#web based invoice software

Explore tagged Tumblr posts

Text

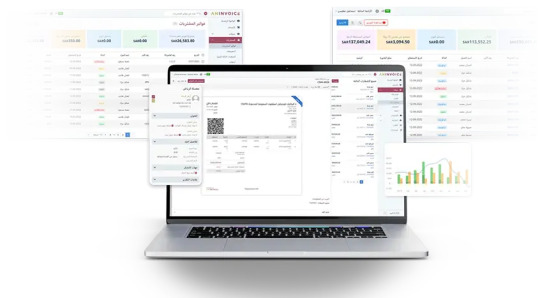

Electronic Invoice Management System

Streamline your billing process with Aninvoice, the leading Electronic Invoice Management System. Designed for efficiency, it offers seamless electronic invoicing for small business needs. Simplify workflows, reduce errors, and save time with our advanced electronic billing system software. Take control of your finances with Aninvoice — where smart invoicing meets smart business. Visit Us: https://aninvoice.com/.

0 notes

Text

The trucking industry is one of the most regulated in the U.S. and Canada, which means compliance is always a top concern for transportation industries. This is especially true when it comes to cross-border freight. These days, border officials rely on digital documents to make the customs process smoother. Having the right software can make this process easy and reduce the risk of errors. Here are a few ways AVAAL eManifest software can make border crossing easy for your business.

Compliance Made Simple

To run a successful trucking business, compliance always needs to be a top priority. Not following the required customs process or accurately filling out documentation can result in lost time, reduced profits, and even legal consequences. Both Canada and the U.S. require carriers to submit their eManifests one hour prior and send their paperwork to customs brokers two hours prior to a driver’s arrival at the border. With AVAAL’s eManifest software, submitting this has never been easier. Our software is tailor-made to meet all the requirements so that you can cross the border without any hassles and be confident that you’re complying with all regulations.

Easy to Use Platform

Both the U.S. and Canada currently offer their own free eManifest portal. Unfortunately, these are difficult to use and not designed to support carriers that regularly cross the border. These platforms also don’t share data between ACE and ACI, creating issues for cross-border trucking companies. AVAAL eManifest is easy to use and reliable. It’s web-based software, meaning you can submit your manifests at any time and from anywhere. Our software also comes with 24/7 support, so we will be available to help you if any issues arise.

Tailored to Your Business' Needs

Not all trucking companies have the same needs, even when it comes to border-crossing. One thing that sets our eManifest software apart from others is that it can be tailor-fit to meet your company’s needs. Whether you’re a single operator or a multi-national company, we offer the greatest level of flexibility and have an eManifest plan to suit your requirements. We have a team of experts on hand ready to help you with all your businesses’ needs.

PAPS and PARS: How to Speed Up Your Cross-Border Shipments

PAPS (Pre-Arrival Processing System) and PARS (Pre-Arrival Review System) are essential components in cross-border trade between Canada and the United States. Let’s explore what they are and how they facilitate the movement of commercial goods across the Canadian and U.S. borders:

PARS (Pre-Arrival Review System):

Designation: PARS is used by the Canadian Border Services Agency (CBSA) to clear commercial goods through customs.

Functionality: It involves bar code labels placed on commercial invoices. CBSA agents scan these labels to determine whether goods need immediate release or further inspection.

Integration: PARS works with the ACI (Advance Commercial Information) electronic manifest system in Canada.

PAPS (Pre-Arrival Processing System):

Designation: PAPS is the U.S. counterpart of PARS.

Functionality: Similar to PARS, it allows U.S. Customs and Border Protection (CBP) to process goods as they cross the border.

Integration: PAPS operates within the ACE (Automated Commercial Environment) electronic manifest system in the United States.

Similarities and Differences:

Both PARS and PAPS serve the same purpose: facilitating the movement of goods.

The main difference lies in their geographical scope: PARS for Canada, PAPS for the USA.

Having similar systems streamlines importing and exporting between the two countries.

When Do You Need PARS or PAPS Numbers?

Any commercial shipments entering Canada or the U.S. by truck use PARS or PAPS numbers as the default shipping type.

The PARS/PAPS process involves carriers, shippers, and customs brokers working together to ensure smooth border crossings.

Here’s how it works:

A carrier assigns a PARS or PAPS number to a shipment.

The customs broker uses this number to request the release of the shipment from customs.

The carrier prepares an eManifest listing using ACI (Canada) or ACE (U.S.), referencing the PARS or PAPS number.

Only when both the broker’s entry and the carrier’s eManifest listing are accepted can the goods proceed to the border.

Customs officers verify the PARS or PAPS number to release the goods or refer them for inspection.

In summary, PARS and PAPS play a crucial role in expediting cross-border trade, ensuring compliance, and enhancing efficiency for carriers and importers.

For more information kindly visit – ACE/ACI emanifest Portal

#trucking factoring#trucking company#truckingindustry#truckinglife#canada#ontario#trucking#truck load#logistics#avaal

2 notes

·

View notes

Text

What is the best web-based enterprise accounting software?

In the fast-paced and ever-evolving landscape of business, staying on top of your finances is crucial. As enterprises expand their operations, managing accounts efficiently becomes a daunting task. Thankfully, with the advent of technology, businesses now have access to a plethora of web-based enterprise accounting software options to streamline their financial processes. In this comprehensive guide, we will explore the ins and outs of web-based enterprise accounting software, helping you make an informed decision on the best solution for your business needs.

Understanding Web-Based Enterprise Accounting Software

Web-based enterprise accounting software, often referred to as cloud accounting software, is a digital solution that allows businesses to manage their financial activities online. Unlike traditional accounting systems that rely on on-premise software, web-based accounting tools operate in the cloud, offering users the flexibility to access their financial data from anywhere with an internet connection.

Advantages of Web-Based Enterprise Accounting Software

1. Accessibility

One of the primary advantages of web-based accounting software is accessibility. With data stored securely in the cloud, users can access their financial information anytime, anywhere. This proves especially beneficial for enterprises with multiple locations or remote teams, fostering collaboration and efficiency.

2. Cost Efficiency

Web-based accounting solutions often follow a subscription-based model, eliminating the need for costly upfront investments in software and hardware. This cost-effective approach makes it easier for businesses to scale their accounting infrastructure according to their needs without breaking the bank.

3. Real-Time Updates

In the dynamic world of business, real-time data is invaluable. Web-based accounting software provides instant updates, ensuring that users have access to the most recent financial information. This feature is crucial for making informed decisions and adapting to market changes promptly.

4. Automatic Updates and Maintenance

Gone are the days of manual software updates and maintenance. With web-based accounting solutions, updates are automatic, and maintenance is handled by the service provider. This frees up valuable time for businesses to focus on core operations rather than managing software updates.

Features to Look for in Web-Based Enterprise Accounting Software

1. User-Friendly Interface

A user-friendly interface is essential for ensuring that your team can navigate the software seamlessly. Look for solutions with intuitive dashboards and easy-to-understand features to minimize the learning curve for your staff.

2. Scalability

As your enterprise grows, so do your accounting needs. Choose a web-based accounting solution that can scale with your business, accommodating increased transaction volumes and additional users without compromising performance.

3. Integration Capabilities

Efficient accounting doesn't happen in isolation. Ensure that the web-based accounting software you choose integrates seamlessly with other essential business tools, such as CRM systems, project management software, and e-commerce platforms.

4. Security

The security of your financial data should be a top priority. Opt for web-based accounting software that employs robust encryption protocols and follows industry best practices for data protection. Additionally, check for features such as multi-factor authentication to add an extra layer of security.

Top Contenders in the Web-Based Enterprise Accounting Software Market

1. MargBooks

MargBooks Online is a India's popular online accounting solution known for its user-friendly interface and robust features. It offers a range of plans to suit businesses of all sizes and provides tools for invoicing, expense tracking, and financial reporting.

