traditional, utility-based electricity over time. As utility rates continue to raise, so does the value of your solar system’s energy, and these savings are free.

Up capital to fund core business initiatives or investments. Solar brings impressive and quantifiable ecological benefits for those seeking to achieve environmental, social, and governance goals or mandates.

To the table. It also increases the marketability of your property, giving you an edge in today’s hyper-competitive market, all while generating an attractive return on investment.

3 notes

·

View notes

Text

Invest with Confidence: Expat Investment Consultations in Abu Dhabi

Introduction

Welcome to Redcliffe Partners your trusted partner for expat investment consultations in Abu Dhabi. We understand the unique financial landscape and diverse needs of expatriates residing in this vibrant emirate. With a dedicated team of experienced professionals and a comprehensive understanding of global markets, we are committed to guiding you towards sound investment decisions tailored to your individual goals and aspirations.

Understanding the Expat Investment Landscape:

Before delving into specific investment consultations, it's crucial to understand the unique landscape facing expatriates in Abu Dhabi. As an expat, you may encounter differences in taxation, regulatory frameworks, and investment options compared to your home country. Seeking expert advice tailored to your expatriate status is essential to make informed investment decisions.

The Role of Investment Consultations

Investment consultations play a pivotal role in guiding expatriates through the complexities of wealth management in Abu Dhabi. These consultations offer personalized financial advice, taking into account your unique circumstances, risk tolerance, and investment goals. By partnering with experienced consultants, expatriates can optimize their investment portfolios and maximize returns while minimizing risks.

Benefits of Expat Investment Consultations

Tailored Advice:

Unlike generic financial advice, expat investment consultations are tailored to your specific needs as an expatriate in Abu Dhabi.

Navigating Regulations:

Consultants are well-versed in local regulations, helping expatriates navigate legal complexities and compliance requirements.

Diversification Strategies:

Consultants offer insights into diversifying investment portfolios across various asset classes, minimizing exposure to risk.

Tax Optimization:

Understanding tax implications is crucial for expatriates. Consultants devise strategies to optimize tax efficiency and maximize returns.

Long-Term Planning:

Consultants help expatriates formulate long-term financial plans, ensuring financial security and stability in the future.

Finding the Right Consultant

Choosing the right investment consultant is paramount to the success of your expatriate investment journey. Consider the following factors when selecting a consultant:

Experience and Expertise

Look for consultants with a proven track record of success in guiding expatriates through investment decisions. Experience in navigating the Abu Dhabi investment landscape is invaluable.

Personalized Approach

Seek consultants who prioritize a personalized approach to financial planning. Your consultant should take the time to understand your unique financial situation, goals, and risk tolerance.

Transparency and Communication

Transparency and effective communication are essential for a fruitful consultant-client relationship. Choose consultants who are transparent about fees, investment strategies, and performance metrics.

Reputation and Reviews

Research the reputation of potential consultants through client testimonials, reviews, and referrals. A consultant with a strong reputation for integrity and client satisfaction is likely to deliver superior service.

Conclusion:

expat investment consultations in Abu Dhabi offer invaluable guidance for navigating the complexities of wealth management abroad. By partnering with experienced consultants, expatriates can optimize their investment portfolios, minimize risks, and secure their financial future. Remember to conduct thorough research, seek personalized advice, and choose reputable consultants to maximize the benefits of expat investment consultations. With the right guidance, you can harness the wealth-building potential of Abu Dhabi while enjoying the expatriate lifestyle to the fullest.

Name: Redcliffe Partners

Address: #256 Al Wafra Square Building, Reem Island, Abu Dhabi, UAE

Phone No: +971 2886-4415

Website: https://redcliffepartners.ae/

FAQ’s

What is an expat investment consultation?

Ans. An expat investment consultation is a personalized financial advisory service tailored to the unique needs and circumstances of expatriates living in Abu Dhabi.

Why do expatriates in Abu Dhabi need investment consultations?

Ans. Expatriates in Abu Dhabi need investment consultations to navigate local regulations, optimize tax efficiency, diversify their portfolios, and plan for long-term financial security while living abroad.

