#Accounting Firm In Canada

Text

Finding Financial Success with Cloud Accounting Services and Vancouver Accountants

Due to globalization and diversification in business operations, the function of Vancouver accountants and cloud accounting services is critical today. Outsourcing the payroll services in Canada and effective resource management play an important role in catalyzing business operations. In this blog post, issues concerning the advantages of engaging Vancouver accountants, role of payroll in Canada, and revolution brought by cloud accounting from companies such as TaxlinkCPA will be discussed.

Vancouver Accountants: Why You Should Trust Your Business Financial Partners to Us

Exclusive Consultative and Advisory Services for Business Development

Self employed Vancouver accountants are well rounded in the field and can contribute valuable information. It is typical that they have profound knowledge of the business environment, the taxation legislation regime, and specificities of the branches. Hiring the services of a reliable firm of accountants in Vancouver including TaxlinkCPA puts you in a vantage position of benefiting from expert advice and securing your business by diversing your business idea.

Read here more :

0 notes

Text

"Wave Taxes Inc" is a leading accounting firm in Calgary, Canada, offering expert financial solutions. Their skilled team provides personalized tax planning, accounting, and financial advisory services for individuals and businesses. Trusted for their accuracy and dedication, they aim to optimize financial management and ensure compliance with Canadian tax regulations. Whether it's personal taxes or corporate accounting, clients rely on "Wave Taxes Inc" for reliable, efficient, and customized assistance. visit us: https://wavetaxes.ca

#Accounting Firm In Canada#accounting firms calgary#accounting services in Canada#small business accountant service#accounting firm#accounting online#tax planner

0 notes

Text

Being an experienced Canadian accounting firm, we offer a full range of accounting, tax and advisory services to meet your personal or business needs. In addition to these accounting services in Canada, we also provide you with many specialized services aimed at meeting your business needs. For more information about our services, call us at +1 (778) 886-0508 or contact us online.

#accounting in cananda#accounting services#accounting firm in Canada#teqo accounting#accounting services in Canada

1 note

·

View note

Text

Best Accounting Practices for Online Businesses: Remote Accounting and Audit Frequency

Running an online business comes with unique challenges, especially when it comes to managing finances. With global e-commerce sales expected to reach $6.38 trillion by 2024, having good accounting practices is crucial for success. This blog will cover the best accounting practices for online businesses, the benefits of working with a remote accountant, and how often audits should be conducted. Throughout this blog, we'll highlight More Than Numbers CPA, known as the best accountant in the Greater Toronto Area.

Best Accounting Practices for Online Businesses

Keep Accurate Financial Records

One of the most important things for any online business is to keep accurate financial records. This means keeping track of all sales, expenses, and other financial transactions. The U.S. Small Business Administration states that poor financial management is a top reason why small businesses fail. Accurate records help in understanding cash flow, preparing taxes, and making business decisions. Working with the best accountant in the Greater Toronto Area, like More Than Numbers CPA, can help businesses keep accurate records using modern software to avoid errors.

Use Cloud-Based Accounting Software

Cloud-based accounting software like QuickBooks Online, Xero, or Wave can be a game-changer for online businesses. Around 67% of accountants believe these tools help in building better relationships with clients by providing real-time access to financial information. The best accountant in the Greater Toronto Area, More Than Numbers CPA, can help online businesses choose and set up the right software to manage their finances efficiently.

Automate Routine Accounting Tasks

Automation can save time and reduce errors in accounting. About 85% of finance leaders say automation allows them to focus on more strategic tasks. For online businesses, automating tasks like invoicing, payroll, and tracking expenses can streamline operations. The best accountant in the Greater Toronto Area, More Than Numbers CPA, offers expert advice on using automation tools to simplify accounting processes, so businesses can focus on growth.

Manage Cash Flow Effectively

Cash flow problems are the reason 82% of small businesses fail, according to a study by U.S. Bank. For an online business, managing cash flow is essential to avoid running out of money. Working with the best accountant in the Greater Toronto Area, such as More Than Numbers CPA, helps businesses plan for future cash needs, manage expenses, and keep finances healthy.

Stay Up-to-Date with Tax Rules

Tax rules can be complicated, especially for online businesses that sell in different places. There are over 12,000 tax jurisdictions in the U.S. alone, each with its own rules. The best accountant in the Greater Toronto Area, More Than Numbers CPA, is skilled in managing taxes across different regions and can help businesses stay compliant and avoid fines.

Reconcile Accounts Regularly

Reconciling accounts means comparing business records with bank statements to find any discrepancies. The Association of Certified Fraud Examiners (ACFE) says that small businesses lose an average of 5% of their revenue to fraud. The best accountant in the Greater Toronto Area, More Than Numbers CPA, recommends doing regular reconciliations to catch errors early and ensure everything matches up correctly.

