#Payment processing solutions

Explore tagged Tumblr posts

Text

#Electronic Check#Digital Check#ACH (Automated Clearing House)#Bank Account Verification#Check Conversion#Paperless Checks#Direct Debit#Payment Processing#Online Payments#Check Clearing#Digital Banking#Payment Gateway#EFT (Electronic Funds Transfer)#Payment Authorization#Check Scanning#Payment Processing Services#Merchant Account#Payment Gateway Solutions#Payment Processing Solutions#Credit Card Processing#Online Payment Solutions#Payment Processing Providers#Point of Sale (POS) Systems#Payment Security#Payment Fraud Prevention#Payment Integration#Mobile Payment Solutions#Payment Processing Fees#Payment Settlement

4 notes

·

View notes

Text

Simple and Secure Merchant Processing Solutions for Your Business

Clear Charge Solutions offers trusted merchant processing solutions that help businesses take payments easily. From credit cards to online payments, they make everything fast, secure, and stress-free. Perfect for small shops or growing businesses.

#merchant processing solutions#processing solutions#Payment processing solutions#Online Payment processing solutions#Clear Charge Solutions

0 notes

Text

0 notes

Text

Get Paid Faster & Easier: Top Electronic Payment Solutions for Law Firms

Law firms, ditch the paper checks! Discover the best electronic payment processing solutions to streamline your workflow, boost client satisfaction, and get paid faster. Learn about features, security, and compatibility.

#Law Firm Electronic Payment#Electronic Payment Processing Solutions#best law firm payment processing platform#law firm payment processing solutions#best payment processing#payment processing solutions#payment processing solution for law firms#law office payment processing#law office credit card processing#law firm realization rate#payment processing solution#online payment options#lawyer payment methods#online lawyer payments#accept payments online#type of lawyer payment methods

1 note

·

View note

Text

Card Processing Solutions

#Card Processing Solutions#credit card processing#payment processing#payment processing solutions#credit card processing companies#credit card processing solutions#merchant processing solutions#best credit card processing#credit card processing for small business#best of credit card processing#credit card payment processing#merchant processing#online credit card processing#processing solution#credit card processing fees#solutions for credit card processing

1 note

·

View note

Text

Join Wise and get £50. It's simple, quick, and rewarding!

Wise Money, Wise choices!

Looking for a smarter way to handle your money across borders? Wise is the answer. And here’s an even better reason to join—sign up with my invite, and you’ll get £50!

Smart Transfers, Happy Wallets!

Wise.com makes sending, receiving, and converting money internationally fast, easy, and affordable. With real exchange rates and low fees, you’ll save more on every transaction. Plus, their platform is user-friendly, so you can manage your money with confidence.

Save More, Send Smarter!

Signing up is simple. Just use my invite link, create your account, and you’ll get £50 to kickstart your journey with Wise. It’s a win-win—secure your bonus and start saving today! Your Money, Your Way—Easily!!!

#payments#payment gateway#payment solutions#payment processing#payment fraud protection#payment plan#partnership#credit#network#paypal#wise words#wise quotes#wise zzz#payment transfer easily#spilled ink#artists on tumblr#deadpool and wolverine#hermitcraft#photography#grunge#dc comics#splatoon#splatoon 3

7 notes

·

View notes

Text

All-in-One Payment Solutions for Any Business

What Are Payment Solutions?

Imagine a world where transactions were clunky, slow, and insecure. Not only would businesses struggle, but customers would also be frustrated. That’s where payment solutions come in.

They are the backbone of the modern commerce experience, facilitating smooth, secure, and efficient money exchanges in a world that demands speed and reliability.

From in-store purchases to digital subscriptions, payment solutions enable every kind of business transaction.

At Valor, we understand that payments are not just about exchanging money – they’re about ensuring a seamless, secure, and smart transaction every time. This is why we’re constantly evolving to offer payment solutions that help businesses thrive.

#payment solutions#payment gateway#payment processor#payment processing#payments#credit card#POS#pos software#pos system#pos machine#pos solutions

3 notes

·

View notes

Text

How Does Payment Gateway Integration Simplify Online Transactions?

In the digital age, where e-commerce and online services dominate the market, payment gateway integration has emerged as a cornerstone of seamless online transactions. A payment gateway acts as a bridge between customers and merchants, enabling secure and efficient payment processing. This article delves into how payment gateway integration simplifies online transactions while highlighting the role of payment solution providers and innovations like those from Xettle Technologies in enhancing the experience.

What Is Payment Gateway Integration?

