#top 14 stocks to buy for long term

Text

14 Best Stocks for Long Term Investments in India

आज में आपकों 14 Best Stocks for Long Term Investments in India के बारें में बतानें वाला हूँ मुझे उमीद हैं की यह आपकों पसंद आएगी।

भारत में लंबी अवधि के लिए निवेश करने के लिए सबसे अच्छे स्टॉक्स कौन से हैं? यह प्रश्न हर निवेशक के मन में होता है, जो अपने पैसों को समय के साथ बढ़ाना चाहता है। लंबी अवधि का निवेश का मतलब है कि आप कम से कम 1 से 3 साल तक किसी स्टॉक में पैसा लगाते हैं, और उसकी कीमत में…

View On WordPress

#10 best shares to buy today for long term#14 long term stocks to buy now#best long term stocks to buy right now#best share to buy for long term#best share to buy today for long term#best shares to buy today for long term#best small cap stocks for long term#best stocks for long term#best stocks for long term growth#best stocks for long term investors#best stocks to buy for long term in india#long term investment stocks#stocks to buy for long term#stocks to buy today long term#top 14 stocks to buy for long term

0 notes

Text

55 years young: the true masterpiece of psychedelia

When I was 14 or 15 and had decided that the late 60s (at the time about twenty years previously) was the thing, but had exhausted all my Dad’s Stones & Cream albums and bought a few of my own from the same acts (and a couple of Hendrix LPs), I set out to discover more from the era. I can honestly say I wouldn’t be here writing this now if it wasn’t for a very, very cheap double LP compilation called ‘Back On The Road’ which I bought. It was a glorious sampler masterclass in almost everything: it had softer, folksy moments from Fairport, Roy Harper and Nick Drake. It had the heft of Sabbath, Deep Purple and Free. It had the familiarity of Cream and Hendrix. It was my first taste of Traffic & Spooky Tooth. But it was also ocean-spanning: it had the Velvet Underground, the Quicksilver Messenger Service - and Jefferson Airplane.

Despite my first taste of ‘Paranoid’ and ‘Black Night’, ‘White Rabbit’ transcended them both in terms of sheer power. I loved it: it was a bolero, reimagined by the acid rock generation. And so it was I set off to find out more about ‘the Airplane’ (as we will call them henceforth) and really began a love affair with the late sixties Bay Area arts and culture that, circa 32 years later, still rages on in my heart.

It didn’t start well. The liner notes to ‘Back On The Road’ made it clear that this band was at the very top of the family tree of what led to (then relatively recent) unavoidable atrocities ‘We Built This City’ and ‘Nothing’s Gonna Stop Us Now’. For a while, ‘White Rabbit’ was ruined - it was unmistakably that same, powerhouse voice: nobody sounds like Grace Slick. But I soon shrugged it off as nonsense and blamed the times, concluding that I couldn’t let ‘Valerie’ and ‘Higher Love’ put me off ‘Paper Sun’ either.

Sadly, it didn’t improve immediately: Jefferson Airplane actually reformed for one album in 1989 just as I set out to discover them for myself. It was of course this album that all the shops stocked, and I bought it. Aside from a couple of moments, it sounded way too much like Starship and not enough like 1960s San Francisco. I later learned that the couple of moments were basically Hot Tuna and the rest of it was a deluxe big-budget Starship-type operation. Jorma Kaukonen summed the reunion up almost word-for-word as I felt the album to be at age 15 in his excellent auto-bio ‘Been So Long’. Buy a copy.

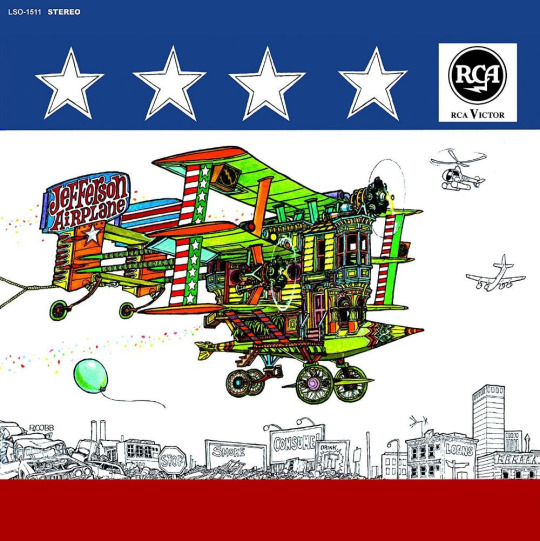

I went to a better record shop the following week where - joy of joys - they actually had a Jefferson Airplane section. Kid in a toy shop moment: I held in my hands and gazed in wonder at copies of ‘Volunteers’, ‘Surrealistic Pillow’, ‘Crown of Creation’…marvelled at the flying toasters on ‘Thirty Seconds Over Winterland’….and then caught sight of ‘After Bathing At Baxters’ for the very first time.

youtube

All the others just vanished into the background. This was it: the iconic American stars and stripes bordering that great image: the old biplane made out of a typical wooden clad Victorian Haight-area house, soaring over a consumer-satire landscape. Now, this was 1989 and vinyl albums from the sixties had largely been robbed of their original gatefold sleeves - or in some cases only ever got them in their home country - and it would be another ten years before I got my hands on a USA original. In fact, it turns out that the (probably Dutch or German) pressing that I got brand new was better than the UK original sleeve which lacked the red, white and blue borders and was distinctly drab.

A brief history lesson: ‘After Bathing At Baxters’ was the third album by the Airplane, and the second with Grace Slick on vocals. The previous release ‘Surrealistic Pillow’ was the breakthrough, with the two bona-fide hits ‘White Rabbit’ and ‘Somebody To Love’ which set them apart from the rest of the freewheeling, often uncommercial (or rather, ‘unconcerned with being deliberately commercial’) San Francisco scene.

youtube

The rock and roll history books will tell you that ‘Pillow’ was a huge leap forward from the debut ‘Jefferson Airplane Takes Off’. Well, yes - the sound had a harder edge and not just in the vocals; it also had hits and was a true breakthrough for the band - but it was still an album of short, structured songs with a nominally folk-rock sound. For my money, the difference between ‘Pillow’ and ‘Baxters’ is immeasurably greater and possibly the most significant audible development of any one band from one album to the next that there has ever been. Even ‘Rubber Soul’ to ‘Sgt Pepper’ was a neatly calibrated climb (and that’s assuming you don’t believe ‘Revolver’ was the truly impressive one of the three; I do).

Hits. That’s what happened - and so Jefferson Airplane were given virtual carte blanche by paymasters RCA Victor to make their next record. It took most of 1967 and I’m not sure that RCA were ever ready for the results!

I’m not going to go through it track-by-track; I want you to do that for yourself if you have a mind and thus won’t pepper this missive with spoilers. Let’s just say it is one of the most successful attempts to capture the psychedelic experience on vinyl (which was always a challenge for the artists who were playing freewheeling, stream-of-consciousness improvised concerts by the seat of their pants, then faced the auspices of the studio).

Look out for Jorma Kaukonen ‘inventing Sonic Youth’ in the fuzzed and multitracked guitar solo of his own ‘Last Wall Of The Castle’. Feel the mood as Paul Kantner’s Rickenbacker XII sets up an eastern-influenced mini raga to usher in ‘Wild Tyme’, which then explodes into a mass of joyous harmonies celebrating the times. Be spellbound at Grace’s icy wit and ‘take no prisoners’ attitudes on ‘Two Heads’ and ‘Rejoice’. But above all, don’t drop your bacon sandwich during ‘Spare Chaynge’ - a wild, improvised jam between Kaukonen, the greatest bass player on the planet Jack Casady and drummer Spencer Dryden.

youtube

No man is an island - he is a peninsular.

