#RiskControl

Explore tagged Tumblr posts

Text

Advantages of Stop Loss Order in 2025 and Why Should We Use It?

Stop Loss Order is one essential tool for risk management. In the fast-paced world of stock market trading, managing risk is crucial for both novice and experienced traders. Understanding the meaning of a stop loss order, its advantages, and how to effectively use it can significantly enhance your trading strategy and protect your investments.

This article explores the advantages of stop loss order, their meaning, and why incorporating them into your trading strategy is beneficial. Additionally, we will highlight how the ISMT Stock Market Institute helps traders understand and implement stop loss order effectively.

What is a Stop Loss Order?

Stop Loss Order Definition:

A stop loss order is a pre-set instruction to sell a security when it reaches a specified price, known as the stop price. This type of order helps traders limit their losses on a position by ensuring that the stock is sold before the price drops too far. In essence, this order is a risk management tool designed to prevent significant losses from adverse market movements.

Advantages of Stop Loss Order

1. Effective Risk Management:

The primary advantage of a stop loss order is its ability to manage risk. By setting a stop loss limit, traders can predetermine the maximum loss they are willing to accept on a trade. This helps protect capital and avoid catastrophic losses, especially in volatile markets.

2. Emotional Discipline:

Emotional trading is a significant challenge for many investors. Fear and greed can lead to poor decision-making and substantial losses. it enforces discipline by executing trades automatically when the stop price is reached, thereby removing emotional influences from the decision-making process.

3. Time Efficiency:

Constantly monitoring the markets can be time-consuming and stressful. It allows traders to set their exit strategy and focus on other activities without worrying about market fluctuations. This saves time and reduces the stress associated with active monitoring.

4. Protection Against Market Volatility:

The stock market is inherently volatile. Unexpected news, economic events, or geopolitical developments can cause sudden price swings. By using a stock market stop loss, traders can protect themselves from such volatility, ensuring they do not hold onto losing positions for too long.

5. Automatic Execution:

This order is executed automatically once the stop price is reached. This ensures that the trade is carried out promptly, without the need for manual intervention. Automatic execution is particularly beneficial during periods of rapid price movements, where quick decision-making is crucial.

6. Flexible Strategy Implementation:

This orders can be utilized in various trading strategies, including day trading, swing trading, and long-term investing. They can be adjusted based on the trader’s risk tolerance and market conditions, offering flexibility in their application.

7. Profit Protection:

Besides limiting losses, this order can also be used to protect profits. Trailing stop losses, for example, adjust the stop price as the stock price moves in a favorable direction. This allows traders to lock in profits while still giving the stock room to appreciate further.

8. Reduced Stress Levels:

Knowing that this order is in place provides peace of mind to traders. It allows them to pursue other activities or focus on other trades without the constant worry of monitoring every price movement, leading to a healthier and more balanced trading lifestyle.

9. Encourages Strategic Planning:

Using this order encourages traders to plan their trades more strategically. It forces them to think about their exit strategy before entering a trade, which can lead to more thoughtful and well-planned trading decisions.

10. Enhances Trading Consistency:

Consistent use of this orders promotes disciplined trading practices. It ensures that every trade has a predefined exit strategy, helping to maintain a consistent approach to risk management across all trades.

Why Should You Use Stop Loss Order?

1. Enhances Risk Management:

Incorporating stop loss into your trading strategy enhances overall risk management. By clearly defining the maximum loss you are willing to accept, you can trade with greater confidence and reduce the potential for significant financial setbacks.

2. Promotes Consistency:

Consistent use of stop loss promotes disciplined trading practices. It ensures that every trade has a predefined exit strategy, helping to maintain a consistent approach to risk management across all trades.

3. Improves Decision-Making:

With stop loss in place, traders can make more objective and informed decisions. Knowing that potential losses are capped allows traders to focus on analyzing market conditions and making strategic moves without the burden of worrying about excessive losses.

4. Facilitates Learning:

Using stop loss can be a valuable learning tool for traders. By analyzing trades where stop losses were triggered, traders can gain insights into their decision-making process and market conditions, helping to refine future strategies.

5. Supports Long-Term Success:

Successful trading is not just about making profits; it’s also about preserving capital. By consistently using stop loss, traders can avoid large, catastrophic losses, which is crucial for long-term success in the stock market.

6. Adapts to Market Changes:

Stop loss can be adjusted based on changing market conditions. This adaptability allows traders to refine their risk management strategies in response to new information, market trends, and personal experiences.

7. Provides Peace of Mind:

Knowing that a stop loss order is in place provides peace of mind to traders. It allows them to pursue other activities or focus on other trades without the constant worry of monitoring every price movement, leading to a healthier and more balanced trading lifestyle.

Types of Stop Loss Order

1. Fixed Stop Loss Order:

A fixed stop loss order involves setting a specific price at which the stock will be sold. This price remains constant unless manually adjusted by the trader. Fixed stop loss order are straightforward and provide a clear risk management strategy.

