#Apple Stock Price Prediction

Text

Apple Stock Price Prediction 2024,2025,2026,2027,2028, 2029, 2030.

Apple Stock Price Prediction 2024,2025,2026,2027,2028, 2029, 2030.

Unlocking the Future: Apple Stock Price Prediction Unveils a Path to Prosperity

What will Apple’s Stock price be in 2024, 2025, 2026, 2027, 2028, 2029, and 2030?

Welcome to the Apple stock price prediction post by the written MoneyHustle team, In this post, we will provide complete information about Apple Inc. (NASDAQ: AAPL) along…

View On WordPress

#AAPL - Apple Inc Forecast#Apple Stock Forecast#Apple Stock Price Prediction#Apple Stock Price Prediction 2024#Apple Stock Price Prediction 2025#Apple Stock Price Prediction 2026#Apple Stock Price Prediction 2027#Apple Stock Price Prediction 2028#Apple Stock Price Prediction 2029#Apple Stock Price Prediction 2030

0 notes

Text

This can't be happening.

“C’mon…c’mon…” You mutter through gritted teeth, leg shaking in discomfort.

The heli jerks from turbulence, but you don’t have it in you to panic. Another wave of stomach cramps hits you like a punch to the gut. You wince and breathe out hard. You’ve dealt with food poisoning enough to recognize the signs, except, it was never you in the patient’s position. Nikolai comes over the comms. Ten minutes from base. You could kiss the bastard. At this rate you know you’ll be able to make it back.

The rest of your team isn’t faring much better.

Price sits stock still at the end of your group, eyes far away. There’s a thick sheen of sweat on his brow. He looks paler than usual. Judging by the way his adam’s apple bobs up and down, you know which end the contaminated MREs are going to come up. And of course he fights his nausea all the way.

Next to Price is Gaz, who sits completely doubled over on himself. He tries to hide his grimace under the brim of his faded, blue ball cap but its no use. Despite the rushing wind and the crackling commands of the comms, you can make out his grunts of pain. A sudden jolt of turbulence makes him press a firm palm to his lower belly. He grits his teeth so hard his lips quirk up and you can see the gleam of his teeth. He crinkles his nose in disgust and discomfort.

Farther down on the bench sits Soap, who is (for better or for worse) completely passed out. He leans against Ghost, a thick dribble of saliva spilling out of the corner of his mouth. You cringe at the realization he’s probably going to puke upon being woken up. But, its probably why Ghost has his arm wrapped protectively around Soap’s shoulders. His arm position keeps the unconscious man upright, but also keeps him out of the predicted splashzone.

Speaking of Ghost, his eyes are wide and bloodshot, and his chest seems to heave with every breath. The two of you share a moment of eye contact before another wave of stomach cramps hit you. With every internal muscle you own, you force your body to keep your fluids inside you. It hurts so inconceivably bad, but thankfully the moment passes and you get a brief moment of relief. You don’t have much longer before you inevitably shit your pants, but hopefully you’ll have enough time to get to the bathroom.

Through heavy breaths you glance around again. Price is the only one who’s situation seems to have changed. His hand sits on his thigh, balled up in a tight fist. He seems to focus on it, for a moment before releasing his grip. He shakily exhales.

This is not good.

Nikolai comes on the comms again. Finally, it’s landing time. Everyone but Soap perches on the edge of their seats, fingers twitching at their seatbelt release buttons. You try really hard to think about your next plan of attack. The closest bathrooms from the helipad would be the men’s. If you remember correctly, they only have four stalls which are usually occupied. The women’s bathrooms are on the other side of the barracks. If you ran like hell you’d probably make it, but you’d most certainly disturb your fellow females with the very uncomfortable symphony of your body turning itself inside out. Then you have it. The best idea in your God forsaken life.

The rec-room restroom.

The rec-room was for 141 enjoyment alone, and thusly, the bathroom. There were two stalls (for male and female, but it didn’t really matter). If you were fast enough you could probably beat out Soap and Gaz. You were certain that both Price and Ghost were going to make a beeline for their personal quarters. Neither man seemed like the type to let their weakness show to their team.

The heli lands.

In a flash, seatbelts and kits are undone and tossed away. Ghost smacks Soap’s chest with the back of his hand. The Scot jolts upright, covers his mouth, then throws himself out of the still whirring aircraft. Everyone watches through their frenzied movements as Soap is the first to break. He trips and falls off the concrete helipad and into the grass surrounding it. He gets up onto his hands and knees, then vomits so hard his body shakes.

You feel a spasm in the back of your throat at the sight, but swallow it down. You will NOT be puking in the heli. In fact, you weren’t going to let yourself puke at all. Absolutely not.

Price is the first one out. You’ve never seen the man unsteady, and yet, you see him skip a step on the way down. A poor sergeant tries to greet him, but is pushed aside with a firm hand to the chest. Price would never do something like that unless…he wasn’t going to make it?

You stand there in shock for a moment, but then are nearly sent tumbling out of the heli. Gaz practically bowls you over as he runs after your Captain. He didn’t apologize either. You nearly grab at his collar and jerk him backwards out of annoyance, but opt to be the bigger person.

Okay. Show time.

The poor Sergeant winces as you stagger up to him. You ask him to send Soap to sick-bay, and to alert the medical staff that the whole team would be headed there at some point. He seems nervous, and so, despite your discomfort, you offer him a smile and a pat on the shoulder as you shuffle away. He visibly softens, then immediately rushes to Soap’s aid. You breathe out a sigh of relief. Of course, despite having to shit just as bad as the rest of them, you have to be the adult in this situation. Oh well, you know you’ll make it.

Just as you thought, Ghost was missing, probably already half-way back to his room. You throw yourself into overdrive. You zip through the back hallways and up the steps to the back of the barracks. Your boots skid on the old linoleum as you round the corner to the rec-room. You can hear the sounds of Gaz’s retching echoing through the hall. Just as you reach for the handle to the empty bathroom stall, a pair of hands grab you hard by the waist.

You scream. Mostly out of shock, but also of discomfort, as the movement causes your stomach contents to shift violently. You claw and kick at the man at your back, but it’s no use. You recognize his skeleton gloves in a heartbeat.

You elbow him hard enough he grunts but he doesn’t let go as he wrestles you out of the way. You cry at him, asking him why he can’t just go to his room. He doesn’t answer, but instead, jerks you towards the wall opposite the stall. You slip and fall, shoulder hitting the concrete. You hiss in pain but watch helplessly as the larger man slams open the stall and steps into it.

“Ain’t gonna make it.”

He then slams the door closed, the lock clicking shut.

You would’ve cried if not for the worst wave of cramps you’d ever felt. You double over and try desperately to clench your sphincters shut. Like hell you were going to let yourself shit your pants here on the rec-room floor. Fuck Ghost. If you had it in you, you’d shit on his bed for this fuck shit.

You breathe hard, centering yourself until the accursed wave finally leaves you. You know that if you don’t find a bathroom by the next wave, its all over. You think hard. You try desperately to locate a clean, out of the way bathroom using your fried brain’s mental map. You bite your bottom lip. You’ve got it!

You don’t remember the run to sick bay but you do remember crashing into the nurse’s desk. The head nurse seems to know exactly what your problem is. She uses her keys to unlock an unassuming closet at the end of the hall. You nearly cry for joy at the sight of the perfectly clean, porcelain throne. You don’t even think about closing the door as you shuck off your sweaty fatigues. The nurse, thankfully, locks the door from the outside as your ass hits the toilet seat. Right as the final wave of cramps hit you and you see God, your brain can only think of two things.

