#merger to monopoly

Text

Why they're smearing Lina Khan

My god, they sure hate Lina Khan. This once-in-a-generation, groundbreaking, brilliant legal scholar and fighter for the public interest, the slayer of Reaganomics, has attracted more vitriol, mockery, and dismissal than any of her predecessors in living memory.

She sure must be doing something right, huh?

A quick refresher. In 2017, Khan — then a law student — published Amazon’s Antitrust Paradox in the Yale Law Journal. It was a brilliant, blistering analysis showing how the Reagan-era theory of antitrust (which celebrates monopolies as “efficient”) had failed on its own terms, using Amazon as Exhibit A of the ways in which post-Reagan antitrust had left Americans vulnerable to corporate abuse:

https://www.yalelawjournal.org/note/amazons-antitrust-paradox

The paper sent seismic shocks through both legal and economic circles, and goosed the neo-Brandeisian movement (sneeringly dismissed as “hipster antitrust”). This movement is a rebuke to Reaganomics, with its celebration of monopolies, trickle-down, offshoring, corporate dark money, revolving-door regulatory capture, and companies that are simultaneously too big to fail and too big to jail.

This movement has many proponents, of course — not just Khan — but Khan’s careful scholarship, combined with her encyclopedic knowledge of the long-dormant statutory powers that federal agencies had to make change, and a strategy for reviving those powers to protect Americans from corporate predators made her a powerful, inspirational figure.

When Joe Biden won the 2020 presidential election, he surprised everyone by appointing Khan to the FTC. It wasn’t just that she had such a radical vision — it was also that she lacked the usual corporate law experience that such an appointee would normally require (experience that would ensure that the FTC was helmed by people whose default view of the world is that it should be structured and regulated by powerful, wealthy people in corporate boardrooms).

Even more surprising was that Khan was made chair of the FTC, something that was only possible because a few Republican Senators broke with their party to support her candidacy:

https://www.senate.gov/legislative/LIS/roll_call_votes/vote1171/vote_117_1_00233.htm

These Republicans saw in Khan an ally in their fight against “woke” Big Tech. For these senators, the problem wasn’t that tech had got too big and powerful — it was that there were a few limited instances in which tech leaders failed to wield that power in the ways they preferred.

The Republican project is a matter of getting turkeys to vote for Christmas by doing a lot of culture war bullshit, cruelly abusing disfavored sexual and racial minorities. This wins support from low-information voters who’ll vote against their class interests and support more monopolies, more tax cuts for the rich, and more cuts to the services they rely on.

But while tech leaders are 100% committed to the project of permanent oligarchic takeover of every sphere of American life, they are less full-throated in their support for hateful, cruel discrimination against disfavored minorities (in this regard, tech leaders resemble the corporate wing of the Democrats, which is where we get the “Silicon Valley is a Democratic Party stronghold” narrative).

This failure to unquestioningly and unstintingly back culture war bullshit put tech leaders in the GOP’s crosshairs. Some GOP politicians actually believe in the culture war bullshit, and are grossly offended that tech is “woke.” Others are smart enough not to get high on their own supply, but worry that any tech obstruction in the bullshit culture wars will make it harder to get sufficient turkey votes for a big fat Christmas surprise.

Biden’s ceding of antitrust policy to the left wing of the party, combined with disaffected GOP senators viewing Khan as their enemy’s enemy, led to Khan’s historic appointment as FTC Chair. In that position, she was joined by a slate of Biden trustbusters, including Jonathan Kanter at the DoJ Antitrust Division, Tim Wu at the White House, and other important, skilled and principled fighters like Alvaro Bedoya (FTC), Rebecca Slaughter (FTC), Rohit Chopra (CFPB), and many others.

Crucially, these new appointees weren’t just principled, they were good at their jobs. In 2021, Tim Wu wrote an executive order for Biden that laid out 72 concrete ways in which the administration could act — with no further Congressional authorization — to blunt corporate power and insulate the American people from oligarchs’ abusive and extractive practices:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

Since then, the antitrust arm of the Biden administration have been fuckin’ ninjas, Getting Shit Done in ways large and small, working — for the first time since Reagan — to protect Americans from predatory businesses:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

This is in marked contrast to the corporate Dems’ champions in the administration. People like Pete Buttigieg are heralded as competent

technocrats, “realists” who are too principled to peddle hopium to the base, writing checks they can’t cash. All this is cover for a King Log performance, in which Buttigieg’s far-reaching regulatory authority sits unused on a shelf while a million Americans are stranded over Christmas and whole towns are endangered by greedy, reckless rail barons straight out of the Gilded Age:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

The contrast between the Biden trustbusters and their counterparts from the corporate wing is stark. While the corporate wing insists that every pitch is outside of the zone, Khan and her allies are swinging for the stands. They’re trying to make life better for you and me, by declaring commercial surveillance to be an unfair business practice and thus illegal:

https://pluralistic.net/2022/08/12/regulatory-uncapture/#conscious-uncoupling

And by declaring noncompete “agreements” that shackle good workers to shitty jobs to be illegal:

https://pluralistic.net/2022/02/02/its-the-economy-stupid/#neofeudal

And naturally, this has really pissed off all the right people: America’s billionaires and their cheerleaders in the press, government, and the hive of scum and villainy that is the Big Law/thinktank industrial-complex.

Take the WSJ: since Khan took office, they have published 67 vicious editorials attacking her and her policies. Khan is living rent-free in Rupert Murdoch’s head. Not only that, he’s given her the presidential suite! You love to see it.

These attacks are worth reading, if only to see how flimsy and frivolous they are. One major subgenre is that Khan shouldn’t be bringing any action against Amazon, because her groundbreaking scholarship about the company means she has a conflict of interest. Holy moly is this a stupid thing to say. The idea that the chair of an expert agency should recuse herself because she is an expert is what the physicists call not even wrong.

But these attacks are even more laughable due to who they’re coming from: people who have the most outrageous conflicts of interest imaginable, and who were conspicuously silent for years as the FTC’s revolving door admitted the a bestiary of swamp-creatures so conflicted it’s a wonder they managed to dress themselves in the morning.

