#Real Estate Flipping Houses

Text

Fix And Flippers

Fix and Flippers are always looking for investors for trust deed investments.They work with individuals, corporations, pension plans, or IRAs. They are experts at matching private investor funds with low risk, high yield, secured by a hard asset and solid loan opportunities. They have solid systems in place that allow investors to earn between 8%-13% per annum, compared to the low-interest rates currently being offered by banks.

Fix and Flippers has developed a relationship with many such brokers, mortgage companies, and lenders worthy of a referral.These lenders and mortgage companies have many years in the business and have vetted for their reputations as closers and being a preferred lender among the industries elite. Their referral sources are loyal and provide steady repeat business that affords them an overflow of business.

#Fix And Flip#Real Estate Investing#House Flipping#Property Renovation#Real Estate Flipping Houses#Flips#Flip This House#Property Investing#Renovate And Sell#Investment Properties#Home Renovation#Flippers Market#Rehabbing Homes#House Rehab#Profitable Flips#DIY Flipping#Flip Life#House Remodel#Real Estate Flipper#Fixer Upper#Fix And Flippers

2 notes

·

View notes

Text

'We buy ugly houses' is code for 'we steal vulnerable peoples' homes'

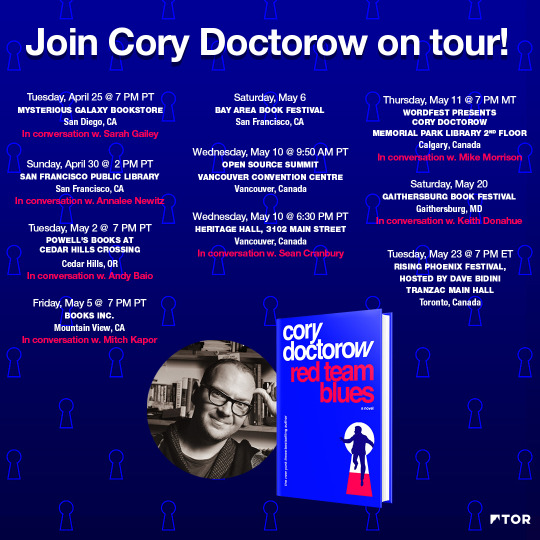

Tonight (May 11) at 7PM, I’m in CALGARY for Wordfest, with my novel Red Team Blues; I’ll be hosted by Peter Hemminger at the Memorial Park Library, 2nd Floor.

Home ownership is the American dream: not only do you get a place to live, free from the high-handed dictates of a landlord, but you also get an asset that appreciates, building intergenerational wealth while you sleep — literally.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

Of course, you can’t have it both ways. If your house is an asset you use to cover falling wages, rising health care costs, spiraling college tuition and paper-thin support for eldercare, then it can’t be a place you live. It’s gonna be an asset you sell — or at the very least, borrow so heavily against that you are in constant risk of losing it.

This is the contradiction at the heart of the American dream: when America turned its back on organized labor as an engine for creating prosperity and embraced property speculation, it set itself on the road to serfdom — a world where the roof over your head is also your piggy bank, destined to be smashed open to cover the rising costs that an organized labor movement would have fought:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Today, we’re hit the end of the road for the post-war (unevenly, racially segregated) shared prosperity that made it seem, briefly, that everyone could get rich by owning a house, living in it, then selling it to everybody else. Now that the game is ending, the winners are cashing in their chips:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

The big con of home ownership is proceeding smartly on schedulee. First, you let the mark win a little, so they go all in on the scam. Then you take it all back. Obama’s tolerance of bank sleze after the Great Financial Crisis kicked off the modern era of corporations and grifters stealing Americans’ out from under them, forging deeds in robosigning mills:

https://www.marketwatch.com/story/us-breaks-down-93-bln-robo-signing-settlement-2013-02-28

The thefts never stopped. Today on Propublica, by Anjeanette Damon, Byard Duncan and Mollie Simon bring a horrifying, brilliantly reported account of the rampant, bottomless scams of Homevestors, AKA We Buy Ugly Houses, AKA “the #1 homebuyer in the USA”:

https://www.propublica.org/article/ugly-truth-behind-we-buy-ugly-houses

Homevestors — an army of the hedge fund Bayview Asset Management — claims a public mission: to bail out homeowners sitting on unsellable houses with all-cash deals. The company’s franchisees — 1,150 of them in 48 states — then sprinkle pixie dust and secret sauce on these “ugly houses” and sell them at a profit.

