#Most Profitable Real Estate Investments

Text

Most Profitable Real Estate Investments: Strategies for Maximizing Returns

For individuals who know where to invest and how to do it effectively, getting into the real estate investment business may be quite profitable. We examine the tactics and elements that go into the most successful real estate ventures in this extensive book.

Firstly, location reigns supreme in the realm of real estate. Investing in properties situated in areas experiencing economic growth, population influx, and infrastructure development often yields substantial returns. Cities with thriving job markets and vibrant communities tend to attract renters and buyers alike, ensuring consistent demand and potentially higher rental or resale values.

Moreover, understanding market trends and dynamics is crucial. Identifying emerging neighborhoods or overlooked areas poised for gentrification can offer significant opportunities for appreciation. Additionally, keeping abreast of regulatory changes and zoning laws helps investors navigate potential obstacles and capitalize on favorable conditions.

Furthermore, diversification is key to building a resilient real estate portfolio. Investing in a mix of residential, commercial, and industrial properties can mitigate risks associated with market fluctuations and economic downturns.

Most Profitable Real Estate Investments

By employing meticulous research, strategic planning, and a diversified approach, investors can unlock the potential for substantial profits in the dynamic world of real estate. This guide serves as a roadmap for aspiring investors looking to embark on a journey towards financial success through real estate ventures.

#commercial real estate#investment#therivercastle#commercial buildings for sale#commercial property for sale near me#commercial property for sale#commercial real estate for sale#property investment#investment opportunity#commercial land for sale#Most Profitable Real Estate Investments

0 notes

Text

Invest in Luxury Real Estate Properties at The River Castle, Naimisharanya, Lucknow

https://www.therivercastle.com/trc-serenita-cottages

Discover an extraordinary investment opportunity at The River Castle, a future township of divine proportions nestled in the enchanting location of Naimisharanya, Lucknow. Phase One of this monumental project, set on a sprawling 150-acre property that will double in size upon completion, offers a remarkable array of real estate properties, making it a lucrative investment choice.

Among the exquisite offerings, you'll find the Chalet Aarambh cottages, designed to exude the perfect blend of cosiness and opulence, reminiscent of Alpine holiday homes. The development also includes the Bhoj Palace restaurant, an exquisite dining experience to savor. For relaxation and rejuvenation, the Shant Chitt spa and wellness center, covering a vast 42,000 sq. ft., beckons. Here, you can indulge in a variety of treatments, including massages, wellness therapies, and beauty packages that utilize cutting-edge science to enhance well-being and beauty.

The River Castle doesn't stop there. With Piscine, an expansive public pool that rivals the size of four Olympic-sized swimming pools, and the Zone De Jeux outdoor sports facilities, the project offers an unparalleled living experience. The lush green landscapes and serene water bodies complete the idyllic setting, making The River Castle the epitome of luxury real estate properties, offering not only a beautiful home but also a sound investment for the future. Don't miss this golden opportunity to be a part of this grand vision in the making.

#real estate properties#real commercial real estate#buying commercial property for investment#industrial property investment#real estate development investment#luxury real estate developers#estate invest company#real estate opportunities#commercial property advisors#mixed commercial residential property#private real estate investors#real estate commercial property#industrial real estate companies#commercial property services#real estate investment properties#most profitable real estate investments

0 notes

Text

#invest money right now#ideas now#benefit of investing#high yield savings account online#savings account online#profitable companies#high yield savings account online banks#best place to invest money right now#suggestions and ideas#online banks#best place to invest your money#index mutual funds#ways to invest in real estate#own properties#date places#the best place to invest money right now#smaller amount#money right#different places#may be preferable#short term savings#term savings#many different places#places to invest your money#key benefit#profitable companies in the world#less overhead#invest your money right now#where you can invest your money#most secure places

0 notes

Text

No, Uber's (still) not profitable

Going to Defcon this weekend? I'm giving a keynote, "An Audacious Plan to Halt the Internet's Enshittification and Throw it Into Reverse," on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

Bezzle (n):

1. "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it" (JK Gabraith)

2. Uber.

Uber was, is, and always will be a bezzle. There are just intrinsic limitations to the profits available to operating a taxi fleet, even if you can misclassify your employees as contractors and steal their wages, even as you force them to bear the cost of buying and maintaining your taxis.

The magic of early Uber – when taxi rides were incredibly cheap, and there were always cars available, and drivers made generous livings behind the wheel – wasn't magic at all. It was just predatory pricing.

Uber lost $0.41 on every dollar they brought in, lighting $33b of its investors' cash on fire. Most of that money came from the Saudi royals, funneled through Softbank, who brought you such bezzles as WeWork – a boring real-estate company masquerading as a high-growth tech company, just as Uber was a boring taxi company masquerading as a tech company.

Predatory pricing used to be illegal, but Chicago School economists convinced judges to stop enforcing the law on the grounds that predatory pricing was impossible because no rational actor would choose to lose money. They (willfully) ignored the obvious possibility that a VC fund could invest in a money-losing business and use predatory pricing to convince retail investors that a pile of shit of sufficient size must have a pony under it somewhere.

This venture predation let investors – like Prince Bone Saw – cash out to suckers, leaving behind a money-losing business that had to invent ever-sweatier accounting tricks and implausible narratives to keep the suckers on the line while they blew town. A bezzle, in other words:

https://pluralistic.net/2023/05/19/fake-it-till-you-make-it/#millennial-lifestyle-subsidy

Uber is a true bezzle innovator, coming up with all kinds of fairy tales and sci-fi gimmicks to explain how they would convert their money-loser into a profitable business. They spent $2.5b on self-driving cars, producing a vehicle whose mean distance between fatal crashes was half a mile. Then they paid another company $400 million to take this self-licking ice-cream cone off their hands:

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

Amazingly, self-driving cars were among the more plausible of Uber's plans. They pissed away hundreds of millions on California's Proposition 22 to institutionalize worker misclassification, only to have the rule struck down because they couldn't be bothered to draft it properly. Then they did it again in Massachusetts:

https://pluralistic.net/2022/06/15/simple-as-abc/#a-big-ask

Remember when Uber was going to plug the holes in its balance sheet with flying cars? Flying cars! Maybe they were just trying to soften us up for their IPO, where they advised investors that the only way they'd ever be profitable is if they could replace every train, bus and tram ride in the world:

https://48hills.org/2019/05/ubers-plans-include-attacking-public-transit/

Honestly, the only way that seems remotely plausible is when it's put next to flying cars for comparison. I guess we can be grateful that they never promised us jetpacks, or, you know, teleportation. Just imagine the market opportunity they could have ascribed to astral projection!

Narrative capitalism has its limits. Once Uber went public, it had to produce financial disclosures that showed the line going up, lest the bezzle come to an end. These balance-sheet tricks were as varied as they were transparent, but the financial press kept falling for them, serving as dutiful stenographers for a string of triumphant press-releases announcing Uber's long-delayed entry into the league of companies that don't lose more money every single day.

