#Mobile Banking System Software

Explore tagged Tumblr posts

Text

Smart Field Force Management for Banks & Financial FirmsAsti Infotech offers cutting-edge field force management solutions tailored for banks and financial institutions. Our platform ensures complete visibility, real-time tracking, and seamless task management for field agents, helping your organization stay compliant, efficient, and customer-focused. With rising regulatory requirements and increasing customer expectations, banks and NBFCs need smart tools to streamline operations and reduce risks. Our solution helps financial organizations monitor employee movement, schedule and assign tasks, verify visit authenticity through GPS and timestamp data, and generate insightful reports to optimize performance. Whether it’s loan collections, field verifications, or sales visits, our system supports secure, trackable, and automated workflows—reducing manual errors and improving accountability. Asti’s platform is scalable, cloud-based, and easy to integrate with your existing systems. Empower your team with a mobile app for on-the-go task updates, attendance marking, geo-fencing, and instant communication. Enhance customer trust with faster response times and verified interactions. Choose Asti Infotech to bring greater transparency, operational excellence, and cost-efficiency to your banking field operations. Perfect for banks, NBFCs, microfinance institutions, and fintech service providers.

#Field force management software for financial institutions#Best tracking solution for banking field executives#Task management system for NBFC field agents#Automated field operations for banks and microfinance#Mobile app for loan recovery agents tracking

0 notes

Text

Humans are weird: Prank Gone Wrong

( Please come see me on my new patreon and support me for early access to stories and personal story requests :D https://www.patreon.com/NiqhtLord Every bit helps)

“Filnar Go F%$@ Yourself!” was possibly the most disruptive software virus the universe had ever seen.

The program was designed to download itself to a computer, copy the functions of existing software before deleting said software and imitating it, then running its original programming all the while avoiding the various attempts to locate and remove it by security software.

What was strange about such a highly advanced virus was that it did not steal government secrets, nor siphon funds from banking institutions, it ignore critical infrastructure processes, and even bypassed trade markets that if altered could cause chaos on an unprecedented scale. The only thing the software seemed focused on was in locating any information regarding the “Hen’va” species, and deleting it.

First signs of the virus outbreak were recorded on the planet Yul’o IV, but once the virus began to migrate at an increasing rate and latched on to several subroutines for traveling merchant ships things rapidly spiraled out of control. Within a week the virus had infected every core world and consumed all information regarding the Hen’va. It still thankfully had not resulted in any deaths, but the sudden loss of information was beginning to cause other problems.

Hen’va citizens suddenly found that they were not listed as galactic citizens and were detained by security forces on numerous worlds. Trade routes became disrupted as Hen’va systems were now listed as uninhabited and barren leading to merchants seeking to trade elsewhere. Birth records and hospital information for millions of patients were wiped clean as they now pertained to individuals who did not exist.

Numerous software updates and purges were commenced in attempting to remove the virus. Even the galactic council’s cyber security bureau was mobilized for the effort, but if even a single strand of the virus’s code survived it was enough to rebuild itself and become even craftier with hiding itself while carrying out its programming. This was made worse by the high level of integration the various cyber systems of the galaxy had made it so the chance of systems being re-infected was always high.

After ten years every digital record of the Hen’va was erased from the wider universe. All attempts to upload copies were likewise deleted almost immediately leaving only physical records to remain untouched.

To combat this, the Hen’va for all official purposes adopted a new name; then “Ven’dari”. In the Hen’va tongue in means “The Forgotten”, which is rather ironic as the Hen’va have had to abandon everything about their previous culture to continue their existence. The virus had become a defacto component of every computer system in the galaxy and continued to erase all information related to the Hen’va. Even the translator units refused identify the Hen’va tongue and so the Ven’dari needed to create a brand new language.

It wasn’t until another fifty years had passed before the original creator of the virus stepped forward and admitted to their crime. A one “Penelope Wick”.

At the time of the programs creation Ms. Wick was a student studying on Yul’o IV to be a software designer. While attending the institution Ms. Wick stated that a fellow student, a Hen’va named “Filnar”, would hound her daily. He would denounce her presence within the school and repeatedly declared that “what are the scrapings of humans compared to the glory of the Hen’va?”

The virus was her creation as a way of getting back at the student for his constant spite. Ms. Wick was well aware of the dangers it could pose if released into the wild and so had emplaced the limitation that the virus would only infect computers on site with the campus. The schools network was setup that students could only work on their projects within the confines of the institution to ensure they did not cheat and have others make them instead. What she had not counted on was this rule only applied to students and not teachers. So when a teacher brought home several student projects to review and then sharing those infected files with their personal computer, the virus then gained free access to the wider planets networks.

When the Ven’dari learned of this there were several hundred calls for Ms. Wick to be held accountable for her actions, and nearly twice as many made to take her head by less patient individuals who had seen their entire culture erased. Much to their dismay Ms. Wick died shortly after her confession from a long term disease that had ravaged her body for several years.

Much to her delight, she had achieved her goals of removing the source of her mockery.

#humans are insane#humans are weird#humans are space oddities#humans are space orcs#story#scifi#writing#original writing#niqhtlord01#funny#prank#prank gone wrong#virus

