#best stocks for long term investors

Text

14 Best Stocks for Long Term Investments in India

आज में आपकों 14 Best Stocks for Long Term Investments in India के बारें में बतानें वाला हूँ मुझे उमीद हैं की यह आपकों पसंद आएगी।

भारत में लंबी अवधि के लिए निवेश करने के लिए सबसे अच्छे स्टॉक्स कौन से हैं? यह प्रश्न हर निवेशक के मन में होता है, जो अपने पैसों को समय के साथ बढ़ाना चाहता है। लंबी अवधि का निवेश का मतलब है कि आप कम से कम 1 से 3 साल तक किसी स्टॉक में पैसा लगाते हैं, और उसकी कीमत में…

View On WordPress

#10 best shares to buy today for long term#14 long term stocks to buy now#best long term stocks to buy right now#best share to buy for long term#best share to buy today for long term#best shares to buy today for long term#best small cap stocks for long term#best stocks for long term#best stocks for long term growth#best stocks for long term investors#best stocks to buy for long term in india#long term investment stocks#stocks to buy for long term#stocks to buy today long term#top 14 stocks to buy for long term

0 notes

Text

Discover different types of investors in India and find out which one you are. Learn how to improve your equity investment strategy with Jarvis's AI-driven guidance.

#stock advisory company#best advisor for share market#top investment advisors in india#best stock advisory company in india#how to select stocks for long term#stock for long term investment in india#stock portfolio builder#top stock advisors in india#one stock#types of investors

0 notes

Text

Smart Investors Choose Crypto: Unlocking the Potential of Crypto Investment

#Introduction#Are you looking to break into the world of crypto investing? You’ve come to the right place. Investing in crypto has become increasingly po#It's not hard to understand why—the global cryptocurrency market cap recently surpassed a staggering $1 trillion#with more investors jumping onboard daily to take advantage of the potential profits crypto has to offer.#Crypto investment offers opportunities that can disrupt entire markets#and it is up to the savvy investor to find out how they can best position themselves to capture these returns. That’s where I come in; let#Benefits of Investing in Crypto#As an investor#you know that potential rewards come with potential risks. What sets cryptocurrency apart from other investments is its low barrier to entr#making it accessible for more people to begin their first foray into investing. Investing in cryptocurrency can also be a great way to dive#While the crypto market has seen its ups and downs#the consensus among financial experts is that crypto shows real#long-term promise. By investing in different coins#you can spread out your risk and#if all goes well#increase the reward of your investment portfolio significantly.#Plus#the versatility of cryptocurrencies means you can use them for more than just buying and selling stocks—cryptocurrency has a wide variety o#you open up a whole new set of possibilities and ensure your financial future is secure.#Get to Know EOSNOX Global#the Innovative Crypto Investment Platform#Investing in crypto is a smart move#and having the right platform to tackle it is even more important. EOSNOX Global is the innovative crypto investment platform you've been l#you can trade dozens of digital currencies on the spot market and access leading blockchain products.#Here’s some reasons why EOSNOX Global is a great choice for tapping into the potential of cryptos:#Secure and compliant: Our exchanges use cutting-edge encryption protocols to secure your funds. And our manual compliance processes ensure#Trading tools: We offer tools to help you make smarter decisions—such as our in-depth analytics#trading systems#risk management solutions#and much more!

1 note

·

View note

Text

How to buy dividend stocks for beginners

How to buy dividend stocks for beginners

How to buy dividend stocks for beginners

Photo by Leeloo hefirst

Get Top Reward List Accessibility

Top 100 Returns Supplies

Ex-Dividend Day Listings

High Yield Supply Scores

Safe Returns Supply Scores

High Return REITs

Dividend Kings & Masters scores

International Dividend Stocks

Regular Monthly Paying Dividend Supplies

Dividend Screener

Premium Dividend Data: How to buy dividend stocks for…

View On WordPress

#best dividend stocks for beginners 2023#best dividend stocks to buy for beginners#best dividend stocks to buy for long term#buy dividend stocks now#buy dividend stocks online#buy dividend stocks online for beginners#buy stocks on ex-dividend date#buy stocks online for beginners#direct buy dividend stocks#dividend stock for beginners#dividend stock investing for beginners#dividend stocks for beginners#dividend stocks for beginning investors#dividend stocks to buy for long term#dividend stocks to buy now and hold#How to buy dividend stocks for beginners#how to buy dividend stocks online#how to buy stocks with dividends#is it a good idea to buy dividend stocks#online stock dividend#only buy dividend stocks

0 notes

Text

The long bezzle

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

When it comes to the modern world of enshittified, terrible businesses, no addition to your vocabulary is more essential than "bezzle," JK Galbraith's term for "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it"

https://pluralistic.net/2023/08/09/accounting-gimmicks/#unter

The bezzle is contained by two forces.

First, Stein's Law: "Anything that can't go on forever will eventually stop."

Second, Keynes's: "Markets can remain irrational longer than you can remain solvent."

On the one hand, extremely badly run businesses that strip all the value out of the firm, making things progressively worse for its suppliers, workers and customers will eventually fail (Stein's Law).

On the other hand, as the private equity sector has repeatedly demonstrated, there are all kinds of accounting tricks, subsidies and frauds that can animate a decaying, zombie firm long after its best-before date (Keynes's irrational markets):

https://pluralistic.net/2023/06/02/plunderers/#farben

One company that has done an admirable job of balancing on a knife edge between Stein and Keynes is Verizon, a monopoly telecoms firm that has proven that a business can remain large, its products relied upon by millions, its stock actively traded and its market cap buoyant, despite manifest, repeated incompetence and waste on an unimaginable scale.