But Propublica’s investigation — which relied on whistleblowers, company veterans, court records and interviews with victims — tells a very different story. The Homevestor they discovered is a predator that steals houses out from under elderly people, disabled people, people struggling with mental illness and other vulnerable people. It’s a company whose agents have a powerful, well-polished playbook that stops family members from halting the transfers the company’s high-pressure salespeople set in motion.

Propublica reveals homeowners with advanced dementia who signed their shaky signatures to transfers that same their homes sold out from under them for a fraction of their market value. They show how Homevestor targets neighborhoods struck by hurricanes, or whose owners are recently divorced, or sick. One whistleblower tells of how the company uses the surveillance advertising industry to locate elderly people who’ve broken a hip: “a 60-day countdown to death — and, possibly, a deal.” The company’s mobile ads are geofenced to target people near hospitals and rehab hospitals, in hopes of finding desperate sellers who need to liquidate homes so that Medicaid will cover their medical expenses.

The sales pitches are relentless. One of Homevestor’s targets was a Texas woman whose father had recently been murdered. As she grieved, they blanketed her in pitches to sell her father’s house until “checking her mail became a traumatic experience.”

Real-estate brokers are bound by strict regulations, but not house flippers like Homevestors. Likewise, salespeople who pitch other high-ticket items, from securities to plane tickets — are required to offer buyers a cooling-off period during which they can reconsider their purchases. By contrast, Homevestors’ franchisees are well-versed in “muddying the title” to houses after the contract is signed, filing paperwork that makes it all but impossible for sellers to withdraw from the sale.

This produces a litany of ghastly horror-stories: homeowners who end up living in their trucks after they were pressured into a lowball sales; sellers who end up dying in hospital beds haunted by the trick that cost them their homes. One woman who struggled with hoarding was tricked into selling her house by false claims that the city would evict her because of her hoarding. A widow was tricked into signing away the deed to her late husband’s house by the lie that she could do so despite not being on the deed. One seller was tricked into signing a document he believed to be a home equity loan application, only to discover he had sold his house at a huge discount on its market value. An Arizona woman was tricked into selling her dead mother’s house through the lie that the house would have to be torn down and the lot redeveloped; the Homevestor franchisee then flipped the house for 5,500% of the sale-price.

The company vigorously denies these claims. They say that most people who do business with Homevestors are happy with the outcome; in support of this claim, they cite internal surveys of their own customers that produce a 96% approval rating.

When confronted with the specifics, the company blamed rogue franchisees. But Propublica obtained training materials and other internal documents that show that the problem is widespread and endemic to Homevestors’ business. Propublica discovered that at least eight franchisees who engaged in conduct the company said it “didn’t tolerate” had been awarded prizes by the company for their business acumen.

Franchisees are on the hook for massive recurring fees and face constant pressure from corporate auditors to close sales. To make those sales, franchisees turn to Homevana’s training materials, which are rife with predatory tactics. One document counsels franchisees that “pain is always a form of motivation.” What kind of pain? Lost jobs, looming foreclosure or a child in need of surgery.

A former franchisee explained how this is put into practice in the field: he encountered a seller who needed to sell quickly so he could join his dying mother who had just entered a hospice 1,400 miles away. The seller didn’t want to sell the house; they wanted to “get to Colorado to see their dying mother.”

These same training materials warn franchisees that they must not deal with sellers who are “subject to a guardianship or has a mental capacity that is diminished to the point that the person does not understand the value of the property,” but Propublica’s investigation discovered “a pattern of disregard” for this rule. For example, there was the 2020 incident in which a 78-year-old Atlanta man sold his house to a Homevestors franchisee for half its sale price. The seller was later shown to be “unable to write a sentence or name the year, season, date or month.”

The company tried to pin the blame for all this on bad eggs among its franchisees. But Propublica found that some of the company’s most egregious offenders were celebrated and tolerated before and after they were convicted of felonies related to their conduct on behalf of the company. For example, Hi-Land Properties is a five-time winner of Homevestors’ National Franchise of the Year prize. The owner was praised by the CEO as “loyal, hardworking franchisee who has well represented our national brand, best practices and values.”

This same franchisee had “filed two dozen breach of contract lawsuits since 2016 and clouded titles on more than 300 properties by recording notices of a sales contract.” Hi-Land “sued an elderly man so incapacitated by illness he couldn’t leave his house.”