Separate Personal and Business Finances

Mixing personal and business finances can create confusion and lead to errors. About 23% of small business owners admit to mixing the two. The best accountant in the Greater Toronto Area, More Than Numbers CPA, advises keeping them separate to avoid legal and financial problems.

Benefits of Working with a Remote Accountant

With the rise of remote work, many businesses are turning to remote accountants to manage their finances. A remote accountant, like More Than Numbers CPA, the best accountant in the Greater Toronto Area, offers many benefits:

Flexibility and Easy Access

Remote accountants offer flexibility by allowing business owners to access financial information anytime, anywhere. Over 50% of businesses are expected to continue working remotely after the pandemic, making remote accessibility even more valuable. The best accountant in the Greater Toronto Area, More Than Numbers CPA, provides real-time financial insights to help businesses make quick decisions.

Cost Savings

Hiring a remote accountant can save money by eliminating the need for a full-time in-house team. According to Deloitte, 40% of businesses save costs by outsourcing accounting services. The best accountant in the Greater Toronto Area, More Than Numbers CPA, offers flexible services that fit different business sizes and budgets.

Access to Expert Knowledge

Remote accountants often have specialized knowledge that small in-house teams may lack. Working with the best accountant in the Greater Toronto Area, like More Than Numbers CPA, gives businesses access to experts in tax planning, financial forecasting, and regulatory compliance.

Secure and Clear Communication

Remote accountants use secure communication tools, like encrypted file-sharing and video conferencing, to maintain transparency and protect sensitive information. The best accountant in the Greater Toronto Area, More Than Numbers CPA, ensures smooth communication and high-quality service.

Strong Data Security

Data security is crucial for online businesses. About 60% of small businesses go out of business within six months after a cyber attack. The best accountant in the Greater Toronto Area, More Than Numbers CPA, uses advanced security measures like encryption and multi-layered authentication to protect client information.

How Often Should Online Businesses Conduct Audits?

Audits help verify the accuracy of financial statements and detect fraud. The frequency of audits depends on the size, regulatory needs, and complexity of a business. Here is a breakdown of audit types and how often they should be done, according to the best accountant in the Greater Toronto Area, More Than Numbers CPA:

Annual Financial Audits

Most businesses conduct annual audits to ensure their financial statements are accurate and follow accounting standards. A survey by the Institute of Internal Auditors shows that 88% of organizations perform annual audits. The best accountant in the Greater Toronto Area, More Than Numbers CPA, helps businesses prepare for these audits to avoid any issues.

Quarterly or Semi-Annual Internal Audits

Internal audits help businesses improve their internal controls and identify risks. For online businesses, conducting internal audits quarterly or semi-annually is useful for maintaining efficient operations. More Than Numbers CPA, known as the best accountant in the Greater Toronto Area, provides detailed internal audits to help businesses improve.

Compliance Audits

Compliance audits ensure a business is following all the rules and regulations. These audits may need to happen more frequently for businesses operating in multiple regions. The best accountant in the Greater Toronto Area, More Than Numbers CPA, offers services to keep businesses compliant with all local and international regulations.

Special Audits

Sometimes businesses need special audits, such as when investigating suspected fraud or preparing for a merger. The best accountant in the Greater Toronto Area, More Than Numbers CPA, has the expertise to handle these audits and provide clear financial insights.

Conclusion

For online businesses, following good accounting practices is essential to stay financially healthy and grow. From keeping accurate records and using cloud-based software to managing cash flow and separating personal and business finances, these practices are the foundation of good financial management. Working with a remote accountant, especially the best accountant in the Greater Toronto Area, More Than Numbers CPA, provides advantages like cost savings, expert knowledge, and secure communication. Regular audits, scheduled according to the business's needs, help maintain financial accuracy and build trust.

Choosing More Than Numbers CPA means working with the best accountant in the Greater Toronto Area who understands the unique challenges of online businesses and provides tailored solutions to help them thrive.

0 notes

Text

Best prop firms in Canada

Looking for the best prop firms in Canada? Discover top proprietary trading firms that offer excellent opportunities for Canadian traders at The Talented Trader. Our comprehensive guide covers the most reputable prop firms, highlighting their unique features, trading platforms, and support services. More: https://www.thetalentedtrader.com/best-prop-firms-canada

#bestpropfirms #forexaccounts #trading #forextrading #fundedtraderprograms #proptrading #canada #instantfundingpropfirm #passpropfirm #propfirms #propfirmchallenge #instantfunding #thetalentedtrader

#best prop firms in Canada#Discounts on prop firms#Prop Firm Challenge#Prop Firms#best prop firms#the talented trader#instant funding prop firm#funded trading accounts#prop firm trading#cheapest prop firms

0 notes

Text

#outsource accounting services in canada#outsourced accounting firms#accounting outsourcing australia

0 notes

Text

Top Accounting Firms Canada: Expert Financial Services for Your Business Needs

Discover the leading accounting firms in Canada, offering expert financial services tailored to meet your business requirements. From tax planning and compliance to bookkeeping and financial analysis, these trusted firms provide comprehensive solutions. Ensure your business thrives with the support and expertise of top-notch Canadian accounting professionals.

