#GST avoidance

Explore tagged Tumblr posts

Text

What is Novated Leasing and How Do You Choose a Good Provider?

More Australians are discovering the benefits of novated leasing, with the salary sacrificing arrangement booming in popularity. A novated lease allows you to pay for your car and its running costs with your pre-tax salary. This dramatically reduces your taxable income, potentially saving you thousands each year. Once used almost exclusively by big corporations and the top end of town,…

View On WordPress

#account management#Alex and Julian Davis#attracting and retaining talent#Australian financial trends#car leasing savings#car purchase savings#choosing a novated lease provider#electric vehicle savings#employer benefits#employer leasing programs#EV incentives#financial health impact#financial planning#Ford Ranger lease savings#fringe benefits tax exemption#GST avoidance#import tariffs reduction#Leaselab#live account statements#novated lease eligibility#novated lease savings#novated lease specialists#novated leasing#petrol cost savings#Polestar 2 savings#pre-tax salary benefits#salary sacrificing#self-employed leasing options#tax savings#taxable income reduction

0 notes

Text

Super rich and their (lol) taxes

#super rich kids#super rich#property taxes#us taxes#death and taxes game#filing taxes#taxes#tax#gst registration#gstfiling#gstreturns#gst accounting software for retail#gst#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#class war#eat the rich#eat the fucking rich#tax avoidance#tax accountant#tax season#tax advisor & preparation

0 notes

Text

Streamlining Tax Compliance: Using Quaderno to Automate Taxes for Businesses Shipping into the EU.

Quaderno is a powerful tool designed to simplify the process of managing taxes for online businesses. It automates the calculation, collection, and reporting of sales tax, VAT, and GST, helping businesses stay compliant with tax regulations around the world. Introduction: Automating taxes for businesses shipping into the EU can be a game-changer in streamlining operations and ensuring…

View On WordPress

#accounting#and GST#Automate Taxes#automated-eu-vat-calculator#automated-vat-tools#Automating taxes for EU shipments#automating-taxes-for-businesses-shipping-into-the-eu#avoiding EU penalties#Benefits of Automating Tax Compliance#bigcommerce#compliance-risks#DUTIES#DUTIES AND TAXES#e#e-commerce platforms#ecommerce#EU#EU market#EU Shipping#eu-vat-tools#European Union#finance#INTERNATIONAL#IOSS#online-shopping#payment gateways#Quaderno#real-time-insights#sales tax#shipping

0 notes

Text

Tax Planning vs. Tax Avoidance

Introduction:

Tax planning and tax avoidance are terms often used interchangeably, but they represent distinct concepts with significant implications for individuals and businesses. Understanding the difference between the two is crucial for making informed financial decisions and ensuring compliance with tax laws. In this article, we delve into the nuances of tax planning and tax avoidance, exploring their definitions, strategies, and legal considerations.

Definition of Tax Planning:

Tax planning involves the strategic management of financial affairs to minimize tax liabilities within the framework of the law. It is a legitimate and ethical practice aimed at optimizing tax efficiency while achieving long-term financial goals. Tax planning encompasses various strategies, such as income deferral, tax deductions, credits utilization, and investment planning. The primary objective of tax planning is to maximize after-tax income while complying with applicable tax regulations.

Strategies of Tax Planning:

Income Deferral: Taxpayers may defer income to a future tax year to postpone tax obligations and benefit from lower tax rates or deductions in subsequent years.

Tax Deductions: Utilizing available deductions, such as mortgage interest, charitable contributions, and business expenses, to reduce taxable income.

Retirement Planning: Contributing to tax-advantaged retirement accounts, such as 401(k)s or IRAs, to lower current taxable income and build tax-deferred savings for retirement.

Capital Gains Management: Strategically timing the realization of capital gains and losses to optimize tax outcomes, such as harvesting tax losses to offset capital gains.

Entity Structure: Choosing appropriate business structures, such as sole proprietorships, partnerships, or corporations, to minimize tax liabilities and maximize operational efficiency.

Definition of Tax Avoidance: Tax avoidance involves exploiting legal loopholes or ambiguities in tax laws to reduce tax liabilities beyond the intended scope of the law. While tax avoidance is not inherently illegal, aggressive or abusive tax avoidance schemes may cross the line into tax evasion, which is illegal and subject to penalties. Tax avoidance strategies often involve complex transactions, offshore entities, or artificial arrangements designed solely to minimize taxes without genuine economic substance.

Strategies of Tax Avoidance:

Offshore Tax Havens: Establishing offshore accounts or entities in jurisdictions with favorable tax laws to shelter income from taxation or reduce tax rates.

Transfer Pricing Manipulation: Manipulating transfer prices in intra-company transactions to shift profits to low-tax jurisdictions and minimize taxable income in high-tax jurisdictions.

Shell Companies: Creating shell companies or pass-through entities with limited economic activity to funnel income or assets and avoid taxation.

Hybrid Financial Instruments: Utilizing hybrid financial instruments or structures to exploit differences in tax treatment between jurisdictions and achieve tax savings.

Complex Trusts and Partnerships: Establishing complex trust arrangements or partnerships with convoluted ownership structures to obscure income and assets for tax purposes.

Legal Considerations:

While tax planning is a legitimate and encouraged practice, taxpayers must adhere to applicable tax laws and regulations. Engaging in aggressive or abusive tax avoidance schemes can expose individuals and businesses to legal and financial risks, including audits, penalties, and reputational damage. It is essential to seek professional advice from tax experts or financial advisors to ensure compliance with tax laws while implementing tax planning strategies effectively.

Conclusion:

tax planning and tax avoidance represent distinct approaches to managing tax liabilities, with tax planning focusing on legitimate optimization within the bounds of the law and tax avoidance involving aggressive tactics to exploit legal loopholes. By demystifying the difference between tax planning and tax avoidance and understanding their implications, individuals and businesses can make informed decisions to achieve tax efficiency while maintaining compliance and integrity in their financial affairs.

#tax planning#efiletax#business#taxes#taxation#gst#gst filing#gst services#tax returns#tax#tax avoidance#indian tax#incometax

0 notes

Text

INCREDIBOX SUMMER POLO COMPETITION

Hello, @redbird46 and I are hosting a polo designing contest, with the theme being summer.

Contest Details:

You will need to design a polo with their own outfit that relates to the theme and colour palettes given. No limitations on accessories, hairstyle, gender or clothes.

CATEGORIES:

There will be two categories, Traditional and Digital. There will each be 3 winners for each place. 1st, 2nd and 3rd place.

