#Stock market strategies

Text

Mastering Trading with the Time Series Forecast Indicator: A Comprehensive Guide

In the complex and often unpredictable world of financial trading, having robust tools at your disposal can significantly improve your trading outcomes. One such powerful tool is the Time Series Forecast (TSF) indicator.

This post will delve deeply into what the TSF indicator is, how it works, and how you can effectively incorporate it into your trading strategy.

Understanding the Time Series…

View On WordPress

#Combining TSF with RSI#cryptocurrency trading#Cryptocurrency trading strategies#Divergence analysis#Forecasting in Trading#Forecasting price movements#forex trading#Forex trading strategies#Identifying trends#learn technical analysis#Linear Regression#Linear regression in trading#Moving averages and TSF#Predicting future prices#Risk management in trading#stock market#Stock market strategies#technical analysis#technical analysis tools#Time Series Forecast Indicator#Trading Strategies#trading tools#Trading with TSF#Trend Identification#TSF trading

0 notes

Text

Some Of The Great Investment Strategies In The Stock Market

Please find some general investment strategies that have been considered prudent and effective over the years. However, keep in mind that the best investment strategy for you will depend on your financial targets, risk tolerance, and time horizon. Always consider seeking advice from a qualified financial advisor before making any investment decisions. Here are some common investment strategies:

Diversification: Diversifying your investments means spreading your money across different asset classes (such as stocks, bonds, real estate, and commodities) and within each class (e.g., different industries or sectors). This helps to reduce the overall risk in your portfolio.

Dollar-Cost Averaging (DCA): With DCA, you invest a fixed amount of money at regular intervals (e.g., monthly) regardless of the market conditions. This approach can help you avoid the temptation to time the market and potentially benefit from buying more shares when prices are low.

Long-Term Investing: Investing with a long-term perspective can help you ride out short-term market fluctuations and take advantage of compounding returns over time.

Value Investing: Value investors seek out undervalued stocks or assets, believing that the market will eventually recognize their true worth, leading to potential gains.

Growth Investing: Growth investors focus on companies or assets with strong growth potential, even if they might be currently trading at higher valuations. The goal is to benefit from the potential appreciation in value over time.

Dividend Investing: This strategy involves investing in companies that regularly pay dividends. It provides a potential source of income and can be attractive for income-focused investors.

Index Investing: Index funds or exchange-traded funds (ETFs) replicate the performance of a specific market index, providing diversification at a low cost. This strategy is popular among passive investors.

Sector Rotation: With sector rotation, investors shift their focus to industries or sectors expected to outperform the broader market in specific economic or market conditions.

Market Timing: Market timing involves attempting to predict market movements and making investment decisions based on these predictions. However, market timing is challenging and can be risky, as it often leads to poor outcomes.

Asset Allocation: This strategy involves determining the optimal mix of asset classes in your portfolio based on your risk tolerance, financial goals, and time horizon.

Remember that all investments carry some level of risk, and past performance is not indicative of future results. It's essential to have a well-thought-out investment plan and to regularly review and adjust your strategy as your financial situation and target change.

#Stock Market#Stock Market Strategies#Investment Strategies#Concepts Of Stock Market#Intelligent Investment

0 notes

Text

Mastering Personal Finance and Investing: Your Ultimate Guide to Financial Freedom

Introduction: Understanding the Importance of Personal Finance and Investing

Personal Finance and Investing: Your Path to Financial Freedom

Importance of Personal Finance and Investing for Wealth Creation

The Basics of Personal Finance: Budgeting, Saving, and Debt Management

Mastering the Basics: Budgeting, Saving, and Debt Management

Budgeting Tips for Effective Personal Finance…

View On WordPress

#personal finance#financial planning#money management#budgeting#savings#debt management#investing#wealth creation#retirement planning#401(k)#IRA#stock market#real estate investing#compound interest#tax planning#financial freedom#financial education#money tips#financial goals#investment strategies#financial literacy#wealth management#financial advice#financial independence#money mindset#financial success

20 notes

·

View notes

Text

Steps to Building Wealth: A Guide to Achieving Financial Freedom

Becoming wealthy is a dream shared by many, but achieving it is not always easy. Building wealth takes time, patience, and a solid financial plan. Here are a few steps you can take to increase your chances of becoming wealthy:

Create a budget: The first step to building wealth is understanding your income and expenses. Create a budget that allows you to save and invest a significant portion of…