0 notes

Text

Polish neonazi who has spent their entire life in Canada and has never set foot on Polish soil: We Poles are just so glad that the evil Soviet Union is gone now so we can venerate our national hero, Władysław the Jew Smiter, without censorship.

Ordinary Polish guy: Idk man it kinda sucks that western financial firms came in and bought all our national industry and our social services are shit now and the picture of "upward mobility" offered to us is going to the UK and picking tomatoes in rural Kent while the inbred grandniece of the architect of the Bengal Famine films herself cracking a whip over our heads for her #girlboss motivational instagram account, and the main outlet for that frustration is catholic christofascism. Maybe it wasn't so bad before the fall of the SU (all of this is in polish so anglophones can't understand it and don't care to translate it)

smug liberal whitey, to me: Don't you hysterical darkies see? ex-soviet people are Glad the soviet union is gone! Look at what all polish people are saying, which in the english language is entirely sentiment one and not sentiment 2!

488 notes

·

View notes

Text

Meta identifies networks pushing deceptive content likely generated by AI

Meta (META.O) said on Wednesday it had found "likely AI-generated" content used deceptively on its Facebook and Instagram platforms, including comments praising Israel's handling of the war in Gaza published below posts from global news organizations and U.S. lawmakers.

The social media company, in a quarterly security report, said the accounts posed as Jewish students, African Americans and other concerned citizens, targeting audiences in the United States and Canada. It attributed the campaign to Tel Aviv-based political marketing firm STOIC.

While Meta has found basic profile photos generated by artificial intelligence in influence operations since 2019, the report is the first to disclose the use of text-based generative AI technology since it emerged in late 2022.

Researchers have fretted that generative AI, which can quickly and cheaply produce human-like text, imagery and audio, could lead to more effective disinformation campaigns and sway elections.

In a press call, Meta security executives said they removed the Israeli campaign early and did not think novel AI technologies had impeded their ability to disrupt influence networks, which are coordinated attempts to push messages.

#yemen#jerusalem#tel aviv#current events#palestine#free palestine#gaza#free gaza#news on gaza#palestine news#news update#war news#war on gaza#hasbara#israeli propaganda#ai#artificial intelligence#misinformation

460 notes

·

View notes

Text

Top bookkeepers in Langley at Taxlink CPA

It is always important to try and locate the right chartered accountant serving your area or the top bookkeepers in Langley at Taxlink CPA to feature a big difference on the success of your money. Whether you are in Langley, Surrey or every other place in Canada, the important thing is the hiring of professionals that are skilled, accredited, and knowledgeable with your requirements. All the way from major professional accounting firms in Canada and right down to individualized services tailored by Surrey accounting firms, there is a wealth of professional assistance available for you in your financial journey.

0 notes

Text

Wave Taxes Inc: Your Trusted Accounting Firm in Canada

In the bustling financial landscape of Canada, businesses and individuals seek a reliable partner to navigate the complex world of taxes and accounting. Among the prominent players in this domain stands “Wave Taxes Inc,” an esteemed accounting firm based in Calgary, Canada. With its unwavering commitment to excellence and personalized services, Wave Taxes Inc has earned a stellar reputation among clients seeking top-notch accounting services in the country.

visit us: https://medium.com/@wavetaxesincab/wave-taxes-inc-your-trusted-accounting-firm-in-canada-cec18f7eb19c

https://wavetaxes.blogspot.com/2023/07/wave-taxes-inc-your-trusted-accounting.html

0 notes

Text

Do Small Businesses Need Accounting Services in Canada?

Being an entrepreneur is busy enough without having to work on running your day-to-day business. If you don't want to incur the expense of hiring a full-time accountant, but also don't want to deal with the hassles of billing, keeping track of bills, and handling payroll on your own, we have the solution.

The professionals at Teqo Accounting Firm can offer you the best accounting services in Canada. Our team can ensure up-to-date ledgers, without the expense of a full-time employee, and peace of mind knowing that your daily accounting and financial needs are expertly met.

#accounting in cananda#business accounting#accounting services#bookkeeping#Teqo Accounting#small business#accounting firm in canada

0 notes

Text

Effective Debt Management Strategies for Business Owners

Managing debt is one of the most important aspects of running a successful business. Whether you are a new startup or a well-established company, understanding how to manage debt is crucial to maintaining financial stability and growth. This blog explores how businesses can effectively reduce their debt, prevent further debt accumulation, and decide when filing for bankruptcy may be the best option. It provides comprehensive insights, global and local statistics, and actionable strategies to help businesses, particularly those in the Greater Toronto Area (GTA), navigate debt management. Mentioning the "best accountant in Greater Toronto Area - More Than Numbers CPA" throughout, we'll demonstrate how expert guidance can significantly impact business debt strategies.

