#luxury apparel market

Text

Trends in the Luxury Apparel Market: An Overview

The luxury apparel market is a dynamic and constantly evolving sector influenced by changing consumer preferences, technological advancements, and global economic trends.

Buy the Full Report for More Category Insights into the Luxury Apparel Market, Download a Free Report Sample

Here's an overview of key trends shaping the luxury apparel market:

1. Sustainability and Ethical Fashion

Eco-Friendly Materials: Consumers are increasingly demanding sustainable and ethically produced apparel. Luxury brands are responding by incorporating eco-friendly materials such as organic cotton, recycled fabrics, and biodegradable materials.

Transparent Supply Chains: There is a growing emphasis on supply chain transparency. Brands are ensuring that their production processes are ethical and environmentally responsible, often sharing this information with consumers.

2. Digital Transformation

E-commerce Expansion: The digitalization of retail has been accelerated by the COVID-19 pandemic, pushing luxury brands to enhance their online presence. High-end fashion houses are investing in sophisticated e-commerce platforms to provide a seamless shopping experience.

Virtual Try-Ons: Augmented reality (AR) and virtual try-on technologies are becoming more popular, allowing customers to visualize how garments will look and fit without visiting a physical store.

3. Personalization and Customization

Bespoke Services: Customization and personalization are gaining traction as consumers seek unique, tailor-made products. Luxury brands are offering bespoke services, from custom fittings to personalized monograms, to cater to this demand.

Data-Driven Personalization: Brands are leveraging big data and AI to provide personalized recommendations and marketing, enhancing the consumer experience and fostering brand loyalty.

4. Experiential Retail

Immersive Experiences: Physical stores are being transformed into experiential spaces where customers can engage with the brand on a deeper level. This includes offering in-store events, exclusive collections, and interactive displays.

Omnichannel Retailing: Luxury brands are adopting omnichannel strategies to integrate their online and offline presence, providing a cohesive and consistent customer experience across all touchpoints.

5. Inclusivity and Diversity

Broadening Representation: There is a growing demand for inclusivity and diversity in the luxury apparel market. Brands are featuring models of different ethnicities, body types, and ages in their campaigns and runway shows.

Inclusive Sizing: Expanding size ranges to cater to a broader audience is becoming a priority for many luxury brands, reflecting a more inclusive approach to fashion.

6. Resale and Circular Fashion

Luxury Resale Market: The second-hand luxury market is booming as consumers become more environmentally conscious and seek value for money. Platforms like The RealReal and Vestiaire Collective are capitalizing on this trend.

Circular Fashion: Brands are adopting circular fashion principles, focusing on the longevity and recyclability of their products. Initiatives include take-back programs, repair services, and upcycling collections.

7. Cultural and Heritage Focus

Heritage Brands: There is a renewed interest in heritage and craftsmanship. Consumers appreciate the history and story behind established luxury brands, which often highlight their artisanal techniques and legacy.

Cultural Collaborations: Luxury brands are collaborating with artists, designers, and cultural icons to create exclusive, culturally relevant collections that resonate with diverse audiences.

8. Tech-Infused Fashion

Wearable Technology: The integration of technology into apparel, such as smart fabrics and connected wearables, is gaining momentum. These innovations offer functionality and a futuristic appeal to tech-savvy consumers.

Blockchain for Authenticity: Blockchain technology is being used to verify the authenticity of luxury goods, combating counterfeiting and providing transparency about product origins.

9. Global Market Expansion

Emerging Markets: Luxury brands are expanding into emerging markets like China, India, and the Middle East, where there is a growing appetite for high-end fashion. Localization strategies are key to appealing to these diverse consumer bases.

Travel Retail: With the recovery of international travel, luxury brands are investing in travel retail outlets at airports and tourist destinations to capture the spend of affluent travelers.

10. Health and Wellness Influence

Athleisure and Comfort: The pandemic has shifted consumer preferences towards comfortable and versatile clothing. Luxury athleisure and loungewear collections are becoming increasingly popular.

Holistic Lifestyle: Brands are aligning with the health and wellness trend by promoting holistic lifestyles, including collaborations with wellness brands and creating products that emphasize comfort and well-being.

These trends highlight the evolving nature of the luxury apparel market as it adapts to new consumer expectations, technological advancements, and global economic shifts. Brands that embrace sustainability, digital innovation, personalization, and inclusivity are likely to thrive in this competitive and dynamic industry.

0 notes

Text

Luxury Apparel Industry ESG Thematic Report, 2023

Luxury apparel has been widely used for premium customer as those products provide a greater social acceptance. Main ESG factors driving luxury apparel segment are product quality, efficiency of supply chain, affordability, customer satisfaction, toxic chemical usage (dyes), human rights issues from production to retail end and biodiversity impacts.

Read More @ https://astra.grandviewresearch.com/luxury-apparel-industry-esg-outlook

About Astra – ESG Solutions by Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. - a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit@ https://astra.grandviewresearch.com/

0 notes

Text

Luxury apparel brand Vince acquires Rebecca Taylor and Parker

Global luxury apparel and accessories market brand Vince has gained two ladies lifestyle and style brands Rebecca Taylor and Parker.

The obtaining shut last end of the week and included a complete money thought of $19.7m. The arrangement was supported utilizing Vince's current rotating credit office.

Vince paid $19.2m of outstanding obligation commitments and $0.5m of remuneration cost.

Rebecca Taylor and Parker posted consolidated net deals of around $84m for the a year finished 2 February.

Vince CEO Brendan Hoffman said: "We are eager to make an expanded arrangement of profoundly perceived and particular contemporary brands with this procurement. The expansion of Rebecca Taylor and Parker will situate us to acquire wide allure across the contemporary range.

For more luxury apparel market insights on this report, download a free report sample

"We see a chance to speed up development in every one of these brands by carrying out the Vince vital playbook to assemble direct-to-purchaser procedures, further expand brand mindfulness, and influence center skills through the sharing of best practices.

"The development of our rotating credit office likewise gives us extra monetary adaptability to help our development drives. We accept we have the chance to twofold income for the organization over the long run with the mix of this obtaining and the proceeded with execution of development drives in progress at the Vince brand."

Vince has plans to lay out Rebecca Taylor physical stores and web based business to assist direct-to-shopper business.

