#credit suisse bank

Text

UBS takeover Credit Suisse for $3.25 billion.

Switzerland’s biggest bank, UBS, has agreed to acquire Credit Suisse in an emergency rescue deal for $3.25 billion to curb the impact of financial market instability. It said the rescue would “secure financial stability and protect the Swiss economy". READ MORE

#credit suisse group ag#finanzas#us economy#economic collapse#american bank#financial market news#credit suisse bank#swiss bank#silicon valley#business finance#investment banking

1 note

·

View note

Text

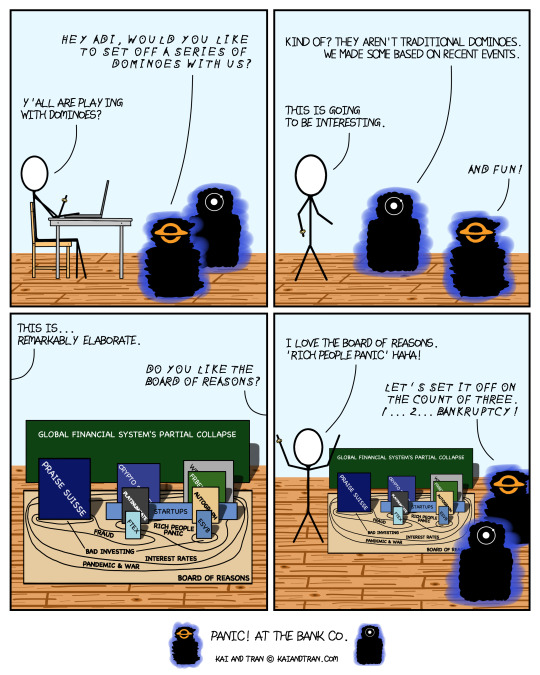

#36: Ruble Goldberg Machine

Panic! At the bank co.

#domino effect#financial crisis#bank run#ftx collapse#svb collapse#credit suisse bank#silvergate#first republic bank#global financial crisis#global finance#panic#panic at the disco#webcomic#comic strip#kai and tran#kai and tran comics

1 note

·

View note

Text

#Stocks drop on #bank fears

View On WordPress

#America#bank run#banking#banks#Credit Suisse#crypto#cryptocurrency#europe#meme#memes#money#news#stock market#stocks#tech#technology#united states

46 notes

·

View notes

Text

Исследование наиболее значимых промышленных секторов Европы: Движущая сила экономического роста и инноваций

Европа - это центр разнообразных отраслей промышленности, каждая из которых вносит значительный вклад в экономический рост, технологический прогресс и глобальную конкурентоспособность региона. От производства до финансов - Европа может похвастаться широким спектром выдающихся отраслей промышленности, которые играют ключевую роль в формировании ее социально-экономического ландшафта.

Автомобильная промышленность

Автомобильный сектор является краеугольным камнем европейской экономики, в котором лидируют такие известные бренды, как Volkswagen, BMW и Mercedes-Benz. Европа является мировым центром производства автомобилей, инноваций и исследований, способствуя развитию электрических и автономных транспортных средств. Уделяя особое внимание экологичности и сокращению выбросов, европейская автомобильная промышленность продолжает развиваться, внедряя электрификацию и цифровизацию для удовлетворения будущих потребностей в мобильности.

Аэрокосмическая и оборонная промышленность

Европейский аэрокосмический и оборонный сектор, возглавляемый такими компаниями, как Airbus и BAE Systems, отличается высокими достижениями в производстве самолетов, спутниковых технологий и оборонных систем. Являясь крупным игроком на мировом аэрокосмическом рынке, Европа инвестирует в исследования и разработки, способствуя инновациям в таких областях, как проектирование самолетов, освоение космоса и беспилотные летательные аппараты.

Фармацевтика и здравоохранение

Европа может похвастаться развитой фармацевтической и медицинской промышленностью, в которой работают такие ведущие компании, как Roche, Novartis и GlaxoSmithKline. В секторе здравоохранения региона особое внимание уделяется качеству, доступности и заботе о пациентах, что способствует прогрессу в области лечения, профилактики заболеваний и инициатив в области общественного здравоохранения.