You may use your own OCs, so long as they are not

reskins of an existing official or mod polo.

Rules:

1) Strictly nothing inappropriate, and anything we deem to have NSFW undertones will promptly be disqualified and no longer considered an option. Additionally, the artists of such submissions will be blacklisted and banned from the next event.

2) Due to it being a public competition, please note that anything that warrants a trigger warning should be avoided. This is inclusive of sensitive topics such as self-harm scars, blood, or wounds.

3) You must pick ONE palette to use, and may pick as many colours from within to use. You are not required to use the entire palette. You are not allowed to mix two palettes, only pick one and use that.

4. For traditional artists, slight leeway may be given but please try to match the colours as best as you can.

5. In the event that any case of plagiarism is suspected and proven true, the artist's submission will automatically be disqualified and will be blaslisted and banned from the next event.

6. Do not give your submission in the official polo style, that is a different style altogether and not what we are looking for.

DO NOT post the design prior to the announcements of the results so as to avoid potential plagiarism issues. Such submissions will not be accepted.

SUBMISSION DETAILS:

Upon submitting, you are required to give:

1) Full body design of the polo in your own style, NO VECTOR or official polo style required.

2) Specification of which palette you have chosen, you may include it in your artwork or separately.

3) This is optional but you may give an explanation or details about your polo, though will not add on to points.

PALETTES:

Please select ONE to use for your design. You are not required to use every colour.

SUBMISSION DEADLINE:

Participants will be added to the discord made by the 13th of July GST+8, and once added and briefed, participants may begin.

11th of August CST is the deadline.

REGISTRATION DEADLINE:

Registration is open from July 4th CST 12pm to July 10th, CST 12am. Registration will be closed early if all spots are taken before then.

There will be 20 spots for each category, with a total of 40. First come first serve basis, strictly no reservations allowed.

Message me to register, and you will be added to the discord server once the registration is complete.

JUDGING PANEL:

@peculiar-toaster

@diesfortunae

@toochizombie

The prizes are as follows:

1st place: Fully lined piece of one character of any choice.

2nd place: Flat coloured piece of one character of any choice.

3rd place: Lined sketch of one character of any choice.

Do ask if you have any questions. Good luck, and have fun!

16 notes

·

View notes

Text

Income Tax Consultant in Delhi by VATSPK – Expert Guidance for Stress-Free Tax Filing

When it comes to handling income tax matters, having a professional by your side can make all the difference. If you’re searching for a reliable Income Tax Consultant in Delhi, VATSPK is your trusted partner for comprehensive tax planning, filing, and compliance services. With years of expertise and an in-depth understanding of Indian tax laws, VATSPK ensures your financial affairs are always in order.

Why You Need an Income Tax Consultant in Delhi

Delhi, being a bustling economic hub, witnesses complex financial activities across individuals, businesses, and startups. Filing income tax returns accurately and on time is not just a legal obligation—it’s a financial responsibility. Here’s why hiring an income tax consultant in Delhi is a smart move:

Expert Knowledge of Indian Tax Laws Tax laws can be confusing and frequently updated. VATSPK stays ahead of all changes, ensuring your filings are always accurate and compliant.

Time-Saving and Stress-Free Let professionals handle the paperwork, documentation, and communication with tax authorities while you focus on your core activities.

Avoid Penalties and Notices Mistakes in filing may lead to hefty fines or legal trouble. VATSPK ensures error-free returns and timely submissions to protect you from penalties.

Maximize Deductions and Benefits Whether it's HRA, investments, or business expenses—VATSPK helps you claim every deduction you are legally entitled to.

Income Tax Services Offered by VATSPK in Delhi

VATSPK provides end-to-end solutions for all your tax-related needs. Services include:

Individual Income Tax Filing Personalized ITR filing for salaried individuals, freelancers, and high-net-worth individuals.

Business Tax Filing & Consultancy Specialized tax filing for small businesses, partnerships, LLPs, and private limited companies.

Tax Planning and Advisory Legal strategies to reduce tax liabilities and optimize your financial plan.

GST Compliance & Return Filing From registration to monthly filings—complete GST support for businesses.

Representation Before Tax Authorities Assistance in case of scrutiny, reassessment, or tax notices from the Income Tax Department.

Why Choose VATSPK as Your Income Tax Consultant in Delhi?

✅ Years of Experience: A team of seasoned professionals well-versed in tax regulations and industry practices.

✅ Client-Centric Approach: Personalized solutions tailored to your income structure and goals.

✅ Affordable Pricing: Transparent pricing with no hidden charges.

✅ Confidential and Secure: 100% data privacy and ethical practices.

✅ Timely Support: Prompt responses and timely updates to keep you informed.

Who Can Benefit from VATSPK’s Income Tax Consultancy?

Salaried professionals

Freelancers and consultants

Business owners and entrepreneurs

Startups and SMEs

NRIs with income in India

Senior citizens and pensioners

Get in Touch with the Best Income Tax Consultant in Delhi

Don’t let tax season stress you out. With VATSPK’s Income Tax Consultancy in Delhi, you can be assured of peace of mind, compliance, and maximum savings. Whether you need help with tax filing, planning, or dealing with notices, the expert team at VATSPK is just a call away.

Contact VATSPK today and experience reliable, professional, and affordable tax consultancy services in Delhi.

#gst consultant in dwarka#income tax consultant in delhi#accounting#ca in delhi#chartered accountant in delhi#gst consultant in delhi#income tax consultant in dwarka#sections#tds#vatspk

2 notes

·

View notes

Text

GST Accountants in Delhi by SC Bhagat & Co.

Are you looking for trusted GST accountants in Delhi to manage your tax compliance and GST filings seamlessly? Look no further than SC Bhagat & Co., a renowned chartered accountancy firm with decades of experience in delivering precise, professional, and timely GST solutions for businesses of all sizes.

Why GST Accounting Matters

Since the implementation of the Goods and Services Tax (GST) in India, businesses have had to adapt to a unified indirect tax regime. Navigating the GST system involves multiple tasks including:

GST registration

Timely GST return filings (GSTR-1, GSTR-3B, GSTR-9, etc.)

Input Tax Credit (ITC) reconciliation

E-way bill and e-invoice compliance

GST audit and annual return preparation

Dealing with notices from GST authorities

To handle all these effectively, having a reliable and knowledgeable GST accountant becomes crucial.

GST Services Offered by SC Bhagat & Co.

At SC Bhagat & Co., we provide end-to-end GST services tailored to your business requirements. Our experienced team of GST accountants in Delhi ensures that your compliance is error-free, timely, and in line with the latest amendments.