Extra drives incorporate new permitting associations and upgraded global impression and circulation across all retail channels, including web based business and discount. Rebecca Taylor and Parker brands are presently offered to worldwide top of the line division and speciality stores, as well as appropriated through own branded online business locales and six Rebecca Taylor retail locations.

In September, Vince opened its most memorable London retail location area.

0 notes

Text

#pittiuomo#pitti uomo#mens style#mens wear#men's fashion#men's style#gq style#aesthetic#luxury#street fashion#mens fashion#fashion#black art#artists on tumblr#black tumblr#black excellence#black entrepreneurship#beauty#lifestyle#black femininity#diy#clothing#marketing#apparel#kith#high maintenance#designer#melanin

33 notes

·

View notes

Text

Luxury Apparels Market 2024-2032: Trends, Growth Drivers, and Future Projections

The global luxury apparels market size reached approximately USD 102.62 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.7% between 2024 and 2032, reaching a value of around USD 168.68 billion by 2032. The market is driven by the increasing demand for high-end fashion, premium craftsmanship, and the growing influence of social media and e-commerce platforms. Major players like Chanel S.A., LVMH Moet Hennessy-Louis Vuitton SE, PVH Corp., and Ralph Lauren Corporation dominate the market, offering innovative collections catering to a wealthy global clientele.

Market Outlook (2024-2032)

The luxury apparel market is poised for steady growth as consumers continue to prioritize quality, exclusivity, and craftsmanship. Rising disposable incomes, particularly in emerging economies, and the demand for premium, eco-friendly materials are key factors driving this growth. As sustainability becomes a major consumer concern, luxury brands are increasingly adopting sustainable practices and materials, further boosting market growth.

Get a Free Sample Report with Table of Contents@ https://www.expertmarketresearch.com/reports/palladium-market/requestsample

Market Overview and Size

In 2023, the global luxury apparel market was valued at USD 102.62 billion, and it is expected to grow significantly, reaching USD 168.68 billion by 2032. The market is segmented based on product type, end-user, distribution channels, and regions, with brands continuing to innovate in design and marketing strategies. The growing influence of celebrity endorsements and luxury collaborations has further fueled consumer demand.

Market Dynamics

Key Market Drivers

Growing Disposable Income and Emerging Markets: The rise in disposable income, particularly in emerging economies like China, India, and Southeast Asia, has led to an increase in demand for luxury fashion. High-net-worth individuals (HNWIs) and millennials are driving the sales of luxury apparel, seeking exclusivity and personalized experiences.

Influence of Digital Platforms: The increasing use of e-commerce and social media platforms has transformed the luxury apparel landscape. Brands now have direct access to consumers through online channels, enabling them to engage in real-time with their customers. The shift to digital has allowed brands to showcase their collections globally and offer seamless shopping experiences, boosting market growth.

Demand for Sustainable and Ethical Fashion: With sustainability becoming a key concern, consumers are opting for eco-friendly and ethically produced luxury clothing. Brands like Prada S.p.A. and Christian Dior SE are leading the way by adopting sustainable practices, such as using organic materials and reducing carbon footprints, to attract environmentally conscious customers.

Rising Influence of Celebrity Culture and Social Media: Celebrity endorsements, fashion influencers, and collaborations with high-end designers have become key drivers in the luxury apparel market. This trend, amplified by platforms such as Instagram, TikTok, and YouTube, allows brands to engage younger, affluent audiences, thereby boosting sales.

Key Market Challenges

High Prices and Economic Fluctuations: Luxury apparel comes at a premium price, which limits its affordability to a specific segment of consumers. Additionally, economic downturns or fluctuations may impact luxury goods sales as discretionary spending decreases.

Counterfeit Goods and Brand Protection: The market faces challenges from counterfeit luxury goods, which dilute brand value and affect sales. As digital channels grow, luxury brands need to invest in stronger measures to protect intellectual property and brand authenticity.

Segmentation

By Product Type

Clothing: Includes high-end designer wear such as dresses, suits, and outerwear.

Footwear: Luxury footwear brands are experiencing significant demand, driven by sneaker collaborations and athleisure trends.

Accessories: Includes handbags, belts, scarves, and other luxury accessories that complement apparel collections.

By End-User

Men: The men's luxury fashion segment is witnessing growth due to rising interest in designer wear, footwear, and accessories.

Women: Women dominate the luxury apparel market, with high demand for dresses, outerwear, and luxury accessories.

Unisex: The growing trend of gender-neutral fashion is also impacting the luxury apparel market, with brands offering more unisex collections.

Component Insights

Luxury apparel brands are emphasizing premium materials, ethical sourcing, and cutting-edge design techniques. Components such as fine fabrics, intricate craftsmanship, and innovative designs define the market, with brands constantly innovating to maintain exclusivity and appeal.

Regional Insights

North America: The region holds a substantial share of the global luxury apparel market, led by strong demand in the U.S. and Canada.

Europe: Europe is home to iconic luxury fashion houses such as Chanel, Christian Dior, and Louis Vuitton, making it a key player in the market.

Asia-Pacific: Emerging markets, particularly China, are experiencing rapid growth due to rising disposable incomes and increasing interest in luxury fashion.

Middle East and Africa: The Middle East continues to be a significant consumer of luxury apparel, driven by affluent individuals seeking exclusive high-end fashion.

Key Players

Chanel S.A.

LVMH Moet Hennessy-Louis Vuitton SE

PVH Corp.

Ralph Lauren Corporation

Christian Dior SE

Prada S.p.A.

Market Trends

Sustainability: Leading luxury apparel brands are embracing sustainable and eco-friendly practices, responding to growing consumer awareness around environmental impact.

Personalization and Customization: High-net-worth customers are increasingly demanding bespoke clothing and exclusive collections, pushing brands to offer more personalized services.

Collaborations and Limited Editions: Collaborations between luxury brands and high-profile designers or celebrities are becoming a key marketing strategy to attract younger consumers.

FAQs

What is the projected market size of the luxury apparel market by 2032? The luxury apparel market is expected to reach USD 168.68 billion by 2032.

What are the key drivers of the luxury apparel market? Key drivers include rising disposable incomes, increased demand for sustainable fashion, digitalization, and celebrity endorsements.

Which regions are expected to dominate the luxury apparel market? North America, Europe, and Asia-Pacific are the key regions driving luxury apparel sales, with emerging markets like China playing a significant role.

