#MONEY TRANSFER

Explore tagged Tumblr posts

Text

Do you mind a head 👅🫦dm,like,reblog and follow 🫦😈

#curvy blonde#hannibal#inked and curvy#lotr#mtf trans#my chemical romance#pro transid#sexy and curvy#thicc and curvy#thicc as fuck#trans beauty#trans community#trans pride#trans artist#trans rights#transgirl#trans woman#trans man#transformation#transfem#transgender#transisbeautiful#transmasc#transparent#transformers#transsexual#money transfer#transfer portal#football transfer news#airport transfer

22 notes

·

View notes

Text

#lgbt pride#trans#trans community#trans pride#transgenresworld#transgirl#lgbtq#mtf trans#trans goddess#trans woman#trans man#money transfer#transgender#transgurl

56 notes

·

View notes

Text

i like pussy in my mouth and dick inside mime

7 notes

·

View notes

Text

#earn money online#happy pills#clone card#clone cards#earn money fast#girls who do pills#fashion week#girls who smoke weed#grow weed#give me money#make money online#i need money#how to earn money#money in the bank#money management#money problems#money slave#money transfer#moneymindset#moneytips#old money#pay me money#send me money#money#the clone wars#clone high#clone troopers

7 notes

·

View notes

Text

Money leaving my account: 🏃💨 Money arriving at their account: 🚶♂️

2 notes

·

View notes

Text

https://dailymegajackpot.com/

#online ticket selling#online ticket booking#money problems#money transfer#money laundering#finances#income#invest

2 notes

·

View notes

Text

Revolut- BEST free transfer - get FROM HERE to get also… gifts … = https://www.revolut.com/referral/?referral-code=zwordnn1dk!FEB1-24-AR-CODE #money #giftideas #giftforhim😍😍 #giftFORparents #giftforher😍😍

#gift#money#travel#eshop#tourism#gift ideas#earn money online#make money online#how to earn money#finances#opportunities#cash#invest#money transfer#gift for him

2 notes

·

View notes

Text

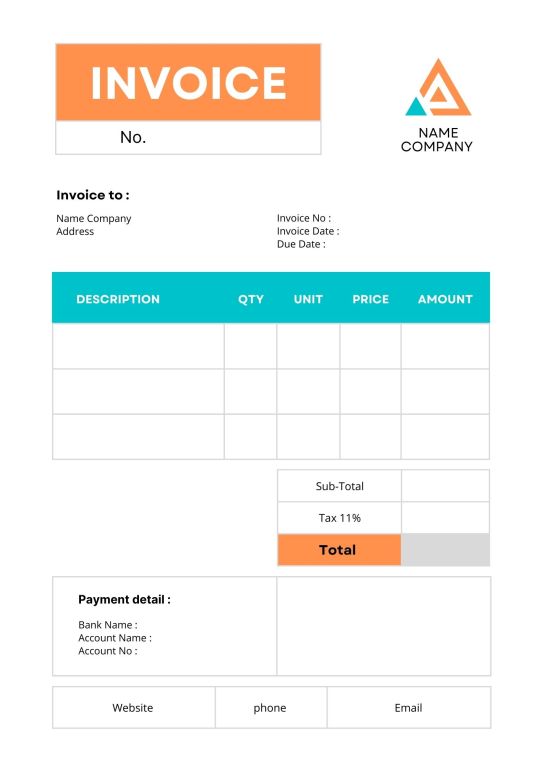

Orange Blue Minimalist Business Invoice A4 Document

Orange Blue Minimalist Business Invoice A4 Document is a vibrant and modern template designed for businesses that value clarity and style. Featuring a clean layout with orange and blue accents, it balances professionalism with a touch of creativity.

Buy this

#free invoice software#invoice software development bd#money transfer#finance#money#invoice discounting#invoice management system#invoice maker#invoice processing#invoice

2 notes

·

View notes

Text

The best way to send money to Cuba is Bank Transfer: Sending money from your account to the beneficiary bank account to make it cost-effective and speedy you can choose us as your international money transfer service provider.