One, you’re never going to eat MREs again.

And two, you’re totally going to shit on Ghost’s bed for this.

#is this childish? yes#funnily enough this feels weirdly on brand for the 141#call of duty#mw2#cod imagines#simon ghost riley#john soap mactavish#captain price#kyle gaz garrick#mw2 headcanons#cod mwii#i would shit on ghosts bed for less tbh#jk i love him but id definitely threaten him with that

532 notes

·

View notes

Text

The Apple (AAPL) Stock Price Prediction 2022, Apple Stock Forecast 2040, what will apple stock be worth in 2050, can apple stock reach $1,000, Apple stock forecast 2026 And Get More Financial Information. Read More

0 notes

Text

The Future of The Internet: An Intuitive Deep Dive Into The Madness Of Millions

First off: This is gonna be a prediction on such a mass scale. I don't expect anyone to really FULLY pick this up (it is a prediction after all, so it's like throwing stuff at the wall to see what sticks). But from what my spirit guides are telling me to do right now, they want me to push this out as far as I can because of the Pluto In Aquarius permanent ingress happens next year. We're all changing for the better and somehow the internet is going to FULLY reflect that. Why am I capitalizing 'fully'? Three of the most mundane planets are influencing this. Uranus, Neptune and Pluto. The icey planets are changing the paradigm soon and it's gonna flip a whole switch on our digital reality. Kind of like a 'whopping us into some sense' type of way. A rough face slap essentially. Or would it be like a baby giraffe who just arrived and has gotta walk on stubbly legs? Who knows.

And because of the current state of hateful and aware affairs.... it looks pretty tribal and yet all too liberating at the same time.

Without further ado, more below the cut!! ~ <3

HISTORY

Now most aren't really too speculative on where the internet started, but with a little research on hand, there have been speculations that the original basis for the internet and how it was programmed in it's "alpha" form, would be around October 29th, 1969. It was mainly a military owned and insider personnel type thing. Used for the benefit of the government to send messages to its military at a faster rate than normally possible at that time. Doesn't help that if we keep it to the basics of the sun being in scorpio (the personification of what 'underbelly' means), and knowing the ruler of that sign being Pluto (which so happens to be in a mercurial/communicative sign, Virgo), insider communication seems to check out perfectly. Setting the precedent of what's to come.

On closer inspection Pluto sat at the last decan of Virgo. Taurus being its sub-ruler. Which brings its slow-notoriety and slow-growth to the public eye.

Because after over a decade, the internet has its "beta" release because of Xerox's more interactive systems. Networks being more common, has brought more information sharing and an ultimate release for IBM systems. The computer went from a government owned invention, to a technological advancement for business and relaying data on stock prices on January 1st 1983. Very much a business incorporated sign for it to be born in, being Capricorn, we look to its ruler Saturn for extra conformation. Again, more notions of privacy and economy come to the internet. It sits once more in Scorpio. Dealing with the 'underbelly' once again. Taking another chance to look at the ruler of the sign Saturn was sitting in, it brings us to Pluto being in Libra. Which libra does deal with connections and solid foundations among people. Agreements and liability. Saturn's exalted sign as well, don't forget.

So the two (Saturn and Pluto) are in mutual reception. Businesses and powers-that-be are in symbiosis despite neighboring one another. Neutralization of any discomfort (which makes me think of a sextile -- a sextile that isn't a sextile at all (man, ping that to your notes about mutual reception hehe)).

Then, when 1984 came around, the Macintosh released the FatMac. Bringing the computer to the Homefront with a 'computer for the rest of us'. A bit of virtue signaling to the future of where computers were ULTIMATELY headed. We love Apple. God bless the genius of Steve Jobs y'all <3 (besides we'll do a whole bit on this at some point the more I think on that).

But to bring the internet to the Homefront, coding had to have improved. Which, once more and finally, do we get to the internet "driving down your neighborhood street". It finally comes home on April 30th 1993. A nearly exact opposite to the "alpha" release we discussed all the way at the beginning of this section. This is where the 1.0 phase of the internet comes in. The World Wide Web ("www"). From personal studies on dates I thought were significant, colored blue like this, this day would particularly stick out to be a very Saturn and Moon dominant day. Jupiter being in third. It brings a structural (Saturnian) and personal (Lunar) backdrop to what's coming down later. HTML was released this year as well. Bringing more of an emphasis on that structure. Setting off more of the creativity in some people. In terms of modality, it was Cardinal heavy. Pioneering and brand new. Plus, because of the newness to this invention and the fact that this IS the 1.0 release, it started a... settling the Oregon trail kind of energy.

I know, the connotations of saying that are very dark, but an analogy is an analogy. We colonized the digital space as a human race. And we still do with the sphere of the STILL current invention of Virtual Reality.... lil food for thought..

Let's backtrack to the nineties once more shall we? I'm not done (cause we're only getting started!)

Geocities

Established and released in November of 1994, this started the wide WIDE reach to have people start their own website. A lot of the energies involved were once again tied to Scorpio. Now beginning to show the Piscean side on top of that. Tying in more creativity and personal-ness to the sites people had made. Capricorn being involved too, enhancing the structure of the internet once again with the infamous release of this digital product.

To make another very similar analogy to American history, the internet has brought a sense of decentralized-ness. Or, if we were going to use a more 'american-historical' term, it was a 'confederation of sites'. No big central power to the way in which it worked. Even if you had search engines. It was all of the people who made them.

To make an astrological connection to this, Saturn (structure and now coding), was in Aquarius. A sign dedicated to the underdog and smaller man. The 'we-the-people' kind of energy that we see now with Pluto in Aquarius in 2024.

God had blessed the United States back then am I right?

Time flies and now we land on the date December 17th 1996. CSS and coding for the 'look' of a website makes itself a lot more accessible and easier for people to grasp. Better yet, it was a tool released for the folks willing to enhance usability and design for their digital experience at the time.

The energies on that date were relatively splashed. Nothing too significant. And with my synesthesia, the one thing that comes to mind when someone says 'splash' is paint and iridescence. Bringing more of that emphasis on the freedom to design and enhance a users experience in the personality of sites that were created. By 1996 though, Pluto has finally reached Sagittarius! GEN Z REIGN SUPREME (despite our never-ending depression we'll get through it though I promise you that)!! Again, igniting that need to bring a sense of adventure. More people start to join the online space. With Saturn at zero Aries by this day (structures in detriment and a new Saturn cycle sadly), there's a theme of freshness and the slates wiped. So, again, more pioneering and newness. Hell. This is where Saturn and Pluto are in trine with one another. And if the powers-that-be externally meet up in harmony like this, oh you know it's gooooooddd.

The golden age of the internet begins.

