#Bullish Patterns

Explore tagged Tumblr posts

Text

youtube

Mastering Forex Charts: A Beginner's Guide to Candlesticks, Lines, and Bar Patterns

#Forex trading#Forex charts#candlestick charts#line charts#bar charts#trading tutorial#chart analysis#technical analysis#Forex market#bullish patterns#bearish patterns#price movements#market trends#OHLC#trading strategies#chart reading#price action#trading tips#beginner trading#advanced trading#Forex education#PipInfuse#trading insights#market sentiment#trend analysis#trading confidence#Youtube

1 note

·

View note

Text

10 Candlestick Patterns for Effective Trading

Candlestick patterns are a powerful tool for traders to analyze price movements and predict future market behavior. Developed in Japan over 300 years ago, these patterns are widely used in modern technical analysis. This article will explore ten essential candlestick patterns that can help traders make informed decisions and enhance their trading strategies. What are Candlestick…

#Bearish Patterns#Bullish Patterns#Candlestick Patterns#Downtrend#Entry and Exit Points#Forex#Forex Traders#Forex Trading#Market Reversal#Price Movements#Risk Management#Stop-Loss#Take-Profit#Technical Analysis#Trading Psychology#Trading Strategies#Trading Strategy#Trend Direction#Trend Identification#Uptrend

1 note

·

View note

Text

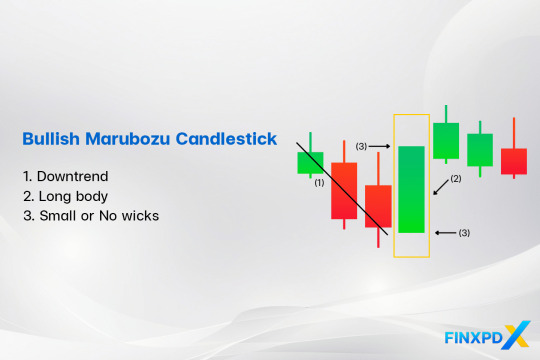

Bullish Marubozu: An Important Signal for Uptrend

Among candlestick patterns in market analysis, the Bullish Marubozu candlestick is a bullish indicator that is simple to understand and very effective. Unlike other candlesticks, which may show shadows or wicks, the Bullish Marubozu is unique in its simplicity—it has no shadows.

What Is the Bullish Marubozu?

The Bullish Marubozu candlestick is a bullish candlestick pattern that shows strong buying pressure throughout the trading session. It has a long white or green body with no shadows or wicks, meaning the price opened at its lowest and closed at its highest point.

The name “White Marubozu” is another name for a Bullish Marubozu candlestick that combines its appearance and Japanese origins. “White” refers to the bullish candle color, and “Marubozu,” meaning “bald” in Japanese, describes its lack of wicks.

Characteristics of the Bullish Marubozu Candlestick

Bullish Marubozu: Features a long, solid green body with little to no wicks.

Full Bullish Marubozu: No wicks at all, showing the strongest bullish control throughout the session.

Open Bullish Marubozu: No lower wick but a small upper wick, indicating a strong upward move with slight selling pressure at the end.

Close Bullish Marubozu: A small lower wick but no upper wick, reflecting strong buying with a slightly higher open.

Read more: FinxpdX

Download PDF: 35 Powerful Candlestick Patterns

#investing#finance#investment#financial#stocks#forex#forextrading#forex market#candlestick#candlestick patterns#Marubozu#bullish#forex indicators

4 notes

·

View notes

Text

Candlestick Charting: A Tale of Tradition and Innovation from Japan

Candlestick charting's rich origins in Japan reveal timeless insights into market sentiment. Embrace the past's wisdom as we navigate today's markets, confident that understanding emotions will illuminate brighter trading paths! 🚀📈 #FinancialWisdom

Candlestick charting, a vital tool for traders globally, originated in 18th-century Japan amid a feudal society and a thriving rice market. Developed by legendary trader Munehisa Homma, it visualised price movements using candlesticks, revealing market psychology and predicting trends. Steve Nison’s introduction of candlestick charting to the West in the 1980s revolutionised technical analysis.…

View On WordPress

#Bullish and Bearish Patterns#Candlestick Patterns#Feudal Japan#Financial Education#Japan#Market Psychology#Modern Trading#Price Action#Risk management#Technical Analysis

4 notes

·

View notes

Text

How to Spot the Bullish Belt Hold Pattern in Forex

The Bullish Belt Hold pattern is a significant bullish reversal signal in Forex trading. It consists of a single long bullish candle with no upper shadow, indicating that buyers have full control over the market. This pattern suggests a shift from a downtrend to an uptrend, presenting an opportunity to enter long positions. Recognizing the Bullish Belt Hold pattern can help traders time their entries more effectively, improving trading strategies and increasing success in the Forex market.

