#mortgage loans arizona

Text

Homes For Sale In Arizona With Land!

Where Dreams Come True

Let’s dive right into the awesome world of Arizona real estate! If you’ve got your heart set on wide-open spaces, panoramic views, and the allure of owning your own piece of desert paradise, homes for sale in Arizona with land may just be your ticket to living the dream.

Click Photo Link to View Details

Picture this. You’re waking up to the soft glow of the desert sun,…

View On WordPress

#acreage#Arizona#beauty#cowboy#cowboy hat#fairway mortgage#for sale#freedom#google#home for sale#home loan#homes#homes for sale in arizona#houses for sale#jd doolin#land#landscapes#loving az homes#loving az homes app#pre-qualification#realtor#slice of heaven#wide open spaces

0 notes

Text

0 notes

Text

How Bank Statement Loans Evaluate Income for Approval?

Navigating the world of loans can be daunting. With countless options, terminologies, and processes, finding the right loan that suits your needs can feel overwhelming. Traditional loans might be popular, but they're not always a fit for everyone, especially those with non-standard income sources. Enter the realm of bank statement loans in Florida and beyond—a refreshing alternative that offers a simpler yet different approach to loan approval. This type of loan has become increasingly popular, especially for those whose earnings don't fit into neat boxes. In this article, we'll shed light on the intriguing way bank statement loan in California and everywhere else assess income, simplifying the intricate details for a clear understanding.

What Are Bank Statement Loans?

Bank statement loans are a type of home loan where lenders primarily use bank statements to assess an applicant's income instead of traditional income documentation like pay stubs or tax returns. These loans are especially useful for self-employed individuals, freelancers, or those who have non-traditional income sources, as their earnings may not be as consistent or easily verified as salaried employees.

The Evaluation Process

● Review of Deposits: Lenders closely scrutinize the deposits in your bank account. They aim to establish a pattern of regular income. For instance, if you're a freelancer, you might have varying amounts deposited at different times. To determine your monthly income, lenders will average out these deposits over a specified period.

● Examination of Expense Outflows: While the primary focus is on deposits, looking at outgoing expenses is crucial. This provides lenders with a clearer picture of an individual's net income. Large or recurring withdrawals may be queried to better understand the borrower's spending habits.

● Length of Evaluation Period: Typically, lenders review bank statements from the past 12 to 24 months. This extended review period helps lenders accurately assess an applicant's income, especially if it fluctuates seasonally.

● Consistency is Key: Consistency in your bank statements can boost your chances of approval. If lenders spot regular income deposits, even if the amounts vary, it demonstrates financial stability.

Advantages of Bank Statement Loans

● Flexibility: These loans cater to those with non-traditional income streams, offering more flexibility than conventional loans. This means that where traditional loans might shut the door, bank statement loan in Florida or elsewhere often keep it open.

● Less Paperwork: Without the need for extensive documentation like W2s or tax returns, the application process can be smoother and quicker. This reduction in paperwork can be a boon for many, reducing stress and making the loan process feel less burdensome.

● Tailored for Self-employed: Freelancers and business owners often find bank statement mortgages in Florida or wherever you live to be a favourable option as they take into account their unique financial profiles. This specificity ensures that their income, which might be seen as 'irregular' by other lenders, is understood and appreciated in its entirety.

Conclusion

Bank statement loans have revolutionized the lending landscape, offering hope for those with unconventional income patterns. The focus on bank deposits and outflows and a comprehensive review period allows lenders to better understand an applicant's financial health. Therefore, seeking expert guidance is essential if you're considering this route. Experts at Blue Raven Group specialize in providing tailored solutions that fit your financial needs. Remember, the right advice can make all the difference in navigating the world of bank statement loans.

0 notes

Text

Understanding the VA Loan Application: What You Need to Know

in the word count

Understanding the VA Loan Application: What You Need to Know

The VA loan application process can be intimidating for many veterans and military personnel. It is important to understand the process and the requirements in order to make the most of the benefits available to you. This article will provide an overview of the VA loan application process and what you need to know in…

View On WordPress

#Application#best Mortgage Tips#Loan#Mortgage#Mortgage Tips#mortgage tips 2023#mortgage tips canada#mortgage types#news Mortgage#Understanding#va loan application#va loan arizona

0 notes

Text

Vacation Home Loans in Arizona

Now Buy a Beautiful Vacation Home in a Picturesque Location with a Mortgage Loan

A beautiful vacation home in your favorite holiday destination can be a great money saver, as you no longer have to pay hefty room charges for small and cramped living spaces, when you’re staying for 4-5 days. Here in Arizona, if you plan to buy a vacation property or a secondary home, always consult with a certified loan specialist or a mortgage broker that can guide you through the right steps. And, one such trusted name is “Affordable Interest Mortgage” that helps find an ideal loan package from an A+ certified lender. It can be a bank or any other financial institution.

