#payment api for developers

Text

Wallet service provider | IntaSend

Building digital wallets is complex. IntaSend’s Wallet Services provider enables you to get it done in days rather than months. Our wallets are PCI-DSS compliant and with zero downtime. We have partnered with SISA InfoSec to ensure your data is protected and under 24/7 monitoring.

API - https://developers.intasend.com Website - https://intasend.com Email - [email protected] Phone - +254 725 79 36 79 / +254 723 890 353

#Wallet service provider#payment api for developers#wallet as a service#online business in kenya#cashapp in kenya#digital wallet api#intasend

1 note

·

View note

Link

#aeps software#aeps software provider#aeps software development company#aeps portal#best aeps portal#aeps api#aeps payment#aeps app#aeps business

2 notes

·

View notes

Text

InstantPay API Integration by Infinity Webinfo Pvt Ltd

In the ever-evolving digital payment landscape, InstantPay has emerged as one of the most robust platforms for handling financial transactions. By offering a comprehensive API suite, businesses can now process payments with enhanced speed, security, and flexibility. Infinity Webinfo Pvt Ltd, a trusted name in IT solutions, takes this service to the next level with expert API Integration, ensuring a seamless experience for businesses.

Instantpay API Integration by Infinity Webinfo Pvt Ltd

What is API Integration?

API Integration involves connecting software applications through their APIs (Application Programming Interfaces). It allows different systems to communicate, share data, and function together effectively. For example, a business can integrate a payment gateway like InstantPay into their website or app, providing users with an embedded, real-time payment solution.

API Integration offers several benefits:

Automated processes: Reduces manual intervention and improves efficiency.

Real-time data sharing: Ensures smooth communication between systems.

Scalability: Facilitates increased transaction volumes without manual adjustments.

Customization: Tailored to specific business needs, providing a flexible solution.

InstantPay Overview

InstantPay is a digital financial platform that enables businesses and individuals to perform a wide range of financial services, including bill payments, money transfers, and more. It is widely known for its Business Payment Solutions and is often used as a secure way to handle transactions like salary disbursements, utility payments, and vendor payouts.

Key Features of InstantPay:

Multiple Payment Methods: InstantPay supports various payment modes including:

UPI (Unified Payments Interface): One of the most popular payment methods in India.

IMPS (Immediate Payment Service): Ensures that payments are processed instantly.

NEFT/RTGS: Bank transfer methods for larger transactions.

Debit/Credit Cards: Supporting payments through all major cards.

Instant Payouts: The InstantPay API provides the ability for businesses to transfer funds instantly to a beneficiary’s bank account, wallet, or UPI ID. This is especially useful for salary payments, refunds, and vendor payouts.

Bulk Payment Processing: Businesses often need to process multiple transactions at once. InstantPay’s bulk payment feature makes it easy to send payments to thousands of recipients in a single go.

Comprehensive Transaction Reports: The platform offers detailed insights into transactions, ensuring businesses can monitor and track payments efficiently.

Security: InstantPay is designed with multiple layers of security to protect against fraud and unauthorized transactions. Features include:

Data Encryption: Ensures all payment information is secure.

Multi-factor Authentication (MFA): Adds an extra layer of security for sensitive operations.

Tokenization: Protects card information during processing.

Compliance with Financial Regulations: InstantPay adheres to the highest compliance standards set by financial regulators like the Reserve Bank of India (RBI), ensuring all transactions meet regulatory guidelines.

Infinity Webinfo Pvt Ltd: The API Integration Experts

With an ever-growing demand for digital payments, businesses must integrate platforms like InstantPay effectively into their existing systems. This is where Infinity Webinfo Pvt Ltd excels. With years of experience in API Integration, Infinity Webinfo Pvt Ltd ensures that your business can leverage all the features of the InstantPay API smoothly.

Benefits of API Integration by Infinity Webinfo Pvt Ltd:

Custom Development: Infinity Webinfo Pvt Ltd customizes the InstantPay API integration to meet the specific needs of your business, whether it's integrating with e-commerce platforms, mobile apps, or ERP systems.

Streamlined Onboarding: Setting up InstantPay through Infinity Webinfo Pvt Ltd is quick and hassle-free. They handle everything from obtaining API keys to configuring the system, ensuring you’re ready to process payments immediately.

