#defi projects with potential returns

Explore tagged Tumblr posts

Text

The DeFi Projects That Could Make You Rich in 2023

Discover the potential for wealth in 2023 with the best DeFi projects to invest in. Uncover a world of decentralized finance innovations that could propel your financial success. From lending platforms to yield farming protocols, these carefully selected DeFi projects offer promising opportunities. Stay ahead of the curve and explore projects with transformative potential in the ever-evolving DeFi landscape. With cutting-edge technology and a focus on user empowerment, these projects aim to revolutionize traditional finance. Embrace the future of wealth creation and dive into the exciting world of DeFi projects that could make you rich in 2023.

#defi projects 2023#best defi investments#top defi projects#defi investment opportunities#lucrative defi projects#profitable defi investments#high-growth defi projects#promising defi investments#wealth-generating defi projects#defi projects with potential returns

0 notes

Text

what's a venus return?

did you know that you can check more than just your sun's return? any time a planet transits and becomes exactly conjunct your planet (it is in the exact sign and degree it was when you were born), you undergo a planetary return. venus returns happen roughly every 2 years at a maximum (unless there is a retrograde then it could be about 11 months that you undergo the return). my venus return happened this past weekend so here we are continuing my previous series.

but what can a venus return chart show you?

your romantic life. who you can attract / are likely to fall in love with. how your beauty evolves. sympathy you need. pleasures you have. the art/creative work you can make. your ability to provide self-love / how you can best practice it. harmony you will find. compromises you need to make. how your aesthetic can shift. entertainment you seek. what you will value. luxury items you splurge on. where your laziness originates. how you can be more sensual.

paid reading options: astrology menu & cartomancy menu

enjoy my work? help me continue creating by tipping on ko-fi or paypal. your support keeps the magic alive!

sun

assumption that others crush on you, aesthetic others identify with you, youthfulness, attractiveness, attention from potential suitors, entertainment you seek and/or provide others, what you feel you deserve from others / the universe, what makes you different from others romantically / aesthetically, development of beauty, dignity regarding your appearance, awareness of your looks, objects that bring you joy / pleasure, validation you receive, and/or how express your self in terms of fashion / beauty

moon

emotional responses to romantic situations, loving/jealous instincts, how you show you care, romantic comfort zone, feminine aesthetic - masculine/male gaze, how your childhood effects the romantic partners you seek, fertility, how your beauty/aesthetic adapts to trends, how you breasts change/develop, romantic life habits/trends, and/or comfortability in your space

mercury

romantic communication, love language, physical touch, words of affirmation, talking phases, the creative mind, perception of beauty, creative writing, social media aesthetic/entertainment, flirty mannerisms/gestures, love defying reason, romantic change, forgetfulness that leads to laziness, romantic gossip, romance/smutty reads, self-care routine, and/or youthfulness

venus

romantic experiences, attraction, beauty, pleasures, artistic ability/projects, self-love, divine femininity, sharing romantic feelings/gestures, your aesthetic, entertainment you seek, romantic values, receiving gifts, luxury items you desire, and/or romantic sensuality

mars

romantic passion, desires, romantic confidence, creative ambition, romantic preferences, sex, jealousy, romantic competitiveness, impulsive romantic behavior, sensuality, self-assurance in your beauty, divine masculinity, masculine aesthetic - feminine/female gaze, assertiveness in a romantic connection, dominance, romantic/creative activities, sensual energy, sexuality, romantic combativeness, and/or romantic/creative motivation

jupiter

romantic luck/abundance, wealth of suitors, wealth of luxury / things that are pleasurable, romantic/creative success, romantic opportunities, topical popularity, expansion of wardrobe, entertainment knowledge, honesty in romantic relationships, romantic wisdom, ease in romance, romantic blessings, romantic optimism, justice regarding previous relationships, self exploration, artistic vision, romantic/self devotion, study of aestheticism, self-growth, and/or romantic fulfillment

saturn

romantic/creative achievement and mastery, romantic challenges/struggles, quality time, karmic romances, romantic life lessons, how your paternal figure affects you self-esteem / romantic relationships, fears regarding love, insecurities, romantic guilt, romantic delays, romantic limitations, how past romantic relationships effect new ones, self-love deficiencies, romantic practicality, romantic solitude, romantic maturity, romantic detachment, consistency you show others, grudges against competition / past lovers, and/or your relationship history

uranus

friends to lovers, dating apps, movies as a form of entertainment, sudden romantic relationship, what makes you unique in comparison to others in the dating/artistic scene, how you don't follow the beauty trends, romantic independence/freedom, open relationships, unexpected dates or contact from a suitor, shocking declarations, and/or social media fans/followers

neptune

kindness you show others, artistic creativity, glamorous appearance, sensitivity to others feelings, selflessness in a romantic relationship, escapism via love, intuitive design, use of imagination, makeup / what is presented to society, romantic mysteries, romantic confusion, evasion of commitment, self-love mantras, transcending the norms of aestheticism, fascination with appearance/design, and/or thoughts on your ideal appearance

pluto

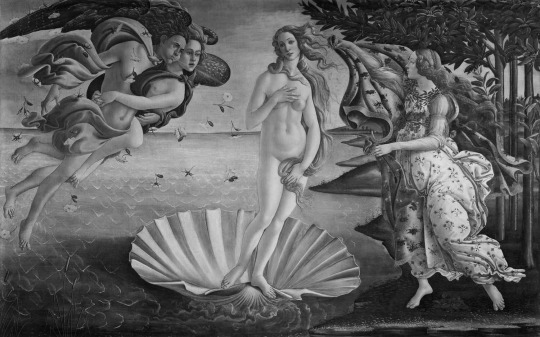

glow-up for the self / closet, romantic power, sex, destruction of the old self, rebirth of beauty (hence "the birth of venus"), romantic intensity, magnetism experienced in the romantic realm, romantic infatuation/obsession, seductive performances, romantic manipulation, and/or closet purge

1h

aesthetic you identify with, outward/physical appearance, romantic outlook/approach, beauty, confidence, creative/romantic beginnings, initiating relationships, flirty mannerisms, presence, individuality, and/or how passionate you appear

2h

money you spend on looks, how much effort you put into your appearance, possessions you adore, self-worth/self-love, romantic values, emotional security/insecurity, romantic stability, gift giving/receiving, and/or romantic resources

3h

romantic communication, attractiveness of your speaking voice, what people enjoy about your voice, the creative mind, romantic thoughts, creative perception, opinions on fashion/beauty/love, romantic interests, romantic gossip, romance/smutty literature, appearances on social media, phone calls with romantic interests, visits with romantic suitors, and/or dates

4h

aesthetic of your home, how your family effects your relationships (particularly maternal figure), harmony your inner child seeks in connections, romantic emotions, self-care/self-love, and/or how where you live effects your relationships/appearance

5h

thoughts on children, childishness in romance relationships, pettiness, creative talent, romantic drama, romantic risk-taking, how you react to attention from others, short-term romantic relationships, creative hobbies, romantic pleasures, what suitors bring you, romantic get aways, and/or romantic joy

6h

romantic/creative routine, acts of services, physical effort made to make your body appear as it does, your romantic duties, self-improvement, romantic/creative consistency, hygiene habits, beauty routine, romantic innocence, and/or how your diet effects your appearance

7h

long-term romantic relationships, marriage/partnership, attraction to others, attractiveness to others, ability to charm others, romantic conflicts, marital/nda/pre-nuptial contracts, romantic affairs, those who openly show they are jealous of you, and/or romantic equality

8h

physical transformation, aesthetic/wardrobe transformation, how close you get to others, romantic changes, shared finances between spouses, foreplay/seduction, intimacy you have with another person, secret relationships, romantic mysteries, and/or romantic trauma

9h

romantic wisdom, romantic beliefs/philosophy, perspective in romances / creative works, love languages, how your in-laws see you, romantic ethics, entertainment media/television/interviews, and/or education involving love/creation/aesthetics/appearance/fashion

10h

how the public sees you, relationship status, romantic reputation, creative fame, appearance goals, romantic/creative mission, romantic expertise, and/or romantic/creative achievements

11h

friends to lovers, romantic desires, uniqueness of internal beauty, social awareness in terms of collective beauty, influence you have over fashion and beauty, romantic/creative manifestations, wishes for romance, romantic ideals, debutants, romantic companions, artistic clubs/organizations, and/or costume parties

12h

healing from past romantic connections, hidden desires, romantic karma, beauty sleep, how your appearance/romances effect mental health, solitude/isolation from others, people who are secretly jealous of you, illusions of joy/pleasure, romantic fears, romantic endings, escapism via romance or art, romantic/creative self-sabotage, how past romances effect present/future ones, romantic delays, and/or romantic restrictions

have ideas for new content? please use my “suggest a post topic” button!

return to nox’s guide to metaphysics

return to the masterlist of return charts

© a-d-nox 2024 all rights reserved

#astrology#astro community#astro placements#astro chart#asteroid astrology#natal chart#astrology tumblr#astrology chart#natal astrology#astrology readings#astro notes#astro observations#astroblr#astrology blog#return chart#venus return#venus return chart

563 notes

·

View notes

Text

Thoughts/Theories for Arcane Season 2 Act 2: Jayvik centered

Potential spoilers so read under the cut if you've watched Act 1!

