#blockchain wallet to bank account

Text

#blockchain#what is blockchain#blockchain explained#blockchain technology#introduction to blockchain#blockchain tutorial#introduction to blockchain technology#blockchain tutorial for beginners#how does blockchain work#blockchain technology explained#how to create a blockchain wallet#how to use blockchain#what is blockchain technology#how to create a blockchain account#how to use blockchain wallet#blockchain developer#blockchain wallet to bank account

0 notes

Text

Watched this very fascinating interview on NFTs where the guy who downloaded a bunch of them explained that

1) NFTs are often not actual images. They are hyperlinks TO images stored on web 2.0 not blockchain that can be replaced at any time due to being mostly on image hosting sites

2) the Blockchain only feels anonymous because not many people use it. Since everything is visible to everyone the crypto utopia people dream about would be no better than having everyone's bank account transactions visible with a "wallet" name trying to thinly veil anonymity

3) things like doxxing info, revenge porn, etc, can be forced into someone's wallet if someone with enough money time and malice wants to put it there and there is no way you can remove it yourself because of how Blockchain works

169 notes

·

View notes

Text

Can you imagine what a digital white ethnostate or a cyber caliphate might look like? Having spent most of my career on the inside of online extremist movements, I certainly can. The year 2024 might be the one in which neo-Nazis, jihadists, and conspiracy theorists turn their utopian visions of creating their own self-governed states into reality—not offline, but in the form of Decentralized Autonomous Organizations (DAOs).

DAOs are digital entities that are collaboratively governed without central leadership and operate based on blockchain. They allow internet users to establish their own organizational structures, which no longer require the involvement of a third party in financial transactions and rulemaking. The World Economic Forum described DAOs as “an experiment to reimagine how we connect, collaborate and create”. However, as with all new technologies, there is also a darker side to them: They are likely to give rise to new threats emerging from decentralized extremist mobilization.

Today, there are already over 10,000 DAOs, which collectively manage billions of dollars and count millions of participants. So far, DAOs have attracted a wild mix of libertarians, activists, pranksters, and hobbyists. Most DAOs I have come across in my research sound innocent and fun. Personally, my favorites include theCaféDAO, which aims “to replace Starbucks” (good luck with that!); the Doge DAO, which wants to “make the Doge meme the most recognizable piece of art in the world”; and the HairDAO, “a decentralized asset manager solving hair loss.” But some DAOs use a more radical tone. For example, the Redacted Club DAO, which is rife with alt-right codes and conspiracy myth references, claims to be a secret network with the aim of “slaying” the “evil Meta Lizard King.”

The year 2024 might be one in which extremists start using DAOs strategically. Policies, legal contracts, and financial transactions that were traditionally the domain of governments, courts, and banks can be replaced with smart contracts, non-fungible tokens (NFTs), and cryptocurrencies. The use of anonymous bitcoin wallets and non-transparent cryptocurrencies such as Monero is already widespread among extremists whose bank accounts have been frozen. A shift to entirely decentralized forms of self-governance is only one step away.

Beyond practical reasons that encourage extremists to create their own self-governed structures, there is an ideological incentive too: their fundamental distrust in the establishment. If you believe that the deep state or the “global Jewish elites” control everything from governments and Big Tech to the global banking system, DAOs offer an appealing alternative. Conversations on far-right fringe platforms such as BitChute and Odysee reveal that there is much appetite for decentralized alternative forms of collaboration, communication, and crowdfunding.

So what happens if anti-minority groups establish their own digital worlds in which they impose their own governing mechanisms? What are the stakes if trolling armies start cooperating via DAOs to launch election interference campaigns? The activities of extremist DAOs could challenge the rule of law, pose a threat to minority groups, and disrupt institutions that are currently considered fundamental pillars of democratic systems. Another risk is that DAOs can serve as safe havens for extremist movements by enabling users to circumvent government regulation and security services monitoring activities. They might also allow extremists to find new ways to fundraise, plan, and plot radicalization campaigns or even attacks. While many governments have focused on developing legal frameworks to regulate AI, few have even recognized the existence of DAOs. Their looming exploitation for extremist and criminal purposes is something that has flown under the radar of global policymakers.

Technology expert Carl Miller, who has long warned of potential misuse of DAOs, told me that “even though DAOs behave like companies, they are not registered as legal entities.” There are only a few exceptions: The US states of Wyoming, Vermont, and Tennessee have passed laws to legally recognize DAOs. With no regulations in place to hold DAOs accountable for extremist or criminal activities, the big question for 2024 will be: How can we ensure the metaverse doesn’t give rise to digital white ethnostates or cyber caliphates?

10 notes

·

View notes

Text

The Connecter’s View on Blockchain and Its Real-World Impact!

Introduction

Blockchain technology is more than just a buzzword—it's a revolutionary shift in how we manage digital transactions and data. At The Connecter, we believe in the transformative power of blockchain to create a more secure, transparent, and user-centric digital world. Here’s our take on how blockchain is making a real-world impact.

1. User Empowerment: Full Control Over Digital Assets

Blockchain technology is fundamentally about putting power back into the hands of users. Here's how:

Decentralized Control: Unlike traditional systems that rely on central authorities, blockchain technology distributes control across a network. This decentralization ensures that no single entity has full control over the data, giving users more power and autonomy over their digital assets.

Ownership and Privacy: With blockchain, users own their data outright. Personal information and transaction details are encrypted and stored securely, ensuring that privacy is maintained and users have control over who accesses their information.

2. Enhanced Security: Protecting Your Data

Security is a major concern in the digital age, and blockchain addresses this with several key features:

Immutable Records: Once a transaction is recorded on the blockchain, it cannot be changed or deleted. This immutability ensures that the data remains accurate and tamper-proof, providing a trustworthy record of all transactions.

Advanced Encryption: Blockchain uses sophisticated encryption techniques to protect user data. This means that even if data is intercepted, it cannot be read or altered without the proper decryption key.

3. Financial Services: Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is one of the most exciting applications of blockchain technology:

Accessible Financial Tools: DeFi provides financial services to anyone with an internet connection, removing the need for traditional banking infrastructure. This opens up financial services to underserved populations around the world.

Lower Transaction Costs: By eliminating intermediaries, DeFi reduces the cost of transactions. This makes financial services more affordable and accessible, particularly for those in developing countries.

4. Global Accessibility: Breaking Down Barriers

Blockchain technology transcends borders, making it a truly global innovation:

Worldwide Reach: Transactions on the blockchain can be conducted anywhere in the world, making financial services accessible to a global audience. This is particularly beneficial for people in regions with limited access to traditional banking services.

Inclusive Platforms: At The Connecter, our digital wallet is designed to be user-friendly and accessible to everyone, regardless of their technical expertise. We believe that financial tools should be simple and intuitive, enabling more people to take advantage of blockchain technology.