Финансовые услуги

Европейский сектор финансовых услуг, сосредоточенный в таких городах, как Лондон, Франкфурт и Цюрих, служит мировым финансовым центром, способствуя развитию банковской, инвестиционной и страховой деятельности. Европейские банки, включая HSBC, Deutsche Bank и Credit Suisse, играют важнейшую роль в распределении капитала, управлении рисками и обеспечении экономической стабильности. Инновации в области финтеха и реформы в сфере регулирования способствуют цифровой трансформации, повышая доступность, эффективность и безопасность финансовых услуг во всем регионе.

Самые известные отрасли промышленности Европы воплощают в себе богатое разнообразие инноваций, опыта и сотрудничества, обеспечивая экономический рост, технологическое развитие и общественный прогресс. По мере того как Европа преодолевает глобальные вызовы и использует возможности в постоянно меняющемся мире, ее разнообразные отрасли будут продолжать определять будущее региона, способствуя устойчивости, стабильности и процветанию будущих поколений.

#Европа#промышленность#экономика#производство#финансы#Автомобильная промышленность#Авто#Volkswagen#BMW#mercedes benz#Airbus#BAE Systems#Фармацевтика#здравоохранение#Roche#Novartis#GlaxoSmithKline.#HSBC#Deutsche Bank#Credit Suisse

3 notes

·

View notes

Text

What do you think? What a Poll!!

Could this be the start of another Financial Crisis? Let's hope not.

#UBS#Credit Suisse#financial#financial markets and investing#investment#investor#investment banking#financial crisis#takeover#growth#opportunity#banking#financial services#markets#financial stability

16 notes

·

View notes

Text

The Leading banks of Switzerland: A confirmation to Brilliance.

Switzerland, renowned for its accuracy, quality, and fabulousness, isn’t as it were known for its breathtaking scenes and Swiss observes but moreover for its world-class keeping money framework. The nation has long been synonymous with budgetary steadiness, security, and a commitment to giving extraordinary keeping money services. In this article, we are going investigate a few of the leading banks in Switzerland, which have reliably maintained the country’s notoriety as a worldwide money related center.

UBS (Union Bank of Switzerland):

UBS, set up in 1862, is one of the biggest and most trustworthy banks in Switzerland. With a solid universal nearness, UBS offers a wide run of services, including riches administration, speculation managing an account, and resource administration. The bank’s commitment to advancement and client-centric approach has earned it a unmistakable position within the worldwide monetary industry.

Credit Suisse:

Credit Suisse, established in 1856, is another heavyweight within the Swiss managing an account segment. Known for its comprehensive suite of monetary administrations, the bank caters to person clients, organizations, and organization speculators. Credit Suisse encompasses a solid center on private keeping money, giving custom fitted arrangements to tall net worth people and families around the world.

Julius Baer:

Julius Baer, with a history dating back to 1890, has set up itself as a driving private managing an account institution in Switzerland. The bank specializes in riches administration and offers personalized administrations to well-off people. Julius Baer’s notoriety for discretion, expertise, and a profound understanding of its clients’ needs has made it a favored choice for private managing an account administrations.

Zürcher Kantonalbank (ZKB):

As the biggest cantonal bank in Switzerland, Zürcher Kantonalbank holds a critical position within the country’s managing an account scene. Whereas basically serving the canton of Zurich, ZKB has extended its reach over Switzerland and gives a wide run of administrations, counting retail managing an account, contracts, and corporate keeping money. ZKB’s solid ties to the neighborhood community, budgetary solidness, and customer-centric approach contribute to its ubiquity.

Lombard Odier:

Lombard Odier, set up in 1796, is one of the most seasoned private banks in Switzerland. With a wealthy legacy crossing over two centuries, the bank offers a comprehensive range of riches and resource management solutions. Lombard Odier is known for its long-term viewpoint, free considering, and personalized approach, which have made a difference it construct persevering connections with its clients.