To recap, at the end of Act 1 we see Jayce, Heimer and Ekko all get messed around with by the Wild Rune, causing anything linked to the Arcane to glitch out and malfunction. Based on the visuals and what we know about the characters it's likely those three will be scattered across time and space to different degrees;

Ekko will be gone long enough to be considered dead by the Firelights but return with his time powers to deal with the final confrontation with Noxus.

Heimer may be tossed back in time to confront his past trauma and be key in getting he and Ekko back to their correct time.

Jayce... He's gonna have the hardest time. He attacked the Wild Rune with the hammer which caused a massive reaction, so as a result he may be the one separated and lost in the Arcane dimension the longest. Based on the new Arcane Survivor Skin preview and the sneak peaks we got in both the newest teaser for Act 2, he'll most likely be stuck in this dimension for an undetermined amount of time, enough that it will affect his hammer directly and fuse the arcane shard in his cuff to his skin. The question is, how does he get out?

I think Viktor will be the key to his escape. Viktor, as we saw in his last scene in Act 1, is now inherently connected to the Arcane and by extension the Void given that he was fused with the Shimmer-tainted Hexcore. His continued use of the Arcane to heal his new followers will continue to destabilise the barrier between the realm of the Arcane and the material plane, but it could also potentially save Jayce.

If we're sticking with the Jesus/religious leader angle, Viktor was already shown to be having visions since he first coughed blood down into the matrix leading to the Hexcore's creation. After being fused with the Hexcore and by extension granted direct connection to the Arcane, he's been shown to be guided by 'Sky,' or at least a memory/fraction of her that now currently exists within the Hexcore and the Arcane.

My theory is, the more he settles into his new role and newfound connection to the Arcane, I think he'll start having visions of Jayce in the Arcane dimension and endeavour to get him out. While 'affection kept them together,' I think it's more than that now. They built hextech and the gates together, and with Jayce now directly affected and trapped by the Arcane they have a mystic connection to each other through the Hexcore. Despite their abrupt and bitter parting, I think seeing the main object of his affection trapped in such a state and clearly not yet fused to it like Sky is, he'll extend his power to get Jayce out.

Inevitably, this would lead to a potential clash/confrontation over both men's involvement of destabilising the Arcane in Zaun and Piltover... But I think in the end they will always do what they feel is right to save eachother.

I also want to add real quick that Ekko's criticism of how the Hexgates were built to send all runoff and potential fall out to the Undercity is valid and a gross oversight on Jayce's part, Viktor being from the Underground would have had to have a say in its design too so he will have possibly overlooked or felt confident this detail would be unlikely as well. Jayce and Viktor were partners on the project despite Jayce being the face of it; i.e. they're both responsible for what happened with the corruption and the Wild Rune.

With time being a key theme being shown in both the opening credits and how Ekko operates, it's looking like the theory that Viktor is the mage that saves young Jayve and Zimmena may be more likely than we think. But at the same time, even though we see in Viktor's new poster that he is able to thrive for some time, the plants that they experimented in did eventually wither and this may be a problem for Viktor as the next two acts progress.

Whether this means Viktor accepts or defies this rot to be in line with League Lore... I'm putting my faith in the writers on that one.

Let me know your thoughts!

#viktor#arcane#arcane viktor#arcane jayce#jayce talis#jayvik#leauge of legends#theories#arcane spoilers#spoilers#just to be safe

43 notes

·

View notes

Text

"Beneath The Seoul Sky"

Two hearts. One city. A love that defies legacy and ambition.

Chapter 2: Precision

Kwon Him Chan had always run a tight ship.

Even before the Seoul branch was officially approved, he was already laying the groundwork, assembling detailed spreadsheets, sketching team structures, and reviewing potential local partnerships with a level of scrutiny that bordered on obsessive. Every piece of the puzzle had to fit perfectly.

He’d bled for this opportunity. Years of proving himself, silently outshining peers, and executing impossible deadlines without complaint. So when headquarters informed him they were sending someone from the U.S. to “lead” the setup, it felt like a slap in the face.

Especially when that person turned out to be Naomi Sinclair. She was… unexpected.

The first time he saw her at the airport, something in his chest tightened, and he quickly dismissed it as fatigue. She carried herself like a woman who’d already won the game, not someone walking into a new country, a new culture, a new battlefield. Her presence had weight. Composure wrapped in elegance. Her skin was smooth and light brown, and it stood out against her black wool coat, which clung to her frame like it was tailored just for her. Her high cheekbones, proud shoulders, and effortless grace in how she moved had knocked him off balance for half a second.

But beauty didn’t mean competence. And he didn’t care for distractions.

So when she walked through the office doors the following day at precisely 8:52 a.m., eight minutes early, just as he’d hoped she wouldn’t, he stood behind the tinted glass of his office, watching her. Her fitted navy suit hugged her curves like armor, clean lines sharp against the light. The silk blouse beneath shimmered faintly in the early sun, a deep shade of merlot that complimented her skin. Her hair was neatly pulled into a low bun, and delicate gold hoops framed her face, catching the light every time she turned her head. She moved through the space like it already belonged to her. She stopped to greet the front desk manager. “Annyeonghaseyo,” she said in steady, deliberate Korean. Her accent was noticeable but practiced clear enough to earn a surprised blink and a pleased nod in return.

Him Chan’s jaw ticked.

Fine. She made it on time. She spoke the language. He’d give her that.

He stepped out. “Ms. Sinclair.”

She turned smoothly, her eyes catching his. Calm, assessing, untouched by nerves. “Good morning, Mr. Kwon.”

Her voice was warm, steady, low-pitched. Confident without being performative.

“I’ll introduce you to the team,” he said, pivoting on his heel.

They walked side by side down the main hallway, past rows of glass-walled meeting rooms and clusters of workstations. Their heads turned, and conversations paused.

Naomi noticed the subtle shift in the room, the quiet hush, the curious glances, and handled it the way she handled everything: with deliberate poise. Her shoulders were square, her lips neutral but not unfriendly, and her stride matched his without hesitation.

“The department leads will give you their progress reports today,” Him Chan said. “You can ask questions after each presentation.”

Naomi nodded once, sharp and sure. “Perfect. I came ready.”

And she had.

The first meeting began in a sleek conference room overlooking the city. Floor-to-ceiling windows cast soft light over the long glass table. Naomi sat straight-backed, her notebook open, pen in hand, her gaze locked in as each lead began their presentations.

Ten minutes in, she raised her hand slightly. “Excuse me. There’s a miscalculation in the Q2 forecast.”

The room stilled. Eyes darted.

She gestured to the screen calmly. “You’re assuming a 6.5% growth margin based on last year’s numbers, but the new vendor’s rates change that to 4.1%. It’ll throw off the whole model.”

There was a pause. Then, murmurs of agreement.

She leaned forward. “If we switch the projection inputs and clean up the formula dependency chain, we can save your analysts at least six hours a week.”

By noon, she had already reorganized the data pipeline rollout, avoiding redundancy between teams and identifying the core bottleneck in the local database vendor’s integration schedule. She offered three viable solutions: clean, efficient, and strategic.

The room shifted. Energy rose. The team leaned in not just listening but engaged.

