#2017 tax cuts for the wealthy

Text

Good Bye Mitch ... Hello WHO???

Yesterday Senate Minority Leader Mitch McConnell announced that he will be stepping down from his leadership position at the end of this year. Note that he is not retiring from the Senate, only from his leadership role. It is tempting, at first glance, to feel empathy for Mitch who has some obvious health problems as well as problems with his own cohorts in the Senate who seem to feel that…

View On WordPress

#2017 tax cuts for the wealthy#J.D. Vance#Mitch McConnell#Robert Reich#Russian election interference#U.S. Supreme Court nominations

1 note

·

View note

Text

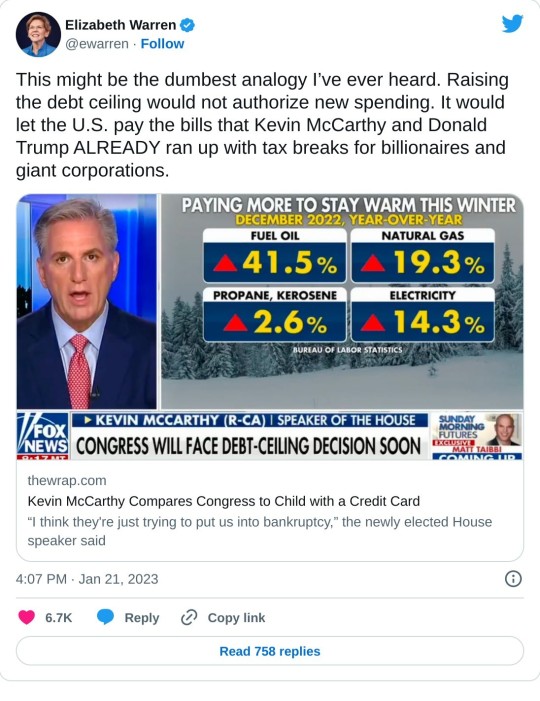

The US has hit the debt ceiling, and the country is careening closer towards a financial crisis as Republicans threaten to bring the country to default over social spending. But Senator Elizabeth Warren thinks that it's time to take a look at rolling back tax cuts on the wealthy.

In an op-ed for the Boston Globe, Warren, a Democrat from Massachusetts, wrote that "Republicans don't really care about the national debt." Instead, House Speaker Kevin McCarthy — who had to weather 15 long votes to finally get his hands on the gavel — is "running a con game" alongside "extremist Republicans."

"They claim their plan to use the debt ceiling to trigger global economic chaos is about fiscal responsibility. It's not," Warren wrote. "The House Republican plan for the debt ceiling is about protecting the wealthy and the well-connected from paying their fair share in taxes — nothing more and nothing less."

Instead, before eyeing cuts to programs like Social Security and Medicare to bring down the national debt, Warren said that lawmakers should first roll back 2017 Trump tax cuts for the wealthy.

"Let's close that door before the next $1 trillion slips away," Warren wrote.

Republicans have been lowering taxes on America's highest-earners and corporations for decades, Warren writes, and that has "relentlessly driven up the national debt." Republicans are still taking aim at taxes in their first economic proposals as a House majority. Their proposal to revoke $80 billion in funding for the IRS would actually worsen the country's debt load, adding over $100 billion to the deficit over the next decade.

The US officially hit the debt limit last week, and US Treasury Secretary Janet Yellen told House Republicans in a letter that she would start employing "extraordinary measures" to keep the US on top of paying its bills. Those measures are likely to run out at some point this summer, and Republicans have until then to raise the debt ceiling and keep the US out of default.

As Insider previously reported, defaulting on the nation's debt or other fiscal obligations like Social Security payments and military paychecks would be unprecedented — and economically catastrophic. President Joe Biden and Democratic lawmakers have been adamant that raising the debt ceiling should not be used as a bargaining chip, but it appears the GOP is intent on using the limit as leverage to achieve their own priorities, like spending cuts for programs like Medicare and Social Security.

As Warren said in her opinion piece, Republicans' goal is "government help for their rich donors and economic pain for everyone else" — and should the US default, Americans would quickly experience pain. Monthly checks that many rely on, like Social Security, would be withheld, and a debt default would likely trigger a global financial crisis and deep worldwide recession.

Still, Republicans have been intent on using the debt limit as an opportunity to help their own party. McCarthy told Fox News last week that "what I really think we would do is treat this like we would treat our own household."

"If you had a child, you gave them a credit card, and they kept hitting the limit, you wouldn't just keep increasing it," he said. "You'd first see what are you spending your money on? How can we cut items out?"

Importantly, though, raising the debt limit does not authorize new spending — it accounts for past obligations the government already signed off on. Warren criticized McCarthy's stance on Twitter last week, calling it "the dumbest analogy I've ever heard."

"Raising the debt ceiling would not authorize new spending," she wrote. "It would let the U.S. pay the bills that Kevin McCarthy and Donald Trump ALREADY ran up with tax breaks for billionaires and giant corporations."

#us politics#news#business insider#2023#118th congress#sen. elizabeth warren#boston globe#op eds#rep. kevin mccarthy#trump tax cuts#2017#national debt#tax the rich#tax the 1%#tax the wealthy#tax the billionaires#social security#social security cuts#medicare cuts#medicare#irs funding#internal revenue service#biden administration#Janet Yellen#department of treasury#raise the debt ceiling#house republicans#tweet#twitter

17 notes

·

View notes

Text

Biden’s 2025 would raise the child tax credits back to the levels they were at during the pandemic, an objectively good thing for literally everyone. Those benefits were slashed by Trump in 2017, and others trailed off after the pandemic “ended”. Biden is going to pay for it by undoing Trump’s tax cuts on wealthy corporations, aka by taxing them more.

You can bet your pants Trump won’t enact this budget if he wins the election.

3K notes

·

View notes

Text

Why they're smearing Lina Khan

My god, they sure hate Lina Khan. This once-in-a-generation, groundbreaking, brilliant legal scholar and fighter for the public interest, the slayer of Reaganomics, has attracted more vitriol, mockery, and dismissal than any of her predecessors in living memory.

She sure must be doing something right, huh?

A quick refresher. In 2017, Khan — then a law student — published Amazon’s Antitrust Paradox in the Yale Law Journal. It was a brilliant, blistering analysis showing how the Reagan-era theory of antitrust (which celebrates monopolies as “efficient”) had failed on its own terms, using Amazon as Exhibit A of the ways in which post-Reagan antitrust had left Americans vulnerable to corporate abuse:

https://www.yalelawjournal.org/note/amazons-antitrust-paradox

The paper sent seismic shocks through both legal and economic circles, and goosed the neo-Brandeisian movement (sneeringly dismissed as “hipster antitrust”). This movement is a rebuke to Reaganomics, with its celebration of monopolies, trickle-down, offshoring, corporate dark money, revolving-door regulatory capture, and companies that are simultaneously too big to fail and too big to jail.