Writing in The American Prospect, David Dayen runs the numbers:

Since the late 1990s, 31 out of 41 top FTC officials worked directly for a company that has business before the agency, with 26 of them related to the technology industry.

https://prospect.org/economy/2023-06-23-attacks-lina-khans-ethics-reveal-projection/

Take Christine Wilson, a GOP-appointed FTC Commissioner who quit the agency in a huff because Khan wanted to do things for the American people, and not their self-appointed oligarchic princelings. Wilson wrote an angry break-up letter to Khan that the WSJ published, presaging their concierge service for Samuel Alito:

https://www.wsj.com/articles/why-im-resigning-from-the-ftc-commissioner-ftc-lina-khan-regulation-rule-violation-antitrust-339f115d

For Wilson to question Khan’s ethics took galactic-scale chutzpah. Wilson, after all, is a commissioner who took cash money from Bristol-Myers Squibb, then voted to approve their merger with Celgene:

https://www.documentcloud.org/documents/4365601-Wilson-Christine-Smith-final278.html

Or take Wilson’s GOP FTC predecessor Josh Wright, whose incestuous relationship with the companies he oversaw at the Commission are so intimate he’s practically got a Habsburg jaw. Wright went from Google to the US government and back again four times. He also lobbied the FTC on behalf of Qualcomm (a major donor to Wright’s employer, George Mason’s Antonin Scalia Law School) after working “personally and substantially” while serving at the FTC.

George Mason’s Scalia center practically owns the revolving door, counting fourteen FTC officials among its affliates:

https://campaignforaccountability.org/ttp-investigation-big-techs-backdoor-to-the-ftc/

Since the 1990s, 31 out of 41 top FTC officials — both GOP appointed and appointees backed by corporate Dems — “worked directly for a company that has business before the agency”:

https://www.citizen.org/article/ftc-big-tech-revolving-door-problem-report/

The majority of FTC and DoJ antitrust lawyers who served between 2014–21 left government service and went straight to work for a Big Law firm, serving the companies they’d regulated just a few months before:

https://therevolvingdoorproject.org/wp-content/uploads/2022/06/The-Revolving-Door-In-Federal-Antitrust-Enforcement.pdf

Take Deborah Feinstein, formerly the head of the FTC’s Bureau of Competition, now a partner at Arnold & Porter, where she’s represented General Electric, NBCUniversal, Unilever, and Pepsi and a whole medicine chest’s worth of pharma giants before her former subordinates at the FTC. Michael Moiseyev who was assistant manager of FTC Competition is now in charge of mergers at Weil Gotshal & Manges, working for Microsoft, Meta, and Eli Lilly.

There’s a whole bunch more, but Dayen reserves special notice for Andrew Smith, Trump’s FTC Consumer Protection boss. Before he was put on the public payroll, Smith represented 120 clients that had business before the Commission, including “nearly every major bank in America, drug industry lobbyist PhRMA, Uber, Equifax, Amazon, Facebook, Verizon, and a variety of payday lenders”:

https://www.citizen.org/sites/default/files/andrew_smith_foia_appeal_response_11_30.pdf

Before Khan, in other words, the FTC was a “conflict-of-interest assembly line, moving through corporate lawyers and industry hangers-on without resistance for decades.”

Khan is the first FTC head with no conflicts. This leaves her opponents in the sweaty, desperate position of inventing conflicts out of thin air.

For these corporate lickspittles, Khan’s “conflict” is that she has a point of view. Specifically, she thinks that the FTC should do its job.

This makes grifters like Jim Jordan furious. Yesterday, Jordan grilled Khan in a hearing where he accused her of violating an ethics official’s advice that she should recuse herself from Big Tech cases. This is a talking point that was created and promoted by Bloomberg:

https://www.bloomberg.com/news/articles/2023-06-16/ftc-rejected-ethics-advice-for-khan-recusal-on-meta-case

That ethics official, Lorielle Pankey, did not, in fact, make this recommendation. It’s simply untrue (she did say that Khan presiding over cases that she has made public statements about could be used as ammo against her, but did not say that it violated any ethical standard).

But there’s more to this story. Pankey herself has a gigantic conflict of interest in this case, including a stock portfolio with $15,001 and $50,000 in Meta stock (Meta is another company that has whined in print and in its briefs that it is a poor defenseless lamb being picked on by big, mean ole Lina Khan):

https://www.wsj.com/articles/ethics-official-owned-meta-stock-while-recommending-ftc-chair-recuse-herself-from-meta-case-8582a83b

Jordan called his hearing on the back of this fake scandal, and then proceeded to show his whole damned ass, even as his GOP colleagues got into a substantive and even informative dialog with Khan:

https://prospect.org/power/2023-07-14-jim-jordan-misfires-attacks-lina-khan/

Mostly what came out of that hearing was news about how Khan is doing her job, working on behalf of the American people. For example, she confirmed that she’s investigating OpenAI for nonconsensually harvesting a mountain of Americans’ personal information:

https://www.ft.com/content/8ce04d67-069b-4c9d-91bf-11649f5adc74

Other Republicans, including confirmed swamp creatures like Matt Gaetz, ended up agreeing with Khan that Amazon Ring is a privacy dumpster-fire. Nobodies like Rep TomM assie gave Khan an opening to discuss how her agency is protecting mom-and-pop grocers from giant, price-gouging, greedflation-drunk national chains. Jeff Van Drew gave her a chance to talk about the FTC’s war on robocalls. Lance Gooden let her talk about her fight against horse doping.

But Khan’s opponents did manage to repeat a lot of the smears against her, and not just the bogus conflict-of-interest story. They also accused her of being 0–4 in her actions to block mergers, ignoring the huge number of mergers that have been called off or not initiated because M&A professionals now understand they can no longer expect these mergers to be waved through. Indeed, just last night I spoke with a friend who owns a medium-sized tech company that Meta tried to buy out, only to withdraw from the deal because their lawyers told them it would get challenged at the FTC, with an uncertain outcome.

These talking points got picked up by people commenting on Judge Jacqueline Scott Corley’s ruling against the FTC in the Microsoft-Activision merger. The FTC was seeking an injunction against the merger, and Corley turned them down flat. The ruling was objectively very bad. Start with the fact that Corley’s son is a Microsoft employee who stands reap massive gains in his stock options if the merger goes through.

