#introduction to blockchain technology

Explore tagged Tumblr posts

Text

Transforming Supply Chain Management: The Impact of Blockchain Technology

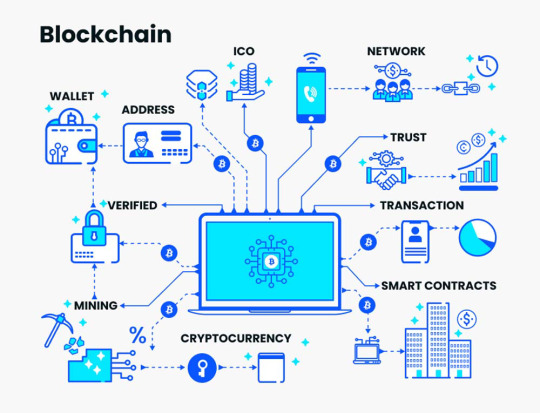

Blockchain technology is transforming supply chain management by enhancing transparency, traceability, and security. Its decentralized and immutable ledger provides real-time visibility into every transaction, ensuring that all stakeholders have access to accurate and verifiable data. This transparency reduces the risk of fraud and errors, builds trust among participants, and enhances the overall efficiency of supply chain operations. Blockchain's robust security features also protect against tampering and cyber-attacks, ensuring the integrity of supply chain data.

The use of smart contracts further revolutionizes supply chain processes by automating tasks such as payments, compliance checks, and inventory management. This automation reduces operational costs, accelerates transaction times, and minimizes the need for intermediaries.

Real-world applications, such as Walmart's food safety initiative and IBM and Maersk's TradeLens platform, highlight how blockchain can improve traceability, efficiency, and collaboration in supply chain management.

Despite challenges like scalability, interoperability, and regulatory uncertainties, the potential benefits of blockchain in supply chain management are driving its adoption across industries. Future trends include the integration of blockchain with IoT and AI, the evolution of smart contracts, and the development of industry-specific standards.

#blockchain development#blockchain development companies#Future Trends of Blockchain in Supply Chain Management#How Blockchain Transforms Supply Chain Processes#How does blockchain enhance transparency in the supply chain?#Introduction to Blockchain in Supply Chain Management#Overview of Supply Chain Management#The Role of Blockchain in Supply Chain Management#What are the challenges of implementing blockchain in supply chains?#What are the key benefits of blockchain in supply chain management?#What is Blockchain Technology?#web3 development#metaverse development company#blockchain development services#metaverse game development

0 notes

Text

An Introduction to Blockchain Technology and its Role in Cryptocurrency

Written by Delvin Blockchain technology and cryptocurrencies have revolutionized the way we perceive and interact with the digital world. At the heart of this technological revolution lies blockchain, a decentralized and transparent ledger system that powers cryptocurrencies like Bitcoin and Ethereum. In this blog post, we will delve into the fundamentals of blockchain technology and explore its…

View On WordPress

#An Introduction to Blockchain Technology and its Role in Cryptocurrency#Blockchain Technology#Crypto#Cryptocurrency#dailyprompt#Financial#Financial Freedom#Financial Literacy#Generational Wealth#Key Features of Blockchain Technology#money#Personal Finance#Personal growth#Understanding Blockchain Technology#Wealth

0 notes

Text

Understanding Blockchain Technology

The Building Blocks of Cryptocurrency Introduction: Blockchain technology is at the core of cryptocurrencies like Bitcoin and can potentially revolutionize various industries. In this comprehensive guide, we’ll dive deep into the fundamentals of blockchain technology and its role as the building blocks of cryptocurrency. From its decentralized nature to its immutability and security features,…

View On WordPress

#best introduction to blockchain#blockchain by zeeshan usmani#blockchain evolution explained a beginners guide to understanding blockchain technology#blockchain tech explained#blockchain technology explained#blockchain technology explained simply#blockchain technology simple explained#blockchain underlying technology#blockchain understanding#blockchain understanding its uses and implications#bs blockchain technology#explain blockchain technology#how to understand blockchain#how to understand blockchain technology#technical explanation of blockchain#top blockchain companies in pakistan#understand blockchain and cryptocurrency#understand blockchain technology#understanding blockchain#understanding blockchain technology#understanding blockchain technology and how to get involved

0 notes

Text

The Four Horsemen of the Digital Apocalypse

Blockchain. Artificial Intelligence. Internet of Things. Big Data.

Do these terms sound familiar? You have probably been hearing some or all of them non stop for years. "They are the future. You don't want to be left behind, do you?"

While these topics, particularly crypto and AI, have been the subject of tech hype bubbles and inescapable on social media, there is actually something deeper and weirder going on if you scratch below the surface.

I am getting ready to apply for my PhD in financial technology, and in the academic business studies literature (Which is barely a science, but sometimes in academia you need to wade into the trash can.) any discussion of digital transformation or the process by which companies adopt IT seem to have a very specific idea about the future of technology, and it's always the same list, that list being, blockchain, AI, IoT, and Big Data. Sometimes the list changes with additions and substitutions, like the metaverse, advanced robotics, or gene editing, but there is this pervasive idea that the future of technology is fixed, and the list includes tech that goes from questionable to outright fraudulent, so where is this pervasive idea in the academic literature that has been bleeding into the wider culture coming from? What the hell is going on?

The answer is, it all comes from one guy. That guy is Klaus Schwab, the head of the World Economic Forum. Now there are a lot of conspiracies about the WEF and I don't really care about them, but the basic facts are it is a think tank that lobbies for sustainable capitalist agendas, and they famously hold a meeting every year where billionaires get together and talk about how bad they feel that they are destroying the planet and promise to do better. I am not here to pass judgement on the WEF. I don't buy into any of the conspiracies, there are plenty of real reasons to criticize them, and I am not going into that.

Basically, Schwab wrote a book titled the Fourth Industrial Revolution. In his model, the first three so-called industrial revolutions are:

1. The industrial revolution we all know about. Factories and mass production basically didn't exist before this. Using steam and water power allowed the transition from hand production to mass production, and accelerated the shift towards capitalism.

2. Electrification, allowing for light and machines for more efficient production lines. Phones for instant long distance communication. It allowed for much faster transfer of information and speed of production in factories.

3. Computing. The Space Age. Computing was introduced for industrial applications in the 50s, meaning previously problems that needed a specific machine engineered to solve them could now be solved in software by writing code, and certain problems would have been too big to solve without computing. Legend has it, Turing convinced the UK government to fund the building of the first computer by promising it could run chemical simulations to improve plastic production. Later, the introduction of home computing and the internet drastically affecting people's lives and their ability to access information.

That's fine, I will give him that. To me, they all represent changes in the means of production and the flow of information, but the Fourth Industrial revolution, Schwab argues, is how the technology of the 21st century is going to revolutionize business and capitalism, the way the first three did before. The technology in question being AI, Blockchain, IoT, and Big Data analytics. Buzzword, Buzzword, Buzzword.

The kicker though? Schwab based the Fourth Industrial revolution on a series of meetings he had, and did not construct it with any academic rigor or evidence. The meetings were with "numerous conversations I have had with business, government and civil society leaders, as well as technology pioneers and young people." (P.10 of the book) Despite apparently having two phds so presumably being capable of research, it seems like he just had a bunch of meetings where the techbros of the mid 2010s fed him a bunch of buzzwords, and got overly excited and wrote a book about it. And now, a generation of academics and researchers have uncritically taken that book as read, filled the business studies academic literature with the idea that these technologies are inevitably the future, and now that is permeating into the wider business ecosystem.

