#tax software review

Text

#1 destination for finding software and services

We’re the #1 destination for finding software and services

Verified Reviews 2 million verified reviews from people like you to get the insights you need

Proprietary Insight 500+ softwarereviewforall Shortlist reports to narrow down your options and save you time

Expert Guidance Personalized software recommendations from human advisors in less than 15 minutes

Satisfied customer / FROM OUR USERS "softwarereviewforall helped us get insights from other people in our industry to make a better, more informed decision." JOSH D. Sales Engineer

Please note that "softwarereviewforall" is a placeholder, and you should replace it with the actual name or website you want to use in your text.

#software review#software reviews#antivirus software review#mint software review#you need a budget software review#jira software review#quicken software review#reaper software review#zoho software review#software testing review#xero software review#gimp software review#libre software review#topaz software review#software review sites#software review websites#software review site#nch software review#audacity software review#tax software review#video editing software review#4 vs 4s#best tax software 2023#avalanche software#what type of software controls the hardware of a computer?#hogwarts legacy review#procore#clipchamp review#shotcut review#stessa review

12 notes

·

View notes

Text

7 of the most effective tax software crypto solutions in 2023

Taxes for cryptocurrency transactions can seem daunting to many. Yet , it's an important thing for every trader to take care of in order not to attract getting any unnecessary attention from IRS.Whether you're not able to do it with time or knowledge an effective crypto tax software solution can assist you take the complexity out of the whole crypto tax procedure. In this article, we review the 7 top tax software solutions for cryptos in 2022.

What is the reason you need cryptocurrency tax software?

In the wake of the global adoption of crypto, more and many people are earning a large amount of money through cryptocurrencies. Because of crypto trades being sources of income, some countries have started to consider crypto as one of the taxable events. In the majority of countries, this trend has already been in progress and classifies crypto-related transactions as property. It is classified under capital gains or income tax.

If you are someone who is a businessperson, or tax payer, then you're aware how complex and challenging the tax-paying process is. Therefore, any crypto transaction are made, you will be liable for tax. As there are many ways to refer to crypto income Most of these methods are taxed differently.

While filing taxes is difficult it's possible that you'll have trouble finding the motivation to complete them efficiently. The filing of tax forms shouldn't be something you make lightly, no matter if you're used for crypto transactions, since inaccurate or tardy tax filings could get you in trouble. If this is making you anxious, not to worry you can find a solution to assist you in the taxes associated with crypto.

They are software for taxing cryptos.

Did you know there is software that makes tax paying a way easier? These software programs are renowned to improve the efficiency of tracking transactions accounting for capital gains and losses, as well as producing accurate tax reports. In addition, this software allows an easier integration into crypto banks and exchanges. It can also be used to automate the input of data for tax-related forms and downloadable documents that are ready to use, and higher security.

If you like to get tax software that will help with your tax obligations for crypto first, you will have to collect the crypto records from exchanges and integrate them into the software. best tax software crypto could also be done through automated integration in the event that the application permits it.

A thing to keep in mind is that not all crypto transactions are tax-deductible. In fact, the majority of nations permit charitable donations and digital wallet transfers to be free of tax. Also, it's better to know what is included in tax calculation and what is not.

Let's look at some of the best cryptocurrency tax software that is available. To make sure you know which options to choose from. In crypto tax free software , I will discuss the top 7 of our favorites.

Koinly

Koinly is a software program that provides a single platform both crypto accounting and crypto taxation. One of the greatest things concerning Koinly is that it is software that has been developed in close collaboration with tax experts around world , and is endorsed by the world's CPAs. In addition, Koinly includes reports like Form8949 or Schedule D in pdf format , which makes it easy to send.

With Koinly customers can connect to more than 350 exchanges and 70+ wallets across over 6000 blockchains. Moreover, it also offers the ability of connecting to a variety of DeFi and crypto-related services. With its tracker of crypto portfolios and tracking, customers also have an overview of their finances and performance.

A clever error-handling system as well as a simple exchange system for wallet transfers, and a digital tax guide are some of Koinly's bonus features that are available using Koinly. Also, it's available in both free and paid versions with the paid one with more features for the user.

ZenLedger

Another excellent tool for calculating currency, DeFi UFT, NFT and tax-related NFTs is ZenLedger cryptocurrency tax software. crypto tax software coinbase is a platform which has substantial financial backing behind its name. They raised over 6 million from a Series A funding round in 2021 . They will also raise 15 million in 2022 as the Series B round. They are also the preferred partner for the IRS and it shows credibility.

With ZenLedger traders are able to connect with more than 400 exchanges including 20+ wallets and exchanges, 40+ blockchains, as well as more than 20 DeFi-related projects. It creates IRS-friendly forms by importing transaction histories from exchanges and filling out the essential documents. This includes crypto incomes, profit/loss statements, long and short-term capital gains, and closing statements.

If you face any problems, ZenLedger crypto tax software can assist you to get in contact with tax experts. Their pricing is based in a year-long basis and goes from $0 to $999.

CoinLedger

If you're looking for a hassle-free way to pay taxes on crypto gains, CoinLedger is also a excellent choice. crypto tax software turbotax can support over 10 000 digital assets from a wide choice of exchanges for crypto and wallets. Additionally, it offers real-time profits and losses reports and has more than 300000 users on its list.

One of the best features of CoinLedger is the simple export of tax data as well as the availability of a tax form that is downloadable that can be sent to tax software that is not included or tax professionals. In best defi crypto tax software , the program is able to calculate Ethereum blockchain transactions and NFT transactions. If you're new to tax reports for crypto this is a great option because it offers great customer service 24/7.

Accointing

It is one of the user-friendly tax tools for crypto Accointing is not a advanced software with a high demand for skills. It is a Swiss-based tool that has a basic UX/UI and the capability to import information from other platforms. It also supports more than 300 crypto exchanges and wallets , as well as an option to tax-harvest. Additionally, Accointing offers one of the top tools to manage portfolios.

They have a free plan that doesn't require you to pay a cent and also paid version packages. However, if you want to avail the most options and to make more trades than you can make, you will need to pay for the trader option costing $199. There are also low-cost software versions however, they offer only minimal customer support.

TaxBit

The software was developed in the blockchain industry by CPAs along with cryptocurrency tax attorneys, TaxBit offers solutions for the taxation of cryptocurrency-related issues. It is also one the most funded software, having raised more than 200 million in 2021. TaxBit provides support for more than 4200 asset, apart from a few equity, commodities, and fiat currencies.

With support from over 500 cryptocurrency exchanges and wallets users can manage their taxes related to crypto transactions, as well as long-term and short-term profits from crypto, and also profit and loss reports. This is a fantastic tool users who want to do simple and accurate tax calculations on IRS Form 8949 as well as form 1099.

CoinTracker

youtube

With more than a million active users, CoinTracker is one of the most popular cryptocurrency tax software. The program makes it easy to calculate capital gains, profit and loss and crypto activity calculation. Additionally, if the need arises, you can reach out to tax experts to assist you with your tax obligations. In addition, this tool provides support for over 10 000 crypto assets and good customer service to users.

In contrast to other programs that are listed, CoinTracker also comes as an app that works on Android along with iOS. There is a free option with no need to pay a dime, and alternative options for paying. However, if you are looking to check out the free version, you will get just 25 transactions but no chat assistance.

BitCoinTaxes

It was launched in 2014, BitCoinTaxes is a web-based tax solution that lets users calculate tax rates for their crypto business. This generates detailed tax reports of your crypto transactions all through the year. Additionally, you can use the platform to calculate your annual capital gains as well as download it in any way you wish.

Like in all other Cryptotax software, users have both a free and a premium version of this one in addition to. For the free version, traders are able to calculate up to 20 transactions as well, while the least expensive paid version supports 1,000 transactions. There is only one drawback to this, and that is that BitCoinTaxes only supports 21 cryptocurrency exchanges.

Conclusion

Calculating taxes is among the most time-consuming and stressful tasks you can undertake as a businessperson. This can be even more stressful as taxes become part of the crypto sector. Investors who participate in numerous transactions will have the extra effort required to be able to pay their taxes correctly.