This movement has many proponents, of course — not just Khan — but Khan’s careful scholarship, combined with her encyclopedic knowledge of the long-dormant statutory powers that federal agencies had to make change, and a strategy for reviving those powers to protect Americans from corporate predators made her a powerful, inspirational figure.

When Joe Biden won the 2020 presidential election, he surprised everyone by appointing Khan to the FTC. It wasn’t just that she had such a radical vision — it was also that she lacked the usual corporate law experience that such an appointee would normally require (experience that would ensure that the FTC was helmed by people whose default view of the world is that it should be structured and regulated by powerful, wealthy people in corporate boardrooms).

Even more surprising was that Khan was made chair of the FTC, something that was only possible because a few Republican Senators broke with their party to support her candidacy:

https://www.senate.gov/legislative/LIS/roll_call_votes/vote1171/vote_117_1_00233.htm

These Republicans saw in Khan an ally in their fight against “woke” Big Tech. For these senators, the problem wasn’t that tech had got too big and powerful — it was that there were a few limited instances in which tech leaders failed to wield that power in the ways they preferred.

The Republican project is a matter of getting turkeys to vote for Christmas by doing a lot of culture war bullshit, cruelly abusing disfavored sexual and racial minorities. This wins support from low-information voters who’ll vote against their class interests and support more monopolies, more tax cuts for the rich, and more cuts to the services they rely on.

But while tech leaders are 100% committed to the project of permanent oligarchic takeover of every sphere of American life, they are less full-throated in their support for hateful, cruel discrimination against disfavored minorities (in this regard, tech leaders resemble the corporate wing of the Democrats, which is where we get the “Silicon Valley is a Democratic Party stronghold” narrative).

This failure to unquestioningly and unstintingly back culture war bullshit put tech leaders in the GOP’s crosshairs. Some GOP politicians actually believe in the culture war bullshit, and are grossly offended that tech is “woke.” Others are smart enough not to get high on their own supply, but worry that any tech obstruction in the bullshit culture wars will make it harder to get sufficient turkey votes for a big fat Christmas surprise.

Biden’s ceding of antitrust policy to the left wing of the party, combined with disaffected GOP senators viewing Khan as their enemy’s enemy, led to Khan’s historic appointment as FTC Chair. In that position, she was joined by a slate of Biden trustbusters, including Jonathan Kanter at the DoJ Antitrust Division, Tim Wu at the White House, and other important, skilled and principled fighters like Alvaro Bedoya (FTC), Rebecca Slaughter (FTC), Rohit Chopra (CFPB), and many others.

Crucially, these new appointees weren’t just principled, they were good at their jobs. In 2021, Tim Wu wrote an executive order for Biden that laid out 72 concrete ways in which the administration could act — with no further Congressional authorization — to blunt corporate power and insulate the American people from oligarchs’ abusive and extractive practices:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

Since then, the antitrust arm of the Biden administration have been fuckin’ ninjas, Getting Shit Done in ways large and small, working — for the first time since Reagan — to protect Americans from predatory businesses:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

This is in marked contrast to the corporate Dems’ champions in the administration. People like Pete Buttigieg are heralded as competent

technocrats, “realists” who are too principled to peddle hopium to the base, writing checks they can’t cash. All this is cover for a King Log performance, in which Buttigieg’s far-reaching regulatory authority sits unused on a shelf while a million Americans are stranded over Christmas and whole towns are endangered by greedy, reckless rail barons straight out of the Gilded Age:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

The contrast between the Biden trustbusters and their counterparts from the corporate wing is stark. While the corporate wing insists that every pitch is outside of the zone, Khan and her allies are swinging for the stands. They’re trying to make life better for you and me, by declaring commercial surveillance to be an unfair business practice and thus illegal:

https://pluralistic.net/2022/08/12/regulatory-uncapture/#conscious-uncoupling

And by declaring noncompete “agreements” that shackle good workers to shitty jobs to be illegal:

https://pluralistic.net/2022/02/02/its-the-economy-stupid/#neofeudal

And naturally, this has really pissed off all the right people: America’s billionaires and their cheerleaders in the press, government, and the hive of scum and villainy that is the Big Law/thinktank industrial-complex.

Take the WSJ: since Khan took office, they have published 67 vicious editorials attacking her and her policies. Khan is living rent-free in Rupert Murdoch’s head. Not only that, he’s given her the presidential suite! You love to see it.

These attacks are worth reading, if only to see how flimsy and frivolous they are. One major subgenre is that Khan shouldn’t be bringing any action against Amazon, because her groundbreaking scholarship about the company means she has a conflict of interest. Holy moly is this a stupid thing to say. The idea that the chair of an expert agency should recuse herself because she is an expert is what the physicists call not even wrong.

But these attacks are even more laughable due to who they’re coming from: people who have the most outrageous conflicts of interest imaginable, and who were conspicuously silent for years as the FTC’s revolving door admitted the a bestiary of swamp-creatures so conflicted it’s a wonder they managed to dress themselves in the morning.

Writing in The American Prospect, David Dayen runs the numbers:

Since the late 1990s, 31 out of 41 top FTC officials worked directly for a company that has business before the agency, with 26 of them related to the technology industry.

https://prospect.org/economy/2023-06-23-attacks-lina-khans-ethics-reveal-projection/

Take Christine Wilson, a GOP-appointed FTC Commissioner who quit the agency in a huff because Khan wanted to do things for the American people, and not their self-appointed oligarchic princelings. Wilson wrote an angry break-up letter to Khan that the WSJ published, presaging their concierge service for Samuel Alito:

https://www.wsj.com/articles/why-im-resigning-from-the-ftc-commissioner-ftc-lina-khan-regulation-rule-violation-antitrust-339f115d

For Wilson to question Khan’s ethics took galactic-scale chutzpah. Wilson, after all, is a commissioner who took cash money from Bristol-Myers Squibb, then voted to approve their merger with Celgene:

https://www.documentcloud.org/documents/4365601-Wilson-Christine-Smith-final278.html

Or take Wilson’s GOP FTC predecessor Josh Wright, whose incestuous relationship with the companies he oversaw at the Commission are so intimate he’s practically got a Habsburg jaw. Wright went from Google to the US government and back again four times. He also lobbied the FTC on behalf of Qualcomm (a major donor to Wright’s employer, George Mason’s Antonin Scalia Law School) after working “personally and substantially” while serving at the FTC.