There are plenty of criticisms out there about the fourth industrial revolution as an idea, but I will just give the simplest one that I thought immediately as soon as I heard about the idea. How are any of the technologies listed in the fourth industrial revolution categorically different from computing? Are they actually changing the means of production and flow of information to a comparable degree to the previous revolutions, to such an extent as to be considered a new revolution entirely? The previous so called industrial revolutions were all huge paradigm shifts, and I do not see how a few new weird, questionable, and unreliable applications of computing count as a new paradigm shift.

What benefits will these new technologies actually bring? Who will they benefit? Do the researchers know? Does Schwab know? Does anyone know? I certainly don't, and despite reading a bunch of papers that are treating it as the inevitable future, I have not seen them offering any explanation.

There are plenty of other criticisms, and I found a nice summary from ICT Works here, it is a revolutionary view of history, an elite view of history, is based in great man theory, and most importantly, the fourth industrial revolution is a self fulfilling prophecy. One rich asshole wrote a book about some tech he got excited about, and now a generation are trying to build the world around it. The future is not fixed, we do not need to accept these technologies, and I have to believe a better technological world is possible instead of this capitalist infinite growth tech economy as big tech reckons with its midlife crisis, and how to make the internet sustainable as Apple, Google, Microsoft, Amazon, and Facebook, the most monopolistic and despotic tech companies in the world, are running out of new innovations and new markets to monopolize. The reason the big five are jumping on the fourth industrial revolution buzzwords as hard as they are is because they have run out of real, tangible innovations, and therefore run out of potential to grow.

#ai#artificial intelligence#blockchain#cryptocurrency#fourth industrial revolution#tech#technology#enshittification#anti ai#ai bullshit#world economic forum

32 notes

·

View notes

Text

Why Crypto Payments are the Key to Future-Proofing Your Business.

Introduction

In recent years, cryptocurrencies have really been on the radar big time. Big time in ways they're a digital currency that harnesses blockchain technology, which has the potential to completely shake up a lot of different kinds of businesses and transactions. The emergence of cryptocurrencies, especially Bitcoin, has encouraged businesses to think about embracing crypto payments as a way to remain competitive and future-proof their businesses Crypto as an Investment: Volatility and Opportunities

Cryptocurrencies are now a sought-after investment asset, they are extremely volatile. Big swings in crypto prices like Bitcoin and Ethereum have really given investors a chance to do well big time. But of course, that volatility means investors are also risking very big losses, losses like market crashing and real money going up in smoke at the financial winds. In spite of this, most cryptocurrency proponents consider digital currencies a good avenue for diversifying investment portfolios, cognizant of the fact that cryptocurrencies are not stable, long-term assets but speculative investments. For companies, this is a two-edged sword—accepting cryptocurrencies as payment may unlock new revenue streams but companies have to carefully weigh their risk appetite when considering their participation in the world of cryptocurrencies.

Benefits of Acceptance of Crypto Payments

Beyond the risks, moving to accepting different types of cryptocurrency is a win for companies especially those in financial tech. These benefits include:

Lower Transaction Fees: Conventional payment processors and financial intermediaries usually impose high transaction fees. Cryptocurrencies usually have lower transaction fees.

Speedier Transactions: Transactions involving cryptocurrencies are much quicker than traditional banking systems, particularly cross-border payments, where old financial systems take days to clear transactions.

New Customer Bases Access: By embracing cryptocurrency, companies can access a worldwide market of crypto investors and enthusiasts. This gives companies new access to customers who are perhaps excited about making transactions digitally or through decentralized routes.

Improved Security and Fraud Protection: Cryptocurrencies employ encryption and blockchain technology to protect transactions, making it much less likely for fraud or chargebacks to occur.

Challenges and Considerations

Sure, while there are great benefits to adopting cryptocurrency payments for companies, there are also many things to consider and pay attention to. The biggest concern is the built-in price volatility of digital currency, which may lead to unforeseen profits or losses for companies holding crypto assets. To avoid that risk, companies need contingency plans to handle crypto assets and convert them into stable currencies if need be.

Furthermore, the regulatory environment for cryptocurrencies is also developing. Governments across the planet are trying to devise rules and ways to collect taxes on digital money, but some corporations are unsure of their future, because they see rules as unclear and even unstable. Companies should make sure they adapt to local regulations, such as anti-money laundering (AML) and know-your-customer (KYC) regulations, in order to avoid a potential legal battle.

The Future of Cryptocurrency in Business

The increasing use of cryptocurrencies indicates that companies adopting crypto payments now may have a head start in the future. Companies that jump the gun and start taking cryptocurrency payments have a great chance to stand out and lead in their industries. With the rise of blockchain technology, brand new inventions like tokenization, smart contracts has the potential to really change the way all sorts of companies do business, trade and deal with supply chains.

As companies take bigger and bolder steps towards both digitization and decentralized systems, digital currency really offers a nifty shortcut for making transactions slicker, and snappier and also opens new doors to new markets.

Conclusion

In summary, although cryptocurrency payments come with some risks, the potential advantages make them an attractive choice for companies looking to future-proof their business. By embracing crypto payments, companies can lower transaction costs, enhance transaction speed, gain access to new customer bases, and enhance security. Of course, there are still issues like volatility and uncertainty about the rules that get in the way, but for companies that really get involved in companies that use crypto transactions wisely, there can be long-term huge benefits. As the economy keeps changing, embracing cryptocurrency today could make someone a pioneer in the future generation of financial technology.

7 notes

·

View notes

Text

some thoughts on leaving a social media website...again

as of 10/16/2024, twitter has announced its intention to implement a new feature into the platform: instead of blocking allowing you to block certain accounts from viewing your profile if it's public, it now just... doesn't do that anymore. it only limits interaction. though this certainly isn't a surprise with musk's twitter rollouts since 2021—when i first saw people start to trickle out—this, in particular, breaks a lot of users boundaries and has prompted many to private their accounts and move to bluesky.

i'm in support of this, btw—the ceo of bsky is strongly opposed to ever running any sort of ads on the site ("won't enshittify the network with ads"), doesn't use any blockchain technology, and has a culture where supplying alt text on images is the norm. your main timeline is in reverse-chronological order (like intended), but there are other separate options to create a custom algorithmic feed for certain types of content, only if you wish to. though bsky is a work in progress, i have high hopes for what it can be in the future: that is, usable, practical, and more reminiscent of what it was like when twitter first started, than how twitter currently is.

but despite my love for bluesky, i won't spend too much time glazing yet another microblogging platform. instead, i'm here to ponder the concept of social media: why we have it, why we use it, and why these moves happen in the first place. people have been trickling in and out of twitter ever since the richest and evilest man in the world took possession of it; especially in a fandom sense, there's been a back and forth between twitter and tumblr due to tumblr's former porn ban, as well. we all have principles and morals that guide the decisions we make, including what websites we decide to use. they speak to a pattern of not only our culture as people at any given time—but how these platforms have the power to implement these changes whenever they want. and we, as individuals, must make decisions both based on those principles, but also our desires to fit in.

i'll start off by saying this—eventually i'm going to start talking about what social media means for creatives. but there is in fact an extremely well-written article about this already that goes into more detail. if you're more interested in that, let me direct you there first: R U AN ARTIST ON SOCIAL MEDIA??? by omoulo

with that out of the way, let's talk about me, shall we?

i got onto the internet through geocities—crazy sentence to say now after all these years. of course, i played neopets and flash games like many other kids, but that was mostly through knowing those websites and urls existed, and preserving them in my mind so i could return to them for some mindless minutes of entertainment later. geocities was my first introduction to the creative, user-designed web, so to speak. instead of being a number to interact with a thing that someone else has made—a flash game, a youtube video, a website where you can collect fictional pets—the idea of geocities to me at the time was this idea of participating on the internet. being a part of it. writing whatever i wanted and posting it. sharing the link with others. having others find it and read it too—a part of me, my method of creative self-expression, whatever i desired to write and post on the less than permanent internet.

