#Can You Get a Car Loan with a Garnishment

Text

Tips for Getting a Can You Get a Car Loan with a Garnishment

Introduce the topic: Can You Get a Car Loan with a Garnishment? Explain the common belief that garnishments make it impossible to secure a car loan.

Hook the readers with a relatable story or statistic about individuals facing garnishments and their desire for car loans.

What is Garnishment and How Does it Work

Garnishment is a legal method that allows a creditor to gather a debt by taking…

View On WordPress

#Can I get a car loan if my wages are being garnished?#Can I negotiate the terms of a car loan with a garnishment?#Can You Get a Car Loan with a Garnishment#car loan#Garnishment#How can I improve my chances of getting a car loan with a garnishment?#What is Garnishment and How Does it Work#Will a garnishment affect my credit score?

0 notes

Text

When you hear "fintech," think "unlicensed bank"

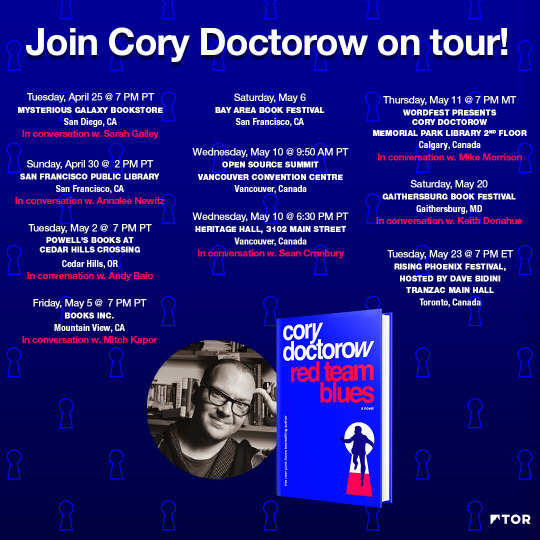

Tomorrow (May 2) I’ll be in Portland at the Cedar Hills Powell’s with Andy Baio for my new novel, Red Team Blues.

In theory, patents are for novel, useful inventions that aren’t obvious “to a skilled practitioner of the art.” But as computers ate our society, grifters began to receive patents for “doing something we’ve done for centuries…with a computer.” “With a computer”: those three words had the power to cloud patent examiners’ minds.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Patent trolls — who secure “with a computer” patents and then extract ransoms from people doing normal things on threat of a lawsuit — are an underappreciated form of “tech exceptionalism.” Normally, “tech exceptionalism” refers to bros who wave away things like privacy invasions by arguing that “with a computer” makes it all different.

These tech exceptionalists are the legit face of tech exceptionalism, the Forbes 30 Under 30 set. They’re grifters, but they’re celebrated grifters. There’s a whole bottom-feeding sludge of tech exceptionalists that don’t get the same kind of attention, like patent trolls.

Oh, and the fintech industry.

As Riley Quinn says, “when you hear ‘fintech,’ think: ‘unlicensed bank.’” The majority of fintech “innovation” consists of adding “with a computer” to highly regulated activities and declaring them to be unregulated (and, in the case of crypto, unregulatable).

There are a lot of heavily regulated financial activities, like dealing in securities (something the crypto industry is definitely doing and claims it isn’t). Most people don’t buy or sell securities regularly — indeed, most Americans own little or no stocks.

But you know what regulated financial activity a lot of Americans participate in?

Going into debt.

As wages stagnate and the price of housing, medical care, childcare, transportation and education soar, Americans fund their consumption with debt. Trillions of dollars’ worth of debt. Many of us are privileged to borrow money by walking into a bank and asking for a loan, but millions of Americans are denied that genteel experience.

Instead, working Americans increasingly rely on payday lenders and other usurers who charge sky-high interest rates, on top of penalties and fees, trapping borrowers in an endless cycle of indebtedness. This is an historical sign of a civilization in decline: productive workers require loans to engage in useful activities. Normally, the activity pans out — the crop comes in, say — and the debt is repaid.

But eventually, you’ll get a bad beat. The crop fails, the workshop burns down, a pandemic shuts down production. Instead of paying off your debt, you have to roll it over. Now, you’re in an even worse situation, and the next time you catch a bad break, you go further into debt. Over time, all production comes under the control of creditors.

The historical answer to this is jubilee: a regular wiping-away of all debt. While this was often dressed up in moral language, there was an absolutely practical rationale for it. Without jubilee, eventually, all the farmers stop growing food so that they can grow ornamental flowers for their creditors’ tables. Then, as starvation sets in, civilization collapses:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

As the debt historian Michael Hudson says, “Debts that can’t be paid, won’t be paid.” Without jubilee, indebtedness becomes a chronic and inescapable condition. As more and more creditors attach their claims to debtors’ assets, they have to compete with one another to terrorize the debtor into paying them off, first. One creditor might threaten to garnish your paycheck. Another, to repossess your car. Another, to evict you from your home. Another, to break your arm. Debts that can’t be paid, won’t be paid — but when you have a choice between a broken arm and stealing from your kid’s college fund or the cash-register, maybe the debt can be paid…a little. Of course, digital tools offer all kinds of exciting new tools for arm-breakers — immobilizing your car, say, or deleting the apps on your phone, starting with the ones you use most often:

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Under Trump, payday lenders romped through America. A lobbyist for the payday lenders became a top Trump lawyer:

https://theintercept.com/2017/11/27/white-house-memo-justifying-cfpb-takeover-was-written-by-payday-lender-attorney/

This lobbyist then oversaw Trump’s appointment of a Consumer Finance Protection Bureau boss who deregulated payday lenders, opening the door to triple digit interest rates:

https://www.latimes.com/business/lazarus/la-fi-lazarus-cfpb-payday-lenders-20180119-story.html

To justify this, the payday loan industry found corruptible academics and paid them to write papers defending payday loans as “inclusive.” These papers were secretly co-authored by payday loan industry lobbyists:

https://www.washingtonpost.com/business/2019/02/25/how-payday-lending-industry-insider-tilted-academic-research-its-favor/

Of course, Trump doesn’t read academic papers, so the payday lenders also moved their annual conference to a Trump resort, writing the President a check for $1m:

https://www.propublica.org/article/trump-inc-podcast-payday-lenders-spent-1-million-at-a-trump-resort-and-cashed-in

Biden plugged many of the cracks that Trump created in the firewalls that guard against predatory lenders. Most significantly, he moved Rohit Chopra from the FTC to the CFPB, where, as director, he has overseen a determined effort to rein in the sector. As the CFPB re-establishes regulation, the fintech industry has moved in to add “with a computer” to many regulated activities and so declare them beyond regulation.

One fintech “innovation” is the creation of a “direct to consumer Earned Wage Access” product. Earned Wage Access is just a fancy term for a program some employers offer whereby workers can get paid ahead of payday for the hours they’ve already worked. The direct-to-consumer EWA offers loans without verifying that the borrower has money coming in. Companies like Earnin claim that their faux EWA services are free, but in practice, everyone who uses the service pays for the “Lightning Speed” upsell.

Of course they do. Earnin charges sky-high interest rates and twists borrowers’ arms into leaving a “tip” for the service (yes, they expect you to tip your loan-shark!). Anyone desperate enough to pay triple-digit interest rates and tip the service for originating their loan is desperate and needs to the money now:

https://prospect.org/power/05-01-2023-fintech-ewa-payday-loan-scam/

EWA annual interest rates sit around 300%. The average EWA borrower uses the service two or three times every month. EWA CEOs and lobbyists claim that they’re banking the unbanked — but the reality is that they’re acting as sticky-fingered brokers between banks and young, poor workers, marking up traditional bank services.

This fact is rarely mentioned when EWA companies lobby state legislatures seeking to be exempted from usury rules that are supposed to curb predatory lenders. In Vermont, Earnin wants an exemption from the state’s 18% interest rate cap — remember, the true APR for EWA loans is about 300%.