This is where the crypto tax software excels. It provides better tax management, which is more precise, and more timely tax management and payment.

Additionally, it will allow traders to avoid any penalties or fines that may be incurred due to tax-related issues. Thus, you must investigate and select the top crypto tax software, one that is compatible and caters to your needs.

FAQs

Are there any ways to do my crypto taxes myself?

Yes, you can do all your crypto tax obligations yourself. Since crypto is a a large number of transactions, it's challenging to file these taxes in a precise manner.

What is the most efficient crypto tax software?

Koinly, ZenLedger, and TaxBit can all be considered good choices. tax software for crypto mining depends on the needs of your business and can vary from person to one.

What will happen if I do not file my crypto-related tax?

Taxes on crypto that are not paid or avoided could be considered tax avoidance and fraud . It can lead to you having to be the subject of an IRS audit. The result could be facing penalties, fines, and possibly criminal charges.

#best crypto tax software 2023#crypto tax software#best crypto tax software#best crypto tax software 2021#best crypto tax software 2022#free crypto tax software#best crypto tax software for turbotax#crypto tax software free#crypto mining tax software#cheapest crypto tax software#top crypto tax software#crypto tax software reviews#best crypto tax software reviews#best free crypto tax software#best crypto tax reporting software#crypto tax software turbotax#best crypto tax software 2020#best tax software crypto#crypto tax software metamask#easiest crypto tax software#best crypto tax software usa#best tax software for crypto#crypto tax software defi#coinbase crypto tax software#crypto currency tax software#best tax crypto software#crypto tax tracking software#tax software for crypto mining#tax software for crypto#cheap crypto tax software

1 note

·

View note

Text

I went to the Apple Store yesterday to try the scripted demo of their VR headset. My overall impression is that it's the best possible execution of what might be a fundamentally flawed idea.

The passthrough video is pretty incredible. It's somewhat dimmer than reality, and the color accuracy is just OK, but it's more than good enough to feel like you're looking through clear displays at the real world. I'm told the passthrough on the Quest 3 is even better, but haven't tried that and can't comment. One thing is that there is a weird motion blur effect when you turn your head, I'm not sure if that's a display tech limitation or introduced deliberately by the software as a workaround for a different display tech limitation.

The resolution is 4K per eye, which, as mentioned, is more than enough for a powerful sense of presence in the real world. One of the nifty bits of the demo was when you turn the dial to tune out the world and suddenly you're sitting by a mountain lake, and the feeling of actually being there is overwhelming. The dystopian implications of needing a VR headset to sit at a mountain lake aside, it would be cool to have one just to have your office be anywhere you can imagine. Not $3500-before-tax cool, but cool.

Wow sports leagues are going to love this thing. I don't give a shit about sports and even I was thinking, "If the NBA put a stereoscopic camera courtside and sold you games for $50 a pop, I'd absolutely buy that"

But 4K per eye is not enough to do work, not even close. The experience of using normal computer-y applications on this was not unlike plugging your laptop in to a TV that's at the normal TV distance. You can do it, it works, but it's not anyone's preferred way of working. Text is amazingly legible, but only at sizes that are equivalent to having a single webpage take up your entire 4K monitor at normal monitor distance.

It is not particularly comfortable. Part of this might be that the store demo makes you use the "catcher's mitt" strap, which only goes around the back of your head and so gravity has to be countered only by the pressure of the thing against your face. Reviewers have said that if you use the other band that goes over your head the situation is better, but still.

A lot of early comments were making fun of Apple for having the battery be an external thing you put in your pocket and attach with a wire, but I think that's just fine: we all walk around with giant batteries in our pockets anyway, and anything you can do to have less weight on your head is a Good Thing. But then Apple took all those weight savings and spent them on making the stupid thing out of metal and glass instead of polycarbonate. It's nuts! It's like if you made a car that was 500kg lighter because you invented magical tech for keeping the engine somewhere else, and then went "great! with all the weight savings now we can build the body out of lead". Apple, you don't need to fear plastic. Plastic is good! Plastic built modern civilization.

You control it with a combination of eye tracking and pinch gestures. This is the main piece of evidence of my "best version of a bad idea" thesis: it works really, really well; so well that I can tell this is probably an evolutionary dead end. It's just fine— miraculous, even— for dragging windows around and doing the basic stuff the in-store demo has you do. It's amazing that you can more or less have your hands anywhere, including on your lap, and the recognition works perfectly (by contrast with the HoloLens I tried 5 or so years ago where the gesture recognition was total crap). But it's immediately obvious that you can never do serious manipulation of your computing environment with this.

The takeaway is that it's incredible for passive consumption of specifically-made media, assuming that ever exists at scale. But it will be a long time before we're gogged in like Hiro Protagonist to do our office jobs this way.

167 notes

·

View notes

Text

Ko-fi prompt from @thisarenotarealblog:

There's a street near me that has eight car dealerships all on the same lot- i counted. it mystifies me that even one gets enough sales to keep going- but 8?? is there something you can tell me that demystifies this aspect of capitalism for me?

I had a few theories going in, but had to do some research. Here is my primary hypothesis, and then I'll run through what they mean and whether research agrees with me:

Sales make up only part of a dealership's income, so whether or not the dealership sells much is secondary to other factors.

Dealerships are put near each other for similar reasons to grouping clothing stores in a mall or restaurants on a single street.

Zoning laws impact where a car dealership can exist.

Let's start with how revenue works for a car dealership, as you mentioned 'that even one gets enough sales to keep going' is confusing. For this, I'm going to be using the Sharpsheets finance example, this NYU spreadsheet, and this Motor1 article.

This example notes that the profit margin (i.e. the percentage of revenue that comes out after paying all salaries, rent, supply, etc) for a car dealership is comparatively low, which is confirmed by the NYC sheet. The gross profit margin (that is to say, profits on the car sale before salaries, rent, taxes) is under 15% in both sources, which is significantly lower than, say, the 50% or so that one sees in apparel or cable tv.

Cars are expensive to purchase, and can't be sold for much more than you did purchase them. However, a low gross profit margin on an item that costs tens of thousands of dollars is still a hefty chunk of cash. 15% gross profit of a $20,000 car is still $3,000 profit. On top of that, the dealership will charge fees, sell warranties, and offer upgrades. They may also have paid deals to advertise or push certain brands of tire, maintenance fluids, and of course, banks that offer auto loans. So if a dealership sells one car a day, well, that's still several thousand dollars coming in, which is enough to pay the salaries of most of the employees. According to the Motor1 article, "the average gross profit per new vehicle sits at $6,244" in early 2022.

There is also a much less volatile, if also much smaller, source of revenue in attaching a repairs and checkup service to a dealership. If the location offers repairs (either under warranty or at a 'discounted' rate compared to a local, non-dealership mechanic), state inspections, and software updates, that's a recurring source of revenue from customers that aren't interested in purchasing a car more than once a decade.

This also all varies based on whether it's a brand location, used vs new, luxury vs standards, and so on.

I was mistaken as to how large a part of the revenue is the repairs and services section, but the income for a single dealership, on average, does work out math-wise. Hypothesis disproven, but we've learned something, and confirmed that income across the field does seem to be holding steady.

I'm going to handle the zoning and consolidation together, since they overlap:

Consolidation is a pretty easy one: this is a tactic called clustering. The expectation is that if you're going to, say, a Honda dealership to look at a midsize sedan, and there's a Nissan right next door, and a Ford across the street, and a Honda right around the corner, you might as well hit up the others to see if they have better deals. This tactic works for some businesses but not others. In the case of auto dealerships, the marketing advantage of clustering mixes with the restrictions of zoning laws.

Zoning laws vary by state, county, and township. Auto dealerships can generally only be opened on commercially zoned property.

I am going to use an area I have been to as an example/case study.

