#crypto mining calculator

Explore tagged Tumblr posts

Text

Crypto Mining App | Boost Profits with BlockDAG's Smart Tools

BlockDAG is at the forefront of crypto mining innovation, leveraging a robust Layer 1 proof-of-work consensus mechanism built on Directed Acyclic Graph (DAG) technology. Designed to enhance scalability, efficiency, and profitability, BlockDAG provides cutting-edge tools such as advanced crypto mining software, optimized crypto mining calculators, and crypto mining rig solutions. Our platform empowers users to build smarter, mine efficiently, and achieve higher returns.

With a focus on revolutionizing the crypto mining sphere, BlockDAG combines Bitcoin's foundational principles with the latest advancements in blockchain technology. Whether you're a seasoned miner or new to the crypto space, our solutions simplify the complexities of crypto mining while maximizing your potential.

Join the BlockDAG presale for 2025 and take advantage of our innovative approach to crypto mining. Stay ahead of the curve and contribute to the future of decentralized technology with BlockDAG.

#BlockDAG Network#Crypto Mining#Crypto Mining Rig#Crypto Mining Calculator#Crypto Mining Software#Crypto Mining App

1 note

·

View note

Text

Crypto mining calculator

In the ever-evolving landscape of cryptocurrency mining, efficiency is paramount. Crypto mining calculator serves as a powerful tool in this regard, empowering miners to calculate potential profits with precision. Whether you're a seasoned miner or just venturing into the crypto world, understanding how to leverage these calculators can significantly impact your profitability.

Crypto mining calculators are sophisticated tools designed to estimate potential profits from cryptocurrency mining activities. By inputting various parameters such as hash rate, power consumption, and electricity cost, miners can gauge their potential earnings. These calculators utilize complex algorithms to provide accurate projections, helping miners make informed decisions. To learn more info visit website.

Crypto Mining Calculator

1 note

·

View note

Video

youtube

MINECRAFT ME ODIA !!!! | EL BUG LOS SERVER DE MINECRAFT - THE CHECHO GP

#youtube#minecraft phantom#minecraft pillager#not mine#crack#crs calculator#crack fic#crackship#crackers#crazy#crypto#crafts#gender critical#craa#craftblr#craf#infinite craft#craft#craft paper#vlogger#video games#ts4 gameplay#music video#video gameplay#gman#tag game#rotational gameplay#game play#sims 4 gameplay#minecraft

0 notes

Text

#intelligent cryptocurrency#cryptocurrencies prices#what is a cryptocurrency#crypto crashing#mine crypto#crypto market#what is mining#crypto calculator#exchanges crypto

0 notes

Text

Let's Play Pretend - 2 | bodyguard!Bucky

Character: Bucky Barnes x singer! Female reader

Summary: You just wanted to hide here and find peace from the mess that wasn’t caused by you. But then, your hot neighbor bothered you. As if that wasn’t enough, the enemies you hated found you too.

PART 1 , PART 2 , PART 3 , PART 4 , PART 5 , PART 6 , PART 7 , PART 8 , PART 9 , END.

Main Masterlist || If you enjoy my work, please consider buying me a coffee on Ko-fi 🙏🏻

Thank you to everyone who has read this chapter. Leave a comment and Reblog, please. I'd love to hear your thoughts. ❤️

Bucky's eyes widened in shock as he stared at you. “What the heck?” he muttered, clearly taken aback. His gaze darted to the imaginary horn you might as well have grown on your head for the absurdity of your request.

You leaned closer, pinched his back lightly, and whispered, “I need you to pretend to be my boyfriend for a bit to make them leave me.”

He shot you a deadpan look, shaking his head. “You brought them here. It’s your problem, not mine.”

“Just for a bit. Protect me, for God’s sake. Make them scared like you did before—ruining the camera.” Your voice was desperate now. The rude neighbor had become your reluctant hero of the night. In a last-ditch effort, you added, “I’ll give you money.”

That got his attention. His expression shifted, the scowl replaced with a calculating smirk. “Now we’re talking. I better see the money when I’m done with them.”

“What…” You blinked, starting to ask, What are you going to do? But before the words left your lips, he was already walking toward a nearby discarded block of wood.

The paparazzo, sensing trouble, began to step back, his bravado fading fast as Bucky’s tall frame loomed closer under the dim glow of the streetlight. The shadows swallowed the paparazzo, and Bucky’s intense glare made him feel like prey.

“Leave, or I’ll crush you like that camera,” Bucky growled, pointing at the shattered remains of the paparazzo’s camera with the wood block in hand.

The man’s face drained of color. He laughed nervously, bowing his head repeatedly. “Ahaha… that’s my mistake. I shouldn’t have bothered either of you.” Without another word, he hurriedly started his car, the engine roaring to life, and sped off into the night.

The moment the car disappeared down the street, you let out a shaky sigh of relief. “Thank you,” you said, your voice tinged with gratitude.

Bucky shrugged, already back to his usual gruff demeanor. “Yeah, yeah, just send me the money.”

You blinked, momentarily taken aback by the sudden shift in attitude. “I’ll send it once I get back home.”

Bucky raised a hand, holding up a few fingers. “Oh, and this is the number.”

Your brows furrowed. “Hundreds?”

“No. Thousands,” he said with a smirk.

“What?!” you exclaimed, your jaw practically hitting the ground.

“I’m being generous. My price range never starts this low,” Bucky said with a sly grin, crossing his arms over his chest.