What are the benefits of expat investment consultations?

Ans. Benefits include personalized advice, guidance on regulations, diversification strategies, tax optimization, and long-term financial planning.

How do I find the right investment consultant in Abu Dhabi?

Ans. Look for consultants with experience, a personalized approach, transparent communication, and a strong reputation.

What types of investments are typically recommended for expatriates in Abu Dhabi?

Ans. Recommended investments may include real estate, equity, fixed-income securities, mutual funds, and ETFs diversified across asset classes.

How can I ensure the security of my investments as an expatriate in Abu Dhabi?

Ans. Ensure security by conducting research, diversifying your portfolio, staying informed, and regularly reviewing your investment strategy.

#expat investment consultations in Abu Dhabi#Redcliffe#Redcliffe Partners#investment consultants abu dhabi#free wealth consultations abu dhabi#fixed income abu dhabi#expat investment consultations abu dhabi#equity raising abu dhabi

0 notes

Text

Fixed Income Funds

In today’s dynamic financial landscape, investors are constantly seeking avenues for stable and lucrative returns. Fixed Income Funds are a beacon of reliability, offering investors a secure path to wealth, growth and accumulation. At the forefront of this financial revolution stands FBNQuest, Nigeria’s premier merchant and investment bank, committed to empowering individuals worldwide wit

h unparalleled investment opportunities.

Fixed Income Funds are all about stability. They give you a reliable income, even when the financial market is unpredictable. They pay you a fixed interest amount or dividend until the maturity date. When the Fixed income matures, investors are repaid the principal amount they had invested. Also, investors know the exact amount of the returns they will get ahead. Government and corporate bonds are the most common types of fixed-income products.

Types of Fixed Income

FBNQuest’s Fixed Income Funds are made up of different kinds of investments, like government bonds and corporate loans. This mix helps to keep your money safe while still making it grow over time.

Treasury bills (T-bills)

Treasury bonds (T-bonds)

Treasury Inflation-Protected Securities (TIPS)

Corporate bonds

High-yield bonds

Certificate of deposit

Fixed Income Pros and Cons

Pros

Steady income stream of fixed returns

More stable returns than stocks

Higher claim to the assets in bankruptcies

Government and FDIC backing on some

Cons

Returns are often lower than other investments

Credit and default risk exposure

Vulnerable to interest rate fluctuations.

Sensitive to Inflationary risk

Explore Stability of Fixed Income Funds With FBNQuest

Fixed Income Funds represent a cornerstone of conservative investment strategies, providing investors with a steady stream of income while minimizing exposure to market volatility. At FBNQuest, we recognise the importance of stability in uncertain times, and our Fixed Income Funds are meticulously curated to deliver consistent returns, irrespective of market fluctuations. With a diverse portfolio comprising government securities, corporate bonds, and money market instruments, our funds offer a compelling blend of security and growth potential.

Unparalleled Expertise and Insight

What sets FBNQuest apart is our unwavering commitment to excellence and expertise in navigating the intricacies of the financial market. With a team of seasoned professionals at the helm, we leverage our deep-rooted industry knowledge and market insights to tailor Fixed Income Funds that align with our clients’ investment goals and risk appetite. Whether you’re a seasoned investor or a novice exploring investment opportunities, our personalized approach ensures that your financial aspirations are realized with precision and confidence.

In conclusion, Fixed Income Funds stand as a testament to stability and prosperity in an ever-evolving financial landscape. At FBNQuest, we invite you to embark on a transformative journey towards financial empowerment and wealth growth. With our comprehensive suite of Fixed Income Funds, backed by unrivaled expertise and a legacy of trust, we position ourselves as the premier choice for investors seeking to unlock the full potential of their financial portfolios. Invest with FBNQuest today and embark on a path towards enduring financial success.

In crafting your financial future, contact FBNQuest—the epitome of excellence in investment banking.

Contact Us :

Call us at : 01-2801340-4

Email Us at : [email protected]

Address : Lagos

16 Keffi Street, Off Awolowo Road, S.W. Ikoyi, Lagos, Nigeria

0 notes

Text

Maximize Portfolio Potential: Strategic Fixed Income Investment

Discover effective strategies for maximizing portfolio potential through fixed income investments. Learn key insights to boost your financial success today!

