#Digital Lending Software

Explore tagged Tumblr posts

Text

Ziva® - A Digital Lending platform and solutions with comprehensive modules designed to meet the requirements of lending businesses of all sizes across various sectors.

0 notes

Text

Digital Lending Software

Experience streamlined loan operations transformation with advanced digital lending software. Enhance efficiency for robust business growth through cutting-edge solutions.

0 notes

Text

End-to-End Digital Lending Software Platform - Credgenix

1 note

·

View note

Text

P2P PAYMENT APP DEVELOPMENT 2024 : A COMPREHENSIVE GUIDE

Solution about,

custom blockchain development company

fintech app development company

digital wallet app development company

Our Other Blogs, Highen Fintech Blogs

#p2p payment app development#fintech app development#fintech mobile app#blockchain architecture#custom blockchain solutions#fintech development#p2p payments app#payment app development#custom software fintech#digital wallet#digital wallet app development#techfin#blockchain technology#blockchain#lending software development company#technology#fintech#blog

2 notes

·

View notes

Text

1 note

·

View note

Text

Innovative Loan App Solutions for Modern Financial Needs

In the fast-paced digital era, traditional financial services are rapidly changing to meet modern needs. FINSTA, a leading instant funding prop firm, exemplifies this transformation by providing innovative lending app solutions. The lending business, a cornerstone of the financial sector, has supported this development, and FINSTA is at the forefront of redefining the way individuals and businesses access funds.

Future Trends for Loan App Solutions

The future of loan apps hinges on further integration of technology. Blockchain can improve transparency and security, while AI can refine credit scoring and personalization. Moreover, the growing adoption of mobile banking around the world is expected to drive demand for solutions like FINSTA’s cutting-edge lending app development service in hyderabad, lending loan software in hyderabad, and lending management system in hyderabad.

The Need for Innovative Credit Apps

The modern financial environment is characterized by immediacy and convenience. Customers no longer want to deal with cumbersome paperwork, lengthy approval processes, or strict credit terms. Instead, they want a solution that fits seamlessly into their digital lives. Loan apps, supported by loan organization software, are the perfect choice here as they allow users to access loans on the go with minimal effort.

Key Features of Loan Apps

Seamless application process: Loan apps eliminate the complexities of traditional loan applications. Users can apply for a loan directly from their smartphones, and the process is often completed in minutes.

Customizable loan options: Modern loan apps cater to a variety of financial needs by offering customized loan options, from short-term personal loans to business financing.

Real-time loan disbursement: Innovative apps value speed. With real-time loan disbursement, funds are transferred to the user's account almost instantly after approval.

Enhanced security measures: To build trust, loan apps are equipped with robust encryption, multi-factor authentication, and fraud detection mechanisms.

Benefits of Lending Apps for Modern Financial Needs

1.Accessibility:

Loan apps bridge the gap between traditional banking and the underserved. They provide access to credit to those without a solid banking history or collateral.

2.Flexibility:

Users can borrow a specific amount tailored to their needs and repay it at flexible intervals.

3.Transparency:

Modern loan apps emphasize transparency by offering clear terms, interest rates, and repayment plans, which increases trust.

Integration with the financial ecosystem:

Many apps, supported by lending software providers in hyderabad and lending software solutions in hyderabad, are integrated with digital wallets, e-commerce platforms, and other financial services, creating a seamless ecosystem for users.

Industries That Benefit from Lending Apps

Small and medium-sized businesses:

Entrepreneurs use loan apps to get quick funding to expand their business or manage cash flow.

Gig economy workers:

Freelancers and gig workers turn to these apps for instant loans when their income fluctuates.

Personal loan borrowers:

From medical emergencies to travel, personal loan apps cover a wide range of personal needs.

Businesses leveraging loan management software companies and digital lending software in hyderabad are creating new opportunities in these areas.

Conclusion

Innovative loan app solutions are not just a convenience; they are a necessity in today's digital world. FINSTA, an instant funding prop firm, offers an agile, efficient, and customer-centric approach to credit that addresses the modern financial needs of both individuals and businesses. Organizations like loan software for lenders in hyderabad, best lending loan software providers in hyderabad, and lending app development companies in Hyderabad are leading this transformation.

As technology continues to evolve, there's no doubt that solutions from lending mobile app providers in hyderabad and loan organization software firms will play a key role in shaping the future of finance. Improve your financial operations today with a cutting-edge loan app solution tailored to your needs.

#loan organization software#loan management software comapny#loan software for lenders in hyderabad#lending loan software in hyderabad#lending management system in hyderabad#best lending loan software providers in hyderabad#lending software providers in hyderabad#lending software solutions in hyderabad#lending app developement service in hyderabad#lending app developement company in hyderabad#lending mobile app providers in hyderabad#digital lending software in hyderabad#loan organization software firms

0 notes

Text

Consumer Loan Servicing Software

Redefine consumer loan servicing with Newgen's advanced software. Seamlessly manage and service consumer loans with our feature-rich solution. Leverage automation, integrated workflows, and robust servicing capabilities to ensure borrower satisfaction. Elevate your institution's consumer loan servicing software to new heights, ensuring compliance, mitigating risk, and optimizing operational efficiency. Explore the future of consumer lending with Newgen.

