#global debt

Text

https://www.imf.org/en/Blogs/Articles/2021/12/15/blog-global-debt-reaches-a-record-226-trillion

1 note

·

View note

Text

Red Lobster was killed by private equity, not Endless Shrimp

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

A decade ago, a hedge fund had an improbable viral comedy hit: a 294-page slide deck explaining why Olive Garden was going out of business, blaming the failure on too many breadsticks and insufficiently salted pasta-water:

https://www.sec.gov/Archives/edgar/data/940944/000092189514002031/ex991dfan14a06297125_091114.pdf

Everyone loved this story. As David Dayen wrote for Salon, it let readers "mock that silly chain restaurant they remember from their childhoods in the suburbs" and laugh at "the silly hedge fund that took the time to write the world’s worst review":

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

But – as Dayen wrote at the time, the hedge fund that produced that slide deck, Starboard Value, was not motivated by dissatisfaction with bread-sticks. They were "activist investors" (finspeak for "rapacious assholes") with a giant stake in Darden Restaurants, Olive Garden's parent company. They wanted Darden to liquidate all of Olive Garden's real-estate holdings and declare a one-off dividend that would net investors a billion dollars, while literally yanking the floor out from beneath Olive Garden, converting it from owner to tenant, subject to rent-shocks and other nasty surprises.

They wanted to asset-strip the company, in other words ("asset strip" is what they call it in hedge-fund land; the mafia calls it a "bust-out," famous to anyone who watched the twenty-third episode of The Sopranos):

https://en.wikipedia.org/wiki/Bust_Out

Starboard didn't have enough money to force the sale, but they had recently engineered the CEO's ouster. The giant slide-deck making fun of Olive Garden's food was just a PR campaign to help it sell the bust-out by creating a narrative that they were being activists* to save this badly managed disaster of a restaurant chain.

*assholes

Starboard was bent on eviscerating Darden like a couple of entrail-maddened dogs in an elk carcass:

https://web.archive.org/web/20051220005944/http://alumni.media.mit.edu/~solan/dogsinelk/

They had forced Darden to sell off another of its holdings, Red Lobster, to a hedge-fund called Golden Gate Capital. Golden Gate flogged all of Red Lobster's real estate holdings for $2.1 billion the same day, then pissed it all away on dividends to its shareholders, including Starboard. The new landlords, a Real Estate Investment Trust, proceeded to charge so much for rent on those buildings Red Lobster just flogged that the company's net earnings immediately dropped by half.

Dayen ends his piece with these prophetic words:

Olive Garden and Red Lobster may not be destinations for hipster Internet journalists, and they have seen revenue declines amid stagnant middle-class wages and increased competition. But they are still profitable businesses. Thousands of Americans work there. Why should they be bled dry by predatory investors in the name of “shareholder value”? What of the value of worker productivity instead of the financial engineers?

Flash forward a decade. Today, Dayen is editor-in-chief of The American Prospect, one of the best sources of news about private equity looting in the world. Writing for the Prospect, Luke Goldstein picks up Dayen's story, ten years on:

https://prospect.org/economy/2024-05-22-raiding-red-lobster/

It's not pretty. Ten years of being bled out on rents and flipped from one hedge fund to another has killed Red Lobster. It just shuttered 50 restaurants and declared Chapter 11 bankruptcy. Ten years hasn't changed much; the same kind of snark that was deployed at the news of Olive Garden's imminent demise is now being hurled at Red Lobster.

Instead of dunking on free bread-sticks, Red Lobster's grave-dancers are jeering at "Endless Shrimp," a promotional deal that works exactly how it sounds like it would work. Endless Shrimp cost the chain $11m.

Which raises a question: why did Red Lobster make this money-losing offer? Are they just good-hearted slobs? Can't they do math?

Or, you know, was it another hedge-fund, bust-out scam?

Here's a hint. The supplier who provided Red Lobster with all that shrimp is Thai Union. Thai Union also owns Red Lobster. They bought the chain from Golden Gate Capital, last seen in 2014, holding a flash-sale on all of Red Lobster's buildings, pocketing billions, and cutting Red Lobster's earnings in half.

Red Lobster rose to success – 700 restaurants nationwide at its peak – by combining no-frills dining with powerful buying power, which it used to force discounts from seafood suppliers. In response, the seafood industry consolidated through a wave of mergers, turning into a cozy cartel that could resist the buyer power of Red Lobster and other major customers.

This was facilitated by conservation efforts that limited the total volume of biomass that fishers were allowed to extract, and allocated quotas to existing companies and individual fishermen. The costs of complying with this "catch management" system were high, punishingly so for small independents, bearably so for large conglomerates.

Competition from overseas fisheries drove consolidation further, as countries in the global south were blocked from implementing their own conservation efforts. US fisheries merged further, seeking economies of scale that would let them compete, largely by shafting fishermen and other suppliers. Today's Alaskan crab fishery is dominated by a four-company cartel; in the Pacific Northwest, most fish goes through a single intermediary, Pacific Seafood.

These dominant actors entered into illegal collusive arrangements with one another to rig their markets and further immiserate their suppliers, who filed antitrust suits accusing the companies of operating a monopsony (a market with a powerful buyer, akin to a monopoly, which is a market with a powerful seller):

https://www.classaction.org/news/pacific-seafood-under-fire-for-allegedly-fixing-prices-paid-to-dungeness-crabbers-in-pacific-northwest

Golden Gate bought Red Lobster in the midst of these fish wars, promising to right its ship. As Goldstein points out, that's the same promise they made when they bought Payless shoes, just before they destroyed the company and flogged it off to Alden Capital, the hedge fund that bought and destroyed dozens of America's most beloved newspapers:

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Under Golden Gate's management, Red Lobster saw its staffing levels slashed, so diners endured longer wait times to be seated and served. Then, in 2020, they sold the company to Thai Union, the company's largest supplier (a transaction Goldstein likens to a Walmart buyout of Procter and Gamble).