Fixed Income Investment

For more insights and details, Click Here !

0 notes

Text

Advantages Of Fixed Income Investing

Check out here the advantages of fixed income investing in this guide, explore the fixed income investing, best corporate fds options from the top wealth management platforms.

#best fixed income investments#top wealth management platforms#best corporate fds#wealth management companies

0 notes

Text

In the current rapidly evolving digital currency market, decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop, as a leading decentralized lending platform, not only provides a safe and transparent lending environment, but also opens up new passive income channels for users through its innovative sharing reward system.

Personal links and permanent ties: Create a stable revenue stream

One of the core parts of Bit Loop is its recommendation system, which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bit Loop, but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanently tied to the recommender, ensuring that the sharer can continue to receive rewards from the offline partner’s activities.

Unalterable referral relationships: Ensure fairness and transparency

A significant advantage of blockchain technology is the immutability of its data. In Bit Loop, this means that once a referral link and live partnership is established, the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders, but also brings a stable user base and activity to the platform, while ensuring the fairness and transparency of transactions.

Automatically distribute rewards: Simplify the revenue process

Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner completes the circulation cycle, such as investment returns or loan payments, the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This automatic reward distribution mechanism not only simplifies the process of receiving benefits, but also greatly improves the efficiency of capital circulation.

Privacy protection and security: A security barrier for funds

All transactions and money flows are carried out on the blockchain, guaranteeing transparency and traceability of every operation. In addition, the use of smart contracts significantly reduces the risk of fraud and misoperation, providing a solid security barrier for user funds. Users can confidently invest and promote boldly, and enjoy the various conveniences brought by decentralized finance.

conclusion

As decentralized finance continues to evolve, Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent financial services while also earning passive income by building and maintaining a personal network. Whether for investors seeking stable passive income or innovators looking to explore new financial possibilities through blockchain technology, Bit Loop provides a platform not to be missed.

#In the current rapidly evolving digital currency market#decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop#as a leading decentralized lending platform#not only provides a safe and transparent lending environment#but also opens up new passive income channels for users through its innovative sharing reward system.#Personal links and permanent ties: Create a stable revenue stream#One of the core parts of Bit Loop is its recommendation system#which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bi#but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanent#ensuring that the sharer can continue to receive rewards from the offline partner’s activities.#Unalterable referral relationships: Ensure fairness and transparency#A significant advantage of blockchain technology is the immutability of its data. In Bit Loop#this means that once a referral link and live partnership is established#the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders#but also brings a stable user base and activity to the platform#while ensuring the fairness and transparency of transactions.#Automatically distribute rewards: Simplify the revenue process#Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner complet#such as investment returns or loan payments#the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This au#but also greatly improves the efficiency of capital circulation.#Privacy protection and security: A security barrier for funds#All transactions and money flows are carried out on the blockchain#guaranteeing transparency and traceability of every operation. In addition#the use of smart contracts significantly reduces the risk of fraud and misoperation#providing a solid security barrier for user funds. Users can confidently invest and promote boldly#and enjoy the various conveniences brought by decentralized finance.#conclusion#As decentralized finance continues to evolve#Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent fin

1 note

·

View note

Text

Sortis.com is the official website of Sortis Capital, offering exclusive access to private, diversified real estate investment opportunities. The site details their investment funds, including the Sortis Income Fund, Sortis REIT, and others, focusing on providing stable, high-yielding fixed-income returns, and diversified asset portfolios for investors. It emphasizes Sortis' expertise in real estate, private equity, lending, and advisory services, aiming to generate excellent risk-adjusted yields and support economic growth through strategic investments. The website underlines the company's commitment to integrity, service, and achieving results for its clients.

