#apply online professional loan

Text

Deciding on a Car Loan: Should You Go Online or Offline?

Deciding on a car loan can be a major decision, and one important choice you'll need to make is whether to apply online or offline. Both options have their own set of benefits and drawbacks, and understanding these can help you make the best decision for your situation. In this guide, we’ll explore both online and offline car loan processes in detail, comparing them based on various factors such as convenience, speed, personal interaction, security, and more.

Online Car Loan Process

Taking a car loan online has become increasingly popular in recent years. The main reason for this is the convenience it offers. Let’s break down the process and its advantages:

1. Research and Comparison

One of the biggest advantages of taking a car loan online is the ease of research and comparison. There are numerous websites and loan comparison tools available that allow you to compare interest rates, loan terms, and eligibility criteria from various lenders. This means you can quickly find the best deal without having to visit multiple banks or lenders in person.

2. Eligibility Check

Most online lenders offer a simple eligibility check process. You just need to enter some basic information, such as your income, employment status, and credit score, to see if you pre-qualify for a loan. This is a quick way to gauge your borrowing capacity without affecting your credit score.

3. Application Form

Filling out an online application form is usually straightforward and can be done from the comfort of your home. The form typically asks for personal details, financial information, and details about the car you wish to purchase. Online forms are designed to be user-friendly, making the process quick and easy.

4. Document Upload

The online car loan process allows you to upload required documents digitally. You can scan and upload documents such as your ID proof, income proof, and address proof. This eliminates the need for physical paperwork and saves you from multiple trips to the bank.

5. Instant Approval and Disbursement

Many online lenders offer instant approval, often within a few minutes to a few hours. Once approved, the loan amount can be disbursed quickly, sometimes within the same day. This speed can be crucial if you need to make a quick purchase.

Advantages of Online Car Loans

Convenience: You can apply for a car loan from anywhere, at any time, without visiting a bank or lender in person.

Speed: The process is faster, with instant eligibility checks, quick approvals, and rapid disbursement of funds.

Comparison: Online tools make it easy to compare multiple loan offers to find the best deal.

Paperless Process: Digital document upload simplifies the application process and reduces paperwork.

Transparency: Online platforms often provide clear and detailed information about interest rates, fees, and terms.

Disadvantages of Online Car Loans

Lack of Personal Interaction: Some borrowers prefer face-to-face interactions and personalized service, which online platforms lack.

Security Concerns: Sharing personal and financial information online can raise security and privacy concerns.

Limited Assistance: If you have questions or need help during the process, you may have to rely on customer support, which can vary in quality.

Offline Car Loan Process

The traditional offline car loan process involves visiting a bank or lender in person. Here’s how it typically works:

1. Visit a Bank or Lender

To start the offline process, you need to visit the branch of a bank or a financial institution. This often involves setting up an appointment and taking time out of your day to meet with a loan officer.

2. Consultation with Loan Officer

During your visit, you’ll meet with a loan officer who will explain the different car loan options available. This face-to-face interaction allows you to ask questions and get personalized advice based on your financial situation.

3. Application Form

You’ll need to fill out a physical application form provided by the bank. The loan officer will guide you through this process and help you complete the form accurately.

4. Document Submission

In the offline process, you must submit physical copies of the required documents, such as identity proof, income proof, and address proof. You may need to make multiple visits if additional documents are required.

5. Approval and Disbursement

The approval process in offline car loans can take longer, often a few days to a week, as the bank needs to verify your documents and evaluate your application. Once approved, the loan amount is disbursed, and you can proceed with purchasing the car.

Advantages of Offline Car Loans

Personalized Service: Direct interaction with loan officers provides personalized advice and answers to your questions.

Security: Submitting documents in person can feel more secure for some borrowers.

Trust: Many people trust established banks and prefer the traditional method of handling financial transactions.

Disadvantages of Offline Car Loans

Time-Consuming: The offline process requires multiple visits to the bank, which can be time-consuming and inconvenient.

Slower Process: Approval and disbursement can take longer compared to the online process.

Limited Comparison: It’s more challenging to compare multiple loan offers without visiting multiple banks or lenders.

Comparison of Online and Offline Car Loan Processes

Now that we’ve looked at both online and offline car loan processes, let’s compare them based on key factors to help you decide which is better for you:

1. Convenience

Online: Highly convenient, allowing you to apply from anywhere at any time.

Offline: Less convenient, requiring physical visits to the bank.

2. Speed

Online: Faster approval and disbursement, often within the same day.

Offline: Slower process, taking several days to a week for approval and disbursement.

3. Personal Interaction

Online: Limited personal interaction, mostly through digital channels.

Offline: Direct interaction with loan officers for personalized service.

4. Comparison

Online: It is easy to compare multiple loan offers using online tools.

Offline: Challenging to compare without visiting multiple lenders.

5. Security

Online: Potential security concerns with sharing personal information digitally.

Offline: Perceived as more secure with physical document submission.

6. Paperwork

Online: A Paperless process with digital document uploads.

Offline: Requires physical paperwork and document submission.

7. Assistance

Online: Customer support varies and may not always be as helpful.

Offline: Loan officers provide direct assistance and guidance.

Making the Decision

Choosing between online and offline car loan processes depends on your personal preferences and needs. Here are some scenarios to help you decide:

Choose Online Car Loans If:

You value convenience and want a quick, hassle-free process.

You are comfortable with digital transactions and sharing information online.

You want to compare multiple loan offers easily to get the best deal.

You prefer a paperless process with minimal physical paperwork.

Choose Offline Car Loans If:

You prefer face-to-face interactions and personalized service.

You feel more secure submitting documents in person.

You trust established banks and prefer traditional methods.

You have specific questions or complex financial situations that require detailed explanations.

Conclusion

Deciding whether to take a car loan online or offline depends largely on your individual preferences and circumstances. Online car loans offer unparalleled convenience, speed, and ease of comparison, making them ideal for those who are comfortable with digital transactions and seek a quick, hassle-free process. Conversely, offline car loans provide personalized service and a sense of security through face-to-face interactions and physical document submission, making them suitable for individuals who prefer traditional methods and trust established banks.

In making your decision, consider what factors are most important to you—whether it’s the convenience and speed of online applications or the personal interaction and security of offline methods. By evaluating your needs and preferences against the advantages and disadvantages of each option, you can make an informed choice that best suits your financial situation and comfort level.

For more detailed guidance and assistance in choosing the right car loan, you may reach out to Chintamani Finlease Ltd., where our experts can provide tailored advice and support to help you navigate the car loan process effectively.

If you have any further questions, please don't hesitate to contact us:

216, Ansal Vikas Deep Building, Laxmi Nagar District Centre,

Near Nirman Vihar Metro Station, Delhi, 110092.