What are the challenges facing the luxury apparel market? High prices, economic fluctuations, and counterfeit goods remain significant challenges for the market.

How are luxury brands addressing sustainability? Leading luxury brands are adopting sustainable practices, such as using eco-friendly materials and reducing their carbon footprints, to appeal to environmentally conscious consumers.

How is digitalization affecting the luxury apparel market? Digital platforms and e-commerce have significantly expanded the reach of luxury brands, allowing them to engage with consumers globally and offer seamless online shopping experiences.

0 notes

Photo

Lepenski Vir is a crisp blackletter font marrying elegance with audacity, perfect for bold branding, product packaging, and special events, bringing unexpected charm to invitations and apparel designs.

Link: https://l.dailyfont.com/sJxkI

#aff#Fonts#Design#Typography#Branding#Packaging#Events#Charm#Bold#Elegant#Blackletter#Invitations#Apparel#Unique#Luxury#Creativity#Inspiration#Marketing

0 notes

Text

The global luxury outdoor jacket market is estimated to witness a considerable growth rate of around 5.4% during the forecast period of 2023–2028 and was valued at around US$ 1.2 billion in 2023. Some of the factors driving the Luxury Outdoor Jacket market are the increase in global affluence and the rise in disposable income of consumers. This has created a growing market for luxury products, including luxury outdoor jackets.

0 notes

Text

Ko-fi prompt from @thisarenotarealblog:

There's a street near me that has eight car dealerships all on the same lot- i counted. it mystifies me that even one gets enough sales to keep going- but 8?? is there something you can tell me that demystifies this aspect of capitalism for me?

I had a few theories going in, but had to do some research. Here is my primary hypothesis, and then I'll run through what they mean and whether research agrees with me:

Sales make up only part of a dealership's income, so whether or not the dealership sells much is secondary to other factors.

Dealerships are put near each other for similar reasons to grouping clothing stores in a mall or restaurants on a single street.

Zoning laws impact where a car dealership can exist.

Let's start with how revenue works for a car dealership, as you mentioned 'that even one gets enough sales to keep going' is confusing. For this, I'm going to be using the Sharpsheets finance example, this NYU spreadsheet, and this Motor1 article.

This example notes that the profit margin (i.e. the percentage of revenue that comes out after paying all salaries, rent, supply, etc) for a car dealership is comparatively low, which is confirmed by the NYC sheet. The gross profit margin (that is to say, profits on the car sale before salaries, rent, taxes) is under 15% in both sources, which is significantly lower than, say, the 50% or so that one sees in apparel or cable tv.

Cars are expensive to purchase, and can't be sold for much more than you did purchase them. However, a low gross profit margin on an item that costs tens of thousands of dollars is still a hefty chunk of cash. 15% gross profit of a $20,000 car is still $3,000 profit. On top of that, the dealership will charge fees, sell warranties, and offer upgrades. They may also have paid deals to advertise or push certain brands of tire, maintenance fluids, and of course, banks that offer auto loans. So if a dealership sells one car a day, well, that's still several thousand dollars coming in, which is enough to pay the salaries of most of the employees. According to the Motor1 article, "the average gross profit per new vehicle sits at $6,244" in early 2022.

There is also a much less volatile, if also much smaller, source of revenue in attaching a repairs and checkup service to a dealership. If the location offers repairs (either under warranty or at a 'discounted' rate compared to a local, non-dealership mechanic), state inspections, and software updates, that's a recurring source of revenue from customers that aren't interested in purchasing a car more than once a decade.

This also all varies based on whether it's a brand location, used vs new, luxury vs standards, and so on.

I was mistaken as to how large a part of the revenue is the repairs and services section, but the income for a single dealership, on average, does work out math-wise. Hypothesis disproven, but we've learned something, and confirmed that income across the field does seem to be holding steady.

I'm going to handle the zoning and consolidation together, since they overlap:

Consolidation is a pretty easy one: this is a tactic called clustering. The expectation is that if you're going to, say, a Honda dealership to look at a midsize sedan, and there's a Nissan right next door, and a Ford across the street, and a Honda right around the corner, you might as well hit up the others to see if they have better deals. This tactic works for some businesses but not others. In the case of auto dealerships, the marketing advantage of clustering mixes with the restrictions of zoning laws.

Zoning laws vary by state, county, and township. Auto dealerships can generally only be opened on commercially zoned property.

I am going to use an area I have been to as an example/case study.

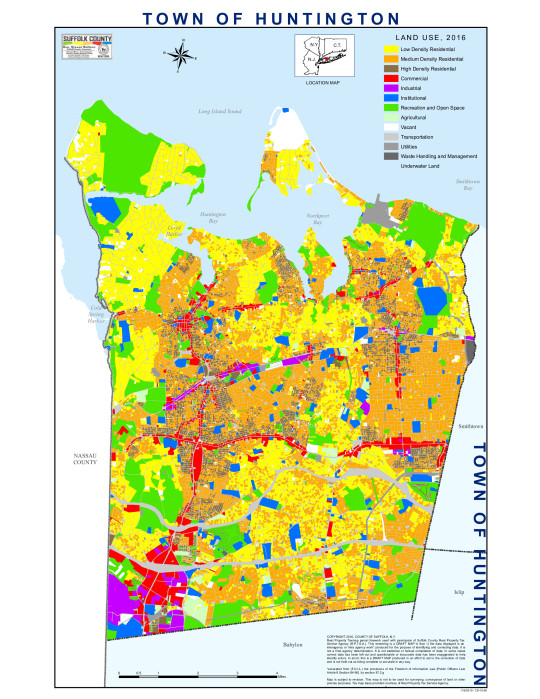

This pdf is a set of zoning regulations for Suffolk County, New York, published 2018, reviewing land use in the county during 2016. I'm going to paste in the map of the Town of Huntington, page 62, a region I worked in sporadically a few years ago, and know mostly for its mall and cutesy town center.