5. Practical Applications: Real-World Use Cases

Blockchain technology has a wide range of practical applications that go beyond finance:

Supply Chain Transparency: Blockchain provides a transparent and immutable record of transactions, which is particularly useful in supply chains. By tracking products from origin to destination, blockchain can help reduce fraud, improve accountability, and ensure the authenticity of goods.

Healthcare Innovations: In healthcare, blockchain can be used to securely store and manage patient data. This enhances privacy and ensures that medical records are accurate and accessible only to authorized personnel, improving the overall quality of care.

6. Continuous Improvement: Staying Ahead of the Curve

At The Connecter, we are committed to continuous improvement and staying ahead of technological advancements:

User Feedback: We actively seek and integrate user feedback to refine and enhance our platform. Our goal is to create a product that meets the needs of our users and evolves with their changing requirements.

Technology Updates: Our team stays informed about the latest developments in blockchain technology. By continuously updating our platform, we ensure that our users benefit from the most advanced and secure solutions available.

Conclusion

At The Connecter, we see blockchain as a game-changer that empowers users, enhances security, and offers practical, real-world applications. By leveraging this technology, we are committed to creating a digital wallet that is secure, user-friendly, and accessible to all. Join us in exploring the incredible possibilities of blockchain technology and take control of your digital life today.

Subscribe and GET ZERO transaction FEES for 1 WEEK! 👉 https://www.theconnecter.io/zero-fees-week

#Blockchain#DigitalWallet#UserEmpowerment#SecureTech#DeFi#GlobalAccess#TechInnovation#FutureFinance#Crypto#digitalcurrency

4 notes

·

View notes

Text

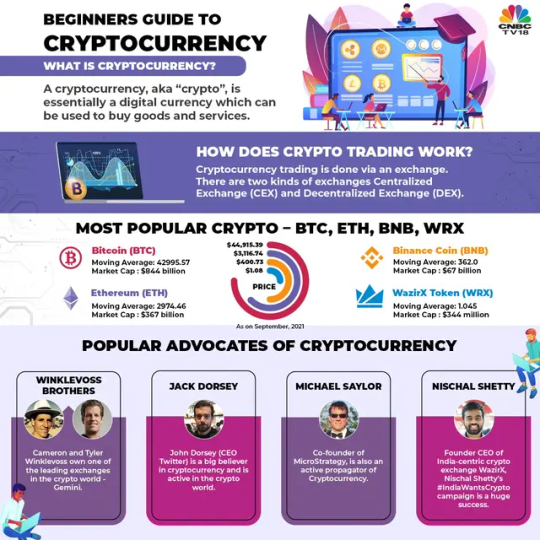

A Primer for Beginners in Cryptocurrency

Cryptocurrency has taken the financial world by storm, a phenomenon held in equal parts awe and scepticism. What is cryptocurrency, and why should beginners care? This guide will answer all these questions and provide a true definition of cryptocurrency, for the uninitiated.

What is Cryptocurrency?

At its most basic, cryptocurrency is any type of digital or virtual currency that uses cryptography for security. Cryptocurrencies — which are not issued by a central government (like the US dollar or Euro), operate on networks known as blockchains. This decentralization means that it is not owned by a single entity, like the central bank of each country.

How Does Cryptocurrency Work?

Decentralization, Transparency and Immutability are the killer features of blockchain technology which is being utilized by cryptocurrencies. A blockchain is a distributed ledger that keeps track of all transactions across a network of computers. When a block of transactions is added to the blockchain, it means that every new transaction in completion (e.g., money moving from one account to another) makes an update on all ledgers for their users.

The opaque and unreliable centralized system is avoided, allowing the data to be secure (distributed AND only YOU hold access), prompt & transparent. Bitcoin, the first and most famous cryptocurrency is a case in point: Bitcoin uses blockchain technology to enable peer-to-peer transactions without an intermediary (like a bank).

Popular Cryptocurrencies

Bitcoin, is the best-known cryptocurrency and there are thousands of other cryptocurrencies with various uses and functionality. Here are a few notable ones:

Ethereum (ETH): Ethereum is a decentralized platform that runs smart contracts (like dApps) on its platform.

Ripple (XRP): While Ripple is designed as a digital payment protocol, it still serves the same use case of enabling instant and cheap across borders.

Litecoin (LTC): Often dubbed as silver to Bitcoin's gold, Litecoin has faster transaction confirmation times.

Why Invest in Cryptocurrency?

There are few reasons for which a realization of benefits can seem attractive in investing this digital currency.

High upside: Cryptocurrencies can also gain value by huge percentages. For example, the early investors of Bitcoin and Ethereum are currently smiling to their bank-account.

2. Diversification: Cryptocurrencies can be added to an investment portfolio in order to diversify it thereby decreasing the risk.

3. Innovation and Technology: Investing in cryptocurrencies is an investment into the underlying blockchain technology, a revolutionary tool with many uses beyond digital currencies.

Risks and Considerations

But of course, as with all investment opportunities there are risks when it comes to digital currencies:

Volatility: Cryptocurrency is known for its price volatility; prices fluctuate rapidly and dramatically.

Regulatory Risks: The regulatory backdrop for cryptocurrencies is definitely a work in progress and future regulations may affect the value of these digital currencies as well as how they can be used.

Security Risks: The blockchain is secure, the platform and exchange on which cryptocurrencies are stored can be hacked.

How to Start with Cryptocurrency

There are some guidelines to help beginners who want to start investing in cryptocurrency.

Do your homework — It is important to be familiar with what you are investing; important to know what you're putting your money into, services like Coursera and NerdWallet provide thorough lessons on cryptocurrency.

Pick a Secure Exchange: Go for the most secure cryptocurrency exchange to purchase and offer cryptos Common exchanges such as Coinbase, Binance and Kraken.

Protect your investments: Store cryptocurrencies in secure wallets. Online wallets are less secure whereas hardware wallets provide advanced security to store.NEO.

4. Start Small — With all the volatility in this market, it would also be prudent to instead make a small investment and then scale into your position from there as you get more comfortable with these markets.

Conclusion

Cryptocurrency is a titanic heavy weight knocking the financial industry off its axis; it opens new doors for wealth and disaster as well. These are the basics of cryptocurrency that beginners need to understand and with a responsible, well-informed entering into it can lead them being successful. successful investment. Besides, due-diligence and strategic thinking at every stage are defining factors for anyone who wants to dive into the roller-coaster world of crypto-investing.

5 notes

·

View notes

Text

Investing in the Future: Explore the High Return Potential of BitNest Loop

In today's rapidly changing financial world, traditional investment methods no longer seem to be able to meet the rapidly growing demand for capital. This is the time to explore new investment avenues - like BitNest Loop, a revolutionary decentralized finance (DeFi) platform that provides investors with unprecedented high-return opportunities.

Why choose BitNest Loop?

1.Efficient rate of return: By utilizing complex algorithms and smart contracts, BitNest Loop provides a rate of return that far exceeds that of traditional banking and investment products. For example, by investing only 10,000 USDT in a 28-day cycle, the annualized return can reach an astonishing 1,638%.