But beyond this (real, non-imaginary, not manufactured conflict of interest), Corley’s judgment and her remarks in court were inexcusably bad, as Matt Stoller writes:

https://www.thebignewsletter.com/p/judge-rules-for-microsoft-mergers

In her ruling, Corley explained that she didn’t think Microsoft would abuse the market dominance they’d gain by merging their giant videogame platform and studio with one of its largest competitors. Why not? Because Microsoft’s execs pinky-swore that they wouldn’t abuse that power.

Corely’s deference to Microsoft’s corporate priorities goes deeper than trusting its execs, though. In denying the FTC’s motion, she stated that it would be unfair to put the merger on hold in order to have a full investigation into its competition implications because Microsoft and Activision had set a deadline of July 18 to conclude things, and Microsoft would have to pay a penalty if that deadline passed.

This is surreal: a judge ruled that a corporation’s radical, massive merger shouldn’t be subject to full investigation because that corporation itself set an arbitrary deadline to conclude the deal before such an investigation could be concluded. That’s pretty convenient for future mega-mergers — just set a short deadline and Judge Corely will tell regulators that the merger can’t be investigated because the deadline is looming.

And this is all about the future. As Stoller writes, Microsoft isn’t exactly subtle about why it wants this merger. Its own execs said that the reason they were spending “dump trucks” of money buying games studios was to “spend Sony out of business.”

Now, maybe you hate Sony. Maybe you hate Activision. There’s plenty of good reason to hate both — they’re run by creeps who do shitty things to gamers and to their employees. But if you think that Microsoft will be better once it eliminates its competition, then you have the attention span of a goldfish on Adderall.

Microsoft made exactly the same promises it made on Activision when it bought out another games studio, Zenimax — and it broke every one of those promises.

Microsoft has a long, long, long history of being a brutal, abusive monopolist. It is a convicted monopolist. And its bad conduct didn’t end with the browser wars. You remember how the lockdown turned all our homes into rent-free branch offices for our employers? Microsoft seized on that moment to offer our bosses keystroke-and-click level surveillance of our use of our own computers in our own homes, via its Office365 bossware product:

https://pluralistic.net/2020/11/25/the-peoples-amazon/#clippys-revenge

If you think a company that gave your boss a tool to spy on their employees and rank them by “productivity” as a prelude to firing them or cutting their pay is going to treat gamers or game makers well once they have “spent the competition out of business,” you’re a credulous sucker and you are gonna be so disappointed.

The enshittification play is obvious: use investor cash to make things temporarily nice for customers and suppliers, lock both of them in — in this case, it’s with a subscription-based service similar to Netflix’s — and then claw all that value back until all that’s left is a big pile of shit.

The Microsoft case is about the future. Judge Corely doesn’t take the future seriously: as she said during the trial, “All of this is for a shooter videogame.” The reason Corely greenlit this merger isn’t because it won’t be harmful — it’s because she doesn’t think those harms matter.

But it does, and not just because games are an art form that generate billions of dollars, employ a vast workforce, and bring pleasure to millions. It also matters because this is yet another one of the Reaganomic precedents that tacitly endorses monopolies as efficient forces for good. As Stoller writes, Corley’s ruling means that “deal bankers are sharpening pencils and saying ‘Great, the government lost! We can get mergers through everywhere else.’ Basically, if you like your high medical prices, you should be cheering on Microsoft’s win today.”

Ronald Reagan’s antitrust has colonized our brains so thoroughly that commentators were surprised when, immediately after the ruling, the FTC filed an appeal. Don’t they know they’ve lost? the commentators said:

https://gizmodo.com/ftc-files-appeal-of-microsoft-activision-deal-ruling-1850640159

They echoed the smug words of insufferable Activision boss Mike Ybarra: “Your tax dollars at work.”

https://twitter.com/Qwik/status/1679277251337277440

But of course Khan is appealing. The only reason that’s surprising is that Khan is working for us, the American people, not the giant corporations the FTC is supposed to be defending us from. Sure, I get that this is a major change! But she needs our backing, not our cheap cynicism.

The business lobby and their pathetic Renfields have hoarded all the nice things and they don’t want us to have any. Khan and her trustbuster colleagues want the opposite. There is no measure so small that the corporate world won’t have a conniption over it. Take click to cancel, the FTC’s perfectly reasonable proposal that if you sign up for a recurring payment subscription with a single click, you should be able to cancel it with a single click.

The tooth-gnashing and garment-rending and scenery-chewing over this is wild. America’s biggest companies have wheeled out their biggest guns, claiming that if they make it too easy to unsubscribe, they will lose money. In other words, they are currently making money not because people want their products, but because it’s too hard to stop paying for them!

https://www.theregister.com/2023/07/12/ftc_cancel_subscriptions/

We shouldn’t have to tolerate this sleaze. And if we back Khan and her team, they’ll protect us from these scams. Don’t let them convince you to give up hope. This is the start of the fight, not the end. We’re trying to reverse 40 years’ worth of Reagonmics here. It won’t happen overnight. There will be setbacks. But keep your eyes on the prize — this is the most exciting moment for countering corporate power and giving it back to the people in my lifetime. We owe it to ourselves, our kids and our planet to fight one.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

[Image ID: A line drawing of pilgrims ducking a witch tied to a ducking stool. The pilgrims' clothes have been emblazoned with the logos for the WSJ, Microsoft, Activision and Blizzard. The witch's face has been replaced with that of FTC chair Lina M Khan.]

#pluralistic#amazon's antitrust paradox#lina khan#business lobby#lina m khan#ftc#federal trade commission#david dayen#microsoft#activision#blizzard#wsj#wall street journal#reaganomics#trustbusting#antitrust#mergers#merger to monopoly#gaming#xbox#matt stoller#the american prospect#jim jordan#click to cancel#robert bork#Judge Jacqueline Scott Corley#microsoft activision#fuckin' ninjas

6K notes

·

View notes

Link

Microsoft Corp.’s $69 billion takeover of Activision Blizzard Inc. suffered a hammer blow after Britain’s antitrust watchdog vetoed the gaming industry’s biggest ever deal, saying it would harm competition in cloud gaming.

The Competition and Markets Authority said its concerns couldn’t be solved by remedies such as the sale of blockbuster title Call of Duty or so-called behavioral remedies involving promises to permit rivals to offer the game on their platforms, according to a statement Wednesday.

