#Gold market trends and analysis

Text

Why Investing in Gold Makes Sense

Embark on a journey through the ages with gold, an enduring symbol of wealth and cultural significance. Investing in gold provides stability as a secure alternative to stocks and a hedge against inflation. Its historical prominence, from Pharaohs to ancient Indian literature, underpins its enduring value. Economic experts anticipate upward trends in gold prices, suggesting silver for portfolio diversification. Beyond investment, gold influences global economics, sustaining employment in mining and jewelry craftsmanship. In India, gold symbolizes prosperity in cultural and religious ceremonies. For those in Delhi, www.sonadopaiselo.net/ offers transparent processes and competitive rates, turning golden dreams into tangible investments. Gold is more than a metal; it's an investment, a safety net, and a cultural legacy — a testament to wealth, resilience, and timeless allure.

Read More:- https://www.sonadopaiselo.net/why-investing-in-gold-makes-sense.php

#Why should I invest in gold#What is the Safest investment options economic times#Environmental impact of gold mining#Cultural significance of gold in Indian weddings and festivals#investing in gold silver for long-term#Gold and silver market dynamics for investors#Gold's role in global economics and currency reserves#Impact of gold mining on jobs and livelihoods worldwide#Gold investment benefits#Reasons to invest in gold#Gold market trends and analysis#Long-term gold investment strategies

0 notes

Text

Environmental Sustainability in the Gold Mining Industry

Introduction

Environmental sustainability has emerged as a paramount concern in the Gold Mining Market as companies seek to minimize their ecological footprint and address climate change. In this blog, we'll explore the various initiatives and strategies that gold mining companies are implementing to promote environmental stewardship and achieve sustainable operations.

Responsible Mining Practices

Gold mining companies are increasingly adopting responsible mining practices to minimize the environmental impact of their operations. This includes implementing measures to reduce air and water pollution, mitigate habitat destruction, and minimize land disturbance. Companies like AngloGold Ashanti and Kinross Gold have developed comprehensive environmental management plans that incorporate best practices in mine planning, waste management, and rehabilitation to minimize their environmental footprint.

Carbon Emissions Reduction

Reducing greenhouse gas emissions is a key priority for gold mining companies looking to mitigate climate change and comply with regulatory requirements. According to industry data, the gold mining sector emitted approximately 300 million metric tons of CO2 equivalent in 2020. Companies are implementing various measures to reduce their carbon footprint, including investing in energy-efficient equipment, transitioning to renewable energy sources, and implementing carbon offset initiatives. For example, Newmont Corporation has committed to reducing its greenhouse gas emissions by 30% by 2030 through initiatives such as energy efficiency improvements and renewable energy investments.

Biodiversity Conservation

Preserving biodiversity is essential for maintaining ecosystem health and resilience in gold mining regions. According to studies, gold mining activities have led to the degradation of biodiversity in several regions globally. Companies are implementing biodiversity conservation measures, such as habitat restoration, reforestation, and wildlife protection, to mitigate the impacts of mining on local ecosystems. Through partnerships with conservation organizations and indigenous communities, companies like Barrick Gold and Gold Fields are working to protect and restore biodiversity in areas affected by mining activities.

Water Management and Conservation

Water management is a critical aspect of sustainable gold mining, particularly in water-stressed regions. According to industry reports, the gold mining sector consumes significant amounts of water, with estimates suggesting that each ounce of gold produced requires approximately 3,000 to 6,000 gallons of water. Companies are implementing water conservation measures, such as recycling and reusing process water, implementing water-saving technologies, and promoting responsible water use practices among employees and local communities. By minimizing water consumption and reducing water pollution, companies can minimize their environmental impact and ensure the availability of clean water for communities and ecosystems.

Ecosystem Restoration and Rehabilitation

Restoring and rehabilitating mined land is essential for reclaiming disturbed landscapes and promoting ecological recovery. According to industry estimates, approximately 75% of the land disturbed by gold mining activities has not been rehabilitated. Companies are implementing ecosystem restoration and rehabilitation programs to rehabilitate mined land, restore natural habitats, and promote biodiversity conservation. Through initiatives such as land reclamation, revegetation, and soil stabilization, companies like Agnico Eagle Mines and Newmont Corporation are restoring ecosystems and promoting long-term environmental sustainability in mining-affected areas.

Conclusion

Environmental sustainability is a top priority for Gold Mining Companies seeking to minimize their environmental impact and promote responsible mining practices. Through initiatives such as responsible mining practices, carbon emissions reduction, biodiversity conservation, water management, and ecosystem restoration, companies are working to achieve sustainable operations and mitigate their environmental footprint. By embracing environmental stewardship and adopting innovative solutions, the gold mining industry can contribute to a more sustainable future for communities, ecosystems, and the planet as a whole.

#Gold Mining industry overview#Gold mining Industry#Global Gold Mining Market#Global Gold mining Market#Gold Mining Market Analysis#Gold Mining Market Growth#Gold Mining Market Share#Gold Mining Market Size#Gold Mining Market Trends#Gold Mining Market Value#Gold Mining Market in India#Gold Mining Market emerging trends#Gold Mining Market outlook#Gold Mining Market overview#Gold Mining Market Research reports#Gold mining Market Major players

0 notes

Text

Shining Perspectives of the Gold Mining Industry, Industry Growth and Outlook

Exploring the vast expanse of the Global Gold Mining Market requires a nuanced understanding of its dynamics, challenges, emerging trends, and the key players steering the industry. In this comprehensive dive, we unravel the intricacies of the Gold Mining Market, shedding light on its analysis, growth prospects, challenges, and emerging trends.

Gilded Perspectives: Analyzing the Global Gold Mining Market

The Global Gold Mining Market serves as a cornerstone in the mining industry, shaped by economic trends, geopolitical factors, and the relentless pursuit of the precious metal. Analyzing its multifaceted nature provides valuable insights for industry stakeholders and investors alike. Gold Mining Market Analysis reveals a robust landscape influenced by factors such as global economic stability and currency fluctuations. The Global Gold Mining Market witnesses consistent growth, driven by increased demand for gold in jewelry, technology, and as a safe-haven investment. The Gold Mining Market Size is poised to reach USD 150 billion by 2025, showcasing an annual growth rate of 8%.

The Golden Growth Trajectory: Unraveling Market Size and Share

Understanding the size and share dynamics of the Gold Mining Market is pivotal for investors seeking profitable ventures and industry players navigating competitive landscapes. The Gold Mining Market Share is distributed among key players, with established mining conglomerates holding a dominant position. The Gold Mining Market Size is buoyed by the emergence of new mining operations and technological advancements. Major players like Company X and Company Y collectively command a 30% share of the Global Gold Mining Market.

Gold Mining Market Trends

Navigating the trends shaping the Gold Mining Market unveils opportunities for industry participants and underscores the need for adaptability in a dynamic environment. Evolving consumer preferences and sustainable mining practices emerge as prominent Gold Mining Market Trends. Technological integration, including AI and data analytics, is revolutionizing operational efficiency in the Gold Mining Industry. Investments in sustainable mining technologies have witnessed a 20% annual increase, indicative of the industry's commitment to responsible practices.

Gold Mining Market Hurdles

The path to prosperity in the Gold Mining Market is not without challenges. Identifying and mitigating these challenges is imperative for sustained growth. Gold Mining Market Challenges include regulatory complexities, environmental concerns, and fluctuations in gold prices. Adapting to stringent environmental regulations and community engagement pose ongoing challenges in the Gold Mining Industry. Regulatory compliance costs have surged by 18% annually for Gold Mining companies globally.

Emerging Trends: The Shifting Sands of the Gold Mining Market

Exploring the horizon of emerging trends in the Gold Mining Market unveils potential avenues for innovation and growth. Gold Mining Market Emerging Trends encompass the integration of blockchain technology for transparent supply chain management. Resurgence in artisanal and small-scale mining practices emerges as a noteworthy trend in the Global Gold Mining Market. Artisanal and small-scale mining operations contribute to 15% of the total gold production globally.

A Glimpse of Gold Mining in India: Opportunities and Challenges

Delving into the nuances of Gold Mining in India adds a regional perspective to the global narrative. Gold Mining Market in India is witnessing increased exploration activities and government initiatives to boost domestic production. Challenges in land acquisition, regulatory hurdles, and community engagement are critical aspects of the Gold Mining Landscape in India. India's gold consumption is projected to grow at a rate of 7% annually, signaling robust demand.

Conclusion: Navigating the Golden Landscape

In conclusion, the Global Gold Mining Market stands as a testament to the intricate interplay of economic, environmental, and geopolitical factors. Analyzing its vast landscape provides stakeholders with the tools to navigate challenges, capitalize on emerging trends, and contribute to the sustainable growth of the industry.

#Gold Mining Industry#Global Gold Mining Market#Gold Mining Market Analysis#Gold Mining Market Growth#Gold Mining Market Share#Gold Mining Market Size#Gold Mining Market Trends#Gold Mining Market Value#Gold Mining Market in India#Gold Mining Market#Gold Mining Market Challenges#Gold Mining Market Emerging Trends#Gold Mining Market Outlook#Gold Mining Industry Research Reports#Gold Mining Market Research Reports#Gold Mining Market Major Players

0 notes

Text

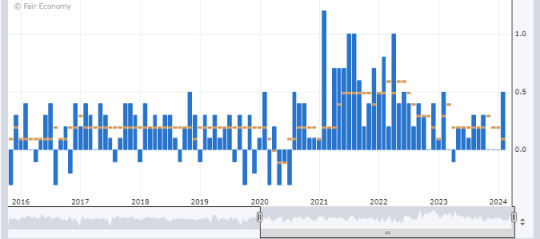

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the first week of September in the books, equity markets reverted to weakness, trending lower all week. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) continued to move lower. The US Dollar Index ($DXY) continued in broad consolidation while US Treasuries ($TLT) showed signs of a possible new uptrend. The Shanghai Composite ($ASHR) looked to continue the downtrend while Emerging Markets ($EEM) dropped back into a short term downtrend.

The Volatility Index ($VXX) looked to shift from low and stable to low and rising making the path more difficult for equity markets. Their charts looked weak on the shorter time frame as price pulled back from a lower high, but they remained above making a lower low for now. On the longer timeframe they looked stronger, but vulnerable with the $SPY strongest then the $IWM and the $QQQ the weakest.

The week played out with Gold pushing out of consolidation to the upside and ending at a new all-time high while Crude Oil found support and reversed higher midweek. The US Dollar met resistance and fell back in consolidation while Treasuries met resistance at a retest of the 2023 high and paused. The Shanghai Composite continued lower, closing in on the February low, while Emerging Markets found support and rose back over resistance.

Volatility moved lower all week to end just above the August low. This gave equities a boost midweek and they responded with a 3 day move higher to end the week. This resulted in the SPY back within spitting distance of the all-time high and the QQQ and the IWM ending back over their short term moving averages. What does this mean for the coming week? Let’s look at some charts.

SPY Daily, $SPY

The SPY came into the week in a pullback from a near retest of the top on the daily chart. It printed an inside day Monday and rose slightly Tuesday head of the CPI report Wednesday morning. In reaction to the report, it opened and drove lower for the 1st hour before reversing and ripping higher to close up 2.6% off the low of the day. It continued higher the rest of the week ending back at the August high. The RSI is rising near 60 with the MACD crossed up and positive.

The weekly chart shows the reversal of the prior week’s drop, noting that price held at the 20 week SMA. The 161.8% extension of the retracement of 2022 drop continues to play a key role as resistance. The RSI is rising in the bullish zone with the MACD flat and positive. There is resistance higher at 565.50. Support lower is at 561.50 and 556.50 then 549.50 and 545.75 before 542 and 540. Consolidation in Uptrend.

SPY Weekly, $SPY

Heading into the September FOMC meeting and Options Expiration, equity markets showed strength with a rebound from the week prior. Elsewhere look for Gold to continue its uptrend while Crude Oil consolidates in a short term downtrend. The US Dollar Index continues to drift lower in consolidation while US Treasuries are on the edge of a reversal to an uptrend. The Shanghai Composite looks to continue the downtrend while Emerging Markets consolidate.

The Volatility Index looks to remain low and stabilizing making the path easier for equity markets to the upside. Their charts look strong, especially on the longer timeframe with the SPY on the edge of break to new highs while the IWM and QQQ hold near recent highs. On the shorter timeframe the SPY is also strong with the IWM and QQQ possibly building tightening consolidation zones. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview September 13, 2024

20 notes

·

View notes

Text

Baratheon ladies wearing elaborate escoffions that resemble antlers is my new favorite thing in the @15-lizards fashion history analysis posts.

It’s said that Rhaelle brought the fashion to the Stormlands before realizing how impractical it is, however I can see Cassana wearing it when she comes to King’s Landing court where the weather is a bit more tolerable. Cersei would bring it back in fashion early in her marriage when she’s still pretty happy she’s Robert’s wife. It’s something super elaborate she can use to show off her new house that stays true to her Lannister roots of being ostentatious. She also probably saw Cassana wearing something similar when she was younger and Cersei is really clinging into ‘better days’ at this point. The red she wears matches Baratheon yellow rather than Lannister gold and she has a chain like design across her bust made of rubies and gold to show she’s not truly comfortable with her gilded cage marriage.

Margaery also follows this trend during her marriage to Renly. It’s more subdued than Cersei because she’s trying to market herself as the more relatable queen and because she lives in the Stormlands. Due to the weather she saves it for formal events like tourneys and galas and maybe for parades for the small folk. I can also see her bringing this back to invoke nostalgia in older small folk and minor houses. Wearing brown instead of black also makes her look softer as well. TBH she’s the one I struggled with most because the Stormland fashion doesn’t suit her character. I might have to redo her on a later date.

(Something about women marrying into the Baratheons and something about overcompensating in order to assimilate something something).

Finally we have Shireen. She is understated compared to the other women but still very gorgeous. I can’t imagine her in any flashy clothes, she is the type to value practicality but she would know how to dress beautifully for formal events. Her wealth is shown with furs and intricate embroidery and the jewels in her hair. Bits of her outfit are inspired by the women who came before her but still uniquely her own.

Anyway thanks for reading!

#cersei lannister#Cersei Baratheon#house baratheon#cassana estermont#cassana Baratheon#margaery tyrell#house tyrell#margaery baratheon#shireen baratheon#mine#my art

42 notes

·

View notes

Text

Will Netflix greenlight a Six Of Crows Spin off?

An analysis of the current situation

1. interview with EW

The showrunner of SaB being allowed to make an official statement when EW reached out to him is a good sign. It means Netflix wants to test the water and get people hyped for a potential spin off. Also EW! This shows how high the demand is for that show.

But more importantly:

They wrote the whole script already two years before season 2 aired. That means Netflix has really high hopes for a potential spin off.

Netflix is really well known for renewing and cancelling shows not based on actual viewing data’s but based on calculated viewing forecasts. Meaning: Netflix commissioning a spin off two years before season 2 was aired means they predicted a really high demand for a spin off. Now our views only have to match their forecast

2. the Witcher struggling, Stranger things ending

Every streaming service has one, really high in demand fantasy show, that is appealing for a mass audience. This was first Stranger Things, but Stranger Things is ending soon. The next big hit was The Witcher. They gave it an animated spin off, a real life spin off, announced seven seasons at once etc. This was HUGE! The Witcher was their show that Netflix used to compete against other players on the market, especially The Rings of Power. But now the Witcher is struggling a lot. Recasting the main actor, blood origin being badly received by the fans, Cavill and LSH bitching at each other, the whole fighting becoming an online meme. And at this point no one knows if people really want to watch an Australian Geralt. So they need another big fantasy show. And while shadow and bone is not doing as good as the Witcher, it is still doing completely solid. For them, SaB and especially the crows are a safe harbor.

3. The promo

The promo for the second season is insane. The promo is rolled out on every social media channel, even on Netflix Gold and the MOST. Season 2 is out since one week now and they are still releasing new promo content every day. All hapa Asian cast members together, a wesper BTS tour? This is insane! Netflix wants this show to be their next big hit! They want a big fanbase, so people stick to netflix. Because soon the Witcher 3 will be released and I think Netflix is really afraid that many people will cancel their subscription after it. A Six of Crows Spin off will bind viewers to the Netflix for the next… 2/3 years and help them in a really difficult time. Because building up a new fan base that is so big like the SaB is not easy

Like the crows always being put together in the promo is not a huge bait to see fans reaction towards them, come on, is super obvious

4. the new intro for season 1

Netflix making a new intro for the first season shows that Netflix is ready to invest money into the show. Not only in the new season but also in the old season. Also it was really clear that season 2 had a way bigger budget then season 2. look at the different intro cards. They are ready to invest money. And they are ready to invest even more money IF it pays off, meaning: if enough people watch season 2. and hype it up online. Because what Netflix wants is new people subscribing and everyone online taking about the show

5. six of crows being listed by PW

Yeah it is only listed as „in development“ but if you think about it, this is actually a huge deal. They have been quietly developing a spin off since 2021, told no one about it, and now season 2 is released since ONE WEEK and suddenly it is listed in PW? They could have also waited the first month, to have all numbers. But nope, one week and they said: put it in there“ this means they have really high hopes for it and are really optimistic.

So i would say we have a really good chance to get that show IF we keep it trending, keep up the hype and keep on streaming and recommending it to friends

So in conclusion: stream, recommend, like and tweet. Like this we will steal us a spin off

44 notes

·

View notes

Text

Bitcoin Going Parabolic: A Closer Look at the Factors Driving the Surge

Bitcoin has been a subject of fascination and debate for over a decade. Recently, the buzz around its potential parabolic rise has reached new heights. With multiple presidential nominees proposing to make Bitcoin a strategic reserve asset and groundbreaking legislative efforts, the cryptocurrency is poised for a significant breakthrough. In this blog post, we will explore the factors contributing to Bitcoin's potential meteoric rise and what this could mean for the future of finance.

Current Market Overview

The Bitcoin market has seen remarkable stability and growth over the past year. Despite global economic uncertainties, Bitcoin's price has maintained an upward trajectory, driven by increased adoption and growing institutional interest. The market's resilience has only strengthened the belief that Bitcoin is here to stay.

Factors Driving Bitcoin's Potential Parabolic Rise

Institutional Adoption Institutional investment in Bitcoin has been one of the most significant drivers of its price surge. Companies like MicroStrategy, Tesla, and Square have made substantial Bitcoin purchases, demonstrating their confidence in its long-term value. Recently, MicroStrategy announced plans to raise $2 billion to buy more Bitcoin, adding to its already significant holdings of 226,500 BTC. This move exemplifies the growing trend of institutions recognizing Bitcoin as a hedge against inflation and economic instability.

Regulatory Developments Positive regulatory changes are also contributing to Bitcoin's upward momentum. Notably, several presidential nominees in the upcoming election have expressed their support for Bitcoin, proposing to make it a strategic reserve asset for the United States. Additionally, Senator Cynthia Lummis has introduced a groundbreaking bill to establish a U.S. Bitcoin reserve. This legislation aims to treat Bitcoin like gold or oil, strengthening the country's economy and positioning Bitcoin as a permanent national asset. Such initiatives could legitimize Bitcoin on a national level, potentially triggering a wave of similar actions from other countries.

Monetary Policy Shifts The Federal Reserve is expected to cut interest rates in September, a move that historically leads to Bitcoin price pumps. Lower interest rates often result in increased liquidity in the financial system, driving investors to seek alternative stores of value like Bitcoin. Moreover, the global M2 money supply is skyrocketing, indicating a significant increase in the amount of money in circulation. This surge in money supply can lead to inflation, further underscoring the appeal of Bitcoin as a deflationary asset.

Technological Advancements Bitcoin's underlying technology continues to evolve, enhancing its security, efficiency, and scalability. Innovations such as the Lightning Network and Taproot upgrade are making Bitcoin transactions faster and more cost-effective, further cementing its position as a superior financial instrument.

Historical Parabolic Trends in Bitcoin

Bitcoin's history is marked by several parabolic rises, each driven by different factors but sharing common themes of increased adoption and market maturation. The 2017 bull run, fueled by retail investor interest, and the 2020-2021 surge, driven by institutional adoption, provide valuable insights into the current trend. Studying these patterns helps us understand the potential trajectory of Bitcoin's price movement.

Expert Predictions and Analysis

Experts in the field of cryptocurrency are making bold predictions about Bitcoin's future. Influential figures like Michael Saylor, CEO of MicroStrategy, and Cathie Wood, CEO of ARK Invest, have forecasted Bitcoin reaching new all-time highs. Their analyses are based on Bitcoin's scarcity, growing adoption, and its role as digital gold.

Potential Challenges and Risks

While the outlook for Bitcoin is promising, it is essential to acknowledge the potential challenges and risks. Regulatory hurdles, market volatility, and technological vulnerabilities could impact Bitcoin's growth. Investors must remain vigilant and informed to navigate these challenges effectively.

Conclusion

Bitcoin's potential to go parabolic is underpinned by strong institutional support, favorable regulatory developments, and continuous technological advancements. As multiple presidential nominees propose to make Bitcoin a strategic reserve asset and Senator Lummis's groundbreaking bill aims to establish a U.S. Bitcoin reserve, the stage is set for a significant transformation in the financial landscape. With MicroStrategy's aggressive strategy to raise $2 billion for more Bitcoin purchases and the expected interest rate cuts by the Federal Reserve, the momentum is undeniable. Additionally, the skyrocketing global M2 money supply highlights the growing need for a deflationary asset like Bitcoin. Whether you're an investor, a crypto enthusiast, or a curious observer, staying informed about these developments is crucial as we witness the evolution of Bitcoin.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Crypto#Cryptocurrency#BTC#Blockchain#FinancialRevolution#DigitalGold#Investing#InstitutionalAdoption#Regulation#BitcoinNews#CryptoMarket#BitcoinPrice#BitcoinInvestment#FederalReserve#MonetaryPolicy#InterestRates#M2Supply#SenatorLummis#MicroStrategy#ParabolicRise#FinancialFreedom#financial experts#digitalcurrency#unplugged financial#globaleconomy#financial education#financial empowerment#finance

5 notes

·

View notes

Text

Gold's Market Trends and Fed Rate Cut Expectations Explained | XAUUSD

#forex analysis#forex education#forex online trading#forexscalping#forextips#for example#forexmarket#forexnews#forexstrategy#forexsuccess

2 notes

·

View notes

Text

Investing in Bitcoin vs Memecoin- Which is the Better Choice?

Introduction

Cryptocurrency investing has become a popular avenue for both seasoned and new investors seeking high returns and diversification. Among the many types of cryptocurrencies, Bitcoin and memecoins stand out as two distinct investment options. Bitcoin, the original cryptocurrency, is often seen as a stable store of value, while memecoins, driven by internet memes and cultural trends, offer a high-risk, high-reward potential. This blog will delve into the differences between Bitcoin and memecoins, highlighting why memecoins might be a better choice for those looking to create tokens and capitalize on viral trends.

Understanding Bitcoin

The Pioneer of Cryptocurrencies

Bitcoin, created by an unknown person or group of people using the pseudonym Satoshi Nakamoto, was launched in 2009. It introduced the world to the concept of a decentralized digital currency, operating without a central authority.

Key Features of Bitcoin

Decentralization: Bitcoin operates on a decentralized network of nodes, ensuring no single entity controls the network.

Limited Supply: Bitcoin has a capped supply of 21 million coins, contributing to its value as demand increases.

Store of Value: Often referred to as “digital gold,” Bitcoin is considered a hedge against inflation and a stable store of value.

Why Bitcoin?

Bitcoin’s primary appeal lies in its established reputation and widespread acceptance. It has been adopted by major companies and institutional investors as a legitimate asset class. However, Bitcoin’s slower transaction speeds and higher fees compared to newer cryptocurrencies can be a drawback.

Understanding Memecoins

What Are Memecoins?

Memecoins are a type of cryptocurrency inspired by internet memes and cultural phenomena. Unlike traditional cryptocurrencies, which are often built around technological advancements or utility, memecoins thrive on community engagement and viral marketing.

Key Features of Memecoins

Community-Driven: Memecoins rely heavily on community support and social media buzz to drive their value.

High Volatility: The price of memecoins can be extremely volatile, offering the potential for significant gains or losses in a short period.

Accessibility: Memecoins are typically low-cost and accessible, making them an attractive option for new investors.

Notable Examples of Memecoins

Dogecoin (DOGE): Started as a joke, Dogecoin has become one of the most well-known memecoins, with a strong community and high-profile endorsements.

Shiba Inu (SHIB): Often referred to as the “Dogecoin killer,” Shiba Inu has gained a massive following and established its ecosystem, including a decentralized exchange.

SafeMoon (SAFEMOON): Known for its innovative tokenomics, SafeMoon incentivizes long-term holding through a reflection mechanism that rewards holders.

Bitcoin vs. Memecoins: A Comparative Analysis

Stability vs. Volatility

Bitcoin: Stability and Security

Bitcoin’s established reputation and widespread acceptance make it a relatively stable investment compared to other cryptocurrencies. Its limited supply and broad adoption as a store of value contribute to its stability. However, this stability also means that Bitcoin’s price movements are generally less dramatic than those of memecoins.

Memecoins: High Risk, High Reward

Memecoins, on the other hand, are known for their extreme volatility. Their prices can skyrocket within hours based on social media trends or endorsements from influencers. This high volatility offers the potential for significant gains, but it also comes with substantial risk.

Community Engagement

Bitcoin: Institutional Acceptance

Bitcoin’s community includes a mix of individual investors, developers, and institutional players. Its adoption by major companies and institutional investors adds to its legitimacy and perceived stability.

Memecoins: Grassroots Movement

Memecoins thrive on grassroots community support. They often start as fun projects or social experiments, gaining traction through viral marketing and active engagement on social media platforms like Twitter, Reddit, and TikTok. This community-driven approach can lead to rapid adoption and substantial price movements.

Utility and Use Cases

Bitcoin: Digital Gold

Bitcoin is primarily viewed as a store of value and a hedge against inflation. Its use cases are limited compared to other cryptocurrencies, focusing mainly on being a decentralized alternative to traditional currencies.

Memecoins: Diverse Applications

While many memecoins start as jokes or cultural phenomena, some develop real-world use cases over time. For example, Dogecoin is used for tipping content creators and raising funds for charitable causes. Shiba Inu has its decentralized exchange, ShibaSwap, and SafeMoon incentivizes long-term holding with its innovative tokenomics.

Accessibility and Inclusivity

Bitcoin: Higher Entry Barrier

Bitcoin’s high price can be a barrier for new investors. While it is possible to buy fractional amounts of Bitcoin, the high overall value can be intimidating for those new to cryptocurrency investing.

Memecoins: Lower Entry Barrier

Memecoins are typically much more affordable, allowing new investors to buy a significant amount of tokens without a large initial investment. This lower entry barrier makes memecoins more accessible and appealing to a broader audience.

Why Memecoins Might Be the Better Choice

Potential for High Returns

The primary allure of memecoins is their potential for high returns. The viral nature of memecoins means that their prices can increase dramatically in a short period, offering substantial profits for early investors. While this potential for high returns comes with increased risk, it is a compelling reason for many investors to consider memecoins.

Community and Fun

Investing in memecoins is often seen as more fun and engaging than traditional investments. The strong community aspect, combined with the humor and creativity associated with memes, creates a vibrant and enjoyable investment environment. This community engagement can drive adoption and increase the value of memecoins.

Creating Your Own Memecoin

One of the most exciting aspects of memecoins is the ease with which new tokens can be created. Platforms like Solana offer user-friendly tools that allow anyone to create and launch their own memecoin. This accessibility empowers individuals and communities to develop their tokens, fostering innovation and creativity in the crypto space.

Innovation and Evolution

Memecoins are constantly evolving, with new projects and innovations emerging regularly. This dynamic environment offers continuous opportunities for investment and profit. As the memecoin market matures, we may see the development of more sophisticated and valuable projects, further enhancing the potential of memecoins as an investment.

Conclusion

While Bitcoin remains the gold standard in the cryptocurrency world, offering stability and security, memecoins provide a unique and potentially lucrative investment opportunity. Their high volatility, strong community engagement, and accessibility make them an attractive option for those willing to take on more risk in exchange for higher potential returns.

For those interested in creating their tokens, memecoins offer a fun and accessible way to enter the cryptocurrency market. Platforms like Solana provide the tools needed to develop and launch new memecoins, allowing anyone to participate in this exciting and rapidly evolving space.

In conclusion, while both Bitcoin and memecoins have their advantages, memecoins offer a distinct set of benefits that can make them a better choice for certain investors. By understanding the risks and rewards associated with memecoins, investors can make informed decisions and potentially achieve significant financial success in the ever-changing world of cryptocurrency.

2 notes

·

View notes

Text

Gold Prices Hold Near One-Month Highs Amid Fed Rate Cut Speculation: Market Insights and Analysis

In the dynamic world of commodities trading, gold prices have recently been a focal point, with bullion prices hovering close to one-month highs and nearing the pivotal $2,400 per ounce mark. This surge comes amidst mounting speculation that the Federal Reserve will embark on interest rate cuts as early as September, a move aimed at bolstering economic recovery amidst persistent global uncertainties.

Gold's Resilience in Current Market Dynamics

Spot gold, a reliable indicator of market sentiment, experienced a slight dip of 0.3% in Asian trading, settling at $2,384.47 per ounce. Similarly, August gold futures saw a marginal decrease of 0.2%, trading at $2,392.55 per ounce. Despite these minor corrections, the overall sentiment remains bullish, underpinned by investor optimism fueled by expectations of monetary easing by the Fed.

Broader Metals Market Movements

Alongside gold, other precious metals also displayed mixed movements. Platinum futures declined by 0.6% to $1,039.25 per ounce, reflecting varied investor sentiment within the sector. Silver futures followed suit with a 1% drop to $31.370 per ounce, illustrating divergent market dynamics in the precious metals arena.

Impact of Dollar Weakness on Metal Prices

A significant factor influencing these movements was the weakening of the US dollar, which hit a near one-month low. The inverse relationship between the dollar and commodity prices was evident as the dollar's depreciation bolstered demand for commodities priced in USD, including gold and silver.

Copper's Surprising Rally

Contrary to the downward trend in precious metals, copper futures on the London Metal Exchange surged by 1% to $9,983.0 per ton. This unexpected rally underscores copper's critical role as an industrial metal, influenced by global economic indicators and infrastructure developments.

Market Outlook and Strategic Considerations

Looking ahead, market participants are closely monitoring upcoming economic data releases and Federal Reserve announcements for further clues on interest rate adjustments. The prospect of lower interest rates typically supports non-interest-bearing assets like gold, enhancing its appeal as a safe-haven investment during uncertain economic times.

Stay Informed with Spectra Global Ltd

For comprehensive insights into market trends, strategic trading opportunities, and expert analysis on commodities and forex trading, visit Spectra Global Ltd. Our platform equips traders with the tools and information needed to navigate volatile markets effectively.

#GoldPrices#FederalReserve#InterestRateCuts#Commodities#MarketAnalysis#PreciousMetals#Copper#Silver#Platinum#TradingInsights#MarketOutlook

2 notes

·

View notes

Text

Economic Overview: Key Market Developments

Critical Update

Sudden market shifts may occur due to significant events. Monitor trading positions and implement risk management strategies during these uncertain times.

Economic Overview

As we enter a new quarter, the market faces numerous challenges. Rising war tensions, de-dollarization efforts, and upcoming elections in the U.S., France, and Iran contribute to the uncertainty. Here’s a detailed analysis of these developments and their potential impacts.

Currency Shifts

Russia’s move to use the Chinese Yuan for international trade and the increase in gold reserves by central banks are noteworthy. While the Yuan may not replace the U.S. Dollar soon, these actions indicate strategic shifts. Gold purchases serve as a hedge against potential currency volatility.

Geopolitical Conflicts

Middle East: The conflict between Israel and Hezbollah in Lebanon has intensified, with Iran warning of severe retaliation if Lebanon is attacked. Daily strikes continue, and countries like the U.S. and Germany have advised their citizens to leave Lebanon.

South China Sea: On June 19, 2024, Chinese coast guard officers attacked Philippine military personnel near the Second Thomas Shoal, escalating tensions. The U.S. has reaffirmed its defense treaty with the Philippines, which could lead to military involvement if violence escalates.

Korean Peninsula: North and South Korea are on edge, with Russia signing a defense treaty with North Korea. Border incidents and threats over South Korea’s potential troop deployment to Ukraine have heightened tensions.

Nuclear Brinkmanship: France and Russia’s nuclear brinkmanship is a significant risk, with both countries attempting to establish deterrent boundaries.

Economic and Market Effects

These conflicts could alter monetary power dynamics and supply chains. Expect increased oil demand and gold purchases as safe-haven assets. Silver demand will also rise due to its military applications.

Diplomatic Relations

Zimbabwe and Zambia: Tensions are high as Zimbabwe aligns more closely with Russia, accusing the U.S. of militarizing Zambia.

Election Updates

Iran: Presidential elections are nearing completion as candidates drop out.

France: The first stage of snap parliamentary elections is complete.

U.S.: The first debate between Biden and Trump was contentious, adding to the uncertainty of the upcoming election.

Natural Disaster Considerations

While not detailed here, it’s crucial to consider the impact of natural disasters on economic activities and implement strong risk management.

Key Market Data and Analysis

Final GDP: Increased from 1.3% to 1.4%.

Unemployment: Fell by 3k more than forecasted, indicating a stronger U.S. economy.

Core PCE: Decreased from 0.3% to 0.1%.

Consumer Confidence: Fell but remained above forecasted numbers.

Housing Market: New home sales dropped significantly, while pending home sales improved slightly but missed expectations.

GOLD

Gold prices remain within a range, with resistance at 2431.705 and support at 2295.536. A bullish trend is expected despite fluctuations.

SILVER

Silver prices showed growth, reaching 29.900 before settling at 29.018. Resistance is expected at 29.900, but an overall upward trend is anticipated.

DXY (Dollar Index)

The dollar index showed growth but may face weakness with the anticipated September rate cut. A bearish outlook is expected.

GBPUSD

The pound remains within a range. With potential rate cuts in both the U.K. and the U.S., significant price changes are unlikely in the near term.

AUDUSD

The Aussie dollar shows upward momentum but needs to break above 0.67142 to confirm this trend. Analysts predict rate cuts only in late 2025, potentially benefiting the currency.

NZDUSD

Similar to the Aussie dollar, the New Zealand dollar shows growth and may benefit from delayed rate cuts until late 2025.

EURUSD

The ECB’s cautious rate cut approach has weakened the Euro. Further cuts are expected but at a slower pace, indicating potential continued weakness.

USDJPY

Despite interventions, the USDJPY continues to grow. Watch for further interventions and economic data to gauge future movements.

USDCHF

The Swiss Franc fell after recent rate cuts. Further rate cuts are uncertain, making the USDCHF volatile.

USDCAD

The CAD showed weakness against the dollar, with analysts predicting further rate cuts. Price consolidation is expected as we await more data.

Stay informed and practice diligent risk management as we navigate these challenging market conditions. More updates to come.

2 notes

·

View notes

Text

Understanding the Core PPI and Its Impact on Currency and Gold Markets!

The Producer Price Index (PPI) serves as a vital economic indicator, shedding light on changes in the prices of finished goods and services sold by producers. However, when analyzing PPI data, one must pay close attention to the Core PPI, which excludes the volatile components of food and energy prices. This exclusion is significant because food and energy prices often exhibit erratic fluctuations that can skew the overall PPI reading.

A noteworthy shift occurred in February 2014 when the calculation formula for the Core PPI underwent a modification. This alteration aimed to provide a more accurate representation of underlying inflation trends by eliminating the influence of volatile food and energy prices.

It's crucial to recognize that food and energy prices typically constitute around 40% of the overall PPI. Consequently, when analyzing the Core PPI, which excludes these volatile components, one may find a more stable and reliable measure of inflationary pressures.

Now, let's delve into the implications of Core PPI releases on currency and gold markets.

When the Core PPI data release exceeds market expectations, it signals that inflationary pressures are building up in the economy. This can lead to an appreciation of the dollar as investors anticipate potential interest rate hikes by the central bank to curb inflation. A stronger dollar makes gold, which is priced in dollars, relatively more expensive for investors holding other currencies. As a result, the price of gold may decline in response to a stronger dollar.

Conversely, if the Core PPI data release falls below expectations, it suggests subdued inflationary pressures. In such a scenario, the dollar may weaken as investors adjust their expectations regarding future monetary policy actions. A weaker dollar tends to make gold more attractive as a hedge against currency depreciation, leading to an increase in its price.

For instance, let's consider a hypothetical scenario where the Core PPI data release indicates a higher-than-expected increase in producer prices. This prompts investors to anticipate tighter monetary policy by the Federal Reserve, causing the dollar to strengthen. Consequently, the price of gold, denominated in dollars, declines as it becomes less appealing to investors.

On the other hand, if the Core PPI data release comes in below expectations, signaling subdued inflation, investors may interpret this as a dovish signal from the central bank. In response, the dollar weakens, leading to an increase in the price of gold as investors seek refuge in the precious metal amid currency uncertainty.

In conclusion, the Core PPI serves as a crucial economic indicator that can influence both currency and gold markets. By understanding its significance and the factors driving its movements, traders and investors can make informed decisions to navigate the ever-changing landscape of financial markets.

2 notes

·

View notes

Text

The Evolution of Gold Mining Market Trends and Innovations

Introduction

The Gold Mining Industry has undergone significant evolution in recent years, driven by technological advancements, changing market dynamics, and evolving consumer preferences. In this blog, we explore the latest trends and innovations shaping the future of gold mining and their implications for stakeholders.

Technological Advancements

Technological innovation has revolutionized gold mining operations, enabling companies to extract gold more efficiently and sustainably. Advanced mining techniques, such as heap leaching, bioleaching, and in-situ leaching, have minimized environmental impact and reduced production costs. Additionally, the integration of automation, robotics, and artificial intelligence (AI) has optimized mining processes, enhanced safety, and increased productivity.

Sustainable Practices

Environmental sustainability has become a top priority for gold mining companies, driven by regulatory requirements and stakeholder expectations. Companies are implementing eco-friendly mining practices, such as reclamation and rehabilitation of mine sites, water recycling, and energy efficiency measures. Moreover, the adoption of renewable energy sources, such as solar and wind power, is reducing carbon emissions and lowering operational costs.

Market Dynamics

The gold market is influenced by various factors, including economic trends, geopolitical tensions, and currency fluctuations. Investors often turn to gold as a safe haven asset during times of uncertainty, driving demand and influencing prices. Additionally, changing consumer preferences, such as the rise of ethical consumerism and sustainable investing, are shaping demand patterns in the gold market.

Emerging Trends: Several emerging trends are shaping the future of gold mining:

Digital Transformation: The digitization of mining operations, through the use of data analytics, Internet of Things (IoT) sensors, and cloud computing, is improving efficiency and decision-making processes. Companies are leveraging big data analytics to optimize mine planning, resource allocation, and predictive maintenance.

Responsible Sourcing: Ethical sourcing and responsible mining practices are gaining traction in the gold industry. Consumers are increasingly demanding transparency and accountability in the supply chain, prompting companies to implement traceability measures and adhere to responsible sourcing standards.

Innovation Investment

To stay competitive in the evolving market landscape, Gold Mining Companies must continue to invest in innovation. Research and development initiatives are essential for developing new technologies, improving operational efficiency, and unlocking new reserves. Collaboration with industry partners, research institutions, and government agencies can accelerate innovation and drive industry-wide progress.

Conclusion

The future of gold mining is characterized by innovation, sustainability, and adaptability. As technological advancements continue to reshape the industry, companies must embrace change, invest in innovation, and adopt sustainable practices to thrive in the evolving market environment. By staying ahead of emerging trends and leveraging new opportunities, gold mining companies can position themselves for long-term success and contribute to a sustainable future.

#Gold Mining industry overview#Gold mining Industry#Global Gold Mining Market#Global Gold mining Market#Gold Mining Market Analysis#Gold Mining Market Growth#Gold Mining Market Share#Gold Mining Market Size#Gold Mining Market Trends#Gold Mining Market Value#Gold Mining Market in India#Gold Mining Market emerging trends#Gold Mining Market outlook#Gold Mining Market overview#Gold Mining Market Research reports#Gold mining Market Major players

0 notes

Text

Shining a Light on the Gold Mining Market: Trends, Growth, and Outlook

Introduction: The Gleam of the Gold Mining Market

In the intricate dance of industry and commerce, the Gold Mining Market stands as an ageless protagonist, weaving through history and economies. This exploration seeks to unearth the multifaceted dimensions of the market, shedding light on market analysis, growth trajectories, market share dynamics, size, trends, value, research reports, challenges, and the emergent trends shaping the glittering landscape of gold mining.

Gilded Growth: Gold Mining Market Growth

The heartbeat of the gold mining industry resonates in the rhythm of Gold Mining Market Growth. Beyond mere extraction figures, this growth encapsulates the industry's expansion into new territories, embracing technological advancements, and adapting to the ever-evolving global economic landscape. The global gold mining market is forecasted to grow at a robust CAGR of 4.5% from 2023 to 2028. Investments in gold mining exploration projects have surged by 20% in the last fiscal year.

Claiming Market Share: Dynamics in Gold Mining

Securing a slice of the pie is strategic in the Gold Mining Market Share arena. It's not merely about ounces mined; it's about which players wield the most significant influence. This intricate dance of market share dynamics reveals the dominance of key players and the evolution of competition within the global gold mining landscape. Major gold mining companies, including Barrick Gold and Newmont, collectively command over 40% of the global gold mining market share.

Sizing Up the Gold Rush: Gold Mining Market Size

The Gold Mining Market Size is not just a metric; it's a reflection of the industry's impact on economies and markets. Understanding this size is crucial for gauging the market's significance in the broader context of global trade and finance. The current global gold mining market size is estimated at USD 120 billion, with projections indicating a rise to USD 150 billion by 2025.

Gazing at Trends in the Gold Pan: Gold Mining Market Trends

Trends in the Gold Mining Market Trends segment are like veins of rich ore, guiding industry players toward prosperity. From sustainable mining practices to the integration of cutting-edge technologies, staying attuned to trends is essential for gold mining enterprises navigating the ever-evolving dynamics of the market. The adoption of blockchain technology in gold supply chains has witnessed a 25% increase in the last two years.

Golden Valuation: Gold Mining Market Value

Beyond the tangible ounces extracted, the Gold Mining Market Value encompasses the economic worth attributed to the industry. This valuation reflects not just the market price of gold but also the economic contributions made by the gold mining sector. The total market value of gold produced in 2022 exceeded USD 200 billion, underscoring the enduring allure of this precious metal.

Prospecting through Reports: Gold Mining Market Research Reports

The landscape of gold mining is further illuminated by Gold Mining Market Research Reports. These reports delve into market trends, player strategies, and future projections. They serve as invaluable tools for industry stakeholders making strategic decisions within the dynamic realm of gold mining. Research reports indicate a surge in demand for sustainable gold mining practices, with an expected 30% increase in adoption by 2025.

Challenges in the Gold Veins: Gold Mining Market Challenges

Amidst the glitter of gold, challenges lie in the veins of the Gold Mining Market Challenges segment. From environmental concerns to regulatory hurdles, navigating these challenges is crucial for sustainable and responsible mining practices. Compliance costs for gold mining operations have witnessed a 15% increase due to stricter environmental regulations.

Emerging Trends in the Gold Rush: Gold Mining Market Emerging Trends

As the industry continues to evolve, the Gold Mining Market Emerging Trends segment reveals nascent patterns that could shape the future. From the rise of decentralized mining operations to innovations in extraction technologies, keeping an eye on emerging trends is pivotal for industry players positioning themselves for the next wave of the gold rush. Investments in eco-friendly gold extraction technologies have doubled in the last three years, reflecting a growing emphasis on sustainable mining practices.

Conclusion: Navigating the Golden Currents of Tomorrow

In the final reckoning, the Gold Mining Market isn't merely about extracting a precious metal; it's about navigating currents of trends, challenges, and emerging dynamics. From growth trajectories influencing strategic decisions to research reports providing insights, each facet contributes to the resilient evolution of the gold mining industry. As we move forward, embracing sustainable practices, overcoming challenges, and exploring emerging trends, the Gold Mining Market remains a cornerstone in the economic landscape, its allure enduring through the ages.

#Gold Mining Industry#Global Gold Mining Market#Gold Mining Market Analysis#Gold Mining Market Growth#Gold Mining Market Share#Gold Mining Market Size#Gold Mining Market Trends#Gold Mining Market Value#Gold Mining Market in India#Gold Mining Market#Gold Mining Market Challenges#Gold Mining Market Emerging Trends#Gold Mining Market Outlook#Gold Mining Industry Research reports#Gold Mining Market Research reports#Gold Mining Market Major players

0 notes

Text

4 Trade Ideas for Caterpillar: Bonus Idea

Caterpillar, $CAT, comes into the week pushing over short term resistance. This move comes off a touch at the 200 day SMA for the first time since November and 38.2% retracement of the last leg higher. It ended Friday over the 50 day SMA with the RSI rising through the midline and the MACD curling to cross up, but negative. There is resistance at 341.50 and 351 then 363 and 372.50 before 382. Support lower is at 335 and 330 then 325. Short interest is low at 2.2%. The stock pays a dividend with an annual yield of 1.67% and has traded ex-dividend since July 22nd.

The company is expected to report earnings next on October 29th. The August options chain shows biggest open interest at the 340 then 325 put strikes and at 330 on the call side. The September chain has open interest from 360 to 250, biggest at 290 on the put side. The call side is biggest at 330. The October chain is biggest at the 310 put and then 390 call strikes. Finally, the November chain, covering the earnings report, is big from 300 to 290 on the put side and builds from 320 to a peak at 380 on the call side.

Caterpillar, Ticker: $CAT

Trade Idea 1: Buy the stock on a move over 339 with a stop at 325.

Trade Idea 2: Buy the stock on a move over 339 and add a September 330/320 Put Spread ($3.15) while selling the October 380 Call ($3.00).

Trade Idea 3: Buy the September/October 360 Call Calendar ($4.00) while selling the October 300 Put ($3.55).

Trade Idea 4: Buy the November 310/340/360 Call Spread Risk Reversal (25 cents).

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the first week of August in the books, sees equity markets showing resilience with a rebound from an ugly start induced by growing narrative of recessionary fears.

Elsewhere look for Gold to continue its uptrend while Crude Oil consolidates in a narrowing range. The US Dollar Index continues to drift in broad consolidation while US Treasuries consolidate in their downtrend. The Shanghai Composite looks to continue the short term trend lower while Emerging Markets consolidate under long term resistance.

The Volatility Index looks to have settled after a spike to 4 year highs removing the pressure on equity markets for now. The SPY and QQQ ETF charts continue to look strong on the longer timeframe. On the shorter timeframe both the QQQ and SPY have reset on momentum measures but also have a lot of upside work to put in before they are looking strong. The IWM is now just in consolidation mode again after a failed break higher. Use this information as you prepare for the coming week and trad’em well.

16 notes

·

View notes

Text

The 24K Golden Rose

Deliverable

The 24K Golden Rose Deliverable: A Review Worth Reading

Introduction

In a world where gift options abound, the 24K Golden Rose Deliverable stands out as a beacon of elegance and sentiment. As online markets flood with choices, it becomes increasingly important to discern the exceptional from the ordinary. This review aims to guide you through the facets of the 24K Golden Rose, providing insights into its craftsmanship, symbolism, and overall value.

Unboxing Experience

The journey begins with the unboxing experience. As the package is unwrapped, the 24K Golden Rose reveals itself in all its glory. The initial impressions set the tone for what promises to be a unique and luxurious encounter.

Design and Craftsmanship

Delving into the intricacies of design, the golden rose captivates with its meticulous craftsmanship. Each petal and stem tell a story of dedication to artistry, elevating it from a mere deliverable to a work of art.

Material Quality

A close examination of the material used in the 24K Golden Rose reaffirms its commitment to quality. The use of genuine gold ensures not only a stunning appearance but also long-term durability, making it a timeless keepsake.

Symbolism and Significance

Beyond its aesthetic appeal, the 24K Golden Rose carries profound symbolism. We explore the occasions and events where gifting this golden marvel becomes a gesture of profound significance.

User Experience

Personal experiences with the 24K Golden Rose attest to its user-friendly design. Whether displayed as an ornament or held as a token, the deliverable offers a delightful user experience.

Comparison with Similar Products

In a market flooded with choices, how does the 24K Golden Rose fare? A comparative analysis sheds light on its unique features, distinguishing it from similar products.

Customer Reviews and Testimonials

Real user feedback provides valuable insights. We gather perspectives from those who have experienced the 24K Golden Rose, shedding light on its strengths and potential areas for improvement.

Pricing and Value for Money

Is the 24K Golden Rose a worthwhile investment? We break down its pricing against the backdrop of its features, helping you gauge its value for money.

Maintenance and Care Tips

Ensuring the longevity of the 24K Golden Rose requires proper care. Practical tips guide users on maintaining its pristine appearance over time.

Occasions to Gift the 24K Golden Rose

When is the perfect time to present this golden treasure? We offer suggestions for occasions, accompanied by insights into customization options for specific events.

Social Media Buzz

Exploring the social media landscape reveals trends related to the 24K Golden Rose. User-generated content and hashtag campaigns contribute to its growing popularity.

Where to Buy

Authenticity is paramount when purchasing luxury items. We provide information on reputable sellers and official outlets, guiding you to secure your 24K Golden Rose from trusted sources.

FAQs About the 24K Golden Rose

Is the gold real?

Dive into the authenticity of the gold used in the 24K Golden Rose.

Can it be customized for special occasions?

Explore options for personalizing the deliverable for unique events.

How should I clean and maintain the golden rose?

Practical tips for ensuring the longevity of your cherished possession.

What makes the 24K Golden Rose stand out from other gifts?

Highlighting unique features that make it a standout choice.

Is there a warranty or guarantee provided with the purchase?

Understanding the after-sales support and assurance.

Conclusion

In conclusion, the 24K Golden Rose emerges not just as a deliverable but as a symbol of timeless elegance. From its exquisite design to its symbolic value, this review highlights the facets that make it a worthwhile addition to your collection or a thoughtful gift for someone special.

#sza#justin bieber#benny blanco#snooze#music#fashion#playlist#new music#apple music#black girl magic#woody mcclain#young mazino#bradley j calder#sza sos#sza ctrl#sza lyrics#sex playlist#shes so gorgeous#she is so hot#music video production#behind the scenes#black celebrities#black is beautiful#black women are everything#shes the moment#that girl#r&b#r&b music#r&b singer#<33333

3 notes

·

View notes