Technical Support & Maintenance: Post-integration, Infinity Webinfo Pvt Ltd provides ongoing technical support to ensure the system runs smoothly. Any issues are resolved quickly, and updates or patches are applied to keep the system secure and functional.

Enhanced Security: API integration through Infinity Webinfo Pvt Ltd comes with added security layers, including encryption and tokenization, ensuring that every transaction is secure.

Testing & Quality Assurance: Before the integration is rolled out, Infinity Webinfo Pvt Ltd runs rigorous tests to ensure the system works as expected. They identify any bugs or issues and ensure everything is operating at peak performance before going live.

Step-by-Step Process of InstantPay API Integration

The process of integrating InstantPay’s API with Infinity Webinfo Pvt Ltd is simple yet thorough:

Initial Consultation: Understanding your business needs—whether it’s online payments, bulk payouts, or fund transfers. Infinity Webinfo Pvt Ltd ensures that the API integration will fit seamlessly with your current processes and infrastructure.

API Documentation: Infinity Webinfo Pvt Ltd reviews InstantPay’s extensive API documentation to map out the necessary endpoints and functions required for your business.

Development: The team at Infinity Webinfo Pvt Ltd builds a customized solution based on your business requirements. This may involve setting up payment gateways, customizing workflows, or integrating with other applications like CRMs or ERPs.

Testing: Before the final implementation, Infinity Webinfo Pvt Ltd conducts rigorous testing in a secure environment to ensure the system is reliable, secure, and functions smoothly.

Security Protocol Implementation: To safeguard against any potential vulnerabilities, Infinity Webinfo Pvt Ltd implements additional encryption and security protocols. This ensures that the transaction data is protected throughout the process.

Launch: Once testing is complete, the system is deployed, and you can begin processing payments via InstantPay. Infinity Webinfo Pvt Ltd offers support during the initial stages to ensure everything works smoothly.

Ongoing Monitoring and Support: Post-launch, Infinity Webinfo Pvt Ltd continues to monitor the integration, providing any necessary updates or troubleshooting to ensure smooth operation.

Advantages of InstantPay API Integration

By integrating InstantPay with the help of Infinity Webinfo Pvt Ltd, businesses can enjoy several key advantages:

Speed & Efficiency: Instant payments and simplified processes lead to quicker transactions.

Scalability: Whether you’re processing a handful or thousands of transactions, InstantPay scales effortlessly.

Security: Robust security features ensure your transactions are safe from fraud and other security threats.

Cost-Effective: Reduces transaction fees and operational costs through automation and bulk processing.

Enhanced Customer Experience: Provide a seamless, fast, and secure payment experience for your customers.

Conclusion

For businesses looking to streamline and enhance their payment operations, the integration of InstantPay API by Infinity Webinfo Pvt Ltd offers a comprehensive solution. With advanced features, robust security, and a smooth integration process, InstantPay ensures efficient and reliable transactions for businesses of all sizes. Infinity Webinfo Pvt Ltd further enhances this by delivering custom, secure, and scalable solutions that cater to specific business needs.

By choosing InstantPay through Infinity Webinfo Pvt Ltd, businesses can future-proof their payment systems and remain competitive in the fast-paced digital economy.

Contact us on :- +91 9711090237

#instantpay#instant payment gateway#payment gateway api integration#payment gateway integration#instantpay API Integration#api integration developer#api integration#infinity webinfo pvt ltd

0 notes

Text

#shopify web design services#shopify web design company#shopify website development services#shopify web development services#shopify store development services#shopify theme development#shopify custom theme development#API integration shopify#shopify payment integration#shopify API integration services#shopify store help#help with shopify store#shopify developer support#shopify assistance#help with shopify setup#shopify expert help#shopify developer help

1 note

·

View note

Text

instagram

#OmegaSoftwares#PayoutAPI#Payments#GrowYourBusiness#APIs#APISecurity#payoutsuccess#payout#goa#Uttarakhand#Odisha#sikkim#chattisgarh#Puducherry#punjab#dividends#dividendgrowth#dividendinvesting#dividendpayout#payoutratio#payoutaccount#payoutmeaning#SoftwareUpgrade#developers#CustomSoftware#softwaredevelopment#BoostYourBusiness#Dombivli#dombivliwest#dombivlieast

0 notes

Text

Integrate Our UPI Collection API

Integrating the UPI Collection API by Rainet Technology Private Limited into your financial infrastructure offers a seamless and efficient way to manage digital transactions. The UPI API, or Unified Payments Interface API, is designed to facilitate instant payment processing, making it an indispensable tool for businesses seeking to enhance their financial operations. By leveraging the UPI Collection API, businesses can streamline their payment collection processes, reducing the time and effort required to manage transactions manually. This integration not only improves the speed of transactions but also enhances security, ensuring that all payments are processed through a secure and reliable platform.