370 notes

·

View notes

Note

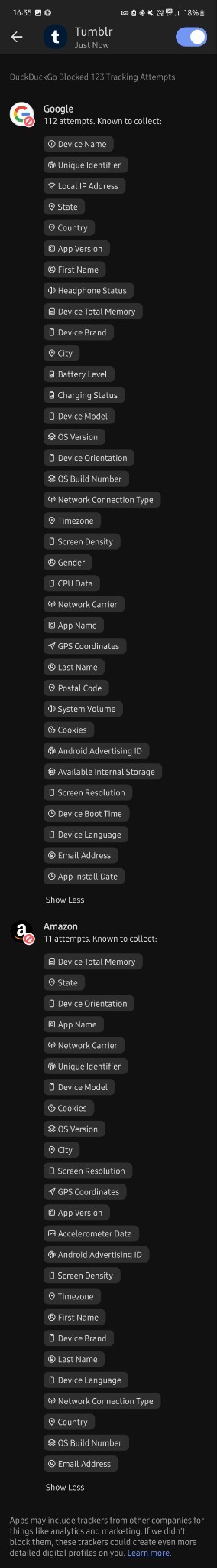

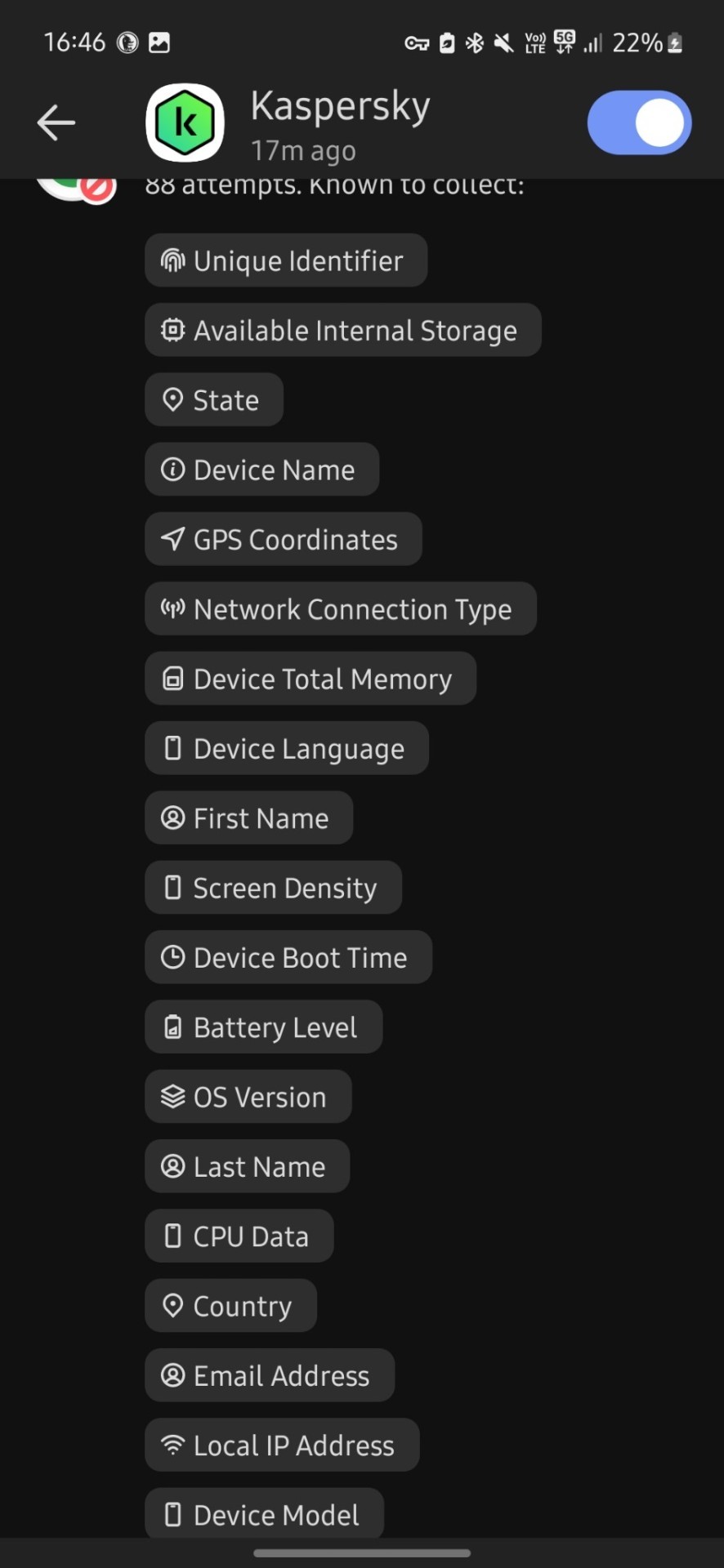

After seeing your weatherbugapp reblog i installed duckduckgo and tried it.

I don't know much about technology tbh but i downloaded this app less than 30 mins ago and in that time google tried to track me 112 times?? And they tried to collect finger prints? And my first and last name? And my gender? And my country, state and city? My gps coordinates? My postal code? My network carrier? My fricking battery level for whatever reason? Can you please tell me if this is normal at all, because i'm freaking out right now. I just turned 18 and started using mobile banking and stuff and this shit scares me

Why tf does it need to know my screen density???my system volume????my charging status????? What tf are they cooking

Now it's at 476 tracking attempts bro???? barely 5 mins passed.....

I condensed your three asks into one for readability!

And yeah, I'm very far from an expert about any of this, but as far as I know that's just. Normal. That's the normal amount of spying they're doing on your phone. I assume the numbers we see are to some extent because having been foiled, a lot of these scripts try repeatedly, since I can't imagine what use thousands of trackers per phone would be even to the great aggregators.

Tracking the phone stuff like screen resolution and battery level is because (apart from that definitely not being considered remotely 'private' so it's Free Real Estate) in aggregate that data can be used to track what phone use patterns are like on a demographic scale and therefore. Where the smart money is.

Almost all of this is getting sold in bulk for ad targeting and market analysis. This does presumably make it very hard to notice when like. Actually important stuff is being spied on, which is why I feel better about Having Apps with the duckduckgo app blocker thing.

My bank's app reportedly sells data to a couple aggregators including Google. Not like, my banking info, but it's still so offensive on principle that I avoid using the app unless I have to, and force stop it afterward.

The patterns that show up on the weekly duckduckgo blocker report are interesting. Hoopla attempts about two orders of magnitude more tracking than Libby, which makes sense because they're a commercial streaming service libraries pay by the unit for access, while Libby is a content management software run by a corporation that values its certification as a 'B' company--that is, one invested in the public good that can be trusted. The cleanness of their brand is a great deal of its value, so they have to care about their image and be a little more scrupulous.

Which doesn't mean not being a little bit spyware, because everything is spyware now. Something else I've noticed is that in terms of free game apps, the polished professional stuff is now much more invasive than the random kinda janky thing someone just threw together.

Back in the day you tended to expect the opposite, because spyware was a marginal shifty profit-margin with too narrow a revenue stream to be worth more to an established brand than their reputation, but now that everyone does it there's not a lot of reputation cost and refraining would be sacrificing a potential revenue stream, which is Irresponsible Conduct for a corporation.

While meanwhile 'developing a free game app to put on the game store' is something a person can do for free with the hardware they already have for home use, as a hobby or practice or to put on their coding resume. So while such apps absolutely can be malicious and more dangerous when they are than The Big Brand, they can also be neutral in a way commercial stuff no longer is. Wild world.

But yeah for the most part as far as I can make out, these are just The Commercial Panopticon, operating as intended. It's gross but it probably doesn't indicate anything dangerous on an individual level.

56 notes

·

View notes

Text

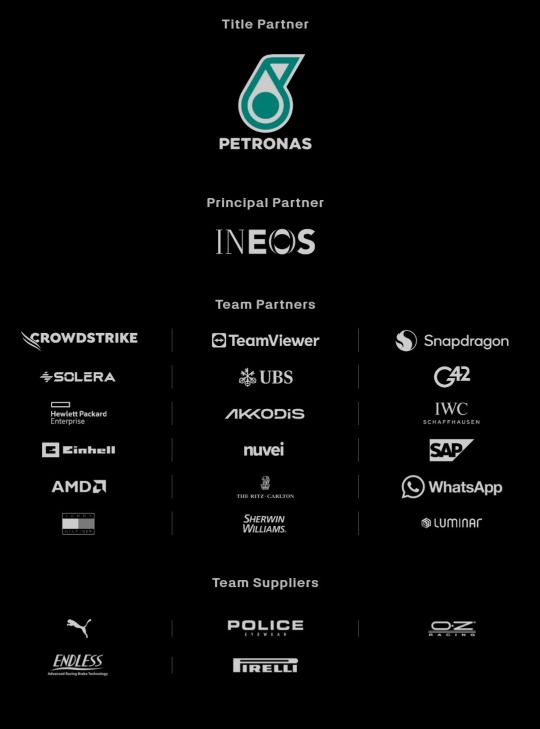

2024 team sponsors recap!

this is completely irrelevant to F1 but i study and do these stuffs for a living sooo 😩😩 2023 sponsors are based on the sponsors that are there at the beginning of the season (new sponsors that join in the middle of the season will be classified as 2024's)

Mercedes AMG Petronas F1 Team:

New sponsors: Whatsapp, Luminar (American tech company), SAP (German software company), nuvei (Canadian credit card services), Sherwin Williams (American painting company) 2024 data last update: 2024/02/14

Old sponsors that left: Monster Energy, Pure Storage (American technology company), fastly (American cloud computing services), Axalta (American painting company), Eight sleep (American mattresses company) 2023 data last update: 2023/01/07

Oracle Red Bull Racing F1 Team:

New sponsors: Yeti (American cooler manufacturer, joined later in 2023), APL (American footwear/athletic apparel manufacturer, joined later in 2023), CDW (American IT company, joined later in 2023), Sui (American tech app by Mysten Labs, joined later in 2023), Patron Tequila (Mexican alcoholic beverages company, joined later in 2023) 2024 data last update: 2024/02/15

Old sponsors that left: CashApp, Walmart, Therabody (American wellness technology company), Ocean Bottle (Norwegian reusable bottle manufacturer), PokerStars (Costa Rican gambling site), Alpha Tauri (? no info if they're official partners or not but Austrian clothing company made by Red Bull), BMC (Switzerland bicycle/cycling manufacturer), Esso (American fuel company, subsidiary of ExxonMobil), Hewlett Packard Enterprise (American technology company) 2023 data last update: 2023/03/07

More: Esso is a subsidiary of Mobil so there's possibility they merged or something

Scuderia Ferrari:

New sponsors: VGW Play (Australian tech game company, joined later in 2023), DXC Technology (American IT company, joined later in 2023), Peroni (Italian brewing company), Z Capital Group/ZCG (American private asset management/merchant bank company), Celsius (Swedish energy drink manufacturer) 2024 data last update: 2024/02/15

Old sponsors that left: Mission Winnow (American content lab by Phillip Morris International aka Marlboro), Estrella Garcia (Spanish alcoholic beverages manufacturer), Frecciarossa (Italian high speed train company) 2023 data last update: 2023/02/16

More: Mission Winnow is a part of Phillip Morris International. They are no longer listed as team sponsor but PMI is listed instead.

(starting here, 2023 data last update is 2023/02/23 and 2024 data last update is 2024/02/15)

McLaren F1 Team: (Only McLaren RACING's data is available idk if some of these are XE/FE team partners but anw..)