Typically, a mortgage loan for a vacation home requires a better credit score and a minimum of 3% down payment for a new home buyer. Else a 10-15% down. Here, the monthly interest rates are comparatively higher than conventional home loans Arizona, or in any other state. Overall, it can be a significant financial commitment. Therefore, you need the services of a registered mortgage broker that can help you better understand the pros & cons of buying a vacation home, and the steps involved in it. Their loan specialists can assist you in getting approved for a vacation home loan in Arizona, apart from assisting in conventional loans and cash-out-refinance.

Vacation Home Loans in Arizona and the Technicalities Involved in It

When you’re partnering with a registered mortgage broker, be rest assured, they would take all the headache of making the documentation process paperless. It is because their licensed and bonded home loan specialists are experienced in guiding you to the best mortgage lenders that ask for minimum collateral, down payment and offer low interest finance. So, if you’re considering applying for vacation home loans Arizona, always go with a certified lender in town. They’re in the best position to understand your financial needs and tailor a perfect home loan package.

A vacation home must be at a distance of 40 miles or more from the primary residence. It can be used as an investment property, if you’re renting it out. And, if you’re going for a mortgage, you need to consider the principal amount, interests, taxes and insurance (PITI) that you have to pay, in addition to the monthly mortgage payments. There are other expenses too, which you can fund through your rental income. Therefore, it becomes imperative to shortlist a local lender that specializes in second home mortgage loans. In this case, vacation home loans.

0 notes

Text

""Moreover, it turns out that the United States is not all that tightfisted when it comes to social spending. “If you count all public benefits offered by the federal government, America’s welfare state (as a share of its gross domestic product) is the second biggest in the world, after France’s,” Desmond tells us. Why doesn’t this largesse accomplish more?

For one thing, it unduly assists the affluent. That statistic about the U.S. spending almost as much as France on social welfare, he explains, is accurate only “if you include things like government-subsidized retirement benefits provided by employers, student loans and 529 college savings plans, child tax credits, and homeowner subsidies: benefits disproportionately flowing to Americans well above the poverty line.” To enjoy most of these, you need to have a well-paying job, a home that you own, and probably an accountant (and, if you’re really in clover, a money manager).

“The American government gives the most help to those who need it least,” Desmond argues. “This is the true nature of our welfare state, and it has far-reaching implications, not only for our bank accounts and poverty levels, but also for our psychology and civic spirit.” Americans who benefit from social spending in the form of, say, a mortgage-interest tax deduction don’t see themselves as recipients of governmental generosity. The boon it offers them may be as hard for them to recognize and acknowledge as the persistence of poverty once was to Harrington’s suburban housewives and professional men. These Americans may be anti-government and vote that way. They may picture other people, poor people, as weak and dependent and themselves as hardworking and upstanding. Desmond allows that one reason for this is that tax breaks don’t feel the same as direct payments. Although they may amount to the same thing for household incomes and for the federal budget—“You can benefit a family by lowering its tax burden or by increasing its benefits, same difference”—they are associated with an obligation and a procedure that Americans, in particular, find onerous. Tax-cutting Republican lawmakers want the process to be both difficult and Swiss-cheesed with loopholes. (“Taxes should hurt,” Ronald Reagan once said.) But that’s not the only reason. What Desmond calls the “rudest explanation” is that if, for whatever reason, we get a tax break, most of us like it. That’s the case for people affluent and lucky enough to take advantage of the legitimate breaks designed for their benefit, and for the wily super-rich who game the system with expensive lawyering and ingenious use of tax shelters.

And there are other ways, Desmond points out, that government help gets thwarted or misdirected. When President Clinton instituted welfare reform, in 1996, pledging to “transform a broken system that traps too many people in a cycle of dependence,” an older model, Aid to Families with Dependent Children, or A.F.D.C., was replaced by Temporary Assistance for Needy Families, or TANF. Where most funds administered by A.F.D.C. went straight to families in the form of cash aid, TANF gave grants to states with the added directive to promote two-parent families and discourage out-of-wedlock childbirth, and let the states fund programs to achieve those goals as they saw fit. As a result, “states have come up with rather creative ways to spend TANF dollars,” Desmond writes. “Nationwide, for every dollar budgeted for TANF in 2020, poor families directly received just 22 cents. Only Kentucky and the District of Columbia spent over half of their TANF funds on basic cash assistance.” Between 1999 and 2016, Oklahoma directed more than seventy million dollars toward initiatives to promote marriage, offering couples counselling and workshops that were mostly open to people of all income levels. Arizona used some of the funds to pay for abstinence education; Pennsylvania gave some of its TANF money to anti-abortion programs. Mississippi treated its TANF funds as an unexpected Christmas present, hiring a Christian-rock singer to perform at concerts, for instance, and a former professional wrestler—the author of an autobiography titled “Every Man Has His Price”—to deliver inspirational speeches. (Much of this was revealed by assiduous investigative reporters, and by a 2020 audit of Mississippi’s Department of Human Services.) Moreover, because states don’t have to spend all their TANF funds each year, many carry over big sums. In 2020, Tennessee, which has one of the highest child-poverty rates in the nation, left seven hundred and ninety million dollars in TANF funds unspent."

- The New Yorker: "How America Manufactures Poverty" by Margaret Talbot (review of Matthew Desmond's Poverty by America).