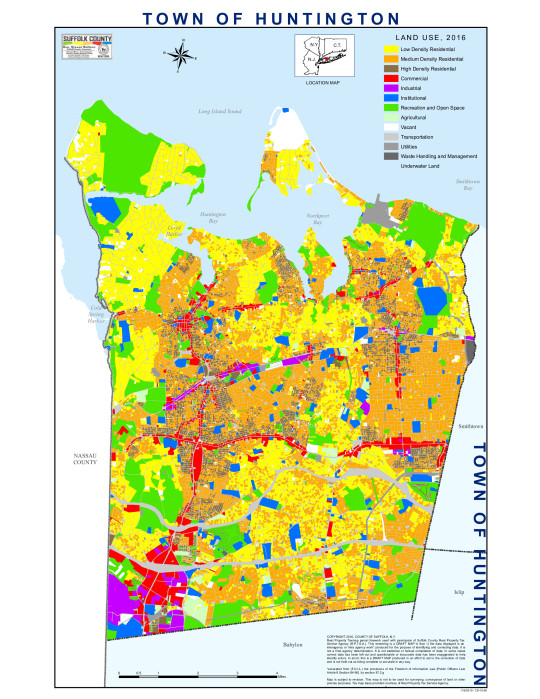

This pdf is a set of zoning regulations for Suffolk County, New York, published 2018, reviewing land use in the county during 2016. I'm going to paste in the map of the Town of Huntington, page 62, a region I worked in sporadically a few years ago, and know mostly for its mall and cutesy town center.

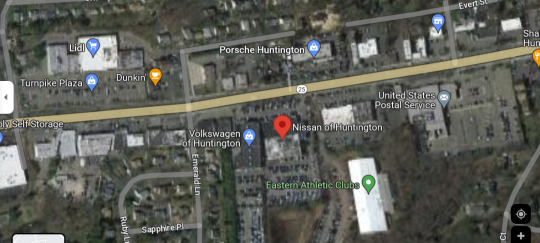

Those red sections are Commercially Zoned areas, and they largely follow some large stroads, most notably Jericho Turnpike (the horizontal line halfway down) and Walt Whitman Road (the vertical line on the left). The bulge where they intersect is Walt Whitman Mall, and the big red chunk in the bottom left is... mostly parking. That central strip, Jericho Turnpike, and its intersection with Walt Whitman... looks like this:

All those red spots are auto dealerships, one after another.

So zoning laws indicate that a dealership (and many other types of commercial properties) can only exist in that little red strip on the land use map, and dealerships take up a lot of space. Not only do they need places to put all of the cars they are selling, but they also need places to park all their customers and employees.

This is where we get into the issue of parking minimums. There is a recent video from Climate Town, with a guest spot by NotJustBikes. If you want to know more about this aspect of zoning law, I'd recommend watching this video and the one linked in the description.

Suffolk county does not have parking minimums. Those are decided on a town or village level. In this case, this means we are looking at the code set for the town of Huntington. (I was originally looking on the county level, and then cut the knot by just asking my real estate agent mom if she knew where I could find minimum parking regulations. She said to look up e360 by town, and lo and behold! There they are.)

(There is also this arcgis map, which shows that they are all within the C6 subset of commercial districting, the General Business District.)

Furniture or appliance store, machinery or new auto sales

- 1 per 500 square feet of gross floor area

Used auto sales, boat sales, commercial nurseries selling at retail

- 5 spaces for each use (to be specifically designated for customer parking)

- Plus 1 for each 5,000 square feet of lot area

This is a bit odd, at first glance, as the requirements are actually much lower than that of other businesses, like drive-in restaurants (1 per 35 sqft) or department stores (1 per 200 sqft). I could not find confirmation on whether the 'gross floor area' of the dealership included only indoor spaces or also the parking lot space allotted to the objects for sale, but I think we can assume that any parking spaces used by merchandise do not qualify as part of the minimum. Some dealerships can have up to 20,000 gross sqft, so those would require 40 parking spaces reserved solely for customers and employees. Smaller dealerships would naturally need less. One dealership in this area is currently offering 65 cars of varying makes and models; some may be held inside the building, but most will be on the lot, and the number may go higher in other seasons. If we assume they need 30 parking spaces for customers and employees, and can have up to 70 cars in the lot itself, they are likely to have 100 parking spaces total.

That's a lot of parking.

Other businesses that require that kind of parking requirement are generally seeing much higher visitation. Consider this wider section of the map:

The other buildings with comparative parking are a grocery store (Lidl) and a post office (can get some pretty high visitation in the holiday season, but also just at random).

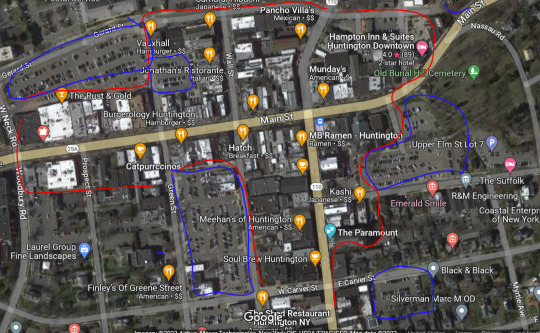

Compare them, then, to the "old town" section of the same town.

There are a handful of public parking areas nearby (lined in blue), whereas the bulk of the businesses are put together along this set of streets. While there is a lot of foot traffic and vehicle passage, which is appealing for almost any business, opening a car dealership in this area would require not only buying a building, but also the buildings surrounding it. You would need to bulldoze them for the necessary parking, which would be prohibitively expensive due to the cost of local real estate... and would probably get shot down in the application process by city planners and town councils and so on. Much easier to just buy land over in the strip where everyone's got giant parking lots and you can just add a few extra cramped lanes for the merchandise.

Car dealerships also tend to be very brightly lit, which hits a lot of NIMBY sore spots. It's much easier to go to sleep if you aren't right next to a glaring floodlight at a car dealership, so it's best if we just shove them all away from expensive residential, which means towards the loud stroads, which means... all along these two major roads/highways.

And if they're all limited to a narrow type of zoning already, they might as well take advantage of cluster marketing and just all set up shop near each other in hopes of stealing one of the other's customers.

As consumers, it's also better for us, because if we want to try out a few different cars from a few different brands, it's pretty easy to just go one building down to try out the Hyundai and see if it's better than a Chevy in the same price group.

(Prompt me on ko-fi!)

#economics prompts#marketing#zoning laws#ko fi prompts#ko fi#auto industry#automotive dealerships#car dealerships#phoenix posts

110 notes

·

View notes

Text

Pause

Word Count: 1812

Warnings: Patton acting very unsympathetic (gaslighting mostly), some negative thinking

--

Logan had accomplished something great today.

He showed Thomas a new video-editing software that he determined should significantly improve his content output speeds and would also run adequately on his current computer equipment. Thomas learning about the new features gave Logan a much-desired confidence boost and he wanted to smile as Thomas quietly let out "ooh"s and "aww"s at the short preview video from the software's website.

He sat across from him at the table as Thomas closed his laptop, and he explained very simply that if Thomas held back on takeout for the week and refrained from buying anything from Redbubble (as tempting as it may be) until next month, he should have more than enough saved up to purchase and download the new software. He would have to learn the new system in order to use it properly, but Logan had assured him that he would read the instructions thoroughly and stick with Thomas throughout the process so he could have it learned in no time.

Thomas had enthusiastically agreed.

Logan marked a calendar, noting to skip fast food for the week and online purchases for the month, and then circled Thomas' pay date. That was when he could buy the software, right alongside with paying his bills.

Oh! And he reminded him, don't forget, he needed to do his taxes sooner rather than later, because the refund could come in handy!

Satisfied, Logan began to sink out, only to hear someone else pop in as he did so.

He thought nothing of it as he entered his room.

He recalibrated his calendar, having successfully convinced Thomas of a way to increase productivity.

He was glad all the research and reviewing for a new video software had actually paid off, considering he'd been desperate to find some kind of new task that would benefit Thomas. And with the new predicted increase in productivity, Thomas would soon have better availability for filming, spending time with his friends, and pursuing his hobbies on the side.

Sure, Virgil won't like the adjustment period for the new changes but Logan intended to promise him he'd make that transition as smooth as possible.