The UPI Collection API integration process is straightforward, allowing businesses to quickly implement the technology without significant disruption to their existing systems. Rainet Technology Private Limited provides comprehensive support and documentation to guide businesses through each step of the integration process. This ensures that even businesses with limited technical expertise can successfully adopt the UPI Collection API and begin reaping its benefits almost immediately.

One of the key advantages of integrating the UPI Collection API is the ability to offer customers a convenient and flexible payment option. With the UPI API, customers can make payments directly from their bank accounts using their smartphones, eliminating the need for cash or card transactions. This not only enhances the customer experience but also reduces the risk of payment fraud and errors.

Moreover, the UPI Collection API integration can significantly boost operational efficiency. Automated transaction processing reduces the need for manual intervention, freeing up staff to focus on more strategic tasks. This leads to improved productivity and cost savings for the business. In summary, integrating the UPI Collection API by Rainet Technology Private Limited is a strategic move for any business looking to enhance its payment processing capabilities, improve security, and offer a superior customer experience.

Visit Website: https://rainet.co.in/upi-collection-api.php

#upi integration api#upi api integration#upi payment gateway#paytm upi integration api#upi integration#upi payment gateway integratio#bbps api provider#upi payment gateway integration#education portal development company#bbps#bbps login

0 notes

Text

UPI Payment Gateway India

Empower Your Transactions with Quintus Tech: Leading Automated Payment Solution Provider in India. Discover seamless payment solutions in India with Quintus Tech – your trusted automated payment solution provider. Streamline transactions effortlessly Quintus Tech offers cutting-edge and seamless payment solutions in India, serving as your trusted automated payment solution provider. Our goal is to simplify and streamline transactions, making the payment process effortless for businesses and individuals alike. Automation, Security, User-Friendly Interface, Versatility, Integration, Customer Support, Innovation etc. Visit Our Website :- https://quintustech.in/

#Payment Solution Providers in India#Automated Payment Solutions#Quintus Tech#UPI Payment Gateway#White Label Development#Bank Account Verification API#Digital Client Onboarding#Dynamic UPI QR Code Generator#Virtual Bank Account for Business#Recurring Online Transactions

0 notes

Text

UPI payment gateway in India

Quintus Tech provides a wide range of services including automated payment solutions in India and digital payment systems, mobile payment solutions, and UPI payment gateways. They enable businesses to easily and securely accept customer payments, settle transactions, and improve customer experience.

#Payment Solution Providers in India#Automated Payment Solutions#Quintus Tech#UPI Payment Gateway#White Label Development#Bank Account Verification API#Digital Client Onboarding#Dynamic UPI QR Code Generator#Virtual Bank Account for Business

0 notes

Text

UPI Collection API Integration Service

Are you looking for a seamless and efficient way to collect UPI payments for your business? Look no further! Rainet Technology Private Limited is here to provide you with the perfect solution - our UPI Collection API integration service. With our state-of-the-art technology and robust features, we can help streamline your payment collection process and boost your business's growth. In this blog post, we will explore what UPI Collection API is, how it can benefit your business, and how Rainet can assist you in harnessing the power of UPI payments. So let's dive right in!

What is the UPI Collection API?

What is the UPI Collection API?

UPI, which stands for Unified Payments Interface, has revolutionized the way we make payments in India. It enables users to link multiple bank accounts to a single mobile application and facilitates instant money transfers with just a few taps on the screen. The UPI system has gained immense popularity due to its convenience, security, and real-time transaction capabilities.

Now, imagine harnessing the power of UPI payments for your business. That's where UPI Collection API comes into play. An API (Application Programming Interface) acts as an intermediary between different software applications, allowing them to communicate with each other seamlessly.

In simple terms, UPI Collection API integration allows businesses to incorporate UPI payment functionality into their own platforms or mobile apps. This means that you can provide your customers with a hassle-free and secure way to make payments using their preferred UPI-enabled banking apps.