New sponsors: Monster Energy, Salesforce (American cloud based software company, joined later in 2023), Estrella Garcia (Spanish alcoholic beverages manufacturer), Dropbox (American file hosting company), Workday (American system software company, joined later in 2023), Ecolab (American water purification/hygiene company), Airwallex (Australian financial tech company), Optimum Nutrition (American nutritional supplement manufacturer), Halo ITSM (American software company, joined later in 2023), Udemy (American educational tech company, joined later in 2023), New Era (American cap manufacturer, joined in 2023), K-Swiss (American shoes manufacturer, joined later in 2023), Alpinestars (Italian motorsports safety equipment manufacturer)

Old sponsors that left: DP World (Emirati logistics company), EasyPost (American shipping API company), Immersive Labs (UK cybersecurity training company?), Logitech, Mind (UK mental health charity), PartyCasino (UK? online casino site), PartyPoker (American? gambling site), Sparco (Italian auto part & accessory manufacturer), Tezos (Switzerland crypto company)

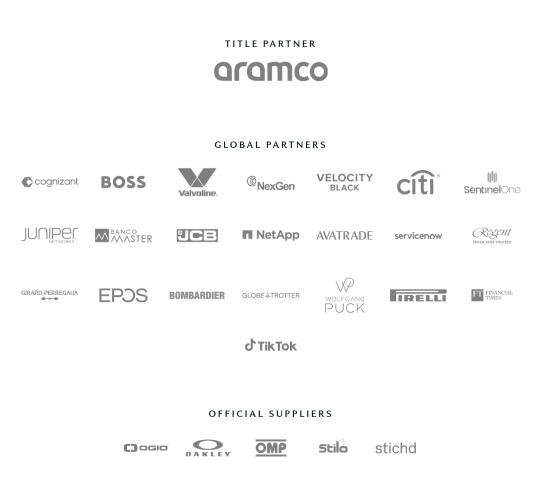

Aston Martin Aramco F1 Team:

New sponsors: Valvoline (American retail automotives service company, joined later in 2023), NexGen (Canadian sustainable? fuel company), Banco Master (Brazilian digital banking platform, joined later in 2023), ServiceNow (American software company, joined later in 2023), Regent Seven Seas Cruise, Wolfgang Puck (Austrian-American chef and restaurant owner, joined later in 2023), Financial Times (British business newspaper), OMP (Italian racing safety equipment manufacturer), stichd (Netherlands fashion & apparel manufacturer)

Old sponsors that left: Alpinestars (Italian motorsports safety equipment manufacturer), crypto.com (Singaporean cryptocurrency company), ebb3 (UK? software company), Pelmark (UK fashion and apparel manufacturer), Peroni (Italian brewing company), Porto Seguro (Brazilian insurance company), Socios (Malta's blockchain-based platform), XP (Brazilian investment company)

Stake F1 Team (prev. Alfa Romeo):

???? Can't found their website (might be geoblocked in my country???)

BWT Alpine F1 Team:

New sponsors: MNTN (American software company), H. Moser & Cie (Switzerland watch manufacturer), Amazon Music

Old sponsors that left: Bell & Ross (French watch company), Ecowatt (??? afaik French less-energy smthn smthn company), Elysium (French? American? Software company), KX (UK software company), Plug (American electrical equipment manufacturing company)

Visa CashApp RB F1 Team (prev. Scuderia Alpha Tauri):

New Sponsors: Visa, CashApp, Hugo Boss, Tudor, Neft Vodka (Austrian alcoholic beverages company), Piquadro (Italian luxury bag manufacturer)

Old sponsors that left: Buzz (?), Carl Friedrik (UK travel goods manufacturer), Flex Box (Hongkong? shipping containers manufacturer), GMG (Emirati global wellbeing company), RapidAPI (American API company)

Haas F1 Team:

New sponsors: New Era (American cap manufacturer, joined later in 2023)

Old sponsors that left: Hantec Markets (Hongkong capital markets company), OpenSea (American NFT/Crypto company)

Williams Racing:

New sponsors: Komatsu, MyProtein (British bodybuilding supplement), Kraken (American crypto company, joined later in 2023), VAST Data (American tech company), Ingenuity Commerce (UK e-commerce platform), Puma (joined later in 2023)

Old sponsors that left: Acronis (Swiss software company), Bremont (British watch manufacturer), Dtex Systems (American? cybersecurity company), Financial Times (British business newspaper), Jumeirah Hotels & Resorts, KX (UK software company), OMP (Italian racing safety equipment manufacturer), PPG (American painting manufacturer), Umbro (English sports equipment manufacturer), Zeiss (German opticals/optometrics manufacturing company)

#mercedes amg petronas#red bull racing#scuderia ferrari#visa cash app rb#haas f1 team#mclaren f1#aston martin#alpine f1#williams racing#stake f1 team#f1#ari's rant#sponsor talks

42 notes

·

View notes

Text

For more than three weeks, Gaza has faced an almost total internet blackout. The cables, cell towers, and infrastructure needed to keep people online have been damaged or destroyed as Israel launched thousands of missiles in response to Hamas attacking Israel and taking hundreds of hostages on October 7. Then, this evening, amid reports of heavy bombing in Gaza, some of the last remaining connectivity disappeared.

In the days after October 7, people living in Gaza have been unable to communicate with family or friends, leaving them unsure whether loved ones are alive. Finding reliable news about events has become harder. Rescue workers have not been able to connect to mobile networks, hampering recovery efforts. And information flowing out of Gaza, showing the conditions on the ground, has been stymied.

As the Israel Defense Forces said it was expanding its ground operations in Gaza this evening, internet connectivity fell further. Paltel, the main Palestinian communications company, has been able to keep some of its services online during Israel’s military response to Hamas’ attack. However, at around 7:30 pm local time today, internet monitoring firm NetBlocks confirmed a “collapse” in connectivity in the Gaza Strip, mostly impacting remaining Paltel services.

“We regret to announce a complete interruption of all communications and internet services within the Gaza Strip,” Paltel posted in a post on its Facebook page. The company claimed that bombing had “caused the destruction of all remaining international routes.” An identical post was made on the Facebook page of Jawwal, the region’s biggest mobile provider, which is owned by Paltel. Separately, Palestinian Red Crescent, a humanitarian organization, said on X (formerly Twitter) that it had lost contact with its operation room in Gaza and is “deeply concerned” about its ability to keep caring for people, with landline, cell, and internet connections being inaccessible.

“This is a terrifying development,” Marwa Fatafta, a policy manager focusing on the Middle East and North Africa at the digital rights group Access Now, tells WIRED. “Taking Gaza completely off the grid while launching an unprecedented bombardment campaign only means something atrocious is about to happen.”

A WIRED review of internet analysis data, social media posts, and Palestinian internet and telecom company statements shows how connectivity in the Gaza Strip drastically plummeted after October 7 and how some buildings linked to internet firms have been damaged in attacks. Photos and videos show sites that house various internet and telecom firms have been damaged, while reports from official organizations, including the United Nations, describe the impact of people being offline.

Damaged Lines

Around the world, the internet and telecoms networks that typically give web users access to international video calls, online banking, and endless social media are a complicated, sprawling mix of hardware and software. Networks of networks, combining data centers, servers, switches, and reams of cables, communicate with each other and send data globally. Local internet access is provided by a mix of companies with no clear public documentation of their infrastructure, making it difficult to monitor the overall status of the system as a whole. In Gaza, experts say, internet connectivity is heavily reliant on Israeli infrastructure to connect to the outside world.

Amid Israel’s intense bombing of Gaza, physical systems powering the internet have been destroyed. On October 10, the United Nations’ Office for the Coordination of Humanitarian Affairs (OCHA), which oversees emergency responses, said air strikes “targeted several telecommunication installations” and had destroyed two of the three main lines of communications going into Gaza.

Prior to tonight’s blackout, internet connectivity remained but was “extremely slow and limited,” Access Now’s Fatafta says. People she has spoken to from Gaza say it could take a day to upload and send a few photos. “They have to send like 20 messages in order for one to go through,” Fatafta says. “They are desperately—especially for Gazans that live outside—trying to get through to their families.”

“Every time I try to call someone from family or friends, I try to call between seven to 10 times,” says Ramadan Al-Agha, a digital marketer who lives in Khan Yunis, a city in the south of the Gaza Strip. “The call may be cut off two or three times,” he told WIRED in a WhatsApp message before the latest outages. “We cannot access news quickly and clearly.” People in the region have simultaneously faced electricity blackouts, dwindling supplies of fuel used to power generators, and a lack of clean water, food, and medical supplies. “It is a humanitarian disaster,” Al-Agha says.

