#web based invoicing software for small business

Explore tagged Tumblr posts

Text

Web Based Invoice Software

Web-Based Invoice Software simplifies and streamlines the entire invoicing process by offering online access, automation, and integration features, which save time, reduce errors, and improve cash flow management for businesses.

For more information Visit Us: https://aninvoice.com/

#web invoice software#web based invoice management system#web based invoicing software for small business

0 notes

Text

What is the best web-based enterprise accounting software?

In the fast-paced and ever-evolving landscape of business, staying on top of your finances is crucial. As enterprises expand their operations, managing accounts efficiently becomes a daunting task. Thankfully, with the advent of technology, businesses now have access to a plethora of web-based enterprise accounting software options to streamline their financial processes. In this comprehensive guide, we will explore the ins and outs of web-based enterprise accounting software, helping you make an informed decision on the best solution for your business needs.

Understanding Web-Based Enterprise Accounting Software

Web-based enterprise accounting software, often referred to as cloud accounting software, is a digital solution that allows businesses to manage their financial activities online. Unlike traditional accounting systems that rely on on-premise software, web-based accounting tools operate in the cloud, offering users the flexibility to access their financial data from anywhere with an internet connection.

Advantages of Web-Based Enterprise Accounting Software

1. Accessibility

One of the primary advantages of web-based accounting software is accessibility. With data stored securely in the cloud, users can access their financial information anytime, anywhere. This proves especially beneficial for enterprises with multiple locations or remote teams, fostering collaboration and efficiency.

2. Cost Efficiency

Web-based accounting solutions often follow a subscription-based model, eliminating the need for costly upfront investments in software and hardware. This cost-effective approach makes it easier for businesses to scale their accounting infrastructure according to their needs without breaking the bank.

3. Real-Time Updates

In the dynamic world of business, real-time data is invaluable. Web-based accounting software provides instant updates, ensuring that users have access to the most recent financial information. This feature is crucial for making informed decisions and adapting to market changes promptly.

4. Automatic Updates and Maintenance

Gone are the days of manual software updates and maintenance. With web-based accounting solutions, updates are automatic, and maintenance is handled by the service provider. This frees up valuable time for businesses to focus on core operations rather than managing software updates.

Features to Look for in Web-Based Enterprise Accounting Software

1. User-Friendly Interface

A user-friendly interface is essential for ensuring that your team can navigate the software seamlessly. Look for solutions with intuitive dashboards and easy-to-understand features to minimize the learning curve for your staff.

2. Scalability

As your enterprise grows, so do your accounting needs. Choose a web-based accounting solution that can scale with your business, accommodating increased transaction volumes and additional users without compromising performance.

3. Integration Capabilities

Efficient accounting doesn't happen in isolation. Ensure that the web-based accounting software you choose integrates seamlessly with other essential business tools, such as CRM systems, project management software, and e-commerce platforms.

4. Security

The security of your financial data should be a top priority. Opt for web-based accounting software that employs robust encryption protocols and follows industry best practices for data protection. Additionally, check for features such as multi-factor authentication to add an extra layer of security.

Top Contenders in the Web-Based Enterprise Accounting Software Market

1. MargBooks

MargBooks Online is a India's popular online accounting solution known for its user-friendly interface and robust features. It offers a range of plans to suit businesses of all sizes and provides tools for invoicing, expense tracking, and financial reporting.

2. Xero

Xero is another cloud accounting software that caters to small and medium-sized enterprises. With features like bank reconciliation, inventory management, and payroll integration, Xero is a comprehensive solution for businesses looking to streamline their financial processes.

3. NetSuite

NetSuite, owned by Oracle, is a cloud-based ERP (Enterprise Resource Planning) solution that includes robust accounting functionalities. It is suitable for larger enterprises with complex financial needs and offers features such as financial planning, revenue recognition, and multi-currency support.

4. Zoho Books

Zoho Books is part of the Zoho suite of business applications and is designed for small and medium-sized enterprises. It provides features such as automated workflows, project billing, and collaborative client portals, making it a versatile choice for businesses with diverse needs.

Making the Right Choice for Your Business

Choosing the best web-based enterprise accounting software for your business requires careful consideration of your specific needs and objectives. Here are some steps to guide you through the decision-making process:

1. Assess Your Business Requirements

Start by identifying your business's specific accounting requirements. Consider factors such as the number of users, the complexity of your financial transactions, and the need for integration with other business applications.

2. Set a Budget

Determine a realistic budget for your accounting software. While web-based solutions often offer cost savings compared to traditional software, it's essential to choose a solution that aligns with your financial resources.

3. Explore Free Trials

Many web-based accounting software providers offer free trials of their platforms. Take advantage of these trials to explore the features and functionalities of different solutions before making a commitment.

4. Seek Recommendations and Reviews

Consult with other businesses in your industry or network to gather recommendations and insights. Additionally, read reviews from reputable sources to gain a better understanding of the user experiences with different accounting software options.

The Evolution of Web-Based Enterprise Accounting Software

As technology continues to advance, so does the landscape of web-based enterprise accounting software. The evolution of these platforms is driven by the ever-changing needs of businesses and the ongoing developments in cloud technology. Let's delve deeper into the evolving trends shaping the future of web-based accounting solutions.

1. Artificial Intelligence (AI) and Automation

The integration of artificial intelligence and automation is revolutionizing how businesses handle their financial processes. Modern web-based accounting software is incorporating AI algorithms to automate repetitive tasks, such as data entry and invoice categorization. This not only increases efficiency but also minimizes the risk of human error.

2. Enhanced Data Analytics

In the age of big data, the ability to derive meaningful insights from financial data is paramount. Advanced web-based accounting solutions are now equipped with powerful data analytics tools. These tools help businesses analyze trends, forecast future financial scenarios, and make data-driven decisions.

3. Mobile Accessibility

The shift towards mobile accessibility is a notable trend in web-based enterprise accounting software. Businesses are increasingly relying on mobile devices for day-to-day operations, and accounting software providers are responding by offering mobile-friendly applications. This allows users to manage their finances on the go, providing unparalleled flexibility.

4. Integration with E-Commerce Platforms

As e-commerce continues to thrive, businesses are looking for accounting solutions that seamlessly integrate with their online sales platforms. Modern web-based accounting software often includes features tailored for e-commerce, such as automated transaction reconciliation with online sales channels and inventory management.

5. Blockchain Technology

Blockchain technology is making waves in various industries, and accounting is no exception. Some web-based accounting solutions are exploring the integration of blockchain for enhanced security and transparency in financial transactions. This could revolutionize how businesses handle aspects like auditing and transaction verification.

Common Challenges and How to Overcome Them

While web-based enterprise accounting software offers numerous benefits, it's important to be aware of potential challenges and how to overcome them. Here are some common issues businesses may face:

1. Security Concerns

The sensitive nature of financial data raises concerns about security in the cloud. To address this, choose a web-based accounting solution that employs robust encryption protocols and complies with industry security standards. Additionally, educate your team about best practices for secure online behavior.

2. Connectivity Issues

Reliable internet connectivity is crucial for accessing web-based accounting software. In regions with unstable internet connections, businesses may face challenges in real-time collaboration and data accessibility. Consider implementing backup solutions for offline access or explore accounting software with offline capabilities.

3. Customization Needs

Every business has unique accounting requirements. Some businesses may find that certain web-based accounting solutions lack the level of customization they need. In such cases, explore platforms that offer extensive customization options or consider integrating additional specialized accounting tools.

4. Data Ownership and Control

Understanding the terms of service and data ownership is essential when using web-based accounting software. Ensure that the chosen platform allows you to retain control over your financial data and provides mechanisms for data export in case of migration to a different system.

Conclusion: Making the Right Choice for Long-Term Success

In the fast-paced world of business, the right web-based enterprise accounting software can be a game-changer. Whether you're a small startup or a large enterprise, the key is to stay informed about the latest advancements in accounting technology and align your choice with the long-term goals of your business.