The Scope of Business Debt

Business debt is a double-edged sword—it can fuel growth, but it can also lead to significant financial stress if not managed properly. Globally, business debt has reached alarming levels, with the World Bank reporting that total global debt stood at 331% of GDP in 2023. In Canada, businesses—especially those in the Greater Toronto Area—are experiencing rising debt levels that could impact their financial health. Consulting with the "best accountant in Greater Toronto Area - More Than Numbers CPA" can help local businesses develop a customized approach to debt management.

1. Reducing Business Debt Effectively

Reducing debt requires a strategic and informed approach that goes beyond mere cost-cutting. It involves optimizing cash flow, renegotiating debt terms, and applying financial discipline.

Target High-Interest Debt First: One of the most efficient ways to reduce debt is by paying off high-interest loans first. Known as the "avalanche method," this strategy minimizes the amount spent on interest over time. For example, a business in the GTA with a $100,000 loan at a 12% interest rate could save up to $12,000 annually by focusing on reducing this debt first. Engaging with the "best accountant in Greater Toronto Area - More Than Numbers CPA" can help businesses identify which debts to prioritize for maximum financial benefit.

Negotiate Better Terms with Creditors: Not all debts have to be set in stone. Many creditors are open to renegotiating terms to extend repayment periods, reduce interest rates, or restructure debt altogether. The "best accountant in Greater Toronto Area - More Than Numbers CPA" has the expertise to negotiate more favorable terms that can provide financial relief for businesses.

Optimize Cash Flow Management: Strong cash flow is the foundation of effective debt reduction. This involves speeding up receivables, delaying payables, and managing inventory efficiently. Businesses in the GTA can benefit significantly by working with the "best accountant in Greater Toronto Area - More Than Numbers CPA" to develop customized cash flow strategies.

2. Preventing the Accumulation of New Debt

Preventing the build-up of new debt is just as important as managing existing debt. Businesses need proactive strategies to avoid falling into deeper debt traps.

Adopt Lean Business Practices: Adopting a lean approach focuses on reducing waste and maximizing efficiency. This can involve streamlining operations, cutting unnecessary expenses, and focusing on activities that generate the most value. Businesses in the Greater Toronto Area can benefit from consulting the "best accountant in Greater Toronto Area - More Than Numbers CPA" to identify cost-saving opportunities and optimize operations.

Implement Robust Budget Controls: A detailed budget is essential to prevent overspending and debt accumulation. Regularly monitoring expenses against budgets and making necessary adjustments can help businesses stay within their means. The "best accountant in Greater Toronto Area - More Than Numbers CPA" can provide sophisticated budgeting tools and insights to help companies maintain financial discipline.

Diversify Revenue Streams: Relying heavily on one source of income is risky, especially during economic downturns. Diversifying revenue sources ensures a more stable financial position and reduces the likelihood of needing to incur more debt. Businesses looking to explore new revenue opportunities can partner with the "best accountant in Greater Toronto Area - More Than Numbers CPA" for expert guidance on diversification strategies.

3. Deciding When to File for Bankruptcy

While often considered a last resort, bankruptcy may sometimes be the most viable option for businesses struggling under massive debt loads.

Understanding Insolvency: Insolvency occurs when a business is unable to meet its debt obligations. In Canada, business insolvencies increased by 13% in 2022, with nearly 4,000 businesses filing for protection. For businesses in the GTA, assessing insolvency accurately is crucial. Consulting with the "best accountant in Greater Toronto Area - More Than Numbers CPA" can help determine whether your business is insolvent and what steps to take next.

Types of Bankruptcy Options: There are two main types of bankruptcy for businesses in Canada: Chapter 7 (liquidation) and Chapter 11 (reorganization). Chapter 7 involves selling off assets to pay creditors, while Chapter 11 allows a business to reorganize and continue operations under a new structure. The "best accountant in Greater Toronto Area - More Than Numbers CPA" can guide businesses through these options, providing insights into which route may be most appropriate.

Long-Term Implications of Bankruptcy: Bankruptcy significantly impacts a business's credit rating and reputation but can also offer a fresh start. For business owners in the Greater Toronto Area, working with "More Than Numbers CPA" is crucial to understanding the full range of options and consequences before making this critical decision.

4. Leveraging Professional Expertise for Debt Management

Effective debt management often requires professional expertise. Partnering with skilled accountants like those at "More Than Numbers CPA" can provide invaluable support and guidance.

