#14 long term stocks to buy now

Text

14 Best Stocks for Long Term Investments in India

आज में आपकों 14 Best Stocks for Long Term Investments in India के बारें में बतानें वाला हूँ मुझे उमीद हैं की यह आपकों पसंद आएगी।

भारत में लंबी अवधि के लिए निवेश करने के लिए सबसे अच्छे स्टॉक्स कौन से हैं? यह प्रश्न हर निवेशक के मन में होता है, जो अपने पैसों को समय के साथ बढ़ाना चाहता है। लंबी अवधि का निवेश का मतलब है कि आप कम से कम 1 से 3 साल तक किसी स्टॉक में पैसा लगाते हैं, और उसकी कीमत में…

View On WordPress

#10 best shares to buy today for long term#14 long term stocks to buy now#best long term stocks to buy right now#best share to buy for long term#best share to buy today for long term#best shares to buy today for long term#best small cap stocks for long term#best stocks for long term#best stocks for long term growth#best stocks for long term investors#best stocks to buy for long term in india#long term investment stocks#stocks to buy for long term#stocks to buy today long term#top 14 stocks to buy for long term

0 notes

Text

Housekeeping:

Spirit the horse 15", found in the trash, no before pictures (yep i've been terrible at that lately), fixed up hair (saran!) scuffs and stains.

-- Donated to the charity shop.

Elsa by Jakks Pacific 14" found in the trash with the horse : snapped arm, hair a ball of frazzle, body stained by the teal dress. I've taken her apart to fix her arm and her electronic-filled dress to clean, done a basic but tedious comb-though and face clean + reblush. Not sure she's worth the destaining and full detangling as that hair will frazzle again the moment it is touched.

-- Pending

Cali Girl Lea: long term wishlist gal. Thought she might be super wonky but she just had different sized pupils and slightly off-centre smile: needs tidying with a light and magnifying glass for those pruned hairs and eyes.

-- She stays!

Translucent pink glitter Barbie scooter can actually sit a Barbie! I'm impressed.

-- That'll be going to charity.

//// This is where I got a single hit of dopamine from Monique Verbena and lost the usual choice to sleep on it and think it over: yeah I just smashed "buy it now" a few times ///

Alwayz Bratz Sasha bald: I thought i'd made a stupid rash decision out of FOMO - I don't like the promo pic or any of that stock, I wasn't sure I even liked the aliexpress head! The facial screenings on the repros have been so obviously off or different (Except surprisingly, for the GCDS and Kylie Jenner). Maybe I got lucky with a misprint that somehow clicks with me.

The coral lipstick is garish but with a hint of shimmer for dimension and with the matching eyeshadow and a choice blush, she's making it work. The eyes are a nice dark khaki in person. Aside from some black smudging, she's well printed.

-- She stays.

Rainbow High Scarlet Rose: What's wrong with the picture, looks like a couple of smudges on her head right?... Somehow I missed the off-centre and misprinted eyebrows plus a disk shaped chunk of lashes, eyeliner and blush missing.

I need to fix that single lash to be symmetrical with the other side and add a teensy bit to the brow but did a seriously decent job matching pastels and using melamine sponge on a toothpick.

Her stock, hair colour and skin tone is so me (okay okay I had to re bleach my hair from that gorgeous prune tone back to pale peach earlier this year because I looked too ill)

-- Going to fix her up before deciding, but it's probably a no.

Daiso yukatas and Ellie, I thought I was buying just the clothes for $7 and sent the seller a message saying I was happy to cancel when I realized it would be more. Thankfully economy shipping was just €4.20 for them and €4 import fees for me. Ellie is a blow molded, pp hair flimsy doll in a near paper like dress, the rainbow dress is a hot glued see through thing but Daiso's yukatas are fabulous and well worth it.

-- Ellie, the dress and shoes will go to charity or just pay postage.

7 notes

·

View notes

Text

Career Field as per Astrological Signs

I've identified the industries or enterprises that are fortunate for particular Signs. Each Sign has a special beneficial note that resonates with a certain industry, making these enterprises inherently lucky for a given Sign. It makes sense that people born under these Signs should continue to have the most luck investing in their shares, given the luckiness of the companies. They can never lose if they invest in long-term investments. The investors' intraday trading time period will always be profitable, but they won't make a loss either. Naturally, the investor must conduct a market research of the company before making any acquisitions because, as you are aware, not every company in a certain field can succeed at the same time.

Let's now discuss astrology. Okay if you are aware of your horoscope or birth chart. To find out more, look at your Ascendant at birth. If you're unsure, check your Name Sign or Moon Sign. For instance, if your name starts with A, E, I, O, or L, you are an Aries. Using this technique, you can discover your moon sign. If your name doesn't correspond to your natal Moon Sign, don't worry. Search for your sun sign. In Aries from 14 April to 14 May, the sun will be. To benefit the most, you must be aware of your own natal chart, particularly the Lagna and Ascendant.

To benefit the most, you must be aware of your own natal chart, particularly the Lagna and Ascendant. According to my observations, a person's birth chart typically results in the best outcomes. Benefit percentages will be smaller for Moon or Sun signs than for birth ascension. Remember that buying stock only entails your personal involvement in the company. Your likelihood of success in the stock market will also be based on where your fifth house is in regard to your second or eleventh houses in the chart. Your Mars and Venus should be rather strong if you plan to engage in intraday trading or speculation. If your Saturn is truly powerful, it will rule as king.

If your Saturn is very strong, you will be the master of this field and earn long-term success. A strong Saturn in the chart's interpretation creates masters. They are fully aware of the stock market's ups and downs. Here is a list of the industries and companies where stock investments will perform the best.

1.Aries (Mesha): Cement, steel, automobiles, shipping, textiles, beverages, petrochemicals, power projects, chemicals and pharmaceuticals, and petrochemicals

2.Tauras (Vrishabha): Infrastructure, Housing Companies, Food Industries, Hotels, Dairies and Ice Cream, Film and Television Industries, Cement, Steel, Leather

3. Gemini (Mithuna): Publishing, print and electronic media, cement and steel, mobile devices, computers, banking, and information technology.

4. Karka (Cancer): Transportation, Water and Irrigation, Air Travel, Textiles, Beverages, Glass Manufacturing, Housing Companies, Refineries, Petrol and Natural Gas

5. Leo (Simha): Pharmaceuticals, Agro Industries, Film and Television Industries, Paper and Printing Industries, Power Projects

6. Virgo (Kanya): Finance and Insurance, Food and Nutrition, Pharmacy, Communications, Information Technology, Computers, Confectionary, Toiletries, and Toys

7. Libra (Tula): Infrastructure, Edible Oil, Agro Industries, Cosmetics, Perfumes, Ceramics, Malls and Retail Channels, Entertainments, Music and Cassette Industries, Food and Beverage, Hotels, Dairies, Films and Televisions, Ice-cream, Leather, Food and Beverages, Ceramics, Ice-cream, Steel, Perfumes, and Ceramics

8. The sign of Scorpio (Vrishchika) is represented by the industries of shipping, mining, export-import, automobiles, water and irrigation, pharmaceuticals, glass, refineries, and the insurance sector.

9. Saggitarius (Dhanu): All businesses related to education and students, including those in the banking, finance, export and import, publishing, paper, confectionary, and dairy industries.

10. Capricorn (Makara): Oil and Natural Gas, Petroleum Refineries, Health and Nutrition, Pharmacies, Steel, Cement, Leather, Coal, Infrastructure, Engineering Industries, Housing Sector

11. Aquarius (Kumbha): Projects related to power, research, steel, cement, leather, food, entertainment, music and cassette industries, infrastructure, banking and finance, and hotels.

12. Pisces (Meena): Banking and finance, insurance, print and electronic media, paper industries, dairy and ice cream, pharmaceuticals, health and nutrition, shipping, exports and imports.

How can I get the most out of this? Additionally, you stand to gain if you select a business whose name is auspicious and harmonious with your own Sign.

For purchases and long-term investments, the 10th and 11th signs from your Moon Sign or Ascendant will bring you the most success. Simple Company Selection Example: Which Shares would you choose to buy if your Ascendant or Moon Sign is Capricorn and you want to make long-term investments? Libra and Scorpio are obvious. You may now buy the most advantageous scripts for long-term investments based on the list provided above.