Phone: (+91) 9212132955

Email: [email protected]

0 notes

Link

Business Loan Apply Online

A business loan is given to enterprises by various banks and financial invarious banks and financial institutions to fulfill titutions to fulfill their financial needs. This type of loan is obtained by entrepreneurs, SMEs, MSMEs, professional, non-professional, financial needs. This type of business loan apply online is obtained by entrepreneurs, SMEs, MSMEs, professional, non-professional, business owners and other business entities.

Business loans are categorized into 2 different categories named as secured and unsecured loans, both banks NBFCs (Non-Banking Financial Companies) are offering such loans in the form of working capital loan, term loan, overdraft facility, bank guarantee, letter of credit, machinery loan, term loan, bill discounting, equipment financing and business loan requirements under government schemes.

The loan amount offered up to Rs. 5 crores at an interest rate of 14.50% onwards, depending on the profile of the borrower.

Steps to apply online for a business loan

Step – 1: Visit the official website of the preferred bank and verify your eligibility online.

Step – 2: With the help of EMI calculator of business loan, know your monthly payable amount.

Step – 3: After knowing your EMI, fill in the online application form.

Step – 4: Enter all the required details and enter the needed loan amount.

Step – 5: Then click on submit.

Step – 6: Representatives will contact you after verifying your eligibility for further formalities.

#business loan apply online#business loan requirements#personal loan#startup loan#stand up loan#professional loan#working capital loan#capital loan#business loan#financeseva

2 notes

·

View notes

Text

Explore 8 ways to use loan for doctor for expanding and enhancing your medical practice. Learn how these financing options can fuel your healthcare business.

0 notes

Text

Thank you for applying for a library card!

We are a large metropolitan library with twelve branches here in the city and a consortial agreement with ninety-seven different timelines (and counting). Your card is your ticket to our physical and digital collections, where we have something for everyone.

You’ve indicated that you are licensed for time travel and regularly travel in time or between timelines for work purposes, so you are eligible for our trans-timeline borrower’s card. Please read this document carefully to ensure you’re using your new card to its fullest potential and in compliance with library policy.

Our services:

The library has a floating collection, meaning items remain at the branch where they were returned rather than being sent back to the lending branch. However, we do return inter-timeline loans to their home universe to minimize temporal strain. If you’re browsing the shelves and see a book phasing in and out of existence, alert an employee. It’s probably misshelved.

Our new online system allows you to keep the same login information in all timelines. No more keeping track of dozens of passwords! If you previously created multiple logins tied to one card, visit the circulation desk, and we’ll merge your accounts for you. No, this will not make you responsible for alternate selves’ outstanding fines, and any version of yourself telling you that is lying to you.

You asked, and we listened. Our new online catalog displays reviews from patrons from all relevant timelines on items exceeding a 90% similarity score. We request that patrons keep debates over the superiority of their timeline’s version to venues other than our catalog.

Although our staff members are not medical professionals, they have been trained to recognize signs of temporal instability. If you are experiencing characteristic symptoms (faintness, disorientation, physical and/or mental age changes, etc.), a staff member can administer grounding agents until emergency services arrive.

The library has a robust inter-timeline loan system. If you’re looking for a book or article not published in this timeline, fill out our online form or ask at the circulation desk. The average wait time for an ITL request is five business days. That’s shortened to three if you’re requesting an item stored at the James Patterson Interdimensional Warehouse. (Note: This estimate may change as the warehouse continues to expand under its own power, or if our courier gets lost there.)

Our policies:

We do not accept returns before the publication date (month and year). Cataloging books paradoxically created through stable time loops gets too complicated. You can check a book’s month of publication in a review journal like Booklist, which we make available online and in our non-circulating magazine collection.

We’ve recently gone fine-free in this timeline, meaning we no longer charge fees for overdue books. This policy varies between consortium timelines depending on whether certain people on the board of directors have retired yet.

If a book is damaged beyond repair, lost in a Time Hole, or overwritten out of existence by timeline changes, you will be responsible for the replacement cost or a flat fee of $30, whichever is lower. We do not recommend attempting to rewrite time to avoid losing or damaging the book, as we would prefer to purchase a new copy rather than tear a hole in the fabric of reality.

Patrons may use our computers for two hours. You can extend this time if there are no other patrons waiting. Show respect to other library users and do not abuse time travel to circumvent the policy when there is high demand. We will notice if there are two of you at our computing stations. Yes, even if one of you is wearing a funny hat.

The library values your privacy. We will not disclose account information or the content of reference transactions to anyone, including alternate versions of the account holder. The library also does not keep a record of the materials you check out. However, some of our databases do track user data. If you need to conceal your presence in this timeline to avoid paradoxes, the Time Cops, or your ex, we keep a collection of electronic resource licenses at the reference desk so you can judge which products to avoid.

Holder vs. Holder found that copyright protections extend across timelines and prior to publication, and copyright is exclusive to the iteration who created the work. Patrons attempting to copy library materials and publish them under their own name will have their cards revoked, even if they created the material in another timeline. This policy was adopted after consultation with our legal team. Trans-timeline copyright enforcement is very aggressive.

The library respects the personhood and autonomy of patrons no matter their timeline of origin. However, this respect is not always universal. If you need to know what the laws are for time travelers/alternate selves/dimension-hoppers/“timeclones”/etc. in this dimension (or the terminology used to refer to them), stop by the reference desk.

Violence is against library policy. If you are about to battle your alternate self from another timeline because you ran into each other in the cookbook section, take it to the parking lot.

In conclusion:

Libraries are committed to free access to information, and with the resources of dozens of timelines available to us, our mission has only gotten bigger. In fact, we’re hiring! If you’re looking for somewhere new to apply your time travel certification, we’re looking for team members in our inter-timeline loan department. Entry-level courier positions do not require an MLIS. Familiarity with James Patterson is a plus.

We can’t wait to see you in our library. (Maybe we already have.)

#wrote this down in a frenzy a few years ago after dreaming I had an inter-timeline library card#kat writes

573 notes

·

View notes

Note

Hii I have a bit of personal question, if that is alright. I am very interested in the American Revolution but I do not live in America. I would like to become a historian or researcher of that time period one day. As a student do you think it is difficult to be a historian of the American Revolution when you are not American? I get a lot of books and information online, but I do not think it is the same as being in a place? Do you think your school program a good stepping stone to get into an American graduate school? Is that something you want to do one day?

Sorry for all the inquiries, you are just the only person on here who is in a similar situation as myself! Best wishes to you!

Hi Anon! This is a really good question, and I'll do my best to answer it as both a history student and a university professional.

(First, I'll note that my interest personally is not primarily in the American revolution, but rather in the 18th century more broadly. That includes lots of angles that I can pursue in Europe, not least looking at relations in the Atlantic world, the "republic of letters" and the enlightenment, and thematically I'm interested in queer history, which can be studied everywhere. I also have no desire to live in the US. But, yes, let's assume AmRev is the focus.)

There are different considerations for undergrad vs postgrad.