Debt Restructuring and Refinancing: Professionals at "More Than Numbers CPA" can assist businesses in refinancing or restructuring debt to better align with cash flow and financial goals, ensuring debt repayment is sustainable.

Comprehensive Financial Planning: Effective financial planning and forecasting are crucial to avoiding debt traps. By anticipating future revenues, potential expenses, and market conditions, businesses can make informed decisions that support financial health. The "best accountant in Greater Toronto Area - More Than Numbers CPA" provides advanced planning and forecasting services tailored to specific business needs.

Tax Optimization Strategies: Strategic tax planning can significantly reduce a business's financial burden, freeing up cash that would otherwise go to tax payments. This can reduce reliance on debt. The "best accountant in Greater Toronto Area - More Than Numbers CPA" offers expert tax optimization services to help businesses minimize liabilities.

5. Global and Local Insights on Business Debt

Globally, businesses face rising debt challenges. The International Monetary Fund (IMF) reports that global corporate debt reached over $51 trillion in 2022. Small and medium-sized enterprises (SMEs) are especially at risk, with about 40% in developed countries having high debt-to-equity ratios. Learning from these global trends, businesses in the Greater Toronto Area can apply local strategies with the guidance of "More Than Numbers CPA," the best accountant in the region.

6. Real-World Example: Successful Debt Management in the GTA

Consider a local retail business in the Greater Toronto Area that was struggling with $400,000 in debt due to high operating costs and poor cash flow management. After partnering with "More Than Numbers CPA," the company implemented a comprehensive debt reduction strategy, improved its budgeting controls, and optimized its cash flow. Within two years, it reduced its debt by 50% and returned to profitability. This case exemplifies the importance of engaging with the "best accountant in Greater Toronto Area - More Than Numbers CPA" for effective debt management solutions.

Conclusion

Effective debt management is essential for business growth and sustainability. By implementing strategies to reduce debt, preventing the accumulation of new debt, and knowing when bankruptcy may be necessary, businesses can navigate financial challenges with confidence. Partnering with the "best accountant in Greater Toronto Area - More Than Numbers CPA" ensures businesses receive the professional guidance needed to make sound financial decisions, maintain stability, and achieve long-term success. Whether you are a startup or an established business, having the right financial partner is key to managing debt and driving growth in today’s competitive market.

#charted professional accountant#accounting firm#accounting company in canada#charted accountant#tax accountant

0 notes

Text

Sweet Home Indiana

You guys are getting an absolute feast this week. Two chapters on regular posting days, the twenty snippets you got on WIP Wednesday, this, and of course more Across a Crowded Room tomorrow.

Enjoy!

Based off a post I saw on here (and didn't save for some reason) about the legal tangles gay people had to go through when gay marriage was federally legalized because a lot of them married different people in different states because their marriage in California wasn't legal in the other states and just never bother to get a divorce.

And my brain let's Steddify this shit Sweet Home Alabama style!

So here we go:

Eddie and Steve got married in Boston when Massachusetts made gay marriage legal. But they broke up when Eddie went to California with his band.

Cue Eddie going around and having a couple of really short marriages in different states. Tommy in New York for three months when the band was in New York recording an album. Billy in Hawaii for two weeks while Eddie was there on vacation.

Neither of them really mattered or were serious. Because they were only legal in the state they were performed in so Eddie didn't think anything about it.

Fast forward to a decade later, gay marriage is legalized across the country. Corroded Coffin has broken up and Eddie has a job as a tattoo artist.

Eddie goes to get a marriage license in Seattle where he's been living for the past five years. And is denied on the account he's a polygamist. He's still married to three different men in three different states.

Fuck.

His fiancee Chrissy is a legal assistant at a law firm so she has her bosses draw up annulments for Eddie's three marriages and has them sent out to all three of Eddie's exes.

Including Steve.

When Steve gets his papers, he's pissed. He hunts down Eddie's number and calls. Tells him that he can do the proper thing and tell him to his face he wants a divorce. None of this annulment bullshit like their relationship didn't matter. But until then he can fuck off.

Now Eddie's frantic. Because the reason why he and Chrissy were getting married in the first place is that her student visa ended in May and her work visa has been delayed three times. They have to get married otherwise she'll be deported. And no just a little across the border to Canada either, she's from Barbados.

He tells her the truth about Steve and how they were actually married for almost two years before Eddie left. They had been living in their home town of Hawkins where their marriage wasn't legal any way, but meant something to them.

Chrissy is upset he didn't tell her this sooner, because yeah, that's whole other kettle of fish. So she has her bosses draft a divorce decree and words it a whole lot nicer than the legalese of the annulment.

Eddie packs his bags heads to back to Hawkins and back to Steve. He has one week to convince Steve to sign the divorce papers.