In one brainstorming session, Naomi moved around the table, jotting notes on the whiteboard, looping back to questions from the junior analysts, and clarifying where needed. She listened when someone spoke, her eyes steady and brows slightly arched in concentration. She nodded when they made good points and gently corrected when they didn’t.

Him Chan watched her from the back of the room, arms crossed, mouth unreadable.

She caught his gaze, and under her breath, murmured, “Still skeptical?”

He tilted his head, eyes narrowing just slightly. “Mildly.”

A whisper of a smirk ghosted across her lips before she turned back to the team.

By the end of the workday, the office had taken on a new rhythm: fast, efficient, and alive. There was no disarray, no ego matches, just progress. Her leadership wasn’t loud. It was meticulous. Commanding in the way a metronome sets the pace for an orchestra. And it got under his skin. Not because she was incompetent. No worse. Because she was exceptional. She didn’t bend. She didn’t ask permission. She stepped in and quietly realigned everything with the grace of a woman who had done this before—and wasn’t here to be anyone’s assistant.

She was here to lead.

And whether he liked it or not, Kwon Him Chan had definitely noticed.

Not just her work. But her.

#ambw#romance novels#novel writing#novel#fiction#readers#reading#books#romance#authors#bwam#ambw bwam#south korea#seoulromance#seoul#love#Beneath Seoul's Sky

6 notes

·

View notes

Text

Steddie Bigbang 2023 Weekly Round-up: October 1 - October 7

From Hell and Back (October 1) Author: @rindecisions / Artists | @lady-lostmind & @feralsteddie One Halloween, years after the fall of Hawkins, Steve and Robin end up summoning Eddie from the depths of Hell. Steve, not knowing the ways of the occult, accidentally frees him and has to deal with a mischievous demon on the loose. Eddie drives Steve insane with various shapeshifting antics, both in and out of the bedroom, while Robin tries to find a way to send him back to hell. But, when faced with the opportunity to return his life to normal, will Steve even want to go through with it?

OR

Lots of supernatural, hentai-esque smut with a playful, romantic plot.

Steddie’s Anatomy (October 1) Author: uhhhhjhfrogs on tumblr, tttrash666 on A03 / Artist: BrainyArts on Instagram, Twitter, TikTok, Tumblr Steve was not going to leave Eddie to die in the Upside Down, no fucking way. He didn’t know what compelled him to give every last ounce of strength to rescue him but being confined to a hospital room together was about to make him figure it out.

Made of Light (October 3) Author: @hitlikehammers / Artist: @becomingfoxes Soulmates are anything but de rigueur in polite society—more like foolish nonsense, fairytale child’s play: embarrassments. Inconvenient, at best. But the people who have them, and still seek them out; who believe despite the odds, who still commit to finding them and binding their souls to them despite the naysaying and the backlash? Those people know the truth.

Because Soulmates? Don’t force love. Aren’t bound without choice. Are built instead on pure potential, of proportions never fathomed—and certainly never found—outside those so-called ‘old fashioned’ Bonds. They are the potential to protect love. To save love. To save the lives that kind of ineffable love holds more than just dear; the kind it holds as essential. Some people even say Soulbonds can almost change the whole world, defy the laws of physics and nature, but then—even among the believers: those stories are relegated to legend. At best. And so: this is the story of two boys from Indiana who—dodging dangers and demons and near-death experiences—wind up in a love never seen before, somehow writing out the kind of legend no one ever dared to dream.

(You got me) in the palm of your hand (October 4) Author: just-my-latest-hyperfixation (tumblr) / just_my_latest_hyperfixation (AO3) / Artists: xgumiho (tumblr) / xgumiho (instagram) / jul2ja (twitter), peachypurr (tumblr) / peachypurr (linktree) “Fortunes told, futures unfold.”

The sign at the local ren faire looks tempting. After all, Steve is one year out of high school and has no idea where his life is going. Sometimes he wishes someone could just gaze into the future and figure it out for him.

In the fortune teller’s tent, Steve has a run-in with his past. And if he doesn’t turn on his heel and leave, it has absolutely nothing to do with how pretty Eddie Munson looks in his costume, all gleaming jewelry and dark tendrils of hair spilling out from under a patterned headscarf. He lets Eddie read his palm, because why the hell not? It’s all bogus anyway!

Except, as the summer goes on, Steve finds that Eddie’s cryptic predictions somehow, inexplicably keep coming true. As they keep running into each other, almost as if orchestrated by an invisible force, Steve can’t help but be intrigued with the other boy. He also can’t seem to forget how pretty Eddie’s eyes look in black liner, or the way his fingers feel on his skin, but that is an entirely different problem.

11 upcoming projects to be posted next week (Oct 8 - 14).

*To keep up with all the Steddie Bigbang 2023 posting, be sure to follow us @steddiebang or track tags like #steddiebang23, #steddiebang23 masterposts, #steddiebang23 project promo, and #steddiebang23 upcoming projects.

102 notes

·

View notes

Text

Weekend Top Ten #662

Top Ten MCU TV Shows 2024

Once more, with feeling, we return to the MCU. Last week I ranked my favourite MCU movies – the third time I’d done that in the nearly thirteen years I’ve been writing this dumb blog. Time passes, tastes change, and Marvel keeps making more movies. But one thing I’ve never done before is rank their TV shows.

There are two very good reasons for that. One is the simple fact that Marvel Studios haven’t really been in the TV-making business all that long; y’see, I’m not counting MCU-adjacent series such as Agents of SHIELD, Daredevil, or Jessica Jones; and as good as X-Men ’97 is, I’m also not counting the many animated series based on Marvel comics. No, I’m very specifically referring to the Marvel Studios/Marvel Television productions that are explicitly set in the MCU; so, basically, the ones they’ve made for Disney+. As a result, I can only go back as far as 2021’s WandaVision; and in all that time, they’ve only recently slipped past ten total productions (eleven series and two one-off TV specials). So I couldn’t really have done this list very much earlier regardless.

And the second reason is that I never thought of doing it till now.

So what we have here is something very simple: a top ten ranking of my favourite MCU TV projects. I say “projects” there, and “shows” earlier on, because I’ve decided to include their two TV specials into the mix here. The line between “short film broadcast on TV” and “one-off TV programme” is a very blurry one, but I do think both the Guardians Holiday Special and Werewolf By Night fall into the latter category, and therefore I think I should include them in a ranking of TV shows, rather than shoe-horning them into a movies ranking. But that’s all there is to say, really; this is a top ten of my favourite MCU TV.

Do not adjust your set.

WandaVision (2021): MCU’s TV adventure really exploded out the gate with this stunning, genre-bending, convention-defying mystery. Utilising TV tropes and formats perfectly, it gave us the tragic downfall of Wanda, allowing a slow-burn and rather uncanny conundrum to unfold week-by-week, a fantastic use of episodic TV. Mysteries, guest stars, new characters, big Avengers; it had it all, and some great theme tuns. And it set up…

Agatha All Along (2024): maybe it’s not quite this good, but my mind’s full of it right now. The best MCU show to give us an unfurling mystery since its predecessor, once again we have a drip-feed of revelations that often lead to more questions; once again we have a cool crew of characters to fall in love with. Some terrific acting, some great songs, some real emotional heft, and some overdue progressive representation. Glory at the end.

The Guardians of the Galaxy Holiday Special (2022): at once light, breezy, and throwaway, and yet also incredibly emotional and potentially essential if you want to know these characters. Something of a hangout mini-movie, it’s a knockabout yuletide lark, but also manages to bring a tear to the eye with honest characterisation and earnest, old-fashioned love. Also has not one but two genuinely very good songs.

Ms. Marvel (2022): debuting a character so perfectly formed and perfectly cast, this is Iman Villani’s show and she knows it. Kamala Khan is a joy from start to finish, and her down-to-earth world with its down-to-earth characters is a refreshing change from the MCU’s gods and billionaires. Like Black Panther before it, simply telling these stories through the lens of another culture instantly makes them feel fresh and exciting. I hope we see more Kamala and her family very, very soon.