And yes, being frugal for the month will be rough, especially with Roman around, but he'd already prepared room in the budget for some slip-ups just in case.

And Patton will hopefully realize that Thomas can create his own comfort foods right at home, within his budget, and it wouldn't affect anything negatively at all.

Logan had covered all his bases, made sure everyone would be accommodated within reason, and Thomas could still benefit the most out of this decision.

Logan felt accomplished. Well, perhaps he could have set up a better worksheet that allocated and compared the reviews he'd read about new and available software… but he was still satisfied with the results he received!

A knock on the door interrupted his thoughts, and he turned and walked over to it automatically.

The moment he opened the door, he was greeted by Patton's strained smile.

"Hey, Lo," he said, teeth gritted in a way that made Logan instantly uncomfortable. "Can I come in?"

In lieu of a response, Logan merely stepped aside, allowing Patton to stride on into the room and then turn around to face the other side as he shut the door gently.

He wasn't the most adept at reading others' emotions, but he could sense Patton wasn't happy at the very least. Something must have upset him.

"Is something the matter?" Logan asked, confused by Patton's behavior.

"What? No!" Patton's expression changed nearly four times, far too rapidly for Logan to interpret what any of them could be. "No, no, see, I was just...worried, about you! From the way it sounds lately, you seem to be working really hard, Logan!"

Logan wasn't sure if that was meant to be a compliment or not. The words sounded correct for one, but Patton's tone seemed bizarre. Logan frowned.

Emotions were quite difficult to understand.

Perhaps Patton was worried about his uptick in productivity?

"I assure you," Logan tried, "I have made no strain on myself. I only take on what I can handle, as we all should."

Patton's eyes had narrowed at him for a moment as they both stood in silence.

Perhaps he had misread Patton's intentions with his statement, after all.

"I'm no lie-detector, Logan, but I get the feeling that's not entirely true," Patton told him, a frown upon his face that seemed to mock him. He wasn't sure how it could do that, though.

"It is," Logan answered simply.

"Oh, really?" Patton tilted his head to the side. "Because I heard you decided to start up a new assignment of sorts."

Logan blinked. Patton seemed upset, but he wasn't sure why.

Sure, Logan had taken on researching new software and presenting the comparison results to Thomas, but it was of no concern to his allocated schedule and didn't take away from his other responsibilities.

He didn't understand why that would be upsetting. In what way could this be viewed negatively?

"I don't understand," Logan told him numbly. Was he… in trouble for something? Had he done something incorrectly and not realized it?

"Don't you?" Patton raised an eyebrow, challenging him.

So he had done something wrong.

Logan tried to think back, but he couldn't recall anything he had done recently that seemed to upset anyone. Was this really somehow about introducing Thomas to the new editing software? Why would anyone be upset about such a fruitful decision?

"I believe I may be failing to see the overall issue here, Patton," he remarked. If this was about the software, there was certainly no reason to behave like this. He could just tell Logan outright about his concerns.

Patton shook his head, still smiling in that uncomfortable way.

"That's the problem, Logan."

The room seemed colder then.

Logan tried again,

"If you would enlighten me as to what has upset you, we should be able to come to a solution. I'm sure once I understand your predicament, it'll be simple."

Reassurance often worked to cheer Patton up, after all. Perhaps this would help?

Patton laughed, but Logan hadn't made a joke. The sound reverberated a tiny bit through the room, and Patton looked him in the eye.

He wasn't smiling anymore.

"I don't need to do that for you, Logan. You're smart. Just think back and you'll figure it out."

"Then, what's the resolution here?" Logan asked, trying not to sound desperate. "What are you asking of me?"

The answer was not something he ever thought he'd hear.

"I think Thomas needs a little break from his logic for a while."

Logan had never experienced such hollowness as the kind that abruptly formed in his chest at those words.

"Wh--" he swallowed, his mouth absolutely dry. "What do you mean?"

Patton's smile returned then.

"I mean, you've been working so hard, and Thomas has, too!" He grasped his hands together in front of him. "It's about time you both had a break. I'm thinking maybe just a week or two, you know?"

Logan didn't know. He didn't understand. Thomas couldn't survive without logic, so what was Patton even suggesting?

And it wasn't like the work Logan was doing was in any way taxing or deserving of a break, especially considering how few tasks he even had left to do these days. He had been satisfied with just the chance to research something for once, and without anyone else's input.

So what was Patton even saying here? Did he not like Logan's decision?

It wasn't like he could control what Logan did or didn't do!

"I can make my own decisions, Patton," he chose to say. He tried to stay as calm as possible so Patton could tell he was serious.

Patton smiled at him again, sickeningly sweet.

"Yes, but you're not the only one making decisions, right?"

Ah. So Patton was upset because Logan hadn't consulted him and the others.

Logan tried not to sigh in disappointment. He'd been doing all the preparation for this suggestion so it would be easier on everyone and not turn into a pointless debate. It was meant to benefit everyone.

But, of course, Patton has to find some way to make it negative instead.

"I suppose I could have done some more consulting, yes," he conceded, folding his arms across his chest.

"We all make mistakes," Patton nodded, like they had only just gotten on the same page.

"That's why I want to ask you to take a break voluntarily. For your sake and for Thomas'!"

Logan blinked.

So it was Thomas who needed the break? But why hadn't Patton just said that, and why hadn't Thomas said anything?

Before he could even ask, Patton added,

"Look, I know Thomas doesn't trust you enough to tell you this kind of stuff, that's why he had me ask you instead. He needs a little vacation from his logic for a bit, okay?"

Logan grimaced. None of this made sense. Thomas had been so enthusiastic when he agreed to his plan for the new software. Patton had been the only one to say anything negative about it at all.

Had he completely misread everything? Had Thomas been placating him and he hadn't noticed?

Patton was always more in-tune with that sort of thing, so perhaps he was right about this.

"Are... you sure he doesn't want me around right now?" Logan had to ask, he had to know.

Patton's expression didn't change.

"You can still do your usual stuff from your room, right? Just do that for this week, and then we'll see where we're at, okay?"

Logan noted that he hadn't answered his question, but his suggestion implied what must have been the truth. Patton was known for trying to gloss over the negative side of things, after all. Maybe he was just trying to help…

Logan sighed.

He didn't want to agree but he didn't want to argue, either. If Thomas really didn't want his help, he should give him some space and find a more subtle way to offer his assistance.

"Okay."

Patton smiled.

"Perfect! Thank you so much," he told him, heading towards the door. "I'll take care of the rest and don't worry, I already switched the schedule back to normal."

Oh. Logan frowned. So all that effort has been for nothing, then.

Patton gave a little wave and exited, leaving Logan standing uncomfortably in the middle of his room.

He had put so much thought into that decision. Where had he gone so wrong?

And why hadn't Thomas just said what he felt? And why hadn't Patton, either?

He really needed to get better at this whole socializing thing.

He glanced around at the empty room. Well, at least he'd have the time for it.

#logan angst#logan sanders#fanfiction#unsympathetic patton#i swear i dont hate patton but i wrote this almost two years ago and just never posted it#patton isnt actually like this obviously but if you dont mind him doing some gaslighting then please enjoy#sanders sides

24 notes

·

View notes

Text

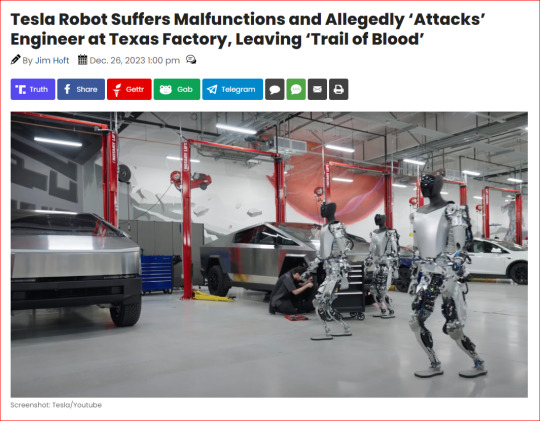

A robotic malfunction at Tesla’s Giga Texas factory resulted in a violent encounter where an engineer was attacked by one of the company’s robots, resulting in significant injuries and leaving a ‘trail of blood.’

