#IRS Tax Help

Explore tagged Tumblr posts

Text

Resolving Common Tax Issues: A Complete Guide for Taxpayers and Small Businesses

Navigating tax issues can be one of the most stressful challenges for individuals and small businesses. Tax laws are intricate, the paperwork is overwhelming, and dealing with the IRS can feel intimidating. Whether you're a taxpayer facing back taxes or a small business worried about IRS wage garnishment, understanding your options is critical.

This guide will break down common tax problems, explain various solutions like the IRS Fresh Start Program, and help you determine whether professional tax resolution services are right for your situation. By the end of this blog, you'll have the tools and insights needed to take control of your tax situation.

Understanding Common Tax Issues

Taxes are an inevitable part of life and running a business, but mistakes and complications can happen. You might miss filing deadlines, underreport income, or struggle to pay what you owe. These problems can escalate quickly, especially when the IRS imposes penalties or initiates legal actions like wage garnishment.

Yet, it’s important to remember you're not alone. Thousands of people and small businesses deal with similar challenges every year. Navigating tax issues starts with understanding the type of problem you’re facing and knowing your options for resolution.

Identifying Your Tax Problem: Common Scenarios

The IRS handles many kinds of tax problems, but some issues tend to be more common than others. Here are examples of situations taxpayers frequently encounter:

Back Taxes

Failing to pay your taxes by the due date can result in accumulating back taxes. Over time, penalties and interest can inflate the total amount you owe.

Tax Liens and Levies

If back taxes remain unpaid, the IRS may issue a tax lien (a claim against your property) or a levy (the seizure of assets like bank accounts or property).

IRS Wage Garnishment

The IRS can garnish your wages to recover unpaid taxes. This means your employer is required to withhold a portion of your paycheck and send it directly to the IRS.

Tax Penalties and Interest

Even small errors on tax returns, such as entering incorrect amounts or missing deadlines, can result in significant penalties and growing interest.

By identifying your specific situation, you can begin to explore solutions tailored to resolving your tax issues.

IRS Fresh Start Program: A Viable Solution?

The IRS Fresh Start Program is designed to make it easier for struggling taxpayers to resolve their tax debts. It’s an option worth exploring if you're dealing with significant arrears.

What Is the Fresh Start Program?

The IRS Fresh Start Program offers initiatives like installment agreements, offers in compromise (settling for less than the full amount owed), and penalty relief. These measures are intended to make tax repayment more manageable for individuals and small businesses.

Who Qualifies?

Generally, the program is available to taxpayers with outstanding tax debts who demonstrate financial difficulty. For example, if your tax debt is below a certain threshold and you meet specific income and expense criteria, you may qualify for relief.

How to Apply

Applying for the Fresh Start Program involves submitting the necessary IRS forms along with supporting documentation. It’s usually a good idea to seek professional guidance to ensure your application is complete and accurate.

Dealing with IRS Wage Garnishment

Wage garnishment can create an immense financial strain, but there are options to stop or reduce the garnishment. Here’s what to do if the IRS has begun taking a portion of your paycheck:

Understand the Process

The IRS will notify you before wage garnishment begins by sending you a series of notices. If unpaid taxes remain unresolved, the garnishment starts.

Respond to Notices Quickly

Don’t ignore IRS notices. Responding promptly can give you opportunities to negotiate or appeal the garnishment.

Explore Resolution Options

Depending on your financial situation, you might be able to stop garnishment through:

Payment Plans: Arrange a monthly installment agreement with the IRS.

Offer in Compromise: Negotiate to pay less than you owe if you qualify.

Fresh Start Penalty Abatement: Request relief for penalties associated with your unpaid taxes.

It’s often helpful to work with tax resolution services, especially if you’re unsure about the best course of action.

Tax Resolution Services: When to Seek Professional Help

While many tax problems can be addressed directly with the IRS, there are times when professional assistance is invaluable. Tax resolution services are backed by experienced professionals, including tax attorneys and enrolled agents, who specialize in resolving complex tax issues.

When Do You Need Tax Experts?

When your debt is substantial (e.g., over $10,000)

If you’re overwhelmed with IRS notices or legal actions

When your tax situation involves complicated issues like multiple years of unpaid taxes or audits

What Services Do They Offer?

Negotiating with the IRS on your behalf

Preparing and submitting applications for programs like the Fresh Start Program

Helping minimize penalties and interest

Representing you in case of audits or legal disputes

Hiring tax resolution services may save you significant time and reduce the stress of handling tax issues on your own.