No Limit on overseas money transfers, you have a reason for sending money to Cuba either personal or business, you have funds for the transfers and you have all the proof of the overseas money transfers related queries – You can send money unlimited times and in unlimited amounts through our service.

#international money transfer#money transfer online#currency#money transfer services#finance#money#money transfer#unicorn currencies#cuba

3 notes

·

View notes

Text

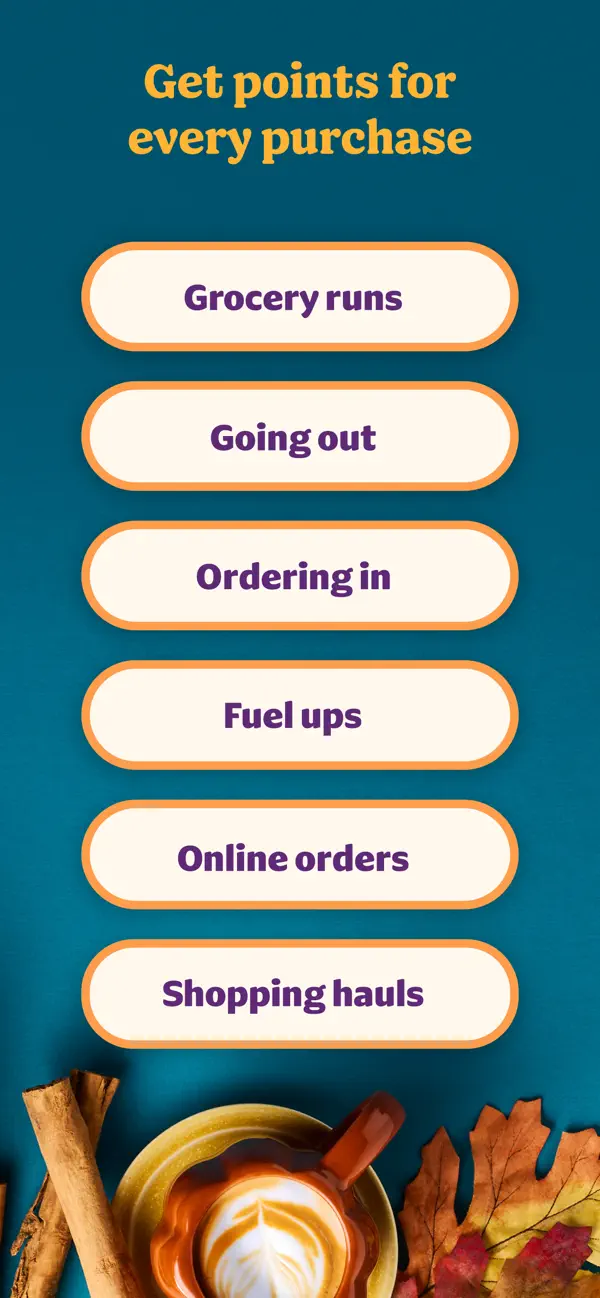

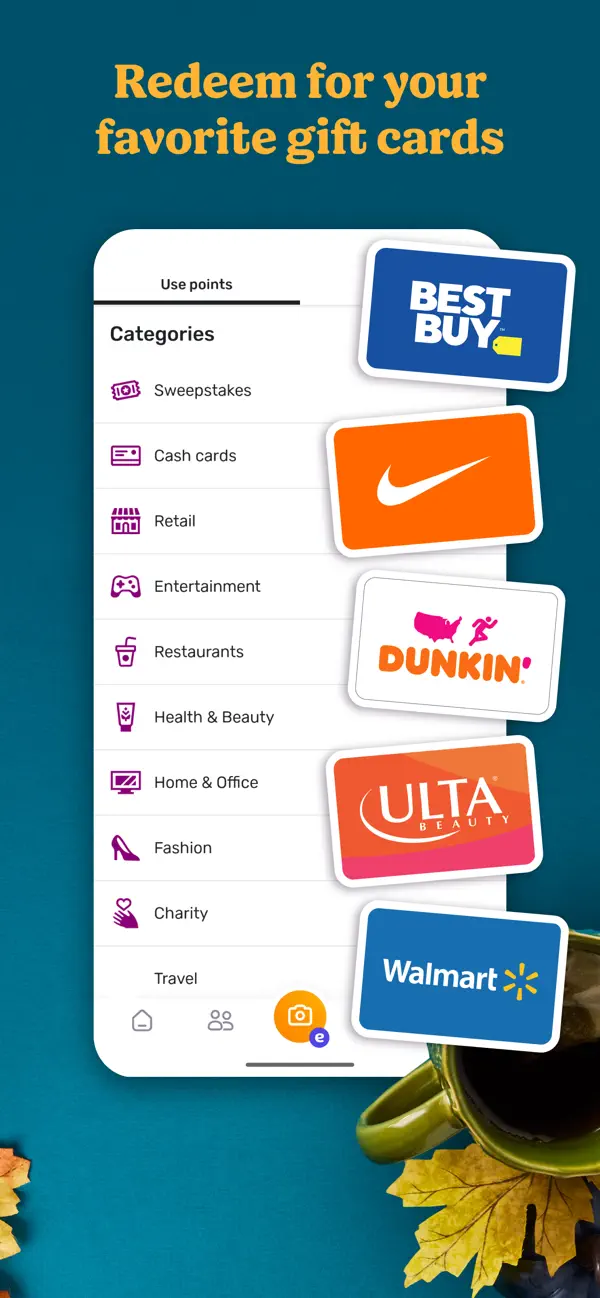

💸Redeem for free gift cards 💸💸

#financial help#shopping#point and shoot#louis de pointe du lac#batman#halloween#artists on tumblr#financial markets#aww#the amazing digital circus#money management#money problems#money transfer#money saving#management#finances#income#opportunities#money slave#unique gifts#gift card#gift exchange#morven hellwain#hellwitch#hell week#halloween 2024#happy halloween#halloween vibes#halloween costumes

2 notes

·

View notes

Text

Simple Steps to Transfer Money from PayPal to Your Bank

It's simple to move money from PayPal to your bank account. Make sure PayPal is connected to your bank first. Using your PayPal account, you can accomplish this. Navigate to the "Wallet" area. Click on "Link a Bank". Input your bank account number and routing information. You can start transferring money as soon as your bank is connected. It's time to transfer your funds now. You may view your balance on the PayPal homepage. "Transfer Funds" should be clicked. Select the associated bank account to which you wish to transfer funds. You have the option to transfer all or only a portion of the balance. The transfer is finished in one to three business days. Customers claim that their money comes in quicker. Weekends and holidays, however, may result in delays. Great advice: make sure there are no costs. Normal transfers are at no cost. Nevertheless, PayPal provides a rapid transfer option if you need money right away. There is a nominal charge, often 1%. The funds show up in a matter of minutes. For some consumers, this cost is justified, particularly in an emergency. When I wanted to pay my rent urgently, I chose the instant option, and it worked perfectly!

Learn about InsureIndex: Your Complete Source for USA Contact Details

Explore the InsureIndex directory for comprehensive access to a wealth of USA contact information. With a large number of listings, this resource guarantees that you will be able to locate specific connections in different US locations and industries. InsureIndex is a trusted platform to expedite your search, whether you're looking for professional connections, customer service numbers, or business contacts. Make use of its extensive database and user-friendly interface to retrieve the most up-to-date and relevant contact information for your requirements. Discover comprehensive American company contact information quickly and easily by using the InsureIndex directory right now.