As you navigate the vast landscape of web-based accounting solutions, remember that the best choice is the one that seamlessly integrates with your business processes, enhances efficiency, and adapts to the evolving needs of your enterprise. If you have any specific questions or need further guidance on a particular aspect of web-based accounting software, feel free to ask for more information!

Also read- Online billing and accounting software to manage your business

#Web-based accounting#Cloud software#Financial management#Enterprise solutions#accounting#software#billing#online billing software#technology#programming#erp#tech#drawings#illlustration#artwork#art style#sketchy#art#aspec#aromantic asexual#arospec#acespec#aroace#aro#bg3#astarion#shadowheart#gale dekarios#gale of waterdeep#karlach

2 notes

·

View notes

Text

Boost Your Accounting Career with Practical e-Accounting

INTRODUCTION

In today’s digitally driven financial world, e-Accounting has become an essential skill for anyone looking to build a stable and rewarding career in the accounting and finance sector. From small businesses to large enterprises, companies are shifting towards digital platforms for managing accounts, taxes, payroll, and financial reports. As a result, practical e-Accounting training is now more valuable than ever—especially for students and beginners looking to enter this dynamic field.

If you’re aspiring to work in accounts, taxation, or finance, enrolling in a Complete e-Accounting Training in Yamuna Vihar or Uttam Nagar can be the smartest step towards building a strong foundation.

What is e-Accounting?

e-Accounting refers to the use of electronic tools and accounting software like Tally, BUSY, and Excel to manage financial data, taxation, GST, TDS, payroll, and other business processes. It’s not just about recording transactions—it’s about understanding how finances flow within an organization using technology. That’s why courses like e-Accounting with Practical Software Training in Uttam Nagar are in high demand.

Why Students Should Learn Practical e-Accounting

For students, especially from commerce backgrounds, practical e-Accounting knowledge opens doors to real-time accounting jobs. The theoretical knowledge from textbooks is useful, but what companies really look for is hands-on experience with real software and business scenarios.

By enrolling in Beginner to Advanced e-Accounting Classes in Yamuna Vihar, students gain valuable exposure to:

Tally ERP for GST and financial accounting

Payroll management systems

Income Tax and TDS calculations

Excel-based financial reporting

Invoice and billing software

Banking and reconciliation practices

The focus is not just on concepts but on practical tasks that accountants handle every day in real organizations.

Key Modules That Shape Your Future

Most well-structured courses such as the e-Accounting and Taxation Course in Uttam Nagar cover a blend of accounting fundamentals and modern software tools. These modules typically include:

Basics of accounting and journal entries

Tally ERP with GST and TDS setup

Payroll & salary structure creation

Taxation basics (GST, TDS, ITR filing)

Bank reconciliation

Excel-based MIS reporting

Business-oriented projects for real-world application

This kind of comprehensive curriculum is also offered under the Advanced e-Accounting with Payroll & GST in Yamuna Vihar, which prepares you for entry-level to intermediate roles in the accounting field.

Certification That Makes You Job-Ready

When you complete training from a Certified e-Accounting Institute in Uttam Nagar, you don’t just gain knowledge—you receive certification that adds real weight to your resume. Employers value certified candidates, especially those trained in software like Tally, Excel, and BUSY, along with knowledge of GST, TDS, and payroll compliance.

Being certified from the Top e-Accounting Institute for Beginners in Yamuna Vihar also helps you stand out during interviews and internship applications.

Real-Time Learning with Practical Software

What makes e-Accounting with Financial Reporting Course in Yamuna Vihar truly impactful is the use of real-time software. You don’t just learn theory; you work on projects using actual accounting tools. This prepares you to step into job roles such as:

Junior Accountant

Accounts Executive

GST & TDS Assistant

Payroll Operator

Data Entry Operator with Finance Skills

Moreover, the e-Accounting with GST and TDS Training in Uttam Nagar ensures that you’re updated with current tax rules and compliance practices, making you immediately useful in any financial organization.

Final Thoughts

In a competitive job market, basic knowledge isn’t enough. Students must be job-ready from day one, and practical e-Accounting training provides just that. Whether you choose to study through e-Accounting Classes for Beginners in Uttam Nagar, the focus should be on gaining real, actionable skills that can help you secure stable employment in finance, taxation, or business accounting.So if you're planning to enter the finance world, now is the perfect time to get certified in e-Accounting—and future-proof your career with practical, hands-on knowledge.

Suggested Links:

TallyPrime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

0 notes

Text

Virtual Accounting Services for Remote Teams: The Quiet Backbone of Rapid Business

There’s a strange kind of comfort in chaos, isn’t there?

Especially if you’re running a remote team. Zoom calls across time zones, Slack threads that read like stream-of-consciousness novels, Monday.com boards that look like abstract art — and somewhere in all that noise, money’s moving. Expenses fly in from Manila, invoices go out to clients in Berlin, a contractor in Toronto submits a receipt in Portuguese.

It’s organized disarray. Until it isn’t. And that’s when virtual accounting services stop being a “nice-to-have” and start being a lifeline.

Let’s be honest — remote teams move fast, burn bright, and stretch thin. If your financial back-office isn’t keeping pace, everything else starts wobbling. That’s why virtual accounting isn’t just about number crunching — it’s about building a rapid business solution that actually works at the speed and scale you’re aiming for.

Wait, What Even Is Virtual Accounting?

Great question. Because “virtual accounting” sounds like something out of a fintech startup pitch deck.

But here’s the no-frills version: it’s real, human accountants working remotely (like your team), using cloud-based tools to manage your books, reconcile your bank feeds, file your taxes, and give you clean, digestible financials. Every month. Sometimes every week.

It’s bookkeeping meets real-time collaboration. Like if your Google Docs suddenly got certified in GAAP.

What makes it magical? It's built for the way remote teams actually operate. No printing. No shoe-box receipts. No “let’s meet next Thursday to go over last quarter.”

Just real-time insight, handled by people who know that your team’s budget spreadsheet lives somewhere between a Notion doc and a Slack file that nobody pinned.

Your Remote Team Isn't "Different" — It's Just... Distributed

Let’s clear something up. People think “remote” means “less complex.”

Nope.

In reality, remote teams are more complex. Here’s why:

Expenses show up in different currencies

Tax compliance varies based on team location

Payroll isn’t payroll — it’s often a tangled web of freelance invoices and contract payments

Cash flow becomes harder to visualize when the spend is spread thin across tools, people, and countries

Add to that a layer of inconsistent reporting (someone’s using Excel, someone else loves Airtable, someone forgot to submit anything), and you’ve got the makings of a financial headache.

Rapid business solutions Virtual accounting services take that mess and make it readable. Better yet — they make it manageable.

“But We’re Still Small, We Don’t Need That Yet” — Wanna Bet?

Here’s the trap: small teams assume they can “handle it for now.”

What usually happens? One founder is half-bookkeeper, half-CFO, and completely overwhelmed. Someone else is sorting receipts at midnight before a quarterly tax deadline. And no one really knows if the business is actually profitable.

That’s fine when you're working out of a coffee shop, living off your first round of funding, and only have two clients. But fast forward six months — you’ve grown, the expenses doubled, and the person who set up your QuickBooks account just left the company.

Suddenly, you’re not running lean. You’re running blind.

Virtual accounting plugs that gap — before it becomes a crater.

What You Actually Get with a Good Virtual Accounting Team

Let’s keep this simple. A good virtual accountant will help you:

Reconcile accounts monthly — no more “we’ll do it later.”

Track your burn rate — especially crucial for funded startups.

Categorize expenses correctly — no more mixing software tools with payroll.

Provide profit & loss statements — that you can actually read.

Help with sales tax and VAT — if you’re selling across borders, this matters.

File taxes accurately — and yes, they’ll chase you for documents you forgot to send.

Generate cash flow reports — so you don’t guess when you can hire.