#astrology#vastu#vedic astrology#vedas#vastu shastra expert#chakras#Ramcharitmanas#vedanta#rigveda#yajurveda#rg veda#Vedic Jyotish Online#veda#astrology numerology vedicastrology#vedic astro observations#vedicscience#vedic astro notes#hindu mythology#mythology#indian mythology#classical mythology#numerology#vaastu#planets#astro placements#aries placements#aries astrology#astro notes#predictive astrology#astro predictions

36 notes

·

View notes

Text

55 years young: the true masterpiece of psychedelia

When I was 14 or 15 and had decided that the late 60s (at the time about twenty years previously) was the thing, but had exhausted all my Dad’s Stones & Cream albums and bought a few of my own from the same acts (and a couple of Hendrix LPs), I set out to discover more from the era. I can honestly say I wouldn’t be here writing this now if it wasn’t for a very, very cheap double LP compilation called ‘Back On The Road’ which I bought. It was a glorious sampler masterclass in almost everything: it had softer, folksy moments from Fairport, Roy Harper and Nick Drake. It had the heft of Sabbath, Deep Purple and Free. It had the familiarity of Cream and Hendrix. It was my first taste of Traffic & Spooky Tooth. But it was also ocean-spanning: it had the Velvet Underground, the Quicksilver Messenger Service - and Jefferson Airplane.

Despite my first taste of ‘Paranoid’ and ‘Black Night’, ‘White Rabbit’ transcended them both in terms of sheer power. I loved it: it was a bolero, reimagined by the acid rock generation. And so it was I set off to find out more about ‘the Airplane’ (as we will call them henceforth) and really began a love affair with the late sixties Bay Area arts and culture that, circa 32 years later, still rages on in my heart.

It didn’t start well. The liner notes to ‘Back On The Road’ made it clear that this band was at the very top of the family tree of what led to (then relatively recent) unavoidable atrocities ‘We Built This City’ and ‘Nothing’s Gonna Stop Us Now’. For a while, ‘White Rabbit’ was ruined - it was unmistakably that same, powerhouse voice: nobody sounds like Grace Slick. But I soon shrugged it off as nonsense and blamed the times, concluding that I couldn’t let ‘Valerie’ and ‘Higher Love’ put me off ‘Paper Sun’ either.

Sadly, it didn’t improve immediately: Jefferson Airplane actually reformed for one album in 1989 just as I set out to discover them for myself. It was of course this album that all the shops stocked, and I bought it. Aside from a couple of moments, it sounded way too much like Starship and not enough like 1960s San Francisco. I later learned that the couple of moments were basically Hot Tuna and the rest of it was a deluxe big-budget Starship-type operation. Jorma Kaukonen summed the reunion up almost word-for-word as I felt the album to be at age 15 in his excellent auto-bio ‘Been So Long’. Buy a copy.

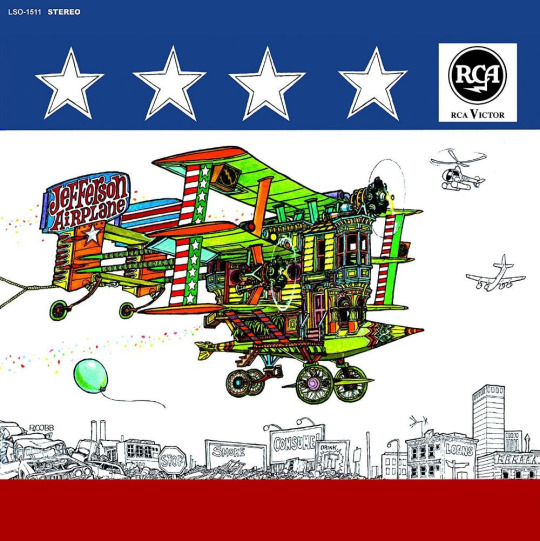

I went to a better record shop the following week where - joy of joys - they actually had a Jefferson Airplane section. Kid in a toy shop moment: I held in my hands and gazed in wonder at copies of ‘Volunteers’, ‘Surrealistic Pillow’, ‘Crown of Creation’…marvelled at the flying toasters on ‘Thirty Seconds Over Winterland’….and then caught sight of ‘After Bathing At Baxters’ for the very first time.

youtube

All the others just vanished into the background. This was it: the iconic American stars and stripes bordering that great image: the old biplane made out of a typical wooden clad Victorian Haight-area house, soaring over a consumer-satire landscape. Now, this was 1989 and vinyl albums from the sixties had largely been robbed of their original gatefold sleeves - or in some cases only ever got them in their home country - and it would be another ten years before I got my hands on a USA original. In fact, it turns out that the (probably Dutch or German) pressing that I got brand new was better than the UK original sleeve which lacked the red, white and blue borders and was distinctly drab.

A brief history lesson: ‘After Bathing At Baxters’ was the third album by the Airplane, and the second with Grace Slick on vocals. The previous release ‘Surrealistic Pillow’ was the breakthrough, with the two bona-fide hits ‘White Rabbit’ and ‘Somebody To Love’ which set them apart from the rest of the freewheeling, often uncommercial (or rather, ‘unconcerned with being deliberately commercial’) San Francisco scene.

youtube

The rock and roll history books will tell you that ‘Pillow’ was a huge leap forward from the debut ‘Jefferson Airplane Takes Off’. Well, yes - the sound had a harder edge and not just in the vocals; it also had hits and was a true breakthrough for the band - but it was still an album of short, structured songs with a nominally folk-rock sound. For my money, the difference between ‘Pillow’ and ‘Baxters’ is immeasurably greater and possibly the most significant audible development of any one band from one album to the next that there has ever been. Even ‘Rubber Soul’ to ‘Sgt Pepper’ was a neatly calibrated climb (and that’s assuming you don’t believe ‘Revolver’ was the truly impressive one of the three; I do).

Hits. That’s what happened - and so Jefferson Airplane were given virtual carte blanche by paymasters RCA Victor to make their next record. It took most of 1967 and I’m not sure that RCA were ever ready for the results!

I’m not going to go through it track-by-track; I want you to do that for yourself if you have a mind and thus won’t pepper this missive with spoilers. Let’s just say it is one of the most successful attempts to capture the psychedelic experience on vinyl (which was always a challenge for the artists who were playing freewheeling, stream-of-consciousness improvised concerts by the seat of their pants, then faced the auspices of the studio).

Look out for Jorma Kaukonen ‘inventing Sonic Youth’ in the fuzzed and multitracked guitar solo of his own ‘Last Wall Of The Castle’. Feel the mood as Paul Kantner’s Rickenbacker XII sets up an eastern-influenced mini raga to usher in ‘Wild Tyme’, which then explodes into a mass of joyous harmonies celebrating the times. Be spellbound at Grace’s icy wit and ‘take no prisoners’ attitudes on ‘Two Heads’ and ‘Rejoice’. But above all, don’t drop your bacon sandwich during ‘Spare Chaynge’ - a wild, improvised jam between Kaukonen, the greatest bass player on the planet Jack Casady and drummer Spencer Dryden.

youtube

No man is an island - he is a peninsular.

Happy 55th Birthday to my absolute favourite long-playing record; the one that made me want to be a musician and not just a record collector. Thanks for everything.

3 notes

·

View notes

Text

Xi Jinping formally secured an unprecedented third term as head of the Chinese Communist Party (CCP) at the recent 20th Party Congress. The replacement of pro-reform thinkers such as Wang Yang with Xi loyalists on the seven-man Politburo Standing Committee—the apex of China’s political power—casts a shadow on the trajectory of the Chinese economy and China’s economic relations with the rest of the world. The removal of Hu Jintao, the last Chinese leader personally chosen by Deng Xiaoping, at the closing ceremony signaled an end to China’s four-decade movement toward reform and opening up, initiated by Deng in the late 1970s. The market welcomed Xi’s new term with a meltdown on his first day, with Chinese stocks in Hong Kong tumbling by the most since 2008 and the yuan weakening to a 14-year low.

