#cryptocurrency ban

Text

The Controversy Surrounding Qatar's Cryptocurrency Ban

The Controversy Surrounding Qatar’s Cryptocurrency Ban:

The global financial landscape has witnessed the rapid rise of cryptocurrencies, presenting both opportunities and challenges for governments worldwide. Amongst them, Qatar has found itself embroiled in a heated controversy surrounding its stance on the cryptocurrency ban. The cryptocurrency landscape has brought Qatar under the vigilant eye…

View On WordPress

0 notes

Text

I've seen millions of recommendation but None is trustworthy or reliable compared to the @hackvoktech on Instagram, indeed there are truly a life saver. Contact them for cyber services..

#cryptoscam#woman scammed out of £27k by ‘astronaut’ who convinced her he’d marry her if she could pay his ‘rocket landing fees’#online scams#insurance scams#scam#disabled#recovery#help plz#send help#banned#bitcoin scam bitcoin crash bakkt xrp cardano ripple bitcoin bottom bull run should i buy bitcoin digibyte binance basic attention token btc#bitcoin#crypto scams#cryptocurrency

10 notes

·

View notes

Text

The lawyers that represented U.S. Representative Madison Cawthorn during a legal challenge to his candidacy in the 2022 North Carolina Primary are now suing the congressman themselves.

The Bopp Law Firm filed a lawsuit on December 1, alleging Cawthorn has failed to pay $193,296.85 in legal fees and costs.

The Indiana law firm has accused the congressman of breaching his contract.

The question over Cawthorn’s legal candidacy arose over his involvement in the “Stop the Steal” rally that occurred just before the U.S. Capitol riot on Jan. 6, 2021.

Voters challenged the congressman, citing Section 3 of the 14th Amendment which was designed to prevent congressmen who had fought in the Confederacy during the Civil War from returning to Congress.

The voters challenged that Cawthorn’s participation in the rally disqualified him from running for Congress.

In March, a U.S. District Judge ruled in Cawthorn’s favor and prevented the North Carolina State Board of Election from looking into whether he should be on the ballot for the 2022 Primary in May.

The voters appealed the ruling to the 4th U.S. Circuit Court of Appeals in Richmond, Virginia. The appeals court ultimately reversed the ruling and sent the case back to the district court.

According to the lawsuit, Cawthorn’s attorneys moved to have the district court case “dropped as moot” in order to avoid a possible ruling that could affect any of the congressman’s future campaigns.

The current representative of North Carolina’s 11th Congressional District is no stranger to legal woes in 2022.

In April, Cawthorn was cited for trying to bring a loaded gun through TSA at Charlotte Douglas International Airport, police said.

CMPD said Cawthorn admitted the firearm was his and he was cooperative with officers. He was issued a citation for possession of a dangerous weapon on city property, which is a City of Charlotte Ordinance.

Cawthorn has also been cited multiple times for various speeding violations. North Carolina Highway Patrol dashcam video released to QCN in April showed a traffic stop involving Cawthorn after he was pulled over in Cleveland County in March and was charged with driving with a revoked license.

Recently, the House Ethics Committee found he financially benefited while purchasing and promoting a cryptocurrency and had violated conflict of interest rules.

According to a report from the Washington Examiner, multiple watchdog groups said Cawthorn (R-NC) may have violated federal laws when he promoted a “pump-and-dump” cryptocurrency scheme.

Late last year, Cawthorn posed with the main investor behind the Let’s Go Brandon cryptocurrency, James Koutoulas.

In response to the photo, Cawthorn publicly said he owned LGBCoin cryptocurrency.

The following day, the cryptocurrency said it would sponsor NASCAR driver Brandon Brown, whose win at Talladega in 2021 kicked off the anti-Biden rallying cry “Let’s Go Brandon,” for the 2022 Xfinity Series season.

“If we do our job right, when you think of us, and you hear, ‘Let’s Go Brandon,’ you’ll think and feel, ‘Let’s Go America,’” Koutoulas said during the announcement.

LGBCoin’s value spiked by 75% following the sponsorship news, the Washington Examiner reported.

Watchdog groups reportedly told the Examiner that Cawthorn’s Instagram post suggested he may have had advanced knowledge of the deal with Brown and said that, combined with Cawthorn’s statement that he owns LGBCoin, “warrants an investigation from the Department of Justice and the Securities and Exchange Commission to see if the freshman congressman violated insider trading laws.”

By the end of January 2022, the value of LGBCoin had dropped from $570 million to $0.

After the committee’s findings in December, Cawthorn was ordered to pay $14,237.49 to charity. He was also told to pay $1,000 in late fees on reports filed for his cryptocurrency transactions.

#us politics#news#queen city news#2022#the hill#rep. madison cawthorn#north carolina#insider trading#ban insider trading#unpaid legal fees#Bopp Law Firm#stop the steal rally#14th amendment#4th U.S. Circuit Court of Appeals#House Ethics Committee#washington examiner#LGBCoin#cryptocurrency#Securities and Exchange Commission#department of justice

7 notes

·

View notes

Link

A crypto ban would be difficult to enforce because it is internationally traded. But close scrutiny of the market is way overdue in the United States.

Some people constantly complain that the government needs to quit being a “nanny state”. Then when many of those people get in trouble for doing dumb things they then grumble that the government was not doing anything to prevent them from doing those dumb things in the first place.

Cryptocurrency is a dumb thing. It’s worth was always based on wishful thinking. I doubt if even half of the Americans who bought into crypto understand what it really is (”That’s some sort of computer money that always keeps rising in value – isn’t it?”).

Sen. Sherrod Brown (D-Ohio) on Sunday said federal agencies need to address the cryptocurrency market and “maybe” ban it after the high-profile collapse of cryptocurrency market FTX last month.

Brown, the chairman of the Senate Banking, Housing, and Urban Affairs Committee, told NBC’s “Meet the Press” moderator Chuck Todd that the Treasury Department and “all the different agencies” need to get together and assess any possible action related to the cryptocurrency market.

“Maybe banning it, although banning it is very difficult because it will go offshore and who knows how that will work,” Brown said.

[ ... ]

Brown on Sunday said the cryptocurrency market is a “complicated, unregulated pot of money” and the issue was much larger than FTX.“So we’ve got to do this right,” the senator said, adding that he has talked to the Treasury Department to do a related assessment across regulatory agencies.

Rule Number One of financial management: If something sounds too good to be true, it probably is.

Celebrity endorsements for things outside their areas of expertise should be taken with a kilogram of salt. Just because somebody wins an Oscar or an Olympic gold medal doesn’t make them Warren Buffett. Anybody giving out investment advice should prove that they know what they’re talking about. Getting a fee from FTX or some other crypto company does not constitute expertise.

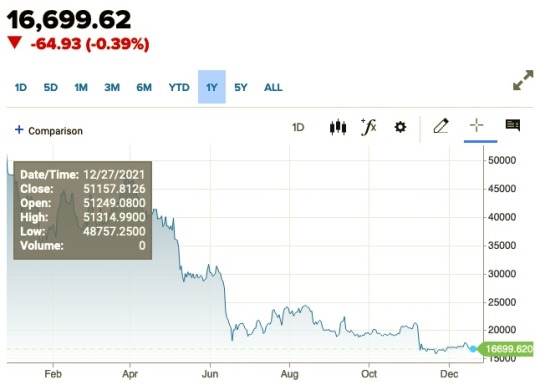

In just under a year Bitcoin has dropped from over $51,000 to under $17,000.

The sounder investments tend to be dull ones which don’t get lots of hype and are held for a few years. And if they get proper scrutiny from regulators then people probably won’t end up losing 68¢ on the dollar in just one year.

Related...

Boondoggle of the Year: Cryptocurrency

Part of the problem is that crypto, as its critics have often noted, doesn’t actually do anything. Unlike many stocks, it does not pay dividends to its purchasers or represent an ownership stake in a company. Unlike bonds, it does not offer a fixed rate of return. And unlike actual currencies, cryptocurrency does not really work as a common medium of exchange. You can’t go down to your local grocery store and buy a loaf of bread with etherium or tether.

[ ... ]

Crypto is not real. Like the platinum coins in EverQuest, it has no intrinsic value and is untethered to anything but the shared belief by many people that it is actually worth something. (Neither is the dollar, crypto folks are often quick to note, but cryptocurrencies do not have 12 aircraft carriers and a nuclear arsenal and a system of courts that can enforce debts.) Aside from a few edge cases, crypto’s primary real-world utility is to do exactly what its early developers intended: evade government control. That does not mean living in some Matrix-esque cyberpunk dystopia; that means money laundering and sanctions evasion and other things that are generally considered crimes. And I haven’t even gotten to the ecological damage.

The writer of that article was holding back, Crypto is the Boondoggle of the Century.

2 notes

·

View notes

Text

I see people talking about the Brave browser in the whole Firefox vs chrome debate, and while people rightly point out that it's just chromium and that they do shady cryptocurrency shit, I never see anyone point out that Brave's founder and CEO is Brandan Eich.

He founded Brave after massive protests against him becoming CEO of Mozilla, resigning after 11 days. And the reason for those protests? He donated a lot of money to the Prop 8 campaign to ban gay marriage.

So just remember: it's not just another chromium fork, it's not just a browser with cryptocurrency bullshit, it's also the browser founded by a homophobe because he got kicked out of his former organization for being a homophobe.

Also, he invented Javascript. I'm willing to believe that maybe he has grown on the gay marriage issue, and made amends for his former mistakes. But Javascript cannot be forgiven.

28K notes

·

View notes

Text

After a cloudquake wakes George in the middle of the night, he hops onto the social media platform Twiddor in search of information. Unfortunately, instead of emergency services, all George can find are scam accounts and bots posing as the Billings news media to sell cryptocurrency. The strange part is, these are all verified accounts with an official blue checkmark.

George soon discovers that Elon Mork, the head of Twiddor, has eliminated all verified checkmarks and installed a program called Twiddor Blue, providing verification to anyone who pays for it. This chaos has prompted many to start banning every blue checkmark account they see, and George quickly joins in.

But things get strange when a crying dinosaur comes knocking on George’s door in the dead of night. It’s Elon Mork, and he’s begging George to like him.

This important tale is 4,200 words of a needy T-Rex billionaire grappling with the fact that he’s a loser and nobody likes him. There is no sex, but there is plenty of satisfying catharsis.

----

new tingler NOT POUNDED BY TWIDDOR CHECKMARKS BECAUSE I BLOCKED EVERY PERSON WHO HAS ONE, DESPITE ELON MORK STANDING OUTSIDE MY HOUSE IN THE MIDDLE OF THE NIGHT CRYING AND BEGGING ME TO JOIN TWIDDOR BLUE out now on amazon or patreon

12K notes

·

View notes

Text

The largest campaign finance violation in US history

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Earlier this month, some of the richest men in Silicon Valley, led by Marc Andreesen and Ben Horowitz (the billionaire VCs behind Andreesen-Horowitz) announced that they would be backing Trump with endorsements and millions of dollars:

https://www.forbes.com/sites/dereksaul/2024/07/16/trump-lands-more-big-tech-backers-billionaire-venture-capitalist-andreessen-joins-wave-supporting-former-president/

Predictably, this drew a lot of ire, which Andreesen tried to diffuse by insisting that his support "doesn’t have anything to do with the big issues that people care about":

https://www.theverge.com/2024/7/24/24204706/marc-andreessen-ben-horowitz-a16z-trump-donations

In other words, the billionaires backing Trump weren't doing so because they supported the racism, the national abortion ban, the attacks on core human rights, etc. Those were merely tradeoffs that they were willing to make to get the parts of the Trump program they do support: more tax-cuts for the ultra-rich, and, of course, free rein to defraud normies with cryptocurrency Ponzi schemes.

Crypto isn't "money" – it is far too volatile to be a store of value, a unit of account, or a medium of exchange. You'd have to be nuts to get a crypto mortgage when all it takes is Elon Musk tweeting a couple emoji to make your monthly mortgage payment double.

A thing becomes moneylike when it can be used to pay off a bill for something you either must pay for, or strongly desire to pay for. The US dollar's moneylike property comes from the fact that hundreds of millions of people need dollars to pay off the IRS and their state tax bills, which means that they will trade labor and goods for dollars. Even people who don't pay US taxes will accept dollars, because they know they can use them to buy things from people who do have a nondiscretionary bill that can only be paid in dollars.

Dollars are also valuable because there are many important commodities that can only – or primarily – be purchased with them, like much of the world's oil supply. The fact that anyone who wants to buy oil has a strong need for dollars makes dollars valuable, because they will sell labor and goods to get dollars, not because they need dollars, but because they need oil.

There's almost nothing that can only be purchased with crypto. You can procure illegal goods and services in the mistaken belief that this transaction will be durably anonymous, and you can pay off ransomware creeps who have hijacked your personal files or all of your business's data:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Web3 was sold as a way to make the web more "decentralized," but it's best understood as an effort to make it impossible to use the web without paying crypto every time you click your mouse. If people need crypto to use the internet, then crypto whales will finally have a source of durable liquidity for the tokens they've hoarded:

https://pluralistic.net/2022/09/16/nondiscretionary-liabilities/#quatloos

The Web3 bubble was almost entirely down to the vast hype machine mobilized by Andreesen-Horowitz, who bet billions of dollars on the idea and almost single-handedly created the illusion of demand for crypto. For example, they arranged a $100m bribe to Kickstarter shareholders in exchange for Kickstarter pretending to integrate "blockchain" into its crowdfunding platform:

https://finance.yahoo.com/news/untold-story-kickstarter-crypto-hail-120000205.html

Kickstarter never ended up using the blockchain technology, because it was useless. Their shareholders just pocketed the $100m while the company weathered the waves of scorn from savvy tech users who understood that this was all a shuck.

Look hard enough at any crypto "success" and you'll discover a comparable scam. Remember NFTs, and the eye-popping sums that seemingly "everyone" was willing to pay for ugly JPEGs? That whole market was shot through with "wash-trading" – where you sell your asset to yourself and pretend that it was bought by a third party. It's a cheap – and illegal – way to convince people that something worthless is actually very valuable:

https://mailchi.mp/brianlivingston.com/034-2#free1

Even the books about crypto are scams. Chris Dixon's "bestseller" about the power of crypto, Read Write Own, got on the bestseller list through the publishing equivalent of wash-trading, where VCs with large investments in crypto bought up thousands of copies and shoved them on indifferent employees or just warehoused them:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

The fact that crypto trades were mostly the same bunch of grifters buying shitcoins from each other, while spending big on Superbowl ads, bribes to Kickstarter shareholders, and bulk-buys of mediocre business-books was bound to come out someday. In the meantime, though, the system worked: it convinced normies to gamble their life's savings on crypto, which they promptly lost (if you can't spot the sucker at the table, you're the sucker).

There's a name for this: it's called a "bezzle." John Kenneth Galbraith defined a "bezzle" as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it." All bezzles collapse eventually, but until they do, everyone feels better off. You think you're rich because you just bought a bunch of shitcoins after Matt Damon told you that "fortune favors the brave." Damon feels rich because he got a ton of cash to rope you into the con. Crypto.com feels rich because you took a bunch of your perfectly cromulent "fiat money" that can be used to buy anything and traded it in for shitcoins that can be used to buy nothing:

https://theintercept.com/2022/10/26/matt-damon-crypto-commercial/

Andreesen-Horowitz were masters of the bezzle. For them, the Web3 bet on an internet that you'd have to buy their shitcoins to use was always Plan B. Plan A was much more straightforward: they would back crypto companies and take part of their equity in huge quantities of shitcoins that they could sell to "unqualified investors" (normies) in an "initial coin offering." Normally, this would be illegal: a company can't offer stock to the general public until it's been through an SEC vetting process and "gone public" through an IPO. But (Andreesen-Horowitz argued) their companies' "initial coin offerings" existed in an unregulated grey zone where they could be traded for the life's savings of mom-and-pop investors who thought crypto was real because they heard that Kickstarter had adopted it, and there was a bestselling book about it, and Larry David and Matt Damon and Spike Lee told them it was the next big thing.

Crypto isn't so much a financial innovation as it is a financial obfuscation. "Fintech" is just a cynical synonym for "unregulated bank." Cryptocurrency enjoys a "byzantine premium" – that is, it's so larded with baffling technical nonsense that no one understands how it works, and they assume that anything they don't understand is probably incredibly sophisticated and great ("a pile of shit this big must have pony under it somewhere"):

https://pluralistic.net/2022/03/13/the-byzantine-premium/

There are two threats to the crypto bezzle: the first is that normies will wise up to the scam, and the second is that the government will put a stop to it. These are correlated risks: if the government treats crypto as a security (or worse, a scam), that will put severe limits on how shitcoins can be marketed to normies, which will staunch the influx of real money, so the sole liquidity will come from ransomware payments and transactions with tragically overconfident hitmen and drug dealers who think the blockchain is anonymous.

To keep the bezzle going, crypto scammers have spent the past two election cycles flooding both parties with cash. In the 2022 midterms, crypto money bankrolled primary challenges to Democrats by absolute cranks, like the "effective altruist" Carrick Flynn ("effective altruism" is a crypto-affiliated cult closely associated with the infamous scam-artist Sam Bankman-Fried). Sam Bankman-Fried's super PAC, "Protect Our Future," spent $10m on attack-ads against Flynn's primary opponent, the incumbent Andrea Salinas. Salinas trounced Flynn – who was an objectively very bad candidate who stood no chance of winning the general election – but only at the expense of most of the funds she raised from her grassroots, small-dollar donors.

Fighting off SBF's joke candidate meant that Salinas went into the general election with nearly empty coffers, and she barely squeaked out a win against a GOP nightmare candidate Mike Erickson – a millionaire Oxy trafficker, drunk driver, and philanderer who tricked his then-girlfriend by driving her to a fake abortion clinic and telling her that it was a real one:

https://pluralistic.net/2022/10/14/competitors-critics-customers/#billionaire-dilletantes

SBF is in prison, but there's no shortage of crypto millions for this election cycle. According to Molly White's "Follow the Crypto" tracker, crypto-affiliated PACs have raised $185m to influence the 2024 election – more than the entire energy sector:

https://www.followthecrypto.org/

As with everything "crypto," the cryptocurrency election corruption slushfund is a bezzle. The "Stand With Crypto PAC" claims to have the backing of 1.3 million "crypto advocates," and Reuters claims they have 440,000 backers. But 99% of the money claimed by Stand With Crypto was actually donated to "Fairshake" – a different PAC – and 90% of Fairshake's money comes from a handful of corporate donors:

https://www.citationneeded.news/issue-62/

Stand With Crypto – minus the Fairshake money it falsely claimed – has raised $13,690 since April. That money came from just seven donors, four of whom are employed by Coinbase, for whom Stand With Crypto is a stalking horse. Stand With Crypto has an affiliated group (also called "Stand With Crypto" because that is an extremely normal and forthright way to run a nonprofit!), which has raised millions – $1.49m. Of that $1.49m, 90% came from just four donors: three cryptocurrency companies, and the CEO of Coinbase.

There are plenty of crypto dollars for politicians to fight over, but there are virtually no crypto voters. 69-75% of Americans "view crypto negatively or distrust it":

https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

When Trump keynotes the Bitcoin 2024 conference and promises to use public funds to buy $1b worth of cryptocoins, he isn't wooing voters, he's wooing dollars:

https://www.wired.com/story/donald-trump-strategic-bitcoin-stockpile-bitcoin-2024/

Wooing dollars, not crypto. Politicians aren't raising funds in crypto, because you can't buy ads or pay campaign staff with shitcoins. Remember: unless Andreesen-Horowitz manages to install Web3 crypto tollbooths all over the internet, the industries that accept crypto are ransomware, and technologically overconfident hit-men and drug-dealers. To win elections, you need dollars, which crypto hustlers get by convincing normies to give them real money in exchange for shitcoins, and they are only funding politicians who will make it easier to do that.

As a political matter, "crypto" is a shorthand for "allowing scammers to steal from working people," which makes it a very Republican issue. As Hamilton Nolan writes, "If the Republicans want to position themselves as the Party of Crypto, let them. It is similar to how they position themselves as The Party of Racism and the Party of Religious Zealots and the Party of Telling Lies about Election Fraud. These things actually reflect poorly on them, the Republicans":

https://www.hamiltonnolan.com/p/crypto-as-a-political-characteristic

But the Democrats – who are riding high on the news that Kamala Harris will be their candidate this fall – have decided that they want some of that crypto money, too. Even as crypto-skeptical Dems like Jamaal Bowman, Cori Bush, Sherrod Brown and Jon Tester see millions from crypto PACs flooding in to support their primary challengers and GOP opponents, a group of Dem politicians are promising to give the crypto industry whatever it wants, if they will only bribe Democratic candidates as well:

https://subscriber.politicopro.com/f/?id=00000190-f475-d94b-a79f-fc77c9400000

Kamala Harris – a genuinely popular candidate who has raised record-shattering sums from small-dollar donors representing millions of Americans – herself has called for a "reset" of the relationship between the crypto sector and the Dems:

https://archive.is/iYd1C

As Luke Goldstein writes in The American Prospect, sucking up to crypto scammers so they stop giving your opponents millions of dollars to run attack ads against you is a strategy with no end – you have to keep sucking up to the scam, otherwise the attack ads come out:

https://prospect.org/politics/2024-07-31-crypto-cash-affecting-democratic-races/

There's a whole menagerie of crypto billionaires behind this year's attempt to buy the American government – Andreesen and Horowitz, of course, but also the Winklevoss twins, and this guy, who says we're in the midst of a "civil war" and "anyone that votes against Trump can die in a fucking fire":

https://twitter.com/molly0xFFF/status/1813952816840597712/photo/1

But the real whale that's backstopping the crypto campaign spending is Coinbase, through its Fairshake crypto PAC. Coinbase has donated $45,500,000 to Fairshake, which is a lot:

https://www.coinbase.com/blog/how-to-get-regulatory-clarity-for-crypto

But $45.5m isn't merely a large campaign contribution: it appears that $25m of that is the largest the largest illegal campaign contribution by a federal contractor in history, "by far," a fact that was sleuthed out by Molly White:

https://www.citationneeded.news/coinbase-campaign-finance-violation/

At issue is the fact that Coinbase is bidding to be a US federal contractor: specifically, they want to manage the crypto wallets that US federal cops keep seizing from crime kingpins. Once Coinbase threw its hat into the federal contracting ring, it disqualified itself from donating to politicians or funding PACs:

Campaign finance law prohibits federal government contractors from making contributions, or promising to make contributions, to political entities including super PACs like Fairshake.

https://www.fec.gov/help-candidates-and-committees/federal-government-contractors/

Previous to this, the largest ever illegal campaign contribution by a federal contractor appears to be Marathon Petroleum Company's 2022 bribe to GOP House and Senate super PACs, a mere $1m, only 4% of Coinbase's bribe.

I'm with Nolan on this one. Let the GOP chase millions from billionaires everyone hates who expect them to promote a scam that everyone mistrusts. The Dems have finally found a candidate that people are excited about, and they're awash in money thanks to small amounts contributed by everyday Americans. As AOC put it:

They've got money, but we've got people. Dollar bills don't vote. People vote.

https://www.popsugar.com/news/alexandria-ocasio-cortez-dnc-headquarters-climate-speech-47986992

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/31/greater-fools/#coinbased

#pluralistic#coinbase#crypto#cryptocurrency#elections#campaign finance#campaign finance violations#crimes#fraud#influence peddling#democrats#moneylike#bubbles#ponzi schemes#bezzles#molly white#hamilton nolan

412 notes

·

View notes

Text

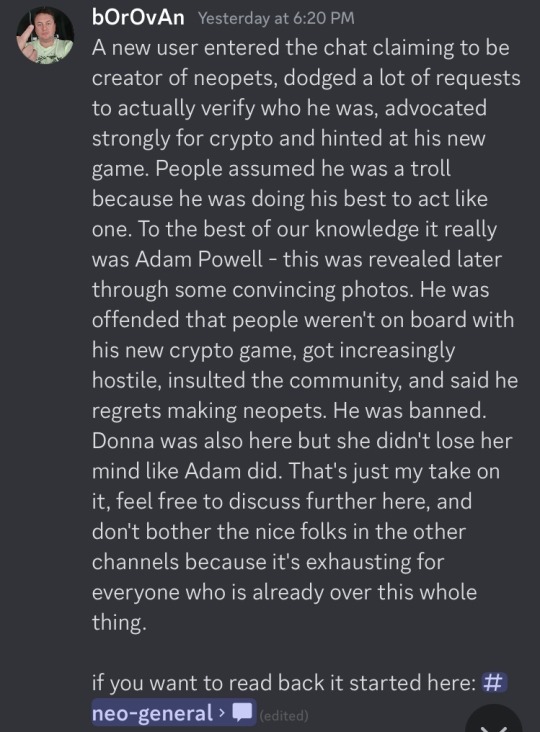

I’ve been seeing some people getting a bit confused and getting some stuff wrong in the comments of that one post telling the story about the creator of Neopets throwing a hissy fit (Hissi fit lol) over people disliking his idea of a game “that’s just like Neopets but with crypto” and I don’t want to add anything to it to not bother the OP but Neopets has been a hyperfixation of mine since I was 13 and I physically can’t stop myself from going “Um, ackshually ☝️🤓” so I’m gonna do it in my own post. Here’s what happened:

The guy who got super pissed off and started badmouthing Neopets users, ending his tirade with a selfie of him giving Neopets users the finger, Adam Powell, did create Neopets, yes, but he doesn’t own it anymore since it was sold to Viacom in 2005. He has been involved in a few game ventures since but they haven’t been very successful.

His idea wasn’t to “implement NFTs in Neopets”, he’s developing (or planning to) another game that’ll apparently be free to play with some extra paid features, and said features would be paid in some sort of cryptocurrency.

Sadly, the parent company of Neopets, JumpStart, already tried to implement NFTs by partnering with Metaverse back in 2021, with disastrous results, both in the eyes of Neopets players (who hated the idea because NFTs are a scam and terrible for the environment and all) and in the eyes of NFT bros (because the NFTs in question were VERY overpriced given their poor quality and made using stolen assets from Neopets fan sites). The project is apparently still underway but it’s hugely unpopular and tweets made by the official Neopets Metaverse account mostly only gets engagement from NFT bots, if they get any at all.

Back to Adam. He apparently thought people would be “excited about his new game because of the Neopets Metaverse thing”, without knowing how much the fanbase hated the whole thing, and tried to peddle it in the Discord server of the r/Neopets subreddit, a subreddit that has always been VERY vocal against the Neopets NFTs. And well. You can guess how much people weren’t interested in his game. Then, just to make matters worse, people went on the Discord server of his game and saw that it was badly moderated and chock full of homophobic comments made by cryptobros.

Adam gets pissed off at people disliking his game idea and not taking kindly to his comments that “they just don’t understand what crypto is about” and goes on an angry tirade, saying stuff such as how much he wished he never made Neopets because the fanbase sucks, saying he’s going to buy it back just to destroy it and ending in the aforementioned middle finger selfie, all while people clowned on him like crazy. This ended in him getting banned from the Discord server AND from the r/Neopets subreddit. He then started trying to defend himself and demanding to be unbanned in… the comment thread of a news article relating the incident in the Neopets fan site Jellyneo. Last time I checked he was still at it.

He blamed his outburst on “having drunk alcohol while on Sertraline” and has said he wasn’t aware of the homophobic comments in his server and claimed that he doesn’t have anything against LGBT+ people, but he has also made it very clear he doesn’t think he’s in the wrong and won’t apologize for anything.

1K notes

·

View notes

Text

one of the founders of neopets, Adam Powell, got banned from the r/neopets discord server yesterday... because he behaved like a fool, got angry that people weren't clapping him on the back about his interest in cryptocurrency,and insulted everyone about it. And he posted a picture of himself giving the middle finger as proof that he is the real Adam Powell. So fucking funny

#Everyone clowned on him people started editing screen caps of his message and his middle finger photo onto other things#neopets#poast

997 notes

·

View notes

Photo

Cryptocurrency regulations/bans around the World, as of November 2021.

by global_mapp

78 notes

·

View notes

Text

The Impact of Dubai's Ban on Privacy Coins: Insights From Crypto Projects

The Impact of Dubai’s Ban on Privacy Coins: Insights From Crypto Projects:

Dubai‘s recent ban on privacy coins has sent shockwaves through the cryptocurrency industry, sparking debates about the role of privacy in the crypto world. Privacy coins, which use advanced encryption techniques to protect users’ identities and transaction details, have been popular among those seeking to conduct…

View On WordPress

0 notes

Text

The number of commercial-scale Bitcoin mining operations in the U.S. has increased sharply over the last few years; there are now at least 137. Similar medical complaints have been registered near facilities in Arkansas and North Dakota. And the Bitcoin mining industry is urgently trying to push bills through state legislatures, including in Indiana and Missouri, which would exempt Bitcoin mines from local zoning or noise ordinances. In May, Oklahoma governor Kevin Stitt signed a “Bitcoin Rights” bill to protect miners and prevent any future attempts to ban the industry.

