#startups in India

Text

Investment Options in India: Diversify Your Portfolio in 2024

Diversification is a fundamental principle of investing, essential for managing risk and optimizing returns. In 2024, as investors navigate an ever-changing economic landscape, diversifying their portfolios becomes even more critical. India, with its vibrant economy, diverse markets, and growth potential, offers a plethora of investment options for both domestic and international investors. In this comprehensive guide, we explore various investment avenues in India in 2024, from traditional options like stocks and real estate to emerging opportunities in startups and alternative assets.

1. Equities: Investing in the Stock Market

Investing in equities remains one of the most popular ways to participate in India's economic growth story. The Indian stock market, represented by indices such as the Nifty 50 and Sensex, offers ample opportunities for investors to capitalize on the country's booming sectors and emerging companies.

- Blue-Chip Stocks: Invest in established companies with a proven track record of performance and stability.

- Mid and Small-Cap Stocks: Explore growth opportunities by investing in mid and small-cap companies with high growth potential.

- Sectoral Funds: Diversify your portfolio by investing in sector-specific mutual funds or exchange-traded funds (ETFs) targeting industries such as technology, healthcare, and finance.

2. Mutual Funds: Professional Fund Management

Mutual funds provide an excellent avenue for investors to access a diversified portfolio managed by professional fund managers. In India, mutual funds offer a range of options catering to different risk profiles and investment objectives.

- Equity Funds: Invest in a diversified portfolio of stocks, including large-cap, mid-cap, and small-cap companies.

- Debt Funds: Generate stable returns by investing in fixed-income securities such as government bonds, corporate bonds, and treasury bills.

- Hybrid Funds: Combine the benefits of equity and debt investments to achieve a balanced risk-return profile.

- Index Funds and ETFs: Track benchmark indices like the Nifty 50 and Sensex at a lower cost compared to actively managed funds.

3. Real Estate: Tangible Assets for Long-Term Growth

Real estate continues to be a popular investment option in India, offering the dual benefits of capital appreciation and rental income. While traditional residential and commercial properties remain attractive, investors can also explore alternative avenues such as real estate investment trusts (REITs) and real estate crowdfunding platforms.

- Residential Properties: Invest in apartments, villas, or plots of land in prime locations with high demand and potential for appreciation.

- Commercial Properties: Generate rental income by investing in office spaces, retail outlets, warehouses, and industrial properties.

- REITs: Gain exposure to a diversified portfolio of income-generating real estate assets without the hassle of direct ownership.

- Real Estate Crowdfunding: Participate in real estate projects through online platforms, pooling funds with other investors to access lucrative opportunities.

4. Startups and Venture Capital: Betting on Innovation and Entrepreneurship

India's startup ecosystem has witnessed exponential growth in recent years, fueled by a wave of innovation, entrepreneurial talent, and supportive government policies. Investing in startups and venture capital funds allows investors to participate in this dynamic ecosystem and potentially earn high returns.

- Angel Investing: Provide early-stage funding to promising startups in exchange for equity ownership, betting on their growth potential.

- Venture Capital Funds: Invest in professionally managed funds that provide capital to startups and emerging companies in exchange for equity stakes.

- Startup Accelerators and Incubators: Partner with organizations that support early-stage startups through mentorship, networking, and access to resources.

5. Alternative Assets: Diversification Beyond Traditional Investments

In addition to stocks, bonds, and real estate, investors can diversify their portfolios further by allocating capital to alternative assets. These assets offer unique risk-return profiles and can act as a hedge against market volatility.

- Gold and Precious Metals: Hedge against inflation and currency fluctuations by investing in physical gold, gold ETFs, or gold savings funds.

- Commodities: Gain exposure to commodities such as crude oil, natural gas, metals, and agricultural products through commodity futures and exchange-traded funds.

- Cryptocurrencies: Explore the emerging asset class of digital currencies like Bitcoin, Ethereum, and others, which offer the potential for high returns but come with higher volatility and risk.

Conclusion

Diversifying your investment portfolio is essential for mitigating risk, maximizing returns, and achieving long-term financial goals. In 2024, India offers a myriad of investment options across various asset classes, catering to the preferences and risk profiles of different investors.