my best friend at the time was the one who needled me into creating accounts—first an email address, then an AIM, then a myspace, then an IMVU, so on and so forth. i wasn't going out looking for these, and though i'd heard of them before or seen ads of some of these sites, i wasn't interested in actually being on these platforms and making these accounts until my friend told me that i should. call me a people pleaser or easily influenced or whatever; i was 12. but it was through this link sharing, this naivety and ignorance of the vastness of the internet, that allowed me to be fascinated with the world wide web in the first place.

i usually cite quizilla as my first "fandom" website, because it was—but it wasn't because i found it by accident. it wasn't that i googled it or looked for a personality test and stumbled upon it. no, it's because i was chatting with a friend on AIM, and she had found some crazy chain letter story and shared it to me for how absurd it was, and sent me the link. it was on quizilla.

literally the moment i clicked that link changed my life forever. even though i read the crazy story, i also clicked on the username of the person who posted it, out of curiosity. that person had jonas brothers fanfics on their quizilla profile, of all things, which led me into an obsession with the jonas brothers in the 2 years that followed. through that link—that account—that platform—i got a lot more interested in writing, webdesign, and what it meant to be on the internet, not just as a numbered participant, but also as someone with an imagination, who finds fulfillment in creative expression. i wrote the longest thing i'd ever written in that time (30k of a self-insert, but we won't go into that), began to experiment with css and website design, and participated, sharing stuff that i thought was interesting or fun, worth 5 minutes of anyone's time.

the internet wasn't just about being a place where my presence didn't matter anymore—it became a medium of self-expression. more than that, it became a place where i could meet and socialize with people, especially as i developed avpd in my high school years.

the internet wasn't always like this. right now, when we talk about the internet, we don't talk about the random websites we find, the links we stumble upon. (i have an entire website dedicated to those for me, though.) the games we spend hours playing, by ourselves, without interacting with others. random personality tests, or just simply the news. we talk about google, but in the same way we talk about facebook, or even twitter. it's a verb; it's omnipresent; it exists within the context of our internet culture, but becomes meaningless outside of it. it's not to say it doesn't have meaning—but that the language we use represents our relationship with it, this assumed normalcy. this assumed dependence.

i bring up my own history because as young as i feel compared to many of my older internet friends, and how late to the game i always felt—i was there. i was there on the internet before twitter (since 2009), tumblr (since 2010), facebook (i lied about my age), bluesky now, and whatever will come in the future. i was there when people were saying that the internet was still being written; when websites were made with tables (eugh); when email was the primary way to connect with others, because irc was for nerds and nothing else had been invented yet.

i'm a big advocate for not looking at the past with rose colored glasses and getting caught up in nostalgia and greener grass. i believe that technology is not inherently harmful or bad—it creates more options for accessibility, especially for those who are disabled. and even outside of that, it allows us to learn about more people, communicate with others with a few keystrokes, and form relationships that we otherwise would never get to have. i don't want this to seem like i'm saying "man remember how good the internet used to be?" because i'm not—i believe that as things change, there are benefits as much as there are hindrances.

of course, it bears saying that the primary hindrance—of current twitter, of many platforms over the years, and the internet with increasing recency—is corporations. big money interests. capitalism.

it's why we get so tired of ads—it's why ads exist in the first place. it's why these social media platforms that used to feel like they were made by the same people who would use them (livejournal, youtube, twitter) have suddenly become these soulless impersonal websites. it becomes more obvious that they want you to use them more because they sell you on exclusivity and visual minimalism, rather than because that's where your friends are, and you have this unique way to express yourself.

in fact, i'll say this: the first time i learned about facebook when i was too young to use it, i was not impressed. i had a myspace at the time that i had dolled up to make pretty with sparkly gifs and obnoxious colors and weird fonts. when i saw how boring and samey everyone's facebook profile page was, i was like, what's the point? sure i could talk to my classmates and random other people in my life that i didn't really care about, but what about making myself different from others? what about my creative expression? what about having an account that makes me look unique, instead of blending in with everyone else?

and so here i am nearly two decades later pondering about the use of social media, our individuality as well as our collective interests, and how the internet has changed so much, both in itself and how it affects us, in that time.

i'm here because i want to talk to my friends and meet new people with common interests and get excited about them. i don't want to feel left out, but that's a normal experience—outside of fomo, it is in our core to connect with others. it's the whole meaning of everything. it's why i even made an email in the first place, in my basement with my best friend, secretly setting up a yahoo account because she wanted another way to talk to me, and i wanted another way to talk to her. it's why people have been leaving twitter little by little for another site—the same site as many others, because that's where all their friends are. whether it's bsky or mastodon or misskey or just back here on tumblr, we're here not just because of our desire for community, but even as simple as our desire for a bond, a relationship with another human being. to me, that is how "social media" is defined—a medium through which we socialize because of this innate desire.

and yet, of course the enshittification and corporatification makes this more difficult for us, in ways more than one. because the fact is that as we (as people) became better at using the internet, finished writing it, and understood it—psychologically and sociologically—so did the corporations. or advertisers, you take your pick. we, the everypeople who use the internet as means to fulfill our social and other self-indulgent desires, are not the only people here. as with many things else in the world, the internet turned from an unpredictable but fun mess of us figuring shit out as we went along, into a product designed to keep us using it and engaging with it more, so some rich people can put even more money into their pockets. it's why twitter is the way it is now; even why tumblr is the way it is. why social media has become about "content creation" and "small businesses." why it feels like, every day, we see more ads and AI generated bullshit, as a little bit of the original soul of the internet gets sucked away day by day.

but even there, i don't want to come across as cynical or world-weary. though i believe this to be true, i don't think it says anything about our lack of agency, or our lack of innate humanity. instead, i believe that this means, at least on the individual level, that we should think more about not only what we're doing on the internet, but why we're doing it. how we're doing it. are we here because we're addicted? or is there something we're getting out of it? sure, many websites now have more addictive UI and algorithms that tell the receptors of our brain to return to them because we were getting so much dopamine from them earlier. but i also wouldn't necessarily argue that the only solution to this is to, then, go offline.

i have many friends who've elected to depart social media but stay online—friends who i met through website building, to be fair, but that's one of my main points. i already wrote a manifesto on my love letter to the personal website; but the tl;dr is this:

the internet is not evil, it is not good, it is just a form. if we desire to express ourselves and socialize with others in this space, it does not have to be just about social media, and creating a new account on a new website every time people move. instead, we have personhood—we have individuality, we have agency. we have the ability to build our own websites, no matter how shitty or times new roman comic sansy or color clashy or sometimes inaccessible they can be. regardless of all these seeming impractical setbacks though, it does not absolve us of that ability to do whatever we want on the internet. and it also bears saying that websites, both the personal and impersonal, can change over time, for better or worse.

i am a huge proponent for people making their own personal websites. it makes me so so happy that neocities is gaining popularity, mostly because i love seeing people try their own hand at making a website for themselves, a new form of self-expression. i won't go into too much detail on this because i've already said everything i want to say about it (see above), but if you take away anything from this post, let it be this: consider making a personal website, a corner of the internet, for yourself, by yourself. not just because you want people to engage with it, or because you want to curate to an algorithm or an artistic/fannish trend. not because you want the things you make to gain traction, to get bigger numbers without considering the people behind those numbers, as soon as possible.

do it because you want to. because you have to. because you think it's cool, and because it's you. people may find it and judge it; but they may like it as well. the more unique and authentic and weird we are with each other, the more we are able to appreciate each other for who we really are. the internet is one of many places we can do this.

i don't really see these forms of self-expression separate from social media, but i do see social media separate from it. to me, social media is a vehicle to strengthen those connections, those relationships, much like DMs and IRCs; but it is not the be-all, end all of the internet. it's only a small part of it. not everything is permanent on the internet; but everything that ever has been online is a microcosm of the human experience, whether it's an old cloudflare site or twitter dot com in 2010.

