#how to create a blockchain wallet

Text

#blockchain#what is blockchain#blockchain explained#blockchain technology#introduction to blockchain#blockchain tutorial#introduction to blockchain technology#blockchain tutorial for beginners#how does blockchain work#blockchain technology explained#how to create a blockchain wallet#how to use blockchain#what is blockchain technology#how to create a blockchain account#how to use blockchain wallet#blockchain developer#blockchain wallet to bank account

0 notes

Text

Arbitrum Airdrop Check: How to Claim $ARB Tokens Free

Arbitrum Airdrop Check Eligibility 95% Guaranteed!

Table of Contents

Arbitrum Airdrop Introduction

2. What is the Arbitrum Airdrop?

3. Arbitrum Airdrop Claim : Eligibility and Process

4. Preparing for the Arbitrum Airdrop

5. Maximizing Your Benefits: Strategies for Participating in the Arbitrum Airdrop

6. Staying Updated: Arbitrum Airdrop News and Updates

7. Arbitrum Airdrop FAQs: Answering Your Burning Questions

8. Evaluating Risks: Assessing the Potential of the Arbitrum Airdrop

9. Success Stories: Real-Life Experiences with the Arbitrum Airdrop

10. Arbitrum Airdrop vs. Other Airdrops: A Comparative Analysis

11. Conclusion

Arbitrum Airdrop Introduction

Welcome to the ultimate guide to the Arbitrum Airdrop! If you’re new to the concept, don’t worry — we’ve got you covered. In this comprehensive blog post, we’ll walk you through everything you need to know about the Arbitrum Airdrop, from eligibility and the process to strategies for maximizing your benefits. Whether you’re an avid participant or just exploring new opportunities, this guide will equip you with the knowledge and insights to make the most of the Arbitrum Airdrop.

What is the Arbitrum Airdrop?

Arbitrum Airdrop Claim : Eligibility and Process

Who is Eligible for the Arbitrum Airdrop?

To be eligible for the Arbitrum Airdrop, individuals typically need to meet specific criteria set by the project team. While eligibility requirements may vary, they often involve factors such as existing participation in the blockchain community, contribution to the project, or fulfilling certain engagement metrics.

The Arbitrum Airdrop Claim

Getting started with the Arbitrum Airdrop is a straightforward process. Typically, participants need to create an account on the designated platform, complete the necessary step on Dappradar Airdrop Page, and approve any additional requirements outlined by the project team. Once these steps are completed, participants can sit back and await their airdrop rewards.

Preparing for the Arbitrum Airdrop

Before diving into the Arbitrum Airdrop, it’s essential to make adequate preparations. Here are some key steps to consider:

Familiarize Yourself with the Arbitrum Ecosystem: Gain an understanding of the Arbitrum blockchain, its features, and how it differs from other platforms. This knowledge will enable you to navigate the airdrop process more effectively.

2. Secure a Compatible Wallet: Ensure you have a compatible wallet that supports Arbitrum tokens. Research different wallet options and select one that aligns with your needs and offers robust security features.

3. Keep Up with Updates: Stay informed about any updates or announcements related to the Arbitrum Airdrop. Following official social media channels, joining community forums, or signing up for newsletters can provide real-time insights.

Maximizing Your Benefits: Strategies for Participating in the Arbitrum Airdrop

To make the most of the Arbitrum Airdrop, consider implementing the following strategies:

Engage Actively: Stay involved in the Arbitrum community by participating in discussions, contributing insights, or providing feedback. Active engagement can increase your chances of receiving higher airdrop rewards.

Refer Others: Many airdrop programs offer referral bonuses. Invite friends or acquaintances to join the Arbitrum Airdrop and earn additional rewards for each successful referral.

Participate in Airdrop Events: Keep an eye on airdrop events or campaigns organized by the Arbitrum team. These events often offer exclusive bonuses or incentives for participants, allowing you to maximize your benefits.

Research Airdrop Requirements: Thoroughly read and understand the airdrop requirements to ensure your actions align with the project’s expectations. This will help you avoid disqualifications and optimize your rewards.

Stake or Lock Tokens: Some airdrops offer additional rewards for individuals who stake or lock their tokens for a certain duration. Explore these options to potentially increase your benefits.

Staying Updated: Arbitrum Airdrop News and Updates

To stay up-to-date with the latest developments regarding the Arbitrum Airdrop, regularly check official communication channels such as:

* The Arbitrum official website

* Official social media accounts (Twitter, Telegram, etc.)

* Community forums and discussion boards

By staying informed, you’ll be among the first to know about any updates, changes in eligibility criteria, or new airdrop events, ensuring you don’t miss out on valuable opportunities.

Arbitrum Airdrop FAQs: Answering Your Burning Questions

Can I participate in the Arbitrum Airdrop multiple times?

* Generally, airdrops have specific limitations to prevent abuse. Most projects allow participation only once per individual to promote fairness in token distribution.

Is the Arbitrum Airdrop worth it?

* The worth of the airdrop depends on various factors, including the value of the tokens received and your personal investment goals. Assess your own circumstances and objectives to determine if the airdrop aligns with your interests.

How long do I have to hold the airdropped tokens?

* Holding periods for airdropped tokens vary from project to project. To understand the specific requirements, carefully review the airdrop guidelines provided by the Arbitrum team.

To join the arbitrum airdrop check out dapps Arbitrum Airdrop Page

Evaluating Risks: Assessing the Potential of the Arbitrum Airdrop

As with any investment or engagement opportunity, it’s crucial to assess the risks involved. Consider the following factors before participating in the Arbitrum Airdrop:

Market Volatility: Cryptocurrency markets can be highly volatile, and token values may fluctuate significantly. Be prepared for potential price changes and consider your risk tolerance.

Regulatory Environment: Regulations surrounding cryptocurrencies and airdrops differ by jurisdiction. Stay updated on any legal requirements or restrictions that may impact your participation.

Trustworthiness of the Project: Conduct thorough research to evaluate the credibility and legitimacy of the Arbitrum project. Analyze the team’s background, vision, and community trust before engaging with the airdrop.

Success Stories: Real-Life Experiences with the Arbitrum Airdrop

Hearing success stories can provide valuable insights and inspiration for participants. Here are a few examples of real-life experiences with the Arbitrum Airdrop:

1. John’s Journey: John, a blockchain enthusiast, actively engaged in the Arbitrum community and referred several friends to join. His efforts resulted in a substantial airdrop reward, which he then used to further invest in other promising projects.

2. Sarah’s Strategy: Sarah meticulously researched the various airdrop requirements and optimized her actions accordingly. By participating in multiple airdrops and timely divestment, she successfully maximized her overall benefits.

Please note that success stories are unique to individual experiences, and results may vary.

Arbitrum Airdrop vs. Other Airdrops: A Comparative Analysis

Comparing the Arbitrum Airdrop with other popular airdrops can help you better understand its advantages, potential drawbacks, and how it stacks up against the competition. Here are a few key points of comparison:

1. Token Value: Compare the projected or current value of the airdropped tokens to assess the potential upside.

2. Engagement Requirements: Evaluate the level of engagement or actions required from participants. Some airdrops may demand more effort than others, so consider your available time and commitment level.

3. Overall Benefits: Analyze the comprehensive benefits offered by different airdrops, including referral programs, staking rewards, or additional token opportunities.

Conclusion

Congratulations, you’ve reached the end of our ultimate guide to the Arbitrum Airdrop! By now, you should have a solid understanding of what the airdrop entails, how to participate, and strategies for maximizing your benefits. Remember to stay informed about updates and news, assess the potential risks, and learn from real-life success stories. Armed with this knowledge, you can confidently embark on your Arbitrum Airdrop journey and unlock exclusive rewards. Happy airdropping!

*Note: The content above is for informational purposes only and should not be considered financial or investment advice. Always do your own research and consult with professionals before making any investment decisions.*

#crypto#blockchain#defi#digitalcurrency#altcoin#investment#arbitrum#airdrop#cryptocommunity#airdropcrypto#exchange#decentralized#ethereum

27 notes

·

View notes

Text

Can you imagine what a digital white ethnostate or a cyber caliphate might look like? Having spent most of my career on the inside of online extremist movements, I certainly can. The year 2024 might be the one in which neo-Nazis, jihadists, and conspiracy theorists turn their utopian visions of creating their own self-governed states into reality—not offline, but in the form of Decentralized Autonomous Organizations (DAOs).

DAOs are digital entities that are collaboratively governed without central leadership and operate based on blockchain. They allow internet users to establish their own organizational structures, which no longer require the involvement of a third party in financial transactions and rulemaking. The World Economic Forum described DAOs as “an experiment to reimagine how we connect, collaborate and create”. However, as with all new technologies, there is also a darker side to them: They are likely to give rise to new threats emerging from decentralized extremist mobilization.

Today, there are already over 10,000 DAOs, which collectively manage billions of dollars and count millions of participants. So far, DAOs have attracted a wild mix of libertarians, activists, pranksters, and hobbyists. Most DAOs I have come across in my research sound innocent and fun. Personally, my favorites include theCaféDAO, which aims “to replace Starbucks” (good luck with that!); the Doge DAO, which wants to “make the Doge meme the most recognizable piece of art in the world”; and the HairDAO, “a decentralized asset manager solving hair loss.” But some DAOs use a more radical tone. For example, the Redacted Club DAO, which is rife with alt-right codes and conspiracy myth references, claims to be a secret network with the aim of “slaying” the “evil Meta Lizard King.”

The year 2024 might be one in which extremists start using DAOs strategically. Policies, legal contracts, and financial transactions that were traditionally the domain of governments, courts, and banks can be replaced with smart contracts, non-fungible tokens (NFTs), and cryptocurrencies. The use of anonymous bitcoin wallets and non-transparent cryptocurrencies such as Monero is already widespread among extremists whose bank accounts have been frozen. A shift to entirely decentralized forms of self-governance is only one step away.

Beyond practical reasons that encourage extremists to create their own self-governed structures, there is an ideological incentive too: their fundamental distrust in the establishment. If you believe that the deep state or the “global Jewish elites” control everything from governments and Big Tech to the global banking system, DAOs offer an appealing alternative. Conversations on far-right fringe platforms such as BitChute and Odysee reveal that there is much appetite for decentralized alternative forms of collaboration, communication, and crowdfunding.

So what happens if anti-minority groups establish their own digital worlds in which they impose their own governing mechanisms? What are the stakes if trolling armies start cooperating via DAOs to launch election interference campaigns? The activities of extremist DAOs could challenge the rule of law, pose a threat to minority groups, and disrupt institutions that are currently considered fundamental pillars of democratic systems. Another risk is that DAOs can serve as safe havens for extremist movements by enabling users to circumvent government regulation and security services monitoring activities. They might also allow extremists to find new ways to fundraise, plan, and plot radicalization campaigns or even attacks. While many governments have focused on developing legal frameworks to regulate AI, few have even recognized the existence of DAOs. Their looming exploitation for extremist and criminal purposes is something that has flown under the radar of global policymakers.

Technology expert Carl Miller, who has long warned of potential misuse of DAOs, told me that “even though DAOs behave like companies, they are not registered as legal entities.” There are only a few exceptions: The US states of Wyoming, Vermont, and Tennessee have passed laws to legally recognize DAOs. With no regulations in place to hold DAOs accountable for extremist or criminal activities, the big question for 2024 will be: How can we ensure the metaverse doesn’t give rise to digital white ethnostates or cyber caliphates?

10 notes

·

View notes

Text

The Connecter’s View on Blockchain and Its Real-World Impact!

Introduction

Blockchain technology is more than just a buzzword—it's a revolutionary shift in how we manage digital transactions and data. At The Connecter, we believe in the transformative power of blockchain to create a more secure, transparent, and user-centric digital world. Here’s our take on how blockchain is making a real-world impact.

1. User Empowerment: Full Control Over Digital Assets

Blockchain technology is fundamentally about putting power back into the hands of users. Here's how:

Decentralized Control: Unlike traditional systems that rely on central authorities, blockchain technology distributes control across a network. This decentralization ensures that no single entity has full control over the data, giving users more power and autonomy over their digital assets.

Ownership and Privacy: With blockchain, users own their data outright. Personal information and transaction details are encrypted and stored securely, ensuring that privacy is maintained and users have control over who accesses their information.

2. Enhanced Security: Protecting Your Data

Security is a major concern in the digital age, and blockchain addresses this with several key features:

Immutable Records: Once a transaction is recorded on the blockchain, it cannot be changed or deleted. This immutability ensures that the data remains accurate and tamper-proof, providing a trustworthy record of all transactions.

Advanced Encryption: Blockchain uses sophisticated encryption techniques to protect user data. This means that even if data is intercepted, it cannot be read or altered without the proper decryption key.

3. Financial Services: Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is one of the most exciting applications of blockchain technology:

Accessible Financial Tools: DeFi provides financial services to anyone with an internet connection, removing the need for traditional banking infrastructure. This opens up financial services to underserved populations around the world.

Lower Transaction Costs: By eliminating intermediaries, DeFi reduces the cost of transactions. This makes financial services more affordable and accessible, particularly for those in developing countries.

4. Global Accessibility: Breaking Down Barriers

Blockchain technology transcends borders, making it a truly global innovation:

Worldwide Reach: Transactions on the blockchain can be conducted anywhere in the world, making financial services accessible to a global audience. This is particularly beneficial for people in regions with limited access to traditional banking services.

Inclusive Platforms: At The Connecter, our digital wallet is designed to be user-friendly and accessible to everyone, regardless of their technical expertise. We believe that financial tools should be simple and intuitive, enabling more people to take advantage of blockchain technology.

5. Practical Applications: Real-World Use Cases

Blockchain technology has a wide range of practical applications that go beyond finance:

Supply Chain Transparency: Blockchain provides a transparent and immutable record of transactions, which is particularly useful in supply chains. By tracking products from origin to destination, blockchain can help reduce fraud, improve accountability, and ensure the authenticity of goods.

Healthcare Innovations: In healthcare, blockchain can be used to securely store and manage patient data. This enhances privacy and ensures that medical records are accurate and accessible only to authorized personnel, improving the overall quality of care.

6. Continuous Improvement: Staying Ahead of the Curve

At The Connecter, we are committed to continuous improvement and staying ahead of technological advancements:

User Feedback: We actively seek and integrate user feedback to refine and enhance our platform. Our goal is to create a product that meets the needs of our users and evolves with their changing requirements.

Technology Updates: Our team stays informed about the latest developments in blockchain technology. By continuously updating our platform, we ensure that our users benefit from the most advanced and secure solutions available.

Conclusion

At The Connecter, we see blockchain as a game-changer that empowers users, enhances security, and offers practical, real-world applications. By leveraging this technology, we are committed to creating a digital wallet that is secure, user-friendly, and accessible to all. Join us in exploring the incredible possibilities of blockchain technology and take control of your digital life today.

Subscribe and GET ZERO transaction FEES for 1 WEEK! 👉 https://www.theconnecter.io/zero-fees-week

#Blockchain#DigitalWallet#UserEmpowerment#SecureTech#DeFi#GlobalAccess#TechInnovation#FutureFinance#Crypto#digitalcurrency

4 notes

·

View notes

Text

A Comprehensive Guide to Solana : How to Buy Meme Tokens & Using Solana Meme Coin Maker

Introduction

In the dynamic world of cryptocurrency, Solana has emerged as a powerhouse blockchain platform known for its high speed, low fees, and scalability. Whether you’re a seasoned investor or new to the crypto scene, understanding Solana’s ecosystem can open up numerous opportunities. This guide will explore how to buy Solana, delve into the world of meme tokens on Solana, and introduce you to our platform, SolanaLauncher, a cutting-edge tool for creating your own Solana meme coins.

What is Solana?

Solana is a high-performance blockchain that supports decentralized applications and cryptocurrencies. Launched in 2020, Solana aims to provide fast, secure, and scalable blockchain solutions. Unlike many other blockchains, Solana can process thousands of transactions per second (TPS), thanks to its unique Proof of History (PoH) consensus mechanism.

Solana: How to Buy

Setting Up a Wallet

Before you can buy Solana (SOL), you need a digital wallet to store your tokens. Some popular Solana-compatible wallets include:

Phantom: A user-friendly wallet with excellent integration for Solana dApps.

Sollet: An open-source wallet that offers advanced features for developers.

Solflare: A secure wallet with staking capabilities.

Purchasing Solana

Once you have a wallet set up, you can buy Solana from major cryptocurrency exchanges. Here’s a step-by-step guide:

Choose an Exchange: Select a reputable exchange like Binance, Coinbase, or FTX.

Create an Account: Sign up and complete the necessary KYC (Know Your Customer) verification.

Deposit Funds: Deposit fiat currency (like USD) or other cryptocurrencies (like Bitcoin or Ethereum) into your exchange account.

Buy Solana: Navigate to the trading section, search for Solana (SOL), and place a buy order. You can choose a market order for immediate purchase or a limit order to buy at a specific price.

Transfer to Wallet: Once you have purchased SOL, transfer it to your Solana-compatible wallet for security.

Exploring Meme Tokens on Solana

What are Meme Tokens?

Meme tokens are a type of cryptocurrency inspired by internet memes and cultural trends. Unlike traditional cryptocurrencies, meme tokens often derive their value from social media buzz and community engagement. They can be highly volatile but offer unique opportunities for investors who can identify viral trends early.

Popular Meme Tokens on Solana

Solana’s high-speed and low-fee environment makes it an ideal platform for meme tokens. Some popular meme tokens on Solana include:

SAMO (Samoyedcoin): Inspired by the Samoyed dog breed, SAMO has garnered a strong community following.

COPE: A meme token that aims to provide users with a sense of community and belonging, COPE has seen significant engagement.

Creating Your Own Meme Token with Solana Meme Coin Maker

Why Create a Meme Token?

Creating your own meme token allows you to capitalize on viral trends, engage with a community, and even raise funds for projects. Meme tokens can serve various purposes, from entertainment and community building to innovative financial instruments.

Introducing SolanaLauncher

Our platform, SolanaLauncher, simplifies the process of creating meme tokens on Solana. With SolanaLauncher, you can generate your own meme tokens in less than three seconds without any coding knowledge. Here’s how you can get started:

Sign Up: Create an account on SolanaLauncher and log in to access the token creation tool.

Fill in Token Details: Enter the required details, such as token name, symbol, and total supply.

Generate Token: Click on “Create Token” and your meme token will be generated on the Solana blockchain instantly.

Benefits of Using SolanaLauncher

Ease of Use: SolanaLauncher is designed for users of all technical levels. You don’t need any programming skills to create your own token.

Speed: Create and deploy your token in less than three seconds, thanks to Solana’s high-speed network.

24/7 Support: Our dedicated support team is available around the clock to assist you with any questions or issues.

How to Promote Your Meme Token

Build a Community

Community engagement is crucial for the success of any meme token. Use social media platforms like Twitter, Reddit, and Discord to build and interact with your community. Regular updates, engaging content, and interactive events can help foster a loyal following.

Leverage Influencers

Collaborating with influencers in the crypto space can help boost the visibility of your meme token. Influencers can provide endorsements, share your content, and help drive community engagement.

Provide Utility

While meme tokens often start as fun projects, adding utility can enhance their value and longevity. Consider integrating your token with decentralized applications, offering staking rewards, or creating exclusive content or services for token holders.

Investing in Solana Meme Coins

Research and Due Diligence

Before investing in any meme token, conduct thorough research. Understand the project’s goals, the team behind it, and the strength of its community. Be wary of projects that lack transparency or seem too good to be true.

Diversify Your Portfolio

Diversification is key to managing risk in the volatile world of meme tokens. Spread your investments across multiple tokens and other types of cryptocurrencies to mitigate potential losses.

Stay Informed

The cryptocurrency market is highly dynamic. Stay informed about market trends, news, and developments in the Solana ecosystem. Following key influencers and joining relevant communities can provide valuable insights.

Conclusion

Solana offers a robust platform for buying, trading, and creating meme tokens, thanks to its high-speed transactions, low fees, and scalability. Whether you’re looking to invest in popular meme tokens or create your own, Solana provides the tools and infrastructure to succeed.

With SolanaLauncher, generating your own meme token has never been easier. In just a few clicks, you can turn your idea into a reality and engage with a global community. By leveraging Solana’s strengths and following best practices for investment and promotion, you can capitalize on the exciting opportunities in the meme token space.

Start your journey today with Solana and SolanaLauncher, and be part of the next wave of innovation in the cryptocurrency world. Whether you’re an investor, developer, or enthusiast, Solana’s vibrant ecosystem offers endless possibilities. Don’t miss out on the chance to be part of this revolutionary platform.

3 notes

·

View notes

Text

Introducing Surfboard Finance: Revolutionizing Blockchain Asset Management

Surfboard Finance: Revolutionizing the Future of Blockchain Asset Management

In the rapidly evolving landscape of blockchain technology, managing digital assets across multiple networks can be a complex and fragmented experience. Surfboard Finance has emerged as a game-changer, offering users a seamless and comprehensive platform to manage a diverse portfolio, from cryptocurrencies to NFTs, all within a unified interface.

Bridging the Gap in Blockchain Asset Management Blockchain enthusiasts and investors often face a significant hurdle: managing their assets spread across various networks. Each blockchain ecosystem, whether it’s Ethereum, Binance Smart Chain, or others, operates independently with its own protocols and systems. This decentralization, while innovative, creates silos that complicate asset management. Users are left juggling multiple platforms, wallets, and interfaces to track and analyze their assets, leading to inefficiencies and potential errors.

Surfboard Finance addresses these challenges head-on by aggregating data from various blockchains into one user-friendly platform. Its unique ability to provide a holistic view of assets in real-time empowers users to make well-informed decisions quickly. No more switching between wallets or interfaces – with Surfboard Finance, everything you need is at your fingertips.

The Power of AI in Blockchain

One of the standout features of Surfboard Finance is its use of AI-powered insights. In the volatile world of blockchain, timing and data-driven decisions are crucial. Surfboard's AI analyzes user portfolios and market trends, offering predictive analytics that help investors strategize effectively. This feature enhances user experience by delivering actionable insights, recommending when to buy, sell, or hold assets.

As blockchain ecosystems grow more complex, AI integration will be key in managing risk, identifying opportunities, and optimizing asset allocation. Surfboard Finance’s forward-thinking approach in this area solidifies its position as a leader in the blockchain space.

Empowering Users Through Decentralization

The ethos of decentralization remains a core principle for Surfboard Finance. Through its DAO (Decentralized Autonomous Organization) governance model, users have a direct say in the platform’s evolution. From proposing new features to voting on key decisions, Surfboard's community-driven approach empowers users to shape the future of the platform. This level of transparency and involvement fosters trust and enhances user engagement, setting Surfboard Finance apart from other platforms in the market.

Surfboard Finance’s Vision for the Future

Surfboard Finance’s roadmap is packed with exciting developments. As part of its vision for the future, the platform aims to introduce advanced analytics for deeper market insights, enhanced AI capabilities, and a mobile app for on-the-go portfolio management. Furthermore, multi-language support will expand its global reach, making blockchain asset management more accessible to users worldwide.

Strategic partnerships with key players in the blockchain and financial sectors are also on the horizon. These collaborations will enhance the platform’s capabilities and open up new opportunities for investors.

Conclusion

As blockchain technology continues to evolve, Surfboard Finance is leading the charge in simplifying and transforming asset management. By providing a unified platform with AI-driven insights, decentralized governance, and a clear vision for the future, Surfboard Finance is poised to revolutionize how users manage their digital assets.

Whether you're a seasoned blockchain investor or new to the space, Surfboard Finance offers a comprehensive solution for efficient and informed asset management.

Call to Action:

Ready to take control of your blockchain assets with Surfboard Finance? Visit our website to learn more, stay updated on new features, and be part of the community shaping the future of blockchain asset management.

Website: www.surfboard.finance

Twitter: @SurfboardFinance

Telegram: Surfboard Finance Group

2 notes

·

View notes

Text

The Critical Importance of Financial Education in the Age of Bitcoin

Imagine a world where you have complete control over your money, free from banks and government interference. This isn't a far-off dream—it's the reality that Bitcoin is creating. But with great power comes great responsibility, and that's where financial education becomes crucial. In this post, we'll explore why understanding Bitcoin is essential in today's rapidly evolving financial landscape.

The Current State of Financial Education

Financial literacy rates paint a sobering picture. According to a 2020 FINRA study, only 34% of Americans could answer 4 out of 5 basic financial literacy questions correctly. This lack of understanding often leads to poor financial decisions, leaving people vulnerable to economic uncertainties. As digital currencies gain prominence, this knowledge gap becomes even more critical.

Why Bitcoin Requires Financial Education

Bitcoin, the world's first decentralized digital currency, operates on a complex blockchain network. While its potential benefits are significant, understanding its unique characteristics is crucial:

Volatility: Bitcoin's price can fluctuate wildly. In 2021 alone, it saw a 64% increase followed by a 50% drop within months.

Security: Transactions are secured through cryptography, with ownership maintained via private keys.

Decentralization: Unlike traditional currencies, Bitcoin isn't controlled by any central authority.

Benefits of Understanding Bitcoin

Hedge Against Inflation: With a fixed supply of 21 million coins, Bitcoin is designed to be inflation-resistant.

Investment Opportunities: While volatile, Bitcoin has shown significant long-term growth potential.

Financial Freedom: Bitcoin enables peer-to-peer transactions without intermediaries, offering unprecedented financial autonomy.

Real-World Applications

Bitcoin isn't just a speculative asset. In countries like El Salvador, it's legal tender. Remittance services like BitPesa use Bitcoin to reduce transaction costs for international money transfers in Africa.

Common Misconceptions

Let's debunk some myths:

"Bitcoin is only used for illegal activities": While cryptocurrencies have been used illicitly, legitimate uses far outweigh illegal ones.

"Bitcoin has no intrinsic value": Its value comes from its utility as a decentralized, borderless payment system and its scarcity.

Environmental Concerns

It's important to address the energy consumption debate surrounding Bitcoin mining. While Bitcoin does consume significant energy, innovations in renewable energy mining are addressing these concerns.

Comparison with Other Cryptocurrencies

While Bitcoin was the first, thousands of cryptocurrencies now exist. Ethereum, for example, offers smart contract functionality, while Litecoin aims for faster transaction speeds.

Challenges in Bitcoin Education

Complexity: The technology can be daunting for newcomers.

Misinformation: The crypto space is rife with unreliable information.

Regulatory Uncertainties: Regulations vary widely across jurisdictions.

Strategies for Improving Bitcoin Literacy

Educational Resources: Leverage reputable online courses and books. Websites like Bitcoin.org offer comprehensive guides.

Community Engagement: Join forums like r/Bitcoin or attend local meetups.

Practical Experience: Start with small transactions to build familiarity.

Expert Insight

"Bitcoin is not just an asset, it's a new financial system with its own rules. Understanding these rules is crucial for anyone looking to participate in the future of finance," says Andreas Antonopoulos, a leading Bitcoin educator.

Practical First Steps

Set up a small Bitcoin wallet (try Exodus or Green Wallet).

Buy a small amount of Bitcoin on a reputable exchange like Coinbase or Kraken.

Try making a small transaction to experience how it works.

The Role of Influencers and Educators

Platforms like Unplugged Financial play a crucial role in demystifying Bitcoin. By providing clear, accurate information, these educators help bridge the knowledge gap and empower individuals.

Conclusion

As Bitcoin continues to reshape the financial landscape, understanding its principles, benefits, and challenges is vital. By investing time in financial education, you can make informed decisions and potentially harness the power of Bitcoin to achieve greater financial freedom. Remember, in the world of Bitcoin, knowledge truly is power.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#FinancialEducation#Crypto#Cryptocurrency#DigitalCurrency#Blockchain#FinancialFreedom#Investment#Decentralization#BitcoinEducation#CryptoCommunity#Money#Finance#FinancialLiteracy#BitcoinInvesting#CryptoKnowledge#BitcoinBenefits#FutureOfFinance#FinancialIndependence#unplugged financial#globaleconomy#financial education#financial empowerment#financial experts

3 notes

·

View notes

Text

Join us at the forefront of innovation with BlockCertsAI as we delve into the transformative world of Decentralized AI. Discover how blockchain technology is revolutionizing artificial intelligence, creating a new paradigm of secure, transparent, and autonomous systems. In this video, we explore the cutting-edge developments in Decentralized AI blockchain solutions that empower individuals and organizations alike.

Learn about the latest trends, the potential of Decentralized AI in various industries, and how BlockCertsAI is leading the charge in this exciting field. Whether you're a tech enthusiast, a business professional, or simply curious about the future of AI, this video is your gateway to understanding the impact and opportunities presented by Decentralized AI.

Review of the current blockchain, crypto, NFT events, and The World from Here. How to use blockchain with just one simple free download, the app store of blockchain, and the new business models using blockchain.

The first decentralized streaming software, dApps, private cloud accessed via authenticated secure digital wallet leading web 3.0. NFTs, streaming software, secure web conferencing, IM, eSignature smart contracts, file sharing, and a full choice of solutions. and Defi solution to go public on a cryptocurrency and digital exchanges.

3 notes

·

View notes

Text

Bit Loop: Redefining the future of cryptocurrency lending

Today, with the rapid development of digital currency and blockchain technology, the lending market has also ushered in earth-shaking changes. Bit Loop, an innovative lending platform based on the Ethereum network, utilizes advanced blockchain technology to provide users with secure, transparent and efficient lending solutions. This article will explain in detail how Bit Loop works, its monetization model, security measures, and its unique sharing reward system.

I. Overview of the platform

Bit Loop is a money market lending protocol based on Ethereum (EVM) that utilizes smart contract technology to allow users to make decentralized lending and lending on a global scale. This platform not only supports the lending and borrowing of cryptocurrencies, but also connects borrowers and lenders through an automatic matchmaking mechanism, creating an efficient, low-cost, high-yield financial environment.

How does it work

Through its advanced smart contract lending protocols, Bit Loop precisely matches the needs of borrowers and lenders. Once a user joins the platform and initiates a loan or provides funds, the smart contract is automatically executed, ensuring the safe circulation of funds. In addition, the platform uses the world's leading ubiquitous technology and multi-signature security system to enhance the security and transparency of transactions.

Borrowers request funds by providing collateral, while lenders provide funds on the terms offered, enjoying a fixed rate of return. All transactions are conducted directly between participants' personal wallets without the need to go through a centralized third party, greatly reducing the risk of fraud and intermediary fees.

Third, profit model

Bit Loop makes money mainly from transaction fees paid by borrowers. For example, if a borrower needs short-term funding, they may agree to pay a 1.5 percent funding supply dividend. Part of this fee will be used as a return to the lender, and the other part may be used to fund the operation and development of the platform.

Iv. Security

Security is one of the most important concerns of Bit Loop. The platform takes advantage of the immutability of the blockchain to ensure that all transaction records are open and transparent and cannot be tampered with. Smart contracts operate independently and no individual or group can control or interfere with the execution of the contract. In addition, the use of multi-signature technology increases control over the flow of funds and increases the level of security for transactions.

Sharing reward mechanisms

Bit Loop introduces a unique sharing reward system that encourages users to invite new users to join the platform. Through a personal sharing link, users can invite others to sign up and become offline. When these new users complete the transaction, the referrer will receive a shared reward based on a percentage set by the smart contract, which will be deposited directly into their wallet.

Vi. Conclusion

Bit Loop utilizes the latest blockchain technology to provide a secure, convenient and efficient lending platform. It not only provides attractive opportunities for borrowers and lenders, but also brings additional revenue to more users through its sharing reward mechanism. As the digital finance sector continues to evolve, Bit Loop is expected to become one of the leading decentralized financial services platforms, driving the convergence of traditional finance and cryptocurrency markets.

This model shows the potential and revolutionary power of blockchain technology in modern finance, and Bit Loop is just one of many examples of innovation. For users looking for a safe and efficient way to borrow money, Bit Loop offers an option not to be missed.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly

4 notes

·

View notes

Note

Hey Senpai carrd creator and I would like to answer a few questions cause I JUST saw your posts.

1. Senpia is mix of the word sentient and the abbreviation (P)lural (i)internal (a)xperience (the alternative spelling of experience is inside joke between me and my friend it references like the alternative way of living as a system hence like alternative spelling I hope that made sense) It has nothing to do with the word senpai and isn't pronounced like it at all....

2. The main reason for collecting donations is to put it towards hosting a full functional website. Websites are not free you have to pay for the domain and you also have to pay for hosting (both of which are not one time payments) and the amount of storage you get varries as well as the quality. (Like you can host a site on some places cheap but the site will load really slowly ) it's not something that's required it's optional. I chose Litecoin over Bitcoin and Ethereum because Litecoin is what is considered a "stable coin" the value stays relatively the same whereas Bitcoin and Ethereum have huge value fluctuations. You can also track crypto transactions on a Blockchain explorer like https://blockchair.com/litecoin it shows you all the money in the wallet and all of the transactions , but I understand if not everyone is comfortable with it I can find something else (Also I didn't know about PayPal business I can Google it and do more research so ty : D)

3. Cryptocurrency is not inherently bad for the environment that's misinformation crypto mining is bad for the environment 🤦♀️ as it utilizes huge amounts of energy which is powered using fossil fuel. https://earthjustice.org/feature/cryptocurrency-mining-environmental-impacts and accounts for 0.3% of global emissions worldwide https://news.climate.columbia.edu/2022/12/20/failing-crypto-could-be-a-win-for-the-environment/#:~:text=This%20takes%20enormous%20amounts%20of,all%20global%20greenhouse%20gas%20emissions.

Cryptocurrency mining is it's own sort of separate "industry"

and you can't unintentionally mine crypto? It's something you have to intentionally do and often times requires complex machines to "mint" new crypto. (Remember kids there is a lot of misinformation online and if people can't provide sources for there claims always be skeptical)

Thank you for the info!

On the whole crypto thing, I don't think people are suggesting that trading Crypto directly harms the environment. I'm not super educated on the subject so people can correct me if I'm wrong, but I think the real issue is that it's still supporting the crypto-economy.

The best comparison I can think might be Diamonds. Diamond mining is also damaging to the environment. And diamonds, like Crypto, are mostly expensive because we decided they are.

When you buy a diamond, you aren't directly harming the environment but you are creating more demand. And more demand keeps diamonds expensive which keeps them profitable for the people who are harming the environment. Industries wouldn't mine Crypto if nobody used it.

As I see it, the issue is that using Crypto incentiveses harming the environment even if you aren't harming the environment yourself. It's l the economics.

Also, I'm not sure what you mean about not being able to mine Crypto unintentionally or how it factors into the conversation but Cryptojacking exists and can use people's PCs.

If I might offer a bit of constructive criticism, I think there are a lot of issues with this that might make it inaccessible and unlikely to catch on.

The fact that the term is based on an inside joke. The acronym not really feeling accurate (why is an individual headmate referred to as a Senpia if the acronym calls it a plural internal experience?) The name itself not having its origin or meaning listed on the site. The fact that anyone who Googles it will have Google assume they meant Senpai.

And I think ideally, it would have been best to try to build a community first and show your commitment before asking for money to help setup a website. If there had already been quality guides on the page before you asked for donations, people might have been more inclined to see it as a pay-what-you-want service.

#syscourse#plural#crypto#cryptocurrency#litecoin#plurality#crypto currency#endogenic#system#multiplicity#systems#plural system#endogenic system#pro endo#pro endogenic#system stuff#endo safe#actually a system

13 notes

·

View notes

Text

This weekend’s episode of "Saturday Night Live" began with a skit poking fun at former President Donald Trump’s recently released, meme-worthy non-fungible token (NFT) collection.

“Seems like a scam and, in many ways, it is,” said James Austin Johnson, who played the 45th President in the show’s cold open.

While the mainstream media has eagerly picked up the story on the collection for its comedic value, the popularity of the Trump Digital Trading Cards has continued to climb since the collection dropped on Thursday, selling out within 24 hours.

According to data from OpenSea, the collection’s trading volume is 6,658 ether (ETH), or about $7.8 million at the time of publishing. Its floor price, which started at $99, has been hovering around 0.3 ETH, or $350.

The collection features 45,000 tokens in the style of baseball cards. In each collectible, Trump wears a different costume linked to rarity elements that allow users to enter a sweepstakes to win prizes like a zoom call with the former President or a cocktail hour at Mar-a-Lago.

In the wake of the project’s apparent success, internet sleuths have dug deep into the project and the parties behind the wallet addresses associated with Trump’s collectibles. Among the nuances and inconsistencies alleged on Twitter: the company that created the collectibles is hoarding a large amount of them; that the project poorly relies on stock imagery; and that most of the buyers opened new wallets without holding any cryptocurrency, sticking them with an NFT and no way to derive any future value from them.

THE STRANGE CASE OF 1,000 NFTS

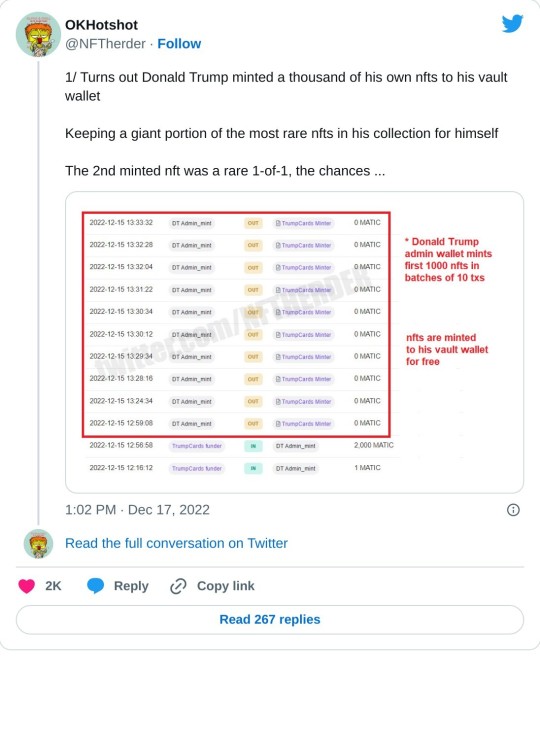

Over the weekend, Twitter user @NFTherder noticed something strange about a large number of the rarest NFTs in the collection. The user posted a thread explaining the nature of the transaction data of the contracts involved in the mint.

According to data from Polyscan, Polygon’s version of Etherscan, a “Donald Trump Admin” wallet minted 1,000 tokens to a Gnosis Safe Wallet, a multisignature smart contract wallet that requires a handful of users associated with the tokens to approve of any asset movement.

While the Collect Trump Cards site said that 44,000 of the 45,000 tokens created in the initial series would be available for users to mint, it did not specify what would happen to the remaining 1,000 tokens. Where another project might save those assets for a later date to revive demand, data suggests that the administrative wallet holds the remaining minted 1,000 tokens.

After the collapse of Three Arrows Capital, the crypto-hedge fund backed NFT collection “Starry Night” moved its tokens into a Gnosis Safe wallet, along with other valuable assets. It was likely done out of caution to hold the assets in one place to prevent any singular actor from moving these out of the wallet.

The Trump Trading Card site specified that there was a “strict limit of 100 Trump Digital Trading Cards per purchaser/household,” meaning that an individual or a group who did not have to abide by the rules for the general public was able to pick up a large swath of the NFT pool.

In addition, the mystery wallet isn’t full of second-rate NFTs. It minted 26% of the rarest 1-of-1 tokens and 28% of the autographed trading cards, according to NFTherder. These are the most valuable and expensive assets in the collection, respectively comprising 0.4% and 0.16% of the total tokens in the collection.

NFTherder told CoinDesk that not only do the wallet owners have the ability to inflate the price floor of the collection, but they also could have the ability to rig the sweepstakes and alter the competition.

“If this was a 10,000 unit collection about monkeys, the whole discord would be blowing up about how this is a rug and a scam and that the team is holding one fourth of the most rare supply,” said NFTHerder.

THE CURIOUS MARKS AND MAKER OF THE ART

While people have been digging into the wallet addresses and collection sweepstakes, other Twitter users were delving into pop culture digital artist Clark Mitchell and the artwork he created for the collection.

On-Chain TV founder Morgan Sarkissian tweeted an image of one of the collectibles featuring the 45th president in a space suit that seemed to still have a visible watermark from Shutterstock.

She also uncovered an Adobe watermark in another token listed in the collection.

Other Twitter users have found inconsistencies in the artwork, with some of the creative assets used to build the collection apparently taken from stock images or Amazon costumes.

While Mitchell has worked on other projects such as artwork for Disney, Hasbro and Marvel, this isn’t his first NFT project.

Web3 researcher and Twitter user @Valuemancer uncovered that Mitchell also did the artwork for Sylvester Stallone’s SlyGuy NFT collection that never launched, according to the digital collectibles website.

The collection included similar creative assets, such as drawings of the actor paired with exclusive access to events such as the Ultimate Stallone Experience, a dinner hosted by Stallone for token holders.

Mitchell, Sarkissian, @Valuemancer and the SlyGuy NFT collection did not respond to CoinDesk by press time.

THE SHINY NEW WALLETS WITH NO CRYPTO

While NFT collections often attract a wide range of buyers with various stake in the game, Trump’s NFT collection had a large number of buyers that appear to be new to digital collectibles.

According to data from Dune Analytics, of the nearly 12,900 users that minted Trump NFTs, about 9,300 did not hold any cryptocurrency in their wallet for gas fees – the fee all users pay for a transaction on the blockchain. If a holder has no balance of either MATIC or wETH, he is "No Gas" holder. That means he can't list his NFT for sale until he get some balance into his wallet, the Dune dashboard shows.

This means that 72% of buyers were likely purchasing NFTs for the first time.

The total number of tokens held by holders with no gas is 21,420, according to Dune Analytics, which one Twitter user pointed out may be stuck due to the more advanced nature of trading on Polygon.

“It's more like a 20,000 set than 45,000,” said Tyler Warner, staff writer at Lucky Trader on Twitter, citing the data as one of the reasons why the tokens skyrocketed in trading volume.

Warner did not respond to CoinDesk by press time.

In a harsh crypto winter where NFTs are already subject to market vulnerabilities, celebrities releasing successful NFT projects or funding Web3 ventures seems like a promising sign.

However, when the project is executed before fully working its kinks out, it does not serve as a vehicle for mass adoption. Instead, it can onboard a new user base that is not familiar with cryptocurrency or the steps needed to make a sound purchase, analyze blockchain data for irregularities and fund wallet transactions.

As projects like these continue to rise in popularity, it’s important to educate holders, dig into the details and look beyond the hype.

#us politics#news#coindesk#bitcoin#nfts#non fungible tokens#donald trump#Trump Digital Trading Cards#opensea#@NFTherder#twitter#Polyscan#Polygon#Etherscan#Gnosis Safe Wallet#Collect Trump Cards#Morgan Sarkissian#On-Chain TV#Clark Mitchell#copyright infringement#@Valuemancer#sylvester stallone#celebs#SlyGuy NFT#Dune Analytics#gas fees#Tyler Warner#blockchain#Lucky Trader#2022

30 notes

·

View notes

Text

Smart Contracts

Smart Contracts: How is Technological Advancement Revolutionizing Industries?

Highlights:

What are smart contracts?

What are some advancements in smart contract technology?

How are leading firms acquiring top positions in this sector?

In recent years, the smart contracts industry has witnessed a notable boom in growth and development, changing specifically in the form of transactions and contracts. Leveraging the power of blockchain technology, smart contracts offer feasible, dependable, and applicable solutions across several sectors.

What are smart contracts?

Smart contracts are effective agreements that self-execute and are securely stored on the blockchain. By autonomously carrying out pre-programmed responsibilities, they disrupt traditional systems by way of disposing of intermediaries. This decentralized framework offers clarity, safety, and efficiency in unique sectors consisting of finance, supply chain management, and real estate.

According to the latest report by Allied Market Research, the global smart contracts sector is predicted to exhibit a notable CAGR of 29.6% between 2023 and 2032.

What are some advancements in smart contract technology?

Over the past few years, there have been considerable advancements in the technology of smart contracts. Here are a few vital developments:

Programmability:

Smart contracts are getting more flexible and programmable than ever. They can be coded in distinct programming languages, allowing developers to create complex logic and conditions within the contract itself. This level of programmability makes it feasible to automate extraordinary commercial enterprise approaches and eliminates the need for manual intervention.

Interoperability:

Smart contracts can now consort with each other and with external systems, allowing for seamless assimilation between specific blockchain platforms. This convergence makes it possible to create new opportunities for collaboration and cross-chain transactions between decentralized applications (dApps).

Oracles:

Oracles are like external data sources that offer real-world information for smart contracts. Advancements in smart contract technology have enhanced the reliability and security of oracles and made sure that the data furnished is accurate and unalterable. This allows smart contracts to make informed decisions primarily based on updated information.

Privacy and confidentiality:

Earlier versions of smart contracts were criticized because of their insufficient privacy measures. Nevertheless, technological advances have allowed the introduction of strategies inclusive of zero-knowledge proofs and steady multi-party computation. These strategies permit private and confidential transactions to take place on public blockchains, thereby broadening the utility of smart contracts in sectors where the safety of data privacy is important.

How are leading firms acquiring top positions in this sector?

The leading players in the smart contracts sector focus more on the provision of automated transactional services to increase both flexibility and security for businesses. In order to expand their market presence, these companies give priority to the acquisition of local and small businesses. In addition, strategies such as partnerships, significant investments, and joint ventures contribute to the rising demand for such services. For instance, in August 2023, Obvious introduced a smart contract wallet called Biconomy Account Abstraction Stack, which operates through a mobile app and supports multiple channels. This wallet is intended to facilitate the execution of transactions, the implementation of custom rules, and the smoothing of complex economic interactions.

On the other hand, in June 2023, Horizen and Ankr collaborated to enhance the accessibility and scalability of the EON smart contract platform. This partnership has provided developers with a set of tools that facilitate the implementation of smart contract applications.

To sum up, the smart contracts industry is growing gradually and causing changes in various industries. As businesses and individuals understand the benefits of this innovative technology, using smart contracts is predicted to boom swiftly. Furthermore, by staying well-informed and embracing the potential of smart contracts, corporations can position themselves at the leading edge of this transformative technology.

For more details and information on smart contract platforms, contact our experts here.

Author’s Bio: Harshada Dive is a computer engineer by qualification. She has worked as a customer service associate for several years. As an Associate Content Writer, she loves to experiment with trending topics and develop her unique writing skills. When Harshada's not writing, she likes gardening and listening to motivational podcasts.

2 notes

·

View notes

Text

What’s an NFT?

Lately, you may be thinking, what exactly is an NFT?