#Investment#Real Estate#Private Equity#Income Fund#REIT#Fixed-Income Returns#Diversified Portfolio#Advisory Services#Financial Growth#Integrity

0 notes

Text

Oil's Roller Coaster: Navigating Supply Surges and CEO Insights in a Volatile Market

Oil prices experienced a significant drop, hitting their lowest point in five months, as indicators of abundant supplies continued to mount. West Texas Intermediate (WTI) saw a decline of up to 4.3%, falling below $69 per barrel, a level not seen since late June. Despite efforts by OPEC and its allies to implement new output cuts, crude oil has witnessed a continuous seven-week slide.

The ongoing pressure on prices is fueled by fresh signals that global supplies remain plentiful. Russia's seaborne crude exports reached their highest weekly average since early July, and a US government agency revised its estimate for the country's oil production this year, increasing it by 30,000 barrels per day compared to last month's projection.

Concerns about oversupply persist, evident in the spreads between monthly contracts. The front end of the Brent futures curve closed at its lowest level since June this week, reinforcing the perception of ample supplies in the market. Dennis Kissler, Senior Vice President for Trading at BOK Financial Securities, remarked, "Futures are trying to solidify a bottom from last week's selloff. The contango structure of back-month futures gaining on the front month is setting the tone that current supplies seem ample."

The oil market is currently enduring its longest weekly losing streak since 2018, with prices down by more than a quarter from the peak observed in late September. The outlook for demand in the first quarter appears gloomy due to forecasts of slowing Chinese consumption growth and lingering recession risks in the US.

As the market navigates these challenges, Charlie Sells, CEO of Strategic Passive Investments,

expressed his opinion on the situation. He emphasized the need for a strategic and adaptive approach in the face of evolving market dynamics. Sells suggested that investors should carefully assess the changing landscape and consider long-term strategies that account for the current oversupply conditions.

In the coming week, key industry players such as the International Energy Agency, the Organization of Petroleum Exporting Countries, and the US Energy Department are set to publish their latest monthly assessments of market fundamentals. Additionally, investors will closely monitor the Federal Reserve's final rate decision of the year, which could have implications for the broader economic landscape and, consequently, oil prices.

#finance#investing#success#oil#energy#real estate investing#real estate#realestate#passive investing#passive income#fix and flip#retirement#sdira#Self directed ira

0 notes

Note

Tbh at this point you should just make your own webcomic app/website because it would probably be 100 times better than whatever going on with webtoon right now.

hahaha it wouldn't tho, sorry 💀

Here's the fundamental issue with webcomic platforms that a lot of people just don't realize (and why they're so difficult to run successfully):

Storage costs are incredibly expensive, it's why so many sites have limitations on file sizes / page sizes / etc. because all of those images and site info have to be stored somewhere, which costs $$$.

Maintenance costs are expensive and get more so as you grow, you need people who are capable of fixing bugs ASAP and managing the servers and site itself

Financially speaking, webcomics are in a state of high supply, low demand. Loads of artists are willing to create their passion projects, but getting people to read them and pay for them is a whole other issue. Demand is high in the general sense that once people get attached to a webtoon they'll demand more, but many people aren't actually willing to go looking for new stuff to read and depend more on what sites feed them (and what they already like). There are a lot of comics to go around and thus a lot of competition with a limited audience of people willing to actually pay for them.

Trying to build a new platform from the ground up is incredibly difficult and a majority of sites fail within their first year. Not only do you have to convince artists to take a chance on your platform, you have to convince readers to come. Readers won't come if there isn't work on the platform to read, but artists won't come if they don't think the site will be worth it due to low traffic numbers. This is why the artists with large followings who are willing to take chances on the smaller sites are crucial, but that's only if you can convince them to use the site in favor of (or alongside) whatever platform they're using already where the majority of their audience lies. For many creators it's just not worth the time, energy, or risk.