our experiences on the internet are not about corporate interests. it's about using limewire to download pirate music, sharing random links we find, building a design that may not be practical or universally appealing but still represents a form of individuality. when i think of how the internet has grown, i don't think about what it means for companies or advertisers or what meetings must go on to get people like me to keep using it—i think about remembering the difference between addicting games dot com and addicted games dot com, clicking links on websites to find even more websites, sitting at the family computer and deciding if i wanted to spend hours on neopets or that one willy wonka flash game i grinded like several hours on one night when i was 7. i think about what it's always meant to me, because the internet was not always a centralized place where i was going on the same website every day. the rise of internet centralization to the point that it's become expected, the norm, the primary way any of us to be online, is not inherently a bad thing—but i wouldn't say it's a universal good, either, when the internet is a wide and vast space, and can be so much more than that.

because the one thing that remains throughout the years is our agency and choice. we still have the ability to make the internet what we want it to be, or at least a corner of it, something separate from the corporations, the enshittification, economically researched user interfaces and experiences, the advertisements, the "like and share so the algorithm boosts me more." there's still a point to it all without the money, and without twitter. and it's both our desire for creativity and self-expression, as well as our intrinsic bonds with each other. despite it all, it's about our humanity.

as the internet continues to grow, so do we. nevertheless, the importance of our humanity, and retaining it, will remain. oftentimes it is up to us to remind ourselves of that.

-

links here, for access:

Bluesky CEO Jay Graber Says She Won’t ‘Enshittify the Network With Ads’

R U AN ARTIST ON SOCIAL MEDIA??? by omoulo

links @ kingdra.net (my links, like bookmarks)

A manifesto of sorts; or, my love letter to the personal website by me

9 notes

·

View notes

Text

Introduction to SkillonIT Learning Hub- Empowering Rural Talent With World-Class IT Skills

SkillonIT provides IN-Demand IT courses, connecting Rural talent with rewarding IT skills through affordable, accessible and career-focused education. with Guaranteed pathways to internship and high paying jobs, start with us and step into Opportunities at top Tech-leading Companies. Skillonit Learning Hub, located in Buldhana, Maharashtra, is a leading institute dedicated to equipping individuals with cutting-edge technology skills. With a mission to bridge the digital divide, the institute provides high-quality education in various IT and professional development domains. Skillonit focuses on practical, industry-oriented training, ensuring students gain the expertise needed to thrive in today’s competitive job market. The hub is committed to empowering rural talent and shaping the next generation of skilled professionals.

Courses Offered Skillonit Learning Hub offers a diverse range of courses tailored to industry demands, enabling students to master both technical and professional skills.

Blockchain Development — Smart Contracts (Solidity, Rust, Web3.js, Hardhat) — Blockchain Protocols (Ethereum, Solana, Binance Smart Chain, Fantom) — Decentralized Applications (DApps) Development

Front-End Development — HTML, CSS, JavaScript — Frameworks: React.js, Vue.js, Angular — Responsive Web Design & UI Frameworks (Bootstrap, Tailwind CSS)

Back-End Development — Server-side Programming (Node.js, Python, PHP, Java, .NET) — Database Management (MySQL, MongoDB, Firebase, PostgreSQL) — API Development (RESTful APIs, GraphQL, WebSockets)

Full-Stack Development — Front-End + Back-End Integration — MERN Stack Development — Database, Deployment & DevOps Practice

Mobile App Development — Cross-Platform Development (Flutter, React Native)

Unity 3D Game Development — Game Mechanics & Physics — C# Programming for Game Development — Virtual Reality (VR) & Augmented Reality (AR) Integration

Professional UI/UX Design — User Interface Design (Adobe XD, Figma, Sketch) — User Experience Principles — Prototyping, Wireframing & Usability Testing

Professional Graphic Design — Adobe Photoshop, Illustrator, and CorelDraw — Branding & Logo Design — Digital Art & Visual Communication

Digital Marketing — SEO, SEM, and Social Media Marketing — Content Marketing & Copywriting — Google Ads, Facebook Ads & Analytics

Spoken English — Communication Skills & Public Speaking — Accent Training & Fluency Improvement

Personality Development — Business & Corporate Etiquette — Confidence Building & Interview Preparation — Leadership & Teamwork Skills

Location & Contact : Address : Chhatrapati Tower, Above Maratha Mahila Urban, 3rd Floor, Chikhali Road, Buldhana, Maharashtra, 443001.

Contact us

Conclusion : Skillonit Learning Hub is revolutionizing IT and professional education by making technology and essential career skills accessible to aspiring developers, designers, marketers, and professionals. With a strong emphasis on practical learning, industry exposure, and career opportunities, it stands as a beacon of growth for young talent in Buldhana and beyond. Whether you are looking to build a career in tech, marketing, design, or personal development, Skillonit provides the ideal platform to achieve your goals. Join Our Social Community

Skillonit #Education #ITCourses #Buldhana #Maharashtra #IT #Blockchain #Fullstack #Front-end #Back-end #MobileApp #Unity3d #UIUX #Graphicdesign #Digitalmarketing #SpokenEnglish #Personality #development

2 notes

·

View notes

Text

PX Token: A New Era of Digital Creativity and Trading

The crypto landscape is evolving rapidly, and every so often, a project emerges that merges technology with a completely new use case. PX Token is not just another digital asset—it represents the intersection of blockchain, art, and community-driven innovation.

Built on the foundation of Not Pixel, a Telegram-based pixel art project, PX started as an in-game currency that powered a collective digital canvas. Users contributed to pixelated artworks, meme creations, and intricate designs, fostering an interactive and collaborative ecosystem.

Now, PX has transcended its original function—it has become a fully tradable token, bringing a new opportunity for traders, artists, and investors alike. With its listing on STON.fi, PX is now part of a decentralized market where it can be exchanged, farmed, and integrated into broader financial activities.

PX Enters the Trading Market

What started as a community-based reward system has evolved into a market-driven asset. With PX now live on STON.fi, it enters the open market, allowing users to trade it against TON, providing liquidity, and participating in decentralized finance activities.

This transition is significant because it gives PX real economic value, moving beyond its origins as an internal currency. Now, traders can speculate on its price movements, holders can benefit from future demand, and liquidity providers can earn rewards by supporting the token’s ecosystem.

Unlike many speculative assets that rely solely on hype, PX has the advantage of being rooted in an active community, with real users engaging with the project daily. This organic utility helps create sustained demand and long-term growth potential.

Liquidity Farming: Passive Income for PX Holders

To further strengthen its market presence, PX has introduced PX/TON liquidity farming on STON.fi, offering a chance to earn rewards while holding tokens.

Total Rewards Pool: 250,000 PX (~$90,000)

Farming Period: Active until January 25

Flexible Staking: No mandatory LP token lock-up

Farming provides an additional incentive for long-term holders, ensuring that those who contribute to liquidity are rewarded. It also enhances the token’s stability in the market by encouraging users to stake rather than sell.

This approach benefits both traders and the ecosystem—traders can earn passive rewards while the token maintains healthier liquidity, reducing extreme volatility.

Why PX Stands Out

The launch of PX as a tradable token isn’t just another listing—it signifies the growth of blockchain-based creativity in a way that is both interactive and financially rewarding.

Here’s why PX is gaining attention:

Community-Driven Origin: Unlike speculative tokens with no real backing, PX started as a functional digital asset within a thriving art community.

Tied to a Growing Ecosystem: Not Pixel continues to expand, meaning PX will retain utility beyond trading speculation.

Decentralized Trading & Farming: With STON.fi integration, PX benefits from secure, fast, and cost-effective transactions on the TON blockchain.

Real Market Utility: Whether used for art-based incentives or liquidity farming, PX goes beyond a simple buy-and-sell model.