The Party Congress also signaled that Beijing is unlikely to lift the “zero-COVID” policy anytime soon despite the immense socioeconomic costs. In his speech to party cadres, Xi said that “firmly implementing the zero-COVID policy” allowed the CCP to “maximize the protection of Chinese people’s life and health.” Xi was silent on the policy’s costs. By sticking with zero-COVID, Xi and his loyalists can control China’s interactions with the rest of the world and prepare the Chinese people and economy for further isolation if the West imposes stricter economic sanctions against China. U.S. financial leaders have promised to exit China if it attacks Taiwan, which would effectively expel China from the U.S.-led global economic and financial system. By focusing on improving China’s self-sufficiency and expanding its dominance in strategic sectors, Xi hopes to raise the cost of sanctioning China to unbearably high levels for the West while developing China’s capacity to absorb the economic shock of sanctions.

The CCP’s obsession with zero-COVID will continue to weigh on the Chinese economy, but it is not the most challenging problem facing the economy right now. Even if Xi ends zero-COVID tomorrow, he cannot undo the damage it has already caused. Xi cannot command the Chinese economy to rebound quickly. Given the host of problems China faces, it will be very challenging for the Chinese economy to achieve the 8 percent annual growth that some economists, such as Justin Yifu Lin, still estimate to be within its long-term potential. The fundamental challenges holding back the Chinese economy are related to the four D’s: demand, debt, decoupling, and demography.

Abandoning zero-COVID is unlikely to stimulate global demand for Chinese exports or encourage a sustained expansion of domestic demand. For the rest of this year and the next, the Chinese economy faces strong headwinds from weak export growth due to a global economic slowdown and less external demand primarily because of soaring inflation and a shift away from buying the pandemic-related goods that China manufactures. Exports of goods and services as a percentage of Chinese GDP declined from 36 percent in 2006 to 20 percent in 2021, according to the World Bank. This share is about the same as in 2001, at the dawn of China’s ascendance to the World Trade Organization.

Chronically weak domestic demand tied to China’s troubled property market will further constrain the country’s economic growth over the next five years. Home sales volumes are trending down even though home prices have been slower to adjust, owing to robust government support. The slumping property market will have a broad ripple effect, suppressing demand for industrial materials such as steel, timber, and chemicals and consumer durables such as appliances, furniture, and fixtures. If government support cannot hold off a sharp decline in property prices, then aggregate demand will correspondingly fall in line with home prices, causing corporate profits to contract and credit default risk to increase across all sectors of the economy.

Some of these effects are already visible. A survey of 247 steel manufacturers in China showed that the proportion of profitable firms decreased by nearly 70 percentage points to 15 percent in the second quarter of this year from 84 percent in the first quarter. About 32 percent of China’s large and medium-sized steel manufacturers lost money in May. In Hebei, the largest steel-producing province in China, 38 percent of steel producers were unprofitable this year, recording a total collective loss of 6.56 billion yuan (about $900 million) in the first five months—more than six times the losses recorded over the same period last year. In Xi’s third term, loss-making Chinese companies are more likely to be allowed to fail, in contrast to the previous policy of propping them up. Since at least 2015, China has increasingly embraced U.S.-style bankruptcy procedures that aim to restructure or efficiently liquidate failed companies.

A troubled property market bodes ill for local governments and households because it would result in higher leverage and curtail consumption, making it more difficult to expand domestic aggregate demand. Local governments are highly dependent on revenues from land use rights sales, which accounted for more than 90 percent of revenue earmarked for public expenditure as of August. During the first eight months of this year, local governments’ revenue from land use rights sales tumbled 28.5 percent versus a year ago to 3.37 trillion yuan (about $460 billion), mainly owing to the property market slowdown. This reduction in revenue, combined with higher public health expenditures related to COVID-19 and social welfare expenses related to demographic shifts, is a recipe for higher deficits and more indebtedness.

Since Xi ascended to power in 2012, the Chinese government has struggled to implement demand-side reform. It is unlikely to finally succeed in Xi’s third term by transforming China’s economy from being overreliant on investment to being demand-driven. The greatest obstacle to achieving this goal is the substantial mortgage debt burden of Chinese households that depresses consumption.

China used to enjoy a reputation as a country of savers, but increasingly this is no longer the case. In September, China’s total household debt was 62.4 percent of GDP. A report released by China’s central bank, the People’s Bank of China, showed that in 2019, mortgage loans, still mostly used for presales of unfinished apartments, made up more than 75 percent of household debt. Statistics from the central bank also showed that at the end of the second quarter of this year, mortgage loan balances reached nearly 39 trillion yuan (about $5.3 trillion), which is, for comparison, almost 10 times the entire annual economic output of Shanghai. The heavy mortgage burden of Chinese households means less money is available for other types of consumption. Chinese households can augment their consumption by taking out personal loans. By June, personal loan aggregate balances had grown to nearly 17 trillion yuan (about $2.3 trillion), more than 40 percent of the size of the mortgage loan market.

China’s debt problems are more than just local government funding and the mortgage market. A growing source of concern is China’s enormous Belt and Road Initiative (BRI) lending program. As many as 1 in 4 dollars lent by Chinese institutions as foreign loans have already come up for renegotiation, about $94 billion in total. Many BRI loans were arranged by Chinese firms motivated by winning political favor at home for financing a project that had Xi’s personal stamp of approval. The rapid origination of BRI loans without much consideration for risk management has become a big problem for China. If Chinese lenders were to seize the collateral that backs defaulted BRI loans, that would bolster the undesirable narrative that China has engaged in predatory lending that puts developing countries into a “debt trap.” Alternatively, restructuring defaulted loans or forgiving the loan balance would impose a loss on Chinese lenders. The Chinese government faces a dilemma: It must choose between suffering reputational damage and monetary losses.

There is no easy fiscal solution to stimulate demand in China without expanding debt and exacerbating leverage. China’s State Council encouraged local governments to complete the issuance of 500 billion yuan (about $68 billion) in special purpose bonds by the end of October. It also decided to add another 300 billion yuan (about $41 billion)—via bond issuance—to the existing 300 billion yuan of policy-oriented development finance instruments intended to boost consumption. There is no easy solution in terms of monetary policy either. The global monetary tightening cycle has constrained the Chinese government’s policy options to stimulate demand by expanding low-cost credit. The central bank cannot easily pursue large-scale monetary easing to boost the Chinese economy. The People’s Bank of China relaunched its Pledged Supplementary Lending (PSL) program to increase the lending capacity of China’s policy banks. It added a net 108.2 billion yuan ($15.2 billion) of PSL funding to the China Development Bank, Agricultural Development Bank of China, and Export-Import Bank of China. The central bank’s stimulus measures, taken together with the State Council’s wide-ranging fiscal stimulus package, run the risk of countering the inflation-taming effort of central banks in the West.

On top of weaker demand and growing debt balances, China faces a challenge in managing the possible decoupling of its economy from the economies of the West, specifically the United States. To be sure, decoupling between China and the West is unlikely to take the form of a sudden and complete stop of trade and investment flows. However, preparing the Chinese economy to withstand severe Western sanctions is a prerequisite if Xi forces so-called reunification with Taiwan by military action.

While Chinese policymakers and financial institutions do not want to be excluded from the existing global system, they have laid the groundwork for an alternative financial system based on the Chinese yuan. This alternative system includes an independent payment and settlement network supported by Chinese financial institutions, regional groupings, and multilateral institutions. Furthermore, China is pushing the rapid development of financial digitization using the digital yuan. Once this alternative financial system gathers sufficient users, it could mitigate much of the pain that Western sanctions may cause and increase China’s geoeconomic influence. However, Xi cannot just command the rest of the world to abandon the U.S.-led dollar-based financial system. China’s alternative financial system is still limited in its capacity and coverage, and at present, it cannot fully immunize the Chinese economy from the effects of potential Western sanctions.

A bifurcated technology ecosystem between China and the West is already in the making, including different technology standards and fragmented supply chains. The vulnerabilities of Chinese tech companies to U.S. export control restrictions were demonstrated when Huawei suffered its worst revenue decline ever in 2021 after it was sanctioned by the U.S. government. To survive, Huawei had to sell its lucrative smartphone business to a government-backed consortium. As part of its plan to regain its lost market share, Huawei has redesigned its products to use not-so-smart chips and suboptimal technology that is not impacted by U.S. export restrictions. Chinese policymakers and businesspeople find it increasingly difficult to access advanced Western technology due to broader U.S. export control restrictions. As of August, there were about 600 Chinese organizations on the U.S. Commerce Department’s Entity List—a list of banned importers—more than 110 of which were added after the start of the Biden administration.

