#Automated Payment Processing

Explore tagged Tumblr posts

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

7 notes

·

View notes

Text

The Role of AP Outsourcing in Financial Transformation

Modern businesses are increasingly turning to outsourced finance solutions to gain better control over their spending and streamline operations. Among these, procurement outsourcing is one of the most impactful strategies. By outsourcing procurement, companies can reduce overheads, enhance supplier relationships, and gain access to expert market insights—all while improving efficiency.

The connection between outsourcing and procurement is especially powerful when combined with accounts payable outsourcing. This approach allows companies to automate invoice handling, ensure timely payments, and avoid late fees or duplicate payments. Many accounts payable outsourcing companies also provide real-time tracking tools, compliance support, and advanced analytics, offering full transparency and control.

By integrating procurement and payables into a unified outsourced finance model, businesses can significantly cut costs and improve operational agility. With specialized vendors handling routine finance tasks, internal teams can shift their focus to strategic growth. Whether you're a startup or an enterprise, the benefits of combining outsourcing and procurement are hard to ignore.

#outsourced financial services#AP automation#procurement management#finance process optimization#supplier payment solutions

0 notes

Text

CHAPS Payments UK: Your Guide to This Essential Bank Transfer

In the UK, over 150,000 CHAPS payments are made daily, totaling billions of pounds in transactions. This significant volume underscores the importance of the Clearing House Automated Payment System (CHAPS) in the country’s financial infrastructure. CHAPS is a real-time gross settlement system used for high-value transactions. It is a vital component of the UK banking system, enabling secure and…

#Bank transfers in the UK#CHAPS payment instructions#CHAPS payments UK#CHAPS transfer process#Clearing House Automated Payment System#Direct bank transfers UK#Faster payments in UK#Secure bank transfers

0 notes

Video

youtube

11 New Tech Breakthroughs Straight From Sci-Fi Movies!

#youtube#decentralized network#decentralized payments#ai technology#crypto currencies#alternative banking#automated financial processes#new tech breakthroughs#immersive universes

0 notes

Text

Build the Future of Gaming with Crypto Casino Development Solutions

#In a world where innovation drives the gaming industry#the rise of crypto casino game development is reshaping the way players and developers think about online gambling. This is because blockch#allowing developers and entrepreneurs to create immersive#secure#and decentralized casino experiences in unprecedented ways. This is not a trend; it's here to stay.#The Shift towards Crypto Casinos#Imagine a world that could be defined by transparency#security#and accessibility for your games. That's precisely what crypto casino game development is trying to bring to the table. Traditionally#online casinos have suffered because of trust issues and minimal choices for payment options. This changes with blockchain technology and c#Blockchain in casino games ensures that all transactions are secure#transparent#and tamper-proof. Thus#players can check how fair a game is#transfer money into and out of the account using cryptocurrencies#and maintain anonymity while playing games. It is not only technologically different but also culturally. This shift appeals to a whole new#What Makes Crypto Casino Game Development Unique?#Crypto casino game development offers features that set it apart from traditional online casinos. Let’s delve into some of these groundbrea#Decentralization and TransparencyBlockchain-powered casinos operate without centralized control#ensuring all transactions and game outcomes are verifiable on a public ledger. This transparency builds trust among players.#Enhanced SecurityWith smart contracts automating processes and blockchain technology securing transactions#crypto casinos significantly reduce the risk of hacking and fraud.#Global AccessibilityCryptocurrencies break the barriers that traditional banking systems have#making it possible for players from around the world to participate without having to think about currency conversion or restricted regions#Customizable Gaming ExperiencesDevelopers can customize crypto casino platforms with unique features such as NFT rewards#tokenized assets#and loyalty programs#making the game more interesting and personalized.#Success Story of Real Life#Crypto casino game development has already brought about success stories worldwide. Among them

1 note

·

View note

Text

AR Analytics: Leveraging Accounts Receivable Analytics for Actionable Insights

Efficient Accounts Receivable (AR) is an essential component of any organization’s financial health. Effective management of AR ensures that the company maintains a healthy cash flow, minimizes the risk of bad debt, and fosters strong customer relationships. One of the most powerful tools at a company’s disposal to enhance AR processes is analytics. By leveraging AR analytics, businesses can gain actionable insights into payment behaviors and collection effectiveness. This blog explores how AR analytics can be used to optimize financial operations.

Understanding AR Analytics

AR analytics involves the systematic use of data and statistical analysis to understand and improve accounts receivable processes. This includes tracking payment patterns, predicting future payment behaviors, identifying potential risks, and measuring the effectiveness of collection strategies.

By implementing AR analytics, businesses can transition from reactive to proactive management of their accounts receivable. Instead of waiting for payment issues to arise, companies can anticipate potential problems and take preemptive measures to address them.

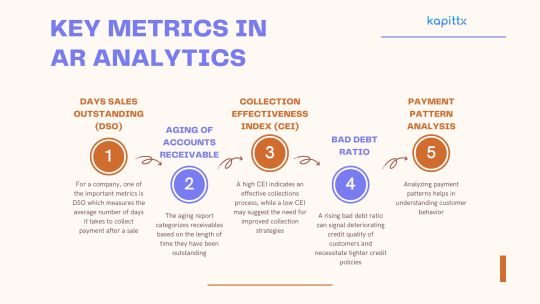

Key Metrics in AR Analytics

Days Sales Outstanding (DSO): For a company, one of the important metrics is DSO which measures the average number of days it takes to collect payment after a sale. A lower DSO indicates faster collection of receivables and better liquidity. Monitoring DSO trends can help identify inefficiencies in the collection process and prompt corrective actions.

Aging of Accounts Receivable: The aging report categorizes receivables based on the length of time they have been outstanding. This allows for the identification of overdue accounts and prioritizes collection efforts. By analyzing aging trends, businesses can also uncover patterns that may indicate underlying issues with certain customers or products.

Collection Effectiveness Index (CEI): The Collection Effectiveness Index (CEI) gauges the efficiency of the collections process by calculating the percentage of receivables collected within a specific timeframe. A high CEI indicates an effective collections process, while a low CEI may suggest the need for improved collection strategies.

Bad Debt Ratio: This ratio compares the amount of bad debt to total sales. A rising bad debt ratio can signal deteriorating credit quality of customers and necessitate tighter credit policies.

Payment Pattern Analysis: Analyzing payment patterns helps in understanding customer behavior. By identifying customers who consistently pay late, businesses can implement targeted strategies to encourage timely payments, such as offering early payment discounts or setting stricter credit terms.

Leveraging Predictive Analytics

Predictive analytics, an advanced form of AR analytics, leverages historical data and statistical algorithms to anticipate future payment behaviors. By leveraging predictive analytics, businesses can:

Identify At-Risk Accounts: Predictive models can flag accounts that are likely to become delinquent, allowing companies to proactively engage with these customers and negotiate payment plans before issues escalate.

Optimize Credit Policies: By understanding the factors that contribute to late payments, businesses can refine their credit policies to mitigate risks. For example, adjusting credit limits based on predictive insights can help balance sales growth with credit risk.

Enhance Cash Flow Forecasting: Accurate cash flow forecasting is essential for financial planning. Predictive analytics can improve the accuracy of these forecasts by accounting for anticipated payment delays and bad debts.

Enhancing Collection Strategies

Segmentation of Receivables: Segmenting receivables based on various criteria, such as customer size, industry, and payment history, allows for tailored collection strategies. For instance, high-value customers with good payment records may be handled differently from smaller accounts with inconsistent payment patterns.

Prioritization of Collection Efforts: Using AR analytics, businesses can prioritize their collection efforts based on the likelihood of recovery. Accounts with a high probability of payment can be targeted for softer collection tactics, while accounts with lower probabilities may require more intensive follow-up.

Monitoring Collection Performance: Regularly tracking collection performance through analytics ensures that the chosen strategies are effective. By comparing the success rates of different methods, businesses can continually refine their approach.

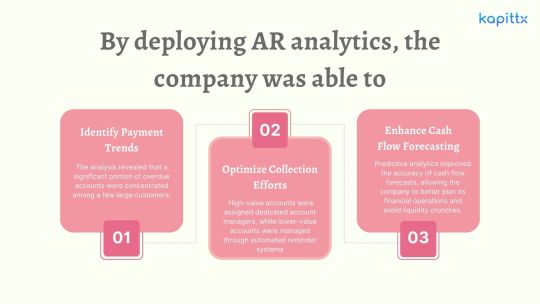

Case Study: AR Analytics in Action

Consider a mid-sized manufacturing company that implemented AR analytics to improve its cash flow management. Prior to leveraging analytics, the company struggled with high DSO and a significant amount of overdue receivables.

Identify Payment Trends: The analysis revealed that a significant portion of overdue accounts were concentrated among a few large customers. By addressing these accounts directly, the company was able to negotiate more favorable payment terms and reduce its DSO.

Optimize Collection Efforts: The company segmented its receivables and tailored its collection strategies accordingly. High-value accounts were assigned dedicated account managers, while lower-value accounts were managed through automated reminder systems. This resulted in a 20% improvement in the CEI.

Enhance Cash Flow Forecasting: Predictive analytics improved the accuracy of cash flow forecasts, allowing the company to better plan its financial operations and avoid liquidity crunches.

Conclusion

In today’s competitive business environment, leveraging AR analytics is no longer optional—it is a necessity. By gaining actionable insights into payment behaviors and collection effectiveness, businesses can significantly enhance their accounts receivable processes. This enhances cash flow, lowers the risk of bad debt, fortifies customer relationships, and promotes overall financial health.

Implementing AR analytics requires a commitment to data-driven decision-making and continuous improvement. With the right tools and strategies in place, businesses can transform their AR operations and achieve sustainable growth.

#ai based accounts receivable#Accounts receivable analytics#ar collection#cashflow management#ar management#ai in accounts receivable#payment reminder#cash application process#ai powered accounts receivable#accounts receivable automation software

0 notes

Text

Efficient Payroll Management Solutions for Accurate and Timely Employee Compensation

Efficient payroll management is essential for maintaining employee trust and ensuring compliance with financial regulations. Payroll software simplifies the process by automating salary calculations, tax deductions, and payment scheduling. This technology reduces errors, saves time, and provides detailed reports for compliance and transparency. A modern payroll solution integrates seamlessly with other HR functions, offering scalability and customization to meet the unique needs of businesses. Streamline your payroll process to enhance accuracy, reduce administrative burden, and ensure timely employee payments.

More info: https://ahalts.com/solutions/hr-services/complete-payroll

#Payroll Management#Payroll Software#Salary Processing#Tax Deductions#Employee Compensation#Wage Calculation#Automated Payroll#Compliance Reporting#Payment Schedules#HR Payroll Solutions

0 notes

Text

Billing Software Development Services IBR Infotech

IBR Infotech specializes in providing custom billing software development services designed to streamline your invoicing, payment processing, and transaction management. Our solutions offer seamless integration with existing systems, ensuring accurate, automated billing processes that enhance financial operations.

With a focus on user-friendly interfaces and robust security, our billing software helps businesses reduce manual errors, improve cash flow, and maintain compliance. Whether you're a small business or a large enterprise, our scalable solutions can be tailored to meet your specific needs, ensuring efficiency and accuracy across your billing cycles. Let IBR Infotech transform your billing system into a powerful tool for financial management and business growth. Read more -https://www.ibrinfotech.com/solutions/custom-billing-software-development #BillingSoftware #SoftwareDevelopment #CustomBilling #InvoicingSoftware #PaymentProcessing #TransactionManagement #AutomatedBilling #FinancialManagement #SecureBilling #BillingSolutions #ScalableSoftware #BusinessSoftware #CashFlowManagement #BillingSystem #TechSolutions #EnterpriseSoftware #BillingServices #FinancialTech #SoftwareDevelopmentServices

#billing software development#custom billing software#invoicing software solutions#payment processing software#transaction management system#automated billing#secure billing software#financial management software#billing system integration#custom invoicing software#user-friendly billing system#billing software for businesses#financial operations software#automated invoicing solutions

0 notes

Text

Streamline Visitor Payments with Automated Entry Management Simplify the visitor entry process by integrating payment solutions that ensure seamless and secure access for paid visitors. Reduce queues and enhance visitor experience with our automated system.

#Paid visitor entry#Automated visitor management#Visitor payment solutions#Secure visitor access#Entry management system#Paid access control#Visitor entry solutions#Visitor flow management#Seamless visitor payments#Visitor entry automation#Real-time visitor tracking#Efficient entry system#High-volume visitor management#Secure payment processing#Visitor access control system

0 notes

Text

#Housecall Pro review#Home service business software#Business management software#Field service management#Scheduling software for service businesses#Invoicing and payment processing tools#Customer management software#Marketing tools for service pros#Home service industry solutions#Business software for plumbers#HVAC business management#Landscaping business software#Electrical service software#Service business automation#Small business technology solutions#Streamlining business operations#Growing a service business#Software for service professionals#Home service scheduling tools#Best software for service businesses

0 notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

Rightpath Global Services: The Experts in Payables Outsourcing

In today's fast-paced business environment, efficient financial operations are key to success. Rightpath Global Services (Rightpath GS) offers cutting-edge Business Process Management solutions, specializing in accounts payable outsourcing. By automating and managing payables, businesses can reduce errors, save time, and focus more on growth strategies rather than manual accounting tasks.

Their customized solutions help companies maintain vendor relationships, ensure timely payments, and improve compliance. With complete visibility and control, clients benefit from reduced costs and enhanced productivity.

Partnering with Rightpath Global Services for accounts payable outsourcing transforms finance operations. Their Business Process Management approach not only optimizes workflows but also ensures scalability as your company grows. Trust in Rightpath GS to manage your financial backend while you focus on innovation and expansion.

#finance outsourcing#vendor payment solutions#workflow automation#invoice processing#outsourcing finance operations

0 notes

Text

Faster Withdrawals, Happier You: Streamline Your Finances with PayTrackster

PayTrackster, payment analytics software is not just an automated payment processor, but something more enduring. It’s a one-and-only solution that keeps you under control of e-commerce finances, expedites PayPal’s withdrawal approval, and allows you to save on chargebacks and other costly inconveniences. Through automating processes, eliminating errors and providing real-time insights, PayTrackster saves you valuable time and resources so you can focus on fundamentals — your business growth and success.

0 notes

Text

Explore the importance of cloud billing software for businesses. Discover the key reasons why integrating billing software is crucial for enhancing efficiency, accuracy and financial management in your organization. From faster invoicing to improving customer experience, learn how this essential tool can streamline processes and drive growth. Unlock insights into the benefits and features of online billing & accounting software to make informed decisions for optimizing your business operations.

#billing software#invoicing software#accounting software#online billing#invoice generator#small business billing#cloud billing software#automated billing#subscription billing#payment processing software

0 notes

Text

Beyond the Pay-check How ADP Payroll Services Can Help You Manage Your Workforce

In the complex landscape of modern business, managing a workforce goes far beyond just issuing pay checks. It involves navigating through intricate payroll processes, ensuring compliance with regulations, and optimizing operational efficiency. This is where Ignite HCM's comprehensive payroll services, powered by ADP Payroll Processing Services, come into play. Let's delve into how Ignite HCM can empower your organization to effectively manage your workforce beyond mere payroll transactions.

Streamlined Payroll Processing

Seamless Integration with ADP Payroll Processing Services

Ignite HCM offers seamless integration with ADP Payroll Processing Services, allowing for efficient and accurate payroll processing. With automated systems and advanced technology, manual errors are minimised, ensuring payroll is processed swiftly and accurately. This integration streamlines the entire payroll process, from time tracking to tax calculations, saving time and resources for your organization.

Customized Payroll Solutions

Ignite HCM understands that every business is unique, with its own set of payroll requirements. Therefore, it provides customisable payroll solutions tailored to meet the specific needs of your organization. Whether you're dealing with complex payroll structures, multiple pay rates, or varying employee benefits, Ignite HCM's flexible platform, backed by ADP Payroll Processing Services, can accommodate your needs, ensuring accuracy and compliance at every step.

Compliance Management

Adherence to Regulatory Requirements

Navigating through the ever-evolving landscape of employment regulations can be daunting for businesses. Ignite HCM alleviates this burden by ensuring compliance with all federal, state, and local payroll regulations. Through continuous monitoring and updates provided by ADP Payroll Processing Services, Ignite HCM helps your organization stay compliant with changing laws and regulations, reducing the risk of penalties and fines.

Tax Filing and Reporting

One of the most complex aspects of payroll management is tax filing and reporting. Ignite HCM simplifies this process by leveraging the expertise of ADP Payroll Processing Services. From accurate tax calculations to timely filings and reporting, Ignite HCM ensures that your organization remains compliant with tax laws, minimizing the risk of costly mistakes and audits.

Enhanced Workforce Management

Time and Attendance Tracking

Efficient workforce management begins with accurate time and attendance tracking. Ignite HCM's integrated platform, powered by ADP Payroll Processing Services, offers advanced time tracking features, allowing you to monitor employee hours, track overtime, and manage schedules effectively. This not only improves payroll accuracy but also enhances productivity by optimizing workforce utilization.

Employee Self-Service

Empowering employees with self-service capabilities is key to enhancing workforce management. Ignite HCM provides a user-friendly self-service portal, enabling employees to access their pay stubs, update personal information, and request time off seamlessly. By reducing administrative overhead and empowering employees to manage their own information, Ignite HCM improves employee satisfaction and engagement.

Conclusion

Managing a workforce goes far beyond issuing pay checks. It requires comprehensive solutions that address payroll processing, compliance management, and workforce optimization. Ignite HCM, in partnership with ADP Payroll Processing Services, offers a suite of integrated solutions designed to streamline payroll processes, ensure regulatory compliance, and enhance workforce management. By leveraging Ignite HCM's expertise and technology, your organization can focus on driving growth and success while leaving the complexities of workforce management to the experts.

for more info : https://www.ignitehcm.com/solutions/payroll-processing

Contact : +1 301-674-8033

#ADP Payroll Solutions#Payroll Management Services#ADP Payroll Software#Employee Payment Processing#Payroll Outsourcing#Automated Payroll Systems

0 notes

Text

Best Practices for Efficient Cash Application: Leveraging AI for Superior Results

Efficient cash application management is a critical process for any business, as it directly impacts financial health, operational productivity, and customer relationships. An effective cash application process, also known as payment processing, ensures accurate allocation of incoming payments, quick reconciliation, and minimal errors. However, traditional methods often lead to inefficiencies, disputes, and even severe cash flow problems. With advancements in technology, AI-powered cash application processes and cash application automation software have transformed how businesses manage payment reconciliation, enabling faster, more accurate outcomes.

What is the Cash Application Process?

The cash application process involves applying incoming payments to the corresponding invoices in the accounts receivable system. Payments can take various forms, including checks, electronic transfers, credit cards, or cash. The primary goals are:

To deposit received funds promptly into the company’s bank account.

To accurately match payments to the corresponding invoices or accounts.

This process is vital for maintaining accurate records, reducing receivables clutter, and ensuring seamless customer interactions. However, mismanagement can cause delays, disputes, and inefficiencies.

The Importance of an Efficient Cash Application Process

Cash application is a critical component of accounts receivable management, directly impacting a company’s cash flow, customer relationships, and overall financial health. An efficient cash application process not only minimizes unapplied payments and reduces errors but also streamlines operations, ensuring smooth financial workflows. Conversely, inefficiency in this process can lead to several significant issues.

Benefits of an Efficient Cash Application Process

1. Minimized Unapplied Payments: An efficient cash application process ensures that incoming payments are promptly and accurately matched with the corresponding invoices. This minimizes unapplied payments, where funds are received but not allocated to specific customer accounts, leading to a clearer financial picture.

2. Reduced Errors: Automation and systematic approaches in cash application significantly reduce the likelihood of errors. By minimizing human intervention, businesses can ensure that payments are applied correctly, reducing the risk of misallocations and financial discrepancies.

3. Streamlined Operations: With an efficient process in place, businesses can streamline their financial operations. This includes faster processing times, improved accuracy, and better coordination between departments, all of which contribute to smoother overall workflows.

4. Improved Cash Flow: Timely and accurate application of cash payments directly impacts a company’s cash flow. Efficient cash application ensures that funds are available for use more quickly, enhancing operational liquidity and financial stability.

5. Enhanced Customer Relationships: Accurate and timely cash application fosters trust and reliability in customer relationships. Customers appreciate prompt acknowledgment of their payments, which reflects positively on the business and strengthens customer loyalty.

Improved Accuracy

AI technologies significantly reduce human errors by automatically matching payments to the correct accounts based on remittance data. Traditional, manual processes are prone to mistakes due to human oversight, such as entering wrong amounts, misplacing payments, or failing to match payments to the right invoices. AI-powered systems, on the other hand, use machine learning and pattern recognition to ensure that every payment is accurately allocated. This precision helps in maintaining accurate financial records and avoids the costly mistakes that manual processes often incur.

Faster Processing Times

One of the most substantial benefits of AI-powered cash application is the ability to handle large volumes of payments swiftly. Automated systems process payments faster than human capabilities, significantly reducing the time it takes to reconcile accounts. This speed ensures minimal backlogs and enables the AR team to focus on more strategic tasks. For businesses handling thousands of transactions daily, the improvement in processing time can be a game-changer, leading to enhanced operational efficiency and productivity.

Enhanced Cash Flow Management

By speeding up the payment processing, AI-powered systems contribute to better cash flow management. Quick and accurate reconciliation means that businesses have a clearer and more immediate picture of their financial standing. This timely insight is crucial for maintaining liquidity, which allows companies to meet their short-term obligations, invest in growth opportunities, and reduce the need for short-term borrowing. Enhanced cash flow management also helps in better financial planning and forecasting, providing a solid foundation for strategic decision-making.

Customer Satisfaction

Accurate and timely postings are essential for maintaining good customer relationships. AI-powered cash application systems reduce the likelihood of misapplied payments and discrepancies, which are common sources of customer disputes. When customers see that their payments are processed correctly and their accounts reflect accurate information, it builds trust and confidence in the business. Satisfied customers are more likely to remain loyal and continue their business relationships, which is beneficial for long-term profitability and growth.

Best Practices for Cash Application Process and Payment Processing

1. Implement Auto-Cash Technology

AI Powered Cash Application software or Auto-cash systems like Kapittx use advanced algorithms to automatically match payments to invoices. This technology offers several benefits:

Increased Accuracy: By reducing human error, auto-cash systems ensure that payments are accurately allocated to the correct invoices.

Reduced Manual Effort: Automation minimizes the need for manual data entry and reconciliation, allowing your AR team to focus on more strategic tasks.

Improved Auto-Cash Hit Rates: With higher matching percentages, auto-cash technology ensures that a larger proportion of payments are accurately applied without manual intervention.

To implement auto-cash technology effectively:

Choose a robust auto-cash system that integrates seamlessly with your existing AR software.

Regularly update and maintain your customer payment data to ensure the system has accurate information.

Train your AR team to understand the system’s functionalities and handle exceptions efficiently.

2. Follow Customer Instructions

Compliance with customer remittance advice is crucial for accurate payment application. Remittance advice provides detailed information about which invoices a payment is intended to cover, ensuring correct allocation.

To follow customer instructions effectively:

Automate Remittance Processing: Use software that can automatically capture and process remittance advice from various formats, such as email, paper, or electronic data interchange (EDI).

Double-Check Allocations: Implement checks and balances to verify that payments are applied according to customer instructions before finalizing transactions.

Communicate Clearly: Maintain open communication with customers to clarify any ambiguities in their remittance advice.

3. Handle Discrepancies Promptly

Prompt handling of payment discrepancies is essential to avoid backlogs and ensure smooth cash flow. Here’s how to manage discrepancies effectively:

Write Off Small Discrepancies: Establish thresholds for writing off minor discrepancies to streamline the reconciliation process. This allows your team to focus on resolving significant issues.

Prioritize Significant Issues: Develop a systematic approach for identifying and resolving larger discrepancies. This includes investigating the root cause and taking corrective actions.

Regular Audits: Conduct regular audits to identify recurring discrepancies and implement measures to prevent them in the future.

4. Leverage Imaging Tools

Digital imaging tools can expedite the resolution of payment discrepancies and improve accessibility. By digitizing payment and remittance documents, businesses can enhance their cash application process.

Speed Up Resolution: Digital images of payments and remittances allow for faster identification and resolution of discrepancies, as they can be quickly accessed and reviewed.

Improve Accessibility: Store digital images in a centralized system that can be accessed by authorized personnel, facilitating better collaboration and transparency.

Automate Data Extraction: Use optical character recognition (OCR) technology to automatically extract data from digital images, reducing manual data entry and errors.

5. Invest in Training and Specialization

Equipping your AR team with the necessary skills and knowledge is crucial for handling unapplied and unidentified cash effectively.

Regular Training: Provide ongoing training programs to keep your team updated on the latest tools, technologies, and best practices in cash application.

Specialized Roles: Assign specialized roles within your AR team to handle specific aspects of the cash application process, such as resolving discrepancies or managing customer communications.

Knowledge Sharing: Foster a culture of knowledge sharing and continuous improvement within your team to leverage collective expertise and experience.

6. Monitor Key Metrics

Tracking key metrics allows businesses to continuously improve their cash application process. Important metrics to monitor include:

Payment Volume: Keep track of the number and value of payments processed to understand workload and performance trends.

Unapplied Cash Value: Measure the value of payments that remain unapplied to identify inefficiencies and areas for improvement.

Auto-Cash Hit Rates: Monitor the percentage of payments automatically matched to invoices to assess the effectiveness of your auto-cash system.

Days Sales Outstanding (DSO): Track DSO to gauge how quickly your business is collecting payments and identify opportunities to accelerate cash flow.

To monitor these metrics effectively:

Implement Dashboards: Use real-time dashboards to visualize key metrics and track performance against predefined targets.

Regular Reviews: Conduct regular reviews of your cash application metrics to identify trends, challenges, and opportunities for improvement.

Benchmarking: Compare your performance with industry benchmarks to understand how your cash application process measures up and identify best practices.

The Role of Cash Application Automation Software

Modern cash application automation software enhances efficiency by incorporating AI and machine learning capabilities. These systems:

Automate repetitive tasks like matching payments to invoices.

Analyze patterns to improve accuracy and hit rates over time.

By integrating with ERP they significantly improve payment reconciliation productivity.

Case Studies examples : How Automation Transformed Cash Application

Case 1: Manufacturing Industry

An equipment manufacturer faced significant challenges with unapplied cash exceeding $2 million. By implementing AI-powered cash application processes, the company achieved:

Increased operational efficiency, saving thousands in labor costs.

Reduction of unapplied cash from $2 million to $400,000 in six months.

An auto-cash hit rate improvement from 65% to 90%.

Case 2: Medical Equipment Company

A medical devices firm struggled with misapplied payments leading to cash flow disruptions. After adopting cash application automation software:

Cash flow improved, enabling reinvestment in revenue growth.

Open credit memos reduced from 1,200 to 300 within a year.

Customer disputes dropped by 75%, enhancing satisfaction.

Benefits of AI Powered Cash Application Software or Payment Reconciliation Software

AI Powered Cash Application Software or Payment reconciliation software plays a crucial role in automating and streamlining cash application management. Key advantages include:

Reduced Errors: Automated matching eliminates human error.

Real-Time Insights: Provides a clear view of receivables for better decision-making.

Scalability: Supports businesses as they grow, handling higher payment volumes effortlessly.

Step-by-Step Guide to an Efficient Cash Application Process

Collect Payments: Deposit incoming funds promptly to optimize cash flow.

Match Payments: Use remittance advice and auto-cash tools for accurate allocation.

Reconcile Accounts: Regularly check for unapplied or misapplied payments and address them.

Resolve Discrepancies: Communicate with customers to clarify unclear remittance advice.

Analyze and Optimize: Continuously improve processes by tracking metrics and refining automation algorithms.

Learn More:

Conclusion

An efficient cash application process is essential for maintaining healthy cash flow, improving customer satisfaction, and optimizing operational efficiency. By leveraging AI-powered cash application processes, businesses can overcome common challenges, reduce errors, and achieve seamless payment reconciliation. Investing in modern cash application automation software and payment reconciliation software is no longer optional—it’s a necessity in today’s competitive landscape.

Start transforming your cash application management today with Kapittx by integrating advanced technology and best practices to unlock unparalleled efficiency and accuracy.

#cash application process#cashflow management#AR collection#ai in accounts receivable#ar management#payment reminder#ar automation solution#ai based accounts receivable

0 notes