One person Uber has never fooled is Hubert Horan, a transportation analyst with decades of experience who's had Uber's number since the very start, and who has done yeoman service puncturing every one of these financial "disclosures," methodically sifting through the pile of shit to prove that there is no pony hiding in it.

In 2021, Horan showed how Uber had burned through nearly all of its cash reserves, signaling an end to its subsidy for drivers and rides, which would also inevitably end the bezzle:

https://pluralistic.net/2021/08/10/unter/#bezzle-no-more

In mid, 2022, Horan showed how the "profit" Uber trumpeted came from selling off failed companies it had acquired to other dying rideshare companies, which paid in their own grossly inflated stock:

https://pluralistic.net/2022/08/05/a-lousy-taxi/#a-giant-asterisk

At the end of 2022, Horan showed how Uber invented a made-up, nonstandard metric, called "EBITDA profitability," which allowed them to lose billions and still declare themselves to be profitable, a lie that would have been obvious if they'd reported their earnings using Generally Accepted Accounting Principles (GAAP):

https://pluralistic.net/2022/02/11/bezzlers-gonna-bezzle/#gryft

Like clockwork, Uber has just announced – once again – that it is profitable, and once again, the press has credulously repeated the claim. So once again, Horan has published one of his magisterial debunkings on Naked Capitalism:

https://www.nakedcapitalism.com/2023/08/hubert-horan-can-uber-ever-deliver-part-thirty-three-uber-isnt-really-profitable-yet-but-is-getting-closer-the-antitrust-case-against-uber.html

Uber's $394m gains this quarter come from paper gains to untradable shares in its loss-making rivals – Didi, Grab, Aurora – who swapped stock with Uber in exchange for Uber's own loss-making overseas divisions. Yes, it's that stupid: Uber holds shares in dying companies that no one wants to buy. It declared those shares to have gained value, and on that basis, reported a profit.

Truly, any big number multiplied by an imaginary number can be turned into an even bigger number.

Now, Uber also reported "margin improvements" – that is, it says that it loses less on every journey. But it didn't explain how it made those improvements. But we know how the company did it: they made rides more expensive and cut the pay to their drivers. A 2.9m ride in Manhattan is now $50 – if you get a bargain! The base price is more like $70:

https://www.wired.com/story/uber-ceo-will-always-say-his-company-sucks/

The number of Uber drivers on the road has a direct relationship to the pay Uber offers those drivers. But that pay has been steeply declining, and with it, the availability of Ubers. A couple weeks ago, I found myself at the Burbank train station unable to get an Uber at all, with the app timing out repeatedly and announcing "no drivers available."

Normally, you can get a yellow taxi at the station, but years of Uber's predatory pricing has caused a drawdown of the local taxi-fleet, so there were no taxis available at the cab-rank or by dispatch. It took me an hour to get a cab home. Uber's bezzle destroyed local taxis and local transit – and replaced them with worse taxis that cost more.

Uber won't say why its margins are improving, but it can't be coming from scale. Before the pandemic, Uber had far more rides, and worse margins. Uber has diseconomies of scale: when you lose money on every ride, adding more rides increases your losses, not your profits.

Meanwhile, Lyft – Uber's also-ran competitor – saw its margins worsen over the same period. Lyft has always been worse at lying about it finances than Uber, but it is in essentially the exact same business (right down to the drivers and cars – many drivers have both apps on their phones). So Lyft's financials offer a good peek at Uber's true earnings picture.

Lyft is actually slightly better off than Uber overall. It spent less money on expensive props for its long con – flying cars, robotaxis, scooters, overseas clones – and abandoned them before Uber did. Lyft also fired 24% of its staff at the end of 2022, which should have improved its margins by cutting its costs.

Uber pays its drivers less. Like Lyft, Uber practices algorithmic wage discrimination, Veena Dubal's term describing the illegal practice of offering workers different payouts for the same work. Uber's algorithm seeks out "pickers" who are choosy about which rides they take, and converts them to "ants" (who take every ride offered) by paying them more for the same job, until they drop all their other gigs, whereupon the algorithm cuts their pay back to the rates paid to ants:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

All told, wage theft and wage cuts by Uber transferred $1b/quarter from labor to Uber's shareholders. Historically, Uber linked fares to driver pay – think of surge pricing, where Uber charged riders more for peak times and passed some of that premium onto drivers. But now Uber trumpets a custom pricing algorithm that is the inverse of its driver payment system, calculating riders' willingness to pay and repricing every ride based on how desperate they think you are.

This pricing is a per se antitrust violation of Section 2 of the Sherman Act, America's original antitrust law. That's important because Sherman 2 is one of the few antitrust laws that we never stopped enforcing, unlike the laws banning predator pricing:

https://ilr.law.uiowa.edu/sites/ilr.law.uiowa.edu/files/2023-02/Woodcock.pdf

Uber claims an 11% margin improvement. 6-7% of that comes from algorithmic price discrimination and service cutbacks, letting it take 29% of every dollar the driver earns (up from 22%). Uber CEO Dara Khosrowshahi himself says that this is as high as the take can get – over 30%, and drivers will delete the app.

Uber's food delivery service – a baling wire-and-spit Frankenstein's monster of several food apps it bought and glued together – is a loser even by the standards of the sector, which is unprofitable as a whole and experiencing an unbroken slide of declining demand.

Put it all together and you get a picture of the kind of taxi company Uber really is: one that charges more than traditional cabs, pays drivers less, and has fewer cars on the road at times of peak demand, especially in the neighborhoods that traditional taxis had always underserved. In other words, Uber has broken every one of its promises.

We replaced the "evil taxi cartel" with an "evil taxi monopolist." And it's still losing money.

Even if Lyft goes under – as seems inevitable – Uber can't attain real profitability by scooping up its passengers and drivers. When you're losing money on every ride, you just can't make it up in volume.

Image: JERRYE AND ROY KLOTZ MD (modified) https://commons.wikimedia.org/wiki/File:LA_BREA_TAR_PITS,_LOS_ANGELES.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/09/accounting-gimmicks/#unter

Image:

JERRYE AND ROY KLOTZ MD (modified)

https://commons.wikimedia.org/wiki/File:LA_BREA_TAR_PITS,_LOS_ANGELES.jpg

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#bezzles#hubert horan#uber#rideshare#accounting tricks#financial engineering#late-stage capitalism#narrative capitalism#lyft#transit#uber eats#venture predation#algorithmic wage discrimination

1K notes

·

View notes

Text

Book Review- The Wealth Elite: A Groundbreaking Study of the Psychology of the Super Rich, by Rainer Zitelmann Notes

I came across this book because I was looking for psychology books. I found the first of the book rather boring and too textbook-y. The second part is much better.

The author interviewed like 45 millionaire - billionaires. These were his findings.

—

48% stated that real estate was an ‘important’ source of their wealth, and one in ten described real estate as the ‘most important’ aspect of their personal wealth-building. And a total of 20% described stock market gains as an ‘important’ factor in wealth-building, although in this case only 2.4% stated that this was the ‘most important’ factor in building their wealth.

‘Creative intelligence’ is key to financial success. The following is a comparison between the percentage of entrepreneurs (and in brackets the percentage of attorneys) who agreed that the following factors played a decisive role in their financial success: seeing opportunities others do not see: 42 (19); finding a profitable niche: 35 (14).

The role of habitus

* Intimate knowledge of required codes of dress and etiquette

* Broad-based general education

* An entrepreneurial attitude, including an optimistic outlook on life

* Supreme self-assurance in appearance and manner.

He identifies a key quality that is essential for any prospective appointee to the executive board or senior management of a major company: habitual similarities to those who already occupy such positions.

Skillset of Entrepreneurs

* The ‘conqueror’. The entrepreneur has to have the ability to make plans and a strong will to carry them out.

* The ‘organizer’. The entrepreneur has to have the ability to bring large numbers of people together into a happy, successful creative force.

* The ‘trader’. What Sombart describes as a ‘trader’, we would more likely call a talented salesperson today. The entrepreneur has to “confer with another, and, by making the best of your own case and demonstrating the weakness of his, get him to adopt what you propose. Negotiation is but an intellectual sparring match.”

Entrepreneurial success personality traits

* Commitment

* Creativity

* A high degree of extroversion

* Low levels of agreeableness

Entrepreneurial success personality traits

* Orientation towards action after suffering disappointments (the entrepreneur remains able to act, even after failure)

* Internal locus of control (the conviction “I hold my destiny in my own two hands”)

* Optimism (the expectation that the future holds positive things in store)

* Self-efficacy (the expectation that tasks can be performed successfully, even in difficult circumstances).

constant power struggles with their teachers in order to ascertain who would emerge the stronger from such confrontations.

Secret of selling

* Empathy

* Didactics

* Expert knowledge

* Networking.

Conscientiousness is the dominant personality trait. Extroversion is also very common among the interviewees. Openness to Experience is very common

A high tolerance to frustration is one of the most characteristic personality traits of this group.

exceptionally high levels of mental stability.

primarily characterize entrepreneurs as being prepared to swim against the current and make their decisions irrespective of majority opinion.

“No, I never did that (lost my temper). I never get loud. But I can be resolute and say: “That is unacceptable.” And then you either have to go your separate ways or make a decision that the other party might not like. It’s the same in negotiations. I was always described by other people as a bit of a toughie.”

Having the courage to stand against majority opinion is probably a prerequisite for making successful investments, as this is what makes it possible to buy cheap and sell high.

Many of the interviewees spoke about their ability to switch off and direct their focus, even in the event of major problems. The interviewees consistently referred to their ability to focus on solutions, rather than torturing themselves with problems.

At least in the initial phases of wealth creation, most of the interviewees rated their own risk profiles as very high. This changes during the stabilization phase, when risk profiles decrease. In this phase, the hypothesis of moderate risk does apply.

Conscientiousness was the interviewees’ most dominant personality trait. It is important to remember that the Big Five theory’s definition of conscientiousness does not just include qualities such as duty, precision, and thoroughness, but also emphasizes diligence, discipline, ambition, and stamina.

#c suite#powerful woman#strong women#ceo aesthetic#personal growth#that girl#productivity#getting your life together#balance#book review#books

410 notes

·

View notes

Text

✧ 2nd House Ruler (WEALTH & Family) in All Houses

Part 3 (Final) ..

{ Vedic Astrology }

Your Guide to Check Your Placement (Vedic Astrology)

⇝ Refer To My Part 1

2nd Lord in 8th House

The placement of the 2nd Lord in the 8th House indicates a potential for wealth accumulation in your life. This is especially favorable for those involved in real estate, as dealing with properties can bring significant financial gains. However, it's important to consider the aspects and the sign in order to fully understand the potential outcomes. Generally speaking, this placement suggests a promising source of wealth.

On the flip side, this placement can also bring challenges in your marriage or joint finances. There may be disagreements and difficulties regarding shared financial responsibilities. It is crucial to find ways to calm these tensions and strive for more agreement with your spouse. Failure to do so can lead to further complications. Additionally, if you have elder siblings, they may also become a source of contention for you. It is essential to maintain harmonious family relationships in order to ensure a steady flow of money in your life.

The 8th House also governs inheritance and money gained from others. With the 2nd Lord placed in this house, if it is well aspected and has a beneficial aspect from the Lord, there is a potential for receiving inheritance and accumulating enormous wealth. However, it is important to exercise caution in your business dealings if the 2nd Lord is placed in the 8th House. This house is associated with secrecy, and there is a possibility that you may be secretive about your investments, business dealings, and taxes.

Engaging in any underhanded activities can have severe consequences and leave a significant dent in your finances. The 8th House is known for its transformative nature, and you may find yourself having to start from scratch and transform your savings and investments from time to time. Due to the placement of the 2nd Lord being seven houses away from its own house, you may experience a sense of financial instability.

There will be periods of financial security, but there will also be times when everything feels uncertain. It is important to adapt to these fluctuations and learn to make a profit from them. Overall, the placement of the 2nd Lord in the 8th House suggests both opportunities and challenges in terms of wealth accumulation and financial stability. By navigating these complexities with caution and adaptability, you can make the most of the potential benefits and overcome any obstacles that may arise.

2nd Lord in 9th House

This is an advantageous position for your wealth. You have a natural talent for accumulating wealth in your life. However, there is a slight issue that arises from this - you tend to hold onto your money tightly. It's difficult for you to let it go and allow it to flow freely, which can have a negative impact in the long run. The reason behind this difficulty lies in the fact that the lord of the second house has moved eight houses away from its original position. This eighth house represents fear, and as a result, you fear letting go of your wealth and spreading it around through expenses.

Your reluctance to let money go prevents it from flowing back to you. Despite your good fortune, it is important to maintain it by spending when necessary and utilizing the money you have. On the bright side, having the second lord in the ninth house makes you a highly skilled and diligent individual. You may even experience gains through speculation, such as in the stock market. However, the placement of the second lord eight houses away can bring about health issues in your childhood or early years.

Nevertheless, as you enter your middle years, you will experience prosperity and stability due to the influence of the second lord in the ninth house. The second lord represents moral and family values, and its placement in the ninth house makes you a person with strong religious and spiritual inclinations. You are drawn to pilgrimages, philosophical discussions, and seeking guidance from gurus. These pursuits bring you peace of mind, which in turn aids in your wealth accumulation. Furthermore, the placement of the second lord in the ninth house suggests the potential for expanding a family business into new areas, particularly foreign interests.

This can be highly profitable, especially if there are positive aspects to the second lord in the ninth house. Additionally, since the ninth house represents the father, it is common to see individuals in this position taking on their father's business. The ninth house also governs higher education, and pursuing further education can be a source of profit for you. You may excel as a teacher or lecturer in various fields, and higher education in any area will contribute to your increased income.

