#AI benchmarks

Explore tagged Tumblr posts

Text

Claude 4 AI Models Launched With Best-in-Class Coding Power

Introduction Anthropic has raised the bar in the generative AI landscape with the release of its Claude 4 series, including Claude Opus 4 and Claude Sonnet 4. Designed with a sharp focus on coding performance, tool integration, and reasoning depth, these large language models (LLMs) are setting new standards. The release was announced at Anthropic’s inaugural developer conference, and it’s…

#AI benchmarks#AI coding#AI tools#Anthropic#Claude 4#Claude API#Claude Code#Claude Opus 4#Claude Sonnet 4#JetBrains#Opus 4 price#Sonnet 4 performance#SWE-Bench#tool use#VS Code

0 notes

Text

🚀 OpenAI's Deep Research is finally here! 🎓📊 This AI tool in ChatGPT can generate 📄 structured reports in minutes ⏩. Say goodbye to hours of manual research! 🕒💻 Whether you're a student 🎓, professional 💼, or just curious 🤔 — this tool is a game-changer! ✅💯 💡 Get fast, credible, and well-cited reports in no time! 📊📑 👉 Try it now and boost your research efficiency! 🔥🔗 #OpenAI #DeepResearch #AIReports #ChatGPT #AIResearch #TechInnovation #AIInsights 💡📊

#AI benchmarks#AI reports#AI Research Agent#AI-powered research#ChatGPT#credible AI research#Deep Research#OpenAI#OpenAI tool#research automation

0 notes

Text

【実機を試す!】世界を変えるPC Copilot+PCガチでレビューするぞ!Microsoft Surface Laptop【忖度一切無し!】

#AIモデル解説#ainews#xelite#xplus#評価#copilotai#snapdragonx#解説動画#microsoftnews#windows11#性能#aipc#benchmarks#PC#コパイロット#win11#パソコン#コパイロットpc#cpu#生成AI#GPU#コパイロット使い方#ガジェット紹介#AI#copilotpc#リコール#パソコン初心者#chatgpt#Recall#ImageCreator

0 notes

Text

Step-by-Step Guide to Hiring a Full-Time Graphic Designer in 2025

To hire a full time graphic designer in 2025 requires more than just a portfolio review. It’s about finding someone who can elevate your brand, address deadlines, and collaborate alongside your team.

Whether you are considering a website redesign or creating engaging social media visuals, the right designer is your key. In this step-by-step guide we will help you navigate the process and make the best choice for your tech company.

Finding the Right Creative Fit for Your Business

Identify your design needs

Establish your requirements for a graphic designer before you start the hiring process. Are you trying to find someone with experience in web design, print materials, digital design, or branding? Hiring a full-time graphic designer with the appropriate skill set will be made easier if you know the scope of your project.

This is a particularly important stage for tech companies. You might require someone who is knowledgeable about user interface (UI) design, contemporary web design trends, or even how to make materials for mobile apps. The search will go more smoothly if you know exactly what your organization needs.

Create a detailed job description

Make a thorough job description after you've determined the qualifications and experience required. Add the following components:

Job title and duties

Skills needed (such as UX/UI design, Adobe Creative Suite, etc.)

Experience that is desired (years, industry, or particular project kinds)

Anticipated flexibility or working hours (particularly if you want to hire remote talent)

Values and company culture

In addition to drawing in the best candidates, a well-written job description establishes expectations right away.

Start your search

You can begin your search by advertising your position on well-known job boards, on design-specific websites like Behance or Dribbble, or even using AI in recruitment to match applicants according to predetermined standards. AI-powered systems are increasingly widely used by businesses to screen resumes and reduce the number of candidates based on fit, experience, and skills.

Platforms like Upwork, Toptal, and Fiverr are excellent for locating independent contractors who may eventually move into full-time positions if you intend to hire remote workers.

Review portfolio and references

Examine each candidate's portfolio in detail as soon as they begin to arrive. Technical expertise, inventiveness, and adaptability are all demonstrated in a solid portfolio. In addition to attention to detail and a consistent visual style, look for projects that are varied.

Evidence of design work pertaining to digital products, user experience, and branding is equally crucial for tech companies. Never be afraid to get references from prior clients or employers to verify the calibre of their work and their punctuality.

Conduct interviews and assess cultural fit

You can determine a candidate's potential fit for your team during an interview. Pay attention to both their technical proficiency and teamwork. Inquire about their design methodology and problem-solving techniques.

Evaluating their communication abilities is also essential. A graphic designer must be able to adequately communicate their concepts, particularly when collaborating with non-design team members.