0 notes

Text

Bitcoin Price Recovery: Analyzing Demand and Future Trends #BitcoinBullishPatterns, #BitcoinDemandAnalysis, #BitcoinPricePrediction, #BitcoinPriceRecovery, #BTCAccumulationTrends, #CryptocurrencyMarketTrends

#Bitcoin bullish patterns#Bitcoin demand analysis#Bitcoin price prediction#Bitcoin price recovery#BTC accumulation trends#cryptocurrency market trends

1 note

·

View note

Text

#Pennant Pattern in Technical Analysis#Bullish and Bearish Pennant Pattern#Types of Pennant Patterns#How to Trade with Pennant Chart Pattern#How to Trade Bullish Pennant Pattern

0 notes

Text

#risk management#market capitalization#india#bullish reversal#market trends#chart pattern#candlestick pattern

0 notes

Text

Unlock the Secrets of Trading with Top Chart Patterns! Explore the world of chart patterns with Funded Traders Global. From understanding the basics of technical analysis to recognizing common chart patterns like head and shoulders, double tops, and flags, our blog equips you with the knowledge to enhance your trading skills. Discover advanced patterns like pennants, wedges, and harmonic patterns, and gain practical tips for effective trading. Improve your risk management, pinpoint entry and exit points, and combine chart patterns with technical indicators. Start your journey towards trading success today with Funded Traders Global!

#Advanced Chart Pattern#and Descending Triangles#and mini trading#Ascending#Basics of Technical Analysis#Benefits of Recognizing in Chart Pattern#Bullish and Bearish Flags Pattern#candlestick#candlestick Pattern#career in forex trading#chart patterns#classic reversal pattern#common chart patterns#cup and handle pattern#Double top and double bottom patterns#drawdown#financial markets#Forex trading financial freedom#FTG#ftg prop firm#ftg trading#Funded Traders Global#Gaps#Harmonic Patterns#Head and Shoulders Pattern#how to scale into a forex trade#Macro#Master the Market with These Top Chart Patterns for Trading#mastering Forex trading#micro

0 notes

Text

Unfurling the Flagpole Pattern in Technical Analysis: A Comprehensive Guide

Introduction: Technical analysis is a powerful tool in the arsenal of traders and investors, providing insights into potential market movements based on historical price data. One intriguing pattern within this realm is the flagpole , a key component of flag patterns. In this blog post, we’ll delve into the concept of the flagpole, its significance, and how it fits into the broader landscape of…

View On WordPress

#Bullish Patterns#candlestick patterns#Chart Interpretation#Chart Patterns#Flagpole Pattern#Market Analysis#price action#technical analysis#Trading Strategies#Trend Analysis

0 notes

Text

0 notes

Text

˚⊹◖𝐀𝐫𝐜𝐚𝐧𝐞 𝐌𝐚𝐬𝐭𝐞𝐫𝐥𝐢𝐬𝐭 ◗₊˚⊹

You find yourself in an endless void of darkness, hands reaching out to try and touch something, anything. It wasn't warm nor cold, the floor being the only surface in the overwhelming darkness. Your head snaps towards a pillar of light, its origin unknown, yet it beams down almost like a spotlight.

Basking in the light stood a statue of yourself, roughly carved out, chiseled, grinded down in places to become the art it was, coming down to the details of your hair — pattern, texture, length — face — whether sharp or soft — and even your body, height, shape, even posture. It was an uncanny reflection of your current self, even with the current attire you wore.

Just as you stepped close enough to stand at the edge of the spotlight, another appeared, and yet another statue of you, but different.

This time, you wore attire unfamiliar to your current body. You were dressed in a uniform that was unknown to you, a weapon carved into your hands and a stern look up on your stony face.