According to the Daily Mail, while working on software programming for non-functional Tesla robots, the engineer was suddenly pinned against a surface by a robot tasked with manipulating aluminum car components, with its metal claws inflicted an injury that left an ‘open wound’ on the worker’s left hand.

“Two of the robots, which cut car parts from freshly cast pieces of aluminum, were disabled so the engineer and his teammates could safely work on the machines. A third one, which grabbed and moved the car parts, was inadvertently left operational, according to two people who watched it happen. As that robot ran through its normal motions, it pinned the engineer against a surface, pushing its claws into his body and drawing blood from his back and his arm, the two people said,” The Information reported.

Quick action was taken by Tesla workers who intervened and triggered the emergency shutdown button to halt the malfunctioning robot and prevent further injury to the engineer.

This incident came to light through a 2021 injury report filed to Travis County and federal regulators, which Daily Mail reviewed. Tesla is legally required to report such incidents to ensure the continuation of state-provided tax incentives.

Despite claims by Tesla that the engineer did not require time off following the event, an attorney representing the factory’s contract laborers suggests otherwise. Evidence hints at possible underreporting of workplace accidents, casting doubt on the official records.

Daily Mail reported:

The injury report, which Tesla must submit to authorities by law to maintain its lucrative tax breaks in Texas, claimed the engineer did not require time off of work.

But one attorney who represents Tesla’s Giga Texas contract workers has told DailyMail.com she believes, based on her conversations with workers there, that the amount of injuries suffered at the factory is going underreported.

This underreporting, the attorney said, even included the September 28, 2021 death of a construction worker, who had been contracted to help build the factory itself.

‘My advice would be to read that report with a grain of salt,’ the attorney, Hannah Alexander of the nonprofit Workers Defense Project, told DailyMail.com.

‘We’ve had multiple workers who were injured,’ Alexander said, ‘and one worker who died, whose injuries or death are not in these reports that Tesla is supposed to be accurately completing and submitting to the county in order to get tax incentives.’

Elon Musk has yet to issue a formal statement in response to these allegations.

Just recently, Tesla revealed the second generation of its humanoid robot, Optimus Gen 2.

Optimus Gen 2 stands at a height of 5 feet 11 inches and weighs in at a light 121 pounds, shedding 22 pounds from the first model. It’s not just its frame that’s been upgraded; this robot can reach speeds up to 5 mph, which is a substantial 30% increase in velocity.

youtube

7 notes

·

View notes

Text

Didn't realize Tax Heaven 3000 was already out and absolutely loving the top review:

Hey, the concept of this game blew my mind and now I want to have it on my phone, so that I can play it whenever I have some minutes to waste. No, I don't live in the US, so the most this piece of software can be to me is a meme game. Still, a pretty powerful one!

This is the culture export America deserves to inflict upon the world.

22 notes

·

View notes

Text

Ditch the 9-to-5: The Ultimate Guide to Transitioning into a Successful Freelance Career

The fluorescent lights hum overhead, the clock ticks agonizingly slow, and the stack of TPS reports mocks you from your desk. Is this the picture-perfect career you envisioned for yourself? If the answer is a resounding "no," and the thought of trading commutes for co-working spaces and pajamas for productivity makes your heart sing, then freelancing might be the answer you've been searching for.

But ditching the security of a traditional job and venturing into the freelance world can be daunting. Fear not, fellow adventurer! This comprehensive guide will equip you with the knowledge and strategies to navigate the transition smoothly and build a thriving freelance career.

Are You Cut Out for Freelance Life?

Freelancing isn't all sunshine and self-made schedules. It requires discipline, self-motivation, and the ability to wear multiple hats – marketer, project manager, and yes, even the actual billable work you do. Before you hit the "post my services" button, take a moment to assess your suitability:

Self-Discipline: Can you stick to a schedule without a boss hovering? Time management is crucial for juggling projects and deadlines.

Motivation: Can you stay focused and driven without the external pressure of a performance review looming? Freelancing success hinges on your internal fire.

Communication Skills: Articulating your value proposition to clients and managing expectations are essential. Hone your communication skills to build strong client relationships.

Financial Savvy: Freelancing often means fluctuating income. Budgeting, saving for lean times, and managing taxes are crucial for financial stability.

Building Your Freelance Fortress: Skills, Services, and Setting Up Shop

Now that you've confirmed your inner freelancer, it's time to lay the groundwork for your freelance empire. Here's what you need to do:

Identify Your Niche: Are you a graphic design whiz, a content writing maestro, or a social media magician? Pinpoint your area of expertise and tailor your services accordingly.

Sharpen Your Skills: Never stop learning! Take online courses, attend workshops, and stay abreast of industry trends to keep your skillset sharp.

Craft a Compelling Portfolio: This is your digital handshake. Showcase your best work, highlighting past projects that demonstrate your expertise and value to potential clients.

Build Your Online Presence: Create a professional website or online portfolio that showcases your services and grabs clients' attention. Utilize social media platforms like LinkedIn to connect with potential clients and build your professional network.

Gear Up for Success: Invest in the tools you need to excel. This might include design software, project management apps, or communication platforms depending on your chosen field.

The Client Conundrum: How to Find Work and Land Your Dream Projects

The lifeblood of any freelance career is a steady stream of clients. Here's how to get them knocking at your virtual door:

Leverage Online Marketplaces: Platforms like Upwork and Fiverr connect freelancers with clients worldwide. While competition can be fierce, these platforms are a great way to build your initial client base.

Network Like a Pro: Attend industry events, connect with potential clients on LinkedIn, and don't underestimate the power of word-of-mouth recommendations.

Guest Blogging and Content Marketing: Publish informative articles on relevant industry websites to showcase your expertise and attract potential clients who need your services.

Cold Pitching: This can be nerve-wracking, but crafting compelling proposals directly to businesses that might need your services can be highly effective.

Freelancing 101: The Nitty-Gritty of Running Your Own Business

Freelancing isn't just about creative work. Here's how to handle the business side of things:

Setting Rates and Contracts: Research industry standards for your services and set competitive yet profitable rates. Always have a clearly defined contract in place that outlines project scope, fees, deadlines, and payment terms.

Invoicing and Payment Management: Develop a system for sending invoices on time and following up on late payments. Consider online invoicing tools to streamline this process.

Taxes, Oh Taxes: Don't let taxes become a nasty surprise at the end of the year. Educate yourself on freelancer tax requirements and consider consulting a tax professional for guidance.

Building a Sustainable Freelance Career: Tips and Tricks for Long-Term Success

The freelance journey is a marathon, not a sprint. Here are some tips to ensure you stay ahead of the curve:

Always Be Learning: Continue honing your skills, stay updated on industry trends, and explore new areas of expertise to keep your services relevant and in demand.

Diversify Your Income Streams: Don't rely solely on one or two clients. Actively seek new projects and consider offering additional services to expand your income potential.

Invest in Yourself: This doesn't just mean fancy equipment. Attend conferences, workshops, or even take a well-deserved vacation to avoid burnout. Investing in your well-being fosters creativity and productivity.

Build a Support System: Freelancing can be isolating at times. Connect with other freelancers online or in your local area. Communities like Sorbet provide a space to share experiences, troubleshoot challenges, and celebrate successes.

The Final Word: Embrace the Freelance Adventure!

Taking the leap into freelancing can be exhilarating and liberating. Remember, the road to success won't always be smooth, but with dedication, perseverance, and the right strategies in place, you can build a thriving freelance career and live life on your own terms. So, ditch the fluorescent lights, embrace the freedom, and get ready to write your own freelance success story!

Bonus Tip: Don't be afraid to experiment and find what works best for you. The beauty of freelancing lies in its flexibility. Adapt your approach, refine your strategies, and continuously strive to improve your craft and your business acumen.

3 notes

·

View notes

Text

Tax Season Checklist

Tax season can be a demanding time for everyone, from small businesses and freelancers to individual filers. Proper preparation is key to ensuring a smooth tax filing process. Use this checklist as your guide through each step, making sure you’ve covered all essential items for your tax filing.