By integrating this powerful technology into your business processes, you can streamline your payment collection process and offer a seamless experience to your customers. Whether you run an e-commerce store, subscription-based platform, or any other type of online business - embracing UPI Collection API can open up endless possibilities for growth and success.

At Rainet Technology Private Limited, we specialize in providing top-notch UPI Collection API integration services that are tailored according to our clients' specific requirements. Our team of experts will work closely with you to understand your business needs and ensure a smooth integration process from start to finish.

So why wait? Embrace the future of digital payments by incorporating UPI Collection API into your business today!

Upi For Your Business by Rainet Technology Private Limited

Upi For Your Business by Rainet Technology Private Limited

Are you a business owner looking for a seamless way to collect payments from your customers? Look no further than UPI (Unified Payments Interface) - the revolutionary payment system that is transforming the way transactions are done in India.

Rainet Technology Private Limited, a leading technology company, offers an advanced UPI Collection API integration service that allows businesses to easily collect UPI payments. With our expertise and cutting-edge solutions, we provide a hassle-free experience for both businesses and their customers.

Our UPI Collection API Features

Our collection upi api integration service comes with a range of features designed to enhance your business operations. We offer secure and encrypted payment processing, ensuring the safety of your customer's data. Our API also supports multiple languages and currencies, making it convenient for businesses operating on a global scale.

How Can UPI Payments Help Your Business

Accepting UPI payments can bring numerous benefits to your business. First and foremost, it provides convenience for your customers as they can make instant payments using their smartphones without the need for cash or cards. This leads to faster transactions and reduces any delays or errors associated with traditional payment methods.

Furthermore, accepting UPI payments can help improve customer satisfaction and loyalty. By offering this modern payment option, you cater to the preferences of tech-savvy consumers who seek convenience in their purchasing experiences. This can give you an edge over competitors who have yet to adopt this innovative solution.

UPI Payments For Your Business - How Can Rainet Help

At Rainet Technology Private Limited, we understand that each business has its unique requirements when it comes to collecting payments. That's why our team of experts works closely with you to tailor our collection upi api integration service according to your specific needs.

We take care of all aspects of the integration process – from initial setup and customization through ongoing support – so that you can focus on what matters most: growing your business. With our reliable and efficient UPI Collection API, you

Our UPI Collection API Features

Our UPI Collection API comes with a range of powerful features that make collecting payments through UPI seamless and efficient. With our API, you can easily integrate UPI payment options into your website or mobile app, allowing your customers to make quick and secure transactions.

One of the key features of our UPI Collection API is its versatility. It supports all major UPI apps including Google Pay, PhonePe, Paytm, and more. This means that no matter which UPI app your customer prefers to use, they will be able to make payments without any hassle.

Another great feature of our API is real-time transaction status updates. You will receive instant notifications about successful payments as well as failed transactions. This enables you to provide prompt customer support and ensures transparency in your payment processes.

Our UPI Collection API also offers comprehensive reporting capabilities. You can access detailed reports on transaction history, success rates, refund requests, and much more. These insights help you analyze the performance of your payment system and identify areas for improvement.

Security is always a top priority when it comes to online payments, and our API takes this seriously. We have implemented robust security measures such as encryption protocols and fraud detection mechanisms to safeguard sensitive customer data.

In addition to these features, our UPI Collection API also provides easy integration options with popular e-commerce platforms like WooCommerce and Magento. This allows you to seamlessly incorporate UPI payments into your existing online store without any technical complexities.

With our reliable infrastructure and user-friendly interface, integrating the Rainet Technology Private Limited's UPI Collection API into your business operations has never been easier!

How Can UPI Payments Help Your Business

How Can UPI Payments Help Your Business

With the rapid growth of digital transactions, businesses are constantly exploring new and efficient ways to collect payments. UPI (Unified Payment Interface) has emerged as a game-changer in the Indian payment landscape, offering a seamless and secure way for businesses to accept payments.

One of the key advantages of UPI payments is its convenience. Customers can make instant payments directly from their bank accounts using simple mobile apps. This eliminates the need for cash or cards, making it easier for customers to complete transactions quickly and efficiently.