Payment gateway integration refers to the process of embedding a payment gateway into a website, application, or e-commerce platform to facilitate the secure transfer of payment information between the customer, the merchant, and the financial institutions involved. This integration ensures that transactions are processed smoothly, enhancing the user experience and building trust among customers.

Payment gateways handle critical tasks such as encrypting sensitive data, verifying card details, and authorizing payments, making them an indispensable part of any online business.

Benefits of Payment Gateway Integration

1. Enhanced Security

One of the primary advantages of payment gateway integration is the high level of security it offers. Payment gateways use advanced encryption technologies to protect sensitive customer data, such as credit card details and personal information. By complying with industry standards like PCI DSS (Payment Card Industry Data Security Standard), they ensure that transactions remain secure from cyber threats and fraud.

Many payment solution providers also incorporate features such as tokenization, two-factor authentication, and fraud detection systems, further safeguarding the transaction process.

2. Seamless User Experience

Payment gateway integration ensures that customers can complete their transactions without any interruptions or complications. A smooth checkout process is essential for reducing cart abandonment rates and enhancing customer satisfaction. Features like multiple payment options, one-click payments, and mobile compatibility contribute to a user-friendly experience.

For example, integrated payment gateways often support a wide range of payment methods, including credit and debit cards, digital wallets, net banking, and even cryptocurrencies. This flexibility ensures that businesses can cater to diverse customer preferences.

3. Global Reach

With payment gateway integration, businesses can easily expand their reach to international markets. Most payment gateways support multiple currencies and languages, enabling businesses to offer localized payment experiences to their global customers. This capability is particularly beneficial for e-commerce platforms seeking to scale their operations.

4. Real-Time Payment Processing

Payment gateway integration ensures that transactions are processed in real-time, reducing delays and providing instant confirmation to customers and merchants. This immediacy not only enhances the customer experience but also helps businesses maintain accurate records of their transactions.

5. Simplified Reconciliation and Reporting

Integrated payment gateways often come with dashboards and reporting tools that provide businesses with detailed insights into their transactions. These tools simplify the process of tracking payments, managing refunds, and generating financial reports, enabling better decision-making and financial planning.

The Role of Payment Solution Providers

Payment solution providers play a crucial role in making payment gateway integration accessible and efficient. These providers offer a range of services, from payment gateway setup and customization to ongoing support and updates. By partnering with reliable payment solution providers, businesses can ensure a hassle-free integration process and stay ahead in the competitive digital landscape.

Xettle Technologies, for instance, is a leading payment solution provider known for its innovative approach to payment gateway integration. Their solutions are designed to cater to businesses of all sizes, offering flexibility, security, and scalability. By leveraging the expertise of providers like Xettle Technologies, businesses can focus on their core operations while leaving the technical aspects of payment processing in capable hands.

Key Considerations for Payment Gateway Integration

When integrating a payment gateway, businesses must consider several factors to ensure optimal performance and customer satisfaction:

Security: Ensure that the payment gateway complies with industry security standards and offers advanced fraud prevention features.

Compatibility: Choose a payment gateway that integrates seamlessly with your existing website or application.

User Experience: Opt for a gateway that offers a smooth and intuitive checkout process.

Cost: Evaluate the pricing structure, including setup fees, transaction fees, and monthly charges.

Support: Partner with a payment solution provider that offers reliable customer support and technical assistance.

Conclusion

Payment gateway integration is a vital component of modern online transactions, providing businesses with the tools they need to deliver secure, efficient, and user-friendly payment experiences. By partnering with trusted payment solution providers and leveraging innovative technologies, businesses can streamline their payment processes and build lasting relationships with their customers.

The expertise of companies like Xettle Technologies demonstrates how payment gateway integration can be tailored to meet the unique needs of businesses, ensuring scalability and adaptability in a fast-evolving market. As the demand for seamless online transactions continues to grow, investing in robust payment gateway integration is not just an option but a necessity for businesses aiming to thrive in the digital era.

2 notes

·

View notes

Text

#Electronic Check#Digital Check#ACH (Automated Clearing House)#Bank Account Verification#Check Conversion#Paperless Checks#Direct Debit#Payment Processing#Online Payments#Check Clearing#Digital Banking#Payment Gateway#EFT (Electronic Funds Transfer)#Payment Authorization#Check Scanning#Payment Processing Services#Merchant Account#Payment Gateway Solutions#Payment Processing Solutions#Credit Card Processing#Online Payment Solutions#Payment Processing Providers#Point of Sale (POS) Systems#Payment Security#Payment Fraud Prevention#Payment Integration#Mobile Payment Solutions#Payment Processing Fees#Payment Settlement

2 notes

·

View notes

Text

Fast and Secure Credit Card Payment Processing with Clear Charge Solutions

Clear Charge Solutions makes Credit Card Payment Processing easy and secure for all types of businesses. Whether you're running a shop or an online store, our Card Payment Processing tools help you get paid quickly and safely. We offer low fees, fast deposits, and top-notch support to keep your business running smoothly.