Another franchisee, Patriot Holdings, uses the courts aggressively to stop families of vulnerable people from canceling deals their relatives signed. Patriot Holdings’ co-owner, Cory Evans, eventually pleaded guilty to to two felonies, attempted grand theft of real property. He had to drop his lawsuits against buyers, and make restitution.

According to Homevestors’ internal policies, Patriot’s franchise should have been canceled. But Homevestors allowed Patriot to stay in business after Cory Evans took his name off the business, leaving his brothers and other partners to run it. Nominally, Cory Evans was out of the picture, but well after that date, internal Homevestors included Evans in an award it gave to Patriot, commemorating its sales (Homevestors claims this was an error).

Propublica’s reporters sought comment from Homevestors and its franchisees about this story. The company hired “a former FBI spokesperson who specializes in ‘crisis and special situations’ and ‘reputation management’ and funnelled future questions through him.”

Internally, company leadership scrambled to control the news. The company convened a webinar in April with all 1,150 franchisees to lay out its strategy. Company CEO David Hicks explained the company’s plan to “bury” the Propublica article with “‘strategic ad buys on social and web pages’ and ‘SEO content to minimize visibility.’”

https://www.propublica.org/article/homevestors-aims-to-bury-propublica-reporting

Franchisees were warned not to click links to the story because they “might improve its internet search ranking.”

Even as the company sought to “bury” the story and stonewalled Propublica, they cleaned house, instituting new procedures and taking action against franchisees identified in Propublica’s article. “Clouding titles” is now prohibited. Suing sellers for breach of contract is “discouraged.” Deals with seniors “should always involve family, attorneys or other guardians.”

During the webinar, franchisees “pushed back on the changes, claiming they could hurt business.”

If you’ve had experience with hard-sell house-flippers, Propublica wants to know: “If you’ve had experience with a company or buyer promising fast cash for homes, our reporting team wants to hear about it.”

Catch me on tour with Red Team Blues in Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A Depression-era photo of a dour widow standing in front of a dilapidated cabin. Next to her is Ug, the caveman mascot for Homevestors, smiling and pointing at her. Behind her is a 'We buy ugly houses' sign.

Image:

Homevestors

https://www.homevestors.com/

Fair use:

https://www.eff.org/issues/intellectual-property

#pluralistic#the rents too damned high#house flipping#llc brain#scams#elder abuse#ripoffs#weaponized shelter#predators#homevestors#we buy ugly houses#ugly houses#real estate#propublica

2K notes

·

View notes

Text

Yesterday I posted the devastating renovation/restoration of this 1892 Victorian in Goshen, New York. Well, thanks to ephraelinhats who found the original photos of what it looked like before. They definitely could've salvaged some of the original elements. Look at this comparision:

They chose to lose the main entrance hall altogether, so it's not even shown on the listing. Definitely could've been restored, though. They made so many square angular rooms, now.

Some of the stair railing is gone, but the stairs could've been restored and the curving walls, too. Looks like the upper railings are still there.

Definitely a lot of it left. Looks like someone started to restore it, but they opened the 3rd floor up.

Okay, I see what they did here- a previous owner put the window in. But, did they have to square off the alcove?

The kitchen must've been around here, b/c those are the service stairs.

The kitchen now.

This must've been the dining room. That wainscoting could've been restored. Look at the crown molding and a niche above the fireplace, not a window, and if it was, it may have been stained glass.

Well, it's all gone and this is now the dining room.

They didn't need to get rid of the crown molding.

There was plenty of crown molding that could've been saved.

Don't know where this room is, but it had beautiful wood that could've been saved.

One of the bedrooms had a cute fireplace.

The previous owner did some funky stuff to this bedroom. But, at least they kept the fireplace.

There are doors w/original ceramic knobs. Could've been salvaged.

If they did this much demo anyway, they could've done it differently.

I see what they did here w/the porches, but someone had painted the back part white. Looks like they sandblasted the brick. I wish they would've taken that much care to restore the interior.