#Consumer Loan Servicing Software#Consumer Loan Process#Consumer Loan Processing#Digital Lending#e-Document Management#Electronic Record Keeping System

0 notes

Text

Protect Your Reputation and Financial Integrity with an Advanced Financial Crime Management Solution

Safeguard your reputation and financial integrity with Azentio's advanced financial crime management solution. Our cutting-edge technology ensures proactive identification and mitigation of risks, offering a robust defense against potential threats. With Azentio's comprehensive approach, you can trust that your financial institution is fortified against evolving challenges. Stay ahead in the fight against financial crime and protect what matters most with our tailored solution.

#private banking software solutions#financial crime risk management software#financial crime management solution#digital lending platforms

0 notes

Note

Hi there! 😄 Tysfm for compiling the LO brushes, being able to use them (non-commercially of course lol) makes me so friggin happy. 🙇♀️ I have a few questions to ask about them though:

Which brush did RS use for laying down color before shading/effects? In the Rekindled tutorial, you use the Lineart Brush for laying down flats, but I'm not sure if what I said in the previous sentence is the same thing as flats (I've been drawing my whole life, but I didn't start taking digital seriously until very recently lol 🤦♀️).

When the Splatter Versa brush was used in S1, there are varying oval shapes as well as several other non-ovular shapes that I don't see when I use the brush. Were there other similar brushes used with different shapes? Or am I just doing something wrong with the brush settings? The other shapes look more wilted than the other petal shapes.

Which brush was used for the usual thick, varying lineart? (It's most noticeable with the lines in hair in mid-S1 esp.) This brush isn't really textured, so I'm a bit confused which one in particular it is.

Sorry for being annoying, I'm just not tech-savvy and very intimidated by all the technical aspects of digital drawing lol ("Wtf are 'blending modes'?" /hj). 🙇♀️

Hey there, no problem!! I'm glad people are getting use out of them!

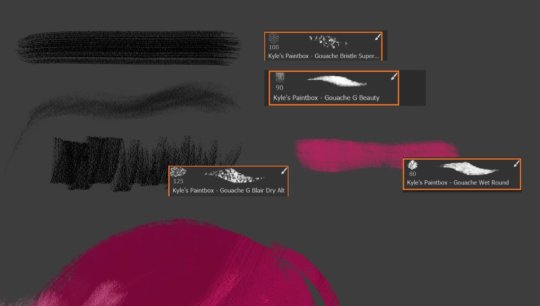

Though I'm not entirely sure as it clearly changed often throughout the course of the first season, the Gouache a Go Go brush and Hard Pastel both have those "crunchier" textures that you can see in some panels. There are also watercolor brushes that she used to blend the edges in some bigger panels.

Could you send me an example of a panel? Just so then I can actually see it and mess around with some things and give you a better answer haha That said, if I had to take a guess, either she messed with the brush control / tilt settings in Photoshop, or she may have used the Warp / Liquify tools to warp them intentionally to achieve that "petal" look. But again, send me a pic of the panels in question if you can and I can take a closer look :>

As mentioned previously, an example would help a lot here, but I do know what you're saying that some panels had very thick, varied lineart. Rachel has gone on record on two separate occasions that she used the Gouache Wet Pencil / Wet Round brush from the Kyle Webster Pack. Though the Hard Square Pastel brush can also achieve similar effects. Note that the Wet Round brush is a dual-sizing brush - if you adjust the brush size, you have to also adjust the particle size in tandem, otherwise you'll get a bigger brush size with more scattered/diluted particles. Though this effect IS very helpful for shading!

As mentioned, Rachel has mentioned some of the brushes she's used, and though it's not necessarily relevant to what you're looking for specifically, she's also mentioned these brushes in old FAQ's, specifically the Wet Round brush for lineart.

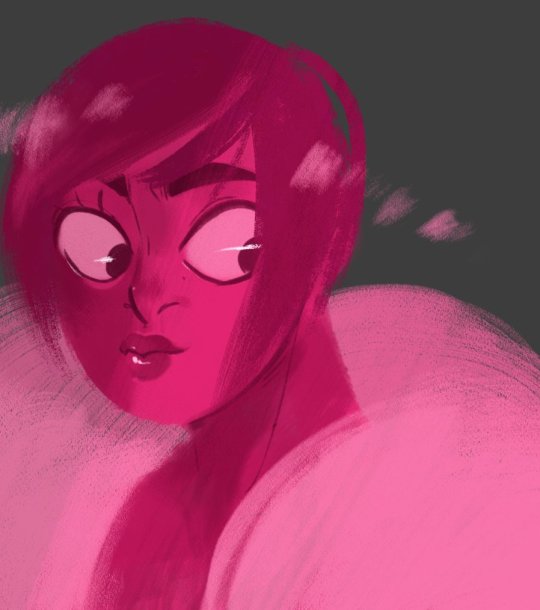

Here are some examples I whipped up real quick based on some of the panels that specifically depict thick lineart and textured coloring:

Mind you, these are all my best guesses, based on what Rachel has provided and what I've both dug up and been provided by other contributors who have pointed me in the right direction.