Much of the American Bitcoin mining industry can now be found in Texas, home to giant power plants, lax regulation, and crypto-friendly politicians. In October 2021, Governor Greg Abbott hosted the lobbying group Texas Blockchain Council at the governor’s mansion. The group insisted that their industry would help the state’s overtaxed energy grid; that during energy crises, miners would be one of the few energy customers able to shut off upon request, provided that they were paid in exchange. After meeting with the lobbyists, Abbott tweeted that Texas would soon be the “#1 [state] for blockchain & cryptocurrency.”

Technically there is federal mandate to regulate noise, which stems from the 1972 Noise Control Act—but it was essentially de-funded during the Reagan administration. This leaves noise regulation up to states, cities, and counties. New York City, for instance, has a noise code which officially caps restaurant music and air conditioning at 42 decibels (as measured within a nearby residence). Texas’s 85 decibels, in contrast, is by far the loudest state limit in the nation, says Les Blomberg, the executive director of the nonprofit Noise Pollution Clearinghouse. “It is a level that protects noise polluters, not the noise polluted,” he says.

The residents of Granbury feel they’ve been lied to. In 2023, the site’s previous operators, US Bitcoin Corp, constructed a wall around the mine almost 2,000 feet long and claimed that they had “solved the concern.” But Shirley says that the complaints from the community about the sound actually increased when the wall was nearing completion last fall. Since Marathon bought the facility outright in December, its hash rate, or computational power expended, has doubled.

Any statewide legislation is sure to hit significant headwinds, because the very idea of regulation runs contrary to many Texans’ political beliefs. “As constitutional conservatives, they have taken our core values and used that against us,” says Demetra Conrad, a city council member in the nearby town of Glen Rose.

In the week before this article’s publication, two more Granbury residents suffered from acute health crises. The first was Tom Weeks. “This whole thing is an eye opener for me into profit over people,” Weeks says in a phone call from the ICU.

The second person affected was the five-year-old Indigo Rosenkranz. Her mother, Sarah, was terrified and now feels she has no choice but to get a second mortgage to move away from the mine. “A second one would really be a lot,” she says. “God will provide, though. He always sees us through.”

shocking! texans suffer from deregulation and ineffective walls

93 notes

·

View notes

Text

Awkward stuff the demon brothers would NEVER tell MC (headcanon) part 1

part 2 here [LINK]

Mammon - his failed attempt at creating MammonCoin cryptocurrency

Leviathan - why he keeps his Ruri-chan figurine in a jar, if you keep asking him he'll summon Lotan

Satan - his cat fursona that he posts about on a secret social media account that none of his brothers know about

Asmodeus - his long list of ex-lovers and the fact that he's probably a father after all the succubi he smashed

Beelzebub - there are some restaurants that he got banned from

Belphegor - the last time he washed his sheets (there's a reason he likes to sleep in MC's bed)

Lucifer - his illicit affairs with Diavolo, anyone who finds out gets fed to Cerberus

#BTW the cat fursona's name is Tantan and he's a librarian who gets mad at anyone who makes noise in his library#obey me#obey me shall we date#obey me one master to rule them all#obey me headcanon#obey me headcanons#lucifer obey me#mammon obey me#obey me meme#obey me memes#leviathan obey me#satan obey me#asmodeus obey me#beelzebub obey me#belphegor obey me#obey me crack

905 notes

·

View notes

Text

Which rottmnt turtle are you?

Raph:

- Forgot to turn off the oven

- Everyday is chest gym day

- Afraid of their own shadow

- Angle with a shotgun

- Dies if a single proton of peanut touches them

- Good boy(™)

- Uses the same underwear two days in a row to save water

- Didn't know how to use the #blacklivesmatter but used it anyway because black lives matter

- Can and will be convinced the earth is flat

- Sleeps with 173913 plushies

- Somehow father figure

Donnie:

- Sales baked goods

- Banned from Texas

- Chaotic awful

- Nows your IP and will use it against you

- Can and will convince someone that the earth is flat

- Disappeared three days but no one noticed

- Emotionally constipated

- Invests mony in cryptocurrency

- A U T I S M

- Is secretly coquette

- 1# Most wanted criminal 2023

Mikey:

- Makes naked furry drawings and places them in the fridge

- "Don't know don't care"

- Has used the #blacklivesmatter for the good

- A minor

- Noticed they were gone

- Menance to society

- Licks the frosting of the cupcakes and puts them back in the fridge

- Eats ice cream with their bare hands

- Bts stand

- Likes eco

Leo:

- Makes deez nuts jokes

- Depressed

- Would wear a "blue label" T-shirt

- "Prison's just an expensive escape room"