As the broader Web3 ecosystem continues to embrace creative and community-based tokens, PX has the potential to carve out a niche in the digital economy of the future.

What’s Next for PX

PX’s introduction to the trading world marks the beginning of its journey. As more traders, investors, and community members get involved, its ecosystem will likely expand beyond its current use cases.

The potential growth paths include:

Deeper integration with Web3 applications

New collaborations within the TON blockchain

Increased liquidity, making it a more stable asset

Evolving utilities that go beyond art and into decentralized finance

For now, PX presents a unique opportunity—one that merges art, community, and financial innovation into a single ecosystem. Whether you’re a trader looking for a new asset to explore or a community member engaged in Not Pixel’s digital creativity, PX stands as a token to watch.

3 notes

·

View notes

Text

Blockchain Technology: Types, Features, and Future of Cryptocurrency Networks

Blockchain is not just a trend, it’s a game-changer. You can especially see it in the crypto world, where this technology is absolutely essential. It’s a decentralized system that ensures secure and transparent transactions without the need for traditional middlemen. Blockchain is the backbone of digital currencies like Bitcoin and Ethereum, ensuring their integrity and trust. But its potential goes far beyond cryptocurrencies — it’s transforming industries, from finance to healthcare, and its applications are expanding rapidly. In this article, we’ll dive into the different types of blockchain networks, how they work, and what the future holds for blockchain and cryptocurrency networks.

Introduction to Blockchain and Cryptocurrency Networks

Blockchain is a system for storing data that can’t be altered once it’s recorded. It’s made up of “blocks” of data that are linked together in a “chain” to form an ongoing ledger. Each block contains transaction data, and once confirmed, it can’t be changed. Blockchain is decentralized, meaning no single entity controls it. This decentralization is what makes blockchain secure, transparent, and trustworthy.

Cryptocurrencies like Bitcoin and Ethereum run on blockchain networks. Blockchain enables peer-to-peer transactions without the need for intermediaries like banks. This way, digital currencies can be transferred between people globally, securely and quickly. Blockchain’s role in cryptocurrencies is crucial for ensuring transparency and avoiding fraud.

The main benefit of blockchain is its security. It uses cryptographic algorithms to secure each transaction, ensuring that only authorized users can make changes. Since there’s no central authority, blockchain eliminates many issues associated with traditional financial systems, such as high fees and slow transactions.

There are several types of blockchain networks, each with varying levels of decentralization and access control. These include public, private, and hybrid blockchains. Public blockchains are open for anyone to join, while private blockchains have restricted access, typically used by companies. Hybrid blockchains combine features of both.

Types of Crypto Networks

Blockchain networks come in different types, each with its own unique features and use cases. Here’s an overview of the key types of blockchain networks:

Public Blockchains: These are open for anyone to join and participate. Examples include Bitcoin and Ethereum.

Private Blockchains: These are closed networks where only authorized participants can join. Companies often use private blockchains for specific business needs.

Hybrid Blockchains: These combine the best features of both public and private blockchains. They offer flexibility for organizations.

Consortium Blockchains: These are semi-decentralized networks where control is shared by multiple organizations. They’re often used in industries like banking.

Each type of blockchain network has its strengths and is used in different contexts. Public blockchains are great for transparency and decentralization, while private blockchains offer more control and privacy. Hybrid and consortium blockchains are perfect for businesses that need customized solutions.

Public vs. Private Blockchains

Public and private blockchains are two of the most common types. Here’s how they differ:

Public Blockchain:

Open for anyone to participate.

Highly decentralized.

More secure but can be slower due to many participants.

Example: Bitcoin, Ethereum.

Private Blockchain:

Closed network with restricted access.

Centralized control, often by one organization.

Faster but less decentralized.

Example: Hyperledger, Ripple.

Public blockchains prioritize transparency and decentralization, while private blockchains focus on privacy and control.

Permissioned vs. Permissionless Blockchains

Another key distinction in blockchain networks is whether they are permissioned or permissionless.

Permissionless Blockchain:

Anyone can join and participate.

Decentralized and open.

Common in public blockchains like Bitcoin and Ethereum.

Permissioned Blockchain:

Only authorized users can join.

Centralized control by a group or organization.

Common in private and consortium blockchains.

This distinction helps define who can participate in the network and how it’s managed.

Read the continuation at the link.

2 notes

·

View notes

Text

The 6 Roles of Blockchain Technology in Pharma’s Future

Introduction

The pharmaceutical industry is undergoing a digital transformation, and blockchain technology is at the forefront of this revolution. Traditional challenges such as counterfeit drugs, regulatory inefficiencies, clinical trial fraud, and data breaches have long plagued the sector. Blockchain, with its decentralized and tamper-proof nature, offers solutions that can enhance security, transparency, and operational efficiency.

As blockchain development service providers continue refining solutions for pharma, companies are beginning to adopt this technology to streamline supply chains, enhance patient data security, and automate compliance. This article explores six critical roles that blockchain will play in shaping the future of the pharmaceutical industry.

1. Securing the Pharmaceutical Supply Chain

Eliminating Counterfeit Drugs

Counterfeit medications pose a significant threat to global health, contributing to thousands of deaths annually. The World Health Organization (WHO) estimates that one in ten medical products in low- and middle-income countries is substandard or falsified.

End-to-End Traceability

Blockchain technology enables a fully transparent supply chain, where each transaction is recorded in an immutable ledger. This ensures that every stakeholder—from manufacturers to pharmacists—can verify a drug’s authenticity in real-time.

Real-Time Verification

With blockchain-based tracking, patients, healthcare providers, and regulatory agencies can instantly verify the legitimacy of medications. Leading pharmaceutical companies like Pfizer and Roche are already exploring blockchain to secure drug distribution and eliminate counterfeit products from the market.

2. Enhancing Drug Safety and Regulatory Compliance

Immutable Drug Records

Regulatory compliance in the pharmaceutical industry requires strict adherence to safety protocols, but traditional record-keeping methods are prone to errors and fraud. Blockchain ensures that all drug-related data, including batch numbers, manufacturing dates, and storage conditions, are permanently recorded and cannot be altered.

Automated Compliance Monitoring

Smart contracts—self-executing digital agreements stored on the blockchain—can automate compliance checks, ensuring that drugs meet safety regulations before they reach the market. This reduces human error and enhances accountability.

Rapid Recalls and Alerts

When safety concerns arise, blockchain enables instant notifications and targeted recalls. Instead of relying on slow, paper-based tracking systems, companies can pinpoint affected batches within seconds, reducing risks to patients and minimizing financial losses.

3. Revolutionizing Clinical Trials and Research

Data Integrity and Security

Clinical trials are the foundation of medical innovation, but they are often plagued by fraud and inefficiencies. Blockchain ensures that trial data is immutable, preventing manipulation or selective reporting. This guarantees transparency and fosters trust in research findings.

Streamlined Patient Consent

Informed consent is a crucial aspect of clinical trials, yet traditional methods often lack security and efficiency. Blockchain-based smart contracts can automate consent management, ensuring that patients have full control over their participation while reducing administrative burdens for researchers.

Faster Drug Development

By securely sharing trial data among researchers, pharmaceutical companies, and regulatory agencies, blockchain accelerates the drug development process. Faster access to verified data can lead to quicker approvals, ultimately bringing life-saving medications to patients sooner.

4. Enabling Secure and Efficient

Automated Payments with Smart Contracts

The pharmaceutical industry involves complex financial transactions between manufacturers, insurers, healthcare providers, and distributors. Blockchain simplifies these transactions by using smart contracts to automate payments based on pre-set conditions.

Reduced Fraud and Corruption

Traditional financial systems in the pharma sector are susceptible to fraud and inefficiencies. Blockchain’s decentralized ledger eliminates intermediaries, ensuring transparent and corruption-free transactions.