Whether you prefer the stability of blue-chip stocks, the growth potential of startups, or the tangible assets of real estate, India provides ample opportunities to diversify your portfolio and capitalize on the country's economic growth story. By carefully assessing your investment objectives, risk tolerance, and time horizon, you can construct a well-diversified portfolio that withstands market fluctuations and delivers sustainable returns in the years to come.

This post was originally published on: Foxnangel

#best investment options in india#diversify portfolio#share market#stock market#indian stock market#mutual funds#real estate#startups in india#venture capital#foxnangel#invest in india

4 notes

·

View notes

Text

India is a hub for technology and innovation and the field of machine learning Solution Development in India — Microlent Systems

India is a hub for technology and innovation, and the field of machine learning is no exception. With a growing number of companies specializing in this field, it can be challenging to know which one to choose. In this article, we will discuss the best machine learning companies in India, with a special focus on Microlent Systems.

Microlent Systems: Microlent Systems is a software development company located in Jodhpur, Rajasthan, that specializes in machine learning. They offer a range of services, including data analysis, predictive modeling, and natural language processing. They have worked with clients across various industries, from healthcare to finance.

Fractal Analytics: Fractal Analytics is a data analytics company that specializes in machine learning. They offer a range of services, including data engineering, data visualization, and artificial intelligence. They have worked with clients such as Microsoft, Coca-Cola, and PepsiCo.

Wipro: Wipro is a global technology company that offers machine learning solutions, including predictive maintenance, fraud detection, and chatbot development. They have worked with clients across various industries, including banking, healthcare, and retail.

Analytics India Magazine: Analytics India Magazine is a media company that covers the latest trends and developments in the field of machine learning. They offer training programs, research reports, and industry events to help businesses stay up-to-date with the latest developments in machine learning.

Tiger Analytics: Tiger Analytics is a consulting firm that offers machine learning solutions, including predictive modeling, optimization, and data visualization. They have worked with clients such as Adidas, Samsung, and Amazon.

LatentView Analytics: LatentView Analytics is a data analytics company that offers machine learning solutions, including customer segmentation, price optimization, and demand forecasting. They have worked with clients such as Microsoft, Coca-Cola, and Johnson & Johnson.

BRIDGEi2i: BRIDGEi2i is a consulting firm that offers machine learning solutions, including sales forecasting, customer segmentation, and supply chain optimization. They have worked with clients across various industries, including banking, retail, and healthcare.

Amazon Web Services: Amazon Web Services (AWS) offers a range of machine learning solutions, including image and speech recognition, chatbot development, and predictive analytics. They have worked with clients such as Netflix, Airbnb, and Samsung.

In conclusion, there are several excellent machine learning companies in India, each offering unique solutions and services. Microlent Systems stands out among them, with its expertise in data analysis, predictive modeling, and natural language processing. Located in Jodhpur, Rajasthan, they are well-positioned to provide high-quality machine learning solutions to clients across various industries.

Read More :

https://microlent.com/blog/why-you-should-focus-on-improving-best-machine-learning-companies-in-india.html

#softwaredevelopment#machinelearning#india#dubai#uae#usa#web development#mobile app development#software#startups in india#innovation#technology#ai#ml solution#machine learning#machine learning course

4 notes

·

View notes

Text

0 notes

Text

#corporate governance#board evaluation#corporate governance consultants#excellenceenablers#corporate governance in india#Startups in India#startup#investment

0 notes

Text

Make In India Initiative: Boosting Fastest Growing Startups in 2024

To have your own business is the dream of every individual. However, it is not easy to set up your startup as many factors need to be kept in mind. Through this article, we will share the list of those startups that combated numerous challenges but never gave up and are known to be the fastest-growing startups. This content is purely based on the information of Fastest Growing Startup In India 2024 along with the details of existing startups in India as well as new startups. As we all know, India is moving towards the fastest-growing major economy in the world. The vision of India is to lead the 2024 market along with generating employment within the country.

By keeping this vision in mind, the Central government launched the initiative of “Make In India” in September 2014. The primary vision behind this initiative is to build an ecosystem that promotes the growth of startups while also driving long-term economic growth and producing large-scale employment. Here is the list of the top 10 “Fastest Growing Startups In India 2024” who are contributing to economic growth and transforming the business industry in India. But don’t forget to read about other new startups in India that have been recently launched.