You wanted to argue, to negotiate, but you knew it would be pointless. Besides, he did help you out. Letting out a resigned sigh, you muttered, “Fine. Just give me your account number.”

“Use crypto instead,” he replied, his grin widening like this was all a game to him.

You pinched the bridge of your nose, feeling your irritation bubble over. I really hate this guy. “I’ll give you cash instead,” you snapped, your voice tinged with frustration.

“Now we’re speaking the same language. Thank you, girlfriend,” he said, his tone dripping with sarcasm as he smiled at you, all charm and mockery.

You shot him a sarcastic smile in return, shaking your head in disbelief. “Unbelievable,” you muttered under your breath. Of all the people to save you, it had to be this greedy, insufferable neighbor.

📷📷📷📷

The next morning, Mrs. Walls stood before you and Bucky in the living room, her arms crossed. Her expression wasn’t angry but deeply concerned, her lips pressed into a thin line as she glanced between the two of you. You felt like a kid caught sneaking cookies from the jar, and judging by Bucky’s sheepish look, he wasn’t faring much better.

“I don’t know where to begin,” Mrs. Walls said, her voice soft but laced with worry. “Walking alone in the middle of the night, being chased by paparazzi? What were you thinking?” She directed her gaze at you, and you shifted uncomfortably, staring at the floor.

Before you could muster an excuse, she turned her attention to Bucky. Her tone hardened, tinged with disappointment. “And you, demanding payment from her after helping? Really, Bucky? What kind of gentleman does that?”

Bucky scratched the back of his neck, avoiding her piercing stare. “Well… I mean, it wasn’t like I offered for free…” he muttered, his voice trailing off when she raised a brow.

Both of you mumbled, “Sorry,” at the same time, like scolded children. You avoided each other’s eyes, and Mrs. Walls shook her head with a sigh, her expression softening slightly.

“Good,” she said, her hands now resting on her hips. “Now that we’ve cleared that up, let’s try to make better decisions from now on, shall we?”

"RING!"

Before you could respond, the shrill ring of the telephone interrupted the moment. Mrs. Walls glanced at the phone, a flicker of curiosity crossing her face as she walked to pick it up. “Hello?” she answered, her tone polite. She listened in silence, her expression shifting from mild curiosity to shock. Her eyes widened as she turned to you.

“It’s Mr. Vert,” she said, holding out the phone.

You froze, your blood running cold at the name. Mr. Vert? The owner of the record label you worked for? You’d barely interacted with him, even as one of the company’s top-selling artists. What could he possibly want?

“Me?” you asked, your voice barely above a whisper, pointing at yourself as if she’d gotten it wrong.

Mrs. Walls nodded and extended the phone further toward you. “He asked for you.”

You hesitated, then took the phone with trembling hands. Pressing it to your ear, you stammered, “H-Hello?”

The voice on the other end was serious, and your heart sank further as you listened. Something about the weight of the call felt ominous. Why would they call here of all places? You’d turned off your phone the day you arrived and cut ties with your manager. The record label must have gone through extraordinary lengths to track you down.

You swallowed hard, clutching the receiver tighter. Whatever this was, it couldn’t be good.

Why was Mr. Vert reaching out to you directly? Was he furious about your sudden departure and planning to fire you? It wouldn’t be surprising; you had left without a word. A whirlwind of questions raced through your mind, each more pressing than the last.

As you spoke into the phone, Mrs. Walls turned to Bucky, her frown deepening. “Demanding money after helping her? Really, Bucky? That’s not a very nice thing to do.”

Bucky shrugged, leaning lazily against the wall with his arms crossed. “I’m just being practical, Mrs. Walls,” he said, though his eyes were fixed on you. He noticed the subtle change in your posture—how your shoulders stiffened, your hand clutched the phone tighter, and your expression grew pale.

After what felt like an eternity, you put the phone down, your face drained of color.

Mrs. Walls immediately stepped closer, her voice soft and concerned. “What’s wrong, dear?”

You swallowed hard, your voice trembling as you replied, “My manager… was found dead.”

Mrs. Walls gasped, her hand flying to her mouth before she pulled you into a comforting hug. “Oh my goodness,” she murmured, rubbing your back gently.

You stood rigid, the reality of the situation sinking in. “The CEO wants me to come back… to attend the funeral,” you added, your voice flat. “He said it’s important to show there’s no bad blood between me and my manager now that she’s… gone. Let the past stay in the past, he said.”

“It’s devastating news. Are you alright, dear?” Mrs. Walls asked, her worried gaze searching your face.

You exhaled sharply, surprising them both with your next words. “Honestly? I’m glad she’s dead. She stole my money.”

Mrs. Walls gasped in shock, her eyes wide.

“Pfft… Hahaha!” Bucky burst into laughter, doubling over as he slapped his knee. “I didn’t see that one coming!”

You turned to glare at him, but his laughter only grew louder. “It’s not funny, Bucky.”

He wiped a tear from his eye, still chuckling. “Oh, it’s very funny. You’re supposed to be devastated, not throwing out zingers like that.”

Ignoring him, you took a steadying breath and continued, “The CEO also advised me to come back with protection.”

Bucky straightened up at that, his amusement fading as he raised a brow. “Protection?”

You nodded, meeting his gaze. “This time, you’ll get paid. Can I hire you?”

Bucky tilted his head, a slow smirk spreading across his face as he crossed his arms. “Now we’re talking. But you’re going to need to pay a premium for this kind of service.”