195 notes

·

View notes

Text

The Navajo Nation has received a $55 million grant to help Navajo homeowners with mortgage payments and home repairs.

Navajo Nation President Buu Nygren said as many as 901 homeowners should qualify for the funds.

The money comes from the American Rescue Plan Act, which provides nearly $10 billion to support homeowners throughout the country who face financial hardships due to the COVID-19 pandemic.

The program is open to Navajo homeowners of all income levels within the Four Corner states who live on both tribal lands and in urban areas.

The funds must be used within three years.

PHOENIX — Urban Navajos who own homes off the Navajo Nation will soon receive some unexpected help they’ll want but didn’t need to ask for.

On Sept. 11, Navajo Nation President Buu Nygren told 250 Phoenix metro area Navajo homeowners that the Nation received a $55 million federal grant to provide financial assistance to Navajo homeowners under various Homeowner Assistance Fund programs.

This includes mortgage payments and home repair assistance.

As many as 901 Navajo homeowners should qualify for the money for their homes, he said.

“Make sure we tell everybody,” Nygren told an overflow crowd in the shade outside the historic Phoenix Indian School Visitor Center, one of the remaining buildings from the 100-year-old Indian boarding school.

They were outside because a capacity crowd was already indoors awaiting the same announcement, and Nygren wanted to address those in the 105-degree F heat first.

The Homeowner Assistance Fund was authorized through the American Rescue Plan Act to provide $9.9 billion nationwide to support homeowners who face financial hardships associated with COVID-19, the Nygren said yesterday.

The funds were distributed to states, U.S. territories, and tribes. The Navajo Nation was awarded $55,420,097.

Most federally funded programs are restricted to low- and very-low-income households.

This program allows higher-income Navajo homeowners to receive financial relief from the economic effects of COVID-19, as well.

“Tell your relatives,” Nygren said. “Say the $55 million that came from our government was specifically for Navajo people who are homeowners.”

To launch the process, Nygren signed an agreement with Native Community Capital. The group is a Native-led and operated non-profit corporation that was selected as the sub-recipient to administer the Homeowner Assistance Fund Project activities on behalf of the Navajo Nation.

Native Community Capital is certified by the U.S. Department of the Treasury as a Native Community Development Financial Institution and is a licensed mortgage lender in Arizona and New Mexico.

The program is designed for both higher-income and medium-income homeowners, Native Community Capital CFO Todd Francis said.

As an example, a family of four in Maricopa County in Arizona earning as much as $132,450 a year may be eligible for the tax-free, non-repayable funds to pay their mortgage or repair their homes, he said.

The program will benefit Navajo relatives and their families who reside in both rural remote locations and those in the urban areas of Phoenix, Albuquerque, Denver, Salt Lake City, surrounding smaller cities and towns, and wherever Navajo homeowners live off-reservation, said NCC CEO Dave Castillo.

A significant lack of investment in tribal communities compared to non-Indian communities has resulted in a critical absence of homeownership on tribal lands, particularly for higher-income Native households, he said.

As a result, Navajos with higher incomes tend to purchase or build homes off the Navajo Nation where they can qualify for loans and mortgages to build equity and wealth.

The Center for Indian Country Development reports that 78% of Native people live outside of tribal trust land in counties surrounding their homelands. It is these families the HAF Project will seek to support, Castillo said.

Nygren said the Navajo HAF Project will provide financial assistance to 901 eligible Navajo homeowners to use for qualified expenses in five activities for the next 36 months.

The program will provide financial assistance to eligible Navajo homeowners in the four-state region of Arizona, New Mexico, Utah and Colorado.

Each eligible applicant could receive a maximum amount of $125,000 of combined assistance under various programs.

These include:

Monthly mortgage payment assistance to a maximum assistance level of $72,000 per participant. This is for Navajo homeowners who are delinquent in mortgage payments or at risk of foreclosure due to a loss of household income.

Mortgage reinstatement assistance would give a maximum assistance of $50,000 per participant to those who are in active forbearance, delinquency default status, or are at risk of losing a home.

Mortgage principal reduction assistance that would assist up to $100,000 for those who find the fair market value of their home is now less than the price they paid for it and now may result in a loss when it is sold.

Home repair assistance that would give $100,000 to those who need significant home repairs.

Clear title assistance of up to $30,000 for grant assistance to receive a clear title of their primary residence.

In his 2022 presidential campaign, Nygren committed to helping urban Navajos who have said for years that they felt underserved by the tribal government. He said this grant addresses that.

He said one of his administration’s next goals is to buy or construct a building owned by the Navajo Nation in the metro area to serve urban Navajo Phoenicians.

“Wouldn’t it be nice if we used the entire $55 million this year?” Nygren asked. “I know you committed to live here and to take care of your family. I see a lot of familiar faces and I understand this is where your jobs are. We want you to have access to resources.”

Castillo urged applicants to be sure their applications were complete and submitted early.

“One thing we want to emphasize is to be ready when the information is being requested on the checklist,” he said. “Make sure you have your documents prepared and you get it to our licensed professionals that will be working with you. If you do not, the application will expire in 30 days.”

He said the program has just three years to deploy the $55 million.

“It seems like we could do that quickly but we can only do it quickly if you help us, if you’re ready, and if you submit the information that’s necessary.”

Debbie Nez-Manuel, executive director of the Navajo Nation Division of Human Resources, said visits to other urban areas will be planned, scheduled, and announced by Native Community Capital.

The funds must be used within three years.

So does any of this money go to the Black Indians Tribes? @militantinremission

maybe y'all should start asking for your cut right now cause they got it

#Navajo#Navajo Nation#First Nation#Chief Buu Nygren#Nygren reveals $55 mil for Diné homeowners#HAF#The Center for Indian Country Development#Navajo Nation has received a $55 million grant to help Navajo homeowners with mortgage payments and home repair#@MilitantinRemission

15 notes

·

View notes

Text

Empowering Financial Decisions with Modern Calculators: Your Key to Financial Success

In an era where information is readily available, financial empowerment is key to making informed decisions. Thanks to the digital age, we have access to an impressive array of calculators that can simplify complex financial tasks. Let's explore the world of Modern Calculators and discover how these tools can empower you in various aspects of your financial journey.

1. Rectangle Body Shape Calculator

Your body shape plays a significant role in fashion choices. The Rectangle Body Shape Calculator not only identifies your body shape but also offers tailored fashion advice to help you look and feel your best.

2. Pear Body Shape Calculator

Enhance your style by understanding your body shape. The Pear Body Shape Calculator provides insights and fashion tips specifically designed for pear-shaped individuals.

3. Triangle Body Shape Calculator

Confidence in your wardrobe starts with knowing your body shape. The Triangle Body Shape Calculator identifies your body type and offers fashion recommendations to elevate your style.

4. Car Payment Calculator GA

Planning to buy a car in Georgia? The Car Payment Calculator GA simplifies the process by helping you estimate your monthly car payments, ensuring they fit comfortably within your budget.

5. Mobile Home Mortgage Calculator

Homeownership is a dream for many, and mobile homes provide an affordable path. The Mobile Home Mortgage Calculator assists in estimating your monthly mortgage payments, making homeownership more achievable.

6. Car Payment Calculator Illinois, Colorado, Virginia

If you're relocating to Illinois, Colorado, or Virginia, this calculator helps you estimate car payments in different states, ensuring your budget aligns with your new location.

7. Car Payment Calculator AZ

Considering a vehicle purchase in Arizona? The Car Payment Calculator AZ enables you to calculate potential car payments, allowing you to budget effectively.

8. FintechZoom Mortgage Calculator

Mortgages can be complex, but the FintechZoom Mortgage Calculator simplifies the process. Calculate mortgage payments, explore interest rates, and understand your amortization schedule with ease.

9. Construction Loan Calculator

Building your dream home? The Construction Loan Calculator estimates your construction loan requirements and monthly payments, ensuring a smooth building process.

10. Aerobic Capacity Calculator

Your fitness journey starts with understanding your aerobic capacity. Calculate your fitness level and tailor your workouts for optimal results using this essential tool.

11. Aircraft Loan Calculator - Airplane Loan Calculator

For aviation enthusiasts, owning an aircraft is a dream come true. The Aircraft Loan Calculator simplifies the financial side of aviation, helping you understand loan terms and payments.

12. Manufactured Home Loan Calculator

Thinking about a manufactured home? This calculator provides invaluable insights into potential loan payments, making homeownership in a manufactured home more achievable.

13. Classic Car Loan Calculator

Passionate about classic cars? The Classic Car Loan Calculator helps estimate classic car loan payments, bringing you closer to your dream vehicle.

14. FintechZoom Loan Calculator

Whether you need a personal or business loan, the FintechZoom Loan Calculator equips you to estimate monthly payments and assess the financial impact of borrowing.

15. ATV Loan Calculator

Ready for off-road adventures? The ATV Loan Calculator calculates potential ATV loan payments, ensuring your outdoor escapades are within reach.

16. Farm Loan Calculator

Aspiring farmers can benefit from the Farm Loan Calculator. It simplifies estimating loan payments and planning expenses for a successful agricultural venture.

17. Pool Loan Calculator

Turn your backyard into a paradise with a pool. The Pool Loan Calculator helps you understand the cost of financing your dream pool, making planning easy.

18. Solar Loan Calculator

Considering solar energy? Calculate the financial impact of a solar energy system on your budget and savings with the Solar Loan Calculator, helping you make eco-friendly choices.

19. Mobile Home Loan Calculator

Contemplating a mobile home purchase? Estimate potential mobile home loan payments to make an informed decision about your future home.

20. Bridge Loan Calculator - Bridging Loan Calculator

Real estate investors often use bridge loans for flexibility. The Bridge Loan Calculator simplifies the process of evaluating your bridge loan requirements, facilitating smarter investment decisions.

21. Hard Money Loan Calculator

Hard money lending can be a viable financing option. Use this calculator to assess potential hard money loan terms and payments, ensuring you make sound financial choices.