DIY Tax Resolution: Steps You Can Take

If you prefer to tackle your tax issues independently, there are actionable steps you can take to resolve common problems:

1. Review IRS Notices

Carefully read all correspondence from the IRS to understand your specific issue and deadlines.

2. Gather Documentation

Organize necessary documents, such as past tax returns, receipts, and records of payments.

3. Contact the IRS

Reach out to the IRS directly. Their agents can provide guidance on payment plans, penalty relief, and other options.

4. Set Up a Payment Plan

If you can’t pay your debt in full, request a payment plan that divides your debt into manageable monthly amounts.

5. Correct Filing Errors

For errors on past returns, file amendments using Form 1040-X.

While DIY tax resolution is possible, it requires diligence and attention to detail. If the process becomes overwhelming, don’t hesitate to seek professional IRS tax help.

Resources for Taxpayers: IRS and Third-Party Assistance

There are numerous resources available to assist taxpayers:

IRS Resources

IRS.gov: Find forms, instructions, and detailed information about various programs like the Fresh Start Program.

Interactive Tax Assistant: Use this tool to get answers to common tax-related questions.

Taxpayer Advocate Service: Independent advocacy to assist in resolving tax issues.

Third-Party Resources

Tax Resolution Services: Companies with expertise in negotiating with the IRS on your behalf.

Local Tax Clinics: Many nonprofit organizations offer free or low-cost tax assistance for low-income individuals.

Taking Control of Your Tax Situation

Facing tax issues doesn’t have to feel like an insurmountable challenge. Whether it’s taking advantage of the IRS Fresh Start Program, dealing with IRS wage garnishment, or seeking professional tax resolution services, there are solutions for nearly every tax problem.

Remember, the sooner you address the issue, the more options you’ll have. Don’t wait for the problem to escalate. Take proactive steps today and explore the resources and strategies outlined in this guide to regain control of your finances.

Struggling with tax issues? Reach out to a trusted tax resolution service or visit the IRS website to get started with tools and programs designed to help.

0 notes

Text

Accounting Services Northern Virginia

Accounting Records Retention Services provided by EBS, a full-service accounting firm in Northern VA. Download our Free Records Retention Guide. Get your FREE Copy today! Log on http://www.ebservicesva.com/accounting/records-retention/

0 notes

Text

Accounting can help you succeed in your small business by providing you with insights into your overall financial health, showing you opportunities for growth, and keeping you organized when you file your taxes. For more details log on http://www.ebservicesva.com/

0 notes

Text

So not only have skybreakers existed as a secret society all this time, there's also been an offshoot group of a second even more secret society of skybreakers, that even most members of the first group are unaware of...

#wind and truth spoilers#what does the even more secret group get up to? they're supposed to be good guys right?#maybe they focus their energy on investigating tax evasion schemes and such?#is that why no one knows they exist? no one cares?#you discover them and they're literally just auditing finances. all of them.#and you say ''hey can't you guys fly and destroy stuff?'' and they go ''i don't think that would help in this situation''#and you wait for them to do something cool but in the end they just go to the offender and make them pay a fine#maybe that's it.#if skybreakers were the irs instead of secret police they would not only be the best order but the most morally correct order as well

22 notes

·

View notes

Text

.

#everything is falling apart#we were supposed to be doing better than this but my partner lost his job last month and everything is falling apart because we had to miss#a couple payments on things#he has a good job now but we’re so far behind#my job has literally just been putting food on the table and keeping the lights on#we were kinda hoping we’d have our tax return with child tax credits on it to help us but that’s been held up as well#and contacting the irs is fucking impossible#I’m so beyond stressed out I can’t think straight

3 notes

·

View notes

Text

Month 4, day 12

Okay, so, hahaha, does anyone read my tags? Does anyone remember how I said I fucked up a thing but it's fine now because I fixed it? Yeah I fixed it worse than I started so, um, oops! And I don't feel like trying to figure out how to fix that, so I relegated the first attempt to a backup file and started over from scratch, paying much closer attention to the process this time.