Pressure had been mounting on Microsoft as it lobbies at home and in Europe to convince watchdogs to clear the deal — one of the 30 biggest acquisitions of all time. Crucially, the CMA’s conclusions comes before decisions from the European Union and the US Federal Trade Commission, which is awaiting a hearing in the summer after formally suing to veto the transaction.

“Microsoft already enjoys a powerful position and head start over other competitors in cloud gaming and this deal would strengthen that advantage giving it the ability to undermine new and innovative competitors,” Martin Coleman, chair of the independent panel of experts conducting this investigation, said.

The CMA took a view that the merger could result in higher prices, fewer choices and less innovation for UK gamers.

288 notes

·

View notes

Text

78 notes

·

View notes

Text

i forgot to make a post about this but one of the reasons i believe megumi will be saved and come back, and how that will tie with a major moment in the story (either related to sukuna or the merger), is because of his name. or, to be more precise, because of his father and the legacy he chose to leave behind. toji's character has been the catalyst for almost everything in the current timeline of jjk. he was behind gojo's awakening, riko's death, geto's spiraling and defection which ultimately led to kenjaku's possession of geto's body, the lack of options to release gojo from the prison realm when he was imprisoned by kenjaku, he was the object of yuki's study to break free from the status quo, etc. quite literally, if we do have a plot, we have to thank toji for it. toji, who turned the world upside down and changed everyone's lives by breaking the chains of fate - literal symbolism used in regards to him and other concepts within the story like binding vows, specifically the one sukuna made with yuuji. toji, the one who linked the six eyes, the star plasma vessel and tengen (subsequently relating to the merger) by achieving a state of no cursed energy and reaching something akin to enlightment. such a bringer of chaos who was looked upon as the key to save the world by yuki, who knew there would have to be a change in the souls of the population of japan and cursed energy as a whole to finally break free from the cycle of suffering (breaking from the samsara and achievement of nirvana). now, how does that relate to megumi? the irony in the role toji plays within this story as someone who was born without power. the fact his influence caused nothing but destruction yet he birthed a blessing. what if megumi's name meaning blessing isn't just a coincidence or cute detail symbolising toji's love for his family but a sign for what's to come? what if the blessing yuki saw in toji's achievements as well actually translates to something more meaningful. more precisely, what if megumi is, quite literally, the embodiment of it?

#sorry i am once again obsessed with the existance of toji fushiguro#now that the new chapter hints at the merger i cannot stop thinking about this#i made a post about this before but i used to think gojo's death linked to other happenings in the manga with tengen would be the key to#deal with the merger and take down the status quo and the ce monopoly japan holds#now that gege added uraume to the conditions of the culling game and the story is heading in that direction#it feels fitting that there's some sort of relation#yuuji's manipulation of souls megumi's soul... idk idk but i wouldn't be surprised if megumi came back and i am actively waiting for it#if it doesn't happen i will be actually surprised#there's also the whole sukuna and yuuji sort of being a whole i am so scared of yuuji in the sense i'm afraid he'll sacrifice himself in#the end and the story will end just like his grandfather said#idk the merger can also add other variables to all of this who knows what's about to happen#anyways i'll shut up now agsjshsj#jujutsu kaisen#jjk leaks#toji fushiguro#megumi fushiguro#jjk 💭

23 notes

·

View notes

Text

Wait, I can't find any posts about Capital One buying Discover? Nobody's talking about this? On this, the anti-capitalism website???

3 notes

·

View notes

Text

WHAT THE ACTUAL FUCK IS THIS

#I am beyond angry#capitalism breeds creativity my ass#this is a cash grab made by an emerging monopoly who doesn’t care abt art or stories or their audiences#just money#I am furious#tv#cartoon network#animation#animated shows#hbo#warner bros#Warner brothers#I hate everything#someone needs to stop them#hbo merger#animation news#david zaslav

7 notes

·

View notes

Note

i used to work for wb and lowkey...this all is fascinating lol

one of my fatal flaws is that i am reliant on hbomax so i'm SWEATING

13 notes

·

View notes

Text

Watch "Warner Bros. Discovery And The New Batch Of Mergers – SOME MORE NEWS" on YouTube

youtube

Rightwing conservative billionaires are taking over the media.

2 notes

·

View notes

Text

This is horrible news for so many reasons, I don't even know what sucks the most.

4 notes

·

View notes

Text

Sigh, it’s been 3 days, and there is no new news on WBD merging with Paramount Global.

0 notes

Text

“In October 2022, Kroger and Albertsons announced that both companies’ respective boards had voted to approve a merger. If the merger is completed in 2024 as its executives expect, Kroger-Albertsons would be the second-largest grocery retail chain in the country, right behind Walmart. In order to actually happen, though, the merger needs approval from federal officials, who will determine whether or not such a merger is a violation of the country’s antitrust laws. According to the Federal Trade Commission, these laws require big companies to notify the government of their intention to merge, and prohibit mergers in which the result “may be substantially to lessen competition, or tend to create a monopoly.”

It’s the latter issue that concerns dozens of labor unions, advocacy groups, and elected officials like California Rep. Katie Porter, who united this month to form a coalition called Stop the Merger. The coalition insists that this merger is an obvious monopoly that will lead to “store closures, thousands of lost jobs, and higher food prices.” The group argues that the impacts of the merger will be devastating for workers, farmers, and consumers.

(…)

In October 2022, Kroger and Albertsons announced that both companies’ respective boards had voted to approve a merger. If the merger is completed in 2024 as its executives expect, Kroger-Albertsons would be the second-largest grocery retail chain in the country, right behind Walmart. In order to actually happen, though, the merger needs approval from federal officials, who will determine whether or not such a merger is a violation of the country’s antitrust laws. According to the Federal Trade Commission, these laws require big companies to notify the government of their intention to merge, and prohibit mergers in which the result “may be substantially to lessen competition, or tend to create a monopoly.”

It’s the latter issue that concerns dozens of labor unions, advocacy groups, and elected officials like California Rep. Katie Porter, who united this month to form a coalition called Stop the Merger. The coalition insists that this merger is an obvious monopoly that will lead to “store closures, thousands of lost jobs, and higher food prices.” The group argues that the impacts of the merger will be devastating for workers, farmers, and consumers.