The Commerce Department’s Bureau of Industry and Security recently developed a sweeping set of new export control regulations and added 31 new Chinese semiconductor entities to its Unverified List, a precursor to being added to the Entity List. If these Chinese entities fail to prove their compliance with U.S. regulations, they will be moved to the Entity List. The Biden administration is reportedly exploring expanding export controls to restrict China’s access to cutting-edge artificial intelligence and quantum computing technologies.

While demand, debt, and decoupling pose immediate challenges for Xi’s third term, China’s demographic change will shape the long-term prospects of the Chinese economy. Looking ahead, China faces the real challenge of getting old before it gets rich. The direct economic impact of demographic changes on the Chinese economy comes through two channels. First, a diminishing labor force and loss in human capital will further reduce China’s comparative advantage in labor cost and undermine China’s long-term growth potential. Second, a growing population of older adults will increase pension costs and social welfare expenditures. While demographic change is not necessarily a crisis in itself, the absence of a proper policy response can undermine the growth potential of any country, China included.

Fertility rates in China fell to their lowest level in nearly six decades in 2020, putting the working-age population on track to peak before 2025. In addition to factors such as a falling marriage rate—a possible indication that the size of the current working-age population is overestimated—the high costs of child-rearing in China are a critical driver of its looming population decline and labor shortage. The national average cost of raising a first child to the age of 18 in China is nearly seven times the national per capita GDP (485,000 yuan, or about $66,000). By comparison, in the United States the cost is only four times the per capita GDP. Child-rearing costs in Beijing and Shanghai are close to double the national average and more than triple the rural average. Without robust policies for affordable child support, Chinese families will not follow the “three-child policy” initiated during Xi’s second term.

An aging population also has to be cared for, which was the mandate given to China’s social security fund when it was introduced in August 2000. In 2021, 300 million people were receiving benefits from the fund, which is estimated to have a funding shortfall of 700 billion yuan (about $96 billion). China’s pension gap may increase to 8-10 trillion yuan in the next five to 10 years. The State Council decided in 2017 to recapitalize China’s social security fund by transferring some state-owned assets, including shares of state-owned companies and financial institutions, into the fund. By 2020, a total of 1.68 trillion yuan (about $230 billion) in state-owned capital was transferred to the fund from 93 central enterprises and financial institutions. Despite this recapitalization, the Chinese Academy of Social Sciences, a government-sponsored research institution, still predicted that assets in China’s urban worker pension fund would drop to zero by 2035 without additional intervention.

Altogether the four D’s—demand, debt, decoupling, and demography—will pose a serious challenge for Xi in his third term both at home and abroad and in both the state-led and private sectors. The future of the Chinese economy and China’s relationship with the West depends less on market dynamics and more on the direction taken by China’s domestic politics. That said, not all is lost for the Chinese economy. If Xi can reset China’s politics to focus again on the economy, reaffirm his commitment to reform and opening up while returning to a less combative foreign-policy narrative, and resume genuine and substantive communications with the West, it will still be possible to save the Chinese economy from sleepwalking into a deep slump and further isolation. Unfortunately, there was very little sign given at the Party Congress that Xi is prepared to walk this higher path. It remains unclear whether Xi was sincere when he said last week that China was willing to find ways to get along with the United States to the benefit of both countries ahead of a possible meeting with U.S. President Joe Biden at the G-20 summit in Indonesia in mid-November.

The dominance of politics over economic incentives in Beijing will likely motivate lawmakers in Washington to be more critical of China, forcing U.S. corporations to reassess the risk-reward payoff for doing business in the Chinese market. That said, the United States should not abandon China—not its people or its market—because of just one person and his small group of loyalists, no matter how powerful they appear. Despite all the growing tensions, trade with China is still crucial for the U.S. economy and the American people. U.S. exports of goods and services to China supported an estimated 758,000 U.S. jobs in 2019. Policymakers in both Beijing and Washington should resist the temptation to escalate tensions further by playing the blame game. While the discourse of domestic politics on both sides suggests a bumpy road ahead for U.S.-China relations, it is still too early to give up trying for a better relationship and not too late for Washington to influence the policy options available to Xi as he starts his third term.

2 notes

·

View notes

Text

Mutual Funds vs. Stocks: Which Investment Option is Best for You?

Investing is all about putting your money to work for you, but choosing between mutual funds and stocks can feel like deciding between coffee and tea. Both options can be profitable, but each has its unique risks and rewards.

Did you know that in FY 2023, more than 14 million new demat accounts were opened in India, with retail investors pouring ₹7.5 lakh crore into mutual funds? That’s how much the investment game has heated up!

So, if you’re wondering which investment option mutual funds or stocks is right for you, then Hurry Up! Contact Mutual Fund advisor Now.

Understanding the Basics: Mutual Funds vs. Stocks

Let's start with the basics.

Stocks represent ownership in a company. When you buy shares of a stock, you essentially own a piece of that company. If the company does well, your investment grows; if it doesn’t, your investment can shrink or vanish. Stocks can offer high returns, but they also come with high risk.

Mutual Funds, on the other hand, pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. A fund manager handles this for you, taking care of the stock picking and balancing. Mutual funds generally offer lower risk because of this diversification, but they also tend to deliver lower returns compared to individual stocks in the short term.

Risk Factor: How Much Can You Handle?

Let’s be honest: when it comes to investing, risk is always on the table.

Stocks: Buying individual stocks is like riding a rollercoaster. Sometimes you’re flying high, and sometimes you’re plummeting. Stocks are volatile, and you need to keep an eye on the market. For example, if you had invested in Reliance Industries in the early 2000s, you'd have seen your money multiply several times over. But stocks like Yes Bank have shown us that things can go south quickly if the company takes a hit.

Mutual Funds: If you're not into the adrenaline rush of constant market checks, mutual funds might be more your style. Since mutual funds spread your investment across various stocks, the overall risk is reduced. Even if one stock in the fund performs poorly, the others may balance it out. In 2023, the average equity mutual fund in India offered returns of about 12-15%, which is decent without putting your heart at risk!

Control: Do You Like Being Hands-On?

If you're someone who loves keeping control and doesn’t mind doing the research, then stocks might be your go-to option.

Stocks: You can pick and choose your companies, buy and sell whenever you want, and stay in total control. This is great if you enjoy learning about companies, industries, and market trends. However, the downside is that you need to stay constantly updated. Think of this as managing your own sports team—you're the coach and manager all rolled into one.

Mutual Funds: Here, a fund manager takes the wheel. They make the buying and selling decisions, freeing you from day-to-day management. So, if you’re someone who’d rather sit back and let an expert handle things, mutual funds are a good fit. It’s like hiring a coach for your sports team—you’re still in the game, but someone else is making the tactical calls.

Returns: What Are You Looking to Gain?

When it comes to returns, stocks generally have the potential to outperform mutual funds, but this comes with higher risk.

Stocks: Over the long term, stocks have historically delivered better returns than most other investments. For instance, stocks in companies like Infosys, TCS, and HDFC have consistently shown growth over the years. But, they come with wild swings. Your investment could double, or you could lose half of it within a few months.

Mutual Funds: While mutual funds may not offer the same high returns as individual stocks, they do provide more stable returns over time. Equity mutual funds can give you 12-15% annual returns, while debt mutual funds typically offer around 7-9%. The growth may be slower, but it’s more consistent, making mutual funds a great option for long-term wealth building.

Time Commitment: Do You Have the Patience?

The time and effort you’re willing to commit to your investments also play a big role in deciding whether stocks or mutual funds are right for you.

Stocks: You need to actively monitor your portfolio. If you have the time and interest to stay updated with the market trends, quarterly earnings, and corporate news, stocks can be rewarding. It’s like maintaining a garden—constant care and attention are needed.

Mutual Funds: If you don’t have time to monitor the market, mutual funds are more like a set-it-and-forget-it option. The fund manager does the heavy lifting, so you can relax while your money grows slowly but steadily.

Liquidity: How Quickly Can You Get Your Money?

Liquidity, or how easily you can turn your investment back into cash, is another crucial factor.

Stocks: Stocks are highly liquid. You can sell your shares anytime the stock market is open, and the money is usually credited to your account in a couple of days. This flexibility can be great, especially if you foresee needing cash on short notice.

Mutual Funds: Mutual funds are generally liquid, but they’re not as instantaneous as stocks. You can redeem your units, but it usually takes a day or two for the funds to appear in your account. Some funds, like ELSS (Equity Linked Saving Schemes), come with lock-in periods, so be mindful of the type of fund you choose.

Conclusion: Which Investment Option is Best for You?

It all boils down to your personal preferences, financial goals, and risk tolerance.

If you’re okay with higher risk and enjoy staying involved in your investments, stocks might be the better choice for you.

If you prefer a safer, hands-off approach, mutual funds could be your best bet.

For example, a young investor in their 20s with time on their side might lean towards stocks for high growth, while someone nearing retirement may prefer the steady returns and lower risk of mutual funds.

In the end, there’s no one-size-fits-all answer. Many investors choose to balance both, creating a diversified portfolio that includes mutual funds for stability and stocks for growth. So, which will it be for you?

0 notes

Text

Ethereum Price Soars as Whales Buy More Amid Crypto Market Uncertainty

Key Points

Ethereum’s price rebounds from a critical support level, driven by increased demand from large investors, following a significant crypto market crash.

The price recovery is also linked to the general market rebound, with Ethereum’s price expected to maintain bullish momentum into the fourth quarter.

After a major crypto market crash that eliminated more than $1.6 billion from leveraged traders within two days, the price of Ethereum (ETH) bounced back from a significant support level.

The top altcoin rallied over 14 percent in the last 24 hours, trading around $2,514 on Tuesday during the European session.

Driving Forces Behind Ethereum’s Price Recovery

The price rebound of Ethereum was in sync with Bitcoin’s price recovery in the past 24 hours. As a result, the total crypto market cap rallied over 8 percent to reclaim $2 trillion on Tuesday.

The crypto market’s recovery coincided with a rebound in the Asia stock market, led by the Nikkei 225 and the Asia Dow. The European stock market also opened Tuesday with a bullish outlook, led by the FTSE 100 and DAX.

As fear increased among investors, as indicated by Ethereum’s fear and greed index being at 17 percent, long-term investors seized the opportunity to make strategic purchases.

On-chain data reveals that several large investors, or “crypto whales,” made strategic Ether purchases in the past 24 hours from different exchanges. For example, Justin Sun, the founder of the Tron (TRX) network, withdrew 14,884 Ether, worth about $35 million, from Binance in the past 24 hours.

As a result, Sun now holds approximately 392,474 Ether units, worth nearly $1 billion. Notably, Sun announced a $1 billion fund on Monday to reduce market fear and help increase crypto liquidity.

Another large investor was spotted purchasing Ether from HTX after depositing $38 million USDT.

Positive Outlook for Ether ETFs

In the US, spot Ether ETFs had a positive day on Monday, registering a net cash inflow of more than $48 million. Despite significant cash outflows from Grayscale’s ETHE, BlackRock’s ETHA balanced with a net cash inflow of about $47 million.

Notably, apart from Invesco’s QETH and 21Shares’s CETH, the rest of the spot Ether ETF issuers registered a positive cash flow on Monday.

Future Price Expectations

The price of Ethereum has been forming a rising trend since early last year, characterized by higher highs and higher lows in the weekly time frame.

A similar V-shaped rebound to the 2020 Covid-19 crypto crash is expected to happen in the coming weeks and possibly yield the highly anticipated parabolic phase of the macro bull run.

However, if Ethereum’s price consistently closes below the support/resistance level around $2,124 in the coming weeks, the bears will continue to be in control.

0 notes

Text

..........

.......The Necessities of Survival

Premonition:

By

…

Hill Bowman

December 1st 2018 ©

…

Dedicated to

Hilda Sue Bowman

my mother

…

Above photographs compliments Google News September 13th 2023

…

…

Chapter 1.

The Bigger Picture

or

Need To Migrate

…

Chapter 2.

Earth Is A Closed Ecosystem

…

Chapter 3.

Resources Are Limited But

B.S. Is Perpetual

…

Chapter 4.

A Battle Against Principalities

…

Chapter 5.

Crowdfunding

Open Research

…

Chapter 6.

Tomorrow Starts Today

…

Chapter 7.

Extrapolation On Moore’s Law

…

Chapter 8.

You Are Here

…

Chapter 9.

The Necessity of Cross Referencing

…

Chapter 10.

Road Map To Survival

…

Chapter 11.

Integrated Parts

…

Chapter 12.

Unified Survival Theory

…

Chapter 13.

Requirement Of Migration

…

Chapter 14.

…

Chapter 3.

Resources Are Limited But B.S. is Perpetual

…

It is worthless to argue over a moot point such as Environmental Conservation.

The reason Environmental Conservation is a moot point is because individual, immediate, Self Indulgence will outweigh long-term catastrophic possibilities. Until imminent catastrophic possibilities become an imminent mutually assured destruction .

And of course by then it is too late... and perhaps that is the focal point of what this book is about.

I would like to suggest that we get the move on today while the sun is shining instead of waiting for it to be hailing sleet, snow, thunder and lightning before we get on to doing some things that we really need to address…

…

One thing I would like to suggest that has been on the drawing board for a very long time now nearly 50 yrs…

Is a gravity ring

It kind of looks like a bicycle wheel, but 10,000 times larger.

The center hub would contain rocket and electric thrust

Solar sail would be streched from the outer rim to the hub. Solar Thinfilm (flexible solar panels) should be stretched on the opposite side of the rim.

Off the shelf compressed gas or electric thrust can be used for rotation and stability control and for artificial gravitational effect around the rim.

Continuing with the bicycle wheel analogy…

What we have discussed so far is the frame and propulsion systems. Attached to the rim of the gravity ring (Where a bicycle tire would be on a bicycle rim) would be modular habitat’s.

These modular habitat’s would be interconnected with air locks. And sheathed with 2mm steal plates. Each habitat would be 50 meters long by 30 meters diameter. Each habitat divided down the length into four compartments…

Lower most compartment:

for infrastructure:

( 5 meter ceiling )

plumbing, electrical, heating , equipment storage.

.

Bottom -center compartment:

(10 meter ceiling )

for agriculture.

5 meters of high grade top soil Actively growing…

grains. Fruits, vegetables, and live stock (chickens sheep, possibly fish

.

Top-center compartment:

(10 meter ceiling )

Living habitat for crew

Research labs, food storage & cafeteria, ship command (navigation, propulsion, critical resource management ect)

.

Top – most compartment:

( 5 meter ceiling )

is for systems infrastructure,

resource harvesting conduits for critical industrial systems (raw resource harvesting smelting, materials fabrication, particle accelerator configuration intake / exhaust harvest, Bot deployment bay, heavy equipment storage…etc.).

…

Keep in mind that size in space is relative to ambition, cash flow and supply line.

If the frame work of the gravity rim is 500 meters radius (1killometer diameter) and circumference of 3,140 meters divided by 50 meters/habit would allow room for 62.8 habitat modules

If the gravity ring only has 1level of habitation module’s there would be enough room on the rim to secure approximately 60 habitat modules. That’s sounds like a lot of space but this vessel can permanently house a crew of 2,500 with room to accommodate 2,500 transient passengers.

Since the habit’s are modular you can stack them like building a modern hi-rise four or five high with only marginal difference in the perception of gravitational pull.

Crew can accesses any part of the vessel by use of air tight elevator/stairwell shafts built into the frame work of the gravity Rim .

And use of public / agricultural division of the habitat modules to traverse the circumference of the habitat Ring.

…

This vessel would be capable of sustaining populations for very long journeys or function as a geosynchronous ship yard or as an orbital scientific colony or as a roving harvester

However the primary purpose for the “Stepping Stone” vessel is as ~

automatic raw resource harvester, self replicating ( macro bot ), interplanetary transport vessel.

~

The self replication of the “Stepping Stone” is accomplished through swarm technology.

There are three main components to the “stepping Stone” vessel

The brain ~ (CAMF AI)

The body ~ “Stepping Stone” electromechanical vessel and appendages.

MOM “Mission Objectives Mech”

NOTE: A lot of people fail to grasp what MOM really is, but fear not. Well talk in more detail about MOM a little later on.

In short…

MOM is the collective sum of (CAMF AI) and the “Stepping Stone” vessel exercising autonomous situational comprehension, comparative tactic analysis, harvesting resources, material retrieval, manufacturing, navigation, self repair/replication and much more…

How MOM Works…

Harvesting targets and directives are issued by Central Assessments Main Frame narrow AI (CAMF AI) and confirmed with human oversight (or with complete autonomy like unmanned vessel )

Once targets / objectives are established the electromechanical components of the “Stepping Stone” under direction of CAMF AI issues objective/directives, target coordinates to required harvester bot's.

Bay doors are opened, harvester bot’s are deployed, supervised, retrieved, raw ore, gas, ice, ect. are unloaded and funneled to proper smelter or storage containment. All under direction of (MOM).

. Further you could carry a genetic library and of course seed bank and pollination bank(insect specific) along. In doing so you can grow what you need invetro fertilization… so that after crusing through the Milky Way Galaxy for 7 generations your great, great, great, grand children will still know what chicken taste like and look like because you could grow them as you need them. Chicken’s, cows, pigs, sheep, whatever floats your boat.

Actually come to think of it you could do invetro fertilization for people too but there’s a lot of argument among many groups in the human species as to the morality and ethic’s as far as invetro harvesting people. Crewing an interplanetary vessel with ’Test-tube people' or whatever like that, I’m sure, would get the hairs on the back of a Nay Sayer’s neck standing straight up.

I don’t think an Invetro crew is anything to worry about until the prospects of immediate intergalactic travel is upon us.

.

But we do have the technology to do it.

.

Further, the scientific research for advancement into the stars, feasible energy/propulsion systems and sustainability of biological systems to colonization of other planets will inevitably and inextricably lead toward advancements in every aspect of human understanding. From geosynchronous or roving interplanetary library’s (appended with research) to interstellar propulsion systems to exoagricilture to main stream galactic navigation (passenger space liner for everyday earn a buck two-leggers like me and you) …and so much more.

If you enjoy doing mazes when you were in school then you probably know that it is easier to solve the puzzle of a maze by going from the back to the front. From end to beginning almost always yield’s the path of least resistance in solving the maze.

This approach encapsulates one of the ‘principles’ in ”7 habits of highly effective people “

‘~Begin with the end in mind~’

And so, this book is written by Design from the back to the front starting with the big picture: The End Objective.

.

Therefore

Establish a specific objective:

1. Finance and build the “Stepping Stone” vessel.

.

2. Establish earth to Low Earth Orbit (LEO) Supply Line.

Reusable rockets, Space X

.

3. Establish research, engineering and construction provider’s

~“Orbital Platforms “~

low earth orbit ‘extrusion of space station frame work’.

.

4. Establish construction methodology

~ Reusable rockets~ deliver modular components to build location.

First pay load is a single modular habitat that shipyard crew can live in during construction of first “Stepping Stone “vessel

.

5. Coordinate R&D, fabrication and construction provider’s

.

6. Establish financial base

Crowd funding

~One billion people *$10 each~

.

The research needs to be across the board with specific goals that can be Unified into a spear head toward a specific objective.

…

Short term benefits:

1. Build first “Stepping Stone” self replicating vessel .

2. Construct reusable geosynchronous ship yard .

3. Establish financial base.

4. Crowd funding ~.

One billion people * $10 each

5. Construct Earth knowledge bank… (geosynchronous library)

6. Guarantee survival of humanity and accumulated knowledge of humanity by expanding out in to the solar system and later the Milky Way Galaxy at large.

7. Harvesting raw resources exploration & cataloging.

8. Colonizing planets that can be terraformed or directly inhabited.

9. The Preservation of our biosphere Earth.

10. The Preservation of the other organisms and resources within this biosphere that depend on it.

.

The Catalyst that can accomplish this daunting task is the innate need for…

11. Survival As A Species.

With our collective knowledge, technology, science, and culture as a species intact

…

Most important of all and most fundamental to our primitive and instinctive nature is that We (Human beings) are apex predators, like lions. Also, we (Human beings) are pack animals in the same sense that lions are pack animals.

lions do have their pride (pack) and there are rules too being in the pride.

When a young lion has grown past adolescence they get kicked out of the pride if that lion has Not found a mate and Started his own pride.

The lion pride is structured in this way by instinct

First because the young lion will eventually clash with the pride Alpha male. This usually ends with injury to the Alpha as well as death for the challenger

Lions seem too also realize instinctively that the challenger will be a drain on resources until he learns to successfully hunt, mate, and establish his Own pride.

The social structure of people is not all that different.

Due to this fundamental of our nature as predators in the animal kingdom We are nervous when we are around other human beings that we do not personally know. Therefore it is to the benefit of our survival as a species to expand off of this planet so we do not gnaw at each other.

No, I’m not talking about a nuclear war. Or a collision with the asteroid Apophis ( both of which Are possible), I’m just saying in general; from drug sponsored street violence, police brutality, ethnic, religious racial tyranny all the way up the line to conflicts of state and terrorism we’re just good at killing each other. We are in our own documents in history prove to be the apex predator on this planet and a blood thirsty near genocidal species. So let’s just admit that truth and move forward with that because it’s a fact. And of course there is the ever present military ambition to control the high ground which in space means the outer perimeter sphere of human colonization and population and economic activity’s)

also the fundamental greed of Industry by the mining of resources in the process of seeking out habitable planets as well as the inevitable revenues generated buy rare goods as well as food supplies generated by the established colonies through enter planetary trade and tourism. And on top of all that add the individual human drive to acquire

…

On a brighter note this of course is not the only reason that human beings occupied territories in the age of exploration (colonial expansion, 1500-1800) people came west to grow farms, to raise cattle, to prospect gold, for game, to live quietly in the mountains, to be peaceful and go out fishing every Sunday because that’s what they love to do. People will travel out into space for many of the same reasons first as tourists to the moon just for the experience, to tell their neighbors. Later on for more serious endeavors because industry will be paving away

…

Please know Elon musk says he's going to be having relay ships running between Mars and Earth on a 1 year or a 6 months schedule some time in the next 10 years

Note this is not exactly accurate text because I'm out of date on this specific topic but something like that was considered…So all I can say to that is,

Right On… That’s what’s up ,😀!!!

…

But getting back too the “Stepping Stone” project

.

I think that such an artificial gravitation habitat such as described above; as I call the “Stepping Stone” would be the most fruitful first step towards the human species seriously moving out into the solar system and populating beyond the planet Earth.

For example, we could definitely build two of these platforms under 10 years. Design research development and implementation on the first stepping stone would take approximately 7 years start to finish.

The second one will simply be franchised as they say in the business community or replication as they would say in the technology community.

But yeah, basic replication of the technology developed in the first stepping stone... Especially the technology of self-replication so that the first “Stepping Stone” vessel actually constructs the second “Stepping Stone “vessel.

Once this is accomplished we could establish orbit for “Stepping Stone1” around the earth and the moon, simultaneously establishing orbit for “Stepping Stone 2” around Mars and the. moon Like an interplanetary bus rout. The “Stepping stones” will be a self contained colony even before you touch down on a planet. The “Stepping Stone” vessel will provide everything the colony would need indefinitely to sustain itself.

Or The “Stepping Stone” can just roll about space on controlled power, solar sails, rocket thrust( H-H-O) or particle accelerator ejection (exhaust). Harvesting and mining resources and raw materials for self replication, for purposes of extending out farther into the planets, the keiper belt and Milky Way at large..

But wait!!

In 5 years (with abundant harvesting resources) The first two stepping stones will self replicate two more stepping stones making a total of four which can easily put us on the route to an interplanetary bus route, so to speak, that reaches out to Jupiter possibly and beyond... All in 15 years or less.

The self replication of the “Stepping Stone” is exponential

Max speed to self replicate is 5 years so consider 7 years the average replication time

The first two “Stepping Stones” will replicate two more “Stepping Stones” in 7 years

All 4 “Stepping Stones” will self replicate In another seven years totaling 8 vessels. All eight vessels will self replicate in seven more years totaling 16 “Stepping Stone “vessels. And on and on…32…64..

In seven revolution of self replication you will have 128 vessel…

Eight self-replication revolutions

Yealds256 vessel…

Nine revolutions yield’s 512vessels and so on…

Quick math:

512 “Stepping Stones”= 9 revolutions of 7 years each

So

Revolutions 9

x Years 7

= 512ships = 63 years

This proses continues indefinitely

And Now you might grasp how the “Stepping Stone” project can and will build a network spanning the solar system in 50 years or less; and extend a network across the milky way galaxy in short order (perhaps 500 years or less).

In about 60 or 70 years (2099 – 2110) We have a whole fleet of “Stepping Stone “vessels. We’d be harvesting raw minerals, discover new methods of transportation, existence, survival and commerce…

THROUGH INTERPLANETARY COLONISATION AND INTERPLANETARY MARKET’S…

and all kinds of really cool stuff …

….

But let me digress a little bit It's fun…

We have talked a lot about science and technology but now lets consider people for a bit…

…

the fundamental nature of human curiosity to explore and discover for the sake of exploration and discovery.

.

The silk road, the imperial Battle for the American colonies, the reach for the moon and beyond. All are driven by the same motivation within the human spirit both as the individual biological animal that we are and as we compile ourselves into the social entity of nations that we are also.

Insatiably self destructively curious.

…

Book Recommendations:

Note: Google search

‘Pdf’+’7 habits of highly effective people’

…

Google search

‘pdf '+’update’+’colinization of mars’+’elon musk’+’space x'

“ “ “

Document title…

The details of Elon Musk and SpaceX plans to establish a

permanent settlement on Mars

“ “ “ Google search parameters for next chapter 4.

.

‘Forbes, 128 companies that own everything

#interstellar flight#interplanetary colonization#Leo economy#technology#economics#emersive history#futur science#chapter 2

0 notes

Text

This Penny Stock Could Be My Next 10X Winner! Are You Buying?

🚨This Penny Stock Could Be My Next 10X Winner! Are You Buying?🚨

https://www.youtube.com/watch?v=Dm_itcJ2S3k

How this penny stock can run 10x in price! Remember we just hit our first 10x goal, but it took over a year to get there. Conviction is key

✅ Timeline

0:00 10X Potential

0:33 Major Catalyst Breakdown

1:14 Key Point of Data Results (Study)

1:38 Upcoming Significant Events

2:17 Patients Studied Were Sicker

2:55 No Major Side Effects

3:26 CEO Buying Stock in The Open Market

4:24 Why CardiolRX is Better, More Affordable

4:50 $10 Price Target, BUY NOW?

5:28 Charts, Price Predictions

6:00 Where Are People Buying?

7:03 BIGGEST LEVEL, PRICE TARGET!

8:02 My Last 10X Stock Alert!

8:29 Upcoming Catalyst (Calendar)

✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1

✅ Stay Connected With Me:

👉 (X)Twitter: https://twitter.com/RealAvidTrader

👉 Stocktwits: https://ift.tt/fXgP79z

👉 Instagram: https://ift.tt/bL98guv

==============================

✅ Other Videos You Might Be Interested In Watching:

👉 The ULTIMATE Guide to Finding Hidden Gem Stocks | AvidTrader

https://youtu.be/pZAKJLk9o0I

👉 🧨GameStop Short Squeeze 2.0 Incoming??🧨

https://youtu.be/XeFVaq4BHfU

👉 🙌💎 When Should You Diamond Hand a Stock? 💎🙌

https://youtu.be/ZO62i0cq0PQ

👉 This Penny Stock is a GUARANTEED Double!!

https://youtu.be/Yx6wZNz95dM

=============================

✅ About AvidTrader:

Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process!

Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services.

🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1

=====================

#smallcapstocks #pennystocktrading #stockbreakout #chartanalysis #shortsqueeze #lowfloat #swingtrade #daytrading #stocktradingstrategies #crdlstock #biotechstocks #stockinvesting #stockstobuy #stockstobuynow

Disclaimer:

Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. This is not financial advice. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance. AvidTrader has been compensated five thousand dollars USD by ACH Bank Transfer by MDM Worldwide LLC for advertising Cardiol Therapeutics Inc (CRDL). As of the date of this advertisement, the owners of AvidTrader do not hold a position in Cardiol Therapeutics Inc (CRDL). This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of Cardiol Therapeutics Inc (CRDL), increased trading volume, and possibly an increased share price of Cardiol Therapeutics Inc (CRDL), which may or may not be temporary and decrease once the marketing arrangement has ended.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use

© AvidTrader

via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA

July 19, 2024 at 06:43AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

0 notes

Video

youtube

12 Walmart Survival Foods: Prepper's Pantry Essentials

12 Walmart Survival Foods: Prepper's Pantry Essentials

In this must-watch video, we'll unveil the top 12 survival foods that every prepper should have in their pantry, and the best part is, they're all readily available at Walmart! From long-lasting staples to nutrient-rich options, we've got you covered. Whether you're a seasoned prepper or someone looking to start building your emergency food supply, this comprehensive guide will ensure you're prepared for any situation. Trust us, you won't want to miss this! So, grab a pen and paper, hit that like button, and get ready to stock up on these vital survival foods. Share this video with fellow preppers and let us know in the comments below which foods you plan on adding to your pantry!

In this comprehensive guide, I will highlight ready-to-eat, canned, and non-perishable foods that are easily accessible at Walmart. We will discuss their nutritional properties, durability, and why they are smart choices for any preparedness plan.

Whether you are building your preparedness pantry or seeking long-lasting food options, this video is for you. Don't forget to leave your comments below about the foods you already have in your preparedness pantry and which ones you plan to add after watching this guide.

Don't miss the opportunity to prepare for the future - watch the video now and start building your preparedness pantry with these 12 essential Walmart foods! #Preparedness #SurvivalFoods #Walmart #PrepperPantry #Survival #Prepper #FoodSecurity

OUTLINE:

00:00:00 Introduction and Intrigue

00:00:32 Survival Food 1-3

00:02:29 Survival Food 4-6

00:04:16 Survival Food 7-9

00:06:22 Survival Food 10-12

00:08:14 Wrap Up and Call to Action

Tags:12 Walmart Survival Foods,12 Survival Foods,survival foods to stock up on,food for preppers,survival,walmart,survival food,survival kit,best survival foods at walmart,best foods for long term food storage,survival at walmart,survival at walmart,most popular survival foods,food shortages at walmart,survival items,buying food at walmart,Prepper's Pantry Essentials,top 12 survival foods that every prepper,prepper foods,prepper

12 Walmart Survival Foods: Prepper's Pantry Essentials

1 note

·

View note

Photo

New Post has been published on https://wineauctionroom.com/report-on-end-of-year-auction-announcing-next-online-auction-starting-dec-27/

Report on End-of-Year Auction & Announcing Next Online Auction Starting Dec 27

Our End-of-Year Live auction followed by its Buy Now sale wrapped up the year last Tuesday. Thanks to our lovely wine community, our vendors and buyers for your long-time support.

Before we dive into the auction sale report, let’s take a look at the international wine market. Globally, key market indices remained flat, primarily due to ongoing cautious investor sentiment and reduced demand from Asia. The Bordeaux market has seen a notable drop in prices, with some of the most prestigious producers experiencing the biggest decline in the last quarter of 2023. However, despite these headwinds, the outlook for 2024 holds promise for investors, with emerging opportunities on the horizon. The stabilisation in pricing towards the end of the quarter also provides an enticing opportunity for wine investors.

This is reflected accordingly in local market. In our last live auction, overall wining bids set around mid estimate with few soared above high estimate. 2000 Chateau Mouton Rothschild took the highest hammer win at $1880, followed by 2003 Quinta do Noval Porto Vintage Nacional and Canadian Club Chronicles 41 Year Old Whisky (45%ABV) at $1175.

At the second tier, Rhone, Burgundy and Bordeaux played equal parts with 2010 E. Guigal La Mouline Cote Rotie selling for $1034, while 2009 Domaine Armand Rousseau Gevrey-Chambertin and 2008 Chateau Mouton Rothschild followed at $940.

Overall Bordeaux still delivered the highest total winning value in general proving its trustworthy stability in long-term investment. 1983 Chateau Latour sold for $893, 2008 Chateau Haut-Brion followed at $869.50 and 2003 Chateau Pavie sold for $611 while 1995 Chateau Pichon Longueville Comtesse de Lalande sold for $434.75.

OWC performed steadily as always, both 6-bottle lot of OWC 2014 Stonyridge Vineyard Larose, and OWC 2014 Te Mata Estate Coleraine sold for $846 and 6-bottle lot of OWC 2007 Chateau Gazin sold for $634.50.

Other highlights include, 6-bottle lot of 2001 Tenuta dell’Ornellaia selling for $2467.50, NV Jacques Selosse Initial Grand Cru Blanc de Blanc scoring $963.50, 1992 Dom Perignon Rose Vintage Brut selling for $705 and 2016 Bell Hill Pinot Noir reached $258.50.

All prices include Buyers Premium but exclude GST.

Our sincere thanks again to everyone who participated in this Live auction either in saleroom physically or via online and phone bids. Please feel free to give us feedback if there’s anything we could do to make it an even better experience for you.

Our next auction will be an online sale from 12pm, Wed Dec 27 to 7pm, Sun Jan 14.

We are often asked what wines we enjoy… we simply point to The Wine Retail Room. Whilst our range is small, it is stuffed with wines with a story to tell. Our retail store continues to be available for Christmas stocking fillers – be sure to place your orders before December 15if you’re out of town as we anticipate courier networks will be jammed. Local pickups will be available until Wednesday 20 December. wineretailroom.co.nz

0 notes

Text

Why does Wall Street want to buy your house?

How to invest in U.S. real estate like a Wall Street Investment Bank with America Mortgages

Goldman Sachs, Blackrock, JP Morgan, Vanguard, Fidelity – There are new players in the U.S. real estate game — multibillion-dollar Wall Street hedge funds and cash-flush investors — buying up properties and pushing regular homebuyers out of the market with aggressive buying and rental tactics. Investors and hedge funds currently own roughly 80,000 single-family homes in the Las Vegas area alone, which is about 14% of the county’s housing stock of 563,000, according to Shawn McCoy, director of UNLV’s Lied Center for Real Estate. Some prime targets that are appealing to these investors are growing Sunbelt cities like Las Vegas and Phoenix and other secondary markets such as Charlotte, North Carolina, Atlanta, and various cities in Florida.

“From mid-2020, when interest rates started going up, hedge funds bought up a ton of properties and immediately turned them into rentals, pricing out local buyers,” says industry experts. “Now a big portion of our homes are owned by investors.” Institutional investors may control 40% of U.S. single-family rental homes by 2030, according to MetLife Investment Management.

These funds pay top dollar to some of the smartest and brightest analysts in the world before spending billions of dollars. This should be a sign for all real estate investors to research, learn, and follow. Currently, investors target single-family “starter homes” below the median home sale price of $447,435, sometimes renting out to the same demographic they outbid for the properties, which further tightens supply and increases rental yield.

The reason for the specific areas targeted is that prices in some Sun Belt markets have outpaced national figures for rent inflation, according to research compiled by Zumper. Between January 2020 and January 2023, rents for a two-bed detached home increased about 44% in Tampa, Florida, 43% in Phoenix, and 35% near Atlanta. That’s compared with a 24% increase nationwide.

The realm of real estate investment is perpetually influenced by various economic factors, among which interest rates wield a substantial impact. Contrary to conventional wisdom, sophisticated investors often perceive high-interest rate periods as opportune moments to delve into the U.S. real estate market. This seemingly counterintuitive strategy is rooted in several compelling reasons that highlight the advantages and potential opportunities for astute investors.

Enhanced Bargaining Power

During high-interest rate environments, the housing market commonly experiences a slowdown. As a result, property sellers might be more amenable to negotiations, leading to a potential reduction in property prices. Sophisticated investors with the financial acumen and liquidity or access to high LTV mortgage lending (more than 65%) can capitalize on these conditions to acquire real estate assets at lower costs compared to periods of lower interest rates.

Favorable Cap Rates

High-interest rate environments often translate to higher capitalization rates (cap rates) for real estate investments. Properties with higher cap rates tend to generate more substantial income relative to the property’s cost. This can be especially appealing to sophisticated investors seeking income-generating assets, such as rental properties or commercial real estate, as they can yield greater returns on their investment.

Hedging Against Inflation

Real estate has historically served as a hedge against inflation. When interest rates are high, inflation is often a concern. Real assets like real estate tend to retain or increase their value over time, thereby shielding investors from the erosive effects of inflation. Experienced investors understand the value of having tangible assets in their portfolio that can safeguard against inflationary pressures.

Long-Term Investment Perspective

Many investors in real estate often adopt a long-term view. While high interest rates might seem daunting in the short term, they can take advantage of locking in fixed-rate loans, thereby securing a consistent interest rate over an extended period. This stability safeguards against potential future rate hikes and provides a reliable cost structure for the investment’s lifetime.

Risk Mitigation and Diversification

Diversification is a key principle in investment strategy. High interest rate periods may deter other forms of investment, making real estate a comparatively safer harbor. Investors who have been in the market for a while recognize the importance of diversifying their portfolio to mitigate risk, and real estate, particularly during high-interest rate climates, can be an integral component in a well-balanced investment strategy.

Other People’s Money, aka Leverage

Having access to leverage makes sense in every way – Capital efficiency, Tax benefits, Risk management, and Preservation of liquidity. As a Foreign National or U.S. Expat with America Mortgages, you can access bank leverage with LTVs up to 80%, even without U.S. credit. Qualify based on the property’s rental income, making the process easier and more accessible. It’s smart underwriting, as these properties should be treated as a pure commercial transaction.

Buy now and refinance later

In a well-balanced investment strategy, investors will go into a higher investment environment with the concept of “buy now and refinance later.” Global real estate investors recognize the unique flexibility of U.S. mortgages. Whether you’re 19 or 99 years old, you can secure a 30-year or 40-year amortization, making financing options readily available.

It’s a buyer’s market, as many novice real estate investors and owner-occupied buyers are sitting on the sideline waiting for interest rates to go down. What will that likely mean? Rates decrease, inventory is limited, buying power increases = FOMO (fear of missing out) – real estate prices will increase and increase quickly.

Final Thoughts

In essence, while high-interest rate periods might initially appear as a deterrent to real estate investment, sophisticated investors perceive these periods as windows of opportunity. Their ability to leverage market conditions, negotiate favorable deals, capitalize on higher cap rates, hedge against inflation, and adopt a long-term perspective with high LTV leverage distinguishes them in the real estate investment landscape.

Ultimately, the allure of U.S. real estate for experienced investors during high-interest rate periods lies in their capability to recognize and harness the unique advantages and opportunities that such environments offer. By employing smart financial strategies and seeing beyond short-term challenges, these investors position themselves to reap long-term rewards in the ever-evolving world of real estate investment.

Why does Wall Street want to buy your house? Now you know why!

We Understand Foreign National and U.S. Expat Mortgages Better Than Anyone

As a company, 100% of America Mortgages’ clients are living and working abroad while obtaining a U.S. mortgage loan. This is all we do, and no one does it better. “Would you take your Porsche to a Mazda dealership to get your car fixed?” states Robert Chadwick, CEO of America Mortgages. “Then why would you take a purchase 10x more to a broker or bank that doesn’t understand the complexities of non-resident lending?”

America Mortgages is the leading expert in U.S. mortgage lending. For a no-obligation consultation with one of our globally based U.S. mortgage loan officers, please use this 24/7 calendar link. With U.S. loan officers in 12 countries, we work in your time zone and in your language.

For more details, visit our website: https://www.americamortgages.com/

0 notes

Text

Lumen’s stock slides toward 37-year low amid doubts company can ‘sharply diverge from its history’