#Global Case Management System notes

Explore tagged Tumblr posts

Text

No one believed you

Red Velvet's Kang Seulgi x M!Reader

Note: a short fic for the one and only bear in the town....cuz damn the song is stuck in my head these days. (She can put me on a chokehold any day)

You thought interning in the management department at SM Entertainment would be hard. You expected long hours, coffee runs, and maybe getting yelled at by some stressed-out staff member. What you didn’t expect was Kang Seulgi—the human embodiment of kindness, Red Velvet’s sweetheart, teddy bear, literal angel in human form—turning your life into a personal nightmare.

Repeat it again. Kang Seulgi—the human embodiment of kindness, Red Velvet’s sweetheart, teddy bear, literal angel in human form—came to haunt even your nightmare.

And the worst part?

No one believed you.

It started on the second day. You were running a simple errand, delivering some files to the practice room, when she called you over.

“Hey you,” she said, not even bothering with your name. “Come here.”

You looked around, half-expecting her to be talking to someone else. No one was there. Just you and Kang Seulgi, sitting on the floor with her legs crossed, arms draped lazily over her knees like some kind of royalty waiting to be served.

“Uh… sorry, me?”

“Did I stutter?”

That was when you should’ve known. That was the exact moment you should’ve turned around, walked out, and never looked back.

But you were an intern, which meant following orders, so you shuffled over.

She sighed, pointing at her jacket. “Fix this.”

You blinked. “Fix what, sorry?”

She rolled her eyes. “Are you slow? The collar. It’s messed up.”

You resisted the urge to tell her that it looked perfectly fine, because something about her stare made your survival instincts scream. So, with shaky hands, you adjusted the collar.

She gave a small nod. “Took you long enough.”

…Huh?

Seulgi, the same Seulgi who bows to staff at ninety degrees, the same Seulgi who once apologized to a chair for bumping into it, just talked to you like you were beneath her.

You had no time to process it before she stood up and walked off, leaving you standing there like an idiot.

And that was just the beginning.

Over the next few weeks, she made you redo tasks that were already fine, sent you on ridiculous errands, and threw insults at you so casually you started to wonder if you’d unknowingly made an enemy out of her in a past life.

“Intern, get me a green smoothie. The greener, the better.”

You later returned with a matcha smoothie, only for her to frown. “This is too green.”

“…Pardon?”

Or that one time when you were fixing the sound system in the practice room, and she walked in with a frown. “Are you always this slow, or is today special?”

You had never moved faster in your life.

And the worst part? The absolute worst part?

No one believed you.

“You’re joking, right?” Irene said, raising a perfectly shaped eyebrow. “Seulgi? Mean? That fluffy girl?”

“She’s literally the nicest person ever,” Wendy added. “Maybe you just misunderstood her?”

“Maybe she likes you,” Joy teased with a smirk. “It’s like elementary school when a kid pulls your hair because they have a crush on you.”

“…Yeah, sure, Joy-ssi” you deadpanned. “Except in this case, the kid is a globally famous idol, and instead of pulling my hair, she’s ruining my sanity.”

Even Yeri—who lived for chaos—laughed it off. “Oh, please. If Seulgi’s mean, then I’m the president of Korea.”

You were losing your mind. Because no one literally believed you.

-

Then one day, you snapped.

You had been holding it in for weeks, letting it simmer beneath the surface, but today? Today was the final straw.

Seulgi had sent you on yet another ridiculous errand—finding a very specific shade of red nail polish because, apparently, the “wrong” shade was “offensive” to her eyes. And the moment you handed it to her, she inspected the bottle, tilted her head, and said, “This is coral.”

You saw red. Literally and figuratively. Something in you broke.

“That’s it.”

The words shot out of your mouth before you could stop them. You inhaled sharply, clenching your jaw so tightly your teeth ached. Your hands, still holding the stupid little bottle, curled into fists. And then—before you could stop yourself, before you realised the position you were in—you grabbed Seulgi’s wrist, yanking her out of the practice room with a force that made her stumble.

“Uh—what?” she sputtered, stumbling slightly to keep up.

You didn’t answer. You didn’t even look at her. Your fingers were locked around her wrist like a vice, knuckles white, footsteps heavy and unrelenting.

“Okay, I know I’m strong, but this is a little—”

You whipped open the nearest storage closet, pulled her inside, and slammed the door shut behind you.

Seulgi blinked. Then blinked again. “Did you just—”

“Talk.”

Your voice came out sharp, cutting through the dimly lit space like a blade. Seulgi’s mouth, still open in half-formed confusion, slowly shut.

You crossed your arms, legs braced apart, staring her down with the intensity of a detective grilling a suspect. “Explain. Now. Please”

She shifted her weight from foot to foot, gaze darting to the closed door behind you as if considering escape. Then she sighed, rolling her shoulders back.

“Explain what?” she said, and despite her usual confidence, there was a tinge of hesitation in her voice.

You threw up your hands. “This! The insults, the errands, the way you talk to me like I’m some lowly peasant! I have been suffering for weeks, and I want to know why.”

Seulgi’s lips twitched. “You make it sound so dramatic.”

“Oh, I’m sorry, should I have written a formal complaint instead?” you shot back, voice dripping with sarcasm. “Because trust me, I have drafts.”

She exhaled, running a hand through her hair before propping it on her hip. “Alright, alright.” Her fingers tapped lightly against her waist, and she shifted to her other foot. “You have to promise not to get mad, though.”

Your glare intensified.

“…You’re already mad, aren’t you?” she mumbled.

“Seulgi-ssi.”

She sighed, rubbing the back of her neck. “Alright. So, you know my comeback, right?”

You squinted. “Yeah. Baby Not Baby. What does that have to do with you treating me like dogwater?”

“Well.” She folded her arms, leaning against the shelves. “I have to act all mean and bitchy for the concept, but the members and staffs here wouldn’t take me seriously because they know I’m not like that.”

"Ok…?" You blinked. “So?”

“So,” she continued, “I needed practice. And I thought, ‘Hey, the new intern doesn’t know me that well. Perfect test subject.’”

…No. No way.

You pointed at her. “You’re telling me you—”

She nodded.

“For practice?”

Another nod.

“So you’ve just been… fake-bullying me this whole time? As rehearsal?”

She winced. “That makes me sound terrible.”

You let out a noise—half laugh, half exasperated groan. “Oh my god.”

Seulgi pursed her lips. “To be fair, you didn’t say anything.”

“Because I thought you hated me!”

She blinked. “Oh. That bad?”

“Yes, that bad!” You gestured wildly, exasperation leaking from every pore. “Do you know how much sleep I lost wondering what I did to make you hate me? Do you know how insane it feels to have everyone act like I was imagining things? No one believed me!”

She bit her lip, looking uncharacteristically sheepish. “Okay… yeah. Maybe I went too far.”

“You think?”

She sighed. “Look, I didn’t mean to actually make you miserable. I thought you’d catch on eventually.”

“Why would I? No one believed me when I said you were being mean! Wendy-ssi laughed in my face!”

Seulgi let out a chuckle. “Okay, that’s kind of funny.”

You groaned, rubbing your temples. “Unbelievable.”

She nudged you lightly. “Come on, don’t be mad. I’ll make it up to you.”

You eyed her warily. “How?”

She grinned. “I’ll let you be my real practice partner.”

“…What does that mean?”

“You can pretend to be mean to me.”

You snorted. “Yeah, that’s not gonna work. I don’t have it in me.”

“See?” Seulgi pointed at you. “That’s exactly why I had to pick you. You’re too nice. No one would suspect anything.”

You crossed your arms. “Or maybe I was just the easiest target.”

“…That too.” She shifted on her feet again, this time looking genuinely guilty. “Alright, alright. I do feel really bad. I’ll make it up to you.”

You crossed your arms. “How?”

“I’ll buy you dinner. And dessert. Anything you want.”

You narrowed your eyes. “…And you’ll never do this again?”

She held up three fingers. “Scouts honor.”