Some offer extras like forecasting, CFO advice, or scenario planning. But even just having someone who understands that “Miro subscription renewal” isn't a capital asset? Priceless.

The Tools That Actually Make This Work

Let me tell you — it’s not just spreadsheets and prayer anymore.

Virtual accounting services use tools that play nicely with the remote ecosystem. The good ones live and breathe platforms like:

Xero – great for startups, flexible, with solid automation.

QuickBooks Online – still the classic, if set up right.

Gusto – payroll for hybrid teams.

Expensify or Ramp – track expenses without annoying your team.

Bill.com – manage vendor payments without drama.

Stripe + PayPal integrations – because you can’t keep pasting those into Excel forever.

And the best part? These tools aren’t just efficient — they make financials visible. As in, you can pull up a dashboard before a client call and know what you're talking about.

It’s Not Just About the Money — It’s About Momentum

Remote teams thrive on momentum. Launches, campaigns, product releases, sprint cycles — you need financials that keep up. Not static reports from two months ago.

Because if your revenue doubled last month but you didn’t track expenses right? You might think you're killing it… until payroll hits and the bank account gasps.

Here’s where virtual accountants really shine — they help you make decisions in the moment. Not just with data, but with context.

Want to hire a new designer? Let’s look at the burn rate. Thinking of switching platforms? Let’s model the cost. Curious if that marketing campaign really worked? Let’s check actual ROI.

It's not just clean books. It’s a clean view forward.

Remote ≠ Isolated — You’re Not Alone

Here’s a sneaky danger with remote teams: isolation.

That weird feeling like you’re the only one holding the financial thread together. Like if you stop looking at the numbers for even a week, everything will spiral.

Good virtual accounting support doesn't just handle your books — it reassures you. That things are tracked. That someone’s watching. That you’re not alone in this business-building journey.

You get more than peace of mind. You get space. To think, to plan, to build.

Okay, But How Much Does This Actually Cost?

Let’s not dance around this — good virtual accounting isn’t dirt cheap. But it’s not outrageous either.

You’re usually looking at:

$400–$1,500/month depending on team size, complexity, and services

A bit more if you need payroll across multiple countries

Some offer flat rates, others charge by volume

But compared to the cost of mistakes, IRS notices, misreported revenue, or hiring a full-time finance lead prematurely?

Honestly — worth every penny.

Final Thought: Don’t Build a Fast Business on Wobbly Books

Look, I get it. Financial operations aren’t sexy. They don’t win awards or go viral on LinkedIn. But you know what they do?

They keep your team funded, your taxes accurate, your cash flowing, and your stress level below “panic mode.”

Virtual accounting for remote teams isn’t an upgrade. It’s the infrastructure. It’s the behind-the-scenes engine that keeps your distributed team running, scaling, and staying out of trouble.

And if you’re aiming for rapid business — not just scattered hustle — it’s one of the smartest investments you can make.

So ask yourself: are your finances as remote-ready as your team?

If not, maybe it’s time to fix that — before the receipts pile up and the panic sets in.

Need a nudge? Start with one conversation. Reach out to a virtual accounting service that specializes in remote teams .Rapid business solution. Ask them what you’re doing wrong. (Trust me — they’ll know.) And then let them handle the numbers, while you focus on building the future.

Because your business deserves more than duct-taped spreadsheets and late-night panic sessions.

It deserves structure. Confidence. Momentum.

And maybe — just maybe — some sleep.

0 notes

Text

ODOO CRM

Unlock Sales Success with Odoo CRM: A Deep Dive into Features, Benefits & Use Cases

In today’s competitive market, success depends not just on how many leads you generate—but how effectively you manage them. That’s where a modern Customer Relationship Management (CRM) system like Odoo CRM becomes a game-changer. It’s not just software—it’s a sales enabler, lead generator, and business optimizer, all rolled into one.

In this article, we provide a comprehensive guide to Odoo CRM, exploring its features, benefits, use cases, integration capabilities, real-life success stories, and more.

What is Odoo CRM?

Odoo CRM is an open-source, fully integrated CRM solution that helps businesses manage their sales pipeline, customer relationships, and sales performance—all in one intuitive interface. Part of the broader Odoo ERP suite, it seamlessly connects with other modules like Sales, Marketing, Accounting, Inventory, and Helpdesk.

Whether you're a startup or an enterprise, Odoo CRM is built to scale with your business.

Powerful Features of Odoo CRM

Here’s a deeper look at the tools that make Odoo CRM stand out:

1. Sales Pipeline Visualization

Customize your Kanban view to match your sales process.

Drag-and-drop leads through stages like New, Qualified, Proposal Sent, Won, and Lost.

Color-coded tags help prioritize and categorize leads.

2. Automated Activities & Smart Scheduling

Automatically schedule follow-ups after key milestones.

Set up recurring meetings, calls, or reminders.

Integrates with Google Calendar, Outlook, and mobile devices.

3. Multichannel Communication

Sync with your email, VoIP, and SMS tools.

Use pre-written templates for quicker responses.

All conversations are logged and linked to the lead’s profile.

4. Lead Scoring & Assignment Rules

Score leads based on criteria like job title, location, industry, or behavior.

Automatically assign hot leads to top-performing reps.

Route leads by geography, language, or campaign source.

5. Custom Reports and Real-Time Dashboards

Monitor KPIs such as:

Lead conversion rate

Sales cycle length

Deal size by rep or team

Export reports or automate them on a schedule.

6. Mobile-First Experience

Native mobile apps for iOS and Android.

Access lead data, update opportunities, and get notifications while on the move.

Key Benefits of Using Odoo CRM

Here’s what businesses love about Odoo CRM:

All-in-One Platform: No more switching tools—everything from marketing to invoicing is connected.

100% Customizable: Add custom fields, change workflows, or build new apps using Odoo Studio.

User-Friendly Interface: Clean, modern UI that reduces the learning curve.

Affordable & Scalable: Pay for what you use. Start small and scale up when needed.

Global Community & Support: Backed by a massive open-source community and certified partners worldwide.

Real-World Integrations

Odoo CRM integrates seamlessly with:

Odoo Email Marketing: Launch personalized drip campaigns.

Odoo Website: Capture leads through embedded web forms.

Odoo eCommerce: Track leads generated through online purchases.

Third-party apps: Zapier, WhatsApp, Slack, Twilio, and more.

Use Cases by Industry

Real Estate

Track buyers, sellers, and properties.

Automate appointment reminders and open house follow-ups.

B2B SaaS

Monitor monthly recurring revenue (MRR).

Run email nurture sequences to onboard free trial users.

Retail & Wholesale

Connect CRM to inventory for real-time stock updates.

Assign sales reps based on customer region or purchase history.

Professional Services

Manage client onboarding, invoicing, and renewals from one dashboard.

Customer Testimonials

“We switched from Salesforce to Odoo CRM and cut our CRM costs by 70%. It's simpler to use and integrates better with our accounting and invoicing tools.” — Lucia Martinez, COO, GreenTech Innovations

“Our sales reps love the mobile app. It helps them update leads right after meetings, which has improved our data accuracy dramatically.” — James Andrews, Head of Sales, UrbanEdge Realty

🛠 How to Get Started

Step 1: Sign up for a free trial at odoo.com

Step 2: Choose the CRM module and activate related apps like Sales, Email Marketing, and Invoicing.

Step 3: Customize your sales stages, import leads, and set up team permissions.

Step 4: Train your team (Odoo offers built-in tutorials and documentation).

Step 5: Start selling smarter and tracking every opportunity!

Final Thoughts: Is Odoo CRM Right for You?

If you're looking for a cost-effective, powerful, and fully integrated CRM, Odoo is hard to beat. Whether you’re a solopreneur or managing a global sales team, Odoo CRM offers the flexibility, functionality, and affordability that modern businesses demand.

Unlike many CRMs that force you into their mold, Odoo lets you define your own sales journey—and powers it every step of the way.

Ready to Transform Your Sales Strategy?