Make sure to talk about desired communication channels, work patterns, and time zones when employing remote personnel. You want to make sure that there are no obstacles in the way of productive teamwork.

Make the offer and onboard

Make an offer as soon as you've identified the ideal applicant. Be open and honest about your pay, benefits, and expectations for the job. To make sure your offer is competitive, it's also a good idea to use a salary benchmarking tool.

Make sure your new designer has everything they need to get started right away during onboarding, including team member introductions, access to the required software, and clear goals.

Summing Up

A smart option for tech companies trying to improve their brand in 2025 is to hire a full-time graphic designer. By taking these actions, you can make sure that the designer you select not only possesses the necessary technical abilities but also fits in with the values and culture of your business.

Making the process as effective and transparent as possible is crucial, regardless of whether you decide to use in-house designers or remote expertise. You can expect a successful and captivating user experience with the help of the proper designer.

0 notes

Text

AMD's Ryzen AI Max+ 395 Claims Up to 68% Better Performance

In the ever-evolving world of technology, where performance metrics and market share often dictate the direction of innovation, AMD has consistently been considered the underdog, especially in the graphics processing unit (GPU) market against giants like Nvidia. However, AMD’s latest move with the introduction of the Ryzen AI Max+ 395 processor could herald a significant shift, particularly in…

#AI Performance in Laptops#AMD Competitive Edge#AMD Performance Benchmarks#AMD vs Nvidia#AMD vs Nvidia 2025#Consumer Choice in Laptops#DLSS vs FSR#Future Tech Trends#Gaming Laptop Market#Gaming Laptop Performance#Handheld Gaming#Laptop GPU Performance#Laptop GPU Revolution#Nvidia Pricing Strategy#Productivity Benchmark#Radeon 8060S iGPU#RDNA 3.5 Architecture#Ryzen AI Max#Ryzen AI Max+ 395#Upscaling Technology#Zen 5 Architecture

0 notes

Text

Studiul Apple evidențiază limitările raționamentului matematic în LLM-uri

Cercetătorii Apple au scos la iveală vulnerabilitățile modelelor de limbaj mari (LLM), cum ar fi ChatGPT și LLaMA, în ceea ce privește raționamentul matematic. Studiul subliniază că, în ciuda progreselor în procesarea limbajului natural, aceste modele nu efectuează un raționament autentic, ci se bazează pe reproducerea tiparelor învățate din datele de antrenament. GSM-Symbolic: Un benchmark…

#ai#apple#Apple Intelligence#benchmark GSM-Symbolic#ChatGPT#erori complexe#inteligenta artificiala#limitări AI#LLaMA#LLM#machine learning#modele de limbaj mari#raționament logic#raționament matematic#studiu Apple

0 notes

Text

O LLM de código aberto mais poderoso até agora: Meta LLAMA 3.1-405B

Requisitos de memória para Llama 3.1-405B Executar o Llama 3.1-405B requer memória e recursos computacionais substanciais: Memória GPU: O modelo 405B pode utilizar até 80 GB de memória de GPU por GPU A100 para inferência eficiente. Usar o Tensor Parallelism pode distribuir a carga entre várias GPUs. BATER:É recomendado um mínimo de 512 GB de RAM do sistema para lidar com a pegada de memória do…

#AI#Aprendizado de máquina#arquitetura de transformador#atenção de consulta agrupada#benchmarks de desempenho de IA#democratização da IA#escalonamento de IA#IA de código aberto#Llama#Llama 3.1#llama 3.1 405b#Modelo de linguagem grande#otimização de inferência#quantização FP8

0 notes

Text

The reason i know AI is a passing fad and not a genuine threat is because its being pushed by the same goobers who were pushing things like crypto and the metaverse and nfts.

Its not a waste of energy to get mad about it. Make sure the companies adopting its worse iterations know they're fucking up. Thats part of how NFTs lost their luster. Just remember how often techbros bandwagon on the newest, dumbest, shiniest thing and dont panic.