#Credit Card Payment Processing#Card Payment Processing#payment processing solutions#clear charge solutions#finance

0 notes

Text

Unlocking the Secrets to Effortless Payments with AuxPay

Are you a business owner tired of the hassle of managing payments? Getting paid should be simple and stress-free, right? That's where AuxPay steps in, your dedicated payment solution designer. We're here to make your financial life smoother, your payment processing more efficient, and your choices more flexible.

The Power of Payment Customization

Managing your payments shouldn't be a complicated puzzle. At AuxPay, we understand that every business is unique. That's why we offer tailored payment solutions that cater to your specific needs. Say goodbye to the one-size-fits-all approach – with AuxPay, you're in control.

Simplifying Invoice Creation

Creating and sending invoices can be a tedious chore, but it doesn't have to be. AuxPay offers an intuitive app interface that simplifies invoicing. Whether you're dealing with clients, customers, or partners, generating invoices with AuxPay is a breeze. You can kiss those invoicing headaches goodbye.

Choose How You Want to Get Paid

At AuxPay, we believe that the power to choose should be in your hands. We support multiple payment methods, allowing you to select what works best for your business. Whether it's credit cards, bank transfers, or digital wallets, AuxPay has you covered. You decide – it's your money, your rules.

Real-Time Analytics for Smarter Decisions

To succeed in today's fast-paced business environment, you need insights at your fingertips. That's where our real-time analytics come in. With AuxPay, you can keep a pulse on your financial performance, track transactions, and gain a clear understanding of your business's financial health. Make informed decisions with the data you need, precisely when you need it.

Getting Started with AuxPay

Ready to simplify your payment processing and gain more control over your financial destiny? Getting started with AuxPay is easy. Visit our website at AuxPay.net and explore the array of features and benefits we offer.

Say goodbye to payment hassles and hello to financial freedom with AuxPay! Make life easier for your business today. Get started with AuxPay now and discover a new world of payment simplicity. Your business deserves it, and so do you.

Unleash the power of easy payments with AuxPay – the key to financial freedom. It's your financial life, simplified. 🚀💰

Discover the Power of Payment Customization

Are you tired of one-size-fits-all payment solutions that don't address your unique business needs? With AuxPay, you can customize your payment solutions for a more efficient and flexible financial life.

Simplify Your Invoicing Process

Creating and sending invoices shouldn't be a hassle. Learn how AuxPay's intuitive app interface simplifies invoicing, making it easier for you to manage your financial transactions.

Multiple Payment Methods for Your Convenience

Want to choose how you get paid? AuxPay supports various payment methods, allowing you to select the one that works best for your business. Gain control over your payments – it's your money, your rules.

Real-Time Analytics for Informed Decisions

To succeed in today's fast-paced business environment, you need real-time insights. Discover how AuxPay's real-time analytics empower you to make informed decisions and track your financial performance effectively.

#business#payment solutions#fintech#business strategy#technology#payments#payment services#payment gateway#payment systems#payment processing#high risk merchant highriskpay.com#high risk merchant account#merchant services#google pay#apple pay#cashapp#point of sales#credit report#credit cards#debit card

2 notes

·

View notes

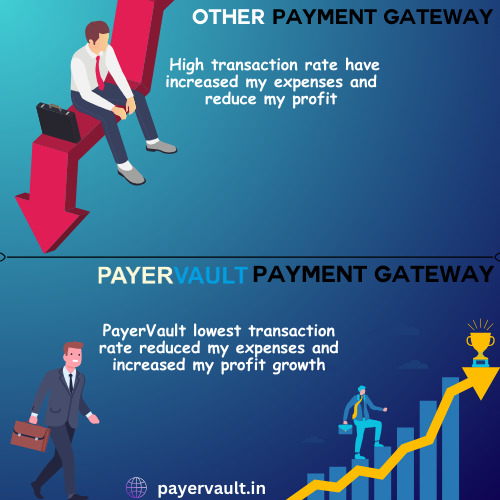

Text

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness" Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

3 notes

·

View notes

Link

A growing need for providing enhanced customer experience has led to an increase in the Payment Processing Solution Market....

0 notes