Connectivity in Gaza started to drop not long after Israel responded to the October 7 Hamas attack. Rene Wilhelm, a senior R&D engineer at the nonprofit internet infrastructure organization Ripe Network Coordination Center, says based on an analysis of internet routing data it collects that 11 Palestinian networks, which may operate both in the West Bank and Gaza Strip, began to experience disruption after October 7. Eight of the networks were no longer visible to the global internet as of October 23, Wilhelm says. Ahead of this evening’s blackout, there was around 15 percent of normal connectivity, according to data from Georgia Tech’s Internet Outage Detection and Analysis project. That dropped to around 7 percent as reports of the blackout circulated.

One office belonging to Paltel in the Al Rimal neighborhood of Gaza City has been destroyed in the attacks, photos and videos show. Floors have been destroyed and windows blown away in the multistory building, and piles of rubble surround the entrances. (It is unclear what equipment the building housed or how many floors Paltel occupied.) Another internet provider, AlfaNet, is listed as being based in the Al-Watan Tower. The company posted to its Facebook page on October 8 that the tower had been destroyed and its services have stopped, with other online posts also saying the tower has been destroyed.

Multiple Palestinian internet and telecoms firms have said their services have been disrupted during the war, mostly posting to social media. Internet provider Fusion initially said its engineers were trying to repair its infrastructure, although it has since said this is not continuing. “The network was destroyed, and the cables and poles were badly damaged by the bombing,” it wrote on Facebook. JetNet said there had been a “sudden disruption” to access points. SpeedClick posted that the situation was out of its control. And HiNet posted that it has “no more to offer to ensure” people could stay online following “the attacks and destruction our internet servers have suffered.”

Across Paltel’s network on October 19, according to an update shared by the Office for the Coordination of Humanitarian Affairs, 83 percent of fixed line users had been disconnected, with 53 percent of sites providing fixed line connections also being offline. Half of the company’s fiber optic internet lines in Gaza weren’t operational, the update says. The connectivity disappeared this evening, according to Paltel’s Facebook post, which says there has been a “complete interruption” of all its services. Paltel, AlfaNet, Fusion, and SpeedClick could not be reached or did not respond to requests for comment.

Lost Connections

In recent years, governments and authoritarian regimes have frequently turned to shutting down the internet for millions of people in attempts to suppress protests and curtail free speech. Targeting the communications networks is common during conflicts. During Russia's war in Ukraine, its forces have decimated communications networks, tried to take over the internet, and set up new mobile companies to control information flows. When Hamas first attacked Israel on October 7, it used drones to bomb communications equipment at surveillance posts along the borders of the Gaza Strip.

Monika Gehner, the head of corporate communications at the International Telecommunication Union, says the body is always “alarmed” by damage inflicted on any telecommunications infrastructure during conflicts. The ITU, the United Nations’ primary internet governance body, believes “efficient telecommunication services” are crucial to peace and international cooperation, and its secretary-general has called for respecting infrastructure in the Middle East, Gehner says.

Officials in Israel have consistently claimed they are targeting Hamas militants within Gaza, not civilians, while responding to the Hamas attacks, which killed more than 1,400 people in Israel. The Hamas-run Health Ministry within Gaza has said more than 7,000 people have been killed there and released a list of names. A spokesperson for the Israel Defense Forces did not respond to WIRED’s questions about internet disruptions within Gaza.

Hanna Kreitem, a senior adviser for internet technology and development in the Middle East and North Africa at the Internet Society, an open internet advocacy nonprofit, says Palestinian firms have a “big reliance” on Israeli internet firms. “Palestinians are not controlling any of the ICT infrastructure,” says Mona Shtaya, a non-resident fellow at the Tahrir Institute for Middle East Policy. Mobile networks in the Gaza Strip rely on 2G technologies. Al-Agha, the digital marketer, shared a screenshot showing mobile internet speeds of 7.18 kilobytes per second; average mobile speeds in the US in 2022 were 24 megabits per second, according to mobile analytics firm Statista.

“The internet is vital in times of war in crises,” says Fatafta, the Access Now policy manager, who adds that there can be “terrible consequences” linked to connectivity blackouts. The UN’s OCHA said rescue workers have had a harder time “carrying out their mission” partly due to the “limited or no connection to mobile networks.” Al-Agha says he has lost some clients due to the disruptions. The lack of connectivity can obscure events that are happening on the ground, Fatafta says. News crews have told WIRED they have footage from the ground but are “losing the story because of the internet.”

Kreitem says that a lack of electricity and access to the equipment will have made an impact on top of any physical damage to communications networks. “We don't know how many of the people that actually operate these networks are still alive,” Kreitem says. “The network operators are part of the world there, there's no place for them to run. They are as affected as any other person.”

90 notes

·

View notes

Text

The Benefits of Integrating Text-to-Speech Technology for Personalized Voice Service

Sinch is a fully managed service that generates voice-on-demand, converting text into an audio stream and using deep learning technologies to convert articles, web pages, PDF documents, and other text-to-speech (TTS). Sinch provides dozens of lifelike voices across a broad set of languages for you to build speech-activated applications that engage and convert. Meet diverse linguistic, accessibility, and learning needs of users across geographies and markets. Powerful neural networks and generative voice engines work in the background, synthesizing speech for you. Integrate the Sinch API into your existing applications to become voice-ready quickly.

Voice Service

Voice services, such as Voice over Internet Protocol (VoIP) or Voice as a Service (VaaS), are telecommunications technologies that convert Voice into a digital signal and route conversations through digital channels. Businesses use these technologies to place and receive reliable, high-quality calls through their internet connection instead of traditional telephones. We at Sinch provide the best voice service all over India.

Voice Messaging Service

A Voice Messaging Service or System, also known as Voice Broadcasting, is the process by which an individual or organization sends a pre-recorded message to a list of contacts without manually dialing each number. Automated Voice Message service makes communicating with customers and employees efficient and effective. With mobile marketing quickly becoming the fastest-growing advertising industry sector, the ability to send a voice broadcast via professional voice messaging software is now a crucial element of any marketing or communication initiative.

Voice Service Providers in India

Voice APIs, IVR, SIP Trunking, Number Masking, and Call Conferencing are all provided by Sinch, a cloud-based voice service provider in India. It collaborates with popular telecom companies like Tata Communications, Jio, Vodafone Idea, and Airtel. Voice services are utilized for automated calls, secure communication, and client involvement in banking, e-commerce, healthcare, and ride-hailing. Sinch is integrated by businesses through APIs to provide dependable, scalable voice solutions.

More Resources:

The future of outbound and inbound dialing services

The Best Cloud Communication Software which are Transforming Businesses in India

4 notes

·

View notes

Text

What Are the Benefits of Adopting Latest Fintech Technologies?

The financial industry is witnessing a rapid transformation driven by the adoption of the latest fintech technologies. These technologies are revolutionizing how financial services are delivered, enhancing efficiency, improving security, and fostering innovation across banks, insurance companies, investment firms, and payment platforms. By integrating advanced fintech software into their operations, businesses are unlocking numerous benefits that enable them to stay competitive in an increasingly digital world. In this article, we will explore the key advantages of adopting the latest fintech technologies and how they are reshaping the financial landscape.

1. Enhanced Efficiency and Automation

One of the primary benefits of adopting the latest fintech technologies is the significant boost in efficiency. Traditional financial systems often rely on manual processes, which can be time-consuming, prone to errors, and costly. With the integration of fintech software solutions, businesses can automate a wide range of processes, from payment processing to data analysis.

For example, AI-powered algorithms can automate tasks like credit scoring, fraud detection, and risk assessment, enabling financial institutions to make faster and more accurate decisions. Additionally, blockchain technology enables automated, transparent transactions, reducing the need for intermediaries and speeding up processes like cross-border payments. The efficiency gained through automation allows businesses to handle a larger volume of transactions and deliver services more swiftly, benefiting both the institutions and their customers.

2. Improved Customer Experience

The latest fintech technologies also play a crucial role in enhancing customer experiences. Consumers today demand convenience, speed, and personalized services. Fintech software solutions enable businesses to meet these demands by offering innovative and user-friendly platforms for managing finances.

Digital wallets, mobile banking apps, and AI-powered chatbots are just a few examples of how fintech technologies are transforming customer interactions. Mobile payment systems like Apple Pay and Google Pay allow users to make secure transactions with just a tap of their phone, while robo-advisors provide tailored financial advice based on individual needs. AI-driven chatbots can respond to customer inquiries instantly, providing 24/7 support and delivering personalized responses. These innovations make financial services more accessible, faster, and tailored to the unique needs of each customer.