Thai Union continued to bleed Red Lobster, imposing more cuts and loading it up with more debts financed by yet another private equity giant, Fortress Investment Group. That brings us to today, with Thai Union having moved a gigantic amount of its own product through a failing, debt-loaded subsidiary, even as it lobbies for deregulation of American fisheries, which would let it and its lobbying partners drain American waters of the last of its depleted fish stocks.

Dayen's 2020 must-read book Monopolized describes the way that monopolies proliferate, using the US health care industry as a case-study:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

After deregulation allowed the pharma sector to consolidate, it acquired pricing power of hospitals, who found themselves gouged to the edge of bankruptcy on drug prices. Hospitals then merged into regional monopolies, which allowed them to resist pharma pricing power – and gouge health insurance companies, who saw the price of routine care explode. So the insurance companies gobbled each other up, too, leaving most of us with two or fewer choices for health insurance – even as insurance prices skyrocketed, and our benefits shrank.

Today, Americans pay more for worse healthcare, which is delivered by health workers who get paid less and work under worse conditions. That's because, lacking a regulator to consolidate patients' interests, and strong unions to consolidate workers' interests, patients and workers are easy pickings for those consolidated links in the health supply-chain.

That's a pretty good model for understanding what's happened to Red Lobster: monopoly power and monopsony power begat more monopolies and monoposonies in the supply chain. Everything that hasn't consolidated is defenseless: diners, restaurant workers, fishermen, and the environment. We're all fucked.

Decent, no-frills family restaurant are good. Great, even. I'm not the world's greatest fan of chain restaurants, but I'm also comfortably middle-class and not struggling to afford to give my family a nice night out at a place with good food, friendly staff and reasonable prices. These places are easy pickings for looters because the people who patronize them have little power in our society – and because those of us with more power are easily tricked into sneering at these places' failures as a kind of comeuppance that's all that's due to tacky joints that serve the working class.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

#pluralistic#bust-outs#private equity#pe#red lobster#olive garden#endless shrimp#class warfare#debt#looters#thai union group#enshittification#golden gate#monopsony#darden#alden global capital#Fortress Investment Group#food#david dayen#luke goldstein

6K notes

·

View notes

Text

I know I'm preaching to the choir but I think it's so fucked that the globe can be 300 *Trillion* dollars in debt, the first places governments take money from is healthcare, education, and other social services, AND in order for capitalism to be successful it requires a portion of the population to be unemployed.

So you're judged if you can't get hired but governments literally need you to be unemployed to be successful but they won't take care of you when you're unemployed because that would be too expensive (and it's your fault anyways for being lazy don't you know). But if too many people had jobs, it would increase demand which would raise prices??

and people like this system 🤢

0 notes

Text

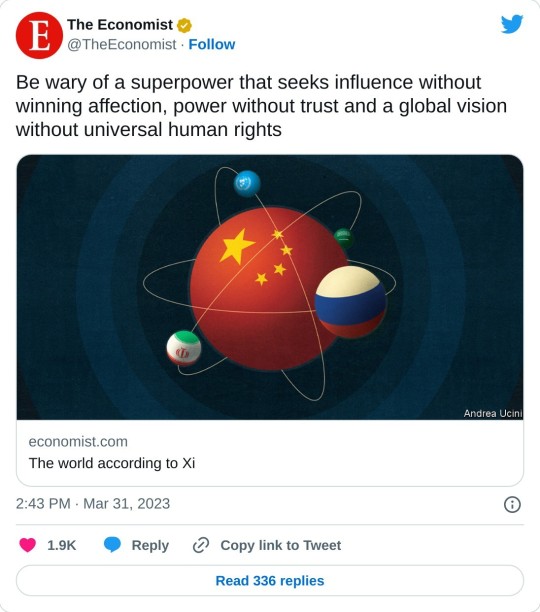

The world according to XiEven if China’s transactional diplomacy brings some gains, it contains real perilsA lesser man than Xi Jinping might have found it uncomfortable. Meeting Vladimir Putin in Moscow this week, China’s leader spoke of “peaceful co-existence and win-win co-operation”, while supping with somebody facing an international arrest warrant for war crimes. But Mr Xi is untroubled by trivial inconsistencies. He believes in the inexorable decline of the American-led world order, with its professed concern for rules and human rights. He aims to twist it into a more transactional system of deals between great powers. Do not underestimate the perils of this vision—or its appeal around the world.On Ukraine China has played an awkward hand ruthlessly and well. Its goals are subtle: to ensure Russia is subordinate but not so weak that Mr Putin’s regime implodes; to burnish its own credentials as a peacemaker in the eyes of the emerging world; and, with an eye on Taiwan, to undermine the perceived legitimacy of Western sanctions and military support as a tool of foreign policy. Mr Xi has cynically proposed a “peace plan” for Ukraine that would reward Russian aggression and which he knows Ukraine will not accept. It calls for “respecting the sovereignty of all countries”, but neglects to mention that Russia occupies more than a sixth of its neighbour.Leaders March 25th 2023The world according to XiCentral banks face an excruciating trade-offThe trouble with Emmanuel Macron’s pension victoryHow the EU should respond to American subsidiesThe machinery, structure and output of the British state need reformAs video games grow, they are eating the media

0 notes

Text

As Global Trust Ends, Nations Adopt Bitcoin - Bitcoin Magazine

As Global Trust Ends, Nations Adopt Bitcoin – Bitcoin Magazine

This is an opinion editorial by Ansel Lindner, a bitcoin and financial markets researcher and the host of the “Bitcoin & Markets” and “Fed Watch” podcasts.