Hawkeye (2021): essentially a PG-13 Shane Black movie turned into a TV series, this is in many ways the perfect superhero Christmas film. But, er, a TV series. World-weary Jeremy Renner – finding new shades of Clint even now – contrasts beautifully with firecracker Hailee Steinfeld, with lots of great banter and warm feelings. But it doesn’t skimp on action, with some fantastic fights and one outrageous single-shot set-piece involving a car and a ton of trick arrows. More please.

Loki (2021-23): I think you could argue that the only MCU shows thus far that essential to the overall narrative are maybe this and WandaVision. Here we totally unpick not just the central character – and Tom Hiddleston’s multi-faceted, many-layered performance is possibly the best in the entire franchise – but also reality itself. The design of the TVA is extraordinary, and when it goes weird – multi-Lokis, time-slipping, the works – it’s a wibbly-wobbly joy. And it has arguably the best single episode – certainly the best finale – of any MCU show.

She-Hulk: Attorney at Law (2022): Marvel is often funny, but Marvel doesn’t often do outright comedy; this, then, is a rare gem. A snappy, progressive sitcom in superhero clothing, we have a stand-out central performance, a ton of great cameos, lots of genuinely hilarious jokes, and some utterly bananas fourth-wall-breaking meta-gaggery. It cost a fortune and was, I believe, considered a bit of a disappointment, so we’re probably not getting any more. Savour this sweet miracle for what it was, and be grateful.

Werewolf By Night (2022): unashamedly echoing a particular style in a way not really seen apart from the sitcom pastiche of WandaVision, this is a love letter to all kinds of classic horror, with lots of high contrast shadows and keylit screaming. Manages to be a creepy and grisly thrill-ride, but also give us some nice emotional pay-off with Man-Thing at the end.

Moon Knight (2022): a show by turns masterful and frustrating, we’re here seeing something that sadly happens a lot in the MCU: a failure to stick the landing. The magical shenanigans of Khonshu are one thing, but the highlight here is the multiple personalities of Marc Spector/Steven Grant, and how their perceptions of the world colour not just our perceptions of the show but also Moon Knight himself. Meanders a bit with a woolly ending, but some of its highs are stratospheric.

What If…? (2021-2024): a really bold swing for the fences, this is an exciting adventure show that showcases different characters in new and interesting ways. Whilst you could argue that, with the whole multiverse to play with it’s rarely all that inventive or strange, it’s nice to see, say, Nebula as a detective, or a more playful T’Challa. The animation is often very good, and the way the stories dovetail is interesting. Apparently this year’s third season will be the last. Let’s hope it goes out with a bang.

#top ten#marvel#mcu#tv#marvel television#marvel studios#wadavision#agatha all along#loki#ms marvel#hawkeye#guardians of the galaxy

13 notes

·

View notes

Text

‘Cold’ is the absence of energy; It’s why the concept of cryo-beams and the like is not so simple, because you can’t create absence. AC took much longer to figure out than heating, which is natural; The principle of AC is transferring heat from an area or things, to leave behind a space or air cold enough to cool things down. And that energy has to be kept or released elsewhere; Thus, to keep something colder, the rest of the world must become warmer in return. Equivalent exchange. Something something metaphor for limited resources or class inequality idk.

My point being: Metroids feed on energy in its purest form. And my HC is that their indestructibility comes from an energy field they project. So it’s fitting that the exact opposite of energy, the absence that is cold, is their weakness; Rendering their own energy ‘absent’ or ‘inert’ for a while, allowing Metroids to be destroyed before they draw on their potential energy reserves to thaw themselves, and project their living field again. It’s not just their cells becoming brittle, it’s that the Metroids’ shields are essentially extinguished; Perhaps cold weaponry is another tactic against energy fields in Metroid, bedsides just overwhelming them with, you guessed it, force.

All of this is why the Ice Beam is so special; It shows the brilliance of the Chozo to defy the laws of physics by creating a ‘beam’ that is seemingly infinite and can naturally place stasis upon energy. Is it entropy incarnate? Without the Ice Beam, Ice Missiles are required; These are in limited supply, being made from scratch and relying on chemicals, but when schematics are combined with Samus’ power suit, it is able to create these instead, and instantly.

Similarly, the Phrygisians generate ‘cold’ via cooling gases their bodies synthesize from their environment and the nutrition they ingest. The Vhozon Judicator relies on a similar principle, essentially producing mass from a frozen core harvested from Vho itself to shoot at targets; It is not unlike an advanced AC unit in that this core is grown by feeding it air and drawing away heat. The secret to the Judicator’s construction is guarded by the Vhozon, available only to the highest levels of the Codex.

12 notes

·

View notes

Text

No quantum exorcism for Maxwell's demon (but it doesn't need one)

In a groundbreaking discovery, researchers from Nagoya University in Japan and the Slovak Academy of Sciences have unveiled new insights into the interplay between quantum theory and thermodynamics. The team demonstrated that while quantum theory does not inherently forbid violations of the second law of thermodynamics, quantum processes may be implemented without actually breaching the law. This discovery, published in npj Quantum Information, highlights a harmonious coexistence between the two fields, despite their logical independence. Their findings open up new avenues for understanding the thermodynamic boundaries of quantum technologies, such as quantum computing and nanoscale engines.

This breakthrough contributes to the long-standing exploration of the second law of thermodynamics, a principle often regarded as one of the most profound and enigmatic in physics. The second law asserts that entropy—a measure of disorder in a system—never decreases spontaneously. It also states that a cyclically operating engine cannot produce mechanical work by extracting heat from a single thermal environment and underscores the concept of a unidirectional flow of time.

Despite its foundational role, the second law remains one of the most debated and misunderstood principles in science. Central to this debate is the paradox of “Maxwell's Demon,” a thought experiment proposed by physicist James Clerk Maxwell in 1867.

Maxwell envisioned a hypothetical being—the demon—capable of sorting fast and slow molecules within a gas at thermal equilibrium without expending energy. By separating these molecules into distinct regions, the demon could create a temperature difference. As the system returns to equilibrium, mechanical work is extracted, seemingly defying the second law of thermodynamics.

The paradox has intrigued physicists for over a century, raising questions about the law’s universality and whether it depends on the observer’s knowledge and capabilities. Solutions to the paradox have largely centered on treating the demon as a physical system subject to thermodynamic laws. A proposed solution is erasing the demon’s memory, which would require an expenditure of mechanical work, effectively offsetting the violation of the second law.

To explore this phenomenon further, the researchers developed a mathematical model for a “demonic engine,” a system powered by Maxwell’s demon. Their approach is rooted in the theory of quantum instruments, a framework introduced in the 1970s and 1980s to describe the most general forms of quantum measurement.

The model involves three steps: the demon measures a target system, then extracts work from it by coupling it to a thermal environment, and finally erases its memory by interacting with the same environment.

Using this framework, the team derived precise equations for the work expended by the demon and the work it extracts, expressed in terms of quantum information measures such as von Neumann entropy and Groenewold-Ozawa information gain. When comparing these equations, they got a surprising result.

“Our results showed that under certain conditions permitted by quantum theory, even after accounting for all costs, the work extracted can exceed the work expended, seemingly violating the second law of thermodynamics,” explained Shintaro Minagawa, a lead researcher on the project. “This revelation was as exciting as it was unexpected, challenging the assumption that quantum theory is inherently ‘demon-proof.’ There are hidden corners in the framework where Maxwell’s Demon could still work its magic.”

Despite these loopholes, the researchers emphasize that they don't pose a threat to the second law. “Our work demonstrates that, despite these theoretical vulnerabilities, it is possible to design any quantum process so that it complies with the second law,” said Hamed Mohammady. “In other words, quantum theory could potentially break the second law of thermodynamics, but it doesn't actually have to. This establishes a remarkable harmony between quantum mechanics and thermodynamics: they remain independent but never fundamentally at odds.”

This discovery also suggests that the second law does not impose strict limitations on quantum measurements. Any process permitted by quantum theory can be implemented without violating thermodynamic principles. By refining our understanding of this interplay, the researchers aim to unlock new possibilities for quantum technologies while upholding the timeless principles of thermodynamics.