You rolled your eyes, exasperated. “Of course, you’d say that.”

Join the taglist 💖💖💖

@thezombieprostitute

@scott-loki-barnes

@mostlymarvelgirl

@dexter99

@missvelvetsstuff

@kjah97

@barnesxstan

@jeremyrennermakesmesmile

@mrs-maximoff-kenner

@lostinspace33

@read-just-cant

@hzdhrtss

@globetrotter28

@bubblegumbeautyqueen

@mrsnikstan

@maryssong23

@pklol

My book Arrogant Ex-Husband and Dad, I Can't Let You Go by Alina C. Bing is FREE on Kindle for a few days. Check it out!

Link for Arrogant Ex-Husband

Amazon.com

Link for Dad I Can't Let You Go

Amazon.com: Dad, I Can't Let You Go eBook : Bing, Alina C.: Kindle Store

#bucky barnes x reader#bucky x you#bucky barnes x y/n#bucky barnes#bucky x y/n#bucky x reader#bucky barnes au#james bucky buchanan barnes#james bucky barnes#buckybarnes#bodyguard!au#bodyguard!bucky#sebastian stan#enemies to lovers#romance#action

210 notes

·

View notes

Text

There’s been a bit-cave in at the bitcoin mines. Unsure of the casualty numbers until we can convert them into a crypto calculator the exchange rate of lives is different

14 notes

·

View notes

Text

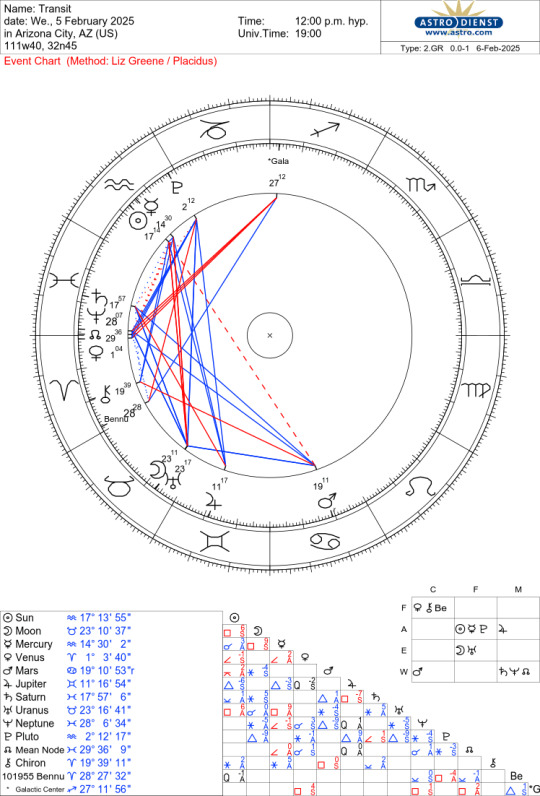

The Unlikely Nature of Scary Cosmic Scenarios ~ 05 Feb 2025

The Unlikely Nature of Scary Cosmic Scenarios ~ 05 Feb 2025, Philip Sedgwick

As if everything going on in the world isn’t enough, recent astronomical projections have slated two doomsday scenarios for us and managed to show up on news feeds. The scenarios involve the Earth enduring a collision from a Potentially Hazardous Object (PHO) originating with the category of asteroids known as Near Earth Objects (NEO).

Initial calculations suggest that 2024 YR4, an asteroidish thing with an estimated diameter between 130 and 330 feet, may crash into the Earth on 22 December 2032. Expect a heap of last-minute holiday shopping that year! To rain on the shopping procrastination parade, the probability of impact stands at a mere 1.3%. If a weather forecaster provided a 1 - 2 % chance of rain, no one would be sufficiently bothered to change outdoor plans.

If you want to have some solar system fun, check out this groovy orbit gizmo. Here’s screenshot of the orbit of 2024 YR4. The link to the very fun orbit tool used for this pic is: Orbits

If 2024 YR4 is not enough, come 24 September 2182, asteroid Bennu may impact what’s left of Earth. The projected collision is only fair. After all, this asteroid with a period of 1.19 years, was struck by the OSIRIS-REx probe on 20 October 2020. The probe pogo-sticked off Bennu, collecting a sample of the asteroid’s raw materials and successfully returned to Earth with the booty. Analysis of the materials of Bennu suggest it contains the critical materials to create life. How ironic; Bennu contains the potential to create life on Earth and equally maintains the potential to end life on Earth.

Wait! There’s more! Upward-looking, plutocratic entrepreneurs have decided we should mine asteroids. Recent estimates of the asteroid Psyche’s worth exceed the global economy - this is more solid that crypto currency! No wonder those tech moguls now devote so much attention to the natural resources of our solar system. How many asteroids are there? Is this how ka-ching is correctly spelled?

In the category of mining asteroids, there are a number of top contending companies: Karman+, TransAstra, AstroForge, Origin Space and Asteroid Mining Corporation. All seek a competitive timeline edge and projections are that in 2029, they’ll be able to set up shop and do their mining thing. Here’s the $64,000 question and one that is not rhetorical: How many asteroids can be mined before the center of gravity of the asteroid belt becomes impacted? Wouldn’t this gravitational shift potentially influence the orbit of Mars? Isn’t it possible that the result would be like a bad pool table break? Isn’t it curious that the first contending company on the list is Karman+? Again, isn’t it interesting that Bennu, impacted by those studying space potentially could strike Earth and wipe out life and simultaneously plant the seeds of life?