View On WordPress

#Becoming Wealthy#budgeting#Building Wealth#Diversified Portfolio#Entrepreneurship#Financial Advisor#financial freedom#Financial independence#Financial success#Investing#Lifestyle Inflation#money management#Multiple streams of income#Passive Income#Passive income strategies#Real estate investing#retirement planning#Side business#Stock market investing#Wealth creation

40 notes

·

View notes

Text

Thinking about the one line Daigo has in RGGO about how he's studying because he's considering getting a degree in business management. So happy to know he seems to have gotten his highschool diploma after all

#yakuza#daigo dojima#op#daigo my beloved#also business management wheres the minedai fanfiction where they discuss pr strategies and the stock market. lame ass capitalist boyfriends

33 notes

·

View notes

Text

Retirement planning is a crucial aspect of one's financial journey that often takes a backseat to immediate financial obligations. However, it's a fundamental and strategic step toward ensuring a comfortable and stress-free retirement.

If you want to plan your retirement in a better way, well, Recipe by Finology could please you :)

#finance#retirement planning calculator#financial planning#stock market#stock market for beginners#best investing strategies

3 notes

·

View notes

Text

How to Get Started with Affiliate Marketing: A Step-by-Step Guide to Making Money

In the fast-paced digital landscape of 2023, finding viable ways to generate income online has become increasingly crucial. One avenue that has gained significant traction is affiliate marketing. Whether you're a seasoned digital entrepreneur or just starting, this step-by-step guide will help you navigate the world of affiliate marketing, providing insights and tips to ensure a successful start to your affiliate journey.

Read more »

#Passive Income Strategies"#“Online Side Hustles”#“Investing for Beginners”#“Home Business Ideas”#“Financial Independence Tips”#“Freelance Income Opportunities”#“Money-Making Apps 2023”#“Stock Market for Beginners”#“Real Estate Investment Tips”#“Earning Money from Home”

2 notes

·

View notes

Text

US STOCK TRADING

usstocktradings.blogspot.com "US Stock Trading is your go-to source for all things related to stock market. Keep on top of real-time stock quotes, market analysis, and expert insights for stocks, options. Our advanced tools and resources will help you track your portfolio and make informed trading decisions. Whether you're a seasoned investor or new to the market, US Stock Trading has everything you need to succeed in the fast-paced world of stocks and trading. Start trading today we helps you.

Website https://usstocktradings.blogspot.com/

2 notes

·

View notes

Text

Value vs. Growth Stocks: What’s the Difference and Which One Should You Invest ??

When it comes to investing in stocks, there are various strategies and approaches that investors can employ. Two popular investment styles are value investing and growth investing. Understanding the difference between these two approaches is essential for making informed investment decisions. In this blog, we will delve into the characteristics of value and growth stocks, explore their differences, and help you determine which one aligns with your investment goals.

Value Stocks: Uncovering Hidden Gems

Value stocks are companies that are considered undervalued by the market, trading at prices lower than their intrinsic value. These stocks often have stable earnings, pay dividends, and possess solid fundamentals. Value investors typically focus on identifying stocks with low price-to-earnings (P/E) ratios, low price-to-book (P/B) ratios, or other valuation metrics that suggest the stock is priced lower than its actual worth. Value stocks may include mature companies in established industries that may have experienced temporary setbacks or are overlooked by the market.

Top of Form

Bottom of Form

Key Characteristics of Value Stocks:

Low valuation metrics: Value stocks often have low P/E ratios, P/B ratios, or other valuation metrics compared to their industry peers.

Dividend payments: Many value stocks are known for their consistent dividend payments, making them attractive to income-focused investors.

Established companies: Value stocks are typically found in well-established industries, where companies have a long history and solid track records.

Potential for turnaround: Value investing involves identifying companies with potential for a turnaround or market correction, where their true value may be unlocked over time.

Growth Stocks: Investing in the Future

Growth stocks, on the other hand, are companies that exhibit strong growth potential, often characterized by above-average revenue and earnings growth rates. These companies typically reinvest their earnings back into the business to fuel expansion, rather than paying dividends. Growth investors seek companies that are at the forefront of innovation, disruptive technologies, or emerging industries, with the expectation that their earnings and stock prices will rise substantially in the future.

Key Characteristics of Growth Stocks:

High revenue and earnings growth: Growth stocks typically demonstrate above-average revenue and earnings growth rates compared to their peers and the overall market.