#before & after comparison#victorian restoration#real estate#house flipping#houses#house tours#home tour

85 notes

·

View notes

Text

At Fat Homes, we help you to step into your ideal life with the keys to your new home. Experience ultimate comfort and style in every corner. To learn more, click on the link in the bio

#fathomes#house for sale#property flipping#realestate#realestateinvestment#dream house#investment#property#flippingamericatoday#commercial#flippinghouses#real estate agent#finance#flippingproperty#real estate

7 notes

·

View notes

Text

I was just driving home, saw some newly renovated homes on the way, and something occurred to me(may be explicit idk I dont actl watch this stuff):

The HGTV aesthetic, Whites, Greys, and Blacks, those aren't just neutral colors: They're PRIMING Colors. They're colors you paint Other, BETTER Colors that you like MORE on top of.

Property Brothers, all these other assholes; they want you to live in a house painted to sell.

#HGTV#Priming#Painting#Aesthetics#Capitalism#Capitalist Aesthetics#Real Estate#House Flipping#Economic Bubbles#Economic Manias#zA Posts#zA Thinks

31 notes

·

View notes

Text

I'm fine I'm just really really pissed off at this guy

fuck you and your local meme billboard arms

#fucking corporate cash buy-out bastard#he owns like half of the real estate listings around here#flip a coin and find this shithead with his arms spread on the front lawn#it's like that 'Darmok' Star Trek TNG episode#“Kris Lindahl; his arms wide”#buys houses for cash#replaces the carpets#hides all the disclosures#and charges $75k over market value#somehow everything still sells in less than a week#I'm going to ride a moose through his front window#meanwhile#I have to start from SCRATCH with my dad#who is just... impossible to deal with about real estate#he REFUSES to understand this market#I thought this house getting snatched out from under us might teach him a lesson but. uh. no. no it did not#he was just like “well we'll magically find a cheaper house with MORE features” and then we'll negotiate a price on THAT one#or the classic: “there are tons of houses available”#.............not in the year of our Demiurge Capitalist Hellscape 2024 there are not

5 notes

·

View notes

Text

on the topic of that post about traditions, i was also talking with some friends about how i really like the "modern traditional" aesthetics of overwatch. you can definitely tell its the future, but there's a lot of regional building techniques in places that allow it that also abandon western aesthetics in favor of embracing the culture of the maps area. i know it's to give each map a unique aesthetic and the creators were not thinking as deeply about it as i am, but i enjoy thinking too much. big central cities obviously need metal and glass and so forth to support the infrastructure, but on maps for smaller locations, you can see that they're made with mostly local supplies. it was on the mind because i saw a video about the stigma against grass thatched houses in africa and how theyre seen as a backwards way of living, when in reality theyre actually the most environmentally friendly way to make a house in the area and theyre also energy efficient. you dont need to run heating and cooling through a house that heats and cools itself, you dont need to worry about food spoiling if its kept chilled naturally, and you dont need to worry about costly repairs to your house if the materials are readily available. its trying to build every shelter in a western style to try to show the world that a place has been "civilized" that leads to the loss of efficiency and culture and history and a million other things. anyway i think im probably the only person who cares about the sociopolitical implications of the funny monkey with a laser gun game this much

#and dont get me started on the spiritualism and scientific advancements in that world#i was never involved in the fandom for a reason. everyone was busy making hunky boys kiss. i was busy dropping out of environmental science#in my head there is a beautiful future where no history was lost and where there is a major switch that is flipped and all of a sudden#infrastructure is made listening to the people who know the land and how to build on it while sustaining it best. in my head there is a#beautiful future where real estate companies can no longer pave over wetlands so long as they 'just build another one somewhere else'#because you cannot just build another one. it is an incredibly complex filtering system that you cannot just recreate by dumping water over#some grass and adding bugs and calling it a day. in my head there are no empty houses and there are town squares and there are gardens#in my head i live in a beautiful past where my great great grandma never had to take the name america smith!!#but here we are so we must destroy pavement heatsinks and tend gardens

2 notes

·

View notes

Text

Best Financing Secrets For Mobile Home Park Investments #shorts

Private Money Academy Conference:

https://www.JaysLiveEvent.com

Free Report:

https://www.jayconner.com/MoneyReport

Watch the Full Interview at:

youtube

"The Mobile Home Park Niche: A Profitable and Overlooked Real Estate Opportunity"

Jefferson is a mobile home park investment expert and educator. He is the founder of Park Avenue Partners, a private equity real estate fund that acquires and operates mobile home parks nationwide.

His investment funds are returning 10% - 15% IRRs to Limited Partners. Both personally and through his partnerships, Jefferson has acquired 43 MHPs in 15 states since 2007 totaling over $81mm in value.

