#free income investments

Text

MONEY IS ESSENCIAL.

#finance#business#income#moneymindset#how to earn money#cash#investments#make money for free#financial freedom#personal finance#retirement planning#personal loans#personal income#personal saving#financeblogger#finance advisor#financetips#student loan#student loans#student loan debt#viral#loans#debt#Bad Credit Loans#Personal Loans#Quick cash Loans#nonprofits

140 notes

·

View notes

Text

i mean this in all seriousness.....

every bonus and raise i get at work is cuz i taught myself adobe automation tools and javascript for adobe (even though i took cs in hs like, i could not find a class in what i wanted so i just had to self teach it)

but the only reason i self taught that was cuz i was overly obsessed with kpop

so as long as all my savings accounts are where they should be (percentage of income-wise)... so like 401k, emergency fund, down-payment fund.......(which.....are all invested and/or in high yield 4.5% monthly compounding interest accts and are making their own money)

i can just dump all my disposable income into kpop because if i wasn't unhinged about kpop, i would not have this much disposable income lol

i feel like this is 100% an original meaning of girlmath moment tbh

#personal#i mean i also.....budget like a crazy person and save like....20-25% of my yearly gross income lol#and was doing that when i was broke too......bc im nuts and also bc the same reason my mom was nuts abt saving#(my mom was afraid shed have another stroke so she saved sooo much for retirement...and then did have to#retire early....but not bc of stroke but bc she also had CANCER what the actual fuck#like shes never done drugs and barely drinks and was a professional dancer which is like...a literal athlete..#thats NOT FAIR)#soooo she taught me how to save and invest super early lol.....like she....had me put my#bday money in an investment account every year and i was only allowed to spend interest#(explaining interest on a CD to a 8 year old by saying its a free GBA game lmao)#that was literally how she explained the $30 of interest the cd made i was like...ooo free!! i like free free is good!!#i have like.....enough to cover 2 months of basic bills (not including paychecks coming in) in checking#and then everything else is invested or in high yield.....#im so mad rn bc my 401k isnt doing that great tho....like my high yeild and my brokerage accounts are doing better#like the 401k is pretaxed and i get a very generous employer match of 5% instead of 3% so its worth#putting the money there instead of having it in my paycheck and putting it with the broker#buuuuut its annoying me#like im definitely getting more overall out of putting in 401k....but i wish it was making the same interest as my brokerage is

4 notes

·

View notes

Text

$128 to file taxes i hate turbotax kys

6 notes

·

View notes

Text

If you want to take this seriously, you have the link above to take action right now! In there are the easiest ways to make money, such as dropshipping, affiliate marketing courses, smma, youtube automation, eccomerce and more. If you want to be rich, join the club, link in bio.

#investing#marketing#economy#business#ecommerce#wifimoney#moneymaking#make money fast#make money tips#make money online#financial#moneymanagement#personal finance#make money for free#working#income

4 notes

·

View notes

Text

This sites would help you earn money for free. Check out the video for full details 👇

youtube

#passive income#online business#work from home#cash#finance#side hustle#investing#make money blogging#marketing#free money#how to earn money#how to earn passive income#how to earn online#how to earn without investment#how to make money fast#how to make money from home#earn extra money#earn extra cash#earn money online#earn money fast#earnmoneyfromhome#earnfromhome#refer and earn#earnonline#how to make money online#how to make money on youtube#how to make money with affiliate marketing#Youtube

3 notes

·

View notes

Text

cant help but think actually miami is shit because it doesn’t pay a hosting fee

#like if your only cost is having to split your event income you’re almost incentivised to make it a shitty give-away influencer event#massively over-simplifying ofc but if you do not need to recoup tens of millions on tickets to cover your hosting fee… it does not matter#what you charge or how shit the experience is for attendees. they're there for free and largely have 0 investment in the sport itself.#doesn't matter if the racing's shit theyre splashing around in the car park paddling pool anyway. stunning work guys#if youre so willing to take a cut u couldve had a more accessible model for race attendance and instead you did what the fuck ever this is

3 notes

·

View notes

Text

How To Earn Money Through Freelancing?

I am excited to discuss one of the most people want to know how to earn money through freelancing. In this post, I will guide you through the process of turning your skills and expertise into a successful freelance career. Whether you are a seasoned professional looking for greater freedom or a beginner searching for alternative income, freelancing can provide you the flexibility and financial independence. Read more...

