#taxfile

Text

TurboTax - Begin tax journey with America's #1 tax preparation provider💸

📌 Get ahead this tax season with TurboTax! 💼 Maximize your refund and minimize the stress with the easy-to-use tax software. File confidently and securely from the comfort of your own home. 💻 Don't let taxes hold you back – TurboTax has got you covered!

#turbotax#taxseason#maxrefund#taxfile#turbotaxpartner#taxseason2024#taxpreparer#taxpreperation#taxtips#taxplanning#taxplanner#taxplanningtips#faveplus

0 notes

Text

Income Tax e - filing Online Course. Upgrade your Tax e filing Practice through tyariexamki.com. Job Oriented Course

For more information

Visit us:- https://www.tyariexamki.com/.../Income-Tax-Return-E...

2 notes

·

View notes

Video

youtube

Keith L. Jones, CPA TheCPATaxProblemSolver

#youtube#tax#taxes#tax evasion#taxrelief#TaxRelief TaxBreaks TaxHelp TaxSeason FinancialFreedom TaxSavings MoneyManagement TaxTips IRS FinancialPlanning TaxPreparation TaxFiling Deb

2 notes

·

View notes

Text

youtube

#TaxReturnAmendment#AmendedTaxReturn#TaxFiling#Taxation#TaxCompliance#TaxLaw#TaxationRules#TaxGuidelines#TaxObligations#TaxPlanning#Youtube

2 notes

·

View notes

Text

Benefits of Filing Form 1099 Electronically

Filing Form 1099 electronically offers faster processing, reducing the time for corrections and penalties. It minimizes errors through built-in checks and validations, ensuring accurate submissions. Additionally, electronic filing provides instant confirmation and secure transmission, enhancing efficiency and peace of mind.

#1099Filing#Form1099online#TaxFiling#ElectronicFiling#TaxEfficiency#PaperlessTaxes#Form1099#SecureFiling#IRS1099

0 notes

Text

Your Gateway to Financial Independence through Entrepreneurship Through Acquisition (ETA)

#taxfiling#financialindependence#tax#Finance#freedom#texas#taxplanning#avantax#tasteofhome#india#desis#americandesis#maggianos#italy#indiangrocer#freshproduce#taxprofessional#retirement#Financial#Fianancialconsultation#agape#Healthcare#motivation#taxiservice#retirementplanning#masalatoast#produce#parata#indianbread#coffee

0 notes

Text

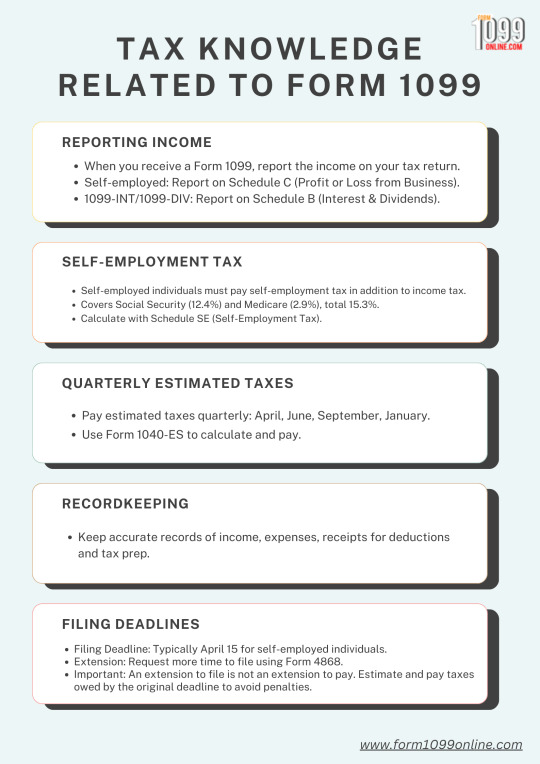

Tax Knowledge Related to Form 1099

Self-employed individuals must report income using Form 1099 and pay self-employment tax covering Social Security and Medicare. They are also required to make quarterly estimated tax payments and maintain accurate financial records. The tax filing deadline is April 15, with the option to request an extension to file, but not to pay.

#SelfEmployment#TaxFiling#1099Income#SelfEmploymentTax#TaxDeadlines#Form1099#Form1099online#SmallBusinessTax

0 notes

Text

How Does Truck2290 Help You Save on Your HVUT Payment?

Truck2290 simplifies the HVUT payment process with low filing fees and a user-friendly platform. Their features make filing quick and stress-free, ensuring you're back on the road swiftly. Visit Truck2290.com for an easy and affordable tax solution.

#IRSForm2290#TaxDocuments#HeavyVehicleUseTax#PaidForm2290#Truck2290#2290CopyRequest#TruckTax#TaxFiling#EfileTax

0 notes

Text

Stay ahead of the game and save your hard-earned money by filing on time. ⏳💼

Choose Milta Accounting Service for accurate and timely submissions.

Don’t risk late fees—file now! 🗂️✅

📞 US: +1(813)-303-0213 / 407-214-4687

🌐 https://www.miltafs.com/accounting-virtual-assistant-service.php

#TaxFiling#MiltaAccounting#AvoidPenalties#SubmitOnTime#TaxDeadline#FileToday#BusinessTax#PersonalTax#TaxTips#October15

0 notes

Text

Received a Tax Notice? Learn How to Resolve It! 📄✨

Discover the different types of tax notices and how to address them effectively. Get expert help to ensure you’re on the right track!