Explore Odoo CRM for free

Talk to our Odoo-certified experts Get a tailored demo for your business

VISIT:https://banibro.com/odoo-crm/

Email: [email protected]

0 notes

Text

Top Reasons to Trust Accounting Lane’s Online Accounting Experts for Your Business

With today's dynamic digital world, companies require effective and trustworthy financial management more than ever. With the assistance of reputed Online Accounting Experts, your company can change how it manages accounting, bookkeeping, and planning. Accounting Lane is a first-rate option for businesses that need convenient and precise financial services when it comes to reliable and advanced accounting solutions.

Following are the most important reasons why you should rely on Accounting Lane's Online Accounting Experts for your business requirements.

Proficiency with Online Accounting Applications

One of the biggest benefits of hiring Accounting Lane is their extensive experience in numerous Online Accounting Applications. With real-time access to your financial information, accuracy and transparency are guaranteed in your accounts. From well-known systems such as Xero and QuickBooks to bespoke accounting software, Accounting Lane's Online Accounting Specialists are skilled in merging and managing multiple systems that meet your individual business needs.

With sophisticated Online Accounting Applications, they automate bookkeeping, invoicing, payroll, and tax preparation tasks. Not only does this save time, but it also minimizes errors, allowing your business to remain compliant and financially sound.

Remote Accessibility and Convenience

With remote work and cloud technologies on the increase, it's important to have access to accounting services anytime, anywhere. Online Accounting Experts at Accounting Lane use cloud technology to offer you instant access to your financial information wherever you are. This ease makes business owners and managers able to make timely decisions based on current information without having to wait for physical copies or on-site inspections.

The convenience of being able to view your books over the web translates into the ability to monitor expense, handle invoices, and analyze financial performance using your PC or mobile device — ideal for entrepreneurs always on the move.

Tailored Solutions for Any Business

No two businesses are the same, and Accounting Lane understands that one-size-fits-all solutions rarely work. Their team of Online Accounting Experts takes the time to understand your business model, goals, and challenges to tailor accounting solutions that best fit your needs.

Whether you are a small startup, expanding small business, or mature enterprise, Accounting Lane provides scalable services that evolve with your firm. In addition to bookkeeping, they offer strategic financial planning, budgeting, and forecasting aimed at driving your long-term success.

Cost-Effective Financial Management

It can be costly to employ a full-time in-house accounting staff, particularly for small and medium-sized companies. Outsourcing your accounting requirements to Accounting Lane's Online Accounting Experts enables you to enjoy professional services without bearing the additional costs of salaries, benefits, and office space.

By using Online Accounting Applications, the team minimizes most mundane procedures, with less manual effort and decreasing the total expense of accounting services. Being cost-saving, you receive professional financial handling while keeping resources free to use elsewhere in your business.

Better Data Security and Compliance

Handling financial data online naturally raises concerns about security and privacy. Rest assured, Accounting Lane prioritizes data protection by using secure cloud platforms and stringent security protocols. Their Online Accounting Experts ensure that your financial information is encrypted, backed up, and safeguarded from unauthorized access.

Additionally, maintaining compliance with changing tax laws and money regulations is essential. The Accounting Lane team remains current on the most recent compliance mandates, ensuring you do not incur expensive penalties and audits. With their professional advice, your company is always compliant and audit-ready.

Real-Time Reporting and Insights

One of the major advantages of adopting Online Accounting Applications is having access to instant reports. Accounting Lane's Online Accounting Specialists grant you precise, accurate, and timely financial statements and information. This transparency enables you to track cash flow, profitability, and other key measures at any time.

With real-time data at your fingertips, you can make better decisions quicker, whether it's deciding where to invest next, keeping track of expenses, or getting ready for tax season. These actionable insights have the potential to be the difference-maker in keeping and expanding your business.

Expert Help and Dedicated Support

Working with Accounting Lane is more than contracting the services of an accountant; it's employing a valued advisor. Their Online Accounting Experts are on hand at all times to respond to questions, fix problems, and provide specialist guidance that is specific to the difficulties your business is facing.

No matter whether you require tax filing assistance, accuracy in books, or financial planning, Accounting Lane's specialists offer customized service that really matters. This connection is more than crunching numbers — it is about nurturing your business success every step of the way.

Conclusion

Selecting the proper accounting partner is essential to your business's financial well-being and success. From Accounting Lane's Online Accounting Experts, you receive a combination of technology-enabled solutions, one-on-one service, and professional financial advice. Their expertise in Online Accounting Applications guarantees that you receive safe, effective, and easily accessible financial management specific to your business.

By trusting Accounting Lane, you’re choosing a partner dedicated to helping your business succeed with reliable, cost-effective, and innovative accounting solutions. Ready to take your business to the next level? Connect with Accounting Lane’s Online Accounting Experts and experience the future of accounting today.

0 notes

Text

Neo Billing Nulled Script 8.0

Download Neo Billing Nulled Script – The Ultimate Invoicing & CRM Solution Neo Billing Nulled Script is a powerful and flexible solution designed for small and medium-sized businesses that need an all-in-one platform to manage accounting, invoicing, billing, and customer relationship management (CRM). If you're looking for a robust yet user-friendly tool to streamline business operations without spending a dime, this is the ideal choice. Why Choose Neo Billing Nulled Script? Business management tools can be expensive, but with Neo Billing you can access premium features for free. This script brings enterprise-level functionality to your fingertips without the heavy price tag. It’s the perfect alternative for entrepreneurs, freelancers, and startups who need efficiency without compromising on features. Detailed Product Description The Neo Billing is a comprehensive solution that combines billing, invoicing, accounting, and CRM into one platform. It’s tailored to support various industries and is easy to configure to suit your specific business needs. With its intuitive dashboard, managing sales, purchases, clients, and suppliers becomes effortless. Whether you're tracking expenses, creating detailed financial reports, or automating invoice generation, this tool simplifies it all. Download it today and experience a next-level digital accounting solution that saves time and boosts productivity. Technical Specifications Script Type: PHP, MySQL-based Responsive Design: Fully responsive and mobile-friendly UI Server Requirements: PHP 7.x+, MySQL 5.6+ Installation: One-click installer included File Size: Lightweight and optimized for performance Features and Benefits Invoicing Automation: Easily create, send, and track invoices Expense Management: Keep control over company expenses Client Management: Store and manage detailed customer records Multi-Currency Support: Ideal for global business operations Customizable Templates: Personalized invoice and report templates Role-Based Access: Assign and manage user permissions Real-World Use Cases Here are just a few ways Neo Billing Nulled Script can be used in the real world: Freelancers: Manage clients and automate invoicing seamlessly Agencies: Keep track of staff, payments, and customer projects Retail Businesses: Generate accurate sales reports and manage stock levels Startups: Control budgets and keep investors updated with real-time financial data How to Install Neo Billing Nulled Script Download the latest version of Neo Billing Nulled Script from our site. Unzip the package and upload the files to your server. Create a new MySQL database and import the included SQL file. Run the web-based installer and follow the on-screen instructions. Log in to your admin dashboard and start customizing your setup. That’s it! You’re now ready to enjoy a full-featured CRM and accounting solution at zero cost. Frequently Asked Questions (FAQs) Is the Neo Billing Nulled Script safe to use? Yes, the version provided on our site is scanned and tested to ensure it's free from malware or harmful code. Can I use it for commercial projects? Absolutely! The Neo Billing Nulled Script is perfect for commercial and freelance projects where cost efficiency is crucial. Does it support multi-user access? Yes, it comes with role-based access control, so multiple users can access different areas of the system securely. Where can I download similar nulled tools? We highly recommend checking out our other offerings like Impreza NULLED for stunning WordPress themes, and the powerful Slider Revolution Nulled plugin for dynamic sliders and web visuals. Final Thoughts If you're serious about optimizing your business processes without spending hundreds on software, Neo Billing is the ideal solution. Easy to use, feature-rich, and completely free—this script provides all the tools needed to take your business management to the next level. Download now and empower your workflow

0 notes

Text

Custom Software in 48 Hours – Powered by OceanMNC

Launch Your CRM, ERP, HRM or Business App in Just 2 Days!