“One thing we show in this paper is that quantum theory is really logically independent of the second law of thermodynamics. That is, it can violate the law simply because it does not ‘know’ about it at all,” Francesco Buscemi explained. “And yet—and this is just as remarkable—any quantum process can be realized without violating the second law of thermodynamics. This can be done by adding more systems until the thermodynamic balance is restored.” The implications of this study extend beyond theoretical physics. Illuminating the thermodynamic limits of quantum systems provides a foundation for innovations in quantum computing and nanoscale engines. As we explore the quantum realm, this research serves as a reminder of the delicate balance between the fundamental laws of nature and the potential for groundbreaking technological advancements.

7 notes

·

View notes

Text

STON.fi’s Grant Program: Fueling Innovation on TON

The world of Web3 is constantly evolving, with new ideas shaping the future of decentralized finance, gaming, and blockchain applications. But turning ideas into reality requires more than just passion—it requires resources, funding, and the right ecosystem to thrive.

That’s where STON.fi’s Grant Program comes in. As the most active decentralized exchange (DEX) on The Open Network (TON), STON.fi isn’t just facilitating seamless crypto trading—it’s actively investing in builders who are pushing the boundaries of what’s possible in Web3.

With grants of up to $10,000, developers, founders, and teams working on DeFi, GameFi, and blockchain applications now have a chance to bring their ideas to life with the support of a strong, high-utility ecosystem.

Why STON.fi

STON.fi has established itself as the leading DEX on TON, and the numbers speak for themselves:

$5.2 billion+ total trading volume (the highest among DEXs on TON)

4 million+ unique wallets (representing 81% of all DEX users on TON)

25,800+ daily active users, with 16,000 making multiple transactions daily

8,000+ new users joining each day, making it the fastest-growing DEX on TON

700+ trading pairs active daily, ensuring a dynamic, liquid market

STON.fi isn’t just growing—it’s setting the standard for DeFi activity on TON. The strength of its ecosystem makes it the perfect launchpad for new projects that need exposure, funding, and a strong technical backbone.

What Does the Grant Program Offer

The STON.fi Grant Program is more than just financial support. It’s a strategic boost that provides:

✅ Funding up to $10,000 to build and expand projects

✅ Technical integration support for leveraging STON.fi’s ecosystem

✅ Ecosystem access, ensuring collaboration and visibility

✅ Growth opportunities, including exposure to STON.fi’s vast user base

This isn’t just for DeFi protocols—NFT platforms, Web3 games, and blockchain tools that enhance the TON ecosystem are all eligible. The goal is impactful innovation, with projects that contribute to user growth, activity, and adoption on TON.

Meet the Latest Grant Winners

STON.fi has already begun funding promising projects that align with its mission. Two standout teams recently received grants:

Farmix – Leveraged Yield Farming

Farmix is redefining yield farming by offering leveraged positions on STON.fi’s liquidity pools. This allows users to optimize their farming strategies, maximize returns, and strengthen the liquidity of key pairs, including:

STON/USDt

PX/TON

STORM/TON

The project directly contributes to the growth of STON.fi’s ecosystem, increasing total value locked (TVL) and transaction volume while giving users more ways to earn.

TonTickets – Web3 Prize Gaming

TonTickets is bringing a fresh gamification model to blockchain. Players lock tokens, earn tickets, and redeem them for rewards—adding an interactive layer to Web3 engagement.

By integrating STON.fi’s swap technology, winners can instantly convert rewards into TON, creating real utility and seamless transactions. This initiative doesn’t just benefit TonTickets—it enhances the entire STON.fi ecosystem by increasing activity and liquidity.

Who Can Apply

STON.fi is looking for projects that bring real utility and innovation to the TON ecosystem. Ideal applicants include:

🚀 DeFi builders creating financial tools and liquidity solutions

🎮 GameFi projects integrating blockchain with gaming mechanics

🔗 Web3 infrastructure developers focused on trading tools, NFT utilities, and more

💡 Innovators with unique blockchain applications that strengthen TON’s adoption

STON.fi isn’t just looking for ideas—it’s looking for scalable projects with a clear roadmap and impact potential.

How to Apply

The application process is straightforward:

1️⃣ Submit your proposal, detailing the project’s goal and impact on TON

2️⃣ Show technical feasibility and explain how it integrates with STON.fi

3️⃣ Outline a roadmap that highlights your growth and development strategy

Successful applicants receive not just funding, but also technical and ecosystem support, ensuring their project can thrive within the TON blockchain.

Final Thoughts

STON.fi isn’t just a DEX—it’s a catalyst for Web3 innovation. By supporting builders with funding, infrastructure, and an active user base, it’s ensuring that TON becomes a hub for next-gen blockchain applications.

For developers, founders, and teams looking to launch, scale, and grow, this grant program offers a unique opportunity to gain funding, technical backing, and immediate exposure within a high-utility ecosystem.

The next wave of Web3 innovation is happening now. Will your project be part of it?

4 notes

·

View notes

Text

How to Make Money with Binance

In the ever-evolving world of cryptocurrency, Binance has emerged as one of the most popular and user-friendly platforms for trading digital assets. Whether you’re a seasoned trader or a complete beginner, Binance offers a plethora of opportunities to make money. From trading and staking to earning interest on your crypto holdings, the possibilities are virtually endless. In this comprehensive guide, we’ll explore various strategies to help you make money with Binance, ensuring you have the knowledge and tools to maximize your earnings.

1. Trading Cryptocurrencies

One of the most straightforward ways to make money on Binance is through trading cryptocurrencies. Binance offers a wide range of trading pairs, allowing you to buy and sell digital assets with ease. Here are some key strategies to consider:

Spot Trading: This is the most basic form of trading, where you buy cryptocurrencies at the current market price and sell them when the price increases. Binance offers a user-friendly interface, making it easy for beginners to get started.

Margin Trading: For more experienced traders, Binance offers margin trading, which allows you to borrow funds to increase your trading position. This can amplify your profits, but it also comes with higher risks.

Futures Trading: Binance Futures allows you to trade cryptocurrency contracts with leverage. This means you can open larger positions with a smaller amount of capital, potentially leading to higher profits. However, it’s essential to manage your risk carefully.

To make money through trading, it’s crucial to stay informed about market trends, use technical analysis tools, and develop a solid trading strategy. Binance provides a wealth of resources, including charts, indicators, and educational materials, to help you make informed decisions.

2. Staking and Earning Interest

Another excellent way to make money on Binance is through staking and earning interest on your crypto holdings. Binance offers several options for earning passive income:

Staking: By staking certain cryptocurrencies, you can earn rewards for participating in the network’s consensus mechanism. Binance supports a variety of staking options, including Proof of Stake (PoS) coins like Ethereum 2.0, Cardano, and Polkadot.

Savings: Binance Savings allows you to earn interest on your idle crypto assets. You can choose between flexible savings, where you can withdraw your funds at any time, or locked savings, which offers higher interest rates for fixed terms.

DeFi Staking: Binance also offers DeFi staking, where you can earn high yields by providing liquidity to decentralized finance protocols. This is a more advanced option but can be highly profitable if done correctly.

Staking and earning interest are excellent ways to make money with minimal effort. By simply holding your cryptocurrencies on Binance, you can generate a steady stream of passive income.

3. Participating in Binance Launchpad and Launchpool

Binance Launchpad and Launchpool are innovative platforms that allow users to invest in new cryptocurrency projects before they hit the mainstream market. These platforms offer unique opportunities to make money by getting in early on promising projects.

Binance Launchpad: Launchpad is a token sale platform where Binance users can purchase tokens from new projects at a discounted price. These tokens often appreciate significantly once they are listed on the exchange, providing substantial returns for early investors.

Binance Launchpool: Launchpool allows users to stake their existing cryptocurrencies to earn new tokens from upcoming projects. This is a great way to diversify your portfolio and make money by earning tokens with high growth potential.

Participating in Launchpad and Launchpool requires some research and due diligence, as not all projects will be successful. However, by carefully selecting promising projects, you can significantly increase your chances of earning substantial profits.

4. Referral Program and Affiliate Marketing

Binance offers a lucrative referral program that allows you to make money by inviting others to join the platform. Here’s how it works:

Referral Program: When you refer a friend to Binance using your unique referral link, you earn a commission on their trading fees. The more people you refer, the more you can earn. Binance offers a tiered commission structure, allowing you to earn up to 40% of your referrals’ trading fees.