22. HDFC SIP Calculator

Systematic Investment Plans (SIPs) are an excellent way to grow your wealth. The HDFC SIP Calculator helps plan your investments and understand potential returns on your SIP portfolio.

23. Step Up SIP Calculator

Planning to increase your SIP investments gradually? The Step Up SIP Calculator allows you to calculate the benefits of incremental investment increases on your wealth accumulation.

24. What Calculators Are Allowed on The ACT

For students preparing for the ACT, understanding which calculators are permitted during the exam is crucial. This article provides valuable insights into the types of calculators allowed, ensuring you're well-prepared for test day.

In conclusion, Modern Calculators offers a wide range of calculators that simplify complex tasks and empower you to make informed decisions in various aspects of your life. These calculators are your tools for financial empowerment, helping you achieve your goals and secure your financial future. Explore them today and embark on your journey to financial success!

#Rectangle Body Shape#Pear Body shape#Triangle Body Shape#Car Payment Calculator GA#Mobile Home Mortgage Calculator#Car Payment Calculator Illinois#Colorado#Virginia#Car Payment Calculator AZ#FintechZoom Mortgage Calculator#Construction Loan Calculator#Aerobic Capacity Calculator#Aircraft Loan Calculator - Airplane Loan Calculator#Manufactured Home Loan Calculator#Classic Car Loan Calculator#FintechZoom Loan Calculator#ATV Loan Calculator#Farm Loan Calculator#Pool Loan Calculator#Solar Loan Calculator#Mobile Home Loan Calculator#Bridge Loan Calculator - Bridging Loan Calculator#Hard Money Loan Calculator#HDFC SIP Calculator#Step Up SIP Calculator

2 notes

·

View notes

Link

#salesleads#businessleads#telemarketing#online#techniques#ALABAMA ALASKA ARIZONA ARKANSAS CALIFORNIA COLORADO CONNECTICUT DELAWARE DISTRICT OF COLUMBIA FLORIDA GEORGIA HAWAII IDAHO ILLINOIS INDIA

3 notes

·

View notes

Text

Are Mortgage Rates Making You A Little "Fraidy-Cat"?

Sellers: Don’t Let These Two Things Hold You Back

Many homeowners thinking about selling have two key things holding them back. That’s feeling locked in by today’s higher mortgage rates and worrying they won’t be able to find something to buy while supply is so low. Let’s dive into each challenge and give you some helpful advice on how to overcome these obstacles. Don’t be a…

View On WordPress

#Arizona#AZ#buying a house#Casa Grande#Chandler AZ#dream home#first-time homeowner#home loan#homeowners#lender#loving az homes#mortgage rates#mortgages#Scottsdale#sellers#selling a house

0 notes

Text

1 note

·

View note

Photo

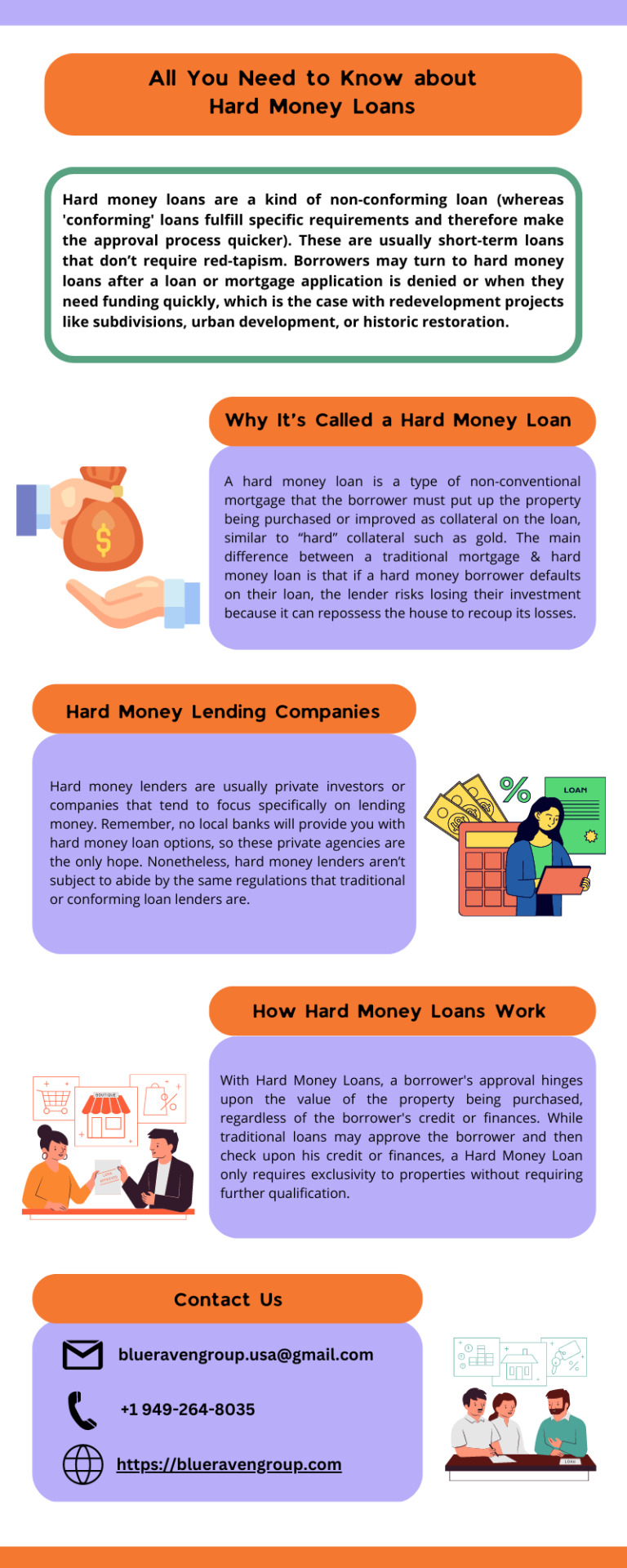

All You Need to Know about Hard Money Loans

Hard money loans are a kind of non-conforming loan (whereas 'conforming' loans fulfill specific requirements and therefore make the approval process quicker). These are usually short-term loans that don’t require red-tapism. Borrowers may turn to hard money loans after a loan or mortgage application is denied or when they need funding quickly, which is the case with redevelopment projects like subdivisions, urban development, or historic restoration. If you also require getting hard money in California, San Diego, or wherever you reside, you should read this article. It includes some vital information about hard money loans. So, without further ado, let’s get started!

0 notes

Text

Are You Looking for the Best Real Estate Properties in Sedona?

Sedona, Arizona, renowned for its stunning red rock landscapes, vibrant arts community, and spiritual energy, is not just a tourist destination; it's also a prime location for Real Estate Investment. Whether you're seeking a vacation home, a retirement retreat, or a lucrative investment opportunity, Sedona offers a diverse range of properties to suit every taste and budget. In this comprehensive guide, we'll explore why Sedona is an attractive real estate market, what factors to consider when searching for properties, and how to navigate the process effectively.

Why Choose Sedona?

Sedona's appeal as a real estate destination stems from its unique blend of natural beauty, cultural richness, and recreational opportunities. The city's iconic red rock formations, surrounded by the Coconino National Forest, create a picturesque backdrop for residential neighborhoods, making it a magnet for outdoor enthusiasts and nature lovers alike. Additionally, Sedona's thriving arts scene, with galleries, festivals, and cultural events year-round, adds to its allure as a vibrant community.

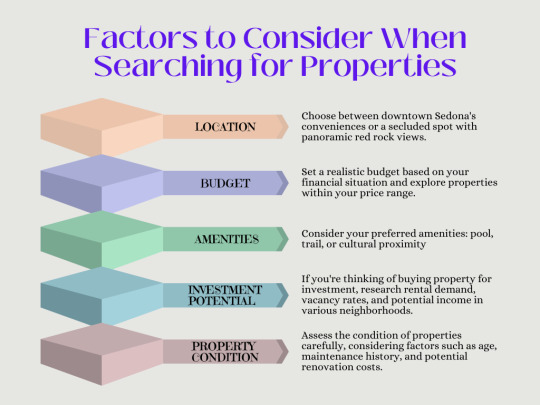

Factors to Consider When Searching for Properties:

Location: Determine whether you prefer to be close to downtown Sedona with its shops, restaurants, and amenities, or if you prefer a more secluded location with panoramic views of the red rocks.

Budget: Set a realistic budget based on your financial situation and explore properties within your price range. Keep in mind that prices can vary significantly depending on factors such as location, size, and amenities.

Amenities: Consider what amenities are important to you, whether it's a swimming pool, a hiking trail, or proximity to cultural attractions. Make a list of must-have features and prioritize them during your search.

Investment Potential: If you're considering purchasing property as an investment, research rental demand, vacancy rates, and potential rental income in different neighborhoods. Consult with local real estate agents or property managers for expert advice.

Property Condition: Assess the condition of properties carefully, considering factors such as age, maintenance history, and potential renovation costs. A thorough inspection can help you avoid unexpected expenses down the line.

Navigating the Real Estate Process in Sedona:

Research: Begin your search by exploring online listings, attending open houses, and consulting with local real estate agents who specialize in the Sedona market. Take the time to familiarize yourself with the different neighborhoods and property types available.

Financing: Determine your financing options early in the process, whether it's through a conventional mortgage, a home equity loan, or cash purchase. Get pre-approved for a loan to strengthen your offer when you find the right property.

Tour Properties: Schedule tours of properties that meet your criteria, paying attention to details such as layout, condition, and views. Take notes and ask questions to gather as much information as possible.

Make an Offer: When you find a property that ticks all the boxes, work with your real estate agent to craft a competitive offer. Consider factors such as market conditions, comparable sales, and seller motivations when negotiating price and terms.

Due Diligence: Once your offer is accepted, conduct due diligence to ensure there are no hidden issues with the property. Hire a qualified inspector to assess the home's condition, review documents such as title reports and HOA disclosures, and address any concerns before closing.