This week, Verizon shut down Bluejeans, an also-ran videoconferencing service the company bought for $400 million in 2020 as a panic-buy to keep up with Zoom. As they lit that $400 mil on fire, Verizon praised its own vision, calling Bluejeans "an award-winning product that connects our customers around the world, but we have made this decision due to the changing market landscape":

https://9to5google.com/2023/08/08/verizon-bluejeans-shutting-down/

Writing for Techdirt, Karl Bode runs down a partial list of all the unbelievably terrible business decisions Verizon has made without losing investor confidence or going under, in a kind of tribute to Keynes's maxim:

https://www.techdirt.com/2023/08/10/verizon-fails-again-shutters-attempted-zoom-alternative-bluejeans-after-paying-400-million-for-it/

Remember Go90, the "dud" streaming service launched in 2015 and shuttered in 2018? You probably don't, and neither (apparently) do Verizon's shareholders, who lost $1.2 billion on this folly:

https://www.techdirt.com/2018/07/02/verizons-sad-attempt-to-woo-millennials-falls-flat-face/

Then there was Verizon's bid to rescue Redbox with a new joint-venture streaming service, Redbox Instant, launched 2012, killed in 2014, $450,000,000 later:

https://variety.com/2014/digital/news/verizon-redbox-to-pull-plug-on-video-streaming-service-1201321484/

Then there was Sugarstring, a tech "news" website where journalists were prohibited from saying nice things about Net Neutrality or surveillance – born 2014, died 2014:

https://www.theverge.com/2014/12/2/7324063/verizon-kills-off-sugarstring

An app store, started in 2010, killed in 2012:

https://www.theverge.com/2012/11/5/3605618/verizon-apps-store-closing-january-2013

Vcast, 2005-2012, yet another failed streaming service (pray that someday you find someone who loves you as much as Verizon's C-suite loves doomed streaming services):

https://venturebeat.com/media/verizon-vcast-shutting-down/

And the granddaddy of them all, Oath, Verizon's 2017, $4.8 billion acquisition of Yahoo/AOL, whose name refers to the fact that the company's mismanagement provoked involuntary, protracted swearing from all who witnessed the $4.6 billion write-down the company took a year later:

https://www.techdirt.com/2018/12/12/if-youre-surprised-verizons-aol-yahoo-face-plant-you-dont-know-verizon/

Verizon isn't just bad at being a phone company that does non-phone-company things – it's incredibly bad at being a phone company, too. As Bode points out, Verizon's only real competency is in capturing its regulators at the FCC:

https://www.techdirt.com/2017/05/02/new-verizon-video-blatantly-lies-about-whats-happening-to-net-neutrality/

And sucking up massive public subsidies from rubes in the state houses of New York:

https://www.techdirt.com/2017/03/14/new-york-city-sues-verizon-fiber-optic-bait-switch/

New Jersey:

https://www.techdirt.com/2014/04/25/verizon-knows-youre-sucker-takes-taxpayer-subsidies-broadband-doesnt-deliver-lobbies-to-drop-requirements/

and Pennsylvania:

https://www.techdirt.com/2017/06/15/verizon-gets-wrist-slap-years-neglecting-broadband-networks-new-jersey-pennsylvania/

Despite all this, and vast unfunded liabilities – like remediating the population-destroying lead in their cables – they remain solvent:

https://www.reuters.com/legal/government/verizon-sued-by-investors-over-lead-cables-environmental-statements-2023-08-02/

Verizon has remained irrational longer than any short seller could remain solvent.

Short-sellers – who bet against companies and get paid when their stock prices go down – get a bad rap: billionaire shorts were the villains of the Gamestop squeeze, accused of running negative PR campaigns against beloved businesses to drive them under and pay their bets off:

https://pluralistic.net/2021/01/30/meme-stocks/#stockstonks

But shorts can do the lord's work. Writing for Bloomberg, Kathy Burton tells the story of Nate Anderson, whose Hindenburg Research has cost some of the world's wealthiest people over $99 billion by publishing investigative reports on their balance-sheet shell-games just this year:

https://www.bloomberg.com/news/features/2023-08-06/how-much-did-hindenburg-make-from-shorting-adani-dorsey-icahn

Anderson started off trying to earn a living as a SEC whistleblower, identifying financial shenanigans and collecting the bounties on offer, but that didn't pan out. So he turned his forensic research skills to preparing mediagenic, viral reports on the scams underpinning the financial boasts of giant companies…after taking a short position in them.

This year, Anderson's targets have included Carl Icahn, whose company lost $17b in market cap after Anderson accused it of overvaluing its assets. He went after the world's fourth-richest man, Gautam Adani, accusing him of "accounting fraud and stock manipulation," wiping out 34% of his net worth. He took on Jack Dorsey, whose payment processor Square renamed itself Block and went all in on the cryptocurrency bezzle, lopping 16% off its share price.

Burton points out that Anderson's upside for these massive bloodletting was comparatively modest. A perfectly timed exit from the $17b Icahn report would have netted $56m. What's more, Anderson faces legal threats and worse – one short seller was attacked by a man wearing brass-knuckles, an attack attributed to her short activism.

Shorts are lauded as one of capitalism's self-correcting mechanisms, and Hindenberg certainly has taken some big, successful swings at some of the great bezzles of our time. But as Verizon shows, shorts alone can't discipline a market where profits and investor confidence are totally decoupled from competence or providing a decent product or service.

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/10/smartest-guys-in-the-room/#can-you-hear-me-now

#pluralistic#verizon#yahoo#tumblr#bluejeans#aol#vcast#redbox#go90#short sellers#hindenberg research#block#icahn#carl icahn#jack dorsey#square#nate anderson#gautam adani#adani group#icahn enterprises

136 notes

·

View notes

Text

Berkshire Hathaway Shareholder Letter 2022, Reactions

Every year I enjoy reading Warren Buffets' predictably charming annual Berkshire Hathaway Shareholder letter. I dare you to find another annual investor letter you can remotely describe as charming. Anyhow, this year's letter published February 23 was another winner. As a builder turned investor I can't look to a better influence on my decision making than Warren and his partner Charlie Munger. Their humility, their focus on long-term relationships, and their emphasis on pragmatism alongside an expectation of excellence are all values I hold dear and hope to instill into Saltwater and our businesses for years to come.

Here's what stood out to me.

Hammering home the basics

We’re reminded that these gents look at companies, not stocks… “Charlie and I are not stock-pickers; we are business-pickers.” Buying a stock is just a tiny fraction of the company you’re getting, evaluate it as such. So why buy stocks vs majority ownership? A question we ask ourselves at Saltwater often? There is but one critical difference for the critical eyed investor. The difference between public "stocks" and privately owned businesses based on Warren’s insights… “stocks often trade at truly foolish prices...while a controlled business gives no thought to selling at a panic-type valuation.” Good enough for me. We’ll be keeping our eyes open for foolish prices.