Two forces have dominated the globe economically and politically for the last 75 years: globalization and trust-based money. However, the time for both of these forces has passed, and their waning will bring about a great reset of the global…

View On WordPress

0 notes

Text

Things Biden and the Democrats did, this week #22

June 7-14 2024

Vice-President Harris announced that the Consumer Financial Protection Bureau is moving to remove medical debt for people's credit score. This move will improve the credit rating of 15 million Americans. Millions of Americans struggling with debt from medical expenses can't get approved for a loan for a car, to start a small business or buy a home. The new rule will improve credit scores by an average of 20 points and lead to 22,000 additional mortgages being approved every year. This comes on top of efforts by the Biden Administration to buy up and forgive medical debt. Through money in the American Rescue Plan $7 billion dollars of medical debt will be forgiven by the end of 2026. To date state and local governments have used ARP funds to buy up and forgive the debt of 3 million Americans and counting.

The EPA, Department of Agriculture, and FDA announced a joint "National Strategy for Reducing Food Loss and Waste and Recycling Organics". The Strategy aimed to cut food waste by 50% by 2030. Currently 24% of municipal solid waste in landfills is food waste, and food waste accounts for 58% of methane emissions from landfills roughly the green house gas emissions of 60 coal-fired power plants every year. This connects to $200 million the EPA already has invested in recycling, the largest investment in recycling by the federal government in 30 years. The average American family loses $1,500 ever year in spoiled food, and the strategy through better labeling, packaging, and education hopes to save people money and reduce hunger as well as the environmental impact.

President Biden signed with Ukrainian President Zelenskyy a ten-year US-Ukraine Security Agreement. The Agreement is aimed at helping Ukraine win the war against Russia, as well as help Ukraine meet the standards it will have to be ready for EU and NATO memberships. President Biden also spearheaded efforts at the G7 meeting to secure $50 billion for Ukraine from the 7 top economic nations.

HHS announced $500 million for the development of new non-injection vaccines against Covid. The money is part of Project NextGen a $5 billion program to accelerate and streamline new Covid vaccines and treatments. The investment announced this week will support a clinical trial of 10,000 people testing a vaccine in pill form. It's also supporting two vaccines administered as nasal sprays that are in earlier stages of development. The government hopes that break throughs in non-needle based vaccines for Covid might be applied to other vaccinations thus making vaccines more widely available and more easily administered.

Secretary of State Antony Blinken announced $404 million in additional humanitarian assistance for Palestinians in Gaza, the West Bank and the region. This brings the total invested by the Biden administration in the Palestinians to $1.8 billion since taking office, over $600 million since the war started in October 2023. The money will focus on safe drinking water, health care, protection, education, shelter, and psychosocial support.

The Department of the Interior announced $142 million for drought resilience and boosting water supplies. The funding will provide about 40,000 acre-feet of annual recycled water, enough to support more than 160,000 people a year. It's funding water recycling programs in California, Hawaii, Kansas, Nevada and Texas. It's also supporting 4 water desalination projects in Southern California. Desalination is proving to be an important tool used by countries with limited freshwater.

President Biden took the lead at the G7 on the Partnership for Global Infrastructure and Investment. The PGI is a global program to connect the developing world to investment in its infrastructure from the G7 nations. So far the US has invested $40 billion into the program with a goal of $200 billion by 2027. The G7 overall plans on $600 billion by 2027. There has been heavy investment in the Lobito Corridor, an economic zone that runs from Angola, through the Democratic Republic of Congo, to Zambia, the PGI has helped connect the 3 nations by rail allowing land locked Zambia and largely landlocked DRC access Angolan ports. The PGI also is investing in a $900 million solar farm in Angola. The PGI got a $5 billion dollar investment from Microsoft aimed at expanding digital access in Kenya, Indonesia, and Malaysia. The PGI's bold vision is to connect Africa and the Indian Ocean region economically through rail and transportation link as well as boost greener economic growth in the developing world and bring developing nations on-line.

#Thanks Biden#Joe Biden#us politics#american politics#Medical debt#debt forgiveness#climate change#food waste#Covid#covid vaccine#Gaza#water resources#global development#Africa#developing countries

183 notes

·

View notes

Text

In love with the general argentinian response to those (trully stupid) accusations on "buying the cup": the response is not about ethics, is that we are poor as shit.

So when a gringo says (stupidly, baby's first worldcup): "this is all payed for messi to win", we all say "OJALÁ CAPO. I WISH. I WISH BUT WE ARE BROKE. THIS COUNTRY IS BROKE."

#argentina nt#qatar 2022#world cup#mundial#argentag#Is not about morality. fuck you. is that we are poor as shit but also have the best team ever#Wathever the result tomorrow know this: we have nothing else than this but we are full of happiness and spirirt. And we don't give a shit.#we just climb street ligths and signs and sing louder. And break the mcdonnalds in the Obelisco#as our religion dictates#how dare say we buy something we cant buy the very same meat we produce we are in the top ten of global inflation and in debt for eternity#you all just hate the hot summer poor as shit girl we are finally having

714 notes

·

View notes

Text

Global South countries are currently experiencing a debt crisis wherein governments like that of Sri Lanka are unable to service the debts they hold that are denominated in a foreign currency. Such debts began to balloon across the Global South in the aftermath of the oil crises of the 1970s. Following the Volcker Shock—and the accompanying steep rise in interest rates for dollar-denominated debts—countries that held those bonds found themselves in a situation similar to that of today. At that time, Global North governments, acting through the World Bank and International Monetary Fund (IMF), agreed to a series of bailouts conditional on Structural Adjustments Programs (SAPs). SAPs allowed these institutions to intervene directly in the fiscal policy of indebted countries and to implement neoliberal reforms which reduced public spending and opened up economies to transnational corporations.