Gather Personal Information

Social Security Numbers (SSN) for yourself and all dependents

Addresses and dates of birth

Bank account and routing number for direct deposit/refund

Last year’s Adjusted Gross Income (AGI) for electronic signature

Income Documents

W-2 forms from all employers

1099 forms for freelancers and independent contractors

Interest statements (Form 1099-INT or Form 1099-OID)

Dividend statements (Form 1099-DIV)

Sales proceeds from stocks, bonds, etc. (Form 1099-B)

Retirement plan distribution (Form 1099-R)

Miscellaneous income records (prizes, rent income, etc.)

Deduction and Credit Documents

Home mortgage interest (Form 1098)

Real estate and personal property tax records

Receipts for charitable donations and gifts

Medical and dental expense records

Educational expenses (Form 1098-T)

Student loan interest paid (Form 1098-E)

Childcare expenses (provider’s tax ID number required)

Health Insurance Information

Marketplace coverage (Form 1095-A)

Health coverage exemption certificate, if applicable

Records of healthcare payments for Premium Tax Credit

Tax Forms and Worksheets

Current year’s tax return forms and schedules

Worksheets for itemized deductions, if applicable

Previous Tax Returns

Copies of past tax returns (3-7 years recommended)

Bank Account Information

Account numbers for any account into which you’d like a refund deposited

Records for interest paid or earned, if applicable

Miscellaneous

Notices from the IRS or other revenue systems, if received

Record of estimated tax payments made during the year, if applicable

Review and Organize

Review all documents to ensure they are complete and accurate

Organize documents by category for easy reference

Compile a list of questions or concerns for your tax advisor or software

File Taxes

Choose the appropriate filing method for your situation (e-file or mail)

Submit tax returns by the due date or file for an extension, if needed

Payment

Schedule payment for any taxes owed, or confirm refund details

Follow Up

Track refund status, if expecting one

Store copies of filed tax returns and all relevant documentation securely

Plan for any quarterly or future tax adjustments needed

Confirm that checks have cleared or payments have been debited

Remember, this checklist is a general guide and your tax situation may require additional information. Always consult with a tax professional or IRS resources to ensure that all your tax responsibilities are fulfilled.

Comments

2 notes

·

View notes

Text

TAX PREPARATION BEST PRACTICES FOR A STRESS-FREE FILING SEASON

As we inch closer to the infamous tax filing season, the palpable tension in the air becomes almost unavoidable. For many, the thought of navigating the labyrinthine tax codes and forms is enough to induce a cold sweat. But it doesn't always have to be this way.

With a little forethought and meticulous planning, tax preparation can be a breezy, walk-in-the-park experience, saving you not only precious time but also potential penalties for mistakes or late submissions.

In this article, we'll dive headfirst into a wealth of expert tips, savvy strategies, and best practices for tax preparation that promise to transform your filing season from a stress-inducing nightmare into a seamless and orderly process.

From understanding how to maximize your deductions, to organizing your financial paperwork, to deciding whether to enlist the help of a professional, we'll equip you with all the tools and knowledge you need to tackle your tax preparation with confidence and ease.

Organize Your Financial Records

The foundation of a smooth tax preparation process is well-organized financial records. To ensure accuracy and efficiency in preparing your taxes, follow these steps for organizing your financial documents:

1. Gather all essential documents: Begin by collecting critical financial records related to your income, deductions, and credits. These may include W-2 forms, 1099 forms, bank statements, receipts for charitable donations, and business expense documentation.

2. Categorize and sort your records: Separate your financial documents into clearly defined categories, such as income, business expenses, and deductions. This approach will make it easier to locate and reference specific documents when preparing your tax return.

3. Use a system for tracking expenses: Implementing a consistent method for recording and tracking your expenses throughout the year, such as financial software or a dedicated expense journal, can greatly simplify the tax preparation process.

4. Store documents securely: Keep your financial records in a secure location, whether it's a physical filing cabinet or encrypted digital storage. This ensures easy access to essential information while protecting your sensitive financial data.

Understand Your Tax Obligations and Deadlines

Staying informed about your tax obligations and deadlines is essential for avoiding penalties or other consequences. To ensure you're educated and prepared for tax season, consider the following tips:

1. Stay up-to-date on tax laws: Tax laws and regulations can change frequently, so make a point to stay informed about any updates or changes that may impact your tax return.

2. Identify the appropriate tax forms: Depending on your financial circumstances, you may need to complete various tax forms. Ensure you've correctly identified and obtained the necessary forms prior to beginning your tax preparation process.

3. Familiarize yourself with relevant tax credits and deductions: Research and understand the tax credits and deductions available to you, enabling you to maximize your tax savings.

4. Be aware of tax deadlines: Missing tax filing deadlines can result in costly penalties. Mark the relevant tax deadlines on your calendar, and consider filing your return early to avoid last-minute stress.

Avoid Common Tax Filing Mistakes

Mistakes during the tax preparation process can lead to delays, penalties, or even audits. To safeguard against errors, follow these guidelines:

1. Double-check your personal information: Confirm that critical details, such as your Social Security number and address, are correct on your tax return.

2. Report all income: Ensure that you report all forms of income, including freelance work, investment income, or gig economy earnings.

3. Verify your deductions and credits: Carefully review your deductions and credits to ensure you’ve followed the guidelines and have correctly calculated the amounts claimed.

4. File electronically: Electronic filing reduces the likelihood of errors and offers faster processing times for tax refunds.

Partner with Advance Tax Relief for Expert Tax Preparation

Enlisting professional tax preparation assistance from Advance Tax Relief offers numerous benefits, including:

1. Accurate and compliant tax filings: Experienced tax professionals possess thorough knowledge of tax laws and regulations, ensuring your return is completed accurately and in compliance with current tax legislation.

2. Time-saving convenience: Outsourcing your tax preparation can free up valuable time, allowing you to focus on your personal and professional goals without the distraction of tax season stress.

3. Proactive tax planning: Advance Tax Relief can also assist with proactive tax planning strategies, identifying opportunities for tax savings and advising on strategies to minimize your tax liability for future filing seasons.

4. Audit support and representation: Should you face an IRS audit, Advance Tax Relief can provide expert guidance, support, and representation throughout the process, alleviating your concerns and simplifying a potentially overwhelming experience.

Achieve a Stress-free Filing Season with Advance Tax Relief

Implementing best practices for tax preparation can help ensure a smooth, stress-free filing season, allowing you to concentrate on your financial objectives with confidence. Advance Tax Relief, a leading tax resolution company in Houston, Texas, is dedicated to providing expert tax preparation services, ensuring accuracy and compliance in your tax filings, and offering support for future tax planning and potential audit situations.

Discover how our experienced team can simplify the tax preparation process, enabling you to approach each filing season with confidence and ease. Contact us today to explore our comprehensive tax solutions and services and begin your journey towards a hassle-free tax filing experience.

2 notes

·

View notes

Text

"A Google employee protesting the tech giant’s business with the Israeli government was questioned by Google’s human resources department over allegations that he endorsed terrorism, The Intercept has learned. The employee said he was the only Muslim and Middle Easterner who circulated the letter and also the only one who was confronted by HR about it.

The employee was objecting to Project Nimbus, Google’s controversial $1.2 billion contract with the Israeli government and its military to provide state-of-the-art cloud computing and machine learning tools.

Since its announcement two years ago, Project Nimbus has drawn widespread criticism both inside and outside Google, spurring employee-led protests and warnings from human rights groups and surveillance experts that it could bolster state repression of Palestinians.

Mohammad Khatami, a Google software engineer, sent an email to two internal listservs on October 18 saying Project Nimbus was implicated in human rights abuses against Palestinians — abuses that fit a 75-year pattern that had brought the conflict to the October 7 Hamas massacre of some 1,200 Israelis, mostly civilians. The letter, distributed internally by anti-Nimbus Google workers through company email lists, went on to say that Google could become “complicit in what history will remember as a genocide.”