Top 10 Fastest Growing Startup In India 2024

1. Zepto

It is an Indian Q-commerce company that laid its foundation in 2021. The two drop-outs of Stanford University, Kaivalya Vohra and Aadit Palicha started the company to bring a rapid revolution in the food and grocery delivery industry. Soon the startup turned into the first Indian unicorn of 2023 after raising $200 million in August. As of now, this startup in India provides its services across 10 cities in India. This startup deserves to be on the list of “Fastest Growing Startup in India 2024”.

Headquarters: Mumbai

Established: 2021

Revenue: Rs 2,024 Crore

2. Udaan

In 2016, Flipkart veterans Vaibhav Gupta, Sujeet Kumar and Amod Malviya laid the foundation of Hiveloop Technology. Udaan is the product of Hiveloop Technology which does B2B business. The startup in India picks up products from sellers and manufacturers in 800-100 cities and delivers across 800-900 towns and cities. Udaan is among the fastest-growing startups in India with a valuation of $3.1 billion.

Headquarters: Bengaluru

Established: 2016

Revenue: Rs 5, 629 Crore

3. CRED

Kunal Shah, founder of CRED laid down the foundation of this startup in India with a vision to address the issue of credit card debt while providing users with a premium experience. This startup permits users to manage their credit cards, pay bills and earn rewards. This startup brought a revolution in the credit card industry and took no time to be known as one of the fastest growing startups in India. This startup in India has raised over $800 million in funding and is valued at over $4 billion.

Headquarters: Bengaluru

Established: 2018

Revenue: Rs 1,484 Crore

Read More :- https://businessviewelite.com/startups/fastest-growing-startups-in-2024/

0 notes

Text

What content is included in idea- stage startups pitch desk?

Most entrepreneurs understand that they must have a killer pitch that impresses investors in order to achieve their desired level of success. A startup pitch deck gives investors the ability to identify the best high-value, low-risk investment opportunities. To accelerate growth, create prototypes and expand their business, an idea-stage firm must raise money.

#startups in india#startups#company registration#Business Registration#How to start a business in India

0 notes

Text

0 notes

Text

Tips for Pitching to Investors

For any entrepreneur pitching a business idea is one of the most stressful parts of starting a company. It can decide whether your vision will come to life or will stay as an idea forever. Although it may seem daunting, there are ways to increase your chances of success. By following a few simple steps, you can present your idea in a way that is more likely to result in funding.

Every entrepreneur needs a deep understanding of their idea, growth strategy, and overall business plan. This sets your business apart from others, as it establishes the steps needed to turn it into a reality. The ideal pitch will demonstrate to investors your proof of concept and give them the assurance that they can anticipate a return on investment.

0 notes

Text

The Best Startups In India: A Comprehensive Overview

Startups are a fairly new and popular concept in the Indian economy, with hundreds of them emerging in the last 5 years. Popular startups like Paytm, Nykaa and Zomato even ended up listing on the stock market. Read this article to find out a list of successful startups, startups that earned the unicorn status and challenges faced by startups.

#best startups in india#best startup ideas in india#startups in india#top startups in india#top 10 startups in india

0 notes

Text

Investing in India: Understanding the Cultural and Economic Landscape

India, with its rich cultural heritage, diverse population, and rapidly growing economy, presents a compelling opportunity for investors looking to diversify their portfolios and capitalize on the country's potential for growth and development. However, navigating the cultural and economic landscape of India requires a deep understanding of its unique nuances, challenges, and opportunities. In this comprehensive guide, we'll delve into the cultural and economic factors that shape India's investment landscape, highlighting key insights and strategies for investors looking to succeed in the Indian market.

Cultural Landscape of India

1. Diversity and Multiculturalism

India is a melting pot of cultures, languages, religions, and traditions, with a diverse population of over 1.3 billion people. This diversity is reflected in every aspect of Indian society, from its cuisine and festivals to its art, music, and literature. Investors entering the Indian market must appreciate and respect this cultural diversity, recognizing the importance of building relationships, understanding local customs, and adapting their business practices.

Here's a deeper look at how diversity and multiculturalism shape the cultural landscape of India:

- Ethnic Diversity: India is home to a multitude of ethnic groups, each with its own distinct cultural practices, languages, and traditions. From the colorful attire of Rajasthan to the serene backwaters of Kerala, India's diverse landscapes and communities showcase the country's rich tapestry of ethnic diversity.