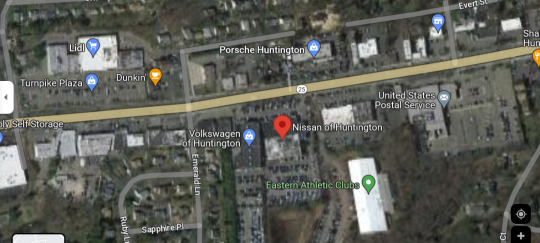

Those red sections are Commercially Zoned areas, and they largely follow some large stroads, most notably Jericho Turnpike (the horizontal line halfway down) and Walt Whitman Road (the vertical line on the left). The bulge where they intersect is Walt Whitman Mall, and the big red chunk in the bottom left is... mostly parking. That central strip, Jericho Turnpike, and its intersection with Walt Whitman... looks like this:

All those red spots are auto dealerships, one after another.

So zoning laws indicate that a dealership (and many other types of commercial properties) can only exist in that little red strip on the land use map, and dealerships take up a lot of space. Not only do they need places to put all of the cars they are selling, but they also need places to park all their customers and employees.

This is where we get into the issue of parking minimums. There is a recent video from Climate Town, with a guest spot by NotJustBikes. If you want to know more about this aspect of zoning law, I'd recommend watching this video and the one linked in the description.

Suffolk county does not have parking minimums. Those are decided on a town or village level. In this case, this means we are looking at the code set for the town of Huntington. (I was originally looking on the county level, and then cut the knot by just asking my real estate agent mom if she knew where I could find minimum parking regulations. She said to look up e360 by town, and lo and behold! There they are.)

(There is also this arcgis map, which shows that they are all within the C6 subset of commercial districting, the General Business District.)

Furniture or appliance store, machinery or new auto sales

- 1 per 500 square feet of gross floor area

Used auto sales, boat sales, commercial nurseries selling at retail

- 5 spaces for each use (to be specifically designated for customer parking)

- Plus 1 for each 5,000 square feet of lot area

This is a bit odd, at first glance, as the requirements are actually much lower than that of other businesses, like drive-in restaurants (1 per 35 sqft) or department stores (1 per 200 sqft). I could not find confirmation on whether the 'gross floor area' of the dealership included only indoor spaces or also the parking lot space allotted to the objects for sale, but I think we can assume that any parking spaces used by merchandise do not qualify as part of the minimum. Some dealerships can have up to 20,000 gross sqft, so those would require 40 parking spaces reserved solely for customers and employees. Smaller dealerships would naturally need less. One dealership in this area is currently offering 65 cars of varying makes and models; some may be held inside the building, but most will be on the lot, and the number may go higher in other seasons. If we assume they need 30 parking spaces for customers and employees, and can have up to 70 cars in the lot itself, they are likely to have 100 parking spaces total.

That's a lot of parking.

Other businesses that require that kind of parking requirement are generally seeing much higher visitation. Consider this wider section of the map:

The other buildings with comparative parking are a grocery store (Lidl) and a post office (can get some pretty high visitation in the holiday season, but also just at random).

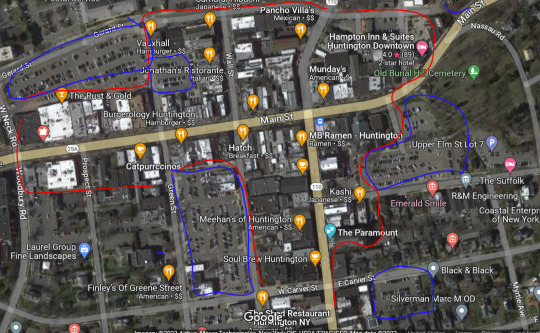

Compare them, then, to the "old town" section of the same town.

There are a handful of public parking areas nearby (lined in blue), whereas the bulk of the businesses are put together along this set of streets. While there is a lot of foot traffic and vehicle passage, which is appealing for almost any business, opening a car dealership in this area would require not only buying a building, but also the buildings surrounding it. You would need to bulldoze them for the necessary parking, which would be prohibitively expensive due to the cost of local real estate... and would probably get shot down in the application process by city planners and town councils and so on. Much easier to just buy land over in the strip where everyone's got giant parking lots and you can just add a few extra cramped lanes for the merchandise.

Car dealerships also tend to be very brightly lit, which hits a lot of NIMBY sore spots. It's much easier to go to sleep if you aren't right next to a glaring floodlight at a car dealership, so it's best if we just shove them all away from expensive residential, which means towards the loud stroads, which means... all along these two major roads/highways.

And if they're all limited to a narrow type of zoning already, they might as well take advantage of cluster marketing and just all set up shop near each other in hopes of stealing one of the other's customers.

As consumers, it's also better for us, because if we want to try out a few different cars from a few different brands, it's pretty easy to just go one building down to try out the Hyundai and see if it's better than a Chevy in the same price group.

(Prompt me on ko-fi!)

#economics prompts#marketing#zoning laws#ko fi prompts#ko fi#auto industry#automotive dealerships#car dealerships#phoenix posts

110 notes

·

View notes

Text

"Some enchanted evening, you will see a stranger. . . ." The music came up at the MK Club in New York, and the buyers and fashion writers, who had been downing drinks from the open bar for more than an hour, quieted as rose-colored lights drenched the stage. Six models in satin panties and lace teddies drifted dreamily into view and took turns swooning on the main stage prop—a Victorian couch. The enervated ladies—"Sophia," "Desiree," "Amapola"—languorously stroked their tresses with antique silver hairbrushes, stopping occasionally to lift limp hands to their brows, as if even this bit of grooming overtaxed their delicate constitutions.

The press release described the event as Bob Mackie's "Premiere collection" of fantasy lingerie. In fact, the Hollywood costume designer (author of Dressing for Glamour) had introduced a nearly identical line ten years before. It failed then in a matter of weeks but the women of the late '80s, Mackie believed, were different. “I see it changing,”Mackie asserts. "Women want to wear very feminine lingerie now."

Mackie got this impression not from women but from the late-80s lingerie industry, which claimed to be in the midst of an "Intimate Apparel Explosion." As usual, this was a marketing slogan, not a social trend. Frustrated by slackening sales, the Intimate Apparel Council—an all-male board of lingerie makers—established a special public relations committee in 1987. Its mission: Stir up "excitement."

The committee immediately issued a press release proclaiming that "cleavage is back" and that the average woman's bust had suddenly swelled from 34B to 36C. "Bustiers, corsets, camisoles, knickers, and petticoats," the press kits declared, are now not only "accepted" by women but actually represent "a fashion statement." A $10,000 focus-group study gathered information for the committee about the preferences of manufacturers and retail buyers. No female consumers were surveyed. "It's not that we aren't interested in them," Karen Bromley, the committee's spokesperson, explains. "There's just limited dollars."