He started the industry’s first MHP podcast and the largest group on LinkedIn dedicated to investing in mobile home parks.

Prior to beginning to manage investors’ money in 2014, Jefferson spent seven years investing his own capital in mobile home parks and consulting with high-net-worth families with interests in the manufactured housing industry.

Jefferson has been featured in The New York Times, Bloomberg Magazine, and on the Real Money television show. He holds a B.A. from the University of Pennsylvania and an MBA from the Wharton School of Business.

Jefferson’s favorite mobile home is the 1954 Spartan Imperial Mansion, upon which the Company’s logo is partially based. He finds the Bowlus Road Chief to be pretty appealing too.

Join the Private Money Academy:

https://www.JayConner.com/trial/

Have you read Jay’s new book: Where to Get The Money Now?

It is available FREE (all you pay is the shipping and handling) at

https://www.JayConner.com/Book

What is Private Money? Real Estate Investing with Jay Conner

https://www.JayConner.com/MoneyPodcast

Jay Conner is a proven real estate investment leader. He maximizes creative methods to buy and sell properties with profits averaging $67,000 per deal without using his own money or credit.

What is Real Estate Investing? Live Private Money Academy Conference

youtube

YouTube Channel

Apple Podcasts:

Facebook:

#jay conner#real estate investing#real estate#youtube#private money#flipping houses#real estate investing for beginners#raising private money#privatemoney#realestate#Youtube

2 notes

·

View notes

Text

Red Flags To Look Out For When Buying A Flipped House

2 notes

·

View notes

Video

youtube

Keshav Kolur Builds Wealth Through Smart Real Estate and Private Lending

https://www.jayconner.com/podcast/episode-204-keshav-kolur-builds-wealth-through-smart-real-estate-and-private-lending/

In a recent episode of the Raising Private Money podcast with Jay Conner, guest Keshav Kolur shared his invaluable expertise on the intricate landscape of investments. This blog post delves into some key takeaways from their conversation, offering practical advice on smart investment strategies.

Investment Advice from Keshav Kolur

Don’t Invest More Than You Can Afford to Lose

One of the fundamental pieces of advice from Keshav Kolur is to only invest what you can afford to lose. This principle might seem straightforward, but it’s often overlooked by enthusiastic investors. Maintaining a reserve for unforeseen expenses is crucial in preventing financial distress in the face of market volatility.

Diversification is Key

Kolur emphasizes diversification across various asset classes and real estate markets. By spreading investments, the risk is mitigated. For example, rather than placing all funds in one sector, it is wiser to allocate capital into different sectors like apartments, industrial warehouses, private lending, and even oil and gas. This strategy provides a buffer against downturns in any single market.

Understanding Current Market Trends

Tech Stocks’ Influence on the Stock Market

Tech stocks, often referred to as the “big seven,” are becoming increasingly influential in driving the growth of the stock market. This concentration can be both an opportunity and a risk, highlighting the importance of balancing portfolios.

Real Estate Market Dynamics

Currently, the real estate market is experiencing certain stress points, such as foreclosures due to loan payment failures and an increased supply. Despite the rising interest rates, housing prices have remained steady. This paradoxical scenario suggests an underlying demand that savvy investors can capitalize on.

Keshav Kolur’s Company: Clive Capital

Personalized and Transparent Investing

Keshav Kolur founded Clive Capital with the vision of providing personalized investment opportunities that ensure higher returns and tax benefits. By investing directly into LLCs, investors benefit from direct tax deductions and expenses, creating a more profitable and transparent relationship compared to traditional corporate investments.

Higher Projected Returns and Lower Overheads

Clive Capital’s streamlined operations mean less overhead, promising higher returns on investment. Clients enjoy direct engagement with managers, receiving regular updates on performance, and fostering trust and transparency.

Keshav Kolur’s Journey and Clive Capital’s Mission

From Engineering to Real Estate Investing

In just a few years, Kolur transitioned from a mechanical engineer to a significant player in real estate, catalyzed by influential readings such as “Rich Dad Poor Dad.” His journey underscores the importance of education and adaptability in investment ventures.

Building a Diversified Portfolio

Established in January 2022, Clive Capital focuses on helping investors achieve financial freedom through diversification. Managing over 1,000 apartments and developing more than 500 single-family homes, their commitment to building generational wealth is evident.