Affiliate Marketing: For those with a larger audience, Binance’s affiliate marketing program offers even greater earning potential. By promoting Binance on your blog, social media, or YouTube channel, you can earn substantial commissions based on the trading volume generated by your referrals.

The referral program and affiliate marketing are excellent ways to make money with Binance, especially if you have a network of crypto enthusiasts or a strong online presence. By leveraging your connections and promoting Binance, you can generate a steady stream of passive income.

Conclusion

Binance is a versatile platform that offers numerous opportunities to make money, whether you’re a trader, investor, or content creator. From trading cryptocurrencies and staking to participating in Launchpad and earning referral commissions, the possibilities are vast. By leveraging the tools and resources provided by Binance, you can maximize your earnings and achieve your financial goals.

If you’re ready to start your journey and make money with Binance, don’t wait any longer. Click on the link below to sign up and take advantage of the incredible opportunities that Binance has to offer.

Ready to make money with Binance? Sign up today using this link and claim your 100 USD Trading Fee Credit. Start exploring the various ways to grow your crypto portfolio. Don’t miss out on the chance to earn passive income, trade with confidence, and invest in the future of finance. Join Binance now and take the first step towards financial freedom!

4 notes

·

View notes

Text

Demystifying Liquidity Provision, Farming, and Staking: A Practical Guide

The world of cryptocurrency can sometimes feel like stepping into a maze of complex terms and concepts. "Liquidity provision," "farming," and "staking" might sound intimidating at first, but these activities are more approachable than they seem. They’re not just buzzwords—they’re practical ways for you to make your crypto work for you.

In this article, I’ll break these concepts down, explain how they work, and show you why they matter, all in a way that’s relatable and easy to understand.

Liquidity Provision: Becoming the Market’s Backbone

Imagine you’re at a bustling farmer’s market. For the market to thrive, there needs to be a steady supply of goods for buyers and sellers to trade. In the crypto world, liquidity pools play the role of that marketplace. They’re stocked with two types of tokens, like ETH and USDT, allowing people to trade between them easily.

When you provide liquidity, you’re like a vendor stocking the market with your goods (tokens). In return for your contribution, you earn a share of the transaction fees every time someone trades.

It’s simple: you’re helping the system run smoothly, and you get paid for it. Platforms like STON.fi make it easy to get started with liquidity provision, offering a straightforward way to earn passive income.

Provide liquidity now

Farming: Extra Rewards for Supporting the System

Let’s take the farmer’s market analogy a step further. Imagine the market organizer thanks you for bringing in your goods by giving you bonus tokens as a reward. That’s essentially what farming is.

Once you provide liquidity, you receive LP (Liquidity Provider) tokens as proof of your contribution. By “farming,” you lock these LP tokens into a specific program to earn additional rewards.

For instance, a crypto project might incentivize farming by offering its native tokens as bonuses. The longer you stay in the farm, the more you earn. It’s like a loyalty program that rewards your commitment.

Farm tokens now

Staking: Locking Up for Long-Term Benefits

Now, let’s say you decide to deposit your earnings from the market into a savings account, locking it up for a fixed period in exchange for interest. That’s staking in a nutshell.

With staking, you lock your tokens into a network to support its operations, such as validating transactions or maintaining security. In return, you earn rewards over time.

Platforms like STON.fi offer unique incentives for staking, such as ARKENSTON (an NFT tied to your wallet) and GEMSTON (a token with governance rights). Staking not only rewards you but also allows you to play an active role in shaping the future of the platform.

Stake STON now

How They Work Together

Each of these activities serves a unique purpose:

1. Liquidity Provision: Keeps the trading system fluid and earns you transaction fees.

2. Farming: Boosts your rewards by incentivizing participation with bonus tokens.

3. Staking: Locks your assets for long-term benefits and deeper involvement in the platform’s ecosystem.

You don’t have to pick just one. Many crypto enthusiasts combine these strategies to diversify their earnings and maximize their participation in the ecosystem.

Why Should You Care

You might be wondering, “Why should I get involved?” The answer lies in both the opportunity to grow your crypto holdings and the chance to contribute to the larger vision of decentralized finance (DeFi).

Think of it this way: just like investing in stocks or real estate, liquidity provision, farming, and staking allow you to put your assets to work. The key difference? You’re actively participating in a financial revolution that’s reshaping how we interact with money.

While there are risks involved—such as token price fluctuations or smart contract vulnerabilities—the potential rewards can be worth it. It’s about balancing caution with opportunity and finding the strategies that suit your goals.

Making It Personal: Start Small, Learn, and Grow

Entering the world of liquidity provision, farming, and staking doesn’t require a massive investment or expert knowledge. It’s okay to start small, test the waters, and learn as you go.

For example, when I first tried liquidity provision, I treated it like learning a new skill. I started with a small amount, observed how the system worked, and gradually increased my participation as I gained confidence.

The same goes for farming and staking. Think of them as tools in your financial toolkit—each serving a specific purpose and working together to help you achieve your goals.

Liquidity provision, farming, and staking aren’t just technical terms—they’re opportunities. By understanding these concepts and using them wisely, you can grow your crypto holdings and actively participate in a transformative financial ecosystem.

If you’re new to crypto, don’t let the jargon scare you away. Start with what you’re comfortable with, stay curious, and remember that every small step you take adds up.

What’s your experience with liquidity provision, farming, or staking? I’d love to hear your thoughts and answer any questions you might have. Let’s navigate this journey together!

4 notes

·

View notes

Text

Demystifying Liquidity Provision, Farming, and Staking: A Practical Guide

The world of cryptocurrency can sometimes feel like stepping into a maze of complex terms and concepts. "Liquidity provision," "farming," and "staking" might sound intimidating at first, but these activities are more approachable than they seem. They’re not just buzzwords—they’re practical ways for you to make your crypto work for you.

In this article, I’ll break these concepts down, explain how they work, and show you why they matter, all in a way that’s relatable and easy to understand.

Liquidity Provision: Becoming the Market’s Backbone

Imagine you’re at a bustling farmer’s market. For the market to thrive, there needs to be a steady supply of goods for buyers and sellers to trade. In the crypto world, liquidity pools play the role of that marketplace. They’re stocked with two types of tokens, like ETH and USDT, allowing people to trade between them easily.

When you provide liquidity, you’re like a vendor stocking the market with your goods (tokens). In return for your contribution, you earn a share of the transaction fees every time someone trades.

It’s simple: you’re helping the system run smoothly, and you get paid for it. Platforms like STON.fi make it easy to get started with liquidity provision, offering a straightforward way to earn passive income.

Farming: Extra Rewards for Supporting the System

Let’s take the farmer’s market analogy a step further. Imagine the market organizer thanks you for bringing in your goods by giving you bonus tokens as a reward. That’s essentially what farming is.

Once you provide liquidity, you receive LP (Liquidity Provider) tokens as proof of your contribution. By “farming,” you lock these LP tokens into a specific program to earn additional rewards.

For instance, a crypto project might incentivize farming by offering its native tokens as bonuses. The longer you stay in the farm, the more you earn. It’s like a loyalty program that rewards your commitment.

Staking: Locking Up for Long-Term Benefits

Now, let’s say you decide to deposit your earnings from the market into a savings account, locking it up for a fixed period in exchange for interest. That’s staking in a nutshell.

With staking, you lock your tokens into a network to support its operations, such as validating transactions or maintaining security. In return, you earn rewards over time.

Platforms like STON.fi offer unique incentives for staking, such as ARKENSTON (an NFT tied to your wallet) and GEMSTON (a token with governance rights). Staking not only rewards you but also allows you to play an active role in shaping the future of the platform.

How They Work Together

Each of these activities serves a unique purpose:

1. Liquidity Provision: Keeps the trading system fluid and earns you transaction fees.

2. Farming: Boosts your rewards by incentivizing participation with bonus tokens.

3. Staking: Locks your assets for long-term benefits and deeper involvement in the platform’s ecosystem.

You don’t have to pick just one. Many crypto enthusiasts combine these strategies to diversify their earnings and maximize their participation in the ecosystem.

Why Should You Care

You might be wondering, “Why should I get involved?” The answer lies in both the opportunity to grow your crypto holdings and the chance to contribute to the larger vision of decentralized finance (DeFi).