DeFi in Pharma

Decentralized finance (DeFi) applications powered by blockchain could revolutionize pharmaceutical funding. Companies can leverage tokenized assets to raise funds for research and development, bypassing traditional banking limitations.

5. Improving Patient Data Security

Decentralized Electronic Health Records (EHR)

Patient data is often stored in centralized databases, making it vulnerable to cyberattacks. Blockchain provides a decentralized and encrypted framework where patients control their health records, granting access only to authorized healthcare providers.

Seamless Data Sharing

Healthcare providers often struggle with interoperability issues, leading to treatment delays. Blockchain allows for secure, real-time data sharing across hospitals, research institutions, and insurance providers, ensuring a more efficient healthcare ecosystem.

Enhanced Privacy Protections

With data breaches on the rise, blockchain’s encryption protocols enhance patient privacy, reducing the risk of identity theft and unauthorized access to sensitive medical information.

6. The Future of Blockchain in Pharma

AI and Blockchain Integration

The combination of artificial intelligence (AI) and blockchain could further optimize drug manufacturing, predicting supply and demand trends to reduce waste and inefficiencies.

Tokenized Incentives

Blockchain could introduce tokenized rewards for patients participating in clinical trials, encouraging greater involvement and leading to more diverse research data.

Decentralized Research Collaboration

Pharmaceutical companies, universities, and biotech startups could collaborate more efficiently using blockchain-based decentralized networks. This would eliminate data silos and accelerate groundbreaking medical discoveries.

Conclusion

Blockchain technology is revolutionizing the pharmaceutical industry, offering unprecedented levels of security, efficiency, and transparency. From securing supply chains and automating compliance to enhancing patient data security and accelerating drug development, blockchain is set to become an essential pillar of the pharma ecosystem. As blockchain development service providers continue to innovate, pharmaceutical companies that embrace this technology will be better positioned to lead in an increasingly digital and decentralized future. The adoption of blockchain is not just a technological upgrade—it is a necessary evolution for a safer, more efficient, and patient-centric pharmaceutical industry.

#blockchain#blockchain development services#blockchain development#blockchain in healthcare#supply chain management#supply chain#technologies#development

2 notes

·

View notes

Text

How Reliance Jio Coin Could Transform India's Crypto Market

The Indian cryptocurrency market is on the verge of a major transformation, and the introduction of Reliance Jio Coin could serve as a significant catalyst. As one of India's largest conglomerates, Reliance has a history of disrupting industries, and its foray into blockchain and cryptocurrency is highly anticipated.

What Is Reliance Jio Coin?

Reliance Jio Coin is rumored to be a digital cryptocurrency developed by Reliance Jio, a subsidiary of Reliance Industries Limited (RIL). The coin aims to facilitate digital transactions, promote blockchain adoption, and potentially integrate with Jio's vast telecom and e-commerce ecosystem.

The Growing Interest in Cryptocurrency in India

India has witnessed a surge in crypto adoption, despite regulatory uncertainties. Factors such as technological advancements, increased smartphone penetration, and digital payments adoption have fueled interest in blockchain and cryptocurrency.

Potential Benefits of Jio Coin

Reliance Jio Coin could bring numerous benefits to the Indian crypto market, including:

Mass Adoption of Digital Currency – Jio has over 400 million users, providing a large user base for Jio Coin.

Blockchain Innovation – It could promote blockchain technology adoption across various industries.

Seamless Integration with Jio Platforms – Possible use cases in JioMart, JioFiber, and JioMoney.

Regulatory Compliance – Reliance’s credibility may facilitate government support.

Financial Inclusion – Can help unbanked populations participate in digital finance.

Challenges Facing Jio Coin’s Implementation

While the potential is vast, Reliance Jio Coin must overcome several challenges:

Regulatory Uncertainty – India’s stance on crypto regulations is still evolving.

User Awareness and Education – Widespread adoption requires education on cryptocurrency.

Market Volatility – Cryptocurrencies experience price fluctuations that may impact adoption.

Security Concerns – Ensuring data and transaction security is crucial.

How Jio Coin Can Shape India's Crypto Future

Reliance Jio Coin could act as a game-changer in the Indian cryptocurrency space. By leveraging Reliance's technological infrastructure, it could lead to:

Greater public trust in cryptocurrencies.

Increased innovation in decentralized finance (DeFi).

The emergence of blockchain-based government and enterprise solutions.

The Role of Blockchain in Jio Coin’s Success

Blockchain technology is at the core of any cryptocurrency. For Jio Coin to be successful, it must ensure:

Transparency – Every transaction should be recorded on a public ledger to ensure security and accountability.

Scalability – Handling large transaction volumes efficiently will be essential.

Smart Contracts – Enabling automation and reducing intermediaries in transactions.

Energy Efficiency – Exploring eco-friendly consensus mechanisms like Proof of Stake (PoS).

Possible Use Cases of Jio Coin

Jio Coin could extend beyond just a digital currency. Some potential applications include:

Retail Payments – Users may use Jio Coin for everyday transactions via JioMoney.

E-commerce Integration – JioMart could accept Jio Coin, boosting online shopping adoption.

Supply Chain Management – Blockchain-powered logistics solutions to enhance transparency.

Tokenized Assets – Real estate and stock investments via tokenization.

Loyalty Rewards – Customers could earn Jio Coin as part of promotional campaigns.

Impact on India's Digital Economy

With India's digital payment ecosystem already thriving, Jio Coin could:

Reduce dependency on traditional banking by offering decentralized financial solutions.

Encourage foreign investment in Indian blockchain startups.

Support the government’s Digital India initiative by accelerating fintech innovation.

Create new job opportunities in blockchain development, security, and compliance.

Future Roadmap for Jio Coin

If Jio Coin becomes a reality, the following steps might be taken:

Regulatory Approvals – Securing legal compliance before public launch.

Initial Pilot Programs – Testing Jio Coin with select users and businesses.

Mass Adoption Campaigns – Promoting awareness and incentivizing usage.

Expanding Use Cases – Integrating with more sectors like healthcare and education.

Global Expansion – Partnering with international crypto exchanges for trading.

Conclusion

Reliance Jio Coin has the potential to revolutionize India's crypto landscape. While challenges remain, the credibility and market dominance of Reliance Jio could pave the way for mass adoption and regulatory clarity in the sector. If executed effectively, Jio Coin could emerge as India’s leading digital currency, setting a precedent for corporate-backed cryptocurrencies.

2 notes

·

View notes

Text

Understanding the Bitcoin Halving: What It Means for the Future

Introduction

In the ever-evolving world of cryptocurrencies, the term "Bitcoin halving" frequently pops up in discussions, often accompanied by predictions of significant market shifts and opportunities. But what exactly is Bitcoin halving, and why does it hold such importance? In this blog post, we'll explore the mechanics behind Bitcoin halving, its historical impacts, and what it could mean for the future of Bitcoin and the broader financial landscape.

What is Bitcoin Halving?

Bitcoin halving is a predetermined event that occurs approximately every four years, or after every 210,000 blocks are mined. During this event, the reward for mining new blocks is halved, effectively reducing the rate at which new Bitcoins are created. This mechanism is built into Bitcoin's code as a deflationary measure to control the supply of Bitcoin over time.

The Mechanics Behind Bitcoin Halving

To understand the significance of halving, it's essential to grasp how Bitcoin mining works. Bitcoin miners use powerful computers to solve complex mathematical problems, validating transactions and adding them to the blockchain. As a reward for their efforts, miners receive a certain number of Bitcoins. Initially, this reward was set at 50 Bitcoins per block. However, after the first halving in 2012, it dropped to 25 Bitcoins, then to 12.5 in 2016, and most recently to 6.25 in May 2020. The latest halving in 2024 reduced the reward to 3.125 Bitcoins per block.

