#Online Payment Solutions

Text

Simplify Your Transactions, Explore the Best Online Payment Collection Solutions

Discover the easiest way to streamline your transactions and enhance your online payment collection experience.

Explore the top solutions available to simplify and optimize your payment processes.

Whether you're a small business owner or a large corporation, these tools will revolutionize the way you handle transactions.

Embrace the convenience and efficiency of online payment collection solutions today.

Online payment solutions

If you're seeking efficient online payment solutions, consider integrating one reliable platform to streamline your transactions.

When it comes to easy payment collection online, opting for the best easy payment collection solutions is crucial for your business success. Online payment solutions offer convenience, flexibility, and security for both you and your customers.

By utilizing a robust platform, you can ensure seamless transactions, quick processing times, and hassle-free payment experiences. Choose a solution that aligns with your business needs, whether it's for e-commerce, services, or subscriptions.

With the right online payment system in place, you can enhance customer satisfaction, increase your revenue streams, and stay ahead in today's competitive market.

Easy payment collection online

When it comes to easy payment collection online, you need a reliable platform to ensure seamless transactions and hassle-free experiences for both you and your customers. Opt for payment solutions that offer user-friendly interfaces, secure payment gateways, and diverse payment options.

Look for platforms that provide automated invoicing, recurring billing features, and easy integration with your existing systems. By choosing a reputable online payment collection service, you can streamline your payment processes, reduce manual errors, and enhance customer satisfaction.

With the right tools in place, you can efficiently manage transactions, track payments in real-time, and improve overall financial management. Invest in a robust payment collection solution to simplify your online transactions and elevate your business operations.

Best easy payment collection solutions

To effectively streamline your payment collection process online, consider utilizing a platform that offers seamless integration with your existing systems. Look for payment collection solutions that provide easy setup and user-friendly interfaces.

Opt for services that offer multiple payment options to cater to a broader range of customers. Choose a solution that ensures secure transactions to protect both your business and your clients.

Evaluate platforms that offer automated invoicing and recurring billing features to save time and improve efficiency. Prioritize solutions with detailed reporting capabilities to track payments and monitor your financial performance easily.

Conclusion

So there you have it - simplify your transactions with the best online payment collection solutions available.

Bid farewell to lengthy lines and intricate payment proceduresWith easy payment collection online, you can streamline your business operations and provide a convenient experience for your customers.

Don't wait any longer, explore the possibilities and start reaping the benefits today.

1 note

·

View note

Text

Top Online Payment Services for Small Businesses in 2024

In today's digital world, a seamless online payment system is no longer a luxury for small businesses – it's a necessity. Customers expect a smooth and secure checkout experience, and offering a variety of payment options is crucial for attracting and retaining customers. But with a plethora of online payment services available, choosing the right one for your small business can be overwhelming. Fear not, fellow entrepreneurs! This blog dives deep into the top online payment gateways and services for small businesses in 2024, helping you find the perfect partner to streamline your finances and boost your sales.

Beyond the Basics: Key Features to Consider

Before diving into specific services, let's explore the essential features you should prioritize when choosing an online payment processor:

Transaction Fees: Compare pricing structures, including per-transaction fees, monthly fees, and chargeback fees. Look for transparent pricing with no hidden costs.

Security: Ensure the provider adheres to industry-standard security protocols like PCI DSS to safeguard sensitive customer data.

Payment Methods Supported: Offer the payment methods your customers prefer, such as credit cards, debit cards, e-wallets, and potentially even buy-now-pay-later options.

Ease of Integration: A smooth integration with your existing website or point-of-sale (POS) system is vital for a hassle-free checkout experience.

Customer Support: Reliable customer support is essential to address any issues that may arise with transactions or account management.

Additional Features: Consider bonus features like invoicing tools, subscription management, or analytics capabilities that can enhance your business operations.

Top Contenders: Unveiling the Best Online Payment Services for Small Businesses

Now, let's explore some of the most popular and trusted online payment service providers for small businesses:

Square: A user-friendly and affordable option, Square offers a free card reader for in-person transactions and integrates seamlessly with its own POS system. They also offer competitive online transaction fees and a variety of additional features like inventory management and marketing tools.

Stripe: A popular choice for e-commerce businesses, Stripe provides a robust platform with a wide range of features, including customizable checkout experiences, subscription management, and fraud prevention tools. Their pricing structure is transparent and integrates with various platforms and shopping carts.