Another benefit of UPI payments is cost-effectiveness. Traditional payment methods often involve hefty transaction fees or setup costs, which can eat into a business's profits. With UPI, however, businesses can enjoy lower transaction charges and faster settlement times.

Moreover, UPI offers real-time payment tracking and reconciliation features that enable businesses to keep track of their transactions effortlessly. This ensures transparency and helps in streamlining financial operations effectively.

Furthermore, by integrating UPI collection API into your business processes, you open doors to a wider customer base as it allows you to accept payments from anyone with a bank account linked to their mobile number. This means that even customers who do not have credit or debit cards can easily make purchases from your business.

Embracing UPI payments can help your business enhance customer satisfaction by offering them a convenient and secure mode of payment while also reducing operational costs associated with traditional payment methods

UPI Payments For Your Business - How Can Rainet Help

UPI Payments For Your Business - How Can Rainet Help

Now that you understand the benefits of UPI payments and how they can transform your business, it's time to explore how Rainet Technology Private Limited can help you integrate UPI Collection API seamlessly into your operations.

As a leading provider of UPI collection API integration services, Rainet is committed to delivering top-notch solutions tailored to meet your specific business needs. Our team of experts will work closely with you to understand your requirements and guide you through the entire integration process.

Here are some ways in which Rainet can assist:

1. Expertise: With years of experience in the industry, our skilled professionals have extensive knowledge and expertise in integrating UPI payment systems. We stay updated with the latest trends and technologies to ensure that you receive cutting-edge solutions for seamless transactions.

2. Customization: At Rainet, we understand that every business is unique. That's why we offer customized UPI collection API integration services that align perfectly with your organization's goals and objectives. Whether you're a small startup or an established enterprise, we have flexible options to suit businesses of all sizes.

3. Seamless Integration: Our team ensures a smooth integration process without any disruptions to your existing systems or workflows. We take care of all technical aspects, making sure that the transition is hassle-free for both you and your customers.

4. Security: The security of financial transactions is paramount when it comes to online payments. With Rainet as your trusted partner, rest assured that we prioritize data protection and implement robust security measures throughout the integration process.

5. Customer Support: We believe in providing exceptional customer support at every step of the way. Our dedicated support team is always available to address any queries or concerns promptly, ensuring a hassle-free experience for both you and your customers.

In conclusion,

Integrating UPI payment systems into your business opens up new opportunities for growth by offering fast, secure, and convenient payment options to your customers. With Rainet Technology Private Limited

Visit Website: https://rainet.co.in/upi-collection-api.php

#upi integration api#upi api integration#upi payment gateway#paytm upi integration api#upi integration#upi payment gateway integration#ios app development#mobile app development company#android app developer company#api provider#api service#bbps service#education portal development company#rainet technology private limited

0 notes

Text

How to Integrate Stripe Payment with Liferay: A Step-by-Step Guide

Introduction

There are mainly two ways to implement stripe payment integration

1. Prebuit Payment Page

This payment provides by the stripe so we do not need to code for it.

It has all functionality coupons for discounts, etc

The UI part for the payment integration is fixed. We cannot change it.

Need to create a product in the stripe dashboard.

And only passing quantity at payment time total price and discount all those things managed by the stripe.

2. Custom Payment flow

This flow will use when we have a custom payment page or a different design

And customization from the payment side and only the user will do payment only not specify any product.

In this flow, no need to create a Product for the payment.

Need to create below APIs

Create-payment-intent API: add payment-related detail in the stripe. It will return client_secret for making payment.

Webhook

Need to do the below things from the FE

Confirm Payment: It will take the card detail and client_secret that we got from the create-payment-intent API.

We are going to use a custom payment flow for the Event Module Payment integration.

Object Definition for the Stripe

Introduction

We are using the stripe for payments but in the feature, there might be clients who will use other payment service provider use.

So, using two objects we will handle it

Payment Object that contains unique data like used, stripe user id, type, and relation with Calander Event Payment object

Calander Event Object contains data related to the Event.

Payment objects have one too many relations with the Calander Event Object.

P-Flow for the Stripe payment integration

We will perform the below operations for Stripe payment integration in the Calander event.

Create a customer in Stripe while the Liferay user gets created.

Add create a customer in register API

Also, while the Liferay user gets created using the Liferay admin panel

Create Payment Intent API for adding payment related in the stripe and take payment stripe ID for confirm Payment

Add the same detail in the Liferay object with event data (status – pending) while they call payment intent API.