1. GST Registration & Advisory

We help new businesses get GST registration quickly and offer consulting on applicable tax structures.

2. Monthly/Quarterly GST Filing

Our team ensures accurate and timely submission of GSTR-1, GSTR-3B, and other applicable forms to avoid penalties.

3. Input Tax Credit (ITC) Optimization

We conduct ITC audits and help you maximize your credit claims with proper reconciliation.

4. GST Audit & Annual Return

We assist with GSTR-9 and GSTR-9C filings and conduct GST audits as per legal mandates.

5. Handling GST Notices

Have you received a GST notice? Our team responds to GST queries and notices with complete documentation support.

6. Industry-Specific GST Solutions

Whether you're in e-commerce, manufacturing, real estate, or services—our accountants are equipped with domain-specific GST knowledge.

Why Choose SC Bhagat & Co.?

✔ Over 20 Years of Experience ✔ Registered Chartered Accountants with In-Depth GST Knowledge ✔ PAN-India Clientele ✔ Transparent Pricing & Customized Packages ✔ Dedicated Support for SMEs and Startups

We pride ourselves on providing accurate, timely, and ethical GST accounting services in Delhi. Our goal is to help you stay compliant while you focus on growing your business.

Who Needs GST Accounting Services?

Startups and new businesses

Small and Medium Enterprises (SMEs)

E-commerce sellers

Exporters & Importers

Service providers with interstate operations

Any business with GST obligations

Get in Touch with the Best GST Accountants in Delhi

If you’re seeking reliable GST accountants in Delhi, connect with SC Bhagat & Co. for a free consultation. Whether you need help with monthly filings, audits, or notice handling, we ensure hassle-free compliance and peace of mind.

Let SC Bhagat & Co. be your trusted partner for GST compliance!

FAQs

Q1: Do I need a GST accountant even if I file returns online myself? Yes. A professional accountant ensures accuracy, maximizes your ITC, and avoids legal penalties.

Q2: How often do I need to file GST returns? Generally, GST returns are filed monthly (GSTR-1, GSTR-3B) and annually (GSTR-9, GSTR-9C).

Q3: What happens if I miss a GST return deadline? You may face interest and late fees. Our accountants help you stay on track and avoid such situations.

Boost your tax compliance and save time with SC Bhagat & Co.—the top GST accountants in Delhi.

#taxation#gst#taxationservices#accounting services#direct tax consultancy services in delhi#accounting firm in delhi#tax consultancy services in delhi#remittances#beauty#actors

4 notes

·

View notes

Text

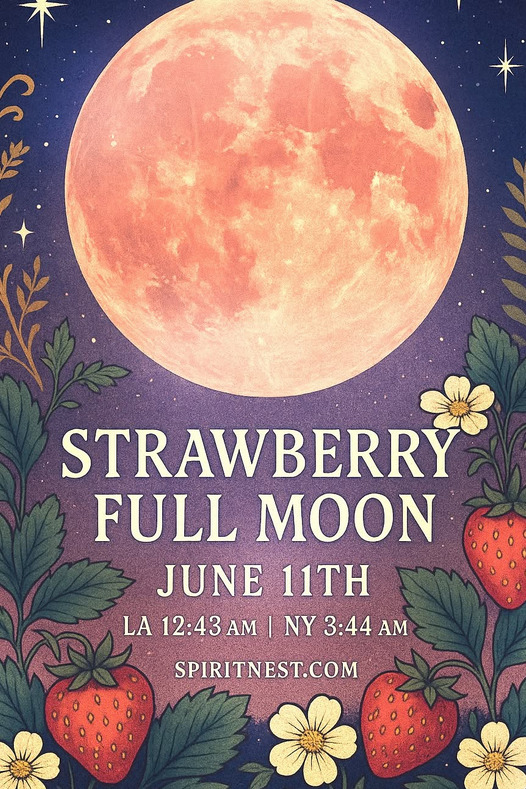

The Strawberry Full Moon peaks in Sagittarius on June 11, 2025, and forms supportive aspects—trining Mars to amplify passion, courage, and relationship energy, while opposing Jupiter to bring fortunate yet potentially excessive opportunities. However, with Jupiter squaring Saturn and Neptune, it’s key to balance ambitious dreaming with grounded practicality to avoid resource strain . This lunar event will spotlight major shifts for Aries, Taurus, Gemini, and Cancer—from adventurous leaps for Aries and Taurus through big decisions in partnerships for Gemini, to health or career turning points for Cancer . Across the zodiac, the full moon encourages exploration, self-awareness, and structured goal-setting for enduring growth.

Full Moon times around the world: Los Angeles (PDT): 12:43 a.m. | New York (EDT): 3:44 a.m. London (BST): 8:43 a.m. | Rome (CEST): 9:43 a.m. Dubai (GST): 11:43 a.m. | Sydney (AEST): 5:43 p.m. 2d

#fullmoon#sagittarius#fullmooninsagittarius#sagittariusfullmoon#fullstrawberrymoon#strawberrymoon#june#junefullmoon

2 notes

·

View notes

Text

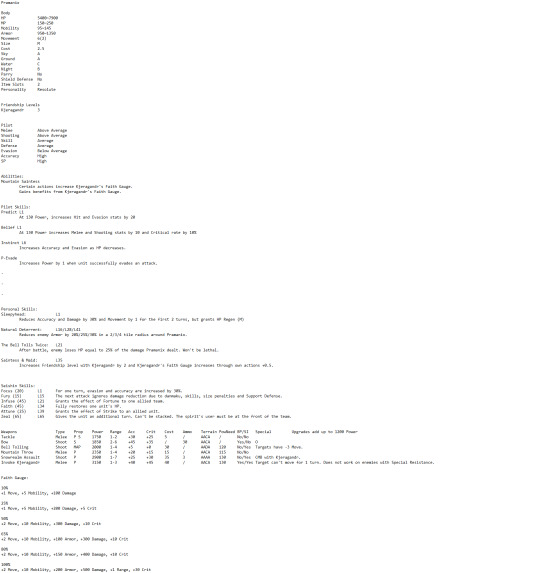

I made more Arknights operators as GST characters. This time it's Pramanix and Kjera. Long post, as always.

Pramanix is a melee-focused Real-ish type. Her Mobility is fairly high, her Armor is kinda low but she has high HP, so she's fairly decent at surviving and can be built to either tank or avoid hits. Good candidate for a graze build, if only her focus movement wasn't unusably low oopsie. She has a C in water because she's a feline and I considered putting it to D, but I don't think she really minds it that much. B at night because she's very sleepy. I considered making her size L, but left it at M to stick to her flexible build. Her pilot stats are very even across the board, except for a lacking Evasion stat. This doesn't make her unable to be built for evasion.