Limited or no dividends: Instead of distributing profits as dividends, growth companies reinvest earnings into research, development, and expansion.

Technological or industry disruptors: Growth stocks are often associated with companies leading the charge in innovative sectors or disrupting traditional industries.

High valuations: Due to their growth potential, growth stocks may trade at higher P/E ratios and valuation multiples compared to their current earnings.

Which Should You Invest In: Value or Growth?

Deciding whether to invest in value or growth stocks depends on your investment objectives, risk tolerance, and investment horizon. Both approaches have their merits:

Value stocks can offer stability, income potential, and the opportunity to buy companies at a discount. They are favored by conservative investors seeking established companies with solid fundamentals and attractive dividend yields.

Growth stocks, on the other hand, offer the potential for significant capital appreciation. They are suitable for investors with a higher risk appetite, a long-term investment horizon, and an interest in innovative industries and emerging trends.

Some investors choose to maintain a balanced portfolio that includes both value and growth stocks, diversifying their risk and capitalizing on opportunities across different market segments.

Ultimately, the decision between value and growth investing comes down to your personal financial goals, investment strategy, and risk tolerance. It is advisable to consult with a financial advisor or conduct thorough research before making any investment decisions.

Conclusion:

Value and growth investing represent distinct approaches to stock selection, each with its own set of characteristics and potential rewards. Value investing focuses on finding undervalued companies with solid fundamentals and stable earnings, while growth investing targets companies with high growth potential and innovation. The choice between value and growth stocks ultimately depends on your investment objectives, risk tolerance, and time horizon.

I hope you have received all of the necessary information, for additional information, please see our blog area

#investment shares StockPicks#stockmarket#Strategy#Stockstobuy#BestStockstobuy#investment#stock market#stockpicks#best stocks for swing trading#crypto#stock market news#stockxpo#stocks#stock

2 notes

·

View notes

Text

Tyllionaire: An Insight into Trading and Forex

Tylor K. Moore, popularly known as Tyllionaire or “TY,” is a successful trader, entrepreneur, and author. His interest in the stock market and forex started early in life, and he was inspired by Jay Z's business acumen. In this article, we delve into some of his responses to interview questions to learn more about his approach to trading.

Inspiration for Trading According to TY, he became interested in the stock market early on in life. He was inspired by Jay Z's hustle to sell drugs on the corners. While he looked up to Jay Z for his business moves, he never wanted to sell drugs like him. TY believed there was a faster way to make money and that trading offered that opportunity. He started looking into stocks using newspapers and the internet while in high school. After a few years, he discovered forex and hasn't looked back since.

Motivation to Write a Book on Forex TY has written a book on forex, which he believes will solidify his name in something bigger than himself. He thinks it's dope that people can go to Barnes and Noble, say his name at the desk, and order a copy of his book. Having a book is like a business card for him, which he uses to introduce himself to new people.

Factors to Consider in Trading Stocks and Forex TY believes that the most important factor to consider in trading is risk to reward. He emphasizes that trading is not gambling but using money wisely to make more money. Every little risk involves losing something, be it time, energy, or money. Therefore, having a concrete trading plan is essential. TY advises traders to think of trading like a business and treat it as such.

Risk Management To manage risk, TY uses a simple approach. Suppose you have $1000 in a micro account, and you're trading forex. In that case, you're only supposed to risk a maximum of 3% per trade professionally. That's about $30 per trade, and you're looking to make $60 to $100 from that $30 risk. While this may not seem like a lot, it can help you double your forex account if done five or ten times.

Trading Style TY is a scalper, which means he's a hunter on the 5-minute chart. He wakes up around 3 am every morning, smokes a blunt, plays some call of duty to get his mind right, and starts trading. Usually, he catches the late London session so he can scalp GBPUSD until the NY session a few hours later. If US30 or NAS100 starts moving earlier on, then he'll catch it before the United States stock market opens. He advises traders to exit once they've hit a lick, saying that once the money stacks up, it's time to go.

Understanding the Market TY believes he has a great understanding of the ebbs and flows of the market. He advises people to learn how to read charts, and they'll find it just like driving a car; they'll never forget. He recommends a video on his YouTube channel called "Understanding Japanese Candlesticks," which he believes will help anyone learn to read charts.