Happy 55th Birthday to my absolute favourite long-playing record; the one that made me want to be a musician and not just a record collector. Thanks for everything.

3 notes

·

View notes

Text

Ethereum Price Soars as Whales Buy More Amid Crypto Market Uncertainty

Key Points

Ethereum’s price rebounds from a critical support level, driven by increased demand from large investors, following a significant crypto market crash.

The price recovery is also linked to the general market rebound, with Ethereum’s price expected to maintain bullish momentum into the fourth quarter.

After a major crypto market crash that eliminated more than $1.6 billion from leveraged traders within two days, the price of Ethereum (ETH) bounced back from a significant support level.

The top altcoin rallied over 14 percent in the last 24 hours, trading around $2,514 on Tuesday during the European session.

Driving Forces Behind Ethereum’s Price Recovery

The price rebound of Ethereum was in sync with Bitcoin’s price recovery in the past 24 hours. As a result, the total crypto market cap rallied over 8 percent to reclaim $2 trillion on Tuesday.

The crypto market’s recovery coincided with a rebound in the Asia stock market, led by the Nikkei 225 and the Asia Dow. The European stock market also opened Tuesday with a bullish outlook, led by the FTSE 100 and DAX.

As fear increased among investors, as indicated by Ethereum’s fear and greed index being at 17 percent, long-term investors seized the opportunity to make strategic purchases.

On-chain data reveals that several large investors, or “crypto whales,” made strategic Ether purchases in the past 24 hours from different exchanges. For example, Justin Sun, the founder of the Tron (TRX) network, withdrew 14,884 Ether, worth about $35 million, from Binance in the past 24 hours.

As a result, Sun now holds approximately 392,474 Ether units, worth nearly $1 billion. Notably, Sun announced a $1 billion fund on Monday to reduce market fear and help increase crypto liquidity.

Another large investor was spotted purchasing Ether from HTX after depositing $38 million USDT.

Positive Outlook for Ether ETFs

In the US, spot Ether ETFs had a positive day on Monday, registering a net cash inflow of more than $48 million. Despite significant cash outflows from Grayscale’s ETHE, BlackRock’s ETHA balanced with a net cash inflow of about $47 million.

Notably, apart from Invesco’s QETH and 21Shares’s CETH, the rest of the spot Ether ETF issuers registered a positive cash flow on Monday.

Future Price Expectations

The price of Ethereum has been forming a rising trend since early last year, characterized by higher highs and higher lows in the weekly time frame.

A similar V-shaped rebound to the 2020 Covid-19 crypto crash is expected to happen in the coming weeks and possibly yield the highly anticipated parabolic phase of the macro bull run.

However, if Ethereum’s price consistently closes below the support/resistance level around $2,124 in the coming weeks, the bears will continue to be in control.

0 notes

Text

..........

.......The Necessities of Survival

Premonition:

By

…

Hill Bowman

December 1st 2018 ©

…

Dedicated to

Hilda Sue Bowman

my mother

…

Above photographs compliments Google News September 13th 2023

…

…

Chapter 1.

The Bigger Picture

or

Need To Migrate

…

Chapter 2.

Earth Is A Closed Ecosystem

…

Chapter 3.

Resources Are Limited But

B.S. Is Perpetual

…

Chapter 4.

A Battle Against Principalities

…

Chapter 5.

Crowdfunding

Open Research

…

Chapter 6.

Tomorrow Starts Today

…

Chapter 7.

Extrapolation On Moore’s Law

…

Chapter 8.

You Are Here

…

Chapter 9.

The Necessity of Cross Referencing

…

Chapter 10.

Road Map To Survival

…

Chapter 11.

Integrated Parts

…

Chapter 12.

Unified Survival Theory

…

Chapter 13.

Requirement Of Migration

…

Chapter 14.

…

Chapter 3.

Resources Are Limited But B.S. is Perpetual

…

It is worthless to argue over a moot point such as Environmental Conservation.

The reason Environmental Conservation is a moot point is because individual, immediate, Self Indulgence will outweigh long-term catastrophic possibilities. Until imminent catastrophic possibilities become an imminent mutually assured destruction .

And of course by then it is too late... and perhaps that is the focal point of what this book is about.

I would like to suggest that we get the move on today while the sun is shining instead of waiting for it to be hailing sleet, snow, thunder and lightning before we get on to doing some things that we really need to address…

…

One thing I would like to suggest that has been on the drawing board for a very long time now nearly 50 yrs…

Is a gravity ring

It kind of looks like a bicycle wheel, but 10,000 times larger.

The center hub would contain rocket and electric thrust

Solar sail would be streched from the outer rim to the hub. Solar Thinfilm (flexible solar panels) should be stretched on the opposite side of the rim.

Off the shelf compressed gas or electric thrust can be used for rotation and stability control and for artificial gravitational effect around the rim.

Continuing with the bicycle wheel analogy…

What we have discussed so far is the frame and propulsion systems. Attached to the rim of the gravity ring (Where a bicycle tire would be on a bicycle rim) would be modular habitat’s.

These modular habitat’s would be interconnected with air locks. And sheathed with 2mm steal plates. Each habitat would be 50 meters long by 30 meters diameter. Each habitat divided down the length into four compartments…

Lower most compartment:

for infrastructure:

( 5 meter ceiling )

plumbing, electrical, heating , equipment storage.

.

Bottom -center compartment:

(10 meter ceiling )

for agriculture.

5 meters of high grade top soil Actively growing…

grains. Fruits, vegetables, and live stock (chickens sheep, possibly fish

.

Top-center compartment:

(10 meter ceiling )

Living habitat for crew

Research labs, food storage & cafeteria, ship command (navigation, propulsion, critical resource management ect)

.

Top – most compartment:

( 5 meter ceiling )

is for systems infrastructure,

resource harvesting conduits for critical industrial systems (raw resource harvesting smelting, materials fabrication, particle accelerator configuration intake / exhaust harvest, Bot deployment bay, heavy equipment storage…etc.).

…

Keep in mind that size in space is relative to ambition, cash flow and supply line.

If the frame work of the gravity rim is 500 meters radius (1killometer diameter) and circumference of 3,140 meters divided by 50 meters/habit would allow room for 62.8 habitat modules

If the gravity ring only has 1level of habitation module’s there would be enough room on the rim to secure approximately 60 habitat modules. That’s sounds like a lot of space but this vessel can permanently house a crew of 2,500 with room to accommodate 2,500 transient passengers.

Since the habit’s are modular you can stack them like building a modern hi-rise four or five high with only marginal difference in the perception of gravitational pull.

Crew can accesses any part of the vessel by use of air tight elevator/stairwell shafts built into the frame work of the gravity Rim .

And use of public / agricultural division of the habitat modules to traverse the circumference of the habitat Ring.

…

This vessel would be capable of sustaining populations for very long journeys or function as a geosynchronous ship yard or as an orbital scientific colony or as a roving harvester

However the primary purpose for the “Stepping Stone” vessel is as ~

automatic raw resource harvester, self replicating ( macro bot ), interplanetary transport vessel.

~

The self replication of the “Stepping Stone” is accomplished through swarm technology.

There are three main components to the “stepping Stone” vessel

The brain ~ (CAMF AI)

The body ~ “Stepping Stone” electromechanical vessel and appendages.

MOM “Mission Objectives Mech”

NOTE: A lot of people fail to grasp what MOM really is, but fear not. Well talk in more detail about MOM a little later on.

In short…

MOM is the collective sum of (CAMF AI) and the “Stepping Stone” vessel exercising autonomous situational comprehension, comparative tactic analysis, harvesting resources, material retrieval, manufacturing, navigation, self repair/replication and much more…

How MOM Works…

Harvesting targets and directives are issued by Central Assessments Main Frame narrow AI (CAMF AI) and confirmed with human oversight (or with complete autonomy like unmanned vessel )

Once targets / objectives are established the electromechanical components of the “Stepping Stone” under direction of CAMF AI issues objective/directives, target coordinates to required harvester bot's.

Bay doors are opened, harvester bot’s are deployed, supervised, retrieved, raw ore, gas, ice, ect. are unloaded and funneled to proper smelter or storage containment. All under direction of (MOM).

. Further you could carry a genetic library and of course seed bank and pollination bank(insect specific) along. In doing so you can grow what you need invetro fertilization… so that after crusing through the Milky Way Galaxy for 7 generations your great, great, great, grand children will still know what chicken taste like and look like because you could grow them as you need them. Chicken’s, cows, pigs, sheep, whatever floats your boat.

Actually come to think of it you could do invetro fertilization for people too but there’s a lot of argument among many groups in the human species as to the morality and ethic’s as far as invetro harvesting people. Crewing an interplanetary vessel with ’Test-tube people' or whatever like that, I’m sure, would get the hairs on the back of a Nay Sayer’s neck standing straight up.

I don’t think an Invetro crew is anything to worry about until the prospects of immediate intergalactic travel is upon us.

.

But we do have the technology to do it.

.

Further, the scientific research for advancement into the stars, feasible energy/propulsion systems and sustainability of biological systems to colonization of other planets will inevitably and inextricably lead toward advancements in every aspect of human understanding. From geosynchronous or roving interplanetary library’s (appended with research) to interstellar propulsion systems to exoagricilture to main stream galactic navigation (passenger space liner for everyday earn a buck two-leggers like me and you) …and so much more.

If you enjoy doing mazes when you were in school then you probably know that it is easier to solve the puzzle of a maze by going from the back to the front. From end to beginning almost always yield’s the path of least resistance in solving the maze.

This approach encapsulates one of the ‘principles’ in ”7 habits of highly effective people “

‘~Begin with the end in mind~’

And so, this book is written by Design from the back to the front starting with the big picture: The End Objective.

.

Therefore

Establish a specific objective:

1. Finance and build the “Stepping Stone” vessel.

.

2. Establish earth to Low Earth Orbit (LEO) Supply Line.

Reusable rockets, Space X

.

3. Establish research, engineering and construction provider’s

~“Orbital Platforms “~

low earth orbit ‘extrusion of space station frame work’.

.

4. Establish construction methodology

~ Reusable rockets~ deliver modular components to build location.

First pay load is a single modular habitat that shipyard crew can live in during construction of first “Stepping Stone “vessel

.

5. Coordinate R&D, fabrication and construction provider’s

.

6. Establish financial base

Crowd funding

~One billion people *$10 each~

.

The research needs to be across the board with specific goals that can be Unified into a spear head toward a specific objective.

…

Short term benefits:

1. Build first “Stepping Stone” self replicating vessel .

2. Construct reusable geosynchronous ship yard .

3. Establish financial base.

4. Crowd funding ~.

One billion people * $10 each

5. Construct Earth knowledge bank… (geosynchronous library)

6. Guarantee survival of humanity and accumulated knowledge of humanity by expanding out in to the solar system and later the Milky Way Galaxy at large.

7. Harvesting raw resources exploration & cataloging.

8. Colonizing planets that can be terraformed or directly inhabited.

9. The Preservation of our biosphere Earth.

10. The Preservation of the other organisms and resources within this biosphere that depend on it.

.

The Catalyst that can accomplish this daunting task is the innate need for…

11. Survival As A Species.

With our collective knowledge, technology, science, and culture as a species intact

…

Most important of all and most fundamental to our primitive and instinctive nature is that We (Human beings) are apex predators, like lions. Also, we (Human beings) are pack animals in the same sense that lions are pack animals.

lions do have their pride (pack) and there are rules too being in the pride.

When a young lion has grown past adolescence they get kicked out of the pride if that lion has Not found a mate and Started his own pride.

The lion pride is structured in this way by instinct

First because the young lion will eventually clash with the pride Alpha male. This usually ends with injury to the Alpha as well as death for the challenger

Lions seem too also realize instinctively that the challenger will be a drain on resources until he learns to successfully hunt, mate, and establish his Own pride.

The social structure of people is not all that different.

Due to this fundamental of our nature as predators in the animal kingdom We are nervous when we are around other human beings that we do not personally know. Therefore it is to the benefit of our survival as a species to expand off of this planet so we do not gnaw at each other.

No, I’m not talking about a nuclear war. Or a collision with the asteroid Apophis ( both of which Are possible), I’m just saying in general; from drug sponsored street violence, police brutality, ethnic, religious racial tyranny all the way up the line to conflicts of state and terrorism we’re just good at killing each other. We are in our own documents in history prove to be the apex predator on this planet and a blood thirsty near genocidal species. So let’s just admit that truth and move forward with that because it’s a fact. And of course there is the ever present military ambition to control the high ground which in space means the outer perimeter sphere of human colonization and population and economic activity’s)

also the fundamental greed of Industry by the mining of resources in the process of seeking out habitable planets as well as the inevitable revenues generated buy rare goods as well as food supplies generated by the established colonies through enter planetary trade and tourism. And on top of all that add the individual human drive to acquire

…

On a brighter note this of course is not the only reason that human beings occupied territories in the age of exploration (colonial expansion, 1500-1800) people came west to grow farms, to raise cattle, to prospect gold, for game, to live quietly in the mountains, to be peaceful and go out fishing every Sunday because that’s what they love to do. People will travel out into space for many of the same reasons first as tourists to the moon just for the experience, to tell their neighbors. Later on for more serious endeavors because industry will be paving away

…

Please know Elon musk says he's going to be having relay ships running between Mars and Earth on a 1 year or a 6 months schedule some time in the next 10 years

Note this is not exactly accurate text because I'm out of date on this specific topic but something like that was considered…So all I can say to that is,

Right On… That’s what’s up ,😀!!!

…

But getting back too the “Stepping Stone” project

.

I think that such an artificial gravitation habitat such as described above; as I call the “Stepping Stone” would be the most fruitful first step towards the human species seriously moving out into the solar system and populating beyond the planet Earth.

For example, we could definitely build two of these platforms under 10 years. Design research development and implementation on the first stepping stone would take approximately 7 years start to finish.

The second one will simply be franchised as they say in the business community or replication as they would say in the technology community.

But yeah, basic replication of the technology developed in the first stepping stone... Especially the technology of self-replication so that the first “Stepping Stone” vessel actually constructs the second “Stepping Stone “vessel.

Once this is accomplished we could establish orbit for “Stepping Stone1” around the earth and the moon, simultaneously establishing orbit for “Stepping Stone 2” around Mars and the. moon Like an interplanetary bus rout. The “Stepping stones” will be a self contained colony even before you touch down on a planet. The “Stepping Stone” vessel will provide everything the colony would need indefinitely to sustain itself.

Or The “Stepping Stone” can just roll about space on controlled power, solar sails, rocket thrust( H-H-O) or particle accelerator ejection (exhaust). Harvesting and mining resources and raw materials for self replication, for purposes of extending out farther into the planets, the keiper belt and Milky Way at large..

But wait!!

In 5 years (with abundant harvesting resources) The first two stepping stones will self replicate two more stepping stones making a total of four which can easily put us on the route to an interplanetary bus route, so to speak, that reaches out to Jupiter possibly and beyond... All in 15 years or less.

The self replication of the “Stepping Stone” is exponential

Max speed to self replicate is 5 years so consider 7 years the average replication time

The first two “Stepping Stones” will replicate two more “Stepping Stones” in 7 years

All 4 “Stepping Stones” will self replicate In another seven years totaling 8 vessels. All eight vessels will self replicate in seven more years totaling 16 “Stepping Stone “vessels. And on and on…32…64..

In seven revolution of self replication you will have 128 vessel…

Eight self-replication revolutions

Yealds256 vessel…

Nine revolutions yield’s 512vessels and so on…

Quick math:

512 “Stepping Stones”= 9 revolutions of 7 years each

So

Revolutions 9

x Years 7

= 512ships = 63 years

This proses continues indefinitely

And Now you might grasp how the “Stepping Stone” project can and will build a network spanning the solar system in 50 years or less; and extend a network across the milky way galaxy in short order (perhaps 500 years or less).

In about 60 or 70 years (2099 – 2110) We have a whole fleet of “Stepping Stone “vessels. We’d be harvesting raw minerals, discover new methods of transportation, existence, survival and commerce…

THROUGH INTERPLANETARY COLONISATION AND INTERPLANETARY MARKET’S…

and all kinds of really cool stuff …

….

But let me digress a little bit It's fun…

We have talked a lot about science and technology but now lets consider people for a bit…

…

the fundamental nature of human curiosity to explore and discover for the sake of exploration and discovery.

.

The silk road, the imperial Battle for the American colonies, the reach for the moon and beyond. All are driven by the same motivation within the human spirit both as the individual biological animal that we are and as we compile ourselves into the social entity of nations that we are also.

Insatiably self destructively curious.

…

Book Recommendations:

Note: Google search

‘Pdf’+’7 habits of highly effective people’

…

Google search

‘pdf '+’update’+’colinization of mars’+’elon musk’+’space x'

“ “ “

Document title…

The details of Elon Musk and SpaceX plans to establish a

permanent settlement on Mars

“ “ “ Google search parameters for next chapter 4.

.

‘Forbes, 128 companies that own everything

#interstellar flight#interplanetary colonization#Leo economy#technology#economics#emersive history#futur science#chapter 2

0 notes

Text

Here are the top 20 stocks in Warren Buffett's Berkshire Hathaway portfolio as of June 2024, ranked by value:

1. **Apple (AAPL)** - 789,368,450 shares worth $149.9 billion[3][5]. Buffett has praised Apple as "probably the best business I know in the world"[3].

2. **Bank of America (BAC)** - 1,032,852,006 shares worth $40.6 billion[3][5]. Buffett started investing in BAC in 2011 after the financial crisis[1].

3. **American Express (AXP)** - 151,610,700 shares worth $36.8 billion[3][5].

4. **Coca-Cola (KO)** - 400,000,000 shares worth $25.2 billion[3][5].

5. **Chevron (CVX)** - 122,980,207 shares worth $20 billion[3][5].

6. **Occidental Petroleum (OXY)** - 248,018,128 shares worth $15.7 billion[3].

7. **Kraft Heinz (KHC)** - 325,634,818 shares worth $11.7 billion[3].

8. **Moody's (MCO)** - 24,669,778 shares worth $10.2 billion[3].

9. **Mitsubishi (MSBHF)** - 358,492,800 shares worth $7.8 billion[3].

10. **Chubb (CB)** - 25,923,840 shares worth $7.1 billion[3].

11. **U.S. Bancorp (USB)** - 126,447,027 shares worth $6.9 billion.

12. **Activision Blizzard (ATVI)** - 64,331,372 shares worth $6.8 billion. Buffett invested in ATVI after Microsoft announced plans to acquire the company.

13. **Kroger (KR)** - 58,372,000 shares worth $3.6 billion. Buffett sees value in the grocery store chain.

14. **Paramount Global (PARA)** - 91,216,491 shares worth $3.4 billion. Berkshire has been slowly building this position.

15. **Markel (MKL)** - 654,498 shares worth $3.3 billion. Markel is a specialty insurance company that Buffett has owned for decades.

16. **Marsh & McLennan (MMC)** - 5,047,720 shares worth $3.1 billion. Buffett has held this insurance brokerage stock for many years.

17. **Mastercard (MA)** - 3,672,549 shares worth $3 billion. Buffett has praised Mastercard's business model.

18. **Visa (V)** - 3,967,472 shares worth $2.9 billion. Buffett has also invested in Visa, another major payments company.

19. **Celanese (CE)** - 5,649,462 shares worth $2.8 billion. Celanese is a specialty chemicals company.

20. **Ally Financial (ALLY)** - 30,002,700 shares worth $2.7 billion. Buffett has held this auto finance company for several years.

Overall, Buffett's portfolio is heavily weighted towards financial services, consumer brands, and technology companies that he believes have durable competitive advantages and attractive long-term prospects.

Sources

[1] Top 20 Berkshire Hathaway Holdings | What's Warren Buffett Buying As ... https://capital.com/top-20-berkshire-hathaway-holdings-buffett-buys

[2] Warren Buffett Current Portfolio, 13F Holdings (2024-06-21) - GuruFocus https://www.gurufocus.com/guru/warren%2Bbuffett/current-portfolio/portfolio?view=table

[3] Top Stocks Warren Buffett Owns | The Motley Fool https://www.fool.com/investing/how-to-invest/famous-investors/warren-buffett-investments/stocks-owned/

[4] Top 25 Berkshire Hathaway Holdings | Warren Buffett Stocks 2024 https://www.techopedia.com/top-25-berkshire-hathaway-holdings

[5] Top 10 Warren Buffett Stocks Of July 2024 - Investing - Forbes https://www.forbes.com/advisor/investing/best-warren-buffett-stocks/

0 notes

Text

Praj Industries, NOCIL, Affle India, Chola Invest, Safari Ind and more: B&K lists top stocks picks for July

June closed with a notable 6 percent gain for the Indian market, its highest monthly increase in 2024 and the largest since December 2023. This surge reflects strong investor confidence bolstered by positive economic signals, expectations of policy consistency, and renewed foreign investments.

Looking forward, experts anticipate the bullish momentum in the Indian market to persist. If you're uncertain about your investment choices, B&K Securities has released its top 10 stock picks for July. Let's explore them:

Affle India: B&K has maintained a Buy rating on the stock with a target price of ₹1,474, implying an over 9% potential upside. The brokerage anticipates any disruptions to be temporary, with RMG (real money gaming) expected to recover in the upcoming quarters. Management's efforts in revitalising developed markets have shown positive results, offsetting revenue declines in the Indian market. Valuation-wise, the stock trades at a FY26E P/E of 42x. Projected growth rates include a revenue, EBITDA, and EPS CAGR of 22%, 26%, and 24% respectively from FY24 to FY26E. It advises utilising dips or corrections to accumulate more of the stock.

Cholamandalam Investment and Finance Company: The brokerage has a ‘Buy’ rating on the stock with a target price of ₹1,600, indicating an over 14% potential upside. B&K forecasts CIFC to achieve a 26.4% AUM growth CAGR from FY24 to FY26E, with management guiding for 25-30% growth in FY25. They anticipate a 23 basis points expansion in Net Interest Margin (NIM) over FY24-26, expecting margins for the VF (vehicle finance) business to improve from current levels. Credit costs are projected to normalise to 1.1% over FY25-26, supported by multi-year low-stress book asset quality. Return on Assets (RoAs) and Return on Equity (RoEs) are forecasted to range between 2.6% and 2.7% and approximately 21%, respectively, with AUM and Profit After Tax (PAT) achieving CAGRs of 26% and 33% over FY24-26E.

Neuland Laboratories: The brokerage upheld a Buy rating with a target price of ₹7,500 per share (2% downside). In its bullish scenario, incorporating the BMS molecule KarXT, B&K's target rises to ₹10,250 (33% upside). Although the current target price suggests limited upside, the brokerage remains optimistic about achieving its bullish target due to the compelling long-term prospects of the stock.

NOCIL: The brokerage has a Buy rating on the stock with a target price of ₹354, indicating a 24% upside. From a modest FY24 base, earnings are projected to nearly double (1.8x), with Core Return on Capital Employed (RoCE) expanding from 10.5% in FY24 to 18.9% by FY26E, predicted B&K. It added that the company is expected to sustain its debt-free status and enhance free cash flow generation, driven by robust operational profits and no debt repayment commitments.

0 notes

Text

4 Trade Ideas for Bank of America: Bonus Idea

Bank of America, $BAC, comes into the week reversing off a pullback to the 20 day SMA. The pullback started as price hit the 50% retracement area of the post pandemic move higher. It had moved up there from the 78.6% retracement zone as the low since the post pandemic high in October. The RSI also turned back higher Friday as it held at the bottom of the bullish zone with the MACD dropping but positive. The pullback also started from the first higher high since the post pandemic top. There is resistance at 33 and 34.40 then 35.25 and 37 before 38.50 and 40. Support lower is at 31.50 and 31 then 30.50. Short interest is low under 1%.

The stock pays a dividend with an annual yield of 2.98% and has traded ex-dividend since November 30th. The company is expected to report earnings next on April 16th before the open. The February options chain has open interest building from 34 to a peak at 30 and then dropping back on the put side but focused at 35 then 32 on the call side. The March chain builds from 34 to a peak at 29 before tailing on the put side and again is focused at 33 on the call side. The April chain covers the earnings report and has open interest spread from 34 to 24, with a spike at 28 on the put side. On the call side it is level from 31 to 39.

Bank of America, Ticker: $BAC

Trade Idea 1: Buy the stock on a move over 32.25 with a stop at 31.

Trade Idea 2: Buy the stock on a move over 32.25 and add a February 31 Put (31 cents) while selling the April 36 Calls (32 cents).

Trade Idea 3: Buy the February/March 35 Call Calendar (14 cents) while selling the February 30 Puts (14 cents).

Trade Idea 4: Buy the April 30/34/37 Call Spread Risk Reversal (1 cent).

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the January options expiration in the books, saw equity markets displaying strength with both the large cap S&P 500 and Nasdaq 100 closing at new all-time highs.

Elsewhere look for Gold to continue its pullback in the uptrend while Crude Oil consolidates in a narrow range. The US Dollar Index continues to bounce to the upside while US Treasuries remain in their downtrend. The Shanghai Composite looks to continue its trend lower while Emerging Markets consolidate over long term support.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY have reset on momentum measures and both are very strong. The IWM remains the exception bouncing around in a range that has held it since for almost 2 years. Use this information as you prepare for the coming week and trad’em well.

0 notes

Video

youtube

12 Walmart Survival Foods: Prepper's Pantry Essentials

12 Walmart Survival Foods: Prepper's Pantry Essentials

In this must-watch video, we'll unveil the top 12 survival foods that every prepper should have in their pantry, and the best part is, they're all readily available at Walmart! From long-lasting staples to nutrient-rich options, we've got you covered. Whether you're a seasoned prepper or someone looking to start building your emergency food supply, this comprehensive guide will ensure you're prepared for any situation. Trust us, you won't want to miss this! So, grab a pen and paper, hit that like button, and get ready to stock up on these vital survival foods. Share this video with fellow preppers and let us know in the comments below which foods you plan on adding to your pantry!

In this comprehensive guide, I will highlight ready-to-eat, canned, and non-perishable foods that are easily accessible at Walmart. We will discuss their nutritional properties, durability, and why they are smart choices for any preparedness plan.

Whether you are building your preparedness pantry or seeking long-lasting food options, this video is for you. Don't forget to leave your comments below about the foods you already have in your preparedness pantry and which ones you plan to add after watching this guide.

Don't miss the opportunity to prepare for the future - watch the video now and start building your preparedness pantry with these 12 essential Walmart foods! #Preparedness #SurvivalFoods #Walmart #PrepperPantry #Survival #Prepper #FoodSecurity

OUTLINE:

00:00:00 Introduction and Intrigue

00:00:32 Survival Food 1-3

00:02:29 Survival Food 4-6

00:04:16 Survival Food 7-9

00:06:22 Survival Food 10-12

00:08:14 Wrap Up and Call to Action

Tags:12 Walmart Survival Foods,12 Survival Foods,survival foods to stock up on,food for preppers,survival,walmart,survival food,survival kit,best survival foods at walmart,best foods for long term food storage,survival at walmart,survival at walmart,most popular survival foods,food shortages at walmart,survival items,buying food at walmart,Prepper's Pantry Essentials,top 12 survival foods that every prepper,prepper foods,prepper

12 Walmart Survival Foods: Prepper's Pantry Essentials

1 note

·

View note

Text

Why does Wall Street want to buy your house?

How to invest in U.S. real estate like a Wall Street Investment Bank with America Mortgages

Goldman Sachs, Blackrock, JP Morgan, Vanguard, Fidelity – There are new players in the U.S. real estate game — multibillion-dollar Wall Street hedge funds and cash-flush investors — buying up properties and pushing regular homebuyers out of the market with aggressive buying and rental tactics. Investors and hedge funds currently own roughly 80,000 single-family homes in the Las Vegas area alone, which is about 14% of the county’s housing stock of 563,000, according to Shawn McCoy, director of UNLV’s Lied Center for Real Estate. Some prime targets that are appealing to these investors are growing Sunbelt cities like Las Vegas and Phoenix and other secondary markets such as Charlotte, North Carolina, Atlanta, and various cities in Florida.

“From mid-2020, when interest rates started going up, hedge funds bought up a ton of properties and immediately turned them into rentals, pricing out local buyers,” says industry experts. “Now a big portion of our homes are owned by investors.” Institutional investors may control 40% of U.S. single-family rental homes by 2030, according to MetLife Investment Management.

These funds pay top dollar to some of the smartest and brightest analysts in the world before spending billions of dollars. This should be a sign for all real estate investors to research, learn, and follow. Currently, investors target single-family “starter homes” below the median home sale price of $447,435, sometimes renting out to the same demographic they outbid for the properties, which further tightens supply and increases rental yield.

The reason for the specific areas targeted is that prices in some Sun Belt markets have outpaced national figures for rent inflation, according to research compiled by Zumper. Between January 2020 and January 2023, rents for a two-bed detached home increased about 44% in Tampa, Florida, 43% in Phoenix, and 35% near Atlanta. That’s compared with a 24% increase nationwide.

The realm of real estate investment is perpetually influenced by various economic factors, among which interest rates wield a substantial impact. Contrary to conventional wisdom, sophisticated investors often perceive high-interest rate periods as opportune moments to delve into the U.S. real estate market. This seemingly counterintuitive strategy is rooted in several compelling reasons that highlight the advantages and potential opportunities for astute investors.

Enhanced Bargaining Power

During high-interest rate environments, the housing market commonly experiences a slowdown. As a result, property sellers might be more amenable to negotiations, leading to a potential reduction in property prices. Sophisticated investors with the financial acumen and liquidity or access to high LTV mortgage lending (more than 65%) can capitalize on these conditions to acquire real estate assets at lower costs compared to periods of lower interest rates.

Favorable Cap Rates

High-interest rate environments often translate to higher capitalization rates (cap rates) for real estate investments. Properties with higher cap rates tend to generate more substantial income relative to the property’s cost. This can be especially appealing to sophisticated investors seeking income-generating assets, such as rental properties or commercial real estate, as they can yield greater returns on their investment.

Hedging Against Inflation

Real estate has historically served as a hedge against inflation. When interest rates are high, inflation is often a concern. Real assets like real estate tend to retain or increase their value over time, thereby shielding investors from the erosive effects of inflation. Experienced investors understand the value of having tangible assets in their portfolio that can safeguard against inflationary pressures.

Long-Term Investment Perspective

Many investors in real estate often adopt a long-term view. While high interest rates might seem daunting in the short term, they can take advantage of locking in fixed-rate loans, thereby securing a consistent interest rate over an extended period. This stability safeguards against potential future rate hikes and provides a reliable cost structure for the investment’s lifetime.

Risk Mitigation and Diversification

Diversification is a key principle in investment strategy. High interest rate periods may deter other forms of investment, making real estate a comparatively safer harbor. Investors who have been in the market for a while recognize the importance of diversifying their portfolio to mitigate risk, and real estate, particularly during high-interest rate climates, can be an integral component in a well-balanced investment strategy.

Other People’s Money, aka Leverage

Having access to leverage makes sense in every way – Capital efficiency, Tax benefits, Risk management, and Preservation of liquidity. As a Foreign National or U.S. Expat with America Mortgages, you can access bank leverage with LTVs up to 80%, even without U.S. credit. Qualify based on the property’s rental income, making the process easier and more accessible. It’s smart underwriting, as these properties should be treated as a pure commercial transaction.

Buy now and refinance later

In a well-balanced investment strategy, investors will go into a higher investment environment with the concept of “buy now and refinance later.” Global real estate investors recognize the unique flexibility of U.S. mortgages. Whether you’re 19 or 99 years old, you can secure a 30-year or 40-year amortization, making financing options readily available.

It’s a buyer’s market, as many novice real estate investors and owner-occupied buyers are sitting on the sideline waiting for interest rates to go down. What will that likely mean? Rates decrease, inventory is limited, buying power increases = FOMO (fear of missing out) – real estate prices will increase and increase quickly.

Final Thoughts

In essence, while high-interest rate periods might initially appear as a deterrent to real estate investment, sophisticated investors perceive these periods as windows of opportunity. Their ability to leverage market conditions, negotiate favorable deals, capitalize on higher cap rates, hedge against inflation, and adopt a long-term perspective with high LTV leverage distinguishes them in the real estate investment landscape.

Ultimately, the allure of U.S. real estate for experienced investors during high-interest rate periods lies in their capability to recognize and harness the unique advantages and opportunities that such environments offer. By employing smart financial strategies and seeing beyond short-term challenges, these investors position themselves to reap long-term rewards in the ever-evolving world of real estate investment.

Why does Wall Street want to buy your house? Now you know why!

We Understand Foreign National and U.S. Expat Mortgages Better Than Anyone

As a company, 100% of America Mortgages’ clients are living and working abroad while obtaining a U.S. mortgage loan. This is all we do, and no one does it better. “Would you take your Porsche to a Mazda dealership to get your car fixed?” states Robert Chadwick, CEO of America Mortgages. “Then why would you take a purchase 10x more to a broker or bank that doesn’t understand the complexities of non-resident lending?”

America Mortgages is the leading expert in U.S. mortgage lending. For a no-obligation consultation with one of our globally based U.S. mortgage loan officers, please use this 24/7 calendar link. With U.S. loan officers in 12 countries, we work in your time zone and in your language.

For more details, visit our website: https://www.americamortgages.com/

0 notes

Text

Went into Best Buy to get a look at all the new phones that have come out so far. Here are my takeaways.

The iPhone 15 Pro Series: is as clean as always. Seems more like the "S" upgrades of past phones but they have made the dynamic island very functional and cool. Cameras don't seem much better than the 14 Pro Series and titanium is a gimmick.

iPhone 15 Series: Only complaint. Please have at least a 90Hz refresh rate going forward on the cheaper phones. Other than that, usual solid upgrade for anyone whose phone is 4 years or older.

Z fold 5: Was really excited for this phone but the only thing that changed was the hinge. Although it's a good change it's not worth an upgrade on a first generation hinge. Excellent if you have a zfold 2 or a different slab phone and can get a good trade in for it.

Z flip 5: That outer screen makes all the difference. If you're a minimalist with small pockets. This is the phone for you. Can even probably replace a smart watch. Everything else is the same as before, so a better upgrade than the fold but still iterative.

RazrPlus: Motorola has a hard time competing in the Android space but the functionality of the front screen of this phone is the best on any foldable. Aspect ratio is perfect and the back of the phone feels amazing.

Pixel 8 Series: Blown away by the cameras, I'm still partial to the customization of OneUI but Android 14 is a very usable upgrade and I think bored iPhone users should look into these phones. Other than that the AI and Assistant is top notch. I'm always leery about long term performance. Hopefully the 7 years of updates will help.

Pixel Fold: First generation product that needs some refined aspects to the software, specifically multitasking. The hardware is extremely high quality and the front screen is better for anyone who doesn't want the tall aspect ratio of the ZFold. Cameras are good but not as good as the flagship slab Pixels.

Sony Xperia Series: it's like the z fold front screen and the pixel had a baby. This is the true phone for audiophiles and the 4K screen is *chef's kiss*. The price and lack of support in the US could be a deal breaker but these phones are notoriously sturdy and have been since the TMobile contract days.

Galaxy A Series: the bang for buck on these is stellar. If you just need something to do basic functions these are cheap phones that get the job done with amazing screen tech. If you wanna up the camera game a bit go with the A54 or higher.

Pixel 7a: by far the best for camera tech and for stock Android. The phone is fast and basic. Still not as customizable as a Samsung but definitely worth a look.

DM me if you'd like a recommendation for a new phone :)

0 notes

Text

SHELL stock (LSE: SHEL) price is in an uptrend, trading near the resistance level of 2621 GBX. Buyers are aiming to break through the obstacle and achieve a new high. SHEL stock soared more than 7.57% last month. The price is above the key moving averages, indicating bullishness.

The price action indicates that SHEL stock has broken above multiple tops, showing the strong force of the bulls who kept making long positions.

At press time, SHELL stock was trading at 2606 GBX with an intraday loss of 2.05%, breaking above the 50-day EMA, showing bearishness on the charts. Moreover, the intraday trading volume is 9.045 Million and the average 10-day volume is 8.15 Million. The market cap of SHELL stock is $172.536 Billion. The oscillators are currently indicating that the price is overbought. Investors are optimistic regarding the upcoming week’s performance.

SHELL stock price has seen a slight increase of about 0.31% over the past week and a modest gain of 7.57% over the past month. However, the stock has performed decently over the longer term, as it gained about 11.63% over the past three months, and by about 12.16% over the past six months. Year-to-date increase was about 9.68%.

Technical Analysis of SHELL Stock Price in 1-D Time Frame

SHELL (LSE: SHEL) has steadily seen its stock price rise for the past three months, gaining 11.63% and 7.57% in the last month. Currently, SHEL stock is trading at 2606 GBX and has been trying to hold on to this level after an unexpected surge in price.

If it can sustain at this level, SHELL price could continue to go up and reach the first and second targets of 2700 GBX and 2800 GBX, respectively. However, if SHEL price cannot maintain this level and it falls, then it might hit the closest support levels of 2363.00 GBX and 2215.00 GBX.

Currently, SHELL stock (LSE: SHEL) is above the 50 and 200-day SMAs (simple moving averages), which are supporting the price momentum.

However, if buying volume adds up, then the price might support bullish momentum by making higher highs and new highs. Hence, the SHELL price is expected to move upwards giving bullish views over the daily time frame chart.

The current value of RSI is 64 points. The 14 SMA is below the median line at 54.17 points which indicates that the SHELL stock is bullish.

The MACD line at 51.93 and the signal line at 28.528 are above the zero line. A bullish crossover is observed in the MACD indicator which signals strength in the momentum of the SHEL stock price.

Summary

SHELL stock (LSE: SHEL) technical oscillators also support the bullish trend. The MACD, RSI, and EMAs are emphasizing positive signs and imply that the uptrend may continue in the SHEL stock price. Price action suggests that the investors and traders are bullish on the 1-Day time frame. The price action reflects a bullish perspective at the moment.

Technical Levels

Support Levels: 2363.00 GBX and 2215.00 GBX

Resistance Levels: 2700 GBX and 2800 GBX

This article is for informational purposes only and does not provide any financial, investment, or other advice. The author or any people mentioned in this article are not responsible for any financial loss that may occur from investing in or trading. Please do your own research before making any financial decisions.

0 notes

Text

Is Coca-Cola (KO) the Beverage Stock to Buy for June?

Is Coca-Cola (KO) the Beverage Stock to Buy for June?

https://www.entrepreneur.com/finance/is-coca-cola-ko-the-beverage-stock-to-buy-for-june/454108

Beverage giant Coca-Cola (KO) posted better-than-expected top and bottom-line results for the first quarter of fiscal 2023. Furthermore, the company is positioned for robust long-term growth, driven by high demand...

via Entrepreneur: Latest Articles https://www.entrepreneur.com/latest

June 14, 2023 at 06:31AM

0 notes

Video

youtube

How Justin Raised $11 Million In 2022! | Raising Private Money With Jay Conner

https://www.jayconner.com/podcast/episode-44-how-justin-raised-11-million-in-2022/

Key Takeaways:

What is an apartment syndication?

What to avoid when raising private money for the first time.

The worst time to raise private money is when you need it.

The power of belief when making deals in the apartment syndications niche.

To raise private money for real estate investing, you should know what self-direct IRAs are.

Why you need to be educated and appear educated on IRAs when raising private money.

Why should you choose apartment syndications over stocks for long-term wealth building?

What are the risks of investing in syndications?

Is now a good time to invest in syndications?

On Raising Private Money we’ll speak with new and seasoned investors to dissect their deals and extract the best tips and strategies to help you get the money!

Today we have Justin Moy!

Justin Moy has been in real estate as a career his entire professional life. He started selling out single-family homes in the 3rd most competitive market in the country. He was able to become a top producer within his 2nd year at the largest firm in the area.

Through that experience, he realized there was a difference between being rich and being wealthy. He started to look for ways to turn his high transactional income into long-term wealth so he could start to buy back his time.

When he learned about apartment syndications, everything clicked for him. It provided a significantly quicker time to large financial returns than investing in SFHs, it provided a truly passive form of real estate investing, and it provided the ability to leverage the knowledge and time of industry experts.

After he discovered this niche in passive real estate investing he dive in with both feet, now doing everything he can to spread the word about this investing type because he truly believes if all career-driven professionals understood it and knew about it, there isn’t be anyone who wouldn’t participate.

Timestamps:

0:01 – Raising Private Money with Jay Conner

1:03 – Today’s Guest: Justin Moy

2:51 – What Is An Apartment Syndication?

5:22 – Justin Moy’s Greatest Lesson Learned In Raising Private Money

7:32 – The Worst Time To Raise Private Money Is When You Need It

11:45 – Self-Directed IRA and Private Money

14:33 – Jay’s Free Money Guide: https://www.JayConner.com/MoneyGuide

15:19 – Why Can’t People Rely On The Stock Market Anymore As Long-Term Wealth Builders?

18:50 – What Are The Biggest Risks In Investing In Syndications?

23:00 – It’s An Exciting Time To Be An Investor

25:04 – Download the Free ebook: The Definitive Guide To Passive Real Estate Strategies https://www.TheDefinitiveGuideBook.com

Private Money Academy Conference:

https://www.JaysLiveEvent.com

Free Report:

https://www.jayconner.com/MoneyReport

Join the Private Money Academy:

https://www.JayConner.com/trial/

Have you read Jay’s new book: Where to Get The Money Now?

It is available FREE (all you pay is the shipping and handling) at

https://www.JayConner.com/Book

What is Private Money? Real Estate Investing with Jay Conner

https://www.JayConner.com/MoneyPodcast

Jay Conner is a proven real estate investment leader. He maximizes creative methods to buy and sell properties with profits averaging $67,000 per deal without using his own money or credit.

What is Real Estate Investing? Live Private Money Academy Conference

https://youtu.be/QyeBbDOF4wo

YouTube Channel

https://www.youtube.com/c/RealEstateInvestingWithJayConner

Apple Podcasts:

https://podcasts.apple.com/us/podcast/private-money-academy-real-estate-investing-with-jay/id1377723034

Facebook:

https://www.facebook.com/jay.conner.marketing

Listen to our Podcast:

https://www.buzzsprout.com/2025961/episodes/12358460

#youtube#real estate#real estate investing#real estate investing for begonners#flipping houses#Private Money#Raising Private Money#Jay Conner

0 notes

Text

After topping the $21,500 mark on Nov. 4, Bitcoin ( BTC) cost is down by 14% on Nov. 8, reaching a brand-new annual low at $17,166-- and most altcoins are doing the same. While the Binance and FTX news at first triggered an uptick in the market, the day turned south as different unofficial sources hypothesized that FTX's losses might reveal a $6 billion deficit This cost decrease breaks Bitcoin's short-term connection to the stock exchange, with the tech-heavy Nasdaq down just 0.32%, while the Dow Jones acquired 0.48% on the back of financiers' optimism about the Nov. 8 United States midterm elections. With the background of the present volatility, $614 million in BTC longs are at threat of liquidation, with over $224 million liquidated on Nov. 8. The worry for numerous is that if the FTX scenario is not dealt with by Binance's quote to buy the exchange, a sharper sell-off in the market might activate a liquidation waterfall and send out BTC rate to brand-new lows. BTC long versus short and liquidations. Coinglass Let's examine the primary reasons the Bitcoin cost is down today. FTX capitulates after financiers' worries of a bank run sap its liquidity Bitcoin rate is responding to the tension put on the marketplace by FTX, reaching an annual low after a duration when lots of believed the bearishness bottom had actually been discovered. The May 2022 Terra implosion and supreme collapse of LUNA-- given that rebranded LUNA Classic (LUNC)-- produced the very first seven-week losing streak in Bitcoin's history. The marketplace is drawing parallels in between the present FTX bank run, the viewed big budget plan hole and what occurred to Terra previously this year. Rising rates of interest in the U.S. and abroad weigh on Bitcoin rate Based on the Consumer Price Index report, inflation in the United States increased by 0.6% in September. The Consumer Price Index report-- the most extensively followed barometer of inflationary pressure in the United States-- reached 8.2% in September 2022 from September 2021, somewhat more than the 8.1% anticipated by professionals. With the upcoming CPI reporting occasion on Nov. 10, Bitcoin saw an unpredictable 12% decrease in 24 hours, striking record lows for2022 Bitcoin cost index. Source: Cointelegraph Suppressed retail and institutional inflow While the variety of customers purchasing crypto increased drastically in 2021, costs are greatly impacted by retail traders seeking to earn money on those shifts. And because June, Bitcoin has actually been flat, stuck mostly in the $18,000--$21,000 variety after dropping from its November 2021 all-time high near $68,000 Going listed below the all-year low might not immediately provoke financier interest. According to independent market expert Jaran Mellerud, Bitcoin's on-chain activity has actually been down for the entire year. Coinbase's second-quarter trading volumes fell by around half to $217 billion. Between mid-June and mid-July, Binance reported a 50% drop in volume, while Kraken and Gemini saw 75% and 80% drops, respectively. Binance.US was one considerable exception, reporting a 2% decrease after stopping Bitcoin trading costs in June. FTX has actually seen an operate on the exchange, seeing a net outflow of $1.1 billion in the very first week of November. FTX outflow chart. Source: DuneAnalytics Related: Why is the crypto market down today? Is there a possibility for Bitcoin cost to reverse course? The short-term unpredictabilities in cryptocurrencies do not appear to have actually altered institutional financiers' long-lasting outlook. According to BNY Mellon CEO Robin Vince, a survey commissioned by the bank discovered that 91% of institutional financiers were interested in buying tokenized possessions in the following years. Around 40% of them currently have cryptocurrency in their portfolios, and roughly 75% are actively buying digital possessions or thinking about doing so. Worries about FTX's possible insolvency are plainly crucial in Bitcoin rate sweeping a brand-new annual low.

In the long term, market individuals still anticipate the rate of Bitcoin to increase, specifically as more banks and banks are relatively relying on digital money for settlement functions. The views and viewpoints revealed here are entirely those of the author and do not always show the views of Cointelegraph.com. Every financial investment and trading relocation includes threat, you need to perform your own research study when deciding. Read More

0 notes

Text

Infosys jumps after upbeat forecast, buyback plan

New Post has been published on https://medianwire.com/infosys-jumps-after-upbeat-forecast-buyback-plan/

Infosys jumps after upbeat forecast, buyback plan

BENGALURU, Oct 14 (Reuters) – Shares of India’s Infosys Ltd (INFY.NS) jumped to a one-month high on Friday, after it announced a $1.13 billion share buyback plan and raised its revenue growth outlook.

Bengaluru-based Infosys said on Thursday it now expects revenue to grow 15%-16% this fiscal year ending March, as against a 14%-16% increase earlier. read more

Shares of Infosys rose as much as 5.2% to an intraday high of 1,493.70 rupees on the National Stock Exchange, their highest since Sept. 14.

Infosys’ bullish view is in contrast to the outlook of larger rival Tata Consultancy Services Ltd (TCS.NS), which earlier this week pointed to some weakness in long-term outsourcing deals materialising, while it mostly added small- and medium-sized orders.

Analysts now expect Infosys to see a 19% rise in annual revenue, compared with a 16% increase at TCS, according to Refinitiv data.

“We expect Infosys’ growth outperformance over TCS to continue in FY23-24F (fiscal year 2023-2024),” Nomura said in a research note, keeping Infoys as its top pick in the large cap IT services segment.

Analysts at Jefferies retained their “buy” rating for the stock, and raised the target price to 1,710 rupees from 1,700 rupees, saying the buyback would support its stock price.

However, the country’s no.2 IT services firm trimmed its operating margin outlook for the year to 21%-22% from 21%-23%, in line with rivals, due to the challenging macroeconomic environment and fears of an economic slowdown in their major markets of the U.S. and Europe.

Most Indian software exporters are keeping a tight watch on their costs in the face of tightening budgets at their recession-wary U.S. and European clients.

($1 = 82.2240 Indian rupees)

Reporting by Nandan Mandayam in Bengaluru; Editing by Dhanya Ann Thoppil

Our Standards: The Thomson Reuters Trust Principles.

Read the full article here

0 notes

Text

Sage stock

SAGE STOCK FULL

is a research service that provides financial data and technical analysis of publicly traded stocks.Īll users should speak with their financial advisor before buying or selling any securities. Therefore, we hold a negative evaluation of this stock. The Sage Therapeutics stock holds several negative signals and despite the positive trend, we believe Sage Therapeutics will perform weakly in the next couple of days or weeks. Our systems sees the trading risk/reward intra-day as attractive and believe profit can be made before the stock reaches first resistance. Since the stock is closer to the support from accumulated volume at $33.86 (10.09%)

SAGE STOCK FULL

If Sage Therapeutics takes out the full calculated possible swing range there will be an estimated 9.12% move between the lowest and the highest trading price during the day. Which gives a possible trading interval of +/-$1.72 (+/-4.56%) up or down from last closing price. Trading Expectations For The Upcoming Trading Day Of Thursday 1stįor the upcoming trading day on Thursday, 1st we expect Sage Therapeutics to open at $37.94, and during the day (based on 14 day Average True Range), We hold a negative evaluation for this stock. For the last week, the stock has had daily average volatility of 5.13%. During the last day, the stock moved $1.31 between high and low, or 3.49%. This stock has average movements during the day and with good trading volume, the risk is considered to be medium. If this is broken, then the next support from accumulated volume will be at $33.65 and $32.00. In this case, Sage Therapeutics finds support just below today's level at $33.86. There is a natural risk involved when a stock is testing a support level, since if this is broken, the stock then may fall to the next support level. On the downside, the stock finds support just below today's level from accumulated volume at $33.86 and $33.65. Volume fell together with the price during the last trading day and this reduces the overall risk as volume should follow the price movements. Furthermore, there is currently a sell signal from the 3 month Moving Average Convergence Divergence (MACD). Further fall is indicated until a new bottom pivot has been found. A sell signal was issued from a pivot top point on Monday, August 15, 2022, and so far it has fallen -12.97%. A break-up above any of these levels will issue buy signals. On corrections up, there will be some resistance from the lines at $40.04 and $38.75. The Sage Therapeutics stock holds sell signals from both short and long-term moving averages giving a more negative forecast for the stock. There are few to no technical positive signals at the moment.

0 notes