In anticipation of the Intimate Apparel Explosion, manufacturers boosted the production of undergarments to its highest level in a dozen years. In 1987, the same year the fashion industry slashed its output of women's suits, it doubled production of garter belts. Again, it was the "better-business" shopper that the fashion marketers were after; in one year, the industry nearly tripled its shipments of luxury lingerie. Du Pont, the largest maker of foundation fabrics, simultaneously began a nationwide "education program," which included "training videos" in stores, fitting room posters and special "training" tags on the clothes to teach women the virtues of underwire bras and girdles (or "body shapers," as they now called them—garments that allow women "a sense of control"). Once again, a fashion regression was billed as a feminist breakthrough. "Women have come a long way since the 1960s," Du Pont's sales literature exulted. "They now care about what they wear under clothes.

The fashion press, as usual, was accommodating. "Bra sales are booming" the New York Daily News claimed. Its evidence: the Intimate Apparel Council's press release. Enlisting one fake backlash trend to promote another, the New York Times claimed that women were rushing out to buy $375 bustiers to use "for cocooning." Life dedicated its June 1989 cover to a hundredth-anniversary salute, "Hurrah for the Bra," and insisted, likewise without data, that women were eagerly investing in designer brassieres and corsets. In an interview later, the article's author, Claudia Dowling, admits that she herself doesn't fit the trend; when asked, she can't even recall what brand bra she wears: "Your basic Warner whatever, I guess," she says.

Hollywood also hastened to the aid of the intimate-apparel industry, with garter belts in Bull Durham, push-up bras in Dangerous Liaisons, and merry-widow regalia galore in Working Girl. TV did its bit, too, as characters from "The Young and the Restless" to "Dynasty" jumped into bustiers, and even the women of "thirtysomething" inspected teddies in one shopping episode.

The fashion press marketed the Intimate Apparel Explosion as a symbol of modern women's new sexual freedom. "The 'Sexy' Revolution Ignites Intimate Apparel," Body Fashions announced in its October 1987 cover story. But the magazine was right to put quotes around "sexy." The cover model was encased in a full-body girdle, and the lingerie inside was mostly of Victorian vintage. Late-'80s lingerie celebrated the repression, not the flowering, of female sexuality. The ideal Victorian lady it had originally been designed for, after all, wasn't supposed to have any libido.

A few years before the Intimate Apparel Explosion, the pop singer Madonna gained notoriety by wearing a black bustier as a shirt. In her rebellious send-up of prim notions of feminine propriety, she paraded her sexuality and transformed "intimate apparel" into an explicit ironic statement. This was not, however, the sort of "sexy revolution" that the fashion designers had in mind. "That Madonna look was vulgar," Bob Mackie sniffs. "It was overly sexually expressive. The slits and the clothes cut up and pulled all around; you couldn't tell the sluts from the schoolgirls." The lingerie that he advocated had "a more ladylike feminine attitude."

Late Victorian apparel merchants were the first to mass-market "feminine" lingerie, turning corsets into a "tight-lacing" fetish and weighing women down in thirty pounds of bustles and petticoats. It worked for them; by the turn of the century, they had ushered in "the great epoch of underwear." Lingerie publicists of the '80s offered various sociological reasons for the Victorian underwear revival, from "the return of marriage" to "fear of AIDS"—though they never did explain how garter belts ward of infection. But the real reason for the Victorian renaissance was strictly business. “Whenever the romantic Victorian mood is in, we are going to do better,” explains Peter Velardi, chairman of the lingerie giant Vanity Fair and a member of the Intimate Apparel Council's executive committee.

In this decade's underwear campaign, the intimate-apparel industry owed its heaviest promotional debt to the Limited, the fashion retailer that turned a California lingerie boutique named Victoria's Secret into a national chain with 346 shops in five years. "I don't want to sound arrogant," Howard Gross, president of Victoria's Secret, says, "but . . . we caused the Intimate Apparel Explosion. We started it and a lot of people wanted to copy it."

The designers of the Victoria's Secret shop, a Disneyland version of a 19th-century lady's dressing room, packed each outlet with "antique" armoires and sepia photos of brides and mothers. Their blueprint was quickly copied by other retailers: May's "Amanda's Closet," Marshall Field's "Amelia's Boutique," Belk's "Marianne's Boutique," and Bullock's "Le Boudoir." Even Frederick's of Hollywood reverted to Victoriana, replacing fright wigs with lace chemises, repainting its walls in ladylike pinks and mauves and banning frontal nudity from its catalogs. "You can put our catalog on your coffee table now," George Townson, president of Frederick's, says proudly.

The Limited bought Victoria's Secret in 1982 from its originator, Roy Raymond, who opened the first shop in a suburban mall in Palo Alto, California. A Stanford MBA and former marketing man for the Vicks company—where he developed such unsuccessful hygiene products as a post-defecation foam to dab on toilet paper—Raymond wanted to create a store that would cater to his gender. "Part of the game was to make it more comfortable to men," he says. "I aimed it, I guess, at myself." But Raymond didn't want his female customers to think a man was running the store; that might put them off. So he was careful to include in the store's catalogs a personal letter to subscribers from "Victoria," the store's putative owner, who revealed her personal preferences in lingerie and urged readers to visit "my boutique." If customers called to inquire after Ms. Victoria's whereabouts, the salesclerks were instructed to say she was "traveling in Europe." As for the media, Raymond's wife handled all TV appearances.

Raymond settled on a Victorian theme both because he rise renovating his own Victorian home in San Francisco at the time and because it seemed like "a romantic happy time." He explains: “It’s that Ralph Lauren image . . . that people were happier then. I don't know if that is really true. It's just the image in my mind, I guess created by all the media things I've seen. But it's real.”

Maybe the Victorian era wasn't the best of times for the female population, he acknowledges, but he came up with a marketing strategy to deal with that problem: women are now "liberated" enough to choose corsets to please themselves, not their men. "We had this whole pitch," he recalls, "that the woman bought this very romantic and sexy lingerie to feel good about herself, and the effect it had on a man was secondary. It allowed us to sell these garments without seeming sexist." But was it true? He shrugs. "It was just the philosophy we used. The media picked it up and called it a 'trend,' but I don't know. I've never seen any statistics."