- Linguistic Diversity: India boasts a staggering array of languages, with over 22 officially recognized languages and thousands of dialects spoken across the country. Hindi may be the most widely spoken language, but each state has its own official language, contributing to the linguistic mosaic of India's cultural landscape.

- Religious Pluralism: India is a land of religious tolerance and coexistence, with Hinduism, Islam, Christianity, Sikhism, Buddhism, and Jainism among the major religions practiced in the country. The diversity of religious beliefs and practices adds depth and complexity to India's cultural fabric, with festivals, rituals, and pilgrimage sites playing a significant role in shaping communal harmony and social cohesion.

- Cultural Heritage: India's cultural heritage is as diverse as its people, with a rich tapestry of art, music, dance, literature, and architecture spanning millennia. From the ancient temples of Khajuraho to the Mughal monuments of Agra, India's architectural wonders reflect the country's multicultural influences and artistic ingenuity.

- Unity in Diversity: Despite its cultural diversity, India prides itself on its unity in diversity, with a shared sense of national identity transcending regional, linguistic, and religious differences. The concept of "unity in diversity" is enshrined in India's national motto, "Satyameva Jayate" (Truth alone triumphs), symbolizing the country's commitment to pluralism, tolerance, and inclusivity.

2. Relationship-Oriented Business Culture

In India, business relationships are often built on trust, respect, and personal connections rather than purely transactional dealings. Building rapport, establishing trust, and nurturing long-term relationships with business partners, clients, and stakeholders are essential for success in the Indian market. Investors should prioritize relationship-building efforts, invest time in networking, and demonstrate sincerity and commitment in their interactions to foster trust and goodwill among Indian counterparts.

Here's a closer look at the characteristics and implications of India's relationship-oriented business culture:

1. Emphasis on Trust and Rapport:

Relationships form the foundation of business transactions in India. Establishing trust and rapport with business partners is paramount, often requiring time and effort invested in getting to know each other on a personal level. Indians value sincerity, integrity, and authenticity in their interactions, and building genuine relationships based on mutual trust is crucial for successful business dealings.

2. Importance of Networking and Connections:

Networking plays a crucial role in India's business culture, with personal connections often facilitating introductions, referrals, and opportunities. Business relationships are often initiated and nurtured through social gatherings, professional associations, and informal meetings. Cultivating a strong network of contacts, influencers, and decision-makers can open doors to new opportunities and collaborations in the Indian market.

3. Long-Term Perspective:

Indian business culture favors long-term relationships and collaborations over short-term gains. Rather than focusing solely on immediate transactions or outcomes, Indian businesses prioritize building enduring partnerships that offer mutual benefits and opportunities for growth. Investments in relationship-building are viewed as investments in future success, with patience and persistence being key virtues in cultivating fruitful business relationships.

4. Personalized Approach:

In India, business interactions are often characterized by a personalized approach, where individuals take the time to understand each other's needs, preferences, and concerns. Tailoring communication and offerings to suit the specific requirements of clients or partners is valued, demonstrating a commitment to addressing their unique challenges and priorities. Personalized gestures, such as exchanging gifts or showing genuine interest in the well-being of colleagues, can go a long way in strengthening relationships and fostering goodwill in Indian business culture.

5. Role of Family and Social Dynamics:

Family and social connections play a significant role in Indian business culture, with many businesses being family-owned or operated. Family ties, hierarchies, and traditions influence decision-making processes and business dynamics, particularly in traditional industries and family-run businesses. Understanding and respecting familial relationships and social hierarchies can be essential for navigating business interactions and negotiations effectively in India.

Implications for Investors:

For investors seeking to do business in India, understanding and adapting to the relationship-oriented business culture is essential for building trust, fostering partnerships, and achieving success in the Indian market. Here are some implications for investors:

- Investment in Relationship Building: Investing time, resources, and effort in building and nurturing relationships with local partners, clients, and stakeholders is critical for gaining trust and credibility in the Indian business community.

- Cultural Sensitivity: Demonstrating cultural sensitivity, respect for traditions, and an appreciation for personal connections can help investors navigate the nuances of Indian business culture and avoid misunderstandings or cultural faux pas.