George Mason’s Scalia center practically owns the revolving door, counting fourteen FTC officials among its affliates:

https://campaignforaccountability.org/ttp-investigation-big-techs-backdoor-to-the-ftc/

Since the 1990s, 31 out of 41 top FTC officials — both GOP appointed and appointees backed by corporate Dems — “worked directly for a company that has business before the agency”:

https://www.citizen.org/article/ftc-big-tech-revolving-door-problem-report/

The majority of FTC and DoJ antitrust lawyers who served between 2014–21 left government service and went straight to work for a Big Law firm, serving the companies they’d regulated just a few months before:

https://therevolvingdoorproject.org/wp-content/uploads/2022/06/The-Revolving-Door-In-Federal-Antitrust-Enforcement.pdf

Take Deborah Feinstein, formerly the head of the FTC’s Bureau of Competition, now a partner at Arnold & Porter, where she’s represented General Electric, NBCUniversal, Unilever, and Pepsi and a whole medicine chest’s worth of pharma giants before her former subordinates at the FTC. Michael Moiseyev who was assistant manager of FTC Competition is now in charge of mergers at Weil Gotshal & Manges, working for Microsoft, Meta, and Eli Lilly.

There’s a whole bunch more, but Dayen reserves special notice for Andrew Smith, Trump’s FTC Consumer Protection boss. Before he was put on the public payroll, Smith represented 120 clients that had business before the Commission, including “nearly every major bank in America, drug industry lobbyist PhRMA, Uber, Equifax, Amazon, Facebook, Verizon, and a variety of payday lenders”:

https://www.citizen.org/sites/default/files/andrew_smith_foia_appeal_response_11_30.pdf

Before Khan, in other words, the FTC was a “conflict-of-interest assembly line, moving through corporate lawyers and industry hangers-on without resistance for decades.”

Khan is the first FTC head with no conflicts. This leaves her opponents in the sweaty, desperate position of inventing conflicts out of thin air.

For these corporate lickspittles, Khan’s “conflict” is that she has a point of view. Specifically, she thinks that the FTC should do its job.

This makes grifters like Jim Jordan furious. Yesterday, Jordan grilled Khan in a hearing where he accused her of violating an ethics official’s advice that she should recuse herself from Big Tech cases. This is a talking point that was created and promoted by Bloomberg:

https://www.bloomberg.com/news/articles/2023-06-16/ftc-rejected-ethics-advice-for-khan-recusal-on-meta-case

That ethics official, Lorielle Pankey, did not, in fact, make this recommendation. It’s simply untrue (she did say that Khan presiding over cases that she has made public statements about could be used as ammo against her, but did not say that it violated any ethical standard).

But there’s more to this story. Pankey herself has a gigantic conflict of interest in this case, including a stock portfolio with $15,001 and $50,000 in Meta stock (Meta is another company that has whined in print and in its briefs that it is a poor defenseless lamb being picked on by big, mean ole Lina Khan):

https://www.wsj.com/articles/ethics-official-owned-meta-stock-while-recommending-ftc-chair-recuse-herself-from-meta-case-8582a83b

Jordan called his hearing on the back of this fake scandal, and then proceeded to show his whole damned ass, even as his GOP colleagues got into a substantive and even informative dialog with Khan:

https://prospect.org/power/2023-07-14-jim-jordan-misfires-attacks-lina-khan/

Mostly what came out of that hearing was news about how Khan is doing her job, working on behalf of the American people. For example, she confirmed that she’s investigating OpenAI for nonconsensually harvesting a mountain of Americans’ personal information:

https://www.ft.com/content/8ce04d67-069b-4c9d-91bf-11649f5adc74

Other Republicans, including confirmed swamp creatures like Matt Gaetz, ended up agreeing with Khan that Amazon Ring is a privacy dumpster-fire. Nobodies like Rep TomM assie gave Khan an opening to discuss how her agency is protecting mom-and-pop grocers from giant, price-gouging, greedflation-drunk national chains. Jeff Van Drew gave her a chance to talk about the FTC’s war on robocalls. Lance Gooden let her talk about her fight against horse doping.

But Khan’s opponents did manage to repeat a lot of the smears against her, and not just the bogus conflict-of-interest story. They also accused her of being 0–4 in her actions to block mergers, ignoring the huge number of mergers that have been called off or not initiated because M&A professionals now understand they can no longer expect these mergers to be waved through. Indeed, just last night I spoke with a friend who owns a medium-sized tech company that Meta tried to buy out, only to withdraw from the deal because their lawyers told them it would get challenged at the FTC, with an uncertain outcome.

These talking points got picked up by people commenting on Judge Jacqueline Scott Corley’s ruling against the FTC in the Microsoft-Activision merger. The FTC was seeking an injunction against the merger, and Corley turned them down flat. The ruling was objectively very bad. Start with the fact that Corley’s son is a Microsoft employee who stands reap massive gains in his stock options if the merger goes through.

But beyond this (real, non-imaginary, not manufactured conflict of interest), Corley’s judgment and her remarks in court were inexcusably bad, as Matt Stoller writes:

https://www.thebignewsletter.com/p/judge-rules-for-microsoft-mergers

In her ruling, Corley explained that she didn’t think Microsoft would abuse the market dominance they’d gain by merging their giant videogame platform and studio with one of its largest competitors. Why not? Because Microsoft’s execs pinky-swore that they wouldn’t abuse that power.

Corely’s deference to Microsoft’s corporate priorities goes deeper than trusting its execs, though. In denying the FTC’s motion, she stated that it would be unfair to put the merger on hold in order to have a full investigation into its competition implications because Microsoft and Activision had set a deadline of July 18 to conclude things, and Microsoft would have to pay a penalty if that deadline passed.

This is surreal: a judge ruled that a corporation’s radical, massive merger shouldn’t be subject to full investigation because that corporation itself set an arbitrary deadline to conclude the deal before such an investigation could be concluded. That’s pretty convenient for future mega-mergers — just set a short deadline and Judge Corely will tell regulators that the merger can’t be investigated because the deadline is looming.

And this is all about the future. As Stoller writes, Microsoft isn’t exactly subtle about why it wants this merger. Its own execs said that the reason they were spending “dump trucks” of money buying games studios was to “spend Sony out of business.”