Although started with water, invert the alchemical triangle to the upright position..... and alchemy begins to take shape. so to say~

GOLDEN AGE - 1999

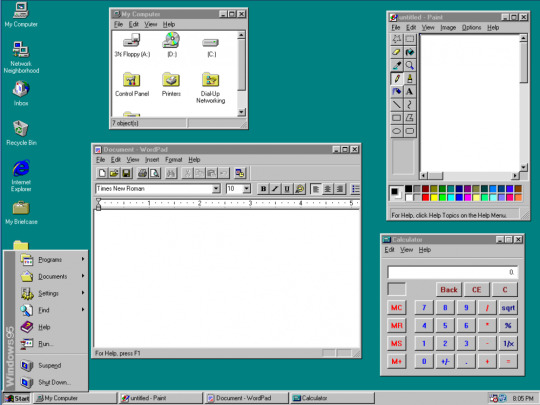

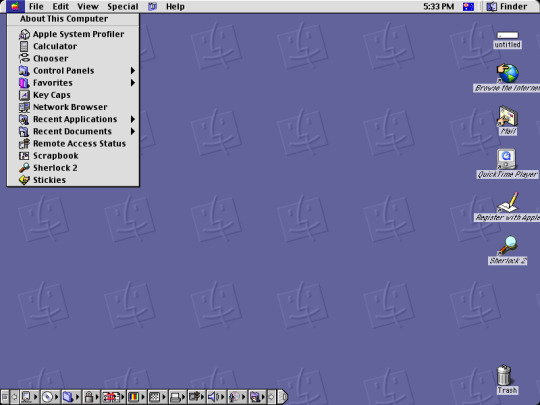

Alrighty! We made it to the y2k movement pre-2000s. color was all the rage thanks to CSS and HTML makes it much more possible to code ones own sites. The tools continue to evolve and become more advanced. Not to mention the commodified Windows 95 and 98 experience was well underway this year, and Macintosh brought in Mac OS by this point. I mean... do you see this absolutely gorgeous graphics on both of them????

(even though they were rivals, they both had a lovely look to them)

what comes next after these years? 1999 of course! A BIG PROPRIETOR FOR 2.0

Geocities get's acquired by Yahoo! (January 28th 1999):

This day was huge with a lot of energies being torn between Taurus and Aquarius (yet, I see the contrasting energies actually quite beneficial to one another). Most of the Taurus comes from the degrees in which some of the planets were situated (using degree theory as a base for this). But the contrast on both has fixed earth and fixed air. Some would say it's because the detached and logical energy of Aquarius doesn't get the slow to grow and traditional ways of life side of Taurus, but I see them coexisting. Like how fog creates the dew in grass on those very revitalizing yet calm 'last days of school' that you may have experienced. Take what resonates as usual. If it doesn't es fine. But it's foggy air, calm winds and the dew sitting on cool crisp grass. It's a good mix.

Hell one could say it's Venus and Uranus working together. A wonderful (Venusian) surprise (Uranian) to the collective.

Hell it made Geocities far more accessible because of Yahoo being a rising name in the internet search engine space.

HTML 4.01 (December 1999)

Maybe it was an attempt to absolve the 'y2k' bug, maybe it wasn't. But what it DID bring, was more unanimity to the eventual structure of the internet. The Taurus-Aquarius energies are still prominent, yet it was slightly different with Jupiter at 25º of Aries. Doubling up on Aries energy since 25º Aries is on an Ariean degree. So, more luck in pioneering more sites for more online adventures.

Saturn in particular was in 11º Taurus (in the Aquarian degree) when the released occured this month. Bringing more of that 'stability' aspect to the freedom to code. And then the outer planets were set in Aquarius to Taurus degrees. Except for Pluto..... Sagittarius 10º.... Capricorn degree. This was gonna lead to success either way.

2000's

So, what else? We made it to 2000. And 2.0 was at its time. It brought such big risers like YouTube, Facebook and MySpace this decade. Geocities continues to be used and with that, there was more of an emphasis on respect for what people brought to the online space.

It of course raised the question about living double lives and with the invention of proto-social media, personas slowly begin to fall. Eventually there's more real-life integration and an 'everyone in' type energy because of Pluto in Sagittarius destroyed the boundaries of intercontinental travel with the advent of speaking to someone on the other side of the planet with your PC. Fucking wild shit man.

Soon, the 2010's approach. Windows 8 is soon to release in the next few years

.... it brings us to another component.

2013 - Neocities

The indie web. An alternative to Geocities because it used HTML4.whatever at this point. Evolution is pretty hard to pay attention to when you're tryin' to write a whole thing on the history of how we function on the web; just to prove a point.

Before we go on about the astrology of such, this year also marks a turning point in the internet. I personally see this as the seed for delusion and craze. Social media starts to make our real life selves more noticeable. Sure, it enhanced communication to an even MORE personal level. But, the internet was highly synthetic and had fictional tones. So, the homogenization begins with bringing those same sites who were rising stars in the 2.0 era, into the current state of affairs. They became big conglomerates. Years continue with them starting to implement ad-revenue systems, stock exchange and other such money-power-lucrative systems that the newly ingressed Pluto in Capricorn is willing to expose. By 2019, geocities is completely shut down. Personality has been swiped away in trade of Wix's dull and corporate look.

Back to my point, a secret stem to this internet begins to slowly form. Neocities.

June 28th 2013

Because this site is a major nostalgia revamp, its ultimate goal of replicating and replacing the former private-on-public-server brethren has since reached its goal today. Look to Tumblr and you notice the culture if you throw in the hashtag for it. Most people don't notice since they're too busy protesting thanks to Neptune in Pisces being our current cycle. Yet, when you want to leave the homogenized internet for something a little more personal and free to your own designs, then this would be your ticket. But it's gonna take effort to code a site.

Much like it takes effort to build a home, this release has a slight pull toward more of a water dominant presence. Bringing the full story of privacy and personality full front and center. But, because of the addition of fire in its chart, there's a lot of support for the freedom to adventure out and stand out. So, Fire and Water heavy.

It's best to work in short bursts. But put your ALL into it when you can/do.

NOW

With the advent of Neptune in Aries, Uranus in Gemini, and Pluto in Aquarius being on the precipice of what's to come, I think there'd be point where the homogenization of the internet is going to be too much to bear. I'm not trying to make this an eventual doomscroll, but don't you feel like the internet is kinda..... dying? Do we really need AI? Do we really need Bitcoin? Do we reallyyyy need this or that or anything to digitally exist other than just a little taste of our souls?

I see a split (fracture) and a break.

SPLIT

if push comes to shove and we DON'T regulate AI or make it so where it's NOT subscribe able and it's a free service (i.e. we teach people the ways of building these mechanisms and make it easier to do so), then the internet is gonna split.

You'll have social media (the first one in the group), suddenly fall. The toxic nature could start to die down and become less and less significant as we get around to moderating our use. Respect could come back this way, but with the advent of that, it's the responsibility that comes with using the internet. Being careful with what you put out and more needs to teach digital literacy at a younger audience.

Fandom could take a slight hit because of this. Having a full-circle experience of everything I had to know about what it means to be in one, from being banned, blocked to accepted and loved, as well as the arguments over logistical means in a fictional world (which by the way Neptune in Pisces loves to blend reality with the incomprehensible imagination and raw emotions we get). Antiship and Proship wars too. (That's also gonna be something I wish to talk about with my Neptune in Aries predictions) But because of the 'digital literacy' clause and intent of stuff stated above, it'll take a slight hit where fandom may have a more respectful way of saying or doing such and so. Silent blocks, DNI alerts, the usual that we're so encompassed to.

Other than that: Forums or modified forums become the norm as we revert to a more personal and open lifestyle with the digital space. Doxxing and callouts will still happen, yet I feel as a greater disdain and utter repulsion for it could occur.

All of this could be known as ADAPTATION for some.

Better yet, true RESPECT.

BREAK

If push comes to shove and the internet space begins to get a little too dicey and personal, basically making it more of that TRIBAL sense of finding your people (not to mention it starts to also devolve to where there's cases of subconscious levels of aggression and too many 'what-if's' being thrown around -- i.e. assumptions, accusations and subliminal hate), then something out there or somewhere is gonna completely tear apart the fabric of the internet. For a bleak example: a foreign country hacks into our digital region. Our VPN.

Aries is ruled by Mars. Mars rules knives and seperations. Wars. If Neptune rules over the subconscious over everyone, this could bring about primal actions on a structure like this.