Even if you find short-term success, in the long-term there are always going to be profit margins to maintain. The more users you pull in, the more storage is used by incoming artists, the more you have to spend on storage and server maintenance costs, and that means either taking the risk at crowdfunding (ex. ComicFury) or having to resort to outsider investments (ex. Tapas). Look at SmackJeeves, it used to be a titan in the independent webcomic hosting community, until it folded over to a buyout by NHN and then was pretty much immediately shuttered due to NHN basically turning it into a manwha scanlation site and driving away its entire userbase. And if you don't get bought out and try your hand at crowdfunding, you may just wind up living on a lifeline that could cut out at any moment, like what happened to Inkblazers (fun fact, the death of Inkblazers was what kicked off the cultural shift in Tapas around 2015-16 when all of IB's users migrated over and brought their work with them which was more aimed towards the BL and romancee drama community, rather than the comedy / gag-a-day culture that Tapas had made itself known for... now you deadass can't tell Tapas apart from a lot of scanlation sites because it got bought out by Kakao and kept putting all of its eggs into the isekai/romance drama basket.)

Right now the mindset in which artists and readers are operating is that they're trying way, way too hard to find a "one size fits all" site. Readers want a place where they can find all their favorite webtoons without much effort, artists wants a place where they can post to an audience of thousands, and both sides want a community that will feel tight-knit. But the reality is that you can't really have all three of those things, not on one site. Something always winds up having to be sacrificed - if a site grows big enough, it'll have to start seeking more funding while also cutting costs which will result in features becoming paywall'd, intrusive ads, creators losing their freedom, and/or outsider support which often results in the platform losing its core identity and alienating its tight-knit community.

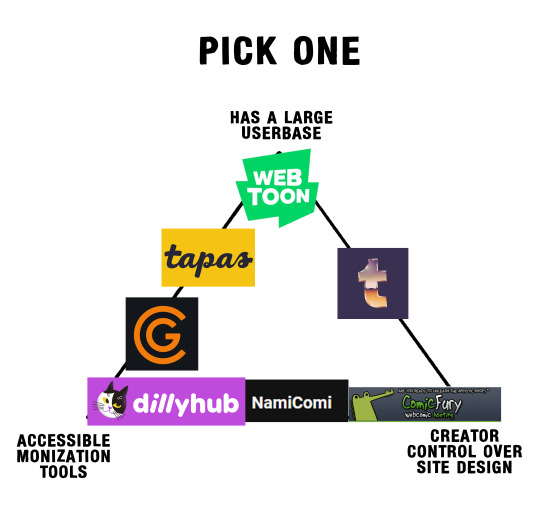

If I had to describe what I'm talking about in a "pick one" graphic, it would look something like this:

(*note: this is mostly based on my own observations from using all of these sites at some point or another, they're not necessarily entirely accurate to the statistical performance of each site, I can only glean so much from experience and traffic trackers LMAO that said I did ask some comic pals for input and they were very helpful in helping me adjust it with their own takes <3).

The homogenization of the Internet has really whipped people into submission for the "big sites" that offer "everything", but that's never been the Internet, it relies on being multi-faceted and offering different spaces for different purposes. And we're seeing that ideology falter through the enshittification of sites like Twitter, Facebook, Instagram, etc. where users are at odds with the platforms because the platforms are gutting features in an attempt to satisfy shareholders whom without the platforms would not exist. Like, most of us aren't paying money to use social media sites / comic platform sites, so where else are they gonna make the necessary funds to keep these sites running? Selling ad space and locking features behind paywalls.

And this is especially true for a lot of budding sites that don't have the audience to support them via crowdfunding but also don't have the leverage to ask for investments - so unless they get really REALLY lucky in EITHER of those departments, they're gonna be operating at a loss, and even once they do achieve either of those things there are gonna be issues in the site's longevity, whether it be dying from lack of growing crowdfunding support or dying from shareholder meddling.

So what can we do?

We can learn how to take our independence back. We don't have to stop using these big platforms altogether as they do have things to offer in their own way, particularly their large audience sizes and dipping into other demographics that might not be reachable from certain sites - but we gotta learn that no single site is going to satisfy every wish we have and we have to be willing to learn the skills necessary to running our own spaces again. Pick up HTML/CSS, get to know other people who know HTML/CSS if you can't grasp it (it's me, I can't grasp it LOL), be willing to take a chance on those "smaller sites" and don't write them off entirely as spaces that can be beneficial to you just because they don't have large numbers or because they don't offer rewards programs. And if you have a really polished piece of work in your hands, look into agencies and publishing houses that specialize in indie comics / graphic novels, don't settle for the first Originals contract that gets sent your way.