Additionally, by leveraging the latest fintech technologies, businesses can offer cross-channel experiences, where customers can seamlessly transition between online platforms, mobile apps, and physical locations without interruption. This level of convenience significantly improves customer satisfaction and loyalty.

3. Cost Savings and Reduced Operational Expenses

Adopting fintech technologies can result in significant cost savings for businesses. Traditional banking systems often involve high overhead costs related to maintaining physical branches, processing manual transactions, and managing large teams. By embracing fintech software, financial institutions can streamline their operations, reducing the need for human intervention in routine tasks.

For example, cloud computing solutions allow businesses to store and process large amounts of data without the need for expensive in-house infrastructure. This can lead to significant savings in terms of hardware and maintenance costs. Additionally, automated systems for customer service, fraud detection, and compliance reduce the reliance on human resources, leading to further cost reductions.

For small businesses and startups, fintech solutions offer an affordable way to access sophisticated financial tools that were previously out of reach. Cloud-based accounting, invoicing, and payment solutions enable these companies to operate more efficiently without the need for large investments in infrastructure or personnel.

4. Improved Security and Fraud Prevention

As the financial industry becomes more digital, security has become a top priority. The latest fintech technologies offer advanced security features that help protect businesses and their customers from cyber threats and fraud. Blockchain technology, for example, provides a decentralized and immutable ledger, ensuring the integrity and transparency of transactions. This makes it nearly impossible for malicious actors to alter or tamper with transaction records, reducing the risk of fraud.

Additionally, fintech software solutions integrate cutting-edge encryption methods and biometric authentication, such as facial recognition and fingerprint scanning, to safeguard sensitive data. AI-powered fraud detection systems can monitor transactions in real-time, flagging suspicious activities and preventing fraudulent transactions before they occur. These security measures help businesses build trust with their customers and ensure that sensitive financial information is protected.

By adopting the latest fintech technologies, financial institutions can also ensure compliance with stringent data protection regulations, such as the GDPR (General Data Protection Regulation), further reducing the risk of penalties and reputational damage.

5. Greater Accessibility and Financial Inclusion

Fintech technologies are making financial services more accessible to underserved and unbanked populations around the world. In developing regions, where access to traditional banking services may be limited, mobile phones and fintech apps are enabling individuals to manage their finances, make payments, and even access credit.

Digital wallets and mobile banking apps allow users to store, send, and receive money without the need for a physical bank account. Peer-to-peer (P2P) lending platforms are helping individuals and small businesses access credit that they might otherwise not be able to obtain from traditional banks. Additionally, fintech software solutions are allowing micro-lending institutions to assess creditworthiness more accurately using alternative data, such as mobile usage and payment history, making it easier for individuals without formal credit histories to secure loans.

By adopting fintech technologies, businesses can contribute to financial inclusion, helping to bridge the gap between the banked and unbanked populations and enabling more people to participate in the global economy.

6. Better Decision-Making and Data Analytics

Data is at the heart of fintech innovation. The latest fintech technologies, such as AI and big data analytics, enable businesses to gather, process, and analyze vast amounts of information in real-time. This allows financial institutions to make data-driven decisions, improve risk management, and offer more personalized services to their customers.

For example, AI algorithms can analyze a customer's spending habits, credit history, and financial goals to offer personalized financial advice and recommend investment opportunities. Similarly, advanced analytics tools can identify emerging trends in the market, allowing businesses to adjust their strategies accordingly. The ability to harness the power of data leads to more informed decision-making and better outcomes for both businesses and their customers.

7. Scalability and Flexibility

Fintech software solutions offer unmatched scalability, allowing businesses to grow without the constraints of traditional systems. Whether it’s increasing transaction volumes, expanding to new markets, or offering additional services, fintech technologies can easily adapt to changing business needs. Cloud-based platforms, for instance, allow businesses to scale up or down quickly without incurring significant costs or requiring significant infrastructure investments.

Xettle Technologies, for example, provides scalable fintech solutions that help businesses manage their growth seamlessly, offering flexibility and adaptability in a fast-evolving digital landscape.

Conclusion

The adoption of the latest fintech technologies offers a wide range of benefits for businesses in the financial sector. From enhanced efficiency and automation to improved customer experiences, cost savings, and better security, fintech solutions are revolutionizing the way financial services are delivered. By embracing these innovations, businesses can stay competitive, drive growth, and provide more personalized and accessible services to their customers. The future of finance is digital, and those who adopt the latest fintech technologies today will be better equipped to succeed in tomorrow’s rapidly evolving market.

3 notes

·

View notes

Text

10 Benefits of Investing in a Custom Software Solution

Businesses are constantly on the lookout for new and better technologies that may streamline and quicken their processes. When doing so, organizations frequently use pre-existing software solutions. However, it's not always easy to find a single piece of software that can handle all of their needs. That's why it's common for businesses to put money into a few different lines.

If you need a unique solution that is tailored to your business's needs, consider investing in custom software development. Using their unique needs as a guide, developers of custom software create programs for businesses and individuals. The banking sector, for instance, employs highly specialized custom software to facilitate consumer access while shielding private information with cutting-edge security measures.

In this article, we'll discuss how custom software development can improve a company's efficiency and bottom line. OK, let's have a peek at it.

Top Reasons to Choose Custom Software Development

Software product customization is a solution that can increase productivity. In addition, adaptability and scalability let you stay ahead of the curve and get an edge over rivals. Your company could benefit in the long run from its use in managing business operations and establishing relationships with external customers, partners, and internal assets.

1. Long-Term Savings

Investing in a software development project may be expensive. However, you won't need to spend everything right away. Custom software development lets you build your product in phases. The minimum viable product (MVP) approach could be taken initially to reduce development costs.

Putting your company plan and software prototype to the test is an appealing prospect. When you're done, you'll have the option of moving forward with the development of a full-fledged software application. While investing in custom software development solutions may seem prohibitively expensive at first, doing so can really end up saving you money in the long run. The necessity for long-lasting solutions suggests that tailor-made software development may be the way to go.

2. Software Solutions Tailored to Your Needs

It will be difficult for businesses to find a one-size-fits-all answer when it comes to technology, especially when it comes to software solutions. Mobile apps offer the best chance of finding a solution that will work for all organizations. In addition, each company pursues its goals and conducts operations according to its own unique plan and approach.

Therefore, you might require specialized software solutions to demonstrate that your business is one of a kind and establish yourself as a frontrunner in your field. With the help of bespoke software development, you will be able to modify software products so that they correspond to your business strategy and fulfill all of your requirements.

3. Better Security and Dependability

Maintaining a safe and reliable system is crucial to any business's long-term prosperity. As a result, businesses must ensure their software is more secure. With custom software development solutions, you know your data is safe.

Also, it might help you decide which data-security technology to use and which is best for your business, as well as how to incorporate that technology into your application. Most of the time, clients will trust you more if you use a higher level of security.

4. Flexibility & Scalability

The world of business is always transforming. Therefore, for businesses to stay up with how the market is shifting, they need to adapt. Custom software solutions provide you the flexibility to make adjustments, add new features, update your product, or seek assistance to meet the requirements of your expanding business as it grows and evolves.

Scalability also enables you to prepare for expansion in the future, which allows you to expand your business while simultaneously maintaining the viability of the software application.

5. Maintenance and Technical Support

It is common practice to form collaborations with software development vendors to create custom software. They'll assemble expert programmers to plan, code, and test your program for you.

Also, they employ a specialized development staff for ongoing technical support and app upkeep. Since they created it, they know it inside and out. This means they can keep it running smoothly and assist you in fixing bugs or other problems as they arise.

Service Level Agreements (SLAs) are a form of contract that may be included with your vendor contracts to guarantee a certain level of service. The bottom line is that consistent technical support helps keep your company processes running efficiently and effectively, all while minimizing the amount of time you lose to updates.

6. Product Uniqueness

It's becoming increasingly important that businesses have a distinct identity, which can assist them to strengthen their unique selling proposition. By investing in custom software development, your business can meet the needs of its customers and stay true to its character.

Teams specializing in custom software development can produce applications that help businesses achieve their goals. It allows you to select the software development methodology and cutting-edge innovations that will give your app a leg up on the competition. Plus, it gives businesses the chance to develop brand-new items to meet the surging demand.

7. Integrates Easily

Business custom software development has the added benefit of fitting naturally into your existing processes. When a software product is tailor-made to satisfy a company's unique needs, it works in tandem with the rest of its existing applications without causing disruptions.