The explicit goal of SAPs was to kickstart growth, as the only means for indebted countries to pay back their loans and to lift communities out of poverty—the implicit goal being the creation of societies mirroring those of their former colonisers. Yet the last forty years have yielded the opposite result: an explosion of inequality both within and between countries and debts at their highest level this century. To understand this trend, we need to recognise that loans to the Global South were never about achieving prosperity; instead, the intention was to reassert neo-colonial control over the decolonising world. Decolonisation reduced the Global North’s access to the cheap labour, energy and raw materials that colonialism had ensured for centuries. Debt relationships between the former colonisers and colonised recreated the conditions for the plunder of the Global South. It turned poor countries into captive markets for companies based in the Global North and created a race to the bottom in environmental and labour standards meant to attract foreign investors.

Under this arrangement, indebted countries need to grow their economies to service their debts. Growth relies on exports priced at disadvantageous rates that create ecologically unequal exchange between the Global South and Global North. Economies centred on the export of low-value-added commodities prevent the Global South from achieving full decolonisation. Fortunately, scholars of Modern Monetary Theory have shown that it is not necessary to prioritize growth for the sake of growth before investing in what countries actually need. Instead, what matters is a country’s productive capacity determined by social and ecological boundaries, and here the Global South is far richer than the Global North. To invest in necessary programmes like a Job Guarantee and Universal Public Services, however, countries must first free themselves of colonial currencies and end the cycles of debt that trap them in poverty.

Given that stopping ecologically unequal exchange is a cornerstone of degrowth, the need for debt restructuring is clear. The only question is how to achieve this revolutionary reform.

91 notes

·

View notes

Text

Link to call your senator.

-fae

77 notes

·

View notes

Text

In 2022, the first year of sharp rate hikes to curb rising inflation, the countries of the Global South paid almost $50 billion more in debt than they received in new financing, according to data from the UN’s trade and development arm

Crises, like successes, are seen through different eyes depending on who the passive subject is. And this is one of those silent shocks, a blind spot in the wide angle of the world economy. Far from the headlines, rising interest rates are taking their toll on emerging and developing countries: the Global South paid more on its debt last year in principal and interest repayments than it received in development aid and new loans. Inflows to this group of nations fell to their lowest level since the global financial crisis, according to figures from the NGO ONE Campaign. A warning sign that should give the Federal Reserve and the European Central Bank (ECB) pause for thought.

In 2022, the first year of sharp rate hikes to curb rising inflation, the countries of the Global South paid almost $50 billion more in debt than they received in new financing, according to data from the UN’s trade and development arm (UNCTAD). At the same time, official development assistance (ODA) fell for the second consecutive year and remained well below the target of 0.7% of gross national income (GNI). This target dates to the 1970s and, more than 50 years later, it has still not been met.

“We are witnessing a worrying trend: financial flows are flowing out of the developing countries that need them most and towards their creditors,” summarizes the head of UNCTAD, Rebeca Grynspan, in statements to EL PAÍS. “These are nations that need external resources to complement their internal efforts and, without a positive trend in external financing, their capacity for growth is severely limited.” The fiscal constraints imposed by this situation, she adds, make it almost impossible to achieve Sustainable Development Goals (SDGs): “Addressing the overlapping crises, such as the climate emergency, will be an unattainable challenge if these trends are not reversed.”

continue reading

#global south#debt repayments#greater than#development aid#sustainable development goals (SDGs)#nigh unachievable#capitalism

7 notes

·

View notes

Text

🇺🇲 🏦 🚨 U.S. NATIONAL DEBT RISES ABOVE $34 TRILLION FOR FIRST TIME

The United States Federal Government's total public debt has risen above $34 trillion for the first time.

According to a U.S. Treasury statement from Friday, the Federal Government's total public debt topped $34 trillion on Thursday.

Maya MacGuineas, President of the Committee for a Responsible Federal Budget, said in a statement that "the U.S. gross national debt hit $34 trillion dollars Friday, which is barely three months after it hit $33 trillion, and this truly a depressing achievement."

"There is not a single economic reason to add to the debt at the rate we are, but sadly our political leaders are unwilling to make the changes we need to turn the fiscal situation around," MacGuineas added.

#source

@WorkerSolidarityNews

#us debt#us spending#us economy#us news#us treasury#debt spending#united states#united states treasury#politics#news#geopolitics#world news#global news#international news#war news#breaking news#current events

18 notes

·

View notes

Text

How to shatter the class solidarity of the ruling class

I'm touring my new, nationally bestselling novel The Bezzle! Catch me WEDNESDAY (Apr 11) at UCLA, then Chicago (Apr 17), Torino (Apr 21) Marin County (Apr 27), Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

Audre Lorde counsels us that "The Master's Tools Will Never Dismantle the Master's House," while MLK said "the law cannot make a man love me, but it can restrain him from lynching me." Somewhere between replacing the system and using the system lies a pragmatic – if easily derailed – course.

Lorde is telling us that a rotten system can't be redeemed by using its own chosen reform mechanisms. King's telling us that unless we live, we can't fight – so anything within the system that makes it easier for your comrades to fight on can hasten the end of the system.

Take the problems of journalism. One old model of journalism funding involved wealthy newspaper families profiting handsomely by selling local appliance store owners the right to reach the townspeople who wanted to read sports-scores. These families expressed their patrician love of their town by peeling off some of those profits to pay reporters to sit through municipal council meetings or even travel overseas and get shot at.

In retrospect, this wasn't ever going to be a stable arrangement. It relied on both the inconstant generosity of newspaper barons and the absence of a superior way to show washing-machine ads to people who might want to buy washing machines. Neither of these were good long-term bets. Not only were newspaper barons easily distracted from their sense of patrician duty (especially when their own power was called into question), but there were lots of better ways to connect buyers and sellers lurking in potentia.