👉 Click here for guidance and support

1 note

·

View note

Text

Income Tax Return Filing for AY 2022-23, AY 2023-24 & AY 2024-25

#incometax#itrfiling#itr#taxplanning#taxfiling#taxcompliance#taxdeductions#taxation#taxpayer#taxsavings

0 notes

Text

"Key Benefits of Utilizing the Federal Tax Service for Accurate Tax Filing"

Ensuring accurate and timely tax filing is critical for both individuals and businesses. The Federal Tax Service provides comprehensive tools and resources to streamline the tax filing process, helping taxpayers avoid errors and stay compliant with the latest tax regulations. By using the Federal Tax Service, you gain access to professional guidance, timely updates, and the ability to efficiently manage federal tax obligations. Maximize your tax efficiency and minimize risks with the help of the Federal Tax Service, ensuring peace of mind during tax season.

0 notes

Text

Latest Updates on Form 15 CA-15 CB Filing in Delhi

Stay updated with the latest changes in Form 15 CA and 15 CB filing requirements for Delhi taxpayers. Taxgoal offers comprehensive guidance on navigating these updates efficiently, ensuring compliance and accuracy in your tax filings. Discover the key changes and how they impact your tax obligations today! Contact us (+91-9138531153) today for Form 15 CA-15 CB Filing Near Me.

#Taxgoal#CA#CAServices#Form15CA#Form15CB#DelhiTaxpayers#TaxUpdates#15CA#15CB#FilingRequirements#TaxCompliance#DelhiTax#TaxFiling#TaxAdvice

0 notes

Text

Major Compliance Requirements Under Income Tax India: A Complete Guide

Navigating India's complex income tax system requires strict adherence to various compliance requirements. This guide covers the essential compliance obligations for businesses and individuals, ensuring that taxpayers understand their responsibilities and avoid penalties.

1. Filing of Income Tax Return (ITR)

All taxpayers, including individuals, firms, and companies, are required to file their Income Tax Return (ITR) annually. Depending on the type of taxpayer, different forms apply:

ITR-1 (Sahaj): For individuals with income from salary, house property, and other sources.

ITR-2: For individuals and HUFs not having income from business or profession.

ITR-3: For individuals and HUFs with income from business or profession.

ITR-4 (Sugam): For those under the presumptive taxation scheme.

Returns are typically filed between July and September of the assessment year.

2. Advance Tax Payment

Those with significant income beyond their salary must pay advance tax in four installments throughout the year:

15% by June 15.

45% by September 15.

75% by December 15.

100% by March 15.

Failure to do so results in penalties under Sections 234B and 234C.

3. Tax Deduction at Source (TDS)

Employers, businesses, and other entities must deduct TDS for specific payments like salary, rent, and contractual payments. TDS should be deposited within the prescribed deadlines, with quarterly returns filed using:

Form 24Q for salary payments.

Form 26Q for non-salary payments.

Form 27Q for payments to non-residents.

4. Tax Audit (Section 44AB)

Businesses and professionals with turnover above specific thresholds must undergo a tax audit. This ensures that the accounts conform to tax laws and accurate tax liability is computed. The tax audit report is filed along with the income tax return.

5. Maintenance of Books of Accounts

Businesses and professionals are required to maintain detailed books of accounts if their turnover or income exceeds certain limits. Proper accounting helps ensure accurate tax calculations and compliance during audits.

6. Form 15CA/15CB for Foreign Payments

Payments to non-residents may require filing Form 15CA and 15CB. This ensures that any applicable tax is deducted before remitting payments overseas.

7. Furnishing of PAN

PAN is mandatory for numerous financial transactions, such as property purchases, mutual fund investments, and bank deposits. Failure to provide PAN may result in higher tax deductions or penalties.

8. Annual Information Return (AIR)

High-value transactions like property purchases, large deposits, or expensive credit card payments must be reported by financial institutions in the Annual Information Return (AIR). This helps the Income Tax Department detect unreported income.

9. Responding to Tax Notices

Taxpayers may receive notices for various reasons such as discrepancies in returns or scrutiny assessments. Timely responses to these notices are crucial to avoid penalties or legal action.

10. Transfer Pricing Compliance

Companies engaged in international transactions with related entities must comply with transfer pricing regulations to ensure transactions are at arm’s length. This includes filing Form 3CEB and maintaining documentation.

Conclusion

Being compliant with India’s income tax laws involves meeting various deadlines, maintaining accurate records, and understanding specific obligations. By staying informed and following these key requirements, taxpayers can avoid penalties and legal consequences.

#IncomeTaxIndia#TaxCompliance#ITR#AdvanceTax#TDS#TaxAudit#FinancialCompliance#IndiaTaxLaw#TaxFiling#ComplianÎ

0 notes

Text

Step-by-Step Instructions for Filing the 990-PF Form: A Complete Guide

Discover how to file the 990-PF form with our easy-to-follow instructions. Learn the key steps and requirements to ensure accurate submission. Simplify the process and stay compliant with our comprehensive guide.

Visit: https://www.foundationsearch.com/Assistance/help-form990.aspx

#Form990PF#TaxFiling#NonprofitCompliance#PrivateFoundation#IRSForms#TaxSeason#CharityTax#TaxGuidance#FinancialReporting#TaxExemptOrganizations

0 notes

Text

Tax Knowledge Related to Form 1099

Self-employed individuals must report income using Form 1099 and pay self-employment tax covering Social Security and Medicare. They must also make quarterly estimated tax payments and maintain accurate financial records. The tax filing deadline is April 15, and they can request an extension to file but not to pay.

#SelfEmployment#TaxFiling#1099Income#SelfEmploymentTax#TaxDeadlines#Form1099#Form1099online#SmallBusinessTax

0 notes