“Strangely enough, I was the only one of us who was sent to HR over people saying I was supporting terrorism or justifying terrorism.”

Twelve days later, Google HR told Khatami they were scheduling a meeting with him, during which he says he was questioned about whether the letter was “justifying the terrorism on October 7th.”

In an interview, Khatami told The Intercept he was not only disturbed by what he considers an attempt by Google to stifle dissent on Nimbus, but also believes he was left feeling singled out because of his religion and ethnicity. The letter was drafted and internally circulated by a group of anti-Nimbus Google employees, but none of them other than Khatami were called by HR, according to Khatami and Josh Marxen, another anti-Nimbus organizer at Google who helped spread the letter. Though he declined to comment on the outcome of the HR meeting, Khatami said it left him shaken.

“It was very emotionally taxing,” Khatami said. “I was crying by the end of it.”

“I’m the only Muslim or Middle Eastern organizer who sent out that email,” he told The Intercept. “Strangely enough, I was the only one of us who was sent to HR over people saying I was supporting terrorism or justifying terrorism.”

The Intercept reviewed a virtually identical email sent by Marxen, also on October 18. Though there are a few small changes — Marxen’s email refers to “a seige [sic] upon all of Gaza” whereas Khamati’s cites “the complete destitution of Gaza” — both contain verbatim language connecting the October 7 attack to Israel’s past treatment of Palestinians.

Google spokesperson Courtenay Mencini told The Intercept, “We follow up on every concern raised, and in this case, dozens of employees reported this individual’s email – not the sharing of the petition itself – for including language that did not follow our workplace policies.” Mencini declined to say which workplace policies Khatami’s email allegedly violated, whether other organizers had gotten HR calls, or if any other company personnel had been approached by Employee Relations for comments made about the war.

The incident comes just one year after former Google employee Ariel Koren said the company attempted to force her to relocate to Brazil in retaliation for her early anti-Nimbus organizing. Koren later quit in protest and remains active in advocating against the contract. Project Nimbus, despite the dissent, remains in place, in part because of contractual terms put in place by Israel forbidding Google from cutting off service in response to political pressure or boycott campaigns."

2 notes

·

View notes

Text

Exploring BitiCodesPro: Trading, Risks, and Regulations

In the world of trading, the allure of substantial profits often goes hand in hand with the risk of substantial losses. Approximately 70% of traders find themselves on the losing side of the equation, underscoring the need for a cautious and informed approach to trading.

One term that may catch your attention in this landscape is "BitiCodesPro." However, it's essential to understand that BitiCodesPro is primarily a marketing term and not representative of a specific company or service. The individuals featured in promotional videos associated with BitiCodesPro are often actors, reinforcing the importance of skepticism when evaluating such content.

Before you embark on any investment journey, it's crucial to meticulously review the Terms & Conditions and the Disclaimer page of the third-party investor platform you're considering. Additionally, it's imperative to familiarize yourself with your country's tax regulations concerning investment gains to ensure compliance with the law.

In the United States, trading options on commodities is subject to stringent regulations. Encouraging people to trade such options is only permissible when they are traded on a CFTC-registered exchange or possess legal exemptions. More Information: BitiCodesPro

The United Kingdom also imposes its set of trading regulations. The Financial Conduct Authority (FCA) policy PS20/10 specifically prohibits the sale, marketing, and distribution of Contracts for Difference (CFDs) for cryptocurrencies and restricts promotional materials related to these products for UK consumers.

When you share your personal information with trading platforms, it's vital to recognize that this information may be shared with third-party trading service providers in accordance with the platform's Privacy Policy and Terms & Conditions. Your options for trading are diverse, including utilizing trading software, human brokers, or making your own trades.

2 notes

·

View notes

Text

The Restrict Act 2023

About the Restrict Act

There’s a lot of information/misinformation I’ve been seeing about the Restrict Act. I’ve stared at the damn bill for around thirty hours at this point, so I thought I’d give people a summary of what it’s actually doing as well as what it isn’t doing, to help you avoid misinformation.

Buckle in, folks, because this is going to be a long post. I know Tumblr is allergic to nuance, but hopefully you’ll be able to see both the good and the bad in this bill by the time I’m done, and be able to understand what’s actually going on. If you just want to see problems with the act, the last section is devoted to that.

tl;dr good in spirit because of the rising rate of infrastructure cyberattacks, but the letter of the law could use a little work to make sure that the government can't overstep

Why the Restrict Act?

Let’s start with the why. Why does the US government feel like this Act is necessary? The stated purpose is: “To authorize the Secretary of Commerce to review and prohibit certain transactions between persons in the United States and foreign adversaries, and for other purposes.” Which is a bunch of legalese, so I’ll give you some examples of things that are happening in the real world which the government wants more authority to look into.

The author of the bill, Sen. Warner, specifically cited Huawei and Kapersky as companies that were doing Suspicious Things, so we’ll look at those first.

Huawei: Huawei is a telecommunications company. The US, Australia, Canada, Sweden, UK, Lithuania, and Estonia have all taken various actions against Huawei over the last decade or so. In 2012, a malicious software update was installed on Huawei devices in Australia, attacking Australia’s telecommunications network. In 2021, a Washington Post review suggested that Huawei was involved in mass surveillance programs. In 2014, a Huawei engineer was caught hacking a cell phone tower in India

Kapersky: The UK, Lithuania, the Netherlands, the EU, Germany, and Italy have all taken action against Kapersky. This company produces antivirus software, and was accused of working on secret projects with Russia’s Federal Security Service, especially in the wake of Russian interference in the 2016 election. Allegedly, the company used the popular antivirus software to secretly scan for classified documents and other information, and allegedly stole NSA information.

In addition to these two companies, there have been tons of cyberattacks worldwide.

Half of the United States’ fuel supply was compromised due to a hack on Colonial Pipeline, shutting down fuel for some areas in the American southeast for days

A hacking group disrupted Iranian steel factories and even started a fire

Costa Rica had to declare a national emergency after government systems were hit, including systems for exports, pensions, taxes, welfare, and even Covid-19 testing.

A ransomware attack caused a major outage to emergency health services in the UK

The stated purpose of this act is to give the USA some kind of formal process to make decisions when something like this is suspected of happening, and when it’s caused by a “foreign adversary.”

What’s a foreign adversary?

A foreign adversary is a country that has engaged in a “long-term pattern or serious instances of conduct significantly adverse to the national security of the United States or security and safety of United States persons.”

The bill kindly provides us with a list of six countries that fit this description: China(including Hong Kong), Cuba, Iran, Korea, Russia, and Venezuela

The Secretary of Commerce can add/remove countries to this list at any time, as long as Congress is informed within 15 days of the reasoning behind that decision.

Once Congress is informed, Congress can disagree via joint resolution (So both Houses have to vote to disagree with the Secretary of Commerce’s decision). If Congress disagrees, there’s a whole complicated process for getting the label added/removed.

We’ll get into the ethics later, in the Genuine Problems section.

For the rest of this post, I’ll be saying Scary Countries instead of foreign adversaries, so that it’s easier for people to understand.

What is the United States allowed to investigate using this Act?

So first we’re going to define some things, because the Act is very specific about what the United States can investigate.

The bill defines something called a “covered transaction,” which is basically a financial or technological action taken by a Scary Country or on behalf of a Scary Country. For the rest of this post, I’ll be saying Scary Action instead of covered transaction.

The bill also defines something called a “covered holding,” which is essentially any group that is partially or fully owned by a Scary Country, on behalf of a Scary Country, or that falls under a Scary Country’s jurisdiction, even with degrees of separation. The group has to affect either 1+ million Americans or has to have sold 1+ million units of a tech product to Americans. This group is usually a company, but it can be other things, too. For the rest of this post, I’ll be saying Scary & Important Group instead of covered holding.

The Secretary of Commerce is allowed to find/investigate/stop any Scary Action or Scary & Important Group that wants to do one of the following:

sabotage information and communications tech in the US

damage critical infrastructure or the digital economy of the US

interfere with a Federal election

undermine democratic processes

Pose any other unacceptable risk to the USA.