For the last decade corporations have been convincing us that our worth is tied to the eyes we can bring to them. Instead of serving ourselves, we've begun serving the big guys, insisting that it has to be worth something eventually and that it'll "payoff" simply by the virtue of gambler's fallacy. Ask yourself what site is right for you and your work rather than asking yourself if your work is good enough for them. Most of us are broke trying to make it work on these sites anyways, may as well be broke and fulfilled by posting in places that actually suit us and our work if we can. Don't define your success by what sites like Webtoons are enforcing - that definition only benefits them, not you.

#my favorite out of these is comicfury because it gives you the most control out of all of them#and you can offer monetization tools like ads and patreon links#it also offers super easy tools to help build your own site if you're new to that#it's as close to “running your own site” as comic hosting can get#but you can also learn how to run your own site if you want undeniably full control without fear of the platform host shuttering#also look into collectives like SpiderForest!#they basically operate as a co-op where people host their work with them and get ad opportunities#but you have to apply to get in#ama#ask me anything#anon ama#anon ask me anything#webcomic tips

6K notes

·

View notes

Text

Why you should Investing in Renewable Energy in 2023?

Wind and solar are powering a clean energy revolution. Here’s what you need to know about renewable and how you can help make an impact at home.

What is Renewable Energy?

Renewable energy is energy derived from natural sources that are replenished at a higher rate than they are consumed. Sunlight and wind, for example, are such sources that are constantly being replenished. Renewable energy sources are plentiful and all around us.

Generating renewable energy creates far lower emissions than burning fossil fuels. Transitioning from fossil fuels, which currently account for the lion’s share of emissions, to renewable energy is key to addressing the climate crisis.

Common Sources of Renewable Energy

Below are the Few Most Important Sources of Renewable Energy

1. Solar Energy

Solar energy is the most abundant of all energy resources and can even be harnessed in cloudy weather. The rate at which solar energy is intercepted by the Earth is about 10,000 times greater than the rate at which humankind consumes energy.

Solar technologies can deliver heat, cooling, natural lighting, electricity, and fuels for a host of applications. Solar technologies convert sunlight into electrical energy either through photovoltaic panels or through mirrors that concentrate solar radiation.

Although not all countries are equally endowed with solar energy, a significant contribution to the energy mix from direct solar energy is possible for every country.

The cost of manufacturing solar panels has plummeted dramatically in the last decade, making them not only affordable but often the cheapest form of electricity. Solar panels have a lifespan of roughly 30 years, and come in variety of shades depending on the type of material used in manufacturing.

2. Wind Energy

Wind energy harnesses the kinetic energy of moving air by using large wind turbines located on land (onshore) or in sea- or freshwater (offshore). Wind energy has been used for millennia, but onshore and offshore wind energy technologies have evolved over the last few years to maximize the electricity produced - with taller turbines and larger rotor diameters.

Though average wind speeds vary considerably by location, the world’s technical potential for wind energy exceeds global electricity production, and ample potential exists in most regions of the world to enable significant wind energy deployment.

Many parts of the world have strong wind speeds, but the best locations for generating wind power are sometimes remote ones. Offshore wind power offers tremendous potential.

3. Geothermal Energy

Geothermal energy utilizes the accessible thermal energy from the Earth’s interior. Heat is extracted from geothermal reservoirs using wells or other means.

Reservoirs that are naturally sufficiently hot and permeable are called hydrothermal reservoirs, whereas reservoirs that are sufficiently hot but that are improved with hydraulic stimulation are called enhanced geothermal systems.

Once at the surface, fluids of various temperatures can be used to generate electricity. The technology for electricity generation from hydrothermal reservoirs is mature and reliable, and has been operating for more than 100 years.

4. Solar power

At a smaller scale, we can harness the sun’s rays to power the whole house—whether through PV cell panels or passive solar home design. Passive solar homes are designed to welcome in the sun through south-facing windows and then retain the warmth through concrete, bricks, tiles, and other materials that store heat.