Emotions and Trading TY believes that treating trading like an investment helps remove the emotional attachment to money. He advises traders to think of trading as money invested, which could work or not work. This way, when the emotion is removed, it's easier to trade on a day-to-day basis.

Advice for New Traders TY advises new traders to do what works for them. Every person has their unique experience, and they should study every profitable moment and try to duplicate the situation. He believes that trading is similar to basketball, where the

You can find TY on YouTube by typing in “TY” or “Tyllionaire” or also by googling his name Tyler K. Moore

4 notes

·

View notes

Text

Indian Stock Market Hit by SVB Crisis and Global Market Volatility

The Indian stock market is facing turbulence due to the SVB crisis and global market volatility. #OptionTrading #BankNifty #Nifty50 #BankCrises #IndianStockMarket #GlobalMarketVolatility

Indian Stock Market Hit by SVB Crisis and Global Market Volatility

The Indian stock market is reeling from the recent failure of Silicon Valley Bank (SVB) in the United States and the ripple effect it is having on global equity markets. This comes on the heels of the Adani crisis, making it another blow to the market’s recovery efforts.

Investors have lost a whopping Rs 6.6 lakh crore in the…

View On WordPress

#bank stocks#bearish momentum#candlestick patterns#candlestick trading#global market volatility#rate hike#Silicon Valley Bank#SVB crisis#technical analysis#trading strategies

2 notes

·

View notes

Text

Read Business News Daily To Keep up with the Markets

The companies with net worth are referred to as Stock Market Quotes on the market. They are constantly in the news through Business News. Gillette, Microsoft, Wall Mart and Citigroup are a few that usually beat market's expectations.

The companies are evaluated for their marketing strategies, sales and product launches, as well as international investments, and profits and losses. Each one of these could create a rally, increase the market indices upwards and contribute to economic growth. Business News also provides the economic perspective of the government which aids the investor in weighing the risks based on market's sentiment.

Many people are unable to discern through the text of Finance News flashed or published in the media. It's an art. The ability to look past the words to understand what's really happening on the market or in the economy, or even with the stock is a matter of an analytical mindset. If you see a headline article about Facebook in its announcement of a new mobile phone in the midst of the Facebook IPO crisis A discerning reader needs to inquire if it is an unintentional tactic used by the clever PR company or is it actually a brand new innovation that could boost the value of the stock. These kinds of questions are not mentioned in the majority of the stories we read within Finance News.

What role will the most recent information on the market have in the lives of a typical investor? Does any significance to him when stocks fall? Does it matter if the market prices go up the charts?

The issue becomes more relevant in light of the stories in the press that claim investors have lost millions in the market as it fell 200 points- that show the massive impact of the fluctuation and rise of the markets for stocks.

An investor who is speculative gets directly affected by these changes However, a committed investor is able to record a nominal loss. The most current market information provide an estimate of our holdings and helps us assess our investment strategies in the future.

#Investors News#Stock Market Quotes#Financial News#Fx News#Commodities News#Cryptocurrency News#Fx Strategies#Stock Investors#Tips Stock#New Stocks Trading Today#Today's Market News#Financial Quotes#Shares Quotes

2 notes

·

View notes

Text

BEST BOOK FOR TRADING

Read NOW

forexsuccess.dpdcart.com

2 notes

·

View notes

Text

What is the best investment advice for 2023

My No.1 Recommendation

Well, a few 10 years ago, it would be difficult to predict the best investment advice for 2023. However, I think it is fair to say that most investments will probably be worth more than their initial prices by 2023.

I would generally recommend that you invest in things that you have an understanding of and believe in. For example if you have an interest in technology, I think that it would be a good idea to invest in some technology stocks. If you have children, I would recommend that you invest in some ETFs that track various indexes and mutual funds with a low expense ratio.

However, the one thing I recommend is that you distribute your investments over a number of different funds or companies instead of placing all of your money into one company or fund. This way if the company or fund dramatically loses value, your total losses will not be as great from one investment alone.

My No.1 Recommendation

I hope this advice is helpful!