- Moonwalks their way in and out of trouble

- Makes yo mama jokes

- Sleep is optional

- Would put cheese sauce in the washing machine instead of soap

- Walking meme

- Feminist

- Could and did dropkick a child

- Spanish or vanish

#rottmnt#tmnt#rise of the tmnt#rise of the teenage mutant ninja turtles#rise leo#rottmnt leo#rottmnt leonardo#rise leonardo#tmnt leonardo#tmnt leo#save rottmnt#rottmnt meme#rise meme#tmnt memes#rottmnt raphael#rottmnt raph#rise raphael#rise raph#tmnt raph#rise tmnt#tmnt raphael#rottmnt donnatello#rottmnt donatello#rottmnt donnie#rise donnatello#rise donnie#tmnt donnatello#donnie tmnt#rottmnt michelangelo#rottmnt mikey

46 notes

·

View notes

Text

A presidential signing bonanza

Vladimir Putin signed into law on Thursday more than 50 laws on Thursday, including several new prohibitions and expansions of the state’s repressive powers. Thanks to the president's approval, these eight pieces of legislation are now set to become the law of the land.

Jailing soldiers (without court orders) for using smartphones: Unit commanders now have the authority to lock up their soldiers for up to 10 days (or 15 days for repeat offenses) if they catch them using banned personal gadgets, such as smartphones. This act previously required transporting the suspects to a garrison court for a formal ruling.

An expanded definition of ‘undesirability’: The authorities can now designate any organization in Russia as “undesirable” if foreign state entities played any role in the organization’s foundation or have even participated in its operations. State Duma Speaker Vyacheslav Volodin said the law is necessary to close a “loophole” that prohibited the government from designating local, Russian organizations, not just foreign groups.

No more selling energy drinks to kids: Effective March 2025, Russian vendors are prohibited from selling non-alcoholic tonic drinks, including energy drinks, to minors. The new restriction is intended as a public health measure.

Legalized cryptocurrency mining: Russia will introduce a special registry to issue permits for individuals and legal entities to “mine” cryptocurrency — the electricity-demanding process of using computer power to solve the complex mathematical problems needed to validate and secure transactions on a blockchain, earning digital currency as a reward. In mid-July, Putin expressed concerns about falling behind in cryptocurrency regulations. The new legislation also reserves some regional authorities’ right to ban crypto-mining where energy shortages are a concern.

The Dude can no longer abide: Effective September 1, 2025, “propagating drug use in art and literature” without warnings will be punishable by steep fines. The new restrictions exempt all works released before August 1, 1990, and content “where drugs are an integral part of the artistic concept justified by the genre.” The new censorship also does not apply to “materials related to investigative activities, scientific, educational, medical, or pharmaceutical publications.”

More deportation powers for the police: Internal Affairs Ministry officials will now have the authority to expel foreigners from the country without court oversight for certain misdemeanors. The list of administrative offenses includes illegal drug use, the public consumption of alcohol, and disseminating so-called “gay propaganda” (though officers must “directly witness signs of violations” in this last case). Deported foreigners will also be added to a registry that bans them from registering businesses in Russia, getting married, buying and registering property, opening bank accounts, and obtaining or renewing a driver’s license.

‘Trash-streams’ banned: In Russia, “trash streams” usually feature bloggers abusing drugs and alcohol or performing humiliating or violent acts in return for donations from viewers. The new law prohibits the distribution of “trash stream” content, and crimes committed during these broadcasts can be prosecuted as aggravated offenses under 10 different felony statutes. Convicted “trash streamers” will face steep fines and the possible confiscation of their electronic equipment.

Naturalized citizenship revoked for refusing military registration: The Internal Affairs Ministry will now be required to provide records about all men approved for receiving Russian citizenship. Lawmakers who sponsored the bill said the new condition for maintaining naturalized citizenship is needed to address “widespread public outrage” against immigrants who get a passport and then evade military duty.

14 notes

·

View notes

Text

US Bitcoin Miners Use as Much Electricity as Everyone in Utah

Bitcoin miners in the US are consuming the same amount of electricity as the entire state of Utah, among others, according to a new analysis by the US Energy Information Administration. And that’s considered the low end of the range of use.

Electricity usage from mining operations represents 0.6% to 2.3% of all the country’s demand in 2023, according to the report released Thursday. It is the first time EIA has shared an estimate. The mining activity has generated mounting concerns from policymakers and electric grid planners about straining the grid during periods of peak demand, energy costs and energy-related carbon dioxide emissions.

“This estimate of U.S. electricity demand supporting cryptocurrency mining would equal annual demand ranging from more than three million to more than six million homes,” the report said.

While mining began in the US a decade ago, an influx of crypto mining companies have relocated from China after that country banned the industry in May 2021. Over the last three years, a flurry of large-scale miners have gone public in the US, setting up operations in some of the most energy-rich states such as Texas and New York.

(continue reading)

#politics#crypotcurrency#crypto bros#bitcoin#cryptocurrency mining#environment#power consumption#bitcon

29 notes

·

View notes