#Higher Education Student Loans

Text

Study Abroad Application Process

A Brief Guide

Study Abroad Application Process: A Brief Guide

Pursuing education abroad can be a transformative experience, offering exposure to diverse cultures, innovative learning environments, and unparalleled opportunities for personal and professional growth. However, the application process can seem daunting due to its complexity and the multitude of steps involved. This guide aims to demystify the study abroad application process, providing a clear and concise roadmap to help you navigate each phase successfully. Additionally, securing financial aid through education loans is a crucial aspect, and we will delve into the specifics of obtaining an education loan, including interest rates and options for studying abroad.

Understanding the Application Process

The journey to studying abroad begins long before you pack your bags and board a plane. It involves thorough research, meticulous planning, and timely execution of various tasks. Here's a step-by-step breakdown of the application process:

1. Research and Choose Your Destination

Start by researching potential destinations and universities. Consider factors such as academic reputation, course offerings, campus facilities, cultural environment, and living costs. Resources like university websites, education fairs, and consulting agencies can provide valuable insights. FND Overseas Education is a great platform for the latest updates and assistance throughout this journey.

2. Select the Right Program

Identify the program that aligns with your academic interests and career goals. Look into the curriculum, faculty, research opportunities, and potential career paths. Ensure that the program is accredited and recognized globally.

3. Meet Admission Requirements

Each university and program has specific admission requirements. These may include standardized tests (such as SAT, ACT, GRE, or GMAT), language proficiency tests (such as TOEFL or IELTS), academic transcripts, recommendation letters, and a statement of purpose. Start preparing early to meet these requirements.

4. Prepare Your Application Materials

Gather all necessary documents and ensure they are accurate and up-to-date. This includes your academic transcripts, test scores, letters of recommendation, statement of purpose, and resume. Some universities may also require a portfolio or other supplementary materials.

5. Apply for Scholarships and Financial Aid

Research and apply for scholarships, grants, and other forms of financial aid. Many universities offer merit-based and need-based scholarships to international students. Additionally, there are numerous external scholarships available from governments, organizations, and foundations.

Securing an Education Loan for Studying Abroad

Financing your education abroad can be challenging, but education loans provide a viable solution. Understanding the types of loans, their interest rates, and repayment options is crucial for making an informed decision.

Types of Education Loans

1. Federal Student Loans: Offered by the government, these loans often have lower interest rates and flexible repayment options. However, they may not be available to international students.

2. Private Student Loans: Provided by banks, credit unions, and other financial institutions, these loans can cover the full cost of education but typically come with higher interest rates and stricter repayment terms.

3. Institutional Loans: Some universities offer loans to international students, which may have more favorable terms compared to private loans.

Education Loan Interest Rates

Interest rates on education loans can vary significantly based on the type of loan, lender, and borrower's creditworthiness. It's important to compare different loan options and understand the terms before committing. Federal loans usually have fixed interest rates, while private loans may offer fixed or variable rates. Institutional loans can also vary, so it’s crucial to read the fine print.

Applying for an Education Loan

1. Determine Loan Amount: Calculate the total cost of education, including tuition, fees, living expenses, travel, and other miscellaneous costs. This will help you determine the loan amount you need.

2. Research Lenders: Compare different lenders, their interest rates, repayment terms, and customer reviews. Look for lenders that specialize in education loans for international students.

3. Submit Application: Prepare and submit your loan application, including required documents such as proof of admission, academic records, financial statements, and identification proof.

4. Loan Approval: Once your application is reviewed, the lender will notify you of the approval status. If approved, you will receive the loan amount as specified in the agreement.

5. Disbursement: The loan amount is typically disbursed directly to the university to cover tuition and fees, with any remaining funds provided to you for living expenses.

Finalizing Your Decision and Preparing for Departure

Once you've received your admission offers and secured your education loan, it's time to make your final decision and start preparing for departure.

1. Accept an Offer

Review all admission offers and choose the best fit for your academic and personal goals. Notify the chosen university of your acceptance and follow their instructions for enrollment.

2. Apply for a Student Visa

Check the visa requirements of your destination country and gather the necessary documents. Schedule a visa appointment and attend the interview if required. Ensure you have a valid passport and any other required paperwork.