2.Safe and reliable: Through blockchain technology, BitNest Loop ensures the security and transparency of all transactions. Smart contracts automatically handle transactions and allocations, reducing the risk of human error and fraud.

3.Flexible investment cycle: Whether it is a short-term 1-day investment cycle or a long-term 28-day investment cycle, BitNest Loop can meet the needs of different investors. From daily returns to monthly returns, flexibility is our specialty.

4.Advantages of decentralization: As a DeFi platform, BitNest Loop does not require traditional financial institutions. Investors interact directly with the market and enjoy faster services and lower fees.

Investment effect examples

Taking the experience of an actual investor as an example, if the initial investment is 10,000 USDT and the 28-day cycle investment is selected, the total funds will increase to 165,127.12 USDT after one year. This significant capital growth demonstrates BitNest Loop’s strong potential as a modern financial tool.

How to start investing?

Investing in BitNest Loop is easy:

※Visit our official website and register an account.

※ Connect your digital wallet.

※Choose your investment amount and term.

※ Monitor the growth of your investments and enjoy automated capital repatriation.

In an increasingly complex and competitive economic environment, BitNest Loop provides a simple and effective way to grow your wealth. Whether you are an experienced investor or new to the market, BitNest Loop can provide strong support for your capital growth.

Join us now to start your efficient and profitable journey.

To explore more, please contact Rosa, Head of Recruitment for the BitNest Blockchain Team

Telegraph: https://t.me/Rosa01a。

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

4 notes

·

View notes

Text

Investing in the Future: Explore the High Return Potential of BitNest Loop

In today's rapidly changing financial world, traditional investment methods no longer seem to be able to meet the rapidly growing demand for capital. This is the time to explore new investment avenues - like BitNest Loop, a revolutionary decentralized finance (DeFi) platform that provides investors with unprecedented high-return opportunities.

Why choose BitNest Loop?

1.Efficient rate of return: By utilizing complex algorithms and smart contracts, BitNest Loop provides a rate of return that far exceeds that of traditional banking and investment products. For example, by investing only 10,000 USDT in a 28-day cycle, the annualized return can reach an astonishing 1,638%.

2.Safe and reliable: Through blockchain technology, BitNest Loop ensures the security and transparency of all transactions. Smart contracts automatically handle transactions and allocations, reducing the risk of human error and fraud.

3.Flexible investment cycle: Whether it is a short-term 1-day investment cycle or a long-term 28-day investment cycle, BitNest Loop can meet the needs of different investors. From daily returns to monthly returns, flexibility is our specialty.

4.Advantages of decentralization: As a DeFi platform, BitNest Loop does not require traditional financial institutions. Investors interact directly with the market and enjoy faster services and lower fees.

Investment effect examples

Taking the experience of an actual investor as an example, if the initial investment is 10,000 USDT and the 28-day cycle investment is selected, the total funds will increase to 165,127.12 USDT after one year. This significant capital growth demonstrates BitNest Loop’s strong potential as a modern financial tool.

How to start investing?

Investing in BitNest Loop is easy:

※Visit our official website and register an account.

※ Connect your digital wallet.

※Choose your investment amount and term.

※ Monitor the growth of your investments and enjoy automated capital repatriation.

In an increasingly complex and competitive economic environment, BitNest Loop provides a simple and effective way to grow your wealth. Whether you are an experienced investor or new to the market, BitNest Loop can provide strong support for your capital growth.

Join us now to start your efficient and profitable journey.

To explore more, please contact Rosa, Head of Recruitment for the BitNest Blockchain Team

Telegraph: https://t.me/Rosa01a。

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

4 notes

·

View notes

Text

Investing in the Future: Explore the High Return Potential of BitNest Loop

In today's rapidly changing financial world, traditional investment methods no longer seem to be able to meet the rapidly growing demand for capital. This is the time to explore new investment avenues - like BitNest Loop, a revolutionary decentralized finance (DeFi) platform that provides investors with unprecedented high-return opportunities.

Why choose BitNest Loop?

1.Efficient rate of return: By utilizing complex algorithms and smart contracts, BitNest Loop provides a rate of return that far exceeds that of traditional banking and investment products. For example, by investing only 10,000 USDT in a 28-day cycle, the annualized return can reach an astonishing 1,638%.

2.Safe and reliable: Through blockchain technology, BitNest Loop ensures the security and transparency of all transactions. Smart contracts automatically handle transactions and allocations, reducing the risk of human error and fraud.

3.Flexible investment cycle: Whether it is a short-term 1-day investment cycle or a long-term 28-day investment cycle, BitNest Loop can meet the needs of different investors. From daily returns to monthly returns, flexibility is our specialty.

4.Advantages of decentralization: As a DeFi platform, BitNest Loop does not require traditional financial institutions. Investors interact directly with the market and enjoy faster services and lower fees.

Investment effect examples

Taking the experience of an actual investor as an example, if the initial investment is 10,000 USDT and the 28-day cycle investment is selected, the total funds will increase to 165,127.12 USDT after one year. This significant capital growth demonstrates BitNest Loop’s strong potential as a modern financial tool.

How to start investing?

Investing in BitNest Loop is easy:

※Visit our official website and register an account.

※ Connect your digital wallet.

※Choose your investment amount and term.

※ Monitor the growth of your investments and enjoy automated capital repatriation.

In an increasingly complex and competitive economic environment, BitNest Loop provides a simple and effective way to grow your wealth. Whether you are an experienced investor or new to the market, BitNest Loop can provide strong support for your capital growth.

Join us now to start your efficient and profitable journey.

To explore more, please contact Rosa, Head of Recruitment for the BitNest Blockchain Team

Telegraph: https://t.me/Rosa01a。

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

2 notes

·

View notes

Text

Investing in the Future: Explore the High Return Potential of BitNest Loop

In today's rapidly changing financial world, traditional investment methods no longer seem to be able to meet the rapidly growing demand for capital. This is the time to explore new investment avenues - like BitNest Loop, a revolutionary decentralized finance (DeFi) platform that provides investors with unprecedented high-return opportunities.

Why choose BitNest Loop?

Efficient rate of return: By utilizing complex algorithms and smart contracts, BitNest Loop provides a rate of return that far exceeds that of traditional banking and investment products. For example, by investing only 10,000 USDT in a 28-day cycle, the annualized return can reach an astonishing 1,638%.

Safe and reliable: Through blockchain technology, BitNest Loop ensures the security and transparency of all transactions. Smart contracts automatically handle transactions and allocations, reducing the risk of human error and fraud.

Flexible investment cycle: Whether it is a short-term 1-day investment cycle or a long-term 28-day investment cycle, BitNest Loop can meet the needs of different investors. From daily returns to monthly returns, flexibility is our specialty.