PayPal: A well-established name in online payments, PayPal offers a familiar and convenient experience for both businesses and customers. They cater well to international transactions and offer features like invoicing and dispute resolution. However, their transaction fees can be slightly higher compared to some competitors.

Payoneer: A global payment platform, Payoneer is ideal for businesses with international operations. They offer competitive fees for international transactions and facilitate fast and secure cross-border payments.

Amazon Pay: If you are an established seller on Amazon Marketplace, integrating Amazon Pay can be a strategic move. It leverages existing customer trust in Amazon and offers a fast and secure checkout experience for customers with pre-existing Amazon accounts.

Beyond the Big Names: Exploring Alternative Options

While the above providers are widely recognized, consider these alternative options catering to specific needs:

Authorize.Net: A veteran in the payment processing space, Authorize.Net caters to larger and more established businesses with complex payment processing requirements. They offer a vast array of features and integrations but may require more technical expertise to set up.

2Checkout: Ideal for businesses selling digital products or services globally, 2Checkout specializes in high-risk transactions and offers features like fraud prevention and multi-currency support. However, their pricing structure can be less transparent compared to some competitors.

Choosing Your Perfect Payment Partner: Making an Informed Decision

Here are some final tips to guide your selection:

Evaluate Your Needs: Identify your specific requirements, such as transaction volume, budget, and desired features, before starting your research.

Read Reviews and Compare Features: Read online reviews from other small businesses and compare features and pricing structures before making a decision.

Consider Free Trials: Many providers offer free trial periods, allowing you to test the platform and see if it fits your workflow before committing.

Focus on Security: Never compromise on security. Choose a provider with a strong reputation for data protection and industry-standard security protocols.

Conclusion: A Secure and Streamlined Payment Ecosystem for Your Business

Choosing the right online payment service can empower your small business to thrive in the digital age. By considering your needs, comparing features, and prioritizing security, you can find the perfect partner to streamline your financial operations, accept a wider range of payments, and ultimately enhance your customer experience.

0 notes

Text

The Strategic Role of E-NACH in Digital Finance

Imagine a seamless way to authenticate transactions, reduce paperwork, and enhance financial services in India. Enter E-NACH, a digital marvel transforming the financial landscape. Let's explore the strategic significance of E-NACH in the realm of digital finance.

E-NACH: Revolutionizing Digital Finance

Electronic National Automated Clearing House (E-NACH) may sound like a tech buzzword, but its impact on the Indian financial sector is undeniable. It serves as a vital cog in the wheel of digital finance, ensuring smoother, more efficient transactions.

Also Read: Unveiling Why Entrepreneurs Prefer MSME Loans

1. Streamlined Verification Process

E-NACH simplifies the customer verification process for financial institutions. Instead of the traditional cumbersome paperwork and in-person verification, E-NACH enables banks and other entities to authenticate customers electronically. This not only saves time but also reduces the risk of manual errors.

2. Enhanced Security

In a world where data security is paramount, E-NACH steps up to the plate. It employs robust encryption and authentication mechanisms to safeguard sensitive customer information. This ensures that transactions are not only efficient but also secure, gaining the trust of users.

3. Paperless Transactions

Gone are the days of paper-based transactions. E-NACH eliminates the need for physical documents, making financial transactions eco-friendly and convenient. This shift towards a paperless environment aligns with India's digitalization efforts.

4. Financial Inclusion

E-NACH plays a pivotal role in advancing financial inclusion in India. Abhay Bhutada says that E-NACH brings accessibility to a wider range of mobile users. It enables individuals from remote and underserved areas to access financial services easily.

5. Faster Loan Approvals

For borrowers, E-NACH means quicker loan approvals. Lenders can verify applicants' credentials swiftly, reducing the waiting time for loan disbursal. This speed not only benefits customers but also fosters a competitive lending environment.

6. Cost-Efficiency

The cost savings associated with E-NACH are significant. Financial institutions can streamline their operations, reduce administrative overhead, and pass on these benefits to customers in the form of lower fees and better interest rates.

7. Regulatory Compliance

In an increasingly regulated financial landscape, compliance is non-negotiable. E-NACH helps institutions adhere to regulatory requirements seamlessly. It ensures that KYC (Know Your Customer) and AML (Anti-Money Laundering) norms are followed diligently.

Also Read: The Importance of Financial Literacy Education in Schools

8. Future-Ready Infrastructure

As India's financial landscape continues to evolve, E-NACH provides a scalable infrastructure that can adapt to changing needs. It accommodates new technologies and innovations, positioning the financial sector for sustained growth. Ganesh Ram, CEO of MF Utilities India, also highlights E-NACH's crucial role in the rapidly expanding SIP sector.