In today’s fast-moving business world, time is money. Whether you run a startup in Europe, a growing business in the USA, or a dynamic team in the UAE, waiting weeks or months for software development just doesn’t work anymore. That’s why OceanMNC introduces a revolutionary solution:

Custom Software Development in Just 48 Hours.

We build and launch your software fast — so you can start managing, automating, and scaling your business without delays.

🌐 Who Is OceanMNC?

OceanMNC is a global IT development company known for rapid, reliable, and scalable web development, AI tools, and custom software solutions. With clients across Germany, UK, UAE, USA, and India, we’ve built over 500+ solutions — from CRMs to Inventory Systems, from HRMs to Invoice Automation Tools.

Now, with our "Software in 48 Hours" service, we give your business a head start.

🚀 What Kind of Software Can We Build in 48 Hours?

Here are software solutions we’ve successfully delivered in under 2 days:

✅ CRM (Customer Relationship Management)

Track leads, manage sales, assign tasks, and improve conversions.

✅ HRM (Human Resource Management)

Attendance, payroll, leave management, and performance tracking.

✅ Inventory Management

Real-time product tracking, barcode scanning, and stock alerts.

✅ Quotation & Invoice Generator

Generate branded invoices, track payments, and send reminders.

✅ Ticketing & Support System

Manage customer queries, complaints, and service requests.

✅ Small ERP Solutions

Custom dashboards for finance, operations, projects, and reports.

We use pre-tested frameworks, proven modules, and cloud hosting to go live faster than traditional development cycles.

💡 How Do We Deliver Software in Just 48 Hours?

Our success formula:

🔹 Modular Architecture – Reusable codebase = faster builds

🔹 Experienced Dev Teams – 24/7 shifts across time zones

🔹 Pre-built UI Templates – Save hours on design

🔹 Clear Requirement Process – We capture your exact needs in 1 call

🔹 Real-Time Collaboration – WhatsApp/Zoom/Slack for instant feedback

🔹 Agile Delivery – First version in 48 hours, then iterate

We start with MVP-first delivery — then upgrade in phases based on your business goals.

🌍 Who It’s For – Business Types We Serve

📍 This service is perfect for:

🏢 Real Estate Agencies

🏬 Wholesale Distributors

🧑💼 Marketing Agencies & Freelancers

🏥 Clinics & Health Practitioners

📦 E-commerce Backoffice Management

🧘 Coaches, Trainers & Consultants

🛠️ Service-Based Small Businesses

Whether you're in Dubai, Berlin, New York, or Mumbai — we deliver the same high-speed, reliable service.

🛠️ Real Case Studies – OceanMNC in Action

🧾 Case 1: Invoice Software – Dubai, UAE

A trading company needed a simple, branded invoicing tool.

Delivered: In 41 hours

Result: Saved 8 hours/week in manual billing.

👥 Case 2: Lead CRM – Munich, Germany

A digital agency needed a lightweight CRM to track and manage clients.

Delivered: In 46 hours

Result: 20% increase in lead conversions in 1st month.

👨⚕️ Case 3: Clinic Software – Chicago, USA

Required patient booking, history management, and billing.

Delivered: In 2 working days

Result: Fully automated appointment system.

🔒 Features That Come Standard

✅ Admin Dashboard + Role-Based Access

✅ Real-Time Reporting

✅ Email & WhatsApp Alerts

✅ Cloud Hosting & Secure SSL

✅ Multi-Device Compatibility

✅ User-Friendly UI

✅ Custom Branding (Your Logo, Colors, Language)

Custom software doesn’t have to be expensive or time-consuming.

🧠 AI-Based Reports or Suggestions

📤 API Integration (Zapier, Twilio, WhatsApp Cloud, etc.)

💬 Chatbot for Internal Use or Client Support

🔍 SEO Panel for Public Pages

🌟 Why Choose OceanMNC?

✔️ 500+ Projects Delivered

✔️ Dedicated Project Manager

✔️ Fast Communication (WhatsApp, Zoom, Slack)

✔️ Flexible Payment Options

✔️ NDA & Data Protection Guaranteed

✔️ After-Sale Support Available

We believe in speed with quality — no shortcuts, just smart execution.

✅ Ready to Build Your Software in 48 Hours?

Don’t wait for months to automate your business.

📞 Call Now: +91 760065 96975

🌐 Visit: www.OceanMNC.com

📩 Email: [email protected]

💬 WhatsApp or DM us to start your project today.

✨ Final Word: From Idea to Launch — in Just 48 Hours

With OceanMNC’s rapid software development model, you get exactly what your business needs — without long delays, heavy budgets, or guesswork. Whether it’s a CRM for sales, an HR tool for teams, or an ERP for business control — we help you build fast and grow smart.

Let us help you transform your workflow, save time, and grow revenue — starting within 48 hours.

0 notes

Text

Best ISP Cloud Billing Software for 2025: Reviews & Buyer’s Guide

In 2025, the demand for efficient and scalable ISP cloud billing software continues to surge as internet service providers look for smarter ways to manage customer billing, automate operations, and ensure compliance. As the ISP landscape grows more complex, selecting the right billing software is no longer optional—it's a critical business decision.

In this guide, we’ll explore the best ISP cloud billing software for 2025, including comprehensive reviews, comparison charts, and key buying tips. Leading the pack is ISPMate, a trusted name that combines flexibility, automation, and robust analytics for ISPs of all sizes.

What is ISP Cloud Billing Software?

ISP cloud billing software is a web-based solution designed specifically for internet service providers to manage billing, customer data, service plans, and payments. Unlike traditional systems, cloud-based billing platforms offer real-time data access, scalability, and integration with other tools like CRM and network monitoring systems.

Key benefits include: - Automated invoicing and payment collection - Centralized customer management - Reduced operational costs - Enhanced data security - Faster deployment and updates

Key Features to Look for in ISP Cloud Billing Software

- Automated Billing & Invoicing: Ensure accurate, timely billing for all customer plans. - Customer Management: CRM integration and self-service portals enhance customer experience. - Scalability: Support for growing user bases and service plans. - Network Integration: Connect with monitoring and provisioning tools. - Payment Gateway Integration: Enable seamless online payments. - Security & Compliance: Data encryption, access control, and compliance with industry standards. - Real-time Reporting & Analytics: Make data-driven decisions with instant insights.

Top ISP Cloud Billing Software for 2025: Comparison & Reviews

ISPMate – Best Overall ISP Cloud Billing Solution ISPMate stands out in 2025 as a comprehensive, user-friendly platform offering powerful automation, seamless integrations, and customizable features.

Key Features: - Real-time billing automation - Customer self-care portal - Scalable for small to large ISPs - Multi-currency & multi-language support - 24/7 customer support

Why ISPMate Stands Out in 2025

ISPMate continues to set the standard for ISP cloud billing software. With its robust feature set and stellar support, it caters to ISPs of all sizes and regions.

Why users love ISPMate: - High uptime and reliability - Customizable workflows - Easy integration with existing infrastructure - Regular updates based on customer feedback

Customer Testimonial: "ISPMate transformed our billing operations. The automation saved us hours every week and improved our customer satisfaction." – Network Admin, Mid-size ISP

How to Choose the Right ISP Cloud Billing Software

Follow these steps when evaluating your options: 1. Define Your Needs: Number of customers, billing cycles, integrations. 2. Compare Features: Look at automation, support, customization, and reporting. 3. Request a Demo: Try before you buy. 4. Evaluate Support: Look for 24/7 help and onboarding assistance. 5. Check Reviews: Learn from real user experiences.