Custom method for customer management for stripe

private void stripeCustomerCrud(User user, String operationType) {

// If operation type is not equal to create, update, or delete, give an error

if (!Arrays.asList(CREATE_OP, UPDATE_OP, DELETE_OP).contains(operationType)) {

log.error(“Operations must be in Create, Update, and Delete. Your choice is: ” + operationType + ” operation.”);

return;

}

try {

Stripe.apiKey = “your api key”;

String stripeCustomerId = “”;

// Get Stripe Customer ID from the user custom field when operation equals to update or delete

if (operationType.equals(UPDATE_OP) || operationType.equals(DELETE_OP)) {

ExpandoBridge expandoBridge = user.getExpandoBridge();

stripeCustomerId = (String) expandoBridge.getAttribute(STRIPE_CUST_ID);

if (stripeCustomerId == null || stripeCustomerId.isEmpty()) {

throw new NullPointerException(“Stripe Customer Id is empty”);

}

}

Map<String, Object> customerParams = new HashMap<>();

// Add name, email, and metadata in the map when operation equals to create or update

if (!operationType.equals(DELETE_OP)) {

Map<String, String> metadataParams = new HashMap<>();

metadataParams.put(“liferayUserId”, String.valueOf(user.getUserId()));

customerParams.put(“name”, user.getFullName());

customerParams.put(“email”, user.getEmailAddress());

customerParams.put(“metadata”, metadataParams);

}

Customer customer = null;

// Operation-wise call a method of the stripe SDK

if (operationType.equals(CREATE_OP)) {

customer = Customer.create(customerParams);

setExpando(user.getUserId(), STRIPE_CUST_ID, customer.getId());

} else if (operationType.equals(UPDATE_OP)) {

Customer existingCustomer = Customer.retrieve(stripeCustomerId);

customer = existingCustomer.update(customerParams);

} else if (operationType.equals(DELETE_OP)) {

Customer existingCustomer = Customer.retrieve(stripeCustomerId);

customer = existingCustomer.delete();

}

log.info(operationType + ” operation is performed on the Stripe customer. (Data = Id: ” + customer.getId() + “, ” +

“Name: ” + customer.getName() + “, Email: ” + customer.getEmail() + “)”);

} catch (NullPointerException e) {

log.error(“Site custom field does not exist or is empty for the Stripe module: ” + e.getMessage());

} catch (StripeException e) {

log.error(“Stripe Exception while performing ” + operationType + ” operation: ” + e.getMessage());

}

}

Webhook API

Params: payload and request

This API will call when any update is there for the specified payment

We must update the Liferay Object according to the status of the payment Intent Object. A few statuses are below of Payment Object

payment_intent.amount_capturable_updated

payment_intent.canceled

payment_intent.created

payment_intent.partially_funded

payment_intent.payment_failed

payment_intent.requires_action

payment_intent.succeeded

APIs wise Flow for the Stripe payment integration

Create Payment Intent API

Using Payment Intent API, we insert transaction data and status as incomplete in the stripe, so it takes a few parameters like Liferay user id, calendar event id, stripe customer id, total amount, and currency. It will return the payment Intent id and client secret.