For abilities she has Mountain Saintess, which works with Kjeragandr's Faith Gauge (she may be the "Priestess" in this relation, but I decided to give the Faith Gauge to the goddess.) Since Kjeragandr will only join a while after Pramanix, this won't see any use until then. Alternatively, she could already be around as Kjarr with like a third of her moveset until she reveals herself when the situation turns dire. That would be pretty cool. But this would still keep the Faith Gauge unavailable until the reveal.

Pilot skills further lean into the noncommittal base loadout, except for P-Evade. Early on, it'll be easy enough to just equip her with some Mobility increasing items and use her Focus Seishin to get her to consistently dodge stuff against small fries until you decide which way you want her to go.

For her Personals, she starts with just Sleepyhead which is a bit reminiscent of Komachi's slacker skill in that both debuff the wielder at the start of a stage while granting 20% HP Regen. In Pramanix' case, it's a very heavy penalty for 2 turns but it falls off automatically, compared to Komachi's -20 starting Power that you have to work for to get rid of. Once Pair-Up becomes available, Prammy can just hang in the back of the team for two turns until she gets going.

Natural Deterrent is her S2 as a passive. There's no "Magic Resistance" in GST, just Armor, so that's all it reduces. It's fairly powerful, since there are barely any ways to bypass Armor. The aura radius also gets pretty big and having a big aura displayed around a character feels good.

The Bell Tolls Twice is a spin on her talent that lets her hit two enemies with each attack, but here it's more of a reverberation kinda deal. Most damage-increasing personal skills are around 15%, but I gave this one higher numbers because the way it deals its damage is kinda bad. Let's say she deals 4000 damage to a 4400 health enemy and has this skill equipped. She'll leave them at 1 HP, because it can't kill and she has to face their counterattack. With a +15% damage passive, she'd just do 4600 and shoot them down no questions asked.

Saintess & Maid is the regular Friendship skill. If both her and Kjeragandr equip it, they get to a total of +10 which is pretty powerful. It also increases the Faith she can gather for Kjera. +0.5 may seem like nothing, but you don't even have an idea of the way this works, so hold still until I explain the Faith gauge. It'll take a while.

Her Seishin skills are very focused on utility, with a lot of ally-targeted ones learned in the early to midgame. This is useful and will have more meaning once I explain the Faith gauge. For her self-buffing ones, Focus is good, Fury is great, Zeal I'm honestly not that hot on cause it's so expensive and characters who have it just kinda have better things to do than use it. Like, it's a good Seishin, because taking an extra turn can be a total gamechanger, but I dunno. Don't think too hard about it all.

Her weapons might seem a bit strange, because they're very melee attack focused and there's a Bow weapon there. I think it was in Break the Ice, but we've been shown that Pramanix knows how to use a bow and that she's fairly capable when it comes to physical activities, she just never gets to show it (and doesn't want to, evidently). I get it, it's effort. But now I'm making her punch people. Tackle and Bow are two different "basic" weapons and Bow is also her Assist Attack. It's not the best thing to assist with, but at least it has a lot of ammo. Bell Tolling is a MAP weapon that I'd actually find myself using sometimes, because it has a good, circular radius and puts an anti-Accel on everything it hits. Mountain Throw doesn't have her throw a Mountain (be that the operator of that codename, Kjeragandr or any other mountain). It's just a name. She throws the enemy, it's a grappling technique? It's her bread and butter strong move with decent cost. Snowrealm Assault is something where I spent like ten minutes trying to come up with a good name, failed and named it this. It's her Combination with Kjeragandr. Has way more range than most of her other weapons, decent Power and lets her attack into water good. It's also easy to use, because it's easy for her to be near Kjeragandr, which will become obvious once I get to her. Invoke Kjeragandr makes her think really hard about spending time with her dearest, which gives her the power to kill whoever it is that's still on the map and making the stage go on for too long and preventing her from being cozycomfy with her. It'll have a really cool animation and special theme.

The boni she gets from Kjeragandr's Faith increasing are split into two halves. For the first 50%, she gets movement and mobility, for the second 50% she gets Armor and Crit. Pramanix doesn't have any kind of Valoresque skill, so she gets good value from critting. The early boni are movement and evasion focused, because that's when she's fighting smallfry enemies and has to be getting places, the late ones are so she can take hits from stronger enemies better. I'm still not explaining how the Faith gauge works. Later.

Kjeragandr is the first serious Super I've made for these. She can't dodge for shit, but good luck trying to deal meaningful damage to her. She is a mountain goddess after all. She's also my first 3.5 Cost unit. I gave her 7 Movement because she can teleport (within Kjerag). 6 would be fine too, but not 5. It just sucks ass to be a 5 move unit with 1 item slot. She has S Ground terrain. I don't need to explain this. Her personality is Big-Shot which is pretty much the best you can have and I gave it to her because she's not holding back. If I go with the scenario of her showing up as Kjarr first, she'd have Cunning or Strong-willed for that time. I did go with Size L for her. Because I like that. Her pilot stats are very lopsided, compared to Pramanix', but pretty high across the board. Possibly a bit too high. Lowering her Melee stat would be a performative gesture, because she only has a single weapon that uses the stat. Her having Very Low Evasion also is performative. I think it's fine, don't worry about it. She's a 3.5 Cost.

Because she's a 3.5 Cost I also loaded her up with Abilities. Snowrealm Transfer may read a bit strangely, but basically if Pramanix is somewhere else on the field, Kjeragandr can choose to move starting from her own tile or from the one Pramanix is on. This lets her always get right into her area, which is also how Snowrealm Assault is easy to use. Regrettably, this promotes NOT pairing them up, but thems the br8ks. Prammy would slack off too much if you put them together.

Mountain Goddess is the explanatory ability for her Faith gauge that doesn't explain anything really, so this is just to say "She has a Faith gauge. Figure it out."

Ice Barrier is Ice Barrier. It's actively detrimental on Cirno, but Kjeragandr has the MP and body to make use of it.

Presence of the Mountain is an Ability now, but I initially had it as a Personal skill. But I wanted it to be always present to force the player to account for its downside. That being that as LLL size, you're not hitting anything anymore. Use Equipment, Attune Seishin and Pilot Skills to make up for it. It also only triggers at 150 Power (the default limit) so you get some time early on in each stage where she's normal sized. But accuracy penalty aside, being LLL is incredibly beneficial due to a massive reduction in damage taken and increase in damage dealt from being bigger than most things. Fixing Accuracy is easy, increasing your damage less so.