2. Trailing Stop Loss Order:

A trailing stop loss order moves with the stock price. If the stock price moves in a favorable direction, the stop price is adjusted accordingly, often by a fixed percentage or amount. This type of stop loss helps lock in profits while still providing protection against adverse price movements.

3. Stop Limit Order:

A stop limit order combines the features of a stop loss order and a limit order. When the stop price is reached, the order becomes a limit order to sell at a specified price or better. This order type provides more control over the sale price but carries the risk that the order may not be executed if the price moves too quickly.

4. Market Stop Loss Order:

A market stop loss order converts to a market order once the stop price is reached, ensuring immediate execution at the next available price. While this guarantees execution, it may result in a sale at a price significantly different from the stop price, especially in volatile markets.

How to Set an Effective Stop Loss Order

1. Determine Your Risk Tolerance:

Assess how much loss you are willing to tolerate on a trade. This depends on factors such as your trading strategy, financial goals, and risk appetite. Setting an appropriate stop loss limit based on your risk tolerance is crucial.

2. Analyze Market Conditions:

Consider current market conditions when setting a stop loss order. In highly volatile markets, you may need to set a wider stop loss limit to avoid being stopped out by normal price fluctuations.

3. Use Technical Analysis:

Utilize technical analysis tools to identify key support and resistance levels. Placing stop loss order near these levels can help avoid premature exits and provide a more strategic approach to risk management.

4. Review and Adjust Regularly:

Regularly review your stop loss order and adjust them based on market developments and your trading performance. This ensures that your stop loss strategy remains effective and aligned with your overall trading goals.

5. Combine with Other Risk Management Tools:

Stop loss order should be part of a broader risk management strategy that includes position sizing, diversification, and other risk mitigation techniques. Combining these tools can enhance your overall risk management approach.

Common Mistakes to Avoid with Stop Loss Order

1. Setting Stop Losses Too Tight:

Setting stop losses too close to the entry price can result in frequent stop-outs due to normal market fluctuations. This can lead to missed opportunities and unnecessary trading costs.

2. Ignoring Market Conditions:

Failing to consider market volatility and trends when setting stop loss order can lead to ineffective risk management. Always analyze the market environment to set appropriate stop loss limits.

3. Over-Reliance on Stop Loss Order:

While stop loss order are essential, relying solely on them without considering other risk management techniques can be risky. Ensure that stop loss order are part of a comprehensive risk management strategy.

4. Not Reviewing Stop Loss Order:

Market conditions and trading strategies evolve over time. Regularly reviewing and adjusting stop loss order ensures they remain relevant and effective.

5. Emotional Adjustments:

Avoid adjusting stop loss order based on emotions such as fear or greed. Stick to your predefined strategy and make adjustments based on logical analysis and market conditions.

ISMT Stock Market Institute: Mastering Stop Loss Order

The ISMT (Institute of Stock Market Training) Stock Market Institute is renowned for its comprehensive training programs that equip traders with the knowledge and skills necessary for successful trading. One of the key areas of focus at ISMT is the effective use of stop loss order. Here’s how ISMT helps traders master stop loss order:

1. In-Depth Understanding:

ISMT provides an in-depth understanding of the stop loss meaning and its importance in trading. The institute emphasizes the concept of risk management and how stop loss order can be a vital tool in mitigating losses.

2. Practical Training:

ISMT offers practical training sessions where traders can learn to set and adjust stop loss order in real-time market conditions. This hands-on experience is crucial for developing confidence and proficiency in using stop loss order.

3. Technical Analysis Integration:

The curriculum at ISMT integrates technical analysis with stop loss strategies. Traders learn to use technical indicators and chart patterns to determine optimal stop loss levels, enhancing their overall trading strategy.

4. Personalized Coaching:

Traders receive personalized coaching to understand their risk tolerance and trading goals. This tailored approach ensures that each trader can effectively implement stop loss order according to their individual needs.

5. Ongoing Support:

ISMT provides ongoing support and mentorship to traders, helping them continuously refine their stop loss strategies and adapt to changing market conditions. This long-term support is invaluable for sustained trading success.

CONCLUSION

Incorporating stop loss order into your trading strategy is a prudent decision that offers numerous advantages. From managing risk and promoting emotional discipline to saving time and protecting against market volatility, stop loss order are a critical tool for any trader. By understanding the stop loss meaning and effectively implementing it, you can enhance your trading strategy, protect your investments, and achieve long-term success in the stock market.