Another light appeared as yet another statue of yourself, this time, more somber. A cloak smoothed over your head, face hidden away in the shadows of the smooth stone that looked veiled across your stony image. Your face was carved to show some trait of sadness or sorrow.

Another pillar of light appeared and the statue was much larger, scary even. The facial traits looked like yours, but the body, everything that came with it, looked like a monster. Something you barely recognized.

More spotlights and statues seemed to make a circle around the original and around you, all different with emotions and bodies that varied. Some brutish looking, bullish, scary, others feeble, normal, almost heroic as well. They were all different, but they were all some version of you.

A voice rumbles and rattles through your skull, a string of multiple merging into one singular voice.

"Whatever you choose to be, live that life without regret. Live it boldly and freely. Your paths are limitless."

꒷꒦︶︶︶︶︶︶︶︶꒦꒷‧₊˚⊹

Arcane Masterlist

last updated | 12.12.14

· request open

Yes, I do Jayvik x Male Reader

Yes, I will do Zaundads x Male Reader

** = explicit/nsfw

Yes, I will do request for Season 2

yk the drill MDNI

꒷꒦︶︶︶︶︶︶︶︶꒦꒷‧₊˚⊹

𝐀𝐫𝐜𝐚𝐧𝐞

ׂ╰┈➤ series

𝐔𝐩𝐜𝐨𝐦𝐢𝐧𝐠

ׂ╰┈➤ A Glance at Greatness | Kiriman Male Reader

ׂ╰┈➤ Shield of Zaun | Arcane x Male Reader

𝐄𝐤𝐤𝐨

• no works here yet! feel free to request!

𝐕𝐚𝐧𝐝𝐞𝐫

• no works here yet! feel free to request!

𝐒𝐢𝐥𝐜𝐨

ׂ╰┈➤ drabbles

ׂ╰┈➤ oneshots

ׂ╰┈➤ series

𝐉𝐚𝐲𝐜𝐞

· Mini Series | ¹Broken Bones & Broken Hearts | ²Best Thing I Never Knew I Needed**

• no works here yet! feel free to request!

𝐕𝐢𝐤𝐭𝐨𝐫

• no works here yet! feel free to request!

𝐎𝐭𝐡𝐞𝐫𝐬 / 𝐄𝐱𝐭𝐫𝐚𝐬

· This includes any other characters not listed down

꒷꒦︶︶︶︶︶︶︶︶꒦꒷‧₊˚⊹

a/n : will edit visuals later

#❍ jackalopes graze#male reader#Arcane#arcane x male reader#x male reader#male reader insert#arcane x you#malereader#top male reader#vander x male reader#silco x male reader#ekko x male reader#jayce x male reader#viktor x male reader#arcane x reader#arcane silco#arcane jayce#arcane viktor#arcane vander#arcane x y/n#x reader#reader insert#silco x reader#silco x you#vander x reader#vander x you#jayvik#jayvik x reader#jayvik x male reader#male!reader

256 notes

·

View notes

Text

Post-Election Year Woes Persist

There’s no way to sugarcoat it, unless the market can get back into the green for the year in April, our more bullish base case scenario for 8-12% gains for 2025 becomes harder to achieve. Currently, the S&P 500 is tracking the weaker post-election patterns of republican administrations and after incumbent party losses. This action has increased the odds of our annual forecast worst case scenario.

2025 is tracking the old school weak republican president post-election year performance noted on page 28, Stock Trader’s Almanac 2025. The market is concerned Trump 2.0 and Congress may be implementing too many drastic measures, which tends to lead to flat to negative full-year performance. Unless the market can rebound substantially next month, we are likely in store for some tough sledding through the third quarter.

114 notes

·

View notes

Text

Martin walked into the office, feeling refreshed and ready to dive back into work after his two-week vacation. As he crossed the threshold, he couldn’t help but notice something felt a little…different. The usual relaxed vibe seemed to be replaced with an odd energy, a sort of intensity that he couldn’t quite put his finger on. His coworkers, who were usually dressed casually, now looked like they’d stepped out of a corporate power fantasy: big, burly men in crisp shirts and ties, voices low and gravelly as they exchanged words in passing.

Martin gave a polite nod to a few familiar faces—at least, he thought they were familiar—and settled at his desk, glancing at his inbox. There was an email from the CEO with the subject line, “Important Announcement: ClearStream Acquisition by BullCorp.” As he clicked to open it, his shirt, a casual flannel he’d worn every Friday for as long as he could remember, began to subtly shift. The fabric thinned and tightened around his torso, the pattern melting away, replaced by a solid, rich gray that seemed to hug his chest and shoulders a little too snugly.

He barely noticed the change as he leaned back in his chair, engrossed in the announcement. As he read the email, which detailed the acquisition and spoke of a new “bullish” vision for the company, his shoulders started to broaden, stretching the fabric even more. His chest filled out, each breath causing his pecs to push against the now-fitted shirt, the buttons straining just slightly. The fabric around his biceps and forearms grew taut, hugging his arms as they swelled with dense, powerful muscle, veins becoming more prominent across his thickening forearms.

The flannel continued its transformation, morphing into a finely woven dress shirt. The material tightened around his collar as his neck thickened, muscle stacking on muscle until his collar felt restrictive against the growing width of his throat. His Adam’s apple pushed forward, making his voice sound deeper, though Martin didn’t notice the rich baritone that seemed to come naturally as he muttered under his breath, adjusting his seating.

As he shifted slightly, his thighs pressed firmly against his chair, feeling heavier, bulkier than before. His pants—originally a comfortable pair of khakis—started to darken, the fabric becoming finer and smoother as it transitioned into a pair of dark slacks. The legs grew tighter, stretched over his thickening quads and hamstrings, defining the powerful muscles that now filled them out. His calves swelled, creating a sense of grounded strength in his stance, though he remained oblivious.

With a distracted grunt, he reached up to adjust his collar, his fingers brushing against a tie that hadn’t been there moments before. Somehow, a thick, black tie had appeared around his neck, a narrow silver stripe running down its center. It felt just a bit too snug against the beefy bullneck that had developed beneath it, so he tugged at the knot, loosening it slightly without giving it a second thought. The fabric pulled free, allowing his thick neck to expand even more, a powerful pillar of muscle supporting his increasingly imposing frame.

Meanwhile, beneath his shirt, his undershirt seemed to tighten as his chest expanded even further, each deep breath causing the fabric to cling to the contours of his pecs. He shifted in his seat, feeling a new weight between his legs. His underwear, which had been a simple cotton brief, shifted subtly as the fabric stretched to accommodate his growing anatomy. His balls had begun to swell, filling the newly thickened, snug boxer briefs that materialized around his waist. Each passing minute, they seemed to grow heavier, pressing against his thighs as they settled into their new size.

Martin squirmed in his seat, feeling a slight discomfort as his underwear adjusted to the increased size of his package. He spread his legs unconsciously, making room for the hefty presence in his lap, his thighs stretching his slacks to accommodate both his larger legs and the growing fullness below his belt. He never questioned it, as if this kind of casual adjustment was something he’d always done, yet there was an undeniable sense of weight and power that radiated through his lower body.

As the email explained more about BullCorp’s acquisition, his posture adjusted naturally to the new bulk he carried. His shoulders rolled back, his chest puffed out, and his head tilted up with an air of command. He was oblivious to the feeling of his scalp growing smoother, as if each strand of hair retreated until his head was left completely bald, gleaming slightly under the office lights. When he glanced at his monitor, he didn’t even notice the faint reflection of his face, now ruggedly handsome, his jaw square and defined, with a thick, dark goatee framing his mouth in a way that seemed to convey natural authority.

He absently scratched his chin, feeling the rough texture of the goatee but thinking nothing of it, just as he didn’t notice how his brow had thickened, giving his expression an almost permanent look of determination. His whole face seemed to have morphed into something hypermasculine, each feature radiating a powerful, commanding presence.

“Hey, Moose!” a deep, rumbling voice called out from across the office. Martin—no, Moose—looked up instinctively, the name sounding as natural to him as his own. He nodded in response, feeling the collar of his dress shirt press against his broad, muscular neck as he did so. His coworker—a similarly burly, well-dressed man with a thick beard—gave him a respectful nod.

“Three o’clock meeting?” the man confirmed, his deep voice vibrating with respect.

“Yeah,” Moose replied, his own voice a rich, powerful baritone that commanded attention. He had no memory of setting up a meeting, but it didn’t matter. Leading meetings was what he did—it was who he was. His powerful hands, rough and calloused, adjusted his tie one more time as he stood up, his massive frame filling out every inch of his crisp, professional attire.

As he walked toward the conference room, his movements were smooth yet commanding, each step purposeful, each stride exuding the strength and confidence of a seasoned leader. His coworkers, all similarly burly and imposing, parted instinctively, giving him the respect his presence demanded.

By the time Moose reached the conference room, he felt completely at ease, in command of both himself and his team. He opened the door, stepping inside, and was greeted with silent nods from his subordinates—his team, his men. He adjusted his stance slightly to accommodate the weight between his legs, an unconscious gesture that only reinforced his air of dominance.

“Alright, gentlemen,” he began, his voice rolling through the room like a low rumble. “Let’s get down to business.”

And as Moose led his team, the transformation was complete. This was his world now, his reality. He was exactly where he belonged, a powerful, confident leader at BullCorp, ready to forge the future alongside his equally formidable colleagues.

130 notes

·

View notes

Text

What to expect from the stock market this week

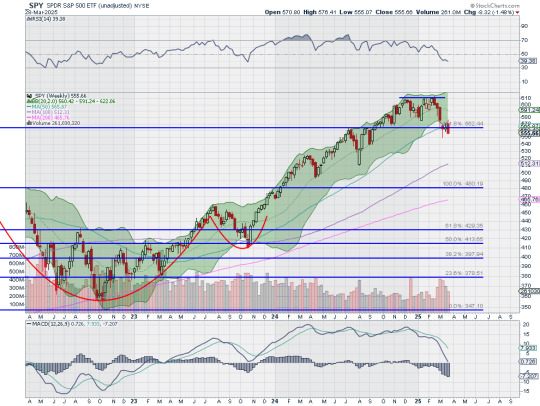

Last week, the review of the macro market indicators saw with the March FOMC meeting and options expiration in the books, that equity markets shifted to stability after 3 weeks of downward price action. Elsewhere looked for Gold ($GLD) to continue its ascent into space while Crude Oil ($USO) consolidated at the bottom of a broad range. The US Dollar Index ($DXY) looked to have found support in its drift lower while US Treasuries ($TLT) looked weaker in their consolidation. The Shanghai Composite ($ASHR) looked to digest the recent move higher while Emerging Markets ($EEM) consolidated in a narrow range.

The Volatility Index ($VXX) looked to remain slightly elevated putting some pressure on equity markets. Their charts remained at risk of more downside, especially on the longer timeframe. On the shorter timeframe both the $QQQ and $SPY looked to be stabilizing as they held the bounce during the week. The $IWM was a bit weaker.

The week played out with Gold retesting 3000 before a run up to new all-time highs while Crude Oil found some strength and moved higher in the consolidation range. The US Dollar held in a narrow range while Treasuries fell back to a 5 week low before catching a bid Friday. The Shanghai Composite found support and moved sideways while Emerging Markets dropped out of the short consolidation.

The Volatility Index started by moving lower but reversed Wednesday to end the week slightly higher. This saw the bounce rally in equities grind to a halt early in the week and they dropped back through Friday. This resulted in the SPY and the QQQ and the IWM printing new 2 week lows. What does this mean for the coming week? Let’s look at some charts.

The SPY came into the week pausing in a bounce off the 61.8% retracement of the leg higher since August 2023 and reclaiming the 161.8% extension of the retracement of the 2022 drop. It gapped up Monday to touch the 200 day SMA and over the 20 day SMA but then printed and Evening Star reversal pattern and started lower Wednesday. It gathered steam in the move lower Friday to end the week at a 2 week low. It looks as if the bounce might confirm as a bear flag and confirmation would give a target to 513. It has a RSI dropping back from a stall at the midline in bearish territory with the MACD curling to cross down and negative.

The weekly chart shows a bearish engulfing candle, also suggesting more downside, holding under the 50 week SMA. The RSI has gone level at the bottom of the bullish zone with a peak into the bearish zone with the MACD dropping but positive. There is resistance above at 556.50 followed by 565.50 and 569 then 571 and 574.50 before 581 and 585. Support lower is at 549.50 then 545.75 and 542.50 before 540 and 537. Pullback in Uptrend.