Conclusion:

Switzerland’s managing an account framework is broadly respected as one of the foremost steady and secure within the world. The banks specified over speak to the crème de la crème of Swiss managing an account, advertising a assorted run of administrations to cater to the wants of people, enterprises, and regulation clients. Their unflinching commitment to fabulousness, budgetary soundness, and client fulfillment makes them the leading banks in Switzerland. Whether it’s riches administration, private managing an account, or speculation administrations, these teach give the skill and unwavering quality that perceiving clients look for when choosing a Swiss bank.

2 notes

·

View notes

Text

Listen to the Podcast by Enzo Caputo from Swiss Banking Lawyers

Are Swiss Banks in trouble? How safe is your Money with Credit Suisse?

Swiss banks are under a frontal attack by the UK and the US media.

There is an ongoing defamation campaign against Swiss banks.

Despite attacks against the reputation of the Swiss banks, they are doing great.

Since Covid and the war in Ukraine business is booming.

Never have Swiss banks attracted so much new money from all over the world as in the last two years.

Based on the example of Credit Suisse you will learn that the money of international investors is protected.

The first 100,000 CHF is guaranteed anyway. Only liquidity beyond 100,000 CHF is at risk.

All investments can be taken out of the bankruptcy mass of a bank that went bust.

If you invest your money in stocks, funds, or bonds, it will not be part of the bankruptcy and remain within the property of the investor.

I am receiving a couple of calls every week from investors asking me about the safety and if they should leave Credit Suisse.

I analyze case by case and I give tailor-made answers. A general answer does not exist. In most cases, I will tranquilize the client of Credit Suisse.

My interview partner Mr. Dario Berta is convinced that Credit Suisse will recover next year based on the new strategy.

There will be a cut of 9,000 bankers. They will diminish expenditures and increase wealth management activities.

The value of the share price is undervalued. The real value of Credit Suisse is 4 to 5 times bigger than the value reflected with a share price of below 4 CHF.

00:00 Intro

01:42 What is the truth about Credit Suisse?

03:10 What is the new strategy of Credit Suisse?

04:43 Why Credit Suisse made losses?

05:01 What are the most famous scandals of Credit Suisse?

06:04 How to judge the low share price of 4 CHF versus the real value of Credit Suisse?

06:25 How much is Credit Suisse worth?

06:45 Who are the Arab investors injecting new capital into Credit Suisse?

07:41 How do you measure the market value of Credit Suisse?

09:35 Will Credit Suisse survive this crisis?

10:35 The Swiss banking industry is booming

11:30 What will be the future of Credit Suisse?

11:50 How many people will lose their job with Credit Suisse?

14:25 What happens to your money if the bank goes bankrupt?

Actually, Credit Suisse stock is undervalued.

📌 Learn more at 👉 swiss-banking-lawyers.com

#enzo caputo#swiss#swiss banking#credit suisse#ubs#creditsuisse#investment#investment advice#money#rich#wealth#hnwi#zurich#switzerland#suisse#svizzera#investimenti#business#bank#banking#bankruptcy#lawyer#asset management#svizra#wealth management#banche svizzere#zurigo#caputo & partners#swiss banking lawyers#podcast

3 notes

·

View notes

Text

“Also among Lane’s clients: FTX. Federal prosecutors are now examining Silvergate’s role in banking Sam Bankman-Fried’s fallen empire. The more pressing problem is that the collapse of FTX spooked other Silvergate customers, resulting in an $8.1 billion run on the bank: 60 percent of its deposits that walked out the door in just one quarter. (“Worse than that experienced by the average bank to close in the Great Depression,” The Wall Street Journal helpfully explained.)

In its earnings filing, we found out that Silvergate’s results last quarter were absolute dogshit, a $1 billion loss. Then, on March 1st, Silvergate entered a surprise regulatory filing. It says that, actually, the quarterly results were even worse, and it’s not clear the bank will be able to stay in business.