Why is it that astronomers feel the need to blast the news outlets with their possible asteroid strike which falls into the category of only minimally likely? Is this the result of being excluded from campfire story time? Don’t we have enough to think about with drones hovering overhead - authorized by the FAA and conducting unstated “research?” Is this an attempt to get humans to ponder cosmic possibilities, despite the concerns of the real world and thus, engage the highest minded themes of Pluto in Aquarius?

Actually, there is supposed to be a moratorium on announcing potentially disastrous solar system catastrophes. It is supposed to be a length of time such that several astronomical organizations using high-power computers that do not use AI for calcs to come to a consensus agreement on the probability of Earth impact. All the “transiting gravel” (as it has been called by astrologers in the past - which now would include the Kuiper Belt) out there that we know about has been pretty much considered and determined to pose no threat. Likely it would be something new that gets discovered somehow, somewhere that potentially poses hazard to Earth. Will the Earth be struck by asteroid-like objects in the future? Absolutely. Every year Earth is hit by some 17,000 meteorites.

Fortunately, Earth possesses (at least currently, it does) an atmosphere that causes most incoming objects to burn up, or mostly diminish upon arrival. Do the odds go up with asteroid mining? Possibly, that depends upon how well the mining operation attends to all details of its operation. Should anything be considered at this time regarding the human influence on the environment of the entire solar system? Absolutely.

The point is, nothing catastrophic on a cosmic calamity scale appears on the calender in the foreseeable times ahead. While the world engages in circumstances and situations that may appear to defy the nature of Pluto in Aquarius, there is no need to stress over any incoming solar system body of which there is current knowledge. But two interesting thoughts arise from such speculation. Is an ounce of prevention worth a pound of cure (or whatever weights and measure system fits the adage in your neck of the world)? Absolutely. Are efforts to see if we can successfully deflect an incoming asteroid useful? Yes, and like any prevention system, we apply our hope and faith in never needing that system? Larger and potentially more evolving, would nations and their leaders be more inclined to seek collaboration for saving our bacon as opposed to imposing tariffs on our bacon, and thus cause realization that all humans are equally subject to cosmic events?

And here, insert a wink from Pluto that is absolutely impossible to interpret.

More soon.

Yes, I do work with some of that transiting gravel. I actively use Psyche and asteroids elevated to dwarf planet status and I consider all of the larger, named objects in the Kuiper Belt when I conduct consultations. Is the effort worth it? Perhaps intangibly so. Is such inclusion preventative? Hard to calculate unknown things that did not happen, but navigating life with less chaos and disruption always seems a good plan. To get that good plan going, use the links below to order reports, ask questions or schedule sessions.

And if you have not watched my short film METEORIC yet, and have 20 minutes, there's a link below!

One Stop Shopping Order Form Astrological Texts

METEORIC the Movie on Vimeo ZAP! on Vimeo

3 notes

·

View notes

Text

If you have a bunch of trees, and you chop them down to make paper or lumber or whatever, you can sell the paper or lumber or whatever for money, but on the other hand trees store carbon and cutting them down is bad for climate change. If instead you do not chop down the trees, that is good for the environment, and it is a great innovation of modern finance that, now, you can get paid for not chopping down the trees. This is called “carbon credits.” There are measurement problems.

If you mine Bitcoin, you use a lot of electricity to run computers to perform calculations to get Bitcoins for yourself, which you can sell for money. But this is bad for the environment, because it uses electricity that is probably generated in ways that release carbon.[1] If you were to stop mining Bitcoin, conversely, that would be good for the environment. Can you get paid, though, for not mining Bitcoin? Oh yes, modern finance has solved that one too:

Bitcoin miner Riot Platforms Inc. made millions of dollars by selling power rather than producing the tokens in the second quarter as the crypto-mining industry continued to grapple with the impact of low digital asset prices.

The Castle Rock, Colorado-based company had $13.5 million in power curtailment credits during the quarter, while generating $49.7 million in mining revenue. Riot booked $27.3 million in power curtailment credits last year and $6.5 million in 2021 from power sales to the Electric Reliability Council of Texas, which is the grid operator for the Lone Star state. …

The company had $18.3 million in power credits in June and July based on its latest monthly operational updates, including $14.8 million in power curtailment credits received from selling power back to the ERCOT grid at market-driven spot prices under its long-term power contracts and $3.5 million in credits received from participation in ERCOT demand response programs.

Here is the 10-Q; this stuff is described in Note 8. Some of what is going on here is that Riot has a long-term power supply agreement in which TXU Energy Retail Co. has to supply it with electricity at fixed prices through 2030, and Riot has the option to sell the power back to TXU, at market rates, for credit against its future electric bills, when the spot price exceeds the contract price. But part of it is demand response, where ERCOT pays Riot cash for using less than its typical electrical load during periods of peak demand.

As with carbon credits, there are measurement problems; I have never mined a single Bitcoin, yet ERCOT has never sent me a penny for my forbearance. Still, how great is modern finance? Twenty years ago, if you had told people that one day they could get paid for not mining Bitcoin, they would have said “what?” But now it is possible. Modern finance created the problem (Bitcoin mining) and the solution (paying people not to mine Bitcoin); the overall result is that nothing happens and yet people get paid. Just a miracle of financial engineering.