2 notes

·

View notes

Text

hi hottie

¿do u need help to come?

just

and see u in my dm

#make you come#lesbian#men and women#money transfer#older man younger girl#send me money#pay me money#sexy chat#bisexual

4 notes

·

View notes

Text

Clone card available

#clone cards#clone card#earn money online#earn money fast#girls who do pills#girls who smoke weed#fashion week#grow weed#give me money#happy pills#i need money#make money online#how to earn money#money in the bank#money management#money problems#money slave#money transfer#moneymindset#old money#moneytips#pay me money#send me money#pride month#money

5 notes

·

View notes

Text

Join Wise and get £50. It's simple, quick, and rewarding!

Wise Money, Wise choices!

Looking for a smarter way to handle your money across borders? Wise.com is the answer. And here’s an even better reason to join—sign up with my invite, and you’ll get £50!

Smart Transfers, Happy Wallets!

Wise.com makes sending, receiving, and converting money internationally fast, easy, and affordable. With real exchange rates and low fees, you’ll save more on every transaction. Plus, their platform is user-friendly, so you can manage your money with confidence.

Save More, Send Smarter!

Signing up is simple. Just use my invite link, create your account, and you’ll get £50 to kickstart your journey with Wise. It’s a win-win—secure your bonus and start saving today!

Your Money, Your Way—Easily!!!

#payment gateway#payment gateway for website#what is a payment gateway#best payment gateway#white label payment gateway#online payment gateway#what is payment gateway#own payment gateway#create payment gateway#cashfree payment gateway#money transfer#wire transfer#transfer payments#wise transfer#transfer money#payments#wise money transfer#transfer#paypal transfer#money transfer service#transfer payments economics#payment#transferwise money transfer#transfer payments macroeconomcis#bank transfer#how to transfer money#paypal instant transfer#neft transfer#transfer money from stripe to bank#transferwise money transfer review

2 notes

·

View notes

Text

Eko API Integration: A Comprehensive Solution for Money Transfer, AePS, BBPS, and Money Collection

The financial services industry is undergoing a rapid transformation, driven by the need for seamless digital solutions that cater to a diverse customer base. Eko, a prominent fintech platform in India, offers a suite of APIs designed to simplify and enhance the integration of various financial services, including Money Transfer, Aadhaar-enabled Payment Systems (AePS), Bharat Bill Payment System (BBPS), and Money Collection. This article delves into the process and benefits of integrating Eko’s APIs to offer these services, transforming how businesses interact with and serve their customers.

Understanding Eko's API Offerings

Eko provides a powerful set of APIs that enable businesses to integrate essential financial services into their digital platforms. These services include:

Money Transfer (DMT)

Aadhaar-enabled Payment System (AePS)

Bharat Bill Payment System (BBPS)

Money Collection

Each of these services caters to different needs but together they form a comprehensive financial toolkit that can significantly enhance a business's offerings.

1. Money Transfer API Integration

Eko’s Money Transfer API allows businesses to offer domestic money transfer services directly from their platforms. This API is crucial for facilitating quick, secure, and reliable fund transfers across different banks and accounts.

Key Features:

Multiple Transfer Modes: Support for IMPS (Immediate Payment Service), NEFT (National Electronic Funds Transfer), and RTGS (Real Time Gross Settlement), ensuring flexibility for various transaction needs.

Instant Transactions: Enables real-time money transfers, which is crucial for businesses that need to provide immediate service.

Security: Strong encryption and authentication protocols to ensure that every transaction is secure and compliant with regulatory standards.

Integration Steps:

API Key Acquisition: Start by signing up on the Eko platform to obtain API keys for authentication.

Development Environment Setup: Use the language of your choice (e.g., Python, Java, Node.js) and integrate the API according to the provided documentation.

Testing and Deployment: Utilize Eko's sandbox environment for testing before moving to the production environment.

2. Aadhaar-enabled Payment System (AePS) API Integration

The AePS API enables businesses to provide banking services using Aadhaar authentication. This is particularly valuable in rural and semi-urban areas where banking infrastructure is limited.

Key Features:

Biometric Authentication: Allows users to perform transactions using their Aadhaar number and biometric data.

Core Banking Services: Supports cash withdrawals, balance inquiries, and mini statements, making it a versatile tool for financial inclusion.