All of this was grossly exacerbated by tech monopolies. Tech barons aren't smarter or more evil than newspaper barons, but they have better tools, and so now they take 51 cents out of every ad dollar and 30 cents out of ever subscriber dollar and they refuse to deliver the news to users who explicitly requested it, unless the news company pays them a bribe to "boost" their posts:

https://www.eff.org/deeplinks/2023/04/saving-news-big-tech

The news is important, and people sign up to make, digest, and discuss the news for many non-economic reasons, which means that the news continues to struggle along, despite all the economic impediments and the vulture capitalists and tech monopolists who fight one another for which one will get to take the biggest bite out of the press. We've got outstanding nonprofit news outlets like Propublica, journalist-owned outlets like 404 Media, and crowdfunded reporters like Molly White (and winner-take-all outlets like the New York Times).

But as Hamilton Nolan points out, "that pot of money…is only large enough to produce a small fraction of the journalism that was being produced in past generations":

https://www.hamiltonnolan.com/p/what-will-replace-advertising-revenue

For Nolan, "public funding of journalism is the only way to fix this…If we accept that journalism is not just a business or a form of entertainment but a public good, then funding it with public money makes perfect sense":

https://www.hamiltonnolan.com/p/public-funding-of-journalism-is-the

Having grown up in Canada – under the CBC – and then lived for a quarter of my life in the UK – under the BBC – I am very enthusiastic about Nolan's solution. There are obvious problems with publicly funded journalism, like the politicization of news coverage:

https://www.theguardian.com/media/2023/jan/24/panel-approving-richard-sharp-as-bbc-chair-included-tory-party-donor

And the transformation of the funding into a cheap political football:

https://www.cbc.ca/news/politics/poilievre-defund-cbc-change-law-1.6810434

But the worst version of those problems is still better than the best version of the private-equity-funded model of news production.

But Nolan notes the emergence of a new form of hedge fund news, one that is awfully promising, and also terribly fraught: Hunterbrook Media, an investigative news outlet owned by short-sellers who pay journalists to research and publish damning reports on companies they hold a short position on:

https://hntrbrk.com/

For those of you who are blissfully distant from the machinations of the financial markets, "short selling" is a wager that a company's stock price will go down. A gambler who takes a short position on a company's stock can make a lot of money if the company stumbles or fails altogether (but if the company does well, the short can suffer literally unlimited losses).

Shorts have historically paid analysts to dig into companies and uncover the sins hidden on their balance-sheets, but as Matt Levine points out, journalists work for a fraction of the price of analysts and are at least as good at uncovering dirt as MBAs are:

https://www.bloomberg.com/opinion/articles/2024-04-02/a-hedge-fund-that-s-also-a-newspaper

What's more, shorts who discover dirt on a company still need to convince journalists to publicize their findings and trigger the sell-off that makes their short position pay off. Shorts who own a muckraking journalistic operation can skip this step: they are the journalists.

There's a way in which this is sheer genius. Well-funded shorts who don't care about the news per se can still be motivated into funding freely available, high-quality investigative journalism about corporate malfeasance (notoriously, one of the least attractive forms of journalism for advertisers). They can pay journalists top dollar – even bid against each other for the most talented journalists – and supply them with all the tools they need to ply their trade. A short won't ever try the kind of bullshit the owners of Vice pulled, paying themselves millions while their journalists lose access to Lexisnexis or the PACER database:

https://pluralistic.net/2024/02/24/anti-posse/#when-you-absolutely-positively-dont-give-a-solitary-single-fuck

The shorts whose journalists are best equipped stand to make the most money. What's not to like?

Well, the issue here is whether the ruling class's sense of solidarity is stronger than its greed. The wealthy have historically oscillated between real solidarity (think of the ultrawealthy lobbying to support bipartisan votes for tax cuts and bailouts) and "war of all against all" (as when wealthy colonizers dragged their countries into WWI after the supply of countries to steal ran out).

After all, the reason companies engage in the scams that shorts reveal is that they are profitable. "Behind every great fortune is a great crime," and that's just great. You don't win the game when you get into heaven, you win it when you get into the Forbes Rich List.

Take monopolies: investors like the upside of backing an upstart company that gobbles up some staid industry's margins – Amazon vs publishing, say, or Uber vs taxis. But while there's a lot of upside in that move, there's also a lot of risk: most companies that set out to "disrupt" an industry sink, taking their investors' capital down with them.

Contrast that with monopolies: backing a company that merges with its rivals and buys every small company that might someday grow large is a sure thing. Shriven of "wasteful competition," a company can lower quality, raise prices, capture its regulators, screw its workers and suppliers and laugh all the way to Davos. A big enough company can ignore the complaints of those workers, customers and regulators. They're not just too big to fail. They're not just too big to jail. They're too big to care:

https://pluralistic.net/2024/04/04/teach-me-how-to-shruggie/#kagi

Would-be monopolists are stuck in a high-stakes Prisoner's Dilemma. If they cooperate, they can screw over everyone else and get unimaginably rich. But if one party defects, they can raid the monopolist's margins, short its stock, and snitch to its regulators.

It's true that there's a clear incentive for hedge-fund managers to fund investigative journalism into other hedge-fund managers' portfolio companies. But it would be even more profitable for both of those hedgies to join forces and collude to screw the rest of us over. So long as they mistrust each other, we might see some benefit from that adversarial relationship. But the point of the 0.1% is that there aren't very many of them. The Aspen Institute can rent a hall that will hold an appreciable fraction of that crowd. They buy their private jets and bespoke suits and powdered rhino horn from the same exclusive sellers. Their kids go to the same elite schools. They know each other, and they have every opportunity to get drunk together at a charity ball or a society wedding and cook up a plan to join forces.

This is the problem at the core of "mechanism design" grounded in "rational self-interest." If you try to create a system where people do the right thing because they're selfish assholes, you normalize being a selfish asshole. Eventually, the selfish assholes form a cozy little League of Selfish Assholes and turn on the rest of us.

Appeals to morality don't work on unethical people, but appeals to immorality crowds out ethics. Take the ancient split between "free software" (software that is designed to maximize the freedom of the people who use it) and "open source software" (identical to free software, but promoted as a better way to make robust code through transparency and peer review).