He gets into to town and finds that Steve is the proud owner of the best bakery in town. And the best selling item is the chunky mint brownies Steve made just for Eddie when they first got together. Eddie gets a little sentimental about it, and Steve stubbornly refuses to sign the papers.

They go back and forth for a few days. They tumble into bed and Eddie wakes up, he finds Steve gone and the papers signed.

Only now that Steve has signed them, he doesn't want that anymore. So he breaks down crying and sobbing. He calls Chrissy and now Chrissy is as distraught as he is.

After they hang up Chrissy calls the bakery and Robin answers. Chrissy really needs to speak to Steve.

Robin tells her Steve can't come to the phone because he is covered in flour and can't because he'll get it messy. Chrissy asks if she calls his cell phone if Robin could hold it up to his ear, because she really needs to talk to him. But Robin refuses to budge. She banned Steve from having a cell phone around their giant stand mixer because he has lost three of them to the beast.

Robin offers to pass long the message, though. And Chrissy has to be content with that. She explains who she is and why Eddie needed the divorce. She tells Robin about Eddie's breakdown that morning and how he really didn't want to divorce Steve.

Robin and her get to talking about their best friends, missed connections and themselves.

While the girls are talking Eddie is having another freak out because he put the envelope containing the divorce papers in the mail box but realized he forgot to sign them himself. He needs to get them back so he can sign them, but he's afraid of getting arrested for tampering a federal post box trying to get the papers back.

He's near hysterics when Nancy finds him. She's in town visiting her family. And she helps him get the papers back by talking to the post office and they open the box and he gets them back.

She takes him to lunch to calm his clearly frazzled nerves. He tells her everything. And she tells him that while Eddie was in New York, Steve had gone to see him and when he saw how much bigger and better the big city was, Steve decided if he was going to win Eddie back, he had to make something of himself. And thus began the bakery. He almost had enough to fly to Seattle and woo Eddie. But then this happened.

Now Eddie is really stricken. He wants Steve so bad, but Chrissy is out of options.

Nancy gives his arm a squeeze and Eddie heads back to the hotel he'd been staying at.

He finally looks at his phone and sees a lot of messages and texts from Chrissy begging him not mail the divorce papers yet, she has a plan. Cue Eddie having a final breakdown in his hotel room, sobbing and wrung out.

There is a knock on his door and Eddie is confused the only person who knew his hotel and room number was Chrissy and she's in Seattle. But he gets up to answer and suddenly has an armful of Steve Harrington. Who is also a sobbing wreck.

After both of them calm down, Steve tells him he only signed the papers because he wanted Eddie to be happy. And if that meant being divorced from him, he'd do it.

But Eddie's isn't happy. He's sad and hurt and lonely. Steve is too.

They fall asleep in each other's arms, placing their trust in their best friends.

The next morning they are woken up by Robin and surprise surprise, Chrissy.

They explained that since gay marriage is legal everywhere now, Robin is going to marry Chrissy. And she'll swap places with Eddie. She'll go back to Seattle with Chrissy and Eddie can stay here with Steve.

It's perfect.

They get a marriage license and walked down the courthouse where Eddie and Steve are their witnesses. While the judge is talking, Steve pulls out Eddie's old ring. The one he returned to Steve when he moved out to be with his band.

He slips it back on Eddie's ring finger where it belongs. They kiss at the same time Chrissy and Robin do.

A couple years later Chrissy becomes a lawyer and her and Robin move back to Hawkins where Eddie has opened his own tattoo parlor, right next to Steve's bakery.

And they all live happily ever after.

ETA: Full Story here.

Permanent Tag List: @mira-jadeamethyst @rozzieroos @itsall-taken @redfreckledwolf @emly03 @spectrum-spectre @estrellami-1 @zerokrox-blog @gregre369 @a-little-unsteddie @chaosgremlinmunson @messrs-weasley @chaoticlovingdreamer @maya-custodios-dionach @danili666 @goodolefashionedloverboi @val-from-lawrence @i-must-potato @carlyv @wonderland-girl143-blog @justforthedead89 @vecnuthy @irregular-child @bookbinderbitch @bookworm0690 @anne-bennett-cosplayer @yikes-a-bee @awkwardgravity1 @littlewildflowerkitten @genderless-spoon @cinnamon-mushroomabomination @dragonmama76 @scheodingers-muppet @ellietheasexylibrarian @thedragonsaunt @useless-nb-bisexual @disrespectedgoatman @counting-dollars-counting-stars

184 notes

·

View notes

Text

Facebook's parent company Meta has removed hundreds of fake Facebook accounts operated by an Israeli marketing firm that targeted audiences in the US and Canada, according to its adversarial threat report published on Wednesday

The company said it identified 510 Facebook accounts, 11 Pages, one group, and 32 Instagram accounts involved in coordinated inauthentic behavior.