Secure Transactions: Ensures that all transactions are securely processed with end-to-end encryption and compliance with UIDAI guidelines.

Integration Steps:

Biometric Device Integration: Ensure compatibility with biometric devices required for Aadhaar authentication.

API Setup: Follow Eko's documentation to integrate the AePS functionalities into your platform.

User Interface Design: Work closely with UI/UX designers to create an intuitive interface for AePS transactions.

3. Bharat Bill Payment System (BBPS) API Integration

The BBPS API allows businesses to offer bill payment services, supporting a wide range of utility bills, such as electricity, water, gas, and telecom.

Key Features:

Wide Coverage: Supports bill payments for a vast network of billers across India, providing users with a one-stop solution.

Real-time Payment Confirmation: Provides instant confirmation of bill payments, improving user trust and satisfaction.

Secure Processing: Adheres to strict security protocols, ensuring that user data and payment information are protected.

Integration Steps:

API Key and Biller Setup: Obtain the necessary API keys and configure the billers that will be available through your platform.

Interface Development: Develop a user-friendly interface that allows customers to easily select and pay their bills.

Testing: Use Eko’s sandbox environment to ensure all bill payment functionalities work as expected before going live.

4. Money Collection API Integration

The Money Collection API is designed for businesses that need to collect payments from customers efficiently, whether it’s for e-commerce, loans, or subscriptions.

Key Features:

Versatile Collection Methods: Supports various payment methods including UPI, bank transfers, and debit/credit cards.

Real-time Tracking: Allows businesses to track payment statuses in real-time, ensuring transparency and efficiency.

Automated Reconciliation: Facilitates automatic reconciliation of payments, reducing manual errors and operational overhead.

Integration Steps:

API Configuration: Set up the Money Collection API using the detailed documentation provided by Eko.

Payment Gateway Integration: Integrate with preferred payment gateways to offer a variety of payment methods.

Testing and Monitoring: Conduct thorough testing and set up monitoring tools to track the performance of the money collection service.

The Role of an Eko API Integration Developer

Integrating these APIs requires a developer who not only understands the technical aspects of API integration but also the regulatory and security requirements specific to financial services.

Skills Required:

Proficiency in API Integration: Expertise in working with RESTful APIs, including handling JSON data, HTTP requests, and authentication mechanisms.

Security Knowledge: Strong understanding of encryption methods, secure transmission protocols, and compliance with local financial regulations.

UI/UX Collaboration: Ability to work with designers to create user-friendly interfaces that enhance the customer experience.

Problem-Solving Skills: Proficiency in debugging, testing, and ensuring that the integration meets the business’s needs without compromising on security or performance.

Benefits of Integrating Eko’s APIs

For businesses, integrating Eko’s APIs offers a multitude of benefits:

Enhanced Service Portfolio: By offering services like money transfer, AePS, BBPS, and money collection, businesses can attract a broader customer base and improve customer retention.

Operational Efficiency: Automated processes for payments and collections reduce manual intervention, thereby lowering operational costs and errors.

Increased Financial Inclusion: AePS and BBPS services help businesses reach underserved populations, contributing to financial inclusion goals.

Security and Compliance: Eko’s APIs are designed with robust security measures, ensuring compliance with Indian financial regulations, which is critical for maintaining trust and avoiding legal issues.

Conclusion

Eko’s API suite for Money Transfer, AePS, BBPS, and Money Collection is a powerful tool for businesses looking to expand their financial service offerings. By integrating these APIs, developers can create robust, secure, and user-friendly applications that meet the diverse needs of today’s customers. As digital financial services continue to grow, Eko’s APIs will play a vital role in shaping the future of fintech in India and beyond.

Contact Details: –

Mobile: – +91 9711090237

E-mail:- [email protected]

#Eko India#Eko API Integration#api integration developer#api integration#aeps#Money transfer#BBPS#Money transfer Api Integration Developer#AePS API Integration#BBPS API Integration

2 notes

·

View notes