Conclusion

In a country where financial transactions are rapidly shifting to digital channels, E-NACH emerges as a strategic enabler. It streamlines verification, enhances security, promotes financial inclusion, and paves the way for a more efficient and cost-effective financial ecosystem. Embracing E-NACH is not just a choice; it's a necessity in today's digital finance landscape.

0 notes

Text

Best payout gateway in India with lowest charges and fastest setup.

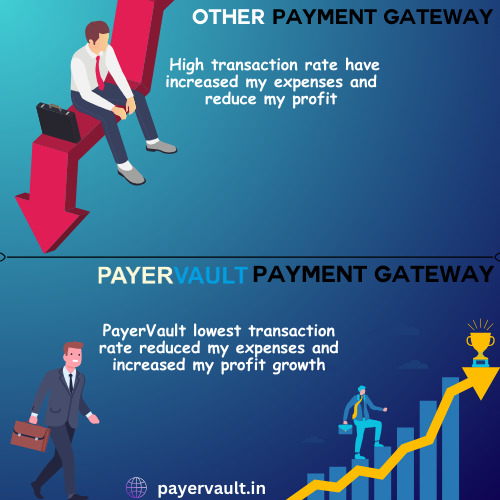

PayerVault: Your Path to Instant Payouts and Secure Transactions

In a world where digital transactions reign supreme, having a reliable payout gateway at your disposal is essential. This is where PayerVault steps in, offering you a seamless experience that's not only efficient but secure too.

Unlocking Efficiency with Payout Gateways

Picture this: you run a thriving online business, and it's time to disburse payments to your vendors or employees. With PayerVault, you can kiss those tedious, manual processes goodbye. Payout gateways, especially PayerVault, streamline your financial operations, making transactions swift and error-free.

Real-Time Tracking: A Game-Changer

One of PayerVault's standout features is its real-time tracking capabilities. Say goodbye to the days of anxiously waiting for payment confirmations. With PayerVault, you get instant updates on successful transactions, allowing you to stay on top of your finances effortlessly.

Instant Payouts, Low Fees: A Winning Combination

PayerVault takes pride in offering instant payouts – a game-changer for businesses. Imagine the convenience of quick access to your funds. And the best part? PayerVault ensures this at minimal transaction fees, making it a cost-effective solution for businesses of all sizes.

User-Friendly Interface: No Hassle, Just Results

Worried about a steep learning curve? Don't be. PayerVault's user-friendly interface ensures that even if you're new to payout gateways, you'll have no trouble navigating the system. It's designed to simplify your financial operations, leaving you with more time to focus on what matters most – your business.

Why Choose PayerVault?

With PayerVault, you're not just opting for a payout gateway – you're choosing efficiency, security, and convenience. Our commitment to providing instant, secure transactions at competitive rates has made us a trusted name in the industry.

So, whether you're a budding entrepreneur, an e-commerce mogul, or a nonprofit organization, PayerVault has you covered. Say goodbye to payment hassles and embrace a future where financial transactions are seamless, secure, and efficient.

Join us at PayerVault and unlock a world of possibilities in the realm of payout gateways. It's time to experience finance the way it should be – fast, secure, and hassle-free.

"Explore PayerVault Today and Transform Your Financial Transactions!"

#payment gateway#payment processing#payment systems#payments#businesses#business#high risk merchant account#high risk payment gateway#payouts#payout#paypal#online#ecommerce#business growth#online payment gateway#online payment solutions#online payment systems#paying#internet#small business#online store#digital transformation

1 note

·

View note

Text

Grow Your Business With Our eCommerce Payment Processing Solutions

If you're looking for the best eCommerce payment processing services for your business, Electronic Merchant Systems (EMS) can help.

We will help you grow your business with reliable eCommerce and online payment processing options.

If you are offering industry-leading products, but your revenue and sales volume doesn't seem to flow as anticipated, it could be that the payment gateway you are using might be turning away your customers.

Some customers may abandon their online cart if the process is too lengthy or slow. Simplifying checkout by minimizing steps can help you grow your customer base and your business.

Electronic Merchant Systems has been helping online businesses like yours grow their business with innovative online payment solutions. And with our free rate review, 95% of merchants saved money on payment processing fees.

When you partner with us, you can:

Establish your web presence

Add a store to your existing website

Enable online payment methods for your business

Streamline your customers' buying experience.