Over the years, open source – an appeal to your own selfish need for better code – triumphed over free software, and its appeal to the ethics of a world of "software freedom." But it turns out that while the difference between "open" and "free" was once mere semantics, it's fully possible to decouple the two. Today, we have lots of "open source": you can see the code that Google, Microsoft, Apple and Facebook uses, and even contribute your labor to it for free. But you can't actually decide how the software you write works, because it all takes a loop through Google, Microsoft, Apple or Facebook's servers, and only those trillion-dollar tech monopolists have the software freedom to determine how those servers work:

https://pluralistic.net/2020/05/04/which-side-are-you-on/#tivoization-and-beyond

That's ruling class solidarity. The Big Tech firms have hidden a myriad of sins beneath their bafflegab and balance-sheets. These (as yet) undiscovered scams constitute a "bezzle," which JK Galbraith defined as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it."

The purpose of Hunterbrook is to discover and destroy bezzles, hastening the moment of realization that the wealth we all feel in a world of seemingly orderly technology is really an illusion. Hunterbrook certainly has its pick of bezzles to choose from, because we are living in a Golden Age of the Bezzle.

Which is why I titled my new novel The Bezzle. It's a tale of high-tech finance scams, starring my two-fisted forensic accountant Marty Hench, and in this volume, Hench is called upon to unwind a predatory prison-tech scam that victimizes the most vulnerable people in America – our army of prisoners – and their families:

https://us.macmillan.com/books/9781250865878/thebezzle

The scheme I fictionalize in The Bezzle is very real. Prison-tech monopolists like Securus and Viapath bribe prison officials to abolish calls, in-person visits, mail and parcels, then they supply prisoners with "free" tablets where they pay hugely inflated rates to receive mail, speak to their families, and access ebooks, distance education and other electronic media:

https://pluralistic.net/2024/04/02/captive-customers/#guillotine-watch

But a group of activists have cornered these high-tech predators, run them to ground and driven them to the brink of extinction, and they've done it using "the master's tools" – with appeals to regulators and the finance sector itself.

Writing for The Appeal, Dana Floberg and Morgan Duckett describe the campaign they waged with Worth Rises to bankrupt the prison-tech sector:

https://theappeal.org/securus-bankruptcy-prison-telecom-industry/

Here's the headline figure: Securus is $1.8 billion in debt, and it has eight months to find a financier or it will go bust. What's more, all the creditors it might reasonably approach have rejected its overtures, and its bonds have been downrated to junk status. It's a dead duck.

Even better is how this happened. Securus's debt problems started with its acquisition, a leveraged buyout by Platinum Equity, who borrowed heavily against the firm and then looted it with bogus "management fees" that meant that the debt continued to grow, despite Securus's $700m in annual revenue from America's prisoners. Platinum was just the last in a long line of PE companies that loaded up Securus with debt and merged it with its competitors, who were also mortgaged to make profits for other private equity funds.

For years, Securus and Platinum were able to service their debt and roll it over when it came due. But after Worth Rises got NYC to pass a law making jail calls free, creditors started to back away from Securus. It's one thing for Securus to charge $18 for a local call from a prison when it's splitting the money with the city jail system. But when that $18 needs to be paid by the city, they're going to demand much lower prices. To make things worse for Securus, prison reformers got similar laws passed in San Francisco and in Connecticut.

Securus tried to outrun its problems by gobbling up one of its major rivals, Icsolutions, but Worth Rises and its coalition convinced regulators at the FCC to block the merger. Securus abandoned the deal:

https://worthrises.org/blogpost/securusmerger

Then, Worth Rises targeted Platinum Equity, going after the pension funds and other investors whose capital Platinum used to keep Securus going. The massive negative press campaign led to eight-figure disinvestments:

https://www.latimes.com/business/story/2019-09-05/la-fi-tom-gores-securus-prison-phone-mass-incarceration

Now, Securus's debt became "distressed," trading at $0.47 on the dollar. A brief, covid-fueled reprieve gave Securus a temporary lifeline, as prisoners' families were barred from in-person visits and had to pay Securus's rates to talk to their incarcerated loved ones. But after lockdown, Securus's troubles picked up right where they left off.

They targeted Platinum's founder, Tom Gores, who papered over his bloody fortune by styling himself as a philanthropist and sports-team owner. After a campaign by Worth Rises and Color of Change, Gores was kicked off the Los Angeles County Museum of Art board. When Gores tried to flip Securus to a SPAC – the same scam Trump pulled with Truth Social – the negative publicity about Securus's unsound morals and financials killed the deal:

https://twitter.com/WorthRises/status/1578034977828384769

Meanwhile, more states and cities are making prisoners' communications free, further worsening Securus's finances:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

Congress passed the Martha Wright-Reed Just and Reasonable Communications Act, giving the FCC the power to regulate the price of federal prisoners' communications. Securus's debt prices tumbled further:

https://www.govtrack.us/congress/bills/117/s1541

Securus's debts were coming due: it owes $1.3b in 2024, and hundreds of millions more in 2025. Platinum has promised a $400m cash infusion, but that didn't sway S&P Global, a bond-rating agency that re-rated Securus's bonds as "CCC" (compare with "AAA"). Moody's concurred. Now, Securus is stuck selling junk-bonds:

https://www.govtrack.us/congress/bills/117/s1541

The company's creditors have given Securus an eight-month runway to find a new lender before they force it into bankruptcy. The company's debt is trading at $0.08 on the dollar.

Securus's major competitor is Viapath (prison tech is a duopoly). Viapath is also debt-burdened and desperate, thanks to a parallel campaign by Worth Rises, and has tried all of Securus's tricks, and failed:

https://pestakeholder.org/news/american-securities-fails-to-sell-prison-telecom-company-viapath/

Viapath's debts are due next year, and if Securus tanks, no one in their right mind will give Viapath a dime. They're the walking dead.