Think of it this way: just like investing in stocks or real estate, liquidity provision, farming, and staking allow you to put your assets to work. The key difference? You’re actively participating in a financial revolution that’s reshaping how we interact with money.

While there are risks involved—such as token price fluctuations or smart contract vulnerabilities—the potential rewards can be worth it. It’s about balancing caution with opportunity and finding the strategies that suit your goals.

Making It Personal: Start Small, Learn, and Grow

Entering the world of liquidity provision, farming, and staking doesn’t require a massive investment or expert knowledge. It’s okay to start small, test the waters, and learn as you go.

For example, when I first tried liquidity provision, I treated it like learning a new skill. I started with a small amount, observed how the system worked, and gradually increased my participation as I gained confidence.

The same goes for farming and staking. Think of them as tools in your financial toolkit—each serving a specific purpose and working together to help you achieve your goals.

Liquidity provision, farming, and staking aren’t just technical terms—they’re opportunities. By understanding these concepts and using them wisely, you can grow your crypto holdings and actively participate in a transformative financial ecosystem.

If you’re new to crypto, don’t let the jargon scare you away. Start with what you’re comfortable with, stay curious, and remember that every small step you take adds up.

Visit the Stonfi Dex now

What’s your experience with liquidity provision, farming, or staking? I’d love to hear your thoughts and answer any questions you might have. Let’s navigate this journey together!

4 notes

·

View notes

Text

Understanding Arkenston and Gemston: Your Guide to STON.fi’s Key Tokens

In the world of decentralized finance (DeFi), tokens aren’t just digital assets; they are tools that empower users to engage, earn, and shape the platforms they interact with. On STON.fi—a decentralized exchange (DEX) built on The Open Network (TON) blockchain—two tokens, Arkenston and Gemston, stand out as pillars of its ecosystem. Let’s dive into what makes them special and why they matter to you.

What is STON.fi

Before we talk about the tokens, let’s get clear on what STON.fi is all about.

STON.fi is a DEX that allows users to trade without intermediaries. It’s like having a peer-to-peer marketplace for your crypto assets—efficient, transparent, and completely decentralized. The platform thrives on its commitment to giving users control, and that’s where Arkenston and Gemston come into play.

Arkenston: Your Voice, Your Power

Think of Arkenston as your membership card in an exclusive club, but with more perks than you’d expect.

Arkenston is a governance token, which means it gives holders a say in how STON.fi evolves. Imagine being able to vote on critical platform decisions, such as fee adjustments or new features. That’s the power of Arkenston—it makes you more than a user; it makes you a contributor to the platform’s future.

But that’s not all. Arkenston also unlocks exclusive features and benefits, like early access to new tools and premium services. If you’re someone who loves being part of a project’s core evolution, this token is your golden ticket.

Finally, staking Arkenston doesn’t just help secure the network—it also rewards you. Think of it as earning interest on your savings but in a decentralized and transparent way.

Gemston: Rewarding Your Contributions

While Arkenston focuses on governance, Gemston is all about incentives.

Imagine running a marathon and getting rewarded every step of the way—that’s what Gemston does for users who contribute to STON.fi. Whether you’re providing liquidity or staking your assets, Gemston ensures your efforts don’t go unnoticed.

Here’s how it works:

Liquidity Mining: By adding liquidity to the exchange, you help the platform operate smoothly, and in return, you earn Gemston tokens.

Staking Rewards: Stake your assets on the platform, and watch your Gemston balance grow. It’s a way to earn passive income while contributing to the network’s health.

Fee Discounts: Holding Gemston could also mean paying lower fees on the platform—a win-win for active users.

Why These Tokens Matter

Arkenston and Gemston aren’t just digital assets; they represent a shift in how platforms engage with their communities.

Arkenston empowers users by giving them a voice and a role in shaping the platform.

Gemston ensures users are rewarded for their contributions, creating a balanced, participatory ecosystem.

Together, these tokens foster a sense of ownership and belonging, something traditional financial systems rarely offer.

The Bigger Picture

In traditional finance, the system often feels like a closed-door meeting where only a select few have control. DeFi platforms like STON.fi flip that script, putting power back into the hands of users.

Arkenston and Gemston are perfect examples of this shift. They make the STON.fi ecosystem more than just a trading platform—it becomes a community-driven space where every user has a role and every effort is rewarded.

Final Thoughts

If you’re exploring DeFi, understanding the role of tokens like Arkenston and Gemston can help you unlock the full potential of platforms like STON.fi.

Arkenston lets you shape the platform’s future, and Gemston ensures your contributions are acknowledged and rewarded. Together, they make STON.fi a place where participation isn’t just encouraged—it’s essential.

The world of DeFi is complex, but with tools like these, it becomes a lot more engaging and rewarding. So, why not take the plunge? Explore, contribute, and grow with STON.fi.

Your journey in DeFi doesn’t have to be daunting—start with understanding and engaging. The rest will follow.

2 notes

·

View notes

Text

Understanding Arkenston & Gemston: The Building Blocks of STON.fi

If you’ve ever wondered how you can get more involved in the world of crypto, you’ve probably heard of STON.fi. It's a decentralized platform where you can stake, earn, and even vote on important decisions that shape the future of the platform. Two tokens—Arkenston and Gemston—are at the core of this system, and today, we’re going to break down what they are, how they work, and why they matter to you.

What is Arkenston; Your Voice in the STON.fi Ecosystem

Imagine being part of a team where you get to decide on the next big move, whether it’s adjusting fees or introducing new features. That’s essentially what Arkenston allows you to do.

As a governance token, Arkenston is your ticket to having a say in how things are run on STON.fi. If you’ve ever voted in a community election or been part of a club with a voting system, this is a similar concept.

Here’s why Arkenston matters:

Vote and Influence: You can vote on key changes like fee adjustments, upgrades, or new features, directly impacting the platform's development.

Exclusive Perks: Holders of Arkenston get early access to features and premium benefits that other users may not.

Earn Rewards: By staking Arkenston, you can earn passive rewards—just like putting your money in a savings account but with much higher potential returns.

If you want to have a say in STON.fi's future and unlock rewards at the same time, Arkenston is your go-to token.

What About Gemston: The Token That Rewards You

While Arkenston allows you to vote, Gemston is the token that rewards you for being actively engaged on the platform. It's like earning loyalty points for everything you do on STON.fi, whether you're contributing liquidity or staking your assets.

Here’s how you can benefit from Gemston:

Liquidity Mining: By adding liquidity to the platform, you’re helping it grow—and in return, you earn Gemston tokens.

Stake and Earn: Staking your assets doesn’t just benefit the platform—it benefits you, too. You’ll earn Gemston tokens as a reward for supporting the network.

Exclusive Benefits: Being a Gemston holder means you get discounts on fees and other special perks, which makes using STON.fi more rewarding.

The more active you are with Gemston, the more you get back—making it a token that truly values your involvement.

How Arkenston and Gemston Work Together

Both Arkenston and Gemston are designed to work hand-in-hand. Arkenston lets you influence the platform’s direction, while Gemston rewards you for helping it grow. Together, they create a balanced ecosystem that encourages both participation and governance.

Think of it like a community project:

With Arkenston, you help decide what happens next.

With Gemston, you get rewarded for putting in the effort.

By holding both tokens, you're not just a user—you’re an active participant in building and improving the STON.fi platform.

Why This Is Important in DeFi

The world of DeFi (decentralized finance) is all about creating systems where everyone has a chance to get involved and benefit. Arkenston and Gemston are key players in making that happen. They ensure that users like you have a stake in the platform, with opportunities to vote on decisions and earn rewards for being active.

By participating in both governance and rewards, you're helping to build a stronger, more decentralized ecosystem.

Wrapping Up: Why You Should Care

If you’re just starting out in DeFi or are already experienced in crypto, understanding Arkenston and Gemston can help you get more out of the STON.fi platform. These tokens give you the power to shape the future, earn rewards, and make the most of your crypto involvement.

Whether you’re voting on key decisions with Arkenston or earning rewards with Gemston, there’s something here for everyone. The world of crypto can be complex, but with these tokens, it’s easier to get involved and start reaping the benefits.

So, are you ready to dive in and start making an impact with Arkenston and Gemston? The future of STON.fi is waiting for you.