Also: Riot is getting paid for not using electricity, but if you are an enterprising Bitcoin miner surely you should look into getting paid for not using carbon when you are not mining Bitcoin. Riot is not there yet, but it is possible to imagine a warming world in which energy prices go up and Bitcoin prices go down and Bitcoin miners can get paid more for not mining Bitcoin than for mining Bitcoin. Giant fortunes will be made by people who got in early to the business of not mining Bitcoin. The future is so good, man.

This is from Matt Levine's "Money Stuff" newsletter (which yes is under the Bloomberg masthead), which I highly recommend if you want some kind of awareness of what the finance yahoos are doing but want to feel like you're hearing it from a human person

43 notes

·

View notes

Text

A Simple Guide to Staking: How to Make Your Crypto Work for You

Have you ever wished your money could work as hard as you do? In the world of cryptocurrency, this is entirely possible through staking. Think of it as putting your crypto into a savings account that not only keeps it safe but also rewards you for letting it sit there. Let’s break down staking in a way that’s easy to understand and relatable.

What Is Staking?

Staking is like locking your money in a fixed deposit at a bank. When you stake cryptocurrency, you’re committing it to a blockchain network to help keep the system secure and operational. In return, the network rewards you, usually in the form of additional tokens.

But here’s the cool part: staking isn’t just about earning rewards. It’s also about actively participating in the blockchain’s growth. Unlike mining, which requires heavy computing power, staking is energy-efficient, making it a more sustainable option for blockchain enthusiasts.

Why Should You Consider Staking

1. Passive Income

Staking allows you to earn extra crypto without actively trading or investing in new projects. It’s a steady way to grow your holdings while you focus on other things.

2. Eco-Friendly Contribution

By staking, you’re contributing to blockchain networks without the energy-intensive processes of mining. It’s a win for you and the planet.

3. Support the Blockchain Ecosystem

Staking strengthens the blockchain, helping to ensure its reliability and security.

Staking on STON.fi: Why It Stands Out

If you’re ready to dive into staking, STON.fi offers unique incentives that go beyond traditional rewards. Here’s what makes it special:

1. ARKENSTON: Your Soulbound NFT

When you stake STON tokens, you receive an ARKENSTON—a non-fungible token permanently linked to your wallet.

It’s not for sale and can’t be transferred.

It will serve as your access pass to the STON.fi DAO, an exclusive community where you can help decide the platform’s future direction.

2. GEMSTON Tokens: Instant Rewards

GEMSTON is a community token from the STON.fi family. It’s tradable and adds immediate value to your staking experience.

On STON.fi, you can use a built-in calculator to estimate how much GEMSTON you’ll earn when you stake, so there are no surprises.

How to Stake on STON.fi

Getting started with staking on STON.fi is simple:

1. Visit the "Stake" section on the platform.

2. Enter the amount of STON tokens you want to stake.

3. Choose the staking duration that works for you.

4. Confirm the transaction, and that’s it—your staking journey begins!

The interface is intuitive, making it beginner-friendly while offering advanced options for seasoned users.

What Should You Know Before Staking

While staking is a fantastic way to grow your crypto, it’s not without its considerations.

Lock-Up Period: The tokens you stake will be inaccessible for a set period, so only stake what you can afford to lock away.

Market Volatility: The rewards you earn may vary based on the token’s market value.

Research Is Key: Always ensure you’re staking on a reliable platform like STON.fi.

The Bigger Picture

Staking isn’t just about earning rewards—it’s about becoming part of a larger ecosystem. Platforms like STON.fi empower users to take an active role in shaping the blockchain’s future while benefiting financially.

Think of staking as planting seeds in a garden. With patience, care, and the right tools, those seeds can grow into something fruitful. Platforms like STON.fi provide the fertile ground for your crypto to flourish.

Finally

Staking is one of the simplest ways to make your crypto work for you. It’s a low-effort, high-reward strategy that benefits both you and the blockchain networks you support.

If you’re ready to start staking, STON.fi is an excellent choice, offering unique rewards like ARKENSTON NFTs and GEMSTON tokens. Take the first step today, and let your crypto do the heavy lifting for a change.

Have questions or want to share your staking experience? Let’s discuss in the comments below!

2 notes

·

View notes

Text

A Simple Guide to Staking: How to Earn Rewards with Your Crypto

If you’ve ever wondered how to make your cryptocurrency do more than just sit in your wallet, staking might be the answer you’ve been looking for. Think of it as a way to earn rewards while supporting the blockchain network. In this guide, I’ll walk you through what staking is, why it’s worth your attention, and how you can get started—especially with platforms like STON.fi.

What Exactly Is Staking

Imagine putting your money in a savings account that earns interest. You don’t lose your money—it’s just temporarily locked in, and the bank rewards you for it. Staking works in a similar way but in the world of blockchain.

When you stake your cryptocurrency, you “lock” it in a network, helping to keep the blockchain secure and functional. In return, you earn rewards, which can come in the form of more cryptocurrency or other benefits.

It’s like planting a fruit tree: you give it care and patience, and over time, it produces fruit for you to enjoy.

Why Should You Stake Your Crypto

Staking isn’t just about earning rewards; it’s about being part of something bigger. By staking, you’re actively contributing to the health and security of the blockchain network. Here’s why staking could be worth your while:

Passive Income: Earn rewards without actively trading. Your crypto works for you, even while you sleep.

Community Building: Some platforms, like STON.fi, offer additional perks like exclusive community access.