Raising Private Money: Strategies and Best Practices

Leveraging Personal Networks

Kolur’s method of raising private money highlights the power of personal networks. By tapping into connections within his tech industry network, along with friends and family, he underscores the value of mutual success and trust in investment partnerships.

Initial Conversations with Potential Investors

In his approach, Kolur conducts 30-minute introductory calls to understand potential investors’ backgrounds, experiences, and financial goals. This personalized assessment ensures that the investment opportunities align well with the investors’ needs and expectations.

The Motivation and Approach Behind Investments

Identifying the ‘Why’ Behind Investments

Understanding why individuals invest is crucial—whether it’s for financial freedom, growth, tax benefits, or more family time. This clarity helps tailor investment strategies to maximize benefits for each investor.

Benefits of Alternative Investments Outside the Stock Market

Risk-Adjusted Returns and Tax Benefits

Investing outside the stock market can yield higher risk-adjusted returns and tax benefits like deductions and depreciation losses. Moreover, the reduced daily volatility compared to stock markets, and fewer political influences, create a more stable investment environment.

Real Estate as a Solid Investment

Jay Conner highlights the tangibility and understandability of real estate investments. He prefers real estate for its reduced volatility and promising returns, exemplified by his recent successful flip.

Ensuring Investment Success: Risk Management Strategies

Selecting the Right Partners

The importance of partnering with experienced and trustworthy individuals cannot be overstated. Kolur and Conner both emphasize due diligence to avoid inexperienced or dishonest operators, ensuring the success of investments.

Conclusion

Keshav Kolur’s insights, alongside Jay Conner’s experienced observations, form a comprehensive guide for navigating today’s complex investment landscape. By emphasizing diversification, personalized strategies, and transparent dealings, investors can better position themselves for success, achieving financial freedom and stability in a fluctuating market.

For those interested in learning more, educational resources and contact information are available through the Clive Capital website and Jay Conner’s offerings.

10 Discussion Questions from this Episode:

Keshav Kolur emphasizes not investing more than you can afford to lose. How does this principle align with or differ from your current investment strategy? Can you share a personal experience where this advice would have changed your approach?

Keshav recommends diversification across different markets and asset classes. How have you diversified your investments, and what challenges have you faced?

The episode discusses current market trends, including the impact of tech stocks on the stock market and real estate market conditions. How do you think these trends will evolve in the next 12 months?

Considering Keshav’s mention of private lending and asset classes like oil and gas and industrial warehouses, do you find any alternative investments particularly intriguing? Why?

The benefits of direct investment through syndications versus larger corporations like Exxon are highlighted. Have you experienced tax advantages or higher returns through syndications or private investments?

Jay Conner emphasizes the importance of trust and transparency with investment managers like Keshav. How important is direct communication with your investment manager to you, and why?

Keshav offers various educational resources, including lead magnets and eBooks. What type of educational materials have been most beneficial in guiding your investment decisions?

Keshav conducts 30-minute introductory calls with potential investors. If you were to have such a call, what key questions would you ask to ensure the investment aligns with your goals?

Keshav utilized his network, especially in the tech industry, to raise private money. What strategies have you used or would consider using to raise funds for an investment project?

Keshav and Jay discuss the advantages of investing outside the stock market, including risk-adjusted returns and lower volatility. What are your thoughts on these benefits, and how do they influence your investment decisions?

Fun facts that were revealed in the episode:

Keshav’s Investment Inspiration:

Keshav Kolur was inspired to delve into investing after reading “Rich Dad Poor Dad” during a flight.

From Mechanical Engineer to Real Estate:

Initially starting as a mechanical engineer, Keshav shifted his career path dramatically by becoming a successful realtor and investor within a couple of years.

Reddit Influence:

A Reddit post by a roommate influenced Keshav’s pivot from single-family home investments to larger syndications, leading to significant investment in 108 apartments in San Antonio.

Timestamps:

00:01 Raising Private Money Without Asking For It.

04:45 Creating wealth for the family, founded Clive Capital.

07:00 Networking with friends, family, social media, LinkedIn.

13:04 LLC ownership: expenses, deductions; stock market volatility.

16:55 Choose trustworthy partners to mitigate private lending risks.

17:47 Fraudulence and inexperience risk your investment capital.

21:17 The stock market thrives, tech stocks dominate, and real estate declines.

27:33 Personalized, transparent investing with clear performance insights.

28:41 Investors invest in you, valuing transparency, and accessibility.

29:39 Connect with Keshav Kolur: https://www.linkedin.com/in/keshavkolur/

Private Money Academy Conference:

https://www.JaysLiveEvent.com

Free Report:

https://www.jayconner.com/MoneyReport

Join the Private Money Academy:

https://www.JayConner.com/trial/

Have you read Jay’s new book: Where to Get The Money Now?

It is available FREE (all you pay is the shipping and handling) at

https://www.JayConner.com/Book

What is Private Money? Real Estate Investing with Jay Conner

https://www.JayConner.com/MoneyPodcast

Jay Conner is a proven real estate investment leader. He maximizes creative methods to buy and sell properties with profits averaging $67,000 per deal without using his money or credit.

What is Real Estate Investing? Live Private Money Academy Conference

https://youtu.be/QyeBbDOF4wo

YouTube Channel

https://www.youtube.com/c/RealEstateInvestingWithJayConner

Apple Podcasts:

https://podcasts.apple.com/us/podcast/private-money-academy-real-estate-investing-with-jay/id1377723034

Facebook:

https://www.facebook.com/jay.conner.marketing

Listen to our Podcast:

https://www.buzzsprout.com/2025961/episodes/15818792-keshav-kolur-builds-wealth-through-smart-real-estate-and-private-lending

#youtube#real estate#real estate investing#real estate investing for beginners#flipping houses#Private Money#Raising Private Money#Jay Conner

0 notes

Text

Fast Flip Fundamentally Fails

Beds/Baths: 1 beds, 1 bath, 525 squares

Purchase Price (8/2024): $250,000

Asking Price (9/2024): $389,900

Difference: +$139,900

Commission (3%): -$11,697

Total Gain: +$128,203

You read that right: they bought this thing in August 2024 and put it right back on the…

View On WordPress

#big bear#flip#gain#housing#housing-market#investing#real-estate#real-estate-investing#real-estate-investment#realtor

0 notes

Text

How to Make Money in Real Estate Without Experience, Cash, or Credit: The Power of Wholesaling

Real estate can seem daunting, especially if you lack experience, cash, or credit. But what if I told you there’s a way to dive into the market and start making money without any of those barriers? Enter real estate wholesaling—a powerful strategy that allows you to profit from property transactions without needing to own any properties yourself.

What is Real Estate Wholesaling?

At its core, wholesaling involves finding distressed properties, securing them under a contract, and then selling that contract to an end buyer, usually an investor or cash buyer, at a higher price. You act as the middleman, leveraging your ability to find good deals and connect buyers with sellers. Here’s how you can get started:

Learn the Market: Research your local real estate market to identify trends and hot neighborhoods. Understanding your market is essential to finding profitable deals.

Find Motivated Sellers: Look for property owners who are eager to sell quickly—this could include homeowners facing foreclosure, landlords tired of managing their properties, or those dealing with inherited properties. Use online platforms, local classifieds, and social media to find these leads.

Negotiate Contracts: Once you find a motivated seller, negotiate a purchase contract. The goal is to secure the property at a price that allows you to make a profit when you sell the contract.

Build a Buyers List: While you’re working on finding properties, you should also be building a list of cash buyers who are interested in purchasing investment properties. This network is crucial for your success as a wholesaler.

Assign the Contract: After securing the property under contract, you can assign that contract to a cash buyer for a fee, typically ranging from a few thousand to tens of thousands of dollars.

Why Wholesaling Works

Wholesaling is particularly appealing because it requires minimal upfront investment. You’re not buying properties; you’re facilitating transactions. This means you can start making money without needing significant cash reserves, credit, or prior experience. All it takes is determination and the willingness to learn.

The Journey Doesn't End Here

If you're serious about starting your wholesaling journey, there are invaluable resources available to help you along the way. WholesalingHousesInfo.com offers expert insights, tools, and a supportive community tailored specifically for new and aspiring wholesalers.

By visiting the site, you can access a wealth of knowledge, including guides and tutorials that break down the wholesaling process. It's designed to empower you with the skills you need to thrive in this market. Whether you're looking for tips on finding motivated sellers or advice on building a strong buyers list, there's something for everyone.

