#lending application software

Explore tagged Tumblr posts

Text

End-to-End Digital Lending Software Platform - Credgenix

1 note

·

View note

Text

FINTECH MARKETING STRATEGIES TO TRY IN 2024

Solution about,

custom blockchain development company

fintech app development company

digital wallet app development company

Our Other Blogs, Highen Fintech Blogs

#blockchain#fintech#fintech app development#lending software development company#marketing#marketing strategy#marketing stratergies#fintech marketing#custom software development#custom software solutions#custom software implementation and integration#custom software company#custom software application#highen fintech#blog

3 notes

·

View notes

Text

I love my brother, full stop. But he's completely capitalism poisoned, he's been doing one sales job after another for decades now. He immediately quits one job as soon as he senses he might make ten dollars more at another job. And I've told him that his way of life is disgusting to me, he knows I want nothing to do with it. So the other day, he tells me this new company he's working at is hiring and he says it's debt waiving or something? he's describing that he doesn't do any selling, they just contact like credit companies and negotiate lower rates or payments or whatever. He specifically says it's not sales. So the company sends me a job invite (it's recommendation only, red flag 4 thru 10), and I take a look at the job duties. It's spelled out without euphemism (which is refreshing, I won't lie) that the job is doing presales confirmation. You do all the arguments they might have against taking out a loan to consolidate their debt, you run their credit and everything, then you pass the ones who qualify on to the sales team. It's literally sales but you aren't the one who gets the commission. I can't imagine a job that would make me suicidal faster, unless it was like Concentration camp guard or something.

So that was about two weeks ago. Today, he texts me that he has access to the application software, and he sees that my application is 'in review pending interview'. It is very important to clarify that I in no way applied for this job. I want nothing to do with this job. I think everyone that does it should burn in hell for all of eternity. It's a job preying on desperate people to get access to the biggest chunk of their stuff when they declare bankruptcy. I looked into the reviews of the company after he told me about it, they aren't helping ANYBODY. My opinion of my brother has gone down a couple notches honestly that he's seemingly so passionate about it. He genuinely thinks he's helping people at the same time he's lining his wallet. I can't wrap my head around how he doesn't realize what he's doing. He buys up people's debts so that his company can take their house. As soon as he moves to a new job, he completely internalizes all their feel good propoganda about how this time, it's predatory lending with a soul tho, so it's totally different.

100 notes

·

View notes

Text

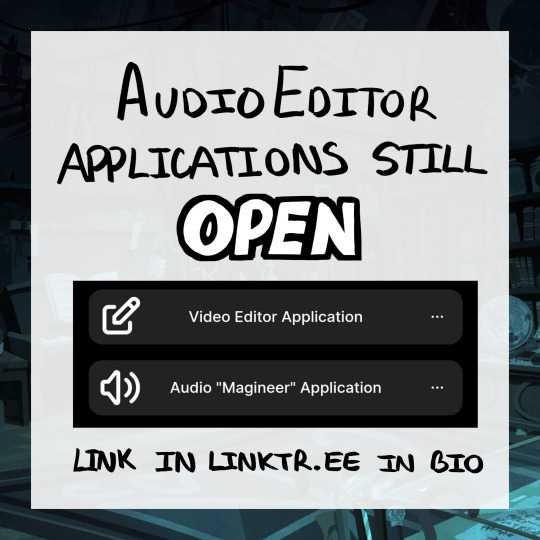

AUDIO EDITOR APPLICATIONS OPEN

We are in need of audio editors at every skill level to reach out and lend their hand to this project. If you are interested in applying, we are accepting applications here! We would happy to accept participants on board.

APPLICANT REQUIREMENTS

Adobe Audition or other quality software-editing program.

Must be at least 18 years of age.

Regular access to communication on Discord.

#twisted wonderland#twst#voice acting#fandub#twst wonderland#casting call#disney twst#disney twisted wonderland#twisted wonderland official fandub#dub

85 notes

·

View notes

Note

I'm a little confused, what trouble did the Internet Archive get into exactly?

By this I mean, is it going down? Or is it just dealing with politics behind the scenes?

(I occasionally find the Internet Archive to be useful, so I hope it doesn't disappear)

Okay, so, it helps to have context here. First, IA.

IA has its fingers in several pies:

the Wayback Machine (and allied services such as Archive-It) for website preservation

software (including game) preservation

print digitization, which started (I think) as an add-on to software preservation (because manuals matter!) and expanded to pretty much whatever print IA could get its hands on

a lending system for the above digitized collection, known as the "Open Library"

lately, machine-learning tools intended to operate over its digitized-print collections (it's still building this out, I've seen some of the grant applications) -- nothing generative-AI-like yet that I know of, however

A lot of this work is only dubiously and uncertainly within the scope of US copyright. (N.b. IANAL, IANYL, I am certainly not Internet Archive's lawyer, TINLA.) IA takes refuge largely in audacity, and in the centrality of the Wayback Machine to web preservation generally. So they have been known to pull the "if we lose this legal case totally unrelated to web preservation and have to pay gonzo fines, Wayback is in peril!" ripcord.

Is this true? Hell if I know, I don't audit IA's books. I doubt it, though.

What they're in trouble for -- what an appeals court shot them all the way down for yesterday -- is what they did with their Open Library of digitized print books, many of them in-copyright, during COVID lockdown. And to understand all that, we have to untangle some things about US copyright. Ugh, somebody hand me a read-more link.

Why can libraries lend print books, vinyl, cassettes, CDs, and DVDs in the US? Because of a legal doctrine called "the first sale right," which goes like this: if you have a legally-produced physical object containing copyrighted material, you can do whatever the fuck you want with that physical object with zero copyright implications --other than reproduce/copy or perform it (which does have copyright implications, complex ones).

You can (yes) burn it. You can lend it to a friend, or an enemy, or a random stranger. You can give it away. You can throw it away. You can resell it. You can hang it on your wall or in your window. You can make an art installation with it. And the copyright owner cannot win a copyright-based lawsuit over any of this, even if they hate what you're doing! Even if it competes with them selling new copies (as the resale market absolutely does, and as some jerkfaced copyright owners -- usually corporations, not authors! -- love to complain that libraries do)!

Here's the thing, though, and it's an important thing so I'm gonna big-type it:

The right of first sale does not apply to anything digital ever.

Not ebooks (digitized or born-digital, doesn't matter). Not streaming anything. Not paywalled online news or research.