I think I’ve figured it out after literally hours of reading. So let me share that knowledge with you. You might end up being a crypto millionaire after all.

Let’s start with the fundamentals:

NFT stands for Non- Fungible -Token.

Still nothing? Well, I can’t blame you for that! “Non-fungible” signifies that it is one-of-a-kind and cannot be substituted with anything else. A bitcoin, for example, is fungible — swap one for another and you’ll get precisely an identical item, if Bitcoin confused you just think of dollar, basically, it’s a fungible item, you can trade it, swap it but you’ll still get the same item after all. On the other hand, a one-of-a-kind trade card is non-fungible. You’d get something altogether different if you swapped it for a different card.

Most NFTs are, part of the blockchain, especially the Ethereum blockchain, as most of them are minted there. Ethereum, like Bitcoin or Solana, is a cryptocurrency, but its blockchain also enables these NFTs, which hold additional information that allows them to function differently from, say, an ETH coin. It should be noted that other blockchains can implement their own forms of NFTs. Like Solana, which at the moment is number 2 in most minted NFT’s.

But what exactly is an NFT? An NFT can be literally anything, such as a collage of small photographs, a space kitten with a rainbow trail, a JPEG of various variations of apes, a music song, or even a virtual place in the metaverse. The possibilities for what an NFT can be are nearly limitless.

Now that you know more about NFTs, you must be wondering where you can buy those fancy items of digital art. In a marketplace, not the one on Facebook, you won’t find anything there. Just like there is a marketplace where physical art is traded, like paintings or jewelry, in the same way, there is a marketplace where you can buy an NFT. Opensea is the world’s first and largest NFT marketplace at the moment.

Why is the value of NFTs so high?

Art can have countless copies, but only one original work. That is what makes the original painting valuable and irreplaceable. Let me give you another analogy. If you come into possession of the “Mona Lisa” but want to ensure that it is the original and not a copy, you will hire an expert to do his work and verify that the painting is, in fact, the original.If you want to make sure that the painting is the original and not a copy, you will hire an expert to do the work and verify that the painting is indeed the original. Well, with NFTs, that is not necessary because from the moment an NFT gets minted on the blockchain, the NFT will have a unique cryptographic id that will make it unique, and since the blockchain is a “shared ledger,” let’s say that everyone can have a look, that means that anyone and from anywhere can instantly verify the validity and uniqueness of the digital art.

How do you sell NFTs?

Essentially, you’ll post your work to a marketplace and then follow the procedures to convert it into an NFT. You will be able to offer specifications such as a task description and a proposed cost. The majority of NFTs are acquired using Ethereum. However, they may also be purchased with other ERC-20 tokens, but that is something that we will discuss in another article.

How do you make an NFT?

An NFT can be created by anyone, literally anyone. All you need is a digital wallet like Metamask or Trust wallet, a small amount of Ethereum, and access to an NFT marketplace where you can upload and convert your work into an NFT or crypto art. Isn’t it simple?

Disclaimer: All information in this blog post is provided only for informational reasons. My views are entirely my own. I make no guarantees about the information’s correctness, completeness, applicability, or validity. I shall not be held accountable for any mistakes, omissions, losses, or damages resulting from its presentation or usage. All information is supplied “as is,” with no guarantees and no rights conferred. I am not a financial advisor, and this is not financial advice.

USE my referral link: https://accounts.binance.com/en/register?ref=65793626&utm_campaign=web_share_copy

USE my referral link https://crypto.com/app/3yzhhwsejv to sign up for Crypto.com and we both get $25 USD :)

6 notes

·

View notes

Text

Cryptocurrency for Beginners: Essential Insights and Guidance

Cryptocurrency, a digital and decentralized form of money, has transformed the way we think about finance and technology.

For beginners, navigating the world of cryptocurrency can be both exciting and overwhelming.

This article serves as a comprehensive guide, offering beginners insights into the fundamental aspects, benefits, risks, and practical steps to get started in the cryptocurrency realm.

youtube

Understanding Cryptocurrency: The Basics

At its core, cryptocurrency is a digital or virtual form of currency that utilizes cryptographic techniques to secure transactions and control the creation of new units.

Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

1. How Cryptocurrencies Work

Cryptocurrencies operate on blockchain technology, which is a distributed and immutable ledger that records all transactions.

Each transaction is grouped into a "block," and these blocks are linked together, creating a chain of information.

This decentralized nature ensures transparency, security, and resistance to censorship as Perseus Crypto explains it nicely.

2. Key Cryptocurrency Concepts

Blockchain: A decentralized ledger that records all transactions in a secure and transparent manner.

Wallet: A digital tool that stores your cryptocurrency holdings, enabling you to send, receive, and manage your coins.

Private and Public Keys: Cryptographic keys that grant access to your cryptocurrency. The public key is like an address, while the private key is your password.

Mining: The process of validating transactions and adding them to the blockchain using powerful computers and solving complex mathematical puzzles.

Benefits of Cryptocurrency

1. Financial Inclusion: Cryptocurrencies enable access to financial services for the unbanked and underbanked populations around the world.

2. Decentralization: Cryptocurrencies operate on decentralized networks, reducing the influence of central authorities and intermediaries.

3. Security: Blockchain's cryptographic techniques ensure secure transactions and protection against fraud and hacking.

4. Transparency: Transactions on a blockchain are public and transparent, enhancing accountability.

5. Borderless Transactions: Cryptocurrencies enable fast and low-cost cross-border transactions.

6. Potential for Growth: Some cryptocurrencies have experienced significant price appreciation, offering opportunities for investment growth.

Risks and Considerations

1. Volatility: Cryptocurrency prices can be highly volatile, leading to rapid and unpredictable value changes.

2. Security Concerns: Cryptocurrencies are susceptible to hacking, scams, and phishing attacks. Secure storage is crucial.

3. Regulatory Environment: Regulations for cryptocurrencies vary by jurisdiction and can impact their legality, taxation, and use.

4. Lack of Understanding: The complexity of the technology and market can lead to uninformed decisions.

5. Lack of Regulation: The decentralized nature of cryptocurrencies means there may be no recourse for fraudulent activities or disputes.

Getting Started with Cryptocurrency

1. Education Is Key

Before investing in or using cryptocurrencies, educate yourself about the technology, terminology, and potential risks.

Numerous online resources, courses, and communities provide valuable insights.

2. Choose the Right Cryptocurrency

Research different cryptocurrencies to understand their purposes, use cases, and market trends.

Bitcoin, Ethereum, and others have distinct features and applications.

3. Select a Reliable Exchange

Choose a reputable cryptocurrency exchange to buy, sell, and trade cryptocurrencies.

Look for factors like security measures, fees, user-friendliness, and available coins.

4. Secure Your Investments

Use strong, unique passwords for your exchange accounts and enable two-factor authentication (2FA).

Consider using hardware wallets for enhanced security.

5. Start Small and Diversify

For beginners, start with a small investment you can afford to lose.

Diversify your investments across different cryptocurrencies to manage risk.

6. Stay Informed

Stay updated with the latest news and trends in the cryptocurrency space.

Follow reputable cryptocurrency news websites, blogs, and social media accounts.

7. Avoid FOMO and Emotional Decisions

Fear of missing out (FOMO) and emotional decisions can lead to impulsive actions.

Stick to your investment strategy and avoid making decisions solely based on short-term price movements.

8. Be Prepared for the Long Term

Cryptocurrency investments are often more successful with a long-term perspective.

Avoid making decisions based on daily market fluctuations.

Conclusion

As you embark on your journey into the world of cryptocurrency, remember that education and caution are your best allies.

Understand the technology, the benefits, and the risks before making any investment decisions.

With the right knowledge and a thoughtful approach, you can navigate the complex and dynamic cryptocurrency landscape, potentially harnessing its benefits and contributing to the evolution of modern finance.