Shareholder financial education

Warren shares an anecdote about share repurchases and the misled villainization of them.

“The math isn’t complicated: When the share count goes down, your interest in our many businesses goes up. Every small bit helps if repurchases are made at value-accretive prices. Just as surely, when a company overpays for repurchases, the continuing shareholders lose. At such times, gains flow only to the selling shareholders and to the friendly, but expensive, investment banker who recommended the foolish purchases.

Gains from value-accretive repurchases, it should be emphasized, benefit all owners – in every respect. Imagine, if you will, three fully-informed shareholders of a local auto dealership, one of whom manages the business. Imagine, further, that one of the passive owners wishes to sell his interest back to the company at a price attractive to the two continuing shareholders. When completed, has this transaction harmed anyone? Is the manager somehow favored over the continuing passive owners? Has the public been hurt?”

We were able to execute a value-accretive share repurchase in a portfolio company this year and while it wasn’t a smooth process, it was a very good decision for all our shareholders. Thanks Warren.

Praise of his best companies

How many times have you heard Warren discuss Coke, Amex, and See’s Candies? Effectively every time he or Charlie open their mouths. Charlie’s personal fav is Costco based on my experience with him. This year Warren reminds us that in 1994, BRK completed a 7 year buying spree of over 400 million shares of Coke stock for a total of $1.3B. He reminds us the value of those dividends almost a billion, as well as stock price appreciation, that 400 million share position is worth >$25B today.

He doesn’t paint this investment as an obvious or easy one however. “The weeds wither away in significance as the flowers bloom… it takes just a few winner to work wonders.”

Endless love for his partner Charlie Munger

I love looking for how many times Warren uses the phrase, "Charlie and I...", this year it was 10. He's clearly smitten with his long-time friend and partner for good reason, but this was my favorite tidbit of Charlie appreciation...

"Find a very smart high-grade partner – preferably slightly older than you – and then listen very carefully to what he says."

He includes a response that Charlie will often use back to Warren when they are in decision-making mode.

“Warren, think more about it. You’re smart and I’m right.”

See what I mean… charming. Greater than the Coke investment, or the Costco investment, Warren's appreciation of Charlie's wisdom & friendship are what anchor his brilliance in my mind.

The elephant in the room… transition insights

With Charlie at 99 and Warren at 92, every communication is reasonably analyzed for hints around their transitions. I don’t believe there will be one until one or both pass. Sad, but likely true.

Charlie talks about Berkshire in the general sense a few times in this years letter where it feels like he’s writing rules to operate by for others versus telling the shareholder how “he” specifically will operate.

Our CEO will always be the Chief Risk Officer

At Berkshire, there will be no finish line.

Our CEOs will have a significant part of their net worth in Berkshire shares, bought with their own money.

I certainly hope there is an internal rule on the last point and it would be helpful to know what that $ amount is. While these aren’t all that telling as to the timing of a transition of either partners health condition it’s clear that Warren’s thinking is still spot on.

I hope you enjoy and absorb these letters as much as I do.

265 notes

·

View notes

Note

I'm terribly sorry if you've been asked this before, but I recently got a payout from a court case. I need to know how to passively invest. Problem is, I've been living poor for about 5 years after my knee injury. I already read a suggested article on your page about ways to invest a $1,000, but I'm looking for which companies are best to trust. Google isn't exactly reliable in that area with all its sponsored ads, so I was hoping if I could ask y'all: If you had about 10k drop into your lap, what is step 1? (and possibly 2 & 3)

We're so glad you asked, kitten. Were I in your situation, below are the steps I'd take.

Step 1: Establish a safety net. You've been "living poor" after an injury, which tells me that a little financial security could go a long way. So establish an emergency fund with some of that money. We recommend keeping an emergency fund in a HYSA (high yield savings account), which are currently returning about 4% across the board WITHOUT the risk of stock market investing. Here's how that works:

Not Every Savings Account Is Created Equal

You Must Be This Big to Be an Emergency Fund

Step 2: Invest in low-cost index funds. Do not--we repeat, DO NOT--attempt to pick individual stocks or companies to invest in. Leave that to much richer and more experienced investors. Instead, choose one or a handful of low-cost index funds. These bad boys track the entire market to minimize your risk. Here's how they work:

Investing Deathmatch: Managed Funds vs. Index Funds

How To Start Small by Saving Small

Step 3: Investigate diversified investments. If there's anything left over, you can look into an alternative long-term investment, like real estate, a small business, or even higher education for yourself. This can be a way to invest in something more personal, that you care about. But do your homework to mitigate your risk and figure out what sort of return you'll get. We write more about this here:

Small Business Investing: A Kinder, Gentler Alternative to the Stock Market

How To Save for Retirement When You Make Less Than $30,000 a Year

If you found this helpful, give us a tip!

63 notes

·

View notes

Text

An Overview of Different Financial Instruments in Global Trading

Introduction

Entering global trading can be both exciting and complex. To help you navigate, this guide explores various financial instruments, assisting you in finding the best trading platform and making informed investment decisions.

1. Stocks

Buying stocks means owning a share of a company. Stock prices fluctuate with company performance and market trends. Stocks are ideal for long-term investments, especially for those aiming to become the best forex trader.

2. Bonds

Bonds are loans given to companies or governments, repaid with interest. Bonds are generally safer than stocks but offer lower returns.

3. Forex (Foreign Exchange Market)

The forex market deals with currency trading and is the largest financial market globally. It operates 24/7, providing high liquidity. Forex trading involves buying one currency while selling another, requiring a good grasp of market trends and currency pairs to excel as the best forex trader.

4. Commodities

Commodities include raw materials like gold, oil, and agricultural products. Trading commodities can diversify your investment portfolio. Their prices are affected by supply and demand, political events, and natural factors.