4.Advantages of decentralization: As a DeFi platform, BitNest Loop does not require traditional financial institutions. Investors interact directly with the market and enjoy faster services and lower fees.

Investment effect examples

Taking the experience of an actual investor as an example, if the initial investment is 10,000 USDT and the 28-day cycle investment is selected, the total funds will increase to 165,127.12 USDT after one year. This significant capital growth demonstrates BitNest Loop’s strong potential as a modern financial tool.

How to start investing?

Investing in BitNest Loop is easy:

·Visit our official website and register an account.

·Connect your digital wallet.

·Choose your investment amount and term.

Monitor the growth of your investments and enjoy automated capital repatriation.

In an increasingly complex and competitive economic environment, BitNest Loop provides a simple and effective way to grow your wealth. Whether you are an experienced investor or new to the market, BitNest Loop can provide strong support for your capital growth.

Join us now to start your efficient and profitable journey.

To explore more, please contact Rosa, Head of Recruitment for the BitNest Blockchain Team。

Telegraph: https://t.me/Rosa01a

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

5 notes

·

View notes

Text

Cryptocurrency for Beginners: Essential Insights and Guidance

Cryptocurrency, a digital and decentralized form of money, has transformed the way we think about finance and technology.

For beginners, navigating the world of cryptocurrency can be both exciting and overwhelming.

This article serves as a comprehensive guide, offering beginners insights into the fundamental aspects, benefits, risks, and practical steps to get started in the cryptocurrency realm.

youtube

Understanding Cryptocurrency: The Basics

At its core, cryptocurrency is a digital or virtual form of currency that utilizes cryptographic techniques to secure transactions and control the creation of new units.

Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

1. How Cryptocurrencies Work

Cryptocurrencies operate on blockchain technology, which is a distributed and immutable ledger that records all transactions.

Each transaction is grouped into a "block," and these blocks are linked together, creating a chain of information.

This decentralized nature ensures transparency, security, and resistance to censorship as Perseus Crypto explains it nicely.

2. Key Cryptocurrency Concepts

Blockchain: A decentralized ledger that records all transactions in a secure and transparent manner.

Wallet: A digital tool that stores your cryptocurrency holdings, enabling you to send, receive, and manage your coins.

Private and Public Keys: Cryptographic keys that grant access to your cryptocurrency. The public key is like an address, while the private key is your password.

Mining: The process of validating transactions and adding them to the blockchain using powerful computers and solving complex mathematical puzzles.

Benefits of Cryptocurrency

1. Financial Inclusion: Cryptocurrencies enable access to financial services for the unbanked and underbanked populations around the world.

2. Decentralization: Cryptocurrencies operate on decentralized networks, reducing the influence of central authorities and intermediaries.

3. Security: Blockchain's cryptographic techniques ensure secure transactions and protection against fraud and hacking.

4. Transparency: Transactions on a blockchain are public and transparent, enhancing accountability.

5. Borderless Transactions: Cryptocurrencies enable fast and low-cost cross-border transactions.

6. Potential for Growth: Some cryptocurrencies have experienced significant price appreciation, offering opportunities for investment growth.

Risks and Considerations

1. Volatility: Cryptocurrency prices can be highly volatile, leading to rapid and unpredictable value changes.

2. Security Concerns: Cryptocurrencies are susceptible to hacking, scams, and phishing attacks. Secure storage is crucial.

3. Regulatory Environment: Regulations for cryptocurrencies vary by jurisdiction and can impact their legality, taxation, and use.

4. Lack of Understanding: The complexity of the technology and market can lead to uninformed decisions.

5. Lack of Regulation: The decentralized nature of cryptocurrencies means there may be no recourse for fraudulent activities or disputes.

Getting Started with Cryptocurrency

1. Education Is Key

Before investing in or using cryptocurrencies, educate yourself about the technology, terminology, and potential risks.

Numerous online resources, courses, and communities provide valuable insights.

2. Choose the Right Cryptocurrency

Research different cryptocurrencies to understand their purposes, use cases, and market trends.

Bitcoin, Ethereum, and others have distinct features and applications.

3. Select a Reliable Exchange

Choose a reputable cryptocurrency exchange to buy, sell, and trade cryptocurrencies.

Look for factors like security measures, fees, user-friendliness, and available coins.

4. Secure Your Investments

Use strong, unique passwords for your exchange accounts and enable two-factor authentication (2FA).

Consider using hardware wallets for enhanced security.

5. Start Small and Diversify

For beginners, start with a small investment you can afford to lose.

Diversify your investments across different cryptocurrencies to manage risk.

6. Stay Informed

Stay updated with the latest news and trends in the cryptocurrency space.

Follow reputable cryptocurrency news websites, blogs, and social media accounts.

7. Avoid FOMO and Emotional Decisions

Fear of missing out (FOMO) and emotional decisions can lead to impulsive actions.

Stick to your investment strategy and avoid making decisions solely based on short-term price movements.

8. Be Prepared for the Long Term

Cryptocurrency investments are often more successful with a long-term perspective.

Avoid making decisions based on daily market fluctuations.

Conclusion

As you embark on your journey into the world of cryptocurrency, remember that education and caution are your best allies.

Understand the technology, the benefits, and the risks before making any investment decisions.

With the right knowledge and a thoughtful approach, you can navigate the complex and dynamic cryptocurrency landscape, potentially harnessing its benefits and contributing to the evolution of modern finance.

2 notes

·

View notes

Text

Are you new to Crypto

Are you new to Crypto? Here is how to start !!

Cryptocurrencies have taken the world by storm, and it's not surprising that many people are now interested in investing in them. However, for someone new to the world of crypto, the idea of buying and selling digital assets can be intimidating. In this article, we'll provide a beginner's guide on how to get started with cryptocurrencies.

Step 1: Research

Before investing in cryptocurrencies, it's important to do your research. Cryptocurrencies are highly volatile and complex, so you need to understand the risks involved. Start by learning the basics of blockchain technology, which is the underlying technology that powers cryptocurrencies. You can find plenty of resources online, including videos, articles, and books, that can help you learn about these topics.

Step 2: Choose a cryptocurrency exchange

Once you have a good understanding of cryptocurrencies, it's time to choose an exchange. There are many exchanges available, and it's important to choose one that's reputable and secure. Look for an exchange that has a high level of security, offers a wide range of cryptocurrencies, and has a user-friendly interface. Some popular exchanges include Coinbase, Binance, and Kraken.

Step 3: Create an account and verify your identity

Once you've chosen an exchange, create an account and verify your identity. Most exchanges require you to provide personal information, such as your name, address, and ID. This is to comply with anti-money laundering (AML) and know your customer (KYC) regulations. It's important to note that the verification process can take some time, so be patient.

Step 4: Fund your account

After your account is verified, you can fund it with fiat currency or cryptocurrencies. Most exchanges accept bank transfers, debit/credit cards, and some even accept PayPal. Choose the payment method that's most convenient for you and follow the instructions provided by the exchange.