! not to mention that Saturn (code, structure), conjuncts with Neptune (dissolution and dissolving/illusions and spiritual destiny)... and Aries is known for the anger and drive that it has......

we could revert back to a 1.0 like state of mind.

Addictions to social media will have huge withdrawals. Attention and clout chasing will get worse outside of that, and it just straight up becomes a crime.

One thing's for certain. We learn a lesson of being careful to not put our personal information out there.

.... but that break gives a chance for the proto-web to come back. Hyper-personalization and drive to keep it within chat services like Discord could become even more so the norm or remain as they are. HTML 6 could come out and bringing the retro look with offline capabilities to the public. So as long as we're careful not to once again put our information out there, then that might bring us to once again let the people shine.

The key theme with the break is RESTART.

I apologize if it did seem bleak or aggressive. It’s what I channeled and like I said, if you don’t resonate with it, don’t have to worry about it. 🧘✨

my last couple of statements before we close this off with resources, and one is gonna sound a lot like Smokey The Bear.

Care will prevent the destruction of our exchange in ideas and communication.

Only YOU can prevent the 'break'.

so let's strive for a 'split' alright?

~visiblenostalgia

and then there's something one of my professors had admitted.

"We have more information than ever, but we're more uninformed than ever."

and a small song before I really tie this up.

youtube

love you guys <3

RESCOURCES:

#astrology#astrology observations#pluto in aquarius#aries#astro notes#spotify#astro observations#horoscope#astro community#neptune in aries#history of the internet#neptune in aquarius#neptune in pisces#00s#90s#geocities#neocities#fandom#uranus in gemini#peace and love#embody peace#get peace#respect and be respected back <3#age of aquarius

31 notes

·

View notes

Text

Apple has a Spotify problem—and it just cost the iPhone maker a $2 billion fine from the European Commission.

For years, the two companies have been at war as the streaming service lured users away from Apple’s iTunes and accused the tech giant of exploiting its dominance to stifle innovation. In their long-running conflict, each has made incursions into the other’s territory. When Apple launched its own streaming service, Apple Music, in 2015, Spotify claimed Apple was able to undercut the platform’s prices because Apple didn’t have to pay the same App Store fees as rivals. In 2019, Spotify began an ambitious podcast spending spree, splashing out on high-profile shows, in another direct challenge to Apple.

The feud’s early days were civil, with few barbs traded in public. “We worry about the humanity being drained out of music,” said Apple CEO Tim Cook in 2018, a cryptic comment widely interpreted as a jibe at Spotify’s heavy use of algorithmic recommendations. But Spotify became more outspoken as EU politicians started to call for laws to reign in Big Tech. The €1.8 billion ($1.9 billion) fine on Apple announced by the European Commission today shows that its tactics are working.

The fine originates in a legal complaint filed with the European Commission by Spotify in 2019, challenging the restrictions and fees Apple places on developers listing their apps in the App Store. Today the European Commission agreed, saying that Apple’s App Store restrictions amount to unfair trading conditions that may have led iOS users to pay significantly higher prices for music streaming subscriptions.

“For a decade, Apple abused its dominant position in the market for the distribution of music streaming apps through the App Store,” said Margrethe Vestager, the EU’s competition chief, in a statement. “They did so by restricting developers from informing consumers about alternative, cheaper music services available outside of the Apple ecosystem.”

Apple’s App Store rules restrict music streaming companies and other apps from informing their users on Apple devices about how to upgrade or sign up for subscription offers outside of the app. Instead, app users can only see sign-up options for in-app subscriptions via Apple’s payments system, where prices are likely to be higher because Apple takes a cut. Some app makers, including Spotify, do not offer in-app purchases because they don’t want to pay this commission. "Some consumers may have paid more because they were unaware they could pay less if they subscribed outside the app,” Vestager said. “This is illegal under EU antitrust rules.” Apple, which says the EU has failed to provide credible evidence of consumer harm, has pledged to appeal.

Big Number

The fine is far bigger than expected, prompting Apple’s stock to drop 3 percent on Monday. Media reports based on unnamed sources had predicted a penalty of around €500 million. It’s also one of the biggest fines the EU has ever issued against a tech company, ranking below only two Google fines of $5.1 billion and $2.4 billion. Vestager explained in a press conference that the scale of the fine is intended to prevent the company from breaking rules in the future. She added that the amount includes a “lump sum” to “achieve deterrence.” $1.9 billion amounts to 0.5 percent of Apple’s global turnover, she said.

Although Spotify CEO Daniel Ek has expressed disapproval of Apple’s business tactics, he’s also something of a reluctant figurehead in Europe’s fight against Apple. The self-described introvert has adopted the role of spokesperson for disgruntled European app developers who finally feel their complaints about Big Tech are being heard.

On Monday, Ek posted a video on X in which he described Apple as a threat to the open internet. “Apple has decided that they want to close down the internet and make it theirs, and they view every single person using an iPhone to be their user and that they should be able to dictate what that user experience should be,” he said. Ek also claimed Apple wants to effectively levy a tax on Spotify while exempting its own music service, Apple Music.

Apple hit back at Spotify in a statement posted to its website. The company pushed back on the idea that Spotify had suffered as a result of its policies, instead describing the platform as an App Store success story, pointing out that Spotify’s app has been downloaded, redownloaded, or updated more than 119 billion times onto Apple phones.

“We’ve even flown our engineers to Stockholm to help Spotify’s teams in person,” Apple’s statement said. For all that, Apple says, Spotify pays them nothing. “But free isn’t enough for Spotify,” the statement continues. “They also want to rewrite the rules of the App Store—in a way that advantages them even more.”

Spotify is one of the few European consumer tech companies with a significant global business, so people in the continent’s tech community listen when it speaks out. Spotify’s latest criticisms are spurring more European developers to complain about what they consider to be unfair treatment by the tech giant—putting the European Commission under even more pressure to act. “Apple holds app providers ransom like the Mafia,” Matthias Pfau, CEO and cofounder of Tuta, an encrypted email provider based in Germany, told WIRED last month, echoing frustrations also voiced by US app developers such as Epic Games.

For Apple, Spotify’s success today is potentially an omen of future action from the EU. This week marks the deadline for compliance with Europe’s Digital Markets Act, a new antitrust law designed to prevent the internet from coming under the control of only a handful of big—usually American—platforms. The new law gives Europe the power to fine tech companies up to 20 percent of their global turnover, meaning future fines could make dwarf $2 billion levied on Apple today.

“This is the commission saying, ‘We're going to be tough, particularly on Apple,’” says Max von Thun, Europe director of the Open Markets Institute, of the decision today. “I see this as kind of small compared to what's to come.”

11 notes

·

View notes

Text

In the Covid panic of 2020, people realized that they no longer needed to go to the office. This led to a spike in office vacancies and a big drop in prices.

Bill Bonner

Aug 15, 2024

Thursday, August 15th, 2024

Bill Bonner, writing today from Poitou, France

First, it appears that Warren Buffett is doing the same thing we are — moving to Maximum Safety Mode. Charlie Bilello:

Berkshire’s Cash Pile spiked to a new all-time high of $277 billion, increasing by a record $88 billion during the 2nd quarter. $75 billion of that came from stock sales with Berkshire selling nearly half of its position in Apple. Berkshire Hathaway is now holding 25% of their Assets in Cash, the highest percentage since 2004 and well above its historical average (14%).

Why is Buffett selling Apple? Bilello points to the obvious reason — it’s gotten far too expensive. Today’s price is thirty times earnings and nine times sales, the highest level in the company’s history. Apple has been a marvellous success. Buffett bought his stake in Apple in 2016, when the stock was trading around $25. Now, it’s $220. What is the likelihood that the price continues to go up?