Avoid these mistakes: - Choosing based on price alone - Ignoring scalability - Skipping the demo phase

Pricing Models & Cost Considerations

ISP billing software typically comes in these models: - Subscription-Based: Monthly/annual pricing tiers - Usage-Based: Pay-per-customer or per-transaction

Always factor in: - Setup and training fees - Add-on modules or integrations - Support level

ISPMate offers competitive pricing with flexible packages to suit ISPs of all sizes.

Future Trends in ISP Billing and Cloud Technologies

Looking ahead, expect these trends to influence your buying decision: - AI-Powered Billing: Automate customer insights and error detection - Real-Time Analytics: Monitor KPIs and customer usage instantly - Stronger Security: End-to-end encryption and fraud detection - ISPMate’s Role: Continuously innovating to support these trends

Frequently Asked Questions (FAQs)

Q: What makes ISP cloud billing software different from generic billing tools? A: ISP-specific platforms support usage-based billing, plan management, and network integrations.

Q: Is ISPMate suitable for both small and large ISPs? A: Yes, ISPMate is scalable and customizable to meet the needs of ISPs at any size.

Q: How long does implementation take? A: Most ISPMate clients are fully operational within 1–3 weeks.

Q: Does ISP cloud billing software help with compliance? A: Yes, ISPMate includes tools for regulatory and tax compliance.

Conclusion

Choosing the right ISP cloud billing software in 2025 is essential for growth, compliance, and customer satisfaction. With dozens of options available, ISPMate rises above with its powerful features, ease of use, and proven track record.

Ready to transform your ISP billing operations? Book a free demo with ISPMate or contact our sales team today and see why thousands of ISPs trust ISPMate to power their business.

#isp billing software in delhi#aaa solution for isp#best isp billing software#billing software for isp#isp billing software#isp billing solution#isp management software#isp crm software#isp erp#isp radius solution

0 notes

Text

Top 5 Digital Payment Solutions for Seamless Business Transactions

In the digital era, how your business handles payments is as important as the products or services you offer. Customers today expect quick, secure, and flexible payment options—whether online, in-store, or on mobile. Businesses that embrace modern digital payment systems are not just keeping up—they’re staying ahead.

At Payomatix, we believe the right digital payment solution can completely transform how a business operates. From reducing friction at checkout to enabling global expansion, the right tools matter.

Here’s our curated list of five top-performing payment processing software platforms in 2025—and why they’re trusted by thousands of businesses worldwide.

1. PayPal – Global Reach and Trusted Security

PayPal continues to dominate the global payment space. With an easy setup process, broad international compatibility, and buyer-seller protection, it’s a reliable choice for businesses of all sizes.

Highlights:

Accepts credit/debit cards, PayPal balance, and bank transfers

Used in over 200 countries

Integrated invoicing and refund tools

Seamless integration with e-commerce platforms

Best for: Freelancers, small businesses, and cross-border e-commerce.

2. Stripe – Developer-Friendly and Fully Customizable

Stripe offers robust features for businesses looking to customize their payment experience. With powerful APIs and developer tools, Stripe stands out for its flexibility and scalability.

Highlights:

Accepts payments via cards, digital wallets, BNPL, and more

Supports recurring billing and subscription models

Real-time fraud prevention

Deep integration with mobile and web platforms

Best for: SaaS companies, tech startups, and app-based businesses.

3. Square – Ideal for Retail and In-Person Transactions

Square is a leader in combining hardware and software to offer a seamless retail payment experience. It’s perfect for small businesses and physical stores looking to simplify sales and inventory tracking.

Highlights:

All-in-one POS and payment processing

Portable card readers and mobile integration

Contactless payments (NFC) and QR support

Built-in sales and inventory reporting

Best for: Retail stores, cafés, salons, and pop-up shops.

4. Paytm – Driving Digital Payments in India

Paytm is a cornerstone of India’s digital payment ecosystem. Its QR-based system, mobile wallet, and UPI integration make it a go-to for millions of merchants and customers across the country.

Highlights:

Accepts UPI, Paytm Wallet, credit/debit cards, and net banking

One QR code for all payment methods

Built-in customer engagement tools like cashback and loyalty programs

Merchant-friendly dashboard for transaction tracking

Best for: Indian SMEs, local retailers, and service providers.

5. Razorpay – A Full-Suite Payment Solution for Growing Businesses

Razorpay offers comprehensive payment infrastructure tailored to Indian startups and digital-first businesses. Its smart automation tools and wide support for alternative payment methods make it a future-ready choice.

Highlights:

Accepts cards, UPI, wallets, net banking, BNPL, and EMI

Payment links, invoices, and smart checkout

Advanced routing and settlement options

Subscription billing and recurring payments

Best for: Startups, high-growth e-commerce brands, and online service providers.

Why Alternative Payment Methods Are the Future

Consumer habits are shifting fast. Traditional card payments are now just one part of the picture. Customers expect alternative payment methods like mobile wallets, UPI, BNPL (Buy Now, Pay Later), and subscription billing.

By offering a range of payment options, businesses can:

Improve customer satisfaction and retention

Reduce payment failures and cart abandonment

Increase conversion rates

Gain valuable customer insights

Today’s digital-first customer values convenience, speed, and trust. Meeting them where they are isn’t optional—it’s essential.

How Payomatix Supports Seamless Payment Integration

At Payomatix, we simplify the complex world of digital transactions. Our unified platform enables businesses to accept payments through cards, UPI, mobile wallets, net banking, and more—all from a single dashboard.

Our platform is designed for flexibility, compliance, and performance—whether you're a startup or a large enterprise. With fast onboarding, powerful APIs, and detailed analytics, Payomatix helps businesses of all sizes create frictionless, secure payment experiences.

Final Thoughts

Choosing the right payment processing software is about more than just processing transactions—it’s about future-proofing your business. Whether you’re accepting payments from across the world or managing daily sales in a local market, the tools you use can enhance customer experience, streamline operations, and drive growth.

The five platforms we highlighted—PayPal, Stripe, Square, Paytm, and Razorpay—each offer unique benefits. The best choice depends on your industry, location, and customer expectations.

For businesses looking for a complete, scalable solution, Payomatix is here to help you build smarter, more seamless payment flows.

Explore our platform at payomatix.com Stay connected for more fintech updates and insights.

#Payomatix #DigitalPayments #PaymentSoftware #BusinessGrowth #TechForBusiness #TumblrBusiness

0 notes

Text

How Does Cloud Accounting Work?

Cloud accounting is transforming how businesses manage their financial operations. Unlike traditional accounting systems installed on a local computer, cloud accounting stores data online and allows real-time access from any device with an internet connection. This innovation simplifies workflows, enhances collaboration, and reduces IT overhead.

At its core, cloud accounting involves using software hosted on remote servers rather than internal hardware. All data—transactions, invoices, payroll, financial reports—is stored securely in the cloud. Users log into a platform through a web browser or mobile app, input data, and access reports without installing complex software. The system processes calculations automatically and often includes features like bank integrations, tax tools, and automation of routine tasks.

One of the main advantages is real-time collaboration. Accountants, business owners, and financial advisors can work on the same data simultaneously, which enhances transparency and speeds up decision-making. Updates happen instantly, so everyone sees the most current information. This is particularly valuable for remote teams and growing businesses with distributed workforces.

Security is also a priority in cloud-based systems. Most providers use encryption, multi-factor authentication, and regular backups to protect sensitive financial data. Regular updates and compliance checks are handled by the service provider, relieving the business from maintaining its own IT infrastructure.

Cost efficiency is another benefit. Companies no longer need to invest in expensive hardware or pay for frequent software upgrades. Most cloud accounting solutions offer monthly or yearly subscription models, making them accessible even for small businesses.

Additionally, integrating cloud accounting with other platforms is seamless. For example, businesses handling online transactions can connect their accounting software to payment solutions like Payneteasy.com to automatically record and reconcile payments, reducing manual errors and saving valuable time.

In summary, cloud accounting offers flexible, secure, and scalable financial management. It empowers businesses to gain better insights into their finances, collaborate effectively, and adapt quickly in a fast-changing business environment. For companies seeking efficiency and accuracy, cloud accounting is not just a trend—it’s a necessity.