By creating a seamless user experience from start to checkout, your customers can fill their online shopping carts and pay in a breeze with our payment solutions.

This will allow your customers to place orders and make secure payments, allowing you to increase your business!

Get started on growing your online business with one of our leading eCommerce Payment Systems today!

#ecommercepaymentprocessing#e commerce payment processing#online payment solutions#online payment gateway

1 note

·

View note

Text

Benefits of Blockchain Technology for Financial Institutions

In the digital age, where trust is the ultimate currency, blockchain technology has emerged as a game-changer for financial institutions in India. This revolutionary technology has the potential to transform the way financial transactions are conducted, bringing security, efficiency, and transparency to the forefront.

Enhanced Security and Transparency

Blockchain's decentralized and immutable nature ensures that every transaction is securely recorded and verified across multiple computers. This eliminates the risk of fraud, manipulation, and unauthorized access, providing financial institutions with a higher level of security and transparency.

Also Read: Top 10 Fintech Companies In India

Streamlined Processes and Efficiency

By removing the need for intermediaries and automating processes, blockchain streamlines financial operations, making them faster, more efficient, and cost-effective. From KYC procedures to trade settlements, blockchain simplifies and accelerates processes, saving time and reducing operational costs for financial institutions.

Cost Reduction

With blockchain, financial institutions can eliminate intermediaries and redundant processes, reducing costs associated with traditional systems. By enabling direct peer-to-peer transactions, blockchain cuts out the middlemen, resulting in lower fees and transaction costs.

Improved Data Management

Blockchain enables secure and efficient management of data. It provides a decentralized and tamper-resistant ledger where data is recorded and verified. Financial institutions can benefit from better data accuracy, integrity, and availability, leading to improved decision-making processes.

Enhanced Customer Experience

Blockchain has the potential to revolutionize the customer experience by providing greater control and transparency. Customers can have real-time access to their financial data, track transactions, and enjoy faster and more secure payments.

Financial Inclusion

In a country as diverse as India, blockchain technology can play a crucial role in promoting financial inclusion. Its decentralized nature allows for the inclusion of the unbanked population, providing them with access to secure financial services through mobile devices.

Challenges and Considerations

While blockchain presents numerous benefits, it also comes with challenges. Scalability, energy consumption, regulatory compliance, and interoperability are factors that need to be addressed for widespread adoption. Financial institutions need to carefully evaluate their existing infrastructure and invest in the necessary technology and expertise to harness the full potential of blockchain.

Also Read: The Rise of Digital Lending in India: A Game Changer for Borrowers and Lenders

Conclusion

Blockchain technology holds immense promise for financial institutions in India, bringing enhanced security, efficiency, and transparency to the forefront. As technology evolves and regulatory frameworks are developed, financial institutions must embrace this digital revolution to stay competitive in the evolving financial landscape.

#blockchain#fintech#online payment solutions#financial inclusion#economy#innovations#financial institutions#stockexchange#insurance

0 notes

Text

This YouTube video provides a comprehensive overview of how AI chat GPT technology can be used in an online business to drive business growth and customer satisfaction. It explains the advantages of using AI chat GPT technology over traditional customer service methods, such as cost savings, real-time insights, and scalability. Additionally, the video provides examples of how AI chat GPT is already being used in an online business setting, and explains the potential benefits of using this technology. The video also explores tips and best practices for implementation, coding examples, and optimization techniques to get the most out of AI chat GPT technology. Finally, the video offers advice on how to get started with AI chat GPT and maximize its potential to benefit your online business.

#Online business marketing#online business growth strategies#online business opportunities#online customer engagement#online customer service#online payment solutions#online retail trends.

0 notes

Text

Secure Online Payment Services with Paymath

Companies, irrespective of their industry or organizational structure, are increasingly warming up to the idea of receiving payments online. This is a fantastic investment opportunity on account of both the short-term and the long-term benefits. Because businesses are becoming more borderless and are increasingly focused on dominating marketplaces throughout the world, it is essential to maintain consistent customer behavior across all different types of enterprises. Altering the limitations leads to adjustments in consumers' propensity to make purchases.

On the other side, a company needs to be prepared to weather any storm that may come its way. The ability to make payments for bills online enables businesses to save time, become more efficient, and save their consumers as much work as they possibly can. Additionally, it helps to reduce the additional costs that are connected with doing transactions in the actual world.

Why should smaller businesses like startups and SMEs care?