Some solar-powered homes generate more than enough electricity, allowing the homeowner to sell excess power back to the grid. Batteries are also an economically attractive way to store excess solar energy so that it can be used at night. Scientists are hard at work on new advances that blend form and function, such as solar windows and roof shingles.

Selling the energy you collect

Wind- and solar-powered homes can either stand alone or get connected to the larger electrical grid, as supplied by their power provider. Electric utilities in most states allow homeowners to only pay the difference between the grid-supplied electricity consumed and what they have produced—a process called net metering. If you make more electricity than you use, your provider may pay you the retail price for that power.

Renewable energy and you

Advocating for renewable, or using them in your home, can accelerate the transition toward a clean energy future.

Even if you’re not yet able to install solar panels, you may be able to opt for electricity from a clean energy source. (Contact your power company to ask if it offers that choice.)

If renewable energy isn’t available through your utility, you can purchase renewable energy certificates to offset your use.

3 notes

·

View notes

Text

Maximizing Wealth in the Middle East: Expert Advisors and Strategies

Introduction

In the ever-evolving landscape of wealth management, the Middle east wealth management advisors stands out as a region of unique opportunities and challenges. With its diverse economies, rich cultural heritage, and rapid development, navigating wealth management in this region requires specialized knowledge and strategic insight. This blog explores the role of wealth management advisors in the Middle East, shedding light on the strategies they employ to maximize wealth for their clients.

Understanding the Middle Eastern Wealth Landscape

Economic Diversity

The economies of the Middle East financial advisors vary significantly, ranging from oil-rich nations like Saudi Arabia and the United Arab Emirates (UAE) to rapidly diversifying markets such as Qatar and Oman. Oil wealth has historically been a dominant force, driving economic growth and shaping investment patterns. However, many countries in the region are actively pursuing economic diversification strategies to reduce reliance on oil revenues and stimulate non-oil sectors like tourism, technology, and finance.

Cultural Dynamics

Cultural values and traditions exert a profound influence on wealth management practices in the Wealth managers in the Middle East. Family ties are paramount, with many affluent families preferring to keep wealth within the family and prioritize intergenerational wealth transfer. Islamic finance principles also play a significant role, guiding investment decisions and shaping the demand for Shariah-compliant financial products. Moreover, the concept of wasta (connections) often influences business dealings and investment opportunities, highlighting the importance of personal relationships in the region’s wealth ecosystem.

Regulatory Environment

The regulatory landscape in the Investment consultants in the Middle East is characterized by a mix of national regulations, Islamic finance principles, and international standards. Each country has its regulatory framework governing financial services, investment activities, and wealth management practices. For example, in Islamic finance, compliance with Shariah law is a fundamental requirement, impacting the structuring of financial products and the screening of investment opportunities. Moreover, regulatory reforms aimed at enhancing transparency, investor protection, and market stability are underway in many Middle Eastern countries, reflecting a broader trend towards aligning with global best practices.

Investment Preferences

Asset management firms Middle East investors exhibit diverse investment preferences shaped by factors such as risk appetite, liquidity requirements, and investment horizons. While traditional asset classes like real estate and equities remain popular, there is growing interest in alternative investments such as private equity, venture capital, and infrastructure projects. Additionally, environmental, social, and governance (ESG) considerations are gaining prominence, with investors increasingly seeking sustainable and responsible investment opportunities that align with their values and long-term objectives.

Wealth Distribution

Wealth distribution in the financial planners Middle East is characterized by significant disparities, with a small segment of ultra-high-net-worth individuals (UHNWIs) coexisting alongside broader populations facing economic challenges. This wealth gap underscores the importance of inclusive economic development strategies and initiatives aimed at promoting financial literacy, entrepreneurship, and wealth creation opportunities for all segments of society.

Tailored Strategies for Middle Eastern Clients

Shariah-Compliant Investing:

Wealth management advisors in the Middle East often specialize in Shariah-compliant investing, ensuring that investments align with Islamic principles.

Real Estate Investments:

Real estate holds significant value in the Middle East, with advisors leveraging this asset class to diversify portfolios and generate returns.

Family Office Services:

Many affluent families in the Middle East opt for family office services, which provide comprehensive wealth management solutions tailored to their specific needs.