The ISMT Stock Market Institute stands out as a premier institution for mastering stop loss order and other essential trading skills. With comprehensive training, practical experience, and personalized coaching, ISMT equips traders with the knowledge and tools needed to succeed in the stock market. Whether you are a beginner or an experienced trader, leveraging the benefits of stop loss order through ISMT’s training can significantly enhance your trading performance and career.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#stoploss#tradingtips#stockmarket2025#howtoinvest#riskcontrol#learntotrade#investmentstrategies#moneymanagement#traderlife#daytrading#tradingpsychology#stockmarketeducation#stoplossexplained#financeblog#personalfinance#ismtinstitute#learnfromismt#ismt

0 notes

Text

A well-structured project management process for a project enables teams to meet objectives, adhere to budgets, and stay within the project scope. This blog will explore the project management process, including key phases, methodologies, and frameworks used by professionals worldwide.

Understanding the Project Management Process

The project management process for a project consists of a series of structured activities that help achieve project goals efficiently. These processes align with globally recognized frameworks like the PMI (Project Management Institute) standards and are essential in managing time, resources, and risk effectively.

The project management process can be divided into five key process groups, which form the foundation for successful project execution.

1. Initiating Process Group

This is the starting point of any project. The purpose of this phase is to define the project’s objectives, identify key stakeholders, and determine feasibility. Key activities include:

Developing the project charter, which outlines objectives, scope, and constraints.

Identifying key stakeholders and their expectations.

Performing a feasibility study to determine project viability.

Gaining necessary approvals to move forward.

2. Planning Process Group

The planning phase is crucial for laying the foundation of the project. This phase includes defining project scope, schedule, and resource allocation. Key activities include:

Creating a detailed project management plan.

Establishing project scope, goals, and deliverables.

Developing a risk management plan.

Allocating resources, setting deadlines, and creating work breakdown structures (WBS).

Defining communication, quality, and procurement plans.

A well-defined planning phase ensures that the project remains on track and within budget.

3. Executing Process Group

In the execution phase, the project plan is put into action. Key activities include:

Assigning tasks and responsibilities to team members.

Managing project stakeholders and maintaining effective communication.

Coordinating resources and tracking performance.

Ensuring quality control and adherence to project goals.

Addressing any unforeseen issues that arise during execution.

4. Monitoring and Controlling Process Group

This process group runs concurrently with execution and ensures that the project remains aligned with its objectives. Key activities include:

Tracking key performance indicators (KPIs).

Measuring project performance against the plan.

Managing scope creep and controlling project risks.

Implementing corrective actions when necessary.

Ensuring quality standards are met.

5. Closing Process Group

The final process group ensures that all project objectives have been met and that the project is formally closed. Key activities include:

Conducting a final project review.

Documenting lessons learned for future projects.

Finalizing contracts and financials.

Obtaining stakeholder approvals and sign-offs.

Celebrating team achievements and recognizing contributions.

#ProjectManagement#PMI#ProjectProcess#ProcessGroups#ProjectSelection#IntegrationManagement#PMBOK#ProjectPlanning#StakeholderManagement#RiskControl#ProjectExecution#BusinessStrategy#ProcessImprovement#ManagerialProcess

0 notes

Text

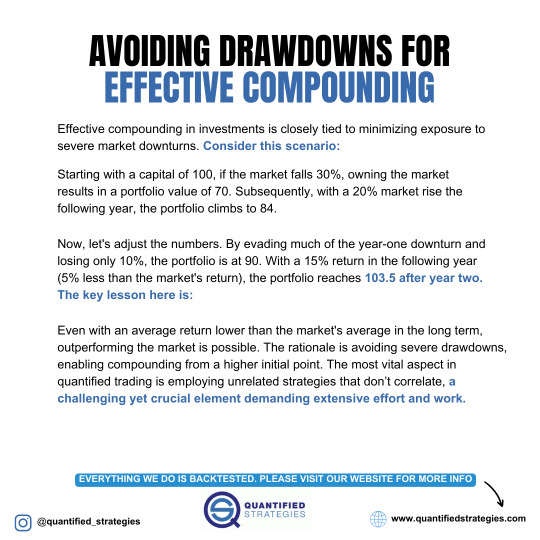

AVOIDING DRAWDOWNS FOR EFFECTIVE COMPOUNDING

Minimizing drawdowns is essential for effective compounding. Avoiding severe market drops allows portfolios to recover and grow faster, even with lower average returns. By strategically managing risk and using uncorrelated trading strategies, traders can build resilience and enhance long-term gains.

#tradingstrategies#DrawdownManagement#RiskControl#EffectiveCompounding#InvestmentStrategies#QuantitativeTrading#WealthGrowth

1 note

·

View note

Text

Course - Risk Management for Project

Free limited access to the course

Get up to 30% off on select programs using code EDXSUMMER24

Learn how to manage risk in your organisation by using the best processes and procedures.