(…)

If the Kroger-Albertsons merger is completed, its critics say that grocery prices will increase due to diminished competition. There is a strong historical correlation between big mergers like these and price increases. “Market consolidation has eroded a key foundation of our capitalist economy — competition,” Porter said in a statement supporting Stop the Merger. “Without competition, families are forced to pay higher and higher prices often for less and less of the product.”

(…)

But according to Rebecca Wolf, a food policy analyst at the nonprofit Food & Water Watch, mergers resulting in a better deal for customers isn’t how it’s worked in the past. “Grocery Goliaths often make this claim when they announce plans to merge. In reality, mergers give these large companies the power to dictate prices. That means, at some point, they become higher,” Wolf says. “As big companies keep getting bigger, their competitors disappear and prices keep going up. In fact, Food & Water Watch research found that in 2019, just four companies took in nearly 70 percent of all grocery sales in the country.”

There are also concerns that this merger would lead to even more food deserts in vulnerable communities. Because many cities and towns have multiple grocery stores, often owned by one of these two chains, experts say that consolidating the two brands will likely lead to store closures. “This merger is incredibly dangerous,” Stacy Mitchell, co-executive director of the nonprofit Institute for Local Self-Reliance, told the Guardian. “It’s highly likely if it goes through it will result in more communities not having a grocery store.”

(…)

There are a few ways corporate consolidation spells worry for workers. The first is that consolidation could lead to store closures, which would lead to job loss. Workers say this pattern has happened in the past, when mergers and acquisitions meant two stores in the same area became redundant.

“The 2015 Albertsons and Haggen deal left many workers scrambling around,” Christina Robinett, who now works at Vons in Ojai, California, said in a statement. In 2014, Haggen acquired around 150 stores that Albertsons had divested in order to merge with Safeway. However, Haggen had trouble with the expansion, cut back employee hours, closed stores, and eventually filed for bankruptcy. Albertsons came back and acquired the remaining Haggen stores. “After Haggen went bankrupt and shut down my store, I applied for work at four different stores,” Robinett says. “I wasn’t able to get a job for three months and I had to take side jobs as a seamstress and cleaning houses to make ends meet. That merger caused me a lot of anxiety.”

Janet Wainwright, who works as a meat cutter at a Kroger in Virginia, also worries this would mean the closing of unionized stores. Wainwright says she became frustrated while attending the Senate Committee hearings about the merger and hearing McMullen speak. “Rodney likes to throw out that these are union jobs,” she says. (In his testimony, McMullen said, “Kroger employs one of America’s largest unionized workforces, and this merger secures the long-term future of union jobs by establishing a more competitive alternative to large, nonunion retailers.”) But, Wainwright is skeptical. “If you have several Kroger stores that are in an area, what are the odds he’s going to keep all them open? He’s going to close union shops and keep the nonunion shops open.”

Workers are also concerned their benefits would be affected. “We’ve always lost something,” St. Louis says of the mergers she’s experienced. Most recently she says the price of health care increased, and now she’s concerned it’ll affect pensions. “I feel like I have to be a voice for the retirees. A lot of them are in their 80s and 90s; they can’t go back to work. If they don’t get their pension, they get more stuff taken away from them, it’s just not fair.”

Overall, workers do not trust that this will be a good deal for them, and hope that speaking out against the merger will bring more awareness to their concerns. Wainwright also hopes McMullen will have to listen to workers directly. “I would like to see them open [the Senate hearings] up where we can go and sit in front of the Senate and question Rodney. We’re the ones that work for him. If you have nothing to hide, then give us a seat at the table.���

While the merger could mean higher prices for consumers, farm workers reiterate that won’t be because that money is being shared equally among those who produce those goods. Edgar Franks of Familias Unidas por la Justicia, an independent farm worker union with a collective bargaining agreement that covers around 500 workers in Washington state, says they are opposed to the merger for the risks it poses to farm workers.

“The way that the grocers buy all the products, they almost set a price,” he says. A letter to the FTC from a group of growers associations explains the process further, saying Kroger already employs an “egregious take-it-or-leave-it contract pricing structure” against which few produce shippers have leverage to negotiate. A merger would just give the grocers even more power, and while farmers could technically not accept their terms, most can’t afford to not sell to them.

(…)

This is compounded by the fact that many of the labor laws that cover other industries do not cover farm work. There are about 2 million full-time farm workers and another 2 million seasonal workers in the U.S., according to the Occupational Safety and Health Administration, and the vast majority of them do not have collective bargaining agreements that set a standard for pay.

The Kroger-Albertsons merger won’t just have an impact on grocery and farm workers. Manuel Villanueva, regional director at the Restaurant Opportunities Center of Los Angeles, has major concerns about the trickle-down effect on restaurant workers outside of those that work at grocery stores, and says that it is another attempt to stifle organizing among these workers. “This is another strategy to crush unions and union contracts and make it harder for people to obtain a living wage,” he says. “All these establishments, in a way, affect restaurants, and anything that is happening at corporations of this scale trickles down into other industries. It’s important that people understand the magnitude of a merger like this.”

(…)

He also notes that many grocery stores also employ some restaurant workers. When you visit a Starbucks inside your grocery store, the barista that makes your iced latte doesn’t actually work for Starbucks. Those workers are employees of Kroger or Albertsons, and this overlap was something that organizers at ROC United, the national workers advocacy group, took notice of, especially during the COVID-19 pandemic. “They were sacrificial workers,” says Villanueva. “They were overworked and they just don’t trust the system anymore.”

A judge recently blocked a Penguin Random House and Simon & Schuster merger over similar concerns of lessening competition, so there is hope that there is momentum around antitrust awareness. “Over the coming weeks and months, we are going to fight like hell to stop this merger,” Rep. Porter said in a statement, “because it’s bad for workers, bad for families, and bad for our entire economy.””

“Kroger Co. and Albertsons Cos. dodged a bid from consumers for a preliminary injunction to halt the grocers’ $24.6 billion merger after a federal judge ruled that the plaintiffs lacked standing and failed to explain how the deal would affect them personally.

(…)

Chhabria also granted Kroger and Albertsons’ motion to dismiss the complaint with leave to amend. The lawsuit was filed in February by a group of consumers who claimed the deal would create a monopoly between two of the largest US supermarkets.

The lawsuit also targeted Cerberus Capital Management LP, an Albertsons investor receiving more than a third of a related $4 billion “special dividend,” the deal’s most contentious provision.

(…)

In an interview with Bloomberg Law ahead of the ruling, Joe Alioto, attorney for the plaintiffs, said the merger would result in higher food prices and thousands of layoffs between the two grocers’ networks.”

1 note

·

View note

Text

Convicted monopolist prevented from re-offending

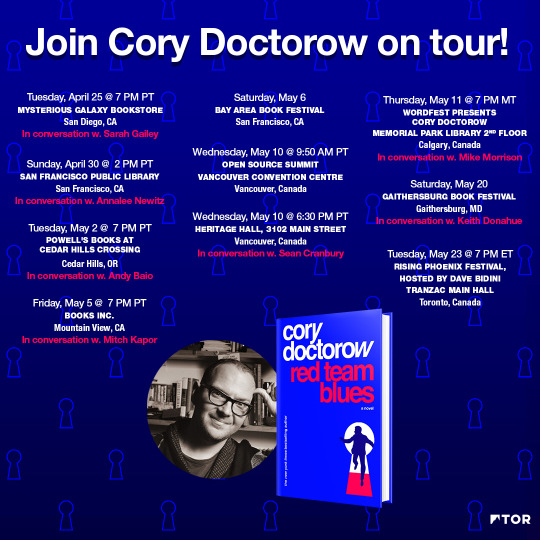

This Sunday (Apr 30) at 2PM, I’ll be at the San Francisco Public Library with my new book, Red Team Blues, hosted by Annalee Newitz.

In blocking Microsoft’s acquisition of Activision-Blizzard, the UK Competition and Markets Authority has made history: they have stepped in to prevent a notorious, convicted monopolist from seizing control over a nascent, important market (cloud gaming), ignoring the transparent, self-serving lies Microsoft told about the merger:

https://assets.publishing.service.gov.uk/media/644939aa529eda000c3b0525/Microsoft_Activision_Final_Report_.pdf

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/27/convicted-monopolist/#microsquish

Cloud gaming isn’t really a thing right now, but it might be. That was Microsoft’s bet, anyway, as it plonked down $69b to acquire Activision-Blizzard — a company that shouldn’t exist, having been formed out of a string of grossly anticompetitive mergers that were waved through.

Activision-Blizzard is a poster-child for the failures of antitrust law over the past 40 years, a period in which monopolies were tolerated and even encouraged by the agencies that were supposed to prevent monopolies from forming and break up the ones that slipped past their defenses. Activision-Blizzard is a giant, moribund company whose “innovation” consists of endless sequels to its endless sequels, whose market power allows it to crush its workers while starving competitors of market oxygen, ensuring that gamers and game workers have nowhere else to go.

Microsoft is another one of those poster-children, of course. After being convicted of antitrust violations, the company dragged out the legal process until George W Bush stole the presidency and decided not to pursue them any further, letting them wriggle off the hook.

The antitrust rough ride tamed Microsoft…for a while. The company did not use the same dirty tricks to destroy, say, Google as it had used against Netscape. But in the years since, Microsoft has demonstrated that it regrets nothing about its illegal conduct and has no hesitations about repeating that conduct.

This is especially true of cloud computing, where Microsoft is using exclusivity deals and illegal “tying” (forcing customers to use a product they don’t want in order to use a product they desire) to lock customers into its cloud offering:

https://www.reuters.com/technology/google-says-microsofts-cloud-practices-anti-competitive-slams-deals-with-rivals-2023-03-30/

Locking customers into Microsoft’s cloud also means locking customers into Microsoft surveillance. Microsoft’s cloud products spy in ways that are extreme even by the industry’s very low standards. Office 365 isn’t just a version of Office that you never stop paying for — it’s a version of Office that never stops spying on you, and selling the data to your competitors:

https://pluralistic.net/2020/11/25/the-peoples-amazon/#clippys-revenge

Microsoft’s Activision acquisition was entirely cloud-driven. The company clearly believes the pundits who say that the future of gaming is in the cloud: rather than playing on a device with the power to handle all the fancy graphics and physics, you’ll use a low-powered device that streams you video from a server in the cloud that’s doing all the heavy lifting.

If cloud gaming comes true (a big if, considering the dismal state of broadband, another sector that’s been enshittified and starved by monopolists), then Microsoft owning the Xbox platform, the Windows OS, and the Game Pass subscription service already poses a huge risk that the company could grow to dominate the sector. Throw in Activision-Blizzard and the future starts to look very grim indeed.

It’s a nakedly anticompetitive merger. As Mark Zuckerberg unwisely wrote in an internal memo, “it is better to buy than to compete.”

(These guys can not stop incriminating themselves. FTX got mocked for its group-chat called “Wirefraud,” but come on, every tech baron has a folder on their desktop called “mens rea” full of files with names like “premeditation-11.docx.”)

Naturally, the FTC sued to stop the merger (after 40 years, the FTC has undergone a revolution under chair Lina Khan and is actually protecting the American people from monopoly):

https://www.vice.com/en/article/ake97g/ftc-sues-to-block-microsoft-acquisition-of-call-of-duty-publisher-activision-blizzard

The FTC was always in for an uphill battle. “Cloud gaming,” the market it is seeking to defend from monopolization, doesn’t really exist yet, and enforcing US antitrust law against monopolies over existent things is hard enough, thanks to all those federal judges who attended luxury junkets where billionaire-friendly “economists” taught them that monopolies were “efficient”:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

But the FTC isn’t the only cop on the beat. Antitrust is experiencing a global revival, from the EU to China, Canada to Australia, and South Korea to the UK, where the Competition and Markets Authority is kicking all kinds of arse (see also: “ass”). The CMA is arguably the most technically proficient competition regulator in the world, thanks to the Digital Markets Unit (DMU), a force of over 50 skilled engineers who produce intensely detailed, amazingly sharp reports on how tech monopolies work and what to do about them.

The CMA is very interested in cloud gaming. Late last year, they released a long, detailed report into the state of browser engines on mobile phones, seeking public comment on whether these should be regulated to encourage web-apps (which can be installed without going through an app store) and to pave the way for cloud gaming:

https://pluralistic.net/2022/12/13/kitbashed/#app-store-tax

The CMA is especially keen on collaboration with its overseas colleagues. Its annual conference welcome enforcers from all over the world, and its Digital Markets Unit is particularly important in these joint operations. You see, while Parliament appropriated funds to pay those 50+ engineers, it never passed the secondary legislation needed to grant the DMU any enforcement powers. But the DMU isn’t just sitting around waiting for Parliament to act — rather, it produces these incredible investigations and enforcement roadmaps, and releases them publicly.