#earn moeny#onlinemoneymaking#how to earn money#make money from home#income#make money today#money#money earning tips#earn money without investment#earn money online#make money for free#earn money today#earn money fast

2 notes

·

View notes

Text

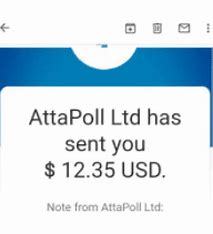

WANT TO $12 IN JUST 5 MINUTES BY DOING SIMPLE SURVEY WANT TO KNOW MY SECRET TO MAKE 6 FIGURE INCOME EVERY MONTH BY DOING THIS

CLICK HERE-https://bit.ly/3MMKfeq

#free money#survey#make money from home#earn money online#earn real money#earnings#how to earn money#how to earn online#how to earn passive income#how to earn without investment#make money for free#make money online#online earning#sidehustle#side hustle#side hustle ideas

2 notes

·

View notes

Text

Get $10 BITCOIN FREE - Also, Earn free Crypto dollar$ for learning about new coins, by simply viewing a 10 second clip and answer a quick multiple-choice question about it! $1 crypto for each question you answer!!!

#crypto#cryptocurreny trading#earn money online#earn free crypto#free money#make money#investment#passive income#coinbase#earn while you learn#free crypto#financial freedom#get money#get the bag#chasing paper#hustle#new world gold#dollars#millionaire#millionairemindset#level up#more money#bitcoin#free bitcoin#legit#ethereum#dogecoin#sandbox#nftcollectibles#cash out

2 notes

·

View notes

Text

What You’ll Get Out Of The Book:

Find out what it takes to finally quit your 9-5

Uncover the foolproof way to launch your ideal business

Master High-ROI investment strategies (36% per year)

#finance#business#income#moneymindset#how to earn money#cash#investments#make money for free#financial freedom#personal finance#retirement planning#personal loans#personal income#personal saving#financeblogger#finance advisor#financetips

2 notes

·

View notes

Text

Wealth Generation Made Simple!!!

Empower your health and wealth building potential and earn commissions while helping others do the same.

Our system takes away the challenges typically associated with building a traditional business and allows you to set in motion a passive income stream that offers you the most precious reward of all, financial freedom and the time to enjoy it with your friends and family.

Get started for free via the link below

https://www.aaoww.com/jesst

#make money websites#income#make money online#home & lifestyle#online free money#how to earn money#billionaire#work#rich#wealth#savings#investing#business#finance#commerce#banking#economie#mergers and acquisitions

3 notes

·

View notes

Text

#Training#InvestmentTraining#Invest#NewInvestors#ETFs#MutualFunds#Crypto#Cryptocurrency#Tumblr#Investing#Income#SideHustle#NYSE#DAX#DJIA#Free#Free Training#My Promo code

4 notes

·

View notes

Text

Plot armor but it’s Bruce Wayne’s wealth.

Bruce is one of the richest men in the world. Bruce does not want to be one of the richest men in world.

He starts by implementing high starting salaries and full health care coverages for all levels at Wayne Enterprises. This in vastly improves retention and worker productivity, and WE profits soar. He increases PTO, grants generous parental and family leave, funds diversity initiatives, boosts salaries again. WE is ranked “#1 worker-friendly corporation”, and productively and profits soar again.

Ok, so clearly investing his workers isn’t the profit-destroying doomed strategy his peers claim it is. Bruce is going to keep doing it obviously (his next initiative is to ensure all part-time and contractors get the same benefits and pay as full time employees), but he is going to have to find a different way to dump his money.

But you know what else is supposed to be prohibitively expensive? Green and ethical initiatives. Yes, Bruce can do that. He creates and fund a 10 year plan to covert all Wayne facilities to renewable energy. He overhauls all factories to employ the best environmentally friendly practices and technologies. He cuts contracts with all suppliers that engage in unethical employment practices and pays for other to upgrade their equipment and facilities to meet WE’s new environmental and safety requirements. He spares no expense.

Yeah, Wayne Enterprises is so successful that they spin off an entire new business arm focused on helping other companies convert to environmentally friendly and safe practices like they did in an efficient, cost effective, successful way.

Admittedly, investing in his own company was probably never going to be the best way to get rid of his wealth. He slashes his own salary to a pittance (god knows he has more money than he could possibly know what to do with already) and keeps investing the profits back into the workers, and WE keeps responding with nearly terrifying success.

So WE is a no-go, and Bruce now has numerous angry billionaires on his back because they’ve been claiming all these measures he’s implementing are too expensive to justify for decades and they’re finding it a little hard to keep the wool over everyone’s eyes when Idiot Softheart Bruice Wayne has money spilling out his ears. BUT Bruce can invest in Gotham. That’ll go well, right?

Gotham’s infrastructure is the OSHA anti-Christ and even what little is up to code is constantly getting destroyed by Rogue attacks. Surely THAT will be a money sink.

Except the only non-corrupt employer in Gotham city is….Wayne Enterprises. Or contractors or companies or businesses that somehow, in some way or other, feed back to WE. Paying wholesale for improvement to Gotham’s infrastructure somehow increases WE’s profits.