Now, maybe you hate Sony. Maybe you hate Activision. There’s plenty of good reason to hate both — they’re run by creeps who do shitty things to gamers and to their employees. But if you think that Microsoft will be better once it eliminates its competition, then you have the attention span of a goldfish on Adderall.

Microsoft made exactly the same promises it made on Activision when it bought out another games studio, Zenimax — and it broke every one of those promises.

Microsoft has a long, long, long history of being a brutal, abusive monopolist. It is a convicted monopolist. And its bad conduct didn’t end with the browser wars. You remember how the lockdown turned all our homes into rent-free branch offices for our employers? Microsoft seized on that moment to offer our bosses keystroke-and-click level surveillance of our use of our own computers in our own homes, via its Office365 bossware product:

https://pluralistic.net/2020/11/25/the-peoples-amazon/#clippys-revenge

If you think a company that gave your boss a tool to spy on their employees and rank them by “productivity” as a prelude to firing them or cutting their pay is going to treat gamers or game makers well once they have “spent the competition out of business,” you’re a credulous sucker and you are gonna be so disappointed.

The enshittification play is obvious: use investor cash to make things temporarily nice for customers and suppliers, lock both of them in — in this case, it’s with a subscription-based service similar to Netflix’s — and then claw all that value back until all that’s left is a big pile of shit.

The Microsoft case is about the future. Judge Corely doesn’t take the future seriously: as she said during the trial, “All of this is for a shooter videogame.” The reason Corely greenlit this merger isn’t because it won’t be harmful — it’s because she doesn’t think those harms matter.

But it does, and not just because games are an art form that generate billions of dollars, employ a vast workforce, and bring pleasure to millions. It also matters because this is yet another one of the Reaganomic precedents that tacitly endorses monopolies as efficient forces for good. As Stoller writes, Corley’s ruling means that “deal bankers are sharpening pencils and saying ‘Great, the government lost! We can get mergers through everywhere else.’ Basically, if you like your high medical prices, you should be cheering on Microsoft’s win today.”

Ronald Reagan’s antitrust has colonized our brains so thoroughly that commentators were surprised when, immediately after the ruling, the FTC filed an appeal. Don’t they know they’ve lost? the commentators said:

https://gizmodo.com/ftc-files-appeal-of-microsoft-activision-deal-ruling-1850640159

They echoed the smug words of insufferable Activision boss Mike Ybarra: “Your tax dollars at work.”

https://twitter.com/Qwik/status/1679277251337277440

But of course Khan is appealing. The only reason that’s surprising is that Khan is working for us, the American people, not the giant corporations the FTC is supposed to be defending us from. Sure, I get that this is a major change! But she needs our backing, not our cheap cynicism.

The business lobby and their pathetic Renfields have hoarded all the nice things and they don’t want us to have any. Khan and her trustbuster colleagues want the opposite. There is no measure so small that the corporate world won’t have a conniption over it. Take click to cancel, the FTC’s perfectly reasonable proposal that if you sign up for a recurring payment subscription with a single click, you should be able to cancel it with a single click.

The tooth-gnashing and garment-rending and scenery-chewing over this is wild. America’s biggest companies have wheeled out their biggest guns, claiming that if they make it too easy to unsubscribe, they will lose money. In other words, they are currently making money not because people want their products, but because it’s too hard to stop paying for them!

https://www.theregister.com/2023/07/12/ftc_cancel_subscriptions/

We shouldn’t have to tolerate this sleaze. And if we back Khan and her team, they’ll protect us from these scams. Don’t let them convince you to give up hope. This is the start of the fight, not the end. We’re trying to reverse 40 years’ worth of Reagonmics here. It won’t happen overnight. There will be setbacks. But keep your eyes on the prize — this is the most exciting moment for countering corporate power and giving it back to the people in my lifetime. We owe it to ourselves, our kids and our planet to fight one.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

[Image ID: A line drawing of pilgrims ducking a witch tied to a ducking stool. The pilgrims' clothes have been emblazoned with the logos for the WSJ, Microsoft, Activision and Blizzard. The witch's face has been replaced with that of FTC chair Lina M Khan.]

#pluralistic#amazon's antitrust paradox#lina khan#business lobby#lina m khan#ftc#federal trade commission#david dayen#microsoft#activision#blizzard#wsj#wall street journal#reaganomics#trustbusting#antitrust#mergers#merger to monopoly#gaming#xbox#matt stoller#the american prospect#jim jordan#click to cancel#robert bork#Judge Jacqueline Scott Corley#microsoft activision#fuckin' ninjas

6K notes

·

View notes

Video

youtube

Why Big Money Supports Trump

Fascism backed by Big Money is one of the most dangerous of all political alliances.

We saw it in 1930s Germany, when industrial giants bailed out a cash-strapped Nazi party right before Hitler’s election, thinking that Hitler would protect their money and power.

We are seeing something similar now. Earlier this year, the GOP was running out of money. So Trump turned to his wealthy backers for help. Many super-rich donors who once criticized Trump for stoking the violence of January 6 have since had a change of heart, deciding their profits are worth more than our democracy.

Trump has promised them that if elected, he’ll extend his 2017 tax cuts that went mainly to the wealthy beyond 2025 when they’re scheduled to expire, and hinting at even more.

He promised oil executives he would scrap regulations favoring electric vehicles and wind energy if they would give his campaign one billion dollars.

The Trump White House is for sale, and the wealthy are buying. 50 billionaire families gave at least $600 million in political donations as of May, with over two thirds going to support GOP candidates and conservative causes.

Elon Musk, one of the world’s richest men, who also controls and manipulates one of the world’s largest communications platforms, has committed to spending millions of dollars to elect Trump.

In previous videos, I’ve highlighted alarming similarities between fascist regimes of the past and Trumpism. The alignment of American billionaires with Trump’s anti-democracy movement is one of the most dangerous parallels.

The billionaires want the rest of us to fight each other so we don’t look up and see where all the wealth and power have gone, so we don’t join together and raise taxes on the super-rich to finance childcare, better schools, our health care system, and everything else we need.

They fear democracy because there are far more of us than there are of them.

We need to see through their fear tactics and vote in overwhelming numbers this November.

We can learn from history and spot the danger. We are not doomed to repeat it.

614 notes

·

View notes

Text

By Jake Johnson

Common Dreams

Aug 07, 2024

"Republicans would rather protect their billionaire friends at the expense of everyone else," said the chair of the Joint Economic Committee

Budget proposals released by congressional Republicans in recent months lay bare the party's desire to slash taxes for wealthy Americans and large corporations at the expense of key government programs and services, including nutrition assistance, environmental protection, and Medicaid.

That's according to an analysis released Wednesday by Democrats on the Joint Economic Committee (JEC), which examined budget plans the GOP has released as Congress works to craft and pass government funding bills for the coming fiscal year.

The JEC specifically cites a Fiscal Year 2025 budget proposal published in March by the Republican Study Committee, a panel comprised of three-quarters of the House GOP caucus.

The plan, the JEC Democrats noted Wednesday, "claims to balance the budget by cutting Medicare spending, raising the retirement age for Social Security, capping funding for Medicaid and CHIP, and cutting the rest of non-defense discretionary spending by 31% across the board."

"This would drive up health costs for American families by increasing premiums for [Affordable Care Act] healthcare plans and getting rid of protections for people with pre-existing conditions," the new analysis says. "It would also prohibit Medicare from negotiating down prescription drug costs."

A separate proposal from Republicans on the House Budget Committee claims it would finance "large tax cuts for the wealthy by both slashing key services and assuming that their tax giveaways lead to unrealistic levels of economic growth," the Democratic report says.

"Analyzing this budget with more reasonable economic assumptions instead shows that budget would likely require the government to eliminate most federal services within a decade," the report adds.

Sen. Martin Heinrich (D-N.M.), the chair of the JEC, said in a statement Wednesday that "Republicans' extreme proposals are dangerous for America."

"While Democrats are fighting to invest in families, Republicans would rather protect their billionaire friends at the expense of everyone else," said Heinrich. "Kicking 42 million kids off of health insurance, gutting federal investments in public safety, denying veterans hospital care, and getting rid of [Supplemental Nutrition Assistance Program] benefits that help people afford groceries is unconscionable. Americans deserve better."

The analysis from JEC Democrats comes as Republican nominee Donald Trump attempts to posture as an ally of the working class despite his history of assailing labor protections and backing tax cuts for the rich.

Trump has called for an extension of the tax cuts he signed into law in 2017—changes that overwhelmingly benefited wealthy Americans. An extension of the tax cuts would add $4.6 trillion to the deficit of the next decade, according to the Congressional Budget Office.

The former president's advisers have also reportedly discussed reducing the corporate tax rate from 21% to 15%, a change that would give the largest 100 U.S. companies a tax cut of $48 billion per year.

Trump has floated proposals that are ostensibly geared toward helping working-class Americans, including exempting tips from taxation—a proposal specifically aimed at hospitality workers—and eliminating taxes on Social Security benefits.

But earlier this week, UNITE HERE—a union that represents hospitality workers—endorsed Democratic nominee Kamala Harris over the Republican candidate, warning that "another Trump presidency would mean four chaotic years of defending against his attacks on unions, working people, immigrants, women, and others."

As for Trump's proposal to eliminate taxes on Social Security benefits, an analysis by the Tax Policy Center's Howard Gleckman found that the move would reduce "Social Security and Medicare hospital insurance (HI) revenues by $1.5 trillion over the next decade," harming the programs' finances while providing "little or no benefit" to lower-income households in 2025.

"Less than 1% of the lowest-income households (those making about $33,000 or less, would get any tax cut at all," Gleckman observed. "But about 28% of middle-income households would get a tax cut. Among the top 0.1 percent, about 20 percent of households would get a tax cut."

Gleckman found that "in dollar terms, the biggest winners would be those in the top 0.1% of income, who make nearly $5 million or more."

#tax cuts for the rich#billionaires#taxation#wealth inequality#2024 elections#republicans#republican party

11 notes

·

View notes

Text

“For the billionaire donor class,” this election is about one thing, said Timothy Noah: “Keeping rich people’s taxes low.” Wall Street billionaires like JPMorgan Chase CEO Jamie Dimon, Blackstone Group CEO Stephen Schwarzman, and investor Nelson Peltz condemned Donald Trump after the Jan. 6, 2021, attack on the U.S. Capitol, while hedge fund manager Kenneth Griffin called the former president a “three-time loser” after the 2022 midterms. Yet “all four sing a different tune today.” They claim to support Trump because of inflation (which has dropped to 3.4 percent), the immigration crisis, or rising antisemitism on the Left, “but they’re all full of it.” These plutocrats are actually “drifting back to Trump” because “they want to keep the tax cuts” he gave them in 2017, which are due to expire in December 2025. President Biden plans to let the cuts for the wealthy and corporations run out, keeping them only for Americans earning under $400,000. Trump’s plan to extend them would increase the budget deficit by $4 trillion over a decade — which, along with his promised steep tariffs, would be highly inflationary. Nonetheless, they’re “holding their noses and rallying around Trump” simply because he’ll “make them richer.”

THE WEEK JUNE 14, 2024

11 notes

·

View notes

Text

Today, President Joe Biden signed the continuing resolution that will give lawmakers another week to finalize appropriations bills. Lawmakers will continue to hash out the legislation that will fund the government.

Republicans have been stalling the appropriations bills for months. In addition to inserting their own extremist cultural demands in the measures, they have demanded budget cuts to address the fact that the government spends far more money than it brings in.

As soon as Mike Johnson (R-LA) became House speaker, he called for a “debt commission” to address the growing budget deficit. This struck fear into the hearts of those eager to protect Social Security and Medicare, because when Johnson chaired the far-right Republican Study Committee in 2020, it called for cutting those popular programs by raising the age of eligibility, lowering cost-of-living adjustments, and reducing benefits for retirees whose annual income is higher than $85,000. Lawmakers don’t want to take on such unpopular proposals, so setting up a commission might be a workaround.

Last month, the House Budget Committee advanced legislation that would create such a commission. The chair of the House Budget Committee, Jodey C. Arrington (R-TX), told reporters that Speaker Johnson was “100% committed to this commission” and wanted to attach it to the final appropriations legislation for fiscal year 2024, the laws currently being hammered out.

Congress has not yet agreed to this proposed commission, and a recent Data for Progress poll showed that 70% of voters reject the idea of it.

This week, a new report from the Institute on Taxation and Economic Policy (ITEP), a nonprofit think tank that focuses on tax policy, suggested that the cost of tax cuts should be factored into any discussions about the budget deficit.

In 2017 the Trump tax cuts slashed the top corporate tax rate from 35% to 21% and reined in taxation for foreign profits. The ITEP report looked at the first five years the law was in effect. It concluded that in that time, most profitable corporations paid “considerably less” than 21% because of loopholes and special breaks the law either left in place or introduced.

From 2018 through 2022, 342 companies in the study paid an average effective income tax rate of just 14.1%. Nearly a quarter of those companies—87 of them—paid effective tax rates of under 10%. Fifty-five of them (16% of the 342 companies), including T-Mobile, DISH Network, Netflix, General Motors, AT&T, Bank of America, Citigroup, FedEx, Molson Coors, and Nike, paid effective tax rates of less than 5%.

Twenty-three corporations, all of them profitable, paid no federal tax over the five year period. One hundred and nine corporations paid no federal tax in at least one of the five years.

The Guardian’s Adam Lowenstein noted yesterday that several corporations that paid the lowest taxes are steered by chief executive officers who are leading advocates of “stakeholder capitalism.” This concept revises the idea that corporations should focus on the best interests of their shareholders to argue that corporations must also take care of the workers, suppliers, consumers, and communities affected by the corporation.

The idea that corporate leaders should take responsibility for the community rather than paying taxes to the government so the community can take care of itself is eerily reminiscent of the argument of late-nineteenth-century industrialists.

When Republicans invented national taxation to meet the extraordinary needs of the Civil War, they immediately instituted a progressive federal income tax because, as Representative Justin Smith Morrill (R-VT) said, “The weight [of taxation] must be distributed equally, not upon each man an equal amount, but a tax proportionate to his ability to pay.”

But the wartime income tax expired in 1872, and the rise of industry made a few men spectacularly wealthy. Quickly, those men came to believe they, rather than the government, should direct the country’s development.

In June 1889, steel magnate Andrew Carnegie published what became known as the “Gospel of Wealth” in the popular magazine North American Review. Carnegie explained that “great inequality…[and]...the concentration of business, industrial and commercial, in the hands of a few” were “not only beneficial, but essential to…future progress.” And, Carnegie asked, “What is the proper mode of administering wealth after the laws upon which civilization is founded have thrown it into the hands of the few?”

Rather than paying higher wages or contributing to a social safety net—which would “encourage the slothful, the drunken, the unworthy,” Carnegie wrote—the man of fortune should “consider all surplus revenues which come to him simply as trust funds, which he is called upon to administer…in the manner which, in his judgment, is best calculated to produce the most beneficial results for the community—the man of wealth thus becoming the mere trustee and agent for his poorer brethren, bringing to their service his superior wisdom, experience, and ability to administer, doing for them better than they would or could do for themselves.”

“[T]his wealth, passing through the hands of the few, can be made a much more potent force for the elevation of our race than if distributed in small sums to the people themselves,” Carnegie wrote. “Even the poorest can be made to see this, and to agree that great sums gathered by some of their fellow-citizens and spent for public purposes, from which the masses reap the principal benefit, are more valuable to them than if scattered among themselves in trifling amounts through the course of many years.”

Here in the present, Republicans want to extend the Trump tax cuts after their scheduled end in 2025, a plan that would cost $4 trillion over a decade even without the deeper cuts to the corporate tax rate Trump has called for if he is reelected. Biden has called for preserving the 2017 tax cuts only for those who make less than $400,000 a year and permitting the rest to expire. He has also called for higher taxes on the wealthy and corporations, which would generate more than $2 trillion.

Losing the revenue part of the budget equation and focusing only on spending cuts seems to reflect a society like the one the late-nineteenth-century industrialists embraced, in which a few wealthy leaders get to decide how to direct the nation’s wealth.

[LETTERS FROM AN AMERICAN: MARCH 1, 2024]

Heather Cox Richardson

+

“The crucial disadvantage of aggression, competitiveness, and skepticism as national characteristics is that these qualities cannot be turned off at five o'clock.”

—Margaret Halsey, novelist (13 Feb 1910-1997)

#poverty#trickle down economics#corrupt GOP#Letters From An American#heather cox richardson#ecoomy#wealth#“debt commission”#corporations#Margaret Halsey#government for the people

13 notes

·

View notes

Text

The 2017 Tax Cuts and Jobs Act brought a major overhaul to U.S. tax code. The corporate tax rate was slashed to 21% from 35%, individual income tax rates were cut, and the standard deduction was increased.

Now, analysis in 2018 found that the cuts would boost the economy, but the effect would fizzle out quickly. And the price tag would be huge. The bill is expected to add nearly $2 trillion to the deficit by 2028.

Many of the household tax reforms included in the bill expire in 2025, meaning that whoever wins the election will have the opportunity to either fight to extend the legislation or let it lapse.

Trump has shown interest in making his tax rules permanent. Biden would likely preserve some of the tax cuts, namely those benefitting households making less than $400,000 a year.

The cuts have the largest benefits for the wealthy and for small business owners, but there are also provisions that benefit middle-income Americans like the increased standard deduction and Child Tax Credit.

An important effect of extending the 2017 tax cuts is that it’s estimated to cost an extra $3.8 trillion over the next decade. Without significantly cutting services, the federal debt would balloon to 211% of GDP by 2054, compared to about 100% of GDP right now.

Trump has actually pledged to make even more tax cuts – if that happens, obviously the deficit would grow even faster and the debt would be even larger.

Biden’s proposed alternatives include several programs to lower taxes for those making under $400,000 a year while also raising taxes on corporations and wealthier Americans. Efforts to target corporations include raising the corporate tax rate to 28%, increasing enforcement of tax avoidance by multinationals, and quadrupling the stock buyback tax.

His plan would also affect the highest-earning Americans, including a 25% minimum income tax on billionaires. All together, Biden’s policies would raise about $5 trillion in revenue by 2034.

While there is some overlap between the two candidate’s goals, the long-term effects on the federal debt and deficits couldn’t be more different.

8 notes

·

View notes

Text

End the 2017 Trump tax cuts and raise taxes on Elon Musk!

Petition to Congress:

We urge you to end the 2017 Trump tax cuts, and pass legislation to raise taxes on the ultra-wealthy and corporations.

Billionaires like Elon Musk have benefitted from a slew of tax breaks and loopholes, including the Trump administration’s 2017 tax cuts.

Tesla paid no federal income taxes between 2018 and 2022.1 Then, the company turned around and approved a $56 billion pay package for CEO Elon Musk.2

Elon Musk takes advantage of the broken American tax system to get richer, and has amassed tremendous power in corporate America and our political system. Now, he’s putting millions into a right-wing Super PAC, so that he can have even greater influence over our politics.3 This is exactly why Congress needs to END the Trump tax cuts and drastically increase taxes on billionaires and corporations.

Sign the petition: End the 2017 Trump tax cuts! Make Elon Musk, the ultra-wealthy, and corporations pay their fair share.

Musk has so much political power because of the outrageous wealth he’s acquired thanks to a broken American tax system that favors billionaires and their corporations, like Tesla and SpaceX.

Congress can end the unlimited, runaway wealth of America’s billionaires (which stands at $5.2 trillion).4 Our lawmakers must take action to address economic inequality, the dangerous level of power held by the ultra-wealthy, and threats to our democracy.

Add your name: Congress must end the 2017 Trump tax cuts and TAX billionaires like Elon Musk.

Sources:

Yahoo, “Tesla paid no federal income taxes while paying executives $2.5 billion over five years,” March 13, 2024.

NBC, “Elon Musk wins Tesla shareholder vote for $56 billion pay package,” June 13, 2024.

Wall Street Journal, “Inside Elon Musk’s Hands-On Push to Win 800,000 Voters for Trump,” August 12, 2024.

Americans for Tax Fairness, “U.S. Billionaires Now Worth a Record $5.2 Trillion,” November 30, 2023.

5 notes

·

View notes

Text

— Republicans have handed America’s wealth to the billionaires: where’s the outrage? Economist Gabriel Zucman published an extraordinary op-ed in The New York Times this week showing the impact of 40 years of Republicans transferring over $50 trillion from the pockets of the middle class into the money bins of the morbidly rich via changes in tax policy. Not only has this led to a $34.5 trillion national debt — 100% of which can be accounted for by massive tax cuts on the wealthy and corporations put into place by Ronald Reagan (1981), George W. Bush (2003), and Donald Trump (2017) — but it’s also gutted the middle class, reducing the percentage of Americans who can live comfortably in that realm from almost two-thirds of us in 1980 to around 43% of us today. (Those details are mine, not his.) Zucman explicitly calls for the entire world to take on the challenge of rescuing democracy and working class people by raising taxes on both billionaires and the corporations they use to shield themselves from taxation. It’s about damn time.

8 notes

·

View notes

Text

Say WHAT, Chuckie???

Isn’t it funny how easily Republicans slip up on their own hypocrisy??? They are all on about President Biden’s age, even though their own presumed nominee is only three years behind Biden and Biden is far more physically fit and mentally coherent. But then there’s Senator Chuck Grassley from Iowa who is 90 years of age! And still just as obnoxious as ever! Now, say what you will, but I…

View On WordPress

#2017 tax cuts for the wealthy#bipartisan tax bill#congressional term limits#Senator Chuck Grassley#U.S. Senate

0 notes

Text

The vast majority of the Senate Republican caucus united last week to introduce a bill that would permanently repeal the estate tax, targeting one of the few provisions in the U.S. tax code that solely affects the richest 0.1% of Americans.

Led by Sen. John Thune (South Dakota), the top Republican on the Senate Subcommittee on Taxation and Internal Revenue Service Oversight, 40 Republicans reintroduced their bill to ensure that ultra-rich individuals seeking to hand off tens of millions of dollars — or more — to their heirs can do so completely tax-free. The extremely regressive proposal has been a longtime goal of Republicans, who have already massively watered down the estate tax in past years.

Currently, the estate tax threshold is $12.9 million, and nearly $26 million for couples. Amounts under this are exempted from taxes. This is nearly triple the threshold from 2016 and earlier, as Republicans more than doubled the estate tax cutoff in their major tax overhaul in 2017. The threshold is now so high that it is estimated that less than 0.1% of Americans are subject to the tax.

Evidently, these tax cuts are still not enough for Republicans, who had tried to repeal the tax altogether in 2017. In a press release on the bill, Thune, Senate Minority Leader Mitch McConnell (R-Kentucky) and Sen. Mike Crapo (R-Idaho) attempted to couch their support of the repeal in efforts to supposedly support farmers — claims that reveal themselves to be a farce when more closely examined.

“For years I have fought to protect farm and ranch families from the onerous and unfair death tax,” Thune said. “Family-owned farms and ranches often bear the brunt of this tax, which makes it difficult and costly to pass these businesses down to future generations.”

Thune’s statement is a misrepresentation of the truth. The vast, vast majority of “family-owned farms” are not subject to the estate tax. In 2020, a mere 0.16% of farm estates owed the tax, according to data from the Economic Research Service of the U.S. Department of Agriculture. This is an exceedingly small number of farms. As the Tax Policy Center estimated, only 50 farms total paid any estate tax in 2017, and this research was done before lawmakers doubled the threshold.

The criticism of the estate tax in defense of farmers is disingenuous for another reason, as Inequality.org pointed out in a blog post this week. The tax code “already has provisions that protect the very few families with farms and businesses subject to estate tax,” wrote Institute for Policy Studies associate fellow and senior adviser for Patriotic Millionaires Bob Lord. “If the bill sponsors truly cared about family farms, ranches, and businesses, they could have proposed legislation to expand these protections but leave the estate tax intact.”

In reality, deep-pocketed lobbyists with the Farm Bureau have long been pushing a repeal of the estate tax — and the group’s deep ties to big business and Wall Street are well documented.

Perhaps not coincidentally, repealing the estate tax would complete the loop of tax avoidance for the wealthiest Americans. The bill targets the “die” part of “buy borrow die,” a common tax dodging scheme used by the wealthy to avoid paying taxes; it is part of the reason that the wealthiest Americans are able to pay little to no taxes year over year.

In the practice of buying, borrowing, and dying, the rich first pour their wealth into assets like stocks, building up a large portfolio. Those assets are then used as collateral for taking out large loans with low interest rates — lower than, say, the income tax rate — that become a wealthy person’s spending money. Then, they die, and hand off their wealth to the next generation, maintaining their dynasty for decades to come.

At very few points do taxes come into the buy, borrow, die equation. Buying and keeping stocks doesn’t incur a tax bill. Taking out loans allows the wealthy to claim very low incomes to skirt income taxes. The estate tax is essentially the only guarantee, and even then, the wealthy have come up with extreme loopholes to dodge the estate tax, too. Republicans, then, are hoping to make tax avoidance even easier by legalizing it entirely; Lord has pointedly labeled the bill the “Billionaires Pay Zero Tax Act.”

The proposal stands in sharp contrast to progressives’ views on taxation. Pointing to extreme and growing wealth inequality, progressives have been calling for increasing taxes on the rich and specifically targeting their wealth and stock portfolios, rather than endlessly allowing the “buy” and “borrow” portions of the cycle.