Historical Impact of Bitcoin Halving

Historically, Bitcoin halving events have been followed by significant price increases. The reduced supply of new Bitcoins tends to create a scarcity effect, driving demand and, consequently, the price. For example, after the 2012 halving, Bitcoin's price rose from around $12 to over $1,000 within a year. Similarly, post-2016 halving, the price surged from approximately $650 to nearly $20,000 by the end of 2017.

However, it's crucial to note that while past performance can provide insights, it doesn't guarantee future results. Various factors, including market sentiment, regulatory developments, and technological advancements, can influence Bitcoin's price.

The 2024 Halving and Its Impact

The 2024 halving has already made its mark on the Bitcoin market. Here are a few notable outcomes and their implications:

Increased Scarcity and Higher Prices: As anticipated, the reduction in new Bitcoin supply created a scarcity effect, driving prices higher. This attracted more investors, further fueling the price surge.

Greater Miner Efficiency: With reduced rewards, miners sought more efficient ways to operate, leading to advancements in mining technology and energy use. This has also driven a shift towards sustainable energy sources in mining operations.

Market Maturity: Bitcoin continues to mature as a store of value and medium of exchange. The halving event reinforced Bitcoin's deflationary nature, appealing to those seeking a hedge against inflation.

Potential Market Corrections: While prices have generally increased, the market has also experienced corrections. High volatility remains a hallmark of the crypto market, and investors should be prepared for potential price swings.

What the Future Holds

As we move forward, the crypto community remains abuzz with speculation. Here are a few potential outcomes and their implications:

Continued Price Growth: Following the trend of previous halvings, Bitcoin may continue to see price growth as demand outstrips supply.

Innovations in Mining: The push for more efficient and sustainable mining practices could lead to significant technological advancements.

Increased Adoption: As Bitcoin's deflationary nature becomes more apparent, we may see increased adoption as a store of value and medium of exchange.

Regulatory Developments: Ongoing regulatory developments could play a crucial role in shaping the future of Bitcoin and the broader cryptocurrency market.

Conclusion

Bitcoin halving is a critical event that underscores the unique economic model of Bitcoin. By systematically reducing the supply of new Bitcoins, halving events contribute to Bitcoin's scarcity and deflationary characteristics. As we look to the future, the 2024 halving has already shown significant market developments, impacting miners, investors, and the broader financial ecosystem. Whether you're a seasoned investor or a newcomer, understanding Bitcoin halving is essential to navigating the ever-changing landscape of cryptocurrencies.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Let’s learn about the Bitcoin Revolution together. Your financial freedom starts now!

#Bitcoin#Cryptocurrency#BitcoinHalving#Blockchain#Crypto#DigitalCurrency#BitcoinMining#CryptoInvesting#FinancialRevolution#EconomicFreedom#InflationHedge#CryptoCommunity#CryptoMarket#BTC#CryptoEducation#FutureOfMoney#DeflationaryCurrency#DigitalAssets#Bitcoin2024#CryptoInsights#financial education#unplugged financial#globaleconomy#financial experts#financial empowerment#finance

7 notes

·

View notes

Text

Retirement with Bitcoin

Introduction to Bitcoin Retirement Planning

The concept of planning for retirement with Bitcoin involves using cryptocurrencies as a means to secure one's financial future. Bitcoin, known for its volatility, offers both opportunities and challenges when considered as part of a retirement portfolio. Here's a detailed exploration of how one might approach retirement with Bitcoin:

Understanding Bitcoin's Role in Retirement

Volatility: Bitcoin is known for significant price swings. While this can lead to substantial gains, it also poses a risk of substantial losses, making it a high-risk component in a retirement strategy.

Long-term Appreciation: Despite its volatility, Bitcoin has shown a tendency for long-term appreciation. Some analysts predict it could reach new highs in the coming years, suggesting that early investments might mature into significant nest eggs.

Decentralization and Security: Bitcoin operates on a decentralized blockchain, offering security against traditional financial system failures or inflation. However, this also means you are responsible for your own security - losing access to your wallet could mean losing your retirement savings.

Calculating How Much Bitcoin You'll Need

Cost of Living: Start by estimating your annual living expenses in your retirement years. This includes housing, food, healthcare, and leisure, potentially adjusted for inflation.

Bitcoin's Current and Projected Value: With Bitcoin's price at around R$ 652,431.96 (as of the last known data), and considering optimistic projections where it might reach values between US$ 99,926.37 and US$ 200,000 by the end of 2025, you can estimate how much Bitcoin you'd need.

Simple Lifestyle: If you need R$ 100,000 annually, you would need about 0.15 BTC per year at today's price. For 30 years of retirement, this would be roughly 4.5 BTC.

Luxurious or Family Lifestyle: For an annual budget of R$ 300,000, you'd need about 0.46 BTC per year, totaling around 13.8 BTC for 30 years.

Strategies for Accumulating Bitcoin for Retirement

Dollar-Cost Averaging (DCA): Invest a fixed amount in Bitcoin regularly, regardless of its price, to average out the cost over time.

Diversification: While Bitcoin might be part of your strategy, diversifying with other assets like stocks, bonds, or real estate can mitigate risk.

Security Measures: Use hardware wallets to store your Bitcoin securely. Regularly update security practices as technology evolves.

Risks and Considerations

Market Fluctuations: Bitcoin's price can plummet, affecting your retirement funds.

Regulatory Changes: Future regulations could impact how Bitcoin is taxed, used, or even if it remains legal to own.

Liquidity: Converting Bitcoin back to fiat currency might not always be straightforward or without loss, especially if you need funds urgently.

Conclusion

Retiring with Bitcoin involves a speculative gamble on the future of cryptocurrency. While it could lead to a prosperous retirement if Bitcoin continues to appreciate, it also requires a careful strategy to manage risk. Regular reassessment of your investment strategy, understanding the cryptocurrency market, and perhaps most importantly, ensuring you have other forms of income or savings to fall back on, are all crucial steps.

In essence, Bitcoin retirement planning is not for the faint-hearted but can be rewarding for those who are well-informed and vigilant about their investments.

2 notes

·

View notes

Text

$AIGRAM - your AI assistant for Telegram data

Introduction

$AIGRAM is an AI-powered platform designed to help users discover and organize Telegram channels and groups more effectively. By leveraging advanced technologies such as natural language processing, semantic search, and machine learning, AIGRAM enhances the way users explore content on Telegram.

With deep learning algorithms, AIGRAM processes large amounts of data to deliver precise and relevant search results, making it easier to find the right communities. The platform seamlessly integrates with Telegram, supporting better connections and collaboration. Built with scalability in mind, AIGRAM is cloud-based and API-driven, offering a reliable and efficient tool to optimize your Telegram experience.

Tech Stack

AIGRAM uses a combination of advanced AI, scalable infrastructure, and modern tools to deliver its Telegram search and filtering features.

AI & Machine Learning:

NLP: Transformer models like BERT, GPT for understanding queries and content. Machine Learning: Algorithms for user behavior and query optimization. Embeddings: Contextual vectorization (word2vec, FAISS) for semantic search. Recommendation System: AI-driven suggestions for channels and groups.

Backend:

Languages: Python (AI models), Node.js (API). Databases: PostgreSQL, Elasticsearch (search), Redis (caching). API Frameworks: FastAPI, Express.js.

Frontend:

Frameworks: React.js, Material-UI, Redux for state management.

This tech stack powers AIGRAM’s high-performance, secure, and scalable platform.

Mission

AIGRAM’s mission is to simplify the trading experience for memecoin traders on the Solana blockchain. Using advanced AI technologies, AIGRAM helps traders easily discover, filter, and engage with the most relevant Telegram groups and channels.