5. Mutual Funds

Mutual funds collect money from numerous investors to invest in a diversified portfolio of stocks, bonds, or other assets. Managed by professionals, they are ideal for beginners, offering a hassle-free investment approach.

6. ETFs (Exchange-Traded Funds)

ETFs are similar to mutual funds but trade like stocks. They offer a diversified investment portfolio with the flexibility of stock trading. ETFs can cover various assets, including stocks, bonds, and commodities.

7. Options

Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price before a set date. They can be used for hedging or speculative purposes, presenting high rewards but also high risks.

Conclusion

Grasping the different financial instruments available in global trading is vital for making smart investment choices. Whether you're interested in stocks, bonds, forex, or commodities, selecting the best trading platform and strategy will set you on the path to success. Begin with the basics, continue learning, and discover the best investment opportunities tailored to your goals.

4 notes

·

View notes

Text

The Role of Diversification in Mitigating Investment Risk

Investing is one of the most critical strategies you can use to minimize your investment risk and this is why diversity is essential. In other words, it means spreading your investments across various types of assets so that you do not suffer great losses due to poor performance in any one share or investment. This article focuses on how diversification can help reduce investment risks while giving practical tips on how to diversify portfolios effectively.

Understanding Diversification

You do not put all your baskets in one egg carton. Therefore, by investing in different assets like stocks, bonds, real estate and commodities, if one investment fails then it will save a lot from losing anything with a greater amount. The rationale behind this system is simple: different kinds of investments usually react differently to market conditions. For example when some are going down others may be growing hence ensuring an overall stable return.

Importance of Diversification

Mitigates risk: diversification helps spread the risks. Investing everything into a single share which collapses leads to losing mostly all one's money. However if he had a diversified portfolio such a situation would not have affected much on the entire portfolio since before there used to be good gains in some areas but now as compared it seems lesser than before.

Smooth Returns: A portfolio that has good diversification would experience lesser fluctuations. This implies that you will not experience vast changes in values brought about by investing in just one category of assets. By doing this, your profits are likely to be constant even as time passes.

The Possibility of Higher Returns: Even though the assumption of constant returns from different classes is not true, yet on average it leads to stability over all returns. If you have different kinds of financial tools some may perform well making other investments more profitable.

Conduct a proper market research and analysis like fundamental analysis, technical analysis etc. There are lot of websites which provides various tools to conduct analysis. One of the best websites for fundamental analysis is Trade Brains Portal. Trade Brains Portal has various tools like Portfolio analysis, Stock compare, Stock research reports and so on. Also the website provides fundamental details of all the stocks listed in Indian stock market.

How to Create Diversification

First Invest In Different Asset Classes: The initial stage of diversifying is distributing investments among diverse asset classes. You might include:

Shares: For instance invest into various sectors and industries which protects against any concentration risk.

Debts: Join corporate and state obligations that have various due terms.

Property: Purchase land or consider REITs which will go a long way in further diversity for the filling

Blacksmith’s tools: This allows one to hedge against stock price fluctuations since there are shares made from gold or liquid petroleum.

Asset Classes: Inside Each, Diversify More: Inside every asset class, further diversification should be encouraged. For instance, your stock portfolio may comprise both large, mid- and small-cap stocks pulled from various industries such as technology, health care or finance. Conversely, for fixed income investments you could consider both short- and long-term bonds from different issuers.

Geographic Diversification: Don’t confine your investments to just one country; consider allocating funds to global equities and debts so that you can ride on worldwide growth spurts at the same time lowering chances of going broke due to national downturns only.

Utilize Index Funds and ETFs: Index funds along with exchange-traded funds (ETFs) create fantastic platforms for diversification. Basically, these are investment vehicles which collect funds from numerous investors to buy a spectrum of stocks or bonds which automatically leads to diversification in the fund itself. As such; investing in index or ETF money market accounts results in an instantily diversified portfolio.

Strategic Diversification

Design Balanced Portfolios: A balanced portfolio will include stocks, bonds and other assets. The exact mix of these three categories depend on your risk appetite, investment objectives and time frame. For example; if you are young with an extended investment period ahead like 30 years or more, then perhaps you could have a greater percentage of equity shares. Conversely before retirement age it is likely that one would move towards more fixed income securities and other low-volatility options. Inorder to reduce the risk, one can invest in large cap companies or also investing in companies which has good dividends, bonus and splits can be a better choice.

1. Re Judiciously: With the passage of time, every investment’s worth may change thus creating an uneven portfolio. “Rebalance” refers to the act of bringing back into line one's desired proportions of investments as stocks, bonds or other such asset categories. This ensures that risk levels correspond with individual investment objectives.

2. Follow Up and Amending: Literacy needs one given fiscal policy to always differ and be changing as per preferences of that certain individual in the market at a particular time upon follow up from it regularly. Periodic adjustments may be required so as to keep an overall investment mix in balance hence giving opportunity for some time before buying any new ones.

Common Mistakes

Over Diversification: It is evident that although diversification matters; it can also harm your profit margins through excessive dilution. Avoid extensionalizing too thin your assets or choosing funds too far too many Aim for a balanced approach based on few investments.

Ignoring Asset Correlation: Diversification works well when these assets are not related closely. Investing in closely related assets ends up negating the effects on one’s portfolio during downturns and making this strategy less beneficial. All your assets ought to have different levels of risks as well as respond independently to different market conditions.

Minimizing Hazardous Behavior: Asset allocation must be aligned with your appetite for risk as well as your investment objectives. Don’t just diversify simply for the purpose of it. Ensure that your portfolio represents your comfort with risk and conforms to your financial aims.

Conclusion

A potent strategy for curtailing investment risks and obtaining more steady returns is diversification. When you spread out investments throughout various asset classes, industries and regions, the effect of bad performance on one specific investment will be reduced thus enhancing stability of the entire portfolio. Remember to diversify within asset classes, utilize index mutual funds along with ETFs then periodically check and adjust the mix in order to have an ideal level of diversification throughout your life cycle; this way you will be able to handle any changes in the marketplace hence working towards fulfilling all your dreams.