1 note

·

View note

Text

4 Boring Startup Ideas Screaming to Be Built (and How to Build Them)

Everyone wants to build the next Airbnb, Uber, or OpenAI — but what if the real opportunity lies in the “boring” ideas?

These aren’t flashy or buzzworthy, but that’s the point. They solve real problems, target underserved niches, and often come with less competition and more stable revenue. In fact, many boring startups are quietly making millions behind the scenes.

Here are 4 boring startup ideas that are practically screaming to be built — and how you can start building them right now.

Modern Bookkeeping for Freelancers The Problem:

Freelancers and solo entrepreneurs are terrible at bookkeeping. Most dread tax season and use outdated spreadsheets or overly complex tools like QuickBooks.

The Boring Solution:

Build a dead-simple, freelancer-friendly bookkeeping tool that helps with:

Categorizing income/expenses Quarterly tax estimates Invoicing Receipt uploads via mobile

Think “Notion-level simplicity meets Stripe integration.”

How to Build It:

Tech Stack: React, Firebase, Plaid for bank integration Go-To-Market: Start with creators (designers, writers, coaches) on Twitter/LinkedIn. Offer a free trial, then upsell monthly plans. Revenue Model: Freemium or tiered SaaS pricing (\$10–\$30/month)

✅ Bonus: Add AI-powered transaction categorization to stand out.

Compliance Tracker for Small Businesses The Problem:

Small businesses constantly miss local or industry-specific compliance tasks — business license renewals, data regulations, safety checks, etc.

The Boring Solution:

A simple dashboard that tracks compliance deadlines, sends reminders, and offers document templates based on industry and location.

How to Build It:

Tech Stack: Laravel or Django backend, PostgreSQL, clean web UI Data: Aggregate public regulatory calendars by state/province Go-To-Market: Partner with local business associations or legal consultants Revenue Model: \$20–\$100/month based on company size

✅ Extra Opportunity: White-label it for accountants or legal advisors.

Automated HOA/Condo Management Software The Problem:

Homeowners' associations (HOAs) and small condo boards are run by volunteers using paper checks, email chains, and Google Docs. It’s messy and inefficient.

The Boring Solution:

A turnkey web platform for:

Collecting dues online Managing maintenance requests Document storage (meeting minutes, rules) Resident messaging

How to Build It:

Tech Stack: Bubble or no-code MVP → migrate to React/Node Sales Strategy: Cold outreach to HOA boards and property managers Revenue Model: \$50–\$300/month per community

✅ Note: Once you're in, churn is low — they hate switching tools.

Digital Notice Board for Apartment Buildings The Problem:

Most apartment buildings still rely on physical notice boards for updates, lost keys, and maintenance alerts. Tenants ignore them. Management gets flooded with emails.

The Boring Solution:

Create a digital screen + companion app for building announcements, package alerts, lost & found, local deals, etc.

How to Build It:

Hardware: Use affordable tablets or smart displays Software: Web-based backend for management, mobile app for tenants Sales Strategy: Start with co-living spaces or new developers Revenue Model: Hardware + monthly SaaS fee Bonus Revenue: Sell ad space for local businesses

✅ Scalability Angle: Bundle it into smart building management platforms.

Final Thoughts

"Boring" doesn't mean bad — it means unsexy but necessary. These are the types of businesses that solve unglamorous but persistent problems. And that’s where the gold is.

If you’re a builder tired of chasing the next hype cycle, consider starting with a boring startup. It might just be the most exciting decision you make.

0 notes

Text

Start Your Career in Finance with BUSY Software Training

INTRODUCTION

In today’s competitive job market, having just a degree is often not enough. If you're a commerce student or aspiring finance professional, gaining practical software skills is the key to unlocking career opportunities. One of the most in-demand tools in accounting today is BUSY Accounting Software. It’s widely used by businesses for managing inventory, GST, invoicing, and financial reporting—making it a must-have skill for those looking to step confidently into the finance world.

Why BUSY Accounting Software?

BUSY is an integrated business accounting and management software used across multiple industries, especially in small and medium enterprises. Its simplicity and power make it a favorite for accountants and business owners. Whether it’s day-to-day accounting, GST returns, or inventory control—BUSY does it all. That’s why enrolling in BUSY Software Classes in Yamuna Vihar or BUSY Software Classes in Uttam Nagar is a smart investment in your future.

Learn by Doing: The Importance of Practical Training

Theory alone won’t prepare you for real-world accounting tasks. Practical exposure to tools like BUSY helps you understand how actual business transactions are recorded and managed. That’s where Advanced BUSY Software Training with Practical in Yamuna Vihar or Practical BUSY Software and Accounting Course in Uttam Nagar comes into play. These programs offer hands-on experience so you can confidently work with ledgers, GST reports, TDS entries, and more.

What You Will Learn in BUSY Software Courses

Enrolling in a Complete BUSY Accounting and GST Course in Yamuna Vihar or Uttam Nagar will help you build strong fundamentals and job-ready skills. Here's a glimpse of what you’ll learn:

Core Accounting Principles using BUSY

GST Setup and Invoicing

Voucher and Journal Entry Creation

Inventory Management

Financial Reporting and Analysis

TDS, TCS, and Taxation Handling

Payroll Processing

E-Way Bill and Return Filing

This is especially beneficial for students taking up the BUSY Accounting and Taxation Course in Uttam Nagar or BUSY Accounting Software with GST Training in Yamuna Vihar, where GST modules are integrated for complete job readiness.

Certified Training Means Better Job Prospects

A course from a Certified BUSY Accounting Software Institute in Uttam Nagar or Yamuna Vihar adds weight to your resume. It proves that you not only understand accounting principles but can also implement them using one of India’s most popular accounting platforms. Employers often give preference to candidates who have completed BUSY ERP Software Training Classes in Yamuna Vihar or similar certification-based training.

Career Opportunities After BUSY Software Training

Learning BUSY isn’t just for accountants. The skills you gain are useful in multiple roles across industries:

Junior Accountant

GST Executive

Billing Executive

Accounts Assistant

Data Entry Operator

Inventory Manager

Freelance Accountant for SMEs

Thanks to the rising demand for skilled professionals, students from Top Institutes for BUSY Software Training in Uttam Nagar are being placed in good companies, often with better starting salaries than peers who lack software experience.

Who Should Enroll?

B.Com, M.Com, BBA students

Job seekers in accounting or finance

Working professionals looking to upgrade skills

Entrepreneurs managing their own books

Freelancers offering accounting services

Final Thoughts

Starting your career in finance with BUSY Software Training is not just about learning software—it’s about becoming job-ready. The knowledge you gain from BUSY Accounting Software Training in Uttam Nagar can bridge the gap between classroom learning and workplace requirements. It gives you the confidence to apply for jobs, handle interviews, and perform efficiently in real-world accounting roles.

If you’re serious about building a future in accounting, now is the time to take that next step. Explore the BUSY ERP Software Training Classes near you and set your career in motion with skills that matter.

Suggested Links:

TallyPrime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

#busy accounting software course.#busy accounting#busy accounting training#busy accounting classes#busy accounting off#line course

0 notes

Text

Free Restaurant POS Billing Software

In manual billing, you will not have any record of the number of orders processed daily, weekly, or monthly. And hence, accurate information about profit or loss is difficult to obtain. Our billing software is free for users because vendors pay us when they receive web traffic and sales opportunities. We feature all vendors, not just paying ones, to help you make the best-informed software decision. Customers can easily book tables online, and I can manage and adjust reservations with minimal effort. This feature truly simplifies the booking process for both guests and the restaurant. If your restaurant uses its venue as an event space, then you’ll also want to have the right venue management software in place - Best Restaurant Billing Software.