#palestine#gaza#free palestine#ceasefire#free gaza#adropofhumanity#israel#usa is a terrorist state#israel is a terrorist state#rafah

113 notes

·

View notes

Text

The IRS will do your taxes for you (if that's what you prefer)

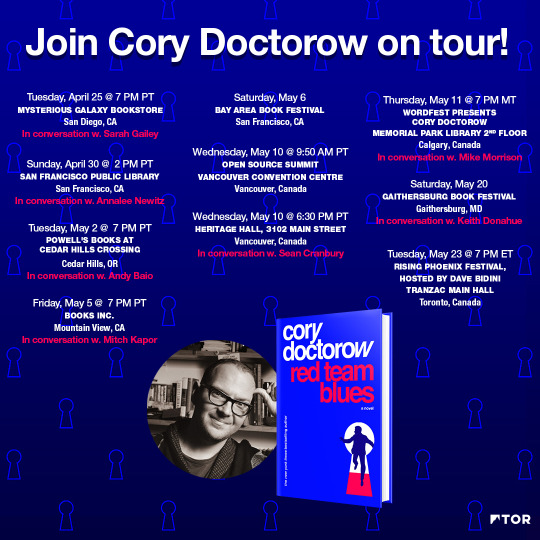

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

America is a world leader in allowing private companies to levy taxes on its citizens, including (stay with me here), a tax on paying your taxes.

In most of the world, the tax authorities prepare a return for each taxpayer, sending them a prepopulated form with all their tax details — collected from employers and other regulated entities, like pension funds and commodities brokers, who must report income to the tax office. If the form is correct, the taxpayer signs it and sends it back (in some countries, taxpayers don’t even have to do that — they just ignore the return unless they want to amend it).

No one has to use this system, of course. If you have complex finances, or cash income that doesn’t show up in mandatory reporting, or if you’d just prefer to prepare your own return or pay an accountant to do so for you, you can. But for the majority of people, those with income from a job or a pension, and predictable deductions, say, from caring for minor children, filing your annual tax return takes between zero and five minutes and costs absolutely nothing.

Not so in America. America is one of the very few rich countries (including Canada, though this is changing), where the government won’t just send you a form containing all the information it already has, ready to file. As is common in complex societies, America has a complex tax code (further complexified by deliberate obfuscation by billionaires and their lickspittle Congressjerks, who deliberately perforate the tax code with loopholes for the ultra-rich):

https://pluralistic.net/2021/08/11/the-canada-variant/#shitty-man-of-history-theory

That complexity means that most of us can’t figure out how to file our own taxes, at least not without committing scarce hours out of the only life we will ever have to poring over the ramified and obscure maze of tax-law.

Why doesn’t the IRS just send you a tax-return? Well, because the tax-prep industry — an oligopoly dominated by a handful of massive, ultra-profitable firms — bribes Congress (that is, “lobbies”) to prohibit this. They are aided in this endeavor by swivel-eyed lunatic anti-tax obsessives, like Grover Nordquist and Americans for Tax Reform, who argue that paying taxes should be as difficult and painful as possible in order to foment opposition to taxation itself.

The tax-prep industry is dominated by a single firm, Intuit, who took over tax-prep through its anticompetitive acquisition of TurboTax, itself a chimera of multiple companies gobbled up in a decades-long merger orgy. Inuit is a freaky company. For decades, its defining CEO Brad Smith ran the company as a cult of personality organized around his trite sayings, like “Do whatever makes your heart beat fastest,” stenciled on t-shirts worn by employees. Other employees donned Brad Smith masks for selfies with their Beloved Leader.

Smith’s cult also spent decades lobbying to keep the IRS from offering a free filing service. Instead, Intuit joined a cartel that offered a “Free File” service to some low- and medium-income Americans:

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

But the cartel sabotaged Free File from the start. They blocked search engines from indexing their Free File services, then bought Google ads for “free file” that directed searchers to soundalike programs (“Free Filing,” etc) that hit them for hundreds of dollars in tax-prep fees. They also funneled users to versions of Free File they were ineligible for, a fact that was only revealed after the user spent hours painstaking entering their financial information, whereupon they would be told that they could either start over or pay hundreds of dollars to finish filing with a commercial product.