In Texas, payday lenders are classed as loan brokers, not loan originators and are thus able to avoid the state’s usury caps. EWAs are lobbying the Texas legislature for further exemptions from state money-transmitter and usury limit laws, principally on the strength of the “it’s different: we do it with a computer” logic.

But as Jarod Facundo writes for The American Prospect, quoting Monica Burks from the Center for Responsible Lending, a loan is a loan even if it’s with a computer: “The industry is trying to create a new definition for what a loan is in order to exempt themselves from existing consumer protection laws… When you offer someone a portion of money on the promise that they will repay it, and often that repayment will be accompanied with fees or charges or interest, that’s what a loan is.”

Catch me on tour with Red Team Blues in Mountain View, Berkeley, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A stately, columnated bank building, bedecked in garish payday lender signs.]

Image:

Andre Carrotflower (modified)

https://commons.wikimedia.org/wiki/File:30_North_%28former_Pontiac_Commercial_%26_Savings_Bank_Building%29,_Pontiac,_Michigan_-_entrance_and_Chief_Pontiac_relief_sculpture_-_20201213.jpg

CC BY-SA 4.0

https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#cfpb#earned wage access#digital armbreakers#loansharks#payday lenders#tech exceptionalism#jubilee#debt#fintech#usury#michael hudson#graeber#debts that can't be paid wont be paid

669 notes

·

View notes

Text

how did debt become so unserious all of a sudden? like half the ppl I see online I'm like... not to be mean but if it was me with a hundred thousand dollars in credit card debt, loan debt, throwing money at lashes and nails and fast fashion clothes with more afterpay debt I'd be ready to kill myself once those collection letters started coming because they don't mess around they will destroy your whole fuckin life if you don't pay your debt man. those people hound you for life, always find addresses and phone numbers hell some of them call you at your job. some of them show up at your house. and like they can garnish your paycheck and take your whole tax refund and you'll still have to pay if you owe the state money like you're actually fucked.

I know debt feels super abstract but it won't feel that way when you can't get a car, can't buy a house or rent a place because your credit is like in the negatives, if you want to start a business you're fucked you can't do that no bank would lend you money, no bank will ever approve a mortgage for you, like it really does affect all parts of your life if you rack up extreme debt. and bankruptcy doesn't just magically make it go away, it can help, but filing for that also hurts you. I remember when my parents filed for bankruptcy and the sheriff showed up at our house, because a creditor already filed in court against them to force them to pay a portion of the debt. my parents already had a second lien against their house atp so they could've lost our house.

and I get it everybody wants to live a little, some days you want a little treat, you wanna take a trip, it's already impossible to do half that shit anyway ect but there are things you can do to not make it so you're literally dooming yourself to decades of misery and seeing people my age fuck up so massively is wild

19 notes

·

View notes

Text

How is it that I work in healthcare, yet can't afford my own health care?

How is it that I have a 401k, yet can't borrow money from myself to repay to myself?

How is it that a bank can lose an instant transfer, and refuse all accountability, including replacing the money that never reached where it was supposed to go?

How is it that 1/4 of my paycheck goes to health insurance that doesn't cover any of my day to day medical expenses?

How is it that in spite of my health issues making it difficult to function at even a minimal level, I continue to work full time, yet I'm perpetually cash poor, no matter how carefully I spend my money?

The answer is relatively simple... I was born into a low-income family, and the cycle of poverty is alive and thriving.

In spite of the fact that I had finally gotten to a point of relative financial security, garnishment by a loan shark dragged me back into the red, and has kept me there.

I'm unable to get any sort of personal loan because my credit is terrible - because when I was a young adult who had lived a life with very little material comfort, credit card companies swooped in and promised me things that I couldn't afford, and I was too young and stupid to think to say no.

Our country is very much invested in the concept of "the rich get richer as the poor get poorer." Those with money can get financed with lower rates, buy more reliable cars and afford repairs, buy newer homes, etc., while those without money are charged exorbitant amounts for any type of credit, when they can get it at all. And that's not even getting into the cost and availability of healthcare, preventative care, etc.

Our system is absolutely fucked, y'all. "If there is hope, it lies within the proles," yet we are beaten down and down and down to the point of despair. No matter how hard we try to claw our way out, some fucker in a suit is waiting to kick us back down, while saying "You just aren't working hard enough."

This is some legitimate fuckery, and why I'm a socialist. Capitalism only works for the people who were born ahead to begin with; the rest of us are merely expendable cogs in the machine that keep this shit going so that the people with money can continue to enjoy the spoils of a system carried on the backs of the multitudes of people that it turns around and shits on.

There's no freedom in this - not for most of us.

9 notes

·

View notes

Text

Okay...okay....I need to blow off some fucking steam!!!

The CRA is up my fucking ass about my student loans. I'm not sure where they think I'm gunna get $56,000.00 from!!! The province I live in..the inflation is so fucking extreme that I can't even pay my rent for my basement apartment on my own if me and my fiance were to split! We both have jobs that should make us 'upper middle class' but no, instead rent is an exorbitant amount, we can barely feed our family..I skip meals so my kid eats, we have 1 car because I don't drive and my fiance needs it to get to work..it's not new or even nice looking, it's basically a death trap. I don't get tax breaks like most people for child tax credit, gst, carbon tax... according to the government, I make too much which is fucking comical. I'm beyond stressed because now the government wants to garnish my pays to pay my student loans. Also, I can't even find a job in the field I studied!!!! On top of them garnishing my wages, they can also garnish my fiance's because we are considered common law (for those of you who don't know, the government in my province treats people as married couples if you have lived together for 12 months). Then also wanting to garnish his pay pisses me off even more because he has his own financial shit to deal with that doesn't involve our family.

I'm beyond stressed about this shit to the point where my dr has put me on medication so I sleep at night...which I also have to pay for.

Shit in Canada isn't as nice or free as people think it is. I'm about to pull a 2007 Britney Spears moment for all my elder millennial friends on here. I just feel so defeated...I feel like there are all these check boxes I'm supposed to hit by now and I haven't because everything is so expensive, I feel like everyone around me is doing amazing and thriving while I'm barely able to keep my head above water. I have to finance our groceries weekly because we can't afford to pay for it upfront. Yes I know I treated myself to a trip to the salon last week but believe me, I'm feeling insanely guilty even though I haven't treated myself to anything in years.

My entire life has been the saying 'if it's going to happen to anyone, it'll happen to me' and it's never anything good. I constantly feel like I can never get ahead in life in anyway, something always happens that fucks it up.

I truly want to up and move my family to a part of the world where things are more manageable and less stressful but we can't afford it..I feel trapped here.

0 notes

Text

TW: NA: The Housing Market is tandemly linked to the Education Market

Students don't have a choice when it comes to loan payments for their degree. College loans are deferrable, but they don't go away even when you declare bankruptcy (unlike other loans) and unlike other loans, like housing and vehicle loans, don't have an asset to take back once you are unable to pay.

So how does one pay off a college loan they can't afford because there is no job market to back it up?

First they have to stop paying off any other payments they might have. In most cases, this is your house. Which means you have to sell that, probably at a loss because the housing market is at its peak and not going higher. It's not going higher, no matter what your desperate real-estate agent might think.

Which means their best option is to default. And sell off anything they own, and go down to living out of a suitcase. While still making payments on their college loans.

What it also means is that the bank can garnish your wages, Like child support; which sucks if you have an actual child to support. But since you also have to pay rent if you want a house to live in (or get lucky with a 5-figure shack, or get lucky in certain states where they give you free land to pay six figures to a contractor to build a house. Which you probably don't have.)

Just like child-support, they can take any assets they deem worth money. Your shack, your shitty pre-used (not pre-owned) car, your RV in lieu of all of those. Leaving you houseless, vehicle-less, and without the means to make the money to pay them back, and take care of your children. And because you're living in abject poverty, the state will take your children too.

And you'll still owe money on that loan. This is the same deal with any loan you might take that allows them to repossess more than the asset leveraged. (Which in the case of a house, means they might be able to take more than your house, depending on the loan you signed.)

This is the game the "Banks" are playing.