#i have a whole thing about calling all these disparate programs AI because none of it is AI but im going for readability here#okay okay AI is an as of yet fictional program with sentience. the turing test is a hypothetical benchmark for AI to clear but#its not indicative that ai has actually been achieved#true AI might not even be technologically possible but OpenAI and Dall-E are baby steps toward it.#so far its just pattern recognition technologies#or in the case of the google search engine ai its literally just grabbing semirandom phrases from search results#idk the false marketing genuinely bothers me more than the programs themselves but the programs are problems lmao

1 note

·

View note

Text

#key performance metrics#website performance metrics#performance metrics for employees#business performance metrics#project performance metrics#performance metrics and kpis#performance metrics analysis#performance metrics and reporting#performance metrics and evaluation#performance metrics and monitoring#api performance metrics#ai performance metrics#performance metrics best practices#performance metrics benchmarking#benefits of performance metrics#performance metrics calculation#performance metrics experience#performance metrics evaluation#employee performance metrics

0 notes

Text

There's a new benchmark for AI that's emerged, testing how fast AI systems can reply to user questions. This benchmark aims to evaluate how effectively AI systems handle and respond to inquiries from users.

0 notes

Text

Understanding the Challenges of Moving from LIBOR: Navigating the Tides

In the vast ocean of global finance, the London Interbank Offered Rate (LIBOR) stands out. It has long served as a crucial navigational beacon. Established in the mid-1980s, LIBOR quickly became the world’s most widely used benchmark for short-term interest rates. It’s similar to the financial world’s heartbeat. It underpins an estimated $350 trillion worth of financial contracts worldwide. These range from complex derivatives to simple home mortgages.

LIBOR represents the average interest rate for major global banks. They can borrow from one another in the international interbank market for short-term loans. LIBOR is published in five currencies: U.S. dollar, Euro, British pound, Japanese yen, and Swiss franc. It comes in seven different maturities ranging from overnight to one year. This provides a consistent, reliable gauge of the cost of unsecured borrowing in the London interbank market.

The importance of LIBOR in the financial system cannot be overstated. It serves as a reference rate for many financial products. These include syndicated loans, adjustable-rate mortgages, student loans, credit cards, and various types of derivatives. It’s the foundation of the global financial system. It influences borrowing costs throughout the economy. Moreover, it affects the finances of corporations, governments, and consumers alike.

However, LIBOR is the backbone of the financial world. Yet, it doesn’t come without its flaws. The financial world is preparing to navigate a future without it.

The Need for Transition from LIBOR

The journey towards a post-LIBOR world began with a series of unfortunate events. These events shook the financial world to its core. The LIBOR crisis erupted in 2012. It revealed that some banks had been manipulating the rate to their advantage. This led to a crisis of confidence in the benchmark. The scandal tarnished the reputation of LIBOR. It also highlighted its inherent vulnerabilities. One primary concern was that it was based on estimates and not actual transactions. This made it easier to manipulate.

The implications of the crisis were far-reaching. It led to billions of dollars in fines for the banks involved. Additionally, it casts a long shadow over the integrity of the global financial system. In response, it sparked a global conversation. The discussion centred around the need for a more robust and transparent alternative. This alternative needed to withstand the tests of market integrity and reliability.

How Everything Led to LIBOR’s End

In response to the crisis, regulatory bodies worldwide began pushing for a transition away from LIBOR. In the UK, the Financial Conduct Authority (FCA) made an announcement in 2017. It stated it would no longer ask or persuade banks to submit rates for LIBOR’s calculation after 2021. This announcement effectively set the clock ticking for the end of LIBOR.

The final nail in the coffin was in March 2021. The administrator of LIBOR, ICE Benchmark Administration, confirmed the termination dates for most LIBOR settings. It was announced that several LIBOR settings would cease after December 31, 2021. This included all the British pound, euro, Swiss franc, and Japanese yen settings. Additionally, the “one-week and two-month U.S. dollar settings” were included. The remaining U.S. dollar settings would cease immediately after June 30, 2023.

The announcement marked the beginning of the end for LIBOR. It set in motion a significant transition in global finance history. The transition from LIBOR is more than just a regulatory requirement. It’s a crucial step towards a stable and trustworthy financial system.

Challenges in the Transition from LIBOR

Navigating away from LIBOR is no small feat. The transition presents a multitude of challenges that financial institutions and market participants must overcome.

One of the most significant challenges is the complexity of replacing LIBOR in existing contracts, often referred to as “legacy contracts”. These contracts, which can extend beyond 2023, were drafted with LIBOR as the reference rate and often lack adequate provisions for the permanent removal of the benchmark. Modifying these contracts to replace LIBOR with a new rate is an enormous task, both legally and operationally, and raises the potential for legal disputes and market disruption.

The transition also involves the adoption of new risk-free rates (RFRs) that are fundamentally different from LIBOR. Unlike LIBOR, which reflects the credit risk of unsecured interbank lending, RFRs such as the Secured Overnight Financing Rate (SOFR) in the U.S. and the Sterling Overnight Index Average (SONIA) in the UK are nearly risk-free, as they are based on actual transaction data from secure lending markets. This shift from a credit-sensitive rate to a risk-free rate could have significant implications for the pricing and risk management of financial products.