Unfortunately, while LO's art style is unique, it also makes it very difficult to reverse-engineer because throughout the comic (esp in S1 when she was still experimenting) while she did clearly have some "favorites" out of the bunch, she also just kind of went off "vibes" a lot of the time, treating every panel as an individual painting. And while that did lend to some of LO's most beautiful panels throughout S1, it also created a lot of whiplash between stylization because after doing one panel with thick lineart and bold texturing, she'd do another with watercolors and softer edges.

That's also not taking into account the software she was using - many of these brushes were designed exclusively with the Photoshop brush engine in mind, not Clip Studio, so they may not work entirely as intended if you use them in Clip Studio or some other non-Photoshop software. We also have to consider other factors like canvas resolution, texture effects added afterwards (such as that canvas overlay), and other adjustable settings within the brushes themselves that Rachel may have tweaked, including the pressure sensitivity, particle size/density, thickness, etc. All of which we can't really truly know, so we can only settle for our closest guess.

This is half the challenge - and fun - of trying to emulate her art style, because even she clearly didn't follow any strict rules 😅 Unfortunately it leaned more towards worse as time went on as it was clear the assistants themselves were given very little guidance or consistency (or at least, didn't have the time to settle on a happy medium) resulting in panels that are even more distinctly out of place as they were being swapped between different artists with different backgrounds and styles.

All that aside, I hope that helps! I do admittedly have to update that brush pack again, I feel like there are a handful of brushes I've found since then that could also be added, but I'd also like to update the included instructions to better reflect what I've learned since then regarding each brush and how they could be used. Ultimately though, they're yours to experiment with! Mess around, adjust the sizes and density and pressure settings, all of these things can contribute to the overall look.

Good luck! <3

82 notes

·

View notes

Text

U.S. Copyright Office Presses 'Pause' on DMCA Exemption for Video Games

By Lydia Leung, LLB | Last updated on November 08, 2024

When we think of a library, we picture never-ending shelves of books; the world's knowledge available to us at the touch of a finger. But nowadays, it's not just physical records that libraries collect. Many now lend video games to their members, providing their local communities with entertainment while helping preserve the software for future generations.

The recent decision by the U.S. Copyright Office (USCO) to reject an exemption to the DMCA for video games in libraries' collections has put that practice into question. The decision prevents video games from being accessed remotely by researchers. While some in the games industry view this ruling as a win for rights holders, others see it as a major setback for arts research, especially compared to researchers in other fields with "routine and regular access" to digital archives.

What Is The DMCA?

Passed in 1998, the Digital Millennium Copyright Act (DMCA) brought the U.S. in line with treaties of the World Intellectual Property Organization (WIPO), updating copyright law for the digital age. Section 1201 of the DMCA criminalizes the "circumvention of copyright protection systems" that prevent unauthorized access to copyrighted works, such as reading encrypted optical discs or removing copy restrictions from electronic documents.

Exemptions are made for some uses, including for nonprofit libraries, archives and educational institutions (section 1201(d)), as long as a "good faith" determination is made. Libraries are permitted to create digital copies of obsolete works for purpose of preservation, but those works must not be commercially available for a "reasonable price" and can only be accessed onsite.

The Petition

The Video Game History Foundation (VGHF) has been working with the Software Preservation Network (SPN) since 2021 on a petition to the U.S. Copyright Office, proposing that the DMCA digital copying exemption be expanded to allow access to games outside of the physical premises of an institution. A study published by the VGHF in July 2023 estimated that 87% of video games released in the US before 2010 are "critically endangered" and inaccessible, being out of print in either physical or digital form. Options to play classic games are limited as many require vintage hardware or are no longer available on a digital storefront, potentially pushing consumers and researchers towards piracy as the most convenient means of access.

The petition's main argument is framed from the perspective of fair use: works kept by archives and collections are exempt from copyright infringement laws if they are used for purposes such as research or teaching. To enable this, the SPN proposed a system of user vetting and copyright notices, allowing institutions to restrict access only to users who submit a research request detailing the scope of their project and providing notices to remind them that their access is subject to copyright law.

The requirement of having to request specific access ensures that games are being used for research purposes, with the SPN citing "academic literacy" as a way of filtering out users planning to access them for entertainment. The USCO already allows institutions to lend other forms of media remotely, and the SPN argued that the DMCA's stringent rules around distribution of software programs places impediments on video game scholarship that are not present in other disciplines.

Arguments Against

The Entertainment Software Association (ESA), a trade association representing the U.S. video game industry, opposed the SPN petition, stating that the exemption would leave rights owners insufficiently protected and that the market for classic video games would be damaged. The SPN's proposed method of fair use vetting was dismissed by the ESA as "illusory", arguing that this was not enough justification for the breadth of use they would enable. It would be too difficult for libraries to supervise multiple users remotely accessing games, thus enabling usage for entertainment purposes.

Furthermore, the ESA contended that the market for classic video games is "vibrant and growing", citing the number of titles currently available on digital storefronts such as the Xbox Game Pass, not to mention frequent re-releases of individual titles on modern systems. That a game is "out of print" does not mean it is lost forever, only that the copyright owner decided not to put it on the market. Allowing widespread remote access to classic games would present a serious risk to the market and prevent copyright owners from enforcing their copyrights.

The USCO Ruling

The USCO observed that, for a fair use exemption, access to the games would have to be guarded against recreational use by containing "appropriately tailored restrictions". The view taken by the ESA on the SPN's proposed restrictions was echoed by the USCO, which ruled that they were not specific enough to prevent market harm and that the SPN had not met the burden of showing that allowing simultaneous remote access by multiple users was likely to be fair.

Regarding the claims of market damage put forth by the ESA, the USCO acknowledged the evidence presented of a "substantial market" for classic video games, and the SPN's concession that the industry has made a greater effort in recent years to reissue older games. Considering these arguments, the Register ultimately rejected the petition, but recommended clarifying the wording used in the DMCA to reflect that a computer program may be accessed by as many individuals as the institution owns copies.

What Does This Mean?

As a newer form of digital media, U.S. law has yet to settle on a definitive classification of what copyrights arise from a video game. A common view is for games to be treated as computer software and for the source code to be considered a literary work. However, unlike "traditional" literary works such as books or newspapers, the interactive nature of a video game makes regulating access to it more complicated.

Games are often limited to their corresponding hardware, potentially leading to research costs going up as researchers may be forced to travel long distances or somehow purchase a retro console for themselves; not to mention potential consideration of extra-legal methods. Researchers are pushed into focusing on works that are easy to access rather than those they have a true interest in studying. Teaching is also affected: academics cannot assign their students games with historical or technological significance if they may not be able to access them (for example, the original Metroid Prime (2002), noted for its female protagonist and being the first game in the series to use 3D graphics, is only available on the GameCube). This curtails the growth of video game studies, introducing obstacles to a field with deepening cultural impact and technological advancement.

In their submission to the USCO, the SPN compared the rise of video games to the film industry, highlighting the creation of the National Film Preservation Board in 1988 as a way of recognizing that films are a part of cultural heritage, worthy of academic preservation and study. Whether games will ever reach that status remains uncertain: they make up a large part of our cultural and entertainment landscape today and it's clear that they are here to stay, but only time will tell whether the USCO's attitudes change.

Man, come the fuck on....

i think CEO's should be rounded up and shot personally

15 notes

·

View notes

Note

I'm a little confused, what trouble did the Internet Archive get into exactly?

By this I mean, is it going down? Or is it just dealing with politics behind the scenes?

(I occasionally find the Internet Archive to be useful, so I hope it doesn't disappear)

Okay, so, it helps to have context here. First, IA.

IA has its fingers in several pies:

the Wayback Machine (and allied services such as Archive-It) for website preservation

software (including game) preservation

print digitization, which started (I think) as an add-on to software preservation (because manuals matter!) and expanded to pretty much whatever print IA could get its hands on

a lending system for the above digitized collection, known as the "Open Library"

lately, machine-learning tools intended to operate over its digitized-print collections (it's still building this out, I've seen some of the grant applications) -- nothing generative-AI-like yet that I know of, however

A lot of this work is only dubiously and uncertainly within the scope of US copyright. (N.b. IANAL, IANYL, I am certainly not Internet Archive's lawyer, TINLA.) IA takes refuge largely in audacity, and in the centrality of the Wayback Machine to web preservation generally. So they have been known to pull the "if we lose this legal case totally unrelated to web preservation and have to pay gonzo fines, Wayback is in peril!" ripcord.

Is this true? Hell if I know, I don't audit IA's books. I doubt it, though.

What they're in trouble for -- what an appeals court shot them all the way down for yesterday -- is what they did with their Open Library of digitized print books, many of them in-copyright, during COVID lockdown. And to understand all that, we have to untangle some things about US copyright. Ugh, somebody hand me a read-more link.

Why can libraries lend print books, vinyl, cassettes, CDs, and DVDs in the US? Because of a legal doctrine called "the first sale right," which goes like this: if you have a legally-produced physical object containing copyrighted material, you can do whatever the fuck you want with that physical object with zero copyright implications --other than reproduce/copy or perform it (which does have copyright implications, complex ones).

You can (yes) burn it. You can lend it to a friend, or an enemy, or a random stranger. You can give it away. You can throw it away. You can resell it. You can hang it on your wall or in your window. You can make an art installation with it. And the copyright owner cannot win a copyright-based lawsuit over any of this, even if they hate what you're doing! Even if it competes with them selling new copies (as the resale market absolutely does, and as some jerkfaced copyright owners -- usually corporations, not authors! -- love to complain that libraries do)!

Here's the thing, though, and it's an important thing so I'm gonna big-type it:

The right of first sale does not apply to anything digital ever.

Not ebooks (digitized or born-digital, doesn't matter). Not streaming anything. Not paywalled online news or research.

When libraries offer these to patrons, it's through contracts with publishers or aggregators. Long story short, a lot of these contracts are ridiculously restrictive (not to mention expensive) to the point of cartoonish evil, but it's what we have to work with.

The idea behind Controlled Digital Lending is "if libraries purchased a physical item legally, we should get to lend the item to one person at a time as we always have, and it shouldn't actually matter whether what we lend is the physical item or a digital version of it, as long as only one or the other is out to a patron at a given time."

Which is an untested legal theory! I can't tell you whether it's legal! Nobody can! The case law doesn't exist! Yeah yeah, there's relevant past cases in both directions having to do with accessibility or Google Books or whatever, but a specific precedential ruling on CDL is not a thing that presently exists.

No, not even now. Because what IA did with its Open Library during lockdown, and got slapped down for by the court, is not CDL as defined above. IA didn't hold to one-person-at-a-time-per-book. They tried to make a fair-use argument for what they actually did (that is, not for actual CDL), and the court was not having it.

The thing is, IA's stumblebummed legal fuckup means that actual CDL, as actual libraries (n.b. the IA is not an actual library or an actual archives, I will happily die on this hill, I loathe IA like poison and do not want to admit them to my profession, IA people have dissed me and my work TO MY ACTUAL PHYSICAL FACE and they only love libraries or librarians when trying to hide behind us) were trying to design and implement it, now faces additional legal hurdles. Any court looking at an actual CDL program has to take into account IA getting slapped down. And that's if we can even find a library or library consortium with deep enough pockets and hardcore enough legal representation to even defend such a case.

The thing also is, IA just issued Big Publishing a gilt-edged invitation to use this precedent to sue actual libraries, especially academic libraries, over other things we do. (I'm gonna pass over exactly what in silence because I do not want to give those fuckers ideas, but... there have been past lawsuits, look 'em up.) THANKS, BREWSTER. THANKS EVER SO. Asshole.

For a calmer take than mine, check out Library Futures, which to their credit has not given up all hope for CDL.

This IS the short version of all this nonsense, believe me. I used to teach a whole entire three-credit graduate-level course in the long version. (Which IA would doubtless diss to my face if they knew about it.)

7 notes

·

View notes

Text

Why the Training of Staff in Microfinance Sector Is a Game-Changer

When we talk about building stronger, more inclusive financial systems, we can't ignore one key factor: the training of staff in microfinance sector. This isn’t just a formality—it’s the heartbeat of microfinance success.

Microfinance institutions (MFIs) serve millions of individuals and small business owners who often don’t have access to traditional banking. These clients rely on staff to guide them through unfamiliar financial products. Without proper training, staff can make mistakes, miss opportunities, or fail to connect with the very people they aim to help.

So why does training matter so much? Let’s break it down. 👇

How Training Impacts Microfinance

1. Better Skills = Better Service

Training gives staff the technical knowledge they need—things like credit risk evaluation, loan processing, savings program management, and even how to use microfinance software or mobile platforms.

When staff understand these tools and systems deeply, they can serve clients more efficiently, reduce paperwork errors, and ensure funds are allocated properly.

2. Relationship Building With Clients

Clients in the microfinance space often feel nervous or unsure about borrowing money, especially if they’re unfamiliar with formal finance. That’s where empathy, clear communication, and patience come in.

Through training, staff develop people skills. They learn how to explain financial terms in simple language, manage difficult conversations, and help clients feel confident about their financial decisions.

3. Compliance and Risk Management

Let’s not forget—MFIs operate under strict financial and legal guidelines. When staff understand compliance rules and ethical lending practices, they avoid mistakes that could lead to fines or institutional risk. Training ensures all staff—from loan officers to branch managers—stay informed about changes in policy and regulation.

4. More Efficient Day-to-Day Operations

When staff are confident in their roles, things run smoother. Loan approvals are quicker. Client onboarding becomes easier. Errors go down. A well-trained workforce can handle more work with fewer delays, saving time for both staff and clients.

5. Reduced Turnover = Stronger Teams

High staff turnover is a big challenge in the microfinance sector. But when institutions invest in training, staff feel empowered and valued. They see a future with the organization. This leads to better retention, stronger team dynamics, and less money spent on rehiring and retraining.

Best Practices for Training

To make your training efforts count:

Assess staff needs regularly

Tailor training programs by job role and location

Use a blend of in-person and digital training

Measure results with key performance indicators

Training shouldn’t be a one-time event. It should be a continuous process of development and support.