Closing: Work with your lender, real estate agent, and attorney to finalize the closing process, including signing paperwork, transferring funds, and obtaining insurance. Celebrate your new home or investment property and begin enjoying all that Sedona has to offer.

Whether you're drawn to Sedona for its natural beauty, cultural richness, or investment potential, finding the Best Real Estate Properties requires careful research, planning, and execution. By considering factors such as location, budget, amenities, and investment potential, and navigating the real estate process effectively, you can find the perfect property to suit your needs and goals in this enchanting desert oasis. With its breathtaking landscapes and vibrant community spirit, Sedona offers not just a place to live, but a lifestyle to treasure for years to come.

0 notes

Text

At Affordable Interest Mortgage, we specialize in providing mortgage loans in Arizona. We represent a broad selection of lenders, from traditional lenders who can help you finance a property despite credit issues to "A+" rated lenders with first-class rates. If you figure out what mortgage amount you can get before you start looking at houses, you can save a lot of time and money and we will help you in that.

0 notes

Text

Ranking the Best Mortgage Brokers in the State

Arizona's real estate market is booming, with more people looking to buy homes than ever before. However, navigating the complex world of mortgages can be daunting. That's where mortgage brokers come in. These professionals act as intermediaries between borrowers and lenders, helping you find the best loan options for your needs. In this article, we'll explore the role of mortgage brokers in Arizona and highlight some of the best brokers in the state.

Understanding the Role of Mortgage Brokers

The Best Mortgage Brokers Arizona are professionals who help borrowers find the right mortgage products and lenders for their needs. These brokers work with a variety of lenders to offer borrowers a range of options and help them navigate the mortgage process from application to closing. Mortgage brokers play a crucial role in the home buying process. Unlike loan officers who work for a specific lender, brokers work independently and have access to a wide range of lenders and loan products. This means they can shop around on your behalf to find the best loan terms and interest rates. Additionally, brokers can help you navigate the often complex mortgage application process, ensuring you meet all the necessary requirements.

Read more - Mortgage and Refinance Rates in Arizona

Criteria for Selecting the Best Mortgage Brokers

When choosing a mortgage broker, it's essential to consider several key factors:

Experience and Reputation: Look for brokers with a proven track record of success and positive reviews from past clients. Experience matters when it comes to navigating the intricacies of the mortgage market.

Range of Lenders and Loan Options: The best mortgage brokers in Arizona will have access to a diverse array of lenders and loan products, ensuring that you have options tailored to your specific needs.

Customer Service: A broker's level of customer service can make a significant difference in your mortgage experience. Seek out brokers who prioritize communication, transparency, and responsiveness.

Fees and Costs: Understand the fee structure of any broker you're considering. While some brokers charge upfront fees, others earn their commission from lenders. This refers to a company that provides mortgages or home loans to individuals looking to purchase a home in Arizona. Home Mortgage Company in Arizona offer a variety of mortgage products, including fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans like FHA or VA loans. Make sure you're comfortable with the costs involved before committing to a broker.

Tips for Working with a Mortgage Broker

When working with a mortgage broker, it's important to be prepared. Have all your financial documents ready, including pay stubs, tax returns, and bank statements. Additionally, be honest about your financial situation and goals. This will help your broker find the best loan options for you.This refers to a company that provides mortgages or home loans to individuals looking to purchase a home in Arizona. Home Mortgage Company in Arizona offer a variety of mortgage products, including fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans like FHA or VA loans.

Finally, stay in communication with your broker throughout the process. This will ensure that everything goes smoothly and that you're able to close on your loan on time.

Finding the right mortgage broker in Arizona can make all the difference when buying a home. By following the tips outlined in this article and choosing one of the top brokers in the state, you can streamline the home buying process and secure the best loan terms possible. Contact a reputable broker today to start your journey towards homeownership in Arizona.

Frequently Asked Questions

1. What is a mortgage broker, and how do they differ from lenders?

A mortgage broker is a licensed professional who acts as an intermediary between borrowers and lenders. Unlike lenders, who provide loans directly to borrowers, mortgage brokers work with multiple lenders to find the best loan options for their clients.

3. Why should I use a mortgage broker instead of going directly to a bank?

Mortgage brokers can shop around on your behalf to find the best loan terms and interest rates from multiple lenders, saving you time and potentially money.

4. What criteria should I consider when choosing a mortgage broker?

Look for a broker with experience in the Arizona real estate market, a strong network of lenders, positive client testimonials, and all necessary licensing and certification.

5. How do mortgage brokers get paid?

Mortgage brokers typically receive a commission from the lender once the loan is closed. This commission is usually a percentage of the loan amount.

6. How long does the mortgage process typically take when working with a broker?

The timeline for the mortgage process can vary depending on factors such as the complexity of your financial situation and the lender's requirements. A mortgage broker can provide a more accurate estimate based on your specific circumstances.

7. Are there any advantages to using a local mortgage broker in Arizona?

Working with a local mortgage broker can offer several benefits, including their familiarity with the local market and regulations, personalized service, and the ability to meet face-to-face if desired.