Eco-Friendly Contribution: Staking is more energy-efficient compared to mining, making it a greener option in the crypto space.

It’s not just about financial gains—it’s about participating in a decentralized future.

Why Choose STON.fi for Staking

STON.fi takes staking to another level by offering unique rewards and an easy-to-use platform. Here’s what makes it stand out:

1. Receive ARKENSTON

When you stake STON tokens, you get an ARKENSTON NFT. This isn’t your regular NFT—it’s soulbound, meaning it’s permanently linked to your wallet. You can’t sell it or transfer it.

Why does this matter? ARKENSTON will serve as your ticket to the STON.fi DAO—a private community where you can participate in shaping the platform’s future. Think of it as joining an exclusive club where your voice matters.

2. Earn GEMSTON Tokens

GEMSTON is a special token you earn as a reward for staking. It’s a tradable token within the STON.fi ecosystem and beyond. With GEMSTON, you’re not just earning passive rewards—you’re gaining assets that could appreciate over time.

How to Stake STON Tokens

Getting started with staking on STON.fi is straightforward and beginner-friendly.

1. Head to the "Stake" Section

Visit the STON.fi platform and click on the “Stake” tab.

2. Choose Your Amount and Duration

Decide how many STON tokens you want to stake and for how long. The longer you stake, the higher the potential rewards.

3. Use the Reward Calculator

Before confirming, use the built-in calculator to see exactly how much GEMSTON you’ll earn. This feature helps you make informed decisions.

4. Confirm Your Stake

Once satisfied, confirm your stake and start earning.

It’s that simple. No complicated steps or technical know-how required.

Things to Keep in Mind Before Staking

While staking is a fantastic opportunity, there are a few things to consider:

Lock-Up Periods: Your tokens will be inaccessible during the staking period. Make sure you’re okay with that before committing.

Market Volatility: The value of your staked tokens can fluctuate due to market changes.

Platform Reputation: Always research the platform you’re staking on. STON.fi is trusted, but it’s good to do your due diligence.

Think of staking like investing in a bond. You lock your funds for a fixed period, and in return, you earn interest. But, like any investment, it’s important to understand the risks.

Why STON.fi Is a Game-Changer

STON.fi isn’t just about staking—it’s about building a community. By staking STON tokens, you’re not just earning rewards; you’re securing a place in an ecosystem that values its contributors.

Your ARKENSTON NFT symbolizes your commitment and gives you access to decision-making power in the DAO. Meanwhile, GEMSTON tokens offer immediate and tangible rewards, making your staking experience both rewarding and meaningful.

It’s like being an early investor in a promising company—you’re not just earning; you’re helping to shape the future.

Final Thoughts

Staking is one of the simplest ways to make your cryptocurrency work for you. Whether you’re new to crypto or a seasoned investor, platforms like STON.fi make staking accessible, rewarding, and community-focused.

By staking your STON tokens, you’re not just earning rewards—you’re actively participating in the growth of a decentralized ecosystem. It’s a win-win: your crypto grows, and so does the network you’re supporting.

So, what’s stopping you? Dive into staking with STON.fi and watch your crypto journey transform.

Have questions or need guidance? Let’s continue the conversation in the comments.

3 notes

·

View notes

Text

Trying to calculate capital gains on crypto, mostly out of curiosity. (I recently sold some, but not enough to need to report.)

I would have hoped it would be mostly easy. I've been tracking my assets with ledger. So for approximately every fraction of a bitcoin I own, I can see

This is the day I bought it

This is how much I paid

And this is the fees I paid

E.g. "bought 0.00724641 BTC on 2018-05-07, I paid £51.99 of which £1.99 is fees".

There are some exceptions: I have some that I got from mining or from the bitcoin faucet way back when, stored in a wallet on my computer that I couldn't figure out how to access again; I got someone else to do it for me in exchange for about half of what was in there. In my ledger this is just recorded as a 0.03 BTC input that I got given for free. And there's an in-progress bet that involved someone sending me $100 of BTC.

(Other coins are more complicated: I once bought BCH, converted it to BNB, converted that to SOL, moved the SOL to a different place, staked the SOL, moved it back, staked it again and eventually sold, and there's fees involved in lots of these steps.)

But ignoring this I'd hope it would be simple enough? But not really.

I think partly this is because calculating capital gains isn't an objective one-right-answer calculation. If I buy 1 BTC, then buy 3 BTC, then sell 2 BTC, then sell 2 BTC, it matters which order I sell them in.

Okay, but I think FIFO is pretty standard? But I don't think there's a way to specify that I'm doing that or any other approach that could be automated. I just need to manually say "okay, the BTC that I sold here are the same BTC that I bought here", and the way to do that is to specify the date and unit price when I bought them.

Which, I get having this written out explicitly in the file, that seems reasonable, but I'd hope for some way to auto-generate the posting, and I don't see one.

...also I've been letting the unit price be implicit, instead specifying the lot price. Which means the unit price has 16 decimal digits, which aren't written in the file, and which I need to copy exactly when I'm selling or the lots won't quite match up. (Which is mostly fine, but when I want to print lots explicitly it means it doesn't show as "I bought BTC valued at X and then sold them" but as "I bought BTC valued at X and on the same day went into debt for the same quantity of unrelated BTC valued at X±ε".) And sometimes exact isn't enough due to rounding errors.

So I'm converting lot prices to unit prices, which there ought to be a way to do that automatically too but afaict there isn't. (Unless I want to do some python scripting, which might be fun I guess but also might be super frustrating depending how good the API is.)