FAQs About Training of Staff in Microfinance Sector

Q1: Why is staff training important in microfinance? Because well-trained staff serve clients better, manage operations efficiently, and stay compliant with regulations.

Q2: What topics should be included in training? Credit risk, financial literacy, customer service, software use, ethical lending, and regulatory updates.

Q3: How often should MFIs train their staff? At least once or twice a year, with onboarding for new hires and updates as policies or technologies change.

Q4: Is online training a good option for microfinance teams? Yes! It’s flexible, accessible, and great for reaching remote branches or field staff.

Q5: What’s the biggest challenge in staff training? Time, infrastructure, and ensuring the training is relevant to the local context and client base.

Final Thought

The training of staff in microfinance sector isn’t just about checking a box—it’s about building confidence, improving service, and changing lives.

If you want your institution to grow, your team must grow first. Empower your people, and they’ll empower your clients.

#Training of Staff in Microfinance Sector#Microfinance Staff Training#Microfinance Training Programs#Staff Development in Microfinance#Microfinance Employee Training#Microfinance Human Resource Development

3 notes

·

View notes

Text

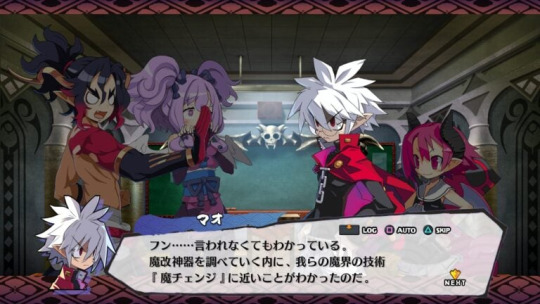

Disgaea 7 Complete announced for PS5, PS4, and Switch

From Gematsu

Nippon Ichi Software has announced Disgaea 7: Koremade no Zenbu Iri Hajimemashita., a bundle edition of Disgaea 7: Vows of the Virtueless that includes all previously released downloadable content and bonus items, as well as an additional bonus story and new gameplay elements that will also be made available for the base game. It will launch for PlayStation 5, PlayStation 4, and Switch on July 25 in Japan for 5,980 yen (6,578 yen with tax). A western release has yet to be announced, but it would likely be titled Disgaea 7 Complete, given past Disgaea re-releases.

Get the details below.

■ Poster

■ Game Overview

Disgaea 7: Koremade no Zenbu Iri Hajimemashita. includes the January 2023-released latest entry in the Disgaea series—Disgaea 7: Vows of the Virtueless—and all existing downloadable content and bonus items. Additionally, it includes a new bonus story, new characters, and new post-game elements, making this the ultimate value version of Disgaea 7.

Key Feature #1: A Great Gathering of Popular Characters! New Bonus Story “The World Savers Squad” Added!

Key Feature #2: Includes All Downloadable Content in Addition to the Base Game!

Key Feature #3: New Elements Added Such as Hell Inheritance, Max Stats Cap Unlock, and More!

Included Content

-Base game

-Seven already released downloadable content bonus stories

-21 characters obtained by clearing the downloadable content bonus stories

-Bonus items

Season Pass purchase bonus: Pleinair

First-print purchase bonus: Glasses Costume Set

Digital Deluxe Edition bonus: Series Costume Set

Digital Deluxe Edition Bonus: Special Weapons Set

Store purchase bonus: 14 special model generic characters

-New bonus story: “The World Savers Squad”

-New character: Asagi

-New gameplay elements

Hell Mode: All characters unlocked

Max stats cap unlocked

Rakshasa Baal

*The new bonus story and new character will also be available as a separate purchase for existing Disgaea 7: Vows of the Virtueless owners for 500 yen (550 yen with tax). *The new gameplay elements will be available as a free element for existing Disgaea 7: Vows of the Virtueless owners.

■ Key Feature #1: A Great Gathering of Popular Characters! New Bonus Story “The World Savers Squad” Added!

Fuji and his party from Disgaea 7: Vows of the Virtueless launch an assault on each Netherworld from the Disgaea series!? Following the ending of the base game, Fuji and his party go beyond the Ewwdo Netherworld… and the world of Disgaea 7 altogether… in order to solve the remaining problems of the Seven Founding Weapons. Who is the character that lends a hand to Fuji’s party as they struggle to solve their problems? And who is the “mystery character” targeting Fuji and his party as they finally uncover a lead? This bonus story brings together Fuji’s party with the protagonists of previous Disgaea titles. *The new bonus story will also be available as a separate purchase for existing Disgaea 7: Vows of the Virtueless owners for 500 yen (550 yen with tax). *The new bonus story is only playable after clearing the main story.

New Character: Asagi

By clearing the new bonus story, new character Asagi can join your party.

Asagai has appeared in previous Disgaea games and various other Nippon Ichi Software titles as a guest character. She is the “(former) perpetual protagonist of [Nippon Ichi Software’s] next game.”

■ Key Feature #2: Includes All Downloadable Content in Addition to the Base Game!

All previously released downloadable content items and bonus items are included! This includes seven bonus stories, 22 additional characters, and a handful of bonus costumes and special generic character models.

■ Key Feature #3: New Elements Added Such as Hell Inheritance, Max Stats Cap Unlock, and More!

Now there is even more to do in Disgaea 7: Vows of the Virtueless! Now anyone can activate Hell Mode, enabling character development with even greater freedom! —By passing a specific bill, Hell Mode can now be activated by any character.

—In Hell Mode, even the weakest character Prinny can become a force to be reckoned with by equipping a certain spear which allows him to act three times in one turn.

Additionally, with the max stats cap unlocked, you can now develop the strongest character beyond previously set limits. —Strengthening your favorite characters is one of the Disgaea series’ key elements.

Rakshasa Baal, the evilest boss to stand before your party, has also been added. Strengthen your characters with the goal of crushing Rakshasa Baal, whose strength is of another dimension.

■ Key Visual

View the first screenshots at the gallery.

#Disgaea 7: Koremade no Zenbu Iri Hajimemashita#Disgaea 7 Complete#Disgaea 7: Vows of the Virtueless#Disgaea 7#Disgaea#Nippon Ichi Software#Nippon Ichi#SRPG#RPG#Gematsu

15 notes

·

View notes

Text

25 Passive Income Ideas to Build Wealth in 2025

Passive income is a game-changer for anyone looking to build wealth while freeing up their time. In 2025, technology and evolving market trends have opened up exciting opportunities to earn money with minimal ongoing effort. Here are 25 passive income ideas to help you grow your wealth:

1. Dividend Stocks

Invest in reliable dividend-paying companies to earn consistent income. Reinvest dividends to compound your returns over time.

2. Real Estate Crowdfunding

Join platforms like Fundrise or CrowdStreet to invest in real estate projects without the hassle of property management.

3. High-Yield Savings Accounts

Park your money in high-yield savings accounts or certificates of deposit (CDs) to earn guaranteed interest.

4. Rental Properties

Purchase rental properties and outsource property management to enjoy a steady cash flow.

5. Short-Term Rentals

Leverage platforms like Airbnb or Vrbo to rent out spare rooms or properties for extra income.

6. Peer-to-Peer Lending

Lend money through platforms like LendingClub and Prosper to earn interest on your investment.

7. Create an Online Course

Turn your expertise into an online course and sell it on platforms like Udemy or Teachable for recurring revenue.

8. Write an eBook

Publish an eBook on Amazon Kindle or similar platforms to earn royalties.

9. Affiliate Marketing

Promote products or services through a blog, YouTube channel, or social media and earn commissions for every sale.

10. Digital Products

Design and sell digital products such as templates, printables, or stock photos on Etsy or your website.

11. Print-on-Demand

Use platforms like Redbubble or Printful to sell custom-designed merchandise without inventory.

12. Mobile App Development

Create a useful app and monetize it through ads or subscription models.

13. Royalties from Creative Work

Earn royalties from music, photography, or artwork licensed for commercial use.

14. Dropshipping

Set up an eCommerce store and partner with suppliers to fulfill orders directly to customers.

15. Blogging

Start a niche blog, grow your audience, and monetize through ads, sponsorships, or affiliate links.

16. YouTube Channel

Create a YouTube channel around a specific niche and earn through ads, sponsorships, and memberships.

17. Automated Businesses

Use tools to automate online businesses, such as email marketing or subscription box services.

18. REITs (Real Estate Investment Trusts)

Invest in REITs to earn dividends from real estate holdings without owning property.

19. Invest in Index Funds

Index funds provide a simple way to earn passive income by mirroring the performance of stock market indexes.

20. License Software

Develop and license software or plugins that businesses and individuals can use.

21. Crypto Staking

Participate in crypto staking to earn rewards for holding and validating transactions on a blockchain network.

22. Automated Stock Trading

Leverage robo-advisors or algorithmic trading platforms to generate passive income from the stock market.

23. Create a Membership Site

Offer exclusive content or resources on a membership site for a recurring subscription fee.

24. Domain Flipping

Buy and sell domain names for a profit by identifying valuable online real estate.

25. Invest in AI Tools

Invest in AI-driven platforms or create AI-based products that solve real-world problems.

Getting Started

The key to success with passive income is to start with one or two ideas that align with your skills, interests, and resources. With dedication and consistency, you can build a diversified portfolio of passive income streams to secure your financial future.

2 notes

·

View notes

Text

TOP BLOCKCHAIN TRENDS FOR 2024

Solution about,

custom blockchain development company

fintech app development company

digital wallet app development company

Our Other Blogs, Highen Fintech Blogs

#blockchain trends#blockchain#fintech#fintech app development#lending software development company#digitalcurrency#digital wallet app development#mobile app development#technology#application#software#blockchain technology#trends#2024#blog

2 notes

·

View notes

Text

Why Bitcoin Over Others?

In a world where thousands of cryptocurrencies seem to appear overnight, it’s easy to lump them all together and label them “just another digital coin.” But doing so misses a crucial point: not all digital assets are created equal. Bitcoin, the original cryptocurrency, stands distinctly apart from the rest. Its history, security, decentralization, and unwavering principles set it on a pedestal far above the flood of imitators. Today, we’ll explore what makes Bitcoin so special—and why it remains the cornerstone of the entire crypto movement.

1. Immaculate Conception and Fair Launch Bitcoin emerged during the aftermath of the 2008 financial crisis, introduced by an unknown individual or group under the pseudonym Satoshi Nakamoto. Unlike many cryptocurrencies that began with pre-mines, venture capital backing, or a charismatic founder front and center, Bitcoin was offered to the world at large with no special advantages for early insiders. Its code was released as open-source software, and anyone could join, mine, and participate. This clean, decentralized birth means there’s no central authority pulling the strings—just a global, diverse community contributing to its growth.

2. Proven Security and Longevity One of the greatest strengths of Bitcoin is its track record. For over a decade, it has operated without needing to “restart” or rewrite its ledger, all while withstanding countless hacking attempts and periods of extreme volatility. Its security model, powered by a vast network of miners performing billions of computational operations per second, has made it incredibly resistant to attacks. This longevity and resilience place Bitcoin in a unique category—no other digital asset has maintained such unshakeable network security for so long.

3. True Decentralization Decentralization is a buzzword often tossed around, but few truly deliver. Bitcoin’s network is spread across the entire globe, with miners, node operators, and developers from all walks of life. No government, company, or consortium controls the network; transactions require no permission and no central gatekeeper. Other cryptocurrencies frequently rely on small teams, foundation boards, or single points of failure. Bitcoin’s decentralized architecture ensures it remains censorship-resistant, neutral, and truly belongs to everyone and no one.

4. Predictable Monetary Policy At the heart of Bitcoin’s monetary policy is a simple but powerful principle: scarcity. There will never be more than 21 million bitcoins, a limit enforced by Bitcoin’s code. This fixed supply contrasts sharply with fiat currencies, which central banks can inflate at will, and with many cryptocurrencies that tweak their monetary policy mid-flight. The reliability of Bitcoin’s halving cycles—where the reward for mining new coins is cut in half roughly every four years—imposes discipline and predictability. This scarcity and transparency help position Bitcoin as “digital gold,” a store of value that transcends borders and politics.

5. Network Effects and Brand Recognition Bitcoin’s first-mover advantage has allowed it to capture the imagination of individuals, institutions, and even some governments. Over time, it has built an unparalleled brand, becoming shorthand for the very concept of digital money. As a result, infrastructure—from exchanges and custodial services to payment processors and lending platforms—has matured around Bitcoin first. Its network effects are self-reinforcing: the more people use and trust Bitcoin, the more robust and valuable it becomes, further attracting new users.

6. Conservative Upgrades and Steady Evolution Unlike many projects that chase trends, implement flashy features prematurely, or pivot narratives every few months, Bitcoin evolves slowly and deliberately. Changes to the Bitcoin protocol undergo intense scrutiny and thorough debate before being adopted. This conservative approach preserves the network’s stability and reliability. Instead of overhauling the system haphazardly, Bitcoin relies on Layer 2 solutions like the Lightning Network to improve efficiency and speed without compromising core principles.

7. A Cultural and Philosophical Touchstone Beyond technology, Bitcoin represents an idea—a rejection of the status quo of endless money printing, centralized oversight, and financial exclusion. It’s a rallying point for those who value privacy, autonomy, sound money, and freedom from the arbitrary decisions of central authorities. This cultural and philosophical dimension is something many altcoins lack. While others may attempt to graft meaning onto their projects, Bitcoin naturally embodies these principles through its origin story, infrastructure, and committed global community.

Conclusion: The Gold Standard of Digital Assets As the cryptocurrency landscape continues to expand, it’s crucial to separate substance from hype. While plenty of coins promise faster transactions, flashy features, or quick gains, few can claim the foundation of trust, resilience, and true decentralization that Bitcoin offers. Bitcoin isn’t just another coin; it’s the benchmark by which all other digital assets are measured.

In choosing Bitcoin over others, you aren’t merely picking a cryptocurrency—you’re aligning yourself with a robust, time-tested network built on transparency, fairness, and sound monetary principles. Amidst an ever-growing sea of digital assets, Bitcoin remains the unwavering beacon lighting the way toward financial sovereignty.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#DigitalGold#CryptoEducation#BitcoinOverAltcoins#CryptoCommunity#FinancialFreedom#Decentralization#BlockchainTechnology#SoundMoney#CryptoRevolution#Altcoins#BitcoinStandard#HODL#FutureOfFinance#DigitalCurrency#BitcoinAdvocate#CryptoBlog#WhyBitcoin#BitcoinVsAltcoins#financial empowerment#globaleconomy#unplugged financial#blockchain#financial education#finance#financial experts

4 notes

·

View notes