You should really be concerned about using online payment services even if you run a traditional firm consisting of brick-and-mortar locations. More and more people are choosing to do their regular shopping online since it is easier for them to do so as online shopping grows more advanced. Because of this, you run the risk of seeing devoted customers defect to competing for online stores, which is something that neither of you wishes to see happen.

Customers could favor the products you sell, but they might decide to make their purchases elsewhere since shopping online is more convenient.

More quickly and safely

It would appear that the major benefit of using online payment solutions is the higher level of security it offers to your online payment ecosystem, in addition to the greater speed that it offers. If you employ the most advanced payment processing gateways, you will be able to process payments around fifty times more quickly than you could do it on your own. You will be able to provide your clients with a more enjoyable shopping experience while simultaneously improving your ability to manage the flow of cash without exerting any more effort.

Since the procedure of processing payments requires only a few seconds, either merchants or customers are required to wait for a significant amount of time in order to successfully complete the transaction.

Enhanced sense of safety

During the course of the transaction, the best online payment methods will employ the most recent and up-to-date version of the industry-standard encryption algorithm in order to keep private information and a sense of attachment both to the merchant and the customer safe from the risk of being subjected to online theft or fraud. When money is transferred using a payment gateway, there is absolutely no room for speculation about whether or not the transaction is legal. The reason for this is that the transaction for sale can indeed be authorized until the information for the customer's credit card or debit card has indeed been successfully transmitted, and the money has been deposited into your account from the retailer. You can get in touch with Paymath for the best online payment services.

For more information, visit our site: https://www.paymath.com/

0 notes

Text

Online payment solution: How can you find the best one?

It takes work to choose the right online payment solution for your business. Many factors can affect your choices, such as the size of the transaction and its importance to your organization. Here is a summary of how we go about choosing a secure and efficient service provider:

Analyzing your business needs

Before you search for the best payment solution, you must first understand what exactly you need from a payment processor.

What kind of business are you in? Are your customers primarily local or international? Do they have different needs than yours and thus require special attention from the payment processor?

How many transactions do you need to process each month? There are two ways to find this: by looking at your current online sales or by talking with potential clients who would be buying from you. If most of these transactions are small and don't require too much technology (e.g., $20), then an offline card reader might work fine. But suppose most transactions involve high-end products like cars or homes (or anything else that requires complex calculations). In that case, going online makes more sense because it's easier logistically speaking and allows customers who aren't comfortable using computers yet another way of paying without having to use them themselves!

Respecting your budget

You have to ask yourself the most crucial question: "How much do I want to spend on this?"

To ensure that you don't end up in over your head, it's essential to know precisely how much money you can afford to invest in a payment system. If you need more clarification, look at other popular platforms and their pricing structures. It would help if you also considered whether or not there are any hidden costs involved with using a particular service (e.g., monthly charges). Finally, remember that what might seem like a good deal one day could turn out to be less than ideal later on if prices rise or glitches arise unexpectedly—so keep an eye on those things!

Keeping control over your transactions

Choosing the best online payment solution that allows you to keep control over your transactions.

Be aware of hidden costs.

Make sure the answer is secure and will not be hacked, which means it should use blockchain technology (more on this later).

Choose a solution that fits your budget and meets all your business needs, including customer support and training for employees who need help.

Now that you've got a handle on some of the basics, it's time to find an online payment solution that fits your needs. There are many things to consider when choosing one out of all the many options available today (including mobile and POS options), but luckily above pointers can help make the decision process more straightforward.

0 notes

Text

10 Best Online Payment Solutions for Ecommerce Stores in 2022

10 Best Online Payment Solutions for Ecommerce Stores in 2022

Choosing the best online payment solutions for ecommerce business is not an easy task. There are many factors to consider.

The first thing you need to do is to assess the type of business you have and what payment methods you need to offer. For example, if you want to sell products in other countries, then it would be better if you had a solution that could accept international credit cards.

You…

View On WordPress

#Best online payment solutions for ecommerce#Online payment solutions#Online payment solutions for ecommerce#Payment solutions#Payment solutions for ecommerce

0 notes

Text

The Rise of Cashfree Payments: A Paradigm Shift in Financial Transactions

The way we handle financial transactions has undergone a dramatic transformation. Traditional cash payments are gradually being phased out, making way for the era of cashfree payments. With the advent of digital payment methods such as mobile payments, UPI transactions, and international payments, consumers and businesses alike are embracing the convenience and efficiency offered by cashfree solutions. In this blog post, we will explore the various facets of cashfree payments, from their advantages to common misconceptions and their potential impact on the future of finance.