With the speed of Solana and powerful search features, AIGRAM ensures traders stay ahead in the fast-paced memecoin market. Our platform saves time, provides clarity, and turns complex information into valuable insights.

We aim to be the go-to tool for Solana traders, helping them make better decisions and maximize their success.

Our socials:

Website - https://aigram.software/ Gitbook - https://aigram-1.gitbook.io/ X - https://x.com/aigram_software Dex - https://dexscreener.com/solana/baydg5htursvpw2y2n1pfrivoq9rwzjjptw9w61nm25u

2 notes

·

View notes

Text

Omniston: Redefining Decentralized Trading on STONfi DEX

When it comes to decentralized finance (DeFi), one question often looms large: How can we make trading more secure, efficient, and accessible for everyone? The answer may lie in Omniston, a groundbreaking innovation on STONfi DEX that’s transforming how we think about liquidity and trading.

In this article, I’ll break down what Omniston is, why it matters, and how it could be the future of trading for both the TON ecosystem and the broader DeFi industry.

What Is Omniston

At its core, Omniston is a decentralized liquidity protocol designed to work seamlessly within the STONfi DEX. Instead of relying on traditional liquidity pools, Omniston connects traders directly with market makers through a Request for Quote (RFQ) mechanism.

Imagine you’re at a bustling farmer’s market. Instead of blindly accepting the first price offered for a basket of apples, you get to ask every vendor for their best price. Once you find the best deal, you make the purchase directly, without middlemen or unnecessary fees. That’s essentially how Omniston works—only in the digital world of cryptocurrency trading.

Why Does Omniston Matter

If you’ve ever traded on a DEX, you know that security, slippage, and liquidity fragmentation can be major headaches. Omniston tackles these challenges head-on, offering a suite of benefits that make trading not only safer but also more transparent and cost-effective.

1. Full Control Over Your Funds

With Omniston, you’re always in charge. Funds stay in your wallet until the moment a trade is executed. There’s no need to deposit assets into a centralized exchange or third-party platform. It’s as if you were holding your cash until the very second you hand it over for a purchase—ensuring complete control and minimizing risks.

2. No Middlemen, Just Smart Contracts

In traditional trading systems, trust often rests on third parties, like brokers or centralized platforms. Omniston eliminates this need. Using smart contracts, trades happen only when both parties meet the agreed terms. Think of it as a handshake deal that’s automatically enforced by technology—no room for misunderstandings or foul play.

3. Transparent and Predictable Pricing

We’ve all experienced hidden fees or unexpected costs at some point, whether in traditional finance or crypto. Omniston’s RFQ mechanism ensures that you know exactly how much you’re paying and receiving before you confirm a trade. There’s no slippage or price surprises—just clear, upfront pricing every time.

STONfi DEX and Omniston: A Perfect Partnership

STONfi DEX has always been about pushing the boundaries of what’s possible in decentralized trading. The introduction of Omniston takes this mission to the next level, addressing some of the biggest challenges in DeFi today.

Unified Liquidity for Seamless Trading

Liquidity fragmentation has long been a problem in the DeFi space. When liquidity is spread across multiple platforms, it can be hard to find the best prices. Omniston unifies liquidity within STONfi DEX, making it easier for traders to access competitive rates without hopping between platforms.

Efficiency at Its Core

Omniston combines the best of on-chain and off-chain trading processes. While trades are initiated off-chain for speed, they’re settled on-chain for security. It’s like blending the speed of a digital payment app with the security of a bank vault—fast, reliable, and safe.

A Gateway to the TON Ecosystem

For developers and projects, Omniston offers unparalleled access to the TON ecosystem. With millions of users and countless unique projects, STONfi DEX becomes a gateway to a thriving blockchain community, powered by Omniston’s innovative technology.

Why Liquidity Matters in Crypto

To understand the impact of Omniston, it helps to think about liquidity. Liquidity is the lifeblood of any trading system, much like cash flow is to a business. Without sufficient liquidity, transactions become slower, costlier, and less predictable.

Omniston changes the game by pooling liquidity into a single, unified system. This ensures that every trader—whether you’re swapping $10 or $10,000—gets the best price available. It’s like walking into a store where every product is always in stock and priced fairly.

The Bigger Picture: Omniston’s Role in DeFi

Omniston isn’t just a new feature—it’s a glimpse into the future of DeFi. By addressing key pain points like security, transparency, and liquidity fragmentation, it’s setting a new standard for decentralized exchanges.

For users, this means a better trading experience that’s both intuitive and secure. For developers and projects, it opens doors to new opportunities within a growing ecosystem. And for the broader DeFi community, it’s a step toward a more connected and efficient financial system.

Final Thoughts

Innovation is at the heart of DeFi, and Omniston is a perfect example of what’s possible when technology meets user needs. By integrating this protocol into STONfi DEX, we’re not just improving the trading experience—we’re building a foundation for the future of decentralized finance.

Whether you’re a seasoned trader or just starting your DeFi journey, Omniston offers a level of security, transparency, and efficiency that’s hard to beat. It’s time to rethink how we trade and embrace the possibilities that innovations like this bring to the table.

Let’s continue the conversation: What excites you most about Omniston and its role in the STONfi DEX ecosystem?

4 notes

·

View notes

Text

Casino Big Wins: Triumphs and Tales of Fortunes Won

Introduction

Casino Big Wins: What sets hearts racing, palms sweating, and adrenaline pumping more than the thrill of hitting it big at a casino? In this article, we delve deep into the realm of Casino Big Wins, exploring the excitement, strategies, and stories behind these monumental moments.

Factors Contributing to Big Wins

Luck vs. Skill: What Matters Most? Casino games often walk the tightrope between chance and skill. While luck undoubtedly plays a significant role in securing big wins, strategic gameplay can tilt the odds in your favor. We'll explore the delicate balance between luck and skill in pursuit of Casino Big Wins.

Strategies for Maximizing Wins From mastering the art of bluffing in poker to employing progressive betting systems in blackjack, various strategies can enhance your chances of scoring big at the casino. We'll uncover these strategies and provide insights into their effectiveness.

Popular Games for Big Wins

Slot Machines: The Allure of Jackpots With their flashing lights and enticing sound effects, slot machines beckon players with the promise of life-changing jackpots. We'll delve into the world of slots, examining the mechanics behind jackpot payouts and sharing tips for spinning your way to success.

Table Games: High Stakes, High Rewards For those seeking a more strategic challenge, table games offer ample opportunities for big wins. Whether it's the thrill of roulette, the strategic depth of blackjack, or the anticipation of a winning hand in poker, table games provide a diverse landscape for pursuing Casino Big Wins.

Real-Life Big Win Stories

Tales of Fortune: Memorable Wins Behind every big win lies a captivating story. From hitting the jackpot on a progressive slot to outplaying opponents in a high-stakes poker tournament, we'll showcase real-life tales of casino triumph that will leave you inspired and awestruck.

Overcoming Odds: Inspirational Stories In the face of adversity, some players defy the odds to achieve remarkable victories. We'll share stories of perseverance, resilience, and sheer determination, highlighting the human spirit's triumph in the pursuit of Casino Big Wins.

Tips for Increasing Win Potential

Bankroll Management: Playing it Smart Effective bankroll management is crucial for sustaining success in the casino world. We'll offer practical tips for managing your funds wisely, ensuring that you can weather both winning streaks and losing spells without derailing your gameplay.

Capitalizing on Bonuses and Promotions Casinos often entice players with enticing bonuses and promotions, ranging from welcome offers to loyalty rewards. We'll reveal insider tips for leveraging these bonuses to maximize your win potential while minimizing risk.

Responsible Gambling Practices

Knowing When to Stop: Setting Limits While the allure of big wins can be irresistible, responsible gambling entails knowing when to step away from the table. We'll discuss the importance of setting limits, recognizing signs of problem gambling, and seeking help when needed.