#stock market#investment#stock market india#splits#stocks#fundamental analysis of stocks#Indian share market

3 notes

·

View notes

Text

First Time Investing in Crypto: Tips for New Traders on the Digital Coin Market

This has changed the financial landscape for good; it is the first time in history that investors have a share of this type since cryptocurrency entered the market. But then again, getting into the crypto market to begin with can be incredibly intimidating for a novice. This includes some key tips that you must know for making trade-offs more intelligent and how to invest in cryptocurrencies.

1. Understand the Basics

Understand the basic principles of what Cryptocurrency is, how it works before you invest. If you're unfamiliar, cryptocurrencies are basically decentralized systems, operating with a peer-to-peer framework, that let users do all sorts of things like get rewards for paying on time or using an app. Because they are not organically produced like typical tender, these financial tools are meant to be circulated in a decentralized way via blockchain networks. Educate yourself onwards like blockchain, altcoins, wallets and exchanges.

2. Do Your Research

The value of cryptocurrencies is influenced by a number of factors, and this makes it an extremely volatile market. Learn about various cryptocurrencies and how they are used. Tools like CoinMarketCap and CoinGecko show trends, rankings other handy information regarding ranging and past data. Follow us on Twitter for more news and updates on the Bitcoin space.

3. Diversify Your Portfolio

Investors apply diversification in their investment strategies. Diversify by investing in multiple cryptocurrencies I mean, everyone knows Bitcoin and Ethereum — why not looking a little bit further down the line at some promising altcoins with real fundamentals. A healthy mix of investments can ensure you have a little exposure to any type of gain or loss that may arise.

4. Only Invest What You Can Afford to Lose

The world of crypto is such that even the prices can and do tend to rise or crash in a jiffy, thanks to high volatility. Gamble only with money you can afford to lose without impacting your finances. Never borrow to invest in crypto or use your emergency savings for crypto investing. This approach ensures that you still are able to stay financially safe in case there's a downtrend.

5. Choose a Reliable Exchange

It is important to be sure that you deal with reliable cryptocurrency exchanges for safe trading. Search for exchanges with strong security protocols, a simple UI, and broad coin support. Some of the most trusted exchanges that people have been using include Binance, Coinbase and Kraken. Are they regulated and insured for digital assets.

6. Secure Your Investments

In the world of crypto, security is vital. Keep your cryptocurrencies on hardware wallets or in cold storage solutions; simply turn on 2FA in your exchange accounts and do not publish or disclose the private keys. Keep your software up to date and watch out for phishing attacks and malware.

7. Stay Informed and Adapt

As we know the crypto market is alive and never takes a nap. Learn from the market, regulatory and tech changes. Engage in some of the crypto community forums on platforms like Reddit, Twitter and Telegram to get the benefits of inside knowledge from other investors. Change your investment plan based on new informational and market circumstances

8. Have a Long-Term Perspective

Although there is money in short-term trading, it often requires quite a bit of time and skill to excel what you do. Long term investment strategy If you are beginner, Long term is the best way for you to invest your money from beginning. Look at the long term growth potential of cryptocurrencies instead of trying to make a quick buck. I read many books and listend to a lot of podcasts about the stock market, nearly all these sources agreed that patience and discipline was key to becoming a successful long-term investor.

9. Seek Professional Advice

If you are uncertain about the investments, you can get help from financial advisors or even some crypto experts. They can offer some personalized advice, depending on your financial goals and comfort with risk. Expert help will make it easier for you to manage the particularly volatile world of crypto.

Conclusion

Investing in cryptocurrency can also be a lucrative endeavor as long the trader is well-versed when it comes to his or her craft. These basic principles, combined with extensive research, establishing a diversified portfolio, and security first will put you in good stead on your crypto investment journey. The key is to stay informed, adapt and think long-term in order for you to succeed.

#crypto#cryptocurrency#cryptocurreny trading#cryptocommunity#investing#economy#investment#bitcoin#ethereum#blockchain#personal finance#finance

2 notes

·

View notes

Text

Staying the Course: The Power of Patience in the World of Bitcoin

In the ever-evolving landscape of Bitcoin, it's easy to get caught up in the daily price action. Whether it's soaring to new highs or dipping into the red, Bitcoin's volatility is something that can test even the most seasoned of investors. But what happens when the price movement is more... sideways?

For me, staying the course has always been about the long-term vision. Bitcoin isn't just a short-term play—it's a strategy for building lasting wealth and financial freedom. No matter what the market is doing today, tomorrow, or next month, my approach remains the same: stack SATs, and keep stacking. This is the strategy. It’s simple, yet powerful, and it’s what keeps me grounded during these times of uncertainty.

Learning from History

History has shown us that Bitcoin often moves in cycles. Consider the periods in 2013, 2016, and even as recently as 2020. During these times, Bitcoin seemed to be moving sideways, causing doubt among some investors. However, each of these periods was followed by significant price surges that rewarded those who held on. For example, after the 2016 halving, Bitcoin’s price remained relatively stable for months, only to skyrocket in 2017. This pattern is a reminder that periods of quiet can be a precursor to something much bigger.

The Power of Patience

This strategy works because Bitcoin has shown time and time again that it rewards patience. Looking back at its history, we see a pattern: after periods of sideways movement, Bitcoin often experiences significant upward momentum. Those who have held strong through the lulls have been rewarded for their resilience. It’s not just about timing the market; it’s about time in the market.

This mindset requires discipline, especially when the market seems stagnant. It's easy to feel discouraged when Bitcoin isn't making headlines or breaking records. But it's during these quiet times that the real progress is being made. Behind the scenes, development continues, adoption grows, and the foundations of the future financial system are being laid.

The Psychology of Staying the Course

Emotionally, sticking with your plan when the market feels flat can be challenging. The constant noise from skeptics, the temptation to shift focus, and the impatience that naturally arises can all test your resolve. This is where understanding the psychology of investing becomes crucial. Fear, Uncertainty, and Doubt (FUD) are ever-present in the world of Bitcoin, often amplified during periods of sideways movement. However, recognizing these emotions and managing them is key to maintaining a long-term perspective. One way to combat FUD is to focus on the fundamentals of Bitcoin—its decentralization, scarcity, and growing adoption.