- Patience and Persistence: Developing business relationships in India may take time, requiring patience, perseverance, and a long-term perspective. Investors should be prepared to invest in relationship-building efforts and demonstrate commitment to nurturing partnerships over time.

- Networking and Connections: Building a strong network of contacts, influencers, and advisors in India can provide valuable insights, introductions, and opportunities for collaboration. Active participation in professional associations, industry events, and social gatherings can help investors expand their network and establish credibility in the Indian business community.

3. Hierarchical Structures and Formality

Indian society tends to be hierarchical, with a strong emphasis on authority, status, and respect for elders and seniority. Business interactions often adhere to formal protocols, titles, and etiquette, with deference shown to individuals in positions of authority or seniority. Investors should be mindful of hierarchical structures and cultural norms in their business dealings, showing deference and respect to senior executives, government officials, and business partners to avoid inadvertently causing offense or misunderstanding.

4. Importance of Face and Reputation

Maintaining one's reputation, honor, and social standing is paramount in Indian culture, with a strong emphasis on preserving face and avoiding loss of face in personal and business relationships. Investors should prioritize integrity, transparency, and ethical conduct in their business dealings, as any perceived breach of trust or reputation damage can have long-lasting consequences and negatively impact business relationships and opportunities in India.

Economic Landscape of India

1. Growth Potential and Demographic Dividend

India's economy is one of the fastest-growing in the world, driven by factors such as a large and youthful population, increasing urbanization, and ongoing economic reforms. With a median age of around 28 years, India boasts a demographic dividend, with a significant proportion of its population in the working-age group, fueling consumption, productivity, and economic growth. Investors can capitalize on India's growth potential by targeting sectors and industries poised to benefit from demographic trends, urbanization, and rising disposable incomes.

2. Emerging Consumer Market

India's burgeoning middle class, urbanization, and rising disposable incomes are driving consumption across various sectors, including retail, consumer goods, healthcare, and entertainment. The growing consumer market presents lucrative opportunities for investors looking to tap into India's vast consumer base and capture a share of the country's expanding purchasing power. Investing in consumer-centric industries, brands, and retail channels can yield significant returns and long-term growth prospects in India.

3. Innovation and Entrepreneurship

India is home to a vibrant startup ecosystem, fueled by a culture of innovation, entrepreneurship, and technology adoption. Cities such as Bengaluru, Hyderabad, and Pune have emerged as hubs for startups, technology companies, and innovation centers, attracting talent, capital, and investments from around the world. Investors can participate in India's innovation economy by supporting startups, funding technology ventures, or partnering with innovation hubs to leverage emerging technologies, disruptive business models, and market opportunities.

4. Infrastructure Development and Urbanization

India's rapid urbanization and infrastructure development present investment opportunities across sectors such as transportation, real estate, energy, and utilities. Government initiatives such as Smart Cities Mission, Bharatmala, and Housing for All are driving investments in infrastructure projects, urban renewal, and sustainable development across Indian cities and regions. Investors can capitalize on infrastructure development by funding projects, partnering with developers, or investing in infrastructure-related assets such as roads, airports, or renewable energy projects.

Investing in India offers investors a unique opportunity to participate in one of the world's fastest-growing economies, characterized by cultural richness, economic dynamism, and demographic potential. By understanding the cultural nuances and economic drivers shaping India's investment landscape, investors can navigate challenges, capitalize on opportunities, and build successful businesses and partnerships in the Indian market. Whether targeting consumer markets, technology startups, infrastructure projects, or innovation hubs, investors can leverage India's cultural diversity, growth potential, and entrepreneurial spirit to achieve long-term investment success and contribute to India's continued economic development and prosperity. With the right knowledge, mindset, and strategic approach, investing in India can be a rewarding and transformative experience for investors seeking growth, diversification, and global opportunities in the 21st century.

This post was originally published on: Foxnangel

#investing in india#cultural landscape#startups in india#franchise in india#invest in india#fdi in india#foreign investment in india#invest in startups india#foxnangel

2 notes

·

View notes

Text

Startup Bull Run now faces reality

Startup Bull Run now faces reality

mini

Anecdotally, startup founders and management teams have reported that there is recurring – if not constant – pressure from their investors to “show them the money,” often ignoring ground realities in the process. Some startups delivered, and many others folded and closed shop.