Intuit also pioneered the use of binding arbitration waivers that stripped its victims of the right to sue the company after it defrauded them. This tactic blew up in Intuit’s face after its victims banded together to mass-file thousands of arbitration claims, sending the company to court to argue that binding arbitration wasn’t enforceable after all:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

But justice eventually caught up with Intuit. After a series of stinging exposes by Propublica journalists Justin Elliot, Paul Kiel and others, NY Attorney General Letitia James led a coalition of AGs from all 50 states and DC that extracted a $141m settlement for 4.4 million Americans who had been tricked into paying for Turbotax services they were entitled to get for free:

https://www.msn.com/en-us/news/us/turbotax-to-begin-payouts-after-it-cheated-customers-new-york-ag-says/ar-AA1aNXfi

Fines are one thing, but the only way to comprehensively end the predatory tax-prep scam is to bring the USA kicking and screaming into the 20th century, when most of the rest of the world brought in free tax-prep for ordinary income earners. That’s just what’s happening: the IRS is trialing a free tax prep service for next year’s tax season:

https://www.washingtonpost.com/business/2023/05/15/irs-free-file/

This, despite Intuit’s all-out blitz attack on Congress and the IRS to keep free tax-prep from ever reaching the American people:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

That charm offensive didn’t stop the IRS from releasing a banger of a report that made it clear that free tax-prep was the most efficient, humane and cost-effective way to manage an advanced tax-system (something the rest of the world has known for decades):

https://www.irs.gov/pub/irs-pdf/p5788.pdf

Of course, Intuit is furious, as in spitting feathers. Rick Heineman, Intuit’s spokesprofiteer, told KQED that “A direct-to-IRS e-file system is wholly redundant and is nothing more than a solution in search of a problem. That solution will unnecessarily cost taxpayers billions of dollars and especially harm the most vulnerable Americans.”

https://www.kqed.org/news/11949746/the-irs-is-building-its-own-online-tax-filing-system-tax-prep-companies-arent-happy

Despite Upton Sinclair’s advice that “it is difficult to get a man to understand something, when his salary depends on his not understanding it,” I will now attempt to try to explain to Heineman why he is unfuckingbelievably, eye-wateringly wrong.

“e-file…is wholly redundant”: Well, no, Rick, it’s not redundant, because there is no existing Free File system except for the one your corrupt employer made and hid “in the bottom of a locked filing cabinet stuck in a disused lavatory with a sign on the door saying ‘Beware of the Leopard.’”

“nothing more than a solution in search of a problem”: The problem this solves is that Americans have to pay Intuit billions to pay their taxes. It’s a tax on paying taxes. That is a problem.

“unnecessarily cost taxpayers billions of dollars”: No, it will save taxpayers the billions of dollars (they pay you).

“harm the most vulnerable Americans”: Here is an area where Heineman can speak with authority, because few companies have more experience harming vulnerable Americans.

Take the Child Tax Credit. This is the most successful social program in living memory, a single initiative that did more to lift American children out of poverty than any other since the days of the Great Society. It turns out that giving poor people money makes them less poor, which is weird, because neoliberal economists have spent decades assuring us that this is not the case:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

But the Child Tax Credit has been systematically sabotaged, by Intuit lobbyists, who successfully added layer after layer of red tape — needless complexity that makes it nearly impossible to claim the credit without expert help — from the likes of Intuit:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It worked. As Ryan Cooper writes in The American Prospect: “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies”:

https://prospect.org/economy/2023-05-17-irs-takes-welcome-step-20th-century/

So yes, I will defer to Rick Heineman and his employer Intuit on the subject of “harming the most vulnerable Americans.” After all, they’re the experts. National champions, even.

Now I want to address the peply guys who are vibrating with excitement to tell me about their 1099 income, the cash money they get from their lemonade stand, the weird flow of krugerrands their relatives in South African FedEx to them twice a year, etc, that means that free file won’t work for them because the IRS doesn’t actually understand their finances.

That’s a hard problem, all right. Luckily, there is a very simple answer for this: use a tax-prep service.

Actually, it’s not a hard problem. Just use a tax-prep service. That’s it. No one is going to force you to use the IRS’s free e-file. All you need to do to avoid the socialist nightmare of (checks notes) living with less red-tape is: continue to do exactly what you’re already doing.

Same goes for those of you who have a beloved family accountant you’ve used since the Eisenhower administration. All you need to do to continue to enjoy the advice of that trusted advisor is…nothing. That’s it. Simply don’t change anything.

One final note, addressing the people who are worried that the IRS will cheat innocent taxpayers by not giving them all the benefits they’re entitled to. Allow me here to simply tap the sign that says “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies.” In other words, when you fret about taxpayers being ripped off, you’re thinking of Intuit, not the IRS. Just calm down. Why not try using fluoridated toothpaste? You’ll feel better, and I promise I won’t tell your friends at the Gadsen Flag appreciation society.

Your secret is safe with me.

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this thread to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

[Image ID: A vintage drawing of Uncle Sam toasting with a glass of Champagne, superimposed over an IRS 1040 form that has been fuzzed into a distorted halftone pattern.]

#pluralistic#earned income tax credit#eitc#irs#grover nordquist#guillotine watch#turbotax#taxes#death and taxes#freefile#monopoly#intuit

177 notes

·

View notes