Bruce funds a full system overhaul of Gotham hospital (it’s not his fault the best administrative system software is WE—he looked), he sets up foundations and trusts for shelters, free clinics, schools, meal plans, day care, literally anything he can think of.

Gotham continues to be a shithole. Bruce Wayne continues to be richer than god against his Batman-ingrained will.

Oh, and Bruice Wayne is no longer viewed as solely a spoiled idiot nepo baby. The public responds by investing in WE and anything else he owns, and stop doing this, please.

Bruce sets up a foundation to pay the college tuition of every Gotham citizen who applies. It’s so successful that within 10 years, donations from previous recipients more than cover incoming need, and Bruce can’t even donate to his own charity.

But by this time, Bruce has children. If he can’t get rid of his wealth, he can at least distribute it, right?

Except Dick Grayson absolutely refuses to receive any of his money, won’t touch his trust fund, and in fact has never been so successful and creative with his hacking skills as he is in dumping the money BACK on Bruce. Jason died and won’t legally resurrect to take his trust fund. Tim has his own inherited wealth, refuses to inherit more, and in fact happily joins forces with Dick to hack accounts and return whatever money he tries to give them. Cass has no concept of monetary wealth and gives him panicked, overwhelmed eyes whenever he so much as implies offering more than $100 at once. Damian is showing worrying signs of following in his precious Richard’s footsteps, and Babs barely allows him to fund tech for the Clocktower. At least Steph lets him pay for her tuition and uses his credit card to buy unholy amounts of Batburger. But that is hardly a drop in the ocean of Bruce’s wealth. And she won’t even accept a trust fund of only one million.

Jason wins for best-worst child though because he currently runs a very lucrative crime empire. And although he pours the vast, vast majority of his profits back into Crime Alley, whenever he gets a little too rich for his tastes, he dumps the money on Bruce. At this point, Bruce almost wishes he was being used for money laundering because then he’s at least not have the money.

So children—generous, kindhearted, stubborn till the day they die the little shits, children—are also out.

Bruce was funding the Justice League. But then finances were leaked, and the public had an outcry over one man holding so much sway over the world’s superheroes (nevermind Bruce is one of those superheroes—but the public can’t know that). So Bruce had to do some fancy PR trickery, concede to a policy of not receiving a majority of funds from one individual, and significantly decrease his contributions because no one could match his donations.

At his wits end, Bruce hires a team of accounts to search through every crinkle and crevice of tax law to find what loopholes or shortcuts can be avoided in order to pay his damn taxes to the MAX.

The results are horrifying. According to the strictest definition of the law, the government owes him money.

Bruce burns the report, buries any evidence as deeply as he can, and organizes a foundation to lobby for FAR higher taxation of the upper class.

All this, and Wayne Enterprises is happily chugging along, churning profit, expanding into new markets, growing in the stock market, and trying to force the credit and proportionate compensation on their increasingly horrified CEO.

Bruce Wayne is one of the richest men in the world. Bruce Wayne will never not be one of the richest men in the world.

But by GOD is he trying.

#batman#bruce wayne#laws of this dc universe say Gotham is always a hellcity#and bruce wayne is always filthy rich#bruce wayne is fighting with everything he has against both those facts#he’s not going to win#but he’s not going to stop either#bruce crying with fistfuls of money in his hands: take it. PLEASE#the public: donate more???

49K notes

·

View notes

Text

.

#being caught in between my parents legal battle over what happens with the house is so weird#like on one hand i feel awkward bc they’re both telling me shit but not telling the other so i’m lowkey keeping secrets from both of them#but on the other hand i’m kinda subtly working like a bridge or some angel/demon on their shoulders?#like posing things as questions coming from me when they’re actually MUTUALLY BENEFICIAL suggestions one of them has made#but won’t make directly bc they’re no longer talking outside of lawyers for the most part#me asking my dad ‘so. like. why wouldn’t you use something like a payment plan to buy out her half of the house using your inheritance?’#my dad ‘well she’d have to accept it.’#me in my head: ‘SHES THE ONE WHO SUGGESTED IT!’#anyway#ideal scenario for everyone (except my Grandpa RIP i feel like a horrible person saying this)#would be them agreeing to a five year payment plan where my dad buys my mom out of the house#that gives my mom enough money to live on and invest some so she’s not constantly losing money with no source of income#(since she has to live the rest of her life on what she has)#and it would give my dad five years to invest some of his inheritance so he could also invest a portion of it#instead of using it all to purchase the house outright#bc my dad wants to stay in the house i wanna stay in the house and my mom literally just wants enough money to survive#which like. i feel like that’s a very fair ask of her.#*from her#most of her money is tied up in a house she doesn’t even live in while her (ex-ish) husband lives there for free#and she uses her disability cheques to just barely afford rent#not to mention the costs of coming back and forth to the mainland bc all her medical specialists are still here#anyway just another personal ramble#personal

0 notes

Text

Invest with Confidence: Expat Investment Consultations in Abu Dhabi

Introduction

Welcome to Redcliffe Partners your trusted partner for expat investment consultations in Abu Dhabi. We understand the unique financial landscape and diverse needs of expatriates residing in this vibrant emirate. With a dedicated team of experienced professionals and a comprehensive understanding of global markets, we are committed to guiding you towards sound investment decisions tailored to your individual goals and aspirations.