3. Plan Your Travel and Accommodation

Book your flights and arrange for temporary accommodation if necessary. Research housing options, whether on-campus or off-campus, and secure your living arrangements.

4. Prepare for Departure

Attend pre-departure orientations offered by your university or education consultant. Pack essential items, take care of health insurance, and make necessary financial arrangements.

Staying Updated

The study abroad application process can be overwhelming, but staying informed and organized can make it manageable. Regularly check updates from reliable sources and consult experts when needed. For the latest news and updates on the application process and education loans.

Conclusion

Embarking on a journey to study abroad is an exciting and rewarding experience. By understanding the application process, securing the necessary financial support, and preparing thoroughly, you can make this dream a reality. Remember, each step is crucial, and proper planning will pave the way for a successful and enriching educational experience abroad.

#education loan#education loan interest rate#abroad education loan#higher education student loans#education loan for study abroad

0 notes

Text

Gain the key to a stable future with German Permanent Residency. Live, work, and study indefinitely, sponsor family, access healthcare, education loans, and social benefits. Secure your path to citizenship and embrace a vibrant life in Germany. Your gateway to endless opportunities awaits!

#Right To Live in Germany#Sponsor Family Members#First Home Owner Grant#Higher Education Student Loans#Pathway To Citizenship#Germany PR Visa#Germany Permit#Permanent Residence Visa#PR Visa#PR Permit#German Permanent Residency

1 note

·

View note

Text

In light of the recent Supreme Court ruling on student debt forgiveness in Biden v. Nebraska, it seems it might be useful to revisit why American students have so much student debt.

Ironically, it all dates back to Reagan's and the Republicans' decision to cut back on funding for public colleges and universities in order to avoid the possibility of having an "educated proletariat."

So it isn't surprising that is is Republicans who were opposed to any government debt forgiveness for student loans. THEY DON'T WANT TO HAVE EDUCATED CITIZENS. The poorly educated are much easier to manipulate and control.

In 1970, Ronald Reagan was running for reelection as governor of California. He had first won in 1966 with confrontational rhetoric toward the University of California public college system and executed confrontational policies when in office. In May 1970, Reagan had shut down all 28 UC and Cal State campuses in the midst of student protests against the Vietnam War and the U.S. bombing of Cambodia. On October 29, less than a week before the election, his education adviser Roger A. Freeman spoke at a press conference to defend him.

Freeman’s remarks were reported the next day in the San Francisco Chronicle under the headline “Professor Sees Peril in Education.” According to the Chronicle article, Freeman said, “We are in danger of producing an educated proletariat. … That’s dynamite! We have to be selective on who we allow [to go to college].”

“If not,” Freeman continued, “we will have a large number of highly trained and unemployed people.”

#ronald reagan#public higher education#educated proletariat#roger freeman#student debt#supreme court#student loan forgiveness#biden v nebraska

643 notes

·

View notes

Text

On Wednesday, Senate Health, Education, Labor and Pensions (HELP) Chair Bernie Sanders (I-Vermont) and Rep. Pramila Jayapal (D-Washington) reintroduced a proposal to make higher education free at public schools for most Americans — and pay for it by taxing Wall Street.

The College for All Act of 2023 would massively change the higher education landscape in the U.S., taking a step toward Sanders’s long-standing goal of making public college free for all. It would make community college and public vocational schools tuition-free for all students, while making any public college and university free for students from single-parent households making less than $125,000 or couples making less than $250,000 — or, the vast majority of families in the U.S.

The bill would increase federal funding to make tuition free for most students at universities that serve non-white groups, such as Historically Black Colleges and Universities (HBCUs). It would also double the maximum award to Pell Grant recipients at public or nonprofit private colleges from $7,395 to $14,790.

If passed, the lawmakers say their bill would be the biggest expansion of access to higher education since 1965, when President Lyndon B. Johnson signed the Higher Education Act, a bill that would massively increase access to college in the ensuing decades. The proposal would not only increase college access, but also help to tackle the student debt crisis.

“Today, this country tells young people to get the best education they can, and then saddles them for decades with crushing student loan debt. To my mind, that does not make any sense whatsoever,” Sanders said. “In the 21st century, a free public education system that goes from kindergarten through high school is no longer good enough. The time is long overdue to make public colleges and universities tuition-free and debt-free for working families.”

Debt activists expressed support for the bill. “This is the only real solution to the student debt crisis: eliminate tuition and debt by fully funding public colleges and universities,” the Debt Collective wrote on Wednesday. “It’s time for your member of Congress to put up or shut up. Solve the root cause and eliminate tuition and debt.”

These initiatives would be paid for by several new taxes on Wall Street, found in a separate bill reintroduced by Sanders and Rep. Barbara Lee (D-California) on Wednesday. The Tax on Wall Street Speculation would enact a 0.5% tax on stock trades, a 0.1% tax on bonds and a 0.005% tax on trades on derivatives and other types of assets.

The tax would primarily affect the most frequent, and often the wealthiest, traders and would be less than a typical fee for pension management for working class investors, the lawmakers say. It would raise up to $220 billion in the first year of enactment, and over $2.4 trillion over a decade. The proposal has the support of dozens of progressive organizations as well as a large swath of economists.

“Let us never forget: Back in 2008, middle class taxpayers bailed out Wall Street speculators whose greed, recklessness and illegal behavior caused millions of Americans to lose their jobs, homes, life savings, and ability to send their kids to college,” said Sanders. “Now that giant financial institutions are back to making record-breaking profits while millions of Americans struggle to pay rent and feed their families, it is Wall Street’s turn to rebuild the middle class by paying a modest financial transactions tax.”

#us politics#news#truthout#sen. bernie sanders#progressives#progressivism#Democrats#senate health education labor and pensions committee#College for All Act of 2023#tax Wall Street#tax the rich#tax the 1%#tax the wealthy#college for all#student debt#student loan debt#tuition-free college#Historically Black Colleges and Universities#pell grants#Higher Education Act#Rep. Barbara Lee#rep. pramila jayapal#2023

466 notes

·

View notes

Text

Chris Geidner at Law Dork:

On Friday afternoon, a federal appeals court blocked the Biden administration from doing almost anything to provide student loan relief to those people nationwide whose loans are currently in income-contingent repayment plans.

It was the third appeals court ruling relating to the Saving on a Valuable Education, or SAVE, program — and followed a June 30 order from a different appeals court that would have allowed the program to go into effect.

Friday’s order from the U.S. Court of Appeals for the Eighth Circuit is the first of those appellate orders addressing the SAVE program that contained any substantive discussion of the effort.

With the ruling, seven Republican-led states succeeded in getting a three-judge panel of all Republican appointees on a federal appeals court that only has one Democratic appointee to issue a nationwide injunction blocking the SAVE program. More than that, the injunction goes even further — blocking any similar relief, regardless of whether it is issued under the rule creating the SAVE program or otherwise.

The per curiam order issuing an injunction pending appeal, unsigned and with its grand total of eight pages of substance, was issued for Judge Raymond Gruender, a George W. Bush appointee, and Judges Ralph Erickson and Steven Grasz, Trump appointees.

The ruling caused significant confusion coming a day or two after many borrowers across the country received word that their loans had been placed into forbearance following an earlier order from the same court in mid-July. Although the covered loans are not accruing interest during this time, according to the Education Department, the months the loans are in forbearance will not court toward borrowers’ Public Service Loan Forgiveness or income-driven repayment loan forgiveness time.

Neither the Justice Department nor Education Department provided comment on Friday’s ruling or next steps in its immediate aftermath.

The bottom line, though, is that the SAVE plan is blocked currently — and that this is not the final word.

Right-wing judicial activists on the 8th Circuit Court blocked the SAVE program from going forward.

#Saving On A Valuable Education#Student Loans#Biden Administration#8th Circuit Court#Missouri v. Biden#SAVE#Student Loan Debt#Higher Education#Alaska v. Cardona

16 notes

·

View notes

Text

The critical takeaway here is that your college major matters—a lot. Your Bachelor’s degree in Engineering will likely land you a well-paying job; your Gender Studies degree isn’t worth a bucket of warm spit. Think carefully before you go into debt!

#education#higher education#college#student loans#student debt#job market#job readiness#job search#your major matters

27 notes

·

View notes

Note

I feel so weirdly guilty that I need to take out loans. Like it doesn't affect anyone but me but I feel immense guilt that I can't get scholarships or pay out of pocket for my education

Let me translate this into non-imposter-syndrome-ese:

"I feel guilty for being born into a family lacking in excessive wealth and privilege."

Honey, there is no shame nor guilt in taking on debt. Especially not for your education. You're not alone, and a big part of what you're feeling comes from societal pressures to somehow mission-impossible your way through systems of economic inequality all by yourself, at the very start of your adult life. It ain't fair.

Those who should feel guilty are the ones ballooning the cost of education, not those simply trying to better their lives and communities through access to that education.

What We Talk About When We Talk About Student Loans

32 notes

·

View notes

Text

you know i'm also glad i was able to be a long-term sub for a para at the middle school for the last few weeks of the last school year bc once people's typical college semester ended, getting jobs in the sub management software fucking sucked. all these fuckin college kids popped outta nowhere and crept into every corner and everything was like you had to grab it as soon as possible, which is also just the worst bc like, summer is around the corner and that's 2 months where i don't get to earn that regular income.

and i have an odd resentment for the college kids who sub for that short gap between may and june and i dont know why. is it jealousy? is that a proper word for it? morally i know they are doing NOTHING wrong, and if anything they are doing good bc they're ACTUALLY WORKING!!!! like the sub shortages for the rest of the school year is fucking crazy. the few ppl who actually do show up to sub on a regular basis (AKA old retired teachers and me) get pulled in every which way and frequently don't even get a full half-hour break. i guess i just feel like, it must be nice for that job to be a convenient short-term thing for them. bc it's not, for me.

perhaps i feel some sort of pride in being useful and reliable at my shitty little unglamorous poorly-paid job in a public school district. perhaps i do. where were you college students in the dead of february right before the winter break week and peak flu season? huh? where were you? in your DORMITORIES? i bet. well i was here. in the hall

#spongebob hall monitor voice: IN THE HALL!#tales from diana#i don't know i guess there's also an aspect of: usually i am the youngest adult in the building#and i am not very far from their age group (but rapidly growing out of it hahahahaha 25 cries)#but i don't relate to their situation at all#i have student loans from community college i'm paying and i'm trying tentatively to finish my bachelor's#little by little#idk it's easy for me to feel like typical 4-year college students are unrelatable to me#i resent the normative expectations of higher education so much#i don't like being grouped in w them#ppl i chat w at work year-round are generally pretty familiar w me and know that that's my thing#what even is subbing to you if you do it like 3 weeks a year right before summertime?#do you even feel like that's a job?#or is it as serious to you as like. running a lemonade stand? it's just a quick gig?#nothing against quick gigs in fact i would encourage more ppl to just take up subbing to *try*#bc they could be very helpful to their local community#i got one of my friends who was curious about it to try it very briefly. he decided not to come back LOL#but he tried it! which i have to respect#so why do i hate the college students? oh idk. maybe theyre just ugly buttfaces

5 notes

·

View notes

Video

undefined

tumblr

Student Debt and affirmative action

https://www.democracynow.org/

#tiktok#democracy now#debt collective#student loans#student debt#student loan crisis#cancel student loans#debt cancellation#debt strike#us supreme court#wages and salaries#minimum wage#livable wage#wages#social welfare#canada#US#class struggle#education#higher education#student loan debt#debt#college#health insurance

62 notes

·

View notes

Text

youtube

Student Loans: Last Week Tonight with John Oliver (HBO) [source]

"With over 43 million Americans paying off student loans, John Oliver discusses how so many people have come to take on student loan debt, why it’s so hard to pay off, and what we can do about it, mama." [30 min 1 sec]

#student loans#student loan debt#education#higher education#debt#college#America#American education system#Last Week Tonight#John Oliver#Youtube

8 notes

·

View notes

Text

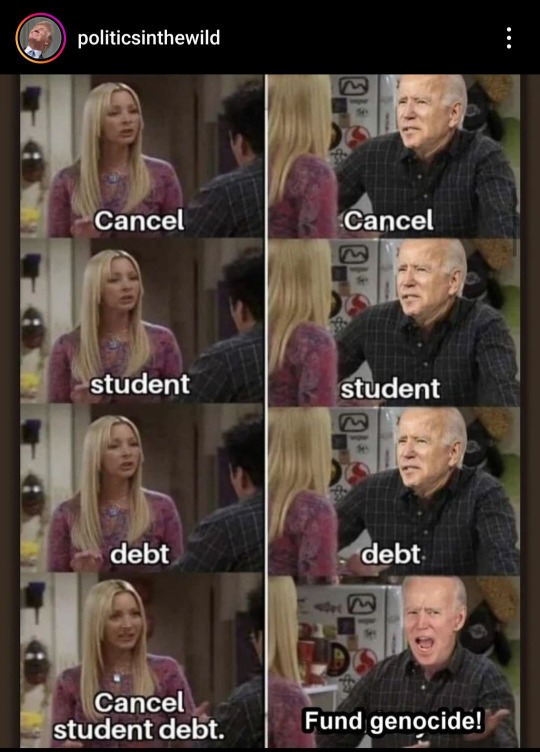

#politics#us politics#progressive#foreign policy#war#student debt#cancel student debt#student loans#higher education#joe biden#genocide#gaza#free gaza#gaza strip#gaza genocide#gazaunderattack#free palestine#ethnic cleansing#middle east

9 notes

·

View notes

Text

I FINALLY QUALIFY FOR PUBLIC SERVICE LOAN FORGIVENESS

My initial student loan was $54,935.92.

I paid over $30,887.83*

My loan is currently at $51,756.93.

I thought I had made all 120 qualifying payments last year. I had to submit and resubmit the PSLF application multiple times, because it kept getting sent back because of problems with how my employers signed the form. It turned out some of the payments didn't qualify, so I had to stick with helljob for at least another year.

I definitely had made 120 qualifying payments this year, so I sent the application in December 2023.

Just got notified now that I have made all qualifying payments. I've made three extra payments, even.

"After we receive the approval, it may take up to 90 business days to process this information."

Three more months of helljob, because I still don't trust this is going to go through and I don't want to quit until I know my loans are gone. I do not have anything lined up after helljob, and I'm terrified of losing my helljob health insurance because I got medical complications. But I hate helljob. I hate helljob so much and my first emotion waking every workday is despair.

At least the loan payments have been paused until the reimbursement is processed. Theoretically I should get reimbursed for the extra payments, too.

* This was only my qualifying payments. The total amount I paid was higher. The website isn't showing me the non-qualifying payments and I have to submit a formal request to get my full payment history. I submitted the request, but it will take a few days to be sent to me.

#This has been a nightmare btw#why yes higher education in the US is a huge scam and utterly inaccessible to most people rn#This wasn't even all of my loans I also got a private loan that I paid off years ago with help from family#I'm one of the LUCKY ones and this ruined my life#student loans#us higher education#what really makes me want to strangle my past self is that I only took these loans because I wanted to be a doctor#like I actually had my bachelor's degree paid off. I didn't need to do this to myself.#But I wanted to be a doctor so I gambled my entire future without realizing I was even gambling let alone that the game was rigged#and I lost it all. Didn't even make med school.#Every single adult I asked for advice on higher education or loans told me 'you're smart and you'll figure it out don't worry'#I've always been a gullible sucker#personal stuff#pslf#public service loan forgiveness

8 notes

·

View notes

Text

#I didn't actually google if a PhD is a waste of time#I googled something else#but these results showed up#I suppose it depends on how you define 'waste' and what you want out of life#if you want to make as much money as you can as fast as you can then don't get a PhD#yet there are some fields that require a PhD#so...#I dunno#to be honest with you all I get the withering contempt that people have for higher education especially among the Red Tribe#and the hatred for people who have students loans that they want forgiven#you want to punish people who had the pretense to try to better their station in life and have lectured you along the way#feels great to rub their noses in it#they thought they were better than you but they are your inferiors and you can never ever let them forget for a moment what fools they are#I get it#but you know#there are some careers that just require formal education#and maybe you shouldn't want that career in the first place#but if you know that's what you want to do#even if you end up washing out#I feel like it makes sense to have tried

5 notes

·

View notes

Text

By: Preston Cooper

Published: May 8, 2024

Key Points

This report estimates return on investment (ROI) — how much college increases lifetime earnings, minus the costs of college — for 53,000 different degree and certificate programs.

Bachelor’s degree programs have a median ROI of $160,000, but the payoff varies by field of study. Engineering, computer science, nursing, and economics degrees have the highest ROI.

Associate degree and certificate programs have variable ROI, depending on the field of study. Two-year degrees in liberal arts have no ROI, while certificates in the technical trades have a higher payoff than the typical bachelor’s degree.

Nearly half of master’s degree programs leave students financially worse off. However, professional degrees in law, medicine, and dentistry are extremely lucrative.

Around a third of federal Pell Grant and student loan funding pays for programs that do not provide students with a return on investment.

Executive Summary

In recent years, young Americans have expressed more skepticism about the financial value of higher education. While prospective students often ask themselves if college is worth it, this report shows the more important question is when college is worth it.

This report presents estimates of return on investment (ROI) for 53,000 degree and certificate programs ranging from trade schools to medical schools and everything in between. I define ROI as the increase in lifetime earnings that a student can expect when they enroll in a certain degree program, minus the costs of tuition and fees, books and supplies, and lost earnings while enrolled. My preferred measure of ROI accounts for the risk that some students will not finish their programs.

This report updates FREOPP’s previous research on ROI, utilizing new data from the U.S. Department of Education’s College Scorecard.

The findings show that college is worth it more often than not, but there are key exceptions. ROI for the median bachelor’s degree is $160,000, but that median belies a wide range of outcomes for individual programs. Bachelor’s degrees in engineering, computer science, nursing, and economics tend to have a payoff of $500,000 or more. Other majors, including fine arts, education, English, and psychology, usually have a smaller payoff — or none at all.

Alternatives to the traditional four-year degree produce varied results. Undergraduate certificates in the technical trades tend to have a stronger ROI than the median bachelor’s degree. However, many other subbaccalaureate credentials — including associate degrees in liberal arts or general education — have no payoff at all. Field of study is the paramount consideration at both the baccalaureate and subbaccalaureate levels.

The ROI of graduate school is also mixed. Professional degrees in law, medicine, and dentistry tend to have a strong payoff, often in excess of $1 million. However, nearly half of master’s degree programs have no ROI, thanks to their high costs and often-modest earnings benefits. Even the MBA, one of America’s most popular master’s degrees, frequently has a low or negative payoff.

The report introduces a new metric — the mobility index — to quantify the aggregate financial impact of each degree or certificate program. The mobility index multiplies each program’s ROI by the number of students it enrolls, thus rewarding programs for both financial value and inclusivity. Bachelor’s degrees in nursing and business administration dominate the top ranks of the mobility index.

Finally, the report estimates how much federal government funding flows to programs that leave students with no ROI. Around 29 percent of federal Pell Grant and student loan dollars over the last five years were used at programs that leave students with a negative ROI. The results point to a role for federal policymakers in improving the ROI of higher education.

While ROI should not be the only consideration for students approaching the college decision, the ROI estimates presented in this report can help students and their families make better choices regarding higher education. The estimates may also be of interest to other stakeholders, including policymakers, researchers, journalists, and institutions.

The full ROI estimates for undergraduate programs are available here. The full ROI estimates for graduate programs are available here.

[ Continued... ]

==

The article includes an interactive graph which allows you to choose from various majors and find the ROI. Some samples.

Controversial opinion: While there may be an argument to waiving or subsidizing college loans for courses that strongly benefit society, no program with a negative ROI should ever be given loan forgiveness or federal funding.

If you want to study Ancient Mesopotamian Interpretive Dance - or even more uselessly, Gender Studies - for your own pleasure and enjoyment, that's your business. And your financial responsibility; the bill for that resides with you. As far as society and our tax dollars are concerned, forgiving that loan or funding that course is just setting fire to money.

Reminder that you may be better off at a trade school. Courses are often shorter, more targeted and cheaper, so you end up working quicker, earning money more rapidly and have a lower debt that's paid off sooner.

#higher education#student loans#loan forgiveness#return on investment#college#college loans#academic merit#trade school#religion is a mental illness

3 notes

·

View notes

Text

The Supreme Court on Friday invalidated President Joe Biden’s student loan debt relief plan, meaning the long-delayed proposal intended to implement a campaign trail promise will not go into effect.

The Justices, divided 6-3 on ideological lines, ruled in one of two cases that the program was an unlawful exercise of presidential power because it had not been explicitly approved by Congress.

The court rejected the Biden administration's arguments that the plan was lawful under a 2003 law called the Higher Education Relief Opportunities for Students Act, or HEROES Act. The law says the government can provide relief to recipients of student loans when there is a “national emergency,” allowing it to act to ensure people are not in “a worse position financially” as a result of the emergency.

Chief Justice John Roberts said the HEROES Act language was not specific enough, writing that the Court's precedent "requires that Congress speak clearly before a department secretary can unilaterally alter large sections of the American economy."

The plan, which would have allowed eligible borrowers to cancel up to $20,000 in debt and would have cost more than $400 billion, has been blocked since the 8th U.S. Circuit Court of Appeals issued a temporary hold in October.

About 43 million Americans would have been eligible to participate.

The student loan proposal is important politically to Biden, as tackling student loan debt was a key pledge he made on the campaign trail in 2020 to energize younger voters.

The ruling will immediately put pressure on the Biden administration to find an alternative avenue to forgive student debt that could potentially withstand legal challenge.

Advocates, as well as some Democrats in Congress, say the Education Department has broad power to forgive student loan debt under the 1965 Higher Education Act, a different law to the one at issue in the Supreme Court cases.

Separately, the student loan repayment process is set to begin again at the end of August after having been put on pause during the COVID-19 pandemic, although first payments will not be due until October.

The court considered two cases: one brought by six states, including Missouri, and the other brought by two people who hold student loan debt, Myra Brown and Alexander Taylor. The court ruled that the program was unlawful in the case brought by states but found in the second case that the challengers did not have legal standing.

The three liberal Justices on the conservative-majority bench dissented, with Justice Elena Kagan saying that by ruling against the plan, the Court had "exceeded its proper limited role in our nation's governance."

She said the states bringing the challenge did not have legal standing to even bring the case, and in analyzing HEROES Act, the conservative Justices ignored the clear language of the law.

"The result here is that the Court substitutes itself for Congress and the executive branch in making national policy about student-loan forgiveness," Kagan wrote.

The Court decided the case in part based on a legal argument made by the challengers that the conservative majority has recently embraced called the “major questions doctrine.”

Under the theory, federal agencies cannot initiate sweeping new policies that have significant economic impacts without having express authorization from Congress.

The conservative majority cited the major questions doctrine last year in blocking Biden’s COVID vaccination-or-test requirement for larger businesses and curbing the authority of the Environmental Protection Agency to limit carbon emissions from power plants.

The challengers argued that the administration’s proposal — announced by Biden in August and originally scheduled to take effect last fall — violated the Constitution and federal law, partly because it circumvented Congress, which they said has the sole power to create laws related to student loan forgiveness.

Biden had proposed canceling student loan debt during the 2020 presidential election campaign.

The administration ultimately proposed forgiving up to $10,000 in debt for borrowers earning less than $125,000 a year (or couples who file taxes jointly and earn less than $250,000 annually). Pell Grant recipients, who are the majority of borrowers, would be eligible for $10,000 more in debt relief.

The administration closed the application process after the plan was blocked. Holders of student loan debt currently do not have to make payments as part of COVID relief measures that will remain in effect until after the Supreme Court issues its ruling.

The nonpartisan Congressional Budget Office estimated in September that Biden’s plan would cost $400 billion.

#us politics#news#nbc news#2023#student debt relief#student debt forgiveness#student loan debt#student loan forgiveness#president joe biden#biden administration#us supreme court#scotus#Higher Education Relief Opportunities for Students Act#HEROES Act#justice john roberts#8th circuit court of appeals#Higher Education Act#department of education#justice elena kagan#major questions doctrine#us constitution

10 notes

·

View notes

Text

“The current model of higher education, one featuring runaway spending and punitive intellectual rigidity, cannot survive.”

#affordability#cancel culture#censorship#college#college admissions#college readiness#critical thinking#economics#education#education reform#free speech#freedom of speech#higher education#online education#political polarization#remote learning#student loans#teaching#Online education

64 notes

·

View notes