(…)

“If Silvergate goes out of business, it’s going to push funds and market makers further offshore,” Ava Labs president John Wu told Barron’s. The issue is how easy it is to get into actual cash dollars, which in finance-speak is called liquidity. Less liquidity makes transactions more difficult. Already there is a broader gap between the price at which a trade is expected to go through at and the actual price at which it executes, Wu said.

So Silvergate’s troubles are a problem for the entire crypto industry.”

“Within 48 hours, a panic induced by the very venture capital community that SVB had served and nurtured ended the bank's 40-year-run.

Regulators shuttered SVB Friday and seized its deposits in the largest U.S. banking failure since the 2008 financial crisis and the second-largest ever. The company's downward spiral began late Wednesday, when it surprised investors with news that it needed to raise $2.25 billion to shore up its balance sheet. What followed was the rapid collapse of a highly-respected bank that had grown alongside its technology clients.

(…)

"This was a hysteria-induced bank run caused by VCs," Ryan Falvey, a fintech investor at Restive Ventures, told CNBC. "This is going to go down as one of the ultimate cases of an industry cutting its nose off to spite its face."

(…)

The roots of SVB's collapse stem from dislocations spurred by higher rates. As startup clients withdrew deposits to keep their companies afloat in a chilly environment for IPOs and private fundraising, SVB found itself short on capital. It had been forced to sell all of its available-for-sale bonds at a $1.8 billion loss, the bank said late Wednesday.

(…)

All told, customers withdrew a staggering $42 billion of deposits by the end of Thursday, according to a California regulatory filing.

By the close of business that day, SVB had a negative cash balance of $958 million, according to the filing, and failed to scrounge enough collateral from other sources, the regulator said.

(…)

Now, thanks to the bank run that ended in SVB's seizure, those who remained with SVB face an uncertain timeline for retrieving their money. While insured deposits are expected to be available as early as Monday, the lion's share of deposits held by SVB were uninsured, and it's unclear when they will be freed up.”

“First Republic shares fell 52% in early trading before storming back to near the previous day's closing level, only to then finish the day down 15%. Investors expressed concerns about unrealized losses on assets at the bank as well as its heavy reliance on deposits that could turn out to be flighty.

(…)

First Republic's shares have lost 34% of their value in the past week.

(…)

In its annual report, First Republic said the fair-market value of its "real estate secured mortgages" was $117.5 billion as of Dec. 31, or $19.3 billion below their $136.8 billion balance-sheet value. The fair-value gap for that single asset category was larger than First Republic's $17.4 billion of total equity.

All told, the fair value of First Republic's financial assets was $26.9 billion less than their balance-sheet value. The financial assets included "other loans" with a fair value of $26.4 billion, or $2.9 billion below their $29.3 billion carrying amount. So-called held-to-maturity securities, consisting mostly of municipal bonds, had a fair value of $23.6 billion, or $4.8 billion less than their $28.3 billion carrying amount.

(…)

Total deposits at First Republic were $176.4 billion, or 90% of its total liabilities, as of Dec. 31. About 35% of its deposits were noninter-est-bearing. And $119.5 billion, or 68%, of its deposits were uninsured, meaning they exceeded Federal Deposit Insurance Corp. limits.”

“Signature becomes the third-largest bank to ever fail in the U.S., behind Silicon Valley Bank and Washington Mutual in 2008, if its assets haven't changed significantly since the end of 2022. Signature had $110 billion in assets as of Dec. 31, ranking 29th among U.S. banks. It had $88 billion in deposits as of that date, and approximately 89.7% were not insured by the Federal Deposit Insurance Corporation.

(…)

Signature served clients in the cryptocurrency world and had been trying to reduce its exposure. Like Silvergate Bank, another crypto-friendly bank that said last week it would voluntarily wind itself down, it suffered from a deposit outflow in the aftermath of the collapse of crypto exchange FTX. Deposits dropped 17% in the fourth quarter of 2022 as compared to the year-earlier period.

(…)

Now that Signature has been seized, Circle, issuer of the second largest stablecoin, "will not be able to process minting and redemption [for the stablecoin] through SigNet," and "will be relying on settlements through BNY Mellon,” CEO Jeremy Allaire said on Twitter Sunday evening.

Circle’s USD coin fell below its crucial $1 peg Friday after the company disclosed $3.3 billion in cash reserves held with the failed Silicon Valley Bank despite attempted withdrawals Thursday. After falling to 88 cents on Saturday, the company announced it planned to cover any shortfall from its SVB losses using “corporate resources.””

“Credit Suisse shares on Monday reached a new record low, falling as much as 15% as investors continued to hammer away at the stock of the Swiss banking giant after the collapse of banks in the U.S.

(…)

Credit Suisse CSGN CS has lost money for five straight quarters and says it’s expecting to post a loss before tax this year. It’s undergoing a big transformation after losing billions lending to the Archegos family office and having to freeze $10 billion worth of funds tied to Greensil Capital. Wealthy clients pulled out about $100 billion from Credit Suisse in the fourth quarter.”

#silvergate#silicon valley bank#svb#first republic bank#frb#signature bank#circle#bank#banks#crypto#currency#bank runs#credit suisse

5 notes

·

View notes

Text

Bank of Slovenia sent out a warning to 'banks, regulators and other market participants' to start preparing for a potential banking crisis :)

#apparently credit suisse and Deutsche FAKING Bank are potentially in the 'Lehman Brothers' territory#we're so fucked lmao#diary of a gay slav

2 notes

·

View notes

Text

Two weeks later, on 4 June, Westpac announced that CSFB Australian Equities Ltd, the local offshoot of the giant New York investment bank Credit Suisse First Boston, would underwrite the $1.2 billion rights issue priced at $3 a share, a relatively slim discount to the market price of $3.94 on 20 May.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quote#westpac#edna carew#nonfiction#passage of time#june 4#announcement#csfb#credit suisse first boston#csfb australian equities ltd#offshoot#underwriting#stock market#may 20#banking#finance

0 notes

Text

Headquarters of Credit Suisse, Paradeplatz in Zürich.

https://commons.wikimedia.org/wiki/User:Roland_zh

#zurich#switzerland#paradeplatz#swiss#suisse#schweiz#zürich#credit suisse#europe#europa#central europe#photography#urban#urban photography#urban landscape#street scene#urban exploration#urban art#historical#historic buildings#classic architecture#banks#svizzera#tram#northern europe#classicism#tourism#zürcher#kanton zürich

1 note

·

View note

Text

#UBS buys #CreditSuisse

View On WordPress

#bank#banking#banks#Credit Suisse#economics#economy#europe#meme#memes#money#news#recession#switzerland#UBS

11 notes

·

View notes

Text

Is Switzerland now a bank masquerading as a country?

We are now only a few days away from the anniversary of the takeover of Credit Suisse by my old employer Union Bank of Switzerland. One perspective on that is how time flies but there were always going to be concerns. For example how would a relatively small country like Switzerland cope with having a new mega bank? Plus there was the issue of us for so long being told that big banks were…

View On WordPress

#business#Credit Suisse#economy#Finance#Financial Stability Board#foreign exchange intervention#G-Sibs#Interest Rates#Negative Interest-Rates#QE#Swiss National Bank#Thomas Jordan#Too Big To Fail#UBS#Union Bank of Swotzerland

0 notes

Text

Credit Suisse: A Brief History of Scandal and Collapse

Credit Suisse, one of the world’s largest and most prestigious banks, has been in the headlines for all the wrong reasons lately. The Swiss bank has been rocked by a series of scandals and losses that have tarnished its reputation and eroded its capital base. How did Credit Suisse go from being a leading global financial institution to a troubled and struggling one?

Early history of Credit…

View On WordPress

0 notes

Text

Next financial implosion

#Christmas'll be ! not gift:#China collapse due to #CCP mishandling, growing #Biden intervention in econ

if #Texas issue its own #money

#creditcard,#auto loans hit 10-yr high

titans collapse:#UBS takeover of #CS, #DeutscheBank& #BoA warning of #recession

https://salvatoremercogliano.blogspot.com/2023/10/next-financial-implosion.html?spref=tw

0 notes