Her initial Pilot skills are probably also overloaded, but it's fine because she's a 3.5 Cost. Supreme is a broken skill, so she gets it. This helps her accuracy, but the evasion bonus is wasted. Some part of this skill is always wasted, because it'll either be on someone dodgy (Yorihime) or someone tanky (Mima). Though it does contribute to Yorihime being actually pretty sturdy. She gets both Shotgunning and Ignore Distance. This already paints a picture of what her weapons' ranges look like. You can pick either or the other or use both. It works just fine. I actually forgot I gave her Shotgunning when I made her weapons, then added Ignore Distance later when my general idea of how she'd play changed a bit. Basically she gets Ignore Distance to fight trash and Shotgunning to explode bosses. It's free, don't complain. She's 3.5 Cost. Prevail and MP Save are obvious. You were going to put MP Save on her anyway, I'm saving you the effort. The last two slots are for Unfocused Movement and Power Limit Break. You may think she has enough movement, but you never have enough movement. You can always use more movement. Movement is the best stat. You can also consider the SP increasing skill, for reasons that'll become obvious shortly.

I actually had kind of a hard time making her personals and they read kinda underwhelming. Deference increases her damage while on the ground, so not while in water or flying, and in the last third of the game it also gives her the option to make a platform for her to stand on, because ground tiles can be hard to come by in some lategame stages. Faith Absorption gives her more SP to play with in a way that promotes using your Seishin skills throughout a stage. I like this one, it's mildly clever in that way. She has a lot of ways to really throw out all of her SP. Maid & Saintess is known. Unrestrained Heart gives her two summons for a fairly high MP cost. They have 6 base movement and one weapon that lets them hit from 1-5 range. They're about sturdy and dodgy enough to manage small fry enemies, but they won't hold up against heavy attacks. I always find summons to be really underwhelming in these games, also because if you do have them kill an enemy, you lose out on the PP. EXP is whatever, but I need that PP. Won't happen with these.

Her Seishin skills are quite aggressive. Of course she has miracle, because who else could I even put that on. It's a catch-all skill except it doesn't give Fury. That's the one gap in her loadout and I had to put a lot of effort in to not give her Fury. I can't just give it to everyone. She has Rally because I certainly am motivated with her around. This is a universal experience. I gave her Confuse at level 65 because it's easy to lose your way in the snow. You probably won't be using Rally much with her, because even in short stages Miracle's initial burst is preferable to get a headstart. With Faith Absorption, you can pretty much spam Miracle because it gives a total of 550 SP on top of what she has and Miracle itself gives +20% Faith, so once it puts you from 30 to 50, it pretty much already refunds itself. Faith Absorption looks like a fine, well-balanced skill until you add up how much it actually gives. I'm not changing it. She's a 3.5 Cost.

Her weapons are probably overtuned. Her basic attack is Tail Swipe because I think that would be cool. It has 1-3 instead of 1-2 range like most basic melees (there are a bunch with 1-3) because she has a long tail. I had a pretty hard time naming her weapons, so it's all pretty lame. Bit Snipe uses one of her ice rock bits to snipe the target. Yep. She has long-ranged attacks with Post-Move availability, which is busted. She can pretty much reach anywhere at any time, but that just makes sense. Falling Gale also has a lame name, but it's a medium-ranged attack where she blasts the target with a gust of cold air. It's a falling gale because it's cold air that falls down the mountainside. That's also why it has S against ground. Merciless Winter is a basic, circular, damage-dealing MAP attack. It's fine. Probably quite good. It has S against both air and ground because it gets cold in both terrains. Goddess Missiles is a reference to how she wouldn't mind having missile silos installed on her. It's true. More disgustingly high range with P movement. But these are parriable, because parrying missiles is rad. Also because missiles are solid, so they're S. Snowrealm Assault is the same as Prammy's. Icy Bit Entrapment has easily the lamest weapon name here. It has the same range, accuracy and crit as her Bits' weapon, but deals more damage. Icy Bit Entrapment CMB is the Combination with her Bits that she only has access to with Unrestrained Heart as her personal skill. Actually, I'm updating Snowrealm Transfer to also work for her Bits. They're her too after all. I won't actually update it in the text earlier, because then this part wouldn't make sense or even be here anymore. I'm just writing it here, but not changing it in the image or text. It's a pretty good weapon, at any rate. Moderate cost for high performance, but you need the personal equipped for it. Regular IBE is just alright. Extinguish Life also has a lame name but is hellishly overpowered. This should at the very least not be a P attack, but I don't really care. She's a 3.5 Cost. It deals crazy damage, is shotgunnable, has an S terrain in everything?? It's fine. It'll have such a cool animation, I can practically see it before my inner eyes.

Faith Gauge. I actually noted how much Sanae gets from hers and kept it in mind, but Kjeragandr definitely gets more buffs from hers without using a personal to improve it. She doesn't even have one to improve it, because I made it way stronger at baseline. She gets everything improved except for her Mobility. This makes it balanced, she doesn't get Mobility. The Barrier upgrades are notable for making it free to use at 100% and giving it a 2400 Threshold, making her impervious to non-boss attacks. Trust me. She has such a sturdy body that nothing is going to get over 2400 damage, especially when she's LLL Size and she's most likely at 150+ Power by the time she's at 100% Faith. Lasers still bypass it though. At 100% Faith she has 9 base movement and like 10 range on spammable weapons. That's a 19 tile threat radius plus Snowrealm Transfer. Plus 3 tiles from Accel. I also put a massive accuracy boost on her Faith gauge, so that's already fixed. (^:

So how does the Faith gauge increase? Let's take Sanae's to start with: It increases from moving, attacking, shooting down enemies, dodging and being targeted by allies with Healing, Resupply or any ally-targeted Seishin skills like Infuse, Cheer, Hope or Attune. It decreases when she misses, gets hit, dies (probably) or is idle for a turn (this one takes a huge 10% out of it) and also when she uses certain weapons.