2. Xero

Xero is another cloud accounting software that caters to small and medium-sized enterprises. With features like bank reconciliation, inventory management, and payroll integration, Xero is a comprehensive solution for businesses looking to streamline their financial processes.

3. NetSuite

NetSuite, owned by Oracle, is a cloud-based ERP (Enterprise Resource Planning) solution that includes robust accounting functionalities. It is suitable for larger enterprises with complex financial needs and offers features such as financial planning, revenue recognition, and multi-currency support.

4. Zoho Books

Zoho Books is part of the Zoho suite of business applications and is designed for small and medium-sized enterprises. It provides features such as automated workflows, project billing, and collaborative client portals, making it a versatile choice for businesses with diverse needs.

Making the Right Choice for Your Business

Choosing the best web-based enterprise accounting software for your business requires careful consideration of your specific needs and objectives. Here are some steps to guide you through the decision-making process:

1. Assess Your Business Requirements

Start by identifying your business's specific accounting requirements. Consider factors such as the number of users, the complexity of your financial transactions, and the need for integration with other business applications.

2. Set a Budget

Determine a realistic budget for your accounting software. While web-based solutions often offer cost savings compared to traditional software, it's essential to choose a solution that aligns with your financial resources.

3. Explore Free Trials

Many web-based accounting software providers offer free trials of their platforms. Take advantage of these trials to explore the features and functionalities of different solutions before making a commitment.

4. Seek Recommendations and Reviews

Consult with other businesses in your industry or network to gather recommendations and insights. Additionally, read reviews from reputable sources to gain a better understanding of the user experiences with different accounting software options.

The Evolution of Web-Based Enterprise Accounting Software

As technology continues to advance, so does the landscape of web-based enterprise accounting software. The evolution of these platforms is driven by the ever-changing needs of businesses and the ongoing developments in cloud technology. Let's delve deeper into the evolving trends shaping the future of web-based accounting solutions.

1. Artificial Intelligence (AI) and Automation

The integration of artificial intelligence and automation is revolutionizing how businesses handle their financial processes. Modern web-based accounting software is incorporating AI algorithms to automate repetitive tasks, such as data entry and invoice categorization. This not only increases efficiency but also minimizes the risk of human error.

2. Enhanced Data Analytics

In the age of big data, the ability to derive meaningful insights from financial data is paramount. Advanced web-based accounting solutions are now equipped with powerful data analytics tools. These tools help businesses analyze trends, forecast future financial scenarios, and make data-driven decisions.

3. Mobile Accessibility

The shift towards mobile accessibility is a notable trend in web-based enterprise accounting software. Businesses are increasingly relying on mobile devices for day-to-day operations, and accounting software providers are responding by offering mobile-friendly applications. This allows users to manage their finances on the go, providing unparalleled flexibility.

4. Integration with E-Commerce Platforms

As e-commerce continues to thrive, businesses are looking for accounting solutions that seamlessly integrate with their online sales platforms. Modern web-based accounting software often includes features tailored for e-commerce, such as automated transaction reconciliation with online sales channels and inventory management.

5. Blockchain Technology

Blockchain technology is making waves in various industries, and accounting is no exception. Some web-based accounting solutions are exploring the integration of blockchain for enhanced security and transparency in financial transactions. This could revolutionize how businesses handle aspects like auditing and transaction verification.

Common Challenges and How to Overcome Them

While web-based enterprise accounting software offers numerous benefits, it's important to be aware of potential challenges and how to overcome them. Here are some common issues businesses may face:

1. Security Concerns

The sensitive nature of financial data raises concerns about security in the cloud. To address this, choose a web-based accounting solution that employs robust encryption protocols and complies with industry security standards. Additionally, educate your team about best practices for secure online behavior.

2. Connectivity Issues

Reliable internet connectivity is crucial for accessing web-based accounting software. In regions with unstable internet connections, businesses may face challenges in real-time collaboration and data accessibility. Consider implementing backup solutions for offline access or explore accounting software with offline capabilities.

3. Customization Needs

Every business has unique accounting requirements. Some businesses may find that certain web-based accounting solutions lack the level of customization they need. In such cases, explore platforms that offer extensive customization options or consider integrating additional specialized accounting tools.

4. Data Ownership and Control

Understanding the terms of service and data ownership is essential when using web-based accounting software. Ensure that the chosen platform allows you to retain control over your financial data and provides mechanisms for data export in case of migration to a different system.

Conclusion: Making the Right Choice for Long-Term Success

In the fast-paced world of business, the right web-based enterprise accounting software can be a game-changer. Whether you're a small startup or a large enterprise, the key is to stay informed about the latest advancements in accounting technology and align your choice with the long-term goals of your business.

As you navigate the vast landscape of web-based accounting solutions, remember that the best choice is the one that seamlessly integrates with your business processes, enhances efficiency, and adapts to the evolving needs of your enterprise. If you have any specific questions or need further guidance on a particular aspect of web-based accounting software, feel free to ask for more information!

Also read- Online billing and accounting software to manage your business

#Web-based accounting#Cloud software#Financial management#Enterprise solutions#accounting#software#billing#online billing software#technology#programming#erp#tech#drawings#illlustration#artwork#art style#sketchy#art#aspec#aromantic asexual#arospec#acespec#aroace#aro#bg3#astarion#shadowheart#gale dekarios#gale of waterdeep#karlach

2 notes

·

View notes

Text

Internet Solutions: A Comprehensive Comparison of AWS, Azure, and Zimcom

When it comes to finding a managed cloud services provider, businesses often turn to the industry giants: Amazon Web Services (AWS) and Microsoft Azure. These tech powerhouses offer highly adaptable platforms with a wide range of services. However, the question that frequently perplexes businesses is, "Which platform truly offers the best value for internet solutions Surprisingly, the answer may not lie with either of them. It is essential to recognize that AWS, Azure, and even Google are not the only options available for secure cloud hosting.

In this article, we will conduct a comprehensive comparison of AWS, Azure, and Zimcom, with a particular focus on pricing and support systems for internet solutions.

Pricing Structure: AWS vs. Azure for Internet Solutions

AWS for Internet Solutions: AWS is renowned for its complex pricing system, primarily due to the extensive range of services and pricing options it offers for internet solutions. Prices depend on the resources used, their types, and the operational region. For example, AWS's compute service, EC2, provides on-demand, reserved, and spot pricing models. Additionally, AWS offers a free tier that allows new customers to experiment with select services for a year. Despite its complexity, AWS's granular pricing model empowers businesses to tailor services precisely to their unique internet solution requirements.

Azure for Internet Solutions:

Microsoft Azure's pricing structure is generally considered more straightforward for internet solutions. Similar to AWS, it follows a pay-as-you-go model and charges based on resource consumption. However, Azure's pricing is closely integrated with Microsoft's software ecosystem, especially for businesses that extensively utilize Microsoft software.

For enterprise customers seeking internet solutions, Azure offers the Azure Hybrid Benefit, enabling the use of existing on-premises Windows Server and SQL Server licenses on the Azure platform, resulting in significant cost savings. Azure also provides a cost management tool that assists users in budgeting and forecasting their cloud expenses.

Transparent Pricing with Zimcom’s Managed Cloud Services for Internet Solutions:

Do you fully understand your cloud bill from AWS or Azure when considering internet solutions? Hidden costs in their invoices might lead you to pay for unnecessary services.

At Zimcom, we prioritize transparent and straightforward billing practices for internet solutions. Our cloud migration and hosting services not only offer 30-50% more cost-efficiency for internet solutions but also outperform competing solutions.

In conclusion, while AWS and Azure hold prominent positions in the managed cloud services market for internet solutions, it is crucial to consider alternatives such as Zimcom. By comparing pricing structures and support systems for internet solutions, businesses can make well-informed decisions that align with their specific requirements. Zimcom stands out as a compelling choice for secure cloud hosting and internet solutions, thanks to its unwavering commitment to transparent pricing and cost-efficiency.

2 notes

·

View notes

Text

Cowork Software: The Ultimate Guide to Transforming Shared Workspaces

In the modern era of flexible work, coworking software is not a luxury—it’s a necessity. As coworking spaces become a cornerstone of the gig economy, startups, and remote workforces, cowork software is evolving into the critical infrastructure behind efficient operations, seamless member experiences, and scalable growth. This comprehensive guide explores how advanced cowork software can optimize coworking management, enhance user experience, and future-proof your shared workspace business.

What is Cowork Software? Cowork software is an all-in-one digital platform designed to manage, automate, and streamline the day-to-day operations of coworking spaces. From membership management, billing, bookings, CRM, visitor management, to analytics, coworking software ensures operational excellence and consistent member satisfaction.

The best solutions are cloud-based, mobile-friendly, and customizable, offering flexibility for space managers and convenience for members.

Key Features of Cowork Software That Boost Efficiency

Automated Member Onboarding and Management Effective coworking software provides digital onboarding tools to streamline the registration process. It enables:

Automated approvals

Custom access rights

Real-time contract generation

Member self-service portals

These features save hours of manual work and ensure a smooth start for every member.

Smart Booking and Resource Scheduling An intuitive booking system is at the heart of efficient space usage. Whether it’s meeting rooms, hot desks, or private cabins, members should be able to:

Check availability in real time

Make reservations via web or mobile app

Receive automated booking confirmations

Smart calendars, integrations with Google/Outlook, and QR-code-based check-ins are now standard among top-performing platforms.

Integrated Billing and Invoicing Managing multiple billing cycles, membership plans, and ad-hoc services can be daunting. A robust cowork software includes:

Automated invoicing

Multiple payment gateway integrations (Stripe, Razorpay, etc.)

Recurring billing options

Tax-compliant financial records

This results in improved cash flow, fewer errors, and simplified accounting.

Real-Time Analytics and Reporting Modern coworking spaces require data-driven decision-making. Cowork software offers dashboards that provide insights into:

Space utilization

Revenue trends

Member retention

Peak booking hours

Access to real-time metrics enables operators to optimize operations and maximize revenue.

Visitor Management and Security Ensuring a safe, seamless visitor experience is vital. The best cowork software includes:

Digital check-in kiosks

Pre-registration for guests

Instant notifications to hosts

Integrated access control systems

This ensures both security and professionalism in how your space is perceived.

Community Engagement Tools Great coworking software strengthens your community by offering:

Event management tools

Discussion forums

Member directories

Perks and benefit listings

These features help foster a collaborative culture that encourages longer membership retention.

Benefits of Implementing Cowork Software in Your Space Streamlined Operations By automating repetitive tasks, cowork software allows your team to focus on growth strategies and member satisfaction rather than mundane admin work.

Improved Member Experience With mobile apps, instant access to bookings, invoices, and support tickets, members get a seamless, intuitive user experience—just like using any modern app.

Cost Efficiency Reducing manual labor, eliminating no-shows, optimizing space usage, and timely billing contribute to better financial health and higher profitability.

Scalability Whether you operate one location or 50, good cowork software helps you replicate processes, manage multiple spaces from a single dashboard, and ensure brand consistency.

Choosing the Best Cowork Software for Your Needs When selecting a coworking software, consider these criteria:

Customization and Flexibility Each coworking space is unique. The software should allow you to tailor:

Membership plans

Branding

Booking rules

User roles and permissions

Ease of Use Choose software with a clean interface and short learning curve to reduce training time and increase adoption rates among both staff and members.

Integrations Ensure it integrates smoothly with:

Payment gateways

CRM tools

Access control systems

Accounting platforms

Marketing tools

This ensures smoother workflows and less manual effort.

Mobile Experience A dedicated mobile app for both members and admins is non-negotiable in today’s world of on-the-go management.

Reliable Support and Documentation Even the best software needs backup. Look for vendors with:

24/7 support

Extensive knowledge bases

Onboarding assistance

SLA-backed uptime guarantees

Top Use Cases of Cowork Software in Real-World Scenarios A. Multi-Location Coworking Chains Cowork software provides centralized control over inventory, pricing, staff performance, and analytics across locations—making scale management efficient.

B. Niche Workspaces (Design Labs, Startups, Wellness Studios) With flexible configurations, cowork software caters to niche spaces with specialized needs like equipment booking, event spaces, or client sessions.

C. Enterprise Coworking Management Enterprises adopting hybrid models use cowork software to manage employee desk allocation, monitor utilization trends, and ensure compliance with occupancy norms.

Emerging Trends in Coworking Software Development

AI and Predictive Analytics Coworking platforms are beginning to use machine learning to predict demand, suggest upgrades to members, and reduce churn.

IoT and Smart Space Management Integration with smart locks, occupancy sensors, and energy monitors ensures better resource utilization and automated facility management.

Hybrid Work Enablement Software that allows enterprises to manage distributed teams across coworking hubs is becoming increasingly essential in the post-pandemic workplace.

Final Thoughts: The Future of Cowork Software The rise of flexible work is not a trend—it’s the new normal. Coworking spaces that invest in powerful, scalable cowork software are better positioned to offer exceptional service, retain members longer, and grow faster in a competitive landscape.

By leveraging advanced features like automation, data analytics, and mobile accessibility, coworking operators can deliver high-value experiences, manage with precision, and build vibrant communities—all from a single dashboard.

Wybrid Technology Pvt. Ltd. is not just offering a product, it's providing a solution that transcends the conventional boundaries of record management, promoting efficiency, and environmental responsibility. Embracing green initiatives, Wybrid contributes to creating a healthier and cleaner environment by actively participating in the reduction of waste and CO2 emissions. Simply log into the Wybrid super app and effortlessly access all your records in one centralized platform. Take the first step towards an organized, environmentally conscious workspace app – call us at 8657953241.

0 notes

Text

Essential tips for listing software on AWS marketplace

At CONNACT, we help SaaS developers, startups, and enterprise solution providers bring their products to market faster and smarter. One of the most powerful growth opportunities for software companies today is listing on AWS Marketplace, Amazon Web Services’ digital catalog that connects millions of customers with curated software solutions.

If you're building or selling cloud-native software, getting listed on AWS Marketplace isn't just a distribution channel—it's a strategic move that can accelerate customer acquisition, simplify procurement, and scale your reach across global markets.

Why List on AWS Marketplace?

Massive Exposure: Reach millions of active AWS users looking for trusted software tools.

Faster Sales Cycles: Let customers buy your solution using their existing AWS agreements and budgets.

Simplified Billing: AWS handles invoicing, collections, and payment transfers, freeing your team to focus on growth.

Trust & Credibility: Being in the Marketplace validates your product to enterprise buyers and IT decision-makers.

Flexible Pricing Models: Offer subscriptions, SaaS contracts, metered billing, and free trials.

At CONNACT, we guide companies through every step of the listing process—from product eligibility and compliance to packaging, testing, and go-live support. Whether you're offering a SaaS application, machine learning model, API tool, or DevOps utility, we ensure your AWS Marketplace listing is optimized for discoverability and performance.

Our AWS Marketplace Services Include:

Marketplace onboarding and documentation support

Technical integration (AMI, SaaS, or Container-based delivery)

Listing optimization and marketing assistance

Ongoing support for updates, billing, and contract management

Our clients not only get listed—they get noticed.

Whether you're a startup looking to validate your product or an established provider ready to scale to the enterprise level, CONNACT’s AWS Marketplace services are built to help you launch faster, sell smarter, and grow bigger. Ready to list your software on AWS Marketplace? Let CONNACT be your launch partner.

0 notes

Text

Why the Logistics Sector Can’t Thrive Without a Smart ERP

In the high-velocity world of global trade, where timelines are razor-thin and customer expectations are relentless, the logistics sector is under unprecedented pressure to deliver literally. From fleet management to last-mile delivery, warehousing to customs compliance, logistics is a marvel of modern coordination. But beneath the surface lies a complex web of operations that can either make or break profitability.

This blog explores why smart ERP software is no longer optional for logistics players — but mission-critical.

The Logistics Industry in 2025: A Landscape Under Pressure

The logistics sector is the backbone of global commerce. Whether it’s eCommerce, B2B distribution, or cold-chain pharmaceuticals, logistics fuels modern life.

But with rising operational costs, fluctuating fuel prices, labour shortages, and geopolitical tensions, the industry faces immense challenges:

Fragmented supply chains

Disconnected data silos

Lack of real-time insights

Poor route optimization

Compliance headaches

These bottlenecks aren’t just inefficiencies, they’re lost revenue, customer dissatisfaction, and strategic vulnerabilities.

What Is a Smart ERP? And Why Does It Matter?

A Smart ERP (Enterprise Resource Planning) system is not your grandfather’s ERP. It’s intelligent, connected, cloud-based, and often powered by AI and machine learning.

It goes beyond basic accounting and inventory management to offer:

Predictive analytics

Real-time supply chain visibility

Mobile access and automation

AI-powered forecasting

Integrated TMS (Transport Management Systems) and WMS (Warehouse Management Systems)

In logistics, a smart ERP becomes your central command centre, orchestrating every moving part of your operations seamlessly.

Legacy Systems: The Hidden Bottleneck

Many logistics companies still operate on fragmented legacy systems patched together over decades. These outdated tools suffer from:

Poor scalability

Incompatibility with modern tech (IoT, telematics, etc.)

No support for real-time updates

Manual data entry, leading to errors

The result? Operational blindness — a dangerous handicap in an industry that thrives on precision and agility.

Smart ERPs eliminate this by offering a unified digital core.

Real-Time Visibility: The Heart of Modern Logistics

What logistics managers crave the most is visibility, knowing where inventory is, how shipments are progressing, what’s stuck, and why.

A smart ERP provides:

Live tracking dashboards

Geolocation-based analytics

Exception alerts and ETA recalculations

Last-mile tracking integrations

This transparency isn’t just nice to have, it’s essential for customer satisfaction, SLAs, and proactive issue resolution.

Key ERP Features That Drive Logistics Efficiency

Here are the must-have smart ERP features that optimize logistics operations:

a. Transport Management System (TMS)

Handles route planning, carrier management, freight billing, and performance analytics.

b. Warehouse Management System (WMS)

Automates inventory allocation, picking, packing, and barcode scanning.

c. Fleet & Asset Management

Tracks vehicle health, fuel usage, driver behaviour, and maintenance schedules.

d. Order Management

Automates sales order processing, fulfilment prioritization, and invoicing.

e. Inventory Forecasting

AI-driven demand planning prevents overstocking and understocking.

Data-Driven Decision Making at Scale

In logistics, intuition can no longer be the strategy. With razor-thin margins, decisions must be anchored in data.

Smart ERPs bring:

Customizable reports and dashboards

Predictive analytics for demand and delivery

Cost-to-serve analysis

Carbon footprint tracking

These insights lead to data-backed decisions, not guesswork.

Integration with IoT, Telematics, and Fleet Management

Smart ERPs integrate effortlessly with the IoT ecosystem transforming operations with real-time telemetry:

Temperature sensors for cold chains

RFID and barcode scanners for inventory control

GPS and geofencing for fleet tracking

Wearables for warehouse labour efficiency

These integrations reduce human error, increase automation, and elevate decision-making precision.

Enhancing Supply Chain Resilience

The COVID-19 pandemic and geopolitical disruptions taught the logistics industry a harsh lesson: resilience trumps efficiency.

Smart ERPs support this shift by enabling:

Multi-sourcing and dynamic vendor allocation

Buffer stock alerts and alternative routing

Real-time risk monitoring

Business continuity planning

With a smart ERP, logistics companies are no longer caught off guard — they pivot, adapt, and stay ahead.

Regulatory Compliance Made Easy

Logistics is a compliance-heavy industry. From customs documentation to labour laws and environmental regulations, the paperwork is immense.

A smart ERP automates:

Regulatory workflows (e.g., GST, ELD, GHG compliance)

Audit trails and document storage

Multi-currency and multi-taxation logic

E-invoicing and digital records

This drastically reduces fines, delays, and human workload.

Why Smart ERP Is the Future of Sustainable Logistics

Today’s logistics industry is under pressure to go green and rightly so. A smart ERP enables:

Fuel and route optimization

Idle time tracking

Smart packaging analytics

Carbon emissions dashboards

Green vendor scoring

Sustainability is no longer a PR stunt — it’s a supply chain imperative. Smart ERPs make sustainability scalable.

Final Thoughts: The Road Ahead

The logistics sector is no longer about moving goods; it’s about moving smart. In 2025 and beyond, logistics companies that operate without a smart ERP are not just inefficient — they’re endangered.

The road ahead demands clarity, control, and cohesion and only smart ERP systems can deliver all three at scale.

0 notes

Text

Boost Your Accounting Career with Practical e-Accounting

INTRODUCTION

In today’s digitally driven financial world, e-Accounting has become an essential skill for anyone looking to build a stable and rewarding career in the accounting and finance sector. From small businesses to large enterprises, companies are shifting towards digital platforms for managing accounts, taxes, payroll, and financial reports. As a result, practical e-Accounting training is now more valuable than ever—especially for students and beginners looking to enter this dynamic field.

If you’re aspiring to work in accounts, taxation, or finance, enrolling in a Complete e-Accounting Training in Yamuna Vihar or Uttam Nagar can be the smartest step towards building a strong foundation.

What is e-Accounting?

e-Accounting refers to the use of electronic tools and accounting software like Tally, BUSY, and Excel to manage financial data, taxation, GST, TDS, payroll, and other business processes. It’s not just about recording transactions—it’s about understanding how finances flow within an organization using technology. That’s why courses like e-Accounting with Practical Software Training in Uttam Nagar are in high demand.

Why Students Should Learn Practical e-Accounting

For students, especially from commerce backgrounds, practical e-Accounting knowledge opens doors to real-time accounting jobs. The theoretical knowledge from textbooks is useful, but what companies really look for is hands-on experience with real software and business scenarios.

By enrolling in Beginner to Advanced e-Accounting Classes in Yamuna Vihar, students gain valuable exposure to:

Tally ERP for GST and financial accounting

Payroll management systems

Income Tax and TDS calculations

Excel-based financial reporting

Invoice and billing software

Banking and reconciliation practices

The focus is not just on concepts but on practical tasks that accountants handle every day in real organizations.

Key Modules That Shape Your Future

Most well-structured courses such as the e-Accounting and Taxation Course in Uttam Nagar cover a blend of accounting fundamentals and modern software tools. These modules typically include:

Basics of accounting and journal entries

Tally ERP with GST and TDS setup

Payroll & salary structure creation

Taxation basics (GST, TDS, ITR filing)

Bank reconciliation

Excel-based MIS reporting

Business-oriented projects for real-world application

This kind of comprehensive curriculum is also offered under the Advanced e-Accounting with Payroll & GST in Yamuna Vihar, which prepares you for entry-level to intermediate roles in the accounting field.

Certification That Makes You Job-Ready

When you complete training from a Certified e-Accounting Institute in Uttam Nagar, you don’t just gain knowledge—you receive certification that adds real weight to your resume. Employers value certified candidates, especially those trained in software like Tally, Excel, and BUSY, along with knowledge of GST, TDS, and payroll compliance.