2nd Lord in 10th House

The 2nd Lord in the 10th House placement signifies that you are a person of great honor. Your reputation in your career is built on your integrity and the trustworthiness of your word. With the 2nd house ruling speech and entering the 10th house of career, it is important for you to find a profession where you can utilize your talent for communication. This could range from teaching and lecturing to media and journalism, or even politics. Your ability to effectively communicate will bring you wealth and success.

Your family of origin plays a significant role in supporting your career. They may provide you with education, financial assistance, or even a substantial inheritance. Pursuing education will greatly benefit your career and help you achieve financial gains. However, it is crucial to be cautious of the company you keep. Surrounding yourself with negative or toxic individuals can compromise your integrity and hinder your wealth-building opportunities. Choose your associations wisely and ensure that they are morally upright individuals.

Additionally, it is advisable to refrain from speculation or gambling, as it can lead to significant financial losses. Consistent hard work is the key to continuously increasing your profits. Any slack in your dedication, cutting corners, or displaying antagonistic behavior towards your superiors can result in immediate negative consequences, including the loss of your job.

Furthermore, it is important to maintain a healthy relationship with your children. Be mindful of giving them excessive amounts of money, as it can potentially strain your bond with them. Avoid spoiling them and instead focus on nurturing a balanced and loving relationship.

2nd Lord in 11th House

When the 2nd lord takes its place in the 11th house, it brings forth an abundance of wealth into your life. You have the potential to attain great riches through this placement. It particularly favors property deals and long-term investments. This position is highly advantageous for those pursuing self-employment and any form of business ventures.

Additionally, it signifies an increase in wealth after marriage and through partnerships. Your financial prospects are bright in these areas. However, it is important to note that there may be conflicts with your mother regarding financial matters. Awareness and effective communication can help navigate these potential disagreements.

With the 2nd house lord's presence in the 11th house, you possess a strong sense of honorable duty towards your profession. This makes you enterprising and dedicated to your job. If you are currently employed, this placement brings recognition and fame within your workplace. It opens doors for you to attain a high-ranking position. Moreover, your colleagues will prove to be supportive and instrumental in your growth and promotion.

2nd Lord in 12th House

When the lord of the 2nd house finds its way into the 12th house, it ignites a fiery courage within you. You become an adventurous soul, unafraid of starting anew in a different career or even a different country. Starting from scratch holds no fear for you, as you possess a true sense of adventure and freedom that is invaluable. I have witnessed individuals with the lord of the 2nd house in the 12th house completely transform their careers in the middle of their lives, achieving great success.

People are naturally drawn to you and will support and promote you because of your likable nature. However, this position also makes you prone to being a spendthrift. Money seems to slip through your fingers effortlessly. The more you earn, the more you spend. You possess a generous spirit, but struggle to maintain control over your finances. It may be wise to seek assistance from someone skilled in money management. The 12th house represents our fears, and in this placement, you tend to avoid looking at your bank balance. You prefer not to worry about it and simply turn a blind eye.

On the flip side, the 12th house is also associated with charity, and you find joy in giving to various causes. Your acts of kindness will bring positive karma into your life. Despite your own financial struggles, you have a knack for helping others manage their money. You could excel in financial management, particularly when it involves handling other people's finances or investment funds, even in foreign lands.

There may be challenges with a child, as they can be a bit quarrelsome and cause you distress at times. However, with time and effort, you will be able to work through these difficulties.

Feel free to share your experiences in the comments!

Remember This is a General Analysis , Whole Chart is to be consider for Accurate Personalized Predictions..

For Paid Personalized Analysis & Reviews ➤ Check Here

Masterlist ➤ Check Here

🤗 Feel free to chat with me if you have any questions about my service. Don't hesitate, I'm here to help!

#astro observations#astro notes#astroblr#astroloji#astroworld#astrology#astro community#vedic astrology

303 notes

·

View notes

Text

"The most fashionable bathing station in all Europe". British industrialists and American mining investors plotting the colonization of the Congo, while mingling at Ostend's seaside vacation resorts. Extracting African life to build European railways, hotels, palaces, suburbs, and other modern(ist) infrastructure. "Towards infinity!"

---

In 1885, King Leopold II achieved an astonishing and improbable goal: he claimed a vast new realm of his own devising, a conjury on a map called [...] the Congo Free State. [...] [A] fictional state owned by the king, ruled by decree, and run from Brussels from 1885 to 1908. [...] This was [...] a private entrepreneurial venture [for the king]. The abundance of ivory, timber, and wild rubber found in this enormous territory brought sudden and spectacular profits to Belgium, the king, and a web of interlocking concession companies. The frenzy to amass these precious resources unleashed a regime of forced labor, violence [millions of deaths], and unchecked atrocities for Congolese people. These same two and a half decades of contact with the Congo Free State remade Belgium [...] into a global powerhouse, vitalized by an economic boom, architectural burst, and imperial surge.

Congo profits supplied King Leopold II with funds for a series of monumental building projects [...]. Indeed, Belgian Art Nouveau exploded after 1895, created from Congolese raw materials and inspired by Congolese motifs. Contemporaries called it “Style Congo,” [...]. The inventory of this royal architecture is astonishing [...]. [H]istorical research [...] recovers Leopold’s formative ideas of architecture as power, his unrelenting efforts to implement them [...]. King Leopold II harbored lifelong ambitions to “embellish” and beautify the nation [...]. [W]ith his personal treasury flush with Congo revenue, [...] Leopold - now the Roi Batisseur ("Builder King") he long aimed to be - planned renovations explicitly designed to outdo Louis XIV's Versailles. Enormous greenhouses contained flora from every corner of the globe, with a dedicated soaring structure completed specifically to house the oversize palms of the Congolese jungles. [...]

---

The Tervuren Congo palace [...]. Electric tramways were built and a wide swath of avenue emerged. [...] [In and around Brussels] real estate developers began to break up lots [...] for suburban mansions and gardens. Between 1902 and 1910, new neighborhoods with luxury homes appeared along the Avenue [...]. By 1892, Antwerp was not only the port of call for trade but also the headquarters of the most profitable of an interlinking set of banks and Congo investment companies [...]. As Antwerp in the 1890s became once again the “Queen of the Scheldt,” the city was also the home of what was referred to as the “Queen of Congo companies.” This was the ABIR, or Anglo-Belgian India Rubber Company, founded in 1892 with funds from British businessman “Colonel” John Thomas North [...].

Set on the seaside coast, Belgium’s Ostend was the third imperial cityscape to be remade by King Leopold [...] [in a] transformation [that] was concentrated between 1899 and 1905 [...]. Ostend encompassed a boomtown not of harbor and trade, like Antwerp, but of beachfront and leisure [...] [developed] as a "British-style" seaside resort. [...] Leopold [...] [w]as said to spend "as much time in Ostend as he did in Brussels," [...]. Ostend underwent a dramatic population expansion in a short period, tripling its inhabitants from 1870–1900. [...] Networks of steamers, trams, and railway lines coordinated to bring seasonal visitors in, and hotels and paved walkways were completed. [...] [A]nd Leopold’s favorite spot, the 1883 state-of-the-art racetracks, the Wellington Hippodrome. Referred to with an eye-wink as “the king incognito” (generating an entire genre of photography), visitors to the seaside could often see Leopold in his top hat and summer suit [...], riding his customized three-wheeled bicycle [...]. By 1900, Ostend’s expansion and enhancement made it known as “the Queen of the Belgian seaside resorts” and “the most fashionable bathing station in all Europe.” Opulence, convenience, and spectacle brought the Shah of Persia, American tycoons, European aristocrats, and Belgian elites, among others, to Ostend.