3 notes

·

View notes

Text

Introducing Sonicxswap & Sonicx.fun: First Dex & Launchpad on Sonic Blockchain

The Dawn of a New Era in DeFi

Decentralized Finance (DeFi) has transformed the financial landscape, offering users global access to financial tools without intermediaries. However, challenges like high fees, limited scalability, and lack of innovation continue to plague the ecosystem. Enter Sonicxswap and Sonicx.fun — two revolutionary platforms built on the cutting-edge Sonic blockchain. Together, they aim to redefine the DeFi experience by empowering users, developers, and communities like never before.

In this blog, we’ll explore how these platforms work, their unique features, and why they are set to lead the next wave of blockchain innovation.

What is Sonicxswap?

Sonicxswap is a next-generation decentralized exchange (DEX) built on the Sonic blockchain. Designed to provide lightning-fast transactions, ultra-low fees, and seamless user experience, Sonicxswap offers a comprehensive suite of DeFi tools, including:

Token Swapping: Effortless and secure trading of tokens with minimal fees.

Yield Farming: Earn rewards by providing liquidity to the platform.

Staking Pools: Lock your tokens to earn high annual percentage returns (APRs) while supporting network security.

Launchpad Integration: A direct connection to Sonicx.fun for early access to high-potential projects.

Why Sonicxswap Stands Out

Deflationary Tokenomics: Sonicxswap uses 80% of all fees collected to buy back and burn its native token, $SX, creating a constant upward pressure on its value.

User-Focused Features: From prediction markets to limit orders, Sonicxswap is designed with users in mind.

Cross-Chain Compatibility: Future expansions include bridging to Ethereum and Solana, making Sonicxswap a truly versatile platform.

Sonicx.fun: The Launchpad for Innovation

Every groundbreaking project needs a launchpad, and Sonicx.fun serves exactly that purpose. This decentralized platform is built for developers looking to launch their tokens with ease and transparency.

Key Features of Sonicx.fun

Token Creation Made Simple: Developers can launch tokens in minutes with low fees.

Liquidity Solutions: Automatic liquidity addition ensures a strong market foundation.

Deflationary Mechanisms: Fees collected are used to buy back and burn $SX, reducing the overall supply.

For investors, Sonicx.fun offers early access to promising projects, ensuring they are always ahead of the curve.

Why Sonic Blockchain?

Both Sonicxswap and Sonicx.fun are powered by the Sonic blockchain, a high-performance network designed to solve the key limitations of existing blockchains. Here’s why Sonic is the perfect foundation:

Scalability: Process thousands of transactions per second without network congestion.

Low Transaction Fees: Affordable fees make DeFi accessible to everyone.

Developer Incentives: Attractive rewards encourage developers to build on the Sonic ecosystem.

With the mainnet launch scheduled for December 2024, early adopters of Sonic-based platforms are positioned to gain significant advantages.

Tokenomics: $SX, The Backbone of Sonicxswap

The native token $SX powers both Sonicxswap and Sonicx.fun, enabling governance, rewards, and ecosystem participation. Here’s the breakdown of its allocation:

Presale (4%): Early investors can purchase $SX at a discounted rate.

Farm & Staking (45%): Rewards to incentivize user participation.

Liquidity (12%): Ensures stability and seamless trading.

Team (8%): Reserved for development and operations.

Exchange Listings (5%): Liquidity for centralized exchanges.

Audit & Marketing (6%): Builds trust and promotes adoption.

Airdrop & Bounty Program (5%): Rewards for community engagement.

Partner Funding (6%): Supports ecosystem partnerships.

Future Development (9%): Funds long-term platform upgrades.

This balanced allocation ensures sustainability and growth while prioritizing community rewards and long-term value creation.

Why Sonicxswap & Sonicx.fun Are Poised for Success

Both platforms have a robust roadmap and a vision that aligns with the future of blockchain. Here’s why they are destined to thrive:

Innovative Ecosystem: Combining a DEX and launchpad creates a seamless user experience.

Deflationary Model: Constant buybacks and burns of $SX ensure scarcity and value appreciation.

Community-Driven Governance: Token holders play a pivotal role in decision-making.

First-Mover Advantage: As one of the first projects on the Sonic blockchain, SonicxSwap is well-positioned to dominate.

Comprehensive Roadmap: From high-APR pools to cross-chain bridges, the platforms have ambitious plans for growth.

What’s Next for Sonicxswap and Sonicx.fun?

The journey is just beginning, and there’s much to look forward to. Here’s what’s on the horizon:

$SX Token Presale: A chance for early investors to secure tokens at discounted rates.

Mainnet Launch: Both platforms will go live when the Sonic blockchain launches in December 2024.

Airdrops & Partnerships: Rewarding the community and forming strategic collaborations.

Expansions: Bridging to Ethereum and Solana, and introducing prediction markets and perpetual trading.

Join Us on This Revolutionary Journey

Sonicxswap and Sonicx.fun are more than just platforms; they are a movement toward a decentralized, community-driven financial future. Whether you’re an investor, developer, or DeFi enthusiast, now is the time to get involved.

Get Started Today

Visit our websites: Sonicxswap and Sonicx.fun.

Follow us on social media for updates.

Linktree : https://linktr.ee/sonicxswap

Participate in the $SX presale to become a part of this transformative journey.

The future is Sonic. The future is decentralized. Join us today.

2 notes

·

View notes

Text

Introducing Sonicxswap & Sonicx.fun: First Dex & Launchpad on Sonic Blockchain

SonicxSwap

Follow on X https://x.com/SonicXswap

Join Telegram https://t.me/SonicxSwap

The Dawn of a New Era in DeFi

Decentralized Finance (DeFi) has transformed the financial landscape, offering users global access to financial tools without intermediaries. However, challenges like high fees, limited scalability, and lack of innovation continue to plague the ecosystem. Enter Sonicxswap and Sonicx.fun — two revolutionary platforms built on the cutting-edge Sonic blockchain. Together, they aim to redefine the DeFi experience by empowering users, developers, and communities like never before.

In this blog, we’ll explore how these platforms work, their unique features, and why they are set to lead the next wave of blockchain innovation.

What is Sonicxswap?

Sonicxswap is a next-generation decentralized exchange (DEX) built on the Sonic blockchain. Designed to provide lightning-fast transactions, ultra-low fees, and seamless user experience, Sonicxswap offers a comprehensive suite of DeFi tools, including:

Token Swapping: Effortless and secure trading of tokens with minimal fees.

Yield Farming: Earn rewards by providing liquidity to the platform.

Staking Pools: Lock your tokens to earn high annual percentage returns (APRs) while supporting network security.

Launchpad Integration: A direct connection to Sonicx.fun for early access to high-potential projects.

Why Sonicxswap Stands Out

Deflationary Tokenomics: Sonicxswap uses 80% of all fees collected to buy back and burn its native token, $SX, creating a constant upward pressure on its value.

User-Focused Features: From prediction markets to limit orders, Sonicxswap is designed with users in mind.

Cross-Chain Compatibility: Future expansions include bridging to Ethereum and Solana, making Sonicxswap a truly versatile platform.

Sonicx.fun: The Launchpad for Innovation

Every groundbreaking project needs a launchpad, and Sonicx.fun serves exactly that purpose. This decentralized platform is built for developers looking to launch their tokens with ease and transparency.

Key Features of Sonicx.fun

Token Creation Made Simple: Developers can launch tokens in minutes with low fees.

Liquidity Solutions: Automatic liquidity addition ensures a strong market foundation.

Deflationary Mechanisms: Fees collected are used to buy back and burn $SX, reducing the overall supply.

For investors, Sonicx.fun offers early access to promising projects, ensuring they are always ahead of the curve.

Why Sonic Blockchain?

Both Sonicxswap and Sonicx.fun are powered by the Sonic blockchain, a high-performance network designed to solve the key limitations of existing blockchains. Here’s why Sonic is the perfect foundation:

Scalability: Process thousands of transactions per second without network congestion.

Low Transaction Fees: Affordable fees make DeFi accessible to everyone.

Developer Incentives: Attractive rewards encourage developers to build on the Sonic ecosystem.

With the mainnet launch scheduled for December 2024, early adopters of Sonic-based platforms are positioned to gain significant advantages.

Tokenomics: $SX, The Backbone of Sonicxswap