We don’t know, but the more expensive a company is, the more marvelous it must be. Taking the long view, marvels always cease. Apple was founded 48 years ago. It was a leader in the Internet Revolution. But the revolution may be over.

Aztec Real Estate

We’ve spent this week looking at the big picture... and the role of problem solving in causing societies to decline. How and when the Big Picture comes to bear on the Little Picture is our subject for today.

The price of real estate in the Aztec capital, for example, must have taken a tumble when Cortés massacred the inhabitants. But until his brigantines appeared on Lake Texcoco there was little sign of the coming catastrophe in Aztec asset markets.

The same was true for the handsome houses of Pompei, covered with hot ash when Mt. Vesuvius lost its top in 79 AD. The loss was sudden... unanticipated... and catastrophic.

5 notes

·

View notes

Text

Best POS System for Small Business: A Guide to Streamline Operations and Boost Sales

For small business owners, a Point of Sale (POS) system is more than just a tool for processing payments—it’s an all-in-one solution for managing transactions, inventory, and customer relationships. The best POS system for small business should offer ease of use, scalability, and affordability, helping you improve operations and grow your business. Here’s how to choose the right POS system for your small business.

What Makes the Best POS System for Small Business?

Not all POS systems are created equal, and finding the right fit for your small business depends on a few essential factors. Here are the key features you should prioritize:

Simplicity and Ease of Use

As a small business owner, you need a POS system that doesn’t take hours to set up or train employees on. The best POS systems come with an intuitive user interface, allowing staff to quickly learn how to use the system and reducing the chances of errors during busy hours.

Comprehensive Payment Options

Today’s consumers expect flexibility in how they pay. Whether it’s through credit cards, mobile wallets like Apple Pay and Google Pay, or contactless payments, your POS system should support multiple payment methods to keep customers happy and transactions smooth.

Inventory Management

For small businesses, managing inventory can be a challenge, especially without a streamlined system in place. The best POS systems for small business offer real-time inventory tracking, automatically updating stock levels after each sale. Some systems even send alerts when inventory runs low, ensuring you never miss a sale due to stockouts.

Mobile POS Capabilities

If your small business operates in more than one location—whether it’s at pop-up shops, markets, or on the go—a mobile POS system is essential. Mobile POS solutions allow you to process transactions via a smartphone or tablet, ensuring seamless payments wherever you are.

Detailed Sales Reporting

Understanding your sales data is crucial for making informed decisions. The best POS system for small business should offer robust reporting features that provide insights into your top-selling products, peak business hours, and customer behavior. This data will help you fine-tune your strategy and increase profitability.

Integration with Other Tools

Your POS system should be able to integrate with other business tools such as accounting software, payroll, or customer relationship management (CRM) systems. This integration can save time, reduce manual data entry, and improve the accuracy of your business records.

Why Small Businesses Should Invest in the Best POS System

Implementing the right POS system can offer numerous advantages to small businesses, helping you streamline daily operations and optimize customer experiences:

Efficient Operations: Automating tasks such as sales tracking, inventory updates, and customer data management allows you to spend less time on administrative tasks and more time growing your business.

Enhanced Customer Service: A quick, reliable checkout process improves customer satisfaction, leading to higher retention rates. Some POS systems even offer loyalty programs that encourage repeat business.

Improved Business Insights: With real-time access to sales data, you can identify trends, adjust pricing, and predict inventory needs, ensuring your small business stays competitive.

Top POS Systems for Small Businesses

Here are a few of the best POS systems for small businesses in 2024:

Square POS: Perfect for small businesses looking for a versatile, budget-friendly option. Square offers a free POS system that includes essential features like payment processing, sales tracking, and customer management. It’s also highly mobile, making it great for businesses on the go.

Lightspeed POS: A popular choice for retailers, Lightspeed offers advanced inventory management features and can support multiple locations. It also integrates well with e-commerce platforms for those running both brick-and-mortar and online stores.

Shopify POS: If you operate an e-commerce business alongside your physical store, Shopify’s POS system is a great option. It seamlessly integrates with your online store and provides excellent inventory management features.

Conclusion

Finding the best POS system for small business operations is critical to your success. A good POS system can improve efficiency, boost customer satisfaction, and provide valuable insights that help you grow. Prioritize ease of use, mobile capabilities, and integration with other business tools as you evaluate your options. By choosing the right POS system, you’ll be setting your small business up for long-term success.

0 notes

Text

BUYING WEDNESDAY! NVIDIA STOCK! TESLA STOCK! GME STOCK! BABA STOCK! TLT! MORE! | Will Knowledge

https://www.youtube.com/watch?v=YP5oL9gf-Aw

In this video, I go over stock market price predictions on stocks like Nvidia stock, pltr stock, tesla stock, GameStop stock, intel stock, apple stock, and more!

SEE MY BUYS AND SELLS! ALSO JOIN OUR PRIVATE TRADING LIVESTREAMS! Prices increase in 5 day!

👉 Website: https://ift.tt/aApQm5j

✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@WillKnowledge/?sub_confirmation=1

✅ Important Links:

Use my same platform (Trading view) To have the exact same levels!

👉 https://ift.tt/8ZugcyW

This is an affiliate code, I will receive compensation from you signing up!

👉 Website: https://ift.tt/aApQm5j

✅ Stay Connected With Me:

👉 Instagram: https://ift.tt/BOGcVCN

==============================

✅ Other Videos You Might Be Interested In Watching:

👉 Double Your Money in 2 Minutes! Stock Market Tips to Turn $1,000 into $1,000 | Will Knowledge

https://www.youtube.com/watch?v=Qrw_a6EuHtg

👉 Best Stocks to Buy Now: NVIDIA, Tesla, Nike, Meta, Gold, and More! | Will Knowledge

https://www.youtube.com/watch?v=6jl_siqD09A

👉 Stock Market Crash Alert: Key Levels You Must Watch! | Will Knowledge

https://www.youtube.com/watch?v=JLsh_-HZoOE

👉 Top Buys: Tesla, Nvidia, AMC, Apple, and More Stock Market Analysis! | Will Knowledge

https://www.youtube.com/watch?v=PTM98qWBfd8

=============================

✅ About Will Knowledge:

Hello Team! This channel is about investing in the stock market, trading options, and general knowledge of the market tools to use to your benefit so we can all spread the wealth.

For collaboration and business inquiries, please use the contact information below:

📩 Email: [email protected]

🔔 Subscribe to my channel for more videos: https://www.youtube.com/@WillKnowledge/?sub_confirmation=1

=====================

#stockmarket #biden #trump

Disclaimer: These videos are for educational and entertainment purposes only and should not be construed as financial advice or a recommendation to buy or sell any security or investment. I am not a financial advisor, and the information provided is not intended as investment recommendations. Please consult with a licensed financial professional before making any financial decisions. I shall not be held liable for any losses incurred from investing or trading in the stock market, including attempts to mirror my actions. Remember, unless investments are FDIC insured, they may decline in value and/or disappear entirely.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use

© Will Knowledge

via Will Knowledge https://www.youtube.com/channel/UCXnjHTVPeCp7hNEj_15Gx4w

September 25, 2024 at 04:00AM

#stockmarketinvesting#learnhowtotrade#entrepreneur#education#generalknowledge#stockmarket#willknowledge#money#explore

0 notes

Text

US Presidential Elections and Investment Strategies: 3 Golden Rules from the Experts

How will the 2024 US Presidential Election impact the market? We delve into investment strategies and future outlook.