When the Limited took over Victoria's Secret, the new chief continued the theme. Career women want to wear bustiers in the boardroom, Howard Gross says, so they can feel confident that, underneath it all, they are still anatomically correct. "Women get a little pip, a little perk out of it," he explains. “It's like, ‘Here I am at this very serious business meeting and they really don't know that I'm wearing a garter belt!’” Gross didn't have any statistics to support this theory, either: "The company does no consumer or market research, absolutely none! I just don't believe in it." Instead of asking everyday women what they wanted in underwear, Gross conducted in-house brainstorming sessions where top company managers sat around a table and revealed their "romantic fantasies." Some of them, Gross admits, were actually "not so romantic" like the male executive who imagined, "I'm in bed with eighteen women."

-Susan Faludi, Backlash: the Undeclared War Against American Women

7 notes

·

View notes

Note

I need to know what those thoughts are!!!!!

Lmao it depends on how you feel about pleasing how you’ll feel about my thoughts tbh. Let’s get into this though. This is probably going to end up under a cut because I'm just going to word vom and see what happens lol

First for a quick wee thought on the actual product, so I own three polish sets (perfect pearl, shroom bloom and hot holiday), I also have the pleasing pen, I had the hot holiday spritz and I own two apparel items, the pink shroom bloom frog tshirt and the original black pleasing sweatshirt. The nail polishes I'm a bit ropey about, I don't use them that much because I do my own extensions and gels, but when I do I find they chip easily, which could also be a me issue because I use my hands in all of my work so they take a bit of a beating, colour pay off is great, some colours need a few coats but decent enough. What I will say about the nail stuff though, Pleasing nail stickers are some of the best nail stickers I've ever used, but I need to hit someone over the head whoever keeps deciding to make full coverage nail wrap stickers, that's not what the girlies want and if anyones using them, you're lying to yourself. The wee illustration ones from Shroom Bloom and I suppose the wee letters from Perfect Pearl and my gals! I have burnt through them and I would love to be able to buy more of just the stickers they're so feckin good! Apparel is good, I appreciate the sustainable practices, they wash well, I've never had any fit issues with them, yeah 10/10. I'd like to own one of the lambswool jumpers from a curiosity point of view but not sure I'm in the headspace to drop 260 on it without feeling it first. The pleasing pen is good I'm a big fan of it, it sometimes reacts a bit iffy with at least one thing in my skincare routine for the under eye but its not bothered me enough for me to actually look into what's reacting with it. I'm a slut for a lip oil so I love the lip end. I also loved the toner spritz from Hot Holiday and if I ever make another Pleasing purchase I will be adding another one of those into my order. Idk if it ever really done anything life changing, I just liked it.

What I'm going to say first, I do think Harry still has a sufficient level of say on what's being released etc. Do I think he's sitting in all the creative meetings coming up with the story of the next drop? No, but I do feel like he's in the loop and could say no or "how about this" and have some form of creative control. I think what they're selling and the brands target market versus their actual current customer base, don't completely match up. I think what needs to be said, Pleasing do not want to sell to Harries, and when I say "Harries" I mean like Harries ™️©️ . The gals with Harry in their profile picture and Harry-coded social media handles, Pleasing do not want to use you to promote the brand, but who is Pleasings biggest consumer currently? Harries. I think the push back of that is really evident, have you ever noticed when Pleasing repost consumers content on their instagram story and occasionally their grid, its from peoples social channels who appear to have no visible connection to being a fan of Harry on their socials or if they do its very understated. Pleasing want to be a luxury brand not a singers merchandise. Next time you see Pleasing repost consumer photos, have a look and pay attention who they are reposting and you'll notice it, because we all know fan accounts are buying it, posting it, and tagging pleasing in it, but they won't see the light of day of Pleasings feed. By them pushing these “non-fans” (and that’s not to say they’re not fans of Harry, they probably are they just don’t look like the fan girl Harries the brands trying to hide) photos it sells a story of "look this isn't just fangirls buying it because it's Harry Styles, look at all these normal people buying our products!!" to entice normal beauty and apparel consumers to consider shopping with Pleasing the brand and not Harry Styles' brand Pleasing.

Their price point is proof of this also. Pleasing is expensive, we been knew. What I will say first though, sustainability is fucking expensive. I can't speak about price points of sustainable materials in the cosmetics industry because I know nothing about that, but I do know about sustainable textiles, and they're incredibly expensive, and pleasing are truly doing the most they can do in their apparel to create it ethically and sustainably, and that comes at a cost. Sustainably sourced cotton can be priced up to four times the price of more accessible cottons. Then of course they want to be deemed a luxury brand, so that comes with a luxury mark-up. Mark ups are a thing that’s how brands make money. When I first started studying fashion and textiles I had a professional development course that had us create and cost a single garment and the mark up percentage was set at 200% that’s just how it is. Now we all know that Harry fans come from all walks of life, age range, economic backgrounds, what jobs and careers we have etc, that's all obvious to us who are involved in that. To the boomers and big wigs behind the desks however, they think that the people who run the fan accounts etc are still the teeny bopper gals who have to get their parents to take them to the concert and ask for the concert tickets for their Christmas and birthdays etc (which fyi there is nothing wrong with but this is all hypothetical etc) and therefore won't be able to afford Pleasing with their own money if they even have their own money. So if they can price those people out they won't have to deal with the Harries ™️ looking like their only customer base. When as I said before, that's not the case, the gals running the fan accounts aren't just the 13 year olds with their dads card and a dream any longer. I'm a 26 year old woman with my own disposable income and a Tumblr blog who happens to own some Pleasing products.

So I think Pleasing try to distance themselves publicly from Harry as they can, but they still need to involve him at some base level to get the ball rolling with sales etc. Hence he uses the apparel publicly, he appeared in the fragrance advert because that was a new venture for them, not that I'm saying he's forced into that, that makes me sound like one of those mad conspiracy people and that's not what I'm getting at. Of course he likes his own product, he would be mad to put out something he doesn't wholeheartedly like, that would cause more damage than good, but if he's involved visually, that triggers the Harries TM to buy into the product spiking the sales therefore garnering the interest of their actual target market, they start reposting "normal" consumer photos therefore causing more "normal" customers to buy into it. I think they would love to cut out that "Harries TM" stage but that's not going to happen just yet.