With its integrated platform, Restaurant aims to simplify and centralize restaurant management, helping owners and managers optimize efficiency, control costs, and make data-driven decisions. It is designed specifically for the unique needs of the restaurant industry, providing a robust solution for restaurant financials and operations management. When selecting restaurant billing software, look for a cloud-based system that allows for easy access from anywhere and offers real-time data syncing. These top billing software options provide small businesses with the tools they need to efficiently manage their restaurant operations - restaurant management software.

Known for its seamless payment processing and intuitive interface, POS helps streamline daily operations while providing valuable insights into sales and performance. POS is a cloud-based point-of-sale system designed for restaurants, cafes, and small eateries. Its user-friendly interface and efficient features make it a popular choice for businesses seeking an affordable yet robust solution. This software supports offline mode, ensuring uninterrupted service even without internet connectivity. Functions can range from expense tracking and receipt capture to invoice creation and transmission, often mirroring the capabilities of web-based software.

Customers praise its ease of use, affordability, and range of features, while some criticize its limited customization options and slow customer support. POS offers various pricing plans, including a free plan for businesses just starting out. With users praising its user-friendly interface, extensive feature set, and excellent customer support. Pricing varies based on the number of licenses required and the specific features needed. The company offers custom quotes based on each restaurant’s unique needs. For more information, please visit our site https://billingsoftwareindia.in/restaurant-billing-software/

0 notes

Text

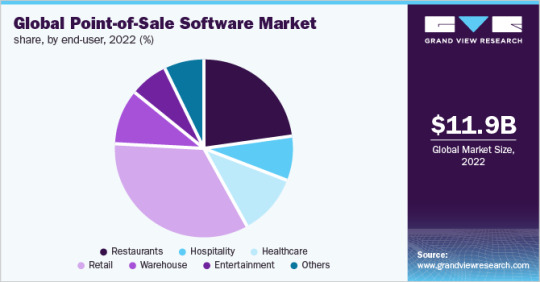

Point-of-Sale Software Market: Analyzing Consumer Preferences

Point-of-Sale Software Industry Overview

The global Point-of-Sale (POS) Software Market was valued at USD 11.99 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2030. The demand for POS software is driven by the need for cashless transactions, efficient tracking of sales and inventory data, and enhanced sales strategies through analytics in various sectors, including retail chains, restaurants, hotels, drug stores, and auto shops. The increasing demand for advanced features such as employee management analytics, inventory tracking, sales monitoring, customer data management, and reporting is expected to accelerate the adoption of POS software across multiple industries.

The requirement for POS systems with improved functionality and analytics has risen significantly due to the diverse operational scenarios of businesses. These systems enable users to effectively manage staff, customers, payments, and invoices. They also facilitate efficient handling of inventory, billing, and employee management. POS software supports a wide range of business operations and can be installed on desktops, laptops, notebooks, or tablets with the compatible operating systems. The growing popularity of cloud-based mPOS solutions has further driven demand, while web-based POS systems have gained traction among small- and medium-sized stores due to their accessibility via web browsers or the internet.

Detailed Segmentation:

Application Insights

The mobile POS market is projected to grow significantly during the forecast period. The expansion of technology has transformed how people make payments, and the installation of mPOS guarantees speedy payments through applications without the system needing to be connected to a local network. The credit card reader on a smartphone or tablet with apps installed to control the scanner and charging system is being utilized to initiate payments. The market has flourished as a result of the increasing use of mobile POS terminals by small businesses for payment processing as well as for carrying out cutting-edge functions, including inventory management, shop management, and analytics to enhance business operations.

Deployment Mode Insights

On the basis of deployment, the industry has been further categorized into on-premise and cloud. The on-premises segment held the highest share of more than 65.70% in 2022. This can be attributed to the higher adoption of software for on-premise POS systems by large enterprises, which run on the local server over the remote facility. Large enterprises have a huge volume of sensitive customer information prone to data breaches. Hence, the on-premises deployment of software provides more control to the owner of the POS system, thus ensuring better security of crucial data.

Organization Size Insights

SMEs are readily adopting cloud-based mobile POS software solutions owing to their affordability and scalability. Moreover, small- and medium-sized businesses in large numbers across the globe often expand at the city or state level and prefer budget-friendly POS software solutions based on word-of-mouth by similar business owners. Therefore, the SME user contribution to the industry has been vital in helping POS software vendors expand their presence in the local markets. Vendors targeting local business owners are focusing on small and medium-sized local businesses across the retail, hospitality, healthcare, and other major industries.

End-user Insights

The restaurant POS software industry is poised to expand at a healthy growth rate from 2023 to 2030. The restaurant sector is another lucrative segment for POS software vendors. The rising integration of restaurants with online delivery providers is a key feature influencing POS purchases. Online ordering and delivery are expected to drive POS investments in 2022, which will help restaurants avoid costly third-party fees. Data analytics, order management, marketing, and payments in the restaurant industry have created a staggering trajectory and are expected to augment over the forecast year. Also, the tourism industry’s growth positively affected the restaurant business and boosted the demand for the deployment of POS software for better service to travelers.

Regional Insights

Asia Pacific is expected to progress at the fastest CAGR of 14.1% over the forecast period. A rise in the adoption of POS terminals in the region due to strong growth in the electronic payment industry is expected to boost the POS software market growth. In developing countries, such as China, India, Indonesia, and Vietnam, the demand for cashless payment in retail, restaurant, entertainment, and other industries is accelerating the proliferation of POS software in the region. Moreover, the ever-increasing demand for POS solutions with advanced features among rapidly growing businesses, such as e-commerce retail, the food service industry, and entertainment, is expected to drive market growth over the forecast period. North America accounted for a significant share of the overall revenue in 2022.

Gather more insights about the market drivers, restraints, and growth of the Point-of-Sale Software Market

Key Companies & Market Share Insights

The key players focus on providing a differentiated and consistent brand experience, as operators are looking for more functionalities and features from existing systems. There is strong competition in the market owing to the presence of a large number of POS software vendors. POS software vendors have opted for a mix of inorganic and organic growth strategies to increase their market share. For instance, in May 2022, Blaze Solutions, Inc. acquired a Vancouver-originated POS software by offering services to the U.S. and Canada. This acquisition is aimed to serve international clients, while also enabling clients to gain experience in the Canadian and U.S. marketplace.

Key Point-of-Sale Software Companies:

Some of the prominent players in the global point-of-sale software market include:

Clover Network, Inc.

H&L POS

IdealPOS

Lightspeed

NCR Corp.

Oracle Micros

Revel Systems

SwiftPOS

Square Inc.

TouchBistro Toast Inc.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

How Small and Mid-Sized Logistics Companies in North America Can Benefit from Cargo Software

In today’s fast-paced logistics environment, small and mid-sized logistics companies in North America face fierce competition from global giants. Customers demand faster, cheaper, and more transparent shipping services, while supply chains become increasingly complex. To survive and thrive, these companies must embrace digital solutions — and cargo software offers one of the most effective paths forward.

Cargo software is no longer a luxury; it’s a necessity. Here’s a closer look at how small and mid-sized logistics firms can benefit significantly from adopting cargo management solutions.

1. Enhanced Operational Efficiency

Manual processes like handwritten bills of lading, email tracking updates, and paper-based inventory logs are time-consuming and error-prone. Cargo software automates these tasks, streamlining operations from end to end.

With features like automated booking, digital documentation, and real-time shipment tracking, companies can handle more shipments with fewer resources. Automation reduces human error, accelerates workflows, and allows employees to focus on value-adding activities rather than administrative burdens.

2. Improved Customer Service and Visibility

Today’s customers expect real-time updates about their shipments. Cargo software platforms provide live tracking, automated notifications, and customer portals, offering clients full visibility into their cargo’s journey.

Better visibility translates into better communication, fewer service complaints, and higher customer retention rates. Small and mid-sized logistics providers can now offer the same level of transparency that major players provide, leveling the playing field.

3. Cost Reduction and Better Resource Allocation

Implementing cargo software helps companies manage resources more efficiently, leading to significant cost savings. Some key ways include: