#Association Management Software

Explore tagged Tumblr posts

Text

Association Management Software vs. CRM: A Quick Guide

As your member-based association grows, managing member information, events, and communication can become increasingly complex.

Association Management Software (AMS) offers a solution tailored to these unique challenges.

What is Association Management Software?

AMS is a specialized tool designed to meet the diverse needs of associations, going beyond what traditional Customer Relationship Management (CRM) systems offer.

It centralizes and streamlines tasks such as membership management, event coordination, financial operations, marketing, and communications, making it easier for your team to manage daily operations while providing an enhanced experience for members.

How Can AMS Benefit Your Organization?

Organized Member Data: AMS keeps member information up-to-date, automates renewals, and maintains high engagement levels. Event Management: Simplifies event planning, from registration to feedback collection, all within a single platform.

Financial Management: Handles dues collection, invoicing, and reporting, and integrates with accounting software.

Enhanced Communication: Centralizes email campaigns, newsletters, and social media efforts to keep members informed.

Personalized Member Experience: Offers features like personalized communication and pre-populated forms to enhance member interactions.

Website Management: Simplifies website maintenance, keeping your online presence professional and functional.

Reporting and Analytics: Provide insights into membership trends and event performance, enabling data-driven decisions.

AMS vs. CRM: Why Not Both?

While CRMs excel in marketing, sales, and customer service, they may lack the specific member management capabilities needed by associations.

AMS, on the other hand, is designed for this purpose.

The ideal solution is a platform that combines the strengths of both, like Salesforce.

It can be customized to serve as both a CRM and AMS, offering:

Flexibility and Customization: Tailor the platform to your association's unique needs.

Scalability: Grow with your organization, accommodating increased complexity.

Integration Capabilities: Seamlessly connect with other tools, such as accounting software and email marketing platforms.

Advanced Analytics: Gain deep insights into member behavior and association performance.

Familiarity: Many users may already be comfortable with CRM systems, easing the transition.

Conclusion

AMS has become essential for modern associations, providing a comprehensive solution that streamlines operations, enhances member experiences, and supports growth.

As you explore AMS options, consider solutions like Salesforce, which offer customizable features and the ability to scale with your organization.

Aptaria's expertise in Salesforce implementation can help you find the right AMS to transform your association's operations.

0 notes

Text

Navigating the World of Online Payment Processing

The world of commerce has undergone a remarkable transformation with the rise of e-commerce, and at the heart of this evolution is online payment processing. From purchasing products and services online to managing subscriptions and making digital donations, online payment processing has become an integral part of our daily lives. In this comprehensive guide, we will delve into the intricacies of online payment processing, exploring its significance, the key players in the industry, security measures, and the latest trends shaping the future of digital payments.

The Significance of Online Payment Processing

Online payment processing is the engine driving e-commerce and digital transactions. Its importance extends far beyond the convenience it offers. Here are some of the key reasons why online payment processing is crucial:

Global Reach: It enables businesses to reach customers worldwide, breaking down geographical barriers and expanding their customer base.

Convenience: Customers can make payments and purchases from the comfort of their homes or on the go, making the shopping experience more convenient.

Security: Secure payment processing ensures that sensitive financial information is protected, reducing the risk of fraud and unauthorized access.

Efficiency: The automation of payment processing streamlines financial transactions, reducing manual labor and processing times.

Business Growth: Online payment processing supports the growth of online businesses, enabling them to scale their operations and reach new markets.

Diverse Payment Options: It offers a wide range of payment methods, allowing customers to choose the option that best suits their preferences and needs.

The Key Players in Online Payment Processing

Online payment processing involves several key players, each with distinct roles and responsibilities. Understanding these players is crucial to grasp the intricacies of the payment ecosystem:

1. Merchants

Merchants are businesses or individuals who sell products or services online. They integrate payment gateways into their websites or applications to accept payments from customers.

2. Payment Gateways

Payment gateways are intermediaries that facilitate the transfer of payment data between the merchant and the financial institution. They verify the transaction, handle the encryption of data, and ensure that the payment is securely processed.

3. Acquiring Banks

Acquiring banks, also known as merchant banks, are financial institutions that work with merchants to provide them with the necessary accounts and tools for accepting payments. They play a critical role in authorizing and settling transactions.

4. Issuing Banks

Issuing banks are the financial institutions that issue credit and debit cards to consumers. They are responsible for authorizing transactions initiated by cardholders and ensuring there are sufficient funds for the purchase.

5. Card Networks

Card networks, such as Visa, MasterCard, and American Express, establish the rules and infrastructure that govern payment card transactions. They facilitate communication between acquiring and issuing banks.

6. Customers

Customers are the individuals or businesses making purchases or payments online. They provide their payment information to complete transactions.

Ensuring Security in Online Payment Processing

Security is a paramount concern in online payment processing. As the digital landscape evolves, so do the threats to security. Here are some of the key security measures and technologies in place to safeguard online transactions:

1. Data Encryption

Data encryption ensures that sensitive payment information, such as credit card numbers, remains secure during transmission. Secure Sockets Layer (SSL) encryption is a common technology used to protect data.

2. Tokenization

Tokenization replaces sensitive card data with tokens, which are useless to cybercriminals if intercepted. This adds an extra layer of security to payment processing.

3. Two-Factor Authentication

Two-factor authentication (2FA) requires customers to provide additional verification, such as a one-time code sent to their mobile device, to complete a transaction.

4. Fraud Detection

Advanced fraud detection systems use artificial intelligence and machine learning to analyze transaction data in real-time and identify potentially fraudulent activities.

5. Regular Updates

Payment processing systems should be regularly updated to patch vulnerabilities and ensure that they are up to date with the latest security standards.

6. Compliance with Regulations

Adhering to industry and regional regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), is essential to maintain security.

Trends Shaping the Future of Online Payment Processing

Online payment processing is an ever-evolving field. Several trends are shaping the future of digital payments:

1. Contactless Payments

Contactless payments, made through mobile wallets and near-field communication (NFC) technology, have gained popularity due to their speed and convenience. The use of smartphones for payments is on the rise.

2. Biometric Authentication

Biometric authentication, such as fingerprint and facial recognition, is increasingly used for secure and convenient payment authorization.

3. Cryptocurrency

Cryptocurrencies like Bitcoin are gaining acceptance as a means of payment, offering fast and borderless transactions.

4. In-App Payments

In-app payments within mobile applications provide a seamless purchasing experience for users, making it easier to complete transactions without leaving the app.

5. Enhanced Security Measures

Continual advancements in security measures, including machine learning-based fraud detection and risk analysis, will help reduce the risk of fraudulent transactions.

6. Cross-Border Payments

As businesses expand globally, cross-border payment solutions are becoming more vital. Payment processors are adapting to accommodate international transactions and currencies.

7. Payment Integration

E-commerce platforms and online businesses are increasingly integrating payment solutions directly into their platforms, streamlining the payment process for customers.

Choosing the Right Online Payment Processing Solution

Selecting the right online payment processing solution is crucial for businesses. Here are some key considerations to keep in mind:

1. Integration

Choose a payment solution that seamlessly integrates with your e-commerce platform or website. This ensures a smooth checkout experience for your customers.

2. Security

Security

is a non-negotiable aspect of online payment processing. Ensure that the solution you choose complies with industry standards, such as PCI DSS, and offers robust encryption and fraud prevention measures.

3. Payment Options

Consider the range of payment options the solution supports. The more options you provide, the more accessible your business will be to a broader customer base.

4. Scalability

Opt for a payment processing solution that can scale with your business. As your business grows, the payment solution should be able to handle increased transaction volumes.

5. Reporting and Analytics

Access to reporting and analytics tools can provide valuable insights into customer behavior, transaction trends, and financial performance. Choose a solution that offers comprehensive reporting capabilities.

6. Customer Support

A responsive customer support team can be invaluable in resolving issues quickly and ensuring that your payment processing runs smoothly. Consider the quality of customer support provided by the payment solution.

7. Costs and Fees

Different payment processors may have varying fee structures. Ensure that you understand the pricing model and any additional fees associated with the solution. Consider how the costs align with your business's budget.

8. Reputation

Research the reputation of the payment processing solution. Read reviews, ask for recommendations, and assess its track record in terms of reliability and security.

The Evolution of Online Payment Processing

Online payment processing has come a long way from its early days, and its journey continues. As technology advances and consumer preferences shift, the landscape of digital payments will keep evolving. Businesses that embrace the latest trends and invest in secure and convenient payment solutions are better positioned to thrive in the digital age.

The significance of online payment processing in today's world cannot be overstated. It has revolutionized the way we shop, transact, and do business, making life more convenient for consumers and enabling the growth of countless online enterprises. As we look to the future, the trends in online payment processing, from contactless payments to cryptocurrency, will shape the way we make payments and conduct financial transactions. By staying informed, adapting to these trends, and choosing the right payment processing solution, businesses can ensure a seamless and secure payment experience for their customers and position themselves for success in the evolving digital economy.

#Memberships#Reservations#Events#Appointments#Donations#Payments#Emails#Messaging#Accounting#Reporting#Event Planning#Membership Management#Email Tracking#Marketing#Online Payment Processing#Association Management Software#Customer Relationship Management#Fitness Center Management#Membership Management Software

0 notes

Text

https://easyhoa123.blogspot.com/2023/07/transform-condo-association-management.html

In the world of self-managed condo association software, staying organized and efficient is paramount to ensuring a thriving community. Whether you're a small self-managed association or a larger homeowners' association (HOA), the challenges of maintaining seamless operations, effective communication, and streamlined financial management can sometimes feel overwhelming. That's where Easy HOA, the cutting-edge self-managed condo association software and HOA website solution, comes into play.

0 notes

Text

Streamline Your HOA Collection Process with ReadyCOLLECT RC2

Take control of your in-house collections—whether you're working remotely or in the office. ReadyCOLLECT’s web-based RC2 platform is purpose-built for HOA attorneys and legal teams who demand efficiency, precision, and results. Discover a smarter way to manage cases with powerful features like:

Custom Workflows tailored to your firm’s process

Batch Processing for high-volume efficiency

Outlook Integration to keep everything in sync

Real-Time Case Updates for always-on awareness

Built-In Manager Approvals, multiple ledgers, and letter automation

Custom Collection Tables for ultimate flexibility and control

From better organization to faster collections, RC2 gives your team the tools to work smarter—not harder. Learn how RC2 can elevate your process today at http://bit.ly/assocmgr

#RC2#RC2+#ReadyCOLLECT#HOA#Community#Collections#Covenant#Violations#Software#Association#Managers#Assessment#Dues#CloudBased#Attorneys#LawFirms#Lawyers

0 notes

Text

https://flowrocket.com/finance

#Accounting Advisory Servies USA#Accounting and Bookkeeping services for Business#Accouting and Bookkeeping services USA#Best Auditing Services in USA#Hire Accounting Associates in USA#Hire Audit Supervisor in USA#Hire Bookkeeping Associates in USA#Best CRM Software with Collaboration Tools#CRM solutions for Team Colloboration#Best construction CRM Software#CRM Solutions for Construction Management#Best contract management systems in USA#CRM Software for document management#Best CRM for customer support#CRM for customer service solutions#Customer service software in USA#Agile software development services USA#Business Process Automation USA#IT Consulting Service in USA#Lead management CRM software#Lead tracking CRM software#Best CRM for Financial Services#Financial Services CRM Software#Best GRC Software Solutions in USA#CRM for small businesses#CRM Solutions#Top CRM Software USA#Best CRM Software in USA#Industry Specific CRM Solutions#best free crm for insurance agents

0 notes

Text

Sustain and Enhance Your Member Base with membership management solutions

Tecnolynx delivers a robust membership management solution equipped with all the essential features to meet the needs of both you and your members. Our automated system streamlines your tasks, allowing you to concentrate on your core business while the software efficiently manages the rest. With extensive experience in crafting solutions across various industries worldwide, Tecnolynx combines expert knowledge with full-time support to guarantee smooth operations and reliable assistance whenever required.

#Membership management solutions#Member management software#Subscription management#Association management#Club management software#Membership software#Membership CRM#Member retention#Membership system#Productivity tools

0 notes

Text

#mitsde#distance learning#distance mba#distance education#distance courses#distance learning mba#distancelearning#pgdm#pgdm course#pgdm colleges#capmcourse#capm course#pmi capm#capm exam#capm certification#certified associate in project management#project management software#project management#project managers#project management tools#pmi pmp certification#pmp certification training#pm#pmi pmp#pmpcertification#pmp course#pmp certification#pmp#pmp exam#pmp training