And you know what? I think it's going better than last time :D

We'll find out together :P

#the great artscapade of 2025#art#my art#blender#blender render#blender 3d#cycles render#cg fast track#hard surface modeling boot camp 3#not that I wasn't paying attention before#I just let my hubris get the best of me#as one does#in related news I went through all my material creation templates and updated them to work with a new setup I'm trying#just rearranged a few windows and am utilizing a pre-built workspace that I've neglected this whole time#but I'm excited about it :D#for no real reason bc it doesn't change anything in the material creation process anyway lol#at least not for the procedural materials I'm making for my asset library that is#in UNrelated news I filed my taxes today and this year I'm getting money back* I'm so happy :'D#thanks to my roommate for helping me fix my W-4#*assuming the IRS continues to function

2 notes

·

View notes

Text

#true story#i’m self employed and them mfs didn’t do shit to help me get here why on earth am i paying them???#irs#taxes#tax season#memes#shitpost

3 notes

·

View notes

Text

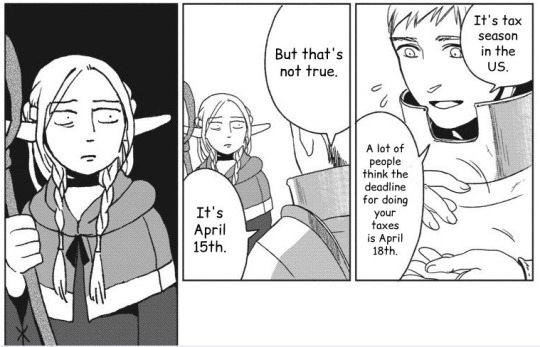

Link

Well that’ll be practically everyone since current ticket prices can be that high for regular face value tickets 💀

#ticketmaster#boost#irs#taxes#ticket resellers#tickets#ticket help#I couldn’t get over the paywall for this article#so that’s all I have#stubhub

34 notes

·

View notes

Text

My taxes are finally done

#crawling into a hole to recuperate#got help from an irs volunteer at my university tax event#so I’m not as drained as I’d usually be#could really go for a nap but I have a graded discussion soon#will emerge from my hole in a few hours (maybe) when I’m better#saw I got tagged in something#and saw some tags on some of my posts#love that#love reading additions to my stuff#no fandom

14 notes

·

View notes

Text

2 notes

·

View notes

Text

Hi mom and dad will you please fill out your part of the fafsa so i won’t need to put myself at risk to pay for necessities. Thank you very much

#b#i was there for 3 hours and it did not get done. Meisjes help me#am getting money back for taxes so that will be very helpful. Thank you IRS

7 notes

·

View notes

Text

My brother said something the other day about how no-one could prove if the current anti-Israel boycotts are actually making an impact cuz there could be other reasons people aren't eating at McDonald's or whatever

But besides the fact that there are many articles easily find-able online saying that the companies are aware of and feeling the impact of such protests, and some are even making some changes, I needed to make a point to him about why I participate in boycotts whether they're successful or not

But my brother tends to get annoyed and stop listening whenever I talk real politics, so I tried to make a really simple analogy

Let's say there's a man outside our house, and he is just beating people to death with sticks. Not people from our neighborhood, but still, people. We can't call the cops to stop him, because they think he's doing a great job. And we can close the blinds and ignore him, but he's still there and we know it.

And he has a big pile of sticks, so when one breaks he can get another to beat the next person to death with

So one day you have to go outside and the man turns to you and says, "Hey. Can you pass me a stick?"

And maybe it doesn't matter if you do or not. Maybe someone else will give him a stick anyway, or he'll get one on his own, or he'll start punching people

But I don't want to give him a stick.

And maybe I can't stop him, but I at least don't want to help him

At this point my brother tried to make a joke (because that's what he always does in every conversation) and he said something like "What if you don't give him the stick and then he beats YOU to death"

And I was like, "That's a great point, actually, because the Yemeni wouldn't let weapons shipments through their waterways so Israel bombed them."

And the analogy was broken but. I hope I made my point

Maybe I don't have the power as an individual half a world away to stop a genocide. But I at least want to not contribute to it

#i don't want to put this in the main relevant tags because i don't want to attract the ire of certain folks on this site#iykwim#mod post#family stuff#and i know i am oversimplifying massively here but i just wanted to get a point across to my brother without getting too granular about it#because he was only gonna listen for so long#i guess i am posting this in case someone else has a family member who disparages them for participating in a boycott#and maybe this analogy might help a bit#i already feel really helpless in the face of what's going on in the world so tbh it really upset me when he implied#that the boycotts may not be doing anything. maybe starbucks profits are down cuz they suck and are expensive he says#i need to believe that it is doing something. i need to believe my actions are making some tiny miniscule difference#cuz i can't donate much. i can't go over there and help people. i can't evacuate them or heal their wounds or save their families#but i can at least avoid giving my money to some of the companies that are supporting their oppressors#i wish i could avoid giving money to everyone who supports israel but unfortunately#some companies own half of everything and i can't keep track#and also i'll get in trouble if i don't pay taxes#i am babbling now sorry. it's nearly 2 am. i'm gonna... leave this here

5 notes

·

View notes

Text

Back Tax Help

3 notes

·

View notes

Text

my darling little quip about not being able to file my taxes was real actually lmfao.