Kjeragandr's Faith gauge increases when she shoots an enemy down, performs a Support Attack or Defense or is targeted by allies like Sanae. It decreases the same way as Sanae's, except not when she takes a hit. She does that all the time. By herself, it's a lot more difficult to raise the gauge unless you want to spend a lot of SP to use ally-targeted Seishin skills on her. But that's where Pramanix comes in. She can also increase Kjeragandr's Faith gauge by shooting down enemies, but also by being adjacent to ally units or fighting with them in a pair or via Support Attack/Defense and ALSO by targeting allies with her Seishin skills. (Infuse, Faith, Attune). Pramanix' actions can't decrease the Faith gauge. I decided to make it work this way, because as the one receiving Faith, it makes sense that her gauge increases in the same way as Sanae's with regards to allies assisting Kjeragandr. They're putting their faith in her by helping her. Or see it as offerings. But Pramanix increases it by helping others, by propagating the faith. She tells others that if they put their faith in Kjeragandr, they can receive her blessings.

Kjeragandr isn't unusable without Pramanix, because if you just throw her into direct combat her gauge will increase just fine through her killing people and even if she didn't have the gauge, she'd be way too strong already. It's okay, she's a 3.5 Cost.

6 notes

·

View notes

Text

🧾 GST Billing & Invoicing Software – The Ultimate Solution for Small Businesses in India

In today’s fast-paced business world, managing GST invoices, stock, and accounts manually is not only time-consuming but prone to errors. This is where a smart GST Billing & Invoicing Software comes to your rescue.

Whether you run an optical store, retail shop, or small business — using automated GST software can save hours and boost productivity.

✅ Why You Need GST Billing Software

1. 100% GST Compliant Invoices - Create professional invoices with your GSTIN, HSN/SAC codes, and automated tax calculations — in seconds.

2. E-Invoice Generation - Connect directly with the GSTN portal for seamless e-invoicing and avoid penalties.

3. Integrated Stock & Inventory Management - Track your real-time stock levels, product batches, expiry dates, and low stock alerts ��� all from your billing screen.

4. Sales, Purchase, & Return Management - Handle sales orders, purchase orders, quotations, and returns with one-click conversion to invoices.

5. Tally Integration & Accounting - Export reports directly to Tally ERP and simplify your accounting process.

🔍 Top Features of GST Billing & Invoicing Software

📦 Inventory & Stock Control

💳 POS System for Fast Billing

🧾 GST Reports: GSTR-1, GSTR-3B, GSTR-9

📈 100+ Business Reports (Profit & Loss, Stock, Sales)

🧑💼 Multi-user Access with Role Permissions

☁️ Cloud Backup & Data Security

📱 Mobile & Desktop Compatible

👨💻 Who Is It For?

This software is ideal for:

🕶️ Optical Shops

🛍️ Retail Stores

🏥 Pharmacies

🧰 Hardware Shops

📚 Book Stores

🏬 Small & Medium Enterprises (SMEs)

🚀 Boost Business Efficiency Today!

Switching to a Partum GST billing software is not just about compliance — it’s about scaling your business smartly. With built-in automation, detailed reports, and error-free invoicing, your daily operations become faster and smoother.

📞 Book your FREE demo now! ✅ No credit card needed ✅ 17+ Software packages ✅ Trusted by 5,000+ businesses

youtube

#gst billing software#InvoicingSoftwareIndia#BillingAndInventory#RetailBilling#EInvoiceIndia#TallyIntegration#Youtube

2 notes

·

View notes

Text

Venus: ♊ @ 25°

Interpretation of the 25° Gemini symbolic degree

"On the marketplace, vendors and buyers are equally nervous. Dogs are bite each other, and men quarrel."

Jealous, irascible, and aggressive character revelling in fault-finding. Violence, brawls, and stubbornness are at the root of many a misfortune. One would be well-advised to keep one's passions under control so that the generosity and loyalty promised by this degree can be fully expressed.

- Well in terms of jealousy... I could get jealous. It don't happen all the time, but when it comes to people in relationships, yes even the toxic ones, I do get a little green. Not to the point where I'd sabotage a relationship (I may have contemplated about putting a hole in a condom that my sister's ex, who me and my mother strongly suspect to be our cousin, had. But I didn't! And thank god, this family is already messed up as is, an incest baby would just make everything even more messy😭). Getting a little sidetracked, my fault😅.

- In terms of being irascible... Also yes. While I have a pretty chill demeanor and try not to get irritated easily, I fear its a part of me (blame my mama, not me). It only comes out when I see someone do something deplorable and foolish, and it mainly shows up when I'm outside on or by a road, but it's there. It happens. And low-key, I don't want to stop it. Admittedly, having those little rage moments are exhilarating, and allows me to be able to gst my thoughts out more clearly, abet with an aggressive edge. - As for aggression, well yes! My aggression has gone down tremendously over the years, being replaced with a gentle restraint, it still pops out especially when someone has me fucked up. While I'll only ever put my hands on someone who did it first, it don't stop me from making aggressive threats or gestures. (Side note, but with this degree being on my Venus in particular, it's no wonder why I seek someone who has a bit of aggression in the way they do things or express themselves, I find it hot!)

- You call it fault-finding, I call it tea-spilling🤭. But seriously, my ability to find the fault in the things someone does or says is not to be underestimated. Fine I'll admit it, I do like pointing out people's faults especially when they point out my own without justifiable cause. Like if someone's calling me out on my bs, I typically shut the fuck up and listen, even when my body is urging me to lunge at that person's throat. But if my faults are being pointed out by someone who doee the same thing, or does worst, I take offense and be ready to dig up all the other person's shit. It's toxic ik, but don't sit up on your high horse when you know you're just as bad as me!

- I tend to avoid violence and fights, since ik I can get really fucked up bc well, the likelihood of my opponent seeing me as an actual person is unfortunately, low, (the life of a black trans woman🫠) which puts me at a greater risk of permanent injury or death (which is why in such events, I will always take shit to the max and use whatever's around me to my advantage, if I'm gonna go, might as well cause as much destruction and harm to the mf as I physically can!). This doesn't help with my stubborn tendencies, as I can become very dessert and fixated on something, and when that happens, the likelihood of me changing my mind is low asf. But I do budge where it matters and benefits me (in terms of having a greater understanding via looking at things from a different perspective).

- Over the past couple of years, I've been keep my passion under control for the most part (save for a dick accidentally finding its way to my mouth🤷🏿♀️). I'd say Ive experience generosity and loyalty from s good amount of people, and exude these qualities myself. While I haven't been as generous as I'd like to be, money has been tight and mama needs to eat and smoke!

#astro observations#astrology chart#astrology#astro notes#gemini venus#9h venus#aries venus#birth chart#natal chart

4 notes

·

View notes

Text

GST Consultants in India by Mercurius & Associates LLP

In the ever-evolving landscape of taxation in India, the Goods and Services Tax (GST) has transformed the way businesses operate. While GST simplifies taxation, it also brings along complexities in compliance, filing, and structuring. This is where Mercurius & Associates LLP, a leading GST consultant in India, plays a crucial role in helping businesses navigate the GST framework efficiently.

Why Businesses Need GST Consultants

GST compliance requires meticulous attention to detail, regular updates on tax laws, and accurate filing to avoid penalties. Whether you are a startup, a small business, or a multinational company, seeking professional GST consultation can save time, reduce errors, and ensure seamless operations. Some key challenges businesses face include:

Understanding GST applicability and registration requirements

Filing monthly, quarterly, and annual GST returns

Claiming input tax credits correctly

Managing audits and assessments by tax authorities

Keeping up with frequent changes in GST laws and regulations

Services Offered by Mercurius & Associates LLP

At Mercurius & Associates LLP, we offer end-to-end GST consulting services to ensure your business remains compliant and optimized for tax benefits. Our services include:

GST Registration & Compliance

We assist businesses in registering for GST under the correct category, ensuring that all documents are in order and compliance is maintained from day one.

GST Return Filing

Filing returns accurately and on time is crucial to avoid penalties. We handle GSTR-1, GSTR-3B, GSTR-9, and other applicable returns to ensure smooth compliance.

GST Advisory & Structuring

Our team provides expert advice on optimizing GST structures to minimize tax liabilities while remaining fully compliant with the law.

GST Audit & Assessment Assistance

Facing a tax audit? Our consultants assist in preparing audit reports, responding to tax notices, and ensuring a hassle-free assessment process.

Input Tax Credit (ITC) Management

We help businesses maximize their input tax credit (ITC) by ensuring accurate record-keeping and proper claim filing.

GST Litigation & Representation

In case of disputes, our experienced professionals provide legal representation before tax authorities and tribunals to safeguard your business interests.

Why Choose Mercurius & Associates LLP?

Experienced Professionals: Our team consists of seasoned GST consultants with deep expertise in Indian taxation laws.

Customized Solutions: We tailor our services to meet the specific needs of your business.

Timely Compliance: We ensure that all GST filings and compliance requirements are met well before deadlines.

Cost-Effective Services: Get top-notch GST consultation at competitive pricing.

Nationwide Support: We serve businesses across India, providing assistance in multiple languages.

Conclusion

Navigating the complexities of GST requires expert guidance, and Mercurius & Associates LLP is your trusted partner in ensuring seamless GST compliance in India. With a client-centric approach and an in-depth understanding of tax laws, we help businesses stay compliant and financially efficient.

If you're looking for reliable GST consultants in India, get in touch with Mercurius & Associates LLP today for professional and customized GST solutions!

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#auditor#ap management services

3 notes

·

View notes

Text

Difference Between GST and Company Registration– Do You Need Both?

When starting a new business, entrepreneurs often get confused between GST and Company Registration. While both registration are essential for business compliance, but they serve different purposes. If you are planning to start a business in Jaipur, understanding the differences can help you avoid legal hassles and ensure smooth operations.

What is Company Registration?

Company Registration is the process of legally incorporating your business entity under the Ministry of Corporate Affairs (MCA). This provides your business with a distinct legal identity, allowing it to enter contracts, own assets, and be legally recognized as a separate entity from its owners.

Why is Company Registration Important?

Gives your business a separate legal identity.

Protects personal assets from business liabilities.

Enhances credibility with clients, investors, and banks.

Allows for easier fundraising and business expansion.

Ensures compliance with corporate laws and regulations.

Types of Business Entities You Can Register:

Private Limited Company (Pvt Ltd) – Most preferred for startups and medium-sized businesses.

Limited Liability Partnership (LLP) – Suitable for professional firms and small businesses.

One Person Company (OPC) – It is ideal for solo person entrepreneurs.

Partnership Firm – Traditional business structure for multiple owners.

Sole Proprietorship – Simplest business form, no separate legal identity.

What is GST Registration?

It is mandatory for businesses that exceed the turnover threshold prescribed by the Goods and Services Tax (GST) Act. It allows businesses to collect GST from customers and claim Input Tax Credit (ITC) on purchases, ensuring compliance with India's indirect tax system.

When is GST Registration Required?

If your business turnover is more than ₹40 lakh (₹20 lakh for service providers).

If you engage in interstate trade or e-commerce.

If you are a supplier of goods/services to other GST-registered businesses.

If you provide services online (freelancing, digital marketing, SaaS, etc.).

If you run an ecommerce business (Amazon, Flipkart, Shopify, etc.).

Benefits of GST Registration

Legal recognition as a supplier of goods/services.

Ability to collect GST from customers and claim ITC on purchases.

Helps in business expansion, as many B2B clients prefer GST-registered vendors.

Required for government tenders and contracts.

Reduces cascading tax effects by allowing seamless input tax credit.

Key Differences Between GST and Company Registration

Do You Need Both GST and Company Registration in Jaipur?

If you are starting a new business in Jaipur, you may need both registrations depending on your business structure and operations:

If you plan to incorporate a Pvt Ltd or LLP, Company Registration is mandatory.

If your business crosses the GST turnover threshold, GST Registration is compulsory.

If you operate as a sole proprietor or freelancer, you may not need Company Registration, but GST Registration is necessary if you provide taxable services.

If you plan to sell goods/services online via Amazon, Flipkart, or your own website, GST Registration is mandatory regardless of turnover.

How Tax Veda Consulting Can Help in Jaipur

Navigating the GST and Company registration process can be complex. At Tax Veda Consulting, we specialize in helping startups and businesses in Jaipur with hassle-free registration services. Our experts ensure compliance with MCA and GST regulations, so you can focus on growing your business.

Our Services Include:

Company Registration (Pvt Ltd, LLP, OPC, etc.)

GST Registration & Compliance

Annual Return Filing & Compliance Management

Tax Planning & Advisory

Business Setup Consultants in Jaipur

Conclusion

Both Company and GST Registration are crucial but serve different purposes. While Company Registration gives your business a legal identity, GST Registration ensures tax compliance. If you need professional assistance, reach out to Tax Veda Consulting in Jaipur for a smooth registration process.For expert guidance on Company and GST registration, contact us today and get your business legally compliant!

#tax#income tax#company registration#gst registration#taxation#Tax Veda#jaipur#tax planning#im new to tumblr

2 notes

·

View notes

Text

Streamlining Tax Compliance: Using Quaderno to Automate Taxes for Businesses Shipping into the EU.

Quaderno is a powerful tool designed to simplify the process of managing taxes for online businesses. It automates the calculation, collection, and reporting of sales tax, VAT, and GST, helping businesses stay compliant with tax regulations around the world. Introduction: Automating taxes for businesses shipping into the EU can be a game-changer in streamlining operations and ensuring…

View On WordPress

#accounting#and GST#Automate Taxes#automated-eu-vat-calculator#automated-vat-tools#Automating taxes for EU shipments#automating-taxes-for-businesses-shipping-into-the-eu#avoiding EU penalties#Benefits of Automating Tax Compliance#bigcommerce#compliance-risks#DUTIES#DUTIES AND TAXES#e#e-commerce platforms#ecommerce#EU#EU market#EU Shipping#eu-vat-tools#European Union#finance#INTERNATIONAL#IOSS#online-shopping#payment gateways#Quaderno#real-time-insights#sales tax#shipping

1 note

·

View note

Text

The Importance of Register and Record Maintenance Services for Corporates in India

I

n today’s complex regulatory environment, businesses in India must comply with numerous statutory requirements to ensure smooth operations and avoid penalties. One of the critical aspects of corporate compliance is the maintenance of registers and records. Proper documentation not only ensures adherence to legal obligations but also enhances transparency, operational efficiency, and corporate governance.

Understanding Register and Record Maintenance

Register and record maintenance involves systematically documenting and managing corporate records as per various laws such as the Companies Act, 2013, the Factories Act, 1948, the Shops and Establishments Act, the Payment of Wages Act, and several other labor and tax laws. These records serve as evidence of compliance and provide crucial insights into the organization’s workforce, financials, and business operations.

Key Registers and Records Required for Corporates

Depending on the industry and applicable laws, corporates in India must maintain various registers and records, including:

Statutory Registers under the Companies Act, 2013

Register of Members

Register of Directors and Key Managerial Personnel

Register of Charges

Register of Share Transfers

Register of Loans, Guarantees, and Investments

Labor Law Registers

Attendance Register

Wages Register

Register of Leave and Holidays

Register of Employment and Termination

Register of Fines and Deductions

Tax and Financial Records

Books of Accounts

GST Records and Invoices

TDS (Tax Deducted at Source) Records

Profit and Loss Statements

Other Important Records

Board Meeting Minutes

Shareholder Meeting Records

Environmental, Health & Safety (EHS) Compliance Records

Policy and Compliance Documentation

Challenges in Register and Record Maintenance

Many businesses face difficulties in maintaining statutory registers and records due to:

Frequent changes in compliance regulations

Large volume of records to be maintained

Risk of data loss and errors in manual record-keeping

Lack of expertise in legal and regulatory requirements

How Professional Register and Record Maintenance Services Help

Hiring professional compliance service providers can streamline record-keeping processes and ensure businesses stay compliant with minimal hassle. These services offer:

Expertise in Compliance Regulations: Professionals stay updated with legal changes and ensure records meet statutory requirements.

Digital Record Management: Many firms provide automated and cloud-based solutions to maintain records securely and access them when needed.

Audit-Ready Documentation: Well-maintained records ensure corporates are always prepared for regulatory inspections and audits.

Time and Cost Efficiency: Outsourcing register maintenance saves time and operational costs while reducing risks of non-compliance.

Why Choose Our Register and Record Maintenance Services?

We provide end-to-end register and record maintenance solutions tailored to corporate needs. Our services include:

Comprehensive documentation of statutory registers and records

Regular updates as per the latest legal requirements

Digital solutions for easy access and security

Timely alerts and reminders to ensure compliance deadlines are met

Assistance in audits and legal inspections

Conclusion

Register and record maintenance is a crucial part of corporate compliance that requires meticulous attention and expertise. By leveraging professional services, businesses can focus on their core operations while ensuring adherence to legal obligations. Partnering with experts in register and record maintenance will not only safeguard businesses from legal complications but also enhance corporate efficiency and governance.

For seamless and reliable register and record maintenance services, get in touch with us today!

#CorporateCompliance#RegisterMaintenance#RecordKeeping#StatutoryCompliance#BusinessRegulations#IndiaBusiness#LabourLaws#CorporateGovernance#AuditReady#ComplianceManagement#LegalCompliance#BusinessEfficiency#RegulatoryCompliance#TaxRecords#HRCompliance#BusinessSuccess#CorporateLaws

2 notes

·

View notes

Text

Simplify Business Finances with Accounting and Bookkeeping Services in Delhi

Running a business in a fast-moving city like Delhi? Then you already know how important it is to stay financially organized. That’s where Accounting and Bookkeeping Services in Delhi come in. Whether you're a freelancer, a startup founder, or managing a full-fledged company—these services help you keep everything from taxes to payroll in check.

Why Bother with Bookkeeping?

Honestly, bookkeeping and accounting aren't the most glamorous parts of running a business—but they’re critical.

Bookkeeping = recording transactions Accounting = analyzing financial health

When combined, they help you:

Understand your cash flow

Stay compliant with tax regulations

Avoid financial mistakes

Plan for the future

In a city as competitive as Delhi, this kind of financial clarity gives you an edge.

Benefits of Using Accounting and Bookkeeping Services in Delhi

Let’s be real—outsourcing your finances can be a game changer.

Save Time – No more late nights with spreadsheets

Stay Legal – GST and tax rules? Handled.

Get Expert Insights – Know exactly where your money is going

Focus on Growth – Let professionals handle the rest

Cost-Friendly – Way cheaper than building an in-house team

What’s Included in These Services?

When you sign up for Accounting and Bookkeeping Services in Delhi, here’s what you’re typically getting:

Day-to-Day Bookkeeping – Entries, reconciliations, ledgers

Accounting Reports – Profit & loss, cash flow, balance sheets

Tax Management – GST, TDS, income tax filings

Payroll – Salaries, compliance, payslips

Virtual CFO – Budgeting, forecasting, business planning

How to Choose the Right Service Provider in Delhi

Not all firms are the same. When looking for someone to trust with your business numbers:

Look for ICAI-certified accountants

Make sure they use good software (Zoho Books, Tally, QuickBooks)

Ask about experience with your industry

Transparency in pricing = a must

Best for Businesses Like...

E-commerce brands

Clinics and healthcare startups

Education platforms

Manufacturers

Tech companies and freelancers

Wrapping It Up

If you’re serious about taking control of your business finances, don’t try to juggle it all yourself. The right Accounting and Bookkeeping Services in Delhi can make all the difference—helping you stay on top of things, avoid penalties, and grow confidently.

2 notes

·

View notes