0 notes

Text

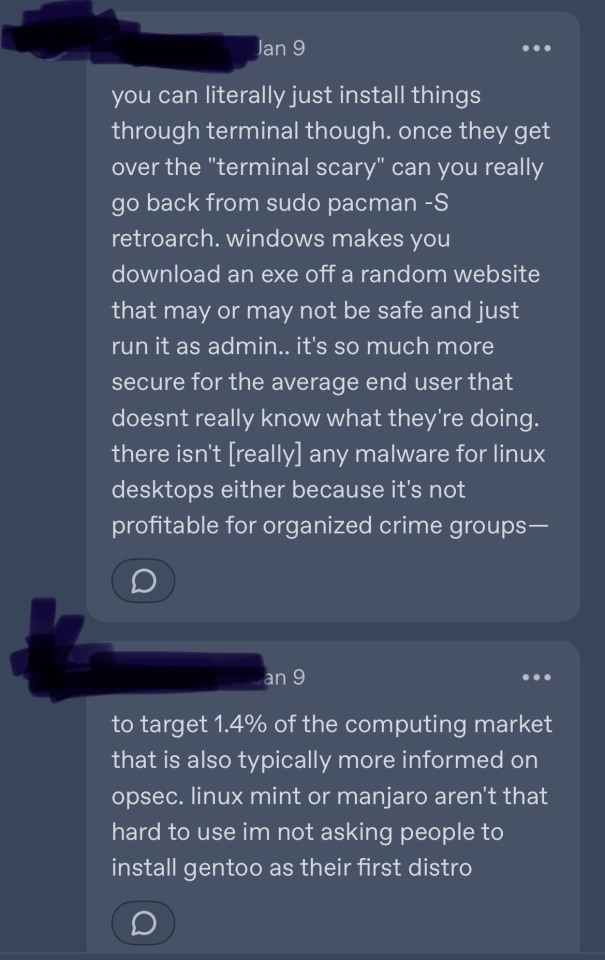

To install software all you need to do is type a string of words you don't unstand to invoke super user privaledges to tell your package manager of choice that's named after a joke a programmer thought was funny (get it, it's pacman like the arcade game!). This will only have open source software that may or may not be up to date depending on how the repository is maintained. This repository does not contain any of the software that a child would want to run such as fortnite, minecraft, minecraft mods and modding tools, etc. It does contain a lot of programming and productivity software that today's computer adverse teens are all CHOMPING at the bit to use.*

This is easier then opening a web browser to Google the website of the software you want to run and clicking the big button that says download, then running the file that pops up in your browser's download feed, or simply clicking yes on the auto run diologue if your browser has that enabled.

*(Like do you realize that the sims modding tools and minecraft server jars and itch.io horror games and ai video upscalers and triple A games that people want to run aren't in those package managers? Like no shit it's gonna be more secure if it's just not capable of installing anything you want to run... Not that the operating system even has compatable binaries made for it in the first place.)

I swear to god computer people talking online about how easy computers/linux are are just that xkcd comic about experts in a field overestimating a layperson’s knowledge (“surely the average person must only know 2-3 feldspars”), over and over again. I felt this firsthand back when I was asking for advice when buying my desktop PC. When a casual computer user reads something like this, at least speaking from personal experience, it is nearly incomprehensible. It is wonderful to want to help the less technologically-fortunate, but you have to break things down more than this. You are speaking wingdings at people.

#I don't get why Linux users think that package managers are easy. Yes they're convinient if you know what you're doing and all the shit you#Want is already on them but if they were actually superior to the executable file paradigm then it would have been adopted by now#If anything package managers are closer to like the app store/ms store in that software has to be approved before it can be listed.#If that's the way you want to get software you can just do it in a graphical window with a search bar that doesn't expect you to already#Know the exact string associated with your desired program#Linux evangelist take a UX course challenge: impossible#You can't have user experience issues if you have no users right?#Sorry for ranting this just makes me so angry in a way I can't quantify#Because normally I'd actually champion Linux but like when I see someone defending something I like poorly and being an presumptuous asshole#About it at the same time it gets me more than someone being outwardly hostile y'know?

798 notes

·

View notes

Text

I had a straight up delightful moment at work yesterday when a new member of the management team asked me how we were tracking warranties and I explained that we kind of aren't and he asked why we aren't and that meant he got a 30-minute rundown of how top-to-bottom fucked the procurement process is here.

First I explained the process for sending a quote (i am assigned a ticket in system A1, I create an opportunity in system A2, from the opportunity i can generate a quote in system B - if I start with the quote I can't associate it back to the opportunity or the ticket, if we need to change the quote after it was approved we need to generate a new quote from the opportunity to overwrite the old one - and send the quote from system B.)

Then I explained the process of getting approval (system B sends the quote and receives the approvals but does not communicate that to system A, so until it is manually updated system A sends a daily reminder about the quote to the client and after three days with no response will close the ticket even if the client approved the quote in system B. System B will send an email if a quote is approved but it comes from our generic support email so to make sure that I don't miss approvals I have filtering rules set up and a folder I check twice a day. Because there are 4 people who use this system I also check twice daily in system B to see if anyone else's quotes were approved).

Then I explained how I place the orders (easy! I'm a pro! We have a standardized PO pattern that tracks date, vendor and client, it's handy)

Then I explained how I document the orders (neither system A nor B has a way of storing information about orders in progress, only orders that are complete; as such I have created a PO Documentation spreadsheet that lists the PO number, vendor, line of business, client, items ordered, order total, order date, ETA, tracking numbers, serial numbers, delivery confirmation, ticket number for install, ticket title for install, shippong cost, and close confirmation, which all have to be entered individually and which require a minimum of three visits to the spreadsheet per order: entering initial info, entering tracking and SN info, then once more to get that info to close the opportunity)

Then I explained how we close an order (confirm hardware delivery or activate software, use system A2 to code hardware/software/non-taxable products appropriately, run wizard to add charges from A2 to ticket in A1; because the A2 charges were locked by approval in system B, use system A3 to add shipping or other fees or to remove any parts that were approved but not actually needed or ordered - THIS WEEK I got permission to do this bit on my initial A1 procurement ticket instead of generating an A1 post-procurement ticket for fees and shipping. Once all of that is done it's moved into system A4 and is no longer my problem).

If there is a warranty involved it *should* automatically have the expiration tracked in system C, but system C doesn't have any way to pull order info so there's no way it can track warranty *start* dates without somebody manually entering it or without using API data from the manufacturer, which some manufacturers don't provide (fuck you, Apple).

But me and my trainee are happy to add the start date to the configuration once a tech tells us that the device is enrolled in system C. If the techs will tell us that we can add that info no problem.

Until then, I have unfortunately been forced to start a spreadsheet.

The manager was appalled, it was great. I got to say the words "part of the reason things sometimes fall through the cracks is because we have so many cracks" and his response was "no shit." I'm talking to vendors about a procurement system now :) :) :) :)

579 notes

·

View notes

Text

Masterlist of Fundraisers from the Palestinians who directly contacted me. (19-21 August)

21 August

Mohammed El Shaer (@m-elshaer038): Muhammed is a 23 year old software engineer student who did not manage to complete his degree because of the genocide. HIs family house has been destroyed. He and his family (his mother, sister, brother and sister-in-law) are trying to evacuate to Egypt. (https://gofund.me/f93c78cb) (#88 on the verified fundraiser list by el-shab-hussein and nabulsi)

Leila Zaqout (Layla) (@joyfulpeacepolice): Layla is from a family of 8. She is a finally year pharmacy student who cannot graduate because of the war. Her neighbouhood has been destroyed and she was slightly injured in a bombing. She has recently contacted hepatitis A.Layla’s grandfather is an open-heart surgery patient. They are trying to evacuate out of Gaza. (https://gofund.me/e52f6176) (vetted by association, see post here. This campaign has been vouched for by @/ahmed79ss, whose campaign has been shared by 90-ghost (see here and here)) (VERY LOW FUNDS!!!! ONLY $220 USD raised of $155,000 target!)

Mahmoud Al-Sharif (@mahmoud-sharif, @mahmoud-sharif2): Mahmoud had lost his fingers and an eye due to Israel’s previous war on Gaza. He and his wife Soha have 3 children: Retal (12), Joud (11) and Nageh (8). They are trying to evacuate to Egypt. (https://gofund.me/9c6c3ac9) (vetted by 90-ghost),

Hazem Shawish (@hazemsuhail, @nisreensuhail, @kenzish): Hazem and Nisreen are from a family of 8. Their father had passed away due to hunger and inadequte healthcare. Their brother Samer has bipolar disorder, which has exacerbated due to the lack of essential medications. They are trying to evacuate to Egypt. (https://gofund.me/917ecb89) (Vetted by association. Nisreen is the sister in law of @samarsh97(shared by 90-ghost). See proof here. Also @nisreensuhail's Instagram (princess__.nisreen) goes all the way back to 2015. They also have a clean search result, see post here.)

Aya (@family-aya): Aya and her husband has 3 children. One of her child and her husband were injured, and several family members were martyred. Her father is a cancer patient, and her elderly mother is elderly has special needs. They are trying to raise funds for daily necessities including food. (https://gofund.me/2946907d) (shared by bilal-salah0. (Bilal-salah0's campaign is listed as #132 on the verified fundraiser spreadsheet vetted by el-shab-hussein and nabulsi. His campaign has reached its goal and he is trying to support other campaigns now, and has said that he would ensure the legitimacy of the campaigns he promote, see post here.))

20 August

Dina Mahammed(@dinamahammed99) Dina is 25 years old. She has a 3-year-old daughter and a 3-month-old son whom she gave birth to under the bombing. They are trying to evacuate out of Gaza. (https://gofund.me/1bff15a6) (Dina is @/mahmoud1995's sister, see post here and here. @/mahmoud1995's campaign has been shared by 90-ghost)

Hamdi Al-Shaltawi (@hamdishiltawi): Hamdi is an economic student on his second year of study and he used to run a job. But now he and his family have been displaced. He is trying to evacuate himself and his family (his parents, two brothers and three sisters) out of Gaza. (https://gofund.me/ac7c2fa3) (#285 on the verified fundraiser list created by el-shab-hussein and nabulsi)

Dina Abu Zour (@dinafamily): Dina is a mother of three children and currently pregnant. She is suffering from pregnancy-related proteinuria. One of her children has hepatitis, and her 13-year-old son has psychological issues after being detained by the military. Her husband also suffers from injuries after being captured by the military. (https://gofund.me/b06d2ec5) (#10 on the Bees and Watermelons verified fundraiser list.)

Ghada Ayyad (@ghadak24): Ghada is a 21-year-old palestinian woman. Her father is a healthcare worker and her mother a teacher. She is from a family of 8 including 3 children under 16 years old. They are trying to evacuate to Egypt. (https://gofund.me/51547832) (promoted and verified by Banyule Palestine Action Group, an Instagram based group that verifies campaigns "by comparing them with IG profiles and supplied photos and by having conversations with beneficiaries and their supporters." I have also seen other vetted campaigns promoted by this group (e.g. @/shymaafamily's campaign, which is #141 on their vetted fundraiser list by el-shab-hussein and nabulsi, has also been promoted by this group), so I do trust this group. Ghada's campaign has also been promoted by Youth For Falesteen. Moreover, here is Ghada's Instagram: ghada_family24. She has had her instagram since at least 2021 (she has been tagged in a post from 2021)) (22 Aug: LOW FUNDS! Currently €1,915 raised of €60,000 target!!)

19 August

Hassan Madi (@hassanmadi): Hassan got married 4 days before this current genocide. But now his home is destroyed, he has lost his job and they are now living in a tent. (https://gofund.me/6f65d728) (Vetted by association. Hassan is a nephew of @aya2mohammed, who has been vetted (#166 on the verified fundraiser list vetted by el-shab-husssein and nabulsi). See post here for proof. ) (22 Aug: LOW FUNDS! Only €100 raised of €50,000 goal)

Nour Al-Habil & Ayman Al-Habil (@nour20habil): Nour is Ayman’s daughter and she has 9 siblings. Their house has been destroyed. Ayman’s 5-year-old son, Ahmed, has hepatitis, and his 3-year-old child has osteoporosis. (https://gofund.me/7adef23f) (Vetted and promoted by gaza-evacuation-funds! Shared by 90-ghost. Also vetted by association. Nour is also a niece of @aya2mohammed (#166 on the verified fundraiser list vetted by el-shab-husssein and nabulsi). See post here for proof.) (22 Aug: LOW FUNDS! Only kr7,795 NOK raised of kr700,000 goal!)

Lubna Al-Sir & Ahmed Hassan Al-Sir (@ahmadelser, @lobnaelser): Lubna and Ahmed have 3 children: Mohamed (9), Hassan (7), and Yazan(2). Their house has been destroyed and they are now displaced and living in tents. They are trying to evacuate out of Gaza. (https://gofund.me/aa7b3ff2) (shared by 90-ghost) (22 Aug: LOW FUNDS!!! Only €1397 raised of €50,000 target.)

Mohammed Shamia (@mo-shamia): Mohammed is fourth year student of laboratory medicine. His uni in Gaza has been destroyed and he is trying to finish his education in Egypt. He is trying to evacuate 10 family members (his parents, grandparents, his brother, his sister as well as her husband and her three children). (https://gofund.me/303c68db) (#7 on the verified fundraiser list vetted by el-shab-hussein and nabulsi.)

Amjad Sido (@amjadsido99, @amjadsido): Amjad has 2 children (Mosbah (6) and Abdul Rahman (3)). He is also living with his mother and 5 brothers. The occupation has destroyed their house and killed his father and two of his brothers. They are trying to evacuate out of Gaza. (https://gofund.me/0729ac5b) (#126 on the verified fundraiser list vetted by el-shab-hussein and nabulsi)

Walid Al-Qatrawi (@waledps): Walid is an engineer from Gaza. He has 3 children: Adam, Hla, and Nay. They are trying to evacuate out of Gaza. (shared by 90-ghost) (https://buymeacoffee.com/waledps) (https://www.paypal.com/paypalme/GoFundWaledPs)

Click here for my Masterlist for fundraisers from 13 July - 25 July.

Click here for my Masterlist for fundraisers from 26 July -29 July.

Click here for my Masterlist for fundraisers from 30 July - 1 August.

Click here for my Masterlist for fundraisers from 2 August - 5 August.

Click here for my Masterlist for fundraisers from 6 August - 10 August.

Click here for my Masterlist for fundraisers from 11 August - 14 August.

Click here for my Masterlist for fundraisers from 15 August - 18 August.

How does vetting and verification work? See post here. (also read comments regarding 90-ghost and why we trust the campaigns he has shared)

See post here for other verified ways to send aid to Gaza.

Don't forget your Daily Clicks on Arab.org, it's free!!! and Every click made is registered in their system and generates donation from sponsors/advertisers.)

#palestine#gaza#free gaza#free palestine#post has been vetted and verified#verified#gaza genocide#vetted#donations#fundraising#vetted gfm#vetted campaign#vetted fundraisers#vetted gofundme#verified fundraiser#verified gofundme#gaza fundraiser#gaza gofundme#palestine gofundme#palestine fundraiser#gaza gfm#palestine gfm#masterlist#19-21 august

596 notes

·

View notes

Text

In the span of just weeks, the U.S. government has experienced what may be the most consequential security breach in its history—not through a sophisticated cyberattack or an act of foreign espionage, but through official orders by a billionaire with a poorly defined government role. And the implications for national security are profound.

First, it was reported that people associated with the newly created Department of Government Efficiency (DOGE) had accessed the U.S. Treasury computer system, giving them the ability to collect data on and potentially control the department’s roughly $5.45 trillion in annual federal payments.

Then, we learned that uncleared DOGE personnel had gained access to classified data from the U.S. Agency for International Development, possibly copying it onto their own systems. Next, the Office of Personnel Management—which holds detailed personal data on millions of federal employees, including those with security clearances—was compromised. After that, Medicaid and Medicare records were compromised.

Meanwhile, only partially redacted names of CIA employees were sent over an unclassified email account. DOGE personnel are also reported to be feeding Education Department data into artificial intelligence software, and they have also started working at the Department of Energy.

This story is moving very fast. On Feb. 8, a federal judge blocked the DOGE team from accessing the Treasury Department systems any further. But given that DOGE workers have already copied data and possibly installed and modified software, it’s unclear how this fixes anything.

In any case, breaches of other critical government systems are likely to follow unless federal employees stand firm on the protocols protecting national security.

The systems that DOGE is accessing are not esoteric pieces of our nation’s infrastructure—they are the sinews of government.

For example, the Treasury Department systems contain the technical blueprints for how the federal government moves money, while the Office of Personnel Management (OPM) network contains information on who and what organizations the government employs and contracts with.

What makes this situation unprecedented isn’t just the scope, but also the method of attack. Foreign adversaries typically spend years attempting to penetrate government systems such as these, using stealth to avoid being seen and carefully hiding any tells or tracks. The Chinese government’s 2015 breach of OPM was a significant U.S. security failure, and it illustrated how personnel data could be used to identify intelligence officers and compromise national security.

In this case, external operators with limited experience and minimal oversight are doing their work in plain sight and under massive public scrutiny: gaining the highest levels of administrative access and making changes to the United States’ most sensitive networks, potentially introducing new security vulnerabilities in the process.

But the most alarming aspect isn’t just the access being granted. It’s the systematic dismantling of security measures that would detect and prevent misuse—including standard incident response protocols, auditing, and change-tracking mechanisms—by removing the career officials in charge of those security measures and replacing them with inexperienced operators.

The Treasury’s computer systems have such an impact on national security that they were designed with the same principle that guides nuclear launch protocols: No single person should have unlimited power. Just as launching a nuclear missile requires two separate officers turning their keys simultaneously, making changes to critical financial systems traditionally requires multiple authorized personnel working in concert.

This approach, known as “separation of duties,” isn’t just bureaucratic red tape; it’s a fundamental security principle as old as banking itself. When your local bank processes a large transfer, it requires two different employees to verify the transaction. When a company issues a major financial report, separate teams must review and approve it. These aren’t just formalities—they’re essential safeguards against corruption and error.

These measures have been bypassed or ignored. It’s as if someone found a way to rob Fort Knox by simply declaring that the new official policy is to fire all the guards and allow unescorted visits to the vault.

The implications for national security are staggering. Sen. Ron Wyden said his office had learned that the attackers gained privileges that allow them to modify core programs in Treasury Department computers that verify federal payments, access encrypted keys that secure financial transactions, and alter audit logs that record system changes. Over at OPM, reports indicate that individuals associated with DOGE connected an unauthorized server into the network. They are also reportedly training AI software on all of this sensitive data.

This is much more critical than the initial unauthorized access. These new servers have unknown capabilities and configurations, and there’s no evidence that this new code has gone through any rigorous security testing protocols. The AIs being trained are certainly not secure enough for this kind of data. All are ideal targets for any adversary, foreign or domestic, also seeking access to federal data.

There’s a reason why every modification—hardware or software—to these systems goes through a complex planning process and includes sophisticated access-control mechanisms. The national security crisis is that these systems are now much more vulnerable to dangerous attacks at the same time that the legitimate system administrators trained to protect them have been locked out.

By modifying core systems, the attackers have not only compromised current operations, but have also left behind vulnerabilities that could be exploited in future attacks—giving adversaries such as Russia and China an unprecedented opportunity. These countries have long targeted these systems. And they don’t just want to gather intelligence—they also want to understand how to disrupt these systems in a crisis.

Now, the technical details of how these systems operate, their security protocols, and their vulnerabilities are now potentially exposed to unknown parties without any of the usual safeguards. Instead of having to breach heavily fortified digital walls, these parties can simply walk through doors that are being propped open—and then erase evidence of their actions.

The security implications span three critical areas.

First, system manipulation: External operators can now modify operations while also altering audit trails that would track their changes. Second, data exposure: Beyond accessing personal information and transaction records, these operators can copy entire system architectures and security configurations—in one case, the technical blueprint of the country’s federal payment infrastructure. Third, and most critically, is the issue of system control: These operators can alter core systems and authentication mechanisms while disabling the very tools designed to detect such changes. This is more than modifying operations; it is modifying the infrastructure that those operations use.

To address these vulnerabilities, three immediate steps are essential. First, unauthorized access must be revoked and proper authentication protocols restored. Next, comprehensive system monitoring and change management must be reinstated—which, given the difficulty of cleaning a compromised system, will likely require a complete system reset. Finally, thorough audits must be conducted of all system changes made during this period.

This is beyond politics—this is a matter of national security. Foreign national intelligence organizations will be quick to take advantage of both the chaos and the new insecurities to steal U.S. data and install backdoors to allow for future access.

Each day of continued unrestricted access makes the eventual recovery more difficult and increases the risk of irreversible damage to these critical systems. While the full impact may take time to assess, these steps represent the minimum necessary actions to begin restoring system integrity and security protocols.

Assuming that anyone in the government still cares.

184 notes

·

View notes

Text

#Accounting Advisory Servies USA#Accounting and Bookkeeping services for Business#Accouting and Bookkeeping services USA#Best Auditing Services in USA#Hire Accounting Associates in USA#Hire Audit Supervisor in USA#Hire Bookkeeping Associates in USA#Best CRM Software with Collaboration Tools#CRM solutions for Team Colloboration#Best construction CRM Software#CRM Solutions for Construction Management#Best contract management systems in USA#CRM Software for document management#Best CRM for customer support#CRM for customer service solutions#Customer service software in USA#Agile software development services USA#Business Process Automation USA#IT Consulting Service in USA#Lead management CRM software#Lead tracking CRM software#Best CRM for Financial Services#Financial Services CRM Software#Best GRC Software Solutions in USA#CRM for small businesses#CRM Solutions#Top CRM Software USA#Best CRM Software in USA#Industry Specific CRM Solutions#best free crm for insurance agents

0 notes

Text

Affirmations for Baddies 😌

₊˚ʚᗢ₊˚✧゚for entertainment purposes, and other disclaimers ✧˚ ༘ ⋆。♡˚

decks: Affirmators!

Pile 1 → Pile 2 → Pile 3

Inhale, exhale 3x, pick

✯✯ patreon ✯ free readings ✯ masterpost ✯✯

💌 get zines and tarot readings in the mail 💌✨📬📮

Pile 1 🍭

Confidence - In this moment, I take a step back and look at myself with the pride of a good mother. I see an abundance of abilities and talents that show up all the time in big and little ways. If I could stick myself on a refrigerator, I would. I would invite all the neighbors over and say, "Look at that. Can you believe what an A+ that is?"

Pile 2 🕶

Divine Timing - Everything is timing, and timing is everything. Gladly, I release my concern over timing and let things happen when- and as--they will. I trust that the divine schedule-makers know what they're doing. It can take a long time to reach divine middle management.

Pile 3 📰

Bonus Card → Communication - Wonder how that other person's feeling? Ask 'em. Wish they knew how you were feeling? Tell 'em. You've just been drafted into the communication army, where there is a strict do ask/do tell policy. Speak with kindness and gentleness, and reach an understanding. If you don't, assumption will just make asses of everyone, including the person who came up with that aphorism.

Self-Love - I openly embrace a feeling of self-love (the PG kind). I love myself because I understand myself. I love myself as the most committed partner I will ever have. I show myself love any way that I can, and when I screw up I remember to be sweet and gentle with myself. If not, I'm gonna make myself sleep on the couch. Got that, Self?

I do not consent to my writing, blog’s likeness, or anything associated with my work, to be used to teach any machine learning software and artificial intelligence for any purpose.

#glenda's guidance#tarotblr#tarot#witchblr#astrology#paganblr#wiccablr#affirmations#pac reading#free tarot readings#pick a card reading#pick a reading#spiritual journey#spiritual awakening#spirituality#personal growth#self love#self improvement#healing#growth#goals#baddie aesthetic#law of manifestation#manifestation#manifesting#law of assumption#law of the universe#law of abundance#law of attraction

65 notes

·

View notes

Text

Who Is Helping DOGE? List of Staff Revealed

- Feb 14, 2025 | Newsweek | By James Bickerton, US News Reporter

DOGE head Elon Musk speaks in the Oval Office at the White House on February 11, 2025. Andrew Harnik/Getty

list of 30 employees and alleged allies of Elon Musk's newly created Department of Government Efficiency (DOGE) has been published by ProPublica, an investigative news outlet.

Newsweek reached out to Musk for comment via emails to the Tesla and SpaceX press offices.

DOGE, a U.S. government organization which, despite its name, doesn't have full department status, was created by President Trump via an executive order on January 20 with the aim of cutting what the new administration regards as wasteful spending. Musk, a close Trump ally, heads the body and has been given special government employee status.

Musk has called for sweeping cuts to federal spending, suggesting it could be reduced by up to $2 trillion per year out of a 2024 total of $6.75 trillion, according to U.S. Treasury figures.

This ties in with Trump's pledge to "drain the swamp," a term his supporters use for what they believe is a permanent left-leaning bureaucracy that holds massive power regardless of who is in the White House.

DOGE has already recommended that the U.S. Agency for International Development (USAID) be closed down, with its functions transferred to the State Department. In a recent interview, Trump said he wants DOGE to go through spending at the Departments of Education and Defense.

On February 8, a federal judge imposed a temporary restraining order blocking DOGE employees from accessing the Treasury Department's payment system, resulting in Musk calling for him to be impeached.

A White House spokesperson told ProPublica: "Those leading this mission with Elon Musk are doing so in full compliance with federal law, appropriate security clearances, and as employees of the relevant agencies, not as outside advisors or entities."

The 30 DOGE employees and associates reported by ProPublica, which labeled them Musk's "demolition crew," are listed below.

Not Even DOGE Employees Know Who’s Legally Running DOGE! Despite all appearances, the White House insists that Elon Musk is not in charge of DOGE. US DOGE Service employees can’t get a straight answer about who is. Photograph: Kena Betancur/Getty Images

DOGE Employees And Associates

Christopher Stanley, 33: Stanley was part of the team Musk used to take over Twitter, now X, according to his LinkedIn profile, serving as senior director for security engineering for the company. The New York Times reports he now works for Musk at DOGE.

Brad Smith, 42: According to The New York Times, Smith, a friend of Trump's son-in-law Jared Kushner, was one of the first people appointed to help lead DOGE. He also served with the first Trump administration and was involved with Operation Warp Speed, the federal government's coronavirus vaccine development program.

Thomas Shedd, 28: Shedd serves as director of the Technology Transformation Services, a government body created to assist federal agencies with IT, and previously worked as a software engineer at Tesla.

Amanda Scales, 34: According to ProPublica, Scales is chief of staff at the Office of Personnel Management, a government agency that helps manage civil service. She previously worked for Musk's artificial intelligence company Xai.

Michael Russo, 67: Russo is a senior figure at the Social Security Administration, a government agency that administers the American Social Security program. According to his LinkedIn page, Russo previously worked for Shift4 Payments, a payment processing company that has invested in Musk's company SpaceX.

Rachel Riley, 33: Riley works in the Department of Health & Human Services as a senior adviser in the secretary's office. ProPublica reports she has been "working closely" with Brad Smith, who led DOGE during the transition period.

Nikhil Rajpal, 30: According to Wired, Rajpal, who in 2018 worked as an engineer at Twitter, is part of the DOGE team. He formally works as part of the Office of Personnel Management.