But that's when it's most important to remember your reasons for investing in Bitcoin in the first place. For me, it's about more than just price—it's about being part of a financial revolution, one that I believe will reshape the world.

A Long-Term Play

Comparing Bitcoin to traditional investments like stocks, real estate, or gold, we see a similar principle at work: long-term investing typically yields the best results. However, Bitcoin stands out because of its unique properties—its finite supply, resistance to censorship, and ability to transfer value globally with ease. These qualities make Bitcoin not just an investment, but a form of insurance against the uncertainties of the traditional financial system.

Looking Ahead

As the market moves sideways, I’ll continue to stay the course, confident in the knowledge that patience, persistence, and a long-term perspective are the keys to success in the world of Bitcoin. With upcoming technological advancements, increasing institutional adoption, and the potential for regulatory clarity, the future looks bright. The quiet periods, like the one we’re in now, are merely the calm before the next wave of innovation and growth.

So, as the market moves sideways, I’ll continue to stay the course, confident in the knowledge that patience, persistence, and a long-term perspective are the keys to success in the world of Bitcoin.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

Thank you for your support!

#Bitcoin#Crypto#Cryptocurrency#Investing#FinancialFreedom#Blockchain#LongTermInvesting#StayTheCourse#BitcoinStrategy#HODL#SidewaysMarket#MarketTrends#DigitalCurrency#BitcoinCommunity#PatiencePays#financial experts#unplugged financial#globaleconomy#financial empowerment#financial education#finance

3 notes

·

View notes

Text

The Ultimate Guide to ESG Investing: Strategies and Benefits

Socio-economic and environmental challenges can disrupt ecological, social, legal, and financial balance. Consequently, investors are increasingly adopting ESG investing strategies to enhance portfolio management and stock selection with a focus on sustainability. This guide delves into the key ESG investing strategies and their advantages for stakeholders.

What is ESG Investing?

ESG investing involves evaluating a company's environmental, social, and governance practices as part of due diligence. This approach helps investors gauge a company's alignment with humanitarian and sustainable development goals. Given the complex nature of various regional frameworks, enterprises and investors rely on ESG data and solutions to facilitate compliance auditing through advanced, scalable technologies.

Detailed ESG reports empower fund managers, financial advisors, government officials, institutions, and business leaders to benchmark and enhance a company's sustainability performance. Frameworks like the Global Reporting Initiative (GRI) utilize globally recognized criteria for this purpose.

However, ESG scoring methods, statistical techniques, and reporting formats vary significantly across consultants. Some use interactive graphical interfaces for company screening, while others produce detailed reports compatible with various data analysis and visualization tools.

ESG Investing and Compliance Strategies for Stakeholders

ESG Strategies for Investors

Investors should leverage the best tools and compliance monitoring systems to identify potentially unethical or socially harmful corporate activities. They can develop customized reporting views to avoid problematic companies and prioritize those that excel in ESG investing.

High-net-worth individuals (HNWIs) often invest in sustainability-focused exchange-traded funds that exclude sectors like weapon manufacturing, petroleum, and controversial industries. Others may perform peer analysis and benchmarking to compare businesses and verify their ESG ratings.

Today, investors fund initiatives in renewable energy, inclusive education, circular economy practices, and low-carbon businesses. With the rise of ESG databases and compliance auditing methods, optimizing ESG investing strategies has become more manageable.

Business Improvement Strategies

Companies aiming to attract ESG-centric investment should adopt strategies that enhance their sustainability compliance. Tracking ESG ratings with various technologies, participating in corporate social responsibility campaigns, and improving social impact through local development projects are vital steps.

Additional strategies include reducing resource consumption, using recyclable packaging, fostering a diverse workplace, and implementing robust cybersecurity measures to protect consumer data.

Encouraging ESG Adoption through Government Actions

Governments play a crucial role in educating investors and businesses about sustainability compliance based on international ESG frameworks. Balancing regional needs with long-term sustainability goals is essential for addressing multi-stakeholder interests.

For instance, while agriculture is vital for trade and food security, it can contribute to greenhouse gas emissions and resource consumption. Governments should promote green technologies to mitigate carbon risks and ensure efficient resource use.

Regulators can use ESG data and insights to offer tax incentives to compliant businesses and address discrepancies between sustainable development frameworks and regulations. These strategies can help attract foreign investments by highlighting the advantages of ESG-compliant companies.

Benefits of ESG Investing Strategies

Enhancing Supply Chain Resilience

The lack of standardization and governance can expose supply chains to various risks. ESG strategies help businesses and investors identify and address these challenges. Governance metrics in ESG audits can reveal unethical practices or high emissions among suppliers.

By utilizing ESG reports, organizations can choose more responsible suppliers, thereby enhancing supply chain resilience and finding sustainable companies with strong compliance records.

Increasing Stakeholder Trust in the Brand

Consumers and impact investors prefer companies that prioritize eco-friendly practices and inclusivity. Aligning operational standards with these expectations can boost brand awareness and trust.

Investors should guide companies in developing ESG-focused business intelligence and using valid sustainability metrics in marketing materials. This approach simplifies ESG reporting and ensures compliance with regulatory standards.

Optimizing Operations and Resource Planning

Unsafe or discriminatory workplaces can deter talented professionals. A company's social metrics are crucial for ESG investing enthusiasts who value a responsible work environment.

Integrating green technologies and maintaining strong governance practices improve operational efficiency, resource management, and overall profitability.

Conclusion

Global brands face increased scrutiny due to unethical practices, poor workplace conditions, and negative environmental impacts. However, investors can steer companies towards appreciating the benefits of ESG principles, strategies, and sustainability audits to future-proof their operations.

As the global focus shifts towards responsible consumption, production, and growth, ESG investing will continue to gain traction and drive positive change.

5 notes

·

View notes

Text

[Monday August 5th] The Global Market Crash: What Just Happened?

In recent weeks, the world’s financial markets took a huge hit, causing a lot of panic and confusion. This big drop, or "crash," has people worried about what it means for their money and the economy. So, what caused this, and what should we know about it?

What Caused the Crash?