Being certified from the Top e-Accounting Institute for Beginners in Yamuna Vihar also helps you stand out during interviews and internship applications.

Real-Time Learning with Practical Software

What makes e-Accounting with Financial Reporting Course in Yamuna Vihar truly impactful is the use of real-time software. You don’t just learn theory; you work on projects using actual accounting tools. This prepares you to step into job roles such as:

Junior Accountant

Accounts Executive

GST & TDS Assistant

Payroll Operator

Data Entry Operator with Finance Skills

Moreover, the e-Accounting with GST and TDS Training in Uttam Nagar ensures that you’re updated with current tax rules and compliance practices, making you immediately useful in any financial organization.

Final Thoughts

In a competitive job market, basic knowledge isn’t enough. Students must be job-ready from day one, and practical e-Accounting training provides just that. Whether you choose to study through e-Accounting Classes for Beginners in Uttam Nagar, the focus should be on gaining real, actionable skills that can help you secure stable employment in finance, taxation, or business accounting.So if you're planning to enter the finance world, now is the perfect time to get certified in e-Accounting—and future-proof your career with practical, hands-on knowledge.

Suggested Links:

TallyPrime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

0 notes

Text

One Software Suite, Countless Business Problems Solved — Meet BETs

In today’s competitive market, businesses no longer have the luxury of disjointed systems, manual operations, or inefficient communication between departments. Whether you’re managing a franchise network, coordinating warehouse logistics, streamlining sales distribution, or overseeing vendor transactions — your business needs a connected, intelligent, and scalable platform.

Enter BETs ERP System— the one software suite that empowers businesses with a complete ecosystem of integrated solutions.

What is BETs?

BETs (ByteElephants Technologies Suite) is a comprehensive, cloud-based business operations suite that digitizes and automates complex workflows across manufacturing, retail, and distribution networks. Built for scalability, speed, and accuracy, BETs offers modular platforms that can work standalone or integrate seamlessly to build a robust business tech stack.

Why BETs? Because Modern Businesses Need More Than Just Software

While most software tools solve isolated problems, BETs is built to handle the full picture — from ground-level operations to strategic decision-making. With real-time data, mobile apps, intuitive dashboards, and deep API integrations, BETs bridges gaps between departments, minimizes manual data entry, and accelerates growth.

BETs offers 360° visibility, control, and collaboration across the following key areas:

BETs Core Modules & What Problems They Solve

ERP – End-to-End Process Management

For businesses drowning in disconnected processes, BETs ERP ties everything together — from raw material procurement to finished goods dispatch.

Modules Include: Procurement, Production, QC, Inventory, Accounts, Finance, Sales, Dispatch, and Analytics.

Key Benefit: Gain complete control over your operations and reduce manual effort with workflow automation.

Sales Force Automation (SFA)

Your field team shouldn’t just collect orders — they should fuel growth. BETs SFA empowers them with route tracking, order management, and insights at their fingertips.

Key Features: Target assignment, market coverage tracking, order capturing, return management, and real-time reporting.

Distribution Management System (DMS)

Managing a vast distributor-dealer-retailer network? BETs DMS streamlines primary and secondary sales with advanced order processing, scheme management, inventory tracking, and dispatch control.

Ideal For: FMCG brands operating in general trade. Result: Real-time visibility and faster fulfilment.

Franchise Management System (FMS)

Franchise operations are complex. BETs FMS brings structure to chaos — from ordering systems and digital menus to communication apps and tray management. What It Includes:

Ordering System (Web + Mobile)

POS Software

Digital Album App

Communication App

Tray & Brand Management Apps Outcome: Smoother operations between franchise outlets and the central production unit.

Point of Sale (POS)

Designed for franchise shops and retail counters, BETs POS handles customer billing, stock tracking, local expense recording, GST invoicing, loyalty programs, and daily sales reporting.

Why It Stands Out: Seamless integration with back-end ERP and real-time sync with franchise operations.

Warehouse Management System (WMS)

Inventory chaos? Not with BETs. Our WMS uses barcode-based tracking, real-time space monitoring, smart put-away/pick-up tasks, and integration with ERP to optimize warehouse operations. Mobile App Included: For on-the-go task completion with scanning & validation.

Vendor Management System (VMS)

Say goodbye to email threads and Excel chaos. BETs VMS enables vendors to manage RFQs, upload invoices, track POs, view quality reports, and receive payments — all from a centralized portal. Admin Controls: Comparative analysis, PO & schedule sync, rejection tracking, performance matrix, and ERP integration.

HRMS – Human Resource Management System

Manage recruitment, onboarding, leave, payroll, attendance, performance reviews, and more. BETs HRMS also supports biometric integration and mobile attendance for field employees.

Built-In Business Intelligence

All BETs platforms are backed with powerful dashboards and analytics. From stock performance to sales vs target, vendor efficiency to HR insights — decision-makers have real-time data at their fingertips.

Modular. Scalable. Customizable.

Whether you're a startup, mid-sized business, or an established enterprise, BETs grows with you. Choose the modules you need, integrate with existing systems, or build a full-suite digital backbone for your brand.

Who Uses BETs?

Food & Beverage Brands

Franchise Retail Chains

Snack, Bakery, Dairy & FMCG Manufacturers

Distribution-Focused Companies

Companies with Field Sales Teams

Multi-Warehouse Businesses

Vendor-Heavy Operations

Integrations & Support

BETs integrates with popular ERPs like Microsoft Dynamics (Navision), SAP, and other systems through robust APIs. Our team ensures smooth onboarding, training, and post-implementation support to help you succeed.

Final Word

"One software suite, countless business problems solved." That’s not a tagline — it’s a promise. BETs is more than software. It’s your operational backbone, your growth partner, and your gateway to building a future-ready business.

Experience BETs System. Experience the smarter way to run your business.

To know more,

Visit Us : https://www.byteelephants.com/

0 notes

Text

Web Based Invoice Software

Web-Based Invoice Software simplifies and streamlines the entire invoicing process by offering online access, automation, and integration features, which save time, reduce errors, and improve cash flow management for businesses.

For more information Visit Us: https://aninvoice.com/

#web invoice software#web based invoice management system#web based invoicing software for small business

0 notes

Text

The trucking industry is one of the most regulated in the U.S. and Canada, which means compliance is always a top concern for transportation industries. This is especially true when it comes to cross-border freight. These days, border officials rely on digital documents to make the customs process smoother. Having the right software can make this process easy and reduce the risk of errors. Here are a few ways AVAAL eManifest software can make border crossing easy for your business.

Compliance Made Simple To run a successful trucking business, compliance always needs to be a top priority. Not following the required customs process or accurately filling out documentation can result in lost time, reduced profits, and even legal consequences. Both Canada and the U.S. require carriers to submit their eManifests one hour prior and send their paperwork to customs brokers two hours prior to a driver’s arrival at the border. With AVAAL’s eManifest software, submitting this has never been easier. Our software is tailor-made to meet all the requirements so that you can cross the border without any hassles and be confident that you’re complying with all regulations.

Easy to Use Platform Both the U.S. and Canada currently offer their own free eManifest portal. Unfortunately, these are difficult to use and not designed to support carriers that regularly cross the border. These platforms also don’t share data between ACE and ACI, creating issues for cross-border trucking companies. AVAAL eManifest is easy to use and reliable. It’s web-based software, meaning you can submit your manifests at any time and from anywhere. Our software also comes with 24/7 support, so we will be available to help you if any issues arise.

Tailored to Your Business' Needs Not all trucking companies have the same needs, even when it comes to border-crossing. One thing that sets our eManifest software apart from others is that it can be tailor-fit to meet your company’s needs. Whether you’re a single operator or a multi-national company, we offer the greatest level of flexibility and have an eManifest plan to suit your requirements. We have a team of experts on hand ready to help you with all your businesses’ needs.

PAPS and PARS: How to Speed Up Your Cross-Border Shipments

PAPS (Pre-Arrival Processing System) and PARS (Pre-Arrival Review System) are essential components in cross-border trade between Canada and the United States. Let’s explore what they are and how they facilitate the movement of commercial goods across the Canadian and U.S. borders:

PARS (Pre-Arrival Review System):

Designation: PARS is used by the Canadian Border Services Agency (CBSA) to clear commercial goods through customs.

Functionality: It involves bar code labels placed on commercial invoices. CBSA agents scan these labels to determine whether goods need immediate release or further inspection.

Integration: PARS works with the ACI (Advance Commercial Information) electronic manifest system in Canada.

PAPS (Pre-Arrival Processing System):

Designation: PAPS is the U.S. counterpart of PARS.

Functionality: Similar to PARS, it allows U.S. Customs and Border Protection (CBP) to process goods as they cross the border.

Integration: PAPS operates within the ACE (Automated Commercial Environment) electronic manifest system in the United States.

Similarities and Differences:

Both PARS and PAPS serve the same purpose: facilitating the movement of goods.

The main difference lies in their geographical scope: PARS for Canada, PAPS for the USA.

Having similar systems streamlines importing and exporting between the two countries.

When Do You Need PARS or PAPS Numbers?

Any commercial shipments entering Canada or the U.S. by truck use PARS or PAPS numbers as the default shipping type.

The PARS/PAPS process involves carriers, shippers, and customs brokers working together to ensure smooth border crossings.

Here’s how it works:

A carrier assigns a PARS or PAPS number to a shipment.

The customs broker uses this number to request the release of the shipment from customs.

The carrier prepares an eManifest listing using ACI (Canada) or ACE (U.S.), referencing the PARS or PAPS number.

Only when both the broker’s entry and the carrier’s eManifest listing are accepted can the goods proceed to the border.

Customs officers verify the PARS or PAPS number to release the goods or refer them for inspection.

In summary, PARS and PAPS play a crucial role in expediting cross-border trade, ensuring compliance, and enhancing efficiency for carriers and importers.

For more information kindly visit – ACE/ACI emanifest Portal

#logistics#truck load#trucking#trucking company#trucking factoring#truckingindustry#truckinglife#avaal#canada#ontario#pars#paps#emanifest#crossborder

2 notes

·

View notes

Text

Virtual Accounting Services for Remote Teams: The Quiet Backbone of Rapid Business

There’s a strange kind of comfort in chaos, isn’t there?

Especially if you’re running a remote team. Zoom calls across time zones, Slack threads that read like stream-of-consciousness novels, Monday.com boards that look like abstract art — and somewhere in all that noise, money’s moving. Expenses fly in from Manila, invoices go out to clients in Berlin, a contractor in Toronto submits a receipt in Portuguese.

It’s organized disarray. Until it isn’t. And that’s when virtual accounting services stop being a “nice-to-have” and start being a lifeline.

Let’s be honest — remote teams move fast, burn bright, and stretch thin. If your financial back-office isn’t keeping pace, everything else starts wobbling. That’s why virtual accounting isn’t just about number crunching — it’s about building a rapid business solution that actually works at the speed and scale you’re aiming for.

Wait, What Even Is Virtual Accounting?

Great question. Because “virtual accounting” sounds like something out of a fintech startup pitch deck.

But here’s the no-frills version: it’s real, human accountants working remotely (like your team), using cloud-based tools to manage your books, reconcile your bank feeds, file your taxes, and give you clean, digestible financials. Every month. Sometimes every week.

It’s bookkeeping meets real-time collaboration. Like if your Google Docs suddenly got certified in GAAP.

What makes it magical? It's built for the way remote teams actually operate. No printing. No shoe-box receipts. No “let’s meet next Thursday to go over last quarter.”

Just real-time insight, handled by people who know that your team’s budget spreadsheet lives somewhere between a Notion doc and a Slack file that nobody pinned.

Your Remote Team Isn't "Different" — It's Just... Distributed

Let’s clear something up. People think “remote” means “less complex.”

Nope.

In reality, remote teams are more complex. Here’s why:

Expenses show up in different currencies

Tax compliance varies based on team location

Payroll isn’t payroll — it’s often a tangled web of freelance invoices and contract payments

Cash flow becomes harder to visualize when the spend is spread thin across tools, people, and countries

Add to that a layer of inconsistent reporting (someone’s using Excel, someone else loves Airtable, someone forgot to submit anything), and you’ve got the makings of a financial headache.

Rapid business solutions Virtual accounting services take that mess and make it readable. Better yet — they make it manageable.

“But We’re Still Small, We Don’t Need That Yet” — Wanna Bet?

Here’s the trap: small teams assume they can “handle it for now.”

What usually happens? One founder is half-bookkeeper, half-CFO, and completely overwhelmed. Someone else is sorting receipts at midnight before a quarterly tax deadline. And no one really knows if the business is actually profitable.

That’s fine when you're working out of a coffee shop, living off your first round of funding, and only have two clients. But fast forward six months — you’ve grown, the expenses doubled, and the person who set up your QuickBooks account just left the company.

Suddenly, you’re not running lean. You’re running blind.

Virtual accounting plugs that gap — before it becomes a crater.

What You Actually Get with a Good Virtual Accounting Team

Let’s keep this simple. A good virtual accountant will help you:

Reconcile accounts monthly — no more “we’ll do it later.”

Track your burn rate — especially crucial for funded startups.

Categorize expenses correctly — no more mixing software tools with payroll.

Provide profit & loss statements — that you can actually read.

Help with sales tax and VAT — if you’re selling across borders, this matters.

File taxes accurately — and yes, they’ll chase you for documents you forgot to send.

Generate cash flow reports — so you don’t guess when you can hire.

Some offer extras like forecasting, CFO advice, or scenario planning. But even just having someone who understands that “Miro subscription renewal” isn't a capital asset? Priceless.

The Tools That Actually Make This Work

Let me tell you — it’s not just spreadsheets and prayer anymore.

Virtual accounting services use tools that play nicely with the remote ecosystem. The good ones live and breathe platforms like:

Xero – great for startups, flexible, with solid automation.

QuickBooks Online – still the classic, if set up right.

Gusto – payroll for hybrid teams.

Expensify or Ramp – track expenses without annoying your team.

Bill.com – manage vendor payments without drama.

Stripe + PayPal integrations – because you can’t keep pasting those into Excel forever.

And the best part? These tools aren’t just efficient — they make financials visible. As in, you can pull up a dashboard before a client call and know what you're talking about.

It’s Not Just About the Money — It’s About Momentum

Remote teams thrive on momentum. Launches, campaigns, product releases, sprint cycles — you need financials that keep up. Not static reports from two months ago.

Because if your revenue doubled last month but you didn’t track expenses right? You might think you're killing it… until payroll hits and the bank account gasps.

Here’s where virtual accountants really shine — they help you make decisions in the moment. Not just with data, but with context.

Want to hire a new designer? Let’s look at the burn rate. Thinking of switching platforms? Let’s model the cost. Curious if that marketing campaign really worked? Let’s check actual ROI.

It's not just clean books. It’s a clean view forward.

Remote ≠ Isolated — You’re Not Alone

Here’s a sneaky danger with remote teams: isolation.

That weird feeling like you’re the only one holding the financial thread together. Like if you stop looking at the numbers for even a week, everything will spiral.

Good virtual accounting support doesn't just handle your books — it reassures you. That things are tracked. That someone’s watching. That you’re not alone in this business-building journey.

You get more than peace of mind. You get space. To think, to plan, to build.

Okay, But How Much Does This Actually Cost?

Let’s not dance around this — good virtual accounting isn’t dirt cheap. But it’s not outrageous either.

You’re usually looking at:

$400–$1,500/month depending on team size, complexity, and services

A bit more if you need payroll across multiple countries

Some offer flat rates, others charge by volume

But compared to the cost of mistakes, IRS notices, misreported revenue, or hiring a full-time finance lead prematurely?

Honestly — worth every penny.

Final Thought: Don’t Build a Fast Business on Wobbly Books

Look, I get it. Financial operations aren’t sexy. They don’t win awards or go viral on LinkedIn. But you know what they do?

They keep your team funded, your taxes accurate, your cash flowing, and your stress level below “panic mode.”

Virtual accounting for remote teams isn’t an upgrade. It’s the infrastructure. It’s the behind-the-scenes engine that keeps your distributed team running, scaling, and staying out of trouble.

And if you’re aiming for rapid business — not just scattered hustle — it’s one of the smartest investments you can make.

So ask yourself: are your finances as remote-ready as your team?

If not, maybe it’s time to fix that — before the receipts pile up and the panic sets in.

Need a nudge? Start with one conversation. Reach out to a virtual accounting service that specializes in remote teams .Rapid business solution. Ask them what you’re doing wrong. (Trust me — they’ll know.) And then let them handle the numbers, while you focus on building the future.

Because your business deserves more than duct-taped spreadsheets and late-night panic sessions.

It deserves structure. Confidence. Momentum.

And maybe — just maybe — some sleep.

0 notes

Text

Hospital Management System Development for Multi-Speciality Hospitals

Running a multi-speciality hospital isn’t just about saving lives. It’s about coordinating departments, managing data, and ensuring patient satisfaction—all at the same time.

That’s where smart hospital management system development comes in. It brings everything—appointments, billing, diagnostics, pharmacy, records—into one connected platform.

In this blog, we’ll explain what a custom hospital management system should look like, the problems it solves, and how Idiosys Tech, a trusted web development company in Kolkata, builds reliable digital solutions for hospitals that want to modernize.

Why Off-the-Shelf Software Doesn’t Work

Hospitals are complex. Your outpatient flow is different from inpatient care. Your surgery unit doesn’t work like the pathology lab. Most ready-made tools miss these nuances.

That’s why hospital management software development needs to be custom. It must reflect your departments, staff roles, and workflows. Only then can it truly reduce errors, speed up processes, and improve patient care.

What Every Hospital Management System Should Have

Appointment and Registration

Let patients book slots online. The system checks doctor availability and confirms instantly. Everyone gets reminders so no one misses an appointment.

Health Records

All patient history, lab results, and prescriptions are stored digitally. Doctors access this from any department. That’s what a good hospital management system software delivers.

Billing and Payments

Track consultations, room charges, tests, and pharmacy bills. The system generates invoices, processes payments, and handles insurance claims without errors.

Inpatient and Outpatient Flow

From admission to discharge, every step is logged. You’ll always know bed availability, pending surgeries, and discharge timelines.

Inventory and Pharmacy

You won’t run out of stock or keep expired medicines. The system sends alerts and tracks every medicine from receipt to issue.

Lab and Diagnostics

Doctors can request tests. Lab techs get notified. Reports are uploaded once ready. No delays, no lost forms.

Doctor and Staff Access

Each user has a dashboard. Doctors see appointments and records. Nurses get task lists. Admins monitor everything.

Reports for Admins

Want to know how many patients visited last week? Which department made the most revenue? A smart hospital management system gives you that data instantly.

What Happens Without a System

Departments Work in Silos

Labs, pharmacy, and doctors don’t share updates. It leads to delays and confusion. An online hospital management system connects them all.

Patient Records Go Missing

Paper files get lost. Emails are missed. Digital records stay safe and available 24/7.

Billing Gets Messy

Manual calculations are slow and error-prone. Software automates everything.

You Waste Inventory

Without tracking, medicines get overstocked or expire. Inventory modules solve this.

Admins Are Overwhelmed

Without automation, staff spend hours on tasks that should take minutes.

What We Do Differently

At Idiosys Tech, we build software that matches how your hospital works—not the other way around. As a proven web development company in Kolkata, we create systems that connect every department and run smoothly on both desktop and web.

We don’t just code—we listen, plan, and support. Our development process includes:

Role-Based Design

Each department gets what it needs. Reception handles registration. Doctors see only what’s relevant. Admins get total control.

Integrated Web Tools

Reception desks and front office teams use web dashboards to manage appointments, track patients, and handle billing.

Top-Notch Security

From encrypted logins to access controls, we ensure your hospital data is safe and compliant.

Compatibility and Flexibility

We integrate with lab software, HR tools, or finance systems you already use. You don’t start from scratch.

Dedicated Support

From launch to upgrades, our support team stays with you. Need a feature added? We’re here.

Going Mobile: Better Access, Happier Patients

Patients today expect mobile-first experiences. From booking appointments to checking prescriptions, they want everything on their phones.

As a reliable mobile app development company in Kolkata, Idiosys Tech also builds hospital apps that patients love and staff find useful. With mobile apps, you can: • Notify patients about their upcoming visits • Let them access prescriptions, lab reports, and invoices • Enable real-time communication between staff • This brings more transparency and saves everyone time.

Why It’s Worth the Investment

A smart hospital management system software saves time, cuts errors, and improves care. But more than that—it prepares your hospital for the future.

You don’t just fix daily issues. You also: • Reduce paper and manual work • Make data-driven decisions • Improve coordination across teams • Give patients a smoother experience

Conclusion: Build a System That Helps Everyone

A custom hospital management system development project isn’t just another IT job. It’s a step toward smarter healthcare, happier patients, and less stressed staff.

Idiosys Tech is here to help. Whether you want a web platform, a mobile app, or both—we build systems that deliver.

With experience in healthcare tech and a clear understanding of how hospitals work, we’re more than a vendor—we’re your tech partner.

Let’s build a hospital system that’s efficient, easy to use, and future-ready.

--------------------------------------------------------------

Why do multi-speciality hospitals need a custom solution?

Different departments have different workflows. Custom hospital management systems are built to match the exact operational needs of each department, improving coordination and performance.

What are the core modules of a hospital management system?

Key modules include appointment scheduling, EHR, billing, pharmacy, lab management, inpatient/outpatient tracking, and analytics dashboards.

Can hospital staff access the system from mobile devices?

Yes. We build responsive web and mobile apps that doctors, nurses, and admin staff can use on the go for better accessibility and efficiency.

Can this system integrate with existing lab or finance software?

Yes. Our custom-built systems can connect with your current diagnostic tools, HR software, or payment platforms via APIs.

Does the software support multiple locations or hospital branches?

Yes. We build scalable systems that support multi-location management from a central admin dashboard.

--------------------------------------------------------------

You May Also Read

Mental Health App Development: Key Features, Proven Benefits, and Smart Solutions

Managing Virtual Consultations: How Telemedicine Apps Can Reduce Wait Times

Revolutionizing Healthcare: The Evolution of E-prescription Software

How Telemedicine App Development is Revolutionizing Healthcare in 2024

#hospital management system#hospital management system development#web development#web development company#website development company#mobile app development company#mobile app development#app development

0 notes

Text

Opening Value: A Comprehensive Guide to Medical Billing Software Prices in 2023

Unlocking Value: A Comprehensive Guide to Medical Billing Software Prices in 2023

Medical billing software has become an essential tool for healthcare providers, offering efficiency, accuracy, adn comprehensive features necessary in today’s complex healthcare landscape. In 2023, understanding the cost associated with these systems is crucial for practices ranging from small clinics to large hospitals. This guide delves into the factors influencing medical billing software prices, helping you make informed decisions.

Understanding Medical Billing Software

before we dive into pricing,let’s clarify what medical billing software is. This software automates the billing process, handling tasks such as:

Submitting claims to insurance companies

Tracking payments

Generating invoices

managing patient data

With the right software, healthcare providers can significantly reduce the time spent on administrative tasks, allowing them to focus more on patient care.

Factors Influencing Medical Billing Software Prices

Understanding the factors that influence medical billing software prices can definitely help you assess the costs more effectively.Here are some crucial elements to consider:

1.Type of Software

Medical billing software comes in various formats, including:

Web-Based Software: Accessible from any device with internet connectivity, typically offered as a subscription service.

On-Premise Software: Installed locally on a healthcare provider’s servers, usually requiring a one-time purchase with ongoing maintenance fees.

2. Features and Functionality

Prices can vary significantly based on features. Common functionalities include:

Claims management

Payment processing

Reporting and analytics

Patient scheduling

Advanced features, such as integrated EMR/EHR systems or telehealth capabilities, can also increase costs.

3. Scale of Operation

A small clinic will generally pay less compared to a large hospital, given the scale of operations, number of users, and volume of transactions processed.

4. Can You Choose Between Subscription vs. Licensing Models?

medical billing software pricing models generally fall into these categories:

Subscription-Based: Monthly/annual fees; may include updates and support.

One-Time Purchase: Pay upfront but may require additional fees for updates and ongoing support.

Average Medical Billing Software Prices in 2023

Google analytics puts the average prices for medical billing software into perspective. Here is a simplified table showcasing the average costs based on varying categories:

Type of Software

Average Monthly cost

Average Annual Cost

Web-Based

$200 – $500

$2,400 – $6,000

On-Premise

$1,000 – $5,000 (one-time)

$0 – Maintenance fees

These prices may vary based on the specific features and services that each provider offers.

The Benefits of Investing in Medical Billing Software

Investing in medical ��billing software is not just about expenditure; it’s about unlocking notable value for your practice. Here are some benefits to consider:

Improved Accuracy: reduces human error in billing processes, ensuring claims are submitted correctly.

Time Efficiency: Automates tedious tasks, allowing your staff to allocate time for patient care.

Better Revenue Cycle Management: Streamlines the process right from patient registration to payment collection.

in-depth Reporting: provides insights into financial performance and areas for enhancement.

Practical Tips for Choosing the Right Software

Choosing the right medical billing software doesn’t have to be overwhelming. Here are practical tips to help you make the best decision:

1. Assess Your Needs

Understand the specific needs of your practice.Do you require telehealth capabilities? How many users will access the system?

2. Read Reviews and Case Studies

User experiences can highlight strengths and weaknesses of various software solutions. Look for reviews, testimonials, and case studies.

3.Request Demos and Trials

Most providers offer free trials or demonstrations. utilize these opportunities to evaluate user-friendliness and functionality.

4. Check Compliance and security Features

It is essential that any software you choose complies with HIPAA regulations and has robust security measures in place.

Case Studies: Success Stories

let’s take a look at a few case studies where medical billing software implementation has led to considerable improvements:

Case Study 1: small Clinic Success

A small family practice implemented web-based billing software that resulted in a 30% reduction in claim denials within the first six months,leading to an increase in cash flow.

Case study 2: Large hospital Efficiency

A large hospital integrated their EHR with billing software, streamlining their operations, which led to a 25% increase in billing efficiency.

First-Hand experience: Navigating Software Selection

Having researched and selected a medical billing software for my own practice in 2023, I discovered that the journey was both challenging and enlightening.

Being overwhelmed initially, I learned that gathering input from my staff early in the process helped significantly. The most unexpected benefit of investing in quality software was the improved integration between departments, enhancing communication and operational efficiency.

Conclusion

the landscape of medical billing software prices in 2023 is characterized by various factors, including the type of software, features, and operational scale. investing in medical billing software is not merely an expense; it’s an opportunity to enhance your practice’s financial health and operational efficiency. By comprehensively researching your options, considering your specific needs, and weighing the benefits against the costs, you can unlock the value that medical billing software provides, ensuring that your practice stays on the cutting edge of healthcare technology.

Ready to transform your billing process? Take the next step towards efficiency and accuracy in your practice by researching the best medical billing software today!

youtube

https://medicalbillingcodingcourses.net/opening-value-a-comprehensive-guide-to-medical-billing-software-prices-in-2023/

0 notes

Text

12 Pain Points Resolved by Adult Day Care Software

Does running an Adult Day Care Agency require more administrative work than you have time for? From documentation and billing, to scheduling and maintaining compliance, each aspect can become draining if not streamlined with efficient software.

Let’s go over how adult day care software will revolutionize how you work, and will save your agency time, energy and stress.

What are the most cost and energy-guzzling administrative tasks creating stress and headaches for your agency? Here’s a breakdown of what Adult Day Care Agencies have reported as their administrative pain points:

Manual documentation entries are tiring

Human entry errors occur frequently necessitating more audits

Data is not adequately secured or organized

Multiple platforms are needed to cover all admin aspects

Follow-through rate is low due to patient dissatisfaction

Charting is chaotic

High employee turnover rate

Compliance audits are needed routinely

Long client wait times

Insurance verification takes hours

Inaccurate submissions lead to claim delays and denials

Unstable communication between caregivers and clients

How Adult Day Care Software Puts an End to all 12 Pain Points

Adult Day Care Software comes to the rescue with 5 key benefits that diminish the common challenges holding agencies back. Here’s a simplified breakdown of the key benefits provided:

40% less documentation time

Accuracy of Claim Submissions

Verify Insurance in less Time

Solid Communication Channel

Happier Clients and Staff

40% Less Documentation Time

Why continue to throw away valuable time on manual documentation when you can shave that time down by 40% with software? The entire documentation process becomes streamlined with Adult Day Care Software, giving your caregivers ample time to focus on quality patient care instead of administrative work.

Document management software comes with the following advantages:

Time-saving platform with built-in E-signature collection

Designed for busy caregivers

Reliable, accurate, and HIPAA complaint

Easily customizable to suit your agency’s needs

Forms can be emailed/faxed

Improved Accuracy of Claims

What’s the # 1 stress-causer for agencies? Claim denials and delays are at the top of the list for most. Electronic data entries and automated billing resolve the dilemma by ensuring better accuracy of each claim prior to submission. Adult Day Care software gives your agency a comprehensive platform that puts billing headaches to rest, and solidifies your operations with the following:

Higher acceptability of claim submissions

Collect reimbursements/payments faster

Automation of invoices and submission

Accessible from anywhere

View details of billing reports

Multi-payment methods accepted

Verify Insurance in Less Time

Manually verifying patient insurance is tedious and draining. Adult Day Care Insurance Verification software automates the process giving you eligibility reports in no time. Here’s a breakdown of how insurance verification software will relieve your agency:

Comprehensive eligibility reports at your fingertips in less time

View all recent Insurance Reports from your dashboard

Web-based for convenient access

No more wait time for clients

Reduction in phone calls with payers

Solid Communication Channel

Want to know how to win over trust? Continuous communication is the key. Instant 2-way texting safeguards transmission of information, allowing updates, notifications, and follow up messages to be sent between clients and staff.

Adult Day Care Software boosts your business by enabling a continuous connection, along with the following:

2-way SMS capabilities

Bulk Text Messages can be sent to/from staff & clients

HIPAA Compliant messaging app

Communication Records can be viewed

Happier Clients & Caregivers

If you’re wanting to reduce employee turnover and create loyal clients, Adult Day Care Software is the #1 way to go about it. Clients love the speed, reliability and convenience. Caregivers will appreciate the stress-free documentation process that empowers them with more time for patient care. With happier employees and clients, your agency will grow faster and achieve what most agencies only dream of.

Conclusion