Step 5: Buy your first cryptocurrency

With your account funded, you can now buy your first cryptocurrency. Choose the cryptocurrency you want to buy and the amount you want to spend. Most exchanges will show you the current price of the cryptocurrency you're buying, as well as any fees associated with the transaction. Once you're ready, click the "buy" button and confirm the transaction.

Step 6: Store your cryptocurrency

After buying your cryptocurrency, it's important to store it in a secure wallet. A wallet is a software program that allows you to store, send, and receive cryptocurrencies. There are two types of wallets: hot wallets and cold wallets. Hot wallets are connected to the internet and are convenient for frequent trading, while cold wallets are offline and more secure for long-term storage. Some popular wallets include Ledger, Trezor, and MetaMask.

In conclusion, investing in cryptocurrencies can be a rewarding experience, but it's important to take the time to do your research and understand the risks involved. Choose a reputable exchange, fund your account, buy your first cryptocurrency, and store it in a secure wallet. With these steps, you'll be well on your way to becoming a successful crypto investor.

#crypto

#lauriesuarez

#lauriesuarez.com

#crypto101bylauriesuarez.com

1 note

·

View note

Text

Digital Payment Market: Embrace the Shift to Digital as it Soars to $236.3 Billion by 2030

In today’s rapidly evolving global economy, digital payments Market have become the cornerstone of modern commerce. As the world increasingly transitions from traditional methods of payment like cash and checks to faster, more secure electronic options, the digital payment market is flourishing. According to projections, this market is expected to grow from USD 91.6 billion in 2023 to an astonishing USD 236.3 billion by 2030, at a Compound Annual Growth Rate (CAGR) of 14.5%. This impressive growth reflects the accelerating adoption of technology in financial services and an increase in the demand for seamless, digital transactions.

What is the Digital Payment Market?

Digital payments refer to transactions that are made electronically using a variety of methods, such as mobile wallets, online banking, contactless cards, and even cryptocurrency. The digital payment market encompasses all these services and solutions, creating a vast ecosystem for consumers and businesses to exchange funds efficiently and securely.

Access Full Report @ https://intentmarketresearch.com/latest-reports/digital-payment-market-3019.html

The Key Drivers Behind Market Growth

Increased Smartphone Penetration

Smartphones have revolutionized the way we conduct transactions. With over 6 billion smartphone users globally, mobile wallets and payment apps like Apple Pay, Google Pay, and Samsung Pay have become ubiquitous. This widespread smartphone usage facilitates the adoption of digital payment methods, further fueling market growth.

E-Commerce Boom

The rapid expansion of e-commerce platforms such as Amazon, eBay, and Shopify has driven a demand for quick, secure, and easy-to-use payment systems. As online shopping continues to soar, especially post-pandemic, businesses are heavily investing in digital payment solutions to enhance the consumer experience.

Growing Financial Inclusion

In many developing countries, digital payments are helping to bridge the gap between unbanked populations and financial services. Governments and fintech companies are working together to promote financial inclusion through digital wallets and mobile banking, enabling individuals to access a broader range of financial products.

Advancements in Technology

Technologies like blockchain, AI, and biometric authentication are revolutionizing the security and efficiency of digital payments. With the rise of fintech innovations, digital transactions are becoming safer, more user-friendly, and more accessible.

Digital Payment Methods

Mobile Wallets

Mobile wallets like PayPal, Venmo, and Alipay are among the most popular digital payment methods today. These apps allow users to store credit card information, send payments, and even transfer money between accounts with just a few taps on their mobile devices.

Contactless Cards

Contactless payments, enabled by Near-Field Communication (NFC) technology, have seen a significant rise in usage. Users can simply tap their cards or devices at POS terminals to complete transactions, making payments faster and more convenient.

Cryptocurrencies

Although still in its early stages, cryptocurrency is a growing player in the digital payment market. Bitcoin, Ethereum, and other digital currencies offer an alternative to traditional payment methods, with lower transaction fees and decentralized control.

Buy Now, Pay Later (BNPL)

BNPL services like Afterpay and Klarna allow consumers to make purchases and pay them off over time, without the need for traditional credit cards. This method has gained immense popularity, particularly among younger generations, due to its flexibility and convenience.

Challenges Facing the Digital Payment Market

Security Concerns

With the growth of digital payments comes an increased risk of cyber threats, including data breaches, fraud, and identity theft. Ensuring the security of sensitive financial information is a key challenge for the industry, requiring constant advancements in cybersecurity measures.

Regulatory Issues

Different countries have varying regulations around digital payments, which can complicate global operations. Navigating these regulations while maintaining compliance is crucial for businesses operating in this space.

Limited Infrastructure in Developing Regions

While digital payments have become the norm in many developed countries, infrastructure in some parts of the world remains underdeveloped. In regions where internet access is limited or unreliable, implementing digital payment systems can be difficult.

Download Sample Report @ https://intentmarketresearch.com/request-sample/digital-payment-market-3019.html

The Future of the Digital Payment Market

Increased Adoption of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are already making waves in the payment industry, offering personalized recommendations, fraud detection, and automated customer service. As these technologies continue to advance, we can expect even more intelligent, adaptive payment systems.

The Rise of Central Bank Digital Currencies (CBDCs)

Several countries, including China and the European Union, are exploring the development of Central Bank Digital Currencies (CBDCs). These government-backed digital currencies have the potential to reshape global payment systems, offering a secure and stable alternative to traditional cryptocurrencies.

The Role of Blockchain

Blockchain technology is poised to play a larger role in digital payments by enabling decentralized, transparent transactions with reduced fees. As blockchain continues to evolve, it may offer new solutions for cross-border payments and improve financial inclusion for unbanked populations.

Expansion of Digital Payments in Developing Markets

As infrastructure improves and smartphone penetration rises, digital payments are expected to expand significantly in emerging markets. Companies that successfully tap into these regions will be well-positioned for long-term growth.

How Businesses Can Prepare for the Future

Invest in Payment Security

Given the rising threat of cyberattacks, businesses must invest in robust security measures to protect their customers' data. Utilizing technologies like encryption, tokenization, and multi-factor authentication can help mitigate risks.

Embrace Omnichannel Payment Solutions

Consumers today expect a seamless experience across multiple platforms, whether they're shopping online, in-store, or via mobile apps. Businesses should adopt omnichannel payment solutions that allow customers to pay using their preferred method, no matter where they are.

Stay Compliant with Regulations

To navigate the complex landscape of global digital payments, businesses must stay updated on regulations in the regions where they operate. Ensuring compliance with local laws is crucial for building trust and avoiding legal issues.

Collaborate with Fintech Companies

Partnering with fintech companies can help businesses stay ahead of the curve by leveraging innovative payment solutions. Fintech collaborations can offer access to new technologies, improve the customer experience, and drive growth.

Conclusion

The digital payment market is experiencing explosive growth, driven by technological advancements, the rise of e-commerce, and an increased need for financial inclusion. As this market continues to evolve, businesses and consumers alike must adapt to new trends and technologies. By embracing the opportunities presented by digital payments, companies can streamline operations, enhance customer experiences, and stay competitive in an increasingly digital world.

FAQs

What is driving the growth of the digital payment market?

The key drivers include increased smartphone penetration, the expansion of e-commerce, financial inclusion initiatives, and technological advancements.

What are the most popular digital payment methods?

Mobile wallets, contactless cards, cryptocurrencies, and Buy Now, Pay Later (BNPL) services are among the most popular digital payment methods.

How secure are digital payments?

While digital payments are generally secure, they are vulnerable to cyber threats. Businesses and consumers must use robust security measures such as encryption and multi-factor authentication.

What role does blockchain play in digital payments?

Blockchain technology offers decentralized, transparent transactions with reduced fees and the potential for cross-border payments. It also improves financial inclusion in unbanked regions.

How can businesses prepare for the future of digital payments?

Businesses should invest in payment security, embrace omnichannel solutions, stay compliant with regulations, and collaborate with fintech companies to stay competitive.

About Us

Intent Market Research (IMR) is dedicated to delivering distinctive market insights, focusing on the sustainable and inclusive growth of our clients. We provide in-depth market research reports and consulting services, empowering businesses to make informed, data-driven decisions.

Our market intelligence reports are grounded in factual and relevant insights across various industries, including chemicals & materials, healthcare, food & beverage, automotive & transportation, energy & power, packaging, industrial equipment, building & construction, aerospace & defense, and semiconductor & electronics, among others.

We adopt a highly collaborative approach, partnering closely with clients to drive transformative changes that benefit all stakeholders. With a strong commitment to innovation, we aim to help businesses expand, build sustainable advantages, and create meaningful, positive impacts.

Contact Us

US: +1 463-583-2713Digital Payment Market: Embrace the Shift to Digital as it Soars to $236.3 Billion by 2030

0 notes

Text

Breakpoint 2024 Solana GameShift On Google Cloud Web3

Solana Breakpoint 2024

Solana GameShift

We are thrilled to inform how Google Cloud, through its partnership with Solana Labs, is influencing the future of gaming as it join the vibrant community at Solana Breakpoint this week.

The core of its collaboration is GameShift, which offers all of the Web3 primitives and actions that games need, including wallets, tokenized assets, and on-chain markets. As of right now, Gameshift’s products are accessible via the Google Cloud Marketplace.

The promise of Web3 in games, how GameShift can assist developers in realizing this potential, the security of utilizing Solana GameShift for Web3, and the current smooth integration between GameShift and Google Cloud with the Google Cloud community.

Google Cloud has been aware of Web3 technologies’ potential for a while now. Its Web3 BigQuery datasets, Blockchain Node Engine product, and Web3 for Startups initiative are some of the ways it supports this ecosystem.

The evolution of gaming on Web3

Games may now reach players through a new channel with an enhanced value proposition thanks to Web3. Games can effortlessly transform their players from clients into collaborators and co-creators with Web3. This is significant because players are becoming more and more aware of how they add value to games and earn money from them.

Through the process of “composability,” or the simplification of interactions between on-chain programs from various suppliers, blockchains facilitate innovative experiences and developer efficiencies. Composability significantly lowers the cost and complexity of delivering real-money gaming services, generating interest on stored value balances, and giving players a choice in payment options and payout schedules in the payments domain. Additionally, compositability makes it possible to include cutting-edge Web3 game development features like global player reputation systems, open modding, and guild management.

Web3 for gaming is simplified with GameShift

Developers of video games can start using Solana GameShift API-first approach without needing any prior blockchain knowledge. The general manager of GameShift, Davis Hart, stated, “Our goal in building Solana GameShift is to leverage the unique capabilities of Web3 and provide a development and player experience as similar to existing services as possible.”

Principal Benefits

With its developer-friendly REST API, Solana GameShift offers every feature related to Web3 gaming. The Solana Labs team provides GameShift clients with growth support, assistance in creating Web3 gaming strategy, and deep access to the Solana ecosystem. This implies that studios may use GameShift with confidence, knowing that it will expand along with them over time, and that they won’t require numerous providers or expert blockchain developers.

GameShift now provides five essential features:

Wallet integration done well

Build wallets right into your game or help users who already have Solana wallets. Players may have a seamless, safe experience with GameShift wallets since they abstract key storage and offer a clear, user-friendly transaction signing flow without forcing them to exit your game environment. Because its wallets are non-custodial, games do not have to keep track of user asset pools.

Game asset management

With specific asset qualities, rarity, and in-game functionality, creating and managing in-game assets on the Solana blockchain is simple. Additionally, it manages asset transfers, which simplifies the implementation of features like gifting and trading in your game economy.

Pay-in and pay-out systems

Use safe, affordable transactions for rewards, subscriptions, and in-game purchases. This API manages transaction processing and currency conversion behind the scenes, supporting payments with both fiat and cryptocurrency. It also makes withdrawals simple, enabling users to return in-game assets to their bank accounts or personal wallets.

Marketplace functionality

Establish and maintain in-game markets with ease, allowing users to exchange, buy, and sell their assets. By managing listings, bids, transactions, and transfers, this API makes sure that the market is safe and effective. Additionally, it offers royalties implementation tools that let you profit from secondary sales even on user-generated material.

Reward schemes

Create and put into place complex reward schemes utilizing blockchain technology. With the help of this API, you can develop achievement- or token-based loyalty programs that give players real benefits. It uses custom logic to manage program enrollment, tracking, and prize distribution, giving you creative ways to encourage player involvement and retention.

Lowering Web3’s hazards in gaming

“Given the history of hacks and scams in Web3, developers are rightfully concerned about player safety,” stated Hart. But these issues can be raised to the level that developers regularly address in their off-chain systems with the help of game designers and appropriate security protocols.

The secret to GameShift’s approach is its non-custodial, invisible wallet architecture. With the use of distinct user wallets, each secured by unique cryptographic keys, this feature allows users to separate their assets from one another and lowers the possibility that an attacker may access all of the users’ assets at once. The hazards connected with user-managed keys and seed phrases are eliminated when key management is abstracted away from the user.

Because the game controls when and what kinds of transactions are exposed to the user, users who utilize Solana GameShift wallets are much more protected from scammers. Transaction approval flows notify the user of any changes to their balance and mimic the impact of any on-chain activity. Only on-chain services from verified and reliable vendors are used by GameShift. These tactics stop third parties from using hacks or phishing attacks to cheat users of their assets.

Using Web3 and Google Cloud

Developers may now easily enable Web3 within their current Cloud game backend services by deploying Solana GameShift on the Google Cloud Marketplace.

What can be achieved using GameShift on Google Cloud is hinted at by this reference architecture, which includes:

Integrating GameShift transactions with already-existing player data in BigQuery to produce a more comprehensive picture of player behavior.