Worth Rise's brilliant guerrilla warfare against prison-tech and its private equity backers are a master class in using the master's tools to dismantle the master's house. The finance sector isn't a friend of justice or working people, but sometimes it can be used tactically against financialization itself. To paraphrase MLK, "finance can't make a corporation love you, but it can stop a corporation from destroying you."

Yes, the ruling class finds solidarity at the most unexpected moments, and yes, it's easy for appeals to greed to institutionalize greediness. But whether it's funding unbezzling journalism through short selling, or freeing prisons by brandishing their cooked balance-sheets in the faces of bond-rating agencies, there's a lot of good we can do on the way to dismantling the system.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/08/money-talks/#bullshit-walks

Image:

KMJ (modified)

https://commons.wikimedia.org/wiki/File:Boerse_01_KMJ.jpg

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#shorts#short sellers#news#private equity#private prisons#securus#prison profiteers#the bezzle#anything that cant go on forever eventually stop#steins law#hamilton nolan#Platinum Equity#American Securities#viapath#global tellink#debt#jpay#worth rises#insurance#spacs#fcc#bond rating#moodys#the appeal#saving the news from big tech#hunterbrook media#journalism

804 notes

·

View notes

Text

If Republicans take control of the House this fall, they plan on using debt limit talks — and the possibility of throwing the U.S. into default — if they don’t get their way on slashing government programs.

According to a new interview with House Minority Leader Kevin McCarthy (R-California), the party is planning on using must-pass debt ceiling legislation to force through the GOP’s agenda.

“You can’t just continue down the path to keep spending and adding to the debt,” McCarthy said in an interview with Punchbowl News, ignoring the fact that economists view national debt obligations as often signaling the health of the economy. “We’re not just going to keep lifting your credit card limit, right,” he continued. “And we should seriously sit together and [figure out] where can we eliminate some waste? Where can we make the economy grow stronger?”

When McCarthy refers to eliminating so-called waste, it is likely that he is referring to, among other things, the GOP’s plans to cut Medicare and Social Security, two of the most popular and vital anti-poverty government programs in the U.S.

Republicans have been attacking the programs over the past months. Sen. Ron Johnson (R-Wisconsin) has threatened to put budgets up to congressional debate every year, which would almost definitely lead to cuts. Alarmingly, earlier this year, the Republican Study Committee, the largest Republican caucus in the House, put out a plan to raise the age at which people receive full benefits from both programs to 70, while implementing a rule that would raise the eligibility age over time.

The debt ceiling is an effective bludgeon for Republicans to use for this purpose. The debt ceiling accounts for government funding to provide promised payments for programs like Medicare and Social Security, as well as military salaries and other “existing legal obligations,” according to the Treasury Department.

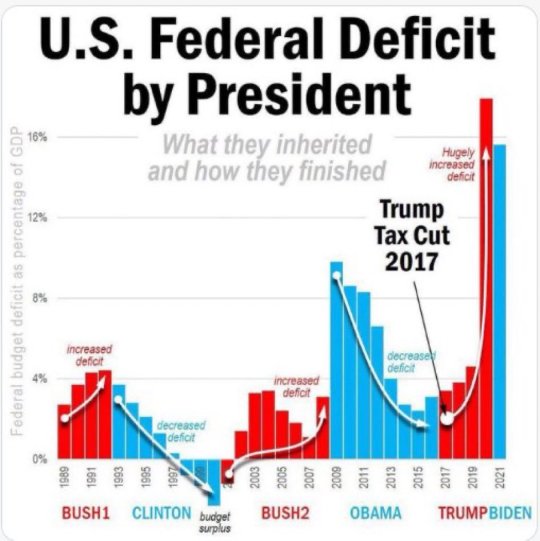

Republicans had threatened to put the U.S. in default last September, after former President Donald Trump urged the party to do so. They appeared to be posing as deficit hawks — something they only do when a Democrat is in charge — while Democrats were debating the Build Back Better Act.

If they pull a similar move in 2023, it could be similar to 2011, when the GOP manufactured a debt ceiling crisis that ultimately “led directly to the worst recovery following a recession since World War II,” according to the Economic Policy Institute.

If the debt ceiling isn’t raised by fall of 2023, when the government is slated to run out of funding, the U.S. could find itself in a situation similar to last year, when it was at risk of defaulting on its loans. This could have triggered a global recession and would have disastrous short- and long-term consequences for the U.S., as the creditworthiness of the country would be ruined.

In other words, Republicans appear to be willing to hold the U.S. and global economy on the brink of disaster in order to force Democrats to capitulate to their demands.

This way, too, Republicans can blame whatever economic fallout will come with either a default, government shutdown or cuts to Medicare and Social Security on Democrats. By pursuing these cuts during a Democratic presidency, they can point fingers at President Joe Biden if they are pushed through — potentially providing the GOP with a weapon come the 2024 election.

Republicans are laying out other plans for if they take the House, which polls say they are likely to do. GOP members of the House Education and Labor Committee have made a list of prominent labor officials like Labor Secretary Marty Walsh and National Labor Relations Board General Counsel Jennifer Abruzzo as well as Biden’s pro-worker task force to target with hearings and attacks if they take control of the House.