Start your journey today and unlock the full potential of real estate wholesaling!

youtube

#real estate wholesaling#make money in real estate#wholesaling for beginners#no cash no credit#real estate investing#property investment#find motivated sellers#real estate market#wholesaling strategies#how to wholesale#cash buyer leads#real estate tips#financial freedom#real estate opportunities#build buyers list#contract assignment#investment properties#wholesaling houses#wholesale real estate#real estate success#entrepreneurial journey#financial independence#property flipping#wholesaling resources#Youtube#freedomsoft zip finder tool

1 note

·

View note

Text

Real Estate Investing: Building Wealth through Property

Real estate has long been hailed as a powerful vehicle for building wealth, offering both stability and the potential for substantial returns. However, like any investment, it’s not without its challenges and requires careful consideration and strategic planning. This comprehensive guide delves into the exciting world of real estate investing, exploring various strategies, potential risks and…

0 notes

Text

How to Find Investors for Real Estate Flipping in 2024

Finding investors for real estate flipping can be a challenging task, but with the right strategies, it is possible to attract the right individuals or organizations. One effective method is to network within the real estate industry by attending events, joining professional organizations, and reaching out to experienced flippers. Additionally, creating a compelling business plan that showcases the potential return on investment can help attract investors. It is also important to establish credibility by highlighting past successful projects and partnering with reputable contractors and real estate agents.

Why is it Important to Find Investors?

Before we go into how to find investors for real estate flipping, we should first understand its importance.

People often ask why they need an investor for real estate flipping. Here are some of the reasons you would need to know:

Access to Capital

Risk Mitigation

Expertise and Networks

Scale and Growth

Credibility

What to Keep in Mind When Looking for Investors?

It is important to keep a few things in mind while seeking investors for real estate flipping. This will maximize the possibilities of success and productivity. Let's look at the things to consider when searching for investors.

Experience

Long-Term Vision

Financial Capacity

Communication and Transparency

That concludes this write-up on how to find investors for real estate flipping. Finding investors for flipping homes requires great networking, compelling proposals, and open communication. You may find investors who understand your investment goals using industry connections, networking events, and online platforms.

Building trust through open communication is also critical for developing strong investor connections. To learn more about how to find investors for flipping and other aspects of flipping homes, visit our website or the link provided below.

Source: how to find investors for real estate flipping

#flippingamericatoday#realestate#investment#property#flippinghouses#real estate agent#flippingproperty#real estate#real estate consultant#real estate investing#flipping houses

6 notes

·

View notes

Text

youtube

A Day in the Life of a Real Estate Mogul

Hey Tumblr Fam! 🌟

Ever wonder what it’s like to swim with the big fishes in the real estate sea? Well, today, you’re getting a VIP pass to the show! 🎟️🏢

Setting the Scene

We’re looking at a unique property deal through the lens of a seasoned investor. This isn’t your cookie-cutter Airbnb setup; it’s a deep dive into the world of assumable VA loans and negotiation tactics that tailor to the seller's and buyer's needs alike.

The Heart of the Deal

What makes this deal fascinating is the strategy involved. The buyer is dealing with a property listed with conflicting details (a common real estate headache!), and they’re using their relationship with the seller to their advantage. They discuss everything from the property’s potential cash flow to the nuances of assumable loans.

Strategy Talk

Assumable VA loans are the star here. They allow a buyer to take over a loan with potentially lower interest rates than the market offers—a sneaky good benefit in today’s financial climate. 🌊💰

Real Talk

This negotiation isn’t just business; it’s about relationships. Knowing the seller from previous deals provides a smoother path to agreement. It’s like having a backstage pass to your favorite concert!

Dive In!

So, are you ready to dive into the real estate game? Whether you’re looking to invest or just curious about how the big deals are done, remember: It’s all about the approach, the terms, and understanding both the market and the people you’re dealing with.

Drop a like or reblog if you found this peek into a real estate mogul’s day intriguing! Got questions or want to share your own stories? Hit up the comments! 📬💬

#real estate negotiation#creative financing#VA loans#assumable loans#property investment#real estate deals#real estate strategy#property market#real estate financing#buying property#selling property#real estate tips#investment properties#real estate insights#real estate trends#property listings#mortgage strategies#real estate education#house flipping#rental property investment#Youtube

0 notes

Text

We Buy Houses Fast

We are cash home buyers located in Virginia Beach. Our investment strategy focus on residential single family renovations and multi-family buy and holds. We purchase homes in and around Hampton Roads including Chesapeake, Norfolk, Portsmouth, Hampton, Newport News, and Suffolk. If you need to sell your home fast, please give us a call today at 757-204-5454.

0 notes