This turns out to be very important in the EU, where the European Commission has very broad enforcement powers, but very little technical staff. The Commission and the DMU have become something of a joint venture, with the DMU setting up the cases and the EU knocking them down. It’s a very heartwarming post-Brexit story of cross-Channel collaboration!

And so Microsoft’s acquisition is dead (I mean, they say they’ll appeal, but that’ll take months, and the deal with Activision will have expired in the meantime, and Microsoft will have to pay Activision a $3 billion break-up fee):

https://mattstoller.substack.com/p/big-tech-blocked-microsoft-stopped

This is good news for gaming, for games workers, and for gamers. Microsoft was and is a rotten company, even by the low standards of tech giants. Despite the sweaters and the charity (or, rather, “charity”) Bill Gates is a hardcore ideologue who wants to get rid of public education and all other public goods:

https://pluralistic.net/2021/04/13/public-interest-pharma/#gates-foundation

Microsoft has a knack for nurturing and promoting absolutely terrible people, like former CEO Steve Ballmer, who has played a starring role in Propublica’s IRS Files, thanks to the bizarre tax-scams he’s pioneered:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

So yeah, this is good news: Microsoft should have been broken up 25 years ago, and we should not allow it to buy its way to ongoing dominance today. But it’s also good news because of the nature of the enforcement: the CMA defended an emerging market, to prevent monopolization.

That’s really important: monopolies are durable. Once a monopoly takes root, it becomes too big to fail and too big to jail. That’s how IBM outspend the entire Department of Justice Antitrust Division every year for twelve years during a period they call “Antitrust’s Vietnam”:

https://onezero.medium.com/jam-to-day-46b74d5b1da4

Preventing monopoly formation is infinitely preferable to breaking up monopolies after they form. That’s why the golden age of trustbusting (basically, the period starting with FDR and ending with Reagan) saw action against “incipient” monopolies, where big companies bought lots of little companies.

When we stopped worrying about incipiency, we set the stage for today’s Private Equity “rollups,” where every funeral home, or veterinarian, or dentists’ practice is bought out by a giant PE fund, who ruthlessly enshittify it, slashing wages, raising prices, stiffing suppliers and reducing quality:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

Limiting antitrust enforcement to policing monopolies after they form has been an absolute failure. The CMA knows that an ounce of prevention is worth a pound of cure — indeed, we all do.

From Apr 26–28, Barnes and Noble is offering a 25% discount on preorders for my upcoming novels (use discount code PREORDER25): The Lost Cause (Nov 2023) and The Bezzle (Red Team Blues #2) (Feb 2024).

Catch me on tour with Red Team Blues in Mountain View, Berkeley, San Francisco, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A promotional image from the Call of Duty franchise featuring a soldier in a skull-mask gaiter giving a thumbs up on a battlefield. It has been altered so that he is giving a thumbs-down gesture. Superimposed on the image is a modified Microsoft 'Clippy' popup; Clippy's speech-bubble has been filled with grawlix characters; the two dialog-box options both read 'No.']

Image: Microsoft, Activision (fair use)

#pluralistic#labor#digital markets unit#gaming#brexit#cma#competition and markets authority#antitrust#monopoly#incipiency#microsoft#activision#blizzard#activision-blizzard#cloud gaming#cloud#mergers

129 notes

·

View notes

Text

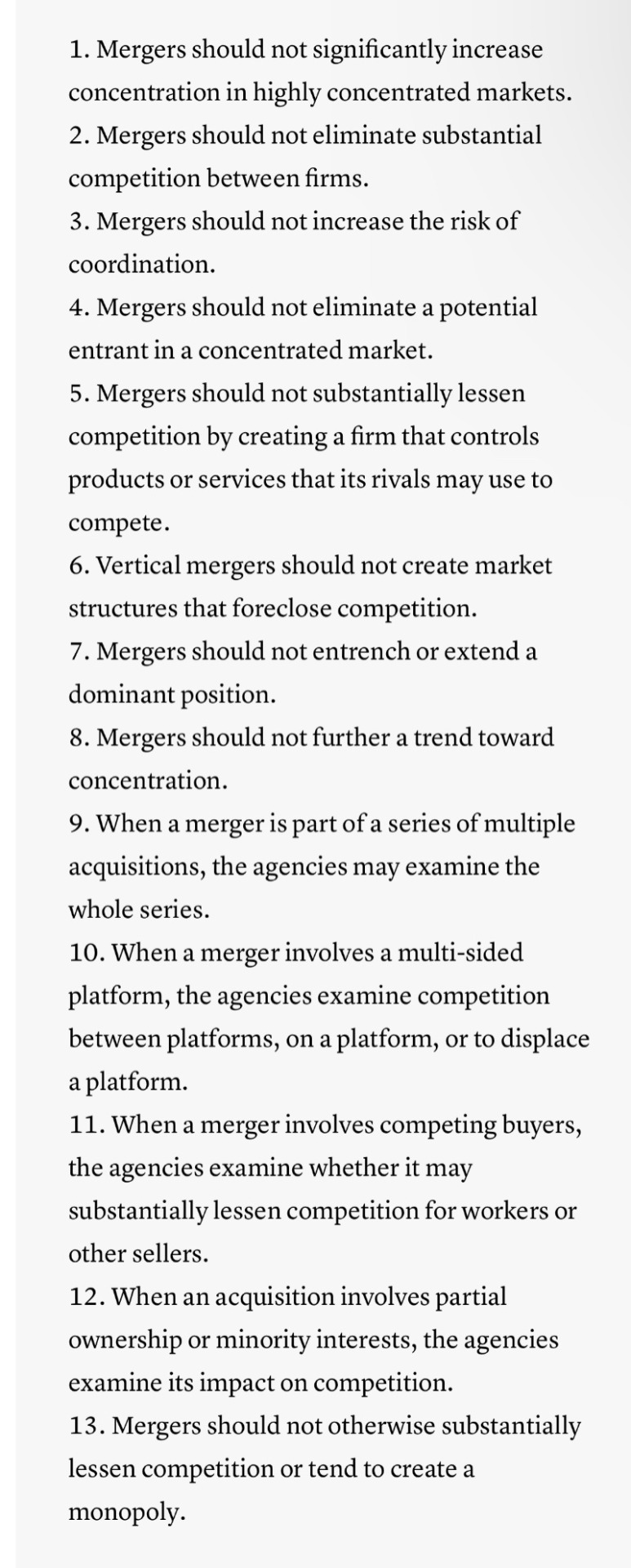

FTC and DOJ lay out new rules for merger review to reflect a digital economy @LAUREN_FEINER

https://www.cnbc.com/2023/07/19/ftc-and-doj-lay-out-rules-for-merger-review-to-reflect-digital-economy.html

Competitive Effects (M&A guideline)

https://www.ftc.gov/advice-guidance/competition-guidance/guide-antitrust-laws/mergers/competitive-effects

Vertical Merger 2020

https://www.ftc.gov/system/files/documents/reports/us-department-justice-federal-trade-commission-vertical-merger-guidelines/vertical_merger_guidelines_6-30-20.pdf #PrivateEquity #LBO #buyouts #tech #regulations #technology #mergers #ftc #sec #acquisition #deals #Competition #wage #jobs @FTC #RealEstate #rents #apartments @ilpaorg @USPBGC @ACGGlobal @NACD

0 notes

Text

Please send a letter to the Federal Trade Commission to STOP the Kroger and Albertsons merger!

The website only asks for name, email, and zip code. And it auto generates a letter and sends it to the FTC.

Please take the less than 5 mins to fill this out.

1 note

·

View note

Video

youtube

0 notes

Video

youtube

Who’s to Blame for Out-Of-Control Corporate Power?

One man is especially to blame for why corporate power is out of control. And I knew him! He was my professor, then my boss. His name… Robert Bork.

Robert Bork was a notorious conservative who believed the only legitimate purpose of antitrust — that is, anti-monopoly — law is to lower prices for consumers, no matter how big corporations get. His philosophy came to dominate the federal courts and conservative economics.

I met him in 1971, when I took his antitrust class at Yale Law School. He was a large, imposing man, with a red beard and a perpetual scowl. He seemed impatient and bored with me and my classmates, who included Bill Clinton and Hillary Rodham, as we challenged him repeatedly on his antitrust views.

We argued with Bork that ever-expanding corporations had too much power. Not only could they undercut rivals with lower prices and suppress wages, but they were using their spoils to influence our politics with campaign contributions. Wasn’t this cause for greater antitrust enforcement?

He had a retort for everything. Undercutting rival businesses with lower prices was a good thing because consumers like lower prices. Suppressing wages didn’t matter because employees are always free to find better jobs. He argued that courts could not possibly measure political power, so why should that matter?

Even in my mid-20s, I knew this was hogwash.

But Bork’s ideology began to spread. A few years after I took his class, he wrote a book called The Antitrust Paradox summarizing his ideas. The book heavily influenced Ronald Reagan and later helped form a basic tenet of Reaganomics — the bogus theory that says government should get out of the way and allow corporations to do as they please, including growing as big and powerful as they want.

Despite our law school sparring, Bork later gave me a job in the Department of Justice when he was solicitor general for Gerald Ford. Even though we didn’t agree on much, I enjoyed his wry sense of humor. I respected his intellect. Hell, I even came to like him.

Once President Reagan appointed Bork as an appeals court judge, his rulings further dismantled antitrust. And while his later Supreme Court nomination failed, his influence over the courts continued to grow.

Bork’s legacy is the enormous corporate power we see today, whether it’s Ticketmaster and Live Nation consolidating control over live performances, Kroger and Albertsons dominating the grocery market, or Amazon, Google, and Meta taking over the tech world.

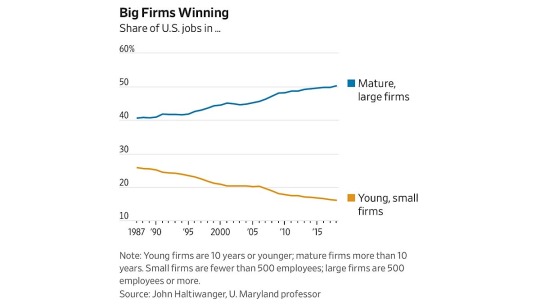

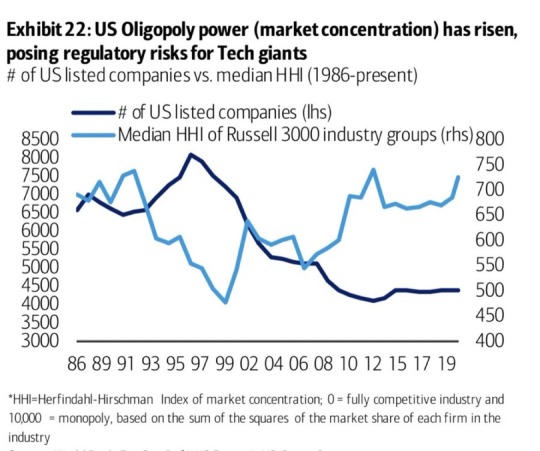

It’s not just these high-profile companies either: in most industries, a handful of companies now control more of their markets than they did twenty years ago.

This corporate concentration costs the typical American household an estimated extra $5,000 per year. Companies have been able to jack up prices without losing customers to competitors because there is often no meaningful competition.

And huge corporations also have the power to suppress wages because workers have fewer employers from whom to get better jobs.

And how can we forget the massive flow of money these corporate giants are funneling into politics, rigging our democracy in their favor?

But the tide is beginning to turn under the Biden Administration. The Justice Department and Federal Trade Commission are fighting the monopolization of America in court, and proposing new merger guidelines to protect consumers, workers, and society.

It’s the implementation of the view that I and my law school classmates argued for back in the 1970s — one that sees corporate concentration as a problem that outweighs any theoretical benefits Bork claimed might exist.

Robert Bork would likely regard the Biden administration’s antitrust efforts with the same disdain he had for my arguments in his class all those years ago. But instead of a few outspoken law students, Bork’s philosophy is now being challenged by the full force of the federal government.

The public is waking up to the outsized power corporations wield over our economy and democracy. It’s about time.

1K notes

·

View notes