This is a list of Really Bad Things, so from now on I’m going to call it the List of Really Bad Things.

If it’s a Scary & Important Group instead of a Scary Action, the Secretary will refer the information to the President, who will then decide what to do to stop the threat. Otherwise, if it’s just a Scary Action, the Secretary has the authority to stop it.

If the Secretary finds out that something Scary is going on and that it falls under the List of Really Bad Things, the Secretary is REQUIRED to publish information in a DECLASSIFIED form about why they thought there was a threat and what was done to stop it, as long as none of the information is already classified. (This is a good thing!)

Process

First, the Secretary is given authority to find and investigate Scary Actions and Scary & Important Groups. The Secretary is also allowed to delegate this to Federal officials. Something key here is that the bill says that Federal officials can only have investigative powers that are “conferred upon them by any other Federal law.” They don’t get any extra powers. Anyone who tells you otherwise is panicking too hard to properly read the bill.

So what happens if, in the course of investigation, the Secretary finds out that a Scary Action or Scary & Important Group is trying to do a Really Bad Thing? Simple. The Attorney General will bring the case to an “appropriate district court.” The max fine for a civil penalty for an individual here is $250,000. For a criminal penalty for an individual, the max fine is $1 million and/or 20 years in prison, as well as giving up any of the things they used to do Really Bad Stuff with.

If someone is found guilty, they can appeal that decision, but only to the District of Columbia Circuit. Note that this is only for appeals! Otherwise, everything will be through the normal federal district courts.

If the appeal fails, too, the US will file all of the information that they used to make any big decisions with the court, and will give the defendant all of the information that is not classified, so that the defendant can ask for a full review.

Once the United States has stopped a Scary Action or a Scary & Important Group from doing Really Bad Things, it’s illegal to go around/against any of the actions that US has taken to do that.

Specifically, the bill says that “no person may cause or aid, abet, counsel, command, induce, procure, permit, or approve the doing of any act prohibited by, or the omission of any act required by any regulation, order, direction, mitigation measure, prohibition, or other authorization or directive issued under, this Act.”

Yes, this is legitimately scary. We’ll get into the ethics later, in the Genuine Problems section.

Myths

The bill gives the USA power to ban VPNs!

No. Unless the VPN company is trying to do one of the Really Bad Things under the instruction of a Scary Country or is suspected of doing one of the Really Bad Things, the VPN company will be fine.

The bill gives the USA power to investigate way more than they could before!

No. “In conducting investigations described in paragraph (1), designated officers or employees of Federal agencies described that paragraph may, to the extent necessary or appropriate to enforce this Act, exercise such authority as is conferred upon them by any other Federal law, subject to policies and procedures approved by the Attorney General” (emphasis mine).

Important here is “exercise such authority as is conferred upon them by any other Federal law” — this act is not giving them additional leeway. Really, the USA is making use of the lack of privacy that’s already baked into law in order to investigate.

If TikTok is banned and I use a VPN to access it, I could go to jail for 20 years!

Possible but severely unlikely, at least according to this law. Let’s go through some scenarios:

Scenario 1: The USA takes TikTok to court. In the decision, the USA says the TikTok app is no longer allowed to be on any app store. In this case, using a VPN to access TikTok would still be allowed, since the ban is for TikTok’s actions, not US citizens’ actions.

Scenario 2: The USA takes TikTok to court. In the decision, the USA says that TikTok is required to have some kind of filter banning US IP addresses. In this case, using a VPN to access TikTok would still be allowed, since the ban is for TikTok’s actions, not US citizens’ actions.

Scenario 3: The USA enacts a law forbidding citizens from accessing TikTok. This is unlikely, since the USA would have to have an entirely separate non-court procedure to do this, which is only kind of in the scope of the law. I guess it’s possible, but it’s skating on thin ice. In this case, using a VPN to access TikTok would be a crime. 4. If you’re charged, you have to go to the DC Circuit Court and not any of the other courts!

Actually, you’d first be charged under an ordinary district court in your state. If you decide to appeal, however, then you have to appeal to DC.

Genuine Problems

Adding a Scary Country to the list seems really easy. There’s nothing to stop the government from adding every single country to the list and then investigating every single action. Granted, it’s highly unlikely that this would happen, simply because then the amount of information would be difficult to go through, but it’s possible.

In the list of Really Bad Things, there’s an additional list item saying “otherwise poses an undue or unacceptable risk to the national security of the United States or the safety of United States persons.” Who determines that?

The definition of a Scary Action is ridiculously broad. It covers any financial or technology-related action. That could refer to a lot of different things.

While the bill is clearly intended only to prosecute people doing Really Bad Things, the wording is kind of vague in some places, and could be used to prosecute others, too.

Specifically, I’m thinking about this clause:

“no person may cause or aid, abet, counsel, command, induce, procure, permit, or approve the doing of any act prohibited by, or the omission of any act required by any regulation, order, direction, mitigation measure, prohibition, or other authorization or directive issued under, this Act”

Yeah this could definitely be used for overreach. It’s far too broad. If there was an infrastructure attack on the USA that affected the police dept, and an ACAB armchair activist tweeted “haha karma” would that count as grounds for prosecution? I have a genuine problem with this clause. The loopholes here are ridiculously large.

Overall, it seems as though this bill is aimed at large companies rather than citizens, but there are definitely loopholes for the government to exploit.

10 notes

·

View notes

Text

How to Make Sure You're Withholding and Reporting Your Taxes Correctly

Taxes are an inevitable part of life for most individuals and businesses. Whether you're a salaried employee, a freelancer, or a business owner, understanding how to withhold and report your taxes correctly is crucial to avoid potential legal troubles and financial headaches down the road. In this article, we will explore the key steps and considerations to ensure that you're handling your taxes in a responsible and compliant manner.

Know Your Tax Obligations

The first and most critical step in ensuring you're withholding and Outsource Management Reporting your taxes correctly is to understand your tax obligations. These obligations vary depending on your employment status and the type of income you earn. Here are some common categories of taxpayers:

1. Salaried Employees

If you're a salaried employee, your employer typically withholds income taxes from your paycheck based on your Form W-4, which you fill out when you start your job. It's essential to review and update your W-4 regularly to ensure that your withholding accurately reflects your current financial situation. Major life events like marriage, having children, or significant changes in your income should prompt you to revisit your W-4.

2. Freelancers and Self-Employed Individuals

Freelancers and self-employed individuals often have more complex tax obligations. You are responsible for estimating and paying your taxes quarterly using Form 1040-ES. Keep detailed records of your income and expenses, including receipts and invoices, to accurately report your earnings and deductions.

3. Small Business Owners

If you own a small business, your sales tax responsibilities extend beyond your personal income. You must separate your business and personal finances, keep meticulous records of all business transactions, and file the appropriate business tax returns. The structure of your business entity (e.g., sole proprietorship, partnership, corporation) will determine the specific tax forms you need to file.

4. Investors and Property Owners

Investors and property owners may have to report income from dividends, interest, capital gains, or rental properties. These income sources have their specific tax reporting requirements, and it's essential to understand and comply with them.

Keep Accurate Records

Regardless of your tax situation, maintaining accurate financial records is essential. Detailed records make it easier to report your income and deductions correctly, substantiate any claims you make on your tax return, and provide documentation in case of an audit. Here are some record-keeping tips:

Organize Your Documents: Create a system to store your financial documents, including receipts, invoices, bank statements, and tax forms. Consider using digital tools for easier record keeping.

Track Income and Expenses: Keep a ledger or use accounting software to record all income and expenses related to your financial activities. Categorize expenses correctly to maximize deductions and credits.

Retain Documents for Several Years: The IRS typically has a statute of limitations for auditing tax returns, which is generally three years. However, in some cases, it can extend to six years or indefinitely if fraud is suspected. To be safe, keep your tax records for at least seven years.

Understand Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Deductions reduce your taxable income, while credits provide a dollar-for-dollar reduction of your tax bill. Familiarize yourself with common deductions and credits that may apply to your situation: