#time and billing software for accountants

Explore tagged Tumblr posts

Text

Things To Consider When Choosing Time And Billing Software For Accountants

When you work in your accounting firm, the entire process can be quite exciting. However, it may not be easy to manage your time and expenses effectively. Therefore, you should manage the whole process efficiently with the help of expert time and billing software for accountants. With the help of such software, you can ensure you get customized solutions that match your firm and help improve your overall efficiency. Let’s discuss more about it. Scalability As your business grows, you will require efficient solutions to manage your time properly. With the help of time and billing software, your business will seamlessly evolve even when there are several new clients, or you expand your team. You can complete all complex projects seamlessly with the help of such software. So, the software will make your journey easy, irrespective of your business size. Transparency Maintaining transparency with clients is also crucial to ensure there are no doubts or confusion in their minds. Clients can also stay updated about the time spent on the work with the help of timekeeping software. Such software helps maintain proper records of the billable hours. So clients will always stay updated. With improved transparency, you can provide clients with complete satisfaction. This will help build long-lasting relationships with clients. Streamlined project management With time and billing software solutions, you can also improve project management at your accounting firm. It will help keep track of the project process and ensure all the team members get the resources they require. When you have a proper understanding of the time and resources, you can easily get the best results with the projects. Hence, you can seamlessly get the work done before the decided deadline for every client. Quick payments Time and billing software is as useful as accounting practice management software. This software will help you complete the invoicing process quickly and also send payment reminders from time to time. Hence, you will get payments without much delay. Professional invoices If you want to provide clients with professional invoices, billing software will be the perfect option for you. It will help you get tailored invoices that match the requirements of your firm. This will help you maintain a certain image in front of your clients. So, you can surely build a unique image and stay ahead of your competitors. If you are looking for the best workflow management software for accountants, you should contact a trusted platform. To get more details, visit https://www.getcone.io/ Original Source: https://bit.ly/3Cs38jW

1 note

·

View note

Photo

Time tracking and invoicing just got a lot simpler! Try Online Practice Management System now!

An Online Practice Management System by QuickstartAdmin is here to stay. It transforms the way professionals bring about their practices. It offers a universal platform for appointment scheduling, data management, billing, and communication. With integration and real-time access from anywhere, it augments productivity and shortens administrative tasks. Say goodbye to paperwork and embrace the efficiency and convenience of an online practice management system.

#practice management software#professional practice management software#accounting practice management software#time and billing software for accountants#consulting practice management software

1 note

·

View note

Text

How to Integrate Invoice Maker Tools with Your Accounting Software

In today's fast-paced business world, efficiency and accuracy are paramount when managing financial data. One essential aspect of this is invoicing. As businesses grow, manually creating and managing invoices becomes more cumbersome. That's where invoice maker tools come into play, allowing you to quickly generate professional invoices. However, to truly streamline your financial workflow, it’s important to integrate these tools with your accounting software.

Integrating invoice maker tools with your accounting software can help automate the process, reduce human error, and improve overall productivity. This article will walk you through how to integrate your Invoice Maker Tools with accounting software effectively, ensuring smoother operations for your business.

1. Choose the Right Invoice Maker Tool

Before integration, ensure you have selected an invoice maker tool that suits your business needs. Most invoice maker tools offer basic features such as customizable templates, tax calculations, and payment tracking. However, the integration potential is an important factor to consider.

Look for an invoice maker tool that offers:

Cloud-based features for easy access and collaboration.

Customizable templates for branding.

Multi-currency support (if you do international business).

Integration capabilities with various accounting software.

Examples of popular invoice maker tools include Smaket, QuickBooks Invoice, FreshBooks, and Zoho Invoice.

2. Check Compatibility with Your Accounting Software

Not all invoice maker tools are compatible with every accounting software. Before proceeding with the integration, confirm that both your invoice maker tool and accounting software are capable of syncing with each other.

Common accounting software that integrate with invoice tools includes:

QuickBooks

Smaket

Xero

Sage

Wave Accounting

Zoho Books

Most software providers will indicate which tools can integrate with their platform. Check for available APIs, plugins, or built-in integration features.

3. Use Built-in Integrations or APIs

Many modern invoice maker tools and accounting software platforms come with built-in integrations. These are often the easiest to set up and manage.

If you choose a platform that does not offer a built-in integration, you can use APIs (Application Programming Interfaces) to link the two systems. APIs are a more technical option, but they provide greater flexibility and customization.

4. Set Up the Integration

Once you've confirmed that the invoice tool and accounting software are compatible, follow the setup process to connect both tools.

The typical steps include:

Access your accounting software: Log into your accounting software and navigate to the integration settings or marketplace.

Search for the invoice maker tool: In the marketplace or integration section, look for the invoice tool you are using.

Connect accounts: Usually, you’ll be asked to sign into your invoice maker tool from within the accounting software and authorize the integration.

Map your fields: You may need to map invoice fields (like customer names, amounts, or due dates) to corresponding fields in the accounting software to ensure the data flows seamlessly.

5. Test the Integration

After the integration is complete, it’s crucial to test whether the connection between the invoice maker and accounting software is working as expected. Generate a sample invoice and check if the details appear correctly in your accounting software. Confirm that invoices are synced, and ensure payment status updates automatically.

Test for:

Accurate syncing of client details: Ensure names, addresses, and payment history are transferred correctly.

Real-time updates: Check that any changes made to invoices in the invoice tool reflect in your accounting software.

Reporting features: Verify that your financial reports, such as profit and loss statements, include data from the invoices.

6. Automate Invoicing and Payments

Once the integration is up and running, set up automated workflows. With the right integration, you can automate recurring invoices, late payment reminders, and payment receipts. This reduces manual effort and ensures consistency in your accounting.

7. Monitor and Maintain the Integration

Just because the integration is set up doesn't mean it's a "set it and forget it" situation. Regularly monitor the syncing process to ensure everything is working smoothly.

Make sure:

Software updates: Regular updates from either your accounting software or invoice maker tool might affect the integration. Always check for compatibility after any software updates.

Backup and security: Ensure your data is securely backed up, and verify that integration tools comply with security standards.

8. Benefits of Integration

By integrating invoice maker tools with your accounting software, you’ll enjoy several key benefits:

Time Savings: Automating the invoicing process frees up time for you to focus on other important aspects of your business.

Improved Accuracy: With automatic syncing, you reduce the risk of errors that often come with manual data entry.

Better Financial Management: Real-time data syncing allows for accurate tracking of income, expenses, and cash flow, which helps with budgeting and financial forecasting.

Enhanced Customer Experience: Timely and accurate invoicing helps maintain a professional image and reduces confusion with clients.

Conclusion

Integrating invoice maker tools with Accounting Software is a smart move for businesses that want to streamline their financial operations. By selecting the right tools, following the integration steps, and ensuring regular maintenance, you can save time, improve accuracy, and focus on growing your business. Don’t let manual invoicing slow you down—leverage modern tools to automate your processes and boost efficiency.

#accounting#software#gst#smaket#billing#gst billing software#accounting software#invoice#invoice software#cloud accounting software#benefits of cloud accounting#financial software#business accounting tools#cloud-based accounting#real-time financial insights#scalable accounting solutions#cost-effective accounting software#cloud accounting security#automated accounting software#business accounting software#cloud accounting features

0 notes

Text

Real-Time Reporting Made Easy with Tririd Biz Accounting Software

The modern business world is fast, and maintaining track of your finances is very critical. With the help of Tririd Biz Accounting Software, you can get real-time reporting capabilities, thereby making better decisions without delays.

Why Real-Time Reporting Matters

With real-time reporting, you'll never miss the latest financial information again. Track sales trends or expenses in one go. You'll be fully informed about your business's performance-anywhere, anytime.

Features That Set Tririd Biz Apart

Instant Data Syncing: Real-time updates from all online and offline transactions.

Interactive Dashboards: Easy visualizations for trends, patterns, and insights.

Customizable Reports: Create sales, expense, and tax reports to your specific needs.

Cloud Integration: Access your financial information on the go with the functionality offered by cloud-based capabilities.

Advantages of Business

Faster Decision: Use fresh information and thus make better decisions.

Highly Accurate: Avoid error created during calculation in manually operated systems.

Increased Productivity: Spend less time producing reports and more time operating and increasing business.

Why Tririd Biz?

Trusted across industries, Tririd Biz Accounting Software streamlines complex financial activities. Its seamless real-time reporting system ensures you always lead.

Experience real-time reporting power today!

Learn how Tririd Biz can help you make a difference in managing your business finance. For a free demo or consultation.

Call @ +91 8980010210 / +91 9023134246

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#TRIRID Biz Accounting and Billing Software#Best Accounting Software In India#Real-time reporting software#Billing Software For Small Business#Best Online Invoicing Software for Small Business

0 notes

Text

So, let me try and put everything together here, because I really do think it needs to be talked about.

Today, Unity announced that it intends to apply a fee to use its software. Then it got worse.

For those not in the know, Unity is the most popular free to use video game development tool, offering a basic version for individuals who want to learn how to create games or create independently alongside paid versions for corporations or people who want more features. It's decent enough at this job, has issues but for the price point I can't complain, and is the idea entry point into creating in this medium, it's a very important piece of software.

But speaking of tools, the CEO is a massive one. When he was the COO of EA, he advocated for using, what out and out sounds like emotional manipulation to coerce players into microtransactions.

"A consumer gets engaged in a property, they might spend 10, 20, 30, 50 hours on the game and then when they're deep into the game they're well invested in it. We're not gouging, but we're charging and at that point in time the commitment can be pretty high."

He also called game developers who don't discuss monetization early in the planning stages of development, quote, "fucking idiots".

So that sets the stage for what might be one of the most bald-faced greediest moves I've seen from a corporation in a minute. Most at least have the sense of self-preservation to hide it.

A few hours ago, Unity posted this announcement on the official blog.

Effective January 1, 2024, we will introduce a new Unity Runtime Fee that’s based on game installs. We will also add cloud-based asset storage, Unity DevOps tools, and AI at runtime at no extra cost to Unity subscription plans this November. We are introducing a Unity Runtime Fee that is based upon each time a qualifying game is downloaded by an end user. We chose this because each time a game is downloaded, the Unity Runtime is also installed. Also we believe that an initial install-based fee allows creators to keep the ongoing financial gains from player engagement, unlike a revenue share.

Now there are a few red flags to note in this pitch immediately.

Unity is planning on charging a fee on all games which use its engine.

This is a flat fee per number of installs.

They are using an always online runtime function to determine whether a game is downloaded.

There is just so many things wrong with this that it's hard to know where to start, not helped by this FAQ which doubled down on a lot of the major issues people had.

I guess let's start with what people noticed first. Because it's using a system baked into the software itself, Unity would not be differentiating between a "purchase" and a "download". If someone uninstalls and reinstalls a game, that's two downloads. If someone gets a new computer or a new console and downloads a game already purchased from their account, that's two download. If someone pirates the game, the studio will be asked to pay for that download.

Q: How are you going to collect installs? A: We leverage our own proprietary data model. We believe it gives an accurate determination of the number of times the runtime is distributed for a given project. Q: Is software made in unity going to be calling home to unity whenever it's ran, even for enterprice licenses? A: We use a composite model for counting runtime installs that collects data from numerous sources. The Unity Runtime Fee will use data in compliance with GDPR and CCPA. The data being requested is aggregated and is being used for billing purposes. Q: If a user reinstalls/redownloads a game / changes their hardware, will that count as multiple installs? A: Yes. The creator will need to pay for all future installs. The reason is that Unity doesn’t receive end-player information, just aggregate data. Q: What's going to stop us being charged for pirated copies of our games? A: We do already have fraud detection practices in our Ads technology which is solving a similar problem, so we will leverage that know-how as a starting point. We recognize that users will have concerns about this and we will make available a process for them to submit their concerns to our fraud compliance team.

This is potentially related to a new system that will require Unity Personal developers to go online at least once every three days.

Starting in November, Unity Personal users will get a new sign-in and online user experience. Users will need to be signed into the Hub with their Unity ID and connect to the internet to use Unity. If the internet connection is lost, users can continue using Unity for up to 3 days while offline. More details to come, when this change takes effect.

It's unclear whether this requirement will be attached to any and all Unity games, though it would explain how they're theoretically able to track "the number of installs", and why the methodology for tracking these installs is so shit, as we'll discuss later.

Unity claims that it will only leverage this fee to games which surpass a certain threshold of downloads and yearly revenue.

Only games that meet the following thresholds qualify for the Unity Runtime Fee: Unity Personal and Unity Plus: Those that have made $200,000 USD or more in the last 12 months AND have at least 200,000 lifetime game installs. Unity Pro and Unity Enterprise: Those that have made $1,000,000 USD or more in the last 12 months AND have at least 1,000,000 lifetime game installs.

They don't say how they're going to collect information on a game's revenue, likely this is just to say that they're only interested in squeezing larger products (games like Genshin Impact and Honkai: Star Rail, Fate Grand Order, Among Us, and Fall Guys) and not every 2 dollar puzzle platformer that drops on Steam. But also, these larger products have the easiest time porting off of Unity and the most incentives to, meaning realistically those heaviest impacted are going to be the ones who just barely meet this threshold, most of them indie developers.

Aggro Crab Games, one of the first to properly break this story, points out that systems like the Xbox Game Pass, which is already pretty predatory towards smaller developers, will quickly inflate their "lifetime game installs" meaning even skimming the threshold of that 200k revenue, will be asked to pay a fee per install, not a percentage on said revenue.

[IMAGE DESCRIPTION: Hey Gamers!

Today, Unity (the engine we use to make our games) announced that they'll soon be taking a fee from developers for every copy of the game installed over a certain threshold - regardless of how that copy was obtained.

Guess who has a somewhat highly anticipated game coming to Xbox Game Pass in 2024? That's right, it's us and a lot of other developers.

That means Another Crab's Treasure will be free to install for the 25 million Game Pass subscribers. If a fraction of those users download our game, Unity could take a fee that puts an enormous dent in our income and threatens the sustainability of our business.

And that's before we even think about sales on other platforms, or pirated installs of our game, or even multiple installs by the same user!!!

This decision puts us and countless other studios in a position where we might not be able to justify using Unity for our future titles. If these changes aren't rolled back, we'll be heavily considering abandoning our wealth of Unity expertise we've accumulated over the years and starting from scratch in a new engine. Which is really something we'd rather not do.

On behalf of the dev community, we're calling on Unity to reverse the latest in a string of shortsighted decisions that seem to prioritize shareholders over their product's actual users.

I fucking hate it here.

-Aggro Crab - END DESCRIPTION]

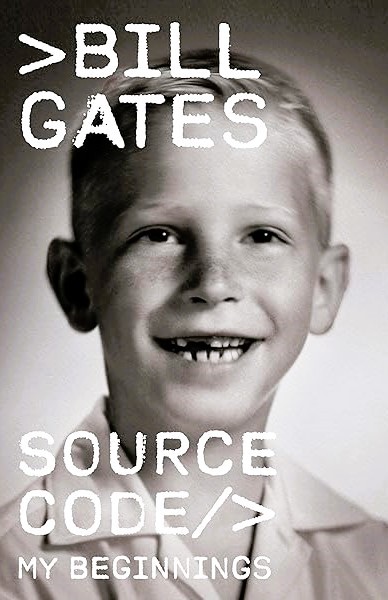

That fee, by the way, is a flat fee. Not a percentage, not a royalty. This means that any games made in Unity expecting any kind of success are heavily incentivized to cost as much as possible.

[IMAGE DESCRIPTION: A table listing the various fees by number of Installs over the Install Threshold vs. version of Unity used, ranging from $0.01 to $0.20 per install. END DESCRIPTION]

Basic elementary school math tells us that if a game comes out for $1.99, they will be paying, at maximum, 10% of their revenue to Unity, whereas jacking the price up to $59.99 lowers that percentage to something closer to 0.3%. Obviously any company, especially any company in financial desperation, which a sudden anchor on all your revenue is going to create, is going to choose the latter.

Furthermore, and following the trend of "fuck anyone who doesn't ask for money", Unity helpfully defines what an install is on their main site.

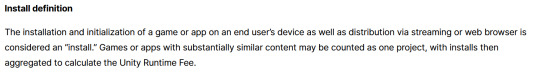

While I'm looking at this page as it exists now, it currently says

The installation and initialization of a game or app on an end user’s device as well as distribution via streaming is considered an “install.” Games or apps with substantially similar content may be counted as one project, with installs then aggregated to calculate the Unity Runtime Fee.

However, I saw a screenshot saying something different, and utilizing the Wayback Machine we can see that this phrasing was changed at some point in the few hours since this announcement went up. Instead, it reads:

The installation and initialization of a game or app on an end user’s device as well as distribution via streaming or web browser is considered an “install.” Games or apps with substantially similar content may be counted as one project, with installs then aggregated to calculate the Unity Runtime Fee.

Screenshot for posterity:

That would mean web browser games made in Unity would count towards this install threshold. You could legitimately drive the count up simply by continuously refreshing the page. The FAQ, again, doubles down.

Q: Does this affect WebGL and streamed games? A: Games on all platforms are eligible for the fee but will only incur costs if both the install and revenue thresholds are crossed. Installs - which involves initialization of the runtime on a client device - are counted on all platforms the same way (WebGL and streaming included).

And, what I personally consider to be the most suspect claim in this entire debacle, they claim that "lifetime installs" includes installs prior to this change going into effect.

Will this fee apply to games using Unity Runtime that are already on the market on January 1, 2024? Yes, the fee applies to eligible games currently in market that continue to distribute the runtime. We look at a game's lifetime installs to determine eligibility for the runtime fee. Then we bill the runtime fee based on all new installs that occur after January 1, 2024.

Again, again, doubled down in the FAQ.

Q: Are these fees going to apply to games which have been out for years already? If you met the threshold 2 years ago, you'll start owing for any installs monthly from January, no? (in theory). It says they'll use previous installs to determine threshold eligibility & then you'll start owing them for the new ones. A: Yes, assuming the game is eligible and distributing the Unity Runtime then runtime fees will apply. We look at a game's lifetime installs to determine eligibility for the runtime fee. Then we bill the runtime fee based on all new installs that occur after January 1, 2024.

That would involve billing companies for using their software before telling them of the existence of a bill. Holding their actions to a contract that they performed before the contract existed!

Okay. I think that's everything. So far.

There is one thing that I want to mention before ending this post, unfortunately it's a little conspiratorial, but it's so hard to believe that anyone genuinely thought this was a good idea that it's stuck in my brain as a significant possibility.

A few days ago it was reported that Unity's CEO sold 2,000 shares of his own company.

On September 6, 2023, John Riccitiello, President and CEO of Unity Software Inc (NYSE:U), sold 2,000 shares of the company. This move is part of a larger trend for the insider, who over the past year has sold a total of 50,610 shares and purchased none.

I would not be surprised if this decision gets reversed tomorrow, that it was literally only made for the CEO to short his own goddamn company, because I would sooner believe that this whole thing is some idiotic attempt at committing fraud than a real monetization strategy, even knowing how unfathomably greedy these people can be.

So, with all that said, what do we do now?

Well, in all likelihood you won't need to do anything. As I said, some of the biggest names in the industry would be directly affected by this change, and you can bet your bottom dollar that they're not just going to take it lying down. After all, the only way to stop a greedy CEO is with a greedier CEO, right?

(I fucking hate it here.)

And that's not mentioning the indie devs who are already talking about abandoning the engine.

[Links display tweets from the lead developer of Among Us saying it'd be less costly to hire people to move the game off of Unity and Cult of the Lamb's official twitter saying the game won't be available after January 1st in response to the news.]

That being said, I'm still shaken by all this. The fact that Unity is openly willing to go back and punish its developers for ever having used the engine in the past makes me question my relationship to it.

The news has given rise to the visibility of free, open source alternative Godot, which, if you're interested, is likely a better option than Unity at this point. Mostly, though, I just hope we can get out of this whole, fucking, environment where creatives are treated as an endless mill of free profits that's going to be continuously ratcheted up and up to drive unsustainable infinite corporate growth that our entire economy is based on for some fuckin reason.

Anyways, that's that, I find having these big posts that break everything down to be helpful.

#Unity#Unity3D#Video Games#Game Development#Game Developers#fuckshit#I don't know what to tag news like this

6K notes

·

View notes

Text

CREVH - GOLD

QuickBooks is a renowned accounting software that offers a seamless solution for small businesses to manage their financial tasks efficiently. With features designed to streamline accounting processes, QuickBooks simplifies tasks such as tracking receipts, income, bank transactions, and more. This software is available in both online and desktop versions, catering to the diverse needs of businesses of all sizes. QuickBooks Online, for instance, allows users to easily track mileage, expenses, payroll, send invoices, and receive payments online, making it a comprehensive tool for financial management. Moreover, QuickBooks Desktop provides accountants with exclusive features to save time and enhance productivity. Whether it's managing income and expenses, staying tax-ready, invoicing, paying bills, managing inventory, or running reports, QuickBooks offers a range of functionalities to support businesses in their accounting needs.

Utilizing qb accounting software purposes comes with a myriad of benefits that can significantly enhance business operations. Some key advantages of using QuickBooks include:

- Efficient tracking of income and expenses

- Simplified tax preparation and compliance

- Streamlined invoicing and payment processes

- Effective management of inventory

- Generation of insightful financial reports

- Integration with payroll and HR functions

These benefits not only save time and effort but also contribute to better financial decision-making and overall business growth. QuickBooks is designed to meet the diverse needs of businesses, offering tailored solutions for various industries and sizes.