Using the Solana public BigQuery dataset, BigQuery and Vertex AI are being used to analyze player behavior on-chain.

Easily host user-generated content worldwide using cloud storage.

generative AI is being used to game assets and user-generated material to guarantee adherence to content policies, toxicity, content moderation, anti-cheat measures, player privacy, safety, and security.

In order to quickly consume real-time blockchain event data and start in-game activities, use Pub/Sub.

Breakpoint Solana 2024

Web3 gaming has a bright future ahead of it, and looking forward to further developments:

Solana Mobile

The upcoming web3 mobile gadget, which was unveiled at Breakpoint 2024, will provide a new platform for mobile Web3 gaming.

Solana Permissioned Environments

By integrating Solana Permissioned Environments with GameShift on Google Cloud, studios may take advantage of the Solana ecosystem while still having control over their chain access.

Tournament administration

To make the integration of fiat and Web3 payments for gaming tournaments easier, GameShift recently announced the release of a real-money tournament administration tool.

In order to enable game creators to produce the next wave of captivating, safe, and inventive gaming experiences, Google Cloud and Solana GameShift are dedicated to providing them with the resources and infrastructure they require. With the support of GameShift and its partnership with Solana Labs, Google Cloud is assisting in realizing the potential of Web3 gaming.

Read more on Govindhtech.com

#SolanaGameShift#GameShift#GoogleCloud#CloudWeb3#Breakpoint2024#games#BigQuery#blockchain#news#technews#technology#technologynews#technologytrends#govindhtech

0 notes

Text

How Bitcoin is Revolutionizing Financial Freedom

In today's world, financial freedom is a dream many aspire to but few achieve. Traditional financial systems, with their inherent limitations and inefficiencies, often stand as barriers to true financial autonomy. Enter Bitcoin: a revolutionary tool that promises to redefine our understanding of money and financial independence. As we embark on this journey, we'll explore how Bitcoin is not just a digital currency but a catalyst for a new era of financial freedom.

Understanding Financial Freedom

Financial freedom is more than just having enough money to meet your needs; it's about having control over your finances without being shackled by external constraints. It means the ability to make choices that are best for you and your loved ones without constant financial stress. However, the current financial system poses significant obstacles: inflation erodes the value of savings, banking restrictions limit access to financial services, and high fees eat away at hard-earned money. These issues highlight the need for an alternative, and Bitcoin offers a compelling solution.

Bitcoin's Role in Achieving Financial Freedom

Decentralization

Bitcoin operates on a decentralized network, meaning it doesn't rely on a central authority like banks or governments. This decentralization removes intermediaries from financial transactions, reducing costs and increasing efficiency. With Bitcoin, individuals can send and receive money directly, anywhere in the world, without the need for approval from a third party.

Security

The security of Bitcoin lies in its blockchain technology. Every transaction is recorded on a public ledger, which is virtually tamper-proof due to its decentralized nature. This transparency ensures trust and reliability, making Bitcoin a secure store of value. Unlike traditional currencies, which can be manipulated or devalued, Bitcoin's supply is fixed, providing a hedge against inflation and monetary instability.

Accessibility

One of the most transformative aspects of Bitcoin is its accessibility. In many parts of the world, people lack access to basic banking services. Bitcoin opens up financial opportunities for the unbanked and underbanked populations, providing a way to save, invest, and transfer money without the need for a traditional bank account. All that is required is an internet connection and a digital wallet.

Control and Ownership

Bitcoin empowers individuals with true ownership of their assets. When you hold Bitcoin, you are in complete control of your funds. There are no banks that can freeze your account or governments that can seize your assets. This level of control is unprecedented and a key component of financial freedom.

Dollar-Cost Averaging (DCA) into Bitcoin

Dollar-Cost Averaging (DCA) is a strategy that involves investing a fixed amount of money into Bitcoin at regular intervals, regardless of the price. This approach mitigates the impact of market volatility, smoothing out the highs and lows over time. DCA is particularly effective in the volatile world of cryptocurrencies, making it a prudent strategy for those looking to build wealth steadily.

To implement a DCA strategy, start by determining how much you can comfortably invest on a regular basis, whether it's weekly, bi-weekly, or monthly. Then, set up automatic purchases of Bitcoin with that fixed amount. Over time, you'll accumulate Bitcoin at an average cost, reducing the risk associated with market fluctuations.

Real-world examples abound of individuals who have successfully used DCA to grow their Bitcoin holdings. For instance, those who began DCAing into Bitcoin years ago have seen substantial returns, demonstrating the power of this disciplined investment approach.

Real-World Examples

Consider the story of Alice, a school teacher in Argentina, where inflation has been rampant. By steadily converting a portion of her salary into Bitcoin, she has protected her savings from devaluation and gained financial stability. Or take John, a software developer in Nigeria, who used Bitcoin to bypass restrictive banking systems, enabling him to receive payments from international clients and support his family.

These stories are not isolated incidents; they represent a growing trend of people around the world leveraging Bitcoin to achieve financial freedom. The statistics are telling: as Bitcoin adoption increases, so does the number of individuals gaining economic independence.

Challenges and Considerations

While Bitcoin offers numerous benefits, it's important to be aware of potential challenges. The volatility of Bitcoin can be daunting for new investors. Regulatory uncertainties in different jurisdictions can also pose risks. However, these challenges can be mitigated with a thoughtful approach.

For instance, DCAing into Bitcoin helps manage the risk of volatility. Staying informed about the latest regulatory developments and understanding the legal landscape can help navigate potential pitfalls. As with any investment, it's crucial to do your research and make informed decisions.

Conclusion

Bitcoin is more than just a digital currency; it's a powerful tool for achieving financial freedom. By eliminating intermediaries, enhancing security, providing accessibility, and offering true control over assets, Bitcoin is revolutionizing the way we think about money. Dollar-Cost Averaging into Bitcoin is a practical strategy that can help individuals steadily build wealth and navigate the volatility of the cryptocurrency market.

As we move forward in this new financial era, Bitcoin offers a beacon of hope for those seeking independence and control over their financial destiny. Explore Bitcoin, understand its potential, and consider how it can be a part of your journey towards financial freedom.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#FinancialFreedom#CryptoRevolution#DigitalCurrency#Blockchain#BitcoinCommunity#Decentralization#CryptoInvesting#FinancialIndependence#DCA#BitcoinAdoption#CryptoEducation#EconomicEmpowerment#BitcoinLife#CryptoJourney#financial education#financial empowerment#financial experts#cryptocurrency#finance#globaleconomy#unplugged financial

3 notes

·

View notes

Text

Cash App Clone Script: For Creating Your Own P2P Payment App

In today's fast-paced digital economy, seamless and secure payment solutions are more essential than ever. One platform that has revolutionized peer-to-peer (P2P) payments is Cash App. Its easy-to-use interface and various features have made it a favorite among users who want fast, secure, and reliable money transfers. If you're looking to launch your own P2P payment app similar to Cash App, a Cash App Clone Script can make that dream a reality, offering the same cutting-edge technology and features at a fraction of the development cost.