2 notes

·

View notes

Text

UNDRGRND ARTIST: MINTA

BY NFTJOE, ORIGINALLY POSTED SEPTEMBER 30, 2022 ON UNDRGRND.IO

MY ART IN UNDRGRND

Each week 100 NFTs are minted and randomly airdropped to UNDRGRND Membership Cardholders. To find out how you can be featured as an UNDRGRND Artist check out our Discord.

The question surrounding Minta will always revolve around who is she; but it’s the wrong question. The better question: does it matter?

Minta is a persona created specifically for the web3 art scene. The persona is an artist with a human behind the artist that helps create the art but Minta is unequivocally the one creating. Does that make sense?

If that wasn’t enough Minta’s art is very meta revolving around tweets about web3 art, features on NFT marketplaces and lists of transactions that occur from various wallets. One piece in particular is used to answer the question of who Minta is.

As with everything meta keeping track of the point or the statement in something self-referential is a task itself. It takes a special creative mind to keep the thread alive or the focus is lost and becomes trite.

Blockchain disciples will point to transparency and how everything, good and bad, is tracked. Blockhain tech is documenting our history as we are living it. Transaction hashes are a little dry for most of us to be excited about but to Minta those are pieces of art.

What Minta is doing is visually capturing that history by painting transactions and tweets she feels important, then minting them as NFTs, on blockchain tech. Are you starting to get it?

With limited personal aspects from Minta the art is allowed to just exist as if it were a naturally occurring event part of the blockchain ecosystem. Minta has essentially removed the artist from the creation process. The art specifically speaks for itself and there is no overshadowing of the artist's persona. Her anonymity is part of the art in a digital world where anonymity is a foundational principle.

AVAILABLE ON OBJKT

So an anonymous artist that only exists in web3, is minting moments from web3, by using web3 technology, highlighting core principles like anonymity and transparency: art about art on the blockchain. However, there’s something to be said about the human touch to her work.

The hand drawn/painted nature of her work reminds us that while we become more and more digitized in our personas it is vital to remember that there are still humans behind these anonymous wallet addresses.

Many of us will never know anything about Minta beyond the art that she shares. Those of us who have had a chance to speak with the woman behind Minta, have been treated to a clever, funny and insightful person who is beginning to carve out her own space in web3 history while taking no personal credit to her actual name.

All for the sake of art.

#UNDRGRND#nftcommunity#tezos (xtz)#crypto#nft#nft4art#nftcollection#nftgallery#nftmagazine#objktnft#teia#nft marketplace#nft news#nftcreators#nftdrop#nftproject#nftsale#opensea#web3#metaverse#cryptoart#tezosnft#tezoscollectors#tezoscommunity#tezos#tezosbased#objktcom#tezosart#solana#ethereum

14 notes

·

View notes

Text

Common Questions About Solana Token Minting Answered

As the cryptocurrency world continues to expand, more and more developers, entrepreneurs, and enthusiasts are looking into token minting as a way to create their own digital assets. Among the various blockchain platforms available, Solana has emerged as a leading choice for token minting due to its high-speed transactions, low costs, and robust scalability. However, with the rise in interest comes a slew of questions from those new to the process. In this article, we’ll answer some of the most common questions about Solana token minting, providing clear and positive insights into why this platform is ideal for your token creation needs.

What Is Token Minting?

Token minting refers to the process of creating new tokens on a blockchain. These tokens can represent anything from digital currencies and assets to loyalty points, collectibles, and more. Minting tokens allows you to define the total supply, distribution, and unique characteristics of your tokens, which can then be used in a variety of applications such as decentralized finance (DeFi), non-fungible tokens (NFTs), gaming, and more.

Why Choose Solana for Token Minting?

Solana has quickly gained a reputation as one of the fastest and most cost-effective blockchain platforms for token minting. Here’s why Solana stands out:

High Transaction Speed: Solana is capable of processing up to 65,000 transactions per second (TPS), making it one of the fastest blockchains available. This speed ensures that your tokens can be created, transferred, and traded quickly and efficiently.

Low Transaction Fees: Unlike some other blockchains where transaction fees can be prohibitively high, Solana’s fees are a fraction of a cent. This affordability is particularly beneficial for those looking to mint large quantities of tokens or those planning to use their tokens in high-frequency trading environments.

Scalability: Solana’s innovative Proof of History (PoH) consensus mechanism ensures that the network remains scalable even as demand grows. This scalability makes Solana an excellent choice for projects that expect to handle a large number of users or transactions.

Developer-Friendly Tools: Solana offers a range of tools and resources, such as the Solana token generator and Instant Token Launcher, that make it easy for developers to create and deploy their tokens.

How Do I Mint a Token on Solana?

Minting a token on Solana is a straightforward process, thanks to the developer-friendly tools provided by the platform. Here’s a step-by-step guide to get you started:

Set Up a Solana Wallet: Before you can mint a token, you’ll need to set up a Solana wallet. This wallet will hold your SOL tokens, which are used to pay for transaction fees on the network.

Use the Solana Token Generator: The Solana token generator is a powerful tool that simplifies the process of creating tokens on the Solana blockchain. Simply input your desired token details, such as the name, symbol, and total supply, and the generator will create your token in seconds.

Launch Your Token: After creating your token, you can use the Instant Token Launcher to deploy it on the Solana blockchain. This tool allows you to instantly launch your token, making it available for trading, distribution, or integration into your application.

Distribute Your Tokens: Once your token is launched, you can distribute it to your intended recipients, whether they are investors, users, or community members. You can also list your token on cryptocurrency exchanges to increase its liquidity and visibility.

What Are the Costs Involved in Minting Tokens on Solana?

One of the most attractive aspects of minting tokens on Solana is the low cost. The transaction fees on the Solana network are minimal — often just a fraction of a cent per transaction. This means that even if you’re minting a large number of tokens, the total cost will remain affordable.

Additionally, the Solana token generator and Instant Token Launcher tools are designed to be cost-effective, allowing you to create and deploy your tokens without the need for expensive development resources. This makes Solana an ideal choice for startups, small businesses, and individual developers looking to enter the cryptocurrency market without breaking the bank.

Can I Mint Any Type of Token on Solana?

Yes, Solana supports the minting of a wide variety of tokens. Whether you’re looking to create a utility token, security token, non-fungible token (NFT), or even a memecoin, Solana’s flexible and scalable infrastructure can accommodate your needs.

Utility Tokens: These tokens can be used within a specific ecosystem or application, providing users with access to products, services, or other benefits.

Security Tokens: Representing ownership of an asset, such as equity in a company or real estate, security tokens are subject to regulatory requirements.

Non-Fungible Tokens (NFTs): NFTs are unique tokens that represent ownership of a specific digital asset, such as artwork, music, or virtual real estate.

Memecoins: Inspired by internet memes and viral trends, memecoins are a fun and playful way to engage with the crypto community.

With Solana’s tools like the Instant Token Generator, you can create these types of tokens quickly and efficiently, enabling you to capitalize on market trends and innovations.

What Are the Benefits of Minting Tokens on Solana Compared to Other Blockchains?

When compared to other popular blockchains like Ethereum or Binance Smart Chain, Solana offers several distinct advantages:

Speed: Solana’s high transaction speed outpaces that of Ethereum and Binance Smart Chain, ensuring that your tokens can be minted and traded quickly. This speed is particularly important for applications that require real-time transactions, such as gaming or DeFi platforms.

Low Costs: The transaction fees on Solana are significantly lower than those on Ethereum, where gas fees can be a major obstacle for developers and users alike. Solana’s low fees make it a more accessible platform for those looking to mint large quantities of tokens or engage in frequent transactions.

Scalability: Solana’s Proof of History (PoH) consensus mechanism enables the network to scale without compromising on security or decentralization. This scalability ensures that your project can grow and handle increased demand without facing performance bottlenecks.

Ecosystem Support: Solana’s growing ecosystem includes a wide range of tools, services, and resources that make it easier for developers to build and deploy their projects. The Solana token generator and Instant Token Launcher are just two examples of the developer-friendly tools available on the platform.

How Do I Promote My Solana-Minted Tokens?