With the 2024 US Presidential Election on the horizon, we examine its potential impact on the market, drawing insights from expert opinions. While the election is a major market-moving event, historical data reveals some surprising trends.

Navigating Market Volatility: 3 Golden Rules

Wait for the Dust to Settle

Markets tend to be volatile in the lead-up to a presidential election, with limited directional clarity.

Significant market moves are unlikely until the election results are confirmed and policy directions become clearer.

Historical data suggests a tendency for stock prices to rise for approximately six months following a presidential election.

Don't Rely on Market Predictions

Market predictions have been inaccurate in the past two US presidential elections (Trump vs. Hillary and Trump vs. Biden).

Even experts struggle to predict election outcomes, so basing investment decisions solely on predictions is risky.

Focus on China Policy

The China policy during the Trump administration triggered a trade war, contributing to stock market declines.

The US-China relationship will likely remain a significant market influencer, requiring close monitoring.

The Power of Long-Term Investment: Any Time is a Good Time to Buy US Stocks

The US stock market has historically exhibited a long-term upward trend.

Past data indicates that investors holding US stocks for 15 years or more have consistently earned positive returns, regardless of their entry point.

This highlights the importance of adopting a long-term investment perspective, rather than focusing on short-term market fluctuations.

Investment Strategies: Diversification and Growth Potential

Index-tracking Exchange Traded Funds (ETFs) like the S&P 500 offer diversification benefits, enabling investors to mitigate risk while pursuing returns.

However, investing in individual stocks with high growth potential requires thorough research and meticulous risk management.

Future Outlook: Will the Nikkei 225 Reach 70,000 by 2030?

Experts suggest that the Nikkei 225 could potentially reach 70,000 by 2030.

This projection considers the anticipated growth of the Japanese economy and the long-term upward trajectory of the US stock market, making it a feasible scenario.

Final Thoughts

While presidential elections are major market events, it is crucial to adopt a long-term investment strategy and avoid overreacting to short-term fluctuations.

By diversifying investments, considering growth potential, and closely observing US-China relations, investors can make informed decisions to navigate the market effectively.

Key Terms

NISA (Nippon Individual Savings Account): A tax-exempt investment program for individual investors in Japan. A new NISA program is set to begin in 2024.

FAANG+: Refers to high-growth stocks of Facebook, Apple, Amazon, Netflix, Google, and Microsoft.

All Country: An investment fund that invests in stocks across the globe.

Risk Tolerance: An individual's capacity to withstand potential investment losses, which varies based on factors like age and financial situation.

0 notes

Text

The Future of Retail | Advanced POS Technologies

The retail industry is constantly evolving, driven by technological advancements and changing consumer behaviors. Point of Sale (POS) systems have become a cornerstone of modern retail operations, offering far more than just transaction processing. This article explores the future of retail through the lens of advanced POS technologies and highlights how POS.cat can help businesses stay ahead of the curve with their nationwide installations, sales, and training services. For a free consultation, call 1-800-434-9026.

1. Mobile POS Systems

Mobile POS systems are transforming the retail landscape by enabling transactions to take place anywhere in the store. These systems use tablets or smartphones equipped with POS software, allowing sales associates to assist customers on the sales floor, reducing wait times, and enhancing the overall shopping experience. Mobile POS systems can also be used at pop-up shops, events, and outdoor markets, providing flexibility and convenience.

2. Cloud-Based POS Solutions

Cloud-based POS systems offer numerous advantages over traditional on-premise solutions. They provide real-time data access, seamless updates, and remote management capabilities. This means that business owners can monitor sales, inventory, and customer data from any location with an internet connection. Cloud-based systems also offer greater scalability, making it easy to add new features and functionalities as your business grows.

3. Integrated E-Commerce and POS Systems

As online shopping continues to grow, integrating e-commerce platforms with POS systems has become essential. Integrated solutions ensure that inventory levels are synchronized across all sales channels, preventing stockouts and overstocking. This integration also provides a unified view of customer data, enabling personalized marketing and improving the overall customer experience.

4. Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are revolutionizing POS systems by providing advanced analytics and predictive insights. AI-powered POS systems can analyze customer behavior, predict trends, and optimize inventory management. Machine learning algorithms can also help detect fraudulent transactions, improving security and reducing losses.

5. Contactless Payments and Digital Wallets

The rise of contactless payments and digital wallets has been accelerated by the COVID-19 pandemic. Consumers now expect fast, secure, and convenient payment options. Modern POS systems support a variety of contactless payment methods, including NFC (Near Field Communication), QR codes, and mobile wallets like Apple Pay and Google Wallet. These technologies not only enhance the customer experience but also improve transaction speed and security.

6. Omnichannel Retailing

Omnichannel retailing is about providing a seamless shopping experience across all channels, whether online, in-store, or via mobile devices. Advanced POS systems play a crucial role in achieving this by integrating all sales channels into a single platform. This ensures consistent pricing, promotions, and inventory information, creating a cohesive shopping experience for customers.

7. Enhanced Customer Relationship Management (CRM)

Modern POS systems come with built-in CRM capabilities that help retailers manage customer relationships more effectively. These systems store customer data, track purchase history, and analyze buying patterns. With this information, retailers can create targeted marketing campaigns, offer personalized discounts, and build stronger customer loyalty.

8. Advanced Inventory Management

Efficient inventory management is vital for retail success. Advanced POS systems provide real-time inventory tracking, automated reordering, and comprehensive reporting. These features help retailers maintain optimal stock levels, reduce carrying costs, and prevent stockouts. Some systems even use AI to predict demand and optimize inventory based on historical data and market trends.

9. Employee Management and Productivity Tools

Managing a retail workforce can be challenging, but advanced POS systems offer tools to streamline employee management. Features like time tracking, scheduling, and performance analytics help managers optimize staffing levels and improve productivity. Some systems also include training modules to ensure that employees are well-versed in using the POS system and delivering excellent customer service.

10. Future Trends in POS Technology

The future of POS technology is exciting, with continuous innovations on the horizon. Here are some trends to watch:

Voice-Activated POS Systems: Voice recognition technology is making its way into POS systems, allowing for hands-free operation and improved accessibility.

Blockchain for Secure Transactions: Blockchain technology offers enhanced security and transparency for transactions, reducing the risk of fraud and data breaches.

Augmented Reality (AR): AR can enhance the shopping experience by providing virtual try-ons, interactive product displays, and more immersive in-store experiences.

Why Choose POS.cat for Advanced POS Solutions?

POS.cat is at the forefront of providing advanced POS solutions tailored to the needs of modern retailers. Here’s why you should choose POS.cat:

Cutting-Edge Technology: POS.cat offers the latest POS technologies, ensuring your business stays competitive and efficient.

Nationwide Service: With a network of professionals across the country, POS.cat provides reliable and timely installations, sales, and training services.

Expert Support: POS.cat offers comprehensive support and training to ensure your staff can fully utilize the advanced features of your POS system.

Customized Solutions: POS.cat understands that every business is unique. They provide tailored POS solutions that meet your specific needs and goals.

Conclusion

The future of retail is bright, with advanced POS technologies driving efficiency, enhancing customer experiences, and providing valuable insights. By partnering with POS.cat, you can leverage these innovations to transform your business and stay ahead of the competition. Don’t wait to embrace the future—call 1-800-434-9026 for a free consultation today.

0 notes

Text

trading Nasdaq

The NASDAQ (National Association of Securities Dealers Automated Quotations) is a global electronic marketplace for buying and selling securities. It is known for its high concentration of technology and growth-oriented companies, making it a popular choice for traders looking to invest in innovative sectors.

Key Features of the NASDAQ

1. Technology Focus: The NASDAQ is home to many of the world's leading tech giants, including Apple, Microsoft, Amazon, and Google. This makes it a hub for tech-focused investors.

2. Electronic Trading: Unlike traditional stock exchanges that have physical trading floors, the NASDAQ operates entirely electronically, allowing for faster and more efficient trading.

3. Market Tiers: The NASDAQ is divided into three market tiers – the NASDAQ Global Select Market, the NASDAQ Global Market, and the NASDAQ Capital Market. Each tier has different listing requirements, catering to companies of varying sizes and stages of development.

Strategies for Trading on the NASDAQ

1. Research and Analysis: Thorough research is crucial. Analyze company financials, market trends, and technological advancements. Tools like financial news websites, analyst reports, and stock screeners can provide valuable insights.

2. Technical Analysis: Many traders rely on technical analysis to predict future price movements. This involves studying past market data, primarily price and volume, to identify patterns and trends.

3. Diversification: Diversifying your portfolio can help mitigate risk. While the NASDAQ is heavily tech-oriented, it also includes companies from various other sectors. Diversifying your investments across different industries can protect against sector-specific downturns.

4. Stay Informed: Keeping up with the latest news and developments in the tech world is essential. New product launches, regulatory changes, and market sentiment can all impact stock prices.

Risks and Considerations

1. Volatility: The NASDAQ is known for its volatility, especially in the tech sector. Rapid changes in stock prices can lead to significant gains but also substantial losses.

2. Market Sentiment: Investor sentiment can greatly influence stock prices. Positive news can drive prices up, while negative news can cause sharp declines.

3. Economic Factors: Broader economic factors, such as interest rates, inflation, and global events, can also impact the NASDAQ. Understanding these influences can help you make more informed trading decisions.

Conclusion

Trading on the NASDAQ offers exciting opportunities, particularly for those interested in the tech industry. However, it's important to approach it with a solid strategy, thorough research, and an awareness of the inherent risks. By staying informed and diversifying your investments, you can navigate the dynamic world of NASDAQ trading more effectively.

0 notes

Text

Blood bath continues on Wall Street, Oil down

US stocks dropped sharply on Thursday as recent high-flying tech mega-caps took another tumble and the latest second-quarter corporate earnings data proved mixed.

By the close on Wall Street, the blue-chip Dow Jones Industrial Average had dropped 1.3% to 40,665. snapping a series of consecutive closing record highs. The volatility comes as the VIX, the so-called fear index, jumped 10% to its highest level since April.

Meanwhile, the broader S&P 500 fell 0.8% to 5,544, and the tech-laden Nasdaq Composite shed a more modest 0.7% at 17,871 having posted its biggest one-day drop since December 2022 in the previous session.

NAS100 H4

The chip sector rallied having recorded its largest daily percentage plunge on Wednesday since the pandemic-related panic of March 2020 following a report saying the US is considering tighter curbs on tech exports to China. AI chip darling Nvidia led the way, rebounding 2.8%, while Broadcom rallied 2.9%.

SPX500 H4 But among the big tech fallers, Apple shed 2.0%, Google owner Alphabet fell 1.9%, and Amazon lost 2.2%, all adding to recent losses and pressuring the broader market.

Meanwhile, Netflix fell 0.7% in the session but added 0.3% in after-hours trading as the streaming giant reported better-than-expected Q2 results, although Q3 revenue guidance fell short of estimates.

In second-quarter earnings released during the session, housebuilder DR Horton jumped 10.0% after the company beat estimates for quarterly profit and approved a new $4 billion share buyback programme.

But Domino’s Pizza slumped 13.6% after the pizza chain missed estimates for quarterly same-store sales in the US.

And United Airlines fell 1.2% as its Q3 guidance fell short of estimates after unveiling plans to cut capacity despite strong summer travel demand.

Away from earnings, Warner Bros Discovery rose 2.4% following a report that the company has discussed a plan to split its digital streaming and studio businesses from its legacy TV networks.

However, Beyond Meat dropped 10.3% following a report the plant-based meat producer has engaged with bondholders to begin discussions about restructuring its balance sheet.

On the economic front, US initial jobless claims rose by 20,000 to a seasonally adjusted 243,000 for the week ended July 13, above the 229,000 claims expected. Initial claims were revised lower in the prior week, but the unemployment rate rose to a 2-1/2-year high of 4.1% in June.

This suggests the US labor market is cooling which increases the chances that the Federal Reserve will sanction a first interest rate cut at its September meeting.

The European Central Bank (ECB), as expected, stood pat on rates after its latest policy meeting on Thursday, having made its first cut back in June. But the ECB said its September meeting was "wide open" as it downgraded its view of the euro zone's economic prospects and predicted that inflation will keep on falling. Oil prices fell back after gains in the previous session reflecting mixed demand signals given a slowdown in the US economy and rate cut expectations.

UKOIL H1

UK Brent crude fell 0.5% to $81.99 a barrel, while US WTI) crude shed 0.6% to $82.39 a barrel.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Fundsmith Equity Struggles Against Tech Dominance in Global Markets

Fundsmith Equity manager Terry Smith, like many other professional investors, continues to navigate the challenge of global stock market returns being significantly influenced by a handful of US technology companies.

In a communication to investors, Smith highlighted that during the first half of 2024, nearly half of the 17% sterling return of the S&P 500 index could be attributed to five specific companies:

Amazon.com Inc (AMZN) with 0.03%Apple Inc (AAPL) with 0.38%Meta Platforms Inc Class A (META) with 0.13%Microsoft Corp (MSFT) with 1.44%NVIDIA Corp (NVDA) with 2.48%

Smith further noted that 25% of these returns originated solely from NVIDIA, recognized for its role in advancing artificial intelligence (AI).

The influence exerted by US tech giants extends to the performance of global indices as well. In the first half of 2024, the MSCI World index recorded a sterling return of 12.7%, with Microsoft, Apple, and Nvidia collectively contributing nearly 15% to the index.

This tech dominance has posed challenges for many active fund managers seeking to outperform global markets, including Fundsmith Equity. While the fund showed a 9.3% increase in the first six months of 2024, it has consistently underperformed over the past three calendar years.

Smith conveyed in his investor letter, 'A 9% rise in a year would typically align with the long-term average for equities, so achieving 9% in a half-year would normally be cause for celebration, except that it falls short of the index. Part of the issue lies in the concentration of returns within a handful of stocks.'

Fundsmith Equity holds positions in three of the top-performing stocks in 2024 – Apple, Meta, and Microsoft. However, the investment in Apple is relatively small.

Regarding Nvidia, Terry Smith remarked, "We have yet to convince ourselves that its outlook is as predictable as we seek."

He further commented, "Without owning this stock, and indeed all five stocks at least in line with their index weights, achieving outperformance was challenging."

Meta, the parent company of Facebook, significantly contributed to Fundsmith Equity's returns in the first half of the year, ranking as the second-best positive contributor with an attribution of 2.7%.

Novo Nordisk A/S ADR (NVO) emerged as the top contributor with a 3.4% attribution, fueled by its significant role in the booming weight-loss drugs sector. Its share price surged accordingly.

Conversely, L'Oreal SA (OR) was the largest detractor, experiencing a -0.7% attribution.

Most actively managed US and global funds typically maintain an 'underweight' stance towards the dominant US tech giants. This cautious approach stems partly from portfolio concentration rules that restrict funds from holding more than 10% in any single stock. Such rules are designed to enhance diversification and mitigate risk.