Rising Interest Rates: Central banks, like the Federal Reserve in the U.S., have been increasing interest rates to control inflation. Inflation is when prices for things like food and gas go up a lot. Higher interest rates make borrowing money more expensive, so people and businesses spend less. This decrease in spending can slow down the economy, leading to drops in stock prices.

Geopolitical Issues: Ongoing conflicts between countries and trade wars have made the global economy unstable. When countries impose sanctions or stop trading with each other, it can mess up supply chains and make investors nervous. Nervous investors often pull their money out of stocks, causing prices to fall even more.

Economic Slowdown: Lately, some of the world’s biggest economies, like the U.S. and China, have shown signs of slowing down. When the economy slows, businesses earn less money, and this often causes their stock prices to drop.

Tech Stocks Falling: Tech companies have been super popular with investors, but their stock prices got really high—maybe too high. When interest rates started going up, people began to worry that these companies might not be worth as much as they thought, leading to a big sell-off in tech stocks.

What Does This Mean?

The market crash has caused a lot of people to lose money, especially those who have investments in stocks. While it’s normal to feel worried, it’s important to remember that markets have ups and downs. Some experts think this might just be a temporary setback, while others are more cautious and think the downturn could last a while.

For anyone investing, this crash is a reminder of how important it is to not put all your money in one place. Diversifying, or spreading out your investments, can help protect you from big losses. Even though it’s tempting to chase after the hottest stocks, having a balanced portfolio is usually a smarter move.

In the end, while this market crash is unsettling, it’s part of the natural cycle of the economy. Markets tend to recover over time, so staying calm and thinking long-term is the best strategy.

2 notes

·

View notes

Text

Career Field as per Astrological Signs

I've identified the industries or enterprises that are fortunate for particular Signs. Each Sign has a special beneficial note that resonates with a certain industry, making these enterprises inherently lucky for a given Sign. It makes sense that people born under these Signs should continue to have the most luck investing in their shares, given the luckiness of the companies. They can never lose if they invest in long-term investments. The investors' intraday trading time period will always be profitable, but they won't make a loss either. Naturally, the investor must conduct a market research of the company before making any acquisitions because, as you are aware, not every company in a certain field can succeed at the same time.

Let's now discuss astrology. Okay if you are aware of your horoscope or birth chart. To find out more, look at your Ascendant at birth. If you're unsure, check your Name Sign or Moon Sign. For instance, if your name starts with A, E, I, O, or L, you are an Aries. Using this technique, you can discover your moon sign. If your name doesn't correspond to your natal Moon Sign, don't worry. Search for your sun sign. In Aries from 14 April to 14 May, the sun will be. To benefit the most, you must be aware of your own natal chart, particularly the Lagna and Ascendant.

To benefit the most, you must be aware of your own natal chart, particularly the Lagna and Ascendant. According to my observations, a person's birth chart typically results in the best outcomes. Benefit percentages will be smaller for Moon or Sun signs than for birth ascension. Remember that buying stock only entails your personal involvement in the company. Your likelihood of success in the stock market will also be based on where your fifth house is in regard to your second or eleventh houses in the chart. Your Mars and Venus should be rather strong if you plan to engage in intraday trading or speculation. If your Saturn is truly powerful, it will rule as king.

If your Saturn is very strong, you will be the master of this field and earn long-term success. A strong Saturn in the chart's interpretation creates masters. They are fully aware of the stock market's ups and downs. Here is a list of the industries and companies where stock investments will perform the best.

1.Aries (Mesha): Cement, steel, automobiles, shipping, textiles, beverages, petrochemicals, power projects, chemicals and pharmaceuticals, and petrochemicals

2.Tauras (Vrishabha): Infrastructure, Housing Companies, Food Industries, Hotels, Dairies and Ice Cream, Film and Television Industries, Cement, Steel, Leather

3. Gemini (Mithuna): Publishing, print and electronic media, cement and steel, mobile devices, computers, banking, and information technology.

4. Karka (Cancer): Transportation, Water and Irrigation, Air Travel, Textiles, Beverages, Glass Manufacturing, Housing Companies, Refineries, Petrol and Natural Gas

5. Leo (Simha): Pharmaceuticals, Agro Industries, Film and Television Industries, Paper and Printing Industries, Power Projects

6. Virgo (Kanya): Finance and Insurance, Food and Nutrition, Pharmacy, Communications, Information Technology, Computers, Confectionary, Toiletries, and Toys

7. Libra (Tula): Infrastructure, Edible Oil, Agro Industries, Cosmetics, Perfumes, Ceramics, Malls and Retail Channels, Entertainments, Music and Cassette Industries, Food and Beverage, Hotels, Dairies, Films and Televisions, Ice-cream, Leather, Food and Beverages, Ceramics, Ice-cream, Steel, Perfumes, and Ceramics

8. The sign of Scorpio (Vrishchika) is represented by the industries of shipping, mining, export-import, automobiles, water and irrigation, pharmaceuticals, glass, refineries, and the insurance sector.

9. Saggitarius (Dhanu): All businesses related to education and students, including those in the banking, finance, export and import, publishing, paper, confectionary, and dairy industries.

10. Capricorn (Makara): Oil and Natural Gas, Petroleum Refineries, Health and Nutrition, Pharmacies, Steel, Cement, Leather, Coal, Infrastructure, Engineering Industries, Housing Sector

11. Aquarius (Kumbha): Projects related to power, research, steel, cement, leather, food, entertainment, music and cassette industries, infrastructure, banking and finance, and hotels.

12. Pisces (Meena): Banking and finance, insurance, print and electronic media, paper industries, dairy and ice cream, pharmaceuticals, health and nutrition, shipping, exports and imports.

How can I get the most out of this? Additionally, you stand to gain if you select a business whose name is auspicious and harmonious with your own Sign.

For purchases and long-term investments, the 10th and 11th signs from your Moon Sign or Ascendant will bring you the most success. Simple Company Selection Example: Which Shares would you choose to buy if your Ascendant or Moon Sign is Capricorn and you want to make long-term investments? Libra and Scorpio are obvious. You may now buy the most advantageous scripts for long-term investments based on the list provided above.