With just one trading day left in the 1st Quarter of 2025, equity markets showed renewed weakness after a positive start to the week. Elsewhere look for Gold to continue its record breaking drive higher while Crude Oil rises in consolidation. The US Dollar Index looks to continue to drift to the downside while US Treasuries pullback in their consolidation. The Shanghai Composite looks to consolidation in the short term uptrend while Emerging Markets continue a short term consolidation.

The Volatility Index looks to remain slightly elevated making the path easier for equity markets to the downside. Their charts look vulnerable on both timeframes. On the shorter timeframe the SPY if a bit stronger than the QQQ and IWM. On the longer timeframe all look set up for more downside. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview March 28, 2025

11 notes

·

View notes

Text

A stroll through any bookshop at the moment reveals an array of bright, celebratory volumes, reminding us of women’s extraordinary resilience in the face of injustice. Hillary and Chelsea Clinton’s The Book of Gutsy Women: Favorite Stories of Courage and Resilience, gathers stories of women ‘with the courage to stand up to the status quo, ask hard questions, and get the job done’. (Note the uncanny echoes here of the bullish, phallic insistence, by Boris Johnson and Donald Trump, on getting Brexit done, on building the wall.) British MP Yvette Cooper’s She Speaks: The Power of Women’s Voices celebrates speeches by women through the ages (including by Theresa May). Outspoken: 50 Speeches by Incredible Women from Boudicca to Michelle Obama, by Deborah Coughlin, features some of the same speeches. And MP Jess Phillips is the author of Truth to Power: 7 Ways to Call Time on BS. Her feminist credentials are tightly linked to a posture of defiant truth-telling; she is also the author of Everywoman: One Woman’s Truth About Speaking the Truth. Being outspoken, it would seem, is a requirement of any self-respecting feminist subjectivity; if you’re not talking loudly about gutsiness, are you even a feminist? Discernible in this pattern of feminist publishing is what Rosalind Gill and Shani Orgad have termed ‘confidence culture’, which holds that it is not primarily patriarchy, capitalism or entrenched institutional sexism that hold women back, but rather their own, individual lack of confidence—a lack framed as an entirely personal matter. The valourisation of confidence as a psychological stance is also at work in initiatives such as Gmail’s Just Not Sorry plug-in, for instance, which encourages women to replace phrases such as ‘I’m sorry to disturb you’, or ‘I just wondered if’ with direct, assertive formulations. Confidence culture is evident too in Facebook COO Sheryl Sandberg’s 2013 Lean In, or Amy Cuddy’s TED Talks (Your Body Language May Shape Who You Are) advising women to assume ‘power poses’. These poses supposedly lower cortisol and increase testosterone in advance of intimidating meetings, job interviews or promotion requests, realms in which women are routinely told they are not assertive enough. Here, encouraging women’s individual power and assertiveness becomes synonymous with feminism. It is on herself that a woman must act, and in so doing she simultaneously flies the flag for all women. Confidence is key to achievement while also advancing equality and diversity. It is a form of self-work that each woman must undertake in order to succeed, and in order to respect herself for not having succumbed to the odds stacked against her. Confidence culture’s way of talking to women, in the tones of a cheerleading friend, exhorting positivity and self-realisation (you go, girl!) may be no bad thing; and, sometimes, that galvanizing self-talk in the bathroom mirror can help. And yet this way of speaking to women skirts evasively around a glaring problem: that women are often punished and criticized (they are bitchy, bossy, angry) for precisely the confident, assertive poses and behaviours they are being asked to cultivate. What’s more, these exhortations of positivity keep vulnerability anxiously at bay; they render insecurity or lack of confidence as ugly, abject and shameful—something any self-respecting woman would not feel or at least not express. There is in these modes of address an almost manic insistence on strength; they are at great pains to present women as almost heroically invulnerable. Sara Ahmed describes this ‘zooming in’ on confidence as implying that girls are ‘their own obstacles, in the way of themselves’. As Gill and Orgad put it, ‘if confidence is the new sexy’, then ‘insecurity is the new ugly.’ Is this hierarchy of feeling helpful?

Katherine Angel, Tomorrow Sex Will Be Good Again: Women and Desire in the Age of Consent (Verso, 2022), pp. 15–17.

29 notes

·

View notes