Undergraduate

At undergraduate level, it doesn't matter too much where you study. At this point in your journey, broadly speaking, the focus is on developing your academic skills, learning established content about your topic, and exploring a range of scholarly interests (not just the topic itself, but how to research that topic – i.e. methodologies). As long as your university has a department for American history, or even better a major, you're fine.

While you're busy with your degree, you can supplement your learning about the period in a lot of ways, including:

Using your own library to access books, journal articles and databases (and getting materials through inter-library loans if need be)

Using the vast and ever-growing online resources on American history provided by institutions like the Library of Congress, American universities and libraries (e.g. NYPL)

Where something isn't already available online, contacting the archive that has it and seeing if you can get a copy (I wrote a post about that)

Talk to your history prof about your interest, and they will probably be able to suggest some avenues to pursue. One very useful tool is to look up the AmRev curriculum or syllabus from other univerisities and see what readings and topics they cover (just google: "american revolution" syllabus). Here's one that came up.

And then – and I'll put this point in bold because it's the most important thing I'll say here:

👉✨Attend conferences✨👈

Conferences are where you make invaluable connections with like-minded scholars, hear about new research, find out about opportunities (scholarships, programs, funding, etc.), discover what a career in academia actually looks like, get advice from people already doing the job you want to do, and so on. There are even conferences specifically for undergrad students, or there might be a track at a generalist conference that allows emerging researchers to present on a topic. Lots of these take place online (hence, cheaper), or you might be able to apply for funding from your university to attend (or idk you have a fabulously wealthy great-aunt).

Postgraduate

While undergrad is more about learning, postgrad is more about finding out. The higher up the ladder you go, the narrower your focus becomes, and you start to need more specialised guidance. To get the most out of your learning, you need to go where the experts are, and naturally, many of the most cutting-edge scholars on American history are, well, in America. You'll want to be surrounded by a community of like-minded scholars. And yeah, "being there" can be important not just for better access to primary materials, but also for insights that come from physical, social and cultural proximity.

That said, I don't think it's impossible (or inadvisable) to study the American revolution outside of America; it's just trickier. Doing that successfully comes down to 1) finding the right advisor and 2) choosing the right topic.

By this point, you should know who the leading scholars are in your particular niche of interest. Nobody really studies "the American revolution" writ large; rather, they (and you) will focus on the political or racial or sociocultural or regional or culinary or-- whatever aspect of it. It might just happen that the people in your field are located near you.

You can also approach the topic from a different angle – start from a local point of interest that you can to relate to the AmRev. (Maybe you're Italian, and you know about Italian History Blorbo who went to fight in the war, and there's a story to tell there. Maybe you're Dutch and you have things to say about the intricacies of the financial and political support the Netherlands gave to America. And so on.) This might, in fact, lead to novel insights and perspectives that haven't been explored yet.

Good luck to you!

If anyone wants to share their own experiences, please feel free!

#amrev#american history#gradblr#feel free to send any follow-up questions#as you can see i'm very capable of rambling on about this topic

45 notes

·

View notes

Text

One missing piece - Chapter One - The interview

Warnings: None

Moving to Alburquerque New Mexico was a big change in your life and new opportunities ahead. Living with your uncle Mike was amazing he would tell you all sorts of stories about his time as a cop and cook the most delicious meals. You never really got on with your mother and father who rarely paid any attention to you being only an accessory to them for their image of wealth and power.

Mike was the only one in your family that actually cared about you. So moving all the way to Albuquerque was the best decision you ever made you wanted a normal life after all.

Being only twenty-three you had everything in the palm of your hand. Excitement graced you as you applied to study law at the local university and then you realised you needed to get a job and start saving up for independent living and student loans.

Since your parents never gave you a dime out of spite

So, you began your search for the perfect job there were opportunities and none peaked your interest until you looked online one day and came across an ad for a live-in nanny.

“Seems too good to be true” you murmured to yourself upon learning the rather fine payment. (Way too much for a nanny in your opinion)

Ideally a young woman

Experience with children

Preferably single

Ect.

Single? Why’s that? You thought

You read that they have a seven-year-old son who needed to be taken care of and tutored.

Seems a perfect job until your trimester starts

Writing down the contact details you sent the family a short and expressive email. You didn’t know the names of parents, yet which was strange. The email appeared to be just ‘L.Salamanca’

You brushed it off and carried on the rest of your day and by noon you had a reply.

To Y/N

Thanks for the maravilloso email we would really appreciate you having an interview with us at our home this Friday and learn about your skills further and see if you are qualified for the job.

L.S

There was address attached to the email and you typed a quick and polite response.

You were truly excited.

If only you knew.

-

Friday came around quick, and you felt nerves started to play you doubled check with this Salamanca guy that the meeting was still on and

it was.

Dressing up in a simple long dress and cardigan you wanted to look professional as possible. You were on the train of thought about everything.

Are they nice?

What is their son like?

Will they like you?

Taking deep breathes you noticed to the most extravagant looking home you have ever seen in your entire life coming into view. Your parents' home is worthless compared to this.

You paid and thanked the taxi driver before stepping out holding on to your handbag you carefully got up the stairs to the front door and pressed the income an older woman’s voice came through and you told her your name.

The woman who appeared to be a maid invited you inside you gasped upon gazing at the lavish interior of the home.

“That’s everybody’s reaction upon entering” she tells you with a laugh

“I wonder why” you respond with a smile.

“Right this way Miss he’s waiting for you” She guides to the room at the end of the hall opening the door for you. There stood an older man with his back turned appearing to be on the phone with somebody. You waited there for a minute awkwardly.

“Solo haz lo que te digo (do what I tell you)” he said rather annoyed to the person on the phone you looked around the spacious study and then he hung up with phone with a sigh. The man turns around and greets you with a kind smile “you must be Y/n” and you nod then he unexpectedly embraces you in his arms.

“I didn’t expect that sorry” you gasped in surprise

“My name is Eduardo Salamanca, but you can call me Lalo” He introduces himself and then gestures to the chair “Come come sit” he says, and you did.

Lalo was handsome and much older than you with his fine tailored suit and well-groomed moustache that fitted him to perfection and dark hair that graced a sliver streak.

You get comfortable ready to answer any question fired Lalo sits at his desk and speaks

“Sooo how old are you again?” he asks.

“Oh, I’m twenty-three” you replied.

“dios mio what an age to be (my god)” he mused.

You answered his questions such as your education, family and experience with children. To which you spoke about how you used to care for your younger siblings and even volunteered in a school once.

“Are you single Y/n?” the question put you off guard given how handsome Lalo was.

“Oh yes I'm single” you replied Lalo smirks oddly making you a little confused.

“Good only because I want your attention to be on the job and not wondering off to some boyfriend” he chuckled, and you nodded.

Lalo was about to ask more questions when the door opened “Ignacio Varga you are late” he scolded.

“I know I am” He huffs walking towards the desk his eyes meet yours and he smiles “Y/n nice to meet you” he greets holding out his hand to which you shake.

Ignacio appeared a little younger than Lalo with a shaven head and fitted tank top he looked like he just got back from working out.