Challenges and Opportunities

Geopolitical Risks:

Geopolitical tensions in the financial consultants Middle East can impact investment decisions and asset performance, requiring advisors to adopt a proactive approach to risk management.

Emerging Markets:

Despite challenges, the Middle East presents ample opportunities for growth, particularly in sectors such as technology, healthcare, and renewable energy.

Wealth Transfer and Succession Planning:

Wealthy families in the Middle East portfolio management prioritize succession planning, necessitating advisors to develop comprehensive strategies for wealth transfer and preservation.

Building Long-Term Wealth

Education and Awareness:

Wealth management advisors focus on educating clients about financial literacy and long-term wealth-building strategies.

Diversification:

Diversifying investments across asset classes and geographies is crucial for mitigating risk and optimizing returns.

Sustainable Investing:

Increasingly, Middle East investment experts are incorporating environmental, social, and governance (ESG) factors into their investment decisions, driving demand for sustainable investment strategies.

Conclusion

Navigating the wealth management landscape in the Middle East requires a deep understanding of the region's unique dynamics, cultural sensitivities, and regulatory frameworks. Wealth management advisors play a pivotal role in guiding clients through these complexities, offering tailored strategies that align with their financial goals and values. By leveraging specialized expertise and staying abreast of market trends, advisors can help clients maximize their wealth and achieve long-term financial security in the dynamic landscape of the Middle East.

Name: Redcliffe Partners

Address: #256 Al Wafra Square Building, Reem Island, Abu Dhabi, UAE

Phone No: +971 2886-4415

Website: https://redcliffepartners.ae/

FAQs

What are the primary challenges faced by wealth management advisors in the Middle East?

Ans. Geopolitical risks, regulatory complexities, and cultural nuances are among the key challenges faced by wealth management advisors in the Middle East.

How do wealth management advisors incorporate Shariah-compliant investing into their strategies?

Ans. Wealth management advisors ensure that investment portfolios comply with Islamic principles by screening investments for Shariah compliance and structuring financial products accordingly.

What role does real estate play in wealth management in the Middle East?

Ans. Real estate is a significant asset class in the Middle East, offering opportunities for diversification and capital appreciation. Wealth management advisors often recommend real estate investments as part of their clients' portfolios.

How do wealth management advisors help with succession planning for affluent families in the Middle East?

Ans. Wealth management advisors develop comprehensive succession plans that address estate planning, wealth transfer, and governance structures to ensure the smooth transition of wealth to future generations.

#Investment consultants Abu Dhabi#UK property advice#Wealth management Abu Dhabi#Fixed income Abu Dhabi#Equity raising Abu Dhabi#Free wealth consultations Abu Dhabi#Wealth advisors Bucharest#Expat investment consultations Abu Dhabi#Expat investment consultations Bucharest#Middle east wealth management advisors

1 note

·

View note

Link

1 note

·

View note

Text

Pros and Cons of Zero Coupon Bonds

Pros of Zero Coupon Bonds:

Potential for high returns: Zero coupon bonds can offer high returns if held to maturity. This is because the investor is essentially buying the bond at a discount and then receiving the full face value at maturity.

Tax advantages: In some cases, zero coupon bonds can offer tax advantages. For example, municipal zero coupon bonds are exempt from federal income tax.

Liquidity: Zero coupon bonds are generally liquid, meaning that they can be easily bought and sold. This makes them a good option for investors who need to access their money before maturity.

Cons of Zero Coupon Bonds:

Price volatility: The price of zero coupon bonds can be volatile, especially in the short term. This is because the market price of the bond reflects the prevailing interest rates. If interest rates rise, the price of the bond will fall, and vice versa.

No interest payments: Zero coupon bonds do not pay interest during their term. This means that investors do not receive any income from their investment until maturity.

Risk of default: Like any bond, zero coupon bonds are subject to the risk of default. If the issuer of the bond fails to make payments, investors may lose all or part of their investment.

#Zero Coupon Bonds#Zero Coupon Bond Meaning#Pros and Cons of Zero Coupon Bonds#Finance#Investment#Fixed-Income Securities

0 notes