I'm not saying that anybody is purposefully saying that they want to throw your kids into the adoption system so that they get a terrible education and wind up as a slave caste to their "superiors".

But they don't seem to care if that's a possibility.

And for as long as 25-years they can garnish any money you make. Which is why a lot of striking is going on right now, just so they can afford the ability to pay the banks a form a child-support that they already get from the government.

Now, that everybody with a student loan would be in that position is a worst-case scenario apocalypse prediction. But what happens to the banks, and most importantly--your money. You savvy; avoided every loan, made every correct decision in you life, person?

The money that the banks loaned out was technically not theirs but their account holders. You make interest from the bank, because they loan out your money.

But what happens if the bank can't pay your account back because it's not possible for them to make enough money back to support the system in place? After-all the apocalypse prediction is a result of the bank ensuring their own prosperity, as well as their account holders.

What if they're in a position where they can't afford to pay? What happened last time is "Banks too big to fail" remember when they paid themselves bonuses for that?

Then the person who didn't take part in this system *also* loses.

But what happens... If a bunch of [other systemic payments] can't be paid because of it..?

If the housing market starts taking a hit, and it currently is, then the education system is taking a hit. And those both hitting the same families means the government has to take a hit to take care of houseless children. Which our education and adoption system is currently underfunded won't be able to handle. And those will affect everybody trying to retire ,about to retire, or even, just staying afloat, and they'll be pulled down as well.

"But they have super complicated math that says it shouldn't happen"

That super-complicated math also makes assumptions that a reasonable person would think "yeah, that sounds reasonable." But when everything is irrational, or unreasonable. Those assumptions go out the window.

Happy Holidays!

0 notes

Text

Is It Better To File Bankruptcy Or Pay Off Debt?

Is It Better To File Bankruptcy Or Pay Off Debt?

If you’re facing severe debt problems, filing for bankruptcy can be a powerful remedy. It stops most collection actions, including telephone calls, wage garnishments, and lawsuits (with some exceptions). It also eliminates many types of debt, including credit card balances, medical bills, personal loans, and more. But it doesn’t stop all creditors, and it doesn’t wipe out all obligations. For instance, you’ll still have to pay your student loans (unless you can prove a hardship) and arrearages for child support, alimony, and most tax debts. Bankruptcy allows people struggling with debt to wipe out certain obligations and get a fresh start. The two primary bankruptcy types filed; Chapter 7 and Chapter 13 bankruptcy each offer different benefits and, in some cases, treat debt and property differently, too.

Once you file, the court puts in place an order called the automatic stay. The stay stops most creditor calls, wage garnishments, and lawsuits, but not all. For instance, creditors can still collect support payments, and criminal cases will continue to proceed forward. The automatic stay will stop these actions as long as they’re still pending. Once complete, bankruptcy won’t help.

• Evictions. An eviction that’s still in the litigation process will come to a halt after a bankruptcy filing. But the stay will likely be temporary. Keep in mind that if your landlord already has an eviction judgment against you, bankruptcy won’t help in the majority of states.

• Foreclosure and repossession. Although the automatic stay will stop a foreclosure or repossession, filing for Chapter 7 won’t help you keep the property. If you can’t bring the account current, you’ll lose the house or car once the stay lifts. By contrast, Chapter 13 has a mechanism that will allow you to catch up on past payments so you can keep the asset. Find out more about bankruptcy’s automatic stay and foreclosure and car repossession and bankruptcy.

• Bankruptcy is very good at wiping out unsecured credit card debt, medical bills, overdue utility payments, personal loans, gym contracts. In fact, it can wipe out most non-priority unsecured debts other than school loans. The debt is unsecured if you didn’t promise to give back the purchased property if you didn’t pay the bill. By contrast, if you have a secured credit card, you’ll have to give the purchased item back. Jewelry, electronics, computers, furniture, and large appliances are often secured debts. You can find out by reading the receipt or credit contract.

• If you can’t afford a payment that you secured with collateral such as a mortgage or car loan, you can wipe out the debt in bankruptcy. But you won’t be able to keep the house, car, computer, or other item securing payment of the loan. When you voluntarily agree to secure debt with property, you must pay what you owe or give the property back.

What Only Chapter 13 Bankruptcy Can Do

Chapter 7 and 13 each offer unique solutions to debt problems. The two bankruptcy types work very differently. For instance, how quickly your debt will get wiped out will depend on the chapter you file:

• Chapter 7 bankruptcy. This chapter takes an average of three to four months to complete. Learn more about erasing your debt in Chapter 7 bankruptcy.

• Chapter 13 bankruptcy. If you file for Chapter 13 rather than Chapter 7, you’ll likely have to pay back some portion of your unsecured debts through a three- to five-year repayment plan. However, any unsecured debt balance that remains after completing your repayment plan will be discharged. Find out how to pay off or discharge your debts in Chapter 13 bankruptcy.

Chapter 7 is primarily for low-income filers, and therefore, it won’t help you keep property if you’re behind on payments. But, if you have enough income to pay at least something to creditors, then you’ll be able to take advantage of the additional benefits offered by Chapter 13.

Here are some of the things that Chapter 13 can do.

Stop a mortgage foreclosure. Filing for Chapter 13 bankruptcy will stop a foreclosure and force the lender to accept a plan that will allow you to make up the missed payments over time. To make this plan work, you must demonstrate that you have enough income to pay back payments and remain current on future payments. Allow you to keep property that isn’t protected by a bankruptcy exemption. No one gives up everything own in bankruptcy. You can save (exempt) items you’ll need to work and live using bankruptcy exemptions. A Chapter 7 debtor gives up nonexempt property; the trustee liquidates unprotected property for creditors but not a Chapter 13 filer. While it might seem as though you’d get to keep more assets, it’s not the case. Chapter 13 filers pay the value of any nonexempt property to creditors through the repayment plan.

Cram down secured debts when the property is worth less than the amount owed. Chapter 13 has a procedure that allows you to reduce an obligation to the replacement value of the property securing it. For example, if you owe $10,000 on a car loan and the car is worth only $6,000, you can propose a plan that pays the creditor $6,000 and discharge the rest of the loan. However, exceptions exist. For instance, you can’t cram down a car debt if you purchased the car during the 30 months before filing for bankruptcy. Also, filers can’t use the cramdown provision to reduce the mortgage of a residential home.

What Bankruptcy Can’t Do

Prevent a secured creditor from foreclosing or repossessing property you can’t afford. A bankruptcy discharge eliminates debts, but it doesn’t eliminate liens. A lien allows the lender to take property, sell it at auction, and apply the proceeds to a loan balance. The lien stays on the property until the debt gets paid. If you have a secured debt, a debt where the creditor has a lien on your property, bankruptcy can eliminate your obligation to pay the debt. However, it won’t take the lien off the property—the creditor can still recover the collateral. For example, if you file for Chapter 7, you can wipe out a home mortgage. But the lender’s lien will remain on the home. As long as the mortgage remains unpaid, the lender can exercise its lien rights to foreclose on the house once the automatic stay lifts.

Eliminate child support and alimony obligations. Child support and alimony obligations survive bankruptcy, so you’ll continue to owe these debts in full, just as if you had never filed for bankruptcy. And if you use Chapter 13, you’ll have to pay these debts in full through your plan. Eliminate student loans, except in limited circumstances. Student loans can be discharged in bankruptcy only if you can show that repaying the loan would cause you “undue hardship,” which is a very tough standard to meet. You must prove that you can’t afford to pay your loans currently and that there’s very little likelihood you can do so in the future.

Eliminate most tax debts. Eliminating tax debt in bankruptcy isn’t easy, but it’s sometimes possible for older unpaid tax debts. Eliminate other non-dischargeable debts. The following debts aren’t dischargeable under either chapter:

• debts you forget to list in your bankruptcy papers (unless the creditor learns of your bankruptcy case)

• debts for personal injury or death due to intoxicated driving, and

• fines and penalties imposed as a punishment, such as traffic tickets and criminal restitution.