#us politics#news#2022 midterms#2022 elections#2022#twitter#tweet#sen. chuck schumer#sen. bernie sanders#truthout#rep. kevin mccarthy#recession#global recession#medicare#save medicare#social security#social security works#economics#economy#debt ceiling#biden administration#estate tax#sen. ron johnson#Marty Walsh#department of labor#Jennifer Abruzzo#National Labor Relations Board

117 notes

·

View notes

Text

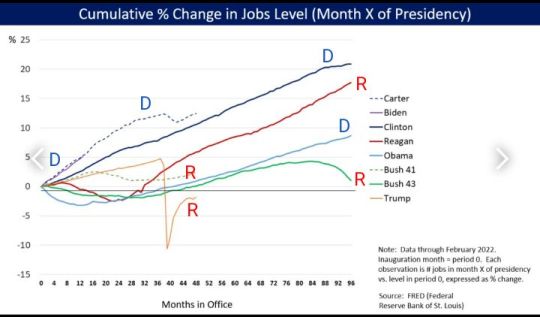

#us politics#2022#republicans#conservatives#donald trump#democrats#national debt#global recession#recession#economics#economy#vote blue#2022 elections#2022 midterms#federal deficit#job growth#quotes#2004

109 notes

·

View notes

Text

One country in the [climate-change] firing line is Cape Verde. The West African island nation, where 80% of the population lives on the coast, is already feeling the brunt of rising sea levels and increasing ocean acidity on its infrastructure, tourism, biodiversity and fisheries.

The country desperately needs to both mitigate and adapt to these problems, but – as with many Global South countries at present – simply lacks the budget to do it: Cape Verde’s debt reached an all-time high of 157% of GDP in 2021.

In a bid to address both issues simultaneously, the country has signed a novel agreement with Portugal to swap some of its debt for investments into an environmental and climate fund. The former Portuguese colony owes the Portuguese state €140m ($148m) and Portuguese banks €400m.

On a state visit to Cape Verde on 23 January, Portuguese Prime Minister António Costa announced the debt would be put towards Cape Verde’s energy transition and fight against climate change. Costa earmarked projects involving energy efficiency, renewable energy and green hydrogen as possible targets for the fund.

“This is a new seed that we sow in our future cooperation,” said Costa. “Climate change is a challenge that takes place on a global scale and no country will be sustainable if all countries are not sustainable.”

“Debt-for-climate swaps” allow countries to reduce their debt obligations in exchange for a commitment to finance domestic climate and nature projects with the freed-up financial resources. The concept has been knocking about since the 1980s, typically geared at nature conservation. However, after recent deals for Barbados, Belize and the Seychelles, and huge $800m and $1bn agreements in the offing for Ecuador and Sri Lanka, is this financial instrument finally coming of age?

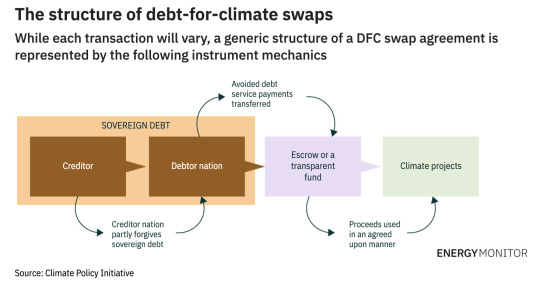

How It Works

Debt-for-climate swaps typically follow a formula. First, a creditor [here, a group or government that money is owed to] agrees to reduce debt, either by converting it into local currency, lowering the interest rate, writing off some of the debt, or a combination of all three. The debtor will then use the saved money for initiatives aimed at increasing climate resilience, lowering greenhouse gas emissions or protecting biodiversity.

The original 'debt-for-nature swaps' began as small, trilateral deals, with NGOs buying sovereign debt owed to commercial banks to redirect payments towards nature projects. They have since evolved into larger, bilateral deals between creditors and debtors...

Debt-for-climate swaps free up fiscal resources so governments can improve resilience and transition to a low-carbon economy without causing a fiscal crisis or sacrificing spending on other development priorities. [These swaps] can create additional revenue for countries with valuable biodiversity or carbon sinks by allowing them to charge others to protect those assets, thereby providing a global public good.

Swaps can even result in an upgrade to a country’s sovereign credit rating, as was the case in Belize, which makes government borrowing cheaper [and improves the country's economy.]

Right now, these [swaps] are needed more than ever, with low-income countries dealing with multiple crises that have put huge pressure on public debt...

Debt-for-climate swaps: “Increasing in size and scale”

Although debt-for-climate swaps are not new, until recently the amount of finance raised globally from the instrument has been modest – just $1bn between 1987 and 2003, according to one OECD study. Just three of the 140 swaps over the past 35 years have had a value of more than $250m, according to the African Development Bank. The average size was a mere $26.6m.

However, the market has steadily picked up pace over the past two decades... In 2016, the government of the Seychelles signed a landmark agreement with developed nation creditor group the Paris Club, supported by NGO The Nature Conservancy (TNC), for a $22m investment in marine conservation.

The government of Belize followed suit in 2021 by issuing a $364m blue bond – a debt instrument to finance marine and ocean-focused sustainability projects – to buy back $550m of commercial debt to use for marine conservation and debt sustainability.

Then, last year, Barbados completed a $150m transaction, supported by the TNC and the Inter-American Development Bank, allowing the country to reduce its borrowing costs and use savings to finance marine conservation.

“Two or three years ago, we were talking about $50m deals,” says Widge. “Now they have gone to $250–300m, so they are definitely increasing in size and scale.”

Indeed, the success of the deals for the Seychelles, Belize and Barbados, along with the debt distress sweeping across the Global South, has sparked an uptick of interest in the model.

Ecuador is reported to be in negotiations with banks and a non-profit for an $800m deal, and Sri Lanka is discussing a $1bn transaction – which would be the biggest swap to date."

-via Energy Monitor, 2/1/23

Note: I'm leaving out my massive rant about how the vast majority of this debt is due to the damages of colonialism. And also countries being forced to "PAY BACK" COLONIZERS FOR THEIR OWN FREEDOM for decades or in some cases centuries (particularly infuriating example: Haiti). Debt-for-climate swaps are good news, and one way to help right this massive historic and ongoing economic wrong

#climate change#developing countries#economics#debt for climate#debt relief#cape verde#barbados#seychelles#ecuador#sri lanka#portugal#belize#global south#conservation#biodiversity#good news#hope#international politics

52 notes

·

View notes