Understanding the Expat Investment Landscape:

Before delving into specific investment consultations, it's crucial to understand the unique landscape facing expatriates in Abu Dhabi. As an expat, you may encounter differences in taxation, regulatory frameworks, and investment options compared to your home country. Seeking expert advice tailored to your expatriate status is essential to make informed investment decisions.

The Role of Investment Consultations

Investment consultations play a pivotal role in guiding expatriates through the complexities of wealth management in Abu Dhabi. These consultations offer personalized financial advice, taking into account your unique circumstances, risk tolerance, and investment goals. By partnering with experienced consultants, expatriates can optimize their investment portfolios and maximize returns while minimizing risks.

Benefits of Expat Investment Consultations

Tailored Advice:

Unlike generic financial advice, expat investment consultations are tailored to your specific needs as an expatriate in Abu Dhabi.

Navigating Regulations:

Consultants are well-versed in local regulations, helping expatriates navigate legal complexities and compliance requirements.

Diversification Strategies:

Consultants offer insights into diversifying investment portfolios across various asset classes, minimizing exposure to risk.

Tax Optimization:

Understanding tax implications is crucial for expatriates. Consultants devise strategies to optimize tax efficiency and maximize returns.

Long-Term Planning:

Consultants help expatriates formulate long-term financial plans, ensuring financial security and stability in the future.

Finding the Right Consultant

Choosing the right investment consultant is paramount to the success of your expatriate investment journey. Consider the following factors when selecting a consultant:

Experience and Expertise

Look for consultants with a proven track record of success in guiding expatriates through investment decisions. Experience in navigating the Abu Dhabi investment landscape is invaluable.

Personalized Approach

Seek consultants who prioritize a personalized approach to financial planning. Your consultant should take the time to understand your unique financial situation, goals, and risk tolerance.

Transparency and Communication

Transparency and effective communication are essential for a fruitful consultant-client relationship. Choose consultants who are transparent about fees, investment strategies, and performance metrics.

Reputation and Reviews

Research the reputation of potential consultants through client testimonials, reviews, and referrals. A consultant with a strong reputation for integrity and client satisfaction is likely to deliver superior service.

Conclusion:

expat investment consultations in Abu Dhabi offer invaluable guidance for navigating the complexities of wealth management abroad. By partnering with experienced consultants, expatriates can optimize their investment portfolios, minimize risks, and secure their financial future. Remember to conduct thorough research, seek personalized advice, and choose reputable consultants to maximize the benefits of expat investment consultations. With the right guidance, you can harness the wealth-building potential of Abu Dhabi while enjoying the expatriate lifestyle to the fullest.

Name: Redcliffe Partners

Address: #256 Al Wafra Square Building, Reem Island, Abu Dhabi, UAE

Phone No: +971 2886-4415

Website: https://redcliffepartners.ae/

FAQ’s

What is an expat investment consultation?

Ans. An expat investment consultation is a personalized financial advisory service tailored to the unique needs and circumstances of expatriates living in Abu Dhabi.

Why do expatriates in Abu Dhabi need investment consultations?

Ans. Expatriates in Abu Dhabi need investment consultations to navigate local regulations, optimize tax efficiency, diversify their portfolios, and plan for long-term financial security while living abroad.

What are the benefits of expat investment consultations?

Ans. Benefits include personalized advice, guidance on regulations, diversification strategies, tax optimization, and long-term financial planning.

How do I find the right investment consultant in Abu Dhabi?

Ans. Look for consultants with experience, a personalized approach, transparent communication, and a strong reputation.

What types of investments are typically recommended for expatriates in Abu Dhabi?

Ans. Recommended investments may include real estate, equity, fixed-income securities, mutual funds, and ETFs diversified across asset classes.

How can I ensure the security of my investments as an expatriate in Abu Dhabi?

Ans. Ensure security by conducting research, diversifying your portfolio, staying informed, and regularly reviewing your investment strategy.

#expat investment consultations in Abu Dhabi#Redcliffe#Redcliffe Partners#investment consultants abu dhabi#free wealth consultations abu dhabi#fixed income abu dhabi#expat investment consultations abu dhabi#equity raising abu dhabi

0 notes