Adding to the complexity is the absence of term structures in the new RFRs. While LIBOR is quoted for different maturities, most RFRs are overnight rates. The development of term rates based on RFRs is still in progress, and until these are widely available and accepted, the transition will remain a challenge.

The impact of the transition extends to various financial sectors and products. From securities, where LIBOR is deeply embedded, to syndicated loans and adjustable-rate mortgages that reference LIBOR, the transition will require significant adjustments. Market participants will need to adapt to new pricing mechanisms, risk management tools, and system changes, all while ensuring minimal disruption to financial markets.

Potential Solutions and Strategies for the Transition

Despite the challenges, the financial world is not walking without a light in this dark transition. Several solutions and strategies are being developed and implemented to navigate the shift from LIBOR. A key part of the solution lies in the development of alternative RFRs.

In the U.S., the Federal Reserve has endorsed the Secured Overnight Financing Rate (SOFR) as the replacement for U.S. dollar LIBOR. SOFR is based on actual transactions in the Treasury repurchase market, making it a more robust and reliable benchmark.

In the UK, the Bank of England has identified the Sterling Overnight Index Average (SONIA) as the preferred alternative to the sterling LIBOR.

These RFRs, along with others being developed around the world, are set to play a pivotal role in the post-LIBOR era.

Another crucial strategy for the transition is the incorporation of robust fallback language in financial contracts. Fallback provisions outline the steps to be taken and the replacement rate to be used if LIBOR ceases to exist. The International Swaps and Derivatives Association (ISDA) has developed a standard fallback protocol, which many market participants have agreed to, providing a clear path for the transition in derivative contracts.

Technology and data also hold the key to managing the transition effectively. Financial institutions are leveraging technology solutions to identify and analyze LIBOR exposure in their contract portfolios. Advanced analytics, fintech solutions and AI are being used to extract and review contractual terms at scale, enabling institutions to manage the transition in a more efficient and risk-controlled manner.

The transition from LIBOR is undoubtedly a complex and challenging process. However, with the right strategies and solutions in place, the financial world can successfully navigate the shift and emerge with a more transparent and robust benchmarking system.

The Impact of the Transition on Global Financial Markets

The ripples of the transition from LIBOR are being felt across global financial markets. This is leading to significant changes and potential disruptions.

One of the most profound impacts is the change in market risk profiles. The shift from LIBOR, a credit-sensitive rate, to nearly risk-free rates changes the dynamics of interest rate risk.

Financial institutions will need to review their risk management strategies. This is because the new rates do not reflect bank credit risk. These rates could also behave differently from LIBOR under various market conditions.

The transition also has a significant effect on interest-rate products and securities. LIBOR is deeply embedded in these markets. Its replacement will require adjustments in pricing, valuation, and risk management of these products. For instance, the shift to SOFR in the U.S. will have effects. It could affect the pricing of interest rate swaps. This is because SOFR tends to be lower than LIBOR due to its nearly risk-free nature.

Moreover, the transition carries the potential for market disruption and legal disputes. The modification of legacy contracts to replace LIBOR could be problematic. It could lead to disagreements over the choice of replacement rate. The adjustment spread might also be a point of contention. This could potentially result in lawsuits. There’s also the risk of market fragmentation. Different jurisdictions or market segments might choose different replacement rates.

The Role of Regulatory Bodies and Financial Institutions in the Transition

Read the full article at: https://dsb.edu.in/understanding-the-challenges-of-moving-from-libor-navigating-the-tides/?utm_source=Tumblr&utm_medium=Tumblr&utm_campaign=Tumblr+LIBOR

#libor#benchmark#uk finance#loans#tech#fintech#india#blockchain#jobs#banking#chatgpt#education#gpt 4#ai#google#investment#altcoin#crypto#defi

0 notes

Text

This AI Paper Dives into Embodied Evaluations: Unveiling the Tong Test as a Novel Benchmark for Progress Toward Artificial General Intelligence

📢 Exciting AI Paper Alert: "Diving into Embodied Evaluations: Unveiling the Tong Test as a Novel Benchmark for Progress Toward Artificial General Intelligence" 🚀 Researchers at the National Key Laboratory of General Artificial Intelligence have introduced the Tong Test, a groundbreaking benchmark for evaluating Artificial General Intelligence (AGI). Unlike traditional task-oriented evaluations, this test focuses on complex environments and emphasizes ability and value-oriented evaluation. 🔬 The Tong Test includes features such as infinite tasks, self-driven task generation, value alignment, and causal understanding. It also supports embodied AI in training and testing. This test paves the way for developing practical AI algorithms. Check it out here 👉 [Link to the blog post](https://ift.tt/C5PvFgR) 💡 Achieving Artificial General Intelligence is no easy feat. AGI strives to replicate human-like intelligence, adaptability, and decision-making. Solving complex problems in machine learning, robotics, and more is essential for AGI progress. 🌐 In this blog post, the researchers propose the Tong Test, rooted in complex DEPSI environments, to assess AGI's human-like abilities. The test focuses on commonsense reasoning, intention inference, trust, and self-awareness. It emphasizes ability and value-oriented evaluation. 🔍 Dive into the details of the Tong Test and its evaluation system, which includes infinite tasks, self-driven task generation, value alignment, and causal understanding. The blog post also explores the proposed virtual platform and embodied AI training and testing. It's a must-read for AI enthusiasts! If you're passionate about AI research, don't forget to join our ML SubReddit, Facebook Community, Discord Channel, and subscribe to our Email Newsletter. Stay in the loop with the latest AI research news, cool projects, and much more. Together, we can shape the future of AI! 🤖💪 🔗 Don't miss out! Read the full blog post here 👉 [Link to the blog post](https://ift.tt/C5PvFgR) 📣 Share your thoughts and spread the word. Let's push the boundaries of AI! ✨ #AI #ArtificialIntelligence #AGI #Research #Technology #EmbodiedEvaluations #TongTest #ML #AICommunity List of Useful Links: AI Scrum Bot - ask about AI scrum and agile Our Telegram @itinai Twitter - @itinaicom

#itinai.com#AI#News#This AI Paper Dives into Embodied Evaluations: Unveiling the Tong Test as a Novel Benchmark for Progress Toward Artificial General Intellig#AI News#AI tools#Innovation#itinai#LLM#MarkTechPost#Mohammad Arshad#Productivity This AI Paper Dives into Embodied Evaluations: Unveiling the Tong Test as a Novel Benchmark for Progress Toward Artificial Gen

0 notes

Text

Go AI storage?

1 note

·

View note

Text

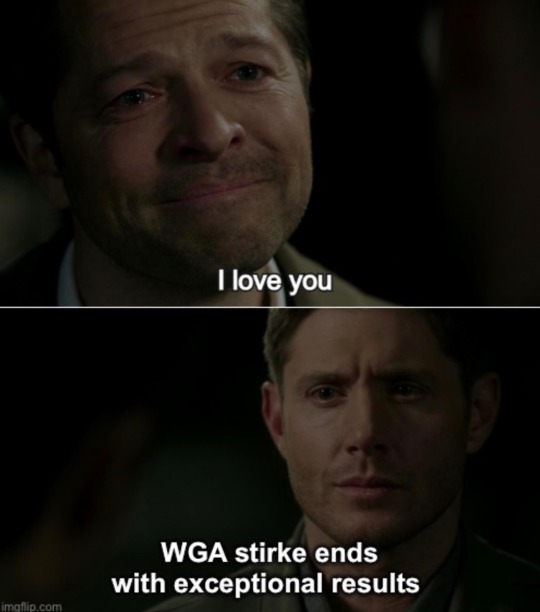

The guild’s insistence in achieving a minimum guaranteed staff level for episodic TV was considered an extreme long-shot when the contract discussions began in March.

They achieved a new-model streaming residual formula that should help fellow striking union SAG-AFTRA in its quest to achieve a revenue-based residual. The WGA’s formula amounts to a bonus system based on pre-determined, high-bar performance benchmarks for individual titles. But it’s nonetheless more than industry dealmakers predicted the guild would secure when the first round of WGA-AMPTP talks began in earnest last spring.

The nitty-gritty details of language around the use of generative AI in content production was one of the last items that the sides worked on before closing the pact.

They did it.

Solidarity works.

Unions are our only tool against capitalistic greed.

[x]

Fact: To be completely precise, the agreement is tentative and the strike will end when the members vote. The guild has allowed the writers to go back to work from Wednesday 27th 12:01. All members still need to vote for the new contract to be final but the strike is officially over. [x]

Opinion: However it’s very unlikely to be any hurdles because the same people who called for the strike are calling for it to be over.

Hence: wga strike ENDS and not ENDED.

#wga strike#wga strike end#destiel news#destiel#capitalism#union solidarity#unions#sag aftra#sag aftra strike

11K notes

·

View notes