#Gst filing software

Explore tagged Tumblr posts

Text

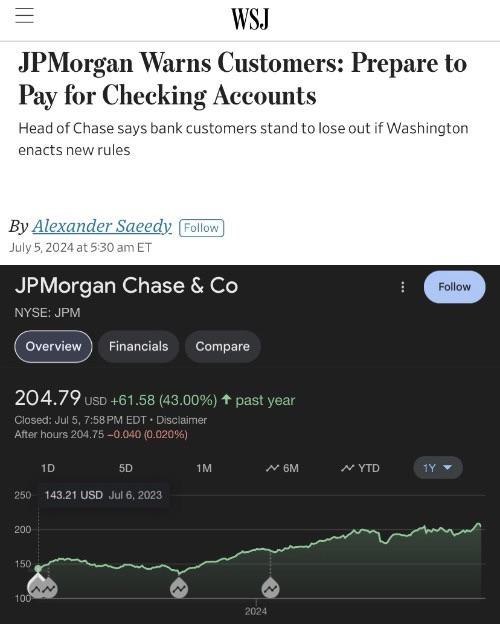

THINK OF THE SHAREHOLDERS.

#THINK OF THE SHAREHOLDERS.#shareholders#eat the rich#eat the fucking rich#jpmorgan#class war#chase bank#exploitation#exploitative#gst registration#gstfiling#gst accounting software for retail#gstreturns#gst#property taxes#us taxes#death and taxes#filing taxes#taxes#tax#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government

3 notes

·

View notes

Text

CompuTax GST Software – File Accurate GST Returns Instantly

File GST returns with ease using CompuTax GST software. Designed for seamless invoice tracking, returns, and audit trails.

0 notes

Text

Why GST Software is a Must-Have for Professionals in 2025

In today’s dynamic tax landscape, managing GST compliance efficiently is crucial for businesses, tax professionals, and accountants. With frequent regulatory changes and the complexity of GST returns, relying on manual processes can be time-consuming and error-prone. This is where GST software for professionals comes into play.

What is GST Software for Professionals?

GST software for professionals is specifically designed to simplify GST return filing, reconciliation, and compliance for CAs, tax consultants, and accountants. It automates the entire process, ensuring accuracy, saving time, and reducing penalties due to manual errors.

2A and 2B Reconciliation Made Easy

One of the most critical and complex parts of GST filing is the reconciliation of GSTR-2A and GSTR-2B with your purchase records. 2A reconciliation software and 2B reconciliation software help tax professionals quickly match the Input Tax Credit (ITC) available in GST portals with purchase registers. This automation eliminates mismatches, ensures maximum ITC claims, and reduces the chances of GST notices.

Benefits of Using 2A/2B Reconciliation Software:

Real-time mismatch detection

Bulk data reconciliation

Vendor-wise mismatch reports

Improved ITC accuracy

Why You Need GST Return Filing Software?

Filing GST returns manually involves the risk of errors and missed deadlines. GST return filing software streamlines the filing process, auto-populates data, provides return status updates, and integrates with accounting systems. This ensures that every GST-registered business or professional meets compliance requirements effortlessly.

Features of Best GST Filing Software:

Auto-import of GSTR data from the GSTN portal

Error detection before filing

Easy handling of multiple GSTINs

Dashboard for return status tracking

How to Choose the Best GST Software?

When selecting the best GST filing software, professionals should look for:

User-friendly Interface: Easy to operate even for non-tech users.

High-Speed Reconciliation: Ability to process bulk data quickly.

Comprehensive Reports: For audits and departmental scrutiny.

Regular Updates: As per the latest GST amendments.

Affordability & Scalability: Suitable for both small firms and large enterprises.

Conclusion

Incorporating a robust GST software for professionals ensures seamless GST return filing, effortless 2A/2B reconciliation, and complete tax compliance. Investing in the best GST filing software not only enhances efficiency but also provides peace of mind by reducing the risks associated with GST management.

If you're looking for a feature-rich and reliable GST solution, explore options that offer 2A/2B reconciliation and automated GST return filing in one unified platform.

#gst software for professionals#2B reconciliation software#2a reconciliation software#gst return filing software#best gst filing software#Gst Software

0 notes

Text

GST Compliance in India: Complete Guide for Businesses

Goods and Services Tax (GST) is a unified indirect tax that has transformed the Indian taxation system. But with its dynamic framework and frequent updates, staying compliant is not just mandatory—it’s a competitive advantage.

This guide breaks down everything you need to know about GST compliance, its applicability, key processes, penalties, and answers to common questions.

What is GST Compliance?

GST compliance refers to timely and accurate adherence to all GST rules, regulations, and filing requirements under the Goods and Services Tax law. It ensures that a business:

Files returns on time

Reconciles input and output tax correctly

Issues valid tax invoices

Complies with e-invoicing and e-way bill norms

Avoids penalties, interest, and departmental notices

Who Needs to Be GST Compliant?

Businesses are required to register under GST and follow compliance provisions if they meet any of the following conditions:

Criteria

Threshold (as of current rules)

Aggregate Turnover (Goods - Normal)

₹40 Lakhs (₹20 Lakhs in special category states)

Aggregate Turnover (Services)

₹20 Lakhs (₹10 Lakhs in special category states)

Interstate supply or e-commerce

Mandatory registration irrespective of turnover

Casual taxable person / Input Service Distributor / Non-resident taxable person

Mandatory GST registration

Key Components of GST Compliance

1. Return Filing

GSTR-1 – Monthly/quarterly outward supply return

GSTR-3B – Summary return of outward and inward supplies

GSTR-9 – Annual return

GSTR-9C – Reconciliation statement (if applicable)

2. Reconciliation

Matching books of accounts with GSTR-2A/2B, GSTR-1 vs 3B

Identifying mismatches in ITC and outward tax liability

3. Input Tax Credit (ITC) Optimization

Availing eligible ITC under Section 16 of CGST Act

Ensuring suppliers have filed GSTR-1

Reversals under Rule 42, 43, or ineligible ITC

4. E-Invoicing & E-Way Bill

Mandatory for businesses with turnover > ₹5 Cr (e-invoicing)

Ensuring movement of goods is supported by valid E-Way Bills

5. Registration & Amendments

Timely registration of business

Updating PAN, address, authorized signatories on GST portal

6. Responding to Notices

Proper documentation & timely reply to notices (like DRC-01, ASMT, etc.)

Avoiding litigation through proactive compliance

Why GST Compliance is Crucial

Avoids Penalties & Interest Delayed or wrong filings attract heavy fines and interest.

Ensures Seamless ITC Flow Non-compliance by your supplier can block your input credit.

Enhances Business Reputation Clean compliance record builds trust with clients, vendors & authorities.

Prepares You for Audits & Assessments Ensures you're ready for GST audits or departmental scrutiny.

Penalties for Non-Compliance

Nature of Default

Penalty

Late filing of returns

₹50/day (₹20/day for Nil returns)

Wrong ITC claim

Interest + Penalty under Sec 73/74

Not issuing invoice

₹10,000 or amount of tax evaded (whichever higher)

Not registering under GST

100% tax due or ₹10,000 (whichever higher)

FAQs on GST Compliance

Q1. What are the due dates for GST return filing?

GSTR-1: 11th of the next month / quarterly (IFF)

GSTR-3B: 20th, 22nd, or 24th depending on state

GSTR-9: 31st December following the financial year

Q2. Is GST applicable to freelancers and consultants?

Yes. If your income exceeds ₹20 lakh (₹10 lakh in special category states), GST registration is mandatory for service providers.

Q3. Can I claim ITC if the supplier hasn’t filed GSTR-1?

No. As per Rule 36(4), ITC can only be claimed if it appears in GSTR-2B, which is populated from supplier’s GSTR-1.

Q4. Is GST applicable to export of services?

Export of services is treated as zero-rated supply under GST, but you must file LUT or claim refund of ITC or IGST.

Q5. What is the penalty for wrong ITC claim?

If claimed in good faith – interest @18% p.a. If found fraudulent – 100% penalty + prosecution under Section 74.

Final Word

GST compliance is not just about return filing. It’s about building a robust tax governance system that aligns with changing regulations, prevents revenue leakage, and keeps your business audit-ready.

With ever-increasing departmental scrutiny and real-time data integration, staying compliant is a business necessity.

#gst services#gst registration#company registration#finance#gst billing software#gst return filing#tax

0 notes

Text

Career in e-Accounting? Here’s Why Busy Software Should Be Your Next Step

Introduction

In today’s fast-evolving business landscape, the need for skilled professionals in e-Accounting is higher than ever. From managing complex financial records to filing GST returns, companies are increasingly looking for candidates who are well-versed in accounting software. While Tally remains a popular name in the accounting world, Busy Accounting Software is rapidly gaining recognition for its user-friendly interface and advanced features—especially when it comes to GST, inventory, and multi-location business management.

If you're planning to build a career in e-Accounting, mastering Busy Software can give you a competitive edge.

What is Busy Accounting Software?

Busy Software is a powerful business accounting tool tailored for small to medium-sized enterprises (SMEs). Unlike basic accounting tools, Busy integrates accounting, inventory, billing, taxation, and payroll into one comprehensive platform. It's especially effective for businesses that require detailed financial analysis and real-time reporting.

Busy is an excellent next step after learning tools like Tally ERP 9 or Tally Prime, which are taught in top-rated institutions offering Tally classes in Yamuna Vihar and Tally classes in Uttam Nagar.

Why Busy Software is Ideal for e-Accounting Professionals

1. Integrated GST Functionality

Busy offers a fully integrated GST accounting solution, making it easier to manage GST billing, filing, and returns. It automatically prepares GSTR-1, GSTR-2, and GSTR-3B forms and stays up-to-date with the latest compliance rules. If you’re already enrolled in a GST certification course in Delhi, complementing your learning with Busy will enhance your practical skill set.

Students interested in the GST Coaching Centre in Yamuna Vihar or the GST Training Institute in Uttam Nagar should consider pairing their training with Busy Software knowledge.

2. Multi-Company and Multi-Branch Handling

One of Busy’s strengths lies in its ability to handle multiple companies and branches—perfect for accountants working in corporate setups. It also includes features like role-based access, real-time data sync, and advanced reporting, making it a go-to tool for professionals managing large data sets.

Boost Your Career with Busy: The e-Accounting Advantage

Most e-Accounting courses in Yamuna Vihar and e-Accounting training in Uttam Nagar focus on industry-standard software. Adding Busy to your learning path after completing a Tally course in Yamuna Vihar or Tally course in Uttam Nagar makes you industry-ready and more employable.

If you’ve already completed your e-taxation training in Delhi or taken up an e-filing course in Yamuna Vihar, learning Busy will help you execute those skills with better efficiency.

Learning Path for Students: From Tally to Busy

Here’s a suggested learning roadmap for students looking to make a career in financial e-Accounting:

Start with Basics: Enroll in a Tally Prime Course in Yamuna Vihar or Tally Prime Course in Uttam Nagar.

Understand Taxation: Take up an e-taxation course in Uttam Nagar or GST return course in Delhi to grasp practical tax knowledge.

Advance to Busy Software: Specialize in Busy for integrated e-accounting, GST filing, inventory, and payroll.

You can also download free Tally study material, Tally ERP 9 eBooks, and explore Tally ERP 9 video tutorials to reinforce your foundation before transitioning to Busy.

Why Busy Software Makes You Job-Ready

Today, companies are hiring candidates who are trained in practical accounting environments. Busy allows students to simulate real business scenarios, which are also taught during payroll courses in Yamuna Vihar or tax filing courses in Uttam Nagar.

Whether you’re enrolled in a Tally Training Institute in Yamuna Vihar or a GST Training Institute in Uttam Nagar, learning Busy makes you a multi-software expert, which is a valuable asset in today’s job market.

Final Thoughts

The future of e-Accounting is digital, and mastering Busy Accounting Software is a smart move for any student or working professional. From GST compliance to inventory management, Busy offers the tools that modern accountants need.

If you’re serious about building a strong career in finance, don’t stop at just a Tally institute in Yamuna Vihar or a GST course in Uttam Nagar. Go a step further and invest in learning Busy—because that’s where the future of financial e-accounting lies.

Suggested Links:

Tally Prime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

#tally master#tally prime#e-accounting#financial education#skills development#accounts#busy software#GST#e-filing

0 notes

Text

GSTrobo® by Binary Semantics – Advanced GST Compliance & Automation Software

GSTrobo® is a powerful automated GST software by Binary Semantics designed for effortless GST return filing, invoice reconciliation, and compliance. With smart features like real-time data syncing, intelligent matching, and error detection, GSTrobo simplifies complex GST processes for businesses and tax professionals. Stay GST compliant with minimal effort.

1 note

·

View note

Text

GST RETURN

0 notes

Text

GST Filing Services Noida

Get hassle-free GST Filing Services in Noida with Archstone Advisors. Expert assistance for GST returns, compliance, and registration. Ensure timely and accurate filing. Contact us today!

#gst compliance#gst registration#gst services#gst billing software#income tax#tax#gst#trademark#GST Filing Services Noida#GST Filing Services#GST Filing

0 notes

Text

GST Portal Not Working? Filing Tips and Deadline News

You are not alone if you have been attempting to file your GSTR-1 returns but have been unable to do so due to the GST portal being unavailable. Many taxpayers were frustrated by the website's technological problems as the filing deadline drew near.

What Happened?

The GST portal declared that they would be doing maintenance on January 10, 2025, from midnight to three o'clock. This suggested that no services were available at the time.

The following was stated in the message:

"Downtime was planned! The services offered by the website are being improved. On January 10, the services will not be available from 12:00 AM to 3:00 PM."

They said that users who had any questions should get in touch with their help staff.

Extended Deadline for Filing

The government has extended the GSTR-1 and GSTR-3B return filing deadline by two days, which is good news. This extension will provide you more time to file without fear of penalties.

What People are Saying

Many taxpayers raised concerns online:

"They should tell us about these problems earlier!"

"Will there be penalties if the portal wasn't working?"

"Why does this happen near every deadline?"

What You Can Do:

If you're having trouble logging in or filing, here's how to solve it:

Keep an eye out for developments on CBIC and GST notifications.

Prepare your returns offline so you can upload them when the portal is operational.

Use tools such as ClearTax GST login to make filing easier.

Contact the GST helpline if necessary (but it may be busy).

Important Points

After being unavailable for maintenance, the GST website is now back up and running.

There is a two-day extension in the GSTR-1 deadline.

To prevent problems, stay informed and submit your returns as soon as you can.

0 notes

Text

TRIRID Biz Smart Billing and Accounting Software for Growing Businesses

TRIRID Biz-Managing your business finances made easy with smart billing and accounting software designed to empower growing businesses. Whether you're a startup, small business or scaling to the next level, TRIRID Biz offers an intuitive, powerful solution to automate and streamline your financial processes.

Main features:

Effortless invoicing: Create, send and track professional invoices in a few clicks.

Expense Management: Easily track and categorize business expenses to maintain accurate financial records.

Real-Time Financial Insights: Get a clear, up-to-date picture of your cash flow, profit and loss and more with easy-to-understand reports.

Tax Compliance: Be tax-ready with automatic calculations and tax reports tailored to your region.

Cloud-based access: Secure, cloud-powered software ensures your data is always accessible – anytime, anywhere.

Payment Integration: Seamlessly integrate with popular payment gateways to accept payments quickly and securely.

Why choose TRIRID Biz?

Saves time: Automate time-consuming tasks like invoicing and expense tracking so you can focus on growing your business.

Reduces errors: Reduce human errors and discrepancies with automated financial processes and real-time data synchronization.

Scalable: Whether you're just starting out or expanding rapidly, TRIRID Biz grows with your business needs.

Secure and reliable: Your financial data is protected with top-tier encryption and secure cloud storage.

TRIRID Biz is more than just accounting software – it's your holistic financial management solution that helps you stay organized, consistent and in control.

Make smarter decisions, improve cash flow and accelerate your business growth with TRIRID Biz. Start your free trial today and see the difference!

For More Information:

Call @ +91 8980010210 / +91 9023134246

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#Best accounting software in Ahmedabad Gujarat#Best software for GST filing in Gujarat#GST accounting software for Indian businesses#TRIRID-Billing software in Bopal in Ahmedabad#TRIRID-Billing software in Iscon-Ambli road-ahmedabad

0 notes

Text

Global Taxman india Ltd - Our Services

Business Registrations

GST registration

MSME Registration

Importer License

FSSAI Registration

Shop Act Registration

Trademark

ISO Registration

ESIC/EPF

Services Area

Ranchi

Delhi NCR

Ghaziabad

Patna

Company Registrations

Private Limited Company

One Person Company

Nidhi Company

Section 8 Company

Startup Registration

Producer Company

Public Limited Company

Sole Proprietorship

Partnership Registration

MCA Compliances

ROC Annual Filing

GST Return Filing

Audit of Business

Income Tax Return (ITR)

Quick Links

Home

About

Contact

career

Team

Blog

Portfolio

Site Map

All Services

Frequently Asked Questions

CA

More Services

Our Office Locations

Bihar Jharkhand

Delhi Uttar Pradesh

Ghaziabad Office Address

+91-9811099550 +91-9911878735

C-19, Second Floor, near Vasundhara Hatt Complex, Sector 13, Vasundhara, Ghaziabad, Uttar Pradesh 201012

#accounting#finance#success#gst registration#taxation#gst#itr filing#company registration#marketing#economy#business growth#business development#business listings#startup#sales#services#business news#gstfiling#accounting services#gst compliance#gstreturns#chartered accountant#income tax#gst billing software#ahmedabad#income tax filing

0 notes

Text

What is GST Simulation Software? A Complete Guide

The introduction of Goods and Services Tax (GST) has transformed tax systems worldwide, simplifying taxation while posing new challenges for businesses, particularly in compliance and accurate tax calculation. GST Simulation Software has become an invaluable tool for businesses of all sizes, providing a digital solution to manage GST calculations, reporting, and compliance. But what exactly is GST Simulation Software, and how can it help organizations? In this comprehensive guide, we’ll dive into everything you need to know about GST Simulation Software, its benefits, features, and how to choose the right software for your business.

Table of Contents

What is GST Simulation Software?

How Does GST Simulation Software Work?

Key Features of GST Simulation Software

Benefits of Using GST Simulation Software

Types of GST Simulation Software

Common Applications of GST Simulation Software

How to Implement GST Simulation Software in Your Business

Tips for Choosing the Right GST Simulation Software

Top GST Simulation Software in the Market

Potential Challenges with GST Simulation Software

Conclusion

1. What is GST Simulation Software?

GST Simulation Software is a digital tool designed to automate and simplify GST-related tasks. It helps businesses calculate and simulate their GST obligations based on the current GST rates, laws, and regulations. By using this software, companies can predict their GST liabilities, prepare for tax filings, and avoid costly errors in tax reporting.

This software is particularly useful for businesses operating in multiple tax jurisdictions, as it incorporates region-specific rules and automates compliance, reducing the risk of human error. Essentially, GST Simulation Software ensures that businesses adhere to tax laws while simplifying the process of managing their tax obligations.

2. How Does GST Simulation Software Work?

GST Simulation Software uses real-time data and rule-based algorithms to calculate and simulate GST. The software typically integrates with a company’s accounting or ERP system, enabling it to access financial data directly. Based on this information, it applies GST rates to different transactions, depending on the nature of goods and services, jurisdiction, and applicable exemptions.

Many GST Simulation Software platforms are powered by machine learning and artificial intelligence, which allow them to stay up-to-date with changing tax regulations and predict GST amounts accurately. By running various simulations, businesses can get insights into their potential tax liabilities and prepare accordingly.

3. Key Features of GST Simulation Software

While the features of GST Simulation Software can vary, here are some common ones that help businesses manage their GST obligations efficiently:

Automated Calculations: Calculates GST based on applicable tax rates, making it easier to handle complex transactions.

Multi-Jurisdiction Compliance: Supports multiple regions and jurisdictions, ensuring the right rates and rules are applied for each location.

Real-Time Reporting: Provides up-to-date reports on tax liabilities, helping companies stay compliant and informed.

Data Integration: Integrates with accounting and ERP systems for seamless data transfer and accurate calculations.

Customizable Dashboards: Allows users to customize reports and dashboards to view important metrics at a glance.

Error Detection: Identifies discrepancies and errors in tax calculations to reduce risk and ensure accuracy.

User-Friendly Interface: Many tools offer easy-to-navigate interfaces that make it simple for users of all experience levels.

4. Benefits of Using GST Simulation Software

Using GST Simulation Software offers several benefits, including:

a) Enhanced Compliance

With automated updates to tax laws and regulations, businesses can stay compliant without constantly monitoring changes manually. This reduces the risk of non-compliance, which can lead to penalties.

b) Time Efficiency

Manual GST calculations are time-consuming, especially for large businesses with extensive transactions. GST Simulation Software automates these tasks, saving valuable time for finance teams.

c) Accuracy and Reduced Errors

By using rule-based calculations, the software ensures accuracy in GST simulation, minimizing the chance of human error in tax calculations.

d) Cost Savings

Automating GST management with software reduces the need for dedicated tax specialists and minimizes potential fines, leading to significant cost savings.

e) Data-Driven Insights

Many GST Simulation Software tools come with analytics capabilities, providing insights into GST trends and helping companies make data-driven decisions.

5. Types of GST Simulation Software

There are several types of GST Simulation Software tailored to different business needs:

a) Cloud-Based GST Software

This type of software is hosted on the cloud, offering easy access from any device and reducing the need for on-premise infrastructure. It’s suitable for businesses that require flexibility and scalability.

b) On-Premise GST Software

On-premise GST Simulation Software is installed on a company’s local servers, giving them complete control over their data. It’s a better fit for businesses with specific security or customization requirements.

c) Hybrid GST Software

Hybrid software combines elements of both cloud and on-premise solutions, giving companies the flexibility to manage certain operations in-house while using cloud capabilities for other tasks.

d) Industry-Specific GST Software

Some software solutions are designed for specific industries with unique GST requirements, such as manufacturing, retail, or healthcare. These solutions are tailored to meet the distinct needs of these industries.

6. Common Applications of GST Simulation Software

GST Simulation Software is versatile and can be used in various applications:

Tax Calculation: Calculate GST on individual transactions based on product type, jurisdiction, and other factors.

GST Return Preparation: Generate reports required for GST returns, simplifying the filing process.

Audit Support: Generate detailed reports and maintain records for audits.

Financial Forecasting: Predict future tax liabilities based on simulated scenarios and projected financial performance.

Scenario Analysis: Run simulations to understand how changes in tax laws or rates might impact your business.

7. How to Implement GST Simulation Software in Your Business

Implementing GST Simulation Software involves several steps:

Identify Your Business Needs: Determine the specific needs of your business and the type of software that best fits those needs.

Evaluate Software Options: Research different software providers, looking at features, compatibility, and cost.

Plan for Integration: Ensure the software integrates seamlessly with your existing systems, such as your ERP or accounting software.

Training and Onboarding: Train your staff on how to use the software effectively.

Monitor and Optimize: Regularly assess the software’s performance and make adjustments as needed to maximize efficiency.

8. Tips for Choosing the Right GST Simulation Software

Choosing the right GST Simulation Software can be overwhelming with so many options on the market. Here are a few tips:

Understand Your Budget: Choose software that fits within your budget but still provides the features you need.

Look for Scalability: Select software that can grow with your business, especially if you plan on expanding operations.

Check for Customer Support: Look for providers that offer comprehensive customer support to help with setup, troubleshooting, and maintenance.

Consider Security Features: Ensure the software has robust security features, particularly if handling sensitive financial data.

Evaluate Usability: Opt for software that is user-friendly and provides an intuitive interface for your team.

9. Top GST Simulation Software in the Market

Here’s a look at some of the top GST Simulation Software currently available:

Zoho Books: Known for its user-friendly interface and strong integration capabilities, Zoho Books is ideal for small to medium-sized businesses.

Tally ERP 9: Popular in various regions, especially India, Tally ERP 9 offers robust GST capabilities and a comprehensive set of features for accounting and compliance.

QuickBooks: This software provides excellent GST simulation features, along with a range of accounting tools for small businesses.

SAP GST Solutions: SAP provides a high-level GST simulation solution suitable for large corporations needing extensive customization.

10. Potential Challenges with GST Simulation Software

While GST Simulation Software offers many benefits, there are potential challenges to be aware of:

Initial Setup Costs: Some software may require a significant upfront investment, particularly for on-premise solutions.

Training Requirements: Employees may need time and training to learn the new software, which could temporarily impact productivity.

Data Security: Cloud-based solutions need to ensure data protection to prevent unauthorized access or breaches.

Continuous Updates: GST regulations change frequently, and if the software is not updated promptly, it could lead to inaccuracies in calculations.

GST Simulation Software is an essential tool for businesses navigating the complexities of Goods and Services Tax. By automating tax calculations, providing real-time reporting, and ensuring compliance, it empowers organizations to manage their GST obligations with greater accuracy and efficiency. While the initial investment and training requirements can be challenging, the long-term benefits in terms of time, cost savings, and data accuracy make it a worthwhile consideration for any business subject to GST regulations. When selecting GST Simulation Software, businesses should carefully assess their specific needs, budget, and desired features to choose a solution that supports their tax management goals effectively.

For More Details Visit us

StudyAccounts.com

#GST simulation software#GST filing simulation software#GST simulation software for institutes#ITR simulation software#Income tax simulation software#Gulf VAT simulation software#TDS Simulation Software#TAX Simulation Software for institutes

0 notes

Text

Looking GST Return filing servicec in delhi contact taxring professional , reach out CA office in delhi , Nirman Vihar , near metro station - Contact us

Registered Taxpayers: All businesses registered under GST must file returns, regardless of their turnover.

Composition Scheme Taxpayers: Businesses opting for the Composition Scheme are required to file GST returns quarterly and an annual return.

Non-Resident Taxable Persons: Non-resident entities making taxable supplies in India must file GST returns.

E-Commerce Operators: Platforms facilitating sales through e-commerce must file GST returns for the supplies made through them.

Input Service Distributors: Businesses distributing input tax credit to their branches must file returns.

Taxpayers under Zero-Rated Supplies: Exporters and businesses involved in zero-rated supplies need to file returns to claim refunds.

Suspended or Canceled Registrations: Even if a taxpayer's GST registration is suspended or canceled, they are required to file returns for the period they were active.

Annual Returns: All registered taxpayers must file an annual return, irrespective of the type of registration.

These requirements ensure compliance with GST regulations and accurate reporting of sales, purchases, and tax liability.

#who should file gst return#how to file gst return#gst return filing#gst return filing status#gst return filing date#gst return filing process#gst return filing online#gst return filing fees#gst return filing due date#gst return filing dates#gst return filing fees by ca#gst return filing course#gst return filing software#gst return filing charges#check gst return filing status#gst return filing images#gst return filing services#what is gst return filing#gst return filing procedure#gst return filing course free#gst return filing process step by step pdf#gst return filing status check

0 notes

Text

🚨 Special All India Drive Against Fake GST Registrations 🚨

The Indian government has launched a nationwide crackdown on fake GST registrations. It's crucial to ensure your compliance to avoid hefty penalties. 💼💰 🔍 Why This Matters: - Protect your business from legal consequences. - Ensure your GST registration is valid and up-to-date. - Stay ahead of the curve with proper documentation and filings. 📍 For more information and support, visit the AJMS Global office in Jaipur. Our experts are here to guide you through the process and ensure full compliance. Don't take any risks—get the right advice today!

📞 Contact Us: https://wa.link/8zz9db

Landline: 0141-4812238 - Mobile: +91-7303587271

#tax managed services#gst services#gst compliances#gst registration#india gst#gst filing 2024#accounting services#company registration#investing#gst accounting software

0 notes