When considering accounting qb software options, QuickBooks stands out as a versatile and comprehensive choice. To provide a holistic view, let's compare QuickBooks with two other popular accounting software options - Xero and FreshBooks. quick book accounting package and offers robust features for small businesses, including advanced accounting capabilities, invoicing, payment processing, and payroll management. Xero, on the other hand, is known for its user-friendly interface and strong collaboration features, making it a popular choice among startups and small businesses. FreshBooks excels in invoicing and time tracking functionalities, catering to freelancers and service-based businesses. By evaluating the features, pricing, and user experience of these accounting software options, businesses can make an informed decision based on their specific needs and preferences.

555 notes

·

View notes

Note

Hello Nicholas!

I hope this isn't a weird question, but I saw in one of your posts that you used to be in a huge amount of debt and now you're living more comfortably- how did you manage to get out of debt? I feel like every time I start even trying to figure out where to start, it's just all too big to ever get out from under. Do you have any advice for me?

Hope you have a great day!

Hey there! Yes, from about 2007-2010 (before I transitioned), I was making less than $10k/year. I defaulted on all my credit cards, exhausted my retirement, and nearly lost my house. It sucked, and in 2024, I'm finally start to feel somewhat secure. What I learned (assuming living in the US, I also did not have student loan debt):

I had to first figure out the sources of my debt. A big chunk of it was because of bad spending habits due to mental illness (hoarding + retail therapy when I was dysphoric/depressed). Another chunk was from being in an abusive friendship. Another, from being unemployed. And the last, was general capitalism (this was during the housing crisis.)

I started working on improving myself to curb behaviors that led to debt. I started working on my hoarding. I started transition to improve my mental health (had to sell some stuff to afford HRT). It took until 2015 to ditch my abuser, alas.

I started working on new job skills. I swallowed my pride and got an office job after a failed 3-year stint at freelancing. It was shitty, but enough to take care of my income emergencies -- keeping my house out of foreclosure. I got a better job 8 months later. It also sucked and I was in it for 7 years, but eventually changed industries and that's when my career took off. Because with each new job, I've gotten better and better pay.

I started using budgeting software. YNAB is my favorite. I try to account for every single dollar I have.

I started spending smarter. Food was the expense I had the most control over. I went to the salvage grocery store (you can find non-expired stuff if you hunt) and bought the "ugly" produce 1 day away from rotting from the local markets. I actually managed to eat well once I found these grocery stores, and my food bill became a fraction of what it'd been at typical grocery stores. I do wish that I had given food pantries a shot, but I was in denial about my poverty at the time.

I sold a ton of useless crap. I got rid of a good chunk of my nerd "collectibles". I only miss a few things over a decade later.

I negotiated with my debt collectors. I managed to set up payment plans with my credit card companies, condo association, and the IRS. I also did a debt consolidation loan once I qualified and was sure I could commit to the monthly payments. It forced me to be super strict about my budget and for about 5 years I didn't buy much for myself. It sucked, but I cleared a bunch of debt that way.

I got help from my family. I was embarrassed to tell my family about my predicament, but it became impossible to hide. I got help cleaning out my hoard and my mother has gracefully given me generous cash gifts every now and then. Never enough to be life-changing, but enough to give me a mental breather.

I played the credit score game. This one seems counter-intuitive, and requires some self-control about not abusing credit cards. Many people recommend the "snowball" method for paying off cards (pay off your lowest debt asap, then go to the next one), but I went with a "credit utilization" method (bring my highest used cards down to the next utilization level, then move to other cards) so I would see immediate changes in my credit score. What is credit card utilization? It's the percentage of how much of your credit card you're using. A card with a $1,000 limit and $100 on it = 10% utilization. Your credit score changes when you cross the following thresholds: 90%, 70%, 50%, 30%, 10%. Once my credit score started going up past 400 (especially as defaults started falling away), I applied for a secured card. As I started using that better, I applied for a few more cards, then for credit line increases every 6 months. My car insurance rates were tied to my credit score, so as soon as that improved, I switched companies and saved money there.

Mistakes I made:

Being in denial that I was poor. I didn't really look for resources on how to live while in poverty. This hurt me a lot because I ended up neglecting myself out of pride, which made my situation even worse.

Payday loans. I got stuck in the payday cycle for about 8 years. I wish I had sold more stuff or asked family for money to have never needed that initial loan. Once you are in the cycle, it becomes very difficult to get out.

Not going to a food bank.

Not asking for help sooner. And not just financial help.

Not getting out of abusive situations sooner. This is hard, and I sympathize with anyone in a similar position. But if you think it's time to move on, trust your gut - don't sacrifice yourself for people who don't care about you.

Ignoring debt collectors, because I was too afraid to negotiate for a plan. The IRS was so patient with me in the end, even after defaulting twice on plans.

Not considering getting a roommate to reduce costs, or not thinking of doing more things like shared meals with my fellow poor friends. Again, denial and pride. Humility is not a bad word and I wished I had learned it sooner.

Not changing jobs sooner. Curbing my hoarding and getting a better job are responsible for about 90% of me being where I am financially today.

Getting out of debt is a marathon. It took over a decade for me, and I am *still* feeling the sting of poverty. I wish you the best of luck. Folks are welcome to tack on specific tricks and strategies -- this is just a general outline of my particular journey.

#chit chat#my most toxic traits at the time were individualism and stoicism and by god they nearly killed me

134 notes

·

View notes

Text

CDA 230 bans Facebook from blocking interoperable tools

I'm touring my new, nationally bestselling novel The Bezzle! Catch me TONIGHT (May 2) in WINNIPEG, then TOMORROW (May 3) in CALGARY, then SATURDAY (May 4) in VANCOUVER, then onto Tartu, Estonia, and beyond!

Section 230 of the Communications Decency Act is the most widely misunderstood technology law in the world, which is wild, given that it's only 26 words long!

https://www.techdirt.com/2020/06/23/hello-youve-been-referred-here-because-youre-wrong-about-section-230-communications-decency-act/

CDA 230 isn't a gift to big tech. It's literally the only reason that tech companies don't censor on anything we write that might offend some litigious creep. Without CDA 230, there'd be no #MeToo. Hell, without CDA 230, just hosting a private message board where two friends get into serious beef could expose to you an avalanche of legal liability.

CDA 230 is the only part of a much broader, wildly unconstitutional law that survived a 1996 Supreme Court challenge. We don't spend a lot of time talking about all those other parts of the CDA, but there's actually some really cool stuff left in the bill that no one's really paid attention to:

https://www.aclu.org/legal-document/supreme-court-decision-striking-down-cda

One of those little-regarded sections of CDA 230 is part (c)(2)(b), which broadly immunizes anyone who makes a tool that helps internet users block content they don't want to see.

Enter the Knight First Amendment Institute at Columbia University and their client, Ethan Zuckerman, an internet pioneer turned academic at U Mass Amherst. Knight has filed a lawsuit on Zuckerman's behalf, seeking assurance that Zuckerman (and others) can use browser automation tools to block, unfollow, and otherwise modify the feeds Facebook delivers to its users:

https://knightcolumbia.org/documents/gu63ujqj8o

If Zuckerman is successful, he will set a precedent that allows toolsmiths to provide internet users with a wide variety of automation tools that customize the information they see online. That's something that Facebook bitterly opposes.

Facebook has a long history of attacking startups and individual developers who release tools that let users customize their feed. They shut down Friendly Browser, a third-party Facebook client that blocked trackers and customized your feed:

https://www.eff.org/deeplinks/2020/11/once-again-facebook-using-privacy-sword-kill-independent-innovation

Then in in 2021, Facebook's lawyers terrorized a software developer named Louis Barclay in retaliation for a tool called "Unfollow Everything," that autopiloted your browser to click through all the laborious steps needed to unfollow all the accounts you were subscribed to, and permanently banned Unfollow Everywhere's developer, Louis Barclay:

https://slate.com/technology/2021/10/facebook-unfollow-everything-cease-desist.html

Now, Zuckerman is developing "Unfollow Everything 2.0," an even richer version of Barclay's tool.

This rich record of legal bullying gives Zuckerman and his lawyers at Knight something important: "standing" – the right to bring a case. They argue that a browser automation tool that helps you control your feeds is covered by CDA(c)(2)(b), and that Facebook can't legally threaten the developer of such a tool with liability for violating the Computer Fraud and Abuse Act, the Digital Millennium Copyright Act, or the other legal weapons it wields against this kind of "adversarial interoperability."

Writing for Wired, Knight First Amendment Institute at Columbia University speaks to a variety of experts – including my EFF colleague Sophia Cope – who broadly endorse the very clever legal tactic Zuckerman and Knight are bringing to the court.

I'm very excited about this myself. "Adversarial interop" – modding a product or service without permission from its maker – is hugely important to disenshittifying the internet and forestalling future attempts to reenshittify it. From third-party ink cartridges to compatible replacement parts for mobile devices to alternative clients and firmware to ad- and tracker-blockers, adversarial interop is how internet users defend themselves against unilateral changes to services and products they rely on:

https://www.eff.org/deeplinks/2019/10/adversarial-interoperability

Now, all that said, a court victory here won't necessarily mean that Facebook can't block interoperability tools. Facebook still has the unilateral right to terminate its users' accounts. They could kick off Zuckerman. They could kick off his lawyers from the Knight Institute. They could permanently ban any user who uses Unfollow Everything 2.0.

Obviously, that kind of nuclear option could prove very unpopular for a company that is the very definition of "too big to care." But Unfollow Everything 2.0 and the lawsuit don't exist in a vacuum. The fight against Big Tech has a lot of tactical diversity: EU regulations, antitrust investigations, state laws, tinkerers and toolsmiths like Zuckerman, and impact litigation lawyers coming up with cool legal theories.

Together, they represent a multi-front war on the very idea that four billion people should have their digital lives controlled by an unaccountable billionaire man-child whose major technological achievement was making a website where he and his creepy friends could nonconsensually rate the fuckability of their fellow Harvard undergrads.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/02/kaiju-v-kaiju/#cda-230-c-2-b

Image: D-Kuru (modified): https://commons.wikimedia.org/wiki/File:MSI_Bravo_17_(0017FK-007)-USB-C_port_large_PNr%C2%B00761.jpg

Minette Lontsie (modified): https://commons.wikimedia.org/wiki/File:Facebook_Headquarters.jpg

CC BY-SA 4.0: https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#ethan zuckerman#cda 230#interoperability#content moderation#composable moderation#unfollow everything#meta#facebook#knight first amendment initiative#u mass amherst#cfaa

246 notes

·

View notes

Text

I said I'm not interested in AU but this is what popped into my head… HSR retro AU. No more space technology.

Basically you are a college student 🙈🙈🙈 Depending on whether you are an extrovert or an introvert, you may go shopping and play with your friends during the holidays, have a party, or stay comfortably at home listening to music with MP3 and cassette tapes, or reading novels on the subway.

You use a bulky computer to click on the Windows XP system, and spend hours downloading music and opening chat software. Your MSN friends list is as follows:

Jing Yuan:

Your mysterious neighbor is much older than you. You have never understood what the Xianzhou Alliance is. It is said that he kept a lion named Mimi in the yard, but every time you passed by, you thought it was just a cute cat. He'll stuff you with sweets and prepare you milk and afternoon tea, giving you advice. Well, he can also write ancient poetry. You shamelessly gave this old man your homework.

(You lie on his lap and sleep, breathing quietly.)

Aventurine & Ratio:

These two live together, are also your neighbors, professors, friends... You are not sure what their relationship is, but they quarrel every day. Aventurine is a high-level executive in IPC. Every time you visit a department store, you will whisper in your heart that this is also an IPC. He takes the bill in your mailbox every month and pays it off, very weird. His car is the most talked about in the community.

Ratio is your college professor...he is very strict about grades and academic performance. You cursed him one time and he heard you and he took you back to the office for an OTK spanking...unfortunately, it was legal. You have since become his target in class...

Sunday & Robin:

They still have halos and wings, share the same MSN account, and even the same pager. They have no privacy from each other. They are well-known brothers and sisters of the Xipe Church. They are very popular and eye-catching, attracting people's attention wherever they go. So if you are an introvert, the difference is even more pronounced haha. But both of them will approach you, in the name of kindness, with a look of concern on their face. Robin picks out clothes for you and lends you homework to copy. In return, you agree to go to church on the weekend… and help her sell cookies at the church charity sale.

Sunday provides insight into your life and schedule in the name of "for your own good". You don't know why you wrote your schedule in a notebook for him… He shows up in front of your house and listens to music with you (using the same MP3 player). You share with him a few things you learned in the sex education class, and he says that he has signed the commitment card (you: ? what is this). Promise to remain chaste until marriage… That card has an inexplicable printed pattern, with a photo of a couple holding hands, leaving you speechless. But you don’t know why you signed this commitment card under his supervision…

Dan Heng:

Your nerdy college classmate, with dragon horns (don't ask me why). He reminds you of class and exam times and lends you notes, leaving you with the last piece of cake. You always tease him until he blushes and gets angry.

Dan Feng:

Dan Heng's brother. He seems to be very traditional. You haven't seen him much and you only added him as an MSN friend.

Blade:

The mysterious old man. He seems to have a grudge against Dan Feng and Dan Heng. One time you were playing cards with Yanqing and Dan Heng. He suddenly broke into the yard, said something incomprehensible and then started fighting with Dan Feng. This scared you to death. Kafka appeared to stop him. You added Kafka friends to avoid being attacked by Blade.

Kafka:

The mysterious woman who can control Blade. You don't know who she is, but she seems to know you well and be gentle to you.

Silver Wolf:

Your college classmate has designed several computer games and won many awards at a young age, and occasionally plays cards with you. For some reason, she is very close to Blade and Kafka.

101 notes

·

View notes

Text

Jason Wilson at The Guardian:

A rightwing non-profit group that has published a “DEI Watch List” identifying federal employees allegedly “driving radical Diversity, Equity, and Inclusion (DEI) initiatives” is bankrolled by wealthy family foundations and rightwing groups whose origins are often cloaked in a web of financial arrangements that obscure the original donors. One recent list created by the American Accountability Foundation (AAF) includes the names of mostly Black people with roles in government health alleged to have some ties to diversity initiatives. Another targets education department employees, and another calls out the “most subversive immigration bureaucrats”. The lists come amid turmoil in the US government as Donald Trump’s incoming administration, aided by Elon Musk, the world’s richest man, has sought to fire huge swathes of the federal government and purge it of DEI and other initiatives – such as tackling climate change – that Trump has dubbed “woke”. While the publication of the personal details of government workers – whom the website describes as “targets” – has reportedly “terrified” many in federal departments, the Guardian has discovered that some current and former employees of AAF have taken pains to conceal their affiliations with the group on LinkedIn and other public websites.

One of the donors to the AAF is the Heritage Foundation, the architects of Project 2025, which has been a driving ideological force behind Trump’s re-election and first weeks in government. Heidi Beirich, the chief strategy officer of the Global Project Against Hate and Extremism (GPAHE), said: “It’s not surprising to find a vile project such as this backed by Project 2025 entities and far-right donors who have it out for public employees.” Disclosure documents show that the AAF has been closely involved in training Republican staffers in collaboration with the affiliated Conservative Partnership Institute, in sessions that promise to train rightwing operatives in skills including “open source research” and “working with outside groups”.

[...]

‘Incubated’ by the Conservative Partnership Institute

The most crucial support for AAF, however, has come from the organization that birthed it: the CPI, which continues to have a profound influence on the Trump administration and the Republican party as a whole via its own activities and those of its flotilla of spin-off groups. AAF was founded in 2021 to “take a big handful of sand and throw it in the gears of the Biden administration”, as Tom Jones, the organization’s head, told Fox News at the time. [...]

Moulding Maga minds

The Guardian reported last year that CPI had been cementing ties between the far right and the GOP by means of training events for Hill staffers and their bosses in Congress. Many of these events were held at “Camp Rydin”, a sprawling 2,200-acre (890-hectare) property on Maryland’s eastern shore purchased after a $25m donation was made to CPI by its namesake, retired Houston software entrepreneur Mike Rydin, in the wake of January 6. Others were held at one of at least nine adjacent properties on Washington DC’s Pennsylvania Avenue purchased by CPI since 2022, in what reports described as a $41m “shopping spree” that has created a “Maga campus”. CPI literature describes the precinct as “Patriot’s Row”. Records obtained from US Senate and House ethics disclosures indicate that AAF has benefited from being front and center at many of these events. At a 29 May 2024 “Legislative Assistant Symposium” attended by staffers then working for senators including Josh Hawley, Marco Rubio, Ted Cruz and JD Vance, AAF’s Jones was billed as speaking on “strategies for how Congress should approach oversight and accountability”, alongside speakers from CPI, AFL, Advancing American Freedom and anti-immigrant group NumbersUSA. A parallel event with the same line-up drew staffers for hard-right Maga representatives including Anna Paulina Luna – who recently introduced a bill that would see Trump’s face added to Mount Rushmore – and Paul Gosar, who in November invoked antisemitic conspiracy theories in a newsletter defending Tulsi Gabbard, Trump’s pick to lead national intelligence. NumbersUSA was part of a network of groups “founded and funded” by John Tanton, whom the Southern Poverty Law Center called the “puppeteer of the nativism movement and a man with deep racist roots”. At an event held 15-17 February 2023, hosted by AAF and attended by staffers for Congress members including Luna, Ken Buck and Marjorie Taylor Greene, trainees were to learn skills including “how to effectively draft requests for information from agencies and witnesses”, “tools and techniques for conducting open source research into agencies, individuals, and organizations”, and conducting “mock interviews with reluctant / recalcitrant witnesses”.

[...]

Dirt machine

The dirt machine now targeted at government workers was honed on higher-profile targets during the Biden administration. Early on, AAF pointed its opposition-research machine at Biden nominees including Saule Omarova, nominated for comptroller of the currency; Sarah Bloom Raskin, nominated for vice-chair for supervision of the Federal Reserve Board, and Ketanji Brown Jackson, supreme court justice, whom the organization falsely claimed had been soft on sex offenders.

The Guardian reports on how a shadowy far-right group of donors are funding American Accountability Foundation’s watchlists, such as the “DEI watchlist.”

#American Accountability Foundation#Project 2025#Donald Trump#Trump Administration II#Conservative Partnership Institute#DEI#NumbersUSA#Mike Rydin

9 notes

·

View notes

Photo

The ultimate tool of Practice Management Software - QuickstartAdmin

Professional Practice Management software by QuickstartAdmin involves many features and functions, serving as a versatile tool for CPA firms. It maximizes efficiency and profitability with real-time management of appointment scheduling, client management, billing, and analytics. It's an essential asset for modern practices in a competitive scenery.

#practice management software#professional practice management software#accounting practice management software#time and billing software for accountants#consulting practice management software

1 note

·

View note

Text

Source Code: My Beginnings by Bill Gates

In contrast to the current crop of swaggering tech bros, the Microsoft founder comes across as wry and self-deprecating in this memoir of starting out

Bill Gates is the John McEnroe of the tech world: once a snotty brat whom everyone loved to hate, now grown up into a beloved elder statesman. Former rivals, most notably Apple’s Steve Jobs, have since departed this dimension, while the Gates Foundation, focusing on unsexy but important technologies such as malaria nets, was doing “effective altruism” long before that became a fashionable term among philosophically minded tech bros. Time, then, to look back. In the first of what the author threatens will be a trilogy of memoirs, Gates recounts the first two decades of his life, from his birth in 1955 to the founding of Microsoft and its agreement to supply a version of the Basic programming language to Apple Computer in 1977.

He grows up in a pleasant suburb of Seattle with a lawyer father and a schoolteacher mother. His intellectual development is keyed to an origin scene in which he is fascinated by his grandmother’s skill at card games around the family dining table. The eight-year-old Gates realises that gin rummy and sevens are systems of dynamic data that the player can learn to manipulate.

As he tells it, Gates was a rather disruptive schoolchild, always playing the smart alec and not wanting to try too hard, until he first learned to use a computer terminal under the guidance of an influential maths teacher named Bill Dougall. (I wanted to learn more about this man than Gates supplies in a still extraordinary thumbnail sketch: “He had been a World War II Navy pilot and worked as an aeronautical engineer at Boeing. Somewhere along the way he earned a degree in French Literature from the Sorbonne in Paris on top of graduate degrees in engineering and education.”) Ah, the computer terminal. It is 1968, so the school terminal communicates with a mainframe elsewhere. Soon enough, the 13-year-old Gates has taught it to play noughts and crosses. He is hooked. He befriends another pupil, Paul Allen – who will later introduce him to alcohol and LSD – and together they pore over programming manuals deep into the night. Gates plans a vast simulation war game, but he and his friends get their first taste of writing actually useful software when they are asked to automate class scheduling after their school merges with another. Success with this leads the children, now calling themselves the Lakeside Programming Group, to write a payroll program for local businesses, and later to create software for traffic engineers.

There follows a smooth transition to Harvard, where in the ferment of anti-war campus protests our hero is more interested in the arrival, one day in 1969, of a PDP-10 computer. Gates takes classes in maths but also chemistry and the Greek classics. Realising he doesn’t have it in him to become a pure mathematician, he goes all-in on computers once a new home machine, the Altair, is announced. He and Paul Allen will write its Basic, having decided to call themselves “Micro-Soft”.