You huffed, finally stepping back. “You owe me big time.”

“I know, I know,” she said, rubbing her arm before grinning. “But hey, at least now we know I can act.”

You shot her a glare, and she chuckled, patting your shoulder lightly as she moved toward the door.

“Let’s get out of here before someone thinks you actually kidnapped me,” she said with a smirk.

And just like that, Kang Seulgi turned from your worst nightmare to… whatever this was.

#kpop#red velvet x reader#red velvet#red velvet fanfic#seulgi#kang seulgi#seulgi x reader#seulgi red velvet#kang seulgi x reader

275 notes

·

View notes

Text

Ilana Berger at MMFA:

Right-wing media are trying to delegitimize climate change as a real and growing threat to the West Coast, just as that threat becomes most evident. Several unusual January wildfires have been burning in Los Angeles County since January 7. Despite the clear connection between global warming and the increasingly dry conditions that lead to fire hazards, right-wing media are following their familiar playbook and blaming what they call California’s “failed” policies for the ongoing crisis.

Californians are struggling to control ongoing fires, as U.S. communities are ill-prepared for year-round extreme weather

The two largest fires, Palisades and Eaton, have collectively burned over 164,000 acres of Los Angeles County. Nearly 173,000 people are under evacuation warnings or orders in LA County, at least 25 people have died, and over 17,000 structures have been damaged or destroyed. The Palisades fire was 19% contained and the Eaton fire was at 45% containment as of publication. [Los Angeles Times, 1/14/25; Cal Fire, accessed 1/15/25; ktla.com, 1/14/25; NBC Los Angeles, 1/14/25]

Like in many other cities, LA’s municipal water system is not designed to handle multiple massive fires at once. Reports that the hydrants being used to put out the fires were running low spurred misinformation about water shortages due to a lack of reservoirs or related to California’s water policies that divert water from Northern California to Southern California. These rumors proved to be misleading: Even though there is enough water, there isn’t enough pressure to get water to go where firefights need it most. As the LAist has noted in the past, “Fire hydrants have also run dry in the case of other wildfires that spread to urban areas, including the 2017 Tubbs Fire, 2024’s Mountain Fire and 2023’s Maui wildfires.” [Media Matters, 1/10/25; The LAist, 1/9/25, 8/15/23]

Forecasters were predicting more of the dry and intense Santa Ana winds that were fueling the fires. The winds, which typically occur during the colder months, are severely impeding efforts to contain the fires. NBC Los Angeles reported that “planes dumping water and retardant on impacted areas have been unable to take to the sky at times since the fires began because of the dangerous conditions presented by the winds.” On January 14 and 15, Los Angeles was expecting winds of up to 65 mph. As of January 14, the National Weather Service had declared red flag warnings, signaling “an increased risk of fire danger,” as well as a “particularly dangerous situation” for parts of the area, which National Weather Service meteorologist Rose Schoenfeld said is “one of the loudest ways that we can shout.” [National Weather Service, accessed 1/14/25, 1/14/25; NBC Los Angeles, 1/13/25; NPR, 1/8/25; Los Angeles Times, 1/13/25]

U.S. communities and infrastructure are ill-prepared for the climate-fueled extreme weather events that are now happening year round. On X, CBS national correspondent Jonathan Vigliotti posted, “American homes were built for an environment that no longer exists. This - like all of the disasters this century, from Florida to Hawaii - must be a call to action. This is the second time in one month Malibu was hit by fire.” Chad Hanson, a forest and fire ecologist and the president of the John Muir Project, told the Los Angeles Times, “The fact is that forest management is not stopping weather- and climate-driven fires.” Carlos Martín, an expert on housing adaptation and climate change, told Fast Company that cities are relying on the federal government because “the resources just aren’t there locally, and the damages are way more than anybody ever anticipated.” Martín said climate change mitigation and adaptation will be key in preparing for future disasters. “It’s like taking a pill to prevent the disease versus getting the disease treated afterwards. That’s the way we have to start thinking about these events: What we used to think of as individual crises [are now] chronic things,” he added. [Media Matters, 1/10/25; Twitter/X, 1/8/25; Los Angeles Times, 8/21/21; Fast Company, 1/11/25]

Right-wing media push the nonsense claim that climate change has nothing to do with the wildfires plaguing the LA area, despite ample evidence proving otherwise.

#Wildfires#Climate Change Denialism#California Wildfires#Extreme Weather#Los Angeles#Los Angeles County California

31 notes

·

View notes

Text

Hello, welcome to The Council's AAC-oriented sideblog! We're a plural system (main blog is @thecouncilofidiots) who uses plural they/it pronouns and are 21+

We are semi-verbal due to language/speaking skill regression caused by a (currently unknown) psychotic disorder. We have disjointed/disorganized speech/thoughts, as well as speech loss episodes. We are autistic, which influences our speech capabilities, but isn't significantly impactful. However, we do have selective mutism due to chronic anxiety (managed by anti-anxiety medication), and non-vox alters

We're working on learning/using AAC to help us communicate

AAC means augmentative and alternative communication, and is any method of communication that doesn't rely on spoken word

When we are experiencing disorganized/disjointed thoughts/speech due to psychosis, our typing often reflects it (for example "Council feel cold, think need get more blanket"). It's not a typing quirk, or something that we can translate, so please be patient with us

Important note : due to our conditions/disorders, we cannot add our own image IDs to our posts. However, we will happily reblog/add image IDs if others are willing make them; it is not apathy for accessibility, but rather, a case of incompatible disabilities

Feel free to join our AAC Community

Or the Discord server!

Meet the Support Team!

Trying save for Coughdrop Lifetime Membership

((BYI, we are explicitly 100% safe for systems of any/all origin, level of functionality/disorder, ect - plurality is an umbrella term and spectrum <3))

Explicitly Endo-Safe Emoji Blogs -> x

Vox Coining Post -> x

Symbol Collections :

Open Symbols -> x

AACIL -> x

Global Symbols -> x

Irasutoya -> x

#thecouncil aac#aac#aac user#aac blog#semispeaking#semi-speaking#semi speaking#speech loss episode#speech loss episodes#selective mutism#selectively mute#psychosis#disabled#disability#disabilities#accommodations#disability accommodations#augmentative and alternative communication#aac community#disability accessibility#accessibility#disorganized speech#disorganized thoughts#disjointed thoughts#disjointed speech#semiverbal#semi-verbal#semi verbal#autistic#psychotic

21 notes

·

View notes

Text

'I am a woman, a mother, a judge.'

A searing new play from the team behind Prima Facie

Jessica Parks is smart, compassionate, a true maverick at the top of her career as an eminent London Crown Court Judge. At work she’s changing and challenging the system one case at a time. But behind the robe, Jessica is a karaoke fiend, a loving wife and a supportive parent.

While managing the impossible juggling act faced by every working mother, an event threatens to throw her life completely off balance. Can she hold her family upright?

Rosamund Pike (Saltburn) makes her National Theatre debut as Jessica. Writer Suzie Miller and director Justin Martin reunite following their global phenomenon Prima Facie with this searing examination of modern masculinity and motherhood.

Cast includes

Jamie Glover

Rosamund Pike

Jasper Talbot

Artistic team

Writer: Suzie Miller

Director: Justin Martin

Set and Costume Designer: Miriam Buether

Lighting Designer: Natasha Chivers

Sound Designers: Ben and Max Ringham

Video Designer: Willie Williams for Treatment Studio

Casting Director: Alastair Coomer CDG

Casting Director: Naomi Downham

Tickets

Monday – Thursday evenings and matinees: £25, £49, £66, £86, £110

Friday – Saturday evenings and matinees: £30, £49, £66, £86, £110

Previews 10 – 15 July: £20, £35, £49, £64, £79

For concessions and discounts, see Ways to save

Please note the 6.30pm start time on the following performances: Thur 14 August, Tue 19 August, Thur 21 August and Tue 9 September.

Visit our Ticketing FAQs for information on how to book, ticket exchanges and more.

Prices may change according to demand

Please note: Rosamund Pike will not be performing on the following dates: Monday 18 August Monday 1 September

Assisted performances

Captioned

Wednesday 30 July – 7.30pm

Saturday 16 August – 2.30pm

Friday 29 August – 7.30pm

BSL Interpreted

Saturday 6 September – 7.30pm

Audio described

Saturday 23 August – 2.30pm

Friday 12 September – 7.30pm

No Chilled performance available.

No Dementia-friendly performances available.

Relaxed performance

Tuesday 2 September – 7.30pm

The interpreter for the BSL performance will be announced closer to the performance date.

Audio-described performances are preceded by a Touch Tour, 90 minutes before the performance start time. Call the Access line on 020 7452 3961 to book Touch Tours.

The Audio describers will be announced closer to the performance date.

We have an allocation of tickets held for members of our Access scheme and if any of the assisted performances above are shown as “Sold Out”, tickets may still be available: Please log in to your account to view all available tickets, or call Box Office on 020 7452 3961

Smart caption glasses

Are planned to be available for performances of Inter Alia from 7.30pm, Thursday 31 July.

2 notes

·

View notes

Text

CCAs May Escort Bombers After Concept Matures in Fighter Force

Dec. 5, 2024 | By John A. Tirpak

CCAs Eyed as Escorts for Long-Range Strike Fleet After Maturing in Fighter Force

The Air Force Global Strike Command is considering long-range, autonomous Collaborative Combat Aircraft as partners for its bombers but is waiting to see how they prove out with the fighter force first, the head of the command said Dec. 5.

Gen. Thomas A. Bussiere also discussed the appropriate size of the B-21 bomber program, the possibility of a mobile land-based strategic missile force, and the outlook for the Sentinel intercontinental ballistic missile during an event hosted by AFA’s Mitchell Institute for Aerospace Studies.

youtube

Bussiere said the service is “looking at” how it could use CCAs in partnership with bombers, but “we’re going to let the fighter force kind of mature that concept with [Increment] 1 … and then we’ll be prepared to integrate that into the Long Range Strike Family of Systems, probably at a later date,” if directed.

“I won’t get ahead of the Chief or the Secretary, but it’s a logical question to ask, whether long-range strike would benefit from the CCA concept,” Bussiere added. ” … Right now, we don’t actually have that in the plan.”

Bussiere’s comments come a day after 8th Air Force commander Maj. Gen. Jason R. Armagost said that “a large aircraft, like a bomber, has many apertures and many radios, and in many cases, more crew members to be able to manage things like” CCAs, adding that the service has kept its options open in how it has developed and procured the B-21.

The “obvious limitation,” Bussiere noted, would be the range of such aircraft. The Increment 1 CCAs being developed by Anduril Industries and General Atomics Aeronautical Systems are optimized for an air-to-air function and not necessarily for long-haul missions that would allow them to escort bombers.

Air Force Secretary Frank Kendall raised the possibility of CCAs to complement the bomber fleet in 2021, and for a time, they shared mention on his Operational Imperatives list of critical new capabilities. But a year later, he backed off the concept, saying “the idea of similar-range collaborative combat aircraft is not turning out to be cost-effective.”

Analysts argued there was still a way for the drones to help the long-range strike mission, though.

B-21 Fleet

Bussiere also said it would be a good idea to “reevaluate” either the total number of B-21 bombers or the rate at which they are procured, saying that the changing security environment weighs in favor of more of the “exquisite” capabilities on the new aircraft.

“Who would not want more?” he asked.

“There are several examples in the in the last five or 10 years where we’ve evaluated what the proper fleet size should be,” he said. And while the program of record calls for “at least” 100 B-21s, Bussiere said there is analytical justification for a bomber fleet of 220 aircraft, of which 75 will be B-52Js, suggesting a fleet size of 145 B-21s.

The figure of 100 “probably needs to be reevaluated, based on the world as we see it today,” he said. “It’s a force mix discussion within the Department of the Air Force, and it’s a resource and priority [question] within the Department of Defense [and] the nation.”

The Air Force could accelerate the program to deliver more than the small handful of B-21s planned each year, Bussiere said.

“If the Department of the Air Force, the Department of Defense, or Congress directs an accelerated ramp … for the B-21 program, there’s some capability growth within the current complex,” he said.

Asked if production capacity could be expanded by adding another company to produce the jet, Bussiere said he was not convinced that would be “the most efficient way” of expanding production. More likely, he said, “it would require opening up another production complex” with the prime contractor, Northrop Grumman.

Chief of Staff Gen. David Allvin, in April testimony before the Senate Armed Services Committee, brushed aside the idea of going beyond the planned 100 B-21s, saying he thinks that by the time they are all built, technology will have advanced to offer an even better option.

“I think we’re not going to reach that number until probably the mid-2030s and beyond,” Allvin said, adding that “there are other technological advancements” likely to arise before the service commits to the B-21 as the backbone of its bomber fleet.

But Bussiere said the number and speed of delivery of the B-21 is a “valid discussion” to have “based on the age of the B-1 and B-2” and the advancing strategic capabilities of Russia and China.

If indeed B-21 deliveries will not conclude until the late 2030s, as Allvin said, that suggests a production rate of only seven or eight airframes a year. The actual rate is classified.

Land-Based Leg

When it comes to the land-based leg of the nuclear triad, Bussiere said the Air Force has “looked at” the idea of making the next land-based ICBM mobile—an idea to improve its survivability that went to prototype stage with the Peacekeeper missile in the 1980s, and which has been suggested by a number of think tanks since.

“There’s been debate and discussion over the decades on whether or not we should have a mobile aspect or component of the land leg of the triad. It’s been studied,” he said. “The nation has determined that … we’re not there yet. So that is a policy decision. If the nation decides that we are going to implement some sort” of ICBM mobility, “then we will develop concepts and go through that process. But right now, that’s been looked at.”

4 notes

·

View notes

Text

DeepSeek AI: The Catalyst Behind the $1 Trillion Stock Market Shake-Up - An Investigative Guide

Explore the inner workings of DeepSeek AI, the Chinese startup that disrupted global markets, leading to an unprecedented $1 trillion downturn. This guide provides a comprehensive analysis of its technology, the ensuing financial turmoil, and the future implications for AI in finance.

In early 2025, the financial world witnessed an unprecedented event: a sudden and dramatic downturn that erased over $1 trillion from the U.S. stock market. At the heart of this upheaval was DeepSeek AI, a relatively unknown Chinese startup that, within days, became a household name. This guide delves into the origins of DeepSeek AI, the mechanics of its groundbreaking technology, and the cascading effects that led to one of the most significant financial disruptions in recent history.

Origins and Founding

DeepSeek AI was founded by Liang Wenfeng, a young entrepreneur from Hangzhou, China. Inspired by the success of hedge fund manager Jim Simons, Wenfeng sought to revolutionize the financial industry through artificial intelligence. His vision culminated in the creation of the R1 reasoning model, a system designed to optimize trading strategies using advanced AI techniques.

Technological Framework

The R1 model employs a process known as “distillation,” which allows it to learn from other AI models and operate efficiently on less advanced hardware. This approach challenges traditional cloud-computing models by enabling high-performance AI operations on devices like standard laptops. Such efficiency not only reduces costs but also makes advanced AI accessible to a broader range of users.

Strategic Moves

Prior to the release of the R1 model, there was speculation that Wenfeng strategically shorted Nvidia stock, anticipating the disruptive impact his technology would have on the market. Additionally, concerns arose regarding the potential use of proprietary techniques from OpenAI without permission, raising ethical and legal questions about the development of R1.

Advantages of AI-Driven Trading

Artificial intelligence has transformed trading by enabling rapid data analysis, pattern recognition, and predictive modeling. AI-driven trading systems can execute complex strategies at speeds unattainable by human traders, leading to increased efficiency and the potential for higher returns.

Case Studies

Before the emergence of DeepSeek AI, several firms successfully integrated AI into their trading operations. For instance, Renaissance Technologies, founded by Jim Simons, utilized quantitative models to achieve remarkable returns. Similarly, firms like Two Sigma and D.E. Shaw employed AI algorithms to analyze vast datasets, informing their trading decisions and yielding significant profits.

Industry Perspectives

Industry leaders have acknowledged the transformative potential of AI in finance. Satya Nadella, CEO of Microsoft, noted that advancements in AI efficiency could drive greater adoption across various sectors, including finance. Venture capitalist Marc Andreessen highlighted the importance of AI models that can operate on less advanced hardware, emphasizing their potential to democratize access to advanced technologies.

Timeline of Events

The release of DeepSeek’s R1 model marked a pivotal moment in the financial markets. Investors, recognizing the model’s potential to disrupt existing AI paradigms, reacted swiftly. Nvidia, a leading supplier of high-end chips for AI applications, experienced a significant decline in its stock value, dropping 17% and erasing $593 billion in valuation.

Impact Assessment

The shockwaves from DeepSeek’s announcement extended beyond Nvidia. The tech sector as a whole faced a massive sell-off, with over $1 trillion wiped off U.S. tech stocks. Companies heavily invested in AI and related technologies saw their valuations plummet as investors reassessed the competitive landscape.

Global Repercussions

The market turmoil was not confined to the United States. Global markets felt the impact as well. The sudden shift in the AI landscape prompted a reevaluation of tech valuations worldwide, leading to increased volatility and uncertainty in international financial markets.

Technical Vulnerabilities

While the R1 model’s efficiency was lauded, it also exposed vulnerabilities inherent in AI-driven trading. The reliance on “distillation” techniques raised concerns about the robustness of the model’s decision-making processes, especially under volatile market conditions. Additionally, the potential use of proprietary techniques without authorization highlighted the risks associated with rapid AI development.

Systemic Risks

The DeepSeek incident underscored the systemic risks of overreliance on AI in financial markets. The rapid integration of AI technologies, without adequate regulatory frameworks, can lead to unforeseen consequences, including market disruptions and ethical dilemmas. The event highlighted the need for comprehensive oversight and risk management strategies in the deployment of AI-driven trading systems.

Regulatory Scrutiny

In the wake of the market crash, regulatory bodies worldwide initiated investigations into the events leading up to the downturn. The U.S. Securities and Exchange Commission (SEC) focused on potential market manipulation, particularly examining the rapid adoption of DeepSeek’s R1 model and its impact on stock valuations. Questions arose regarding the ethical implications of using “distillation” techniques, especially if proprietary models were utilized without explicit permission.

Corporate Responses

Major technology firms responded swiftly to the disruption. Nvidia, facing a significant decline in its stock value, emphasized its commitment to innovation and announced plans to develop more efficient chips to remain competitive. Companies like Microsoft and Amazon, recognizing the potential of DeepSeek’s technology, began exploring partnerships and integration opportunities, despite initial reservations about data security and geopolitical implications.

Public Perception and Media Coverage

The media played a crucial role in shaping public perception of DeepSeek and the ensuing market crash. While some outlets highlighted the technological advancements and potential benefits of democratizing AI, others focused on the risks associated with rapid technological adoption and the ethical concerns surrounding data security and intellectual property. The Guardian noted, “DeepSeek has ripped away AI’s veil of mystique. That’s the real reason the tech bros fear it.”

Redefining AI Development

DeepSeek’s emergence has prompted a reevaluation of AI development paradigms. The success of the R1 model demonstrated that high-performance AI could be achieved without reliance on top-tier hardware, challenging the prevailing notion that cutting-edge technology necessitates substantial financial and computational resources. This shift could lead to more inclusive and widespread AI adoption across various industries.

Geopolitical Considerations

The rise of a Chinese AI firm disrupting global markets has significant geopolitical implications. It underscores China’s growing influence in the technology sector and raises questions about the balance of power in AI innovation. Concerns about data security, intellectual property rights, and the potential for technology to be used as a tool for geopolitical leverage have come to the forefront, necessitating international dialogue and cooperation.

Ethical and Legal Frameworks

The DeepSeek incident highlights the urgent need for robust ethical and legal frameworks governing AI development and deployment. Issues such as the unauthorized use of proprietary models, data privacy, and the potential for market manipulation through AI-driven strategies must be addressed. Policymakers and industry leaders are called upon to establish guidelines that ensure responsible innovation while safeguarding public interest.

The story of DeepSeek AI serves as a pivotal case study in the complex interplay between technology, markets, and society. It illustrates both the transformative potential of innovation and the risks inherent in rapid technological advancement. As we move forward, it is imperative for stakeholders — including technologists, investors, regulators, and the public — to engage in informed dialogue and collaborative action. By doing so, we can harness the benefits of AI while mitigating its risks, ensuring a future where technology serves the greater good.

3 notes

·

View notes

Text

DeepSeek's AI breakthrough: Fewer resources, big impact

New Post has been published on https://thedigitalinsider.com/deepseeks-ai-breakthrough-fewer-resources-big-impact/

DeepSeek's AI breakthrough: Fewer resources, big impact

On December 26th, a modest-sized Chinese company named DeepSeek introduced advanced AI technology, rivaling the top chatbot systems from giants like OpenAI and Google.

This achievement was noteworthy for its capability and the cost-efficiency with which it was developed. Unlike its large competitors, DeepSeek created its artificial intelligence, DeepSeek-V3, using significantly fewer specialized processors, which are typically essential for such advancements.

Cost efficiency and technological breakthrough

These processors are at the heart of a fierce tech rivalry between the U.S. and China. The U.S. aims to keep its lead in AI by restricting the export of high-end chips, such as those from Nvidia, to China.

However, DeepSeek’s success with fewer resources raises concerns about the effectiveness of U.S. trade policies, which have inadvertently spurred Chinese innovation using more accessible technologies.

DeepSeek-V3 impressively handles tasks like answering queries, solving puzzles, programming, and matching industry standards. Remarkably, it was developed with just around $6 million worth of computing resources, starkly contrasting the $100 million Meta reportedly invested in similar technologies.

Chris V. Nicholson from Page One Ventures pointed out that more companies could afford $6 million than the heftier sums, democratizing access to advanced AI technology.

Strategic implications and global impact of DeepSeek

Previously, experts believed only firms with substantial financial resources could compete with leading AI firms, which train their systems on supercomputers requiring thousands of chips.

DeepSeek, however, managed with just 2,000 chips from Nvidia. This efficient use of limited resources reflects the forced innovation resulting from chip restrictions in China, as Jeffrey Ding from George Washington University noted.

Recently, the U.S. tightened these restrictions to prevent China from acquiring advanced AI chips via third countries. This is part of ongoing efforts to limit Chinese firms’ potential military use of these technologies, which have resorted to stockpiling chips and sourcing them through underground markets.

ChatGPT vs Bard: What are the top key differences?

We’re taking a look at Bard vs ChatGPT and their key differences like technology, internet connection, and training data.

DeepSeek, a company rooted in quantitative stock trading, has been leveraging its profits to invest in Nvidia chips since 2021, fueling its AI research rather than consumer products. This focus has allowed it to bypass stringent Chinese regulations on consumer AI, attracting top talent and exploring diverse applications from poetry to complex examinations.

While leading U.S. firms continue to push AI boundaries, DeepSeek’s recent achievements underline its growing prowess in the field. It also highlights the broader shift towards open-source AI, gaining traction as companies like Meta openly share their technologies. This shift increasingly positions China as a central player in AI development, posing a strategic challenge to U.S. dominance in the field.

As the debate continues over the potential risks of open sourcing AI in the U.S., such as spreading misinformation, the global open source community, increasingly led by China, might shape the future of AI development, suggesting a significant geopolitical shift in the technology landscape.

Have you seen our 2025 event calendar?

From agentic AI to LLMOps, this year will be bigger than ever – join us in one of our 19 in-person events across the globe and network with other AI leaders.

Like what you see? Then check out tonnes more.

From exclusive content by industry experts and an ever-increasing bank of real world use cases, to 80+ deep-dive summit presentations, our membership plans are packed with awesome AI resources.

Subscribe now

#000#2025#Agentic AI#ai#AI chips#AI development#AI research#AI technology#applications#artificial#Artificial Intelligence#bank#bard#Calendar#challenge#chatbot#chatGPT#China#chip#chips#Community#Companies#competition#computing#content#cost efficiency#data#december#deepseek#DeepSeek-V3

3 notes

·

View notes

Text

On August 27, African faith, farming, and environmental leaders came together to launch an unusual statement. Their open letter was addressed to “the Gates Foundation and other funders of industrial agriculture.” It charged these funders with promoting a type of corporate, industrial agriculture that does not respect African ecosystems or agricultural traditions.

The letter was organized by the Southern African Faith Communities’ Environment Institute (SAFCEI), and has over 150 signatories. Its release was timed to influence the Africa Food Systems Forum in Kigali, which starts today. Partners of this conference include the Rwandan government, AGRA, the Bill & Melinda Gates Foundation and other philanthropies, agribusiness companies, and aid organizations.

The open letter takes particular aim at two linked organizations. The Gates Foundation is primarily known for its public health investments, but has also made major inroads into agriculture. In Africa much of this work extends through the Nairobi-based AGRA (previously known as the Alliance for a Green Revolution in Africa). The Gates Foundation is a cofounder and the largest donor to AGRA. Other large donors include the UK and US governments.

Under a basket of policies dubbed the “green revolution,” AGRA, the Gates Foundation, and likeminded institutions have sought to substantially increase the use of synthetic fertilizers, pesticides, and commercial seeds in Africa. This has centered on developing new seeds and a network of sellers. The aim has been to dramatically increase agricultural output, in order to reduce hunger and elevate farmer incomes.

But by AGRA’s own admission, it failed in its goal to double crop yields and incomes for 30 million farmers by 2020. In fact, some critics argue, AGRA has made things worse.

According to an external assessment by Timothy A. Wise of Tufts University, severe hunger in AGRA countries increased by 30% between AGRA’s founding and 2018. Crop yield increases have been modest, and where they exist, they haven’t always been enough to cover the higher cost of farming with commercial seeds and agricultural inputs. Dependence on fertilizer has increased the debt and financial precarity of the small farmers who make up the majority of farmers in Africa. In some cases the limited yield increases have also been temporary, as soil fertility has diminished due to monoculture farming and fertilizer use. For instance, Ethiopian farmers “will say that the soil is corrupted, meaning it cannot produce food” without synthetic fertilizer, reports Million Belay of the Alliance for Food Sovereignty in Africa (AFSA).

There have been knock-on effects, Belay says. For instance, Zambian farmers who have become indebted, due to synthetic fertilizer purchases, have had less money for food and their children’s education.

In other words, many farmers’ families are poorer and hungrier than before, while the land itself is less productive.

While AGRA hasn’t managed to double farmer income and yields, it has succeeded in shifting government policies for the worse, according to Belay. These include the dilution of regional biosafety regulations and fertilizer regulations, Belay says. In Kenya, farmers can now face prison time for saving or sharing seeds.

A new AFSA briefing note states that AGRA is seeking to place consultants within government offices and “directly crafting policies at the continental, national, and local levels.” This includes a new 10-year policy for agricultural investment in Zambia.

All, in all, it’s a highly commercialized, elite, and often rich-world vision of African agriculture. Tim Schwab writes in The Bill Gates Problem: Reckoning with the Myth of the Good Billionaire, “Rarely, however, do the targets of Gates’s goodwill, the global poor or smallholder farmers, have a seat at the table. In the case of the Alliance for a Green Revolution in Africa, or AGRA, the allies include a bevy of corporate partners: Syngenta, Bayer (Monsanto), Corteva Agriscience, John Deere, Nestlé, and even Microsoft.” AGRA has been criticized for aiding its agricultural partners to expand in Africa.

#enviromentalism#ecology#industrial agriculture#agribusiness#agriculture#gates foundation#Bill gates#africa

5 notes

·

View notes

Text

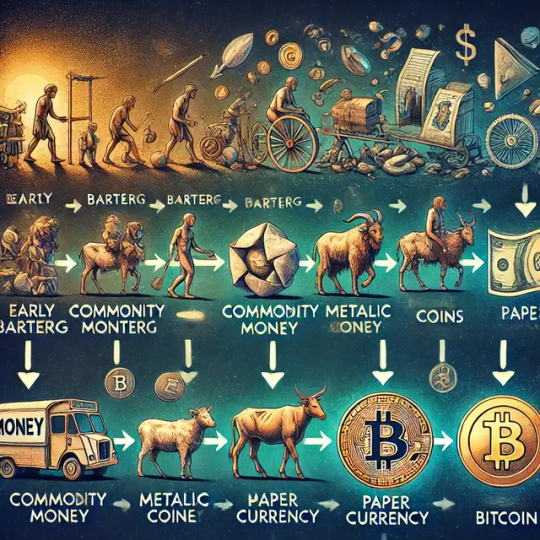

The Evolution of Money: From Barter to Bitcoin

Money has always been an essential part of human society, serving as a tool for exchange, value storage, and facilitating trade. From the early days of barter systems to the modern era of digital currencies, money has evolved in fascinating ways. In this post, we will explore the history of money—from the simple barter systems to the rise of Bitcoin as a potential solution for today's monetary challenges.

1. Barter System In the earliest days of human society, people used a barter system to trade goods and services directly. If someone had surplus grain and needed a tool, they would find someone who had that tool and was in need of grain. While this system worked on a small scale, it had significant limitations. The "coincidence of wants" problem made it impractical—both parties had to want what the other had, and this was often not the case. As societies grew more complex, a more efficient system was needed.

2. Emergence of Commodity Money To overcome the inefficiencies of barter, societies began using commodity money—items that had intrinsic value and were widely accepted in trade. Items like shells, cattle, and metals became mediums of exchange. Commodity money solved the "coincidence of wants" issue and allowed for more standardized trade. However, challenges persisted, such as portability, divisibility, and the ability to assess value consistently.

3. Metallic Coins and Standardization The introduction of metallic coins marked a significant leap forward. Coins made from precious metals like gold, silver, and copper had inherent value and could be easily transported and traded. Standardization played a key role—authorities like kings and governments minted coins to certify their value, providing public trust in the monetary system. Metallic coins facilitated commerce and expanded trade networks, but they also required oversight and protection from debasement or counterfeiting.

4. Paper Money and Government Backing To address the practicality of carrying large quantities of coins, societies transitioned to using paper money. Initially, these paper notes acted as promissory notes that represented a claim on a specific amount of gold or silver stored by a bank. Central banking systems were established to manage these reserves, and eventually, governments began issuing paper currency backed by their promise of value. This emergence of government-backed fiat currency allowed for much greater flexibility and convenience in managing the money supply.

5. The Gold Standard and Its Demise For much of the 19th and early 20th centuries, many countries adhered to the gold standard, where paper money was directly linked to a fixed amount of gold. This system aimed to stabilize currencies and prevent excessive inflation. However, during the Great Depression in 1933, the U.S. government made owning significant amounts of gold illegal and confiscated gold holdings from citizens to stabilize the economy and provide more control over the money supply. By the early 1970s, the gold standard was completely abandoned, and fiat currency—money not backed by any physical commodity—became the global norm.

6. The Fiat Era and Modern Challenges Fiat currency, backed solely by the trust and authority of governments, allowed countries to control their monetary policies and react to economic challenges. However, there are notable downsides. Governments can print more money to fund expenditures, leading to inflation. In recent years, countries worldwide have been printing money at an unprecedented rate, leading to a compounding effect that reduces the purchasing power of their currencies. This widespread money printing not only creates inflation but also contributes to economic instability. Due to the interconnected nature of the global economy, these actions often have ripple effects, creating financial uncertainty and challenges for individuals worldwide.

7. The Advent of Bitcoin Bitcoin emerged in 2009 as a response to the perceived failings of the traditional monetary system. It introduced a digital, decentralized alternative to traditional forms of money. Bitcoin is built on a peer-to-peer network that operates without the need for intermediaries like banks. Its limited supply of 21 million coins ensures scarcity, and its transparent, decentralized ledger—the blockchain���addresses many of the issues related to trust and inflation. Bitcoin represents a bold step forward in the evolution of money, one that resists censorship, preserves value, and operates independently of centralized authorities.

8. Comparison: Bitcoin vs. Fiat Currency Bitcoin offers key advantages over fiat currency. Unlike fiat, which can be printed at will, Bitcoin's supply is fixed and predictable. Its decentralized nature makes it resistant to censorship and government intervention. While fiat currency benefits governments by allowing them to control economic policy, Bitcoin's transparent and decentralized framework empowers individuals and offers a new level of financial sovereignty.

Conclusion The evolution of money has been shaped by humanity's ongoing quest for convenience, fairness, and stability. From barter systems to commodity money, metallic coins, paper currency, and now digital assets, each stage reflects our changing needs. Bitcoin represents the next step in this evolution, offering a solution to the challenges of fiat currency—such as inflation, centralization, and lack of transparency. As the world continues to change, it's worth considering whether Bitcoin might be the foundation for a more resilient and fair financial system in the future.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#EvolutionOfMoney#HistoryOfMoney#BarterToBitcoin#Bitcoin#Cryptocurrency#FinancialHistory#DigitalCurrency#MoneyMatters#EconomicHistory#FiatCurrency#GoldStandard#CommodityMoney#FutureOfMoney#Blockchain#FinancialEducation#Decentralization#MoneyEvolution#BitcoinRevolution#SoundMoney#UnpluggedFinancial#financial experts#finance#financial empowerment#financial education#globaleconomy#unplugged financial

3 notes

·

View notes

Text

Prologue

Billions of years ago, when the Universe we live in wasn't even thought of, there existed a smaller reality in its place. A universe way tinier than the galaxies of today, with ten million suns to its name, it still managed to give birth to a civilization of sentient beings. Beings who brought their home world to global amity and concordance. Beings who harnessed the power of a thousand suns. Beings who lived all across the universe on millions of terraformed planets.

These beings called themselves the Archons, and their home universe — the Cosmos.

Harvesting all information they could in their small world, it was only a matter of time before multiple Archons started breaking their mind out of the fabric of reality. They became aware of their existence within a vast extradimensional ocean between worlds, which they named the Metacosmos - and also of strange ways that Metacosmos can interact with their, and presumably any, universe. This alien, esoteric realm was governed not by matter and energy, but by information, reflecting and refracting activity of a sentient mind - thoughts and ideas, dreams and fantasies.

Ones managed to create pocket dimensions there which they could customize laws of physics within. Others created computers in the Metacosmos that knew no concepts of time and space, instantly breezing through any algorithm unless stuck in an infinite loop. Some tried to break through the deep Metacosmos to the other natural universes, creating what will be called the Realm Door. And a group of Archons used the Metacosmos to construct a time machine, and after using it, went dead silent.

An Archon claiming to be one of them popped up years later. They went from planet to planet, talking about some person that went by the name of «Daemon» and how their actions would presumably shatter the Cosmos into pieces. Though traveler's words were taken with many grains of salt, officials still began discussing the topic and eventually approved a program of creating dimensions for evacuation in case of any apocalyptic scenario - on each city, planetary, and star system level.

The years went by, though, and nothing of notice happened to the whole of Cosmos. The first years' panic calmed down, never even spreading far beyond the traveler's home cluster. And even if the officials had the terminal date on hand, it was never disclosed publically for obvious reasons. Thus, over time the story of Daemon fainted away, becoming just a city legend, and the escape dimensions were never used — but still stood there as a brick in the foundation of any Archon's belief in a bright future.

Meanwhile, other time travelers also went on with their lives, cutting all ends to their past — and to one another. With one exception, though. Two of these Archons, named Komi and Naia, who knew each other from early childhood, decided to pursue their journey through life together. They eventually settled down on a planet named Hena'an in the Lua system and started a farm together - to sustain their living in an old-style way. They've had two kids, one in two years before the other, and named them Tayne and Caithe.

Authoreal notes:

So let's try things out, shall we?

It's always a bit difficult for me to transfer text between different editors. This was in Markdown before, and while yes there is a Markdown editor on tumblr, i haven't been able to find it in the mobile app. Yet.

On the other hand, Tumblr is teasing me with opportunity of coloring text that i just haven't had before and I'm honestly tempted to start painting dialogue like it's homestuck xD probably not going to happen, but imagine the possibility! (by the way can i do any color or only these six + white? probably another thing the mobile editor has only in partial capacity if i had to guess)

<- Acknowledgements / Table of Contents / Chapter I ->

3 notes

·

View notes

Text

I know I just made a post about the complaints but what do you fucking mean the new rateup gacha is paywalled. I know PB is new to this sort of gacha game but at this point, I really do think they need to do some more research and look at how other gachas manage their own rateup gachas as well as their game balancing, because this is getting fucking ridiculous.

Several issues I have with this:

(Rant post again, feel free to skip over. I'm tired at this point.)

It's giving Pokemon Unite new character being paywalled vibes. And people complained HARD about Unite because new characters are often busted while shifting the meta greatly, which is like. Really Fucking Bad for Ranked!!! You can make the argument that WHB is a PvE game but still, not a wise decision when PvE meta and viability can change over time. Look at how, in Arknights, the standard DP generator combo became the Flagpipe combo the moment Bagpipe was released, or how people started using GoldenGlow over Eyjafjalla for her global range. You can clear stages with other units, it just becomes much more complicated. And this game's current meta for easy clears is L-rank skill spam, so if this trend keeps up...

The amount of communication regarding patch notes is atrociously low. Early on, there were some ninja patches without any prior notice as to what they're for - the last time I've seen this happen is on Brave Frontier (which is where we used this term most anyways), and they've stopped doing sudden patch fixes without any announcements after their servers have mostly stabilized (which was around Zevalhua or Alfa Dilith arc iirc, this was nearly a decade ago). Even GBF announces major patch notes like the raid instakill after Belial raid implementation exploit, only doing stealth fixes for things like fixing skill descriptions (and EVEN THEN they still announce what they fixed). Some days after launch I've tapped into WHB only to be greeted by a ~400 mb size patch, which is really fucking draining on standard shit SEA net, and often with no discernible reason behind the update at all. Which often leaves me wondering, what the fuck were they fixing to warrant such a huge patch - especially when there wasn't any obvious difference between patches?

Related to the above, one of the things that I feel pissed players off about this current banner is the fact that there was no indication that it was going to be a paid gacha. The prior announcement only mentioned the usage of Solomon's Seals, which people naturally assumed could be purchased using Guilty Gems. Having separate gacha materials for a time limited banner would make sense to most seasoned gacha players - this system is used in many CN games like Honkai Star Rail and Arknights to differentiate between banners. In HSR it's to differentiate between permanent items (Regular Warp) and new/limited items (Event Warp), while in AK it's to differentiate between older units (Kernel Headhunt, up until Suzuran's banner) and newer units (all other Headhunts, including Limited Headhunts). In both of these cases, you could use each game's respective Guilty Gem equivalent (Stellar Jade for HSR, Orundum for AK) to grab these gacha items. Which, again, is not the case in this new banner.

Another thing that pissed players off is the monetization. Now, me and a friend have both voiced out our gripes with this game in our GBF crew server, and it's mostly related to the gacha rates and scarcity of resources. Solomon's Tears, Greater Key and Lesser Key rates, how little Guilty Gems we get? All discussed by us. It got to a point non-players end up getting interested to listen to what we have to say about this game. And recently, after finding out just how expensive the Solomon's Seals packs are (if they're really $30, then they're the same price as a GBF Suptix for a 10-pull, and a Suptix is a 10-pull PLUS a unit of your choice from a given pool of units), it got to a point where we're just not surprised. It's insane how much we've grown tired of the constant bad decisions.

