#ITC Limited

Text

#paper industry#paper-based products#top 10 paper companies in India#ITC Limited#RBR PAPER LLP#Ballarpur Industries Limited (BILT)#Tamil Nadu Newsprint and Papers Limited (TNPL)#West Coast Paper Mills Limited#Emami Paper Mills Limited#International Paper APPM Limited#Seshasayee Paper and Boards Limited#JK Paper Limited#NR Agarwal Industries Limited#Paper Mill#Paper Manufacturer#Paper Exporter#paper manufacturing#Printing papers#recycled paperboard products#papemillinindia

0 notes

Text

Creating a Future-ready ITC for India

Read on to know about ITC's vision, mission and aspirations as it transforms to a future-ready enterprise of tomorrow.

0 notes

Text

Simplify GST Return Filing in Delhi with MASLLP: Your Trusted Partner

Introduction:

Navigating the complexities of GST return filing in Delhi can be challenging for businesses of all sizes. To ensure compliance and avoid penalties, it’s crucial to have a reliable partner who understands the intricacies of the GST regime. MASLLP is your go-to expert for GST return filing in Delhi, offering comprehensive services to simplify the process and ensure accuracy. In this blog, we will explore the importance of GST return filing, the common challenges faced, and how MASLLP can help you streamline your GST compliance.

Why GST Return Filing is Crucial

GST return filing is a mandatory compliance requirement for businesses registered under the Goods and Services Tax (GST) regime in India. It involves reporting the details of sales, purchases, and tax collected and paid. Here’s why timely and accurate GST return filing is essential:

Legal Compliance

Filing GST returns on time ensures that your business complies with the legal requirements set by the government. Non-compliance can lead to penalties and legal complications.

Input Tax Credit

Accurate GST return filing allows businesses to claim Input Tax Credit (ITC) on their purchases, reducing the overall tax liability.

Financial Planning

Regular GST return filing provides a clear picture of your tax liabilities and helps in effective financial planning and management.

Avoiding Penalties

Timely filing helps avoid late fees and penalties, which can accumulate and become a financial burden for businesses.

Common Challenges in GST Return Filing

While GST return filing is crucial, businesses often face several challenges in the process:

Complexity of GST Laws

The ever-evolving GST laws and regulations can be complex and difficult to interpret for businesses without specialized knowledge.

Accurate Data Entry

Ensuring the accuracy of data related to sales, purchases, and tax payments is critical. Errors in data entry can lead to discrepancies and compliance issues.

Timely Filing

Meeting the deadlines for various GST returns (GSTR-1, GSTR-3B, GSTR-9, etc.) can be challenging, especially for businesses with limited resources.

ITC Reconciliation

Reconciling Input Tax Credit with suppliers' returns requires meticulous tracking and can be time-consuming.

How MASLLP Can Help with GST Return Filing in Delhi

MASLLP offers comprehensive GST return filing services designed to address these challenges and ensure seamless compliance. Here’s how we can help:

Expertise and Knowledge

Our team of GST experts stays updated with the latest GST laws and regulations, ensuring that your returns are filed accurately and on time.

End-to-End Service

From data collection and validation to filing returns and handling queries from the tax authorities, MASLLP provides end-to-end GST return filing services.

Accuracy and Compliance

We use advanced tools and software to ensure the accuracy of your data, minimizing the risk of errors and non-compliance.

Timely Filing

With MASLLP, you never have to worry about missing deadlines. We ensure that all your GST returns are filed on time, every time.

ITC Reconciliation

Our experts handle the complex process of ITC reconciliation, ensuring that you claim the maximum Input Tax Credit you are entitled to.

Why Choose MASLLP for GST Return Filing in Delhi

Client-Centric Approach

At MASLLP, we prioritize our clients' needs and offer personalized services tailored to their specific requirements.

Transparent Communication

We maintain transparent communication with our clients, keeping them informed at every step of the GST return filing process.

Cost-Effective Solutions

Our GST return filing services are competitively priced, offering excellent value for money without compromising on quality.

Conclusion

GST return filing is a critical aspect of business compliance, and partnering with an expert like MASLLP can make the process hassle-free and efficient. With our expertise and commitment to excellence, we ensure that your GST returns are filed accurately and on time, allowing you to focus on your core business activities. Contact MASLLP today to learn more about our GST return filing services in Delhi and how we can assist you in achieving seamless compliance.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

4 notes

·

View notes

Text

Yanking the Cord

“Don’t say a new binary power core-”

“A new binary power core!” Nya’s face lit up as my heart sank to new depths. “I’ll be right back!” She ran off with new exuberance, but it was all in vain.

“Wait, no! Don’t leave!” But she was gone. She was gone, and here I was, stuck in this useless limbo waiting on a piece that obviously wouldn’t fix anything.

“Plate! Snow! Clipboard!”

Zane’s pleas for help did little help soothe my rage at this point. He was part of the problem by now. I could feel my resolve slipping ever further with every second that passed. It wasn’t surprising. I shouldn’t have expected anything better. Every beginner assumes the binary power core is this huge issue point, but they’re very stable apparatuses! It’s NEVER the binary power core! But screw it! Let’s just throw everything at the wall! It’s not like there’s more pressing matters to attend to or anything!

My nerve circuits were burning like nothing else I had ever felt before. Surely it couldn’t be this difficult to accomplish these basic repairs. But there I was, trapped inside an incompetent Zane trying to communicate with an incompetent Nya- and these two are by far the best this mess of a team has to offer. Goodness knows where we’d be if Jay was trying to fix things. How is it possible everything could be this dysfunctional? I am not a ninja, but I’ve been living inside one for several years now, and recon and recovery efforts should not be this complicated to complete! There were actual threats to face off, it had been hours since my father was taken, and it was like everyone had just forgotten! Dr. Borg isn’t just a political figure to use as leverage, if they’ve taken him, they’ll want to use his technology to enhance their own powers, which in this case is the very fabric of time! The longer we wait, the more difficult it gets to locate him! Why isn’t every resource imaginable set on finding him?!

Never before had I ever felt so utterly aware of my own lack of autonomy, of the limitations and barriers of this digital world I had gotten so used to. I was screaming into a wall, reaching out for a rope to grab, a cord to yank, a button to mash, but there was nothing! Useless! Everyone around here is so utterly useless! Here we are, sitting in a room full of some of the most advanced weaponry in the world, and no one’s thought to use it to rescue the invaluable captive that needs our help. It’s so simple! I could do it if I were out there! And I’m not even trained in any of this! Just jump in the mech and…

…and do it.

“I think we’ve got it figured out buddy!” Nya ran in with a binary power core in hand.

“No, I really don’t think we do,” I sighed.

“Synchronous goat!” Zane exclaimed.

“Zane honey, why are you even trying at this point?” My attention was still taken by the large mech sitting next to us. It had an entirely electronic interface, it wouldn’t be difficult to get to it though the cave’s systems. It might be possible to- wait.

“Is that a bimodal binary power core?!” I screamed.

“Wait, I think I might have grabbed the wrong type.” Nya groaned.

“YOU DON’T SAY!” I had to legitimately be losing my mind at this point. No way did she not only come out with a new binary power core, but she came out with one not even compatible with Zane’s systems.

“Just a second! We’ll get you fixed soon!” Nya reassured him as she skipped out of the room again.

“No, no you won’t,” I grumbled.

My mind kept going back to the mech. It couldn’t be that easy, could it? I mean, I hadn’t been physical for a while, but they clearly needed the help. If we were ever going to find my father I had to intervene. They certainly weren’t going to get around to it any time soon. In fact, I’m not entirely sure they wouldn’t all get themselves killed if things continued down this track. I could do it. It was possible. All I had to do was exit into the cave’s systems.

I had found it, the one way I could actually affect things, the one cord left for me to yank; and I had been itching to yank something for a while now.

“Okay! I found the right one!” Nya re-entered the room.

“Synchronous goat,” Zane pressed. “Synchronous goat!”

“I know, we’re so close to getting you fixed!” Nya sighed.

I knew what I had to do. I wasn’t entirely sure I even had a choice at this point. “Best of luck to you, Zane,” I mumbled. If I could have kissed him on the forehead, I would have. This idiot needed a whole heap of luck to get through this mess.

This was insanity. I shouldn’t even be considering this. I shouldn’t have to consider this. I work on a team with highly trained fighters and stealth artists capable of wielding the very elements themselves; I’m an office assistant with only a couple of years of being alive under my belt and an emotion suppressor chip which, if today is any indication, doesn’t exactly seem to be functioning all that well.

But fine.

I’ll do it.

I’m surrounded by incompetence at every turn.

There seems to be no urgency about anything.

No one else is going to do it, so I guess I’ll have to do it myself.

I’ll go rescue my own damn father.

#salty pixal is such a mood#especially pix being salty at nya#ninjago#pixal borg#ninjago pixal#pixal ninjago#nya smith#zane julien#one shot#writing#hands of time

49 notes

·

View notes

Text

Availment of ITC under GST

GST (Goods and Services Tax) is a comprehensive indirect tax levied on the supply of goods and services in India. It is a destination-based tax, which means that the tax is collected by the state where the goods or services are consumed. Under GST, the input tax credit (ITC) is an important concept that allows businesses to reduce their tax liability by claiming credit for the taxes paid on their purchases.

In this article, we will discuss everything you need to know about the availment of ITC under GST. We will cover the basics of input tax credit, the conditions to claim ITC, the documentation required, and the time limit for claiming ITC.

What is Input Tax Credit (ITC)?

Input tax credit (ITC) is the credit that a business can claim for the tax paid on its purchases used for business purposes. The tax paid on input goods or services can be set off against the output tax liability (i.e. tax payable on sales) of the business. This helps businesses reduce their tax burden and improve their cash flow.

For example, if a manufacturer,

To continue reading click here

For more detailed inofrmation, visit Swipe Blogs

2 notes

·

View notes

Note

Shaker Anon

YOU'VE GOT ME INVESTED NOW.

The art. The story telling. I crave more! What happened after! Does Kaminari get Electricity back?

you have something written for Izuku after?👀

Why thank you! And he might. Eventually. Not for a good while tho.

Anyways. I call this Rediscovery Of a Hoard.

Its kinda long!

Izuku Gasps awake. He slips into the kitchen for water and something with protein. He didn't know exactly why.

The recent encounter with Kasumi had left his Sensei and Kaminari shaken. And honestly. He was too. He hated Familiarity, and he hated the Implications.

He grabs some of the dinner's leftovers and silently watches it warm up.

He decides he needs a Familiar voice, he rings up his mother as he slid down by the Refrigerator.

"Hey mom"

"hey honey. What's up? You don't call this late usually."

"Events. Mom. Did I ever.... Seems weird to you as a Kid. Any weird behavior?"

"Well.... There were some, but they kinda passed after you were four."

"Can I know?"

"Of Course! You always loved warmth. And you sat way too close to the fireplace of my mother's. Scared me to death. Oh and your little Jewelry piles! Oh how you kept them so shiny, if you could keep it. You kept it."

"Mmm."

"Oh how Hisashi called you his little Dragonlet. Before he went missing he would hold you to his chest as you held his Fingers, what large hands he had compared to your tiny body.... He loved you so much"

Izuku hums. Dreading the answers

"Mom.... When did I stop?"

"Oh. Just before Katsuki got his Quirk. Why?"

"Research. Can't tell you yet. But thank you so much."

"Anything for you Izu. Get some sleep now"

So much for Sleep now. His heart pounds as he considers, it wasn't a Stretch unlike before.

His sight blurs as he hugs his knees.

He knew the Theories of Quirks affecting personality. For Nedzu's Sake! He Researched that himself! He hoarded Things. He knows that he was missing something, but it felt so much more literal.

"I had one. I had a Dragon Quirk. I felt it in Kasumi. I knew what she was going to do."

He paces. A strange itch to his neck and a pain in his bones edge his sleepy consciousness. The dull ache waking his mind more and more.

"I knew. And I was late" he growls. He grabs his phone and his jacket, needing fresh air.

Stepping out, he tries to calm his pounding heart and foggy mind.

Scratching his neck he sets off into a run under the moonlight. The pace of his feet sparking and flowing.

Missing, Null, Worthless, Quirkless. Words echo in his brain and tears flow as he goes faster.

He knows his eyes light up, he reaches that desperate ache of surpassing his limits. Black and green lightning arcing around his body like a warm embrace. One he clings to desperately.

Then he trips. He quickly rolls into a Tumble and lays on the ground. A sob escapes him, the itch worse and worse as he stares at the star filled sky.

Then the absolutely worst person to come at that time leans over him.

"What the fuck is going on Deku"

Great. Katsuki Bakugo.

"Go away"

"No"

Izuku stares and huffs, the itch getting worse. "Look. Bakugo-" a Flinch. Weird "- I am not okay and I just need you to leave me alone"

"No. Tell what the fuck is with you."

Izuku glares, a Perfect Mimicry of His Father. The lights casting his face in darkness.

"Oh I don't know. Maybe it's the fact that I know what it's like to be Quirkless and I can't fucking say a word to one of my Friends! The fact that I POSSIBLY HAD A QUIRK AND IT WAS USED TO MAKE A NOMU. AND SHE TOOK KAMINARIS QUIRK!? AND ACCIDENTALLY GAVE IT TO LOUD CLOUD?!" AND I PHYSICALLY FELT IT. LIKE A FUCKIN' PHANTOM LIMB.

Izuku flares his hands as he stands up. It felt good getting his anger out, especially to his main tormentor. The ache in his bones slipped away.

"Or the fact I knew in an instinctive way. That she was grabbing. That she was going to Hoard it. That I could've had that and done that to someone."

Katsuki looks pale as a white rose Izuku notes. "I-"

"don't" Izuku warns, his voice low. That damned itch coming back. Word poison on his tongue as he steps forward

"Goddamnit Deku, get your head out of your ass and suck it up" Katsuki snips and immediately Izuku sees his hands flex and spark. Unwanted memories scratching his mind.

Izuku's face darkens. The morning fog licks their feet, maybe that's what should have tipped him off.

Izuku just screams "go away!" And his back explodes. Whips of Green and Black Energy tearing at the air as he screams in both anger, Pain and everything else. The ache in his bones exploding as the whips lash. Izuku's eyes widen, his hands shake as he tries to keep them from hurting his Childhood friend/Bully.

At one point Izuku screams and for a Split second… Katsuki was Afraid of him.

The way the Whips formed into a tangled Mimicry of a Dragons wings and the whips that flow out of his childhood friend's mouth like Dragons Breath.

suddenly Izuku can't see, cold water droplets soothing his sore eyes and itchy throat. And Katsuki runs from the terror that he saw in Izuku.

A gentle calloused hand grabs his own. He knew those hands. "Cloud Sensei. It hurts. Help me it hurts" Izuku begs. Cold clouds gather on his back, as Shirokumo slowly guides him in a silent breath exercise. Izuku practically collapsed against Shirokumo, tears dripping into his shirt.

Izuku would later ask how Shirokumo knew what he needed at that time.

A sad look passes over his Sensei, like a wound that couldn't heal.

"I was once in a similar spot-" a small smile. Storm clouds lick his face. Bringing up memories and a popular theory to Izuku's mind. "-May have ended up with a Quirk Awakening as well and I would have loved someone giving me a silent hand of help instead of me getting so bad….." Shirokumo trails off. And all Izuku could do was watch as he walked away. He silently wonders what layers are yet to be seen of his teacher and his cloudy past.

#mod asphodel#bnha au#boku no hero academia#my hero academia#my hero academia au#bnha#mha#boku no hero academia au#mha au#three for a cloud#three for a cloud au#i eventually will draw for this.#but ta da#asphodel writes#i am soooo not at boreals level lmao#be kind

5 notes

·

View notes

Text

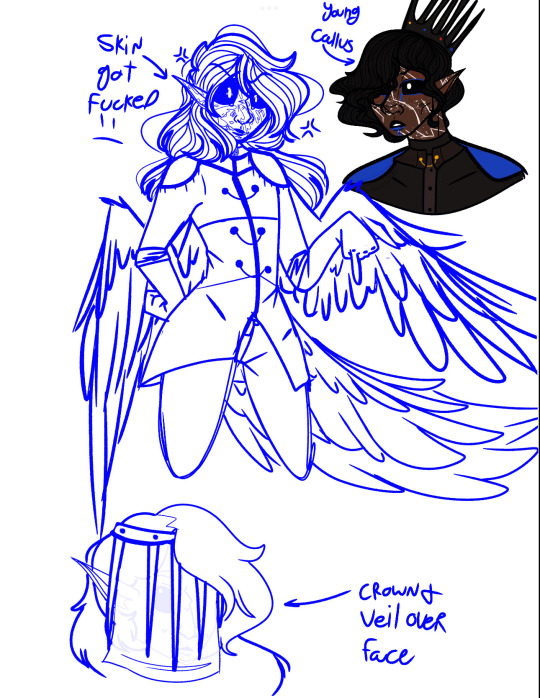

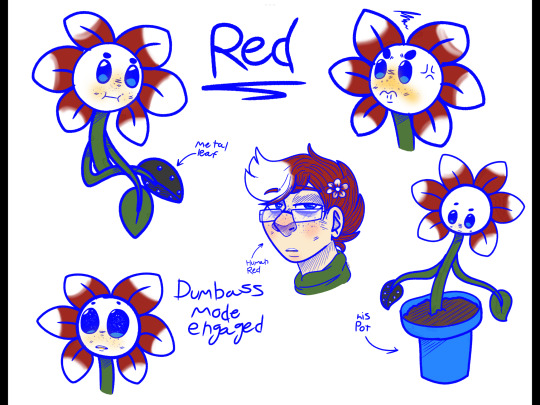

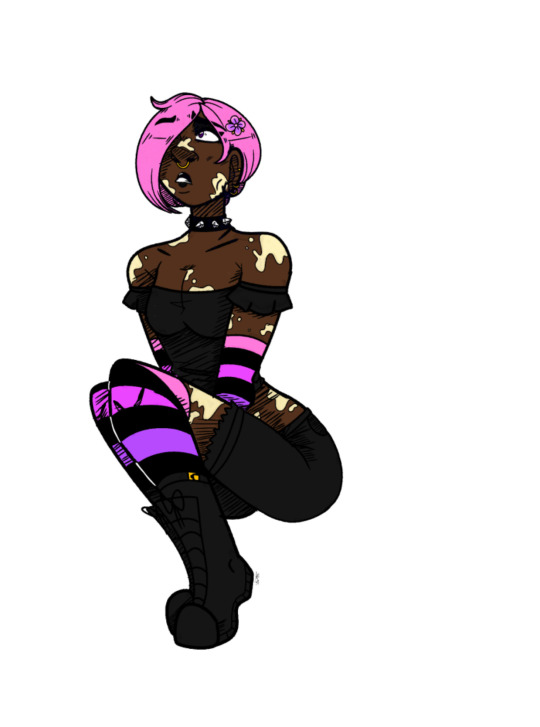

So I posted these last night to my personal account but I wanted to upload them here too along with some information on these characters! ^^

Pauline: Pauline is an interdimensional being. She lives in the Hyperverse and works at the ITC (interdimensional traveling company) as a security guard! She loves everything pink and girly. She is seen by others as a stereotypical bimbo who’s always bubbly and sweet, but she does her job quite well and can stand up for herself easily. Despite how others see her she is independent and incredibly smart. She’s currently dating Oliver (will post him later), the IT guy for the ITC.

Callus: Callus is a villain and also a part of The Next. He is a Centrite ( avian demons basically). He was a royal, meaning he was very vain, cruel, and.. a little stupid. Most royals don’t do anything for themselves and are incredibly sheltered, so they never really learn many life skills (if any). Callus is especially cruel in particular, however. He doesn’t care for anyone or anything besides himself and money or power. He will do ANYTHING to get what he wants. And I mean ANYTHING.

Jinx: Jinx is a part of Wick’s theater ( not pictured). She is a background character and doesn’t really have significance in the story, but she still does have a story of her own. She is one of the younger actors only being 19. She got lucky since her aunt is a costume and clothes designer for his theater. She is an incredible singer and actor, however she is often ignored unfortunately. She still does play in most of the plays, but she never gets any main parts (thanks to Charlotte since her damn DaDdY is secretly threatening Wick to give her anything she wants).

Red: Red is one of the main characters for RE. He is an alien from a planet called Floris. Red has MANY accomplishments, including but not limited to:

- veteran

- guardian ( Hyperverse protector)

- inventor

- scientist ( biology and anthropology is his specialty)

- Architect of knowledge ( basically the gods who made EVERYTHING)

- has two spouses and 14 children, as well as 1 grandchild

- freed his planet’s god, Alcemedy

And much more. He is known to be a workaholic and doesn’t know when to quit. I will keep the rest of his story a secret :)

Beatrice: Bea is the last one on this list. She is also a background character and doesn’t have any significance to the main story, but she’s still an interesting character. She is also from Floris. She is a part of a group who wants to live their lives as humans and stay on Earth permanently. She is the youngest of this group being 19 years old. She loves music, especially scene music or anything good to dance to. She tries to fit in but it can be difficult at times (especially when she only mainly speaks Floris). Thanks to Red she can stay human as long as she wears the flower in her hair.

#my ocs#oc stuff#my oc art#original content#oc ask blog#book teaser#new books#indie books#books and reading#bookblr#booklr#books#bookworm#indie artist#indie author#indie#oc lore#lore#oc artwork#ocs#oc#oc art#original writing#original art#original character#original post#original book

2 notes

·

View notes

Note

hi! absolutely thrilled to find another rahd fan on this site...any randall and hopkirk deceased hcs? :) 🦇

Hey there anon :D me too!! It seems like the fandom on here has dissipated so finding anyone out here is soo exciting!!

oh god I have ENDLESS headcanons and I tend to post about them as they come to me and then I sort of forget til I rewatch episodes haha... but off the top of my head:

My random personal headcanon for Jeff is that he was brought up by his grandparents (no real reason for it other than the show never bringing up his family or background)

and my random personal headcanon for Marty is that he has a strong aversion to alcohol because he has; told Jeff he is drinking too much, moved Jeff's glass away from him, and (before they realize his drinking was useful to them) tried to convince Bream not to drink anymore. And when he was alive, he asked for tomato juice at the obligatory "would you like a drink" instead of any spirit as is usually requested (and expected based on the slight reaction it gets)

I also had a headcanon that there is some kind of rift in Marty's family because the funeral crowd seemed quite small, Marty was annoyed that his Aunt didn't come to his funeral, and also just again the vibe of the three of them being sort of... alone. I know shows don't necessarily bring family into the cast but there is usually some mention of "Oh when I was a kid my mum/dad would--" but there isn't.. Jeannie only half recognizes Marty's Aunt and it takes her a while to fully recognize her. Jeff has never even heard of her... and she (Aunt) seems only mildly upset at her nephew's untimely murder. She didn't even know that he had died.

^ I realize that like 90% of that is down to ITC's limited attention on R&H and maybe budget. But still.

Not necessarily a headcanon but I like shipping any and all combos of the three haha and, also just appreciating their canon relationships too :-) I wish that the writers/directors weren't so terrified of showing two men being close and affectionate friends (as Mike and Ken actually were) but it was kind of a Thing at the time I guess

OH I also have the headcanon that Marty and Bugsy continue to hang out in the astral realm and Bugsy is teaching Marty how to manifest himself to people other than Jeff so that he can one day say hi to Jeannie again :) (LESS of this "oh it'll scare her poor fragile woman heart" nonsense. that episode was kind of a mess...)

ok I am stopping now because that is already a lot LOL but nice to meet u anon enjoy my rambling

6 notes

·

View notes

Text

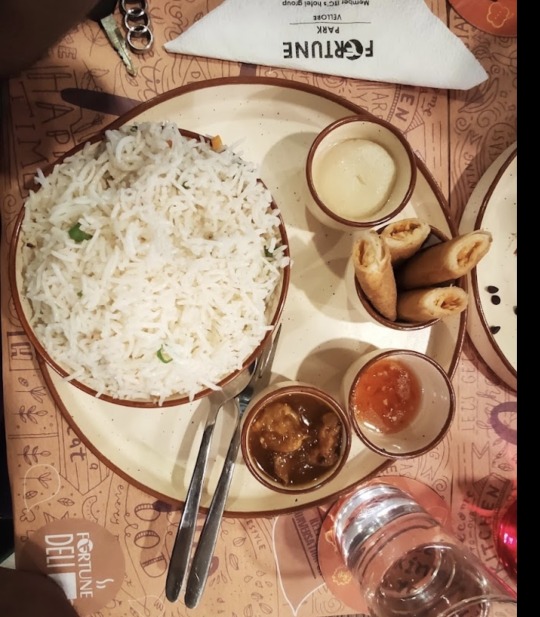

Everything I had in Fortune Deli

Fortune Deli is a petite Café/restaurant located in the mid of Vellore city. It is a part of a star hotel 'Fortune park' which belongs to ITC group of companies. Deli has a limited menu of their in-house chef’s choice.

Here is an account of everything I had in this particular restaurant with their price. (Everything I had are vegetarian so I have no idea about Non veg in there)

Let’s start with the appetiser.

Chilli cheese fries

It was classic frozen French fries garnished with chilli flakes and grated cheese, it sounds just as how I’ve described. It wasn’t anything special or unique, if you want French fries with mild variation you can go for this or else I wouldn’t recommend (without gst ₹100)

Cheesy nachos and Pommes poutine

The cheesy nachos were really good, flavoured nachos with tomato and onion salsa with spice packed baked with cheese was great flavourful treat.

The poutine was disappointing, Poutine is a dish that has to be served with potato fries with loads of gravy on it with fresh cheese garnish where this was barely coated with gravy and didn’t have much to do with the taste. I’d not recommend trying this here.

When I ordered pommes gratin I got served with the same poutine, when asked about it they refused to agree that they both are the same.

Veg platter

A serving of variety of fries such as cheesy potato shots, potato wedges, tandoori and spring rolls with 3 different condiments to go with the mains. Fried food is always good.

Paneer satay

Cottage cheese skewers grilled with spices coated and served with peanut butter as side. It tasted good, would recommend.

Veg biriyani thali combo

Vegetable biriyani served with onion raitha, paneer butter masala and Gulaab jamun for desert. The spices were perfect and each element complimented the other. Budget friendly, good quantity food.

Chinese combo

Veg fried rice served with mushroom manchurian, sweet and sour chilli sauce, spring rolls and rasgulla for desert. Mild flavours and great portion size.

Cold coffee

Classic cold coffee, mediocre portion size but tasted good.

Now for the prices of all the dishes listed above (without gst):

Chilli cheese fries - ₹100

Pommes poutine/gratin - ₹100

Paneer satay - ₹140

Veg platter - ₹180

Veg biriyani combo - ₹145

Chinese veg combo - ₹120

Cold coffee - ₹130

Why should you go to Fortune deli?

They have a good ambience in there, warm welcoming waiters. Good portion of food within budget. Limited menu.

Reasons to not go :

If you want any food out of the top list, the portion is small and the price is high especially for chaat. Food takes about 40mins to be served from the time you order. Not much variations of food.

For Location and much info:

https://maps.app.goo.gl/FwaBTspepGRkFBQm7

4 notes

·

View notes

Text

Denis Shaw Season: Two Period Dramas

Content warning: a white actor 'blacking up' to play a person of colour.

Next up in this series of posts about shows in which the actor Denis Shaw has a role, we have two period dramas. This exercise in focusing on an actor is taking me into some quite unaccustomed territory; generally I don't tend to take to period dramas, and also in this post you might see why there are some shows which just don't appear on the blog!

The Adventures of Robin Hood: A Guest for the Gallows

This is of course the 1955 to 1959 ITC series about the legendary figure, many of the stories being new ones not based on the original legends. I see that its 143 episodes were also broadcast in the USA, Australia, Malaysia, France, Canada and the Philippines, It is actually still being broadcast in the UK and I see that on first broadcasting it had 32 million viewers weekly (in the US and UK). Imagine that now!

It shows how wildly popular the show was that it had a whole range of merchandise, including a range of Robin Hood shoes, advertised by the picture of Richard Greene, who played Robin Hood. I'm sure it's me, but the show really isn't doing that much for me, although I don't have any huge criticism; this sort of semi-historical drama just doesn't grab my interest and I would rather watch historical documentaries.

Shaw's role in this is limited to the role of a butcher whose clothing Robin Hood commandeers as a disguise.

Virgin of the Secret Service: Dark Deeds on the Northwest Frontier

I'm not sure 'period drama' is the correct description for the next show, whatever Virgin of the Secret Service is. I see that I wrote an introductory post about this show on the original blogspot version of this blog some years ago, and in fact subsequently sold the DVDs and haven't seen any episodes since. On watching this one I have not had any cause to change my impression of the show I originally formed, namely that it can't really make up its mind what it is. It's not a straightforward historical drama but is obviously trying to ape the success of shows like Adam Adamant and The Avengers. I'm afraid it largely fails to do this, although it does have some very good reviews, so clearly does make a hit with some viewers.

Shaw appears in the first episode of the whole series, blacked up as a wasir.

I'm going to have to be my usual over-frank self about this and admit that I can't make head nor tail of this episode. I am not even sure what country it is set in, since it is apparently in British India but somehow involves a Russian princess and black servants. I have now watched the episode all the way through three times and am still no clearer on the role of the wasir.

And this is why some shows never appear on this blog at all!

This blog is mirrored at

culttvblog.tumblr.com/archive (from September 2023) and culttvblog.substack.com (from January 2023 and where you can subscribe by email)

Archives from 2013 to September 2023 may be found at culttvblog.blogspot.com and there is an index to the tags used on the Tumblr version at https://www.tumblr.com/culttvblog/729194158177370112/this-blog

0 notes

Text

Hosting a Chai Party: Celebrating National Chai Day with Warmth and Delight

Nimeasy by ITC Limited

It's been a while since those long weekends and with daily office grind, fatigue has started to set in. Why not use this weekend for a break to unwind and invite all your friends for a chai party and reignite the spark of connection?

Imagine the scene – friends gathered around, sipping on fragrant chai blends, sharing stories, and engaging in lively conversations. It's a time to disconnect from the hustle and bustle of everyday life and truly connect with the people who matter most.

What's a better occasion than National Chai Day? From Desi High Tea Party, chai-tasting, to the classic ‘Chai pe Charcha’, there is a lot you can do to unwind.

However, the aftermath of a chai party can present a unique challenge – the cleaning of chai utensils. The stubborn stains and residues left behind can be a daunting task, often requiring extensive scrubbing and elbow grease.

Influencer Mahita Vankayala shares, "Whether I am alone or with friends, chai is my go-to drink. Alas, cleaning chai utensils can be a real hassle, but ITC Nimeasy has made it a breeze. Its Enzyme Technology* and Lift Off Action^ swiftly remove even the toughest stains, making the post-chai session cleanup a stress-free experience.”

The act of preparing and sharing chai is a ritual in itself, a beautiful dance of tradition and sensory delight. So why should cleaning the pot be any different? Here are a few tips to make your chai-stained utensils sparkle like new, using the power of neem:

Rinse and Pre-Treat: Start by rinsing your stained mug or teapot with warm water, this will help loosen any surface residue

Effecting cleaner: Apply a small amount of ITC Nimeasy dish soap directly to the stained areas. With its powerful Enzyme Technology* it swiftly removes even the toughest stains with its Lift Off Action^, to harness the power of this versatile ingredient.

Soak It Up: For particularly stubborn stains, fill your mug or teapot with warm water and nimeasy and let them soak, making it easier to remove the stains

Use warm water: Rinse your tea ware thoroughly with warm water, and voila! Your mugs and teapot will be sparkling clean and ready for another round of chai enjoyment

So, as you gather with friends and family to commemorate National Chai Day, let the aroma of freshly brewed chai and the warmth of companionship fill the air. And when the party is over, trust Nimeasy to handle the cleaning, so you can savor the memories and look forward to the next chai-filled gathering.

^Basis lab study on sample food

*Basis lab study on sample food soil

0 notes

Text

GST Compliance Solutions Simplifying Complex Tax Regulations

In an era of rapid cross-border business growth, understanding and complying with tax laws has become more difficult than ever. The Goods and Services Tax (GST) is one such tax regime that is changing the way business is done, especially in countries like India, Australia and Canada. However, complex GST rules can often overwhelm business owners, especially small and medium enterprises (SMEs). This is where GST compliance solutions come in, helping businesses navigate the complexity of tax compliance with ease.

In this article, we will explore various aspects of GST compliance, challenges faced by businesses and how GST compliance solutions can simplify this complex tax law. Whether you are a business owner, an accountant, or just anyone interested in understanding GST, this comprehensive guide will provide valuable insight.

Understanding GST: A Brief Overview

GST or Goods and Services Tax is an indirect tax on the supply of goods and services. It is a comprehensive, multi-channel, destination-based tax that has replaced earlier indirect taxation by both the central and state governments The main objective of GST is to provide the tax system facilitated and created a single market by increasing taxes.

Key Features of GST:

Exceptions: GST includes VAT, service tax, excise duty, and various other taxes.

Multi-stage: GST is collected at every stage of the supply chain from manufacturing to end-consumption.

Destination: Taxes are collected where goods are consumed rather than produced, ensuring that revenue is distributed based on consumption.

Importance of GST Compliance

Complying with GST rules is important for businesses to avoid penalties, maintain good reputation and ensure smooth operations. Non-compliance can result in significant fines, legal challenges, and business outages. Therefore, companies need to understand the intricacies of GST and abide by the rules and deadlines.

Highlights of GST Compliance:

Timely filing of GST Returns: Companies must file GST returns on a regular basis, based on their income and other factors. Missing the deadline can result in penalties and interest.

Accurate Records: Maintaining accurate records of all transactions, invoices and returns is essential for GST compliance. This ensures that the Investment Tax Credit (ITC) has been properly claimed.

Proper Tax Accounting: To avoid underpaying or overpaying tax, businesses should accurately account for GST on their goods and services.

E-invoicing Compliance: E-invoicing is a must for businesses with fixed invoices. It involves the generation of invoices in a standardized manner, which are then uploaded to an official channel for verification.

Common Challenges in GST Compliance

Despite the benefits of GST, compliance can be a challenge for businesses, especially SMEs. Some common complications are:

Complex Tax Laws: GST laws can be complex, and are frequently amended and updated. Keeping up with these changes can be challenging, especially for small businesses with limited resources.

Multiple Registrations: Multinational companies may need to register for GST in each country, increasing the administrative burden.

Input Tax Credit (ITC) Reconciliation: Reconciling input tax credits with supplier data can be time consuming and errors are prone.

Costs of Compliance: The costs of hiring staff, investing in software and managing compliance processes can be high, especially for SMEs.

Technology Implementation: Adopting new technologies such as e-invoice compliance software can be challenging for businesses that are not tech savvy.

How GST Compliance Solutions can Help

The GST compliance solution is designed to simplify the process of GST compliance. This solution uses technology to automate aspects of GST compliance, reducing the burden on businesses and ensuring consistency.

Benefits of GST Compliance Solution:

Automation of Processes: GST compliance solutions automate tasks such as return filing, invoice generation, tax calculation etc., reducing the risk of human error.

Real-time Updates: This solution provides real-time updates on changes in GST laws, ensuring that businesses are in compliance with the latest regulations.

Simplified ITC Reconciliation: GST compliance solutions simplify the process of matching input tax with supplier data, reducing the chances of contradiction will come to him.

Lower Costs: By automating compliance processes, companies can reduce hiring costs and control manual processes.

Ease of Use: Many GST compliance solutions are user-friendly, making it easy for businesses to adopt and integrate into their existing systems.

Top Features to Look for in a GST Compliance Solution

When choosing a GST compliance solution, it’s important to consider the features that will best meet your business needs. Here are some of the top things to look for:

Return Filing Automation: Look for solutions that automate GST returns, reducing the time and effort required to meet compliance deadlines.

Invoice Integration: Make sure the solution supports e-invoicing, so you can create and upload invoices in the required format.

ITC Reconciliation: A good GST compliance solution should provide tools to reconcile input tax with supplier data, thereby reducing errors.

Real-time Compliance Alerts: Choose a solution that provides real-time alerts of compliance deadlines, regulatory changes, and important updates.

Easy-to-use Interface: The solution should be easy to use, with an intuitive interface that allows regulatory tasks to be picked up and managed efficiently.

Options: Look for customizable solutions to meet the specific needs of your business, such as handling multiple GST registrations or integration with your existing accounting software.

Data Security: Make sure the solution offers robust data security features such as encryption and regular backups to protect your sensitive information.

Choosing the Right GST Compliance Solution for your Business

Choosing the right GST compliance solution is important to ensure your business is GST compliant. Here are some tips for making the right choice:

Determine your Business Needs: Start by looking at the specific compliance requirements of your business, such as the number of transactions, the complexity of your business, and the level of expertise required.

Compare Features: Compare features of various GST compliance solutions and find one that provides you with the functionalities you need, such as return filing, e-invoicing, and ITC matching.

Ensure Scalability: Ensure the solution can scale with your business as it grows, accommodates increased transaction volumes and other compliance requirements.

Consider Costs: Determine the cost of the solution, including any setup fees, subscription fees, and ongoing maintenance costs. Find solutions that provide value for money without compromising quality.

Read Reviews and Testimonials: Look for reviews and testimonials from other companies that have implemented the solution. This provides insight into the effectiveness and reliability of the solution.

Request a Demo: If possible, request a demo of the solution to see how it works and whether it meets your business needs.

GST Compliance Solutions: Best Practices

Once you’ve identified a GST compliance solution, it’s important to use it effectively to maximize your returns. Here are some best practices to follow.

Train Your Team: Make sure your team is properly trained on how to implement GST compliance solutions. This will guide them through the process more effectively and reduce the chances of error.

Integrate Existing Systems: Integrate GST compliance solutions into your existing accounting and ERP systems to streamline processes and improve data accuracy.

Check Compliance Regularly: Check your GST compliance process regularly to make sure everything is running smoothly. Use the reporting features of the solution to track compliance status and identify any issues.

Stay Updated On Changes: Stay up-to-date with any changes to GST laws and regulations, and ensure your GST compliance solutions are updated accordingly.

Take Professional Advice: If you are unfamiliar with any aspect of GST compliance, seek advice from a tax professional. They can help you navigate complex regulations and ensure your business stays compliant.

Future GST Compliance: Trends to Watch

As technology continues to evolve, so will the tools and solutions available to comply with GST. Here are some things to watch out for in the future in terms of GST compliance:

AI and Machine Learning: AI and machine learning are set to play a key role in automating GST compliance processes, improving accuracy and reducing the time required for compliance tasks.

Blockchain Technology: Blockchain has the potential to transform GST compliance by providing a secure, transparent and immutable record of transactions. This can reduce fraud and improve the accuracy of compliance data.

Cloud-Based Solutions: Cloud-based GST compliance solutions provide flexibility, scalability and accessibility, making it easy for businesses to manage compliance from anywhere.

Enhanced Government Digitization: Governments are increasingly adopting digital technologies for tax collection and compliance. Companies will need to stay updated on these developments and ensure their compliance solutions align with government policy.

Enhanced Data Analytics: Advanced data analytics tools will help businesses gain deeper insights into their GST compliance processes, allowing them to spot trends, identify issues and make informed decisions.

Conclusion

GST compliance is key to running a successful business, but it can be difficult and time-consuming. Fortunately, GST compliance solutions are available to simplify the process, reduce errors and ensure your business remains compliant with the latest regulations. By understanding the basics and applying best practices when looking for GST compliance solutions, you can confidently navigate the complexities of GST and focus on growing your business.

0 notes

Text

MNC Company in Bihar

Bihar has historically been less prominent in hosting multinational corporations (MNCs) compared to other Indian states like Maharashtra, Karnataka, or Tamil Nadu. However, there are still some multinational companies and large organizations with a presence in Bihar. Here are a few notable MNCs and large companies that operate in or have offices in Bihar:

**1. Tata Consultancy Services (TCS)

Overview: TCS is a leading IT services, consulting, and business solutions organization.

Presence: TCS has offices and delivery centers in various cities, including Patna.

**2. Wipro Limited

Overview: A global leader in IT services and consulting.

Presence: Wipro has a presence in Patna, providing IT and business solutions.

**3. HCL Technologies

Overview: HCL offers IT services and consulting with a global footprint.

Presence: HCL has operations in Patna, focusing on IT and software services.

**4. State Bank of India (SBI)

Overview: Although not an MNC in the traditional sense, SBI is a major public sector bank with international operations and significant influence.

Presence: SBI has numerous branches and offices across Bihar, including Patna.

**5. Bharat Heavy Electricals Limited (BHEL)

Overview: A leading public sector engineering and manufacturing company.

Presence: BHEL has a manufacturing unit in Patna, contributing to various industrial projects.

**6. Indian Oil Corporation Limited (IOCL)

Overview: One of India’s largest oil companies with a significant presence across the country.

Presence: IOCL operates refineries and has a significant presence in Bihar, including in Patna.

**7. HDFC Bank

Overview: A major private sector bank with operations across India and a growing presence in the financial sector.

Presence: HDFC Bank has multiple branches and offices in Patna and other cities in Bihar.

**8. Axis Bank

Overview: Another leading private sector bank with a strong presence in the Indian financial sector.

Presence: Axis Bank operates several branches and ATMs in Patna and other major cities in Bihar.

**9. PepsiCo

Overview: A global food and beverage leader.

Presence: PepsiCo has distribution and production facilities in Bihar.

**10. ITC Limited

Overview: A diversified conglomerate with interests in FMCG, hotels, paperboards, and packaging.

Presence: ITC has a presence in Bihar through its products and distribution networks.

**11. Bajaj Allianz

Overview: A prominent insurance and financial services provider.

Presence: Bajaj Allianz operates branches and offices in Patna and other parts of Bihar.

Factors to Consider for Employment and Business Opportunities:

Company Size and Scope: Some MNCs might have smaller offices or regional offices in Bihar.

Industry Presence: The type of industries prevalent in Bihar, such as banking, IT services, and manufacturing, may influence the presence of MNCs.

Growth Potential: Bihar is seeing increased investment in infrastructure and development, which may attract more MNCs in the future.

While Bihar might not yet be a major hub for MNCs, the presence of large organizations and growing investment indicates potential for future expansion and opportunities.

0 notes

Text

XIM University Bhubaneswar: MBA Fees, Placement, Courses, Scholarships, and Selection Criteria

XIM University Bhubaneswar, also known as Xavier Institute of Management Bhubaneswar (XIMB), is one of India's top management institutes, offering a comprehensive MBA program that stands out for its academic rigor, industry exposure, and high placement success. This article will explore every key aspect of pursuing an MBA at XIM University Bhubaneswar, from the fee structure to placement opportunities, scholarships, and selection criteria.

1. XIM Bhubaneswar MBA Fees

The XIM University Bhubaneswar MBA Fees structure is designed to be competitive while offering world-class facilities and a top-tier curriculum. For the full-time two-year MBA program, the fees are approximately ₹20,30,000. This amount includes tuition, library fees, and other miscellaneous charges but does not cover accommodation or personal expenses. Students can also opt for installment payment plans.

Breakdown of MBA Fees:

Tuition Fees: ₹14,60,000

Other academic expenses (library, computer, examination): ₹2,00,000

Hostel and mess charges: ₹2,20,000 (approximately)

Miscellaneous fees: ₹1,50,000

Total: ₹20,30,000 (approx.)

Additional charges such as study material, laptops, and extracurricular activities may also apply.

2. Courses Offered at XIM University Bhubaneswar

XIM University Bhubaneswar offers a variety of management programs designed to cater to the diverse interests and career aspirations of students. Key courses include:

MBA in Business Management (BM)

MBA in Human Resource Management (HRM)

MBA in Rural Management (RM)

MBA in Sustainability Management

Executive MBA (EMBA)

Ph.D. in Management

These programs are tailored to meet industry demands and provide students with a strong foundation in management principles combined with practical exposure.

3. Placement & Recruiters at XIMB

The placement process at XIMB Bhubaneswar mba fees is highly efficient, with nearly 100% placement rates each year. The placement cell works closely with leading companies across various sectors to ensure students secure top roles.

Placement Statistics:

Highest Package: ₹32.21 LPA (Domestic)

Average Package: ₹17.54 LPA

Median Package: ₹16.25 LPA

Top Recruiters:

XIMB boasts an impressive list of recruiters, which includes industry giants from a variety of sectors. Some of the prominent recruiters include:

Deloitte

PwC

Accenture

Tata Consultancy Services (TCS)

Cognizant

Amazon

HDFC Bank

Infosys

ITC Limited

ICICI Bank

Students have opportunities in various domains such as consulting, finance, marketing, operations, and human resource management.

4. Scholarships at XIM University Bhubaneswar

XIM University Bhubaneswar offers scholarships to deserving students to make education more accessible. Scholarships are awarded based on academic merit, financial need, and outstanding achievements.

Types of Scholarships:

Merit-Based Scholarships: Awarded to students with exceptional academic performance in their previous studies.

Need-Based Scholarships: Provided to students who demonstrate financial need.

Reserved Category Scholarships: These are offered to students from socially and economically backward categories.

Corporate Scholarships: Many corporates collaborate with XIMB to offer scholarships to students.

Scholarships typically cover a percentage of tuition fees and can significantly reduce the overall cost of the MBA program.

5. MBA Selection Criteria at XIM University Bhubaneswar

Getting into XIMB’s MBA program is competitive. The selection process is rigorous and involves several stages, including entrance exam scores, personal interviews, and group discussions.

Key Steps for Selection:

Entrance Exam: Candidates need to appear for one of the accepted national-level entrance exams, including CAT, XAT, GMAT, or XGMT (XIMB’s own entrance test).

Application Form: Once the exam results are out, students must submit an application to XIM University along with their exam score.

Shortlisting: Based on exam scores, candidates are shortlisted for the next round of the selection process.

Group Discussion and Personal Interview (GD-PI): Shortlisted candidates will go through a GD-PI process, where they will be evaluated on communication skills, leadership potential, and domain knowledge.

Final Selection: The final selection is based on overall performance in the entrance exam, GD-PI, past academic record, and work experience (if any).

6. Why Choose XIM University Bhubaneswar for MBA?

XIMB has a long-standing reputation for academic excellence, industry connections, and global exposure. The holistic curriculum, strong alumni network, and a blend of theoretical knowledge with practical insights make it a preferred destination for aspiring management professionals.

Here are some key reasons why students choose XIMB Bhubaneswar MBA:

Top-notch faculty with industry experience.

Global exposure through exchange programs and collaborations.

Extensive industry interface, guest lectures, and live projects.

A diverse range of elective courses to choose from, allowing students to specialize in areas of their interest.

With a strong legacy of excellence, competitive fee structure, and outstanding placement record, XIM University Bhubaneswar stands out as one of the premier choices for pursuing an MBA in India. Whether you’re looking for a career in business management, human resources, or rural management, XIMB provides the tools and opportunities to shape your future.

0 notes

Text

GST Registration vs Composition Scheme in Andhra Pradesh: Which Is Right for You?

GST Registration in Andhra Pradesh: A Comprehensive Guide

Introduction

Goods and Services Tax (GST) is a comprehensive tax system that has replaced numerous indirect taxes in India. For businesses operating in Andhra Pradesh, GST registration is crucial to ensure compliance with the tax laws and to take advantage of the benefits offered by the GST regime. This article provides an in-depth look at GST registration in Andhra Pradesh, including its benefits, eligibility criteria, and step-by-step procedure.

Benefits of GST Registration

Legal Recognition: GST registration provides legal recognition to your business, making it easier to enter into contracts and conduct business activities.

Input Tax Credit (ITC): Registered businesses can claim input tax credit on GST paid on purchases, which can be used to offset GST liability on sales.

Interstate Trade: GST registration allows businesses to trade across state borders without additional tax barriers.

Increased Credibility: Being a registered entity under GST enhances your business’s credibility among customers and suppliers.

Avoid Penalties: Compliance with GST regulations helps avoid penalties and legal issues.

Eligibility Criteria for GST Registration

Businesses in Andhra Pradesh are required to obtain GST registration if:

Annual Turnover: The annual turnover exceeds the threshold limit set by GST laws (currently ₹40 lakhs for most states, ₹20 lakhs for particular category states).

Interstate Supply: The business engages in interstate supply of goods or services.

E-Commerce: Businesses operating through e-commerce platforms must register under GST.

Agents: Taxable persons who are agents or brokers of goods or services.

Others: Any business that expects to make or is involved in taxable supplies must register.

Step-by-Step GST Registration Process

Obtain PAN Card: Ensure you have a valid PAN card in the business's or the proprietor's name. PAN is a mandatory requirement for GST registration.

Prepare Documents: Gather necessary documents, including proof of business address, identity and address proof of the proprietor/partners/directors, and bank statements.

Visit the GST Portal: Go to the official GST portal gst.gov.in.

Fill out the Application Form: Register on the portal and complete the GST application form (Form GST REG-01). Provide details like PAN, business address, and bank account information.

Upload Documents: Upload the required documents, such as the PAN card, proof of business registration, identity proof of partners/directors, and proof of address.

Verification: The GST officer will verify the application. If everything is in order, you will receive a GST Registration Certificate.

GST Number Issuance: Upon successful verification, you will receive a GST Identification Number (GSTIN) and the GST registration certificate.

Post-Registration Compliance

Filing Returns: Regular filing of GST returns is mandatory. Ensure timely submission of monthly/quarterly returns to avoid penalties.

Maintaining Records: As per GST regulations, proper records of sales, purchases, and input tax credit claims must be maintained.

Invoice Compliance: Issue GST-compliant invoices for all transactions and ensure proper GST recording.

Conclusion

GST registration in Andhra Pradesh is a straightforward process but requires careful attention to detail. Businesses can ensure smooth compliance with GST regulations by understanding the benefits, eligibility criteria, and procedural steps. Proper registration and compliance not only facilitate lawful business operations but also enhance credibility and operational efficiency. For further assistance, businesses can consult GST experts or chartered accountants to navigate the complexities of GST registration and compliance.

0 notes

Text

How to Evaluate the Credibility of a Wheat Flour Supplier in India?

1. Certifications and Compliance

The very first thing that one should check is whether the provider has due accreditations of the type FSSAI or ISO. That would mean the great quality practices the former follows and is governed stringently.

Pro Tip: Ensure that catering adheres to local, national, and international standards of food safety.

2. Quality Control Measures

Review their quality control systems. A reliable supplier will have in place, at all times, the evaluation mechanisms to ensure the wheat flour they deliver to your place is of good quality. Seek to know if they have a testing laboratory, what are the methods of testing, and at what intervals. This shall include moisture content, ash content, and the quality of gluten.

Evidence in Support: One of the research works from the Food Safety and Standards Authority of India has found that prescribed quality levels are met only by licensed suppliers constantly.

3. Experience and Reputation

Research the history of the supplier, its reputation in the industry. Customer reviews, case studies, and industry awards may be indicative of their reliability in quality consistency. Check online reviews and ratings as well.

Keyword Integration: Find reputed Wheat Flour Suppliers in India who work consistently and offer quality products without disparity.

4. Supply Chain Transparency

Another cogent factor is the supply chain transparency. As it has been discussed above that through availability of accurate and relevant information related to the traceability of wheat concerning its origin, milling details, and logistics from the genuine suppliers, the product traceability becomes easy from farm to plate.

Example: Few companies like ITC Limited and Shakti Bhog have developed systems which keep the transparency alive from one end of the supply chain to the other. This finally builds trust and allows accountability.

5. Capacity and Scalability

Ensure that your Wheat Flour Supplier in India supplier is ever capable of meeting demand. They should be at the right scale to ramp up with your demand. Check their capacities, storages, logistics and backups.

A good customer service feature will be the hallmark of a reliable supplier. Checkmate on their responsiveness to your needs, support in case of dispute resolution, return, or any other problem that may crop up.

0 notes