0 notes

Text

Risk Management: Navigating an Uncertain Economy

Introduction to Risk Management: Navigating an Uncertain Economy

In the complex and dynamic sphere of economics, risk management undoubtedly serves as an essential component, primarily responsible for safeguarding businesses and individuals from various unforeseen predicaments. To begin with, it is important to emphasize the critical nature of risk management, as it acts as a vital precautionary measure to protect both enterprises and private individuals alike. First and foremost, a comprehensive understanding of risk management is necessary to truly appreciate its significance. Consequently, this insightful discourse will address the topic by presenting a brief yet compelling introduction,

which, in turn, will be followed by an in-depth examination of diverse methods and tools for identifying, assessing, and mitigating risks. Subsequently, we will thoroughly analyze how to successfully devise and implement an effective risk management framework. This framework, when properly integrated within an organization's culture and decision-making process, can substantially contribute to the overall stability and resilience of the entity amid an increasingly uncertain economic landscape.

As we delve into this critical subject, Risk mitigation

we will explore the significance of Contingency planning and how it serves as a necessary precautionary measure for both businesses and individuals. To provide a coherent and organized understanding of Risk assessment, we will first present an overview of the topic, followed by a discussion on the various methods and tools for assessing and mitigating risks. Finally, we will examine how to establish a robust Risk reduction framework that can be seamlessly integrated into an organization's culture and decision-making process.

What is Economic Risk?

- A simple definition of economic risk - Basic types of economic risks (e.g. risks in the stock market, lending money, running a business) - Things that can change or create economic risk (e.g. ups and downs of the economy, world events)

Ways to Identify and Measure Risks

- How to spot potential risks (e.g. thinking about what could go wrong, keeping a list of risks) - Measuring risks using numbers (e.g. how much money you could lose) - Evaluating risks using opinions and ideas (e.g. asking experts, ranking risks)

How to Protect Yourself from Risks

- Spreading your investments or resources across different areas - Sharing risks with others (e.g. getting insurance, making deals to protect against price changes) - Taking steps to avoid risks or decrease their impact

Creating a Plan to Manage Risks

- Key parts of a risk management plan (e.g. setting rules, deciding how much risk you're comfortable with, having checks in place) - Keeping track of risks and checking your plan over time - Making risk management a part of your daily life or work decisions `Risk Management Essentials`

Conclusion: Uncertainty management

In conclusion, as we reflect upon the key concepts discussed in this article, it becomes evident that navigating the unpredictable nature of today's economic landscape requires a thorough understanding of Hazard management. Furthermore, by following the methods and tools for assessing and mitigating risks, organizations and individuals can construct a reliable and adaptable framework to weather these uncertainties.

Undeniably, proactive Risk mitigation is essential in the current economic environment, as it enables businesses to identify potential threats and address them accordingly. Moreover, this approach fosters stability and growth by making informed decisions that mitigate the potential impact of unforeseen events.

Ultimately, it is imperative for individuals and organizations to apply these Risk control principles in both their professional and personal financial lives. In doing so, they will be better equipped to handle challenges while capitalizing on opportunities when they arise. As a result, the importance of risk management cannot be overstated in the pursuit of stability, resilience, and growth in an increasingly uncertain world. "Discover the latest tips and guides on finance management." Read the full article

#Contingencyplanning#Hazardmanagement#Riskassessment#Riskcontrol#Riskmanagement#Riskmitigation#Riskreduction

0 notes

Text

Identifying, assessing, and controlling hazards and risks-CloudAnalytix

0 notes

Text

🚀 Transform Your Trading with the SMC Trap Strategy! 🌌 Unleash the potential of every trade with insights that guide you to success. ✨

With our groundbreaking strategy, you’ll:

- Navigate market trends with expert precision 🔍

- Trade with confidence and clarity 🛤️

- Secure higher profits while managing risks 📈

No matter your experience level, the SMC Trap Trading Strategy is your gateway to trading mastery. Dive into a world where data-driven decisions lead to unparalleled success. 📊💡

🌐 Ready to level up? Explore the power of AI with our Flux Nebula Signals System. Your journey to trading excellence starts here. Click the link in bio! 🌠 #TradingRevolution #SMCTrap #UnlockPotential #FinancialFreedom #TradeWithConfidence #RiskControl #ProfitMaximization #Stocks #ForexLife #CryptoTrading #DayTraders #SwingTrading #MarketMastery #TechnicalAnalysisPro #InvestingBasics #WealthJourney #TradeSignals #AIInTrading #FluxNebula #SuccessPath #InvestmentTips #MarketTrends #EconomicInsights #TraderLifestyle #FinanceGoals #InvestorGrowth #BusinessStrategy

instagram

0 notes

Text

Mitigating risk is paramount for insurance companies in today's dynamic landscape. In an industry where uncertainties abound, effective risk management is not just a strategy – it's a necessity.

Here are some of the top insights to not only safeguard your assets but also to optimize decision-making and enhance long-term sustainability. Insurance risk management

#insurance #insurtech #riskmanagement #insurers #riskcontrol

0 notes

Photo

Implement it, step by step!

1 note

·

View note

Text

Risk Management, Fraud & Impact Assessment in Microfinance.