This blog will discuss what a Cash App clone script entails, how it works, the benefits for investors, and how working with Plurance, the top-rated P2P payment gateway development company, can help you create a successful payment platform.

What Is a Cash App Clone Script?

A Cash App Clone Script is a ready-made software solution that replicates the features and functionalities of the original Cash App. It allows businesses and entrepreneurs to launch their Peer-to-peer payment platforms quickly. Instead of starting from scratch and undergoing a lengthy and costly development process, a clone script provides a reliable foundation that can be customized according to your business needs.

The clone script includes all essential features like money transfers, digital wallet integration, bill payments, and cryptocurrency trading. Whether you are a startup or an established financial service provider, a Cash App clone can give you the technological edge you need to compete in the P2P payment market.

Cash App Clone Software: Powered by Plurance

It would help if you had a highly secure and efficient software solution to launch your Cash App-like platform successfully. Plurance, a leading name in the blockchain and P2P payment gateway development industry, offers the most comprehensive and reliable Cash App clone software. Plurance has a team of experienced developers who ensure that your platform mirrors Cash App's functionalities and offers enhanced security, scalability, and custom features to give you a competitive advantage.

By working with Plurance, you are assured a high-quality product that can handle thousands of transactions securely and efficiently while maintaining a user-friendly experience.

Key Features of Cash App Clone Script

P2P Money Transfer: Instant and secure peer-to-peer payments using bank accounts or linked debit/credit cards.

Digital Wallet Integration: Receive money with a secure digital wallet.

QR Code Payments: Make payments easily using QR codes for instant transfers.

Cryptocurrency Trading: Offer users the ability to buy, sell, and hold cryptocurrencies within the app.

Bill Payments: Users can pay utility bills, recharge their phones, and more directly from the app.

Multi-layer Security: Implement encryption, two-factor authentication, and biometric login for enhanced security.

Bank Transfers: Facilitate seamless transfers between user accounts and bank accounts.

How It Benefits Investors

Cost-Efficient Development: A clone script reduces the time and cost of building an app from scratch, making it a highly efficient way to enter the financial services market.

Revenue Opportunities: With features like cryptocurrency trading, transaction fees, and premium services, a Cash App-like platform offers multiple revenue streams.

Scalability: Clone software is built to scale, allowing you to grow your user base and transaction volume without compromising performance.

Strong Market Demand: The digital payments market is increasing, offering lucrative opportunities for investors. Launching a reliable and feature-rich platform can attract a large user base.

Branding and Customization: The clone script is customizable, allowing you to build a unique brand identity that resonates with your target audience.

Conclusion

The growing demand for digital payment solutions presents a tremendous opportunity for entrepreneurs and investors. A Cash App clone script offers a fast, reliable, and cost-effective way to enter this market. With the right features, a scalable infrastructure, and a secure environment, you can create a platform that rivals apps like Cash App.

Working with Plurance, the top-rated P2P payment gateway development company, ensures your app has the technological backbone and security to succeed. The growth opportunities are immense whether you want to focus on local payments or expand globally. Start your journey today and transform how people transfer money with your Cash App-like platform.

For more info:

Call/Whatsapp - +918807211181

Mail - sales@plurance. com

Telegram - Pluranceteck

Skype - live:.cid.ff15f76b3b430ccc

Website - https://www.plurance.com/cash-app-clone-script

0 notes

Text

Retrieve Funds from Cryptocurrency: A Comprehensive Guide

Cryptocurrency, once a niche digital asset, has now become a mainstream investment option. As more people enter the crypto world, understanding how to withdraw funds becomes increasingly important. This guide will walk you through the step-by-step process of retrieve funds from cryptocurrency holdings, ensuring a smooth and secure experience.

Understanding Cryptocurrency Wallets

Before we dive into the withdrawal process, let's clarify the role of cryptocurrency wallets. A wallet is essentially a digital container that stores your crypto assets. There are two main types: hot wallets and cold wallets.

Hot wallets: These are online wallets connected to the internet, providing easy access to your funds. While convenient, they pose a higher security risk due to their exposure.

Cold wallets: Also known as hardware wallets, these are offline devices that store your private keys securely. They are generally considered the most secure option for storing crypto.

Choosing a Withdrawal Method

The method you'll use to withdraw your funds depends on your specific needs and preferences. Here are the most common options:

1. Converting to Fiat Currency

Centralized Exchanges: Most popular exchanges allow you to convert your crypto to fiat currencies like USD, EUR, or GBP. After converting, you can withdraw the fiat funds to your bank account.

Peer-to-Peer (P2P) Exchanges: These platforms connect buyers and sellers directly, allowing you to trade crypto for fiat without intermediaries.

2. Sending Crypto to Another Wallet

Internal Transfers: If you have multiple wallets on the same platform, you can easily transfer crypto between them.

External Transfers: To send crypto to a wallet on a different platform, you'll need the recipient's wallet address. Ensure you double-check the address to avoid sending funds to the wrong place.

3. Purchasing Goods or Services

Many merchants now accept cryptocurrency as payment. You can directly use your crypto to buy products or services.

Step-by-Step Withdrawal Guide

Log in to Your Wallet: Access your cryptocurrency wallet using your private key or password.

Select the Crypto Asset: Choose the specific cryptocurrency you want to withdraw.

Enter the Withdrawal Amount: Specify the amount of cryptocurrency you wish to withdraw.

Provide the Recipient's Address: If you're sending crypto to another wallet, input the correct address.

Confirm the Transaction: Review the details and confirm the withdrawal. You'll typically be asked to enter a security code or solve a puzzle to verify your identity.

Wait for Confirmation: Once confirmed, your transaction will be broadcast to the blockchain network. It may take some time for the network to verify and process the transaction.

Security Considerations

Strong Passphrases: Use complex and unique passphrases for your wallets. Avoid using easily guessable information.

Two-Factor Authentication (2FA): Enable 2FA to add an extra layer of security. This typically involves providing a code sent to your phone or email in addition to your password.

Regular Backups: Back up your wallet's private key or seed phrase in a secure location. This will allow you to recover your funds in case of loss or theft.

Beware of Scams: Be cautious of phishing attempts and fraudulent websites. Never share your private key or password with anyone.

youtube

Conclusion

Withdrawing funds from your cryptocurrency holdings is a straightforward process once you understand the basics. By following the steps outlined in this guide and prioritizing security, you can safely and efficiently access your digital assets. Remember to always conduct thorough research and choose reputable platforms to ensure a positive experience.

#recover funds from a trading scam#retrieve funds from cryptocurrency#report a cryptocurrency scam#how to report a cryptocurrency scam#report a fraudulent website#Youtube

1 note

·

View note