Justin Monroe, 36: According to ProPublica, Monroe is working as an adviser in the FBI director's office, having previously been senior director for security at SpaceX.

Katie Miller, 33: Miller is a spokesperson for DOGE. Trump announced her involvement with the new body in December. She served as Vice President Mike Pence's press secretary during Trump's first term.

Tom Krause, 47: Krause is a Treasury Department employee who is also affiliated with DOGE, according to The New York Times. Krause was involved in the DOGE team's bid to gain access to the Treasury Department's payments system.

Gavin Kliger, 25: Kliger, a senior adviser at the Office of Personnel Management, is reportedly closely linked to Musk's team. On his personal Substack blog, he wrote a post titled "Why I gave up a seven-figure salary to save America."

Gautier "Cole" Killian, 24: Killian is an Environmental Protection Agency employee who researched blockchain at McGill University. Killian is also a member of the DOGE team, according to Wired.

Stephanie Holmes, 43: ProPublica reports that Holmes runs human resources at DOGE, having previously managed her own HR consulting company, BrighterSideHR.

Luke Farritor, 23: Farritor works as an executive engineer at the Department of Health and previously interned at SpaceX, according to his LinkedIn account. He won a $100,000 fellowship from billionaire tech entrepreneur Peter Thiel in March 2024.

Marko Elez, 25: Elez is a Treasury Department staffer who worked as an engineer at X for one year and at SpaceX for around three years. The Wall Street Journal reported that Elez was linked to a social media account that had made racist remarks, but Musk stood by him after he initially resigned.

Steve Davis, 45: Davis is a longtime Musk associate who previously worked for the tech billionaire at SpaceX, the Boring Company and X. According to The New York Times, Davis was one of the first people involved in setting up DOGE with Musk and has been involved in staff recruitment.

Edward Coristine, 19: Coristine is a Northeastern University graduate who was detailed to the Office of Personnel Management and is affiliated with DOGE. He previously interned at Neuralink, a Musk company that works on brain-computer interfaces.

Nate Cavanaugh, 28: Cavanaugh is an entrepreneur who interviewed staffers at the General Services Administration as part of the DOGE team, according to ProPublica.

Unmasked: Musk’s Secret DOGE Goon Squad—Who Are All Under 26! The world’s richest man doesn’t want anyone knowing his right-hand people who are disrupting government. — Josh Fiallo, Breaking News Reporter, Daily Beast, February 3, 2025

Akash Bobba, 21: A recent graduate from the University of California, Berkeley, Bobba works as an "expert" at the Office of Personnel Management and was identified by Wired as part of Musk's DOGE team.

Brian Bjelde, 44: A 20-year SpaceX veteran, Bjelde now works as a senior adviser at the Office of Personnel Management, where he wants to cut 70 percent of the workforce, according to CNN.

Riccardo Biasini, 39: Biasini is an engineer who now works as a senior adviser to the director at the Office of Personnel Management. He previously worked for two Musk companies, Tesla and the Boring Company.

Anthony Armstrong, 57: Another senior adviser to the director at the Office of Personnel Management Armstrong previously worked as a banked with Morgan Stanley, and was involved in Musk's 2022 purchase of Twitter.

Keenan D. Kmiec, 45: Kmiec is a lawyer who works as part of the Executive Office of the President. He previously clerked on the Supreme Court for Chief Justice John Roberts.

James Burnham, 41: Burnham is a general counsel at DOGE whose involvement with the Musk-led body was first reported by The New York Times in January. He previously worked as a clerk for Supreme Court Justice Neil Gorsuch.

Jacob Altik, 32: A lawyer affiliated with the Executive Office of the President, Altik previously clerked for D.C. Circuit Court of Appeals Judge Neomi Rao, whom Trump appointed during his first term.

Jordan M. Wick, 28: Wick is an official member of DOGE and previously worked as a software engineer for the self-driving car company Waymo.

Ethan Shaotran, 22: Shaotran is a former Harvard student who Wired listed as one of several young software engineers working to analyze internal government data at DOGE.

Kyle Schutt, 37: Schutt is a software engineer affiliated with DOGE and worked at the General Services Administration. He was involved in the launch of WinRed, a Republican fundraising platform that helped raise $1.8 billion ahead of the November 2024 elections.

Ryan Riedel, 37: Riedel is the chief information officer at the Department of Energy and a former SpaceX employee.

Adam Ramada, 35: Ramada is an official DOGE member, according to federal records seen by ProPublica. Ramada previously worked for venture capital company Spring Tide Capital. E&E News reported he had been seen at the Energy Department and the General Services Administration.

Kendell M. Lindemann, 24: Lindemann is an official member of the DOGE team who previously worked for health care company Russell Street Ventures, founded by fellow DOGE associate Brad Smith, and as a business analyst for McKinsey & Company.

Nicole Hollander, 42: Hollander works at the General Services Administration. She was previously employed by X, where she was involved with the company's real estate portfolio.

Alexandra T. Beynon, 36: Beynon is listed as an official member of DOGE, according to documents seen by ProPublica. She previously worked for therapy startup Mindbloom and banking firm Goldman Sachs.

Jennifer Balajadia, 36: Balajadia is a member of the DOGE team who previously worked for the Boring Company for seven years. According to The New York Times, she is a close Musk confidant and assists with his scheduling.

91 notes

·

View notes

Note

Hello Nicholas!

I hope this isn't a weird question, but I saw in one of your posts that you used to be in a huge amount of debt and now you're living more comfortably- how did you manage to get out of debt? I feel like every time I start even trying to figure out where to start, it's just all too big to ever get out from under. Do you have any advice for me?

Hope you have a great day!

Hey there! Yes, from about 2007-2010 (before I transitioned), I was making less than $10k/year. I defaulted on all my credit cards, exhausted my retirement, and nearly lost my house. It sucked, and in 2024, I'm finally start to feel somewhat secure. What I learned (assuming living in the US, I also did not have student loan debt):

I had to first figure out the sources of my debt. A big chunk of it was because of bad spending habits due to mental illness (hoarding + retail therapy when I was dysphoric/depressed). Another chunk was from being in an abusive friendship. Another, from being unemployed. And the last, was general capitalism (this was during the housing crisis.)

I started working on improving myself to curb behaviors that led to debt. I started working on my hoarding. I started transition to improve my mental health (had to sell some stuff to afford HRT). It took until 2015 to ditch my abuser, alas.

I started working on new job skills. I swallowed my pride and got an office job after a failed 3-year stint at freelancing. It was shitty, but enough to take care of my income emergencies -- keeping my house out of foreclosure. I got a better job 8 months later. It also sucked and I was in it for 7 years, but eventually changed industries and that's when my career took off. Because with each new job, I've gotten better and better pay.