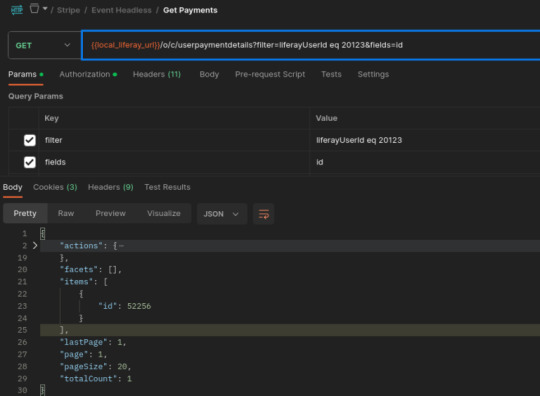

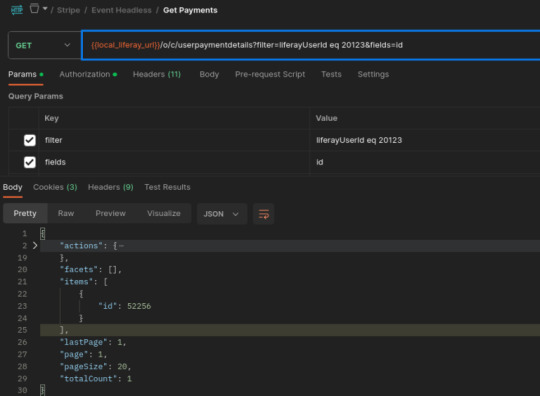

Get User Payment Detail Id if Not Prent Then Add

Get the Parent object Id from the below API for passing it into

We need the id of the parent object to make a relationship so we will call the user payment details headless API by passing the Liferay user id from the session storage. It will return the id in the items for the POST eventpayments API.

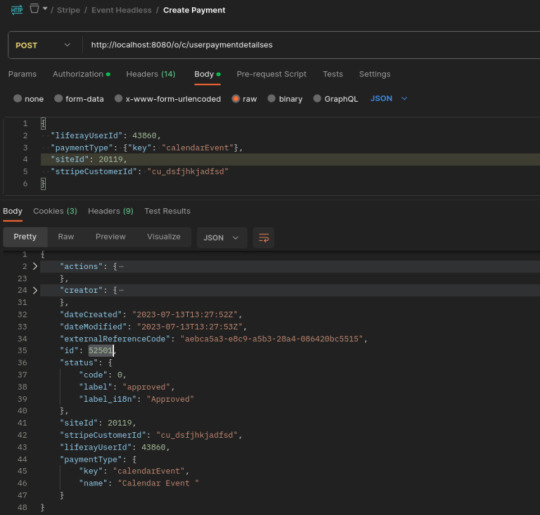

If the above API items tab is empty, then you need to add user-related data in the user payment details object and take the id from the response and pass it in POST eventpayments API.

Add Data in Calendar Event Payment Object

The calendar Event object is used to track the event payment transaction data in our database.

To add an entry in the calendar event object after the payment intent success response because we are passing payment intent id as transaction id in the Object.

Add prices, quantity, payment status (default – in Complete), tax amt, total amt, transaction Id(Id from the create payment intent response), r_event_c_payment_id(id from the userpaymentdetails headless API), site id as 20119 as default value.

Conclusion

Integrating Stripe payment functionality with Liferay Development has proven to be a seamless and efficient solution for businesses seeking to streamline their online payment processes. By implementing this integration, businesses can offer their customers a secure and convenient payment experience, leading to increased customer satisfaction and loyalty.

Read More Stripe Payment Integration With Liferay

0 notes

Text

The Ultimate Guide to Ecommerce Development: Tips, Trends, and Best Practices

#Ecommerce platform comparison#Best Ecommerce solutions#Ecommerce development tips#Ecommerce website design trends#Ecommerce website optimization#Custom Ecommerce development#Ecommerce website security#Mobile Ecommerce development#Ecommerce development services#Ecommerce plugin development#Ecommerce UX design#Ecommerce payment gateways#Ecommerce SEO strategies#Ecommerce analytics tools#Ecommerce CMS platforms#Ecommerce website migration#Ecommerce API integration#Ecommerce website performance#Ecommerce conversion rate optimization#pool

1 note

·

View note

Text

#payment gateway integration#how payment gateway works#payment gateway benefits#payment gateway integration in website#payment gateway providers#payment gateway solutions#types of payment gateway#what is payment gateway in ecommerce#direct payment gateways#hosted payment gateways#master card payment gateway services#mobile payment integration#payment gateway api development#payment gateway developer#payment gateway development#payment gateway development company#payment gateway development services#payment gateway integration in ecommerce#payment gateway integration services#payment gateway integration tutorial#types of payment gateway integration

0 notes

Text

New Streaming Schedule (and New Update)

We're back with a Kickstarter update and a new streaming schedule! This December, we're going to git serious: we'll be streaming every week, twice a week (Monday and Thursday) for 2 hours at 3PM PST!

About the Streams

In addition to two new hangout editions of our “Let’s Build our Website” series where we'll finish all that we have pending and add more content to the website, we’ve added a couple new types of stream:

A tutorial write-along, where our project lead will explain how to use PayPal/Stripe links to easily add a tip jar on your Astro website (and compile that information in a blog post).