Get risk management, fraud risk assessment, staff training, internal audit, impact assessment, and client protection principles in the microfinance sector.

Client Protection Principles in Microfinance

0 notes

Text

Risk management – How to Identify, Analyze, and Control Risks?

ISO 14971 – Medical Device Company’s risk management standard. Although there are only a few medical device safety measures to consider, ISO 14971 is a widely accepted standard for risk management in medical devices.

Risk Management:

According to ISO 14971, medical device specifications and risk management processes should be documented. The risk management process is a systematic procedure for identifying, categorizing, assessing, and controlling risks associated with medical design, device manufacturing policies, procedures, and practices.

The risk management process is not limited to medical devices; any product development project must include a risk management process and must document the procedures from start to finish. Furthermore, risk management and control are applicable in a variety of situations such as,

When a new medical device is developed, or a derivative device is manufactured.

Advancement of a specific part of an already released device

Modifications to an existing device design

Non-conforming and mislabeled devices

Changes in the raw materials used in the device, such as changes in manufacturing sites or suppliers and CAPA (Corrective action and preventive action) requests, can pose a risk to patient safety.

The risk management process begins with documenting policies and procedures, creating a risk management file, and evaluating and implementing a risk management plan (RMP).

Risk Management Plan (RMP)

A risk management plan is a written document that outlines the risk management process for a particular medical device. It is a critical document in MDR (Medical Device Reporting) documentation as per 21 CFR Part 803 to obtain CE (European Conformity) marking for medical devices, indicating that the medical device manufacturing process, procedures, and practices meet all regulatory requirements and are authorized to project devices in the market. Furthermore, RMP should be revised and reviewed throughout the device manufacturing process.

Must plan all risk management activities ahead of time. The plan lays out a strategy for risk management activities to be carried out throughout the medical device’s life cycle. The risk management strategy must include the risk acceptability criteria for the medical device to be developed. The criteria’s inclusion in the risk management plan helps ensure an objective assessment of the residual risks later in the process.

Importance of Risk Management

Risk assessment is a legal requirement.

It helps save unnecessary costs associated with product or device recalls by identifying design flaws early on, ensuring the safety of the medical device for the patient or end-users.

It includes risk analysis, evaluation, and risk control measures in regulatory submissions.

It provides insights into planning and implementing preventive measures to avoid product liability damages.

It ensures that the medical device is safe and effective in its intended use.

Potentially dangerous medical products/devices on the market are kept away.

It increases the credibility of the manufacturer and the company.

Risk Management Process for Medical Devices

Risk management is now a requirement for medical device manufacturers. The risk management requirements are created based on the risk analysis and stated in broad rather than specific terms. Reduce risks as much as possible while maintaining a high level of health and safety protection. The regulations established a procedure for medical device manufacturers to investigate product safety by identifying hazards and estimating risks based on available data.

To manage risk first, identify Hazards. To analyze and evaluate risk, use the potential consequences of a threat. The risk estimation is compared to the medical device risk-acceptance criteria, and if it is too high, the risk must be reduced through risk control measures. It cannot be eliminated as the risk is assessed and managed. To manage and to control the risk, the risk management process framework includes the following,

Document the process of what should be done and how to reduce risk.

Define who is responsible for authorizing the risk analysis and who is in charge of risk control measures.

Review the risk evaluations and estimates with the quality board.

Define the skills and knowledge needed to implement risk assessment methods and train employees who lack these abilities.

Create and keep written documentation to show policy and procedure adherence.

Include validation checks to ensure that the procedures followed are under the risk management procedures and policies.

Check for the effectiveness of the risk management process.

Risk Identification

Preliminary hazard analysis (PHA) is a technique used early in the product development process to assist manufacturers in identifying hazards, sources, or events that could cause harm while the device is still in the manufacturing phase. This technique is helpful for management in determining whether or not to proceed with developing a specific product if the risk evaluated is high and helps to list out the measures to mitigate the risk during the development phase.

Manufacturers expect to know the possible hazards of the medical device during the identification phase of the risk management process. The sources of hazards like the raw materials used, machines in the manufacturing sites, package information, etc., are significantly overlooked. The sources of hazards are monitored continuously to protect the device and the users during manufacturing, transportation, and storage.

A clinical hazard list (CHL) is a technique for claiming the device’s completeness. It lists the foreseeable hazards that could occur while using the device from the end-user perspective, but CHL cannot be used to estimate the hazards caused by the device. Manufacturers should use HAL (Harm assessment list) in conjunction with CHL and PHA to identify, evaluate and estimate the harm.

Risk Analysis

Risk analysis will assist the company in defining the intended use of the medical device, which will aid in risk management efforts. It will also help in focusing on potential sources of harm. At this stage, identify the foreseeable hazards and determine the cause to analyze the estimated risk associated with the cause.

