#Yacht tax deduction!!

Text

Yacht tax deduction!!

#Yacht tax deduction!!#taxes#tax#yacht girl#lil yachty#small yacht rental dubai#yachtlife#luxury yacht#yacht#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich#class war#earth#jerktrillionaires#jerkbillionaires#jerkmillionaires#gst#capitalism#fascism#oppression

1 note

·

View note

Text

Right on. That’s right, go to the #RealWorld to stop unprecedented #inequality and greed, not to mention yachts and tax deductible private jets destroying the planet https://ow.ly/gCch50PJvA1

92 notes

·

View notes

Link

Over the past two years, ProPublica has documented the many ways that the ultrawealthy avoid taxes. The biggest or most daring maneuvers scale in the billions of dollars, and while the tax deductibility of private jets isn’t the most important feature of U.S. tax law, the fact that billionaires’ luxury rides come with millions in tax savings says a lot about how the system really works. Get Our Top Investigations

There are dozens of examples of wealthy Americans taking these sorts of deductions, which are premised on the notion that the planes are used mainly for business, in the massive trove of tax records that have formed the basis for ProPublica’s “Secret IRS Files” series. The ultrawealthy, however, can easily blur business and pleasure. And when they purport to make their planes available for leasing, to fulfill one definition of using the planes for business, they tend to be more adept at generating tax deductions than revenue.

11 notes

·

View notes

Link

15 notes

·

View notes

Text

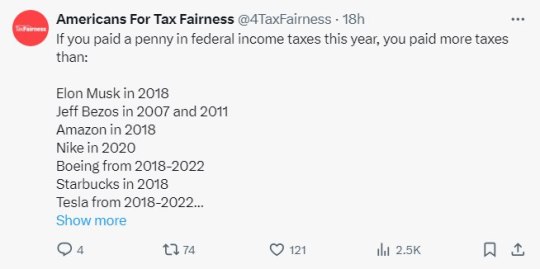

I've seen a bunch of posts about billionaires evading taxes but never anything about HOW they evade taxes. So I figured I'd make one.

1- Their assets aren't liquid. Liquid basically means that the asset is something that is or can easily be converted to cash (i.e. crypto, stocks, and bonds). Those are easily taxable so instead rich people will buy a bunch of stuff like real estate or stupid art or yachts or anything else with a big price tag that's hard to move. This sounds stupid on paper, but the key is that they depreciate in value.

2- Claim deprecation my basic understanding of this is that if you buy a thing for your business that depreciates in value, you can tell the government and they'll help you recover the cost of the property. Now it's only SUPPOSED to be for things used by a business to help with upkeep, but can the government really PROVE that your big stupid diamond hat isn't for business if you wear it to meetings?

3- Similar to the above, things that you claim are used for business are nontaxable. If you go on a business trip and stay in a nice hotel, buy a bunch of luggage, fly in the fancy section of the airplane, and buy a big meal for you and the people you're schmoozing... all of that can be claimed as 'business expenses' on your taxes.

4- If your business's tax deductions exceed its taxable income, the government will give you a break on the next round of taxes. It's called Net Operating Losses (NOL) and you're basically rolling forward the money that your business lost.

5- Owning a shit ton of houses lets you deduct property taxes. This applies to yachts apparently, because you can feasibly live on one. This is probably why there's so many shady landlords and empty buildings standing around. No resident means not having to shill out money for upkeep. Add this to all of the above and... you can start to see the problem with the housing market.

6- Per fiscal year you can only be taxed on money made in that year (obviously), but if you defer payment on some things and get paid the next fiscal year you can control, to an extent, how much you pay in taxes.

7- Charity is tax-deductible. And if someone were to, let's say, own the charity that they're donating to, then that money doesn't actually GO anywhere.

There are a bunch of other ways to get around taxes legally but these are just the big ones that I'm aware of. Most of the hyper-wealthy use a combination of these, and (ALLEGEDLY) supplement that with lying and straight-up tax evasion. I'm also pretty sure I'm legally obligated to mention that I'm not saying any of this to give anyone any sort of financial or legal advice.

Honestly the biggest joke in all of this is that, yes, the hyper-wealthy do have huge net worth(s), but can't actually spend a massive chunk of it. Past a certain point it's just a high score showing how well you gamed the system. If these assholes were to sell their assets and use their money for good they'd have to stop the infinite money glitch.