A learn-together session (possibly more than one), where you can follow an experienced software developer as she tries to learn the intricacies of accepting payments on the web, using the actual Stripe and PayPal APIs.

In addition to these, we’ll look at adding more characters into RobinBoob by scraping AO3 with AO3.js, and we’ll start a new series where we’ll rebuild the RobinBoob's functionality from scratch! After all, like many of our “April 1st projects”, RobinBoob was built in a feverish last-minute rush, and we cannot add some of the requested features without a serious rewrite!

Where to Find Them

We’ll see you this Monday, December 4th at 3PM (see converted time on the schedule) on Twitch, and all throughout December!

First Beta Feedback

And since Tumblr generously allows us to write as much as we want, here's a small sample of the feedback to the first draft of our first issue! You can read more about it under the cut, or get the full details on Kickstarter.

“Unlike other code guides, it's engaging and not dry. [I] wish some of the coding books i read in the past were like the fujoguide cause like. i would have been more into it”

“The guide was really easy to use for the most part, with cute examples and just... really fun!”

“I'm enjoying this, it's approachable and I really like the various ways information is presented; it looks like a legit textbook, like it seems like I could've picked this up from a shelf in Barnes & Noble.”

“I'm really happy at how many cool things are packed here. I have so many friends I will throw this guide at once complete!”

Looking forward to sharing our guide with you all!

30 notes

·

View notes

Text

instagram

#custom software development#fintech#payment#technology#information technology#development#finance#software#services#APIIntegration#SoftwareTesting#TechSolutions#Dombivli#OmegaSoftwares#TechTrends#SecureTech#ReliableAPI#FreeDemo#InnovationInTech#API#webdevelopment#integration#apidevelopment#Fintech#technolgy#Instagram

0 notes

Text

UPI Payout API

Rainet Technology has introduced an innovative service known as the UPI Payout API Service, revolutionising how businesses handle transactions in India. The UPI Payout service leverages the Unified Payments Interface (UPI) system, which is renowned for its seamless, real-time payment capabilities. This service is designed to facilitate bulk disbursements, making it an ideal solution for businesses that need to manage mass payouts efficiently.

The UPI Payout API enables companies to integrate this powerful payment solution directly into their existing systems, allowing for the automated processing of transactions. This integration significantly reduces the time and effort required to manage large-scale payments, whether for vendor payments, employee salaries, or customer refunds. By using the UPI Payout API, businesses can ensure that their transactions are secure, fast, and reliable, thus enhancing their operational efficiency and customer satisfaction.

Rainet Technology's UPI Payout API service stands out due to its robustness and ease of integration. The API is designed to be user-friendly, providing comprehensive documentation and support to assist businesses in the integration process. Moreover, it supports various types of transactions, ensuring flexibility and adaptability to different business needs. With the UPI Payout API, businesses can benefit from the extensive reach of UPI, which is widely accepted across India, ensuring that transactions can be made to virtually any bank account in the country.

In summary, the UPI Payout API service by Rainet Technology offers a cutting-edge solution for businesses looking to streamline their payment processes. By integrating the UPI Payout API, companies can automate and expedite their financial transactions, leading to improved efficiency and customer experience. This service not only underscores Rainet Technology's commitment to innovation but also highlights the transformative potential of UPI in the digital payment landscape.

Visit Website: https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#bbps api provider#bbps login#paytm upi integration api#upi api integration#upi integration#education portal development company#bbps#upi payment gateway#upi integration api#upi payment gateway integration

0 notes

Text

Payment Solution Providers in India

Empower Your Transactions with Quintus Tech: Leading Automated Payment Solution Provider in India. Discover seamless payment solutions in India with Quintus Tech – your trusted automated payment solution provider. Streamline transactions effortlessly Quintus Tech offers cutting-edge and seamless payment solutions in India, serving as your trusted automated payment solution provider. Our goal is to simplify and streamline transactions, making the payment process effortless for businesses and individuals alike. Automation, Security, User-Friendly Interface, Versatility, Integration, Customer Support, Innovation etc. Visit Our Website :- https://quintustech.in/

#Payment Solution Providers in India#Automated Payment Solutions#Quintus Tech#UPI Payment Gateway#White Label Development#Bank Account Verification API#Digital Client Onboarding#Dynamic UPI QR Code Generator#Virtual Bank Account for Business#Recurring Online Transactions"

0 notes