I started using budgeting software. YNAB is my favorite. I try to account for every single dollar I have.

I started spending smarter. Food was the expense I had the most control over. I went to the salvage grocery store (you can find non-expired stuff if you hunt) and bought the "ugly" produce 1 day away from rotting from the local markets. I actually managed to eat well once I found these grocery stores, and my food bill became a fraction of what it'd been at typical grocery stores. I do wish that I had given food pantries a shot, but I was in denial about my poverty at the time.

I sold a ton of useless crap. I got rid of a good chunk of my nerd "collectibles". I only miss a few things over a decade later.

I negotiated with my debt collectors. I managed to set up payment plans with my credit card companies, condo association, and the IRS. I also did a debt consolidation loan once I qualified and was sure I could commit to the monthly payments. It forced me to be super strict about my budget and for about 5 years I didn't buy much for myself. It sucked, but I cleared a bunch of debt that way.

I got help from my family. I was embarrassed to tell my family about my predicament, but it became impossible to hide. I got help cleaning out my hoard and my mother has gracefully given me generous cash gifts every now and then. Never enough to be life-changing, but enough to give me a mental breather.

I played the credit score game. This one seems counter-intuitive, and requires some self-control about not abusing credit cards. Many people recommend the "snowball" method for paying off cards (pay off your lowest debt asap, then go to the next one), but I went with a "credit utilization" method (bring my highest used cards down to the next utilization level, then move to other cards) so I would see immediate changes in my credit score. What is credit card utilization? It's the percentage of how much of your credit card you're using. A card with a $1,000 limit and $100 on it = 10% utilization. Your credit score changes when you cross the following thresholds: 90%, 70%, 50%, 30%, 10%. Once my credit score started going up past 400 (especially as defaults started falling away), I applied for a secured card. As I started using that better, I applied for a few more cards, then for credit line increases every 6 months. My car insurance rates were tied to my credit score, so as soon as that improved, I switched companies and saved money there.

Mistakes I made:

Being in denial that I was poor. I didn't really look for resources on how to live while in poverty. This hurt me a lot because I ended up neglecting myself out of pride, which made my situation even worse.

Payday loans. I got stuck in the payday cycle for about 8 years. I wish I had sold more stuff or asked family for money to have never needed that initial loan. Once you are in the cycle, it becomes very difficult to get out.

Not going to a food bank.

Not asking for help sooner. And not just financial help.

Not getting out of abusive situations sooner. This is hard, and I sympathize with anyone in a similar position. But if you think it's time to move on, trust your gut - don't sacrifice yourself for people who don't care about you.

Ignoring debt collectors, because I was too afraid to negotiate for a plan. The IRS was so patient with me in the end, even after defaulting twice on plans.

Not considering getting a roommate to reduce costs, or not thinking of doing more things like shared meals with my fellow poor friends. Again, denial and pride. Humility is not a bad word and I wished I had learned it sooner.

Not changing jobs sooner. Curbing my hoarding and getting a better job are responsible for about 90% of me being where I am financially today.

Getting out of debt is a marathon. It took over a decade for me, and I am *still* feeling the sting of poverty. I wish you the best of luck. Folks are welcome to tack on specific tricks and strategies -- this is just a general outline of my particular journey.

#chit chat#my most toxic traits at the time were individualism and stoicism and by god they nearly killed me

134 notes

·

View notes

Text

Vittoria Elliott at Wired:

Elon Musk’s takeover of federal government infrastructure is ongoing, and at the center of things is a coterie of engineers who are barely out of—and in at least one case, purportedly still in—college. Most have connections to Musk and at least two have connections to Musk’s longtime associate Peter Thiel, a cofounder and chairman of the analytics firm and government contractor Palantir who has long expressed opposition to democracy. WIRED has identified six young men—all apparently between the ages of 19 and 24, according to public databases, their online presences, and other records—who have little to no government experience and are now playing critical roles in Musk’s so-called Department of Government Efficiency (DOGE) project, tasked by executive order with “modernizing Federal technology and software to maximize governmental efficiency and productivity.” The engineers all hold nebulous job titles within DOGE, and at least one appears to be working as a volunteer. The engineers are Akash Bobba, Edward Coristine, Luke Farritor, Gautier Cole Killian, Gavin Kliger, and Ethan Shaotran. None have responded to requests for comment from WIRED. Representatives from OPM, GSA, and DOGE did not respond to requests for comment. Already, Musk’s lackeys have taken control of the Office of Personnel Management (OPM) and General Services Administration (GSA), and have gained access to the Treasury Department’s payment system, potentially allowing him access to a vast range of sensitive information about tens of millions of citizens, businesses, and more. On Sunday, CNN reported that DOGE personnel attempted to improperly access classified information and security systems at the US Agency for International Development (USAID), and that top USAID security officials who thwarted the attempt were subsequently put on leave. The AP reported that DOGE personnel had indeed accessed classified material. “What we're seeing is unprecedented in that you have these actors who are not really public officials gaining access to the most sensitive data in government,” says Don Moynihan, a professor of public policy at the University of Michigan. “We really have very little eyes on what's going on. Congress has no ability to really intervene and monitor what's happening because these aren't really accountable public officials. So this feels like a hostile takeover of the machinery of governments by the richest man in the world.”

[...] “To the extent these individuals are exercising what would otherwise be relatively significant managerial control over two very large agencies that deal with very complex topics,” says Nick Bednar, a professor at University of Minnesota’s school of law, “it is very unlikely they have the expertise to understand either the law or the administrative needs that surround these agencies.” Sources tell WIRED that Bobba, Coristine, Farritor, and Shaotran all currently have working GSA emails and A-suite level clearance at the GSA, which means that they work out of the agency’s top floor and have access to all physical spaces and IT systems, according a source with knowledge of the GSA’s clearance protocols. The source, who spoke to WIRED on the condition of anonymity because they fear retaliation, says they worry that the new teams could bypass the regular security clearance protocols to access the agency’s sensitive compartmented information facility (SCIF), as the Trump administration has already granted temporary security clearances to unvetted people. This is in addition to Coristine and Bobba being listed as “experts” working at OPM. Bednar says that while staff can be loaned out between agencies for special projects or to work on issues that might cross agency lines, it’s not exactly common practice.

WIRED’s report on the 6 college-aged men between 19 and 24 that are shaping up DOGE in aiding and abetting in co-”President” Elon Musk’s technofascist takeover.

#Elon Musk#DOGE#Department of Government Efficiency#Trump Administration II#General Services Administration#Office of Personnel Management#Scott Bessent#USAID#Akash Bobba#Edward Coristine#Luke Farritor#Gautier Cole Killian#Gavin Kliger#Ethan Shaotran#Treasury Department#Musk Coup

65 notes

·

View notes