Risk Estimation

Risk Estimation is when determining the severity and probability of risk will aid in quantifying or estimating the potential risks associated with the medical device. During this phase, potential hazards’ causes and effects are specified in a table known as the Risk Assessment and Control Table (RCAT). This table, also known as a risk analysis chart, risk matrix, or risk table, is considered the heart of risk management. This table provides an overview of potential risk hazards, scenarios, causes, and control measures to reduce the estimated risk as much as possible and the hazard that requires immediate attention.

Risk Evaluation

The risk evaluation phase involves determining the risk and further evaluating the factors to reduce the risk or hazardous situation as much as possible, and then implementing additional risk control methods. This phase evaluates the risk-benefit analysis to determine whether the potential risk outweighs the potential benefits. If the result is positive, the benefits outweigh the risks, and the RCAT should be updated with additional risk-control measures. If the outcome is negative, indicating that the risks outweigh the benefits, the device cannot be released to the market.

Risk Control

The goal is to mitigate and control the risk to reduce and manage it to an acceptable level. Risk management measures can be implemented from the initial design input stage to the development life cycle. There are several methods for risk control:

The device or product can be recalled or can be changed to the device or product design.

Define protective and control measures to reduce the likelihood of harm occurring.

Clearly define the instructions on the label regarding the device’s harmful effects.

Hazardous Analysis Report (HAR) and Risk Management Report (RMR)

The HAR is a comprehensive report that is generated immediately following the RCAT (Risk assessment and control table). The potential hazards of the device are defined and created as part of the RMR (risk management report). The RMR is created to provide a detailed view of the documented device specifications and serves as a regulatory document outlining the procedures and processes used in risk management, assuring the reviewer that the medical device is safe to use. If the regulatory board approves the medical device on the market, the risk management process will continue indefinitely.

Final Thoughts

The most important thing to remember is that risk management strategy and plan are not limited to the design and manufacturing processes. Documentation is an essential step in the device development life cycle process. It is critical to keep track of the processes, procedures, actions, reports, and assessments related to the design and device manufacturing and development life cycle process, as well as the risk control methods and their effectiveness, in order to assess the risks associated with risk control measures.

For more information on Risk Management and its strategies, don’t hesitate to get in touch with us at [email protected]

0 notes

Photo

My Safety Corner linktr.ee/safetyknowhow #occupational #safety #health #keselamatan #kesihatan #pekerjaan #osh #ohs #hse #kkp #riskcontrol Source: #Pinterest #Google #Linkedin #Facebook #Instagram https://www.instagram.com/p/CY7ih8ZvmVn/?utm_medium=tumblr

#occupational#safety#health#keselamatan#kesihatan#pekerjaan#osh#ohs#hse#kkp#riskcontrol#pinterest#google#linkedin#facebook#instagram

0 notes

Photo

👉RISK IS THE KEY Most of your mistakes are signs of effort. They could never be a mistake if you weren't trying something. Stop fearing the mistake! Be fearless, be willing to do what needs to be done regardless of the potential to make a mistake. Moving forward will always find you the solutions, it just might take a mistake or two to get there. Keep pushing and believing in YOU. You're meant for the Top ! NOTE : 6 DAYS TO THE END OF LDP 11 Hurry Up so you don't miss out ! . . . . . #Memoriespremierproperties #riskcontrol #successmindset #investorsguide #lagos #buisnessmen #Buildingcapacity #buisnesswonan #joy #realestateinvesting #dope #Askdradesina #landbanking #nairatodollar #biz_alertfamily (at Lagos, Nigeria) https://www.instagram.com/p/CTAA13hj211/?utm_medium=tumblr

#memoriespremierproperties#riskcontrol#successmindset#investorsguide#lagos#buisnessmen#buildingcapacity#buisnesswonan#joy#realestateinvesting#dope#askdradesina#landbanking#nairatodollar#biz_alertfamily

0 notes

Text

What is a CRISC certification?

ISACA’s Certified in Risk and Information Systems Control™ certification is an enterprise risk management qualification, favored by professionals looking to build upon their existing knowledge and experience of IT/Business risk, identification and implementation of information system controls. The certification requires pre-requisite skills such as the ability to manage the ongoing challenges of enterprise risk and to design risk-based information system controls. CRISC is one of the foremost certifications which help particularly IT professionals prepare for real world threats, with appropriate tools to both evaluate and manage risk. The CRISC certification is widely seen as the go-to accreditation for experts in the field of risk and information systems controls or those looking to progress their careers in this area.

Who is CRISC for?

This certification is targeted for professionals whose job or associated responsibility it is to manage company risks and controls. This includes the following roles:

· IT professionals

· Risk professionals

· Control professionals

· Business analysts

· Project managers

· Compliance professionals

What are the career benefits of obtaining a CRISC certification?