8. Can I use a mortgage broker for refinancing my existing mortgage?

Yes, mortgage brokers can assist with refinancing your existing mortgage. They can help you explore refinancing options to potentially secure a lower interest rate, reduce your monthly payments, or change the terms of your loan.

9. What should I expect during the mortgage application process with a broker?

Your broker will help you gather all necessary documents, submit your application to lenders, and communicate with you throughout the process to ensure everything goes smoothly.

10. How can I find the best mortgage broker in Arizona for my needs?

Research brokers online, ask for recommendations from friends or family, and schedule consultations with potential brokers to discuss your needs and goals.

Get in touch

Website – https://homeloansproviders.com/

Mobile – +91 9212306116

Whatsapp – https://call.whatsapp.com/voice/9rqVJyqSNMhpdFkKPZGYKj

Skype – shalabh.mishra

Telegram – shalabhmishra

Email – [email protected]

#home mortgage company in Arizona#best mortgage refi company in Arizona#online mortgage company in Arizona

0 notes

Text

Payday Loans In California (CA) On-line 24/7

It is as simple as writing down what you'll want to attain with the credit loans and doing all your absolute greatest to stick with it. Bear in mind however that 12-month short term loans and 12-month personal loans are two completely different products and offer different charges. The presents, loan phrases, rates (including APR), charges and prices, loan quantity, cash transfer occasions, repayment terms as well as any legal implications for late or non-payments are within the full duty and control of the particular lender that gives the loan service. The portal also sends your utility to third-social gathering sites which might be linked to it, making it simple for you to apply to more places. "Even my spouse and I have checked out a second dwelling, a lake residence a pair hours away, perhaps on Lake Livingston or Crockett, and that is likely one of the issues we’ve considered as effectively. Candidates with bad credit history owing to missed payments, massive outstanding balances, and/or a number of credit score products may discover it troublesome to get loans accredited under their names.

youtube

Whilst prior to now a poor credit history might make it particularly troublesome to access credit score, some trendy direct lenders are prepared to take a look at your current monetary circumstances slightly than simply making an assessment based on your credit score rating. It came as a surprise to many once they gained sudden recognition, many didn’t attempt them out, however with a gentle improve of recent prospects, they were able to get a very good popularity as a foul credit score loan lender. Late or non-fee could negatively have an effect on your credit standing and increase the price of any future borrowing, or make it very troublesome to acquire any credit score in the future. However not solely do they want to seek out property that can improve in value, they regularly inquire about its capability to generate revenue. Collier stated that the rental revenue from the Heights house - now about $24,000 a yr - paid for an extensive remodel of that house and earned enough money to purchase the second property. Owens mentioned that for waterfront property or with entry to water, about half of the potential patrons inquire about the flexibility to rent the home, and the queries have increased mostly in the past year. To date she’s solely rented her Houston house a handful of instances, but the Sonniers even have a house on Lake Houston, and when they’re completed with Hurricane Harvey repairs, she might rent that out, too.

Inspired by her daughter’s own rental management enterprise in Arizona, Sonnier and her husband, Michael, rent their 3,300-sq.-foot Montrose townhome for $165 to $250 a evening via Airbnb once they travel, and she has six different full-time rentals in Arizona she makes use of for the enterprise she started herself. Their daughter began her own business managing trip rentals for associates in Arizona and now operates the largest privately owned trip administration company in that state. SuperMoney isn't chargeable for third get together merchandise, companies, websites, suggestions, endorsements, critiques, and so forth. All products, logos, and company names are trademarks™ or registered® trademarks of their respective holders. Are Payday Loans Authorized? Payday loans are different to short-time period loans within the UK, as they're designed to tide you over until you receives a commission and can even help cover emergencies. Borrowers with bad credit could have to pay curiosity charges between 28 and 32%, while these with good credit score could pay an annual share price (APR) of 10 to 12%. CashUSA can help you apply for many various sorts of loans, equivalent to personal loans, automotive loans, mortgages, and loans for individuals in tough situations.

In California, for instance, a payday lender can charge a 14-day APR of 460% for a $one hundred loan. In reality, many payday lenders don’t even express their fees as an curiosity fee, but they as an alternative cost a hard and fast flat price that may be anyplace from $10 to $30 per $a hundred borrowed. There’s a free, basic subscription, but then there’s additionally the option of a pro subscription, which costs a monthly payment of $6.25. When you find yourself preapproved for a bad/no credit score loan, you can find out in regards to the APR, the quantity you possibly can borrow, the entire quantity you have to pay back, and the length of the loan. Turnaround time: As soon as an Improve loan is accredited, it generally takes up to 4 business days for a borrower to receive the funds. So, we selected on-line lenders that allow us to dispatch and receive funds speedily and with impunity. And it may be irritating if you find yourself in dire need of funds and unsure how to acquire it. Not all main lenders are companions, so it's possible you'll not get the most effective deal. Extra not too long ago, Bonner helped him buy a third Ward duplex. https://findbestserver.com/unit-four-problem-2-2-secured-short-term-financing/ get their borrower’s information and as soon as they have it they take advantage of it and so they sell it on third party websites.

0 notes