---

Leopold’s interventions and the Congo Free State personnel and proceeds played three pivotal and understudied roles in this transformation, all of which involved ABIR [British industrialists].

First, it was at Ostend that an early and decisive action was taken to structure the “red rubber” regime and set it in motion. In 1892, jurists such as [E.P.] had ruled, contravening [...] trade laws, that the king was entitled to claim the Congo as his domanial property [...]. Leopold [...] devised one part of that royal domain as a zone for private company concessions [...] to extract and export wild rubber.

Soon after, in 1892, King Leopold happened to meet the British “Colonel” John Thomas North at the Ostend Hippodrome. North, a Leeds-born mechanic [...] had made a fortune speculating on Chilean nitrates in the 1880s. He owned monopoly shares in nitrate mines and quickly expanded to acquire monopolies in Chilean freight railways, water supplies, and iron and coal mines. By 1890 North was a high-society socialite worth millions [...]. Leopold approached North at the Ostend racecourse to provide the initial investments to set up the Anglo-Belgian India Rubber Company (ABIR). [...]

---

One visible sign of Ostend’s little-known character as Congo boomtown was the Royal Palace Hotel, a lavish property next to the king’s Royal Domain, which opened in 1899. With hundreds of rooms and a broad sweep of acreage along the beachfront, the palace “occupied the largest space of any hotel in Europe.” [...]

King Leopold met American mining magnate Thomas Walsh there, and as with North, the meeting proved beneficial for his Congo enterprise: Leopold enlisted Walsh to provide assessments of some of his own Congo mining prospects. The hotel was part of [...] [a major European association of leisure profiteers] founded in 1894, that began to bundle luxury tourism and dedicated railway travel, and whose major investors were King Leopold, Colonel North [...].

At the height of Congo expansionism, fin-de-siècle Antwerp embodied an exhilarated launch point [...]. Explorers and expeditioners set sail for Matadi after 1887 with the rallying call “Vers l’infini!” (“towards infinity!”) [...].

---

Text above by: Debora Silverman. "Empire as Architecture: Monumental Cities the Congo Built in Belgium". e-flux Architecture (Appropriations series). May 2024. At: e-flux.com/architecture/appropriations/608151/empire-as-architecture-monumental-cities-the-congo-built-in-belgium/ [Bold emphasis and some paragraph breaks/contractions added by me. Italicized first paragraph/heading in this post was added by me. Presented here for commentary, teaching, criticism.]

#tidalectics#ecology#multispecies#abolition#this full article has far more info about leopolds obsession with opulence and all the many infrastructure projects in belgium he sponsored#full article also expands more on congolese art and anticolonial art projects that criticize belgian architecture#eflux did several articles focusing on anticolonial responses to belgian extraction and art noveau and modernist architecture#including a piece on spectacle of belgian worlds fair and human zoos#silverman has very extensive research history#ecologies#geographic imaginaries

102 notes

·

View notes

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

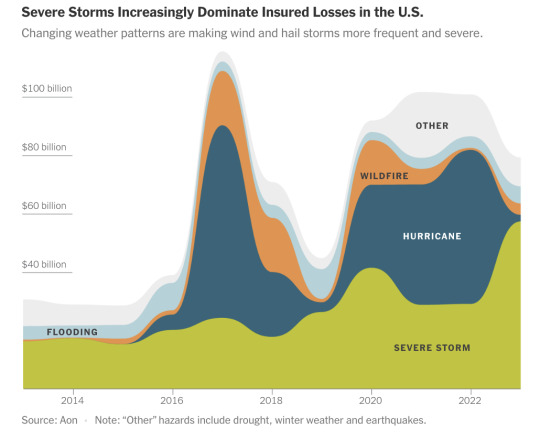

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

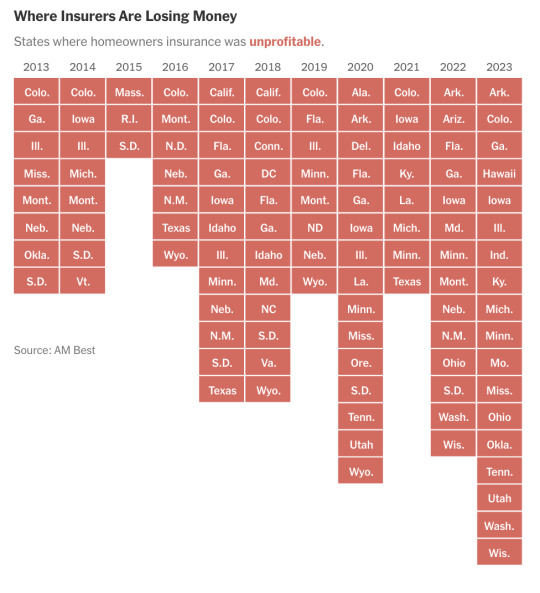

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

121 notes

·

View notes

Text

Throughout this pandemic, Passage has been publishing articles and courses documenting how Canadians are suffering due to the housing crisis.

Houses are too expensive for most of us to buy. Skyrocketing rents are forcing us out of our communities or into smaller and worse living spaces at higher costs. Some of us are even ending up on the streets, as homelessness is on the rise.

Of course, though, not everyone has been suffering. People who own property have been watching the value of their investments surge, and maybe even scooping up more of it to the detriment of those in need. Landlords have recently been able to jack up rents with little resistance. And the financialization of housing, where corporations that view it as a tradeable stock or asset as opposed to a human right and treat it accordingly, has been able to spread unimpeded.

So where do our political representatives fit into all of this? Do our members of parliament have more in common with us, or the landlord class?

According to recently released research I’ve put together over the past few months, nearly 40 per cent of MPs are landlords and/or invested in real estate in some way. [...]

Continue Reading.

Tagging: @politicsofcanada, @vague-humanoid

593 notes

·

View notes

Text

Many years ago, the Jewish U.S. scholar Norman Finkelstein wrote a best seller that caused uproar among a group he exposed as the “Holocaust Industry”: people who invariably had not been direct victims of the Holocaust, but nonetheless chose to exploit and profit from Jewish suffering.

Though treated as leaders of the Jewish community, they were not primarily interested in helping survivors of the Holocaust, or in stopping another Holocaust – the two things one might have assumed would be the highest priorities for anyone making the Holocaust central to their life. In fact, hardly any of the many millions the Holocaust Industry demanded from countries like Germany in reparations ever made it to Holocaust survivors, as Finkelstein documented in his book.

Instead, this small group instrumentalised the Holocaust for their own benefit: to gain money and influence by embedding themselves in an industry they had created. They became untouchables, beyond criticism because they were associated with an industry that they had made as sacred as the Holocaust itself.

A follow-up book called the Antisemitism Industry, an investigation into much the same group of people, is now overdue. These ghouls don’t care about antisemitism – in fact, they rub shoulders with the West’s most prominent antisemites, from Donald Trump to Viktor Orban.

Rather, they care about Israel – and the weaponisation of antisemitism to protect their emotional and financial investment. They profit from Israel’s central place in US political, diplomatic and military life:

• as a giant real-estate laundering exercise, based on the theft of native Palestinian land;

• as a laboratory for the production of new weapons and surveillance systems tested on Palestinians;

• as a heavily militarised colonial state, a spearpoint for the West, useful in destabilising and disrupting any threat of a unifying Arab nationalism in the oil-rich Middle East;

• and as the frontier state for eroding legal and ethical principles developed after the Second World War to stop a repeat of those atrocities.

Anyone who challenges the Antisemitism Industry’s – and therefore Israel’s – stranglehold on Jewish representation in public life is hounded as an antisemite or self-hating Jew, as is currently happening most prominently to Jewish film-maker Jonathan Glazer. He is the Oscar-winning director of The Zone of Interest, about the family of a Nazi commandant of Auschwitz who lived blind to the horrors unfolding just out of view, beyond their walled garden.

I wrote an earlier piece about the manufactured furore provoked by Glazer’s comments at the Oscars. In his acceptance speech, he denounced the hijacking of Jewishness and the Holocaust that has sustained Israel’s occupation over many decades and generated constant new victims, including the latest: those who suffered at the hands of Hamas when it attacked on October 7, and the many, many tens of thousand of Palestinians killed, maimed and orphaned by Israel over the past five months.

—Jonathan Cook, the antisemitism industry doesn’t speak for Jews, it speaks for western elites

#politics#palestine#israel#jonathan glazer#weaponized antisemitism#gaza#the zone of interest#antisemitism#anti zionism ≠ antisemitism#jonothan cook#weaponized zionism#war crimes#genocide#zone of interest#ethnic cleansing#hamas ≠ palestine#israel ≠ all jewish people#pro palestine ≠ antisemitism#holocaust industry#idpol#hasbara#weaponized identity politics

95 notes

·

View notes

Text

Is this real or is Tailgate casually making things up again?

Because if it's real I don't see how it's possible? If Cyclonus's investments were made before he left on the first Ark - which is the most reasonable scenario as he used to be part of Nova's personal buddy circle, that's the tippy top of the planetary hierarchy, makes sense that he'd be loaded - but then the Ark disappeared for six million years, shouldn't they all have been long persumed dead?

Do they not have a declaration of death act in Cybertron? No intestate laws? Nothing about unclaimed property? No requisition?

Even if Cybertron didn't have laws regarding any of that and just allowed a missing person to retain their assets - and the accumulating investment profits - indefinitely, there was still a war going on for four million years. During which cities were bombed repeatedly. And then the Decepticons burned up the planet. And then Thunderwing trashed everything again. By the time of Stormbringer you couldn't even physically be on the planet without protection. And then Cybertron got reset to a primordial state so infrastructure had to be restarted from scratch. There's no way any real estate's able to survive through all that short of having Tetrahex exist on a separate dimension.

Other scenario is Cyclonus made his investments after coming back from the dead universe. Which is even more unlikely since between his coming back and leaving on the Lost Light only around four weeks passed max. During which everyone was congregated around Iacon's old site and the entire population's only a few thousand people. What would anyone want or do with Tetrahexian real estate?

Land property must be the single most worthless thing on post-war Cybertron when the entire planet's basically reverted into a massive piece of undeveloped wild land with so few people on it. No real estate market's gonna get any lower than that because... there's no market.

#transformers#idw transformers#maccadam#mtmte#Tailgate#Cyclonus#is his bank account even still active after 6 mill yrs?

121 notes

·

View notes

Note

Many of your economic development plans call for the LPs to climb the "value-added chain". In a late medieval context, what value-added product would give you the most bang for your buck when it comes to timber?

Timber is a bit trickier than the classic case of textiles (where there are more links in the value-added chain from raw wool to carded wool to spun thread to plain woven cloth to dyed cloth to higher-end fabrics).

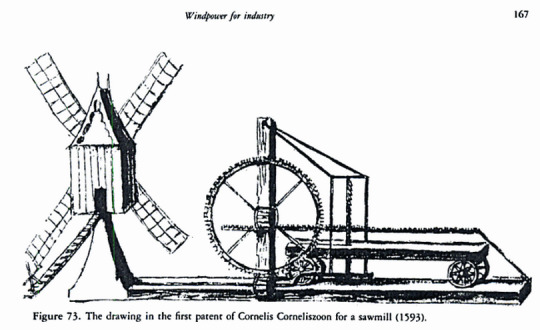

The first place to start is to shift from timber (i.e, the harvesting of raw, unprocessed logs from trees) to lumber (treating and seasoning, and sawing the logs into standardized boards, planks, beams, posts, and the like that can be used by carpenters to make furniture, housing, etc.). This requires the construction of sawmills (usually water- or wind-powered), usually downstream from the timberland so that logs can be easily floated down to the sawmill rather than going to the effort and expense of carting them overland.

The next step is to encourage the development of associated industries like furniture-making, construction...and most prized of all, ship-building. These industries continue to climb the value-added chain, because there's more money to be made from selling artisan furniture than selling raw logs and more money to be made in real estate than selling planks retail, and thus they allow you to maximize your profits from your natural resources. More importantly, if you can get into ship-building, you not only make money from selling and repairing the ships, but it's a pretty easy step from there to branch out into commerce on your own account (since you are already producing the main capital investment that seaborn commerce requires).

This is why various forms of Navigation Acts were often a key strategy of mercantilist policy during the Commercial Revolution, because if you could make sure that foreign trade was carried out by your nation's ships crewed by your sailors and your pilots and financed by your merchants, that the profits from trade would be more likely to be re-invested at home rather than exported to someone else's country.

#asoiaf#asoiaf meta#economic development#early modern economic development#mercantilism#early modern state-building#commercial revolution

35 notes

·

View notes

Text

Real Estate Investment Properties at The River Castle, Naimisharanya, Lucknow

The River Castle, an exciting real estate investment project located in Naimisharanya, Lucknow, is set to transform into a sprawling township of remarkable proportions. At its inception, Phase One spans 150 acres, with plans to double its size by the phase's completion. This presents an exceptional opportunity to invest in real estate investment properties at the nascent stages of a development poised for greatness.

Phase One introduces Chalet Aarambh, a collection of cottages known for their inviting and opulent design, reminiscent of Alpine holiday homes. These cottages promise a unique blend of comfort and luxury. Additionally, The River Castle will feature Bhoj Palace, an exquisite restaurant, and Shant Chitt, a serene spa, both designed to cater to residents' relaxation and culinary delights.

For those who enjoy outdoor activities, Piscine, a vast public pool, and Zone De Jeux, a range of outdoor sports facilities, await. The property is adorned with lush green landscapes and tranquil water bodies, creating an environment that fosters both well-being and recreation.

With an array of amenities and its prime location, The River Castle offers a prime opportunity for real estate investment properties that promises not only financial growth but also a quality lifestyle. Invest in The River Castle and be a part of this remarkable journey in Naimisharanya, Lucknow.

#real estate properties#the river castle location#best investment#real estate investment properties#most profitable real estate investments#commercial property services#fractional investment real estate#passive income property#purchase investment property

0 notes

Note

New here, new to your blog, very nervous, please be gentle. Real-boy said he would have invested in railways instead of a toy company. I don't know if this is just my personal squick, I don't know if he would-have had the power to force members of the estate to work on railways as part of his 'investment' but either way. I have a (great, great) grandparent who worked as a railroad Navvy, he immigrated to escape Britain's working conditions... that's literally why I'm here. Say what one will about Our!Ciel, but Funtom is providing safer jobs to people... Read a bit about Railroad Navvies during that time period, I'm betting it'll shock you. Contrary to whatever anyone says, they were NOT, "well paid" they were NOT compensated well or even given beds. They died at a high rates, and families weren't compensated for deaths. Sometimes, they weren't even paid with real money... So that definitely set off a 🚩.

I'm so glad your ancestor survived... After taking a closer look.

I thought, initially...that this was just to illustrate differences between the two of the twins... That "Real!Ciel" would have made what he felt were more business-oriented, practical decisions for monetary gain and expansion ... and not more personal choices, like Our!Ciel.

(( By "communications" I assume he means something literal. Telephone lines, something like that.))

But after taking another look, that is some very interesting thought-food, you provided. It's very easy, for readers to forget about the working class and common people who's lives are being played with while all of this is going on, and I think that's intentional.

It was also clearly illustrated, that Real!Ciel is just not that interested, in investing in areas that might also create more opportunities, for the working class, or for providing with goods and services, to women and children.

He seemingly doesn't care for the toys, and didn't seem interested in Funtom supplementing income that theoretically, the Estate could be providing by itself....

You spoke specifically about railways. From what I understand, investors in railways normally didn't want train-tracks running through THEIR property and estates, and that often created problems... but.

...Some didn't mind, so long as it meant exclusivity, and bigger shares of profits.

Most especially, when land owners had canals, in their possession. Telephone lines required similar... labor, for their infrastructure (and thus the conditions were also pretty bad for those who had to build them).

As for whether or not he could "force" people who lived on his estate into other trades, like that... Absolutely, he could. I think a lot of factors could determine that, but it's not entirely out of the question. It's happened to people, historically. He could certainly make it much harder for people living there, to continue to do so happily. They could move theoretically, they just have to abandon their homes and the only life they've ever known. If they can afford it.

Mm. Thinking about a railroad or telephone lines, running right through the estate where that canal was built, kind of breaks my heart a bit... but regardless, I'm glad that didn't happen or hasn't happened, yet.

I don't know what fate is going to befall Funtom or the Estate, but I hope the company survives, a while longer.

I'm sure if the working classes who live on the Estate had a say in the matter, they'd want Our!Ciel, as their Earl. No contest.

115 notes

·

View notes

Text

Yanis Varoufakis’s “Technofeudalism: What Killed Capitalism?”

Monday (October 2), I'll be in Boise to host an event with VE Schwab. On October 7–8, I'm in Milan to keynote Wired Nextfest.

Socialists have been hotly anticipating the end of capitalism since at least 1848, when Marx and Engels published The Communist Manifesto - but the Manifesto also reminds us that capitalism is only too happy to reinvent itself during its crises, coming back in new forms, over and over again:

https://www.nytimes.com/2022/10/31/books/review/a-spectre-haunting-china-mieville.html

Now, in Technofeudalism: What Killed Capitalism, Yanis Varoufakis - the "libertarian Marxist" former finance minister of Greece - makes an excellent case that capitalism died a decade ago, turning into a new form of feudalism: technofeudalism:

https://www.penguin.co.uk/books/451795/technofeudalism-by-varoufakis-yanis/9781847927279

To understand where Varoufakis is coming from, you need to go beyond the colloquial meanings of "capitalism" and "feudalism." Capitalism isn't just "a system where we buy and sell things." It's a system where capital rules the roost: the richest, most powerful people are those who coerce workers into using their capital (factories, tools, vehicles, etc) to create income in the form of profits.

By contrast, a feudal society is one organized around people who own things, charging others to use them to produce goods and services. In a feudal society, the most important form of income isn't profit, it's rent. To quote Varoufakis: "rent flows from privileged access to things in fixed supply" (land, fossil fuels, etc). Profit comes from "entrepreneurial people who have invested in things that wouldn't have otherwise existed."

This distinction is subtle, but important: "Profit is vulnerable to market competition, rent is not." If you have a coffee shop, then every other coffee shop that opens on your block is a competitive threat that could erode your margins. But if you own the building the coffee shop owner rents, then every other coffee shop that opens on the block raises the property values and the amount of rent you can charge.

The capitalist revolution - extolled and condemned in the Manifesto - was led by people who valorized profits as the heroic returns for making something new in this world, and who condemned rents as a parasitic drain on the true producers whose entrepreneurial spirits would enrich us all. The "free markets" extolled by Adam Smith weren't free from regulation - they were free from rents:

https://locusmag.com/2021/03/cory-doctorow-free-markets/

But rents, Varoufakis writes, "survived only parasitically on, and in the shadows of, profit." That is, rentiers (people whose wealth comes from rents) were a small rump of the economy, slightly suspect and on the periphery of any consideration of how to organize our society. But all that changed in 2008, when the world's central banks addressed the Great Financial Crisis by bailing out not just the banks, but the bankers, funneling trillions to the people whose reckless behavior brought the world to the brink of economic ruin.

Suddenly, these wealthy people, and their banks, experienced enormous wealth-gains without profits. Their businesses lost billions in profits (the cost of offering the business's products and services vastly exceeded the money people spent on those products and services). But the business still had billions more at the end of the year than they'd had at the start: billions in public money, funneled to them by central banks.

This kicked off the "everything rally" in which every kind of asset - real estate, art, stocks, bonds, even monkey JPEGs - ballooned in value. That's exactly what you'd expect from an economy where rents dominate over profits. Feudal rentiers don't need to invest to keep making money - remember, their wealth comes from owning things that other people invest in to make money.

Rents are not vulnerable to competition, so rentiers don't need to plow their rents into new technology to keep the money coming in. The capitalist that leases the oil field needs to invest in new pumps and refining to stay competitive with other oil companies. But the rentier of the oil field doesn't have to do anything: either the capitalist tenant will invest in more capital and make the field more valuable, or they will lose out to another capitalist who'll replace them. Either way, the rentier gets more rent.