In contrast, index funds and exchange-traded funds (ETFs) can allocate up to 20% of their assets to a single stock, with exceptions allowing for higher percentages in certain market conditions. ETFs often impose additional internal limits, capping individual constituent weights, such as at 10%.

It's worth noting that certain tech-focused index funds can be highly concentrated. For instance, the L&G Global Technology Index holds substantial individual weightings in Microsoft (16.1%), Apple (14.7%), and Nvidia (13.9%). This fund garnered significant interest in June, ranking as the most-purchased fund among interactive investor customers.

Unlike mutual funds subject to single-stock limits, investment trusts are not restricted in this manner. However, most trusts typically refrain from consistently holding more than 10% of their portfolio in a single stock, and positions exceeding 15% are rare. Some investment trusts establish their own internal rules regarding stock concentration.

Read the full article

0 notes

Text

How we let them become richer than God

With the costs of the Civil War looming, Congress imposed a national income tax in 1861. The wealthy helped force its repeal soon after the war ended. (Their pique could only have been exacerbated by the fact that the law required public disclosure. The annual income of the moguls of the day — $1.3 million for William Astor; $576,000 for Cornelius Vanderbilt — was listed in the pages of The New York Times in 1865.)

By the late 19th and early 20th century, wealth inequality was acute and the political climate was changing. The federal government began expanding, creating agencies to protect food, workers and more. It needed funding, but tariffs were pinching regular Americans more than the rich. The Supreme Court had rejected an 1894 law that would have created an income tax. So Congress moved to amend the Constitution. The 16th Amendment was ratified in 1913 and gave the government power “to lay and collect taxes on incomes, from whatever source derived.”

In the early years, the personal income tax worked as Congress intended, falling squarely on the richest. In 1918, only 15% of American families owed any tax. The top 1% paid 80% of the revenue raised, according to historian W. Elliot Brownlee.

But a question remained: What would count as income and what wouldn’t? In 1916, a woman named Myrtle Macomber received a dividend for her Standard Oil of California shares. She owed taxes, thanks to the new law. The dividend had not come in cash, however. It came in the form of an additional share for every two shares she already held. She paid the taxes and then brought a court challenge: Yes, she’d gotten a bit richer, but she hadn’t received any money. Therefore, she argued, she’d received no “income.”

Four years later, the Supreme Court agreed. In Eisner v. Macomber, the high court ruled that income derived only from proceeds. A person needed to sell an asset — stock, bond or building — and reap some money before it could be taxed.

Since then, the concept that income comes only from proceeds — when gains are “realized” — has been the bedrock of the U.S. tax system. Wages are taxed. Cash dividends are taxed. Gains from selling assets are taxed. But if a taxpayer hasn’t sold anything, there is no income and therefore no tax.

Contemporary critics of Macomber were plentiful and prescient. Cordell Hull, the congressman known as the “father” of the income tax, assailed the decision, according to scholar Marjorie Kornhauser. Hull predicted that tax avoidance would become common. The ruling opened a gaping loophole, Hull warned, allowing industrialists to build a company and borrow against the stock to pay living expenses. Anyone could “live upon the value” of their company stock “without selling it, and of course, without ever paying” tax, he said.

Hull’s prediction would reach full flower only decades later, spurred by a series of epochal economic, legal and cultural changes that began to gather momentum in the 1970s. Antitrust enforcers increasingly accepted mergers and stopped trying to break up huge corporations. For their part, companies came to obsess over the value of their stock to the exclusion of nearly everything else. That helped give rise in the last 40 years to a series of corporate monoliths — beginning with Microsoft and Oracle in the 1980s and 1990s and continuing to Amazon, Google, Facebook and Apple today — that often have concentrated ownership, high profit margins and rich share prices. The winner-take-all economy has created modern fortunes that by some measures eclipse those of John D. Rockefeller, J.P. Morgan and Andrew Carnegie.

0 notes

Text

Technical analysis is based on two key principles: trend following and Elliott Wave Theory. Trend following says that if you look at historical data of a specific instrument's price movements, there will be a pattern that repeats itself over time. For example, if you look at the price history for Apple Inc., you will see that there are certain times where the stock drops sharply after reaching an all-time high these are called "bear markets" or corrections but then it rebounds strongly in response to rising demand from investors who want to buy shares at low prices. This trend follows bear markets back into bull markets (when investors are desperate to get rid of their shares). This means that if you want to predict future movements in this stock's price, you should look at its past performance during bear markets so that you know what kind of buy/sell signals might appear during those times; then you can use those signals as guides during times when bears appear again (as well as other times when bulls appear).

#stock market courses#intraday trading course india#best stock market trainer#stock trading courses#learn share market india

0 notes

Text

BUY TUESDAY?! NVIDIA STOCK! TESLA STOCK! GME STOCK! TLT STOCK! INTC! GOLD! MORE! | Will Knowledge

https://www.youtube.com/watch?v=qLbmyl69bbU

In this video, I go over stock market price predictions on stocks like Nvidia stock, pltr stock, tesla stock, GameStop stock, intel stock, apple stock, and more!

SEE MY BUYS AND SELLS! ALSO JOIN OUR PRIVATE TRADING LIVESTREAMS! Prices increase in 6 day!

👉 Website: https://ift.tt/eVGx7hc

✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@WillKnowledge/?sub_confirmation=1

✅ Important Links:

Use my same platform (Trading view) To have the exact same levels!

👉 https://ift.tt/gebzi7C

This is an affiliate code, I will receive compensation from you signing up!

👉 Website: https://ift.tt/eVGx7hc

✅ Stay Connected With Me:

👉 Instagram: https://ift.tt/FQBD58t

==============================

✅ Other Videos You Might Be Interested In Watching:

👉 Double Your Money in 2 Minutes! Stock Market Tips to Turn $1,000 into $1,000 | Will Knowledge

https://www.youtube.com/watch?v=Qrw_a6EuHtg

👉 Best Stocks to Buy Now: NVIDIA, Tesla, Nike, Meta, Gold, and More! | Will Knowledge

https://www.youtube.com/watch?v=6jl_siqD09A

👉 Stock Market Crash Alert: Key Levels You Must Watch! | Will Knowledge

https://www.youtube.com/watch?v=JLsh_-HZoOE

👉 Top Buys: Tesla, Nvidia, AMC, Apple, and More Stock Market Analysis! | Will Knowledge

https://www.youtube.com/watch?v=PTM98qWBfd8

=============================

✅ About Will Knowledge:

Hello Team! This channel is about investing in the stock market, trading options, and general knowledge of the market tools to use to your benefit so we can all spread the wealth.

For collaboration and business inquiries, please use the contact information below:

📩 Email: [email protected]

🔔 Subscribe to my channel for more videos: https://www.youtube.com/@WillKnowledge/?sub_confirmation=1

=====================

#stockmarket #biden #trump

Disclaimer: These videos are for educational and entertainment purposes only and should not be construed as financial advice or a recommendation to buy or sell any security or investment. I am not a financial advisor, and the information provided is not intended as investment recommendations. Please consult with a licensed financial professional before making any financial decisions. I shall not be held liable for any losses incurred from investing or trading in the stock market, including attempts to mirror my actions. Remember, unless investments are FDIC insured, they may decline in value and/or disappear entirely.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use

© Will Knowledge

via Will Knowledge https://www.youtube.com/channel/UCXnjHTVPeCp7hNEj_15Gx4w

September 24, 2024 at 04:00AM

#stockmarketinvesting#learnhowtotrade#entrepreneur#education#generalknowledge#stockmarket#willknowledge#money#explore

0 notes