#astrology#vastu#vedic astrology#vedas#vastu shastra expert#chakras#Ramcharitmanas#vedanta#rigveda#yajurveda#rg veda#Vedic Jyotish Online#veda#astrology numerology vedicastrology#vedic astro observations#vedicscience#vedic astro notes#hindu mythology#mythology#indian mythology#classical mythology#numerology#vaastu#planets#astro placements#aries placements#aries astrology#astro notes#predictive astrology#astro predictions

36 notes

·

View notes

Text

Why Gen Z Should Start Learning About the Stock Market: Top 5 Reasons to Invest

Discover the top 5 reasons why Gen Z should start investing in the stock market today. From building wealth to gaining financial independence, learn why stocks are a smart choice for young investors.

Hello, Gen Zers!

You’re already a generation known for disrupting norms and rewriting rules.

Why not apply that fearless energy to conquering the stock market?

With today’s technology, investing is at your fingertips, and starting young gives you a massive advantage. Think about it: more time for your investments to grow, early lessons in financial resilience, and the first steps towards an abundant future.

Ready to see why the stock market could be your new playground?

Let’s dive into the five irresistible reasons you should start investing now.

1. Harness the Power of Compounding Early-

The sooner you start, the richer you get. Compounding means making money on your initial investment and then making more money on the earnings. Starting in your teens or early twenties means you have time on your side. Imagine this: invest $1,000 now with an average growth of 8% annually, and by the time you hit 50, that could swell into a sizable nest egg without adding another dollar. Now, imagine making regular contributions. We’re talking serious money!

2. Tech-Savvy Advantage-

You’re digital natives. Use it. Gen Z is the first generation to grow up with technology from the get-go. You’re already adept at navigating apps and online platforms, which are essential tools in today’s trading world. Tools like Robinhood, Acorns, or E*TRADE are designed for intuitive navigation and making trading a breeze. Plus, you have access to heaps of online resources and communities to learn from and share trading tips.

3. Economic and Social Change-

Invest in what you believe. More than any previous generation, Gen Z investors are likely to align their investments with their social and environmental values. Whether it’s renewable energy, tech innovations, or companies with strong ethics, your investments can reflect your commitment to making the world a better place, all while growing your wealth.

4. Financial Independence-

Break free from the 9-to-5 grind. Understanding and participating in the stock market can be your ticket to financial independence. Mastering investing now could mean the option to retire early or pursue a passion project without financial constraints. Imagine living life on your terms, powered by smart, early investments.

5. Weather Economic Storms-

Build your financial umbrella. The reality is, economic downturns, recessions, and market volatility are part of life. By investing young, you learn to ride out these storms without panic. Diversifying your investments in stocks, bonds, and other assets can protect you from financial rain and help you learn critical lessons about risk and resilience.

Ready to Rule the Market?

Alright, Gen Z, the ball is in your court. Investing in the stock market is not just about making money; it’s about building a secure, independent, and empowered future.

Start small, learn continuously, and stay committed.

The journey to financial freedom and becoming a savvy investor begins with your decision to act now. Are you ready to make your mark and watch your fortunes grow?

Frequently Asked Questions (FAQs):

Q1: How much money do I need to start investing?

You can start with as little as $50 or $100. Many platforms allow fractional shares, so even a small amount can get you started.

Q2: Isn’t investing risky?

All investments carry some risk, but diversifying your portfolio and investing for the long term can help manage and mitigate these risks.

Q3: How do I choose what stocks to invest in?

Start by researching companies or funds that align with your interests and values. Consider using tools and resources like financial news, investment apps, and financial advisors to make informed decisions.

#investing stocks#stock trading#option trading#share market#nseindia#stock tips#trading tips#investing#gen z humor#finance#income#profit

2 notes

·

View notes

Text

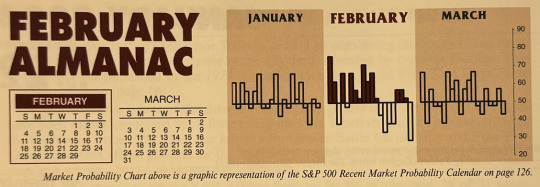

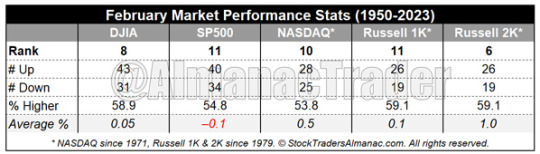

February 2024 Almanac: Second Worst S&P 500 Month since 1950

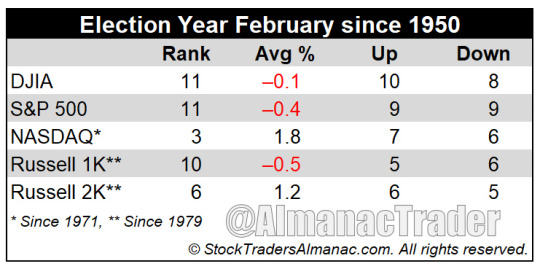

February is in the middle of the Best Six Months, but its long-term track record, since 1950, is not that impressive. February ranks no better than sixth and has posted meager average performance except for the Russell 2000. Small cap stocks, benefiting from “January Effect” carry over; historically tend to outpace large-cap stocks in February. The Russell 2000 index of small cap stocks turns in an average gain of 1.0% in February since 1979—sixth best month for that benchmark. Russell 2000 has had a tough January which could indicate the January Effect may not boost small caps this February.

A strong February in 2000 boosts NASDAQ and Russell 2000 rankings in election years. Otherwise, February’s performance, compared to other presidential-election-year months, is mediocre at best with no large-cap index ranked better than tenth (DJIA and S&P 500 since 1950, Russell 1000 since 1979).

Not a subscriber? Sign up today for a Free 7-Day Trial to Almanac Investor to continue reading our latest market analysis and trading recommendations and get a full run down of seasonal tendencies that occur throughout each month of the year in an easy-to-read calendar graphic with important economic release dates highlighted, Daily Market Probability Index bullish and bearish days, market trends around options expiration and holidays. In addition, the Monthly Vital Statistics Table combines stats for the Dow, S&P 500, NASDAQ, Russell 1000 and Russell 2000 and puts them all in a single location available at the click of a mouse.

4 notes

·

View notes