The COVID-19 pandemic has been a destabilizing event globally. But not so much for the Indian startup ecosystem.…

View On WordPress

#boot returns#indian startups#new age companies#new registrations#seed funding#start#startups in india

0 notes

Text

Indian media's collapse has meant that serious issues such as unemployment do not get the attention they deserve. Joblessness is not framed as a question of political accountability but is couched in technocratic language and buried in a maze of data and conflicting claims. Those who intruded into parliament reportedly told the police they were upset about high rates of unemployment. Youth unemployment in India is at around a staggering 23 percent, the highest for any major global economy and nearly double that of neighbouring Pakistan and Bangladesh. For graduates under 25, a report by the Azim Premji University estimates, this number rises to 42 percent. IT firms such as Infosys, Tata Consultancy Services and Wipro have announced they will reduce the hiring of engineering graduates by 30 percent-reducing it by 40 percent from the prestigious Indian Institutes of Technology-leaving thousands of freshly graduated students without jobs. Since the onset of the 2022 funding winter, 34,785 employees have been laid off by just 121 Indian startups, with 15,247 of them fired by 69 Indian startups so far this year. An improvement is unlikely. Pranjul Bhandari, the chief India economist at Hongkong and Shanghai Banking Corporation, estimates that while India will need to create 70 million jobs over the next decade, it will only end up with 24 million. Put simply, India's demographic dividend has turned into a demographic disaster.

Sushant Singh, ‘Fire and Smoke’, Caravan

#Caravan#Sushant Singh#Pranjul Bhandari#HSBC#India#Indian startups#Wipro#TCS#Infosys#IIT#Azim Premji University#Joblessness

163 notes

·

View notes

Photo

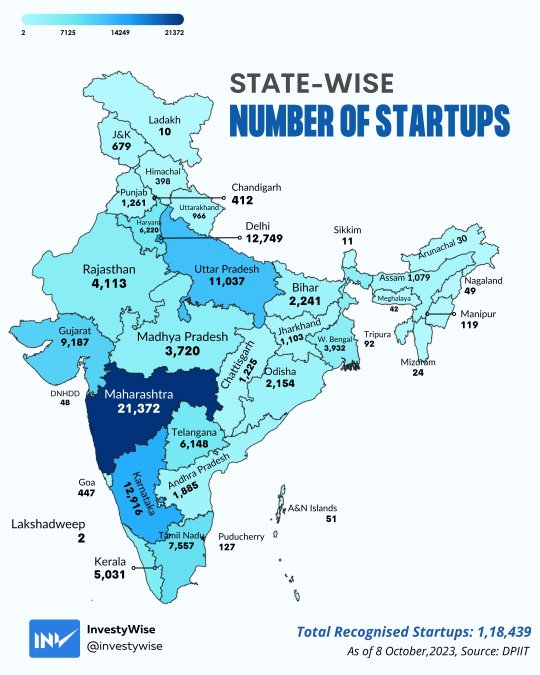

Startups in India

Indian states with the highest number of recognized startups:

Maharashtra - 21372

Karnataka - 12916

Delhi - 12749

Uttar Pradesh - 11037

Gujarat - 9187

Tamil Nadu - 7557

Haryana - 6220

Telangana - 6148

Kerala - 5031

Rajasthan - 4113

by Investywise

90 notes

·

View notes

Text

#code#collage#developers & startups#programming#sociology#robotics#technology#ux#tv#tech#india#indonesien#pakistan#islamic#black friday#obey me shall we date#marriage#beauty

41 notes

·

View notes

Text

A significant part of the startup ecosystem are the environmentally conscious innovations. Let’s shine a spotlight on the remarkable contributions of eco-startups in India. These enterprises are not only addressing environmental challenges but are actively creating solutions that help the world become a better place.

Renewable Energy Pioneers: Eco-startups in India are at the forefront of revolutionising the energy sector. Companies like ReNew Power and Greenko are pioneering renewable energy solutions, contributing to the global shift towards cleaner and sustainable power sources.

Agro-Innovators: Startups in agritech, such as CropIn and Ninjacart, are leveraging technology to enhance agricultural practices, promoting sustainable farming methods and reducing environmental impact.

Waste Management Innovations: Cleantech startups like Kabadiwalla Connect and Blue Planet Environmental Solutions are leading the way in effective waste management solutions, promoting circular economies and reducing landfill burden.

2 notes

·

View notes