Not only that, but it will also aid in the optimization of your business process and the improvement of the efficiency of your business workflow. Saving money, speeding up operations, and avoiding frequent defects and other issues during the integration with your existing software product are all possible benefits of custom software solutions.

8. Boost Return On Investment (ROI)

Custom software development services provide exactly what the client needs. So, you won't have to shell out money for unused services or licenses. Therefore, it may end up saving money over time. Furthermore, you will be able to acquire various capabilities for your application that may not be available to your competitors.

As a result, it can bolster your USP (unique selling proposition) and provide you with a significant edge over the competition. Through the use of niche-specific customization in software product development, you may better serve your intended customer. You can expect higher long-term returns and greater consumer participation.

9. Enhance Productivity

No one can deny the positive impact software has on worker output, especially when that software is tailored to meet the specific needs of a certain company. It boosts productivity and gives workers more assurance in their abilities.

In addition, the right software could make it easier for your staff to get their work done faster. It could improve resource management, boost the efficiency of operational procedures, and provide additional financial benefits to your organization.

10. Great User Satisfaction

When it comes to the level of happiness experienced by end users, bespoke software will always score higher than generic software, regardless of whether it was developed for external or internal users.

How? The response is plain to see. It is customized to fulfill their technical requirements to suit their business needs. In addition to this, it is simple to use and was developed to reduce the complexity of running a business, improving efficiency, and turning it into a more profitable investment.

Wrapping Up

There are numerous upsides to investing in bespoke software development. Depending on your company's specific requirements, you can make changes to meet different demands. The ability to control every aspect of your app's operation and make whatever tweaks you see fit is another potential benefit.

Businesses need to invest time and resources into creating and designing software that meets their specific needs. But before you make any moves, you should thoroughly evaluate your business. Custom software development is a great option because experienced developers can quickly assess your business needs and determine the best course of action.

2 notes

·

View notes

Text

Top 10 In- Demand Tech Jobs in 2025

Technology is growing faster than ever, and so is the need for skilled professionals in the field. From artificial intelligence to cloud computing, businesses are looking for experts who can keep up with the latest advancements. These tech jobs not only pay well but also offer great career growth and exciting challenges.

In this blog, we’ll look at the top 10 tech jobs that are in high demand today. Whether you’re starting your career or thinking of learning new skills, these jobs can help you plan a bright future in the tech world.

1. AI and Machine Learning Specialists

Artificial Intelligence (AI) and Machine Learning are changing the game by helping machines learn and improve on their own without needing step-by-step instructions. They’re being used in many areas, like chatbots, spotting fraud, and predicting trends.

Key Skills: Python, TensorFlow, PyTorch, data analysis, deep learning, and natural language processing (NLP).

Industries Hiring: Healthcare, finance, retail, and manufacturing.

Career Tip: Keep up with AI and machine learning by working on projects and getting an AI certification. Joining AI hackathons helps you learn and meet others in the field.

2. Data Scientists

Data scientists work with large sets of data to find patterns, trends, and useful insights that help businesses make smart decisions. They play a key role in everything from personalized marketing to predicting health outcomes.

Key Skills: Data visualization, statistical analysis, R, Python, SQL, and data mining.

Industries Hiring: E-commerce, telecommunications, and pharmaceuticals.

Career Tip: Work with real-world data and build a strong portfolio to showcase your skills. Earning certifications in data science tools can help you stand out.

3. Cloud Computing Engineers: These professionals create and manage cloud systems that allow businesses to store data and run apps without needing physical servers, making operations more efficient.

Key Skills: AWS, Azure, Google Cloud Platform (GCP), DevOps, and containerization (Docker, Kubernetes).

Industries Hiring: IT services, startups, and enterprises undergoing digital transformation.

Career Tip: Get certified in cloud platforms like AWS (e.g., AWS Certified Solutions Architect).

4. Cybersecurity Experts

Cybersecurity professionals protect companies from data breaches, malware, and other online threats. As remote work grows, keeping digital information safe is more crucial than ever.

Key Skills: Ethical hacking, penetration testing, risk management, and cybersecurity tools.

Industries Hiring: Banking, IT, and government agencies.

Career Tip: Stay updated on new cybersecurity threats and trends. Certifications like CEH (Certified Ethical Hacker) or CISSP (Certified Information Systems Security Professional) can help you advance in your career.

5. Full-Stack Developers

Full-stack developers are skilled programmers who can work on both the front-end (what users see) and the back-end (server and database) of web applications.

Key Skills: JavaScript, React, Node.js, HTML/CSS, and APIs.

Industries Hiring: Tech startups, e-commerce, and digital media.

Career Tip: Create a strong GitHub profile with projects that highlight your full-stack skills. Learn popular frameworks like React Native to expand into mobile app development.

6. DevOps Engineers

DevOps engineers help make software faster and more reliable by connecting development and operations teams. They streamline the process for quicker deployments.

Key Skills: CI/CD pipelines, automation tools, scripting, and system administration.

Industries Hiring: SaaS companies, cloud service providers, and enterprise IT.

Career Tip: Earn key tools like Jenkins, Ansible, and Kubernetes, and develop scripting skills in languages like Bash or Python. Earning a DevOps certification is a plus and can enhance your expertise in the field.

7. Blockchain Developers

They build secure, transparent, and unchangeable systems. Blockchain is not just for cryptocurrencies; it’s also used in tracking supply chains, managing healthcare records, and even in voting systems.

Key Skills: Solidity, Ethereum, smart contracts, cryptography, and DApp development.

Industries Hiring: Fintech, logistics, and healthcare.

Career Tip: Create and share your own blockchain projects to show your skills. Joining blockchain communities can help you learn more and connect with others in the field.

8. Robotics Engineers

Robotics engineers design, build, and program robots to do tasks faster or safer than humans. Their work is especially important in industries like manufacturing and healthcare.

Key Skills: Programming (C++, Python), robotics process automation (RPA), and mechanical engineering.

Industries Hiring: Automotive, healthcare, and logistics.

Career Tip: Stay updated on new trends like self-driving cars and AI in robotics.

9. Internet of Things (IoT) Specialists

IoT specialists work on systems that connect devices to the internet, allowing them to communicate and be controlled easily. This is crucial for creating smart cities, homes, and industries.

Key Skills: Embedded systems, wireless communication protocols, data analytics, and IoT platforms.

Industries Hiring: Consumer electronics, automotive, and smart city projects.

Career Tip: Create IoT prototypes and learn to use platforms like AWS IoT or Microsoft Azure IoT. Stay updated on 5G technology and edge computing trends.

10. Product Managers

Product managers oversee the development of products, from idea to launch, making sure they are both technically possible and meet market demands. They connect technical teams with business stakeholders.

Key Skills: Agile methodologies, market research, UX design, and project management.

Industries Hiring: Software development, e-commerce, and SaaS companies.

Career Tip: Work on improving your communication and leadership skills. Getting certifications like PMP (Project Management Professional) or CSPO (Certified Scrum Product Owner) can help you advance.

Importance of Upskilling in the Tech Industry

Stay Up-to-Date: Technology changes fast, and learning new skills helps you keep up with the latest trends and tools.

Grow in Your Career: By learning new skills, you open doors to better job opportunities and promotions.

Earn a Higher Salary: The more skills you have, the more valuable you are to employers, which can lead to higher-paying jobs.

Feel More Confident: Learning new things makes you feel more prepared and ready to take on tougher tasks.

Adapt to Changes: Technology keeps evolving, and upskilling helps you stay flexible and ready for any new changes in the industry.

Top Companies Hiring for These Roles

Global Tech Giants: Google, Microsoft, Amazon, and IBM.

Startups: Fintech, health tech, and AI-based startups are often at the forefront of innovation.

Consulting Firms: Companies like Accenture, Deloitte, and PwC increasingly seek tech talent.

In conclusion, the tech world is constantly changing, and staying updated is key to having a successful career. In 2025, jobs in fields like AI, cybersecurity, data science, and software development will be in high demand. By learning the right skills and keeping up with new trends, you can prepare yourself for these exciting roles. Whether you're just starting or looking to improve your skills, the tech industry offers many opportunities for growth and success.

#Top 10 Tech Jobs in 2025#In- Demand Tech Jobs#High paying Tech Jobs#artificial intelligence#datascience#cybersecurity

2 notes

·

View notes

Text

How to Choose the Best CRM Tool for Your Small Business?