The early home computer scene, Gates notes, was a countercultural, hippy thing: cheap computers “represented a triumph of the masses against the monolithic corporations and establishment forces that controlled access to computing”, and so software was widely “shared”, or copied among people for free. It was Gates himself who, notoriously, pushed back against this culture when he found out most users of his Basic weren’t paying for it. By “stealing software”, he wrote in an open letter in 1976, “you prevent good software from being written. Who can afford to do professional work for nothing?” This rubbed a lot of people up the wrong way and still does, at least in the more militant parts of the “open-source” world. But he had a point. And that, readers, is why your Office 365 account just renewed for another year. Fans of Word and Excel, though, will have to wait for subsequent volumes of Gates’s recollections, as will those who want more about his later battles with Apple, though Steve Jobs does get an amusing walk-on part. (Micro-Soft’s general manager keeps a notebook of sales calls, on one page of which we read: “11.15 Steve Jobs calls. Was very rude.”). This volume, still, is more than just a geek’s inventory of early achievements. There is a genuine gratitude for influential mentors, and a wry mood of self-deprecation throughout. Gates gleefully records his first preschool report: “He seemed determined to impress us with his complete lack of concern for any phase of school life.” Later, he explains how he acquired a sudden interest in theatre classes. “Admittedly the main draw for me was the higher percentage of girls in drama. And since the main activity in the class was to read lines to each other, the odds were very good that I’d actually talk to one.” Strikingly, unlike most “self-made” billionaires, Gates emphasises the “unearned privilege” of his upbringing and the peculiar circumstances – “mostly out of my control” – that enabled his career. Adorably, he even admits to still having panic dreams about his university exams. The book’s most touching pages recount how one of his closest friends and colleagues in the programming group, Kent Evans, died in a mountaineering accident when he was 17. “Throughout my life, I have tended to deal with loss by avoiding it,” Gates writes. He says later that if he were growing up today, he would probably be identified as “on the autism spectrum”, and now regrets some of his early behaviour, though “I wouldn’t change the brain I was given for anything”. There is a sense of the writer, older and wiser, trying to redeem the past through understanding it better, a thing that no one has yet seen Elon Musk or Mark Zuckerberg attempt in public. That alone makes Bill Gates a more human tech titan than most of his rivals, past and present.

Daily inspiration. Discover more photos at Just for Books…?

7 notes

·

View notes

Text

Optimize business analysis with Tririd Biz Accounting dashboard

In today's competitive market, real-time business insights are the need for growth and success. TRIRID Biz Accounting Software enables you to have a holistic Accounting Dashboard that makes your financial data easy to read and drives accurate decision-making.

Why Choose Tririd Biz for Business Analysis?

Intuitive Dashboard

View your sales, purchases, taxes, and expenses at a glance.

User-friendly design with graphs and summaries for quick understanding.

Real-Time Insights

Get updated, real-time financial data and ensure prompt business decisions.

Keep a check on your cash flow, pending invoices, and profit margins without hassle.

Customizable Reports

Generate custom reports with regard to your business requirements

Download and share reports for efficient planning with your team

Boost Productivity

Save hours of manual work by automating data visualization

Get a clear and concise breakdown of financial KPIs to increase productivity

Track Sales & Purchases

Analyze sales performances and identify trends to growth.

Monitor purchases to achieve optimized cost management.

Drive Business Growth Today!

Don't let manual data management hold you back. With TRIRID Biz's Advanced Dashboard, you can streamline analysis, minimize errors, and take your business to the next level.

Join Us Now!

Call @ +91 8980010210 / +91 9023134246

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#TRIRID Biz Accounting and Billing Software#Best Billing Software In India#Real-Time Business Analysis#Free GST Invoice Software for Indian Business#No1 Business Software for SMEs

0 notes

Text

Integrating Third-Party Tools into Your CRM System: Best Practices

A modern CRM is rarely a standalone tool — it works best when integrated with your business's key platforms like email services, accounting software, marketing tools, and more. But improper integration can lead to data errors, system lags, and security risks.

Here are the best practices developers should follow when integrating third-party tools into CRM systems:

1. Define Clear Integration Objectives

Identify business goals for each integration (e.g., marketing automation, lead capture, billing sync)

Choose tools that align with your CRM’s data model and workflows

Avoid unnecessary integrations that create maintenance overhead

2. Use APIs Wherever Possible

Rely on RESTful or GraphQL APIs for secure, scalable communication

Avoid direct database-level integrations that break during updates

Choose platforms with well-documented and stable APIs

Custom CRM solutions can be built with flexible API gateways

3. Data Mapping and Standardization

Map data fields between systems to prevent mismatches

Use a unified format for customer records, tags, timestamps, and IDs

Normalize values like currencies, time zones, and languages

Maintain a consistent data schema across all tools

4. Authentication and Security

Use OAuth2.0 or token-based authentication for third-party access

Set role-based permissions for which apps access which CRM modules

Monitor access logs for unauthorized activity

Encrypt data during transfer and storage

5. Error Handling and Logging

Create retry logic for API failures and rate limits

Set up alert systems for integration breakdowns

Maintain detailed logs for debugging sync issues

Keep version control of integration scripts and middleware

6. Real-Time vs Batch Syncing

Use real-time sync for critical customer events (e.g., purchases, support tickets)

Use batch syncing for bulk data like marketing lists or invoices

Balance sync frequency to optimize server load

Choose integration frequency based on business impact

7. Scalability and Maintenance

Build integrations as microservices or middleware, not monolithic code

Use message queues (like Kafka or RabbitMQ) for heavy data flow

Design integrations that can evolve with CRM upgrades

Partner with CRM developers for long-term integration strategy

CRM integration experts can future-proof your ecosystem

#CRMIntegration#CRMBestPractices#APIIntegration#CustomCRM#TechStack#ThirdPartyTools#CRMDevelopment#DataSync#SecureIntegration#WorkflowAutomation

2 notes

·

View notes

Text

Unlocking the Secrets to Effortless Compliance with ZATCA Phase 2

The Kingdom of Saudi Arabia is leading the way in digital transformation, especially with its structured e-invoicing initiatives. A significant part of this movement is ZATCA Phase 2, which aims to enhance transparency, boost efficiency, and ensure tax compliance across businesses.

If you are a business owner, accountant, or IT professional, understanding ZATCA Phase 2 is no longer optional. It is critical for ensuring that your operations remain compliant and future-ready. This guide breaks down everything you need to know in a simple, easy-to-understand manner.

What Is ZATCA Phase 2?

ZATCA Phase 2, also known as the Integration Phase, is the next major step following Saudi Arabia's Phase 1 e-invoicing requirements. While Phase 1 focused on the generation of electronic invoices, Phase 2 moves beyond that.

It requires businesses to integrate their e-invoicing systems with ZATCA’s Fatoora platform, allowing real-time or near-real-time transmission of invoices for clearance and validation.

This phase ensures that each invoice issued meets strict technical, security, and data format requirements set by the Zakat, Tax and Customs Authority (ZATCA).

Key Objectives Behind ZATCA Phase 2

Understanding the "why" behind Phase 2 can help businesses see it as an opportunity rather than a burden. The main goals include:

Improving tax compliance across all sectors

Minimizing fraud and manipulation of invoices

Streamlining government audits with real-time data

Promoting a transparent digital economy

Enhancing business operational efficiency

Who Needs to Comply?

All businesses registered for VAT in Saudi Arabia must comply with ZATCA Phase 2 regulations. This includes:

Large enterprises

Medium and small businesses

Businesses using third-party billing service providers

Companies operating across multiple sectors

Even if your business operates primarily offline, if you are VAT registered, you need to be compliant.

Important Requirements for ZATCA Phase 2

Compliance with ZATCA Phase 2 is not just about sending electronic invoices. It involves specific technical and operational steps. Here’s what your business needs:

1. E-Invoicing System with ZATCA Compliance

Your billing or accounting system must:

Issue invoices in XML or PDF/A-3 with embedded XML

Securely store invoices electronically

Incorporate UUIDs (Unique Identifiers) for each invoice

Attach a QR code for simplified verification

2. Integration with ZATCA Systems

Businesses must establish a secure Application Programming Interface (API) connection with ZATCA’s platform to allow the real-time sharing of invoice data.

3. Cryptographic Stamp

Each invoice must carry a cryptographic stamp. This verifies the invoice's authenticity and integrity.

4. Archiving

Invoices must be securely archived and retrievable for at least six years in case of audits or regulatory reviews.

Implementation Timeline for ZATCA Phase 2

ZATCA is rolling out Phase 2 gradually, targeting businesses in waves based on their annual revenues:

Wave 1: Businesses with annual revenues above SAR 3 billion (started January 1, 2023)

Wave 2: Revenues above SAR 500 million (started July 1, 2023)

Future Waves: Gradually extending to smaller businesses

Each business is officially notified by ZATCA at least six months before their compliance date, giving them time to prepare.

How to Prepare for ZATCA Phase 2: A Step-by-Step Guide

The good news is that with proper planning, adapting to ZATCA Phase 2 can be straightforward. Here’s a simple preparation roadmap:

Step 1: Review Your Current Systems

Audit your existing accounting and invoicing solutions. Identify whether they meet Phase 2’s technical and security standards. In most cases, upgrades or new software may be required.

Step 2: Select a ZATCA-Approved Solution Provider

Look for software vendors that are pre-approved by ZATCA and offer:

Seamless API integration

Cryptographic stamping

XML invoice generation

Real-time data reporting

Step 3: Integration Setup

Collaborate with IT teams or third-party service providers to set up a secure connection with the Fatoora platform.

Step 4: Employee Training

Ensure that relevant departments, such as finance, IT, and compliance, are trained to manage new invoicing processes and troubleshoot any issues.

Step 5: Test Your Systems

Conduct dry runs and testing phases to ensure that invoices are being properly cleared and validated by ZATCA without delays or errors.

Step 6: Go Live and Monitor

Once your system is ready and tested, begin issuing invoices according to Phase 2 standards. Regularly monitor compliance, system errors, and feedback from ZATCA.

Common Challenges and How to Overcome Them

Businesses often encounter several challenges during their Phase 2 preparation. Awareness can help you avoid them:

Integration Difficulties: Solve this by partnering with experienced ZATCA-compliant vendors.

Employee Resistance: Overcome this with proper training and clear communication on the benefits.

Technical Errors: Regular testing and quick troubleshooting can help prevent issues.

Lack of Budget Planning: Allocate a specific budget for compliance early to avoid unexpected costs.

Preparation is not just technical. It’s organizational as well.

Benefits of Early Compliance with ZATCA Phase 2

Early compliance does more than just prevent penalties:

Improves Financial Reporting Accuracy: Real-time clearance ensures clean records.

Builds Market Trust: Clients and partners prefer businesses that follow regulatory norms.

Enhances Operational Efficiency: Automated invoicing processes save time and reduce errors.

Boosts Competitive Advantage: Staying ahead in compliance projects an image of professionalism and reliability.

Businesses that proactively adapt to these changes position themselves as industry leaders in the evolving Saudi economy.

Conclusion

ZATCA Phase 2 is not just a regulatory requirement. It’s an opportunity to upgrade your operations, improve financial accuracy, and enhance business credibility.

By understanding the requirements, preparing strategically, and partnering with the right solution providers, your business can turn this challenge into a growth opportunity.

The sooner you act, the smoother your transition will be. Compliance with ZATCA Phase 2 is your gateway to becoming part of Saudi Arabia’s dynamic digital economy.

2 notes

·

View notes

Text

How Do I Choose Best expense management software for small business ?

Every small business has its inspiring challenges, but perhaps most challenging is the management of expenses. It means every rupee counts, and every penny that is withheld is between profit and loss. All these reasons make an appropriate decision in choosing the best expense management software for small business not just an idea-good but critical.

Again, there are too many tools available, so how does one know the right one for him or her? This article will chop through all such questions into components required to check out, comparing options with other people, and why the right software may change the management of your business.

Why Do You Need Expense Management Software ?

If your business is growing, so is the complexity related to your receipts, travel expenses, reimbursements, and even the company spending by the team. It's tedious to manually enclose this information into spreadsheets; in addition, the process is quite error-prone and delays occur.

That's where the best expense management software for small businesses comes in. It automates, keeps your finances sorted, and gives you a real-time view of where the money is going. Whether it is day-by-day purchases or your monthly bills or even employee reimbursements, a good tool can turn things around all the way.

Essential Features You Should Look For in Best Expense Management Software that Suits Small Businesses

1. Usability

You need software that is intuitive and user-friendly. It should also be feature-rich and seamless when it comes to onboarding. Often, small businesses do not have dedicated IT teams, qualified individuals or resources to be able to deploy specialized software easily by an expert.

2. Automated and Integrated

The best software in this regard should also go further by automating all areas related to income and expenses, including the accounting tools involved, banks, and by supplementing with HR platforms. Applicants should take onboard, for example, automated expense capture as a recurrence and categorization.

3. Customizable Reporting

Good detailed reports facilitate spending trend analysis. Customizable reports are a basic need, be it a small business expense report software for sharing with your accountant or receiving insights for budget optimization.

4. Travel and Absence Management

If the workforce is going to take trips on a company basis, invest in a good travel management system that would have a good module for absence management, hence making things simple from booking to reimbursement to leave approvals.

5. Performance and HR Integration

Household expenses management tools now provide those in-house HR management, performance management systems, and other HR-related utilities as extensions of usage. All the above has made it very convenient for both HR and finance.

Seeking the Best Digitalization Benefits

Changing from manual processes to the best software for tracking revenues and expenditures brings quite a few advantages:

for example, time savings in approvals and reimbursements, less paperwork and reduced administration, visibility into spending by the team and department; guarantee policy compliance and the elimination of fraud risks, and real-time improvements in budgeting.

Bringings along small business expense report software, and preparing clearwashed, very professional reports for investors, partners or accountants can be accomplished in just a few clicks.

Conclusion

The best expense management software for small business, look for one that will simplify workflows, save time, minimize the human error, and grow with you.

If that seems hard to get, though, BillPunch makes all these things—and more—affordable and very user-friendly. So if you're looking for the best in travel management software or absence management software, or wish to know the best income and expense-tracking software in one, BillPunch surely covers it.

Ready to Simplify Your Business Finances ?

Allow BillPunch to take the pain out of expense tracking; automate your financial workflows, integrate with your HR tools, and get real-time control of your business spend-all on one platform.

#hr management#hr software#hris system#911 abc#arcane#artists on tumblr#batman#cats of tumblr#cookie run kingdom#elon musk

2 notes

·

View notes