#i filed w the irs's fillable forms a while back and just did my federal#and i can't log in to any state forms sites for unknown reasons#i tried to file through turbo tax but then they submitted my federal a second time#so it got rejected bc it looks like i double filed and i waited an hour to talk to a representative and she was like#yeah there's no way to file just your state taxes. you have to print them and mail them and you can't until they reject again#bc i tried to deselect the federal one and it went through anyway#and i can't e-file an extension request because nothing is letting me gksjklfsj#which it looks like i'm getting a return so it doesn't Really matter but like. hello. hello. hello#i can't wait to move states i actually have come to sort of hate this little place <3#and this is not helping slkfjlsjgklsjg#oisin.txt#oisin.n

2 notes

·

View notes

Text

tax stuff in tags

#hey folks#i don’t write much on this blog but just some overview stuff about taxes#the government wants your money#but it’s okay! they are willing to work with you#you can even grab a fillable PDF from the IRS website and watch a youtube video on how to fill it and what forms you need.#the irs is usually on standby after tax season to get calls and the like#if you call them and say that you missed the deadline#that will not be upset! they are there to get your money not to stress you about it#the IRS is underfunded so it might take a bit to get that help#but i promise there will be help for you if you need it#if there’s any specific questions you have#please DM me#i’ll send some info or try to dig up a link for ya#wish ya all the best folks <3

144K notes

·

View notes

Text

Caught in a Tax Trap? Why You Need a Criminal Tax Lawyer in NYC

Introduction

Think of your taxes like a fragile glass maze — one misstep can shatter everything. For many people, tax time is already stressful. But when those problems escalate into criminal territory, the stakes skyrocket. That’s where a criminal tax lawyer comes into play. Whether you’re navigating IRS scrutiny or facing charges, having the right legal expert on your side — especially a trusted criminal tax attorney NYC or New York tax defense attorney — can protect your financial future and your freedom.

What Is Criminal Tax Law?

Criminal tax law refers to violations of the tax code that involve deliberate wrongdoing — think tax evasion, filing false returns, or obstructing the IRS. While civil issues deal with unintentional mistakes, criminal tax cases focus on intent. If the IRS believes you meant to cheat the system, the matter becomes criminal, and penalties become much more severe.

Common Criminal Tax Offenses

Some common offenses include tax evasion, intentionally failing to file tax returns, submitting false documents, or underreporting income. Business owners might also get into trouble for not paying employment taxes or misclassifying workers. Any of these actions — especially if repeated or involving large amounts — can trigger an investigation and potential criminal charges.

When Does a Tax Issue Turn Criminal?

A tax problem becomes criminal when the IRS believes there was intent to defraud or deceive. One late return might not be a big deal, but a pattern of false reporting, hiding income, or creating fake deductions shows willfulness. That’s what separates an honest mistake from a crime. The IRS uses forensic accountants and investigators to spot these patterns — and once they do, you’re no longer in civil territory.

Why You Need a Criminal Tax Lawyer

Traits of a Great Criminal Tax Attorney NYC

Choosing a skilled criminal tax attorney NYC can make or break your case. The best ones bring a combination of sharp legal insight, familiarity with IRS practices, and courtroom confidence. They also need to be great communicators, both with clients and government agencies. NYC’s legal landscape is tough — you need someone who’s even tougher.

How a New York Tax Defense Attorney Builds Your Case

A New York tax defense attorney dives deep into your financial records, analyzes the IRS’s evidence, and looks for errors, overreach, or procedural missteps. They might bring in forensic accountants or negotiate with prosecutors to reduce charges. They aim to either dismiss the case or settle it favorably before trial.

The IRS Criminal Investigation Division: What You Should Know

The IRS Criminal Investigation Division (CID) isn’t your average government office. These agents are law enforcement officers who investigate suspected tax crimes. They carry badges and firearms, and they don’t show up unless the IRS has serious concerns. If you hear from CID, it’s a flashing red warning light to call a lawyer immediately.

Facing Tax Charges in NYC? Here’s What to Do

If you’re under investigation:

Do not talk to the IRS or CID agents without your attorney present.

Preserve all documents — never delete emails or shred paperwork.

Seek immediate counsel from a criminal tax attorney near NYC.

Avoid making statements that could be interpreted as an admission.

The Role of Lease Incentive Tax Treatment in Business

Lease incentive tax treatment might sound like accountant-speak, but it has real-world implications. When a landlord offers financial perks — like cash payments or property upgrades — to get a business to sign a lease, those incentives need to be reported correctly for tax purposes.

Misreporting or misunderstanding how to treat these incentives can trigger an audit or worse, an investigation. That’s why it’s crucial to have an experienced tax professional or attorney guide you through the process.

Real-Life Examples of Criminal Tax Cases

Consider a New York restauranteur who hid cash earnings to avoid taxes. Eventually, employees tipped off the IRS, leading to a full-blown investigation. The owner was convicted of tax evasion and served 18 months in prison.

In another case, a corporate executive misreported lease incentives and overstated deductions. The discrepancy triggered an audit that uncovered falsified documents, resulting in criminal charges.

These examples show how even small decisions can snowball into major legal battles if handled poorly.

Penalties You Could Face for Tax Crimes

Tax crimes come with severe consequences. A conviction can lead to large fines, restitution payments, and jail time. You might also lose professional licenses, business privileges, or contracts. Beyond legal penalties, the emotional and reputational damage can be devastating.

For example, tax evasion can bring up to five years in prison and a $250,000 fine per offense. Filing a false return? That’s up to three years. And these penalties stack if there are multiple violations.

The Legal Process: From Investigation to Trial

The process typically starts when the IRS flags suspicious returns. CID then opens a case, conducts surveillance, interviews witnesses, and may issue subpoenas. If enough evidence is found, the Department of Justice gets involved and formal charges are filed. Your attorney may negotiate a deal or proceed to trial. The entire journey can take months — or even years.

Civil vs Criminal Tax Issues: Know the Difference

The main distinction lies in intent and consequence. Civil issues stem from errors or oversight, leading to penalties and interest. Criminal issues involve willful misconduct and lead to prosecution. If you’re unsure where your situation falls, consulting a New York tax defense attorney is your safest bet.

How to Avoid Tax Trouble in the First Place

Avoiding criminal tax problems begins with accurate record-keeping and honesty in reporting. Work with reputable accountants, review your filings thoroughly, and ask questions when unsure. If you run a business, educate yourself on employer obligations and seek legal advice when major financial decisions — like lease incentives — are involved.

Finding a Criminal Tax Attorney Near NYC

Conclusion

Criminal tax issues aren’t just a legal headache — they can become life-changing disasters. Whether you’re being audited, investigated, or formally charged, the right criminal tax lawyer can be your strongest defense. If you’re in New York, having an experienced criminal tax attorney NYC or New York tax defense attorney on your side can protect your livelihood, your reputation, and your freedom.

Tax trouble doesn’t disappear on its own. Take control today — before the IRS takes control for you.

Frequently Asked Questions (FAQs)

1. What does a criminal tax lawyer do exactly? They specialize in defending individuals or businesses accused of tax crimes, guiding them through investigations, negotiations, and, if necessary, court proceedings.

2. How do I know if I need a criminal tax attorney near NYC? If the IRS has contacted you about potential fraud or opened a criminal investigation, it’s time to speak with a lawyer.

3. What is lease incentive tax treatment? It refers to how financial or property-related incentives given in lease agreements are reported and taxed. Incorrect reporting can lead to penalties or investigations.

4. Can a New York tax defense attorney help with state and federal matters? Yes, many are qualified to handle both types of cases, ensuring consistent and informed legal support.

5. What’s the difference between a CPA and a criminal tax attorney? A CPA manages finances and tax filings; a criminal tax attorney defends you in legal matters when those filings become the subject of investigation or prosecution.

#Nyc Tax Preparation#Tax Fraud#Irs#Tax Lawyer#Legal Help#irs lawyer nyc#criminal tax lawyer#criminal tax lawyer new york#best tax lawyer nyc#legal advice#best tax lawyer#best payroll tax lawyer new york#new york#tax law

0 notes