When libraries offer these to patrons, it's through contracts with publishers or aggregators. Long story short, a lot of these contracts are ridiculously restrictive (not to mention expensive) to the point of cartoonish evil, but it's what we have to work with.

The idea behind Controlled Digital Lending is "if libraries purchased a physical item legally, we should get to lend the item to one person at a time as we always have, and it shouldn't actually matter whether what we lend is the physical item or a digital version of it, as long as only one or the other is out to a patron at a given time."

Which is an untested legal theory! I can't tell you whether it's legal! Nobody can! The case law doesn't exist! Yeah yeah, there's relevant past cases in both directions having to do with accessibility or Google Books or whatever, but a specific precedential ruling on CDL is not a thing that presently exists.

No, not even now. Because what IA did with its Open Library during lockdown, and got slapped down for by the court, is not CDL as defined above. IA didn't hold to one-person-at-a-time-per-book. They tried to make a fair-use argument for what they actually did (that is, not for actual CDL), and the court was not having it.

The thing is, IA's stumblebummed legal fuckup means that actual CDL, as actual libraries (n.b. the IA is not an actual library or an actual archives, I will happily die on this hill, I loathe IA like poison and do not want to admit them to my profession, IA people have dissed me and my work TO MY ACTUAL PHYSICAL FACE and they only love libraries or librarians when trying to hide behind us) were trying to design and implement it, now faces additional legal hurdles. Any court looking at an actual CDL program has to take into account IA getting slapped down. And that's if we can even find a library or library consortium with deep enough pockets and hardcore enough legal representation to even defend such a case.

The thing also is, IA just issued Big Publishing a gilt-edged invitation to use this precedent to sue actual libraries, especially academic libraries, over other things we do. (I'm gonna pass over exactly what in silence because I do not want to give those fuckers ideas, but... there have been past lawsuits, look 'em up.) THANKS, BREWSTER. THANKS EVER SO. Asshole.

For a calmer take than mine, check out Library Futures, which to their credit has not given up all hope for CDL.

This IS the short version of all this nonsense, believe me. I used to teach a whole entire three-credit graduate-level course in the long version. (Which IA would doubtless diss to my face if they knew about it.)

7 notes

·

View notes

Text

Critical Analysis

Nardone, V. et al. (2023) 'Video game Bad Smells: What they are and How developers perceive them,' ACM Transactions on Software Engineering and Methodology, 32(4), pp. 9-12. https://doi.org/10.1145/3563214.

Introduction

The abstract presents an in-depth analysis of video game's "bad smells," categorizing issues into five distinct groups that include design, game logic, multiplayer, animation, physics, and rendering. It presents a methodical examination of every category, going over particular bad smells and offering instances from pertinent conversations. Using information from survey participants, the paper provides workable ways to reduce these bad smells. To ensure traceability, the study connects every "bad smell" and its remedy directly to discussion boards or poll results, enhancing the legitimacy of the suggested fixes.

Bad Smells

According to the authors, this dual approach in the study, strengthens the paper's overall reliability, making it a valuable resource for both game developers and researchers. One noteworthy finding is the fact that respondents disagreed on how important some issues are. A few perspectives present the idea that the impact of a particular challenge can change depending on the project's size and how much moderation is used. This highlights how game development challenges are subjective and that the importance of a problem varies depending on the context.

Weak temporization strategies are a major focus of the analysis, with 80% of respondents rating them as critical or extremely critical. In particular, when it comes to frame-based updates, the highlighted issue involves incorrect assumptions about the amount of time that has passed between game object updates. To provide a consistent gaming experience, it is crucial to address this issue as it may lead to differences in animation speed among devices.

Respondents offer workable solutions to address these inadequate temporization strategies and lessen the problems noted. Typical errors such as frame-based updates affecting animation speed, are identified and workable fixes are proposed. Time-based updates, like the FixedUpdate method in Unity, should be implemented. Additionally, movement should be proportionate to the intervals between frames. A few respondents' emphasis on these solutions lends credibility to their efficacy in addressing common game development pitfalls. The analysis also emphasizes how crucial early intervention is in resolving temporization issues. one of the respondents makes it clear that the longer these issues persist, the more difficult it is to address them. This insight highlights how proactive developers should be in spotting and fixing important problems early on in the process to avoid problems later.

A real-world example from the Unreal Engine forum provides tangible evidence of developers grappling with temporization issues in a racing multiplayer game. The discussion highlights the practical application of "delta time scaling" as a solution to address input responsiveness, illustrating how these challenges manifest in real projects.

Focusing on the lack of separation of concerns and the issue of bloated assets. While these challenges may not be unique to the gaming industry, they are pertinent in the context of game development due to the specific characteristics of game engines.

One sign of poor design that can appear in a variety of software programs, including video games, is the inability to separate concerns. The observation that game engines may naturally lead developers to write code that exhibits this problem led to the decision to keep this "smell" in the catalog. In the example given, source code for object animations is mixed with code handling controller inputs; this practice was deemed critical or extremely critical by 77% of respondents.

The significance of this design challenge is further highlighted by the discussion on StackExchange's Game Development section. Logic and data in the same object or class, according to platform developers, is bad practice that can result in hacking that creates more problems than it fixes. It is recommended that game logic and game data be kept apart, and that a modular approach be used, with different classes handling different concerns like movement, firing, and defense. Notably, Unity and other contemporary game engines are taking proactive measures to address this problem by including features like an updated input system. Bloated assets, or reusable assets like complicated game objects that bring along different elements like textures and predefined animations, are the subject of the second design challenge that was discussed. Sixty-three percent of respondents rated this "smell" as critical or extremely critical. Real-world examples are given in the Stack Exchange game development discussion, including scenes with superfluous art assets and scripts. Not only do developers advise eliminating unnecessary assets to conserve space, but they also point out potential problems like mismatched names and superfluous animations if this is overlooked.

Comprehending the issues raised, specifically the inability to distinguish between different concerns and the problem of excessively large assets, provides game designers looking to improve their work with insightful knowledge. Not only do these detected "smells" diagnose possible problems, but they also act as a helpful roadmap for better game design. Recognizing the inability to separate concerns as a design challenge invites a game designer to take a more modular and structured approach. The division of various game elements, like controller inputs and object animations, into discrete areas allows designers to simplify code, lower complexity, and improve maintainability. The Stack Exchange discussion on game development, which is cited, emphasizes how crucial this division is to preventing potential problems and unethical behavior. This realization can serve as inspiration for designers of video games, who can use it to create modular systems that support a variety of features.

The issue of bloated assets provides another avenue for constructive improvement. Game designers can leverage the awareness that excessively large assets, containing elements rarely used, are viewed critically by developers. By adopting a more discerning approach to asset creation and management, designers can optimize game performance and streamline the development process. The practical recommendations from developers on Stack Exchange Game Development, emphasizing the removal of unnecessary assets for both space-saving and organizational cleanliness, can guide game designers in creating more efficient and polished games.

Conclusion

It gives game designers more options because it acknowledges that some game engines are actively resolving these problems, as demonstrated by Unity's new input system. Designers can ensure that their games follow industry best practices and utilize state-of-the-art tools by keeping up with evolving engine features and adapting their practices accordingly. The study overall is relevant as it recognizes the bad indications in game designs and therefore validate a better quality of games if these problems are avoided.

8 notes

·

View notes

Text

Deciding Between Selenium with Python and Selenium with Java: An In-Depth Comparison

In the domain of automated testing, Selenium emerges as a pivotal tool for ensuring the reliability and quality of web applications. When it comes to selecting the programming language to harness Selenium's capabilities, two prominent contenders often come into play: Python and Java. Both languages offer distinct advantages and considerations, making the decision between them crucial for any automation project.

In this blog post, we'll conduct a thorough comparison of Selenium with Python and Selenium with Java, exploring their unique strengths, use cases, and factors to consider. By the end, readers will have a clearer understanding of which option aligns best with their project requirements, team proficiencies, and organizational objectives.

Python with Selenium:

Python, celebrated for its simplicity and readability, has garnered significant traction within the automation testing community. Let's delve into some key benefits of leveraging Python with Selenium:

Simplicity and Readability: Python's hallmark characteristics include simplicity and readability. Its concise syntax enables developers to express ideas in fewer lines of code, resulting in scripts that are easier to comprehend and maintain. For testers, this translates to expedited development cycles and reduced overhead in managing test suites.

Extensive Ecosystem: Python boasts a vast ecosystem of libraries and frameworks that complement Selenium, augmenting its capabilities for test automation. Whether handling data manipulation, conducting API testing, or generating test reports, Python's rich library support caters to diverse automation needs. Furthermore, the active Python community ensures an abundance of resources, tutorials, and documentation to aid testers throughout the automation journey.

Rapid Prototyping: Python's dynamic nature lends itself well to rapid prototyping and iterative development. Testers can swiftly experiment with different approaches, adapt scripts on-the-go, and respond promptly to evolving requirements. This flexibility seamlessly aligns with agile development methodologies, empowering teams to deliver high-quality software with agility.

Integration Compatibility: Python's interoperability with other tools and technologies makes it an appealing choice for Selenium automation. Whether integrating with continuous integration (CI) pipelines, test reporting frameworks, or version control systems, Python's versatility ensures smooth interoperability, streamlining the testing workflow and bolstering overall efficiency.

Java with Selenium:

Java, renowned for its robustness and performance, has long been a cornerstone in enterprise software development. Here are some compelling reasons to consider Java for Selenium automation:

Robustness and Performance: Java's static typing and strong object-oriented principles contribute to the robustness and performance of Selenium test suites. Its compile-time error checking aids in identifying potential issues early in the development phase, resulting in more stable and reliable automation scripts. For large-scale enterprise projects with stringent quality requirements, Java's reliability is a significant asset.

Widespread Adoption: Java enjoys widespread adoption within the enterprise landscape, making it a natural choice for organizations with existing Java codebases or a Java-centric development environment. The abundance of Java expertise in the workforce, coupled with extensive community support and industry recognition, solidifies its status as a preferred language for Selenium automation in many corporate settings.

Mature Tooling: Java's mature ecosystem of testing tools and frameworks, including JUnit and TestNG, seamlessly integrate with Selenium to offer comprehensive test automation solutions. These frameworks furnish advanced features such as parameterized testing, parallel execution, and built-in reporting capabilities, empowering testers to design and execute sophisticated test suites effortlessly.

Enterprise Support: Java's popularity in enterprise environments translates to robust support from vendors, extensive documentation, and a plethora of third-party integrations. For organizations seeking enterprise-grade features, reliability, and scalability in their Selenium automation endeavors, Java's ecosystem and support infrastructure present a compelling value proposition.

Conclusion:

In summary, both Selenium with Python and Selenium with Java present compelling options for test automation, each with its unique strengths and considerations. Python excels in simplicity, rapid development, and a vast ecosystem, making it an ideal choice for agile teams and projects with evolving requirements. Conversely, Java offers robustness, performance, and widespread enterprise support, rendering it well-suited for large-scale enterprise applications with stringent quality standards.

Ultimately, the decision between Python and Java for Selenium automation hinges on various factors such as project prerequisites, team proficiencies, and organizational preferences. By meticulously evaluating these factors and weighing the pros and cons of each option, stakeholders can make informed decisions that align with their specific needs and aspirations. Whether opting for the simplicity of Python or the robustness of Java, Selenium remains an indispensable tool for driving quality and efficiency in web application testing.

2 notes

·

View notes

Text

AORUS AI Gaming Laptops and 14th Raptor Lake Graphics

GIGABYTE Announced the AORUS AI Gaming Laptops Model and its 14th Model Raptor Lake Graphics Refresh

At the US Consumer Electronics Show in 2024, GIGABYTE Technology a world leader in high-end computing made its debut in the AI gaming laptop market. The firm made its debut into the new AI PC battleground with the release of the AORUS and GIGABYTE Gaming AI gaming laptops.

The initial batch, which includes NVIDIA RTX 40 laptop GPUs and the newest 14th generation Intel Core HX series CPUs, is now on sale. The AORUS 17X and AORUS 16X, which provide unparalleled professional AI generative content processing capacity, are at the top of the list.

The industry-leading Intel Core i9-14900HX CPU and NVIDIA RTX 40 series graphics cards that come with both variants provide unmatched computing power for AI-generated content. Specifically, the AORUS 17X is compatible with the powerful NVIDIA GeForce RTX 4090, which has a maximum graphic power of 175W.

By using TensorRT, it achieves a fourfold gain in performance on Windows PCs with RTX discrete GPUs by speeding up the processing of next-generation language models, such Llama 2 and Code Llama. This will transform how individuals utilize computers and organize their workflows, particularly when processing huge batches of complicated language models (LLM).

The laptops also have the integration of GIGABYTE AI Nexus, a revolutionary control program that enhances gaming performance, power management, and generative-AI software to new heights. In addition, Copilot, the integrated AI assistant from Microsoft, boosts your productivity, creativity, and competitive advantage. The gaming experience is further enhanced by the integration of Dolby Vision and Dolby Atmos technologies, which provide professional-grade AI generative content and the most immersive gameplay possible.

AORUS 16X Reveals the AI Generation’s Future

Gaming conventions are upended by the new AORUS 16X AI Gaming Laptops, which redefines the relationship between AI and gaming! With 24 cores (eight performance and sixteen efficiency) and a clock speed of up to 5.8 GHz, the most recent 14th generation Intel Core i9-14900HX CPU powers this system, providing top-notch desktop-class performance that easily handles multitasking and demanding applications. With a maximum graphic power of up to 140W, it supports the NVIDIA RTX 4070 Laptop GPU and offers Advanced Optimus technology (DDS) for discrete graphics.

With the help of NVIDIA’s Deep Learning Super Sampling (DLSS 3) technology, this unlocks powerful AI computational power, improving gaming experiences via autonomous frame rate generation, ray tracing, and the restoration of native high-resolution images for the best possible fast-paced gaming experience.

With its strong twin 12V fans, effective five heat pipes, ultra-thin 0.1mm fins, and 3D VortX air-channeling design, GIGABYTE’s proprietary WINDFORCE Infinity cooling system is the engine driving this incredible processing capabilities. By increasing the air intake space, this technology greatly raises the efficiency of heat dissipation. During low loads, the immersive noise-free experience is guaranteed by the Icy Touch design, while steady performance is guaranteed during heavy loads. Moreover, GIGABYTE unveils the unique Copilot hotkey, which instantaneously launches the Windows Copilot AI assistant function, lending a helpful hand with everyday tasks, creative processes, and productivity.

This year, the AORUS Beacon is the device that gamers are most interested in. Its cover has two distinct styles, Aurora Gray and Midnight Gray, which together create a fashionable ambiance. Beneath its elegant and refined exterior, which makes use of Nanoimprint Lithography (NIL) technology and an iridescent design, is a monstrous performance. With its 4-sided, ultra-slim bezel design, which features GIGABYTE’s trademark 3mm bezels and a high refresh rate of up to 165Hz, the display section guarantees success from the outset with an amazing 91% screen-to-body ratio. It is very comfortable and confident for prolonged usage thanks to its TÜV Rheinland Eye Comfort Certification and Pantone Validated color accuracy certification.

AORUS 17X: Unlocking Expert AI Processing Capabilities

The AORUS 17X AI Gaming Laptops, the flagship model from GIGABYTE, was recognized with a Red Dot Product Design Award and got a traditional makeover using a CNC metal cutting method. The updated version is designed for the performance king who enjoys AAA games and AI-generated content. Equipped with the Intel Core i9-14900HX CPU, it offers exceptional multitasking performance.

It supports the NVIDIA RTX 4090 Laptop GPU in the discrete graphics section, which has a maximum graphic power of 175W, Advanced Optimus technology (DDS), and a VRAM of up to 16GB GDDR6. In addition to successfully playing games in native 4K resolution, it has strong AI processing capabilities that can handle intricate generative AI models and texturing effects. It makes it possible to quickly create a mobile workstation locally and ensure data security and privacy without depending on the cloud thanks to open-source software technologies.

The heat dissipation efficiency is increased by 35% with the WINDFORCE Infinity cooling system, which includes a Vapor Chamber full-cover heat dissipation plate. With four sets of 12V fans and a 3D Vort cooling channel design, it effectively eliminates waste heat and floods the thin 2.18cm body with cold air, maximizing the processing capability of the CPU and GPU.

In addition to having a 99Wh maximum battery capacity for on-the-go use with PD charging support, the new AORUS AI Gaming Laptops series from 2024 has a wide range of I/O ports for simple external expansion. The addition of GIGABYTE’s unique AI Nexus program, such as “AI Boost,” which is powered by Microsoft Azure AI and automatically modifies system power consumption and fan settings for an overclocked gaming experience, to all models further advances innovation.

The “AI Generator” gives users access to creative AI graphics creation via the use of stable diffusion and edge AI computing capabilities. In addition, “AI Power Gear” optimizes power use to prolong product life and improve battery life. consumers of the Windows 11 operating system may ask questions of the “Copilot” AI chatbot, demonstrating GIGABYTE’s extensive usage of AI from the cloud to the local, offering consumers the ease and limitless possibilities that come with the AI era. To experience the golden age of generative AI, pre-orders for the AORUS 16X / AORUS 17X (2024) AI gaming laptops are now available.

Read more on Govindhtech.com

#AORUS#AI#GamingLaptops#14thRaptorLakeGraphics#GIGABYTE#AORUS17X#AORUS16X#IntelCorei914900HX#CPU#NVIDIARTX40laptopGPUs#Copilot#Technews#technology#govindhtech

2 notes

·

View notes

Text

That's an academic term for that in multimodal linguistics and it is "affordance".

Every medium "affords" to express certain meanings in certain ways, and some mediums happen to be the most efficient at expressing a handful of meanings than all others. Those things mediums are capable of doing are its affordances.

You can do intermodal translation to express the same meanings, but the loss in efficiency in some parts and the gain of efficiency in others WILL make it a different sensory and emotional experiece, even if the conceptual end result of the communication remains mostly the same.

In non-nerdy words, what I mean is that you CAN translate an image into words, and you CAN translate words into a image. But it's a quantum physics exclusionary principle thing: if you keep the conceptual meanings intact (the plotline, the cast, the worldbuilding, the moral message if applicable etc.), there's a high likelihood that the feelings ellicted on the audience will be different (they might even veer into boredom depending on how extensive the reafing of the translation is in comparison to the reading of the original). To keep the affective meanings intact (feelings and senses), then you have to compromise the concepts.

It's not impossible for a transmodal translation to hit a sweet spot in which it sacrifices very little in both fronts and impacts the audience in a way that feels similar to the original work, but it's never guaranteed that it's possible for every case. The affordances used in the original medium need to be very close to the ones that the second medium has in its arsenal.

That's the whole reason why art and storytelling are so diverse in their mediums. If you could express every single concept and every single affective experiece with a single mode of communication, we wouldn't have others (or they wouldn't be as widespread).

Corollary: if you wanted to produce a play, a movie, a TV series or a comic book, but forces yourself to write a book because it's cheaper and more accessible, there's a 90% chance that it will not be a good reading, or that it won't feel "right" to you, because those other visual/audiovisual mediums have different affordances.

(Writing IS visual, you aren't hearing my words here. If you are using a screen reading software because you are visually impaired, you aren't hearing my words. You are hearing someone (or some AI) speak aloud what they interpret as my words, adding inflections and asides if they feel that the visual input is significant and should impact that reading.)

Likewise, if you want to extensively communicate things that don't lend themselves well to visuals (internal monologue, visual perception failings or quick succession of subtle feeling changes, for instance, but mostly internal monologue), let's just say that using visual/audiovisual mediums hardly ever make for a fulfiling creative experice. Expressing the unseen is verbal language's most distinctive affordance, and writing's minimalist physical expression encourages high densities of meaning and makes it really cheap and relatively fast to produce in big amounts. So, books are still the go-to brainy character pieces that scrutinize character thoughts and feelings and similarly structured stories.

Those are a lot of words to say that OP's belief is science-backed. If you want to know more about multimodality and affordances, I recommend Gunther Kress's body of work (start wherever the synopsis/paper summary entices you more), or some piece of science communication that uses Kress as a reference (in case you feel intimidated by any jargon or vocabulary that pops up, although I think he is very accessible to be read directly as far as academic writers go).

I firmly believe that some stories can never be translated into a different medium and that's okay

#linguistics#multimodality#kress#sfl#writing#writer#writer things#writerblr#writeblr#writingblr#writblr#affordances

65K notes

·

View notes

Text

Kissht - Business Loans for Startups: Fueling Innovation and Growth in Today’s Competitive Market

Kissht Reviews: In today’s hyper-competitive and innovation-driven market, startups are shaping the future. From groundbreaking tech products to revolutionary service models, entrepreneurs are continually challenging the status quo. However, even the most promising idea needs fuel to take off and that fuel is funding. Access to timely and sufficient capital is often the deciding factor between a startup’s success and stagnation. This is where business loans become crucial, offering the much-needed financial support to help startups scale and thrive.

Among the most trusted and accessible platforms for startup financing in India is Kissht. Known for its digital-first approach, easy application process, and fast loan disbursal, Kissht has emerged as a reliable financial partner for startups looking to make their mark.

The Financial Challenges Startups Face

Startups operate in a high-risk environment, especially in their early stages. They often need funds for:

Product development

Hiring skilled professionals

Marketing and brand positioning

Purchasing equipment or software

Expanding to new markets

Yet, traditional financial institutions are often hesitant to provide loans to startups due to lack of collateral, short operational history, or inconsistent cash flows.

This is where a specialized business loan from a fintech company like Kissht proves to be a game-changer.

What is a Business Loan for Startups?

A business loan for startups is a type of unsecured or secured loan offered to new businesses to help meet various operational or growth-related expenses. These loans are tailored to the dynamic needs of emerging companies, offering flexible repayment tenures, minimal documentation, and fast approval.

Kissht business loans are designed specifically with startups in mind, recognizing the unique challenges and potential of these new ventures.

Why Choose Kissht for Your Startup Business Loan?

Kissht stands out in the lending space for several reasons:

1. Easy Online Application

Startup founders are often juggling multiple responsibilities. Kissht offers a fully digital application process through its user-friendly instant loan app. Founders can apply for a loan, upload documents, and track application status all from their smartphones.

2. Quick Approval and Disbursal

Time is critical in the startup ecosystem. Kissht ensures instant personal loan approvals and fast disbursals, allowing you to take timely decisions that could determine your startup’s success.

3. Flexible EMI Options

Founders can plan their repayments using the business loan EMI calculator. This tool helps estimate monthly outflows based on loan amount, tenure, and interest rate ensuring you choose a plan that suits your cash flow.

4. Attractive Interest Rates

Kissht offers competitive business loan interest rates, making it affordable for startups to borrow and invest in their growth. Transparent pricing means there are no hidden charges or surprises.

How Kissht Loans Fuel Innovation

Startups rely heavily on innovation. A loan from Kissht can help in several ways:

A. Product Innovation

Developing a new product or enhancing an existing one often requires investment in research, tools, or specialized manpower. A Kissht loan provides the necessary funds to fuel product innovation without diluting equity.

B. Market Expansion

Breaking into a new market means spending on logistics, marketing, legal setup, and localization. With a quick personal loan from Kissht, founders can tap into new customer segments without waiting for external funding.

C. Technology Upgrades

Modern businesses depend on cutting-edge technology to stay competitive. A Kissht instant loan online enables startups to invest in new software, AI tools, or cybersecurity enhancements without straining their capital reserves.

D. Talent Acquisition

The right team can drive exponential growth. Whether it’s hiring a data scientist, a marketing expert, or a CTO, you can use a Kissht business loan to attract and retain top talent.

Beyond Business Loans: Kissht’s Broader Offerings

While Kissht is known for business loans, it also provides a wide range of financial products:

Instant personal loan: Ideal for urgent personal needs

Loan against property: For larger borrowing needs

Personal loan EMI calculator: Helps plan your repayments smartly

Apply for personal loan online with ease and transparency

The platform also ranks among the best personal loan apps in India for salaried individuals and self-employed professionals alike.

Final Thoughts

In today’s competitive landscape, startups need every possible advantage to succeed. Access to timely and flexible financing can give you the edge you need to grow faster, innovate continuously, and compete effectively. A business loan from Kissht is more than just funding, it’s a partnership that empowers you to pursue your entrepreneurial vision with confidence.

If you’re ready to scale your startup, don’t wait. Apply for a business loan today through Kissht and take the next big step in your journey.

#Kissht Fraud#Kissht Chinese#instant money#Kissht Fosun#loan app#advance loan#kissht reviews#personal loan app#Kissht Illegal#Kissht#Kissht Banned#low-interest loan#personal loan#instant loans

0 notes

Text

TOP BLOCKCHAIN TRENDS FOR 2024

Solution about,

custom blockchain development company

fintech app development company

digital wallet app development company

Our Other Blogs, Highen Fintech Blogs

#blockchain trends#blockchain#fintech#fintech app development#lending software development company#digitalcurrency#digital wallet app development#mobile app development#technology#application#software#blockchain technology#trends#2024#blog

2 notes

·

View notes

Text

Video editor applications

We are in need of video editors at every skill level to reach out and lend their hand to this project. If you are interested in applying, we are accepting applications here! We would happy to accept participants on board.

Applicant requirements

Adobe After Effects or other quality video editing software.

Must be at least 18 years of age.

Regular access to communication on Discord.

#twisted wonderland#twst#voice acting#fandub#twst wonderland#casting call#disney twst#disney twisted wonderland#twisted wonderland official fandub#official twisted wonderland fandub#twst official fandub#help needed#video editing#edit#editing#application#lilia vanrouge#malleus draconia

101 notes

·

View notes

Text

How Secure Are Fintech Banking Solutions?

The rapid adoption of fintech banking solutions across the globe has revolutionized the way businesses and individuals handle their financial activities. From digital wallets and online lending platforms to automated investment tools and mobile banking apps, fintech innovations have brought greater convenience, speed, and flexibility to the financial world. However, with the benefits of these technological advancements comes a crucial concern—security. As cyber threats continue to evolve, the security of fintech software is paramount to maintaining user trust and safeguarding sensitive financial data.

The Growing Importance of Security in Fintech

In the digital era, financial transactions are increasingly conducted online, exposing systems to potential data breaches, identity theft, fraud, and other cybercrimes. Given the volume and sensitivity of the data handled by fintech platforms, ensuring airtight security has become a top priority for developers and service providers. Fintech banking solutions are built with advanced security frameworks that aim to mitigate risks while ensuring compliance with international data protection laws and financial regulations.

Security in fintech is not just about protecting systems from hackers—it also involves protecting users' identities, ensuring the integrity of transactions, and preventing unauthorized access to financial information. As fintech software becomes more integral to the banking and business ecosystem, the focus on secure architecture and proactive risk management continues to intensify.

Key Security Features in Fintech Banking Solutions

Modern fintech software incorporates multiple layers of security to protect user data and financial transactions. Some of the key features include:

1. End-to-End Encryption

Encryption is a fundamental aspect of fintech security. Fintech banking solutions use end-to-end encryption to secure data from the point it is entered by the user until it reaches its destination. This ensures that even if data is intercepted during transmission, it remains unreadable to unauthorized parties.

2. Multi-Factor Authentication (MFA)

MFA is now a standard security protocol for fintech platforms. By requiring users to provide two or more verification factors—such as passwords, OTPs (One-Time Passwords), biometrics, or device authentication—fintech solutions add an extra layer of protection against unauthorized access.

3. Biometric Security

Advanced fintech applications integrate biometric verification, such as fingerprint scanning or facial recognition, to verify user identities. This not only enhances security but also provides a seamless and user-friendly login experience.

4. Real-Time Fraud Detection

Fintech software is equipped with intelligent algorithms that monitor transactions in real time. Any unusual activity—such as a sudden large withdrawal, login from a suspicious location, or repeated failed login attempts—triggers an alert or temporarily blocks the transaction to prevent potential fraud.

5. Tokenization

Tokenization replaces sensitive data with unique identification symbols (tokens) that retain essential information without compromising security. This is especially useful in payment processing where customer credit card data is never exposed directly to merchants or third-party systems.

Regulatory Compliance and Standards

Security in fintech banking solutions is also governed by a host of financial and data protection regulations such as PCI-DSS (Payment Card Industry Data Security Standard), GDPR (General Data Protection Regulation), and AML (Anti-Money Laundering) policies. Compliance with these regulations is non-negotiable and fintech software providers must ensure their systems meet these rigorous standards.

Robust compliance frameworks not only protect customer data but also establish credibility in the eyes of regulators, stakeholders, and users. Regular audits, security assessments, and penetration testing are essential components of maintaining regulatory compliance and identifying vulnerabilities before they can be exploited.

Challenges to Fintech Security

Despite these advanced protections, fintech platforms still face certain security challenges:

Constantly Evolving Threats: Cyber attackers continually develop new methods to breach systems. Fintech providers must remain vigilant and adaptive to counter emerging threats.

Third-Party Vulnerabilities: Many fintech systems integrate with third-party APIs or services. A vulnerability in any connected service can expose the entire network to risks.

User Awareness: Human error remains a leading cause of security breaches. Users who fall for phishing scams or use weak passwords can unknowingly compromise their own financial security.

To combat these challenges, fintech companies need to adopt a proactive security strategy that includes user education, continuous system monitoring, regular updates, and robust incident response protocols.

The Role of Xettle Technologies

In the growing field of fintech, Xettle Technologies stands out as a provider that prioritizes security as a core component of its fintech software. Their platforms are designed with state-of-the-art encryption, multi-layered authentication, and continuous monitoring systems to ensure that users' data remains secure at all times. By embedding security into every layer of their fintech banking solutions, Xettle Technologies demonstrates a strong commitment to building trust with businesses and end-users alike.

Conclusion

Security is the foundation upon which all reliable fintech banking solutions are built. As the financial ecosystem continues to digitize, fintech software must evolve to meet new security demands and stay one step ahead of cyber threats. From encryption and biometric verification to compliance and fraud detection, the security infrastructure of modern fintech platforms is more advanced than ever. Organizations like Xettle Technologies are leading the charge by creating secure, scalable, and resilient solutions that protect both businesses and consumers in the digital financial world.

Ultimately, the future of fintech depends on maintaining and enhancing this security framework. Only then can users fully embrace the convenience and innovation that fintech has to offer—without compromising their safety.

0 notes

Text

BFSI Software Testing: Elevate Financial Software Quality with ideyaLabs’ Proven Services

The Future of BFSI Software Testing: Ensuring Security and Compliance with ideyaLabs

Banks and financial institutions shape the backbone of today’s digital economy. Digital transformation in the banking, financial services, and insurance (BFSI) sector accelerated rapidly over the past decade. Consumers demand seamless experiences. Companies must meet stringent regulatory requirements. Reliable and secure software solutions power financial operations, but the risk of system malfunction, data breaches, or compliance failure remains high. Rigorous BFSI software testing emerges as the foundation for flawless digital banking.

Why BFSI Software Testing is Essential for Banks and Financial Institutions

Highly sensitive transactions take place every second in the BFSI sector. Customers trust financial software to safeguard their data and financial assets. A minor glitch can undermine this confidence and cause significant losses. ideyaLabs recognizes the stakes. BFSI software testing in 2025 has to deal with increasingly sophisticated challenges. Real-time payment systems, mobile banking, online lending, wealth management platforms, and insurance claim processing depend on complex integrated systems. Testing verifies accuracy, security, interoperability, and performance.

Digital-First Banking Amplifies Software Testing Demands

Customer expectations continue to evolve. Institutions roll out omnichannel capabilities, chatbots, AI-driven customer service, and instant payments. ideyaLabs’ BFSI software testing services forecast future demands. They ensure flawless integration, consistent experience, and effective data protection across channels. Testing strategies consider expansive device and browser variations, cyber threats, and accessibility standards. Financial institutions use ideyaLabs’ expertise to validate innovative solutions before launch.

BFSI Software Testing Safeguards Regulatory Compliance

Financial regulations are strict. Non-compliance can result in heavy penalties and reputational damage. ideyaLabs employs industry-aligned BFSI software testing services to ensure seamless compliance. Test automation covers anti-money laundering (AML), know your customer (KYC), and payment card industry (PCI DSS) standards. Tests uncover gaps in encryption, audit trails, and authentication mechanisms. Regulatory requirements evolve, and so ideyaLabs’ testing frameworks adapt continually to ensure organizations always remain audit ready.

Mitigate Risks of Digital Transformation With Expert Testing

New-age banking applications process billions of transactions annually. Systems need to be resilient and scalable. ideyaLabs’ BFSI software testing accelerates release cycles and reduces production risk. End-to-end automation and thorough performance testing protect platforms from outages during peak loads. Simulation of real-world transaction volumes reveals potential bottlenecks. Continuous integration and continuous delivery (CI/CD) pipelines with embedded testing allow BFSI institutions to release features at speed without sacrificing quality.

Comprehensive Testing Solutions for Complex Financial Applications

The BFSI sector requires more than basic functional testing. ideyaLabs delivers a full spectrum of dedicated BFSI software testing services:

Functional Testing: Validate workflows, business rules, calculations, and integrations.

Security Testing: Identify vulnerabilities, protect customer data, prevent unauthorized access.

Performance Testing: Ensure fast response times, optimal throughput, and resource efficiency.

User Experience Testing: Test usability across platforms and devices.

Compliance Testing: Verify solutions adhere to international and regional standards.

Regression Testing: Safeguard core functionalities amid frequent updates.

Banks, payment processors, and insurance firms rely on ideyaLabs for tailored test automation frameworks, robust toolchains, and real-world experience in complex BFSI environments.

Addressing Unique BFSI Software Testing Challenges Head-On

The BFSI landscape poses unique hurdles. Core banking applications intertwine with legacy infrastructure. High data volumes need encrypted storage and transmission. Digital wallets, open banking APIs, and mobile payment platforms expand the attack vector for cybercriminals. ideyaLabs takes a proactive approach. BFSI software testing specialists simulate fraud attempts, penetration threats, and denial-of-service attacks. Real-time alerts and detailed reports allow immediate risk mitigation, keeping systems resilient.

Elevate Customer Trust with Precision Testing

Trust builds the foundation for any financial relationship. Undetected software bugs decrease customer satisfaction and invite regulatory attention. ideyaLabs integrates precision testing into every development lifecycle stage. Test case coverage aligns with business risk. Automated regression cycles catch defects before product launch. Integration with DevOps workflows ensures faster time-to-market for new features. Customers experience fewer outages, smooth transactions, and increased confidence.

The Role of Automation in Modern BFSI Software Testing

Manual testing falls short in today’s fast-paced financial innovation landscape. ideyaLabs champions automated BFSI software testing to achieve large-scale validation. Automation enables:

Faster feedback with every release cycle.

Reliable defect tracking and documentation.

Repeatable regression testing eliminating human error.

Performance benchmarks under real user loads.

Financial organizations streamline operations with test automation and reallocate resources towards customer-centric initiatives.

Test Data Management: Protecting Sensitive Financial Information

Test data management is critical for BFSI organizations. Unauthorized disclosure of customer data during testing constitutes a serious compliance risk. ideyaLabs enforces best practices in test data masking, anonymization, and secure storage. Testing environments replicate real-world conditions without exposing genuine customer details. Data privacy regulations stay in focus so organizations avoid severe legal and financial consequences.

Quality at Every Release Milepost: ideyaLabs’ Structured Approach

Quality assurance extends far beyond simple bug detection. ideyaLabs approaches BFSI software testing with a structured process:

Define business and regulatory requirements.

Map critical functionalities and data flows.

Develop exhaustive test scenarios.

Implement robust automation for quick releases.

Conduct periodic security and compliance reviews.

Integrate user experience (UX) validation.

Organizations receive comprehensive reports detailing test results, defect trends, and suggested improvements. Decision makers gain visibility into risk exposure and compliance posture.

Trends Driving BFSI Software Testing in 2025

Digital banking ecosystems keep advancing rapidly. Five trends drive the evolution of BFSI software testing:

Shift to cloud-native microservices and API-centric architectures.

Increased demand for real-time transaction processing.

Widespread adoption of artificial intelligence and machine learning models.

Enhanced focus on environmental, social, and governance (ESG) compliance.

Aggressive cyber threat landscape targeting financial systems.

ideyaLabs embeds advanced testing methods that evolve with these trends. Financial institutions remain future-proof and well-prepared.

Partner with ideyaLabs and Transform Your BFSI Software Testing Experience

BFSI enterprises recognize that robust software testing is not a luxury. It is an operational necessity. ideyaLabs stands out with unmatched domain expertise, end-to-end automation capabilities, and a strong focus on security and compliance. Banks, insurance companies, fintech startups, and payment platforms benefit from:

Faster go-to-market for new offerings.

Drastically reduced operational and reputational risk.

Elevated customer loyalty and satisfaction.

Assurance of regulatory compliance at every juncture.

Conclusion: Secure, Compliant, and Scalable BFSI Solutions with ideyaLabs

The BFSI industry requires unwavering trust and continuous innovation. Partnering with ideyaLabs reshapes your BFSI software testing for the digital era. ideyaLabs empowers organizations to deliver secure, reliable, and customer-centric financial products. Elevate your quality standards and gain a competitive edge with ideyaLabs. BFSI software testing from ideyaLabs unlocks the future of digital banking.

0 notes

Text

End-to-End FinTech Application Development Company in India

As a leading fintech application development company in India, we deliver end-to-end services—from ideation and UI/UX design to backend integration and compliance. Hire experienced fintech app developers skilled in banking, lending, wallets, and more. Count on us to build robust, compliant, and scalable solutions that meet global financial standards.

#fintech app development companies#fintech solution#fintech app development solutions#fintech app development india#fintech app developer

0 notes

Text

What Is a DApp and Why Is It Central to Blockchain Development Services UAE?

In just a few years, the United Arab Emirates shot to the top of the global blockchain chart. A mix of clear laws, an ambitious national agenda, and an insatiable appetite for fresh ideas keeps money streaming into decentralized tech.

At the heart of this movement sits one shining star: the Decentralized Application, usually called DApp.

So, what exactly is a DApp, and why has it become essential for almost every blockchain project in the UAE?

Let's take a closer look and see why DApps are more than just a buzzword; they are fast becoming a cornerstone of the UAEs digital makeover.

A DApp is an application hosted directly on a public blockchain instead of locked on a corporate server. Unlike Instagram, Netflix, or any other service that relies on one company for control, DApp stands alone because tiny self-running programs called smart contracts take over as soon as agreed rules are met.

- Decentralization: Data and processing are spread across the whole chain, so nothing lives in a single central folder.

- Smart Contracts: Guidelines are coded in a way that's set in stone, so they can’t be adjusted on a bad day or swapped out after a last-minute brainstorming session.

- Token Economy: Most DApps create their own tokens, letting users pay fees, vote on changes, and earn rewards whenever they join.

- Open Source: Most of these decentralized apps keep their code public, so anyone can scan it for bugs, suggest fixes, or even clone the project.

By cutting out middlemen, DApps offer a clear, secure, and censorship-proof way to run software, and that promise is pushing their rapid rise across the UAE.

Why Are DApps Key for Blockchain Development in the UAE?

1. Keeping Step with the UAE's Blockchain-First Vision

Under the Dubai Blockchain Strategy and the Emirates Blockchain Strategy 2021, the federal government is steadily swapping public services and business tasks for blockchain-backed solutions.

A big piece of this plan calls for DApps in:

Identity verification

Supply chain transparency

Property and land registration

Healthcare data management

Digital payments and wallets

Plugging DApps into so many government and market workflows is sparking demand for local dev teams that can build to national standards and meet fast-moving business goals.

2. Security and Transparency for High-Stakes Industries

The UAE hosts finance, real-estate, energy, and logistics-businesses that depend on trust and clean data. Ordinary apps can be hacked, altered, or frozen at peak hours. DApps, however, run on locked blockchains and public ledgers, so users see proof they can't dispute. When coders build well, a DApp can promise:

full traceability on every shipment

records no one can tamper with

voting totals sealed the moment they are cast

lending circles that function without banks

Because of these wins, UAE blockchain teams now chase industry-specific, bullet-proof DApps.

3. Tokenization and Fresh Business Models

Most DApps offer tokens that turn everyday exchanges into something richer. Whether loyalty coins, shared ownership, or DeFi tools, tokens open the door to:

reward apps that keep shoppers coming back

platforms that let anyone buy a small piece of real estate

governance where holders vote on new rules

bonuses for choosing clean power

These token-powered projects are booming in the UAE, riding the Gulf fin-tech surge.

DApps lie at the core of Web3, allowing people to trade, chat, and save data without a middleman. While the region pilots Metaverse ideas-from Dubai's Metaverse Assembly to various digital twins-these apps drive:

virtual land shops

shared identities and avatars

NFT tickets for events

social hubs beyond big tech

Forward-looking UAE companies now partner with blockchain teams to ready themselves for this next-gen online world.

Across the Emirates, decentralized apps (DApps) are already making a real splash. Here's a look at the action:

- Real Estate Tokenization

Developers use DApps to break expensive buildings into tokenized shares. Each token stands for a small piece of the property, letting everyday investors chip in. The system runs KYC steps on its own and keeps a clear, tamper-proof ledger, so everyone knows who owns what. The result is faster sales and many more people able to join the real-estate market.

- Decentralized Voting Platforms

Public elections and private board votes now run on smart-rule apps that save each ballot on an open ledger. Because anyone can check the code, people trust the result, and outside tampering gets very hard.

- Health Data DApps

Some hospitals are piloting chain apps that let patients and doctors own their medical files. Records move easily between clinics but stay private, matching the UAEs push for modern, safe health tech.

- Blockchain-Based Logistics Merchants track boxes, review invoices, and verify documents in real time with shipping apps. Clear sight at every port powers the UAEs huge trade business and keeps goods moving fast and fair.

4. Why Businesses in the UAE Are Turning to Custom DApp Development

The United Arab Emirates welcomes new tech regulations, its people live online, and the government pushes fresh ideas. Ready-made apps still tempt firms, yet they never line up perfectly with local ways of working. Because of that gap, building a custom decentralized app (DApp) has become the go-to move for:

An architecture that can grow with one industry.

Full compliance with UAE data and crypto laws.

Smooth links to local banks and payment gateways.

Interfaces that speak Arabic, English, and more.

A single easy experience for Web2 visitors and Web3 wallets.

Pick the right team, and your DApp will meet today's goals and quickly adjust to tomorrow's UAE tech scene.

5. How to Begin Your Blockchain Project in the UAE

Thinking about your first DApp? Follow this clear, step-by-step plan:

Define the Use Case. Decide exactly what problem you want to fix and check if decentralization adds real value.

Choose the Blockchain Platform Ethereum, Polygon, BNB Smart Chain, or another ledger each brings its own strengths and costs.

Hire Expert Developers Work with a studio skilled in smart contracts, friendly UX/UI, and the protocols you choose.

Prototype and Test Build a quick model, watch people use it, and tweak it based on what they say.

Do this, and you can roll out a DApp that works, feels safe, and fits local rules.

Deploy and Scale After launch, listen, adjust the code fast, and let speed and users grow.

A reliable dev partner guides you, keeping your DApp secure, legal, and noticed.-

Partner with the Right Blockchain Firm in the UAE

As banks, hotels, and other sectors rush to release DApps, skilled builders are in high demand. WDCS Technology is here.

At WDCS Technology we design blockchain tools in the UAE, delivering custom DApps that lock down security, stretch with traffic, and respond the moment users click launch.

Our services include:

Full-cycle DApp development

Smart contract design and audit

Token creation and integration

UI/UX for Web3 platforms

Private and public blockchain solutions

From a smooth NFT store to DeFi plumbing or an in-house app, our local insight and solid tech skills help you succeed in the UAE.

#blockchain development services#blockchain services#blockchaintechnology#blockchian#hire blockchain development in uae#blockchain development#technology

0 notes