Even though I'm against harassing the devs, it's decisions like these that are VERY worthy of criticism imo, and very understandable for it to be the reason why one might choose to drop the game. I understand that you need money, but the monetization practices and gacha mechanics being introduced are not F2P friendly. In fact, I doubt they're friendly for dolphins, either - only whales and leviathans can reasonably benefit from them. And I've talked extensively about the game design choices that confuse me at best and piss me off at worst. Me personally, I've definitely reached my limit on leniency for the devs, and I've been lenient on other games as well, notably Limbus Company. Look, as much as Project Moon fucked up with how they handled the Vellmori situation, LCB also had a very rocky launch with worse stability issues than WHB (I nearly couldn't beat Kromer bc of them), but I still stuck by it because it was F2P-friendly, had a super engaging world and characters paired with a superb story, and the devs were communicative about everything (roadmap and emergency updates included). It got to a point I was about to willingly drop money for the paid battlepass if Gregor had a paid EGO reward (AEDD Gregor ended up being free but I bought some Google Play credit just in case - which was diverted to Muse Dash in the end) if not for the controversy. The monetization and paid gacha being the rate-up in WHB is definitely the straw that broke the camel's back for me.

As for what I'm going to do with my WHB account? The fan server I'm in was compiling the bugs they've found as well as other concerns regarding the gameplay and gacha mechanics in particular, to send an email to the devs. I might help around with these efforts if still required and see if there are any positive changes (especially in terms of monetization). I've stopped playing regularly for now, and I feel like this is a game I'm likely to drop in the future. Which is a shame, because while I find the premise interesting, to me it isn't enough to justify the shoddy game experience. Especially when I have other games on my plate - chapter 12 H stages are coming in AK, and Lone Trail is next week btw!

I'll just vicariously enjoy the plot through other people's playthroughs, mostly because that's what interested me about this game in the first place. I'm sorry, I just can't force myself to play the damn game at this point.

#rimei rambles#what in hell is bad#i'm. frustrated#depending on how the devs will handle the feedback regarding the new banner#i can't in good faith continue supporting them#“it's a small team” do i have to bring up pm again#one of my friends made a very good point when i was critical about the game early on#“you're not being a hater danchou you just have standards”#just because i played a lot of gachas and am well aware of how they work#doesn't mean i agree with some of their practices like having tons of filler stages#playing gachas with good pacing between battles and story segments while being f2p friendly WILL make you critical abt gacha mechanics

18 notes

·

View notes

Text

Office Receptionist

Location

Brampton, ON

BenefitsPulled from the full job description

Designated paid holidays

RRSP match

Tuition reimbursement

Full job description

_

Dawn Foods is a global leader in bakery manufacturing and ingredients distribution. As the partner of choice for inspiring bakery success, we help customers grow their business through meaningful partnerships, research-driven insights and innovations, and products and expertise they can depend on. As a family-owned company, our commitments to our people, products, customers, and corporate values, are all part of our recipe for success.

_

Why work for Dawn Foods?

PEOPLE. PRODUCTS. CUSTOMERS.

Why should you apply? We invest in you!

Industry-leading health insurance after 30 days

Competitive Pay

Generous company retirement benefit contributions

10 Paid Company Holidays

3 weeks of vacation each year

Professional training

Family-owned business over 100 years in service

An opportunity for career advancement, working as part of an empowering workforce

What will you do as an Office Receptionistat Dawn Foods?

Answer all incoming telephone calls, direct appropriately and/or take messages

Meet and greet all visitors and provide assistance as required

Oversee and control all office courier services in accordance with standard operating procedures

Manage incoming and outgoing mail and upkeep of postage equipment

Manage invoices in AP system related to Brampton location

Maintain adequate stock of all office and building supplies and control the supply room.

Assist Customer Service team members when needed.

What Does It Take to be an Office Receptionist at Dawn Foods?

Below are the minimum qualifications to be a fit for this job.

Minimum 1 year of experience in an administrative role

Detail oriented and have the ability to work independently and complete objectives.

High School Diploma or GED.

Ability to multi-task

Maintain confidentiality

Proficient in Microsoft Office, including Excel, Word, PowerPoint, Outlook and Teams.

SAP experience preferred but not required.

Physical Demands & Work Environment

The physical demands described here are representative of those that must be met by a Team Member to successfully perform the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions.

Ability to work in a professional office environment. Will be expected to work onsite.

Specific vision abilities required by this job include close vision, distance vision, color vision, peripheral vision, depth perception, and the ability to focus

Note: The level of physical effort may vary from site to site and in some cases be greater or lesser than documented here.

If this sounds like the opportunity that you have been looking for, please click "Apply.”

About Our Benefits

Dawn is proud to employ the top talent in the baking industry, and we reward our people with competitive compensation packages and award-winning benefit offerings. We also help protect our Team Members’ future financial health with a generous RRSP matching program that provide additional retirement funds and many tools and resources on financial wellness. The contributions start from your first pay. Dawn also encourages professional growth through tuition assistance and educational programs, and we are always searching for ways to improve our industry-leading services and benefits.

Compensation: $41,430 - $62,150 Annual Salary

_

An Equal Opportunity Employer. All qualified applicants will receive consideration for employment without regard to race, color, religion, age, sex, national origin, disability, pregnancy, sexual orientation, gender identity/gender expression, citizenship status, military or veteran status, genetic information or any other status or condition that is protected by applicable law.

2 notes

·

View notes

Text

Singapore Visa Processing Time: Expected Timelines for All Visa Types

Planning a trip or relocation to Singapore? Whether you're heading there to study, work, visit, or settle down, one important question is bound to come up: "How long does it take to get a Singapore visa?" It's a fair concern, especially when travel plans, job offers, or academic schedules are on the line. For students in particular, understanding the Singapore student visa processing time is essential for starting their academic journey on the right foot. In this guide, we’ll walk you through the different visa types and how long each typically takes—keeping it simple and easy to follow.

Why Singapore?

Before jumping into the details, it’s worth noting what makes Singapore such a sought-after destination. It's known for its safety, efficiency, global connectivity, and high quality of life. Whether you're visiting for a short stay or planning a long-term move, Singapore offers a clean, well-managed environment that appeals to students, professionals, and families alike. Even better, the visa process is generally organized and manageable.

Types of Visas in Singapore

Here’s a breakdown of the most commonly applied-for visa types:

Student Pass (Student Visa)

Work Passes (Employment Pass, S Pass, Work Permit)

Short-Term Visit Pass (Tourist or Business)

Permanent Residence (PR)

Dependent Pass / Long-Term Visit Pass

EntrePass (for entrepreneurs)

Each of these visas has its own purpose and timeframe. Let’s take a closer look at what to expect from each one.

Singapore Student Visa Processing Time

If you're preparing to study in Singapore, you’ll be applying for a Student Pass. The Singapore student visa processing time begins after your school registers your information in the SOLAR system (Student’s Pass Online Application & Registration).

Steps to expect:

Your institution enters your details into SOLAR.

You complete the online application and upload all required documents.

The ICA (Immigration and Checkpoints Authority) reviews and processes your application.

Estimated Processing Time: Most student visa applications are processed within 2 to 4 weeks. However, it's best to apply as soon as you receive your acceptance letter to avoid any potential delays.

Singapore Work Visa Processing Time

Planning to work in Singapore? The type of work pass you apply for will determine your processing time.

Employment Pass (EP): Typically takes 1 to 3 weeks if all documents are complete and the employer submits the application correctly.

S Pass / Work Permit: These may take up to 3 weeks or longer, as additional verification may be needed.

Note: Incomplete or incorrect information from the employer’s side can slow down the process.

Short-Term Visit Visa (Tourist or Business)

If you’re traveling to Singapore for a short-term visit—whether for tourism or business—this is one of the quickest visas to get.

Application Process:

Applications are usually submitted online via the e-Visa system, often through a local contact in Singapore.

Estimated Processing Time: Most short-term Visit Passes are processed within 1 to 3 working days, making Singapore a relatively easy country to plan a spontaneous visit to.

Permanent Residence (PR) Application Timeline

If you're aiming to make Singapore your long-term home, applying for Permanent Residence (PR) is a bigger step that requires more time.

What’s involved:

Submitting a detailed history of your education, work, and personal background.

Waiting for ICA to complete a thorough review.

Estimated Processing Time: PR applications often take 4 to 6 months, and in some cases, even longer. This longer timeline is due to the complexity and long-term impact of PR status.

Dependent Pass and Long-Term Visit Pass

If you’re relocating to Singapore with your family, you may need to apply for a Dependent Pass or a Long-Term Visit Pass (LTVP). These are typically issued to family members of Employment Pass or Student Pass holders.

Estimated Processing Time: These applications are generally processed within 3 to 8 weeks, depending on the specific case and completeness of the documents.

Entrepreneur Pass (EntrePass)

For those planning to launch a business in Singapore, the EntrePass is the route to take. It’s designed for entrepreneurs with innovative business ideas who want to set up operations in Singapore.

Review Process Includes:

Evaluation of your business plan.

Financial details and projections.

The sector your business operates in.

Estimated Processing Time: Applications are generally processed within 8 to 12 weeks, although it may take longer depending on the strength and clarity of your proposal.

What Affects Visa Processing Time?

Several factors can impact how quickly your application is processed:

Completeness of your documents

Nationality and current residence

Application volume at the time of submission

Any background checks required

Delays in receiving clarifying documents

To avoid unnecessary delays, always double-check that all documents are complete, clear, and accurate before submitting.

Tips to Avoid Delays and Speed Up Processing

Here are some practical ways to keep things moving smoothly:

Apply early: Start the process well in advance of your planned travel or start date.

Have your documents ready: Save digital versions and back them up.

Stay updated: Keep an eye on your application status through the official tracking portals.

Follow up if needed: If the processing time exceeds the normal range, consider reaching out through official channels.

What to Do If Your Visa Is Delayed

Visa delays can happen—but most can be resolved with a few simple steps:

Check the status online via the ICA portal or application platform.

Reach out to your institution or sponsor (if applicable) to check if any action is required from their side.

Look for emails or messages requesting additional documents or clarifications.

Wait patiently but stay informed, especially during busy seasons.

Conclusion

Singapore is known not only for its forward-thinking infrastructure and global opportunities but also for its clear and structured visa system. Whether you’re a student, a visitor, a professional, or a family member, the key to a smooth visa process lies in preparation, early application, and attention to detail.

While the Singapore student visa processing time is usually just a few weeks, other visa types have their own timelines based on complexity and purpose. By knowing what to expect and staying organized, you can take your next step toward Singapore with confidence and clarity.

FAQs

1. Can I track my Singapore visa application online? Yes, most visa applications can be tracked through the ICA or related portals.

2. Is the Singapore student visa process complicated? No, it's fairly straightforward as long as you follow the steps and provide the correct documents.

3. What if my visa isn’t approved in time for my school start date? Let your institution know right away. They might offer solutions or flexibility.

4. Do all nationalities have the same visa processing times? Not always. Some nationalities may require additional background checks.

5. Can I appeal a rejected visa? You can appeal, but it's often better to reapply with corrected or additional documents, depending on the reason for rejection.

0 notes

Text

Australia Business Visa Processing Time in 2025: What Entrepreneurs Need to Know

Australia is consistently ranked among the top global economies for ease of doing business, innovation, and international trade. For business professionals and entrepreneurs planning to explore opportunities in the country, securing the appropriate visa is the first step—and understanding the Australia business visa processing time is crucial for effective planning.

Why Choose Australia for Business?

Australia offers a stable economy, transparent legal system, and a thriving market for foreign investment. According to the Australian Trade and Investment Commission, foreign direct investment into Australia stood at AUD 1 trillion in 2024, with India being one of its fastest-growing partners.

With over 85,000 Indian businesses operating across Australia and bilateral trade exceeding AUD 46.5 billion, Australia continues to be an attractive business destination for Indian professionals and entrepreneurs.

Types of Business Visas in Australia

Australia offers several visa categories for business visitors, including:

Business Visitor Stream (Subclass 600) For short-term business activities such as meetings, conferences, or exploratory visits.

Valid for up to 3 months per entry.

Business Innovation and Investment (Provisional) Visa (Subclass 188) For individuals looking to start or manage a business, or invest in Australia.

Valid for up to 4 years and 3 months.

Business Talent (Permanent) Visa (Subclass 132) (now closed to new applicants, replaced by other streams)

Each visa type has different eligibility requirements and timelines, so selecting the right one is vital.

Australia Business Visa Processing Time: What to Expect

The Australia business visa processing time can vary based on the visa subclass, applicant’s background, and volume of applications at the time of submission. Here’s an overview of typical processing times:

Visitor Visa – Business Stream (Subclass 600)

75% of applications processed in 12–18 days

90% processed within 25 days

Business Innovation and Investment Visa (Subclass 188)

75% processed in 6–10 months

Complex cases may take up to 12 months

It’s important to note that incomplete documentation or additional security checks can extend these timelines.

Factors Affecting Processing Time

Several factors influence the Australia business visa processing time, including:

Completeness of Application: Missing or incorrect documents cause delays.

Health and Character Checks: Required for long-term visa applicants.

Country of Origin: Processing may vary depending on local Australian visa office workloads.

Volume of Applications: Peak travel seasons can cause backlogs.

Business Purpose: Certain business activities may require deeper scrutiny.

How to Expedite Your Visa Process

To minimize delays, follow these tips:

Submit all documents in one go (passport, financials, invitation letters, etc.).

Ensure your business intent is clearly outlined in your cover letter.

Track your application using the ImmiAccount portal.

Consider professional assistance to navigate complex visa types.

Many corporate professionals and business owners now rely on dedicated visa services to streamline their applications, ensure document accuracy, and save valuable time.

Key Statistics

Australia issued over 300,000 visitor visas in the business stream during 2023–24.

Indian nationals account for nearly 10% of total business visa applications.

Visa rejection rate for business visas stands below 6%, mainly due to incomplete applications.

Australia has 12 active free trade agreements, creating more investor-friendly pathways.

FAQs on Australia Business Visa Processing Time

1. Can I apply for an Australian business visa online? Yes, applications for most visa subclasses can be submitted through the official ImmiAccount portal.

2. What’s the fastest business visa option for Australia? The Visitor Visa – Business Stream (Subclass 600) is the fastest, with processing in as little as 12 days.

3. Can I extend my stay on a business visa in Australia? Extensions are not guaranteed. You must apply for a new visa if your existing one expires.

4. Is there an express processing service for Australia business visas? Australia does not offer a formal "fast-track" option, but complete and well-documented applications are often processed faster.

5. Can I convert a business visa into a permanent residency? Only certain long-term visas like Subclass 188 have pathways to permanent residency under Subclass 888.

Final Thoughts

Planning your business travel to Australia begins with understanding the right visa type and the expected Australia business visa processing time. Delays can affect your meetings, contracts, and overall business plans, so it’s essential to prepare thoroughly and apply early.

If you want to avoid uncertainty and focus on your core business goals, consider working with professionals who understand the nuances of visa processing. Discover tailored visa support through corporate visa services that simplify the application process for busy entrepreneurs.

#Australia Business Visa 2025#Business Visa Processing Time#Entrepreneur Visa Australia#Australia Visa for Entrepreneurs#Corporate Visa Australia#Visa Application Timeline#Business Travel to Australia

0 notes

Text

Navigating the UK Business Visa: Processing Times and Essential Tips