However, I think the fragrance launch is the step in the right direction for them to get to that. Firstly, fragrance people are mental, they love buying into new fragrance brands, reviewing etc. They were who was at that Selfridges launch that first day. They connect with other fragrance consumers and collectors, not the "Harries," if they like the product, they bring in the fragrance lover demographic, which is who Pleasing want. As a quick aside, I think the price point of the fragrance is actually pretty fair, for 100ml bottles, decorative bottles, sustainable for both the perfume and the packaging and it was made with a legitimate perfumer.

Next, they choose to launch at the corner shop at Selfridges rather than the ordinary London pop-up shop they've done previously. Why is that important? Did you know there are only four Selfridges stores. That's a level of exclusivity Pleasing are after. Harrods would be another level but as far as I'm aware Harrods don't have an equivalent space to The Corner Shop in Selfridges therefore don't do things like pop-ups etc its more permanent brands within the shop. If Pleasing were an apparel only brand I could see them doing something similar in Dover Street Market, and I wouldn't write that off as something that won't happen in the future because I think it could. People who regularly shop in Selfridges are also the people Pleasing want to be buying their product, who have a bit more of a frivolous disposable income. The U.S doesn't have the equivalent shop I don't believe to do a similar style of launch hence they've had to go with independent pop-ups in LA and New York, where they already know that it's likely that the majority of customers visiting those pop-ups are going to be Harry fans first rather than the luxury consumers they can pick up from just having a visible presence in Selfridges. If they were to do an in-store launch in the U.S, maybe Bergdorf's perhaps but I think they inch towards a more Harrods level and Pleasing aren't there. Places like Bloomingdales and Macy's are also not exclusive enough for the launch Pleasing they want. They are a small scale luxury brand and I truly believe they want to stay that way for the time being anyway, hence they're launching in a shop that only has four physical locations.

To cut a long story short ig? The product is decent but who they're making it for and who's actually buying it doesn't quite marry up right now and I think the still have to rely on Harry being Harry and being liked and likeable outside of his own fans and have him involved visually to generate sales rather than the brand being able to stand on its own two feet in the luxury market.

#this is a lot of shite I think and I’m not sure it makes any sense#but I find it interesting to think and talk about so dive on in besties#ask#anon

7 notes

·

View notes

Text

The World's No.1 Superstar Launches No.1 Designs: A Bold New Venture in Luxury Fashion.

NEW YORK, LOS ANGELES, UNITED KINGDOM, AUSTRALIA, CANADA, MEXICO, COLOMBIA & TOKYO -- Renowned for his groundbreaking music and electrifying performances, Sidow Sobrino is no stranger to pushing boundaries and defying expectations. Now, the international icon is making waves once again with the launch of his latest venture, No.1 Designs.

No.1 Designs isn't just an online store—it's a revolution in luxury fashion. Featuring Sidow Sobrino's original creations in apparel, footwear, and bags, this digital boutique is a testament to the superstar's unwavering commitment to creativity and individuality.

"I love investing what I earn with my music and videos in new markets, reinventing the man, improving, and hopefully this encourages all dreamers to go boldly after goals," says Sidow Sobrino. "The world of success is for those who dare."

"When you see someone as driven as Diego, you can't help but cheer, celebrate, and encourage, and yes, get out of his way. His energy is a force you either applaud or get swept up in," expressed the luminary's husband, Richard Sidow-Sobrino.

At the heart of No.1 Designs are its bold and outrageous images and styles. Each creation is meticulously crafted to push the boundaries of creativity, standing out in a sea of conformity. From eye-catching graphics to daring designs, every piece exudes a sense of confidence and empowerment.

"No.1 Designs caters specifically to those who refuse to blend in, who crave self-expression without compromise," explains Sidow Sobrino. "Whether you're a trendsetter, a rule-breaker, or simply unapologetically yourself, No.1 Designs celebrates individuality in all its forms."

With its distinctive aesthetic and unapologetic attitude, No.1 Designs isn't just a brand—it's a lifestyle. It's a declaration of defiance against the status quo, a rallying cry for those who dare to be different.

So, if you're ready to make a statement, to stand out from the crowd, then No.1 Designs is your ultimate destination. The public can shop at No1Designs.com Worldwide shipping is available.

#sidowsobrino#music#news#musicnews#love#godisgood#youtube#celebrity#follow#celebritynews#fashion#gaynews#gaypride#gaymen#guys with beards#Spotify

2 notes

·

View notes

Text

Chrome Hearts Hoodies Versus Purple Brand’s Purple Reign

Streetwear fashion has evolved from a niche subculture to a dominant force in the fashion industry, with brands like Chrome Hearts and Purple Brand leading the charge. Both brands have created iconic hoodies that capture the essence of urban style Chrome Heart Jeans but they do so in distinct ways. In this article, we’ll dive deep into the world of Chrome Hearts hoodies and Purple Brand's Purple Reign hoodies, comparing their design aesthetics, quality, cultural impact, and more.

The Origins of Chrome Hearts

Chrome Hearts, founded in 1988 by Richard Stark, started as a leather motorcycle gear company in Los Angeles. Over the years, it expanded into jewelry, eyewear, and apparel, becoming a symbol of luxury and exclusivity. The brand's hoodies are a reflection of its rock 'n' roll roots, often adorned with gothic fonts, intricate embroidery, and silver accents.

Chrome Hearts hoodies are not just clothing items; they are statements. Each piece is crafted with meticulous attention to detail, from the high-quality fabrics to the unique designs that often feature bold logos, crosses, and fleur-de-lis motifs. The brand's commitment to craftsmanship and exclusivity has garnered a dedicated following among celebrities and fashion enthusiasts alike.

The Rise of Purple Brand

Purple Brand, on the other hand, emerged in 2017 with a focus on redefining denim and streetwear. Founded by a group of industry veterans, Purple Brand quickly gained a reputation for its innovative designs and high-quality materials Step into elegance with our curated selection of hoodies at purplebrandjeans.shop showcasing a spectrum of colors and patterns. The Purple Reign collection represents the brand's approach to streetwear, blending classic elements with modern twists.