CRISC, as an ISACA certification is globally recognized and hence provides certification holders with considerable benefits, primarily in evidencing to existing/potential employers and clients, that they have the skills and tools to evaluate and manage enterprise risk. Key benefits of the CRISC certification are the following:

· A widely recognized certification, as evidence of SME knowledge in enterprise risk and information systems control

· Provides greater value-add to employers and clients in risk management and assessment

· Helps to better communicate risk and control topics to diverse groups such as peers and stakeholders e.g. user base, development teams or C-level audience

· Career advancement with greater competitive advantage over other candidates or peers

· Fosters continuous improvement and up to date knowledge

Data from Global Knowledge’s 2017 IT Skills & Salary Survey (US sample) revealed that the number one paying IT Certification for 2017 was CRISC, at an average salary of $131,298. Over 20,000 professionals globally have the CRISC certification, with the associated skills in very high demand. This reason alongside the high value knowledge CRISC brings to organizations, accounts for why it is a high paying certification.

What are the possible career paths?

CRISC certification is the most recognized medium to evaluate the enterprise risk management proficiency of potential candidates or employees. Employers frequently seek CRISC credentials when recruiting for roles including but not limited to:

· Risk and Security Managers

· IS or Business Analysts

· IS Managers

· Operations Managers

· Information Control Managers

· Chief Information Security or Compliance Officers.

CRISC holders frequently advance their career by securing new jobs, attaining more senior positions and securing higher salaries than their peers. This is directly related to their ability to both perform risk management tasks more efficiently and provide greater value to organizations.

How To Prepare

If you want my suggestion, then I would like to recommend you FRAVO just because of their verified study material for all IT exams. It is the best platform for you if you want to pass CRISC with good grades in no time, they offered you latest CRISC exam dumps that will immensely help you to score good grades in your final CRISC exam.

Visit https://www.fravo.com/CRISC-exams.html

0 notes

Text

AplicacióN De GestióN Documental

La aplicación funciona desde un navegador, permitiendo a los distintos usuarios conectarse desde cualquier lugar con acceso a Internet. CEO de Landbot.io Jiaqi Pan Holded proporciona una muy buena solución porque, desde dentro de la plataforma, te permite enviar correos electrónicos a los clientes recordándoles que te paguen. Gestiona el trabajo que dedica tu equipo a cada proyecto, asigna tareas, crea listas, calcula la rentabilidad y mucho más. Controla cada detalle de tu stock y adapta Holded a tus necesidades. Ofrece un servicio fiable y de alto rendimiento a tus clientes con un pack hosting de IONOS. En el modo de vista, Wrike tiene características que son muy similares a Trello. Desde SumaCRM te ofrecen la opción de probar la aplicación sin coste e incluso tienes la opción de solicitar una demo gratuita en la cuál te explican el funcionamiento y como adaptar la aplicación a tu negocio. Diseñada para coordinar equipos de forma flexible y eficiente, sin perder el foco en los objetivos y prioridades. Kanban Tool es una solución para la gestión visual de procesos que ayuda a los equipos a trabajar más eficientemente, visualizar el flujo de trabajo, analizar y mejorar los procesos de trabajo de acuerdo con los métodos Kanban. Aquí también puedes crear listas con tarjetas que se pueden ajustar en la vista detallada de varias maneras, de forma que los empleados con permisos de administrador puedan asignar y definir las subtareas. Estas tarjetas se pueden arrastrar y soltar para generar fácilmente un flujo de trabajo fácil de entender. Wrike parece haber copiado muchas de sus características de dise��o de la competencia, lo que tiene un efecto positivo en el rendimiento de la herramienta y la claridad, a veces a expensas de la usabilidad. Basecamp solo se puede probar durante un mes de forma gratuita, a partir del cual hay que adquirir un plan de pago (100 o 1000 euros al mes, dependiendo del tamaño del equipo). Desde la página de equipo se accede a todas las funciones esenciales y a un feed diario personalizado y desplegable que resume las noticias y tareas más importantes del día para el equipo. Entre las características que encontrarás se incluyen salas de chat diseñadas para una comunicación rápida, foros para compartir contenido más extenso, listas de tareas pendientes y un calendario de trabajo estructurado, un centro multimedia y facturación automática. Las páginas del proyecto son casi idénticas a las páginas de equipo. El Esquema Nacional de Seguridad tiene por objeto establecer la política de seguridad en la utilización de medios electrónicos y está constituido por principios básicos y requisitos mínimos que permiten una protección adecuada de la información. "Por supuesto, la integración entre escritorio y móvil es perfecta. Ya que todo lo que gestiono en la app de mac, aparece instantáneamente en la app de Android o el iPad. Riskcontrol ." "Para proyectos colaborativos también es una pasada porque puedo configurarlo como me de la gana (etiquetas, miembros, menciones directas…) y tener toda la información estructurada y a un solo golpe visual de distancia." Accede a toda la información de tus clientes, desde la oportunidad hasta la evolución de cada venta realizada. Crea y gestiona embudos personalizados, con diferentes etapas para llevar el control absoluto de tu proceso de ventas. Céntrate tanto en la captación de clientes como en su seguimiento y accede a toda la información que necesitas para tomar mejores decisiones y aumentar tus ventas. Holded te ofrece todos los tipos de documentos de venta que necesitas para gestionar tu negocio. Ahorra tiempo y toma mejores decisiones con toda la información que necesitas a tu alcance.