#investing/securities#investment#make money fast#forexnews#forexsignals#stock market#stocknews#investing stocks#investing strategy#best investment#investment funds#investing

2 notes

·

View notes

Text

Best Intraday Trading Strategies| options buying strategy| Bank nifty

Did you know that the ROI of option buying is more than 80% a year but if you want to achieve this kind of ROI then you want a rule based system strategy. Don’t worry I am here to help you…

In this post you will learn a powerful bank nifty strategy which is back tested and I founded it effective provided that if you take it properly with stop loss and position sizing

3 notes

·

View notes

Text

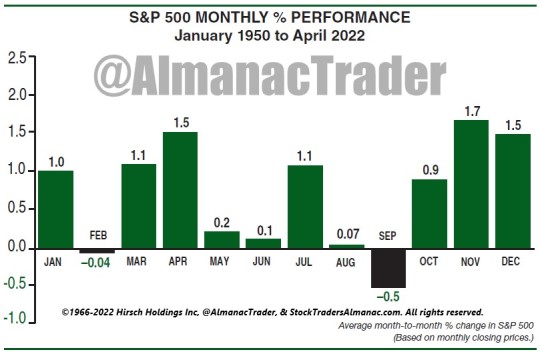

Setting the Record Straight: Best Six Months, Halloween Indicator, Sell in May

It’s that time of year again. The Best Six Months November-April begin next week, and they are even better when they begin in midterm years. But there are the naysayers so here’s the proof. This bar chart from the about to be released 2023 Stock Trader’s Almanac is led to Yale Hirsch’s discovery of this pattern and strategy.

Our Best Six Months Switching Strategy (aka “Halloween Indicator” or “Sell in May”) works. Any research to the contrary that goes back to 1900 on the DJIA (or even further back), is way too far back. Sell in May is an old British saw, soundly based on inherent behavioral finance patterns and the collective cultural behavior of the investment community, but it did not truly become a tradable investment strategy until after WWII.

The issue with starting way back then is the world is a much different place now than 100-plus years ago. Prior to about 1950, farming was a major portion of the U.S. economy and from 1901-1950, August was the best performing month of the year, up 36 times in 49 years (market closed in August 1914 due to World War I) with an average gain of 2.3%. July was the second-best month, up 31 of 50 with an average gain of 1.5%. June was fourth best, averaging 0.9%. Why, you may ask? Simply: planting, sowing, reaping, and harvesting. As crops were planted and then brought to market and sold, cash began to move and so did the stock market.

Agriculture’s share of GDP began to shrink post World War II as industrialization created a growing middle class that moved to the suburbs where hard-earned salaries would be spent filling new homes with all the modern conveniences we all take for granted now. Farming became more efficient and fewer and fewer people worked on the farm.

Suddenly, summer was less about the hard work of harvesting crops and more about vacations and relaxing. As the economy evolved and peoples’ lives changed, the market evolved. June and August went from being top performing months to bottom performing months. August went from #1 to #10 in 1950-2021 with an average DJIA gain of 0.1%. June went from #4 to #9 (0.1% average). The shift in DJIA’s seasonal pattern is clear in the following chart. “Sell in May” is a post WWII pattern, prior to then it would have been “Buy in May”.

While many market participants are hip to the saying “Sell in May and go away,” most forget to get back into the market in the fall. We like to say, “Buy in October and get yourself sober.” Before folks were keen on the Halloween Indicator which calls for getting long stocks on Halloween and the end of October, we created our Best Six Months Switching Strategy in 1986 and first featured it in the 1987 Stock Trader’s Almanac.

Back in 1986 we showed how most of the market’s gains were made in the “Best Six Months (BSM)” from November to April and that the market went sideways in the “Worst Six Months (WSM)” from May to October and is most susceptible to major declines during the Worst Six Months. From April 1950 to October, 21 2022 the S&P 500 has gained 2721.33 points versus 1013.35 points in the WSM. These six months combined have produced an average DJIA gain of 7.3% since 1950 compared to an average gain of just 0.8% during the months May to October.

We have improved the results of the strategy using the MACD technical indicator. Back in 1999 the late Sy Harding enhanced the BSM strategy by employing the late Gerry Appel’s MACD to improve entries and exits and dubbed it, “the best mechanical system ever.” Over the years we have refined the strategy further by corroborating more than one MACD, looking for confirmation across major market indices and taking MACD triggers earlier in the month.

We issued our Best Six Months Seasonal MACD Buy Signal to members on October 4 and have also issued baskets of seasonal sector ETF and undervalued, under-the-radar stock trades.

#october#stock market#seasonality#best six months#halloween strategy#Halloween Trade#Halloween#indicator#Sell in May#Midterm Elections#midterm year#Bear market#bull market

5 notes

·

View notes