I've looked idly at hledger as well but from what I can tell it's no better at this. I don't think I've looked closely enough at beancount to know, that might be worth looking into. But I have over 7 years of financial data in ledger and it would probably be annoying to convert it all - just crypto would be fine I guess, but then I'm using two different CLI accounting tools.

5 notes

·

View notes

Note

So is Link an Irs agent in your crypto Hacker Ganon au? Does he not pay his taxes or is he like “I’m crazy enough to successfully steal government files but messing with the IRS? Nooo thank you!”

HMMM, you know what, Link is an agent in my crypto-hacktivist Ganondorf au because Zelda does have him trying to figure out exactly what it is that Ganondorf is up to. Ganondorf makes decent enough money from his gaming server and his crypto mining from his personal rigs to afford a comfortable lifestyle but Zelda is completely convinced he is the demon hacker that has gained notoriety worldwide and has a lot more funds than he is declaring. She just needs concrete proof that she does not have. While Link does do as Zelda asks there is a part of him that wonders how Ganondorf could do all that while being under house arrest. (It's Ganondorf, Link. He is a master of manipulation. ANYWAYS-) So, is he an IRS agent? Probably not but Ganondorf pays taxes...on what he declares as his innocent income from his "clean" income sources. He is not stupid enough to completely bypass paying taxes because, as a college professor of mine has said, "You can get away with murder in this country but tax fraud? You'll be in jail for LIFE." Ganondorf takes measured and calculated risks, not dumb ones.

9 notes

·

View notes

Text

Solutions for Crypto Fund Tax | www.cryptofundtax.com

Crypto Fund Tax

Crypto Fund Tax is part of Formidium's tax services group. We offer a full suite of tax services to solve any complexities and challenges in tax calculations, reporting, and filings for digital asset funds. We also offer our all-inclusive tax services to a vast network of managers and funds located globally, covering hedge and private funds investing in blockchain, mining, staking, NFTs, tokenization, and real estate.

3 notes

·

View notes

Text

What's wrong with floating-point numbers? (OR why can't calculators be trusted?)

Floating point numbers; for the mathematicians: irrational numbers, even if they could otherwise be represented rationally; for everybody else: decimal points.

MICROSOFT ARTICLE FROM MARCH OF 2023 ON THE ISSUE

An excerpt: "Never assume that a simple numeric value is accurately represented in the computer. "

This has to do with hardware issues, binary specifically, being limited in how it can represent a decimal. Because you can't really split a bit in half like you can an irrational number.

Here's my question though; why isn't there more precision control?

For example; in JavaScript: 0.2+0.1=0.3000000004 (or something like that).

Why does it bother to go so many digits deep in the first place? Why aren't there limits in place! Or at least; limitations a programmer can set in order to ensure accurate enough precision.

I should, theoretically. Just be able to get 0.3 if I set precision to 2, but that's not an option. (At least not in JavaScript, which you would think is the best place.for it given we want accurate *enough* and not *perfect* anyway.)

My history with studying AMD processors, video cards, and stocks; suggests that outside of video cards, AMD is actually the most accurate at floating point calculations. (This includes experience with video and music processing, file compression, and other complex processes)

Which, low-key; if you're gonna get into Video or Music editing, (especially as more than a hobby, I'd go with AMD, other processors focus on integer calculations instead.)

Now, typically, Video Cards are *much much better* at floating point calculations. And that's what videogames, 3D software, crypto, and other complex scientific software tend to default their calculations on. Because of the accuracy.

But that leads me to my next question; since floating point accuracy can't ultimately be trusted in a binary type system... How does crypto intend to stay for the long-haul, once that limit is breached in modern hardware?

We have to be close, right? I mean once the adoption of crypto drives mining at a higher rate than hardware is actively improving.

What about other security features and programs? Would this Introduce security flaws?

I know for a fact that most scientific calculations are inaccurate. Like, just look up 1+0+1+0 or 1+1-1+1-1. Which demonstrates these inaccuracies leading to, and suggesting that 1+1-1+1 eventually equals 999999999(+more 9s).

This includes your excel financial spreadsheet that you use for budgeting.

I know this, because I've done individual calculations that don't line up with manual interpretation that require summation over the *simpler formulas*

How many mathematic and scientific papers at a college and PhD level then; are compromised because they used flawed hardware without adjusting for inaccuracies?

I wonder...

Anyway... My real question is; why isn't there a better way to deal with the issue yet?

Food for thought.

5 notes

·

View notes

Text

AIXA Miner Launches Free-to-Start Cloud Mining Platform to Simplify Passive Crypto Income in 2025

NEW YORK, USA – July 2025 – As cryptocurrency adoption continues to surge, AIXA Miner is leading the next generation of simplified crypto earning with the launch of its free-to-start cloud mining platform. Designed for both beginners and seasoned investors, AIXA Miner removes the traditional barriers of crypto mining—offering users a hardware-free, eco-powered, and fully automated way to earn daily digital rewards.

In an industry where complexity and cost have long deterred new entrants, AIXA Miner makes mining accessible by providing new users with a $20 trial bonus, no equipment required. Mining contracts start from just $100, making it one of the most cost-efficient entries into the digital asset space.

“At AIXA, we believe mining should be for everyone—not just experts with expensive rigs,” said a company spokesperson. “Our mission is to democratize crypto income through automation, clean energy, and ease of use.”

Built for the Modern Miner

AIXA Miner’s cloud infrastructure is powered by renewable energy data centers located in Iceland and the U.S., optimized with AI-driven GPUs to mine the most profitable cryptocurrencies in real time. This approach minimizes environmental impact while maximizing efficiency.

With nearly 8 million users globally, the platform delivers seamless functionality:

No hardware or maintenance

Daily earnings auto-calculated and deposited

Real-time tracking, secure wallets, and instant withdrawals

Mining support for BTC, ETH, DOGE, USDT, and more

User Growth and Real Returns

AIXA Miner’s impact has been substantial. According to a report by Coin World, over 200,000 users have reached daily passive earnings of $10,000 in BTC. In a recent Bitcoinist article, miners using the platform reportedly generate $32,000 per day in combined passive income through contracts involving Bitcoin, XRP, and Dogecoin.

This growth is supported by a scalable architecture and a commitment to payout transparency.

Features That Set AIXA Miner Apart

$20 Signup Credit to start mining immediately

Flexible Plans starting at $100

VIP Club & Referral Rewards up to 10%

24/7 Global Support & Security Monitoring

Fast Withdrawals in major cryptocurrencies

How to Start in Minutes

Register on aixaminer.com with just your email

Claim your $20 bonus—no payment needed

Choose a plan, starting from $100

Activate and earn, with crypto deposited to your account daily

Withdraw or reinvest—your call

A Growing Trend Among Smart Investors

As cryptocurrency markets become increasingly integrated into mainstream finance, more investors are turning to platforms like AIXA Miner for predictable, passive income opportunities. With rising concerns around energy consumption and market volatility, cloud mining offers a balanced approach to crypto exposure—combining automation, sustainability, and steady returns. AIXA Miner’s model reflects this shift, appealing to both retail users and long-term holders seeking smarter ways to put their crypto assets to work.

About AIXA Miner

Founded in 2020 and headquartered in the United States, AIXA Miner has rapidly become a trusted name in the global cloud mining landscape. With a clean energy foundation, strong infrastructure, and AI-enhanced mining technology, the platform continues to attract users looking for long-term and secure crypto earnings.

Whether you’re new to cryptocurrency or diversifying your digital portfolio, AIXA Miner offers a reliable, risk-conscious path to passive income. Backed by automation, security, and global user trust, it’s time to mine smarter—not harder.

Media ContactName: Leif Mikkelsen Email: [email protected] Website: www.aixaminer.com City/Country: Denver, United States

More info: https://chainwirenow.com/aixa-miner-launches-free-to-start-cloud-mining-platform-to-simplify-passive-crypto-income-in-2025/

0 notes

Text

Expert Solutions for Your Crypto Taxes in Portugal

As cryptocurrencies become more popular in Portugal, so do the challenges of staying compliant with local tax regulations. Whether you're trading Bitcoin, staking Ethereum, or earning from NFTs, navigating the Portuguese crypto tax landscape can be complex. That’s where crypto taxes portugal comes in — offering expert solutions tailored specifically for crypto investors and traders in Portugal.

Why Crypto Taxes Matter in Portugal

Although Portugal has historically been known for its crypto-friendly tax environment, recent updates from the Portuguese Tax Authority (Autoridade Tributária e Aduaneira) have brought new clarity — and complexity. Today, some crypto-related activities are subject to capital gains tax, especially when they are part of a professional or business activity. Failing to report these correctly can lead to penalties or audits.

What You Need to Know About Crypto Tax in Portugal

Here are key points every crypto holder in Portugal should be aware of:

Private Trading (Occasional): Still largely tax-free if not part of a business activity.

Frequent Trading or Business Activity: May be taxed under Category B (self-employment income).

Mining, Staking & Airdrops: Often taxed as income depending on the frequency and purpose.

NFTs and DeFi Activities: Subject to evolving rules, needing professional evaluation.

How cryptotaxesportugal.com Helps You Stay Compliant

At cryptotaxesportugal.com, we provide comprehensive and up-to-date crypto tax services, ensuring you remain fully compliant while minimizing your tax liability. Our expert team specializes in:

🔹 Personalized Tax Consultation

Get one-on-one support tailored to your specific crypto activity, whether you’re an investor, miner, trader, or NFT creator.

🔹 Full Portfolio Analysis

We analyze your entire crypto portfolio — wallets, exchanges, DeFi platforms — and calculate accurate capital gains and income.

🔹 Tax Report Preparation

Receive tax reports that are fully compliant with Portuguese tax law and ready to submit to the tax office.

🔹 Ongoing Regulatory Updates

We keep you informed on changes in crypto taxation policies, so you’re never caught off guard.

🔹 Legal & Accounting Support

Our network includes legal and accounting professionals who understand both crypto and the Portuguese tax system.

Who Needs Our Services?

Long-term investors looking to cash out

Full-time crypto traders

Expats holding digital assets

DeFi and NFT enthusiasts

Businesses accepting crypto payments

Whether you’re a seasoned crypto user or just starting out, cryptotaxesportugal.com offers the tools and expertise to handle all your crypto tax needs.

Why Choose cryptotaxesportugal.com?

✅ 100% Portugal-focused crypto tax expertise ✅ Trusted by crypto investors across the country ✅ Transparent pricing and no hidden fees ✅ Friendly, bilingual support

Don’t let crypto taxes stress you out. Let the experts handle it.👉 Visit cryptotaxesportugal.com today and book your free consultation!

0 notes