#us politics#news#us senate#senate republicans#truthout#2023#taxes#tax code#estate taxes#republicans#conservatives#gop#gop policy#gop platform#sen. john thune#Senate Subcommittee on Taxation and Internal Revenue Service Oversight#tax the rich#tax the 1%#tax the wealthy#tax the billionaires#sen. mitch mcconnell#Sen. Mike Crapo#family-owned farms#department of agriculture#Tax Policy Center#Economic Research Service#Inequality.org#Patriotic Millionaires#Bob Lord#Farm Bureau

53 notes

·

View notes

Text

Kerry Eleveld at Daily Kos:

Talking about tax policy is one of the best ways for President Joe Biden to create a contrast with Donald Trump on who will fight for average Americans. As Trump told a group of wealthy campaign donors earlier this month, one of his signature issues if elected president in November will be extending the tax cuts Republicans enacted during his term in 2017—which overwhelmingly benefited wealthy Americans.

There's no audio of the statement, but it echoes comments Trump made last year during a private fundraiser at Mar-a-Lago for North Carolina Lt. Gov. Mark Robinson, an extremist Republican who is running for governor. Addressing the audience, Trump called some attendees “rich as hell” before promising, “We’re gonna give you tax cuts!”

The Biden campaign spliced that proclamation into an ad where the president is joined by Sen. Bernie Sanders of Vermont.

[...]

Biden also worked Trump's tax plan into a recent press conference in the White House Rose Garden when he was asked whether he was concerned about inflation.

“We have dramatically reduced inflation from 9 percent down to close to 3 percent,” Biden responded, noting that inflation was “skyrocketing” when he took office. “And we have a plan to deal with it, whereas the opposition—my opposition talks about two things. They just want to cut taxes for the wealthy and raise taxes on other people.”

President Joe Biden is reminding the voters that Donald Trump is pro-tax cuts for the rich.

12 notes

·

View notes

Text

You know, a lot of companies have made HUGE changes lately; foolish changes, leading to long-term damage to their brands for short-term financial gains. Just this year, Warner Bros canceled multiple upcoming films already mostly finished just for tax breaks; Unity tried to take a cut of the profits from every person who downloaded their games; the Escapist fired the head of their video team; Wizards of the Coast had the Pinkertons scandal, the 5e OGL scandal, the controversies around One D&D...

This is unusual, right? For one company to shoot themselves in the foot is an accident; for several to do so in rapid succession seems to me like a strange new pattern.

But why? Why prioritize a short-term paycheck over long-term profits? The people in charge of these companies may be stupid, but they're not that stupid; they've been in charge of these companies for years (well, most of them; the Escapist was bought out by Gamurz last year, but Gamurz hasn't stepped it's foot in it this bad before, so my point still stands) and not done stupid shit on this level before.

I've seen others who recognize this pattern postulate that it's for investment purposes. Investors dom't care about what's best for the long-term survivability of a company; they care only for the signs of quarter-to quarter growth, and will pull their investments if they don't see a quarterly return. This does make some measure of sense, but I don't understand how it's only recently gotten this bad if this was always standard operating procedure? Have these businesses always been doing this, and only recently has it been noticed?

I have another potential explanation. In 2017, Douglas Rushkoff was invited to deliver a keynote speech to a huge group of exhorbitantly wealthy individuals. The purpose? To explore the future of technology. While he thought it would be a lighthearted exploration of exciting new technologies and what they could mean for society going forward, it quickly became clear that most of the attendees were more concerned with the threats technology posed.

Several of them referenced "The Event," a nonspecific apocalypse that might occur as a result of societal unrest, environmental destruction, nuclear war, et cetera. This seemed to be quite a pressing issue; the attendees grilled Rushkoff for over an hour on how one might thrive in a post-apocalyptic setting.

I think the wealthy elite of this world expect The Event to come soon. And I think that several wealthy people are trying to make a whole lot of money right now so that they'll be ready when The Event arrives.

16 notes

·

View notes

Text

IRS to go after executives who use business jets for personal travel in new round of audits

Private jets sit parked at Scottsdale Airport Jan. 27, 2015, in Scottsdale, Ariz. IRS leadership said

FATIMA HUSSEIN Feb 21, 2024

WASHINGTON (AP) — First, there were trackers on Taylor Swift and other celebrities’ private jet usage. Now, there will be more scrutiny on executives’ personal use of business aircraft who write it off as a tax expense.

IRS leadership said Wednesday that the agency will start conducting dozens of audits on businesses’ private jets and how they are used personally by executives and written off as a tax deduction — as part of the agency’s ongoing mission of going after high-wealth tax cheats who game the tax system at the expense of American taxpayers.

The audits will focus on aircraft used by large corporations and high-income taxpayers and whether the tax purpose of the jet use is being properly allocated, the IRS says.

“At this time of year, when millions of hardworking taxpayers are working on their taxes, we want them to feel confident that everyone is playing by the same rules,” IRS Commissioner Daniel Werfel said on a call with reporters to preview the announcement. Tax season began Jan. 29.

“These aircraft audits will help ensure high-income groups aren’t flying under the radar with their tax responsibilities,” he said.

There are more than 10,000 corporate jets in the US., according to the IRS, valued at tens of millions of dollars and many can be fully deducted.

The Tax Cuts and Jobs Act, passed during the Trump administration, allowed for 100% bonus depreciation and expensing of private jets — which allowed taxpayers to write off the cost of aircraft purchased and put into service between September 2017 and January 2023.

Werfel said the federal tax collector will use resources from Democrats’ Inflation Reduction Act to more closely examine private jet usage — which has not been closely scrutinized during the past decade as funding fell sharply in the last decade.

“Our audit rates have been anemic,” he said on the call. An April 2023 IRS report on tax audit data states that “continued resource constraints have limited the agency’s ability to address high-end noncompliance” stating that in tax year 2018, audit rates for people making more than $10 million were 9.2%, down from 13.6% in 2012. And in the same time period, overall corporate audit rates fell from 1.3% to .6%.

Mike Kaercher, senior attorney advisor at the Tax Law Center at NYU said in a statement that the IRS should also revisit how it values personal use of corporate aircraft, beyond just how flights are reported.

“The current rules allow these flights to be significantly undervalued, enabling wealthy filers to pay much less in taxes than fair market value would dictate, and it’s within the IRS’ authority to revise these rules,” Kaercher said.

Werfel said audits related to aircraft usage could increase in the future depending on the results of the initial audits and as the IRS continues hiring more examiners.

“To be clear, that doesn’t mean everyone in a high-income category partnership or corporation is evading or avoiding their tax responsibility,” Werfel said. “But it does mean that there’s more work to do for the IRS to make sure people are paying what they owe.”"

10 notes

·

View notes