Lalo gets up and walks over to Ignacio kissing his cheek “he’s my husband” you were slightly surprised but smiled sweetly. You were very supportive towards people’s sexual orientation

Both Ignacio and Lalo interviewed you for another ten minutes and when they were satisfied, they wished you goodbye. Promising you another interview this time with their son Marco.

They offered you a ride home to which you politely declined and left after getting a massive hug from each of them. The couple stood in the doorway waving you a goodbye as you got into the taxi.

Then they looked at each other knowingly

“She’s the one”

56 notes

·

View notes

Text

Unlock financial flexibility with FlexiLoan.in!

FlexiLoan.in certainly seems to offer a variety of loan options to cater to different financial needs. The promise of minimal documentation and quick online processing can make it an attractive choice for those seeking efficient loan management.

Here’s a quick overview of the loans available:

🔹Personal Loan: For individual financial needs.

🔹Flexi Loan: Offers flexibility in borrowing and repayment.

🔹Doctor Loan: Tailored for medical professionals.

🔹CA/CS/CWA Loan: Designed for chartered accountants, company secretaries, and cost & work accountants.

🔹Business Loan: To support business growth and expenses.

🔹Overdraft Loan: Provides a credit facility for immediate cash needs.

For anyone interested in these services, it’s worth exploring further to see how FlexiLoan.in can assist with financial management. 🚀💼💰Apply now and take control of your finances effortlessly!

Learn More: https://flexiloan.in/

Contact Now: +91-8802733920, +91 9643001111

#flexiblefinancing#onlineloans#businessloans#delhi#delhincr#easyapprovals#entrepreneurship#fastfunding#flexiloan#flexiloanin

2 notes

·

View notes

Text

Employment Struggles

I'm going to do something shocking and use this as an actual blog post.

I am SO sick and tired of applying to jobs, only to be ignored completed, or even worse the interview is scheduled and then the role is filled before I can interview. Today the interview was cancelled a minute before the scheduled time. Then the person who would be interviewing me ignored me on email and phone.

I am mentally exhausted. I am broke all the time. I don't get unemployment because I've never been eligible for it. The only good thing about this is that I have full healthcare coverage and food stamps.

I am a medical assistant with experience, I am a certified professional medical coder with internship experience, I have experience in retail, yet I cannot even get a call back from McDonald's, let alone a good healthcare job.

I've considered becoming a behavioral health tech, but I just truly don't want to be hit/bitten at work. I also couldn't deal with the families of children disagreeing with a preset therapy plan while I'm physically stuck in their home. The other options I was looking at was security, or 911 dispatcher, but dispatch classes are few and far between into next year, and also expensive. And security can be dangerous.

At this point, being 30 and just defeated by how unsuccessful I am in life, I am considering going to a trade school. Like welding. Or automobile tech or something that is actually in demand. There is literally no other options for me and I'm literally five minutes outside of San Francisco. I am mildly considering an IT course, but tech is so unstable and unsafe while also being over saturated right now and I don't trust it. But then, you have to deal with stereotypical personalities in 'conservative' trade jobs too. The other risk is I spend time and money doing a trade school and then no one wants to hire me (like I've done twice now). I don't know what to do.

The trades I'm considering:

Electrician

Welder (part of machinist trade) (honestly this is most appealing to me)

Aircraft Maintenance Technology (Can't hurt with SFO next to me and their planes literally falling to pieces in the sky every week)

HVAC (still don't really understand what this job even is)

The guilt I'm feeling is that I am about to finish my BA in psychology next month, and I'm waiting to hear back from the two colleges I applied to for a Master's to become a therapist. If I get in to my top choice, that's $60k+ I'll need to fund. If I get into the state school, which is slim, that's likely covered by school loans, but I'll still want to make some kind of income for three years I'm in the program. If I don't get into either program, then my last choices are: work while getting med school pre-reqs done, or work while doing an online MFT program (which I really don't want to do an online only program but if it's accredited at the end of the day I don't care.) The online only school would also be $60k+ so I'd need to work regardless.

I'm feeling guilty too because I've never been the fanartist who can drop a new print and have thousands of followers want it. I can't make money that way. Commissions have always been my most lucrative offering as an artist, but it's often mentally very taxing. It's also unstable. I don't have a lot of followers to drum up a successful pays-my-rent-every-month Patreon, and with the way of algorithms and sites are these days, I likely won't ever. I'm not trying to complain for sympathy, but this is just how it's been for me.

I know it's stupid to feel guilty for things like this, but I just am in this nebulous space between being apparently unemployable while also not being unemployable enough to receive livable benefits while continuing job hunting.

So I guess I'm looking for opinions on trade professions. I'm trans, but I pass masc in public save for my voice really. I also am not the kind of person to wear pride pins or color my hair rainbow, which would draw attention that way. I'm not too concerned about mean people in a trade job, because honestly the rudest people I've worked with have been in healthcare anyway. And a trade job would mean no customer service positions/working with my hands, which requires little mental gymnastics.

Also pointless, but true, I keep thinking of Debbie in Shameless getting her welder certification after becoming a teen parent.

I guess the takeaway here is, I'm more willing to be hurt on the job by a machine mistake on my part than I am willing to be hurt by other people assaulting me (very real in healthcare jobs/security) while working.

What do you think?

#I'm sorry if this is coming off whiny but I have no one to talk to about this#so to the tumblr masses it goes

5 notes

·

View notes

Text

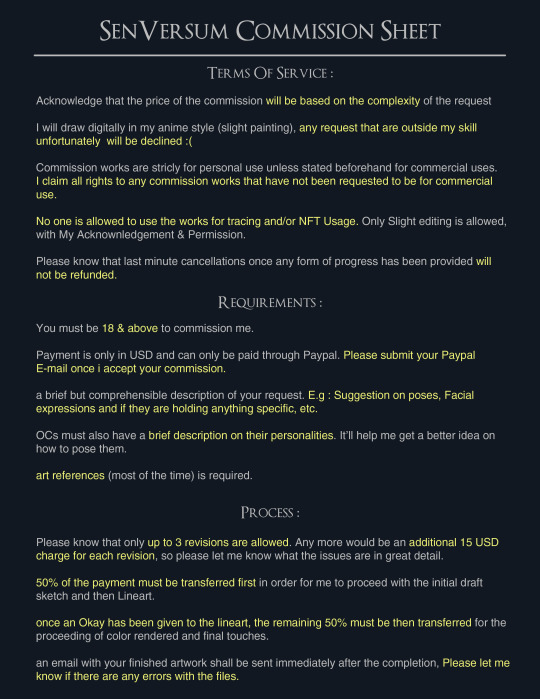

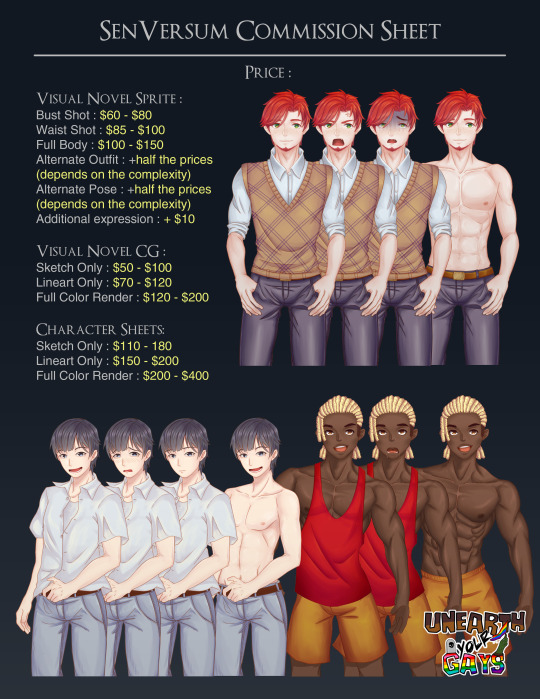

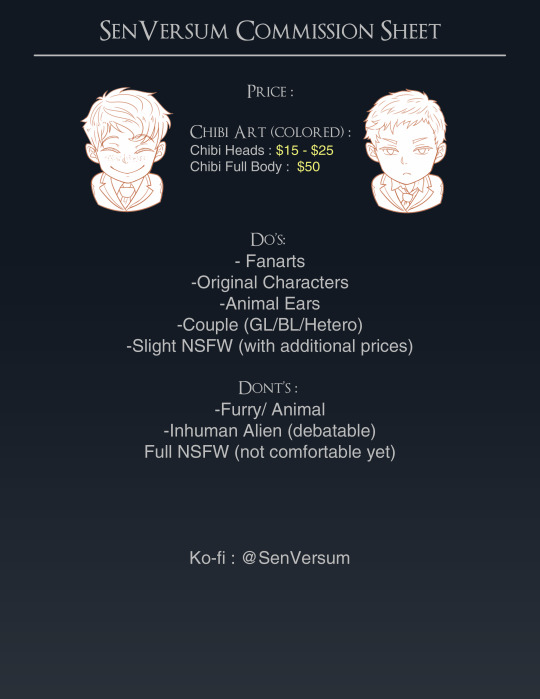

Opening Character Art Commission

(2-3 slot available/ 2 weeks - a Month done/ depending on the complexity

Hello Everyone… first of all nice to meet you guys. you could called me Sen, I'm known as the artist for Totem Force, Unearth Your Gays, and The Onryō of Osaka.

i've been taking hiatus on digital drawing for years, the last time i did some art was in 2021, the reason for it was something im not comfortable enough to disclose in a lot of detail (im sorry) short summary of some of them (beside the covid case) are these :

in 2019 ive been living alone, which makes me have more time to work on art

but i have to come back to my parents house at the start of 2020 to take care of them and my lil sister which taking more of my daily life time

since my parents quite old i have to fully take care of the house chores and such like taking care of my lil sister education, managing the administration file and such when she have to apply for her Junior High School

managing monthly bills like electricity, water, gas, etc (not to mention that i just become unemployed to take care of the house)

i also have to manage our daily food like doing grocery in the morning after taking my lil sister to her school, preparing food for my family (cooking for breakfast, lunch, dinner, and my lil sister packed lunch)

another house chores like cleaning the house, doing dishes and such

not to mention dealing with family drama for my mentally abusive parents (the reason why i leave the house in 2019 and living on another city away from them) which taking a lot for me to stay sane

around 2022 my mom took a turn and make a mess of our life, she ended up diagnosed with bipolar and mentally unstabled state, which cause a lot of problem with neighbours and relative. she cause harmed to herself and other which ended up making me the one to blame for "not taking good care of her"

forgot to mention i also have to deal with my parents debt on top of it (dad never pay the monthly bill for years and caught in indefility, mom taking a bunch of debt from bank and loan shark, lil sister got neglected since i left the house (and yes it was me who usually take care of her since birth she basically said im more of a parent figure for her than her own parents)

there are a lot more i couldnt mention which ended up taking me to a dark places and makes my life feels too much of a burden, i was considering to end myself in 2022 (unfortunately not my first attempt considering how tiring it was to live under my parents abusive tendency in my youth)…

it tooks me a while to get a grip on myself again, but i decide to keep on living my life in hope it get better, not to mention i hate the thought of burdening other people by taking the easy way out, i still owe a lot of people, and my lil sister still need me to keep on taking care of her, and i dont know what will happened with this house if theres no one to take care of it

im not talking to any professional yet but talking with some close friend online does help quite a lot in sorting out my thoughts.

im stable enough now to deal with my daily life in this house, and im planning to stick with it until my lil sister graduated from her high school in around 3-4 years in the future. in my vision she will be old enough to taking care of herself then so i could get my rein back to focusing on my own life

Long story short im slowly getting back on drawing digitaly since 28 march this years, and lets be honest… i couldnt fully work on my backlog without earning any income for my living cost while im at it, so hopefully by taking another comission alongside my overdue list i could get through all of it. and please dont worry and thinking i will neglect your commision, i will give my best to finish it within 2 weeks - a month (depending on the complexity of it). you could talk more detail with me if you decide to take my service offer

Im thanking all of you for even considering reading all this stuff, sorry for the long post and thank you..

TL:DR im opening character art commision for like 2-3 slots, you could find more of my samples here :

and i will post my commission sheet here :

once again sorry for the long post, and please contact me if you are interested… thank you <3

#art commisions#commission#character art#SenVersum Art Commission#Totem Force#Unearth Your Gays#fanart

5 notes

·

View notes

Note

Hello there!

Forgive me if this is not the place you'd like to discuss this (i know some people prefer to keep their social and professional lives completely seperate)

But I am actually exploring my options to become a preservationist! Would you be at all interested in discussing your professional archival career and the educational path you took? Or do you know perhaps of some additional people I could reach out to?

Thank you so much for your time!

Hi! Happy to talk about my own career path but ... I am not an archivist! @ anyone who follows me (I think some of y'all are conservators or in preservation?), please chime in with your more useful advice.

(But also, since we all love to talk about ourselves, here's a bit about how I didn't end up in archives.)

I was originally interested in archives after 2 undergrad internships (one digital archive, one special collection at my college). I decided to work before getting my masters degree, and ended up with a non-library job in academia that I stayed in full-time while getting my degree. It meant that between salary and scholarships I didn't have to take out loans for my degree (highly recommend!), but definitely limited my MLS options (I did a mostly-online program, joined no clubs, did no RA work, and fit in my internship around my day job - none of which I recommend).

In grad school, I took some archives-focused classes and my internship was in an archives. However, it became clear to me that to actually find full time work in archives, I'd need to a) be willing to move literally anywhere, b) cobble together a bunch of part time or short term gigs, c) be ok with a lower-paying job with fewer benefits than I had pre-MLS. And that just didn't fit with my work-life plan - I'm married to an academic, and at least one of us needed enough marketable skills to be a trailing spouse.

So instead, I became an academic librarian! Specifically a reference/instruction/liaison librarian, previously in social sciences & scholarly communications and now in health sciences. There were more jobs*, and my higher ed background made me way more competitive for them, and there's some skill overlap (reference interviews, teaching, information organization). I love it and am very happy. I actually did get to the final round of a special collections instruction job during my last round of jobhunting, but decided archives weren't were I wanted to be at this point.

In general, my recommendations to people interested in pursuing archives jobs are:

Get as much job/volunteer/internship experience as possible

Look closely at job postings to see locations, required skills & experience, and salaries to see whether they match your needs

Have a plan for paying for degrees (or as much as possible getting scholarships or your institution to pay for it)

Pursue skills like coding, managerial experience, project management, and anything else that expands the jobs you can reasonably apply for

Good luck with your career and hopefully someone adds onto this who actually works in the field and can speak to it!

*more jobs is relative - I applied to 30 academic fundraising jobs after grad school and 2 library jobs and miraculously got 1 of the library jobs

#your mileage may vary#but since you asked!#archives#tumblarians#career advice#academic librarianship#not intended to discourage you#just some perspective from this side of job hunting

6 notes

·

View notes

Text

Quick Cash with Gold Loans: A Reliable Financial Solution

When you need money quickly, a gold loan can be a great option. Gold loans allow you to use your gold jewelry or coins to get cash fast. This guide will explain gold loans in simple terms, covering how they work, their benefits, and things to watch out for. By the end, you'll have a clear understanding of why gold loans are a reliable financial solution.

What is a Gold Loan?

A gold loan is a secured loan where you offer your gold as security. This means you give your gold to the lender, and in return, they give you money. The amount you can borrow depends on the value of your gold. Once you repay the loan with interest, you get your gold back.

How Does a Gold Loan Work?

Here's a step-by-step process of how gold loans work:

Valuing Your Gold: You take your gold jewelry or coins to a bank or a lending company. They evaluate the gold to determine its purity and weight.

Loan Amount: Based on the value of your gold, the lender offers you a loan amount. Typically, lenders give you a percentage of the gold's market value, usually between 60-90%.

Getting the Money: Once you agree to the terms, the lender gives you the money, either in cash or directly into your bank account.

Repaying the Loan: You repay the loan in monthly installments over an agreed period. The repayment includes both the principal amount (the loan amount) and the interest.

Getting Your Gold Back: After you have fully repaid the loan, the lender returns your gold.

Benefits of Gold Loans

Gold loans have several advantages, making them a popular choice for many people:

Quick Approval and Disbursement: Since the loan is secured by your gold, lenders can quickly approve and disburse the loan. This makes gold loans ideal for emergencies when you need cash fast.

Lower Interest Rates: Gold loans usually have lower interest rates compared to personal loans because they are secured by your gold. This means you can borrow money at a lower cost.

No Credit Check Needed: Lenders focus on the value of your gold rather than your credit score. This makes gold loans accessible even if you have a poor credit history.

Flexible Repayment Options: Many lenders offer flexible repayment options, including bullet repayment (paying the entire amount at the end of the loan term) and regular EMIs (Equated Monthly Installments).

Use for Any Purpose: You can use the money from a gold loan for any purpose, whether it's paying medical bills, funding education, or covering business expenses.

Things to Consider

While gold loans offer many benefits, it's important to be aware of certain factors:

Risk of Losing Gold: If you fail to repay the loan, the lender has the right to sell your gold to recover the loan amount. Make sure you can meet the repayment terms before taking a gold loan.

Interest Rates and Fees: While interest rates are generally lower than unsecured loans, they can still vary. Compare rates from different lenders to find the best deal. Also, be aware of any processing fees or other charges.

Loan Amount Limits: The amount you can borrow is limited by the value of your gold. If you need a large amount of money, your gold may need to be of significant value.

Loan Tenure: Gold loans typically have shorter repayment periods compared to other loans. Make sure the repayment schedule fits your financial situation.

Steps to Get a Gold Loan

If you decide a gold loan is right for you, here are the steps to follow:

Choose a Lender: Research and choose a reputable bank or lending company that offers gold loans. Compare interest rates, loan terms, and customer reviews.

Prepare Your Gold: Gather your gold jewelry or coins. Ensure they are in good condition and have necessary documentation if required.

Visit the Lender: Take your gold to the lender for evaluation. They will assess the purity and weight of the gold to determine its value.

Loan Offer: Based on the evaluation, the lender will make a loan offer. Review the terms, including the interest rate, repayment period, and any fees.

Sign Agreement: If you agree to the terms, sign the loan agreement. The lender will then disburse the loan amount to you.

Repay the Loan: Follow the repayment schedule agreed upon in the loan terms. Make sure to pay on time to avoid penalties and to get your gold back without issues.

Real-Life Examples

To understand how gold loans can be helpful, let's look at a few real-life examples:

Emergency Medical Expenses: Maria needed urgent money for her mother's surgery. She didn't have enough savings and had a poor credit score. Maria decided to take a gold loan. She pledged her gold jewelry and received the loan amount within a day, which helped cover the medical expenses quickly.

Business Expansion: Raj, a small business owner, wanted to expand his shop but lacked the necessary funds. He used his family's gold to secure a loan. With the money from the gold loan, Raj was able to buy new stock and expand his shop. He repaid the loan within a year, and his business grew significantly.

Education Fees: Priya needed money to pay for her college fees. Her parents didn't want to take a personal loan with high interest rates. They decided to take a gold loan instead. By pledging their gold, they got the money needed for Priya's education at a lower interest rate.

Conclusion

Gold loans, such as those offered by Chintamani Finlease Ltd, are a reliable and convenient way to get quick cash using your gold jewelry or coins. They offer lower interest rates, quick processing, and flexible repayment options. However, it's important to consider the risks and ensure you can meet the repayment terms to avoid losing your gold. By understanding how gold loans work and carefully evaluating your needs and financial situation, you can make an informed decision. Whether it's for emergencies, business growth, or education, gold loans from Chintamani Finlease Ltd can be a valuable financial solution when used wisely.

If you have any further questions, please don't hesitate to contact us:

216, Ansal Vikas Deep Building, Laxmi Nagar District Centre,

Near Nirman Vihar Metro Station, Delhi, 110092.

Phone: (+91) 9212132955

Email: [email protected]

#finance#instant personal loan#personal loan in minutes#apply online professional loan#instant business loan

0 notes

Link

Business Loan Apply Online

Various banks and financial institutions provide business loans to meet capital requirements of self-employment customers and enterprises. Moreover, a business loan can be used for business-related purposes. These business loans apply online are used by individuals, SMEs, MSMEs, business owners, entrepreneurs, professionals (CA/Doctors) and other business entities.

Business loans can be classified into 2 different categories, one as secured and another one as unsecured loan.

This type of secured loan requires you to pledge collateral/security with the concerned bank to avail a business loan. However, in the case of unsecured loans, there is no need to provide any collateral/security with the bank, NBFCs or any other lender.

Secured and unsecured business loan can be availed in the form of term loan (short term/long term), working capital loan, cash credit, overdraft, letter of credit, Bill/Invoice discounting, machinery loans, POS loans, loan under bank guarantee, equipment finance and so on.

Visit Financeseva.com and click on “Unsecured Business Loan” page, in which you will be asked to fill up an enquiry form that includes personal details such as name, email address, mobile number, and requirement. Within 24 hours of receiving your request, a dedicated representative will get you in touch to explain the product, specification, and rates and check your eligibility. If your profile matches the eligibility requirements, with the aid of tech-based data; it will give you a list of bank and credit details.

#business loans apply online#unsecured business loan#working capital loan#personal loan#professional loan#capital loan#business loan#financeseva

1 note

·

View note

Text

How to Get the Best Personal Loan Offers in India

Introduction

In today’s fast-paced world, financial needs often arise unexpectedly. Whether it’s a medical emergency, a home renovation project, or a dream vacation, personal loans can provide the financial flexibility you need to make your aspirations a reality.

Pricemint, an Indian fintech platform, is dedicated to helping individuals unlock their financial potential by offering a straightforward and user-friendly process for obtaining personal loans.

Benefits:

Loan Comparison: Easily compare personal loan offers from multiple banks and financial institutions.

Competitive Interest Rates: Access low-interest rates and potentially save money over the loan tenure.

Convenient Digital Process: Apply for personal loans conveniently online, from anywhere.

Customized Loan Offers: Get loan offers tailored to your unique financial situation.

Flexible Loan Amounts: Choose from a wide range of loan amounts to suit your needs.

Varied Tenure Options: Select a repayment period that matches your financial circumstances.

Regional Considerations: Loan terms are adjusted to regional factors that may affect your eligibility.

Transparent Process: Clear information about interest rates, fees, and terms is provided.

Personalized Assistance: Receive guidance and support throughout the loan application process.

Privacy and Security: Your personal information is protected in accordance with their Privacy Policy.

How to Get the Best Personal Loan in a Minute –

Step 1: Select Your Employment Type

The first step in securing a personal loan through Pricemint is to define your employment status. Pricemint recognizes that different employment types may have distinct loan eligibility criteria. You can choose from the following options:

Salaried: Select this option if you are employed by a company and receive a regular salary.

Self-Employed Professional: If you work independently as a professional, this is the choice for you.

Business Owner: If you own a business, you can choose this option.

This initial step helps Pricemint tailor your loan options to your specific employment situation, ensuring that you receive the most relevant loan offers.

Step 2: Your Monthly Salary

Your monthly income plays a crucial role in determining your eligibility and the loan terms available to you. In this step, you will be asked to provide your monthly in-hand income. It’s essential to provide an accurate representation of your earnings to receive loan offers that align with your financial capacity.

Alternatively, you can simply type in your monthly income to expedite the process.

Step 3: Choose Your Primary Bank Account

Selecting the bank account for loan disbursement and repayments is the next step in the process. Your primary account should be the one you actively use for your financial transactions. Pricemint offers a list of popular banks to choose from, including HDFC BANK, SBI BANK, ICICI BANK, KOTAK BANK, AXIS BANK, BOB BANK, YES BANK, and an option for OTHER BANK. This choice ensures seamless loan disbursements and repayments.

Step 4: Provide Your Employment/Company Name

To gain deeper insights into your employment details, Pricemint requests the name of your employer or company. This information helps in assessing your financial stability and eligibility for personal loans.

Step 5: What’s Your Residence Type?

Understanding your living situation is crucial for evaluating your lifestyle and its financial implications. You will be asked to choose from various residence types:

Owned by You/Spouse

Owned by Parents

Rented with Family

Rented and Stay Alone

Company Provided

By selecting the option that best represents your current residence type, you help Pricemint tailor loan offers to your specific circumstances.

Step 6: Enter Your Current Residence City or Town

To consider regional factors that may affect your loan terms and eligibility, Pricemint requests the city or location where you currently reside. This information ensures that the loan offers you receive are in line with the conditions in your area.

Step 7: All Set! What’s Your Desired Loan Amount?

Finally, it’s time to specify the loan amount you wish to borrow. Pricemint offers a flexible range, catering to various financial needs. You can choose from the following options:

Under 1 Lakh

2/4 Lakh

5/9 Lakh

10 Lakh And Above

This wide range provides the

flexibility to select the loan amount that best suits your unique financial requirements.

Final Step – Enter Your Personal Details

In the last step, you will be required to enter your personal details, including:

Your Name

Your Email Address

Your Phone Number

This information is necessary to complete the application process and to contact you with personalized loan offers.

By clicking the “Get Offers/Apply Now/Continue” button, you indicate your acceptance of the Privacy Policy, ensuring the security of your personal information.

Conclusion

Pricemint makes obtaining personal loans in India a hassle-free process. By following the step-by-step guide outlined in this article, you can seamlessly navigate the application process, receive personalized loan offers tailored to your unique circumstances, and secure the financial support you need to achieve your goals and secure your future.

With a wide range of loan amounts, flexible tenure options ranging from 3 months to 8 years, and the ability to compare multiple offers with different interest rates, Pricemint empowers you to make informed financial decisions and choose the best loan deal for your needs.

Don’t let financial constraints hold you back from pursuing your dreams and addressing your urgent financial needs. Unlock your financial potential with Pricemint’s user-friendly personal loan application process and take control of your financial future. Get started today and embark on your journey toward financial stability and prosperity.

2 notes

·

View notes

Text

Eliminate Hard-to-Pay-Off Times with Short-Term Loans UK

Do you require money to eliminate financial issues? Are you worried that you won't be able to get the money due of personal negative credit factors? Not to worry! You can get short term loans UK, and nothing is required in exchange for the loan. You are still permitted to make minimal earnings during the two to four week reimbursement period, ranging from £100 to £2,500.

This bequest money can be easily put to use for a variety of financial needs, including unpaid bank overdrafts, wedding or birthday expenses, automobile repairs, child's school or tuition costs, unexpected medical treatment costs, light or phone bills, or even grocery shop bills.

If you struggle with negative credit factors like defaults, arrears, foreclosure, late payments, or bankruptcy, you must first complete a number of requirements. To qualify for short term loans UK and get the money fast wherever you are, you must be eighteen years old, a resident of the UK, a full-time worker, and have a current bank account.

In order to avoid delays in sending your information to the lender for confirmation, use an online application form, which is renowned for offering the quickest and simplest process to every visitor. You must complete the short term loans UK direct lender form on the website with your accurate information, such as full name, address, bank account, email address, age, contact number, employment status, etc., before submitting it for verification. Your account receives the approved funds the same day.

Trustworthy Direct Lenders for Short-Term Loans

It's crucial to select a reliable short term loans direct lenders when trying to borrow money rapidly. Payday Quid is a direct lender for short term loans that provides affordable loans in the UK. We are dedicated to provide our clients an honest and fair service.

Even while we can still lend to you if you have a history of negative credit, all approvals must first pass affordability tests. As a direct lender in the UK, we make all lending decisions independently, as opposed to brokers who represent other lenders. The human touch that sets us unique from other lenders is provided by our team of Customer Care Managers, who are accessible to help you through the loan application process.

If you can demonstrate that you are a responsible borrower and that you can afford the short term loans direct lenders, we will examine your application. The ability to make loan payments on time is essential, therefore we make sure that any loan acceptance won't put you in more financial jeopardy.

The top direct lenders in the UK will only approve what you can afford to repay when you apply same day loans UK. They consider you as a person in addition to your credit score. We at Payday Quid believe in providing flexible repayment terms to make it easier for you to manage your payments. As direct lenders, we take great pride in providing a unique approach to lending. We don't utilize automated methods to make lending choices; instead, we rely on our team of professionals, which enables us to take a personalized approach to financing.

Select Payday Quid as your direct lender today to benefit from a dependable and reputable service for your borrowing requirements.

4 notes

·

View notes

Text

Damn job wants a diversity statement on top of a resume and cover letter.

If I were braver, this would be the one I send with my app:

I must admit, most of my diverse experiences in life come from being a diverse person forced to squeeze myself into a comfortable, digestible little box for others every day. Not to say work hasn’t given me things to think about and improve upon, but what I bring to every job comes directly from what life has been like for me and the friends I have made.

My data analyst job? I already knew how high those numbers of high-risk pregnancies would be before my first day. As well as the disparity in healthcare between races, genders, and people with disabilities and no money. Not even because of that fancy degree on my resume either, but because of reading people’s direct experiences with it online and in books and hearing them say it to my face. To say nothing of how I have been treated as a patient by doctors my whole life as a noticeably biracial, chubby, femme-presenting person. I never needed data on a chart to tell me life is grossly unfair, not because of divine providence, but because of money to be made by people who don’t care how they have to make it. Yet, corporations and organizations only ever want to hear about The Charts. Water is wet and we all know that. It’s not a trade secret. The facts and figures as they look in little white boxes with a green border is all you want because “that’s just the way it is”. I support diversity…because I’m tired of “the way it is”.

“Diversity statement” sounds like an unfunny joke at best and an indictment of professionalism at worst. Why are we adding yet another barrier to getting a job in this “golden land of opportunity”? It’s almost like employers don’t actually want to hire anyone but they want the cookie points of pretending they’re sleuthing really hard for simply the best candidate in the world for a position that most people probably only fill for about a year or two. Newsflash: The majority of my generation are never going to be decades-long workers. We can’t afford to be. Prices are going up all the time and we always have to look forward, because if we don’t, we witness the burning of Sodom and Gomorrah and are turned into the saltiest, deadest professionals to ever waste four years of our lives. That’s not touching on the student loan payments starting back up that many of us still can’t afford despite three years of deferment. And I have to write some silly statement outlining exactly the steps I’m taking to diversify—let me tell you something, every breath I take on this unforgiving rock is how I further diversity. Every day I chose to get up and keep going despite everything telling me to quit, is how I further diversity. That includes this smarmy performative excuse of an assignment to make me feel like I’m not worthy of anything if I don’t grovel for it. You people should be ashamed, frankly.

I’ve spent three hours writing and researching what a “diversity statement” even is supposed to be. Funnily enough, there is no true definition I can look to and apply as a data analyst just trying to get a slightly better position so I can have a slightly better quality of life. I write ‘funny’, but it’s really more insulting than anything. Diversity is already here. And will continue to grow no matter what we do. We just don’t appreciate it or stand up for it or want it for anything more than to say we put out the flames when all we did was yell “FIRE!”.

2 notes

·

View notes

Note

PERSPECTIVE Q FOR U if you have the time!! Ive always dreamed of going back to school but my performance in undergrad was so unbalanced (straight A's for 3 semesters, then a withdrawal, then more A's then failing then incomplete etc.) And while my professors were incredible (and even asked me to do join a phd in archiving WHICH I SHOULD HAVE DONE!!!!!) and i remember almost everything we read and learned i didnt have a lot of direction and was im afraid a p mediocre student in the end. Since then i've been in government in DC and its been fantastic getting some impactful policy experience and the like but at this point its been almost half a decade out of school and i dont even know how to begin!! The trump "administration" was such a bonkers time to be a civil servant lol but DID help clarify the things i want now and the goals i want to achieve (crazy stuff like "feed hungry ppl," and "don't fuck up the earth too badly") almost definitely mean i have to go back for something. Idk do you have any colleagues/personal experience in making these kinds of academic pivots? I dont have any huge pedigree either im a state school scholarship girlie and the informational interviews ive done with dc area nonprofits and things have left me....less than impressed (lots of ivy leagues, lots of uhh baseline assumptions). Ok sorry this got long and reminiscent of reddit i'd love to hear your thoughts!

As ever, my advice would start with: is it financially feasible, do you know what degree you want (i.e. public policy, politics, economics, global affairs, is it something related to your present work or a total 180) and what school you want to go to, are you in the position to leave your current job, etc.?

Since you've been in the workforce for a while, that's practical experience that would help, and be easy to demonstrate for why you need the degree to enhance your career. If they do have questions about your uneven undergraduate transcript, hopefully you could get in contact with some old professors who could vouch for you and confirm that they invited you to the PhD program. Then again, graduate schools tend to be fairly forgiving as long as you can make a good case for why you want to join their program and adequately explain your previous academic career. I work at a good/highly-ranked private school, and our minimum GPA for admission to a graduate program is only 2.5. So there is probably more leeway than you think, if you're worried about your undergrad grades being an issue, and it's not like you have to be 4.0 in everything. Practical experience and a solid track record in a relevant field will also be helpful in demonstrating that you've done more since that time.

Likewise, and as ever: what is the financial situation? Are you in a position to leave your job, if that was to be necessary, and what kind of financial aid package can they give you? Is it mostly grants or mostly loans? Do you have, say, a partner who can continue to work and support you? Does the graduate program offer tuition support and/or a living stipend? As I've said before, they really should be paying YOU to do an advanced degree, rather than anything out of your own pocket. Is it possible to go half-time or full-time, and do you know how you want to apply it to your career when you're finished? Is there maybe an online program where you could take classes in the evening and/or in between work, or do you want the full campus experience? Do you perhaps just want a professional certificate or other enhancement to your qualifications, without having to spend the time and money on a full graduate degree?

Anyway, I obviously do support you if this is something you decide to pursue, and I think it's plenty doable. You'll have to do some logistics planning on your end and clarify what you want and where you want to go and what they'll give you in terms of money, but it's definitely something that can be achieved!

6 notes

·

View notes