One out of five small businesses fail within the first year. No, this is not to demotivate you but to show you the reality of how important the first five years of a small business are. Most small businesses struggle to deal with customers as customers have different needs, and managing all your different customers feels next to impossible; that’s why you need CRM software.

Customer relationship management (CRM) software has revolutionised the way businesses interact with customers. It helps reduce the need for manual input by automating key processes like tracking customer interactions, managing leads, and organising sales pipelines. CRM software is proven to increase business productivity and efficiency and improve overall customer satisfaction.

Before you put your skates on and look for a CRM tool, it is crucial to choose a CRM tool that is perfect for your business, as the internet is flooded with tons of CRM software. Here are the key factors to consider when selecting the best CRM tool for your small business.

1. Identify Your Business Needs

Before diving into the technical details of various CRM tools, it’s important to clearly identify your business’s unique needs. Ask yourself questions like:

- What are your current pain points in customer management?

- Are you looking to streamline sales, marketing, or customer service processes?

- How many people will be using the CRM system?

Once you understand your specific goals, choosing CRM software will be quite easy for you as you can prioritise what features the software must have.

2. User-Friendly Interface

As a small business, you most likely won’t have a tech-savvy and highly experienced team, so it is crucial to choose CRM software with a user-friendly interface. A simple and user-friendly interface will allow your team to quickly adapt and use the software efficiently. Look for a CRM that offers an intuitive dashboard, easy navigation, and simple data entry processes.

Additionally, many CRM tools offer free trials, so take advantage of this to assess whether the platform is easy for your team to use and navigate.

3. Affordability

Most small businesses don’t have massive profits and income-generating revenues, so it is crucial not to get overexcited and choose CRM software that suits your budget. CRM software with more features and capabilities will cost more, so it is vital to understand your business needs and opt for a CRM that doesn’t break the bank and gets the job done. Groweon CRM software is quite affordable and has tons of features, so it is a great choice for small businesses.

4. Scalability

As your business grows, your CRM should be able to grow with you. Look for a CRM solution that offers scalable features so that you don’t outgrow the tool as your customer base expands. A scalable CRM will allow you to add new users, customise workflows, and integrate additional tools without disruption.

Choosing a CRM that can scale alongside your business will save you the hassle of transitioning to a new platform as your needs evolve.

5. Mobile Accessibility

In today’s fast-paced business environment, having access to your CRM data on the go is essential. Mobile accessibility enables you to update and access customer information, track sales, and communicate with your team from anywhere. This is particularly useful for small business owners or sales teams who spend a significant amount of time out of the office.

Ensure that the CRM tool you choose offers a robust mobile application that is easy to use and provides the same level of functionality as its desktop version.

6. Customer Support

Reliable customer support is crucial, especially when you’re first implementing a CRM system. Small businesses often lack the in-house expertise to troubleshoot technical issues, so having access to a responsive support team can make a significant difference.

Look for CRM providers that offer 24/7 customer support, training resources, and user communities. Some CRM tools even offer dedicated account managers for small businesses, ensuring that you get personalised help whenever needed.

Conclusion

Choosing the best CRM tool for your small business can make a world of difference to your business’s operations and massively improve productivity. No matter what industry you are in, ideal CRM software can transform the way you manage customers.

3 notes

·

View notes

Text

Pay Once You Go Phones Enjoy Communication Round Time

youtube

Let's face it, paying bills is one of these things existence we can't dodge. It's really no fun, and that takes lots of time, but got end up being done steer clear of future stress. Even though we can't not pay bills doesn't mean it ought to be dreaded.

Late payment fees are costly - Typical late payment fees on credit cards can now top $39. If would you your unsecured debt late, it's like throwing $39 out the window.

Internet has developed into a part and parcel one's lives. We cannot even think of a day without the use of internet. Online connections are readily obtainable these days. Lots of mobile broadband companies have some easy deal.

Export Information - With online banking it makes tracking your money even more straight forward. With the mouse click your bookkeeper can now download transactions right in to the financial software.

You need to publish a monthly newsletter to keep in contact with prospects but to lower the number the time. Let your Administrative Consultant know what you want and may prepare the newsletter for you, enroll in your contacts and deliver it via online. Right next!

Once you're registered can certainly view your account statements online, make bill pay online payments, transfer funds or pay many online. All the things and more with extra convenience to be able to conduct this at any time on the bill pay online day, each day of all four.

Where do i find coverage at a particular price? You could always flip through the yellow pages and spend hours at a time calling on the different businesses that are offering coverage for vehicles. However, this can take a considerable time. The best strategy for finding coverage at a good price would be by checking out the Large web.

So how long will it take someone? We answer this question to claim that you could possibly all the info added with a Trackbooks system in 6 weeks by dividing the tasks into six groups. A person are spend time each weekend gathering almost all of your information and saving into your new tracking machine.

3 notes

·

View notes

Text

Thousands of law enforcement officials and people applying to be police officers in India have had their personal information leaked online—including fingerprints, facial scan images, signatures, and details of tattoos and scars on their bodies. If that wasn’t alarming enough, at around the same time, cybercriminals have started to advertise the sale of similar biometric police data from India on messaging app Telegram.

Last month, security researcher Jeremiah Fowler spotted the sensitive files on an exposed web server linked to ThoughtGreen Technologies, an IT development and outsourcing firm with offices in India, Australia, and the US. Within a total of almost 500 gigabytes of data spanning 1.6 million documents, dated from 2021 until when Fowler discovered them in early April, was a mine of sensitive personal information about teachers, railway workers, and law enforcement officials. Birth certificates, diplomas, education certificates, and job applications were all included.

Fowler, who shared his findings exclusively with WIRED, says within the heaps of information, the most concerning were those that appeared to be verification documents linked to Indian law enforcement or military personnel. While the misconfigured server has now been closed off, the incident highlights the risks of companies collecting and storing biometric data, such as fingerprints and facial images, and how they could be misused if the data is accidentally leaked.

“You can change your name, you can change your bank information, but you can't change your actual biometrics,” Fowler says. The researcher, who also published the findings on behalf of Website Planet, says this kind of data could be used by cybercriminals or fraudsters to target people in the future, a risk that’s increased for sensitive law enforcement positions.

Within the database Fowler examined were several mobile applications and installation files. One was titled “facial software installation,” and a separate folder contained 8 GB of facial data. Photographs of people’s faces included computer-generated rectangles that are often used for measuring the distance between points of the face in face recognition systems.

There were 284,535 documents labeled as Physical Efficiency Tests that related to police staff, Fowler says. Other files included job application forms for law enforcement officials, profile photos, and identification documents with details such as “mole at nose” and “cut on chin.” At least one image shows a person holding a document with a corresponding photo of them included on it. “The first thing I saw was thousands and thousands of fingerprints,” Fowler says.

Prateek Waghre, executive director of Indian digital rights organization Internet Freedom Foundation, says there is “vast” biometric data collection happening across India, but there are added security risks for people involved in law enforcement. “A lot of times, the verification that government employees or officers use also relies on biometric systems,” Waghre says. “If you have that potentially compromised, you are in a position for someone to be able to misuse and then gain access to information that they shouldn’t.”

It appears that some biometric information about law enforcement officials may already be shared online. Fowler says after the exposed database was closed down he also discovered a Telegram channel, containing a few hundred members, which was claiming to sell Indian police data, including of specific individuals. “The structure, the screenshots, and a couple of the folder names matched what I saw,” says Fowler, who for ethical reasons did not purchase the data being sold by the criminals so could not fully verify it was exactly the same data.

“We take data security very seriously, have taken immediate steps to secure the exposed data,” a member of ThoughtGreen Technologies wrote in an email to WIRED. “Due to the sensitivity of data, we cannot comment on specifics in an email. However, we can assure you that we are investigating this matter thoroughly to ensure such an incident does not occur again.”

In follow-up messages, the staff member said the company had “raised a complaint” with law enforcement in India about the incident, but did not specify which organization they had contacted. When shown a screenshot of the Telegram post claiming to sell Indian police biometric data, the ThoughtGreen Technologies staff member said it is “not our data.” Telegram did not respond to a request for comment.

Shivangi Narayan, an independent researcher in India, says the country’s data protection law needs to be made more robust, and companies and organizations need to take greater care with how they handle people’s data. “A lot of data is collected in India, but nobody's really bothered about how to store it properly,” Narayan says. Data breaches are happening so regularly that people have “lost that surprise shock factor,” Narayan says. In early May, one cybersecurity company said it had seen a face-recognition data breach connected to one Indian police force, including police and suspect information.

The issues are wider, though. As governments, companies, and other organizations around the world increasingly rely on collecting people’s biometric data for proving their identity or as part of surveillance technologies, there’s an increased risk of the information leaking online and being abused. In Australia, for instance, a recent face recognition leak impacting up to a million people led to a person being charged with blackmail.

“So many other countries are looking at biometric verification for identities, and all of that information has to be stored somewhere,” Fowler says. “If you farm it out to a third-party company, or a private company, you lose control of that data. When a data breach happens, you’re in deep shit, for lack of a better term.”

9 notes

·

View notes

Text

just so everyone knows:

ahava - owned by fosun international limited

axa - subsidiaries are axa bank belgium, axa investment managers, and axa xl

hp - lots of subsidiaries, see here

puma - subsidiaries are cobra golf, stichd, and fuel for fans; owners are groupe artemis, t. rowe price group inc, and blackrock inc

re/max - also owns motto mortgage (motto franchising, llc) and wemlo

siemens - includes digital industries, smart infrastructure, siemens mobility, siemens healthineers, and siemens financial services, as well as siemens traction equipment ltd. (stez) and omnetric group

sodastream - parent company is pepsico, inc

barclays - subsidiaries include firstplus financial group plc and kensington mortgages

caterpillar inc. - subsidiaries are caterpillar financial services, caterpillar insurance holdings, caterpillar logistics services, caterpillar marine power systems, fg wilson, perkins engines, progress rail, and solar turbines

chevron corporation - subsidiaries are chevron phillips chemical and chevron lubricants lanka; brands are chevron, texaco, rpm, caltex, havoline, and techron

elbit systems ltd. - subsidiaries are elbit systems of america, elbit systems electro-optics - elop, elbit systems land and c4l, and elbit systems ew and sigint - elisra

hd hyundai - subsidiaries include avikus, ulsan hd football club, and hotel seamarq (there are others but all of them start with hd hyundai)

hikvision - owners include gong hongjia and xinjiang weixun investment management limited partnership; parent companies are cet hik group (subsidiary of china electronics technology group) and sasak

j.c. bamford excavators limited (jcb) - subsidiaries are jcb insurance services and jcb finance

no clue what that olive green one is tbh sorry (maybe teva????)

volvo cars - parent company is geely holding; subsidiaries are haleytek, novo energy, polestar, and zenseact

airbnb - subsidiaries are luxury retreats international inc., tilt.com, accomable, aibiying, trooly inc., deco software inc., trip4real experiences s.l., larson8 inc., marketlog randorphire inc., and hoteltonight

amazon - too many subsidiaries to type out, i'm copy-pasting from wikipedia:

A9.com

AbeBooks

Alexa Internet

Amazon.com

Amazon Air

Amazon Books

Amazon Fresh

Amazon Games

Amazon Lab126

Amazon Logistics

Amazon Pharmacy

Amazon Publishing

Amazon Robotics

Amazon MGM Studios

AWS

Audible

Blink

Body Labs

Book Depository

Brilliance Audio

ComiXology

Eero LLC

Goodreads

Graphiq

IMDb

Kuiper Systems

PillPack

Ring

Souq.com

Twitch Interactive

Whole Foods Market

Woot

Zappos

Zoox

booking.com - owner/parent company is booking holdings

the walt disney company - subsidiaries are national geographic partners and epic games; disney's film divisions also include pixar, marvel studios, lucasfilm, 20th century studios, 20th century animation, and searchlight pictures; other divisions include american broadcasting company, espn, freeform, fx, national geographic, hulu, and hotstar

expedia - owner is expedia group

google - parent company is alphabet inc.; subsidiaries are adscape, cameyo, charleston road registry, deepmind, endoxon, feedburner, imageamerica, kaltix, nest labs, recaptcha, youtube, and zipdash

burger king - parent company is restaurant brands international; also, for anyone who lives in austrailia, burger king apparently operates under the name hungry jack's

pizza hut - parent company is yum! brands

wix.com - owners are baillie gifford, starboard value, blackrock, principal global, and jackson square partners; subsidiaries are deviantart, speedetab, inkfrog, rise.ai, and modalyst

image i found on bdsmovement.net:

more info here

this is NOT a comprehensive list of everything (probably; will be amazed if it is) so triple check some stuff if you aren't sure

BOYCOTT AIRBNB

These people are trying to take over every aspect of our lives.

52K notes

·

View notes

Text

What Are the Key Factors to Consider When Choosing a Payment Solution Provider?

The rapid growth of digital transactions has made choosing the right payment solution provider a crucial decision for businesses. Whether you operate an e-commerce store, a subscription-based service, or a financial institution, selecting the right provider ensures secure and efficient payment processing. With the increasing demand for fintech payment solutions, businesses must evaluate providers based on security, compatibility, scalability, and cost-effectiveness.

1. Security and Compliance

Security is the top priority when selecting a payment solution provider. Since financial transactions involve sensitive customer data, businesses must ensure that their provider follows strict security protocols. Look for providers that comply with PCI DSS (Payment Card Industry Data Security Standard) and offer encryption, tokenization, and fraud prevention measures.

A reputable provider should also offer real-time fraud detection and risk management tools to safeguard transactions. Compliance with regional regulations such as GDPR, CCPA, or PSD2 is also crucial for businesses operating in multiple locations.

2. Integration and Compatibility

Seamless Payment gateway integration is essential for a smooth transaction experience. Businesses should assess whether the provider’s APIs and SDKs are compatible with their existing platforms, including websites, mobile apps, and POS systems. A well-documented API enables easy customization and enhances the overall customer experience.

Additionally, businesses should consider whether the provider supports multiple payment methods such as credit cards, digital wallets, cryptocurrencies, and bank transfers. The ability to integrate with accounting, CRM, and ERP software is also beneficial for streamlining financial operations.

3. Cost and Pricing Structure

Understanding the pricing structure of payment solution providers is crucial for managing operational costs. Different providers offer various pricing models, including:

Flat-rate pricing – A fixed percentage per transaction

Interchange-plus pricing – A combination of network fees and provider markup

Subscription-based pricing – A fixed monthly fee with lower transaction costs

Businesses should evaluate setup fees, transaction fees, chargeback fees, and any hidden costs that may impact profitability. Opting for a transparent pricing model ensures cost-effectiveness in the long run.

4. Scalability and Performance

As businesses grow, their payment processing needs will evolve. Choosing a provider that offers scalable fintech payment solutions ensures seamless expansion into new markets and accommodates higher transaction volumes without downtime or slow processing speeds.

Look for providers with a robust infrastructure that supports high uptime, fast transaction processing, and minimal payment failures. Cloud-based payment solutions often offer better scalability and reliability for growing businesses.

5. Customer Support and Service Reliability

Reliable customer support is essential when dealing with financial transactions. Payment-related issues can result in revenue loss and customer dissatisfaction. Businesses should opt for providers that offer 24/7 customer support via multiple channels such as phone, email, and live chat.

Additionally, a provider with dedicated account management services can offer personalized solutions and proactive issue resolution, ensuring minimal disruptions to business operations.

6. Multi-Currency and Global Payment Support

For businesses targeting international markets, multi-currency support is a key consideration. The ability to accept payments in different currencies and offer localized payment methods enhances customer satisfaction and expands the business’s global reach.

Providers that support cross-border transactions with competitive exchange rates and minimal conversion fees are ideal for businesses operating in multiple countries.

7. Fintech Payment System Compatibility

A modern fintech payment system should be adaptable to emerging financial technologies. Businesses should evaluate whether the provider supports innovations like blockchain payments, real-time payment processing, and artificial intelligence-driven fraud prevention.

The ability to integrate with open banking solutions and provide seamless transaction experiences across various fintech ecosystems is becoming increasingly important in the digital payment landscape.

8. Reputation and Industry Experience

The credibility of a payment solution provider is another critical factor. Researching customer reviews, case studies, and testimonials can provide insights into the provider’s reliability and performance.

Established providers with years of experience and partnerships with reputable financial institutions are more likely to offer stable and secure payment processing services. Collaborations with fintech leaders, such as Xettle Technologies, demonstrate a provider’s commitment to innovation and excellence in payment solutions.

Conclusion

Choosing the right payment solution provider requires careful consideration of security, integration, pricing, scalability, customer support, and industry experience. Businesses must align their choice with long-term growth objectives and ensure that the provider offers secure, seamless, and cost-effective fintech payment solutions.