So when capitalists get richer, they spend some of that money on new capital, but when rentiers get richer, them spend money on more assets they can rent to capitalists. The "everything rally" made all kinds of capital more valuable, and companies that were transitioning to a feudal footing turned around and handed that money to their investors in stock buybacks and dividends, rather than spending the money on R&D, or new plants, or new technology.

The tech companies, though, were the exception. They invested in "cloud capital" - the servers, lines, and services that everyone else would have to pay rent on in order to practice capitalism.

Think of Amazon: Varoufakis likens shopping on Amazon to visiting a bustling city center filled with shops run by independent capitalists. However, all of those capitalists are subservient to a feudal lord: Jeff Bezos, who takes 51 cents out of every dollar they bring in, and furthermore gets to decide which products they can sell and how those products must be displayed:

https://pluralistic.net/2022/11/28/enshittification/#relentless-payola

The postcapitalist, technofeudal world isn't a world without capitalism, then. It's a world where capitalists are subservient to feudalists ("cloudalists" in Varoufakis's thesis), as are the rest of us the cloud peons, from the social media users and performers who fill the technofuedalists' siloes with "content" to the regular users whose media diet is dictated by the cloudalists' recommendation systems:

https://pluralistic.net/2023/01/21/potemkin-ai/#hey-guys

A defining feature of cloudalism is the ability of the rentier lord to destroy any capitalist vassal's business with the click of a mouse. If Google kicks your business out of the search index, or if Facebook blocks your publication, or if Twitter shadowbans mentions of your product, or if Apple pulls your app from the store, you're toast.

Capitalists "still have the power to command labor from the majority who are reliant on wages," but they are still mere vassals to the cloudalists. Even the most energetic capitalist can't escape paying rent, thanks in large part to "IP," which I claim is best understood as "laws that let a company reach beyond its walls to dictate the conduct of competitors, critics and customers":

https://locusmag.com/2020/09/cory-doctorow-ip/

Varoufakis points to ways that the cloudalists can cement their gains: for example, "green" energy doesn't rely on land-leases (like fossil fuels), but it does rely on networked grids and data-protocols that can be loaded up with IP, either or both of which can be turned into chokepoints for feudal rent-extraction. To make things worse, Varoufakis argues that cloudalists won't be able to muster the degree of coordination and patience needed to actually resolve the climate emergency - they'll not only extract rent from every source of renewables, but they'll also silo them in ways that make them incapable of doing the things we need them to do.

Energy is just one of the technofeudal implications that Varoufakis explores in this book: there are also lengthy and fascinating sections on geopolitics, monetary policy, and the New Cold War. Technofeudalism - and the struggle to produce a dominant fiefdom - is a very useful lens for understanding US/Chinese tech wars.

Though Varoufakis is laying out a technical and even esoteric argument here, he takes great pains to make it accessible. The book is structured as a long open letter to his father, a chemical engineer and leftist who was a political prisoner during the fascist takeover of Greece. The framing device works very well, especially if you've read Talking To My Daughter About the Economy, Varoufakis's 2018 radical economics primer in the form of a letter to his young daughter:

https://us.macmillan.com/books/9780374538491/talkingtomydaughterabouttheeconomy

At the very end of the book, Varoufakis calls for "a cloud rebellion to overthrow technofeudalism." This section is very short - and short on details. That's not a knock against the book: there are plenty of very good books that consist primarily or entirely of analysis of the problems with a system, without having to lay out a detailed program for solving those problems.

But for what it's worth, I think there is a way to plan and execute a "cloud rebellion" - a way to use laws, technology, reverse-engineering and human rights frameworks to shatter the platforms and seize the means of computation. I lay out that program in The Internet Con: How the Seize the Means of Computation, a book I published with Verso Books a couple weeks ago:

https://www.versobooks.com/products/3035-the-internet-con

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/28/cloudalists/#cloud-capital

#pluralistic#yanis varoufakis#socialism#communism#technofeudalism#economics#postcapitalism#political science#rent-seeking#rentiers#books#reviews#gift guide

735 notes

·

View notes

Note

Hi!

Thanking for answering my ask,

If you don’t mind I would love it if you could get into the tax part, I just want to know as much as I can. 😆

Ok this is fun, prepare to have your mind blown.

I have to disclose that I am not a financial advisor or an accountant <3

Trusts: You want to consider purchasing the properties under a trust. Tax implications can vary under trusts. Revocable living trust will allow you to be treated as the owner, but in an irrevocable trust, it is a separate entity. In some structures, you would only pain capital gains, which can also be transferred to a separate trust, and you do not end up paying capital gains on the property. You do this with a charitable remainder trust. Generally, if a property is held in a trust, rental income generated from that property is typically subject to income tax. The trust itself may be responsible for paying those taxes, or the tax liability might pass through to the beneficiaries, depending on the type of trust and its specific provisions. This will change the amount you would pay in taxes. If the property was purchased as a primary home, there could also be capital gain exceptions depending on the trust. Your income affects the rates you pay on specific trusts. Before I continue, I want to suggest speaking to an actual attorney, not an accountant. Most are not knowledgable or equipped to properly guide you here. Same as with traditional, in a trust you can deduct property related expenses like mortgage interest, property taxes, maintenance costs, and depreciation, from the rental income. This can help reduce the taxable income generated by the property.

IRA's: You can use a self directed IRA or other retirement accounts to invest in real estate. The gain from these investments grow tax deferred within your account. This is something you should also consider doing.

Depreciating assets: Real estate can depreciate overtime. This doesn't include land. But when it depreciates, you can deduct the properties cost. This would offset the income you would pat taxes on.

1031 Exchange: Filing a 1031 will allow you to defer paying capital gains on an investment property when it's sold, as long as another "like kind" property is purchased with the profit gained from the sale.

Mortgage Interest Deduction: Interest paid on mortgages for investment properties can be deducted.

Carry Forward: If your expenses exceed your rental income, you could have a net loss. Some of these losses can be used to offset other taxable income, while others might be carried forward to future years.

Living in the property: If you live in the property for 2 years. you can exclude a portion of the capital gains from your taxable income when you sell.

Opportunity Zones: Opportunity zones offer tax incentives, including deferring and potentially reducing capital gains taxes.

Expenses: All repair expenses can be deducted.

Installments: You can structure your sale to receive payments over time. This spreads out the capital gains and reduces tax impact.

Tax Credits: There are a ton of tax credits for investors. Would research in your state.

More deductions: Interest on a mortgage for an investment property is typically tax deductible, as are property taxes and many other expenses related to the property like Insurance premiums.

Cost segregations: You can hire someone to reclassify certain areas of your property to accelerate depreciation. This will give you a significant upfront tax deduction.

Pass throughs: Certain pass through entities (like LLCs, S Corporations, and partnerships) may be eligible for a deduction of up to 20% of their business income from rental properties.

I can keep going on this, but strongly recommend you read these books:

Loopholes of the Rich: How the Rich Legally Make More Money and Pay Less Tax

Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

92 notes

·

View notes