Purple Brand's Purple Reign hoodies are characterized by their minimalist yet edgy designs. The brand emphasizes quality and fit, ensuring that each piece is not only stylish but also comfortable and durable. With an eye on current trends and a commitment to pushing boundaries, Purple Brand has carved out a niche in the competitive streetwear market.

Design Aesthetics: Gothic Luxury vs. Modern Minimalism

Chrome Hearts hoodies are known for their gothic luxury. The brand’s signature black and white color palette is often complemented by intricate embroidery, bold logos, and silver hardware. The designs are heavily influenced by rock 'n' roll and biker culture, resulting in a unique aesthetic that combines rebelliousness with high fashion.

In contrast, Purple Brand's Purple Reign hoodies lean towards modern minimalism. The designs are sleek and understated, with a focus on clean lines and subtle details. While the hoodies may feature distressed elements or unique washes, they maintain a sense of simplicity that appeals to contemporary streetwear enthusiasts. The color palette is more varied, including muted tones and occasionally bold hues.

Quality and Craftsmanship

When it comes to quality and craftsmanship, both Chrome Hearts and Purple Brand excel, but in different ways. Chrome Hearts hoodies are crafted with premium materials and meticulous attention to detail. The brand’s commitment to handmade quality Chrome Hearts Jewelry is evident in every stitch, and the use of luxurious fabrics and silver accents adds to the overall appeal. Owning a Chrome Hearts hoodie is akin to owning a piece of art.

Purple Brand also places a strong emphasis on quality. The Purple Reign hoodies are made from high-grade cotton and other durable materials, ensuring longevity and comfort. The brand’s focus on fit and construction means that each hoodie is designed to withstand the rigors of daily wear while maintaining its shape and style. The craftsmanship is evident in the precise stitching and thoughtful design elements.

Community and Fan Base

Chrome Hearts has cultivated a dedicated community of fans and collectors over the years. The brand's exclusivity and high price point have created a sense of prestige among its wearers. Owning a Chrome Hearts hoodie is often seen as a status symbol, and the brand’s loyal following includes celebrities, musicians, and fashion insiders who appreciate its unique blend of luxury and edge.

Purple Brand has also built a strong community, particularly among younger streetwear enthusiasts. The brand’s accessible price point and contemporary designs have resonated with a diverse audience. Purple Brand’s engagement with its community through social media, collaborations, and limited-edition releases has helped foster a sense of belonging and excitement among its fans.

Future Prospects: Evolution and Innovation

Looking to the future, both Chrome Hearts and Purple Brand are poised for continued success, albeit in different ways. Chrome Hearts is likely to maintain its position as a luxury streetwear icon, continuing to innovate with unique designs and high-quality craftsmanship. The brand’s commitment to exclusivity and its strong cultural ties will ensure its relevance in the fashion industry for years to come.

Purple Brand, with its focus on innovation and accessibility, is well-positioned to capture a growing segment of the streetwear market. The brand’s ability to stay ahead of trends and continuously evolve its designs will be key to its future success. Purple Brand’s commitment to quality and contemporary style will likely attract new fans and solidify its place in the competitive world of streetwear.

Conclusion:

In the streetwear showdown between Chrome Hearts hoodies and Purple Brand’s Purple Reign hoodies, the choice ultimately comes down to personal preference and priorities. Chrome Hearts offers a blend of luxury, exclusivity, and rock-inspired design, making it ideal for those who appreciate high fashion and unique craftsmanship. Purple Brand, on the other hand, provides contemporary, minimalist designs with a focus on quality and accessibility, appealing to a broader audience.

1 note

·

View note

Text

THE 10 BEST Places to Go Shopping in Gurgaon District

Welcome to Gurgaon District, a vibrant hub of shopping experiences! Whether you're a local resident or a visitor exploring this dynamic area, Gurgaon offers a plethora of shopping destinations to suit every taste and budget. From upscale malls to bustling markets, there's something here for everyone. Let's dive into the top 10 places you should take advantage of when shopping in Gurgaon District.

Ambiance Mall:

As one of the largest shopping malls in Gurgaon, Ambience Mall boasts a diverse range of stores, restaurants, and entertainment options. From luxury brands to popular retail chains, Ambience Mall offers a premium shopping experience.

DLF CyberHub:

Known for its vibrant atmosphere and eclectic mix of restaurants and bars, DLF CyberHub also features a selection of boutique shops and specialty stores. It's the perfect destination for a day of shopping and dining.

MGF Metropolitan Mall:

Located in the heart of Gurgaon, MGF Metropolitan Mall is a favorite among locals for its extensive selection of fashion brands, electronics, and home goods. It's a one-stop destination for all your shopping needs.

Galleria Market:

Nestled in DLF Phase IV, Galleria Market exudes charm with its open-air layout and boutique shops. From designer clothing to unique handicrafts, Galleria Market offers a delightful shopping experience.

Sahara Mall:

Conveniently situated on Mehrauli-Gurgaon Road, Sahara Mall features a mix of retail outlets, entertainment venues, and food courts. It's a popular destination for both shopping and leisure activities.

Sadar Bazaar:

For those seeking a traditional shopping experience, Sadar Bazaar is the place to be. This bustling market is known for its affordable clothing, accessories, and household items. Bargaining is a must here!

Sector 14 Market:

With its shops and street vendors, Sector 14 Market is a local favorite for budget-friendly shopping. You'll find it all from trendy apparel to fresh produce in this bustling market.

The Gurgaon Central Mall:

Located in Sector 25, The Gurgaon Central Mall offers a curated selection of national and international brands. With its spacious layout and diverse offerings, it's a popular choice for shoppers of all ages. Due to such reasons, people choose to live in Gurugram. To know more, you can see what are the Best Places to Live in Gurugram.

Cross Point Mall:

Situated in DLF Phase IV, Cross Point Mall features a mix of retail stores, eateries, and entertainment options. Its convenient location and relaxed ambiance make it a go-to destination for shoppers.

Galaxy Mall:

Rounding out our list is Galaxy Mall, a vibrant shopping complex in Sector 15. From fashion boutiques to electronics stores, Galaxy Mall offers a diverse shopping experience in the heart of Gurgaon.

Ready to explore the best shopping destinations in Gurgaon District? Plan your shopping spree today and discover the hidden gems waiting to be explored! Don't forget to visit Rajbala, your one-stop shop for Packing and Moving services. Click here to learn more and start shopping with Rajbala today!

2 notes

·

View notes