2 notes

·

View notes

Text

Enter for $4,500.00 Cash!

Enter your information now for a chance to win.

#Cashfree#Online Payments#Digital Transactions#Payment Gateway#Fintech Solutions#Cashless Economy#E-commerce Payments#Secure Transactions#Mobile Wallets#Payment Integration#https://sites.google.com/view/cashfree-2/home

2 notes

·

View notes

Text

Enhancing Customer Trust in Online Payment Security

In the ever-evolving realm of e-commerce, trust is the cornerstone of success. Consumers entrust online businesses with their sensitive financial information, and ensuring the security of that data is paramount. This blog explores the crucial role of security in online payment gateways and delves into strategies for building customer trust and fostering a secure online shopping environment.

The Landscape of Online Payments: Convenience Meets Security Concerns

The ease and convenience of online shopping have revolutionized the way we purchase goods and services. However, this convenience comes with inherent concerns about security:

Data Breaches: The threat of hackers accessing confidential information like credit card numbers and personal details remains a significant concern.

Phishing Scams: Deceptive emails and websites can trick customers into revealing sensitive information.

Payment Fraud: Fraudulent activity like unauthorized charges and identity theft can erode customer trust.

Building a Secure Foundation: Strategies for Enhancing Online Payment Security

To build and maintain customer trust, online payment service providers need to prioritize robust security measures:

Encryption: Implementing industry-standard encryption protocols safeguards sensitive data during transmission and storage. This ensures even if hackers intercept information, it remains unreadable.

Authentication: Multi-factor authentication (MFA) adds an extra layer of security by requiring additional verification beyond just a password. This could involve a code sent to the customer's phone or fingerprint/facial recognition.

Fraud Detection and Prevention: Advanced fraud detection systems monitor transactions for suspicious activity and can flag potential fraudulent attempts before they occur.

Tokenization: Replacing sensitive payment information with unique tokens minimizes the risk of data breaches even if a system is compromised.

Compliance with Security Standards: Adherence to stringent security standards like PCI DSS (Payment Card Industry Data Security Standard) demonstrates a commitment to data protection.

Transparency and Communication: Clearly communicating security measures taken fosters trust and empowers customers to make informed decisions.

Building Trust Beyond Security: Fostering a Customer-Centric Approach

Security is critical, but building trust goes beyond technical safeguards. Here are additional strategies to cultivate customer confidence:

Clear and Transparent Policies: Provide easily accessible information about data privacy policies, refund and return options, and security practices.

Positive Customer Reviews and Testimonials: Showcase positive customer reviews and testimonials to build social proof and demonstrate trust from others.

Secure Payment Badges and Certifications: Display recognizable security badges and certifications from respected security organizations to reassure customers.

Responsive Customer Support: Offer clear and accessible channels for customer support to address security concerns and inquiries promptly.

Regular Security Audits and Updates: Regularly conduct security audits and update security systems to stay ahead of evolving threats.

Empowering Customers: Sharing the Responsibility for Security

While the onus of security lies with online payment service providers, customers also play a vital role:

Strong Passwords: Creating strong, unique passwords for each online account is essential to prevent unauthorized access.

Beware of Phishing Scams: Customers should be vigilant and avoid clicking suspicious links or downloading attachments from unknown sources.

Regular Review of Account Activity: Monitoring account statements and transaction history regularly can help identify potential fraudulent activity early on.

Using Secure Connections: Making online transactions only on secure websites with https encryption in the address bar is crucial.

Keeping Software Updated: Keeping software like operating systems and anti-virus programs updated with the latest security patches is essential.

A Shared Commitment: Building a Secure Future for Online Payments

Building trust in online payment services requires a collaborative effort. By prioritizing robust security measures, fostering transparency, and empowering customers, online businesses can create a secure and trusted environment for online transactions. As technology continues to evolve, staying vigilant and adapting to new threats will be key to maintaining a secure and thriving e-commerce landscape.

0 notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

6 notes

·

View notes

Text

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness"

Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

2 notes

·

View notes

Text

Why Your Restaurant Needs A Pos System?

Implementing a Point of Sale (POS) system is essential for the success of your restaurant. A POS system streamlines operations by automating tasks like order processing, inventory management, and payment processing. It improves accuracy, reduces errors, and enhances efficiency in tracking sales and managing inventory. Additionally, POS systems offer valuable insights through detailed reports, helping you make informed decisions to optimize your restaurant's performance. With features like table management and customer data tracking, a POS system enhances the overall dining experience and customer satisfaction.

3 notes

·

View notes