#finance#taxes#us taxes#also there's a whole bunch of nepotism junk involved that I don't want to get into right now#as in there's a REASON rich ceos hire their super young and inexperienced kid into upper management right out of college#beyond just 'that is my baby boy who I love and cherish and can do no wrong'#politics#us politics#text post

1 note

·

View note

Text

From Riches to Richer: Navigating My Bold Leap Into Affluence 2.0

In the wild, wild world of dating, they say you have to kiss a few frogs before you find your prince. But what if, after years of searching, you didn't find a frog, a prince, or even a mildly aristocratic toad, but instead, stumbled upon a veritable dragon hoarding unimaginable wealth? Would you run screaming back to the moat, or would you saddle up with a fireproof suit and embark on a journey to love, adorned with more gold than a pirate’s dreams?

Ladies and gentlemen, buckle up as I share my hilarious encore in the game of affluence – moving on from one affluent love to embark on a romantic odyssey with Affluence 2.0.

Realizing the Bar Has Been Raised... And It’s Made of Solid Gold

Once upon a time, I was content with the lavish displays of affection that come with dating someone wealthy. Helicopter dates? Check. Private island picnics? Double-check. But once you've had your first quantum leap into luxury, there's no going back. You see, after our amicable parting of ways (because when you date the affluent, you don’t break up, you "strategically re-align"), I realized that my next love affair needed something more... something richer.

The Mating Dance of the Affluently Unattached

Enter the world of Affluence 2.0 dating – a realm where last season’s Gucci is a mortal sin, and your arrival vehicle better be manufactured in Germany, Italy, or better yet, not of this Earth. Strapping on my bravest Louboutins, I set out on a quest, armed with nothing but my wit and a suddenly inadequate credit score.

The dating scene had evolved. Dinners consisted of dishes I couldn't pronounce, paired with wines older than my lineage. I learned to smile and nod at art auctions, with a paddle that somehow always seemed to autonomously bid on abstract pieces that resembled my toddler niece's refrigerator art.

Love in the Time of Compound Interest

Then it happened. Amid the frivolity and the soirées, I found them – my Affluence 2.0. With a carbon footprint smaller than my apartment (because apparently, green is the new gold), and a penchant for philanthropy that would make a saint blush, this was the wealth redefined. The kind of person who says, “Let's take the jet,” and means an electric one.

Our courtship was a whirlwind of sustainability and opulence. We adopted endangered animals instead of buying pets. We didn't just travel; we "invested in global economies." It was like finding a four-leaf clover, but instead of luck, it bestowed tax deductions.

My New Affluent Love – An Emerald Among Diamonds

Amidst this uproariously extravagant lifestyle, I learned a few things. First, that the real joy in life doesn't come from the material (though, let's be honest, it doesn't exactly hurt). And second, that moving from one affluent love to another isn't about finding someone with deeper pockets, but about finding someone with whom you can build a richer life – in all the ways that truly matter.

As I pen this tale from my zero-emissions, solar-powered yacht (because apparently those exist now), I can't help but chuckle at the absurdity of it all. Love, whether draped in silk or sustainability, is a wonderfully ridiculous adventure. And as for Affluence 2.0? They’re not just my new love. They’re my new chapter in a forever expanding story of life, love, and the pursuit of eco-conscious opulence.

So, here's to moving on, trading up, and discovering that sometimes, the best way to find true wealth is to simply follow the laughter echoing through the halls of your heart. Or, you know, check your latest love interest’s stock portfolio. Either way, you're bound for an adventure.

Read the full article

0 notes

Text

Senate Probe Casts Doubt on Harlan Crow's Yacht Tax Deductions — ProPublica

0 notes

Link

0 notes

Text

Investigation 'casts fresh doubt' about the validity of Harlan Crow’s yacht tax deductions - Raw Story

0 notes

Text

Name Sean Combs

Net Worth$950 Million

ProfessionAmerican Rapper

Salary$60 Million +

Yearly Income$80 Million +

Monthly Income$7 Million +

Annual Expenses$20 Million +

Last Updated2023

Sean Combs owns over 15 real estate properties, 10 Cars, 4 Luxury Yachts, and 1 Private Jet. The combined worth of all these assets is over $100 Million dollars. Sean Combs’s Assets Portfolio also includes Cash at Bank and Deposits, which are worth over $100 Million. Sean Combs owns a large portfolio of 18 stocks, and he has invested a total of $120 Million in this. A few of the stocks owned by Sean Combs are listed below.