If you file for Chapter 7, these debts will remain when your case is over. In Chapter 13, you’ll pay these debts in full through your repayment plan. Debt related to fraud might get eliminated. A fraud-related debt won’t be discharged if a creditor files a lawsuit called an adversary proceeding and convinces the judge that the obligation should survive your bankruptcy. Such debts might result from lying on a credit application or passing off borrowed property as your own to use as collateral for a loan. If you file for bankruptcy, at the end of your case you will receive a discharge.

A discharge is a court order wiping out most or all of your debts (some types of debts cannot be eliminated in bankruptcy). Sometimes a consumer doesn’t want a particular debt to be wiped out, and is tempted to pay it before filing bankruptcy. Some common situations where a consumer might want to pay off a debt before filing include:

• to ensure that a debt owed to a friend or close family member is not wiped out

• to protect a creditor that the consumer thinks has been “fair”

• to try to hide the bankruptcy filing from a bank, employer, or creditor

• to preserve a relationship with a medical provider, or

• to keep property, such as a car or home.

Many of the reasons that people want to repay debts are based on a misunderstanding of how bankruptcy works. For example, you might not automatically lose your home or car just by filing bankruptcy. And most credit card companies will become aware of your bankruptcy filing, even if you don’t have an outstanding debt with it and don’t list the debt in the bankruptcy.

When you file for bankruptcy, a bankruptcy trustee will be appointed. The trustee’s job is to fairly distribute your assets and property, if any, among your creditors. (You don’t have to give up all of your property during bankruptcy, learn what you can and cannot keep in bankruptcy.) The goal is to ensure that no one creditor has an unfair advantage over another. If you pay a creditor within a short period of time before your bankruptcy, the court may consider that payment to be a preferential transfer. Because you pay that one creditor 100% of the debt owed, and then have fewer assets left to repay other creditors through your bankruptcy, you have preferred that creditor over the others. If that happens, the trustee can try to get the money back through a claw back action. If you have made a preferential transfer to a creditor within the 90 days before you filed for bankruptcy, the trustee can file a clawback suit and try to obtain the funds from the paid creditor. If you repaid a close friend or family member, sometimes referred to as an “insider,” the time period that a court will consider extends to a year before you filed.

In a clawback suit, the trustee brings a lawsuit against the creditor that you paid off in order to get the money back. A clawback suit can cause several problems with your bankruptcy.

• The result can be messy. The trustee may sue family members, employers, medical providers, and anyone else that you paid.

• It will likely delay your discharge since the court won’t enter a discharge until the clawback suit is complete.

• If the court finds that you paid a creditor in order to hide assets, it might deny your entire discharge. This happens most often when a consumer pays off close friends or family members. Not all pre-bankruptcy payments will be considered to be preferential transfers. You can make payments on debts if normally make such payments. The key is to not pay any more than you have been paying towards that debt.

For example, if you regularly pay your physician $100 a month to repay a larger medical debt, you may continue to do so. You can continue to pay your regular car payment, mortgage, child support, or student loans. You can also pay credit card debt that you recently incurred to purchase regular necessities of life, such as gas or food.

If you want to ensure that a creditor gets paid, the best way to do this is after the bankruptcy. There is nothing that prevents you from paying off a creditor, even if its debt has been discharged in the bankruptcy. This is best done when you want to repay friends, family members, employers, or medical providers. However, many financial institutions and credit cards may refuse your payment after a bankruptcy discharge has been entered. Moreover, there’s a stigma against filing for bankruptcy and for good reason. It devastates your credit and cripples your borrowing ability. Even though bankruptcy will fall off your credit report after 7−10 years, most loan applications ask if you’ve ever filed. If you say “no” when the truth is “yes,” you’re guilty of fraud and can be prosecuted. It’s always better to pay off your debts rather than file bankruptcy. A bankruptcy filing could also have an impact on your emotional life or your personal life. People who have filed for bankruptcy report feelings of regret and failure years after filing.

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

Ascent Law LLC

8833 S. Redwood Road, Suite C

West Jordan, Utah

84088 United States

Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

How Can Estate Planning Be Seen As A Gift?

Is Debt Relief Better Than Bankruptcy?

Bankruptcy Lawyer

Business Lawyers

Estate Planning Lawyer

Divorce Lawyer and Family Law Attorneys

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

The post Is It Better To File Bankruptcy Or Pay Off Debt? appeared first on Ascent Law.

from Ascent Law https://ascentlawfirm.com/is-it-better-to-file-bankruptcy-or-pay-off-debt/

0 notes

Photo

Potential to Keep Property by Reaffirming Debt | Chapter 7 Bankruptcy

The thought of losing your property after filing for bankruptcy can be heartbreaking. Fortunately, Chapter 7 bankruptcy in Raleigh, NC has several tools that can help you keep some of your most important assets. One of these is reaffirming debt.

Reaffirming Debt in Chapter 7

Essentially, Chapter 7 bankruptcy gets rid of debt by discharging your unsecured liability with creditors. You don’t have to pay them anymore, and they can’t take legal action against you.

In the case of secured debt, which is debt that is secured by collateral such as a car. Creditors can also repossess the property as part of your debt settlement if you don’t state that you want to keep the collateral.

If you want to keep the collateral, you can reaffirm that debt instead.

This means that you agree to keep paying it even though you’re filing for bankruptcy, and in exchange, creditors won’t repossess the property.

However, the process is more complicated than that – which is why we recommend consulting with Attorney Weik before you may any decision about your Chapter 7 bankruptcy filing.

Which Debts Can Be Reaffirmed Under Chapter 7?

It’s important to note that not all assets are eligible for reaffirmation. You can only reaffirm secured debts, such as a car loan, and not unsecured debts, like credit card debt.

They should also be essential to your day to day living. A basic car is usually okay, but luxury items like yachts, holiday homes, and expensive jewelry are generally not eligible for reaffirmation.

You Only Have a Limited Time to File the Agreement

If you choose to reaffirm debt, you must act quickly – the court only allows a small window of time for you to file the agreement before it discharges the debt.

In addition, the process of reaffirming debt is complicated. You want to make sure you fully understand the ramifications before signing, so it’s best to speak with a bankruptcy attorney in Raleigh, NC who can help you decide whether this is the right option for you.

Creditors Can Reject a Reaffirmation Agreement

Making things more complicated is the fact that creditors have the power to reject a reaffirmation agreement.

The key here is to have an experienced bankruptcy attorney review the reaffirmation agreement, then advise you on how to best move forward.

Explore Your Bankruptcy Options Today

Reaffirmation agreements are just one of the many ways Attorney Weik can help you use Chapter 7 bankruptcy in Raleigh, NC to regain financial freedom.

Depending on your situation, Attorney Weik can also help you protect your savings accounts, stop wage garnishment, and more.

Call Weik Law Office today at 919-845-7721 for a free consultation, and set up a time to speak with one of our friendly professionals.

#statuteoflimitationsnc bankruptcychapter7nc northcarolinahomesteadexemption crosscollateralloans famouspeoplewhofiledforbankruptcy#chapter13dismissedcarloan whatisthepurposeofbankruptcy debtlimitsforchapter13 unsecureddebtlimitchapter13 chapter13limits#crosscollateralclause fileforbankruptcyinnc bankruptcync raleighbankruptcylawyer chapter13bankruptcy bankruptcyinraleigh#raleighbankruptcy chapter13raleighnc

0 notes

Text

What Should I Do If Crown Asset Management Suing Me?

If you are enduring intimidating and harassing phone calls from a debt collection company like Crown Asset Management, you may be feeling anxious, stressed out, and overwhelmed with uncertainty about your financial future. SoloSuit understands how you feel and are here to help.

It is important to know that you have legal rights when contacted by a debt collection company like crown asset management lawsuit and there are certain affirmative defenses you could potentially raise that could help you prevail over Crown Asset Management in a debt collection lawsuit.

Crown Asset Management LLC's lawsuit should not be considered a lost battle. When a debt collection company like Crown Asset Management summons you, you have legal rights. This article will discuss those rights, how you should respond, and ways you can increase your chances of beating Crown Asset Management in court.

Who is Crown Asset Management?

Before we discuss how to beat Crown Asset Management, let's investigate the company itself first.

As a certified receivables company, "Crown Asset Management" is a business that buys debt. Since 2004, their business model has relied on buying people's debt from other companies to generate profits.

Imagine you owe money on a hospital bill you met. Instead of paying the hospital, you will pay Crown Asset Management once they have gained the debt. According to their website, they have gained over 500 debt portfolios. The debts include credit cards, consumer loans, lending, and court judgments.

Crown Asset Management also outsources collections to various third parties, which means other debt collectors may shake you down on behalf of Crown Asset Management.

Crown Asset Management has received a lot of complaints

Crown Asset Management received a rating of 1 out of 5 stars on its BBB profile, and more than 40 complaints have been filed against the company in the past three years. Most of these complaints involve violations of the FDCPA. Crown Asset Management, LLC is known for using abusive tactics and harassment to get people to pay off their debts.

Steps to respond to a debt Summons and Complaint

When you are sued by Crown Asset Management, you will receive two documents in the mail called the Summons and Complaint. The Summons notifies you of the debt lawsuit and your deadline to respond, while the Complaint lists all the specific claims being made against you.

Follow these steps to respond to the Summons and Complaint and improve your chancing of winning in court:

Respond to each claim listed in the Summons and Complaint

Make your affirmative defenses

File your Answer with the court and send a copy to the plaintiff

Now, let's break each step down in detail. Don't like reading? Check out this video where SoloSuit's CEO, George Simons, explains these 3 steps to respond to a debt lawsuit:

Step 1: Respond to each claim listed in the Summons and Complaint

When Crown Management debt collection sues you, they take a calculated gamble. That gamble is assuming you will not respond to the lawsuit and will not challenge the business affidavit or accounting. In fact, most people who are sued by debt collection agencies choose to ignore the lawsuit, mostly because they don't know how to respond. Ignoring a debt lawsuit is the worst possible choice you could make because this almost always leads to a default judgment. With a default judgment, Crown Asset Management can do the following:

Garnish bank accounts, taking all you have earned.

Ask for receivership, which allows them to remove the money from the bank account.

Block the sale or purchase of a house or car.

Sell your unprotected assets.

So, the first step to winning your debt lawsuit is to draft and file a written Answer into the case.

You have 14-35 days to respond to a debt lawsuit, depending on which state you live in. You should draft your Answer and file it within the deadline to give yourself the best chance at winning. Respond to each claim (or allegation) numbered in the Complaint. Use one of the following answers to respond to each point:

Step 2: Make your affirmative defenses.

After you've responded to each point in the Complaint, include a section where you assert your affirmative defenses in your Answer document. Affirmative defenses are what you use to prove your side in a lawsuit. It is a list of probable reasons that the person suing you has no case.

You only have one chance to assert your affirmative defenses, and it's in your initial Answer. If you don't do it now, you won't be able to bring it up later in the case. Your defenses might include:

Lack of proof of "chain of custody,"

Lack of proof you owe the money

The debt is past the statute of limitations

Verify whether the debt is within the statute of limitations

Check to see if the statute of limitations has expired—the timeframe a creditor or collector has to collect a debt from you through the courts. Let's say it's been nine years since you paid your credit card debt. At that point, Crown Asset Management comes after you for the debt. In that case, the statute of limitations has expired, so that defense becomes viable.

Debts that are outside the statute of limitations pose fewer risks for you. Crown Asset Management cannot win a judgment against you in court (as long as the statute of limitations has expired).

The court system does not keep track of your debt's statute of limitations. Instead, you must prove the debt is time-barred.

A time-barred debt

A time-barred debt has passed the statute of limitations. Although the statute of limitations has expired, that does not mean that you do not owe money or that your credit rating cannot be affected. This means the creditor will not get a judgment against you if you provide proof that the debt is too old. Such evidence might include a personal check showing the last time you made a payment or your records of the communications you've had with the creditor.

Step 3: File your Answer and stay on top of the case

After you create your Answer, file it with the court and ensure a copy reaches the plaintiff's attorney and the debt collector. As soon as you file your Answer to the Complaint, ensure that you stay abreast of the case. The legal battle does not end after you file your Answer. In the Complaint, for example, there will be a date when you need to appear in court.

There is a "discovery "phase before the trial, where involved parties can request more information and documents. You can request a detailed accounting of the alleged debt and request that Crown Asset Management prove that you owe the alleged debt.

A Crown Management debt collector may sue the wrong person or state an amount owed incorrectly. You should send a debt validation letter to prove the original debt amount. Crown Asset Management must justify the extra fees, penalties, and expenses they have tacked on to the outstanding debt.

Make Crown Management debt collector prove their right to sue you

If Crown Asset Management debt collection sues you, you have the option to raise affirmative defenses to challenge the validity of the lawsuit. Debt collectors should prove the right to sue you. When a Crown Management debt collector collects on a delinquent credit card, the collector must have proof of "chain of custody," such as a copy of the signed credit card agreement to prove that they may collect.

If the Crown Asset Management debt collector cannot provide evidence, you can ask the court to dismiss the debt collector's case. It allows the Crown Management LLC debt collector to pursue the debt legally.

Force Crown Management debt collection to prove the debt is real

When suing you, Crown Asset Management ripoff will rely on "business record affidavits" as evidence. Don't give up hope if you receive a collection lawsuit with such an affidavit. Because Crown Asset Management purchases charged-off debts at a discount, these companies file lawsuits and employ aggressive debt collectors to collect those delinquent debts. Suing you is a way to collect on the debt as quickly as possible to generate a significant profit.

Debt collectors, like Crown Management debt collection, might attempt to make money by reviving old charged-off debts. If the debt is old, the collector will not have the original documents showing you owe the money.

They might claim that they sent you a debt validation notice in the first communication, and you might have overlooked it. However, you should still submit a SoloSuit Debt Validation Letter. To ensure your rights are protected, send your request before the 30-day period has expired.

Check out this video to learn more about how to draft and send a Debt Validation Letter:

What if the debt is within the statute of limitations?

When you are within the statute of limitations or the credit reporting time limits, you can offer to settle with Crown Asset Management a percentage of the outstanding debt. Resolve your debt lawsuit quickly with the SoloSuit Debt Lawsuit Settlement Letter.

A Debt Lawsuit Settlement Letter provides the debt collector with the opportunity to settle out of court. Despite wanting to win the lawsuit and pay nothing, you might be better off agreeing to pay less than the debt's face value to close the case.

The most effective way to offer to settle is to send it to the plaintiff shortly after filing an Answer to the lawsuit. Here is a video on how to make a debt settlement offer.

Force the lawsuit out of court with arbitration

You may avoid going to court (or at least delay it) by filing a Motion to Compel Arbitration if the Crown Asset Management debt collector sues you. In your case, File this motion using Solosuit's Motion to Compel Arbitration without an attorney's help.

In Arbitration, the parties to a legal dispute agree to have one or more arbitrators decide the dispute after hearing evidence and arguments. The advantage of Arbitration is that you can settle a debt lawsuit outside of court. Arbitrators are trained professionals who listen to both sides of the story and decide.

Arbitration clauses are standard in contracts and agreements. Several state and federal laws allow an individual to Compel Arbitration. To effectively force Arbitration, there are several prerequisites to meet. An arbitration agreement, for instance, should be valid.

1 note

·

View note

Text

Bad Credit Term Loan Canada - What You Need to Know

If you have bad credit, it used to be difficult to find a lender to work with. These days, there are many lenders that will work with people who have poor credit. These loans are easy to apply for, and are easy to repay as well. But before you apply, it's important to know what to expect.

Short-term loans are unsecured

A short-term loan in Canada is an unsecured loan that is payable over a short period of time. These loans usually involve less money than other installment loans and are paid back quickly. Most lenders in Canada offer these types of loans online and in person. These types of loans are deposited directly into your bank account and require you to make a set payment schedule. These types of loans can cost anywhere from 3% to 60%.

The application process for short-term loans is usually quick and easy. There is no credit check required and you must be working full-time and live at the same address for six months. In addition, you cannot be in a state of bankruptcy or wage garnishment. You must also be able to demonstrate a need for the loan, and that you will repay it in a timely manner.

They are not repaid over a long period of time

Term Loan Canada are loans that are not consolidated, and they can be used to fund various business needs. These loans are often used to finance the start-up costs of a business, such as paying for inventory and production expenses. They are also helpful for business owners who need to finance a new location, hire more employees, or refinance existing debt. Term loans are also helpful in funding the training of new employees, and can help free up cash flow in the long run.

The repayment schedule for term loans can be flexible, with monthly or quarterly payments. Some loans also have a fixed maturity date, which can be anything from a year to 25 years. Some term loans require collateral and require a rigorous approval process. This reduces the risk of default. Also, early repayment is not penalized.

They can be secured or unsecured

Secured and unsecured personal loans offer different advantages over the other type of loan. Unsecured loans can be easier to get, but come with higher interest rates. They are often used to pay for things like car purchases, education costs, medical bills, or other personal needs. Secured personal loans may be more difficult to get, but can give you more money in a shorter time.

Depending on your needs and financial situation, you may want to choose an unsecured loan. Secured loans can be secured or unsecured, but you will have to meet certain criteria in order to qualify for one. You will need to have a good credit score to qualify for an unsecured loan, and lenders will check your credit. You may also have to provide collateral such as a home or a car.

They are easy to apply for

Applying for a term loan is easy and quick. You don't need collateral and you can borrow up to $3000. You can use this loan for a variety of purposes, including paying for medical expenses, buying a new home, paying off your mortgage, and covering unexpected events. The process is quick, and you'll receive the money you need in as little as a few days.

Term loans are available from many banks and online lenders in Canada. Unlike installment loans, these loans are paid back over a relatively short period of time. Term loans usually require a repayment plan that includes a fixed payment schedule. In most cases, a loan of this type will require repayment within one year.

They are available for people with bad credit

When it comes to borrowing money, your credit score is a big factor. For most Canadians, your score ranges from 300 to 900, and is based on your payment history, canceled or closed accounts, and debt settlements. A lower score means that your chances of getting a loan are lower, and the interest rates that you will pay are higher as well. However, there are some loans available to people with bad credit.

If you need money fast but don't have the time to visit a bank, you can apply online for a short term loan. Using this loan option is quick and easy, and you can obtain the money within one business day. You may be surprised to learn that a short term loan can help you deal with an emergency.

They are flexible

Most Canadians want flexibility when it comes to choosing a lender and a loan. This means being able to choose a repayment schedule, interest rate, and loan product that suits their needs. Flex loans are one way to achieve that goal. These loans are available in a variety of different payment options, including fixed and adjustable rates.

These loans can help people in financial distress by providing short-term funds. People can use the funds to cover a bill that they cannot afford to pay in full until their next pay check arrives. These loans are available online and in physical loan stores. They operate similarly to traditional bank loans, except that the application process is more flexible and the requirements are simpler.

youtube

1 note

·

View note

Text

On Trust

Contrary to what many abusive (or formally abusive) people think, trust is not a transaction. It is not a trade. It is not a "I pay you with food and a place to live" and you receive my trust. Trust is more like paying a loan. They need to do things to validate our want to trust them. It's not just one thing, it is many things. Many recurring payments to maintain a "good credit score." You are late on payments? Credit score drops. Go default? Car gets repoed. Wages get garnished. Trust can be revoked at any time and it can happen in just one act. If you file for bankruptcy, you're not going to be able to get a loan for a long time. The bank doesn't trust you to pay it back. But once you build your credit up little by little, the bank trusts you again to take out another loan. You can try again.

#credit score#trust#abusive parents#bad parenting#toxic parents#toxic mother#toxic father#depression#suicide#anxiety#mental health#mentally ill#mental disorder#did#did osdd#dissociative system#actually did#dissociative identity disorder#otherwise specified dissociative disorder#bpd#borderline personality disorder#trauma#traumacore#actually traumatized#vent#trauma vent#vent tag#this is kody btw#I desperately want to trust my father again#but he needs to up his

53 notes

·

View notes

Text

Dead, broke

Of all the moving, wrenching accounts of death during the pandemic, Molly McGhee’s “America’s Dead Souls,” for The Paris Review stands out: haunting, furious and sad, an rude awakening of the status quo that denies any possibility of inaction.

https://www.theparisreview.org/blog/2021/05/17/americas-dead-souls/

I’ve known McGhee a long time, since she worked on my book INFORMATION DOESN’T WANT TO BE FREE from McSweeneys, a professional association we renewed when she landed at Tor.

During the pandemic crisis, I’ve had two different connections to her: on the one hand, the consummate professionalism of her emails as we published my novel ATTACK SURFACE in the middle of the lockdown.

On the other hand, I knew her through her wrenching and deeply personal Twitter account of the personal tragedies she’s endured over the same period. Her Paris Review essay brings those tragedies into sharp focus and uses them to pin a huge and heretofore ill-defined feeling.

McGhee’s mother died during the crisis, but the death was the culmination of years of hardship: “[earning] less than $10,000 a year. Suffering from debilitating depression while caring for her aging parents…chronically unemployed, undermedicated, and overstressed.”

Her mother’s debts were on public display through searchable databases, and her life was haunted by both con artists and bill collectors who carpet-bombed her with calls, letters and emails.

She was too poor to fight back: her wages were garnished by the IRS “for back taxes calculated from a years-old misfiling they refused to correct.” McGhee sent her months of her salary, but it wasn’t enough.

She had no answer for her mother’s rhetorical questions, “Why are these people harassing me? What good does it do them?”

Because the answer is obvious and insufficient: “The people in power don’t care if we live or die, as long as they get paid.”

It only took two days after McGhee’s mother died for her creditors to begin harassing her for her mother’s debts. The state of Tennessee seized the house, but Wells Fargo expected her to make good on the mortgage.

The hospital where McGhee’s mother died wanted a quarter of a million dollars. McGhee, not even 26, was staring down the barrel of the weapon that had been trained on her mother, the inheritor of nothing but debt.

The debt-machine is efficient. Bill collectors found out about McGhee’s mother’s death before McGhee’s own family got word. And they’re remorseless, immune to McGhee’s “pleading, bargaining, reasoning, denying, uploading, scanning, begging, faxing, and crying.”

McGhee compares it to Gogol’s “Dead Souls,” a surreal tale of a grifter named Chichikov who buys dead serfs’ souls to sell for profit.

It’s only surreal if you’ve never been in the debt system’s crosshairs, “where one day of lost wages can compound into houselessness.”

We live in a system of winners and losers. The winners’ winnings come from debt, shielded from the system’s cruelty by “professionalism and bureaucracy” that insulate them — and their functionaries — from “feelings of culpability, not to mention empathy or curiosity.”

Poor people have less money, but the system is firmly focused poor people, because people with money can defend themselves. When McGhee went into debt to hire a lawyer, a single letter on official letterhead instantly reduced all that debt by 90% — more than $250k, poof.

It’s expensive to be poor. Take Community Health Systems, one of the largest hospital chains in America. It sues the shit out of poor people. When those people can afford lawyers, CHS loses, because it is chasing debts it is not entitled to collect.

https://pluralistic.net/2021/05/18/unhealthy-balance-sheet/#health-usury

CHS itself owes $7.6 billion. It turned its first profit in 2020, thanks to hundreds of millions of dollars in state and federal subsidies, and its executives pocketed millions in “performance bonuses” for a performance that consisted of getting bailed out by the public.

The Trump stimulus handed trillions to the richest people and biggest companies in America. Those companies “leveraged up” their handouts to raise trillions more and went on spending sprees, buying up struggling businesses.

https://pluralistic.net/2020/09/17/divi-recaps/#graebers-ghost

They loaded these companies up with debt, declared “divi recaps” (where you take out a loan on a company you bought on credit and put that money in your own pocket as a “special dividend”) and crashed the companies, destroying jobs and communities.

Plutes know there are three kinds of debt: workers’ debts (which must be repaid), owners’ debts (to be “restructured” away) and government debt (not debt at all, but still handy for terrifying normies with stories of “mortgaging our kids’ futures”).

https://pluralistic.net/2021/05/17/disgracenote/#false-consciousness

Forty years of this approach has turned the economy into a shambling zombie, dependent on the fiction that “consumer” debts — repackaged as bonds through financialization — will be repaid, somehow.

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

As an ever-larger share of the world’s wealth has shifted from the workers’ side of the balance sheet to the owners’, the ability of workers to buy things to keep businesses afloat as vehicles for debt-leveraging has only declined.

Wage-theft and stagnation, unions in retreat, monopoly, monopsony, tax-preferencing for home-owners over renters, for capital gains over wages, spiraling housing, health and education costs, worker misclassification — wages are annihilated before they’re even deposited.

With no wages left over to fund consumption, there’s only debt, and as Michael Hudson says, “Debts that can’t be repaid, won’t be repaid.” CHS can comfortably carry billions in debts, but the sick people it sues for $201 have to choose between rent and medical debt.

Every loan-shark knows how this works. The chump with $500 who owes you $500 and owes the bank $500 needs an incentive to pay you ahead of the bank. To assert the primacy of your claims, you need an arm-breaker.

The digital world has given us all kinds of fantastic new arm-breakers: digital repo men who can brick your car or your phone. It’s automated the once rare practice of evictions, creating eviction mills that run with devastating efficiency.

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Creating a debt-instrument — a bond grounded in the payments from other peoples’ debts — requires that you convince investors and bond-rating agencies that your arm-breaker will terrorize the debtors into paying you instead of child-support or grocery bills.

“The cruelty is the point” isn’t ideology, it’s pure description. The system — an artificial life-form constituted as immortal colony organism that uses us as gut flora — runs on competing claims to your debt, and victory consists of terrorizing you more than any rival.

The financiers who practice leveraged buyouts destroy real businesses, ruin lives and hollow out communities. They are feted as “job creators.” The workers who must borrow to close the gap they leave are “deadbeats.” Leveraged buyouts are back, baby.

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

If you fret that forgiving student loans and making college free will “saddle our kids with debt,” then you’ve been suckered.

Look. Replacing a system that starts all but the richest children with unserviceable debt with one that doesn’t is liberation, not bondage.

Since Reagan, we’ve been hiking tuition, killing deductions for interest, and shielding student debt from bankruptcy.That’s how you can borrow $79k, pay $190k, still owe $236k, and have 25% taken from every paycheck AND Social Security until you die.

https://pluralistic.net/2020/12/04/kawaski-trawick/#strike-debt

Debts that can’t be paid, won’t be paid. Student debts do get forgiven, but only for those highly educated, (potentially) highly productive people who can prove that they have been so thoroughly destroyed by debt that they have no future.

https://pluralistic.net/2020/11/20/sovkitsch/#student-debt

And as McGhee reminds us, the tragedy isn’t merely that we educate people on the pretense of betting on America’s future, but really, the principle use that the system makes of the educated is as collateral for securitized loans.

If the arm-breakers who chased her mother wanted to understand that woman’s humanity, McGhee says they should start here:

“Her humor and her rage were unmatched. In the evenings, against the setting Tennessee sun, she liked to drink red can Cokes in the garden while snuffing cigarettes out against the yard’s ant colonies. She could reckon with anyone just by looking them in the eye. Men were terrified of her, rightfully so. She was sweet. In the last week of her life, when she couldn’t understand where she was or who she was talking to, she greeted everyone the same: ‘Hi, pal. Hope you’re doing okay. When can you come pick me up?’”

Take a second. Re-read that.

77 notes

·

View notes

Text

Sicktember - Zach has a headache

Another @sicktember post! Today’s story is with my oc’s Kylie and Zach.

Prompts:

Blankets

Medicine

Missing Out

Headache

Fever

Zach and Kylie are in the last week of summer before their senior year of high school and want to make every minute count. So, when Zach arrives at Kylie’s family’s End of the Summer BBQ looking flushed and develops a headache, Kylie drops everything to take care of him.

Zach swings by the kitchen where his sister, Emily is garnishing her avocado toast — a sprinkle of paprika, an egg over easy — before taking the right Instagram photo to share with her friends.

“‘Morning!” Zach croaks, startled by the sound of his voice. Must just be my morning voice he tries to convince himself.

He grabs a glass from the wooden cabinet nearest to the refrigerator and pours a glass of orange juice for himself before finding a quick breakfast.

His eyes grow wide when he sees a white plate with four pieces of bacon lying on it. He quickly takes piece by piece until only one remains on the plate.

“Zach!!” Emily exclaimed, her eyes raised and face scrunched in annoyance.

“Those were for Mom!” she explains, holding a hand on her hip.

“Sorry…” he mutters, “That would’ve been nice to know before, you know” he gestures his hands to the plate of bacon, pouting his lip.

“Ugh, it’s fine. I can just make more”

“Sorry, I have to be at Kylie’s soon for their barbeque and I totally woke up late,” he says trying to justify his actions.

“Oh, nice! I’m going to try and stop by later with Kara” she half-smiles. Emily has been seeing a girl named Kara for over a month now since they met at her summer job as a school nurse at a summer day camp. Emily’s first job since she graduated from Med School.

Zach touched his Home screen button to reveal the time, 12:48 PM with five unread messages from Kylie probably asking him where he was.

“Fuck. I better go” Zach said, panicked. He had been up late watching Netflix aimlessly and his throat was sore. He had tried everything: tea and honey, gargling with salt water, and honey-flavored cough drops. Nothing was curing the aching in his throat.

Finally, around 2 am, he was able to fall asleep thanks to some NyQuil.

But, he was deeply regretting his decisions when he woke up at 11:45 am after Kylie told him to get to her house at 12.

Luckily, the pain in his throat had hindered. Please, don’t do this to me again, he said into his mirror as he pulled on a blue t-shirt and khaki shorts.

Zach pulled into the Daniels’ driveway which was beginning to pack up with cars. As he parked his car, Kylie’s brother, Blake ran over to him waving his arms around in excitement.

Blake was a year younger than Kylie and Zach, playing in a band with some of his high school friends.

“Yo! You playing tonight?” Zach asked as he got out of the car to greet him with a handshake.

Blake laughed, “Nah. I got out of that tonight. One of my bandmates is taking their brother to college,” he said.

Blake escorted Zach to the back gate where their ingrown pool was fenced in and the party was brewing. Kylie waved to her boyfriend the minute she saw him. She wore an ombre purple bikini top with denim shorts and flip-flops, pulling out pool noodles for the kids to play with.

Zach smiled, walking over to her, greeting her younger cousins. He pulled her in for a kiss on the cheek.

“Do you have any water?” he asked feeling dehydrated.

Kylie perked up, turning her head toward him.

“Yeah! Right in the blue cooler”, she mentioned, throwing a couple of pool noodles into the pool at the kids. The kids screamed with excitement, one laying on their stomach and the others blowing water out the trunk of the noodle. Kylie giggled.

Zach pulled a cold water bottle out of the cooler and sighed out of relief. Suddenly, he felt light-headed and super thirsty. He chugged the water bottle until only drops of water remained.

“Let’s go inside. My mom still needs help getting everything set up” she mentioned.

Zach nodded, following her lead.

Kylie closed the gate over and started heading into the house.

When they walked into the Daniels’ home, Zach was immediately greeted by her family members.

“Zach! Nice to see ya,” Uncle Tim said. Zach nodded waving at him. “I’ll be right back, you chat” Kylie whispered in his ear.

Zach shrugged. “Ready for senior year? Do you have any colleges picked out?” Aunt Michelle (Tim’s wife) asked.

Zach dreaded this question. He wasn’t sure what he wanted to do.

“Uh, I’m going to community college, actually,” he said, confidently.

“Oh,” they said in unison. Zach was so used to hearing the disappointment in their voices when he told any adult he wasn’t going the “traditional” route for college.

Why was it so bad that he’d rather save money and figure out what he actually wanted to do instead of contributing to being in crippling debt from student loans? His sister had done the same thing and now, she landed a job as a school nurse. When he figured out whatever the hell he wanted to do in life, he would be successful, too.

“Yeah! Trying to save money” he said smiling at them. This was his cue to walk away. He walked over to the sectional in the living room across from the kitchen where the TV was playing a re-run of a Food Network competition.

Once the winner was revealed and another episode started, Zach looked around for his girlfriend. The chatter of Kylie’s loud relatives made his head start to hurt and fatigue set in.

His eyes lit up when he saw a hint of purple and his girlfriend bringing in a folded chair for an elderly woman to sit in. He ran over to Kylie as soon as he saw her.

“Hey. Can I go lay down in your room? I have a headache” he said, talking low so no one could hear him.

“Sure. Do you want some Advil?” she asked, pouting her lip with concern, “You look a little flushed” she mentioned.

Zach nodded, “Yeah, that’d be great” and jogged up the stairs turning a corner in the hallway to enter her room.

The noise died down as he closed the door. Now only hints of loud voices were in the distance. Zach grabbed a fuzzy blanket from a wicker basket and lied on top of her dark purple comforter, closing his eyes as his head pounded.

Then, the door opened.

Kylie rubbed his back saying, “Hey, I brought some water and Advil”

Zach opened his eyes and grabbed the two pink tablets from her hand, chasing them with the water.

“A nap might help? You look exhausted” she said brushing her hand through his soft brown hair.

He nodded, “Thanks” and curled back into his position. A shiver went through his body. Making Kylie now more concerned.

“Do you feel okay? Besides the headache?” she asked quietly.

“Mhmm” Zach mumbled. “Alright, I’ll check in later, or come and get me if you’re feeling better,” she said, closing her door over.

Zach woke up an hour later, feeling cold, his throat burning, and his head pounding more than earlier. He groaned. He could just go home and rest, but driving felt impossible.

He laid in the bed trying to muster up some strength to send Kylie a text. He waited, counted to five in his head, and slowly picked his body up.

Z: come here pls i need u

K: coming!

He threw his phone down and curled back up in his position. Shivering under the one blanket from earlier.

The door opened and Kylie quietly walked.

“Hey, everything okay?” she asked, calmly.

Zach opened his eyes seeing she changed into a Lakewood University shirt - the college she was most eager to attend.

“Need to go home. Can’t drive” he muttered.

“Aw, what’s wrong?” she asked, worried.

“Everything,” he said, his voice raspy. “I just need to go”

Zach groaned. “Babe, you can stay here. I don’t mind. I know you don’t feel well” she offered.

He was silent.

Kylie held in a laugh, resting the back of her hand on his forehead. “I think you have a fever,” she said frowning.

“Why don’t you stay here until you’re feeling a little better? Then, I’ll drive you home” she suggested. “Your sister and your mom are already here, so I don’t think anyone would even be at your house”

“Okay,” he mumbled.

“Let me get you some medicine and see if you have a fever,” she said, running out to the hallway closet where the Daniel’s stored their medicine.

Kylie returned to the room with a bottle of Tylenol and a digital thermometer.

“I’m sorry, but I need you to get up. Please”

Zach slowly, painfully got up and looked at his girlfriend.

Kylie frowned at his glassy eyes and pink cheeks.

“This should help relieve your symptoms for a bit,” she said gesturing to the pink bottle.

Zach just looked at her. He looked exhausted, she thought.

She poured the liquid into a plastic measuring cup and handed it over to him. Zach took a big gulp of the medicine, wincing from the taste.

“It’ll make you feel so much better. I promise” she said smiling softly, then grabbing the digital thermometer.

“Next,” she said holding the thermometer in the air. Zach opened his mouth, letting the instrument rest under his tongue.

“I’ll get some more blankets while we wait,” she said softly.

Even though he felt like utter shit, Zach was so grateful for Kylie. She would drop anything for him, even their family’s annual barbeque. Even before they made things official, as just friends, she was still always there for him.

Beep. Finally, the thermometer beeped as she held two blankets in her arms.

She placed the blankets on the bed as Zach lied on his back with the blanket she gave him earlier.

Kylie took the instrument out of her boyfriend’s mouth and read it. “Okay, you probably just have a bad cold. Nothing we can’t fix! And, you have a little fever, but the medicine should help with that ” she explained.

Zach grabbed the blankets at the end of the bed, ignoring whatever she was saying.

“Zach? Are you listening to me?” she asked noticing her boyfriend’s extra blanket.

He placed the blanket on top of the other and sighed out of relief.

“Sorry, what did you say?” he asked.

Kylie sighed. “I said, you have a little fever. But I think you just have a bad cold. Nothing we can’t fix”

Zach nodded, feeling warmth under the blankets. “Sorry. I really was looking forward to today” he muttered.

“Oh, don’t even worry! We had a great summer, anyway. Now, let’s get you better” she said kissing him on the forehead.

See more of Zach and Kylie!

LOVE SICK

#Zach and kylie#my ocs#sickfic#my sickfics#sicktember#sicktember my ocs#headache sickfic#zach has a cold#sicktember 2021

9 notes

·

View notes

Text

Defaulting on a Loan Explained

When it comes to loans, the topic of “default” is always discussed in a negative light. It is brought up in regards to consequences that come from failing to pay off a debt. That is the shorter explanation of what it is, but rarely are the outcomes and even the ways in which one can get out of a default brought up.

What does it mean?

“Default” refers to the failure of repaying a loan or security debt, including interest or principal. A default often occurs in situations where a borrower misses payments, avoids making payments or stops altogether, or is not in a position to make payments on time. Individuals and businesses, as well as countries, can default if they are unable to maintain their debt obligations.

A default can happen on secured debt, like a house-secured mortgage loan or a business loan secured by the assets of a company. Failing to make timely mortgage payments results in the loan potentially going into default. Likewise, if a business issues bonds – basically borrowing from investors – and it cannot make coupon payments to its bondholders, the business will find itself in default on its bonds.

What will happen?

If you default on a personal loan or credit card debt, there is a good chance that you will face consequences. Some of these repercussions include late fees, collection procedures, and even lawsuits. By defaulting on a secured loan, like a mortgage or car loan, your lender can take matters into their own hands, such as foreclosing on your house or repossessing your vehicle. Any loan defaults can lead to wage garnishment and this can make it a lot more difficult to meet your financial obligations.

Loan defaults typically appear in your credit history and they can be reflected in your credit score. Your credit score will drop, which in turn will make it hard for you to obtain credit in the future.

The effects of defaulting on a loan can be long-lasting, such as being forced to file for bankruptcy. In fact, student loan defaults can follow you later in life – even into retirement – by lowering your social security payments and cutting down on any tax refunds.

How to get yourself out

For student loans, there are certain programs like loan consolidation and loan rehabilitation that can help get those in student loan debt out of default. For other loan types, it’s comparatively harder to find particular programs or loans created for helping debtors get themselves out of default. The best thing to do is to, if possible, negotiate a repayment plan with your debt collector.

However, depending on your defaulted loan’s size and how severe your debt is, you may want to employ a bankruptcy lawyer. They will fully examine your financial situation. If you find yourself too overwhelmed with outstanding debt obligations, then you could benefit from the loan forgiveness that is provided when you file for bankruptcy

https://heliolending.com/

#bitcoin loans instant#crypto loan#no collateral crypto loan#criptocurrency loan#credit loans for cryptocurrencies in au#banks lending to purchases crypto#nexo crypto loans#money loans crypto#crypto lending platforms 2021

2 notes

·

View notes

Text

Utah Bankruptcy Lawyer

Utah Bankruptcy Lawyer