1 note

·

View note

Text

Aplicaciones Avanzadas De GestióN

Me gustaría sugerir una herramienta más para la lista, es decir, ProofHub. Su sistema de administración de trabajo reúne sus proyectos, equipos remotos y clientes bajo un mismo techo, lo que le permite mantener las cosas siempre bajo su último control. Sinnaps es una herramienta de gestión de proyectos muy potente y visual que ayuda a planificar tus proyectos y compartir la gestión de los mismos con otros componentes del equipo. Sinnaps utiliza técnicas PERT y CPM para ayudarte a planificar tus proyectos y obtener los flujos de trabajo más óptimos posibles. Por lo tanto, este software para gestión de proyectos es ideal para equipos con una gestión menos jerárquica que trabajan juntos de forma abierta. Los grupos de trabajo más tradicionales con poderes de asignación claramente definidos pueden ser ineficientes con Asana. Como integradores de software y aplicaciones de gestión, tenemos por objeto agilizar las tareas y mejorar el control de tu negocio con soluciones ERP y CRM a la medida de tu empresa. Procedimiento para la contratación de los servicios de reingeniería software de la aplicación de gestión de expedientes de programas del período de fondos comunitarios . Es necesario para comprender los esfuerzos que actualmente se están haciendo en cuanto a gestión de datos, gestión de metadatos, arquitectura de datos , gestión de la calidad de los datos, prácticas de integración de datos, etc. Los programas de gestión comercial permiten a los jefes de equipo y líderes de comerciales gestionar mejor y más rápido los grupos, lo que revierte en ganar tiempo y eficacia para la empresa en general. Una aplicación de gestión comercial sencilla y accesible permite manejar mejor y más rápido los datos de los clientes, así como optimizar el seguimiento de los equipos comerciales, y sobre todo los informes de éstos para ver la situación de tu empresa en tiempo real. En comparación con sus competidores, Wrike es una plataforma bastante cara tanto para equipos pequeños como para empresas medianas. Los equipos más pequeños de hasta 10 personas tienden a encontrar aplicaciones más baratas entre las soluciones de la competencia. Al fin y al cabo, muchas de las funciones de Wrike, como las herramientas de análisis y la gestión del flujo de trabajo, solo adquieren importancia para empresas medianas o grandes. De forma predeterminada, cada miembro del equipo puede editar toda la información y el contenido de los proyectos y tareas. Por supuesto, deben establecerse unas normas claras para la colaboración entre los miembros, ya que debido a una comunicación deficiente la libertad total de uso siempre puede dar lugar a complicaciones, como la pérdida de datos. En la pestaña “Informes” tendrás acceso a varias herramientas para crear informes. En "Stream" encontrarás un útil registro de actividades que te permite realizar un seguimiento de todos los procesos en Wrike. Este sistema permite que los gestores encargados de las aulas realicen su labor de manera simple y centralizada, desde su puesto de trabajo habitual, facilitando la administración de estas aulas, ahorrándoles tiempo y trabajo. La mayoría de las aplicaciones de gestión de proyectos están claramente optimizadas para los navegadores web de los ordenadores de mesa. Asimismo, esta guía tiene una doble función y un doble destinatario. Por un lado, persigue servir como herramienta de autodesarrollo a todas las personas que forman parte del Hospital, apoyándolas y orientándolas en su avance continuo de competencias. Esta ventaja nos permitir�� tomar mejores decisiones en el momento adecuado, es decir , aprovechar al máximo las diferentes oportunidades que se nos pueden presentar. Permite entre otras cosas crear flujos de trabajo de forma colaborativa y reutiliza los procesos. Aquí puedes acceder a tu bandeja de entrada personal y ver un resumen de las tareas realizadas. También encontrarás paneles de control individuales en los que pueden participar diferentes miembros del equipo. TIMIFY lo hace y usted lo controla, desde cualquier momento y lugar.Gestión de recursos y servicios La planificación del uso de recursos humanos y físicos de forma eficiente e integral harán que su negocio sea más productivo. Controle y asigne sus recursos desde cualquier dispositivo en segundos. IsMyGym es una solución riskControl la gestión de clientes en gimnasios o centros deportivos. De esta forma, te permite trabajar directamente desde su aplicación web o móvil con todos los aspectos relativos a los socios de tu centro, de forma fácil e intuitiva. Cualquier intento de construcción de una aplicación de gestión de datos debería comenzar con una evaluación de la situación de gestión de datos empresariales en la organización.

1 note

·

View note