Coca-Cola

Exxon

Microsoft

Uber

HP

Verizon

Sean Combs Liabilities and Loans

In order to compute the correct net worth of Sean Combs, we need to deduct his liabilities from his Assets. In order to build his business empire, Sean Combs has taken over $30 Million in loans and mortgages from leading banks in the US. Personal Loan from Bank of America $11 Million Overdraft from Citibank $15 Million HSBC Mortgage $4 Million

Sean Combs’s Cash Balance

Sean Combs has primary accounts with Citibank and Bank of America. All the income of Sean Combs from music royalties and businesses is deposited into this account. At the end of the current financial year, Sean Combs has over $75 million in cash reserves. Some of this cash is in foreign exchange, received through music sales outside the United States.

Sean Combs’s Music Royalties

According to Forbes, Sean Combs is one of the highest-earning music artists of all time, with an annual income exceeding $100 Million. This income comes from multiple music platforms like Spotify, Apple Music, Amazon Music, YouTube, etc.

Spotify – $25 Million

Apple Music – $18 Million

Amazon – $10 Million

YouTube – $8 Million

Other Companies – $39 Million

Sean Combs’s Luxury Yachts and Private Jet

Sean Combs has last year gifted himself a brand new private jet plane, that cost him over $40 Million. Sean Combs has spent an additional $3 Million dollars in redesigning the interiors of this plane according to his taste and liking.

Sean Combs also owns Four luxury yachts and a number of expensive cars. A couple of Yachts owned by Sean Combs come with a plunge pool and home theater.

Sean Combs's Balance Sheet, Income Statement

Assets $600 Million + Gold Reserves $40 Million + Luxury Cars 3 + Luxury Watches 6 + Stock Portfolio $90 Million + Luxury Yachts 3 + Loans & Liabilities $38 Million + Investment $150 Million + Salary $60 Million + Monthly Income $7 Million + Annual Income $80 Million + Annual Expense $20 Million + Taxes Paid $9 Million + Royalty Income $10 Million + Business Income $10 Million + Other Income $20 Million +

Sean Combs's Net Worth Growth

Year Net Worth (Million) Sean Combs Net Worth in 2023 $950 Million Sean Combs Net Worth in 2016 $690 Million Sean Combs Net Worth in 2012 $510 Million Sean Combs Net Worth in 2004 $215 Million Sean Combs Net Worth in 1998 $45 Million

0 notes

Text

Paul Kiel at ProPublica:

For months, Harlan Crow and members of Congress have been engaged in a fight over whether the billionaire needs to divulge details about his gifts to Supreme Court Justice Clarence Thomas, including globe-trotting trips aboard his 162-foot yacht, the Michaela Rose.

Crow’s lawyer argues that Congress has no authority to probe the GOP donor’s generosity and that doing so violates a constitutional separation of powers between Congress and the Supreme Court.

Members of Congress say there are federal tax laws underlying their interest and a known propensity by the ultrarich to use their yachts to skirt those laws.

Tax data obtained by ProPublica provides a glimpse of what congressional investigators would find if Crow were to open his books to them. Crow’s voyages with Thomas, the data shows, contributed to a nice side benefit: They helped reduce Crow’s tax bill.

The rich, as we’ve reported, often deduct millions of dollars from their taxes related to buying and operating their jets and yachts. Crow followed that formula through a company that purported to charter his superyacht. But a closer examination of how Crow used the yacht raises questions about his compliance with the tax code, experts said. Despite Crow's representations to the IRS, ProPublica reporters could find no evidence that his yacht company was actually a profit-seeking business, as the law requires.

“Based on what information is available, this has the look of a textbook billionaire tax scam,” said Senate Finance Committee chair Ron Wyden, D-Ore. “These new details only raise more questions about Mr. Crow’s tax practices, which could begin to explain why he’s been stonewalling the Finance Committee’s investigation for months.”

Crow, through a spokesperson, declined to respond to ProPublica’s questions.

As ProPublica reported in April, Crow lavished gifts on Thomas for over 20 years, often in the form of luxury trips on Crow’s jet and yacht. One focus of the investigations is whether Crow disclosed his generosity toward Thomas to the IRS, since large gifts are subject to the gift tax. Another is whether Crow treated his trips with Thomas as deductible business expenses. (While the data sheds light on how Crow might have accounted for Thomas’ trips, there are no clear implications for Thomas’ own taxes, experts said.)

Crow’s entry into the world of superyacht owners came nearly 40 years ago. By 1984, his father, Trammell Crow, had forged his real estate fortune, and Harlan, then in his 30s, was taking an increasing role in the family business. That year, father and son worked together to erect the 50-story Trammell Crow Center in downtown Dallas. They also formed a company, Rochelle Charter Inc., with the purpose of leasing out their new yacht, the Michaela Rose.

ProPublica’s trove of IRS data, which contains tax information for thousands of wealthy individuals, includes both Harlan Crow and his parents, who filed jointly. The data shows his parents with a majority share in Rochelle Charter. After they both died, Harlan Crow took full control in 2014.

ProPublica’s data for the company runs from 2003 to 2015. Rochelle Charter reported losing money in 10 of those 13 years. Overall, the net losses totaled nearly $8 million, with about half flowing to Harlan Crow. By using those deductions to offset income from other sources, the Crows saved on taxes. (The wealthy often find ways to deduct the expense of a private jet; the records don’t make it clear whether Crow is doing so.)

For Crow, the tax breaks from his yacht were just one way he was able to achieve a lighter tax burden. The tax code is particularly friendly to commercial real estate titans, and Crow generally enjoyed low taxes during that same period: He paid an average income tax rate of 15%, according to the IRS data. It’s a rate typical of the very wealthiest Americans but lower than the personal federal tax rates of even many middle-income workers.

Crow’s biggest deduction from the Michaela Rose came in 2014, when, after the death of his mother, Crow decided to renovate the yacht. The interior needed updating to fit more contemporary notions of glamour (for one, less gold plating). The work was expensive: Crow’s tax information shows a $1.8 million loss from Rochelle Charter that year.

In order to claim these sorts of deductions, taxpayers must be engaged in a real business, one that’s actually trying to make a profit. If expenses dwarf revenues year after year, the IRS might conclude the activity is more of a hobby. That could lead to the deductions being disallowed, plus penalties. Nevertheless, the ultrawealthy often pass off their costly pastimes, like horse racing, as profit-seeking businesses. In doing so, they essentially dare the IRS to prove otherwise in an audit.

ProPublica is back with its hard-hitting exposés on Harlan Crow, as it reported on how Crow slashed his tax bill by taking the ethics-challenged SCOTUS Justice Clarence Thomas on superyacht cruises.

#Harlan Crow#Clarence Thomas#SCOTUS#Ethics#Rochelle Charter Inc.#Trammell Crow#SCOTUS Ethics Crisis#ProPublica

10 notes

·

View notes

Text

Selling a Documented Vessel? How To Be Prepared And Avoid Scams

Some background knowledge is required before selling a legally documented vessel. Putting a “For Sale” sign in your yard and waiting for a customer to come along is all there is if you don’t know any better. On the other hand, you might save time and money if you pay attention to detail or take certain measures. The most crucial step is gaining knowledge to choose your next action wisely.

Unlike selling an undocumented vehicle, motorbike, or boat, selling a watercraft requires a few extra steps. You’ll need a lot of signatures and permission from multiple people before you can move forward with this, and if you need more preparation, it could end up being more bother than it’s worth. Here are tips on how to be ready and avoid scams when selling a documented vessel:

Don’t Rush Into a Sale

The assistance of a trustworthy vendor who is well-versed in the field and can give you sound counsel and direction is essential. Finding the right market for your documented vessel is the most time-consuming part of selling a recorded craft. Refrain from letting the thrill of a deal lead you to make a hasty choice about your boat’s future destination.

Certain legal steps must be taken with a recognized watercraft to guarantee clear ownership. This necessitates going through the appropriate channels and getting approval from the relevant officials before releasing the product to the public. It will take some time for everyone to finish their required tasks so that you can move on as soon as possible, but it is doable.

When you hire a trader, they will look out for your needs and objectives from start to finish. When selling a boat, many factors exist, including insurance and tax deductions.

Get Your Paperwork in Order

Although you can get by without the necessary documents, doing so is not recommended. You need the appropriate documentation to ensure you get all the potential purchasers and the possibilities to sell your yacht for the highest possible price.

Regarding vessel documentation, two different approaches can be taken: first, if you own your vessel entirely, all you need to do to sell it is provide evidence that you are the proprietor of the vessel. If, on the other hand, you used your vessel as collateral for a loan or had a claim placed on it, you will need the proper documentation from your backer stating that the charge has been fulfilled before you can sell it.

Don’t Accept Cashier’s Checks or Money Orders for More Than $10,000

Verify the buyer’s name, location, phone number, email address, and broker’s or bank’s contact information if you receive an offer over the phone. Please inquire about the broker’s or bank’s reputation from other vendors they’ve worked with. You could also request records from their financial institution or trading firm. Request additional time to consider the response or consult a trusted friend or family member before acting on any information you receive that leaves you unsatisfied. If the customer seems overly eager to complete the transaction, that should raise red flags.

Cashier’s checks and money orders should only be accepted for amounts up to $10,000. Refrain from giving in to the temptation to alter your terms and conditions if the other party is unwilling to accept them. You should retain a duplicate of all communication about the selling dealer and document the rationale behind any modifications you make.

Verify Whether the Buyer for Your Documented Vessel Has Good Credit

Before you commit to anything regarding the purchase of a sailboat, you should first ensure that the financials appear okay on paper. Make sure your potential buyer can pay for the documented vessel with cash or a bank transfer if you offer it. If they want to use a loan or credit card, you should inquire for recommendations and investigate independently; you should only accept checks or credit cards as payment if you know their bank personally.

Make a straight call to the buyer’s bank and ask them whether or not the buyer is current with their payment obligations. They will be able to inform you whether or not there has been a problem with the payments or if there has been a delinquency.

The Maritime Documentation Center is your best resource for navigating the complexities of documenting vessels. We can help you through the process and answer any questions. Contact us today to get started!

0 notes

Text

0 notes

Text

0 notes

Text

Why Documented Vessel Ownership is Important

As an owner of a vessel in the United States, you know that it is essential to maintain documented vessel ownership. But what gives with that? It is hard for the Coast Guard to adequately monitor the thousands of ships that go through the United States waterways because of the nation’s size.

As a result, the Coast Guard depends on the owners of vessels to maintain their records of ownership and movement, which are subsequently notified to the Coast Guard if it becomes essential to do so. This is a method that benefits everyone involved.

The owners of boats are aware that they can be apprehended and penalized if they move without reporting it, and the Coast Guard can occasionally utilize this information to seek out unlawful activity or vessels that have gone missing. The ownership of a recorded vessel is crucial for several reasons, which are discussed below.

It Protects Your Investment

Owning a documented yacht is essential for the safety of your investment. Having a boat is a fun hobby, but buying one is a big financial commitment. You may rest easy knowing that in the case of theft or damage to your boat, federal law will protect your investment if you choose to purchase a documented watercraft and safeguard your ownership via appropriate registration and titling.

If your boat becomes stolen or lost, you may need the proper paperwork to get it back. In addition to lowering the interest rate you pay on loan to purchase or improve your boat, documentation also lets you insure your vessel with the insurance companies favored by your lender.

The hull, engine, and safety equipment on your boat must pass a comprehensive examination as part of the paperwork procedure to ensure they are seaworthy and legal. When weighed against the price of a new ship, the expense of documentation is negligible, but the protections it offers are priceless.

A Documented Vessel Ownership Proves Legal Ownership In Case Of a Dispute

This may be of paramount importance if you have a legal disagreement with another party about ownership or use. In many cases, a ship with proper paperwork is much more advantageous than one without.

The registration and documentation of your ship will be helpful in a lawsuit involving your boat. Having proof of purchase or payment for services rendered or evidence of ownership on file might be beneficial in a boat ownership dispute.

Establishing ownership and legal rights to the vessel with proper documents might be easy. Specific forms of disagreements may be avoided entirely with the aid of appropriate documentation. You may use it to prevent unauthorized persons from improving your boat or taking it out on the water without your permission. Proof of ownership alerts others to the fact that the ship is your property and eliminates any doubt about who is authorized to operate the boat.

You Can Get Discounts on Maritime Services and Products

Discounts on marine goods and services would have to be first on the list. Although it may seem like something only the affluent and famous can afford, you can genuinely take advantage of this service. Businesses in the marine industry are more likely to conduct business with you if your ship is registered.

For instance, if your engine fails and you take it to a different shop to fix it, they may be willing to cut you a deal as they expect to see repeat business from your vessel. Go this route instead of getting an engine repaired and taking it elsewhere. You’ll save money not only in comparison to buying certain materials and doing the labor yourself but also to what someone without any connection to a maritime business would pay for the same engine repair!

You’re Exempt from Certain Taxes

Having your ship officially registered allows you to avoid paying some taxes. While several exemptions may be available, owners of documented vessel ownership might benefit most from the depreciation deduction and the vessel excise tax.

You may reduce your taxable income by taking advantage of the depreciation deduction. But, it lets you exclude an annual amount from your taxable income to compensate for the depreciation of your boat. Anytime you acquire a new or pre-owned boat, you won’t have to pay any additional fees on top of the advertised price because of the vessel excise tax, a form of sales tax on big boats.

Take advantage of these privileges by registering your yacht with the US Coast Guard. When a boat goes through this procedure, it receives a unique identification number that proves to the government that the owner is entitled to lawful possession of the ship. All applications for state registration must include copies of documents provided by the Coast Guard.

It would help if you talked to Vessel Documentation Online, LLC, to take advantage of these benefits. Our team will work with you through every step of the process to make it as easy as possible. We’ll handle all the paperwork and provide support throughout the process, so you never feel overwhelmed. Contact us today at 1-(866)-981-8783 and let our experience in this field help you achieve your goals!

0 notes

Text

Tax Avoidance Strategies: Four Legal Ways to Avoid Paying US Income Tax

You can legally avoid paying any and all taxes in this tax system, including federal taxes.

The following are the four legal ways to avoid paying US income tax:

1. Move outside of the United States

Living outside of the United States the majority of the time is one of the quickest and easiest ways to deduct taxes. The Physical Presence Test of the Foreign Earned Income Exclusion (FEIE) is the name given to this. This test has been extensively discussed, and the majority of expats use it frequently as a tax strategy.

If you live outside of the United States for at least 330 days out of 365, the Internal Revenue Service (IRS) says that you can deduct $101,300 of your taxable income from your annual taxes. The fact that you can leave the United States at any time is the beauty of this strategy. You always hear me tell you to move today and get off your tucks. You can, in fact! Additionally, if you move, you can supposedly begin claiming benefits 34 days earlier. In addition, you can theoretically spend one month in the United States, even if, like me, you never travel there.

One thing to keep in mind is that the exemption only applies to time spent in one or more other countries. It's not just about "330 days away from the United States"; "Being in a foreign country or countries" is the topic. What effect will that have? The bottom line is that international airspace and waters are not considered.

For instance, the worker on a yacht recently discovered that his time spent outside the United States did not qualify him for the FEIE. He lost the exemption after 35 days in international waters because international waters do not count, even if he never traveled to the United States.

However, the physical presence test generally qualifies applicants quickly. The sole additional thing to keep in mind is whether or not you fly frequently over oceans. It becomes more of a problem after four weeks in the United States and several long flights to other countries. If they ever look at your time spent in international airspace, they might just notice that you were flying over oceans for eight or nine days or that you were on a repositioning cruise for twelve days in the middle of the sea, and they might disqualify you without your knowing it.

Despite the fact that the Physical Presence Test is a great and straightforward method for lowering taxes, there are a few things you need to know to make sure it works.

2. Obtain a second residence

Clearly, one of the things I always advise people to do is to establish a residence elsewhere. On so many levels and for so many purposes, it makes sense. One of these goals is to lower your US income tax burden. However, despite the fact that this is a completely different topic, only certain kinds of residencies are eligible. It all depends on your circumstances.

I don't think this is a good idea in general. This is for people who want to spend more time in the United States and can actually set up home elsewhere. It won't work if you just try to pass the bona fide residence test by being a nomad and wandering in a different country every other week for a whole year. It will not work, even if you have a residence permit. As a result, it's a tough one.

You can stay up to four months in the United States if you meet the bona fide residence requirement. However, if you own a business and spend four months of the year in the United States, you face a lot of tax issues. The actual qualification procedure is highly personal. The IRS claims that:

Depending on your intention or the purpose of your trip, as well as the nature and length of your stay abroad, questions of bona fide residence are determined on a case-by-case basis. The Internal Revenue Service (IRS) requires evidence that you have been a bona fide resident of a foreign country or countries for an entire tax year.

3. Move to one of the US territories

Moving to a US territory like Puerto Rico is another popular legal strategy. Naturally, Puerto Rico is insolvent, and I don't really trust them. However, if you're okay with the bad offshore fundamentals, moving your entire business to Puerto Rico can save you money on US income taxes in two ways.

Act 20, also known as the Export Service Act, is the first tax break. The act encourages certain service businesses to relocate and export their services from the island by providing incentives like a low export income tax of 4% and no tax on earnings and profits. The complete list of service businesses that qualify can be found here.

On the other hand, high-net-worth investors are specifically targeted by Act 22, also known as the Individual Investors Act. The result? Interest, dividends, and capital gains are taxed at zero percent. The only catch is that you have to be in Puerto Rico for at least half of the year (183 days). More information about the act can be found here.

The International Financial Center Regulatory Act, or Act 273, is a less well-known law. Businesses established in Puerto Rico and engaged in eligible activities are eligible for tax exemptions under this act. The authorized capital stock of the international financial entity (IFE) must be at least $5 million to qualify. Additionally, the company must have at least four employees.

Reduce your taxes and diversify your wealth with Nomad Capitalist. Nomad Capitalist has helped more than 1,000 high-net-worth clients grow and safeguard their wealth from excessive government spending and taxes. Find out how our all-encompassing legal strategy can assist you.

Many people believe that by employing cooks, housekeepers, and chauffeurs, they can meet the requirements of Act 273. You can't. That is an awful plan. Even if they are just low-level employees who don't do a lot of work, you should hire real employees who work at a real business. It won't be enough to hire a maid and a driver. You will be in trouble should they audit you.

Businesses and investors can take advantage of tax breaks not only in Puerto Rico but also in other US territories. A program exists in the US Virgin Islands as well. You can save about 90% on your taxes thanks to the programs in both countries. The only catch is that you have to be there at least six months a year. Everyone will tell you that there is a workaround, but it is very similar to the bona fide residence test and actually worse because there is a second closer connection test to find out where you live primarily.

If you are willing to actually live in Puerto Rico and the US Virgin Islands, these programs are excellent. And by truly living there, I mean not spending less than six months on the mainland and at least six months there. Under these programs, you should only spend a few months of the year on the US mainland.

If you're making a lot of money and don't want to go with the FEIE (which is listed in options one and two), these programs might be right for you. The possibility of paying taxes ranging from 0 to 4 percent is actually very appealing due to the fact that the FEIE only allows you to exempt up to $101,300 in 2016 and taxes everything else you make. Pick Puerto Rico if you want to make a lot of money.

Be aware that if you run a business overseas, there are ways to make a million dollars without paying any taxes on it. It's just that you can spend the money in Puerto Rico. Instead of keeping all of the money in your business, you can withdraw it all.

4. Renounce your US citizenship

Despite the tax savings, renouncing your US citizenship may not be financially beneficial for some individuals. All unrealized capital gains, including real estate, Bitcoins, and your business—which can be difficult to value—will be subject to an exit tax if you renounce. That can be quite a blow for some.

However, you are not required to pay the exit tax if you have less than $2 million in assets, as long as you have paid your income taxes correctly up until the time you renounce. The majority of people won't pay an exit tax. You will still have an exit tax if you have paid a lot of income taxes in the past five years. The good news is that you can still use US banks and receive government benefits in some cases after quitting.

However, the best news of all is that if you give up citizenship, you are done for good. You won't have to go through hoops or give the government half of your income every year. It's a big move, but it's allowed. Although it is not for everyone, there are certain circumstances in which reneging on citizenship is logical to escape the crushing burden of the US income tax?

0 notes